MEMBERS ONLY

NASDAQ IS FIRST INDEX TO CLEAR ITS 200-DAY LINE -- STRONG BIOTECH GROUP LEADS HEALTHCARE HIGHER-- AMAZON.COM LEADS CONSUMER CYCLICALS

by John Murphy,

Chief Technical Analyst, StockCharts.com

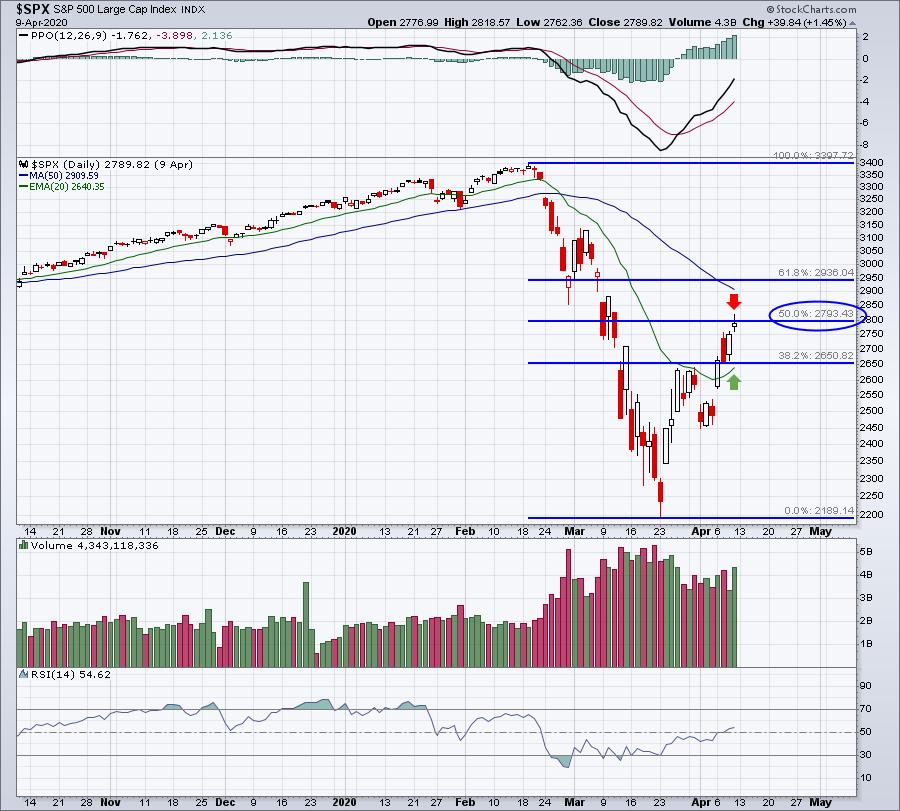

STOCKS EXTEND APRIL RALLY...Stocks ended the week on a strong note to extend their April rally. The daily bars in Chart 1 show the S&P 500 climbing 2.6% on Friday to close just above its 50-day average at 2863; and slightly above its late February broken...

READ MORE

MEMBERS ONLY

Week Ahead: Loss Of Momentum May Be a Slight Worry; RRG Chart Shows These Sectors Languishing

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After a sharp technical pullback in the week before this one, the Indian equities continued with the extension of the pullback, but on a very modest note. The trading range over the past five days remained broad, as the NIFTY oscillated in a 500-point range but kept the net incremental...

READ MORE

MEMBERS ONLY

Is Technology the New Defensive Sector?

by Erin Swenlin,

Vice President, DecisionPoint.com

While co-hosting the WealthWise Women show with me yesterday, Mary Ellen McGonagle said something that got my attention and filled me with intrigue. To summarize, she said that she was finding that the Technology sector is becoming more of a defensive one in the face of the coronavirus. That is...

