MEMBERS ONLY

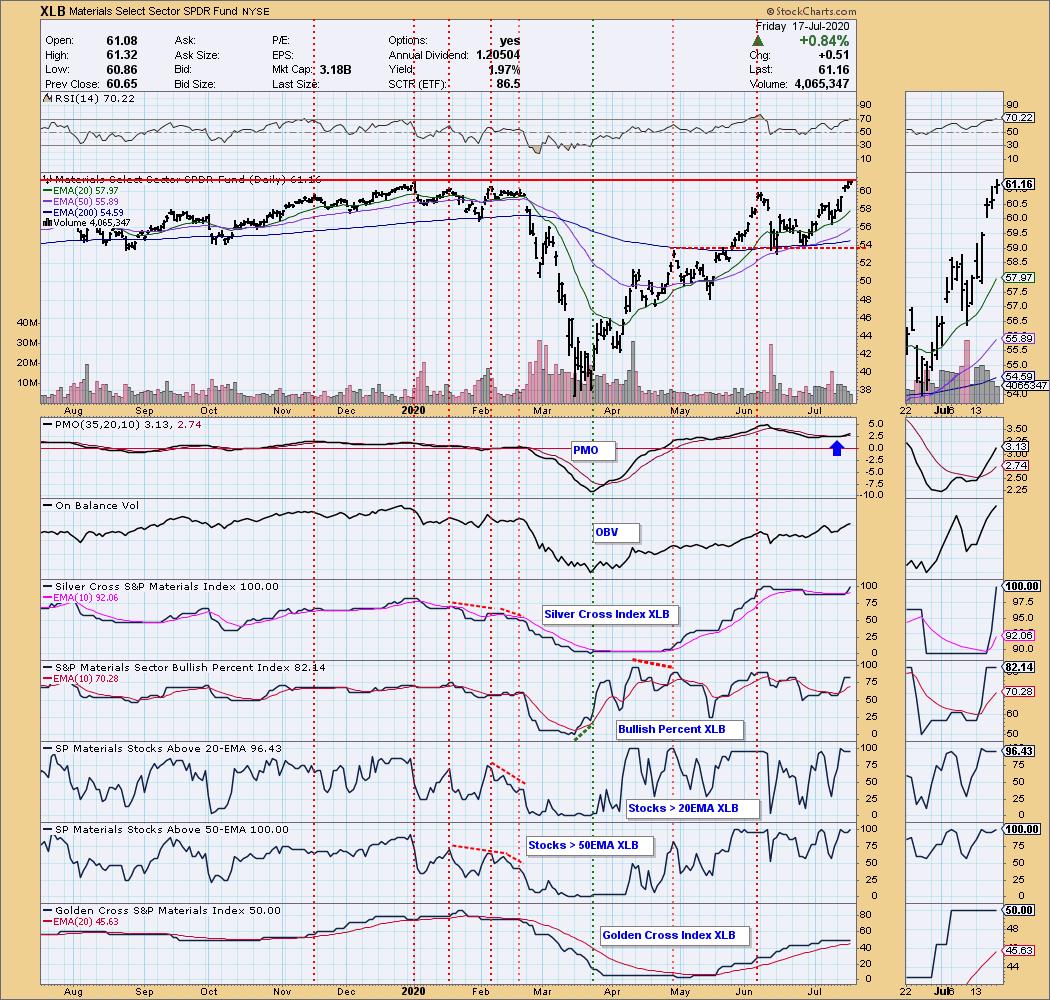

The "Diamonds" of the Materials Sector

by Erin Swenlin,

Vice President, DecisionPoint.com

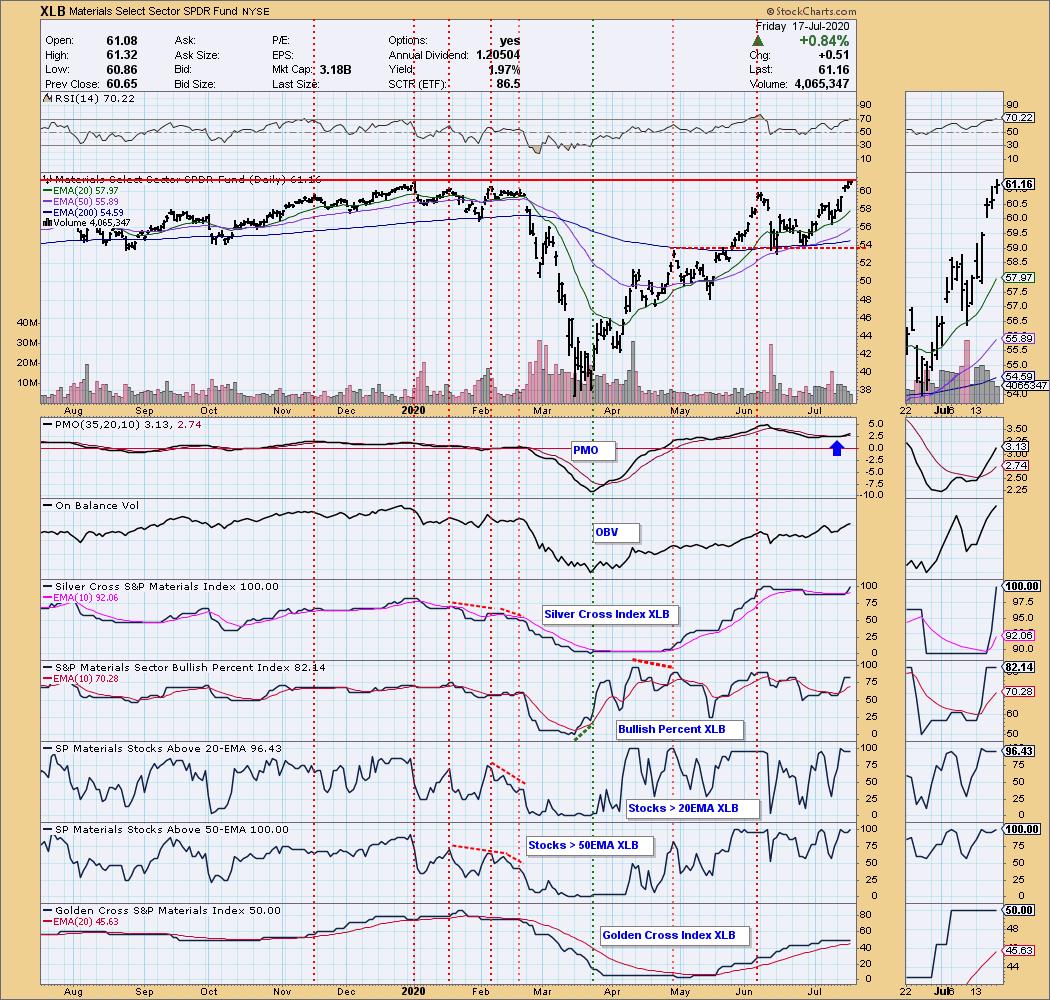

As part of my preparation of the "DecisionPoint Diamonds Report", I seek areas that are showing leadership, and the Materials sector has been doing just that. Materials was up 5.47% on the week, which was only second to Industrials at 5.87%. The "darling" of...

