MEMBERS ONLY

News is Noise - 2019 Recap and Model Review

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

2019 was an easy investing year for everyone, right? The S&P 500 was up 31.5% (including dividends) while the Nasdaq Composite was up 35.2%; the best year for each since 2013. I'm sure everyone did at least that well. Many will look at the...

READ MORE

MEMBERS ONLY

Short-Term Trouble Is Brewing, Be Careful!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Hey, I'm bullish longer-term so I'm not talking about a major bear market ahead, nothing like that. But as a short-term trader, I need to heed the signs of a potential top and I'm beginning to see them. There are a number of these...

READ MORE

MEMBERS ONLY

Special Note: These 3 Charts Have a Story to Tell; RRG Chart Points Toward Higher Alpha Generation on a Relative Basis

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The headline index NIFTY is presently trading near its lifetime-high levels, returning a stellar 15% over the past 12 months and 1.08% on a Year-to-Date basis. Having said this, the loss of momentum and few negative divergences on the leading indicators are quite evident on the charts. It will...

READ MORE

MEMBERS ONLY

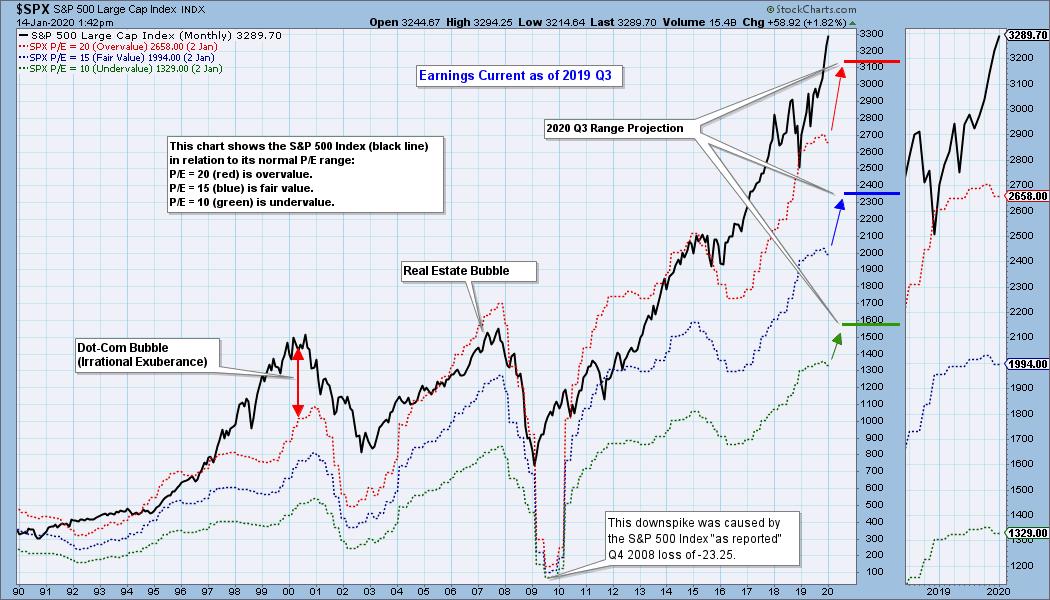

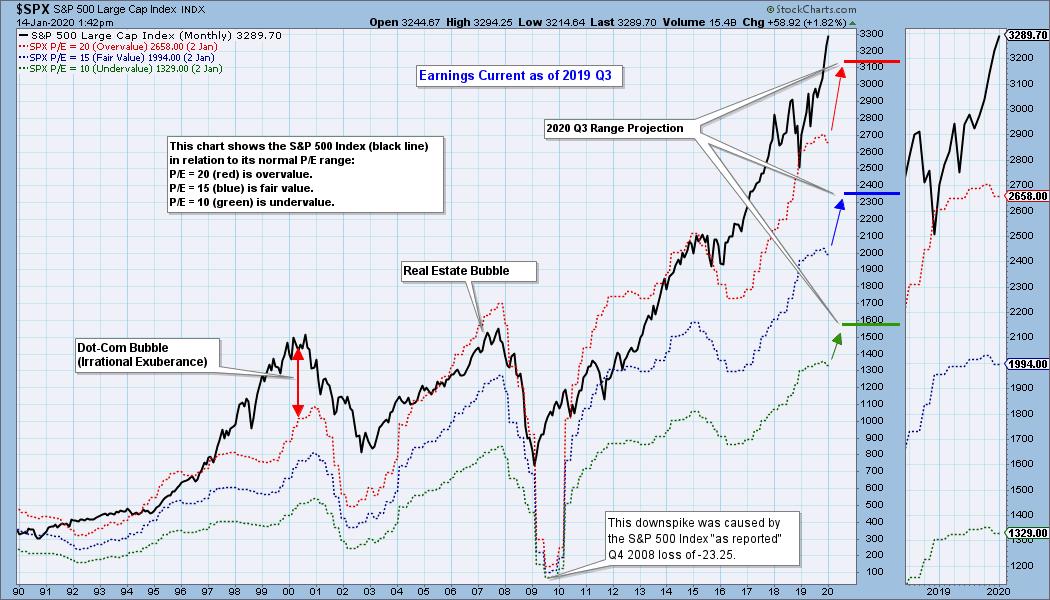

S&P 500 2019 Q3 EARNINGS: Market Is Way Overvalued

by Carl Swenlin,

President and Founder, DecisionPoint.com

The S&P 500 preliminary earnings for 2019 Q3 are available, and based upon GAAP (Generally Accepted Accounting Principals) earnings, the S&P 500 is beyond overvalued. The following chart shows us the normal value range of the S&P 500 Index, indicating where the S&...

READ MORE

MEMBERS ONLY

Dollar Index Reaches a Crucial Technical Juncture Point

by Martin Pring,

President, Pring Research

The Dollar Index has been rising in the last few sessions following its December decline, which has put it at a crucial technical juncture. Whichever way it breaks will have implications for commodities, gold and the relative performance of international equities to the US. A rising currency would have negative...

READ MORE

MEMBERS ONLY

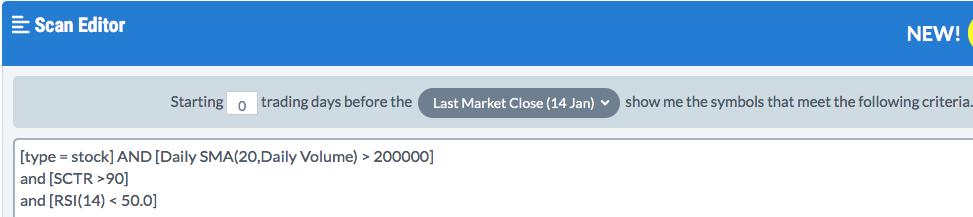

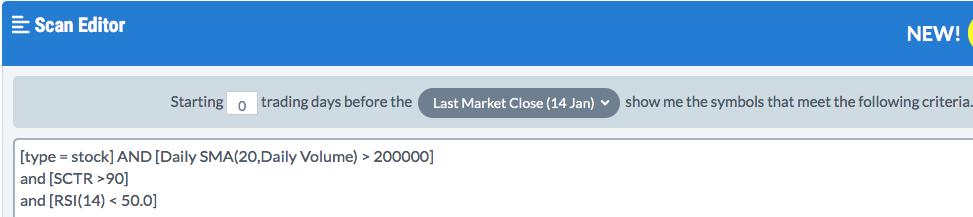

A Simple Scan To Uncover Strong Stocks Pulling Back; Here Are 4 Examples

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

A common question I hear now that we've seen a significant advance in U.S. equities is, "when should I get in"? Well, we're in a secular bull market. It started in 2013 and won't end, in my opinion, until the end...

READ MORE

MEMBERS ONLY

ETF Indexing, Carl's Scan and New ChartLists on DecisionPoint.com

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Erin and Carl present their thoughts on the current market environment and the problems we should be aware of. Stocks above their 20/50/200-EMAs have negative divergences with the SPY price chart. Could ETF indexing be the next "bubble"? It seems the...

READ MORE

MEMBERS ONLY

From a Trading Idea To a Position

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In my last article for the Don't Ignore This Chart blog, which I write for on Thursdays, I wrote about the clear message that the rotation of Growth vs. Value is currently sending. As those are short articles meant to point to potentially interesting situations and usage of...