READ MORE

MEMBERS ONLY

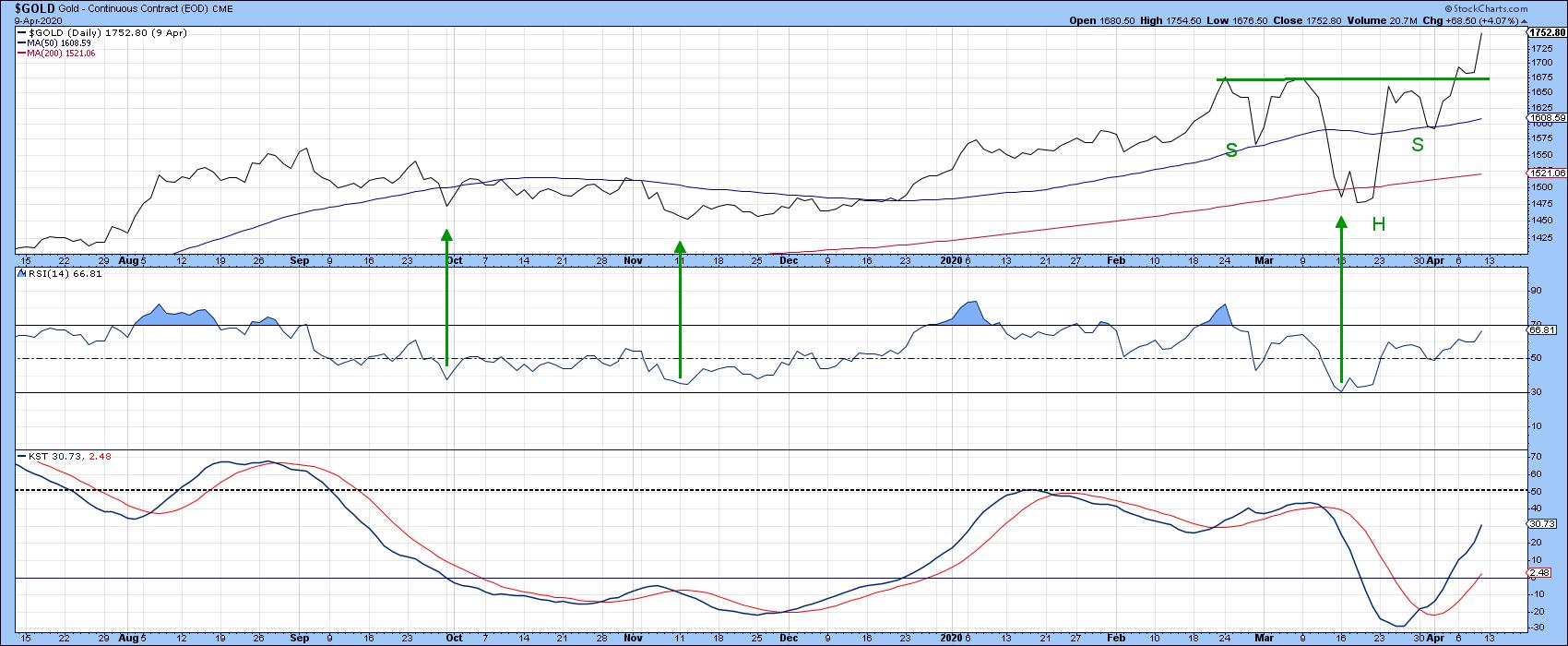

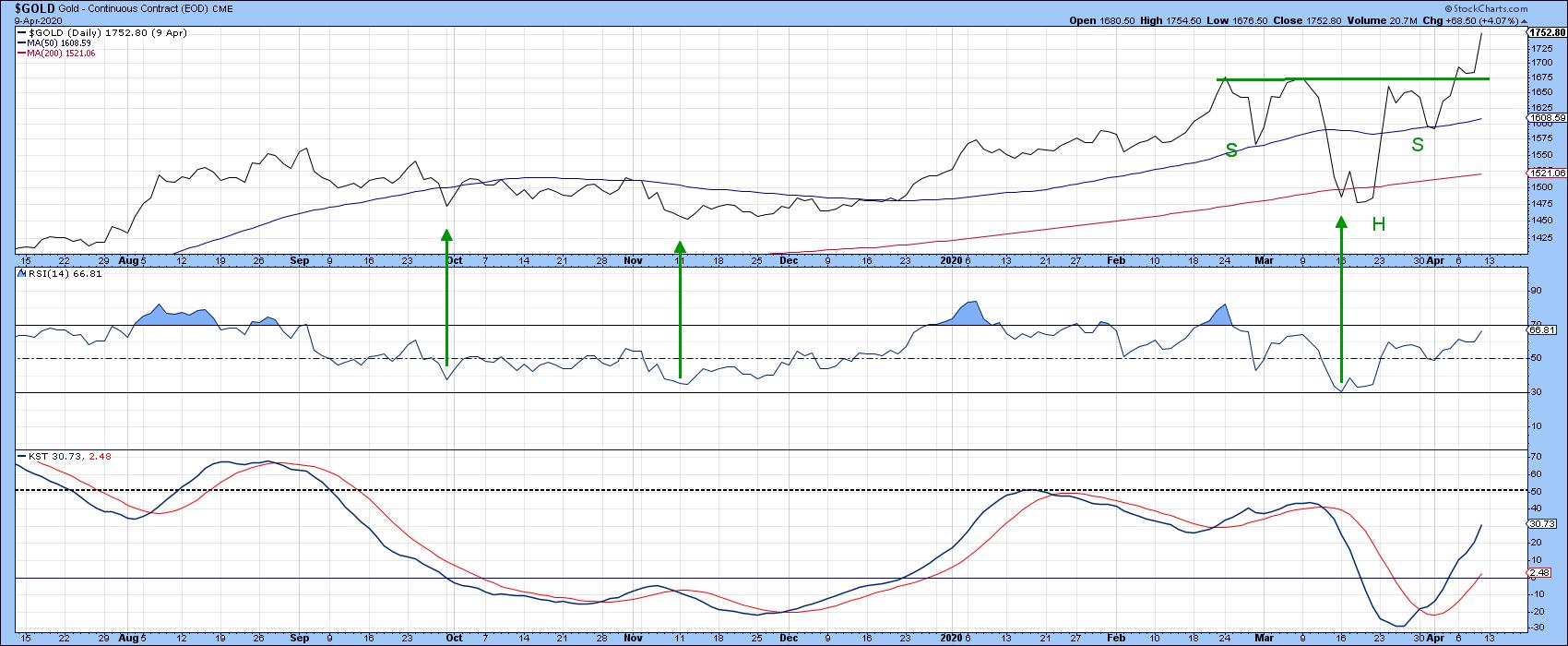

A Rising Gold Market Says It May Soon Be Time to Cover Those Commodity Shorts

by Martin Pring,

President, Pring Research

History tells us that, at major turning points for commodities, there is a strong, albeit imprecise, tendency for the gold price to have preceded that reversal. Gold generally leads because a rising price anticipates inflation, while a falling one anticipates deflation. This idea is represented by the rightward sloping solid...

READ MORE

MEMBERS ONLY

Bullish Signals Abound!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the current state of the broader markets as companies begin reporting their Q1 results. She also highlights where the current strength is in the markets and provides insights into big name stocks that reported earnings.

This video...

READ MORE

MEMBERS ONLY

Step Into The Heart Of Finance In "The Big Board" - An Exclusive, Behind-The-Scenes Tour Of The NYSE Trading Floor

by Grayson Roze,

Chief Strategist, StockCharts.com

Hello Fellow ChartWatchers!

This week, it's story time.

This past December, right in the midst of the holiday rush and the endless festivities of the season, a few of us from the StockCharts team put down the gift wrap, packed up our suitcases and flew across the country...

READ MORE

MEMBERS ONLY

Are You "Fed-Up" Yet? If Not, You Should Be

by John Hopkins,

President and Co-founder, EarningsBeats.com

Some promising news on a drug from Gilead Sciences (GILD) to help those with the coronavirus came out on Thursday after the market closed, which resulted in a big move in futures and a solid end to the week as traders got excited about the prospects of making progress on...

READ MORE

MEMBERS ONLY

Comparing Today's Market with the 1970s

Many are calling the recent market activity similar to the Great Depression of the 1930s. And clearly, there are some comparisons.

But what did not exist in the 1930's was this level of QE.

During 1932, with congressional support, the Fed purchased approximately $1 billion in Treasury securities....