READ MORE

MEMBERS ONLY

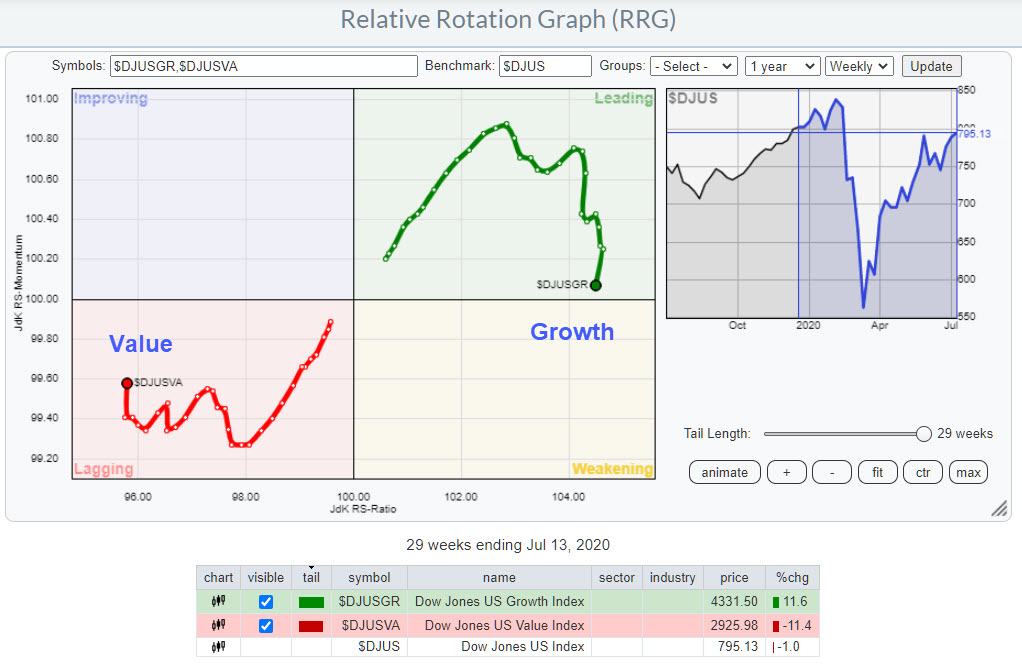

What About Growth vs. Value Going into the Second Half?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

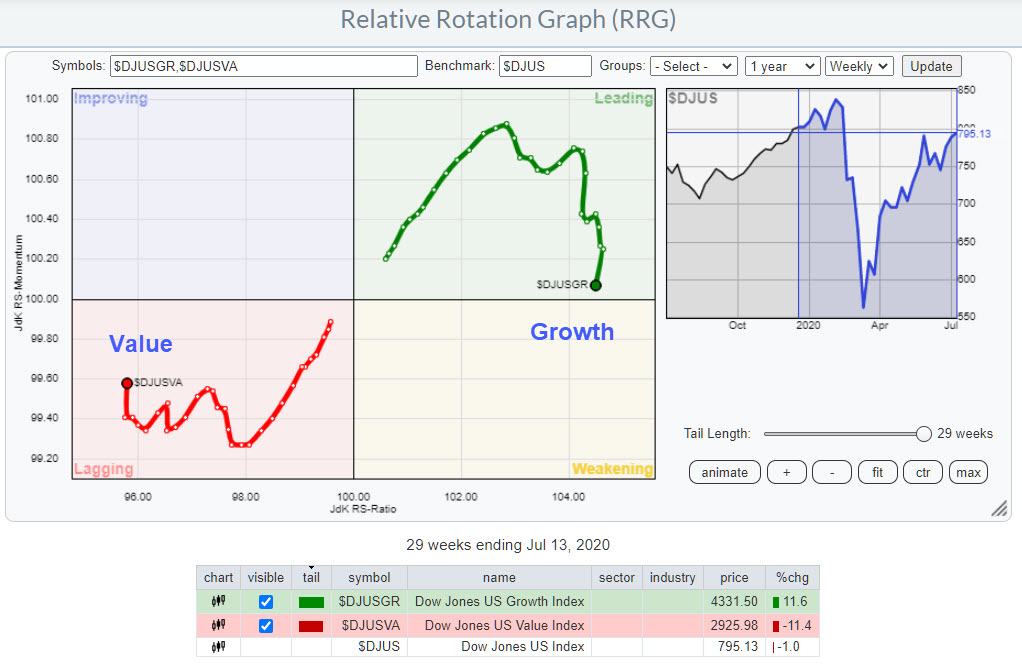

The last time Value took over from Growth was at the end of 2018, and even that was only for a short period going into and following the Christmas Crash. But that situation rapidly reversed a few weeks into 2019, when the uptrend in the Growth-Value ratio continued strongly.

If...

READ MORE

MEMBERS ONLY

Health Care Is Starting Another Leg Higher; Here Are A Few Trading Candidates To Consider

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Below is today's Daily Market Report (DMR) that I send to EarningsBeats.com members every day. Today's focus was definitely on health care (XLV). I've been waiting for a few months for its sideways consolidation to resolve and we're getting that now:...

READ MORE

MEMBERS ONLY

TRUCKERS LEAD TRANSPORTS HIGHER -- JB HUNT, OLD DOMINION, AND KNIGHT-SWIFT TRANSPORTATION HIT RECORD HIGHS -- C.H. ROBINSON IS TURNING UP...LANDSTAR MAY BE NEARING UPSIDE BREAKOUT

by John Murphy,

Chief Technical Analyst, StockCharts.com

RAILS AND TRUCKERS LEAD TRANSPORTS HIGHER... Wednesday's message showed the Dow Transports closing above their 200-day line for the first time since early June. Chart 1 shows them continuing to build on that upturn. Their relative strength ratio in the upper box has turned up as well, which...

READ MORE

MEMBERS ONLY

A Changing of the Guard? New Sector Leadership May Be Emerging

by Martin Pring,

President, Pring Research

* Technology About to Pause?

* New Blood is Starting to Emerge

* Two Fence Sitters

Technology About to Pause?

The undisputed king of sectors so far this year has been technology. This week's price action from the tech dominated NASDAQ Composite ($COMPQ), though, suggests that this leadership may be rotating...

READ MORE

MEMBERS ONLY

Overbought Names Begin Potential Topping Process

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I wrote this article for last Saturday's ChartWatchers newsletter, focusing on the overbought conditions rampant in mega cap technology and consumer names. Monday's selloff certainly changes the short-term look of most of these charts, potentially beginning the topping process I described below.

The next move higher...

READ MORE

MEMBERS ONLY

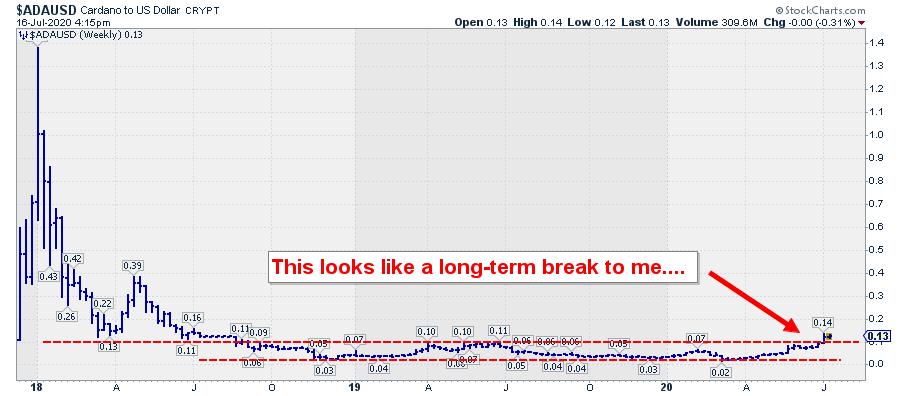

This Thing Has 70% Upside Potential...

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

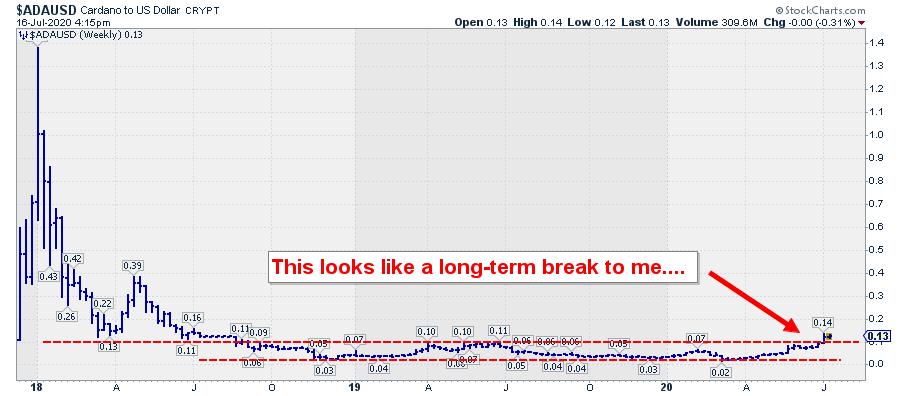

I got triggered to watch the chart printed above when I was scrolling through the pre-defined RRG groups.

