MEMBERS ONLY

Sector Spotlight: Seasonality and RRGs

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

It's a very full show on this episode of Sector Spotlight. After a quick overview of what happened in asset classes and sectors last week, I take a look at seasonality combined with rotations on the RRG. Finally, I finish up the show by answering two mailbag questions...

READ MORE

MEMBERS ONLY

Who Says You Can't Time the Market?

Junk Bonds (JNK) rallied Friday, closing above the 50-week moving average. Then, today, JNK ran up to yet another new high since March. This is an excellent example of "Don't Fight the Fed!" (especially ahead of the Fed meeting). Until I see a shift in risk...

READ MORE

MEMBERS ONLY

Old Bear, New Trick

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

The S&P 500 recently got back to positive territory for 2020, with a year-to-date return of 1.4% as of July 22nd. It didn't stay positive for long though. Trading was down on the 23rd and 24th, bringing it back into negative territory as of the...

READ MORE

MEMBERS ONLY

TECH STOCKS REBOUND -- DOLLAR DROPS NEAR TWO-YEAR LOW AS PRECIOUS METALS SURGE -- FOREIGN ETFS REBOUND

by John Murphy,

Chief Technical Analyst, StockCharts.com

REBOUND IN NASDAQ 100 STEADIES MARKET... Stocks are opening the week on a firmer note. A rebound in tech stocks is one of the reasons why. Last Thursday's high-volume selloff in tech stocks caused some nervous profit-taking as the week ended. Chart 1 shows the Nasdaq 100 (QQQ)...

READ MORE

MEMBERS ONLY

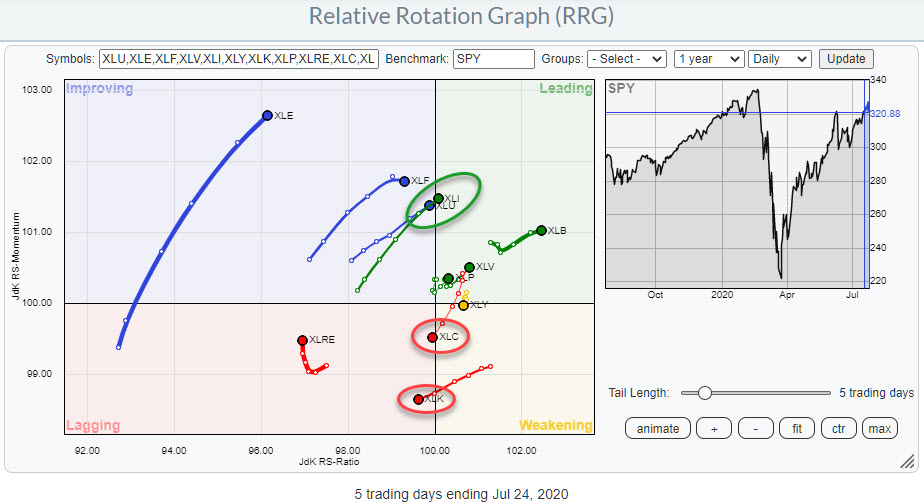

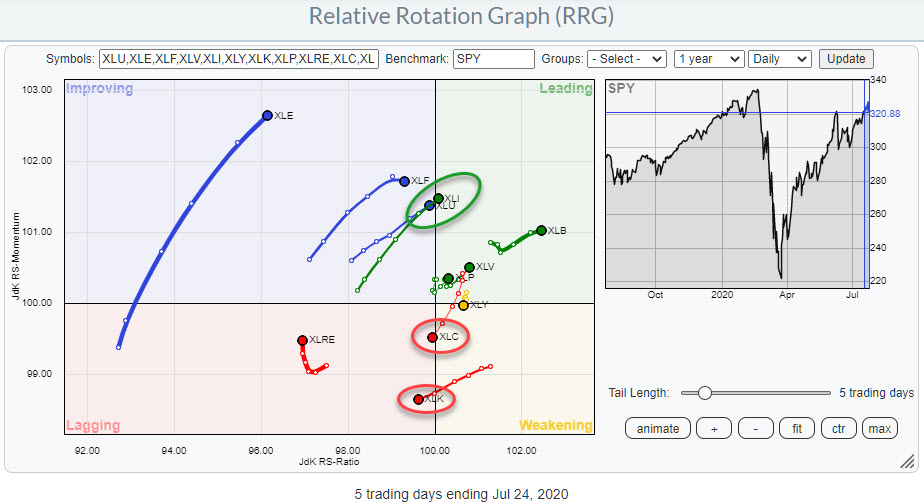

Sector Rotation Shows Weakness for Technology and Communication Services

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Following Friday's close, we are facing a daily Relative Rotation Graph with some interesting (sector) rotations underway.

Energy

The Energy sector had a pretty good week. This comes after I suggested more weakness for this sector in Sector Spotlight on Tuesday 7/21... I recorded that show on...

READ MORE

MEMBERS ONLY

This Telecom Stock Seems To Be Giving Up...

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The upper extended trend line shows that the Double Top breakout not only fizzled out, but the price action failed to move past that double top resistance several times. This has reinforced the credibility of this resistance.

Presently, the price has slipped below the 50-DMA.

The daily MACD has shown...

READ MORE

MEMBERS ONLY

Two Of The Strongest Industry Groups Just Keep Getting Stronger

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It's no secret that I like finding leading stocks in leading industry groups. In my view, however, THAT is the secret sauce in building a portfolio to outperform the benchmark S&P 500 over time. Of course, there will be hiccups along the way and we'...

READ MORE

MEMBERS ONLY

Week Ahead: Chase Momentum Vigilantly If NIFTY Attempts Higher Levels; RRG Chart Show This Sector Taking a U-Turn

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The week before this one had seen the headline index testing a couple of important levels on daily and weekly timeframe charts. On the daily chart, the index had closed a notch above the 200-DMA; on the weekly chart, it had tested the 50-week MA. Over the past five session,...