READ MORE

MEMBERS ONLY

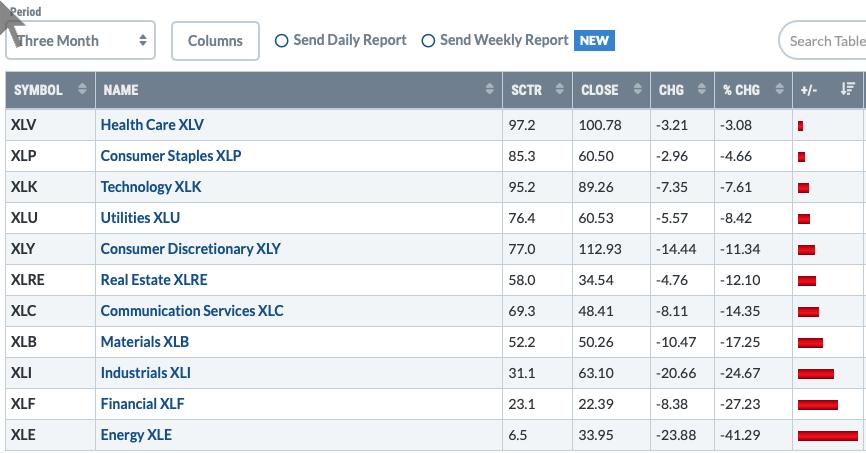

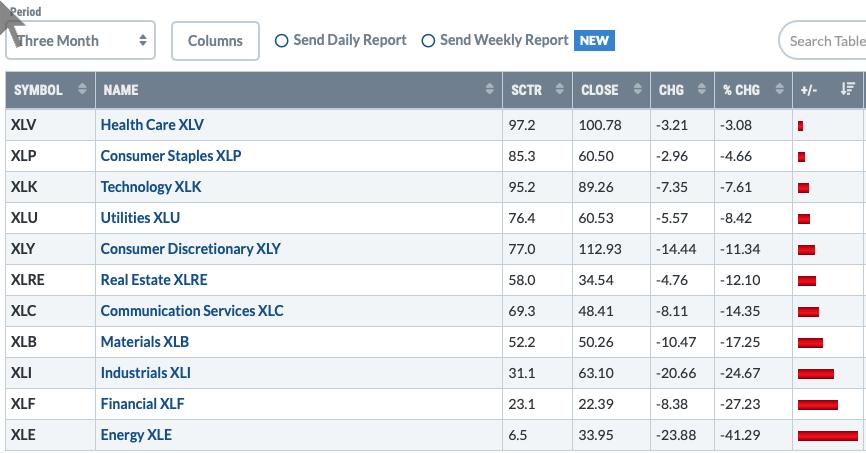

A Few Get Back to Positive, but Many Remain Beaten Down

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

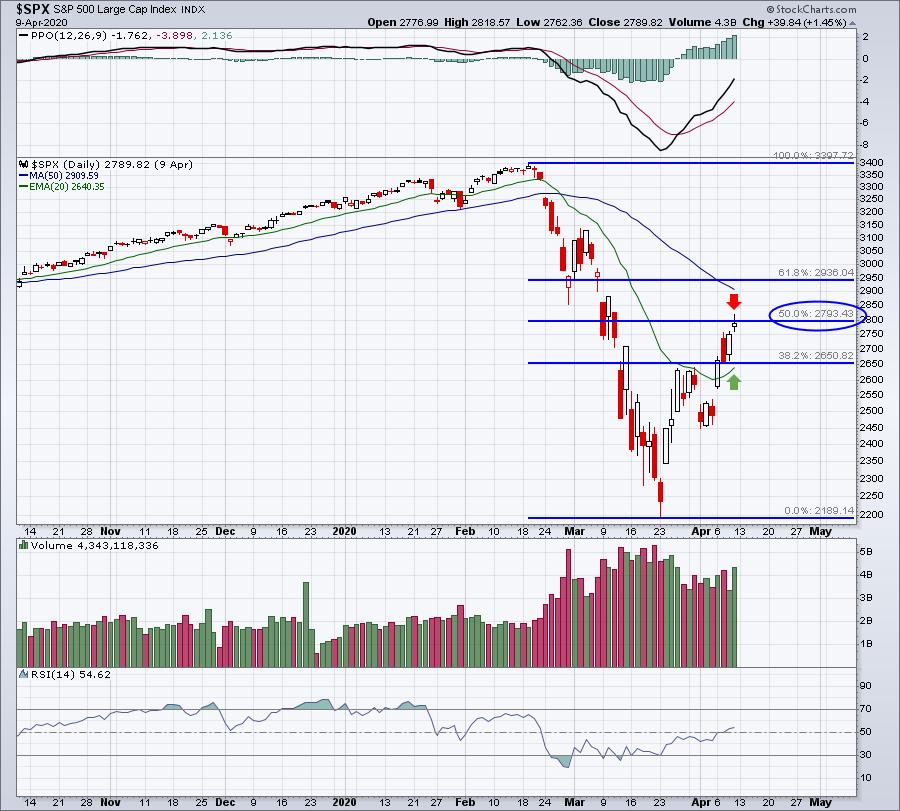

With a surge over the last 18 days, the S&P 500 reclaimed the 50-day moving average for the first time since February 21st. The move is truly remarkable, but the index remains well below the falling 200-day SMA. Moreover, a 28.5% surge in 18 days recovered just...

READ MORE

MEMBERS ONLY

This Hasn't Been More Crucial In The 12 Years Since 2008: ChartPack Update #27 (Q1 / 2020)

by Gatis Roze,

Author, "Tensile Trading"

It's a new age. On March 25th, StockCharts TV held a sensational one-hour summit with 13 commentators focused on "Navigating the Bear Market". What came afterwards was equally big news. StockCharts made the commentators' charts available to download directly into your account together as a...

READ MORE

MEMBERS ONLY

STOCKS OFF TO A STRONG START -- WITH ENERGY, FINANCIALS, INDUSTRIALS, AND MATERIALS LEADING IT HIGHER -- GOLD IS EXPERIENCING SOME PROFIT-TAKING

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK INDEXES TEST SOME MOVING AVERAGE LINES... Today's strong price action suggests that stock indexes are trying to extend their April rebound. All major stocks got off to strong start. Chart 1 shows the Dow Industrials rising more than 2% today and nearing a test of its 50-day...

READ MORE

MEMBERS ONLY

Here Are The Two Best ChartLists I've Ever Created

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The volatility has been extreme and the back and forth action has been dizzying at times. But there have been a couple common denominators throughout this 7-8 week up-and-down roller coaster ride that allow us to improve our odds of trading success. And all the tools you need are right...

READ MORE

MEMBERS ONLY

Three Indices Took the Blue Pill - One Took the Red

We have been here before. Sister Semiconductors (SMH) rocks the house, while her siblings and grandparents lag. Today, the disparity was palpable.

SMH closed up 2.71%.

The Russell 2000 IWM closed down .86%.

Regional Banks KRE closed down 3.68%.

Granny Retail fell by .51%.

In the last several...

READ MORE

MEMBERS ONLY

A Rising Gold Market Says It May Soon Be Time to Cover Those Commodity Shorts

by Martin Pring,

President, Pring Research

History tells us that, at major turning points for commodities, there is a strong, albeit imprecise, tendency for the gold price to have preceded that reversal. Gold generally leads because a rising price anticipates inflation, while a falling one anticipates deflation. This idea is represented by the rightward sloping solid...

READ MORE

MEMBERS ONLY

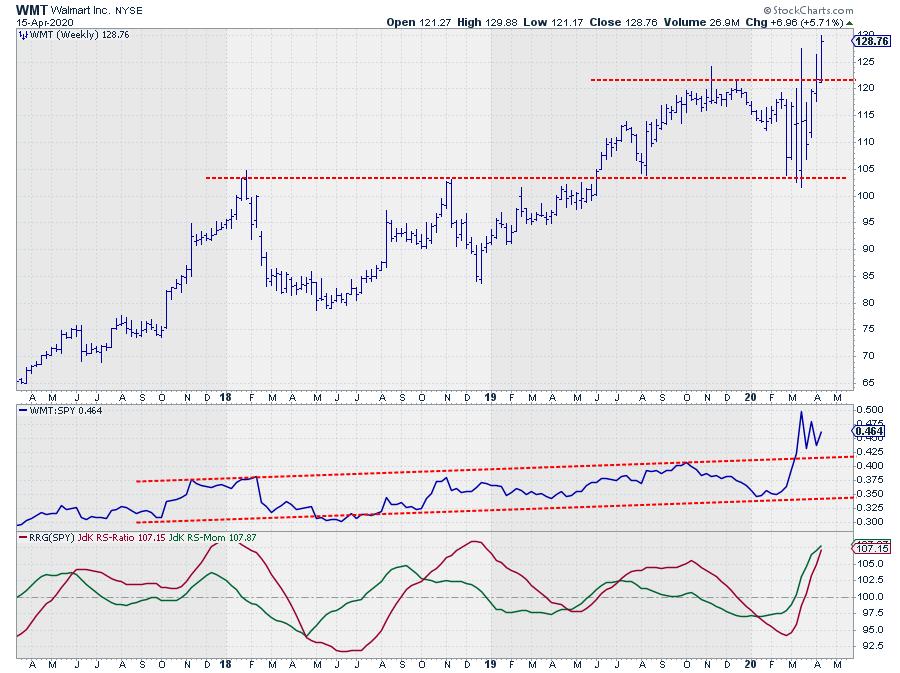

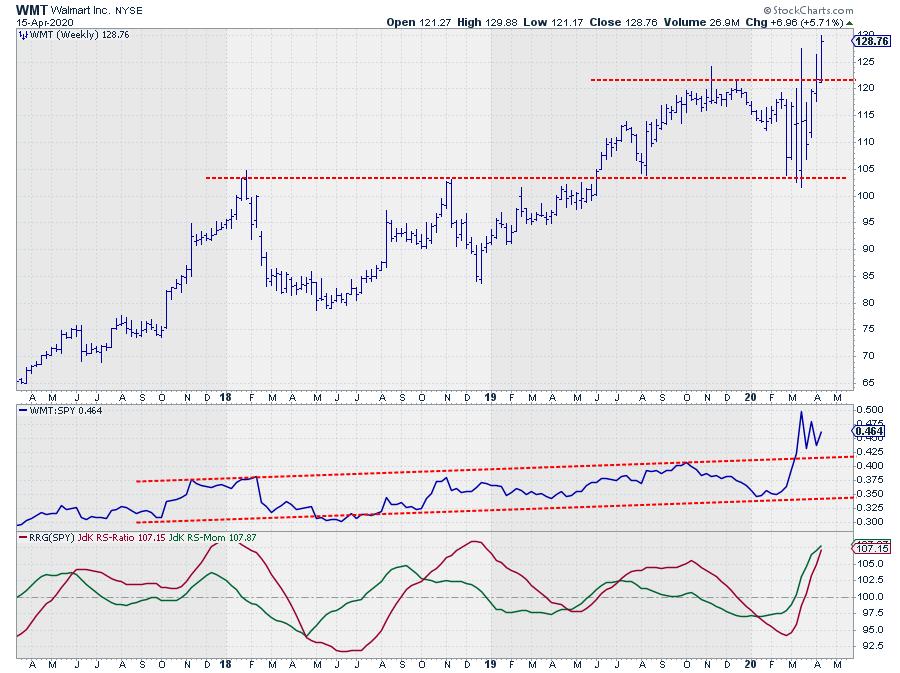

No Crisis For WMT as It Pushes To New Highs

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

No matter what sort of general market regime we are in, there are always a few that go the other direction.

