MEMBERS ONLY

FOOTWEAR IS ANOTHER XLY LEADER -- THAT INCLUDES CROCS, NIKE, AND SKECHERS -- TESLA ACCOUNTS FOR AUTO STRENGTH -- ALL MAY BE TIED TO IMPROVEMENT IN CHINA -- THAT INCLUDES GAMBLING AND HOTEL STOCKS -- ROYAL CARIBBEAN CRUISES SAILS TO NEW RECORD

by John Murphy,

Chief Technical Analyst, StockCharts.com

ADD FOOTWEAR TO LIST OF XLY LEADERS... This week's messages have been focusing on the recent upside breakout in the Consumer Discretionary SPDR (XLY) and groups that are leading it higher. The last two messages showed gambling and hotel stocks taking the lead with some of them hitting...

READ MORE

MEMBERS ONLY

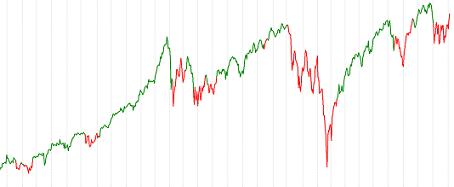

S&P 500 Surges Past 3200; Don't Make This Mistake

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Records continue to fall every day. The S&P 500 has now gained 350 points off its October 3rd low. I don't know if it's going to stop any time soon, so I'd want to remain fully invested, especially given the tremendous bullish...

READ MORE

MEMBERS ONLY

Reader's Proffer "Diamonds in the Rough"

by Erin Swenlin,

Vice President, DecisionPoint.com

Today is "Reader Request Thursday"! My readers provided me with well over 30 symbols to review to see if I agree with them that they are diamonds in the rough. It was an interesting group of choices. Some of my readers picked stocks in areas of the market...