READ MORE

MEMBERS ONLY

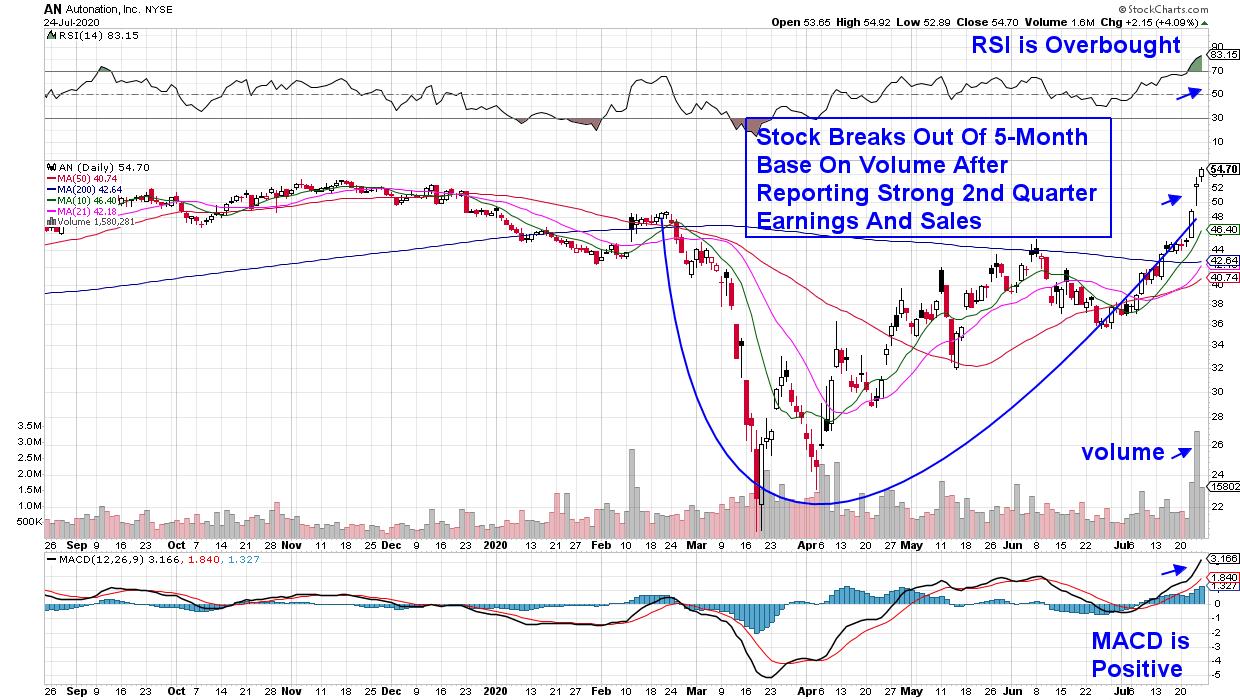

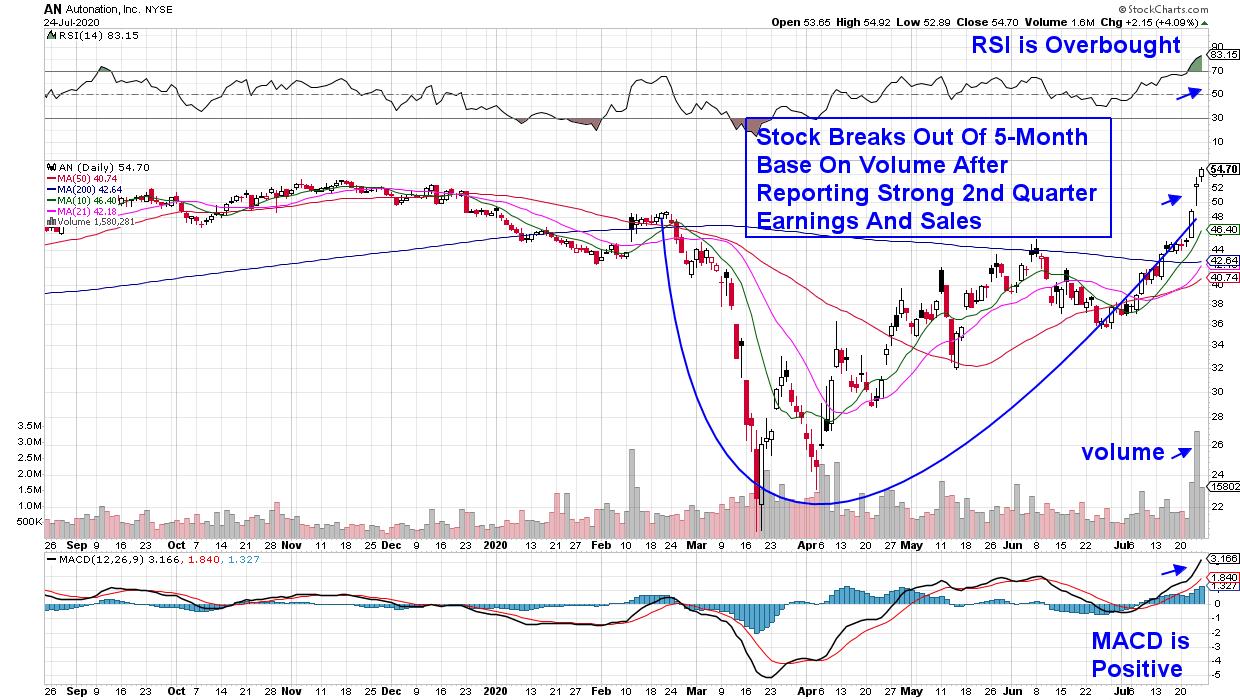

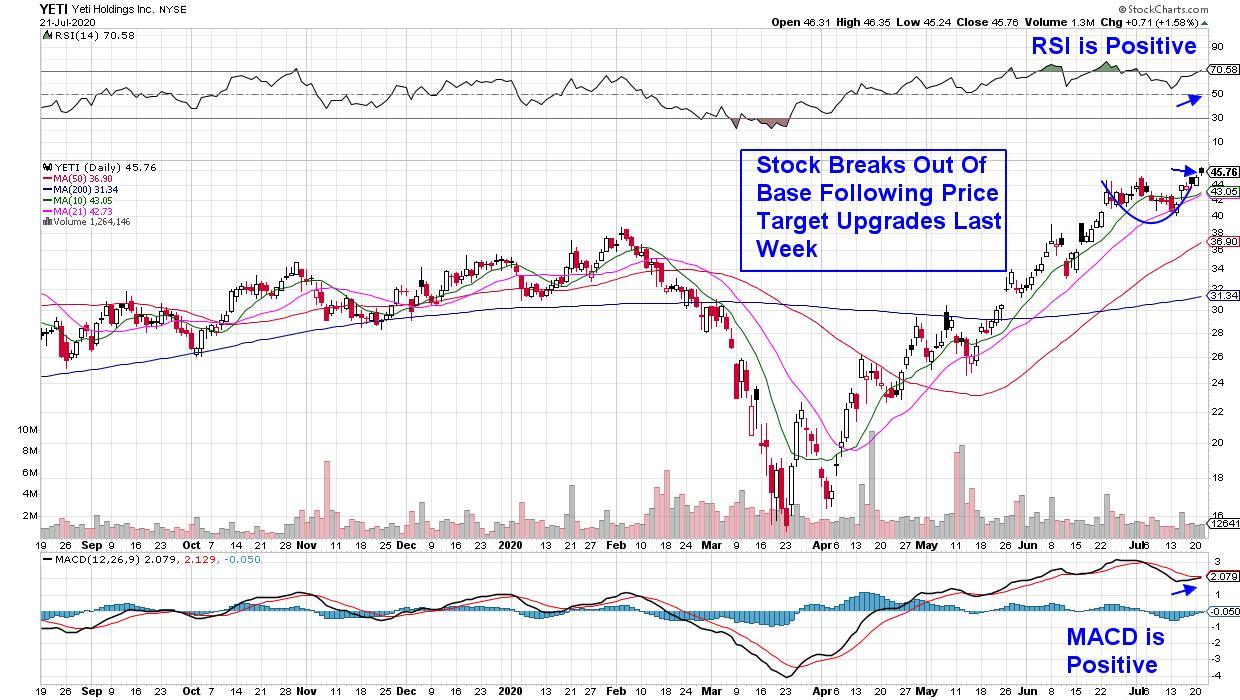

Explosive Earnings Are Propelling Stocks Higher In These 2 Surprising Areas

by Mary Ellen McGonagle,

President, MEM Investment Research

It's been proven that strong earnings are the number one driver of a stock's upward advance and with earnings season under way, there's no better time to vet the next set of stocks poised to trade much higher.

So far, over a quarter of...

READ MORE

MEMBERS ONLY

Those Who Are Patient Could REALLY Cash In!

by John Hopkins,

President and Co-founder, EarningsBeats.com

When Tesla (TSLA) reported its earnings last week, they smashed all expectations, both on the top and bottom line. The immediate reaction was mixed, but then we saw the tech sector in general take a hit for a few days in a row, and TSLA did not escape the selling....

READ MORE

MEMBERS ONLY

Big Techs Lead Market Retreat

by John Murphy,

Chief Technical Analyst, StockCharts.com

A selloff in the biggest tech stocks is putting downside pressure on stocks today; and is helping make the Nasdaq 100 the day's biggest percentage loser. And it looks technically vulnerable to a deeper pullback. The daily bars in Chart 1 show the Nasdaq 100 (QQQ) testing its...

READ MORE

MEMBERS ONLY

Are the Markets Stalling?

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the market's action and highlights key levels for the Indices. She also shares insights into the move away from recently leading areas and how earnings reports are signaling some near-term trend changes.

This video was...

READ MORE

MEMBERS ONLY

Economic Modern Family Has Eyes on Granny Retail

In the world of large cap and tech stocks, Friday was an interesting trading day.

Lots of those stocks touched down on their 50-DMA. To name a few: JD.com (JD), Baidu (BIDU), IQ, Netflix (NFLX) and Microsoft (MSFT). With sentiment or risk on/off gauges flashing bearish, these big...