READ MORE

MEMBERS ONLY

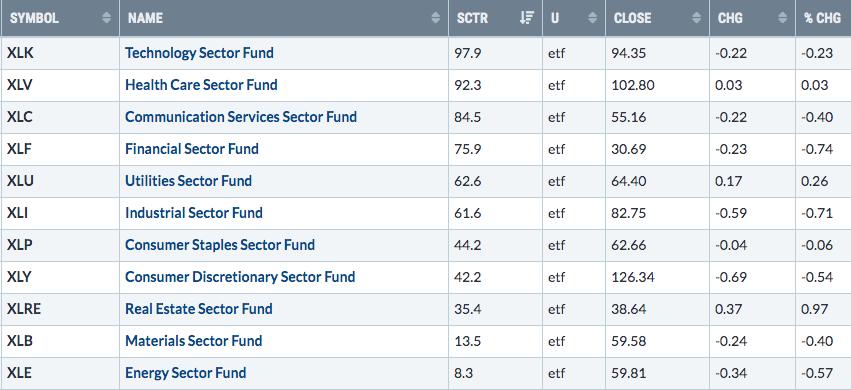

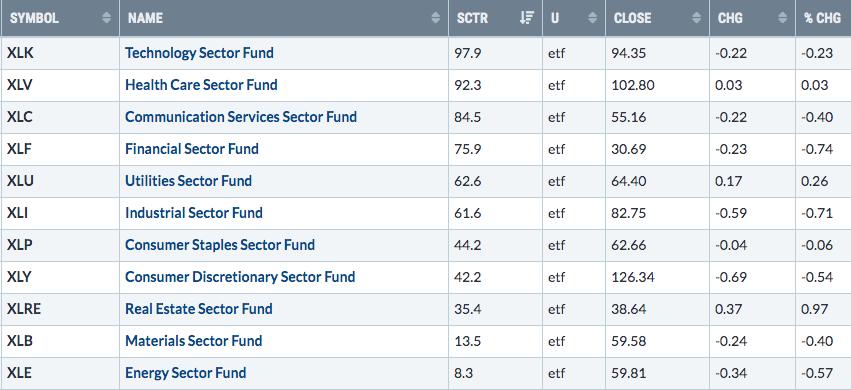

Performance Ranks vs. SCTRs: A 6 Month Test

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Let's first look at our sector SPDR funds, in SCTR order:

It's important to note that SCTR scores are calculated as of today. Performance ranks will change based on whether we look at one day performance, one week performance, six months performance, etc. SCTRs remain the...

READ MORE

MEMBERS ONLY

What Gold's Pullback Means for the 2020 Outlook

by David Keller,

President and Chief Strategist, Sierra Alpha Research

The final chart that I shared in my portion of the StockCharts 2020 Market Outlook (coming soon to our YouTube channel!) was a two-year chart of gold. After a pullback in the fall to Fibonacci support, gold appeared to be resuming its long-term uptrend.Later, gold reached an extreme overbought...

READ MORE

MEMBERS ONLY

STOCKS LOOK VUNLERABLE TO SHORT-TERM PULLBACK -- DIVERGENCE FROM BOND YIELD MAY BE A WARNING -- LOWER TREASURY YIELD BOOSTS UTILITIES AND REITS -- BUT MAY CAUSE PROFIT-TAKING IN BANKS -- HOME CONSTRUCTION ISHARES TEST 2018 PEAK

by John Murphy,

Chief Technical Analyst, StockCharts.com

SHORT-TERM STOCK VIEW LOOKS OVER-EXTENDED...Despite geopolitical concerns at the start of the week between the U.S. and Iran, stocks ended the week higher. All three major stock indexes also hit new records before experiencing some minor-profit-taking on Friday. All trends remain solidly higher here and around the world....

READ MORE

MEMBERS ONLY

NIFTY May Remain Volatile in the Coming Week; RRG Charts Show Key Sectors Continuing to Lose Momentum

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

As the Indian markets traded on the anticipated lines, they continued to consolidate, but also saw tremendous volatility owing to the geopolitical tension in the West Asian region. The NIFTY traded in a wider-than-usual range and ended the week on a relatively flat note. The index witnessed close to 400...

