MEMBERS ONLY

Is the Fed Spreading Rifts in the Market Multiverse?

A rift is a crack, split, or break in something. Hence the obvious title question - what is the Fed doing to engender a market multiverse rift?

The Fed can only buy securities that the federal government guarantees. What the Fed has done on this round of QE is buy...

READ MORE

MEMBERS ONLY

DP Show: Bargain v. Earnings - Recession v. Depression

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin cover a variety of topics. To start, new momentum BUY signals have appeared, but enthusiasm should be tempered based on the bear market technicals. Looking at the DecisionPoint Earnings chart, Carl and Erin examine the concept of "bargains." Finally, they...

READ MORE

MEMBERS ONLY

Can the Fed Stop the Bear?

by Larry Williams,

Veteran Investor and Author

On this special episode of Real Trading with Larry Williams, Larry presents an in-depth discussion of the Federal Reserve System. In addition to walking you through the history of the Fed and describing its primary functions, Larry shares how and why he changed his stance from anti-Fed to a strong...

READ MORE

MEMBERS ONLY

An Industry Group That's Wildly Outperforming During This Pandemic

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

My background is in public accounting. I spent two decades there and I always like to say that "I never met a spreadsheet that I didn't like!" I love to analyze. I actually enjoy studying numbers and relationships and read into the subtleties of what'...

READ MORE

MEMBERS ONLY

Quantifying Leaders and Laggards on this Historic Bounce

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Chartists looking to measure relative performance based on retracements can use the Stochastic Oscillator to quantify these bounces. Way back on March 1st, I posted an article showing how Chartists can quantify downside retracements using Williams %R. For upside retracements or bounces that retrace a portion of the prior decline,...

READ MORE

MEMBERS ONLY

Bear Market Update: A Sobering Message From Italy, PLUS Technical Analysis Is Alive And Well

by Dave Landry,

Founder, Sentive Trading, LLC

I just had a very sobering conversation via Skype with a good friend/business associate from Italy. We're close. I've spent time in his home several times, and we've had him as our guest here. I'm having a hard time writing today&...

READ MORE

MEMBERS ONLY

Week Ahead: Avoid Getting Carried Away By Pullbacks, If Any; These Are Resilient Sectors, Says RRG

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

We are using Line Charts, as they enable us to take a look at the longer-term structure of the weekly charts. We do this so that we can examine the behavior of the markets against the decade-long trend line, which now stands violated. After a massive decline of over 12%...

READ MORE

MEMBERS ONLY

Lots of Short-Term Indicators Reversing from Bearish Extremes - What Does It Mean?

by Martin Pring,

President, Pring Research

I wrote earlier in the week that, whenever the market rallies by 8-9%, it's obvious that some form of bottom has taken place (however fleeting), so I don't want to state the obvious. It is apparent, though, that some of the short-term indicators have finally begun...

READ MORE

MEMBERS ONLY

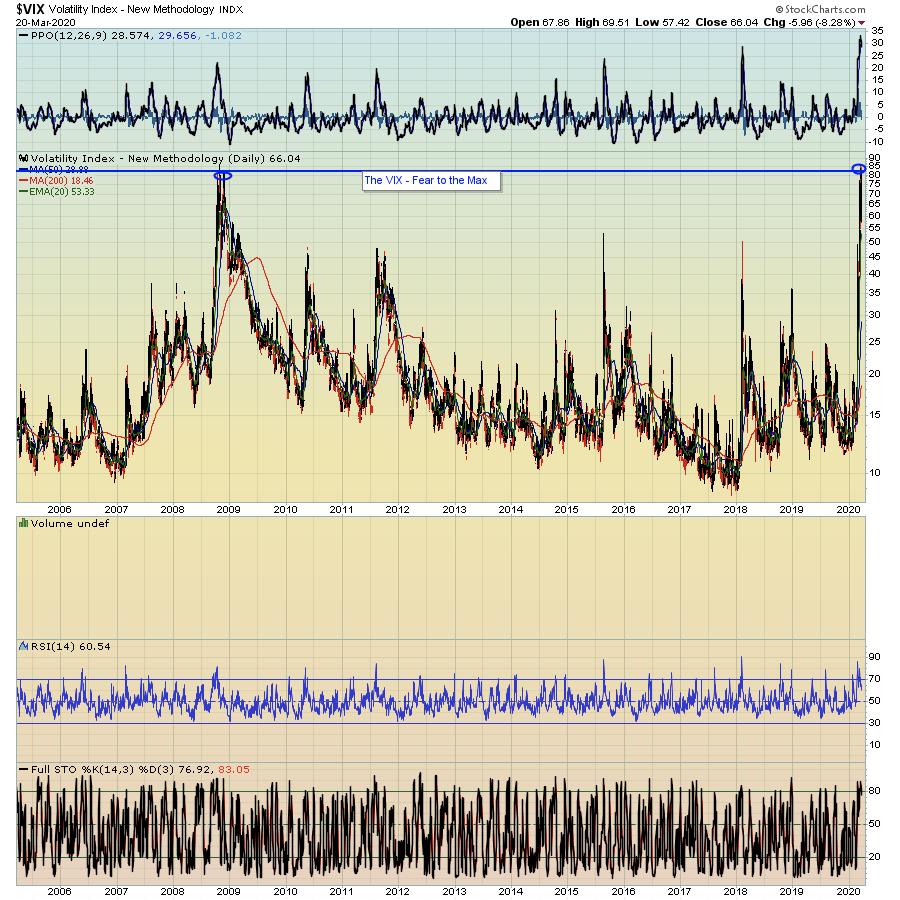

Are You Prepared For Another Selling Episode?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

During tumultuous times like these, I pay particular attention to sentiment levels. Extreme fear tends to mark market bottoms, just as the recent Volatility Index ($VIX) reading above 80 coincided with this week's stock market bottom. It's simply the way bottoms form.

However, last week we...