This is a routine I go through on a regular basis; just flip through all pre-defined RRGs and see if I note any strange or particularly strong or weak rotations. Literally right...

READ MORE

MEMBERS ONLY

DP Show: New BUY Signal for the SPY!

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin discuss their outlooks for the market based on new signals and divergences popping up on the charts. Erin focuses in on the Dollar, Gold and Gold Miners. Carl brings his wisdom discussing Earnings outlooks that aren't in line with price...

READ MORE

MEMBERS ONLY

Granddad Russell 2000 Takes the Lead

Last week I did a piece called "Granny Retail Hangs Tough". At the time, I noted "On the weekly chart, XRT is above the 200-week moving average, while her husband, Russell 2000 (IWM) is not."

Also, at the time I wrote, "XRT is in a...

READ MORE

MEMBERS ONLY

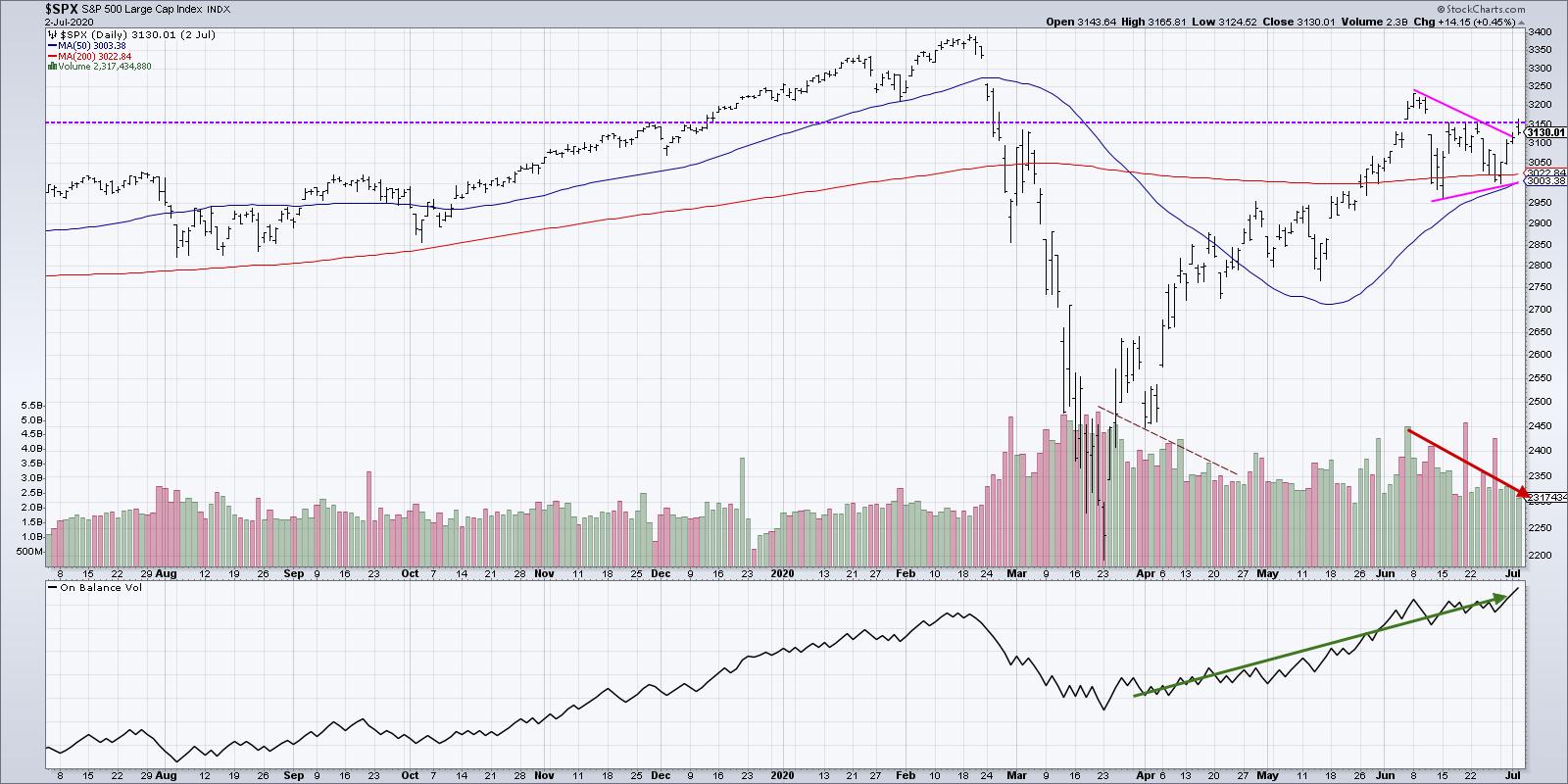

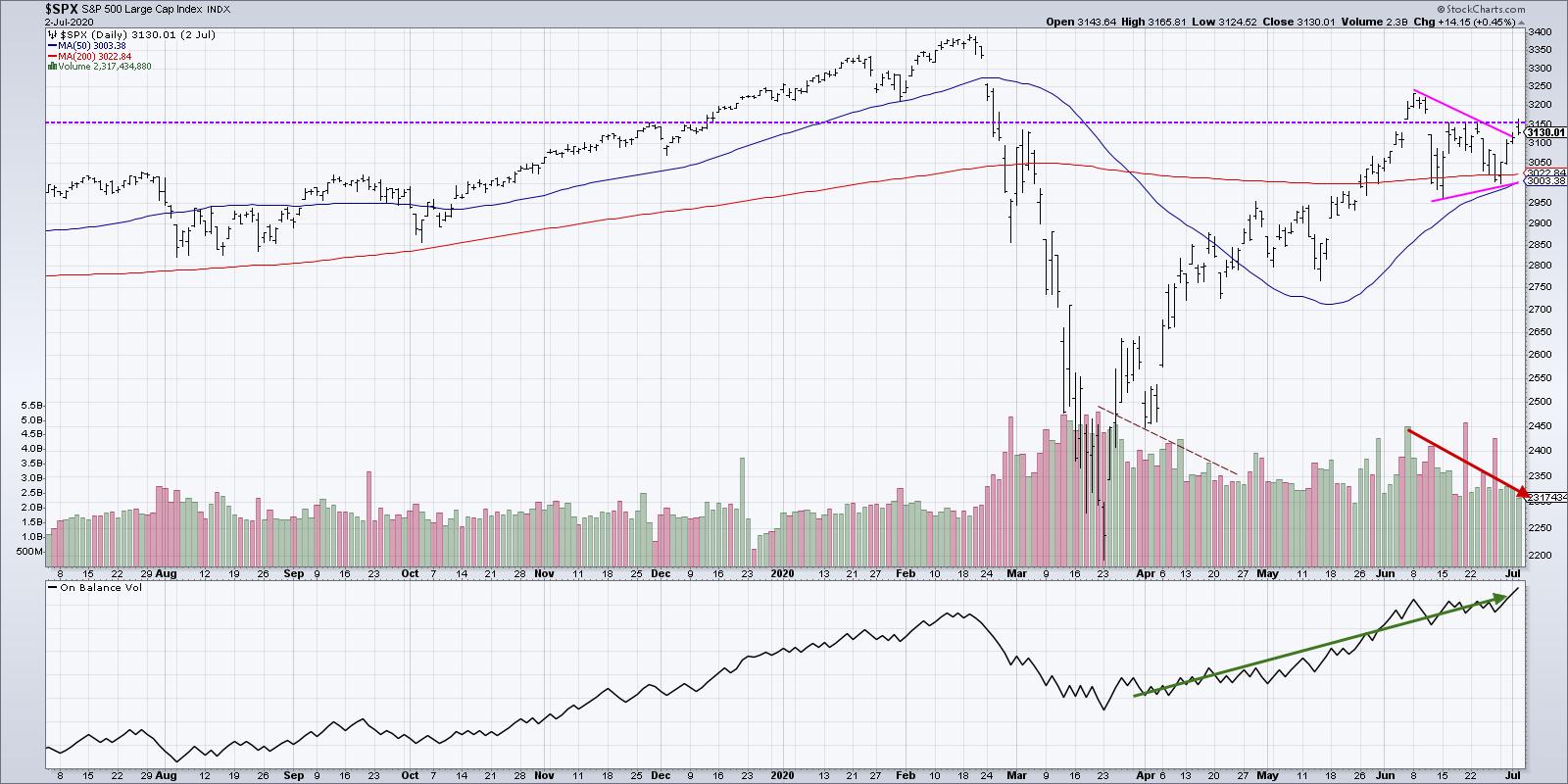

S&P 500 TESTS TOP OF RECENT RANGE -- RUSSELL 2000 AND DOW TRANSPORTS CLEAR 200-DAY LINES -- VALUE STOCKS GAIN GROUND -- HEALTHCARE HITS NEW RECORD -- MATERIAL STOCKS MAY BE NEXT