READ MORE

MEMBERS ONLY

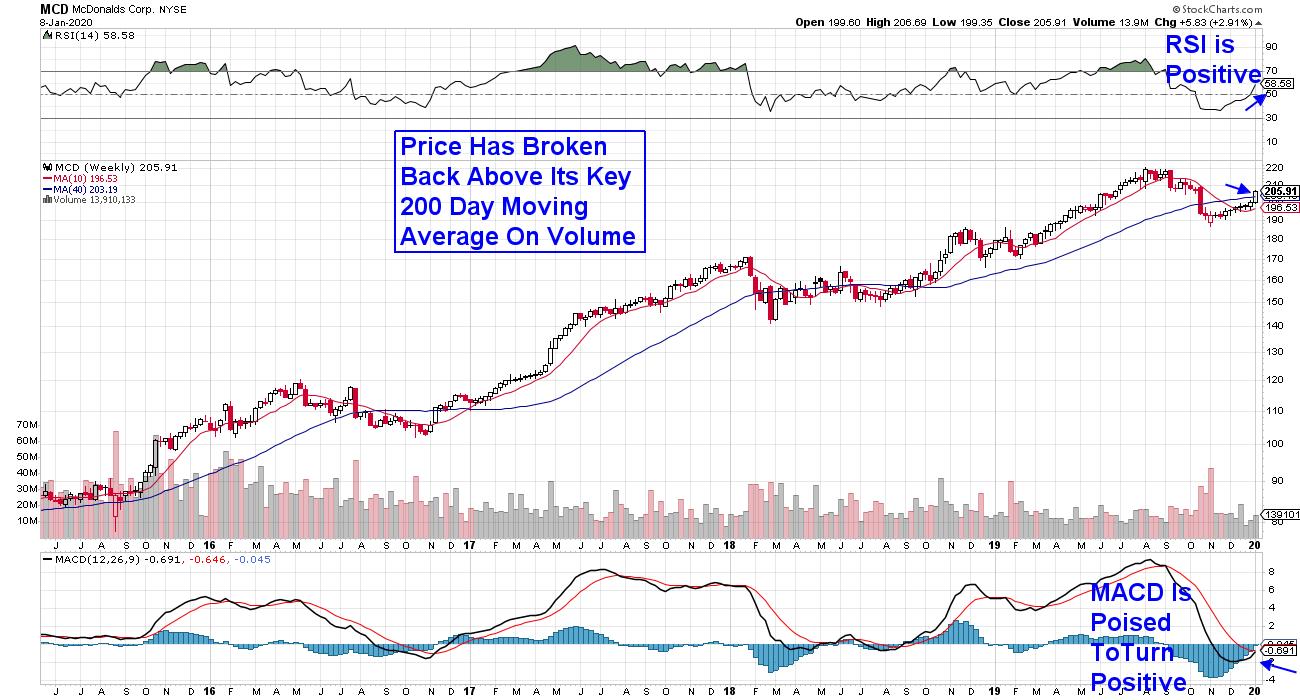

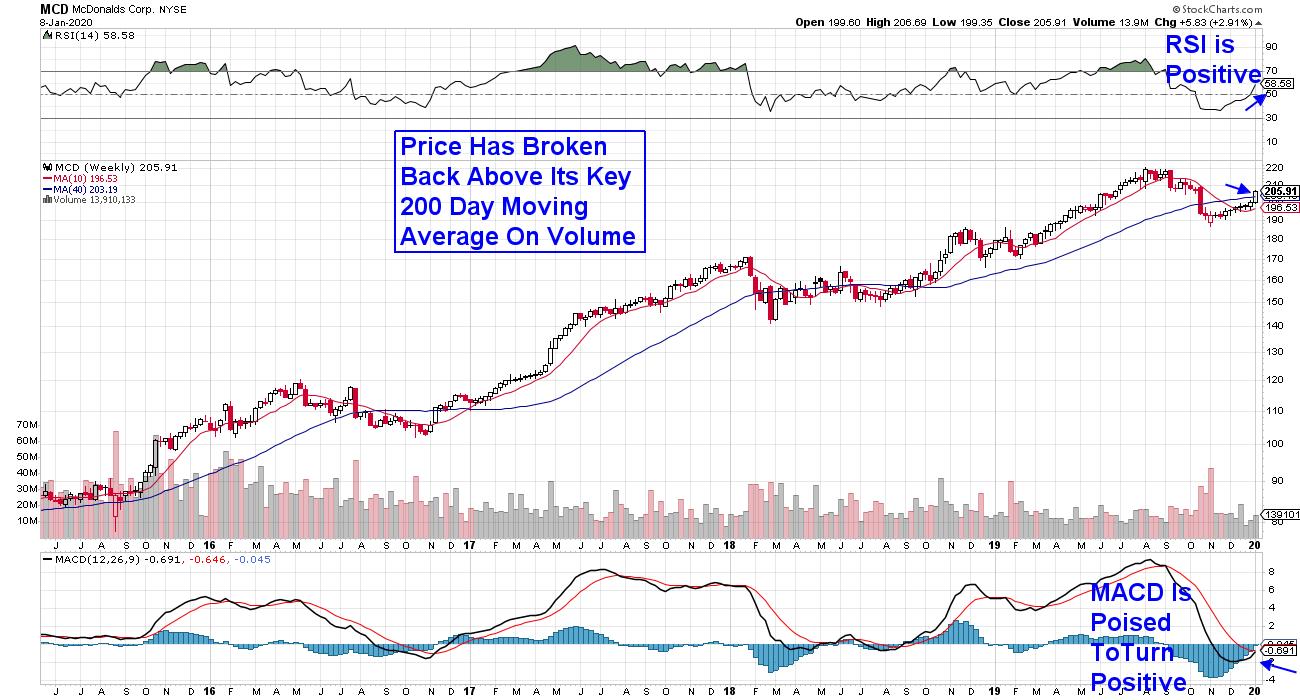

Consumer Discretionary Sector May Be Waking Up – Three Major Retailers That Are Setting The Pace

by Mary Ellen McGonagle,

President, MEM Investment Research

On Wednesday, I wrote about Mega-Cap Retail stock McDonalds (MCD) and its downtrend reversal. (You can read about that here.) Since then, more heavyweight retailers have begun to exhibit signs of renewed performance as they reverse downtrends or break out of lengthy flat bases.

Hampered by reduced foot traffic and...

READ MORE

MEMBERS ONLY

Do You Use The "Krauthammer Conjecture" To Improve Your Sell Discipline?

by Gatis Roze,

Author, "Tensile Trading"

I know a majority of my fellow investors are also ardent sports fans who live-a-little or die-a-little with each win or loss by their respective team. The parallels to investing are self-evident. Afterall, our portfolios of equities are our teams as well.

According to the Krauthammer Conjecture, "the pleasure...

READ MORE

MEMBERS ONLY

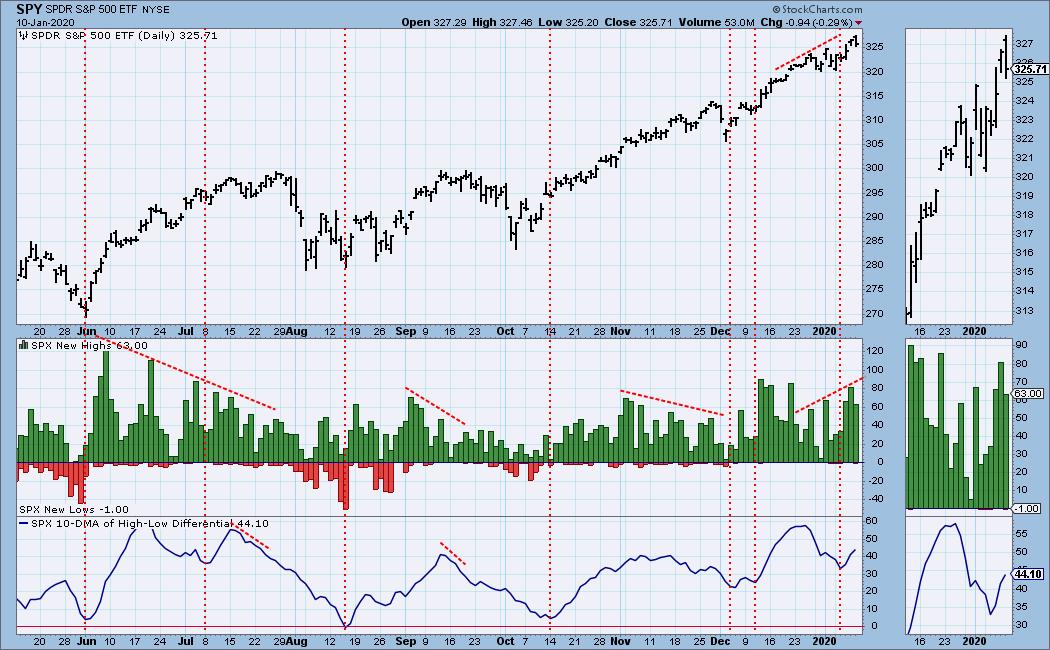

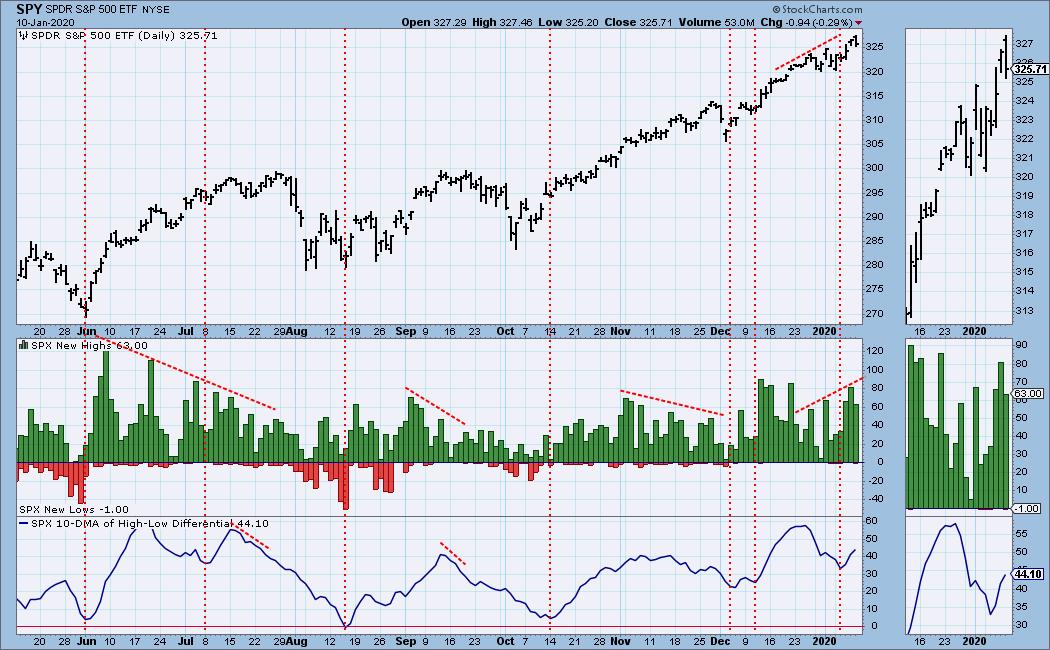

This Chart Suggests Rally Should Continue in the Very Short-Term

by Erin Swenlin,

Vice President, DecisionPoint.com

This is an excerpt from yesterday's DecisionPoint Alert [with updated comments & charts]. If you'd like to subscribe to DecisionPoint.com's DP Alert, click here! You can also join our free newsletter list here!

One of my favorite indicators is the 10-DMA of the...

READ MORE

MEMBERS ONLY

Get Ready - Earnings Season Ready to Kick into High Gear

by John Hopkins,

President and Co-founder, EarningsBeats.com

Most of the talking heads on TV have gone out of their way to indicate that analysts have lowered their expectations for Q4 earnings. Given the way the market has powered forward with a new year underway, one can only imagine what the S&P might look like if...

READ MORE

MEMBERS ONLY

MEM Edge TV: Six Tech Stocks Poised to Trade Much Higher After Revealing New Products

by Mary Ellen McGonagle,

President, MEM Investment Research

On this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the top news from the world's largest tech show and the stocks that will benefit. Afterwards, she provides in-depth market analysis regarding major companies that are due to report earnings next week. This video was...