READ MORE

MEMBERS ONLY

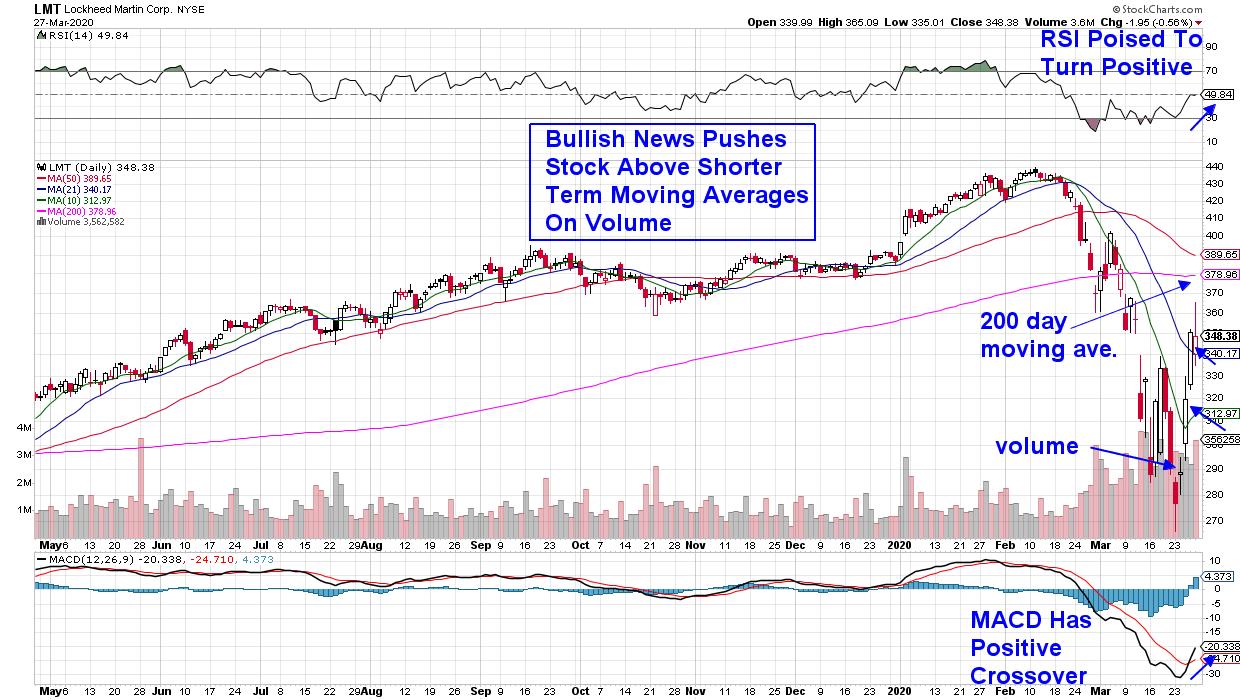

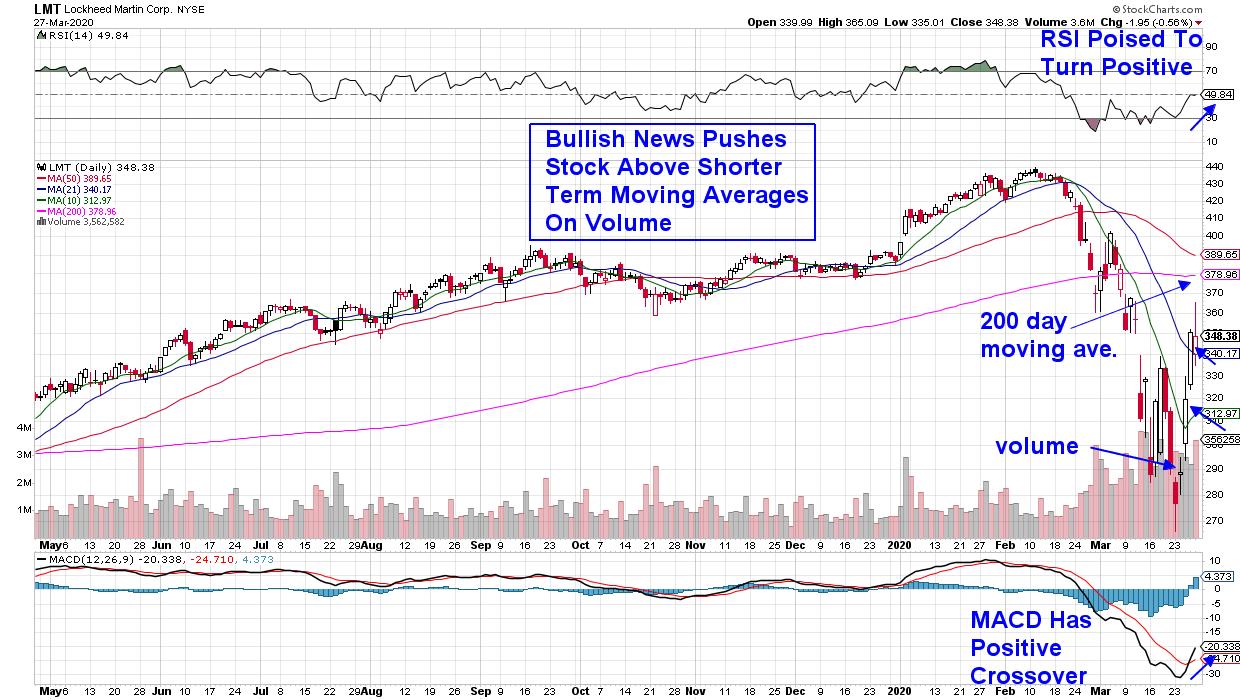

$2 Trillion Coronavirus Relief Bill Makes Bullish Case for Certain Industries

by Mary Ellen McGonagle,

President, MEM Investment Research

The U.S. government passed a coronavirus relief bill today that's thought to be the largest of its kind in history as Washington tries to dampen the sharp economic decline that's expected from the spreading pandemic.

While the plan will provide one-time payments to individuals as...

READ MORE

MEMBERS ONLY

The Charts That Speak to Further Downside

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I very much enjoyed participating in our StockCharts TV special event "Navigating a Bear Market" along with many of my fellow StockCharts contributors. In this article, I'll provide my comments and charts from that special, along with some brief updates on what has changed in the...