From 2017 to 2019, when the S&P surged, GE went completely the other way and more than halved. At the moment, we have a market that is...

READ MORE

MEMBERS ONLY

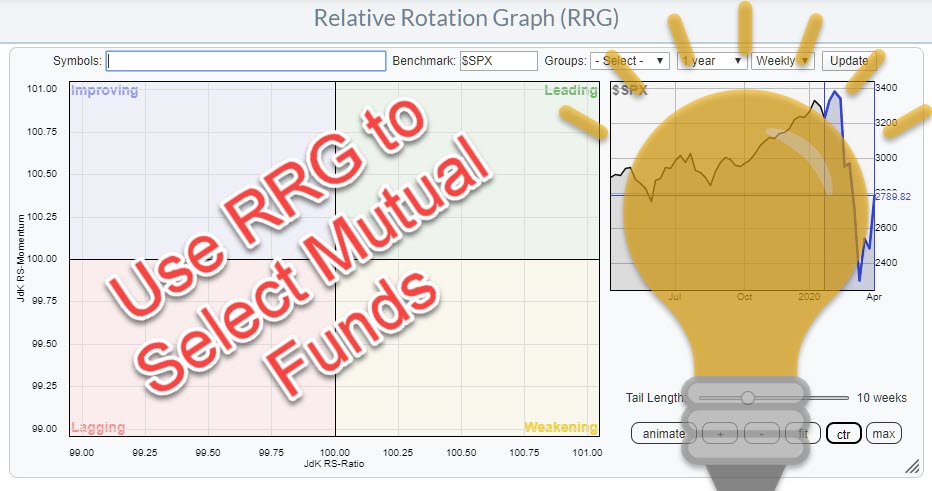

UDIs (User Defined Indexes) + RRG (Relative Rotation Graph) Opens Up New Possibilities

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Relative Rotation Graphs can show many different relationships. They do not necessarily have to come from regular price data-series like stocks or indexes.

In my weekly show on Stockcharts TV, Sector Spotlight, which airs every Tuesday from 10.30-11.00 am ET I spent time on pair trades on a...

READ MORE

MEMBERS ONLY

Bearish Rising Wedges for Technology and Utility Sectors

by Carl Swenlin,

President and Founder, DecisionPoint.com

At DecisionPoint.com I maintain daily charts of the eleven S&P 500 sectors for our subscribers, and I can't help noticing two of the charts have bearish rising wedge formations, which developed after the market's March low. Rising wedges are bearish because they resolve...

READ MORE

MEMBERS ONLY

Random Thoughts: A "Baker's Dozen" Trading Rules from Dave Landry

by Dave Landry,

Founder, Sentive Trading, LLC

Long story endless - last week, I was talking to a colleague, during our conversation, she Googled me. Since her results represented her browsing history, I decided to do the same in an "incognito" window (Who am I kidding? Now you know how I spend my Saturday nights!...

READ MORE

MEMBERS ONLY

12+1 Trading Rules - Part 1

by Dave Landry,

Founder, Sentive Trading, LLC

In this edition of Trading Simplified, Dave gives a rundown of current market conditions. Afterwards, he gets back into talking about the psychology of trading and the rules he follows.

This video was originally broadcast on April 15th, 2020. Please note the video cannot be enlarged on this page; click...

READ MORE

MEMBERS ONLY

STOCKS SELL OFF ON WEAK ECONOMIC NEWS -- BANKS DROP ON WEAK EARNINGS -- ENERGY AND FINANCIALS ARE DAY'S WEAKEST SECTORS

by John Murphy,

Chief Technical Analyst, StockCharts.com

WEAK ECONOMIC DATA CAUSES PROFIT-TAKING IN STOCKS... A lot of weak economic reports today are causing profit-taking in stock prices. Weak bank earnings are making that group one of the day's weakest. A 10 basis point drop by the 10-year Treasury yield to 0.64% may also be...

READ MORE

MEMBERS ONLY

Trading Irrationality - Live with RealVision

Market reaction to the onset of COVID-19 has been volatile and uncertain. Entire economies have closed, over 1 million individuals have been infected, 17 million people have filed for unemployment in the US and GDP is set to contract at the highest rate since the Great Depression.

Yet, the market...

READ MORE

MEMBERS ONLY

Sector Spotlight: Plotting Sector Breadth on RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of Sector Spotlight, I demonstrate how you can create UDIs to plot pairs, as well as how to use breadth data for sectors on RRG. In addition, I also showcase a new idea for a pair trade.

This video was originally broadcast on April 14th, 2020. Please...