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 TESTS JUNE HIGH... Stocks gained more ground today with ten of eleven sectors in the black. Chart 1 shows the S&P 500 ending the day just below its early June intra-day high at 3233. Also encouraging was better participation by value stocks which have...

READ MORE

MEMBERS ONLY

Again with the Financial Sector?

Last night, I featured junk bonds (JNK). As it has been underperforming, I wanted to give a head's up in case it failed a key support area. However, it not only held over the 101 area, it rallied to close up .97%.

With risk appetite still a thing,...

READ MORE

MEMBERS ONLY

ENERGY, MATERIALS, INDUSTRIALS, AND HEALTHCARE LEAD STOCKS HIGHER -- CATERPILLAR AND DEERE ARE XLI LEADERS -- ALIGN TECH AND UNITEDHEALTH ARE XLV LEADERS -- STOCKS CLOSE STRONG

by John Murphy,

Chief Technical Analyst, StockCharts.com

CATERPILLAR AND DEERE HAVE A STRONG DAY...With technology stocks underperforming for the second day in a row, money flowed into cheaper parts of the market today. All eleven sectors closed higher with energy, materials, industrials and healthcare in the lead. Energy is benefiting from crude oil prices over $40,...

READ MORE

MEMBERS ONLY

Sector Spotlight: Charting Mid-Year Sector Rotation

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of Sector Spotlight, I spends the full show in line with StockCharts TV's theme of the week "Charting the Second Half," examining what may be in store for the markets in the next part of 2020. I look at the rotation on the...

READ MORE

MEMBERS ONLY

Time to Watch Risk Appetite Through Junk Bonds

With bank earnings the big buzz this week, here are some highlights to keep in mind.

Bank earnings are set to tank 69% year-over-year for the second quarter. But what's important here is not the expectations, but whether or not those expectations are exceeded.

Analysts are worried about...

READ MORE

MEMBERS ONLY

A NASDAQ 100 Throwover. Is the Uptrend Ending?

by Bruce Fraser,

Industry-leading "Wyckoffian"

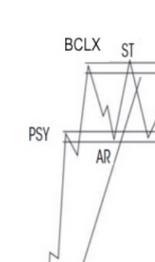

Financial markets are pushing up into the start of earnings season. In June, the S&P 500 and the Dow Jones Industrial Average accelerated into climactic exhaustion as end of quarter window dressing came to a conclusion. This set up a ‘Range-Bound' condition in these averages that continues...

READ MORE

MEMBERS ONLY

HEALTHCARE IS DAY'S STRONGEST SECTOR -- AND MAY BE READY TO RESUME LEADERSHIP ROLE -- HEALTHCARE LEADERS ARE LAB CORP, QUEST DIAGNOSTICS AND PERKINELMER -- S&P 500 TESTS ITS JUNE HIGH -- WHILE THE DOW TRADES ABOVE ITS 200-DAY LINE

by John Murphy,

Chief Technical Analyst, StockCharts.com

BUYING HEALTHCARE AGAIN... After taking a leadership role during March and April, healthcare stocks have essentially moved sideways over the last couple of months while the rest of the market has gained ground. The sector's recent underperformance can be seen by the falling XLV/SPX relative strength ratio...

READ MORE

MEMBERS ONLY

Will Truckers Live Up To Their Pre-Earnings Hype? This Week Provides Our First Clue

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

When a stock, industry group, or sector breaks out before earnings season, that's generally a signal that Wall Street is anticipating solid results. Whether the breakout is sustained, however, boils down to the actual earnings results. In the case of trucking ($DJUSTK), the breakout has been made. This...

READ MORE

MEMBERS ONLY

This Health Care Stock is Poised for a Breakout

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Price action has seen an Ascending Triangle formation in APOLLOHOSP.IN over the past several weeks. In this classically bullish formation, the 200-DMA appears to be acting as a proxy trend line.

The prices have tested the 200-DMA five times; any strong move above this could lead to a breakout....

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Displays Diminishing Momentum; RRG Chart has Only One Sector Comfortably in Leading Quadrant

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Indian equity markets went on to end their fourth week in a row with gains as the NIFTY extended its up move. However, unlike the previous week, the trading range narrowed down considerably and momentum appeared to be losing its strength as well. As compared to the 400-point trading...

READ MORE

MEMBERS ONLY

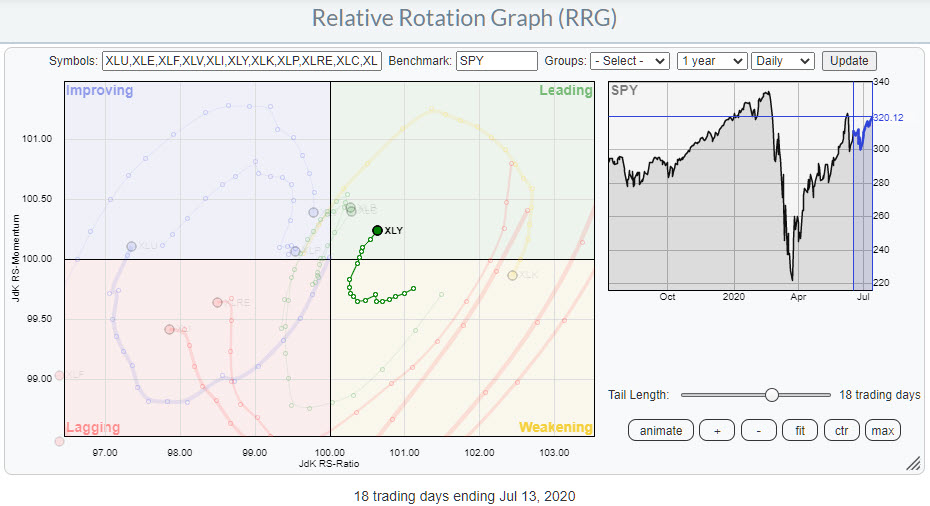

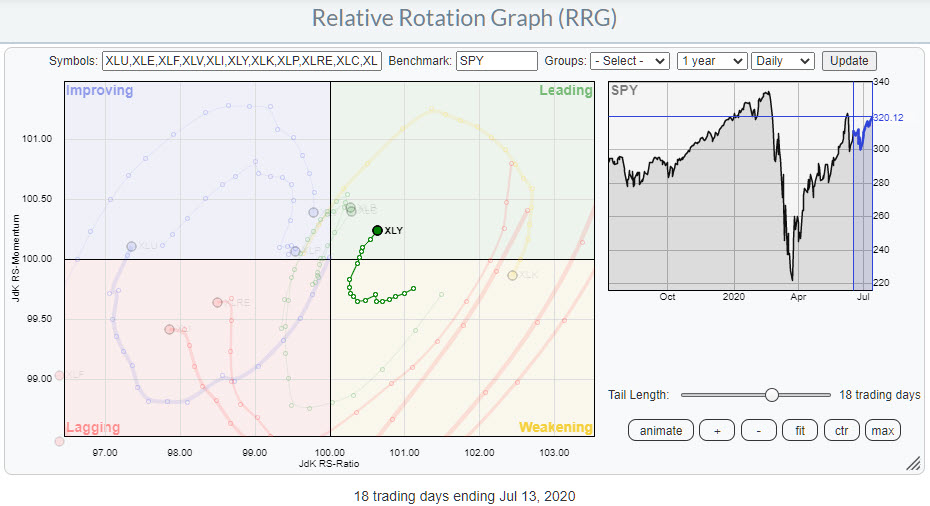

XLY Simultaneously Breaking to New Highs in Price and Relative Strength

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the daily Relative Rotation Graph for US sectors, the Consumer Discretionary sector rotated back into the leading quadrant last week, coming up from weakening. Generally, this is a positive/strong rotation as it reflects the second (or third, etc.) leg within a relative uptrend that is already underway.