READ MORE

MEMBERS ONLY

Stocks Rally on Reduced Mideast Tensions

by John Murphy,

Chief Technical Analyst, StockCharts.com

After several tense days, some calm is being restored to global markets. The fact that last night's attack by Iran on allied bases in Iraq resulted in no casualties; plus a more conciliatory-sounding speech by President Trump shortly before noon appear to have reduced geopolilitical tensions in the...

READ MORE

MEMBERS ONLY

REIT SPDR Holds Key Moving Average as its Biggest Components Spring to Life

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Ten of the eleven sector SPDRs are positive over the last three months. The Real Estate SPDR (XLRE) is the only sector sporting a loss (~.75%), but I am not concerned with relative weakness because the price chart looks bullish overall. Note that XLRE was the leading sector in early...

READ MORE

MEMBERS ONLY

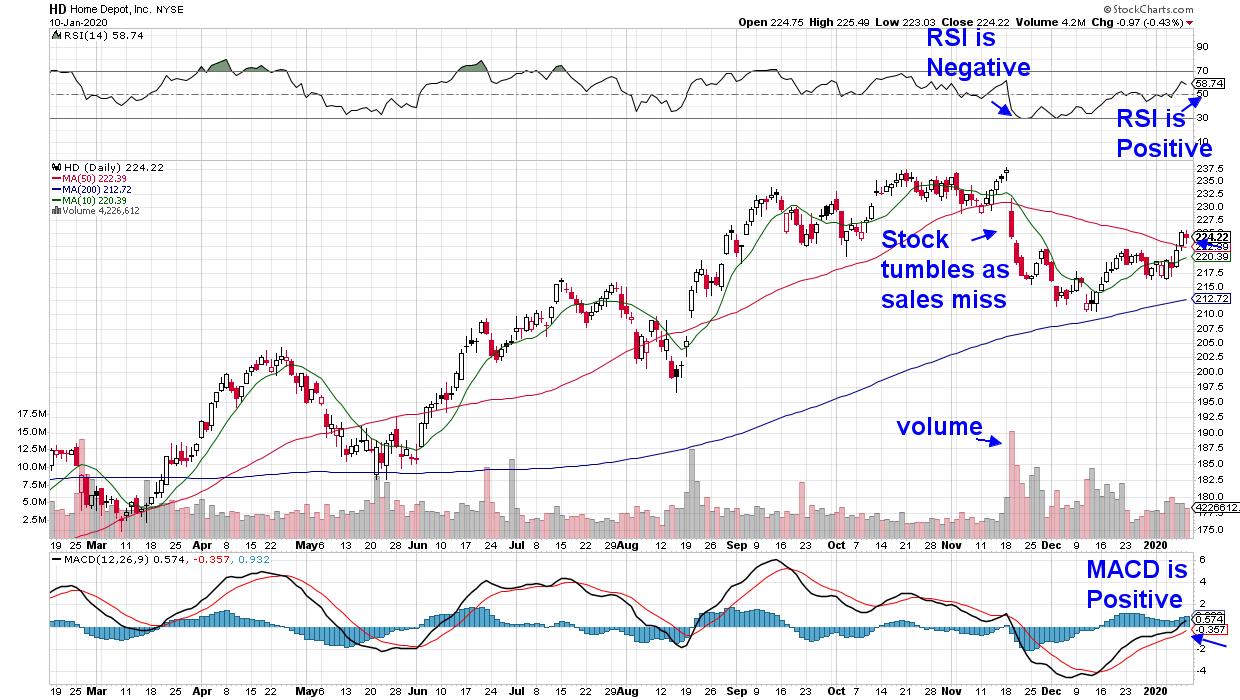

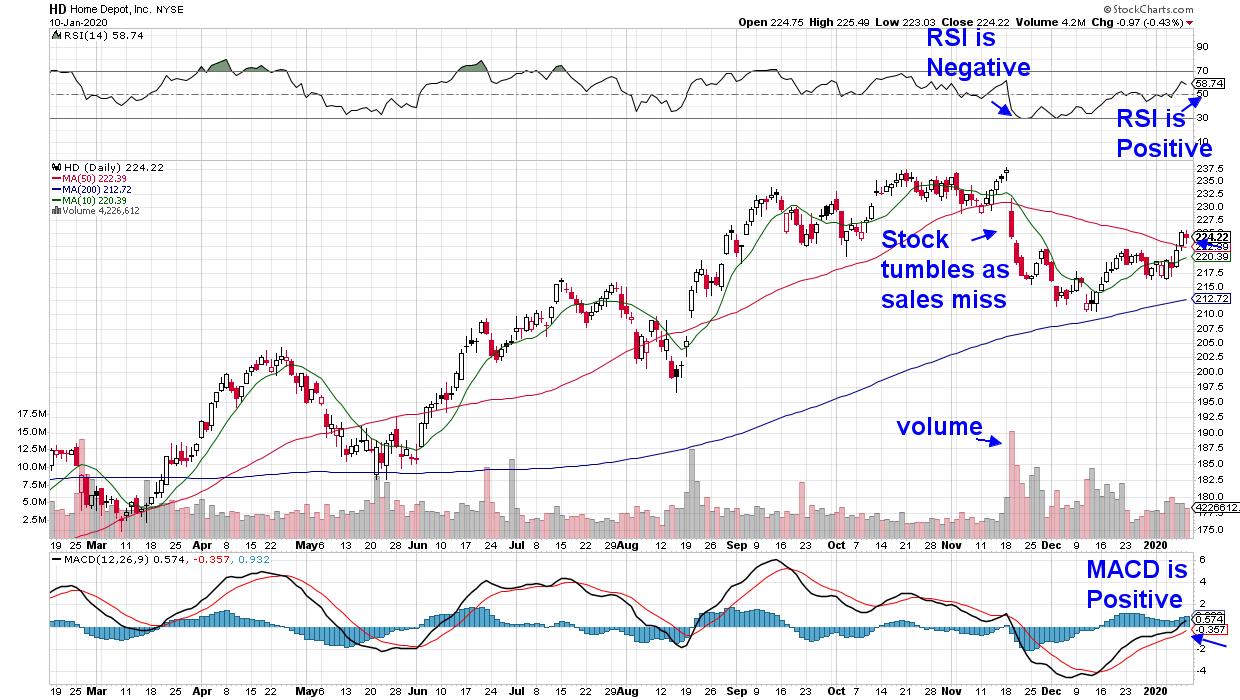

Another Solid Jobs Report Likely To Fuel Further Rally; Here Are A Few Winners

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

December nonfarm payrolls were just released and they were solid, though slightly below expectations. They suggest moderate economic improvement and the very slight increase in average hourly earnings confirms that the labor market, while tight, is not too tight. That combination, moderate growth and tame inflation, along with the reduced...

READ MORE

MEMBERS ONLY

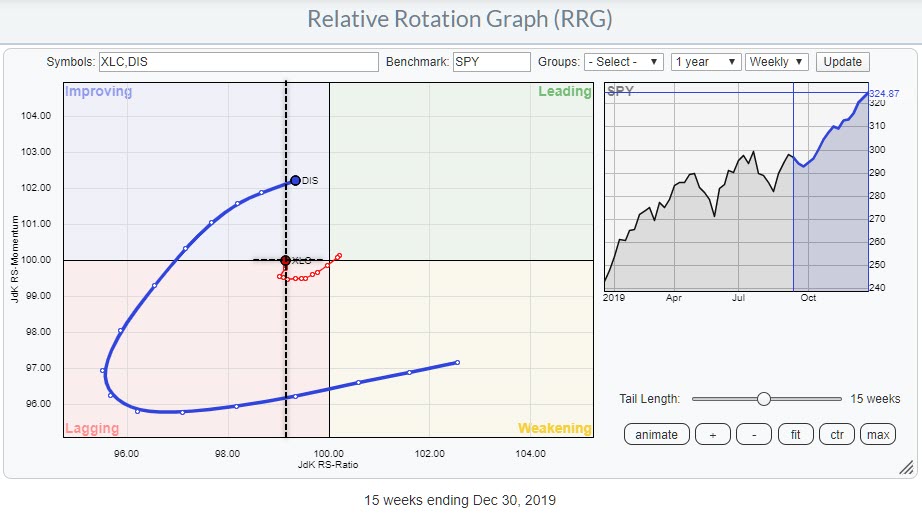

RRG Shows a Clear Winner for Growth vs. Value

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Relative Rotation Graphs enable us to see beyond sectors or individual stock rotations; they can also be used to visualize differently-sorted market segments.