READ MORE

MEMBERS ONLY

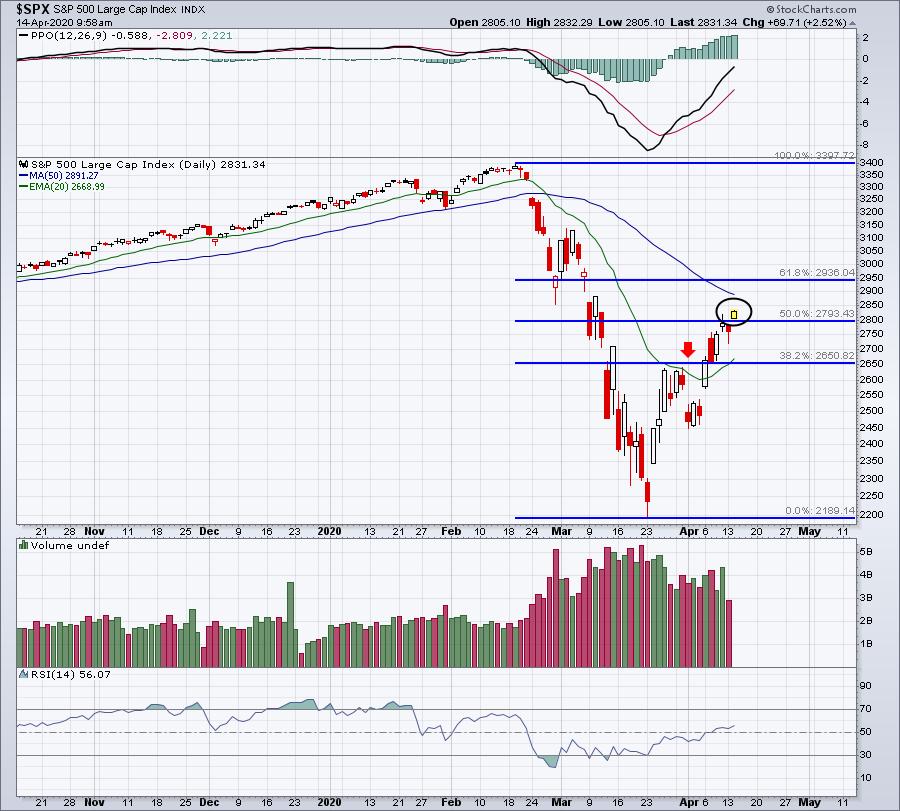

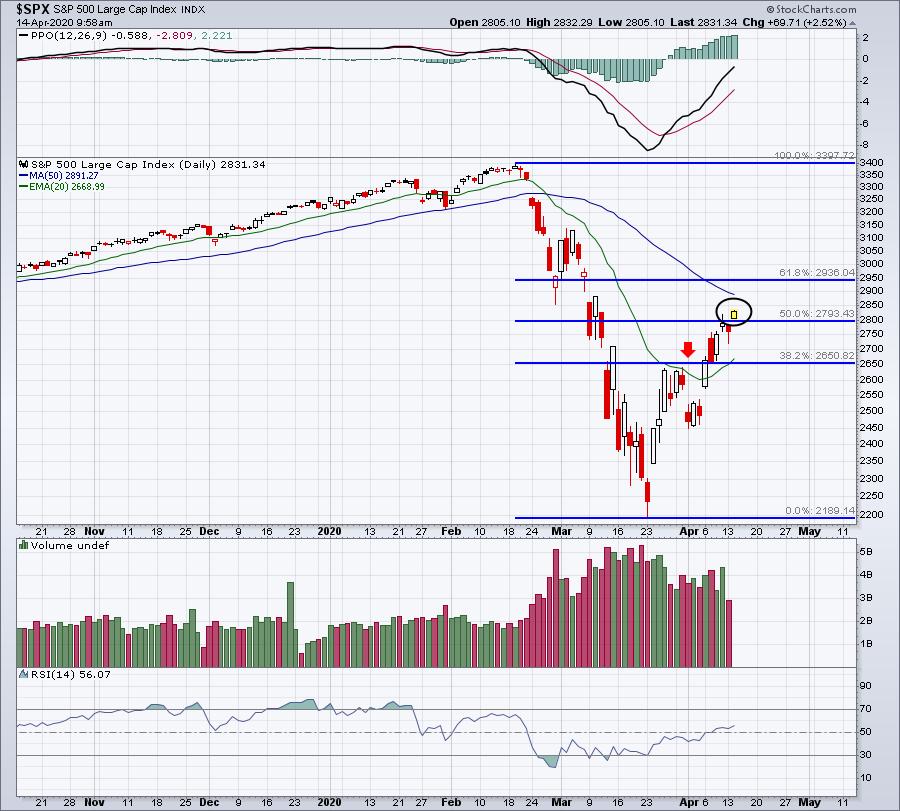

Even The Most Bullish Traders Must Beware This Short-Term Obstacle

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'm not that surprised at the continuing rally. Yes, prior extreme selloffs like 1987 and 2008 resulted only in 38.2% and/or 50.0% Fibonacci retracement rebounds and, when we look at the S&P 500 currently, we're right at that major resistance area:...

READ MORE

MEMBERS ONLY

GOLD REACHES HIGHEST LEVEL IN SEVEN YEARS -- WHILE ITS MINERS MAY ALSO BE BREAKING OUT -- GOLD MINERS ETF IS ALSO SHOWING RELATIVE STRENGTH AGAINST THE METAL AND STOCK MARKET

by John Murphy,

Chief Technical Analyst, StockCharts.com

GOLD REACHES SEVEN-YEAR HIGH... Gold seems to have everything moving in its favor. Low global interest rates, a softer dollar, and fears of global economic recession. And most of all, a bullish chart pattern both for the yellow metal and its miners. A lot of bullish articles on gold have...

READ MORE

MEMBERS ONLY

DP Show: Technology Sector's Reverse Divergence

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin talk about some of the short-term technicals that are beginning to suggest weakness under the surface. Carl explains reverse divergences for On-Balance Volume (OBV) and price both with respect to Technology (XLK) and in general. Erin reveals what our dynamite Swenlin Trading...

READ MORE

MEMBERS ONLY

Seven Bear Market Mistakes and How to Avoid Them

by David Keller,

President and Chief Strategist, Sierra Alpha Research

As a technical analyst who started my career just after the market top in March 2000, I've had the pleasure (I guess?) of living through a number of previous bear market cycles.

I first learned about and started to apply technical analysis during the 2001-2002 bear market, so...

READ MORE

MEMBERS ONLY

Who Loves Free Money But Worries About Oil?

The charts of Regional Banks (KRE), also known as the Prodigal Son of the Economic Modern Family, has told us - and will continue to tell us) - a lot!

On the daily chart, back in mid-January, KRE was one of the first sectors to go into a warning phase...

READ MORE

MEMBERS ONLY

Are We On the Eve of Destruction?

by Larry Williams,

Veteran Investor and Author

On this special episode of Real Trading with Larry Williams, Larry addresses the impact the virus has had on the economy and the markets. Where does he see things going from here? Are we looking at a continued bear market or a bull move to the upside? Watch to find...

READ MORE

MEMBERS ONLY

Gold is Breaking to the Upside - What Does That Mean for the Stock Market?

by Martin Pring,

President, Pring Research

Chart 1 shows that last week, based on daily data, the gold price quietly broke out from a reverse head-and-shoulders pattern. It's certainly a little overstretched on a short-term basis and may need to pause for a couple of sessions or so, but the longer-term indicators are pointing...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY May Get Vulnerable at Higher Levels; RRG Suggests Continued Focus on these Sectors

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After several negative weekly closes, the Indian equity markets finally ended their losing streak this truncated week as they finally finished with gains. In our previous weekly note, we had categorically mentioned the possibilities of a sharp technical pullback despite ongoing uncertainties because of the outbreak of COVID-19. While trading...

READ MORE

MEMBERS ONLY

This Is How I Created My All-Star Trading ChartList

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Let me give you an update as to how the SPY (ETF that tracks the S&P 500) and QQQ (ETF that tracks the NASDAQ 100) have performed since the top on February 19th, broken down by opening gaps (net) and intraday price action:

SPY:

* Closing price, 2/19/...