READ MORE

MEMBERS ONLY

Is the Current Rally Real?

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews areas of the market that are relatively outperforming as product demand heats up for select companies. Shorter term, she shares how to uncover stocks on the move, as well as what chart timeframes to use.

This video...

READ MORE

MEMBERS ONLY

Lots of Short-Term Indicators Reversing from Bearish Extremes - What Does It Mean? (UPDATED)

by Martin Pring,

President, Pring Research

Editor's Note: This is an expansion of a previous Market Roundup article written on Tuesday, March 24th, now with updated charts and commentary. For the original article, click here.

I wrote earlier in the week that, whenever the market rallies by 8-9%, it's obvious that some...

READ MORE

MEMBERS ONLY

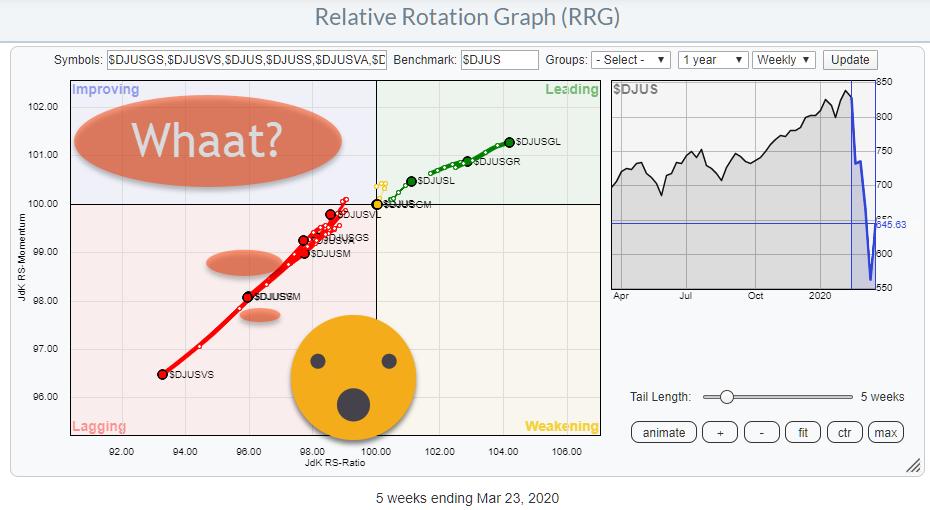

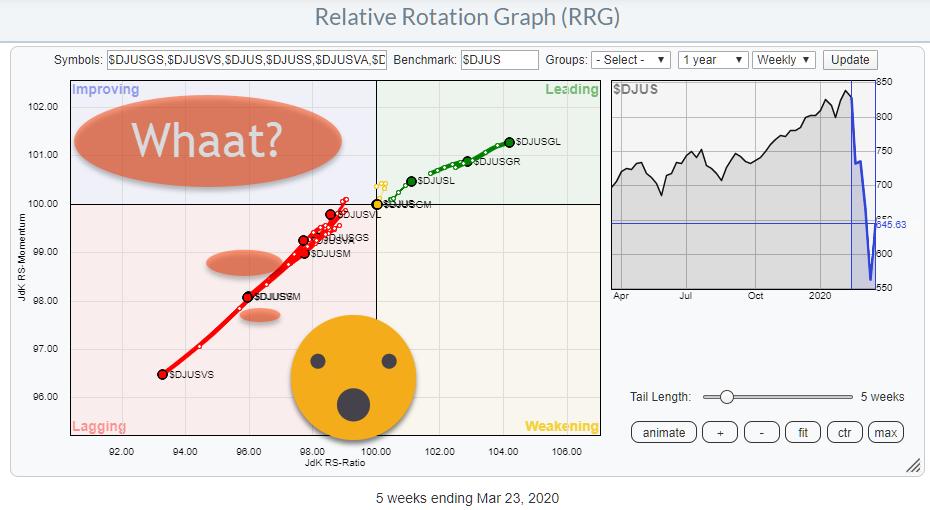

And the Worst Section of the US Stock Market Is.......

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Instead of simply looking at sectors, it also makes sense to keep an eye on segments of the stock market based on different criteria.

The Size Factor

One example is to group stocks based on Market Capitalization, i.e. Large-, Mid- and Small-Cap stocks.

A Relative Rotation Graph of that...

READ MORE

MEMBERS ONLY

Taxes Are the Consequence of Successful Investing

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

In light of tax season being near (albeit delayed) and that we find ourselves in the midst of a bear market, we thought it was a good time to discuss active management and taxes, which is something we are asked about regularly. We often get asked about the impact of...