The RRG above illustrates growth vs. value stocks, a measure that often is also used to gauge the direction for the general market. In general, growth will...

READ MORE

MEMBERS ONLY

This Mega-Cap Stock Just Reversed its 5-Month Downtrend - I'm Lovin It!

by Mary Ellen McGonagle,

President, MEM Investment Research

It's been a tough period recently for many retailers as they struggle to adjust to consumers' ever-shifting demands. Many of these shifts have been driven by technological advances, as digital sales and faster product delivery times are a must if companies want to succeed.

Let's...

READ MORE

MEMBERS ONLY

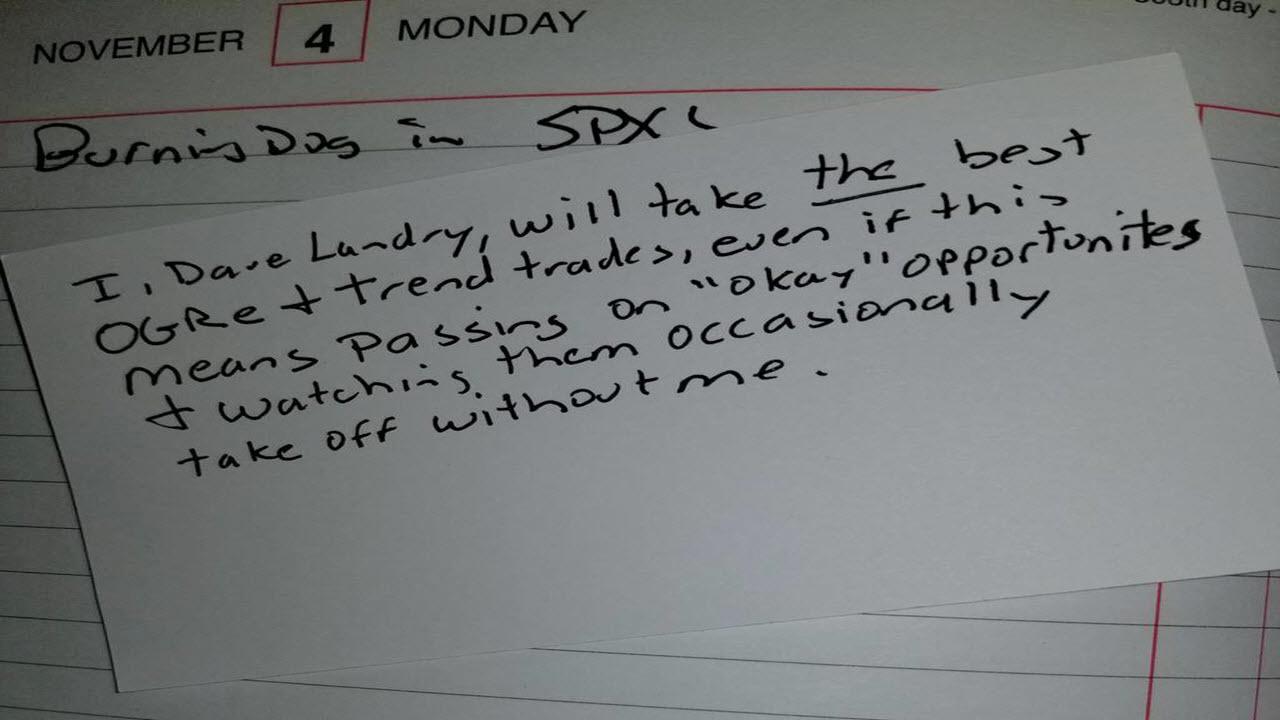

20 Trading Resolutions for 2020, Part 1

by Dave Landry,

Founder, Sentive Trading, LLC

In this edition of Trading Simplified, Dave reveals the first five of his twenty trading resolutions going into 2020. In addition, Dave presents a new edition of "The Missed, The Best or the Worst Trade of the Week", reveals a new Mystery Chart, takes some requests and more...

READ MORE

MEMBERS ONLY

STOCKS RALLY ON REDUCED MIDEAST TENSIONS -- OIL DROPS SHARPLY -- ENERGY SHARES PULL BACK FROM CHART RESISTANCE -- VIX REMAINS WEAK

by John Murphy,

Chief Technical Analyst, StockCharts.com

GLOBAL STOCKS CLIMB ON CONCILIATORY REMARKS... After several tense days, some calm is being restored to global markets. The fact that last night's attack by Iran on allied bases in Iraq resulted in no casualties; plus a more conciliatory-sounding speech by President Trump shortly before noon appear to...

READ MORE

MEMBERS ONLY

Sector Spotlight: Monthly Charts and a Look at Asset Allocation

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV'sSector Spotlight, I take a look at new monthly charts and asset allocation. Afterwards, I build more on the Seasonality visualization and interpretation that I started during last month. This video originally aired on January 7th, 2020.

Sector Spotlight airs weekly on Tuesdays...