READ MORE

MEMBERS ONLY

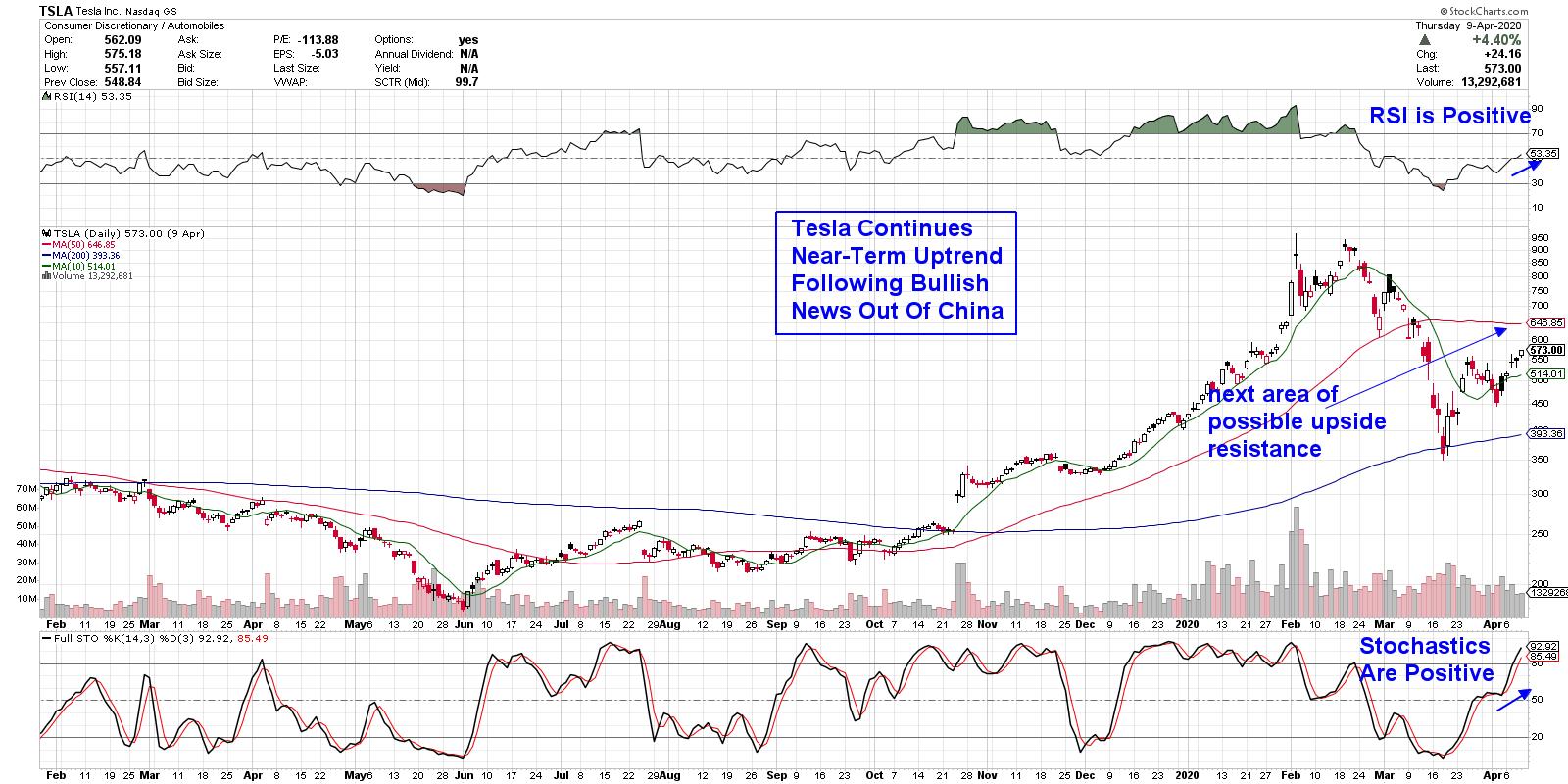

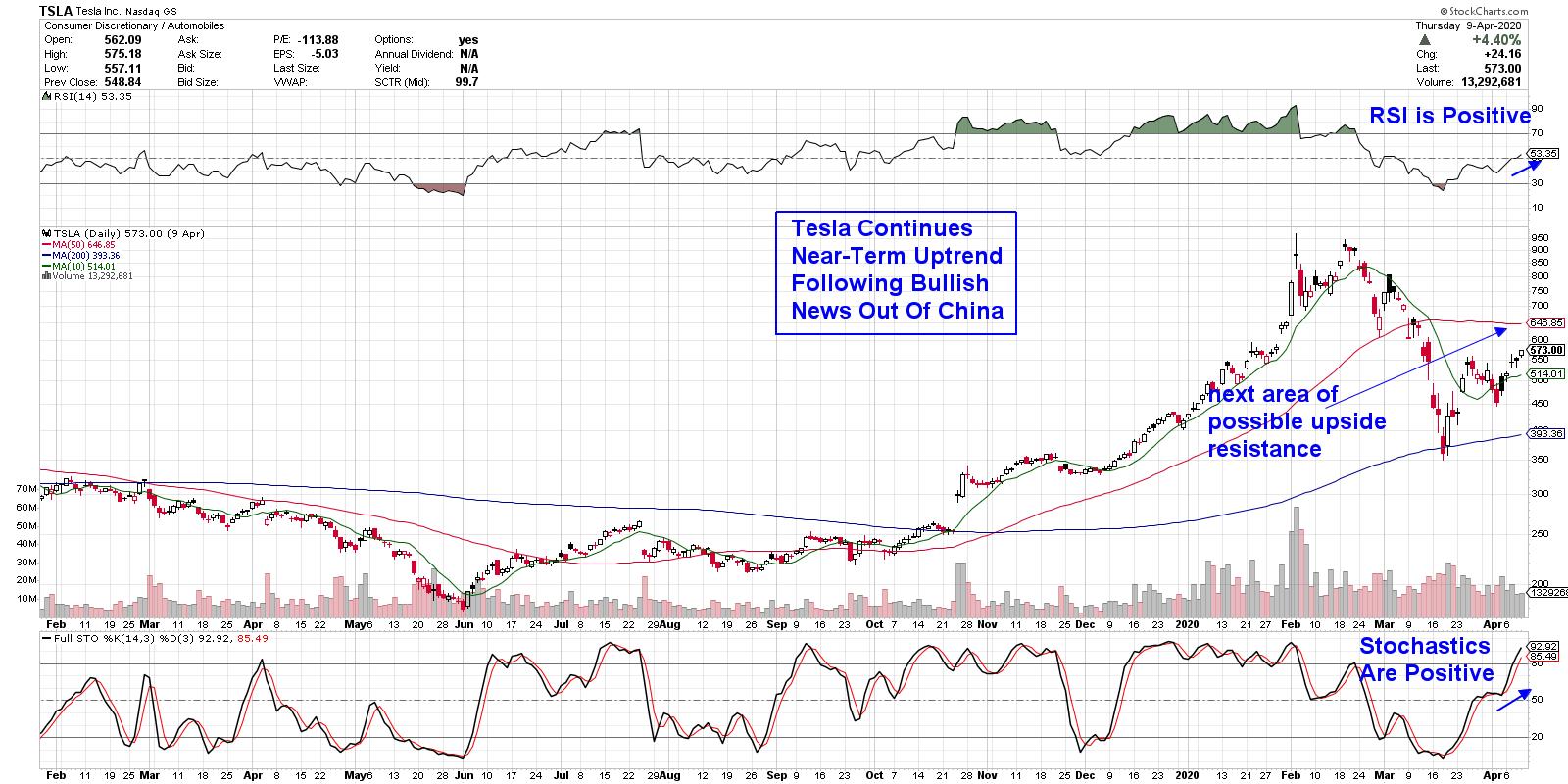

Tesla's On The Move Again – Along With 2 Other Automakers Poised To Race Off

by Mary Ellen McGonagle,

President, MEM Investment Research

The COVID-19 pandemic has hurt the auto industry tremendously as consumer demand for vehicles has collapsed in the face of enforced lockdowns in China, Europe and now the United States. The industry is fighting back with efforts to jump-start production and sales globally, as countries such as China have begun...