READ MORE

MEMBERS ONLY

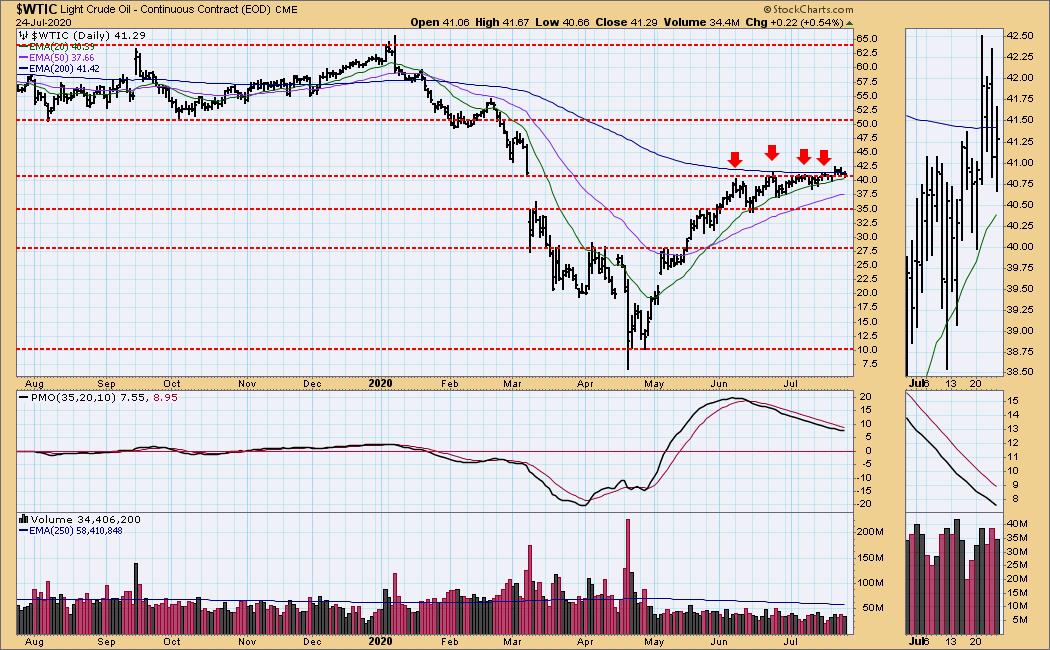

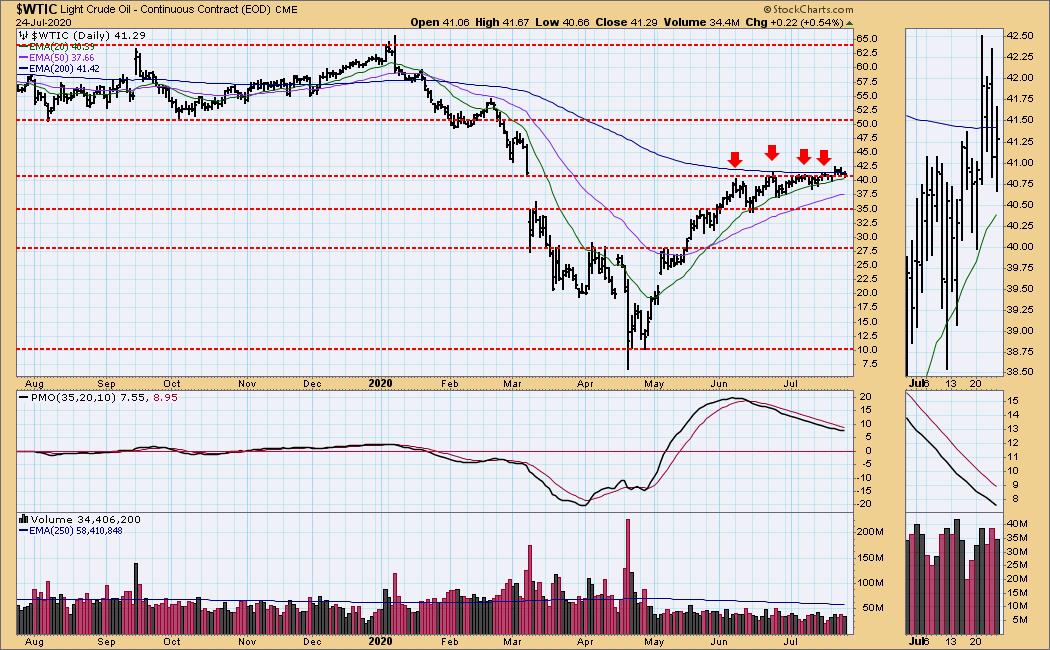

Energy Sector Heating Up - Here are Possible Winners

by Erin Swenlin,

Vice President, DecisionPoint.com

I have been watching the Energy sector closely this week. $WTIC, which I follow daily in the DecisionPoint Alert report, finally broke out and, although the Price Momentum Oscillator (PMO) hasn't turned up, Oil prices are staying above the 20-EMA and have made an attempt to get back...

READ MORE

MEMBERS ONLY

QQQ Goes on a Bender

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

QQQ can do little wrong here in 2020, but the ETF is ripe for a corrective period as it becomes the most extended since 1999. Current conditions, while frothy, are not quite the same as they were in 2000 so I do not expect another crash. For those of us...

READ MORE

MEMBERS ONLY

The Secret to Outperformance: Personal Teflon and Velcro - ChartPack Update #28 (Q2 / 2020)

by Grayson Roze,

Chief Strategist, StockCharts.com

by Gatis Roze,

Author, "Tensile Trading"

What is the singular attribute absolutely ALL successful investors you can name possess? It's resiliency! Consistency, profitability and longevity demand that an investor maintain an even keel through many challenging market cycles. The essential tool they all use are their "Routines". The end result: resiliency.

Routines...

READ MORE

MEMBERS ONLY

TSLA Has Likely Topped, But How Far Could It Fall?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

There's been one common denominator thus far in earnings season: high-flying stocks have seemed to hit a brick wall after posting earnings - even spectacular, way-above-consensus-estimates earnings. That was my biggest question as we headed into earnings season. I knew the numbers would be incredible across several different...

READ MORE

MEMBERS ONLY

BIG TECHS LEAD MARKET RETREAT -- NASDAQ 100 IS BIGGEST LOSER AND LOOKS VULNERABLE TO DEEPER PULLBACK

by John Murphy,

Chief Technical Analyst, StockCharts.com

NASDAQ 100 TESTS 20-DAY LINE... A selloff in the biggest tech stocks is putting downside pressure on stocks today; and is helping make the Nasdaq 100 the day's biggest percentage loser. And it looks technically vulnerable to a deeper pullback. The daily bars in Chart 1 show the...