READ MORE

MEMBERS ONLY

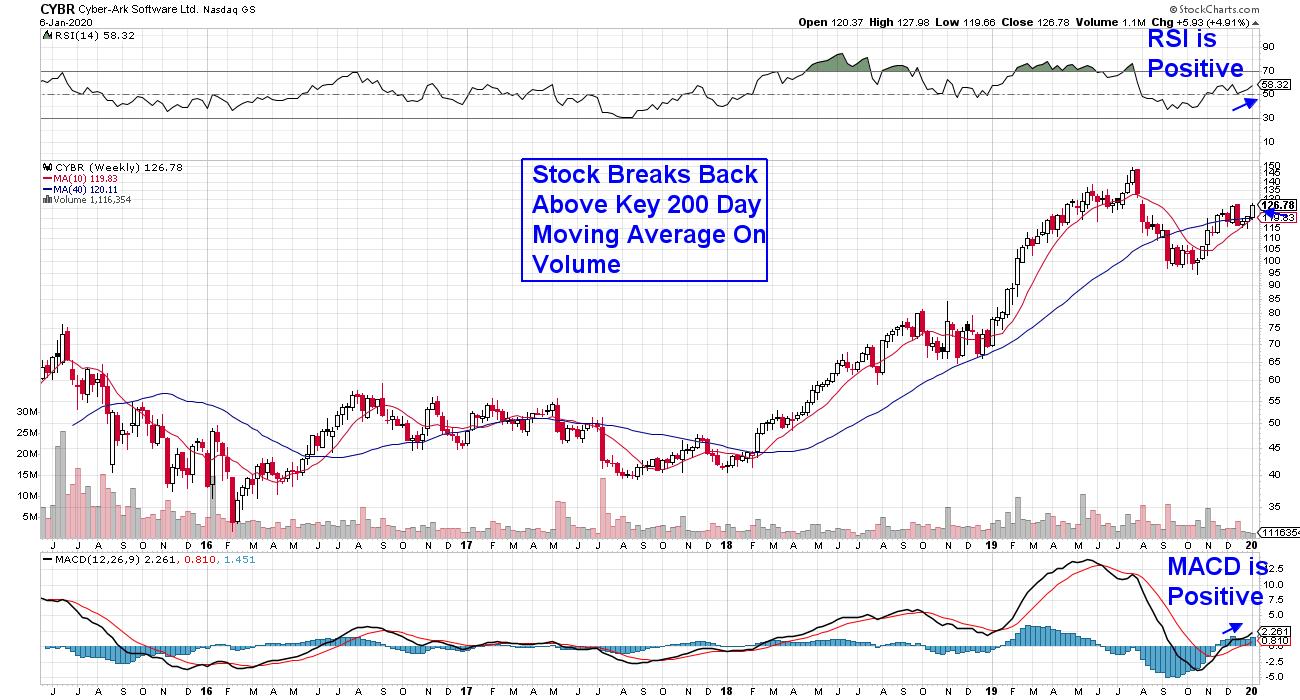

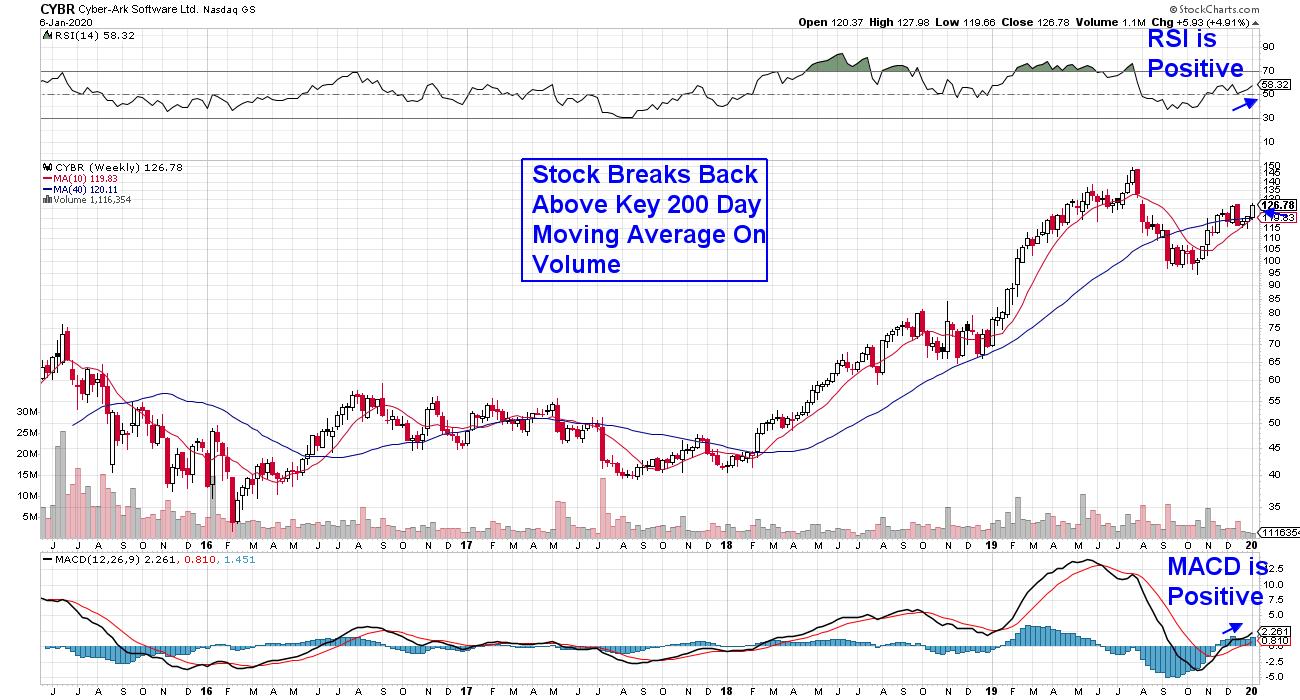

Fears of Retaliation from Iran Cause a Spike in this Group of Stocks

by Mary Ellen McGonagle,

President, MEM Investment Research

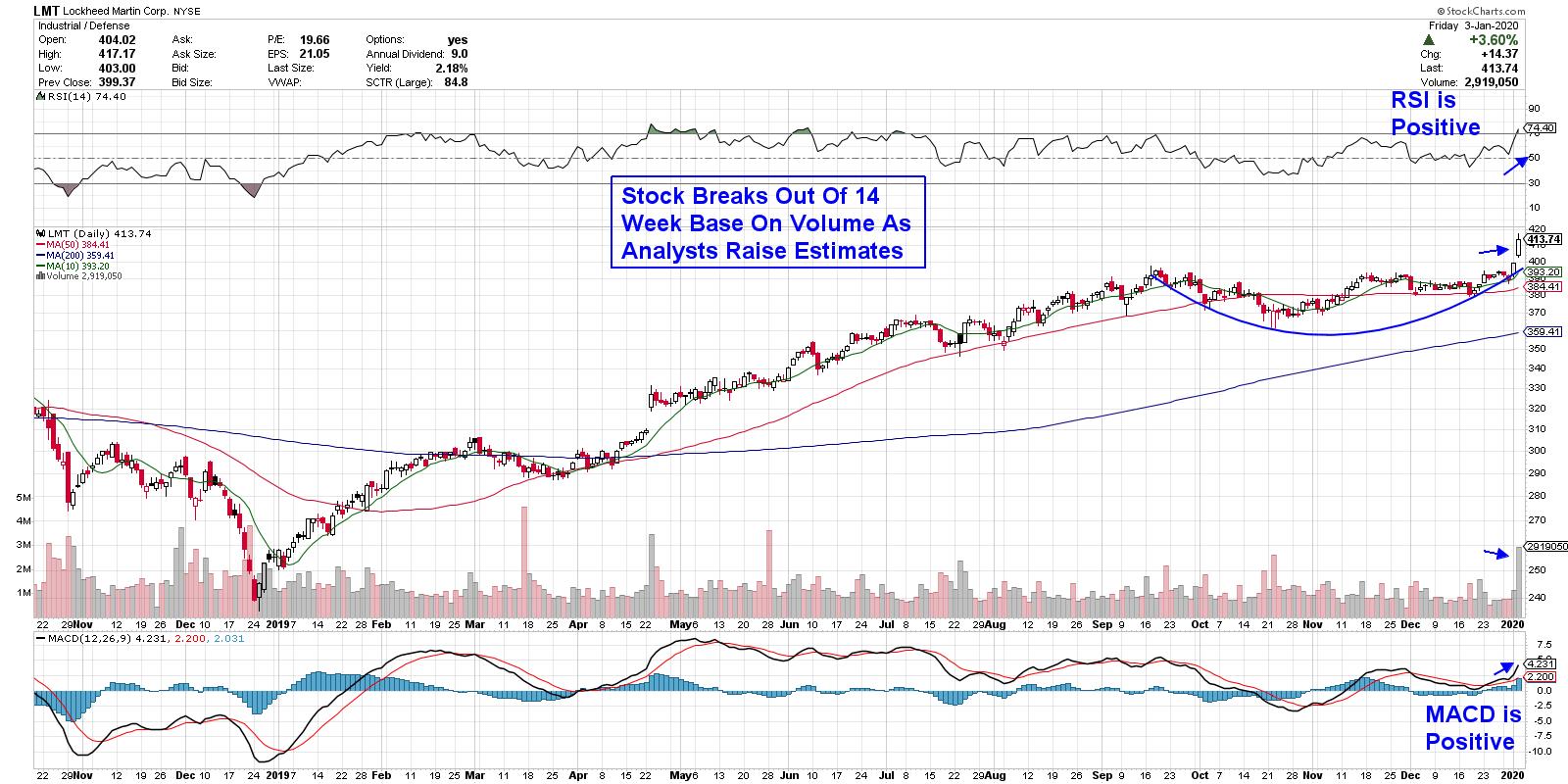

Last Friday, I wrote about the sharp uptick in many defense-related stocks following news of a deadly airstrike against Iran. (You can read that article here) Since then, fears of a retaliation by way of a cyberattack against the U.S. has sparked interest in another area of the markets...

READ MORE

MEMBERS ONLY

DP Show: In the News - Oil Poised to Outperform? + GRAND OPENING of DecisionPoint.com

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

DecisionPoint.comis live! In this episode ofDecisionPoint, Erin unveils the new DecisionPoint website and its features, including the new home of the DecisionPoint Alert and Daily Diamonds features and exclusive Sector ChartLists. In addition, Carl and Erin discuss the effect of rising instability in the Middle East on Oil prices,...