READ MORE

MEMBERS ONLY

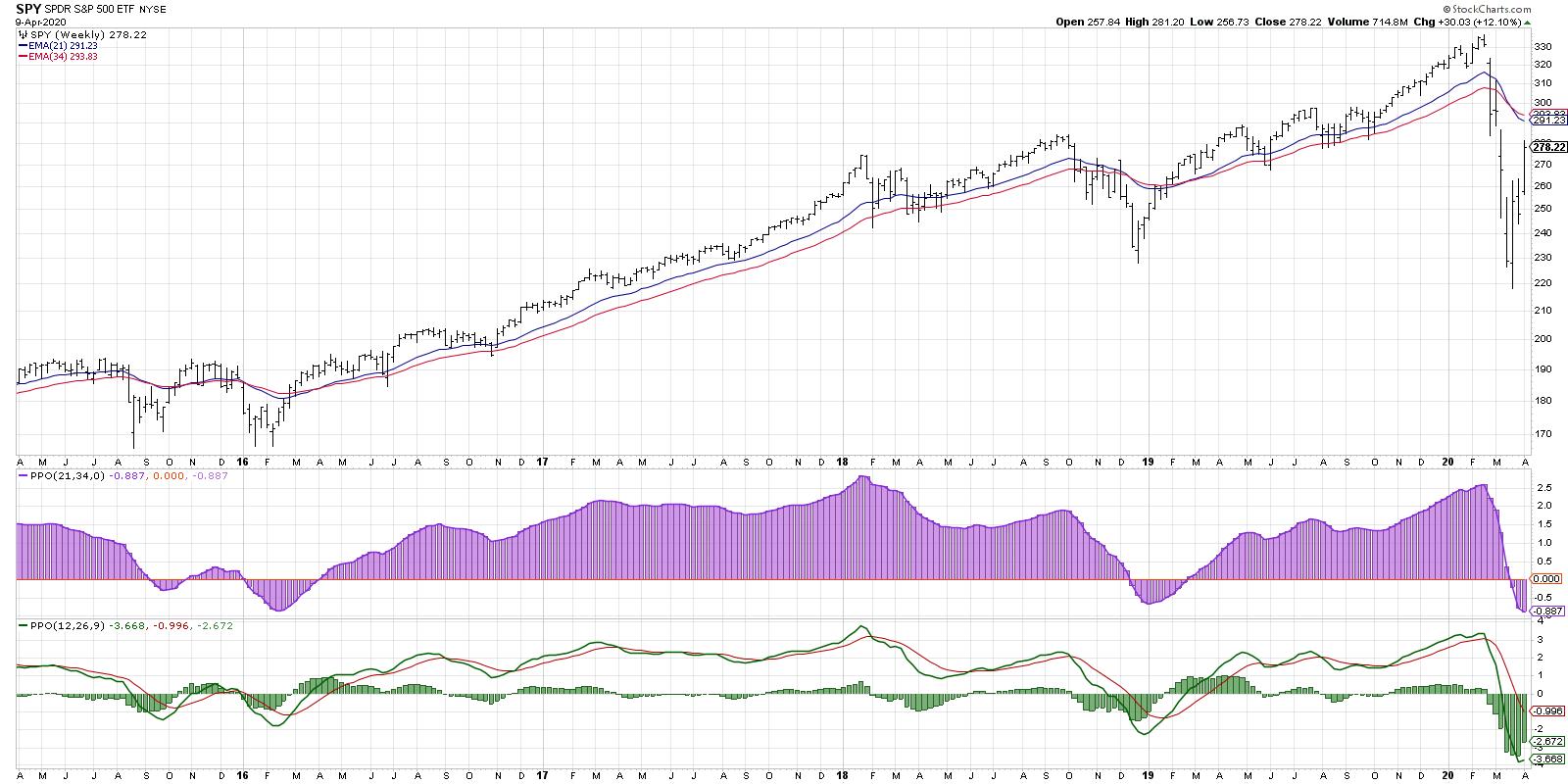

Weekly and Monthly Charts Show Improvement

by John Murphy,

Chief Technical Analyst, StockCharts.com

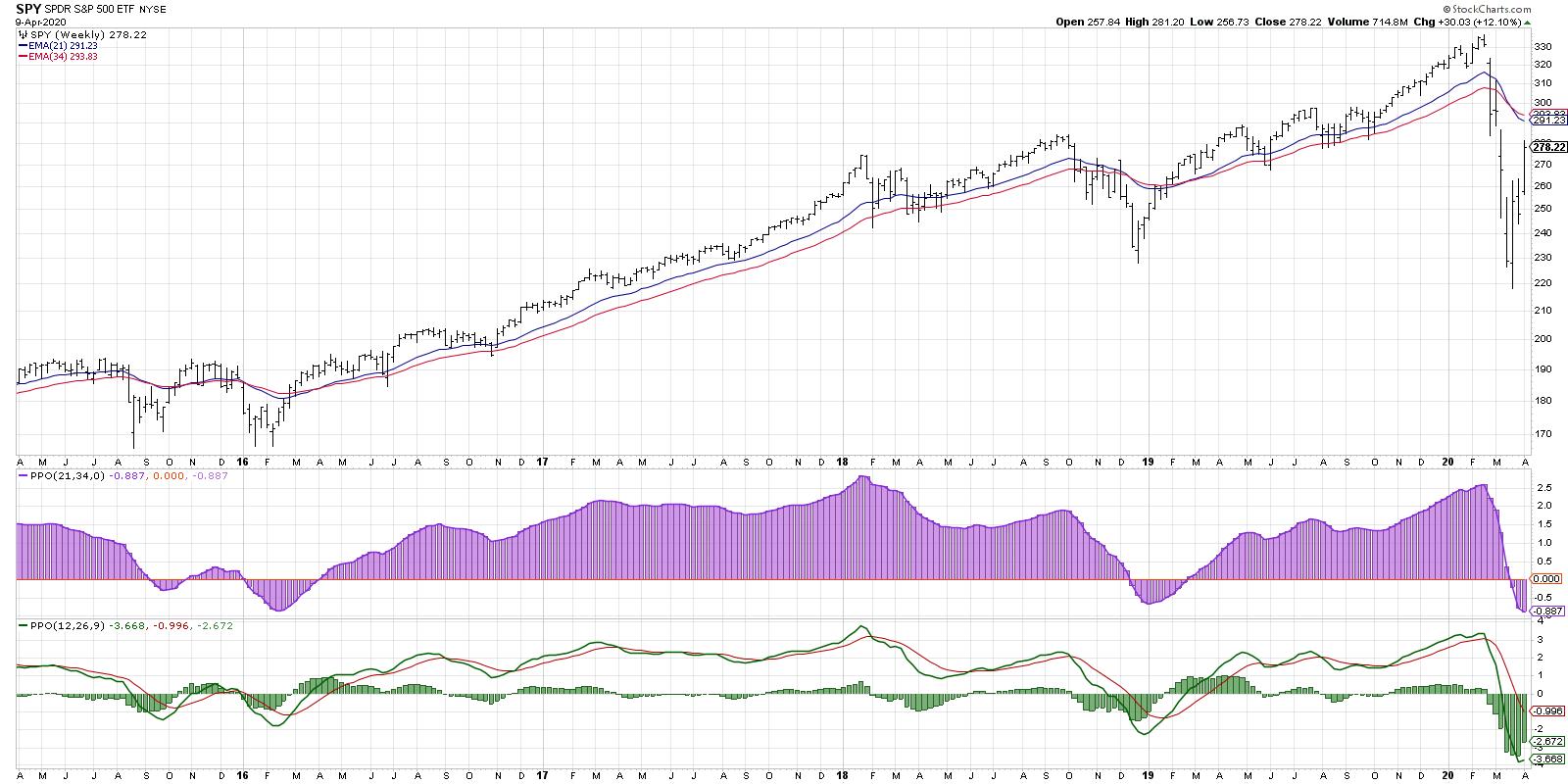

Stock prices are trading higher again today following a Fed injection of $2.3 trillion dollars into the economy. The question is how far can the rally carry, and are there still risks on the downside. For that, we're going to look at weekly and monthly charts to...

READ MORE

MEMBERS ONLY

Market Leadership Beginning to Emerge

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews relative market outperformers with growth prospects that are setting up to perform well. She also discusses stocks that are due to report earnings next week while sharing insights into the broader market's potential.

This video...

READ MORE

MEMBERS ONLY

Seven Bear Market Mistakes and How to Avoid Them

by David Keller,

President and Chief Strategist, Sierra Alpha Research

As a technical analyst who started my career just after the market top in March 2000, I've had the pleasure (I guess?) of living through a number of previous bear market cycles.