READ MORE

MEMBERS ONLY

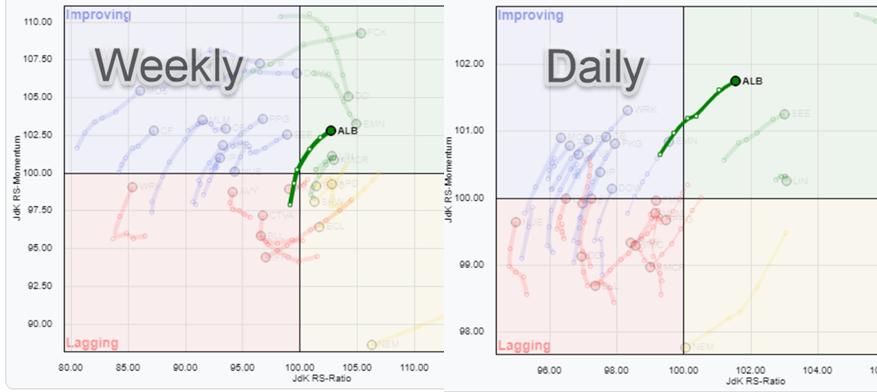

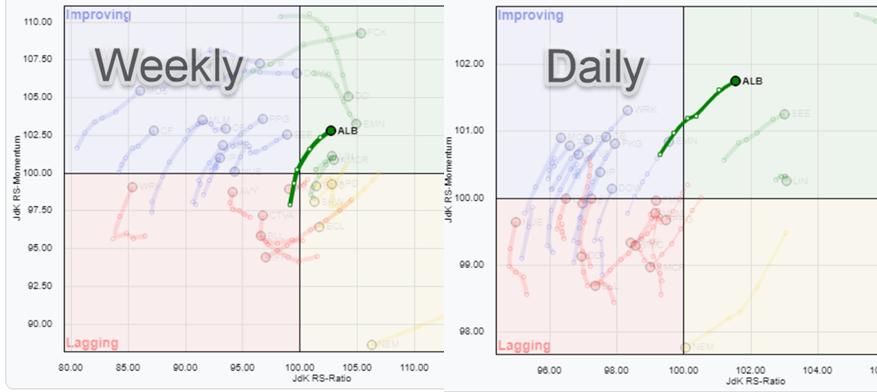

Here's a Materials Stock With Potential

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

With the Materials sector (XLB) moving into the leading quadrant on the weekly RRG, it makes sense to look for some individual stocks that may offer upside potential. Using Relative Rotation Graphs, we can do just that by loading all members of the Materials sector and using XLBas the benchmark...

READ MORE

MEMBERS ONLY

To Buy Or Not To Buy?? That Is The Gap Question

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Trading earnings-related gaps is what I like to do. It's what we do at EarningsBeats.com. Well, we do lots of things at EarningsBeats.com, but doing our homework and preparing our members to trade earnings-related gaps is certainly high on our list. It always amazes me to...

READ MORE

MEMBERS ONLY

Bullish Market Bias - Can't Beat 'Em, Join 'Em

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin discuss negative divergences and BUY signal divergences that are being defeated by a strong bullish bias in the market. Carl looks at breadth anomalies. Apple (AAPL)'s parabolic (or should we say "vertical") price movement should give Apple investors...

READ MORE

MEMBERS ONLY

Follow the Path to Money

As my loyal readers and followers know, I have been bullish on gold and silver since 2018.

Oh sure, we have had some ups and downs, but since the March low, every dip has been a buy opportunity. But my bullish stance in the metals was not always met with...

READ MORE

MEMBERS ONLY

ACP Indicators Unleashed (and More)

by Dave Landry,

Founder, Sentive Trading, LLC

In this edition of Trading Simplified, Dave explores his new "Stick with the Trend" indicators, which have now been released on the StockCharts.com Advanced Charting Platform (StockChartsACP). This is a new FREE plugin you can easily install on ACP, and Dave shows how to make the best...

READ MORE

MEMBERS ONLY

EURO CLIMBS TO TWO -YEAR HIGH -- THAT'S GOOD FOR EUROZONE ETFS -- GERMAN ISHARES NEAR BULLISH BREAKOUT -- WEAK DOLLAR BOOSTS EMERGING MARKETS

by John Murphy,

Chief Technical Analyst, StockCharts.com

EURO RALLIES TO TWO-YEAR HIGH... Yesterday's message showed the euro testing its March high. Chart 2 shows the eurozone currency trading above that level in today's trading. That puts the euro at the highest level in nearly two years. The rising euro is putting more downside...

READ MORE

MEMBERS ONLY

Sector Spotlight: Short-Term Sector Rotation Out of Technology

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of Sector Spotlight, after a quick overview of Asset Class and Sector rotation, I go over and update my longer-term views using the investment pyramid. In the second half of the show, I give a thorough update of the Long/Short baskets while putting these picks in...

READ MORE

MEMBERS ONLY

Small-Cap Stocks Escape Late Day Fade - Here's a Name on the Move!

by Mary Ellen McGonagle,

President, MEM Investment Research

Small Cap stocks were the best performers last week and it's of great interest to me to see them continue outperforming this week. A quick look at the Russell 2000 Small Cap Index will show that last week's bullish break above its 200-day moving average is...

READ MORE

MEMBERS ONLY

AAPL Advance Is Too Steep

by Carl Swenlin,

President and Founder, DecisionPoint.com

Apple (AAPL) has a history of sharp, parabolic price advances, followed by vertical collapses. Normal spacing between the tops runs from about two to four years, but recent periodicity has become compressed. The top in early 2020 arrived only about 15 months after the 2018 top, and it appears to...

READ MORE

MEMBERS ONLY

Where Do You Invest if the Trend Favoring the US Against the World Reverses?

by Martin Pring,

President, Pring Research

* The US versus the Rest of the World

* Europe

* Asia

The US versus the Rest of the World

Chart 1 shows that the up trend favoring the S&P Composite against the Vanguard All-World Ex-US ETF (the VEU) is intact. That's because the latest plot is above...

READ MORE

MEMBERS ONLY

RISING EURO PUSHES DOLLAR TO LOWEST LEVEL SINCE MARCH -- A WEAKER DOLLAR IS BOOSTING ENERGY AND METAL PRICES -- AND STOCKS TIED TO THEM

by John Murphy,

Chief Technical Analyst, StockCharts.com

RISING EURO PUSHES DOLLAR LOWER...Chart 1 show the Invesco Dollar Index Bullish Fund (UUP) declining today to the lowest level since March. The dollar surged during the first quarter in a flight to safety as stock prices plunged. Then fell from late March to July as stocks recovered. And...