Looking...

READ MORE

MEMBERS ONLY

"10 I'm Stalking" - Top Charts and Intriguing Trades (Week of 07.13.2020)

by Grayson Roze,

Chief Strategist, StockCharts.com

Every weekend, my "Sunday Portfolio Review"ends with the same rigorous search process. With my market evaluation and portfolio analysis routines complete, I turn my attention to the discovery phase.

This is the fun part. I sit down with all the results of the scans I've...

READ MORE

MEMBERS ONLY

Long-Term Trend Shifting in Favor of Gold

by John Murphy,

Chief Technical Analyst, StockCharts.com

Recent messages showing the ongoing bull market in gold (and its miners) have stressed that a weaker dollar and historically low global interest rates have pushed the price of gold to the highest level in nearly nine years. Yesterday's message showed gold rising faster than the world'...

READ MORE

MEMBERS ONLY

Earnings Season is Upon Us - And It's Going to Be a Wild Ride!

by John Hopkins,

President and Co-founder, EarningsBeats.com

Let me start right off the bat looking at two companies that reported earnings over the past week or so: FedEx (FDX) and Bed, Bath and Beyond (BBBY).

When FDX reported its numbers on July 1, the stock skyrocketed by 16%.

On the other hand, when BBBY reported its numbers...

READ MORE

MEMBERS ONLY

Stock Market Melt-Up Into Earnings Season

by Mary Ellen McGonagle,

President, MEM Investment Research

Will the markets crack as corporations report their second quarter earnings? In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen shares what to expect ahead of 2nd quarter numbers. She also explains how to take advantage of a Wall Street activity that's having a powerfully...

READ MORE

MEMBERS ONLY

Market Offers New Growth Amidst the Dead Wood

Perhaps the most incredible aspect of the market, for traders, is the ever-changing landscape of investment opportunities.

I spend a lot of time telling followers that the rules have changed. The relationships experienced traders hold dear have changed. The metrics have changed. The world has changed. The younger generation has...