I first learned about and started to apply technical analysis during the 2001-2002 bear market, so...

READ MORE

MEMBERS ONLY

The Fed Gone Wild! (+ Video)

The Fed injected another $2.3 trillion into buying bonds, including junk. They have bypassed the Federal Reserve act, which means they can buy whatever they want. Equity ETFs may be next. The idea is to aid small and mid-sized business as well as state and local governments, according to...

READ MORE

MEMBERS ONLY

Key Charts From Our Top Contributors, Straight To Your Account: Our "Navigating a Bear Market" ChartPack Is Now Available

by Grayson Roze,

Chief Strategist, StockCharts.com

This week was a first for us, but it marks the start of something big – a unique integration between the content you follow from our team of market experts and the charts that you use in your own StockCharts account. Allow me to explain.

Late last month, we released a...

READ MORE

MEMBERS ONLY

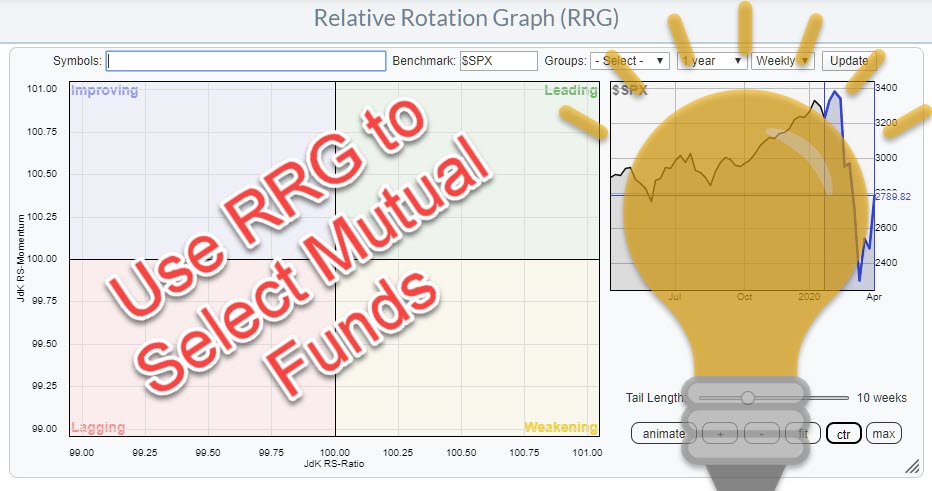

Using Relative Rotation Graphs as a Selection or Evaluation Tool for Mutual Funds

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Last week on Wednesday (4/8) I wrote an article in the RRG blog on how you can use ChartLists, in combination with Relative Rotation Graphs to monitor your mutual fund portfolio. The article was inspired by a question which I received in the mailbag of my weekly show Sector...

READ MORE

MEMBERS ONLY

Can You Name The 7 Industries That Have Lost Less Than 10% During This Crisis?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Wall Street is betting on certain industry groups to weather this COVID-19 storm much better than others. Knowing which groups are favored is very important, especially if we suffer another bout of impulsive selling. Gold mining ($DJUSPM) and mining ($DJUSMG) are the two best performers, gaining 19.51% and 18....

READ MORE

MEMBERS ONLY

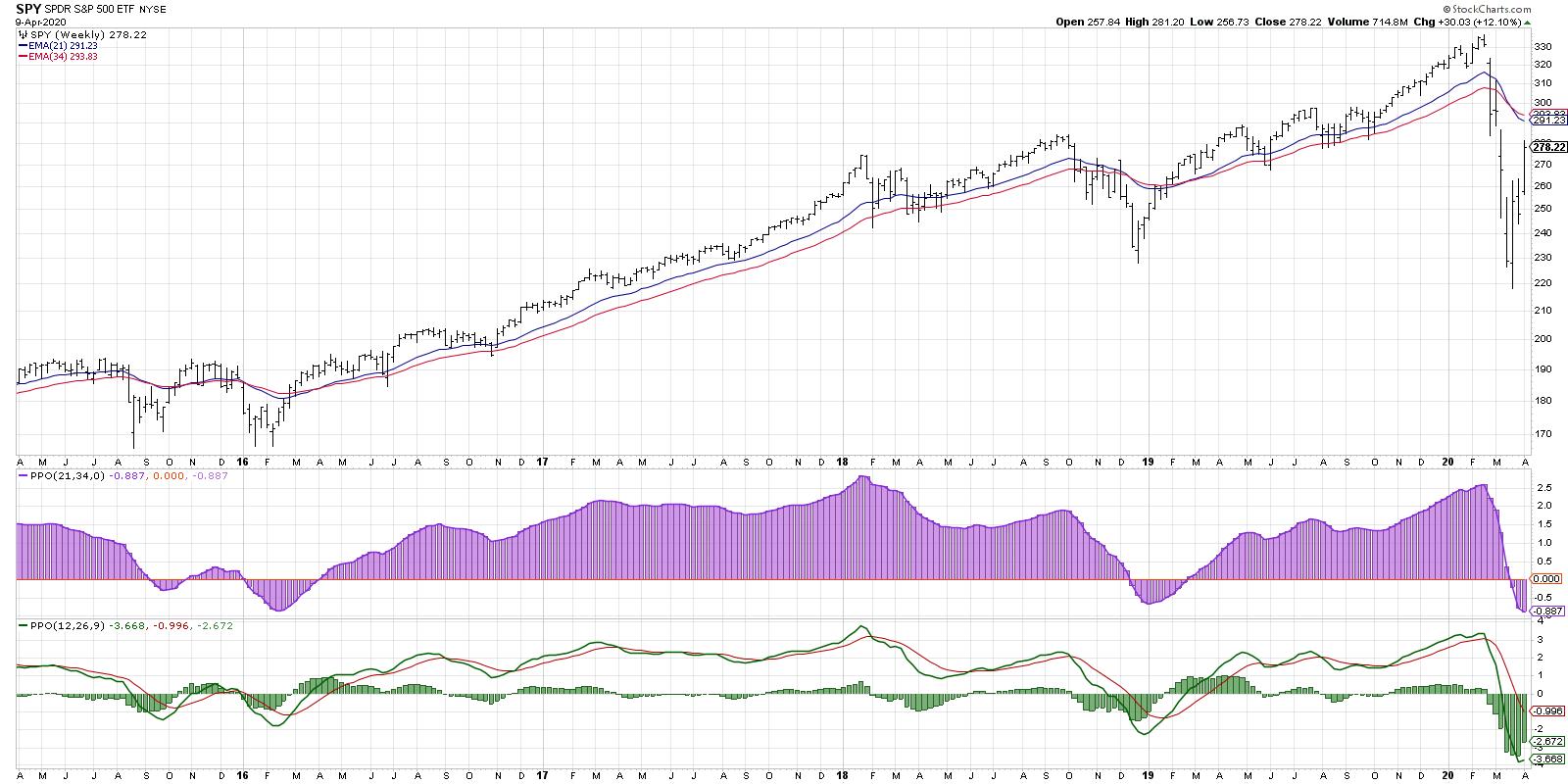

WEEKLY AND MONTHLY CHARTS SHOW IMPROVEMENT -- BUT IDENTIFY POTENTIAL OVERHEAD RESISTANCE -- THE STAYING POWER OF THE CURRENT STOCK REBOUND MAY SOON BE TESTED

by John Murphy,

Chief Technical Analyst, StockCharts.com

POTENTIAL OVERHEAD RESISTANCE ON WEEKLY CHART... Stock prices are trading higher again today following a Fed injection of $2.3 trillion dollars into the economy. The question is how far can the rally carry, and are there still risks on the downside. For that, we're going to look...

READ MORE