READ MORE

MEMBERS ONLY

Stocks are Overdue for a Correction, But These Charts Say It Doesn't Matter

by Martin Pring,

President, Pring Research

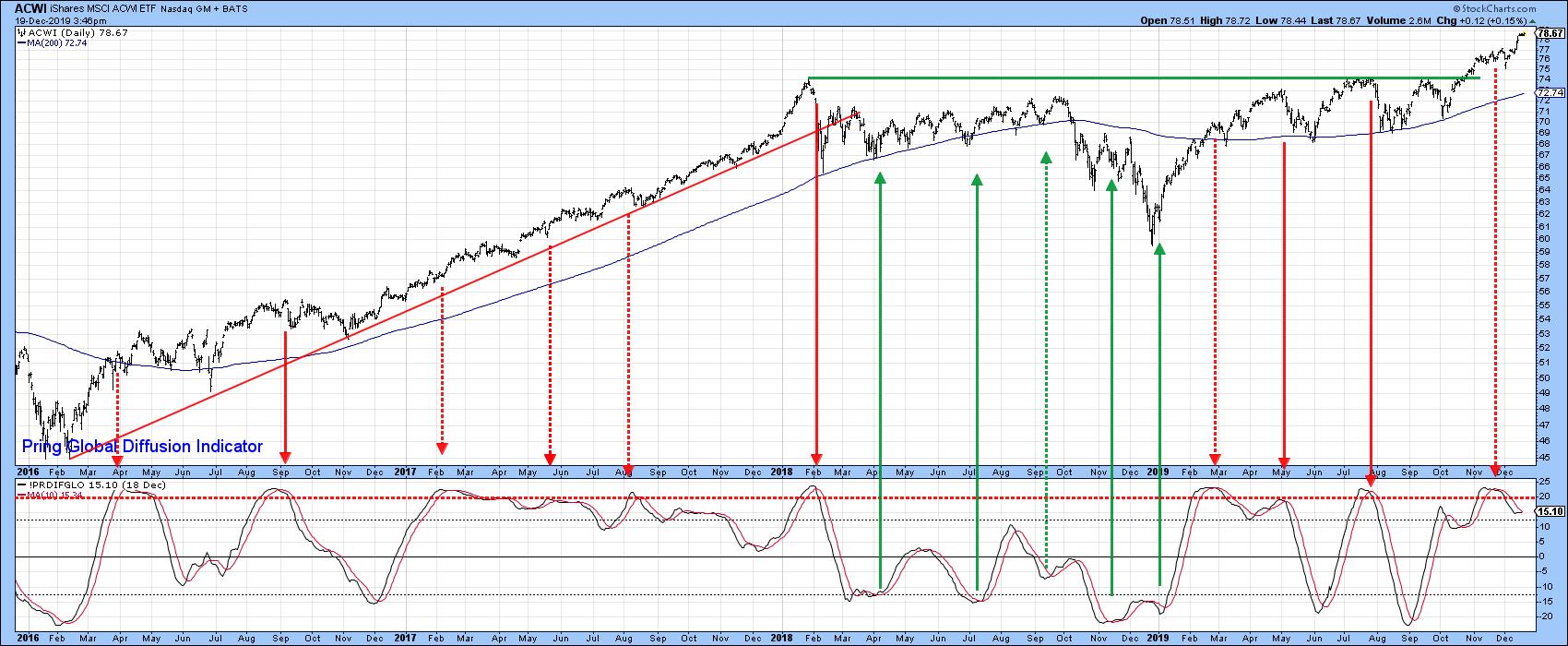

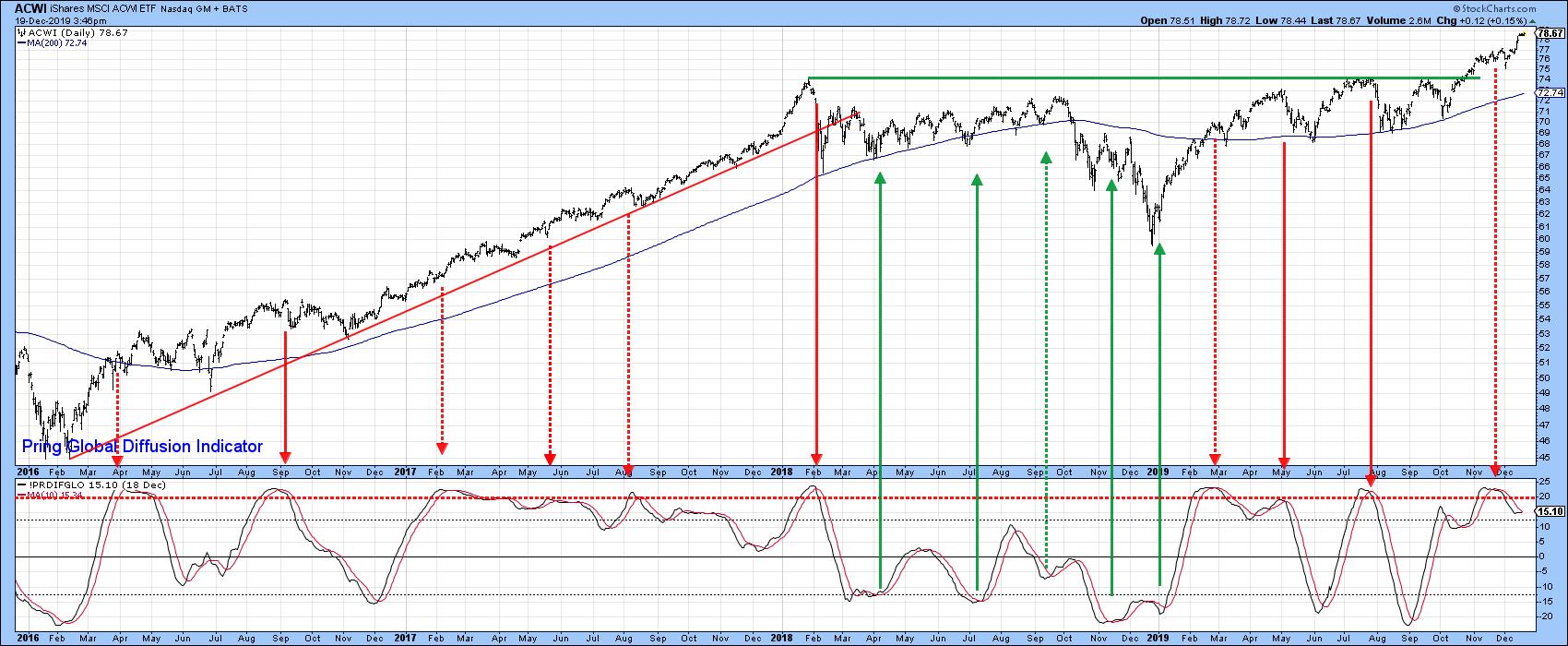

* Confidence is Breaking Out All Over

* Alternative Risk Relationships are Starting to Get Riskier

Right now, stocks are very overextended and likely due for a correction. In Chart 1, for instance, you can see that my Global Diffusion indicator has just triggered a sell signal from an extreme level. The...

READ MORE

MEMBERS ONLY

And That's a Wrap

by Larry Williams,

Veteran Investor and Author

On the 12th and final regular episode of Real Trading with Larry Williams, Larry takes a look at Great Unknown Growth Stocks with a seasonal trade, including Diageo (DEO), Constellation (STZ) and Brown-Forman (BF/A). He also discusses the US Stock Market, Gold and Bonds, as well as his upcoming...