READ MORE

MEMBERS ONLY

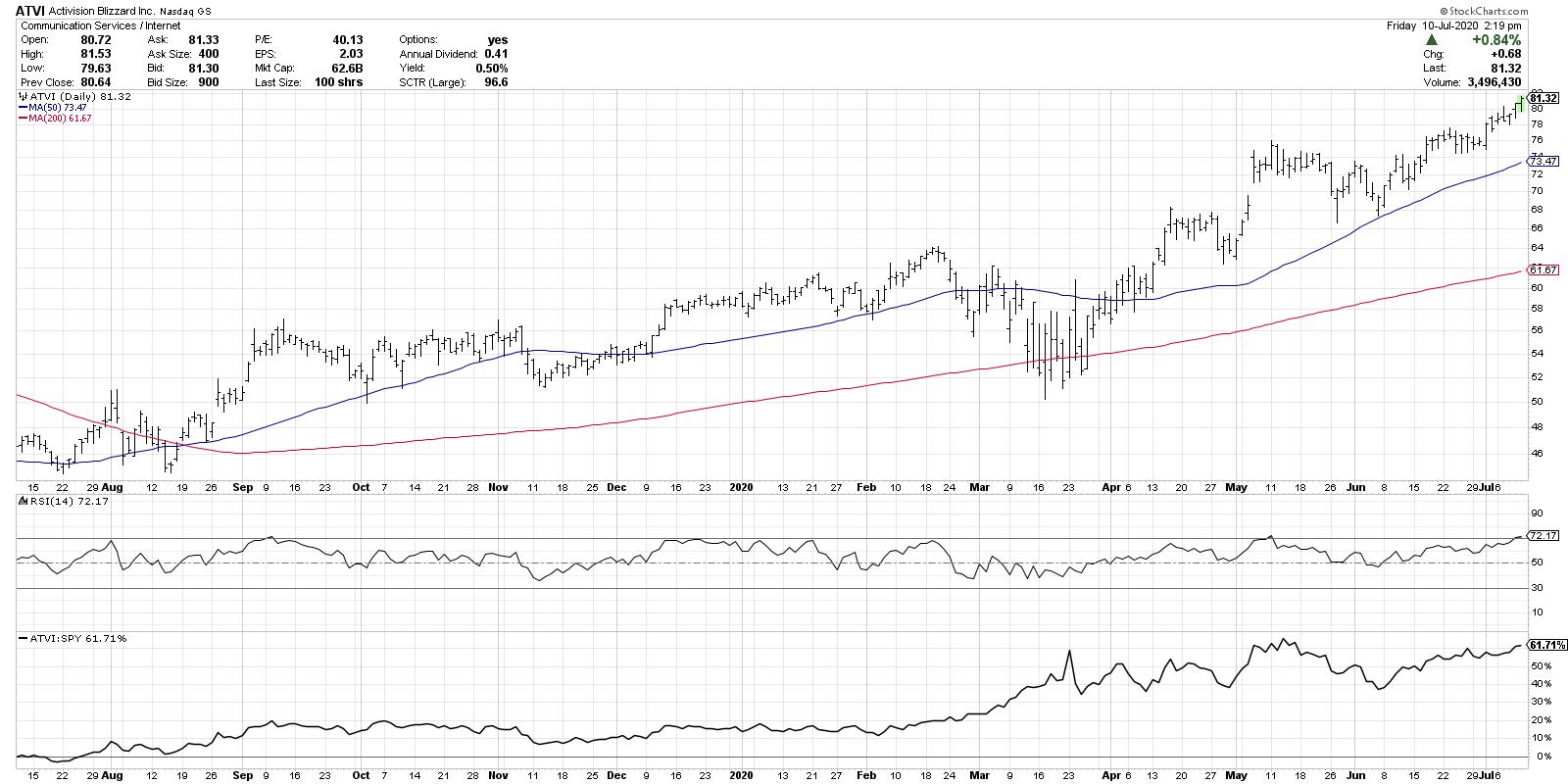

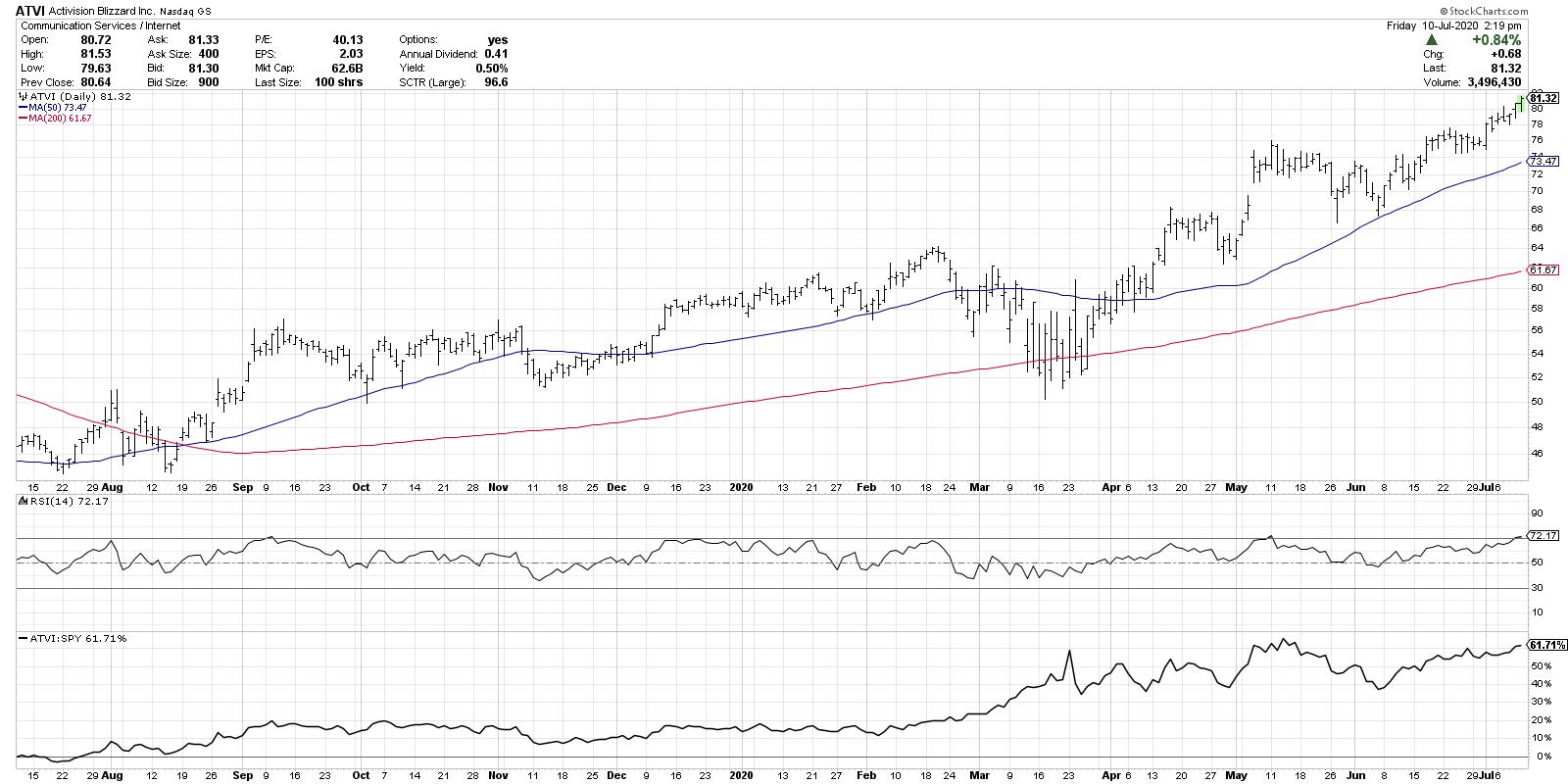

Overbought Means Up A Lot

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I've received many questions recently on stocks experiencing overbought conditions, from stocks like Activision Blizzard (ATVI), which recently broke above RSI 70, to Amazon (AMZN), which has an RSI that has breached 80.

What does it mean to be overbought? Is that a sell signal? What do I...

READ MORE

MEMBERS ONLY

LONG-TERM TREND SHIFTING IN FAVOR OF GOLD -- GOLD/DOW RATIO MAY BE BOTTOMING -- RATIO OF GOLD MINERS TO SPX IS EVEN STRONGER

by John Murphy,

Chief Technical Analyst, StockCharts.com

LONG-TERM TREND APPEARS TO BE SHIFTING TO GOLD OVER STOCKS... Recent messages showing the ongoing bull market in gold (and its miners) have stressed that a weaker dollar and historically low global interest rates have pushed the price of gold to the highest level in nearly nine years. Yesterday'...

READ MORE

MEMBERS ONLY

StockChartsACP v1.0 Has Arrived! Here's What You'll Find In The New Version Of Our Interactive, Full-Screen Advanced Charting Platform

by Grayson Roze,

Chief Strategist, StockCharts.com

3 years, 3 months and 29 days.

That's how long I've been waiting to write this article. Seriously – I took the time to go back through my notes and calendars to confirm it, right down to the day.

Now I know many of you have been...

READ MORE

MEMBERS ONLY

From The Mailbag: When Should I Chase A Gap And When Should I Wait For A Gap Fill?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

This is a question directly from one of our EarningsBeats.com members and it honestly goes right to the heart of my trading strategy, so I thought it was a great question to answer and share with everyone. Because I deal so closely with earnings, gaps are a huge part...

READ MORE

MEMBERS ONLY

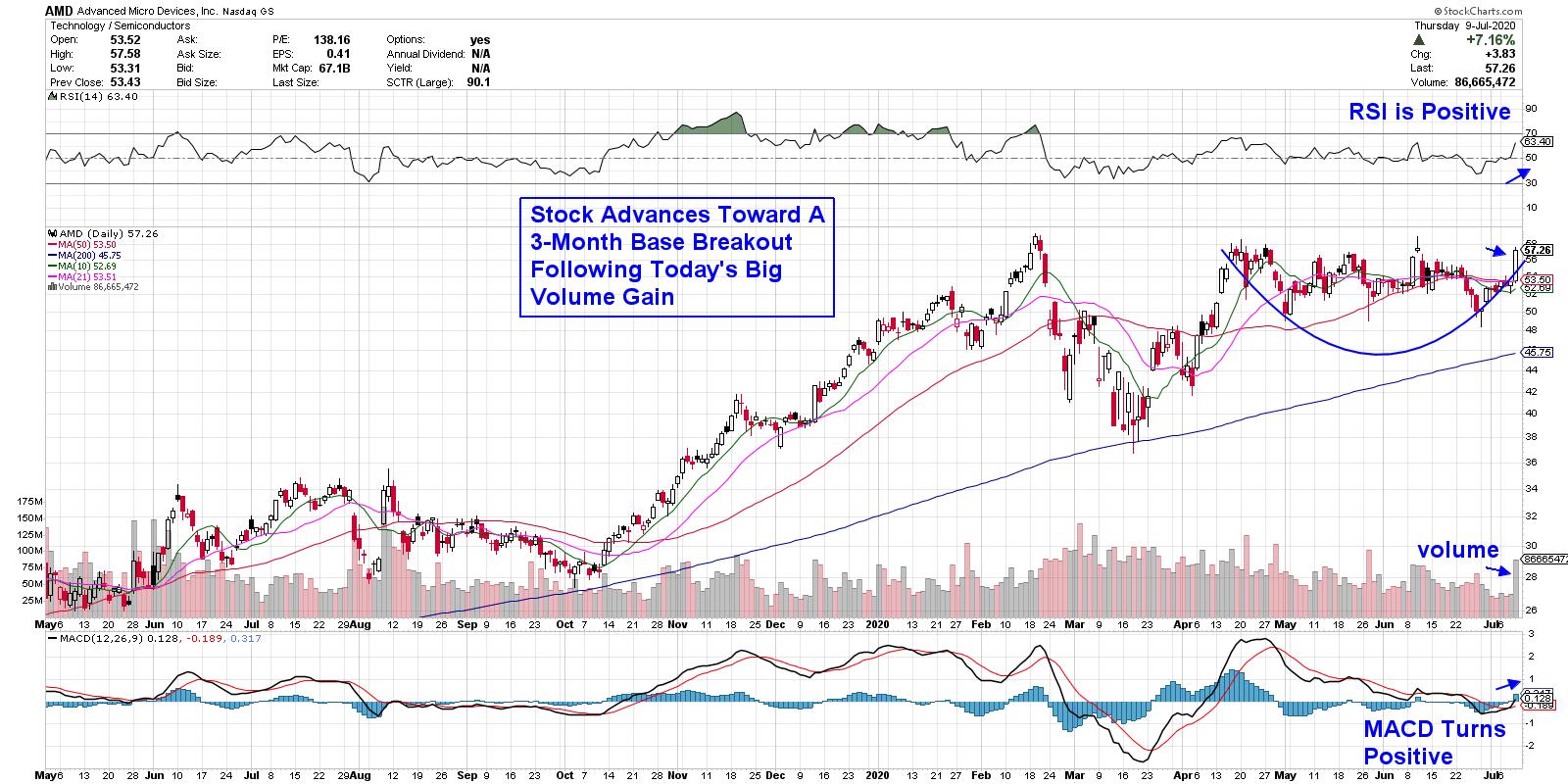

Bullish Action Points to a New Uptrend for this Historical Leader

by Mary Ellen McGonagle,

President, MEM Investment Research

We're in an unprecedented period where a select subset of sectors is outperforming the markets by a very wide margin. And, while my work shows that most of the big winners from these select areas have much more upside, many investors may find it hard to initiate a...