READ MORE

MEMBERS ONLY

Junk Bonds - A Test of Resistance

With such divergence blaringly apparent in the market, I like to look at junk bonds.

Junk bonds help us see risk appetite. Last week, I wrote a piece on JNK when they appeared more vulnerable, skidding along the 50-daily moving average you see in blue. Then, buyers showed up in...

READ MORE

MEMBERS ONLY

SILVER ISHARES REACH FOUR-YEAR HIGH -- SILVER CONTINUES TO OUTPACE GOLD --THE GOLD/SILVER RATIO AT ALL-TIME HIGH -- WHICH MAKES SILVER HISTORICALLY CHEAP

by John Murphy,

Chief Technical Analyst, StockCharts.com

SILVER ISHARES HIT FOUR-YEAR HIGH... Precious metals (and their mining ETFs) are rising again today with all of them hitting multi-year highs. As has been the case recently, however, silver (and its miners) are actually rising faster than gold (and its miners). The black daily bars in Chart 1 show...

READ MORE

MEMBERS ONLY

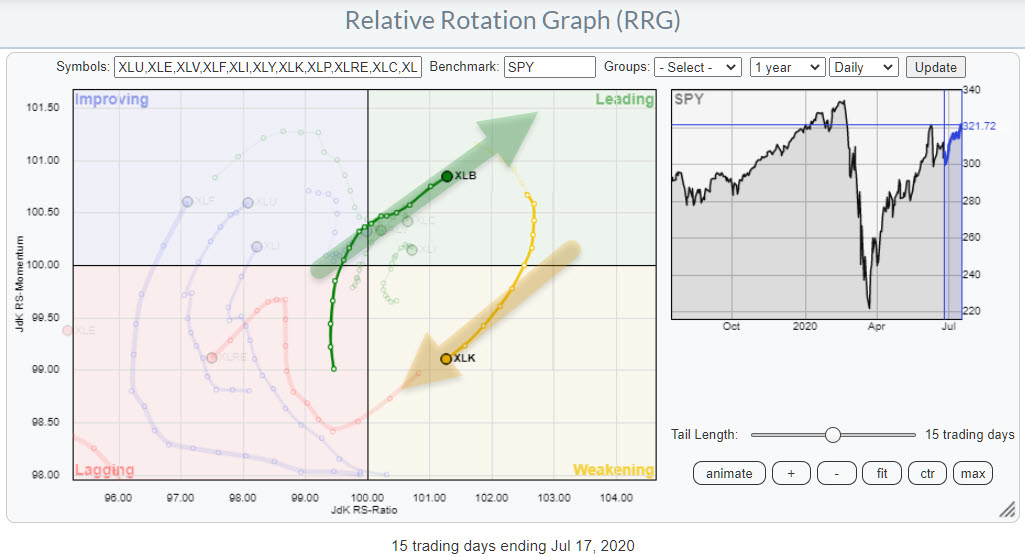

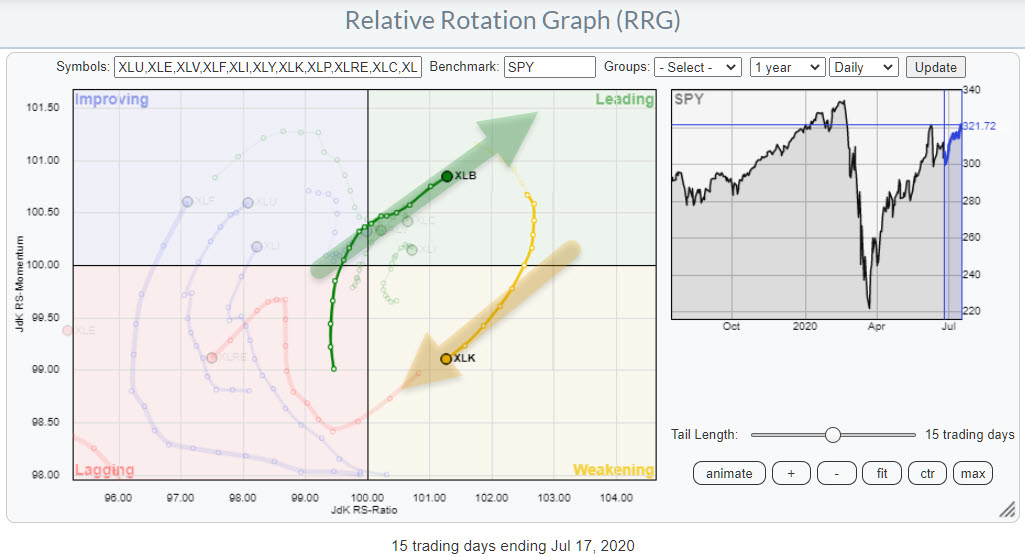

XLB Picking Up More Strength as Sector Rotates Further into Leading; XLK Loses Relative Momentum inside Weakening

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the weekly Relative Rotation Graph for US sectors, there are five sectors rotating at the right hand side of the graph, either inside the leading quadrant (XLB,XLC,XLK,XLY) or inside the weakening quadrant (XLV). On the daily RRG, it's also only these sectors at the...

READ MORE

MEMBERS ONLY

Raising Guidance Can Result In A BIG Advance

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

That seems rather plausible. After all, earnings are one key factor that drives stock prices. But, in this case, I'm referring specifically to Big Lots, Inc. (BIG). It's part of a very strong industry group, broadline retail ($DJUSRB), which set a new 52-week relative high vs....