READ MORE

MEMBERS ONLY

HOTEL STOCKS ARE ALSO XLY LEADERS -- HILTON, HYATT, AND MARRIOTT HIT NEW RECORDS

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW JONES HOTELS INDEX HITS NEW RECORD... Yesterday's message showed gambling stocks helping lead the Consumer Discretionary SPDR (XLY) into record territory this week. It also mentioned leadership from autos, footwear, and hotels. We're going to focus on hotels today. Chart 1 shows the Dow Jones...

READ MORE

MEMBERS ONLY

When You Enter 288 Numbers, This Is What You Get

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

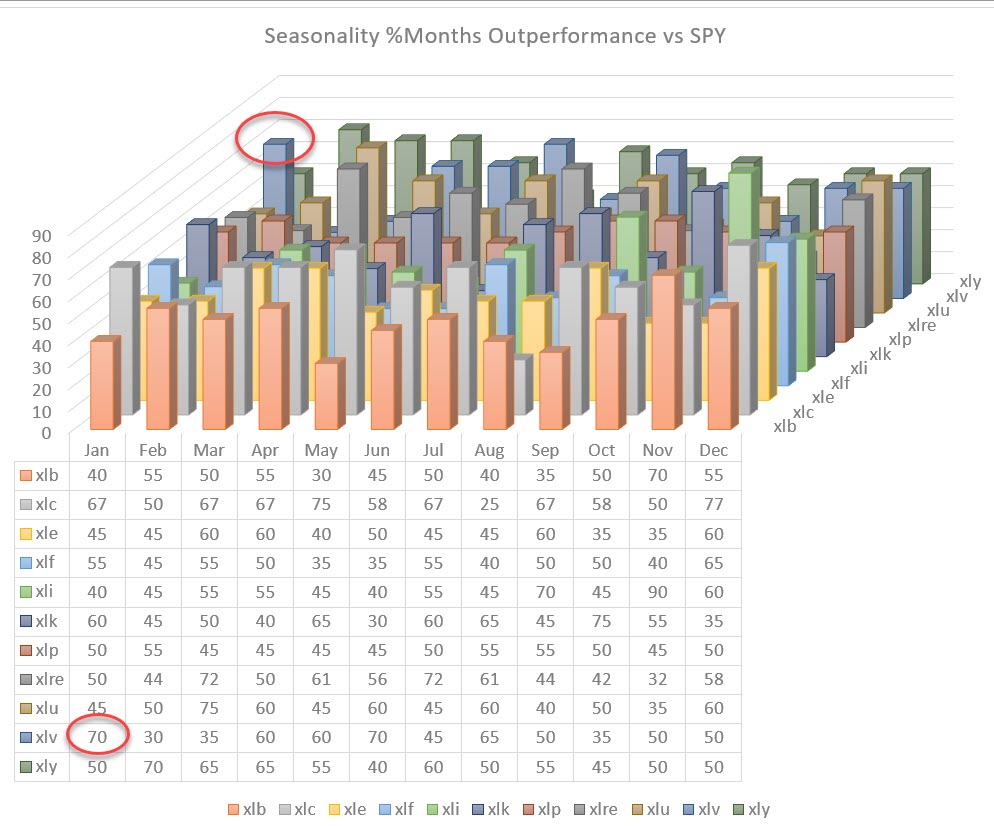

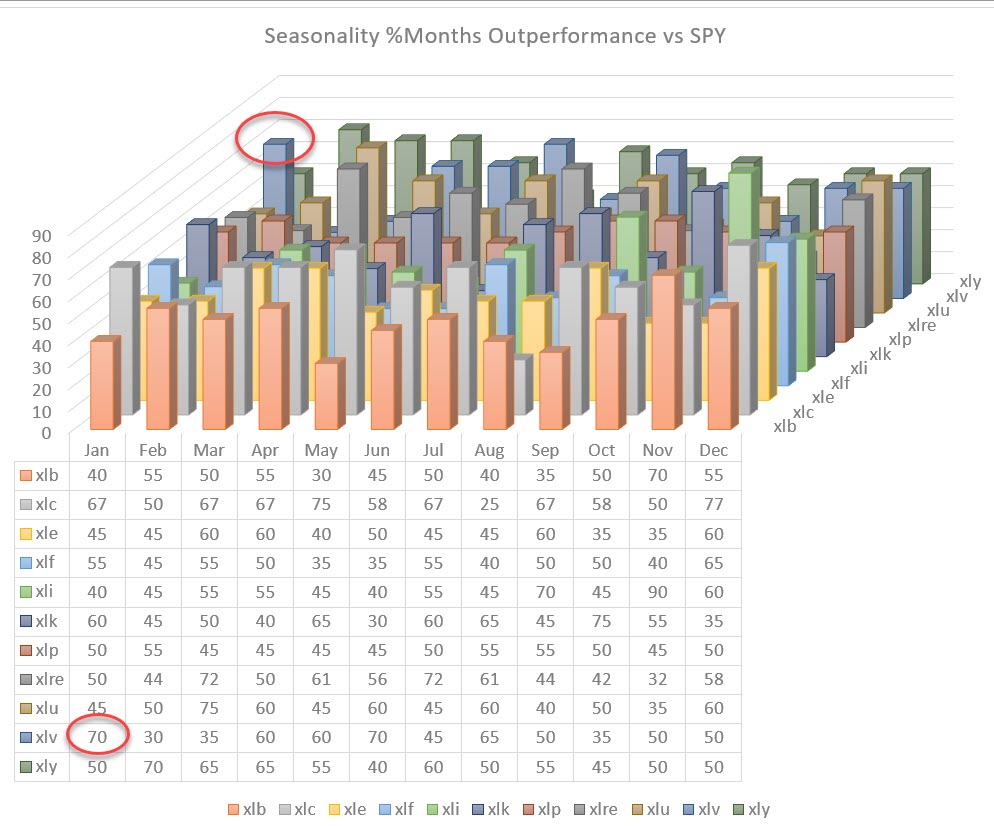

But What is it Showing?

The chart above shows the collective seasonality of all 11 sectors in the S&P 500.

To get there, I collected the numbers from the seasonality chart (which is available on the site) for every sector and the S&P 500 over the...

READ MORE

MEMBERS ONLY

DP Diamonds - These Sectors (and Stocks Within) Could be Diamonds in the Rough

by Erin Swenlin,

Vice President, DecisionPoint.com

A reader wrote to me and asked if I could evaluate the Sector ETFs and/or include a Sector ETF in my Diamonds report for those who mainly trade these vehicles. I took a look at the CandleGlance for all of the sectors and narrowed it down to two diamond...

READ MORE

MEMBERS ONLY

DP Alert Mid-Week: New Short-Term PMO BUY Signal for Dow Industrials ($INDU)

by Erin Swenlin,

Vice President, DecisionPoint.com

For consistency, I have adopted Carl's Weekly Wrap ChartStyles for the Mid-Week Alert. I hope you find them as helpful as I do! We had a new Short-Term Price Momentum Oscillator (PMO) BUY signal arrive for the Dow Industrials today; it was only delayed by a few days...

READ MORE

MEMBERS ONLY

Price Matters

by Dave Landry,

Founder, Sentive Trading, LLC

Don't confuse the issue with facts; be a trend-following moron. In this edition of Trading Simplified, Dave reveals the mystery charts from last week before unveiling a new segment, "The Missed, The Best or the Worst Trade of the Week." Dave discusses seeking (and accepting) the...