READ MORE

MEMBERS ONLY

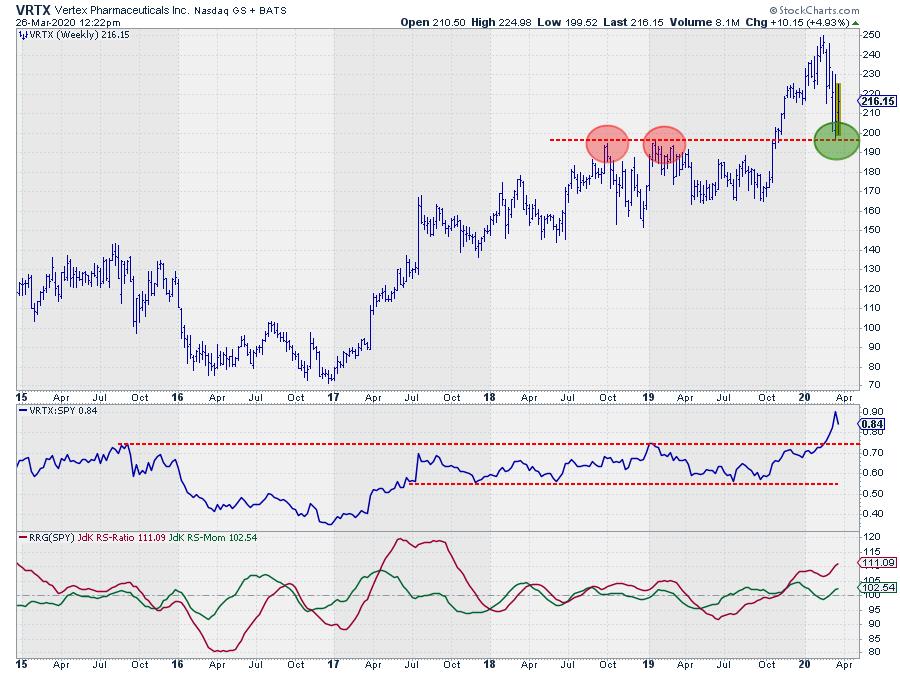

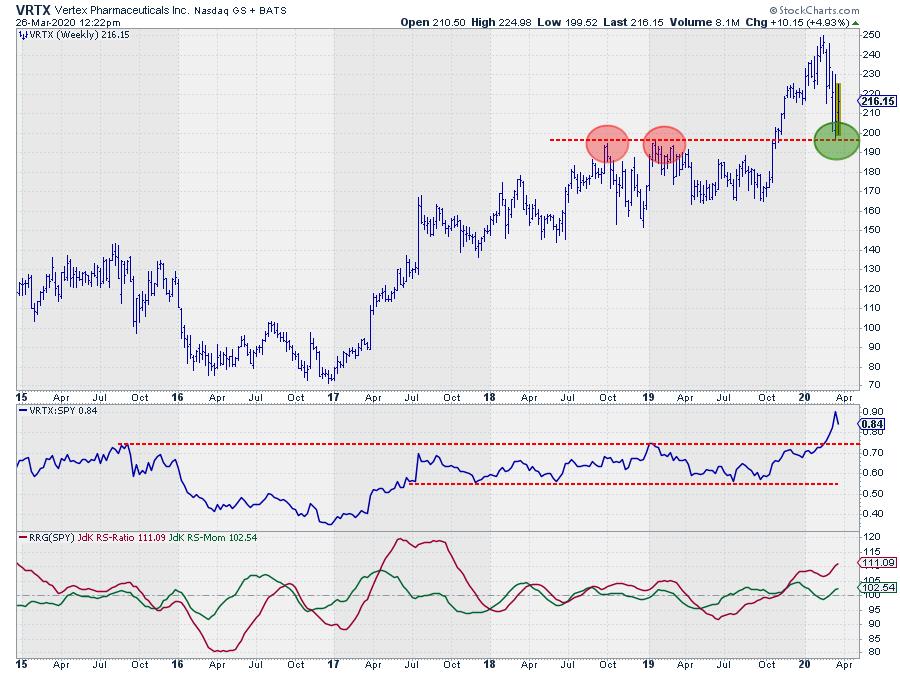

Resistance is Turning Into Support for This Biotech Stock

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

A lot of eye balls on the health care sector these days, and for good reasons. Traditionally, this has been one of the more defensive sectors, and it seems to be picking up that role at the moment.

On the weekly RRG for US sectors, XLF hooked sharply upward, moving...

READ MORE

MEMBERS ONLY

Anatomy of a Bear Market Reversal - Are We There Yet?

by Mary Ellen McGonagle,

President, MEM Investment Research

Yesterday's 9.4% rally in the S&P 500 Index has many investors wondering whether a bottom has been put in place in the markets. Certainly, the fear among the U.S. population has hit new highs, and we now have a historical stimulus package close to...