READ MORE

MEMBERS ONLY

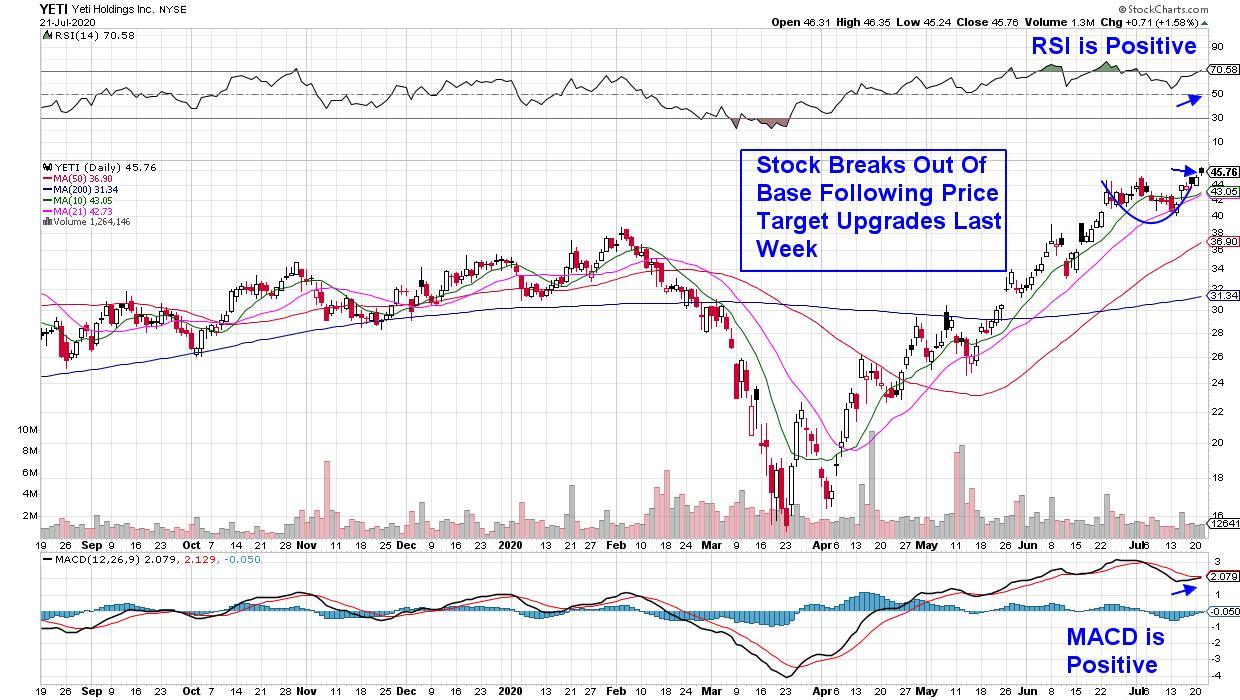

Internet Stocks Remain Strong And This One Could Explode Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

We can talk about earnings, the economic outlook, technical conditions, etc., but to be quite honest, the real keys to successful investing/trading come down to timing, patience, and managing risk. At EarningsBeats.com, we do all the research for our members. We provide so many trading opportunities and literally...

READ MORE

MEMBERS ONLY

Weekend Visit with the Economic Modern Family

With Daily's recently-titled "Granny Retail Hangs Tough" and "Granddad Russell 2000 Takes the Lead", it's no wonder we saw rotation out of tech and into the matriarch and patriarch of the Economic Modern Family. However, this catch-up play is a long time...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY has Three Important Levels to Deal With; RRGs Clearly Show Change of Leadership

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous weekly note, we had mentioned that the markets were losing momentum in general despite some measured incremental up moves. The week that went by traded much on the anticipated lines. The trading range increased over the past couple of days as the NIFTY continued to witness selling...