READ MORE

MEMBERS ONLY

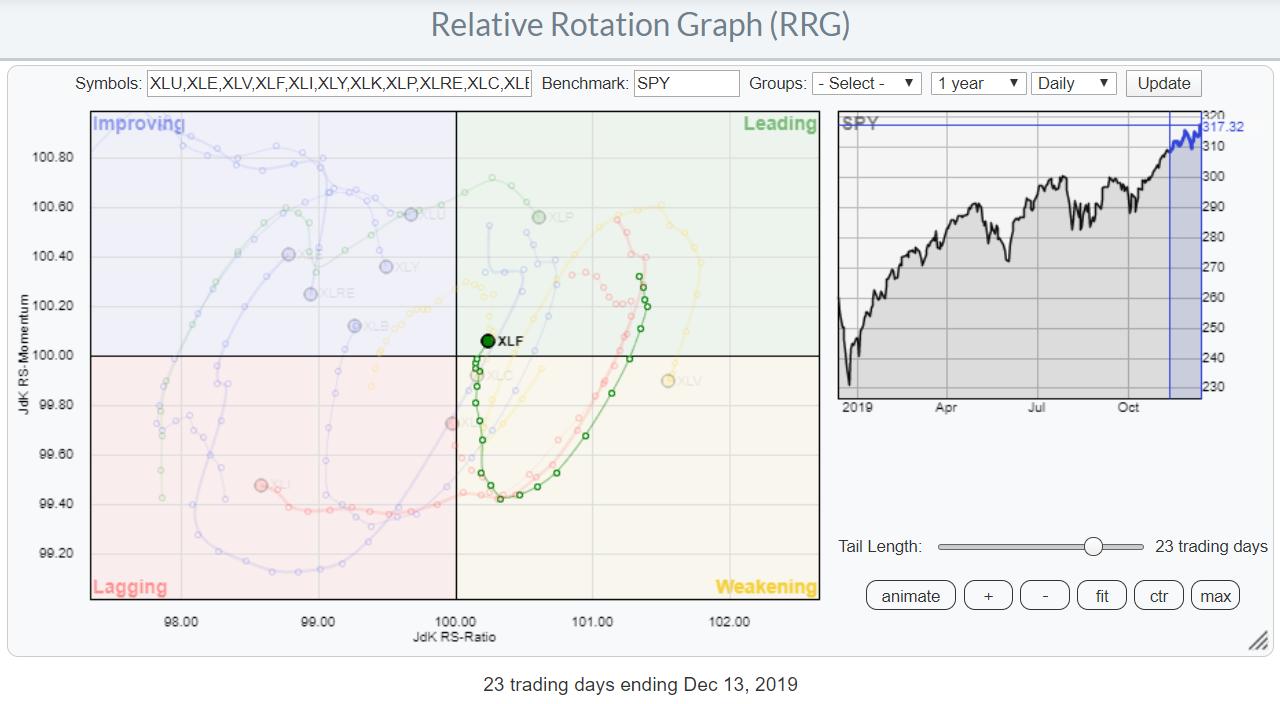

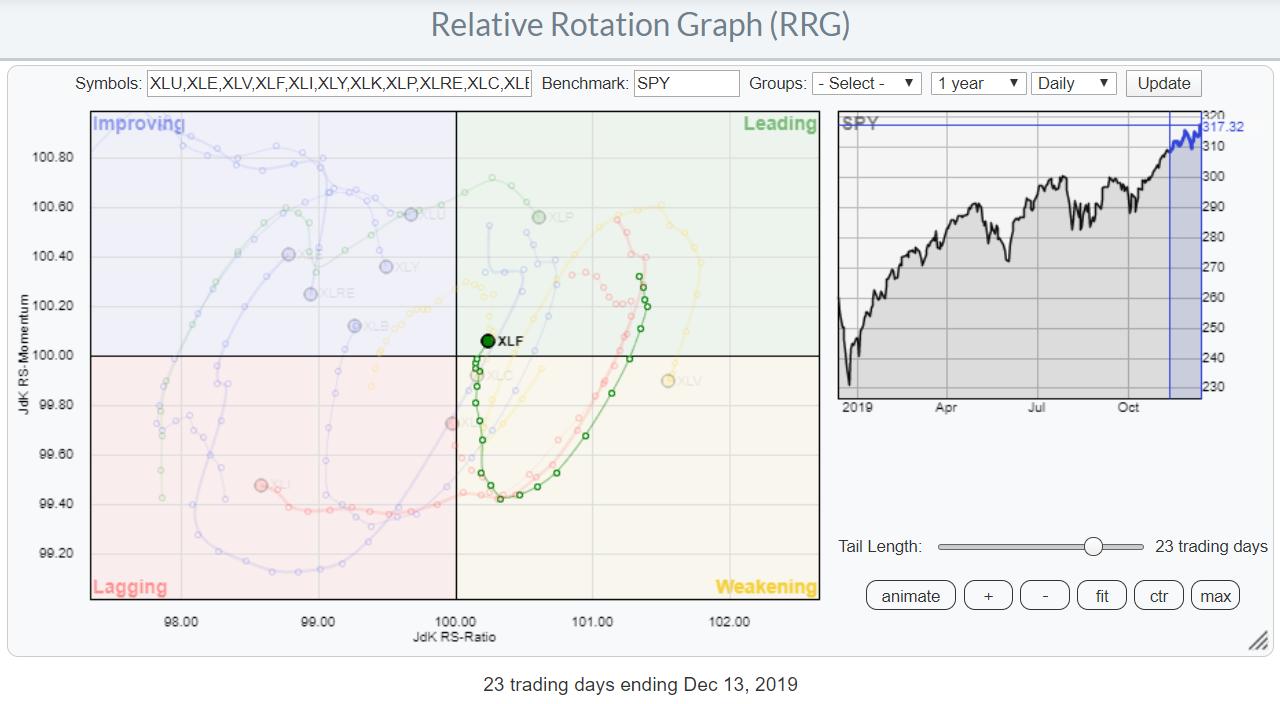

Focus on Financials

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Above is the daily Relative Rotation Graph for US sectors, highlighting the rotation for the financials sector. On the weekly RRG, this sector is solidly inside the leading quadrant and continues to move further west into positive territory.