READ MORE

MEMBERS ONLY

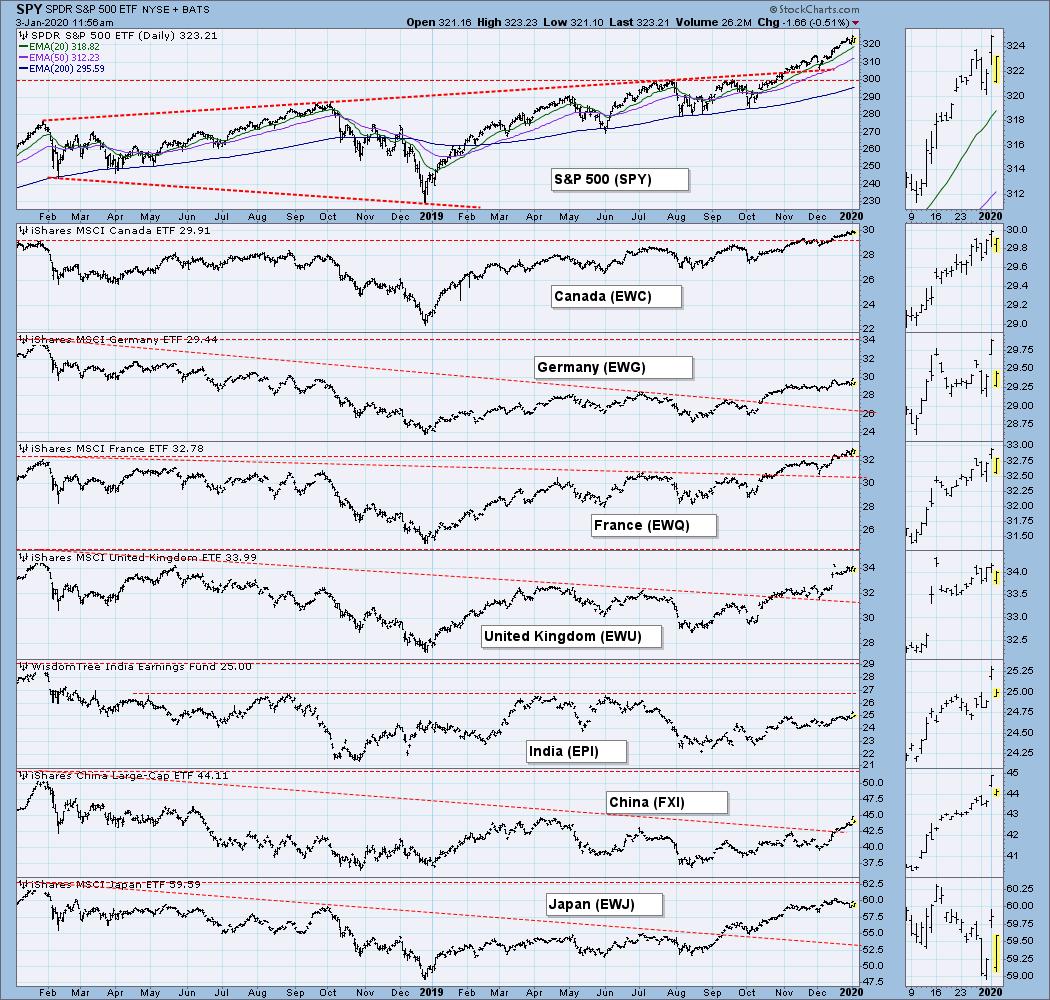

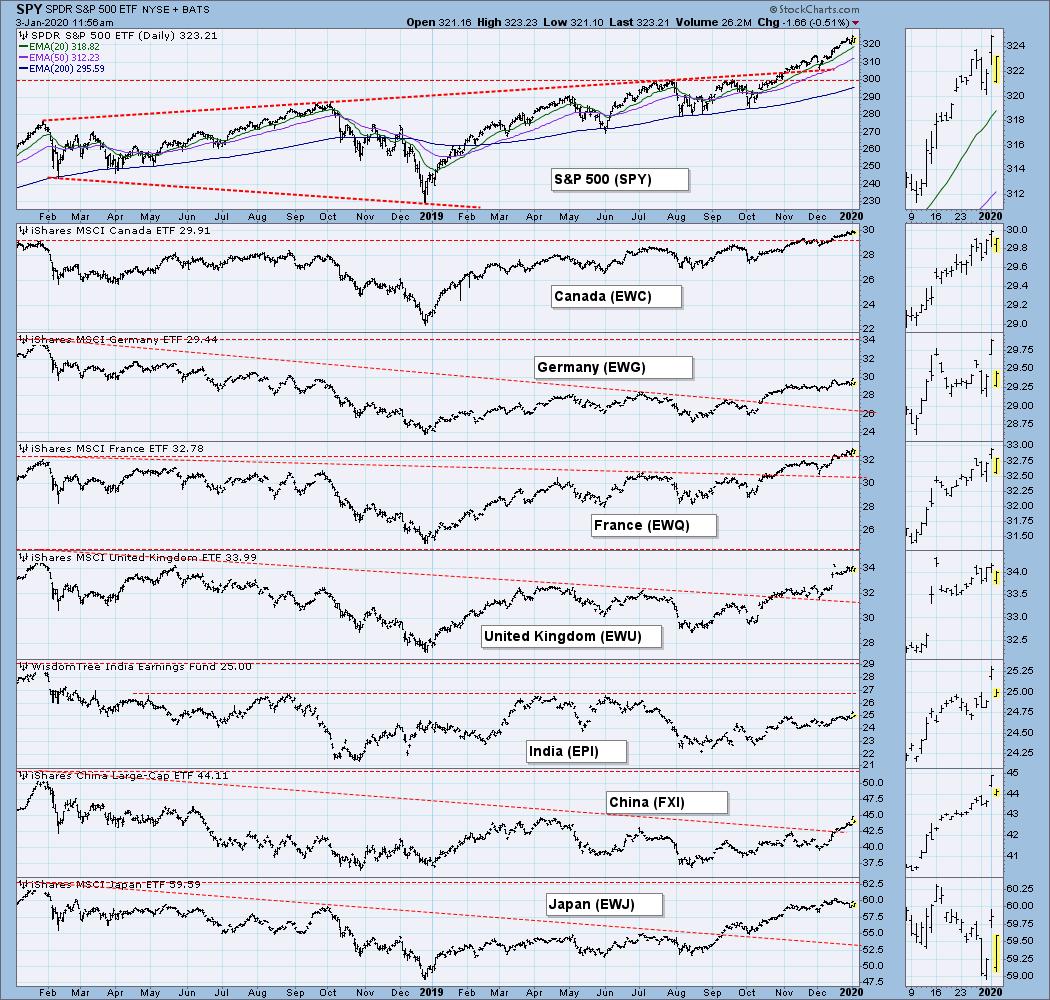

RISING CANADIAN DOLLAR HELPS PUSH CANADA ISHARES TO NEW RECORD -- THAT'S BECAUSE THE EWC IS QUOTED IN U.S DOLLARS -- THAT'S TRUE OF ALL FOREIGN STOCK ISHARES

by John Murphy,

Chief Technical Analyst, StockCharts.com

CANADIAN DOLLAR HITS NEW 52-WEEK HIGH... A couple of my messages posted during Christmas week wrote about a more bullish outlook for commodity markets this year. And the likelihood for a weaker U.S. dollar. One of the messages wrote about the Canadian Dollar being the strongest developed market currency...

READ MORE

MEMBERS ONLY

Random Thoughts: 20 Trading Resolutions for 2020 and Beyond, Part 2

by Dave Landry,

Founder, Sentive Trading, LLC

If you haven't read the first ten 2020 resolutions, click herebefore continuing.

11. I will seek excitement and entertainment outside of the market.

If you're looking for action, the market is a very expensive place to look. As I preach, "have an affair instead. That...

READ MORE

MEMBERS ONLY

Power Charting TV: Wyckoff 2020

by Bruce Fraser,

Industry-leading "Wyckoffian"

Joe Turner and Jim Kopas of Pring Turner Capital Group join me for a discussion of the current state of the business cycle. Their firm (along with Martin Pring and Tom Kopas) does some of the best research on the planet on the domestic and global business cycle. Year end...

READ MORE

MEMBERS ONLY

Putting Declines into Perspective to Find Opportunities - Plus an Opportunity in the Tech Sector

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

2019 was quite the year with many stocks moving sharply higher from January to July-August. In particular, several Technology stocks moved higher during this period and then corrected into October. We can see this pattern reflected in the Equal-Weight Technology ETF (RYT) as it advanced over 40% and then corrected...

READ MORE

MEMBERS ONLY

Week Ahead: Likely to See Increase in Volatility; RRG Chart Shows Likely Resilience from These Sectors

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Indian markets witnessed consolidation again for the second week in a row. The markets saw a generally stable week, one that remained in a limited and defined range and ended mildly in the negative. In the previous weekly note, we had expected the consolidation to continue, and indeed the...