READ MORE

MEMBERS ONLY

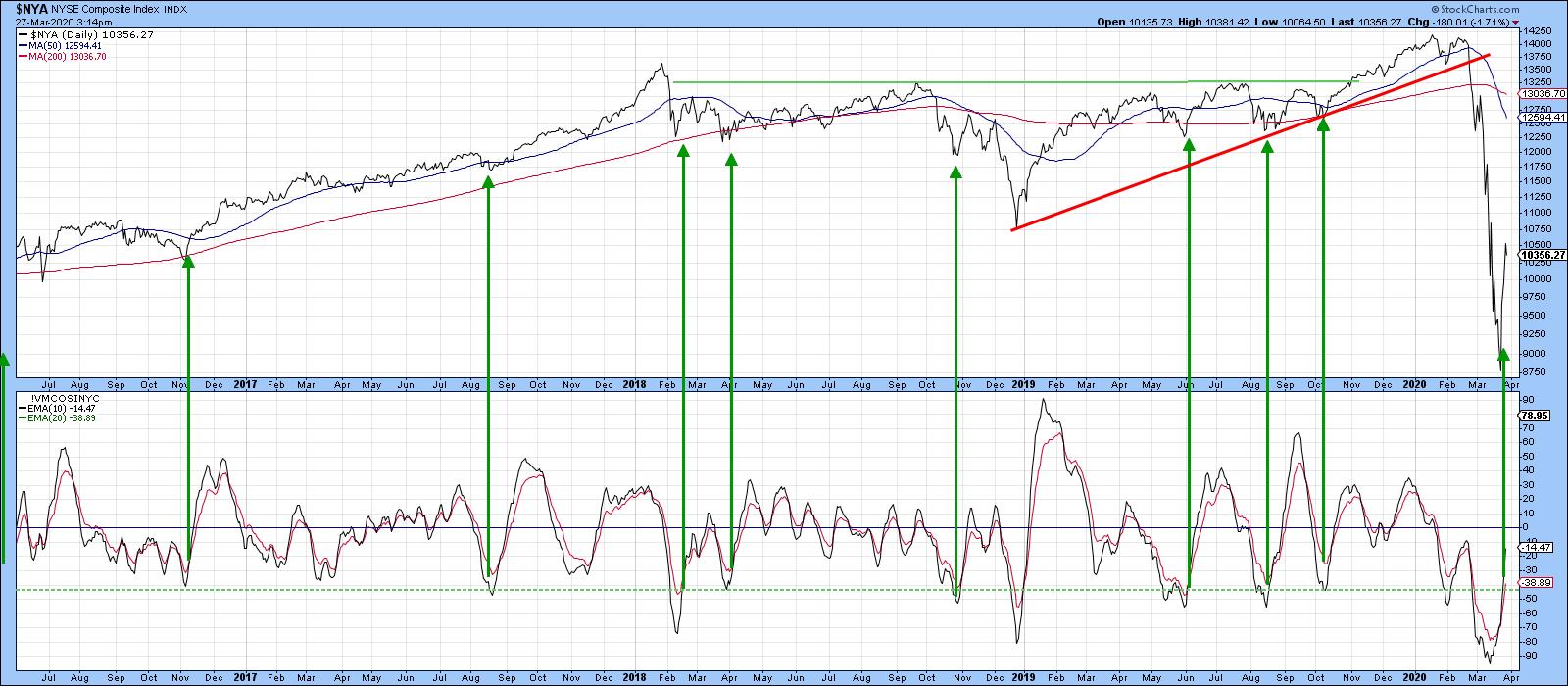

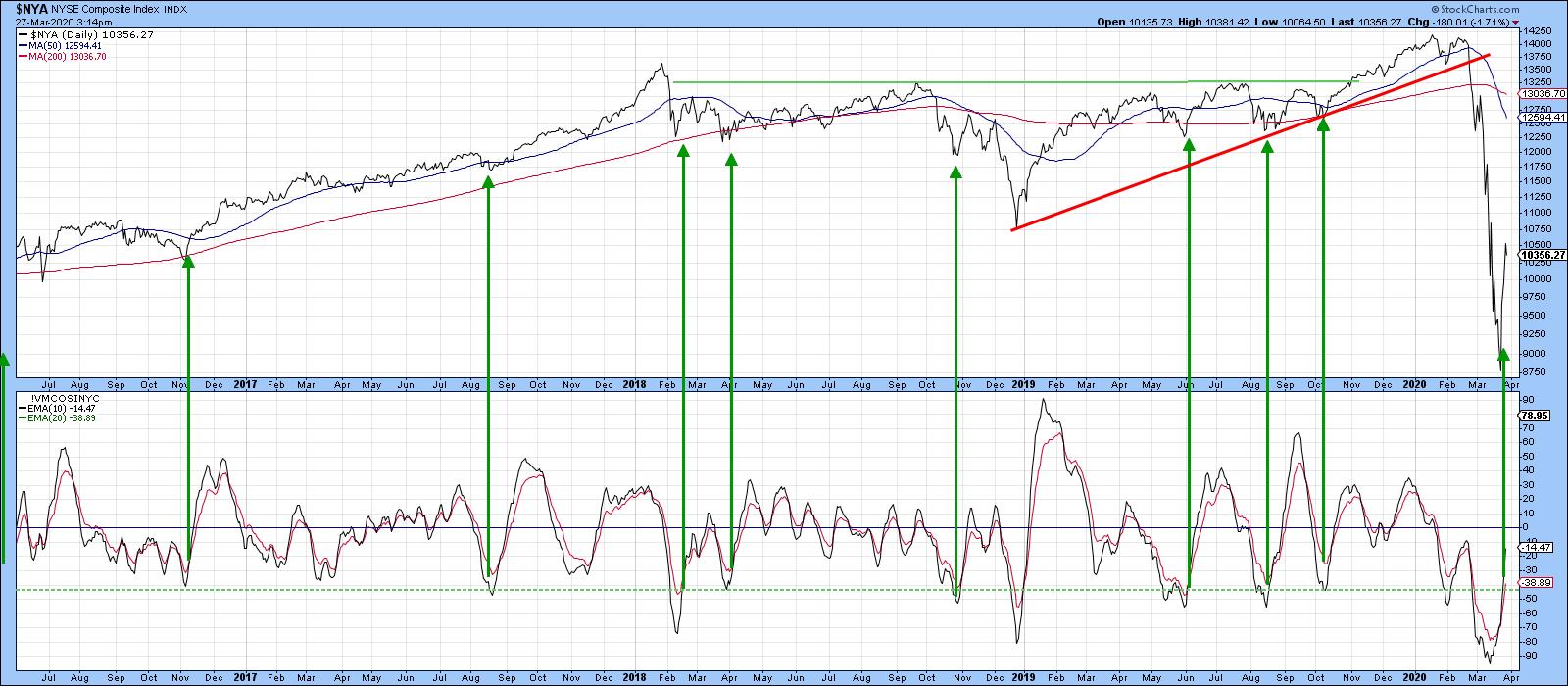

Really, Really Oversold

by Carl Swenlin,

President and Founder, DecisionPoint.com

The Price Momentum Oscillator (PMO) turned down on February 21, two days after the market's all-time high, and it moved steadily downward until Tuesday, when it finally turned up -- a short-term buy signal. The PMO has a normal range for market indexes of about +2.0 to...

READ MORE

MEMBERS ONLY

Understanding Trend Following in Bear Markets

by Dave Landry,

Founder, Sentive Trading, LLC

In this edition of Trading Simplified, Dave talks about trend following in bear markets and how to do it properly. He shows how to determine whether the market is a value, how to identify important bottoming signs/signals and beyond.

This video was originally broadcast on March 25th, 2020. Please...

READ MORE

MEMBERS ONLY

Is Gold Truly Our Safe Haven Right Now?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

At this exact moment? Yes. Am I a fan longer-term? No. Gold ($GOLD) nearly always is a good choice during periods of anxiety and we sure have plenty of that right now. So owning a piece of it would make sense for anyone wanting a hedge against the stock market...

READ MORE

MEMBERS ONLY

Lots of Short-Term Indicators Reversing from Bearish Extremes - What Does It Mean?

by Martin Pring,

President, Pring Research

* Indicators Start to Flash Buy Signals

* What Happened in the 1929-32 Bear Market?

* Longer-Term Perspective

Whenever the market rallies by 8-9%, it's obvious that some form of bottom has taken place (however fleeting), so I don't want to state the obvious. It is apparent, though, that...

READ MORE

MEMBERS ONLY

Sector Spotlight: Cap-Weighted vs. Equal-Weight Sectors

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of Sector Spotlight, I discuss the subtle differences between cap-weighted and equal weight sector ETFs on RRG. I also take some time to show how you can plot pairs/ratios on a Relative Rotation Graph.

This video was originally recorded on March 24th, 2020. Please note the...