READ MORE

MEMBERS ONLY

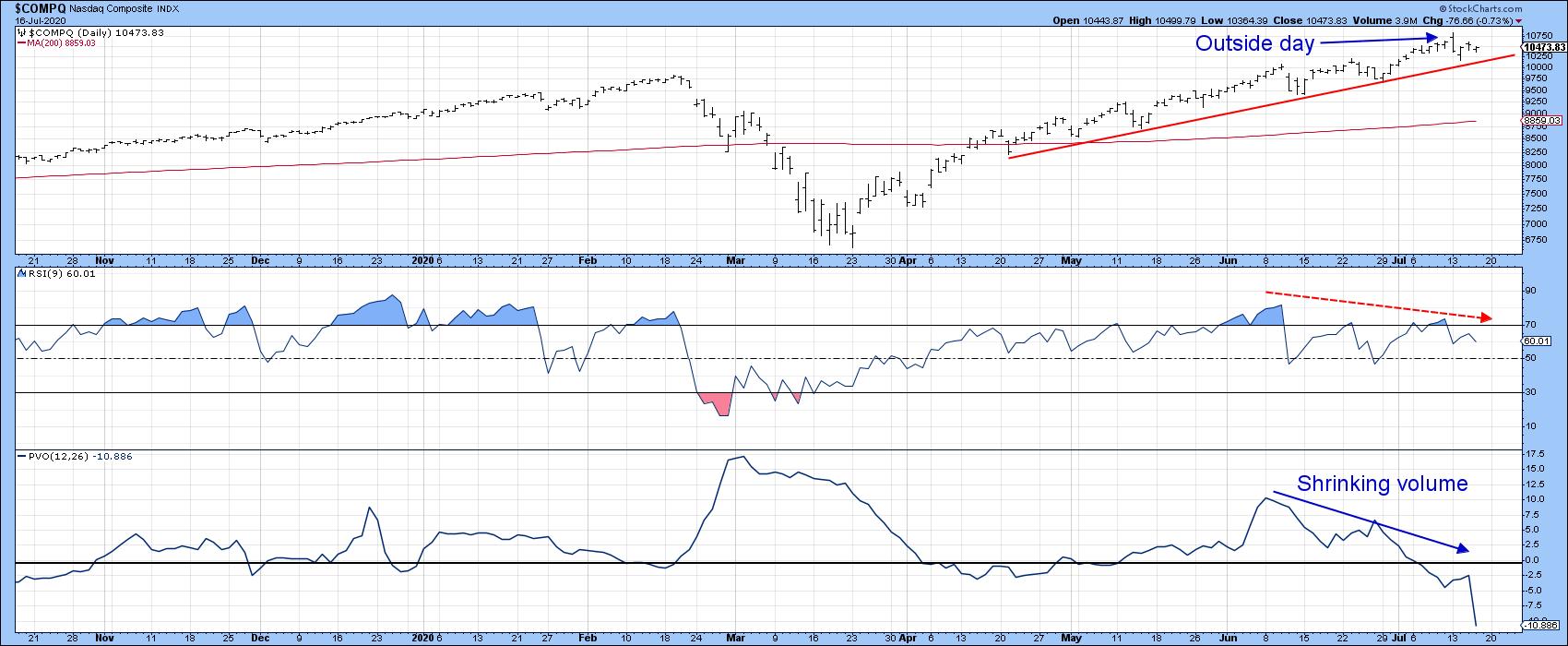

New Sector Leadership May Be Emerging

by Martin Pring,

President, Pring Research

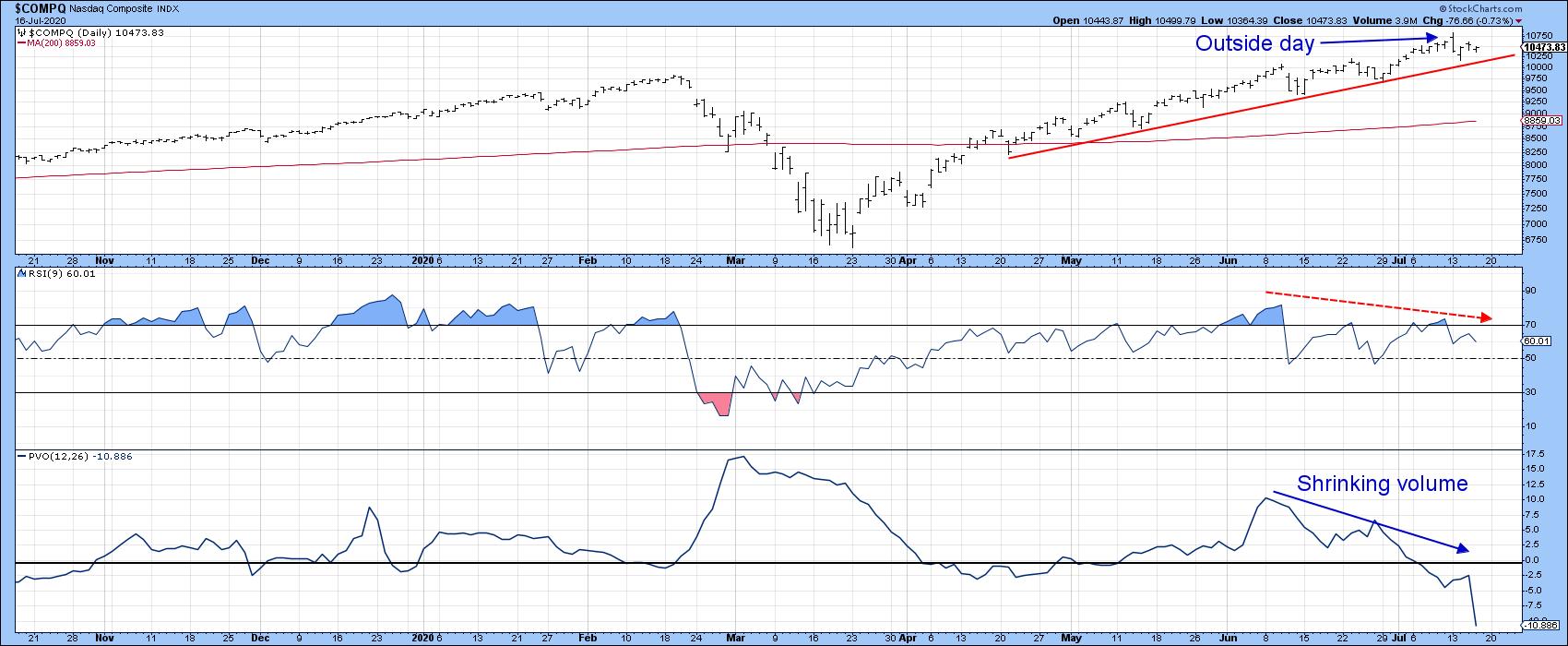

Technology About to Pause?

The undisputed king of sectors so far this year has been technology. This week's price action from the tech dominated NASDAQ Composite ($COMPQ), though, suggests that this leadership may be rotating elsewhere. Take Chart 1, for instance; it shows that Monday's price...

READ MORE

MEMBERS ONLY

These 3 Industries are Poised to Deliver Companies with Blowout Results

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I've been patiently waiting for the BIG breakout, the one that really kickstarts this group. I believe we just saw it on Friday. Health Care (XLV) definitively made its move after already recently providing some very bullish clues. After weeks and weeks of sideways action, in which the...

READ MORE

MEMBERS ONLY

Have Growth Stocks Topped?

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen takes a close look at the Nasdaq as well as individual growth stocks following last week's action. She also shares 5 small-cap stocks that look attractive, as well as a review of notable stocks that have...

READ MORE

MEMBERS ONLY

A BB Breakout or the Dreaded Head Fake?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There were a number of Bollinger Band squeeze plays over the last two weeks and also a number of breakouts. These breakouts are bullish until proven otherwise, but chartists should also be aware of the head fake. In his book, Bollinger on Bollinger Bands, John Bollinger puts it as follows:...

READ MORE