With the current rotation on the daily RRG moving from weakening back...

READ MORE

MEMBERS ONLY

Power Charting TV: Year End Review and 2020 Outlook

by Bruce Fraser,

Industry-leading "Wyckoffian"

As this epic year comes to a conclusion it is appropriate to look back as well as look ahead to 2020. Below are links to the most recent Power Charting episodes where we review 2019 and then consider the forces that could influence the major indexes in the year ahead....

READ MORE

MEMBERS ONLY

GAMBLING STOCKS LEAD XLY-- LAS VEGAS SANDS, MGM, AND WYNN GAIN -- STRONGER CHINESE STOCKS ARE HELPING -- AND CLOSE TIES TO MACAU

by John Murphy,

Chief Technical Analyst, StockCharts.com

GAMBLING STOCKS LEAD XLY TO RECORD...Chart 1 shows the Consumer Discretionary SPDR (XLY) hitting a new record high yesterday. The XLY closed above a flat trendline drawn over its July/September highs to complete a bullish "ascending triangle" formation. Assuming it can hold on to that upside...

READ MORE

MEMBERS ONLY

As The NIFTY is Marking New Highs...

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Indian headline index NIFTY ($NIFTY) moved past its double top resistance level of 12103 on a closing basis, ending at a fresh life-time high at 12221.25. However, looking at the broader NIFTY500 Index ($CNX500) throws up some interesting insights.

The above chart tells a story of a thousand...

READ MORE

MEMBERS ONLY

Which NASDAQ 100 Stock Has Been The Best Performer In 2019?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

If you're trying to think of the best performing semiconductor stock ($DJUSSC), you're heading in the right direction. The DJUSSC has been outstanding throughout much of 2019, gaining nearly 50%, rising from 2888 to 4234 at yesterday's close. Semiconductor stocks actually take up the...

READ MORE

MEMBERS ONLY

Sector Spotlight: Looking at Rotations Inside the DJ Industrials

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this edition of StockCharts TV'sSector Spotlight, I present a short overview of relative trends in play for asset classes and US sectors. Afterwards, I take a deep dive into the rotations of the DJ Industrials index ($INDU) and identify a pair trade idea for this week stemming...

READ MORE

MEMBERS ONLY

Strike Up The Band! News of Google Partnership Hits The Right Chord

by Mary Ellen McGonagle,

President, MEM Investment Research

Many software stocks peaked in price late July as reduced corporate spending worries, coupled with high valuations, pushed these stocks down. The good news is, these formerly leading stocks are coming back into favor as growth prospects are high and the economic outlook has brightened.

Today, we're going...

READ MORE

MEMBERS ONLY

DP Show: Market "Melting Up" - Drill Down Into XLE, XLU, XLV & XLK

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

Is the market in the process of melting down - or melting up? In this episode of DecisionPoint, Carl and Erin discuss the implications they've made about the state of the market from the DecisionPoint indicators, including the new Golden and Silver Cross Indexes. Erin also demonstrates how...

READ MORE

MEMBERS ONLY

What's Your Second Chart of the Day?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I've written before about the importance of a good morning coffee routine. These are the charts you review first thing in the morning as a way of enhancing your market awareness.

The first chart on your list, given that you're a long-term investor, should be a...

READ MORE

MEMBERS ONLY

DP Diamonds - Carl's Scan Produces Some Interesting Diamonds

by Erin Swenlin,

Vice President, DecisionPoint.com

Today I decided to revisit my my Dad (Carl)'s Scan, a very simple combination of rising Price Momentum Oscillator and negative configuration of the price EMAs. The one problem with this scan is that it finds "beat down" stocks that are in the process of reversing....

READ MORE

MEMBERS ONLY

GLOBAL STOCKS CONTINUE TO RALLY -- CONSUMER DISCRETIONARY SPDR IS TESTING UPPER PART OF TRIANGULAR FORMATION AND MAY BE NEARING AN UPSIDE BREAKOUT INTO RECORD TERRITORY

by John Murphy,

Chief Technical Analyst, StockCharts.com

GLOBAL STOCKS START THE WEEK ON A STRONG NOTE... Stocks around the world are starting the week on a strong note. That includes foreign developed and emerging markets in Europe and Asia. The three U.S. stock indexes are hitting new records. So are a number of sector SPDRS including...