READ MORE

MEMBERS ONLY

History Says To Consider This Resistance Level As A Potential Bounce Area

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'm a historian at heart. I absolutely love analyzing history to see what makes the market tick. It's why I turned my attention from fundamentals to technicals a few decades ago. Technical analysis is the study of price action to help forecast future price action. The...

READ MORE

MEMBERS ONLY

DP Show: Deflationary Depression - Bear Market Support

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl talks about the concept of "deflationary depression" and the implications. Carl and Erin discuss current technical levels for price and also look at the technical levels based on earnings at overvalue, fair value and undervalue. Carl reported on the "Big Four&...

READ MORE

MEMBERS ONLY

Where Were You in '62?

by Bruce Fraser,

Industry-leading "Wyckoffian"

In 1959 a dynamic uptrend Climaxed. This began a range-bound market with Broadening features. Higher highs and Lower lows persisted into 1963. In 1962 a surprising waterfall decline fell below the lows of the 1960 SOW, then formed an Accumulation and a fresh new uptrend. This Broadening structure has eerie...

READ MORE

MEMBERS ONLY

A Paradigm Shift: Investing After COVID-19

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It's time to take a new approach to the stock market. There are plenty of times where it's just "rinse and repeat" and we use the same old strategies we've always used. Well, those days are gone. For me, it's...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Has Multiple Negatives to Deal With; RRG Chart Suggests Adopting a Defensive Play

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The unabated meltdown in the equities markets continued this week as well, which saw the NIFTY plunging to the fresh weekly lows. The Indian equities traded in line with the weak global setup and lost ground as rapidly as other global markets. The benchmark index NIFTY declined and ended in...

READ MORE

MEMBERS ONLY

Downtrend Reversal Attempts Beginning to Emerge

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV's The MEM Edge, Mary Ellen shares newly defensive areas of the market that are in the early stages of reversing from steep downtrends. She also reviews cutting-edge companies that are seeing increased demand for products that are assisting during this unprecedented global...

READ MORE

MEMBERS ONLY

Dow Breaks 2018 Low and Signals Lower Prices

by John Murphy,

Chief Technical Analyst, StockCharts.com

My weekend message showed the Dow Industrials testing important chart support along its late 2018 low. The weekly bars in Chart 1 show the Dow falling below that important support line this week. That raises the likelihood of even lower prices. The question is how low. The best way to...