READ MORE

MEMBERS ONLY

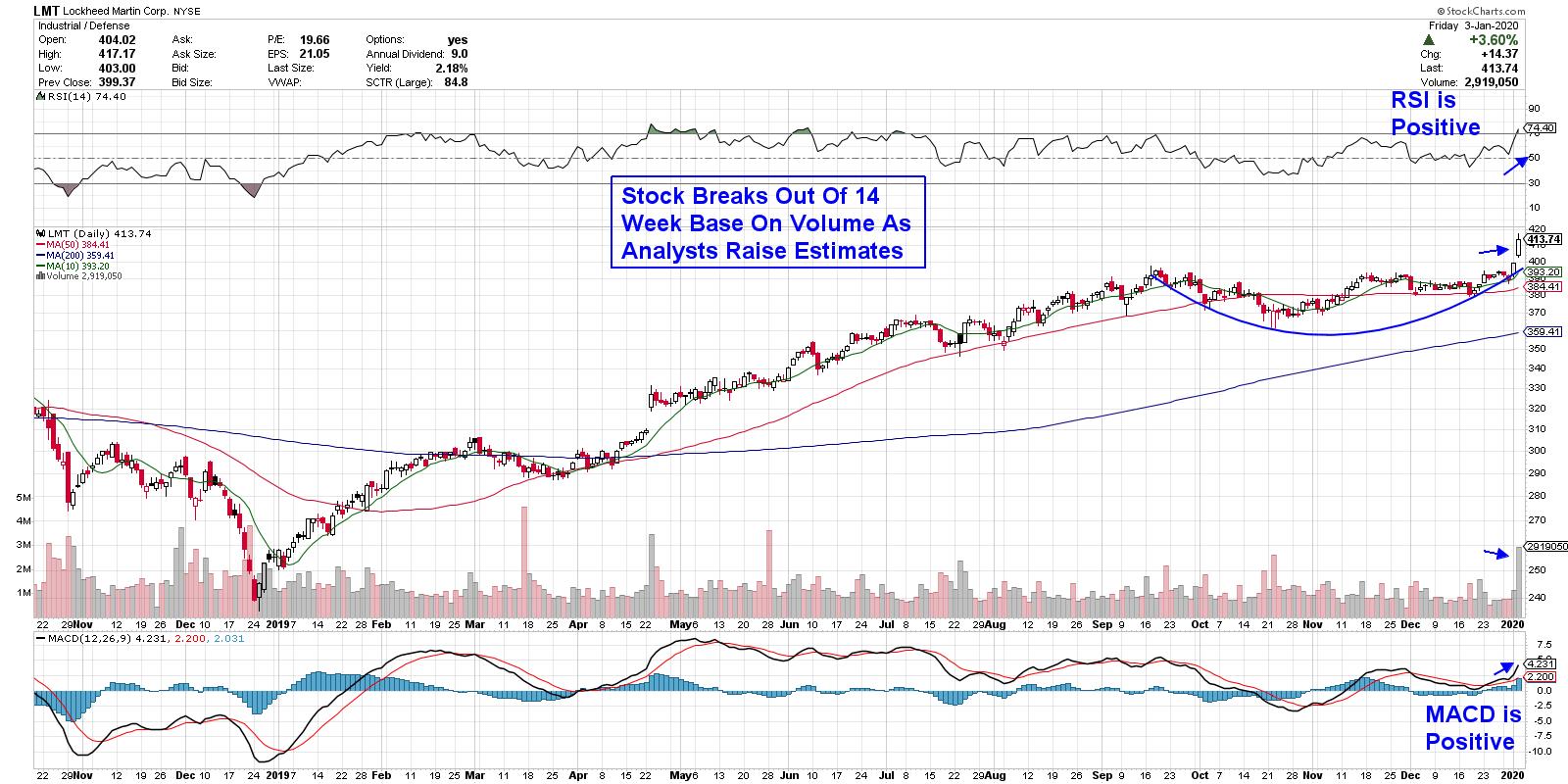

Defense-Related Stocks Rise Sharply on Mideast Tensions – Here are 3 Stocks Poised to Trade Even Higher

by Mary Ellen McGonagle,

President, MEM Investment Research

Defense companies had a strong rally this week after a U.S. airstrike in Iraq killed a key Iranian military leader. While the big move was due to heightened risk fears, this mostly oversold group of stocks could easily trade much higher due to factors at play even prior to...

READ MORE

MEMBERS ONLY

Gold Enters Extreme Overbought Zone

by David Keller,

President and Chief Strategist, Sierra Alpha Research

The final chart that I shared in my portion of the StockCharts 2020 Market Outlook (coming soon to our YouTube channel!) was a two-year chart of gold. After a pullback in the fall to Fibonacci support, gold appeared to be resuming its long-term uptrend. Now, gold has reached the extreme...

READ MORE

MEMBERS ONLY

Coffee, Charts and a Proper Perspective

by David Keller,

President and Chief Strategist, Sierra Alpha Research

You pour yourself a cup and coffee, fire up the computer and begin your daily investment process. What do you look at first? What's the last thing you review before moving on to other things? Most importantly, is your daily process consistent from one day to the next?...

READ MORE

MEMBERS ONLY

DP ALERT WRAP: DecisionPoint.com -- Everything Old Is New Again!

by Carl Swenlin,

President and Founder, DecisionPoint.com

This will be the last free issue of the DecisionPoint ALERT. Last fall StockCharts.com changed its business model regarding our free content, and Erin and I need to embrace the subscription model if we are to continue doing what we do. Our new DecisionPoint.com website launched yesterday, and...

READ MORE

MEMBERS ONLY

Bull in a China Shop

by Martin Pring,

President, Pring Research

Thursday's price action in China resulted in a powerful signal that Chinese equities are headed significantly higher. That should be bullish not only for China but for the world as a whole. In making that statement, I am assuming that that this market is in the process of...

READ MORE

MEMBERS ONLY

Finding the Top 15 S&P 500 Stocks for 2020

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Happy New Year and welcome to a brand new decade! A century later, I believe the stock market is about to repeat itself as I'm expecting another roaring 20's! And yes, that could lead to another rough 30's decade, but let's worry...

READ MORE

MEMBERS ONLY

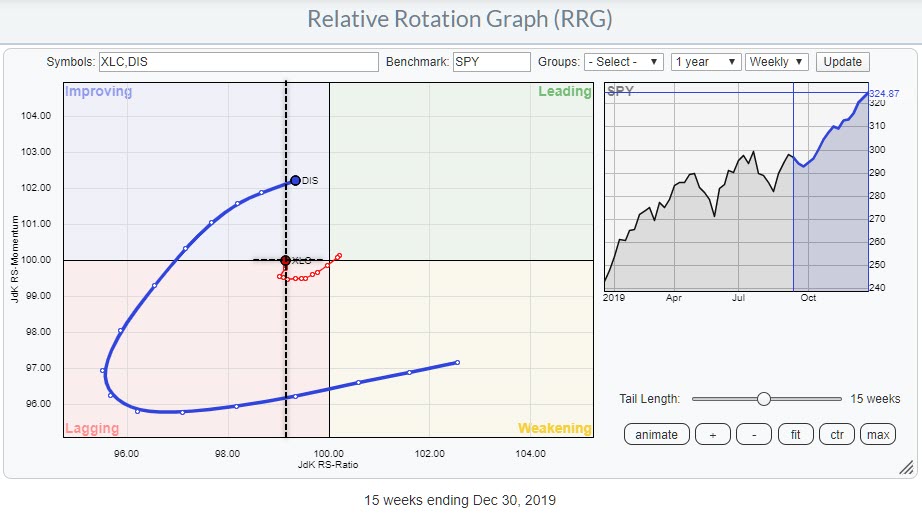

Will Disney Be the New Leader in Communication Services (XLC)?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

XLC, the Communication Services Sector, is sending some mixed signals.

On the price chart, XLC convincingly cleared resistance at $51 in November, when it pushed above the horizontal boundary that ran over the highs (four in total) of 2018 and 2019.

That level was tested one more time as support...

READ MORE

MEMBERS ONLY

INCREASED MIDEAST TENSIONS CAUSE SOME PROFIT-TAKING IN STOCKS -- AND HIGHER CRUDE OIL PRICES

by John Murphy,

Chief Technical Analyst, StockCharts.com

ATTACK ON IRAN'S TOP GENERAL PUSHES OIL PRICES HIGHER... Overnight news of the killing of Iran's top general by the U.S. is having a reasonably predictable effect on global markets. Global stocks are experiencing some profit-taking, while money is flowing into traditional safe havens like...

READ MORE