READ MORE

MEMBERS ONLY

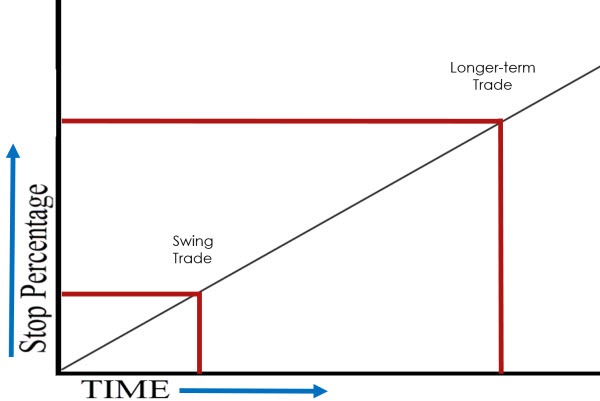

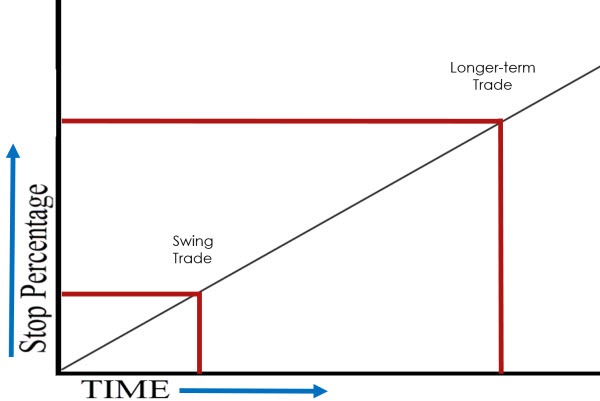

Random Thoughts: How To Capture Long-Term Gains Without Excessive Risk

by Dave Landry,

Founder, Sentive Trading, LLC

Longer-term trading is where the money is, but, unfortunately, so is the excessive risk. Shorter-term trading is much less risky, but you don't make enough, especially since big adverse moves can still occur. The great thing about trading is that it doesn't always have to be...

READ MORE

MEMBERS ONLY

Dissecting Last Week's 5 Trade Setups....And This Week's Setups

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

One week ago, I indicated that I'd have 5 trading candidates for anyone who signed up for a $7 30-day trial. It was similar to the Monday Setups that I had previously provided on MarketWatchers LIVE, the flagship StockCharts TV show that I had hosted for two years....

READ MORE

MEMBERS ONLY

Signs of Strength within the Gold Miners ETF - Will Price Follow?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Gold SPDR (GLD) and the Gold Miners ETF (GDX) have been trending lower and lagging the broader market since September, but breadth indicators show signs of strength within the Gold Miners ETF. Today we will examine four breadth indicators and analyze the price chart for GDX. While breadth can...

READ MORE

MEMBERS ONLY

Two Developments Have Changed My Trading Strategy Heading Into 2020; They Should Change Yours Too

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I am extremely bullish as we head into 2020. Everything is lining up, but there are two factors that I believe will help us help our members - both professionals and individual traders.

First, the Fed has finally moved into the dovish position it should have been in one year...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Crucially Poised with Mixed Cues; RRGs Suggest These Groups Will Relatively Outperform

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The risk-on global setup towards the end of the week saved the Indian markets from ending on a net negative note. Following a weak initial performance, the Indian markets picked up in the second half of the week. The NIFTY pulled itself back after testing the lower end of the...

READ MORE

MEMBERS ONLY

Stock Indexes Hit New Records on Report of Trade Agreement

by John Murphy,

Chief Technical Analyst, StockCharts.com

Reports of a trade agreement between the U.S. and China pushed global stock prices sharply higher today. Chart 1 show the S&P 500 reaching record territory. So did the Nasdaq. Small cap stocks continued to show relative strength. Chart 2 shows the Russell 2000 iShares (IWM) hitting...

READ MORE

MEMBERS ONLY

Diamonds: Darlings and Duds (ENB, MSCI, GMED & HIG)

by Erin Swenlin,

Vice President, DecisionPoint.com

Periodically, I'd like to look at some of my previous "DP Diamond" selections and show you some successes (darlings) and failures (duds). They don't all do what they should, after all. I have to say though, I find far more "darlings" in...

READ MORE

MEMBERS ONLY

DP WEEKLY WRAP: Buy the News, Sell the Quibble

by Carl Swenlin,

President and Founder, DecisionPoint.com

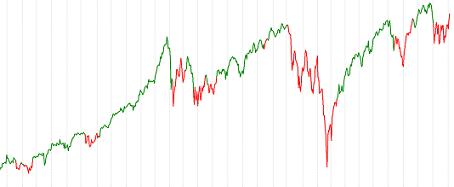

In the last two weeks the S&P 500 has advanced about +3.75% from its low, and about 1.5% of that move was due to two days of news-generated rallies -- the favorable jobs report last week, and apparent successful completion if Phase I of the China...