READ MORE

MEMBERS ONLY

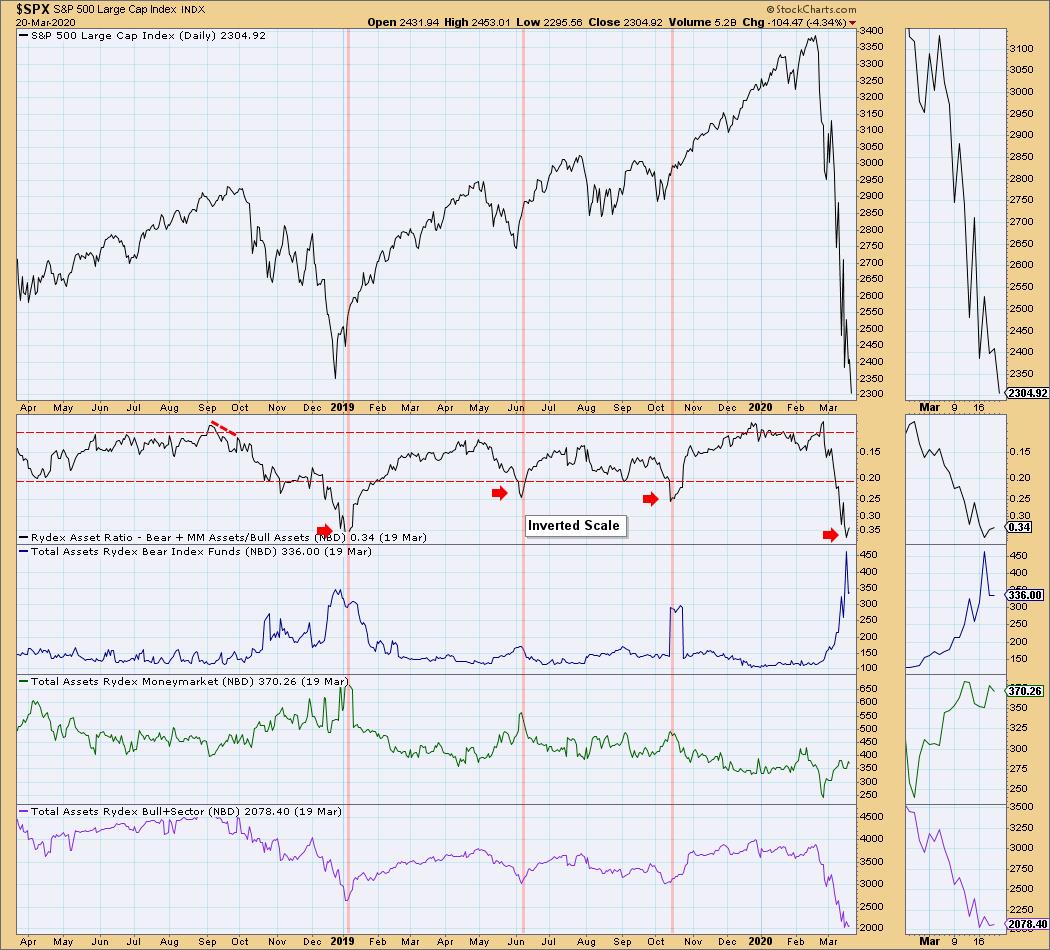

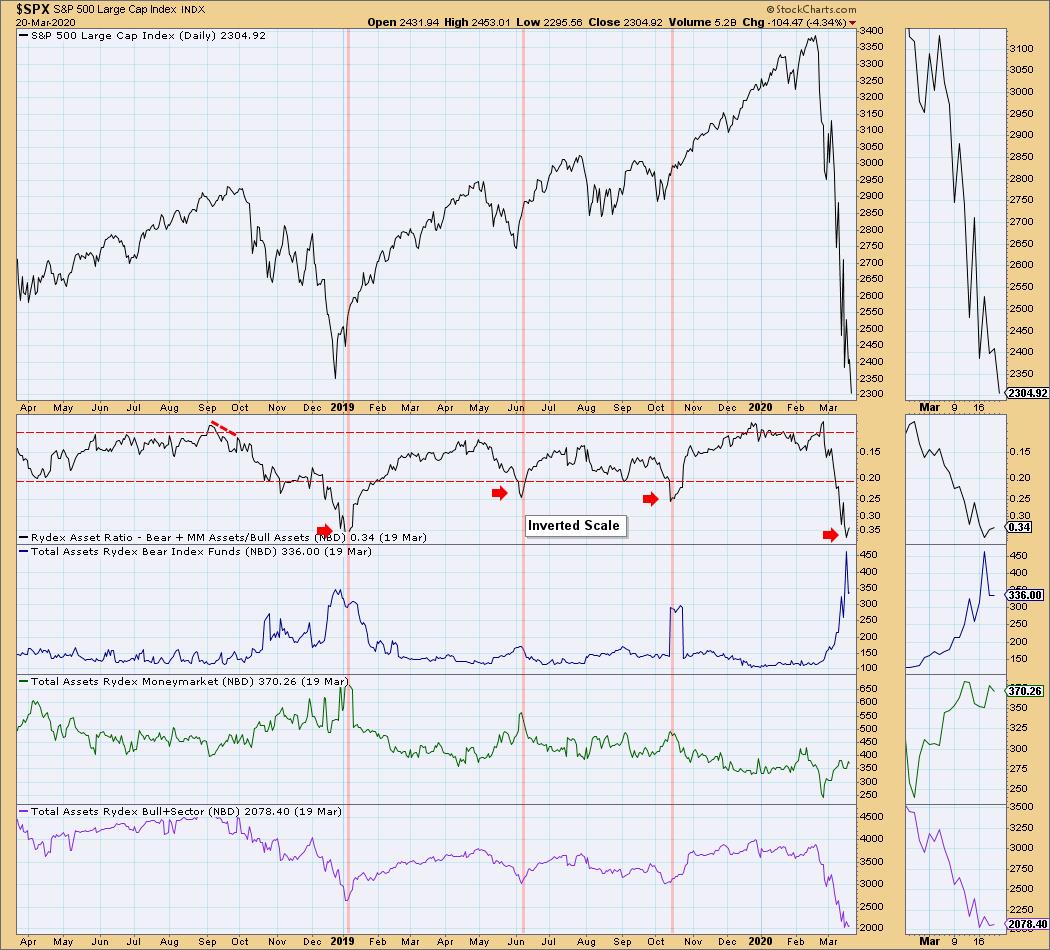

Is Sentiment Bearish Enough? Erin Swenlin & Mark Young Explain

by Erin Swenlin,

Vice President, DecisionPoint.com

I'm so excited to report sentiment to you this weekend with commentary added from Mark Young of WallStreetSentiment.com. We are seeing extraordinarily high bearish sentiment on most of our charts; however, I don't think we are bearish enough based on extremes we've previously...

READ MORE

MEMBERS ONLY

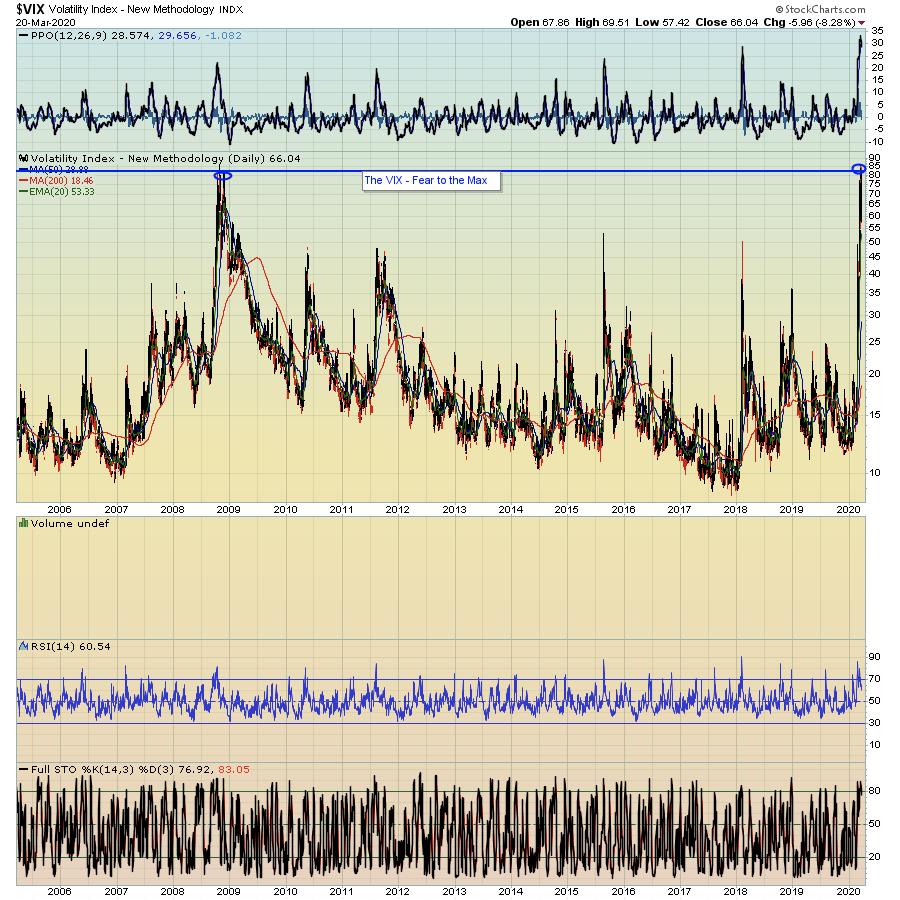

The Times They Are A-Changin'

by John Hopkins,

President and Co-founder, EarningsBeats.com

Generally, my articles focus on corporate earnings. But let's face it - earnings have taken a back seat these days, with traders more in survival mode. How volatile has it gotten out there and how worried are investors? Well, just take a look at the chart on the...