READ MORE

MEMBERS ONLY

A WEAKER DOLLAR IS HELPING TO BOOST GOLD -- BUT GOLD IS ALSO RISING FASTER THAN MAJOR FOREIGN CURRENCIES ON CONCERNS ABOUT GLOBAL ECONOMY -- INVESTORS MAY ALSO BE BUYING GOLD TO HEDGE AGAINST AN UNCERTAIN STOCK MARKET

by John Murphy,

Chief Technical Analyst, StockCharts.com

GOLD VERSUS THE DOLLAR... The generally inverse relationship between gold and the U.S. Dollar is one of the best known and reliable intermarket relationships. Part of the reason is that gold is traded in U.S. dollars. Another part is due to the fact that gold is often preferred...

READ MORE

MEMBERS ONLY

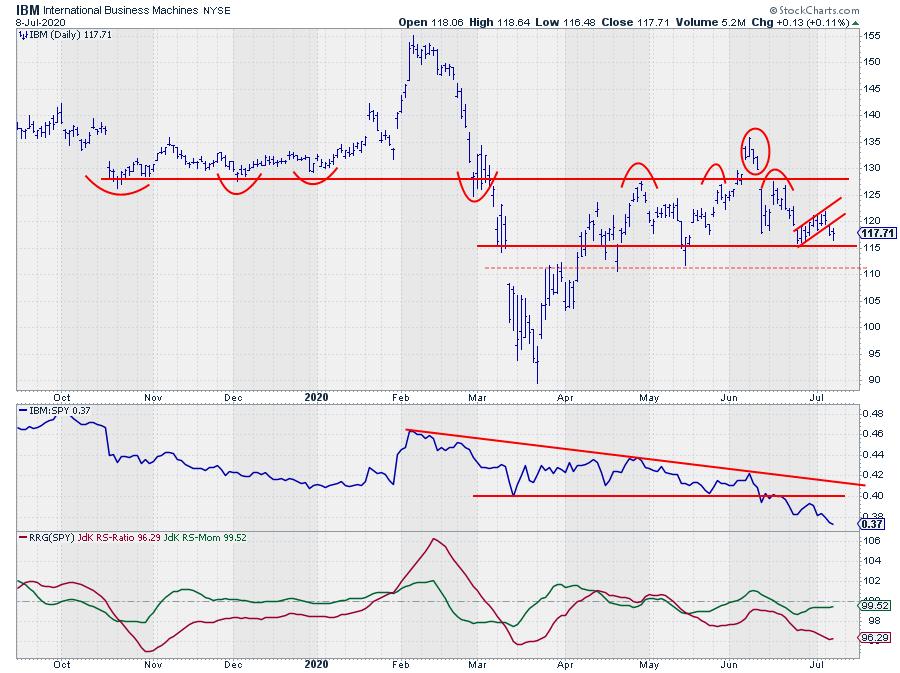

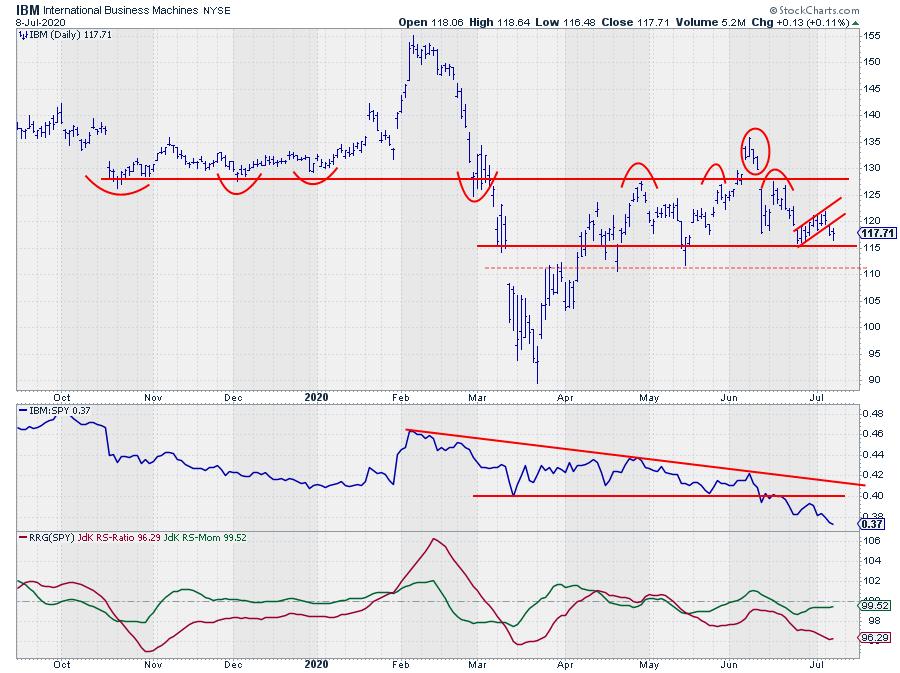

This BIG (BLUE) Tech Stock Is On The Verge Of Breaking Lower

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

There is no doubt that the technology sector is still the strongest segment in the US stock market, but, in the near term, it is losing some of its relative momentum, as you can see on the daily Relative Rotation Graph for US sectors. One of the stocks in that...

READ MORE

MEMBERS ONLY

Price IS the Ultimate Indicator

by Dave Landry,

Founder, Sentive Trading, LLC

In this edition of Trading Simplified, Dave is pleased to that announce his indicators/plugin are now available on the StockCharts.com Advanced Charting Platform (StockChartsACP). Dave presents an explanation on what his indicators are and how they are constructed. He also answers a popular question from a viewer: "...

READ MORE

MEMBERS ONLY

Granny Retail Hangs Tough

The malls were high risk before COVID-19, given the number of bankruptcies of chain stores such as Pier One (PIRRQ) and Toy "R" Us. Online shopping was already leading malls to become like ghost towns. Now, with COVID-19, one would expect the high risk to go to full...

READ MORE

MEMBERS ONLY

GOLD SPDR REACHES AN EIGHT-YEAR HIGH -- ITS MINERS ARE ALSO HITTING MULTI-YEAR HIGHS -- SILVER IS RALLYING AS WELL -- ITS MINERS ARE LEADING THE COMMODITY HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

GOLD SPDR REACHES ANOTHER EIGHT-YEAR HIGH...Gold prices are on the rise again. The monthly bars in Chart 1 show the Gold Shares SPDR (GLD) rising to the highest level since 2012. The August gold contract has risen to $1820 and appears headed toward its 2011 peak at $1923. Gold...

READ MORE

MEMBERS ONLY

Island Bottom, Momentum and Buffett

Rare to see an island bottom. However, the one in UNG, the ETF for natural gas, had a classic one. After making new all-time lows, an island confirmation suggests a reversal of the downtrend.

But that's not all. Warren Buffett bought Dominion Energy (D), a company that heats...