READ MORE

MEMBERS ONLY

The Quarantined Investor: 10 Things To Raise Your Spirits And Your Returns

by Gatis Roze,

Author, "Tensile Trading"

First and foremost, a message to my readership: I hope you are staying safe and healthy during these difficult and unsettling times.

COVID-19 is wreaking havoc on our lives, our families, our jobs and the markets. I ask you all to be mindful of the older generation amongst us — those...

READ MORE

MEMBERS ONLY

High-Low Percent Takes a Tumble - Plus The Essential Breadth Indicator ChartList

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The broad market environment is bearish and volatility remains high, even with stock alternatives, such as gold and bonds. This is hardly a conducive environment for trading or investing, but there are alternatives, such as a bear market project. This can be remodeling a room, finally clearing out the garage...

READ MORE

MEMBERS ONLY

Be Careful, This Could Be Options Manipulation; TSLA Is A Perfect Example

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

On Tuesday, I held a special webinar for EarningsBeats.com members to discuss the massive amount of net in-the-money put premium on major ETFs and many individual stocks. I can't say with any certainty, but I believe the current strength likely won't last. We could see...

READ MORE

MEMBERS ONLY

What About the US Dollar.....? and Other Currencies

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Everybody's looking at the stock market these days, but, in other areas of the market, big shifts seem to be underway as well. One of the areas that I like to keep an eye on is currencies, and Relative Rotation Graphs can help you keep an eye on...

READ MORE

MEMBERS ONLY

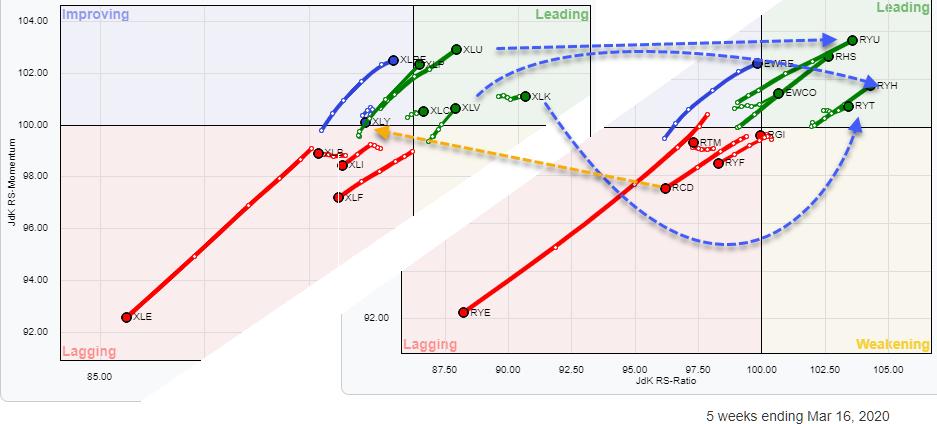

Subtle Differences Between Equal Weight and Regular Sector RRGs

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

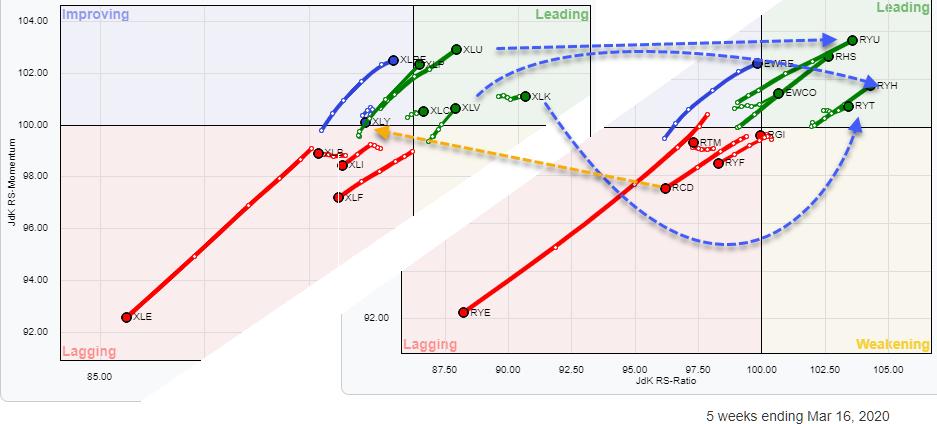

The image above shows two Relative Rotation Graphs for US sectors, side by side. The one on the left is the RRG (as I usually use it in my blogs and the Sector Spotlight show) holding 11 US sector ETFs, the SPDR ETFs offered by State Street. The one on...

READ MORE

MEMBERS ONLY

Update: Downside Potential

by Carl Swenlin,

President and Founder, DecisionPoint.com

EDITOR'S NOTE: This is an update to my 3/13/2002 DP Weekly Wrap comments.

When we look for downside potential for the S&P 500 Index, the simplest way is to look at obvious support levels based upon lines drawn across prior significant highs and lows....

READ MORE

MEMBERS ONLY

DOW BREAKS 2018 LOW AND SIGNALS LOWER PRICES -- THE S&P 500 IS TESTING SUPPORT LINES

by John Murphy,

Chief Technical Analyst, StockCharts.com

LOWER TARGET FOR THE DOW... My weekend message showed the Dow Industrials testing important chart support along its late 2018 low. The weekly bars in Chart 1 show the Dow falling below that important support line this week. That raises the likelihood of even lower prices. The question is how...

READ MORE

MEMBERS ONLY

Traits of Successful Traders, Part 3

by Dave Landry,

Founder, Sentive Trading, LLC

In this edition of Trading Simplified, Dave continues his series regarding the traits of successful traders, impart ing his wisdom and the lessons he's learned throughout his decades of trading. Dave discusses humility, flippancy, being a student of the markets, commitment devices and more.

This video was originally...

READ MORE

MEMBERS ONLY

Sector Spotlight: Looking at US Sectors Through the Mayhem

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of Sector Spotlight, I try to see through the mayhem and get an angle on US sector rotations on weekly Relative Rotation Graphs. In addition, I go a bit more in-depth answering some questions from the Mailbag.

This video was originally recorded on March 17th, 2020. Please...

READ MORE