READ MORE

MEMBERS ONLY

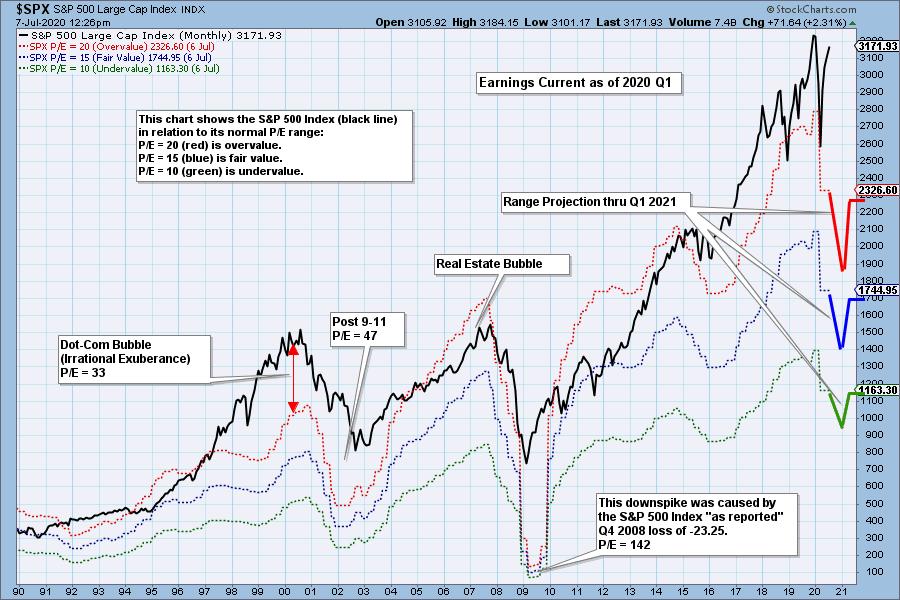

S&P 500 2020 Q1 Earnings: Lies, Damned Lies, and Earnings Estimates

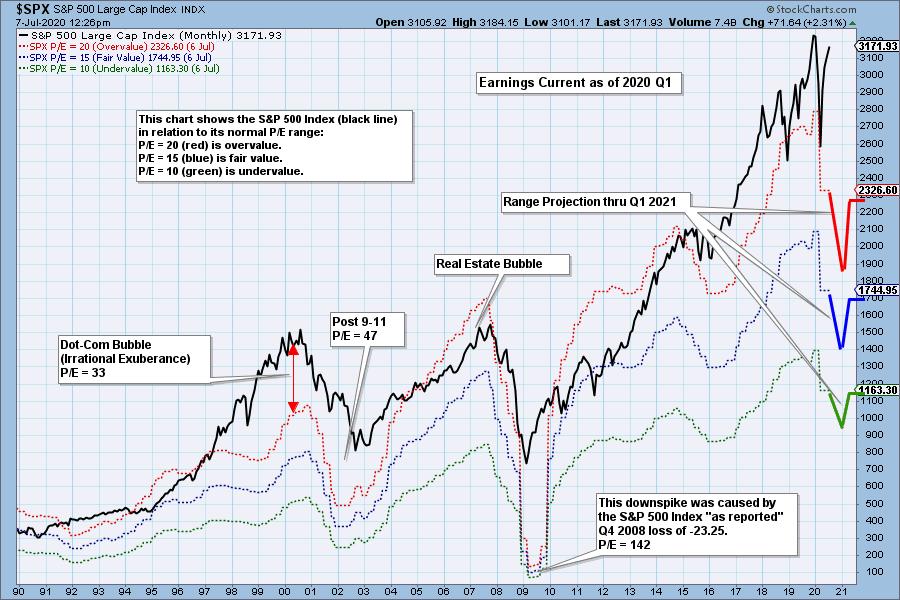

by Carl Swenlin,

President and Founder, DecisionPoint.com

The S&P 500 preliminary earnings results for 2020 Q1 are out, and based upon GAAP (Generally Accepted Accounting Principals) earnings, the S&P 500 is far above its normal value range. The following chart shows us the normal value range of the S&P 500 Index,...

READ MORE

MEMBERS ONLY

Sector Spotlight: Why 322 is Important for SPY

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The first half of 2020 is "done and dusted." On this episode of Sector Spotlight, I start with a quick look back at the performance and rotations for asset classes and Sectors last week. Then, I take a closer look into the long-term trends using monthly charts in...

READ MORE

MEMBERS ONLY

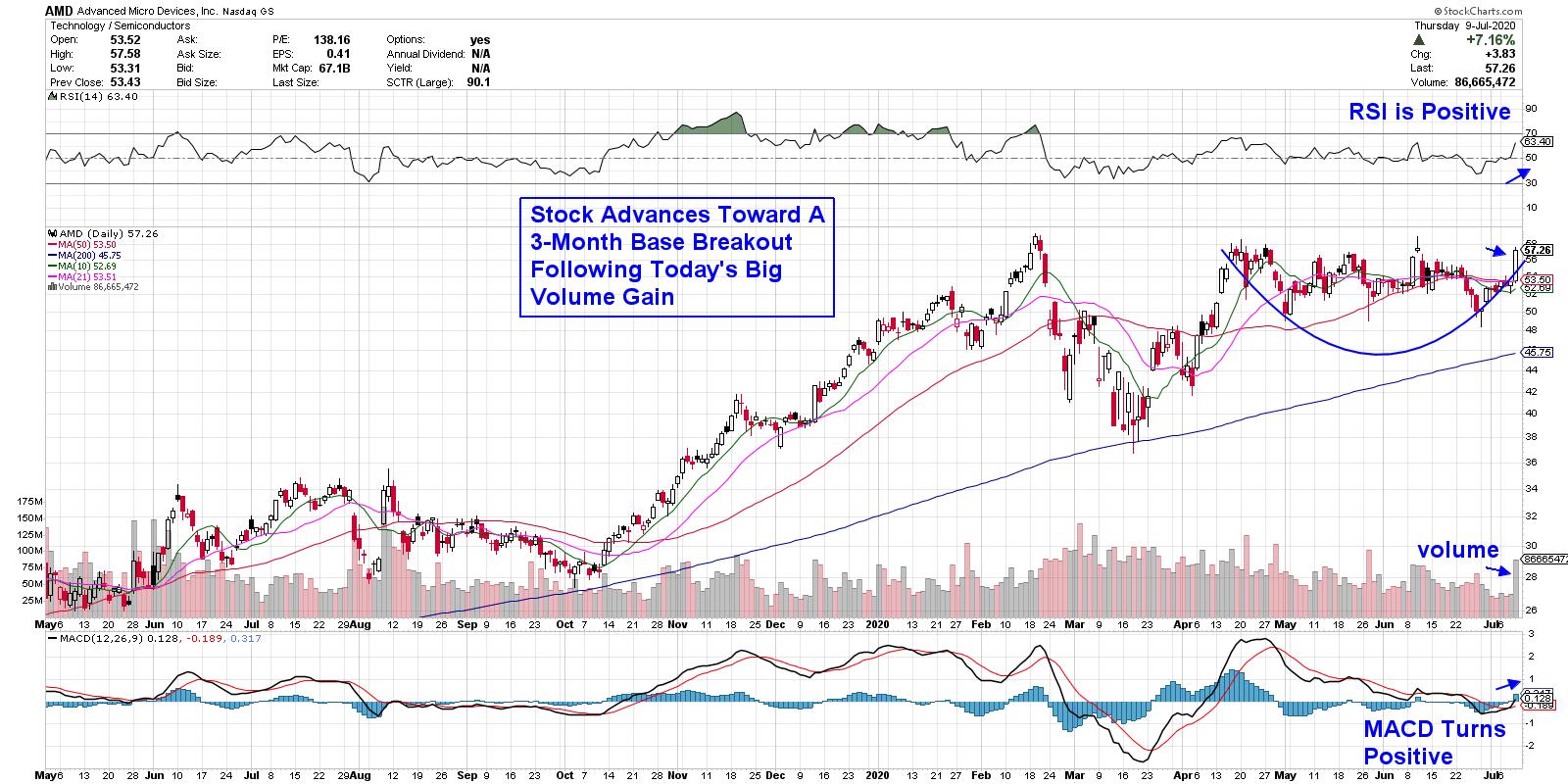

Introducing "The Mindful Six" Stocks Threatening Breakouts

by David Keller,

President and Chief Strategist, Sierra Alpha Research

The S&P 500 index has remained in consolidation mode, spending the shortened holiday week in a rally back to the upper end of the recent trading range. Last week on The Final Bar, I announced "The Mindful Six", a group of six stocks that I feel...

READ MORE

MEMBERS ONLY

Silver May Be Close to a Major Breakout

by Martin Pring,

President, Pring Research

* Silver has been Range-Bound - But is That About to End?

* Silver Shares Starting to Perk Up

* Silver Bottoming Against Gold?

Silver has been Range-Bound - But is That About to End?

Gold has been in a strong bull market recently, which has eclipsed the performance of the gray metal....

READ MORE