READ MORE

MEMBERS ONLY

How Commission-Free Trading Stacks the Odds in our Favor

by John Hopkins,

President and Co-founder, EarningsBeats.com

When Charles Schwab recently announced they were cutting their online brokerage commissions to zero, the other major brokerage houses fell in line. Then, shortly after, Schwab announced they would be buying Ameritrade. Game on!

The most amazing part of this major development is it gives traders a tremendous amount of...

READ MORE

MEMBERS ONLY

MEM Edge TV: Turnaround Candidates for a Market Hitting New Highs

by Mary Ellen McGonagle,

President, MEM Investment Research

On this episode of StockCharts TV'sThe MEM Edge, Mary Ellen presents a powerful-but-simple strategy for identifying stocks that are reversing their downtrends. In addition, she shared how to spot stocks on the move and poised to trade higher. This video was originally recorded on December 13, 2019.

New...

READ MORE

MEMBERS ONLY

The 10 Key Investing Lessons From Two Decades Of Teaching (1999 - 2019)

by Gatis Roze,

Author, "Tensile Trading"

After 20 years of teaching at over 200 continuing education classes, dozens of seminars and conferences and many other events, I've seen, heard, read, and watched it all. Witnessing 5,000 students over these years, I could write another book on the thousands of observations I've...

READ MORE

MEMBERS ONLY

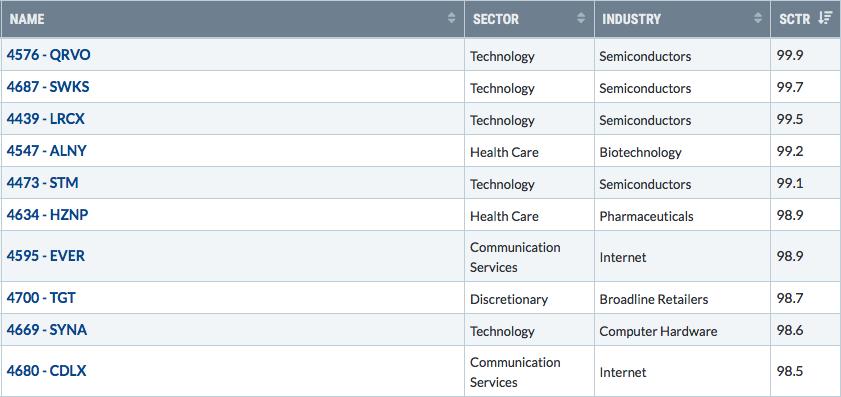

Top Sectors And Industry Groups According To My Proprietary Momentum Ranking System

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

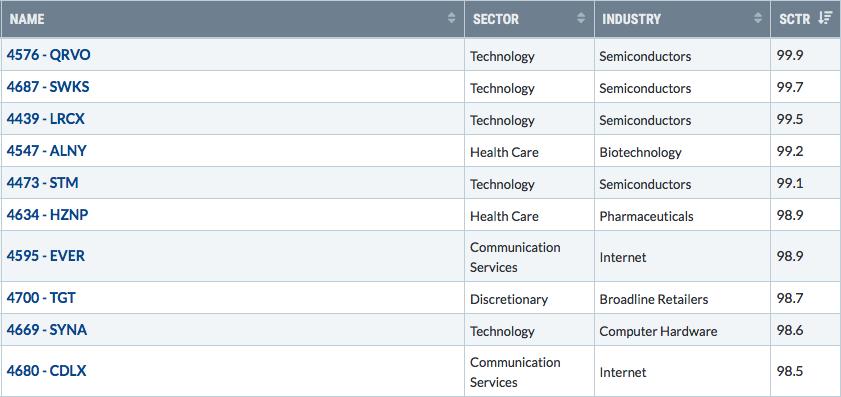

It made sense to underweight healthcare (XLV) throughout much of 2019, but that's no longer the case. In fact, my proprietary momentum ranking system ranks healthcare behind only technology (XLK) and financials (XLF) in terms of sector momentum. The StockCharts Technical Rank (SCTR) has the same ranking as...

READ MORE

MEMBERS ONLY

Are you Following the Trend or Waiting for Perfection?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

We are seeing breakouts and new highs galore in the stock market. Does this sound the all clear? Hardly. Investors waiting for the all clear will probably be waiting a long time. Moreover, the "all clear" could even mark the top, because that's just the way...

READ MORE

MEMBERS ONLY

DP Diamonds: Reader Requests Impressive!

by Erin Swenlin,

Vice President, DecisionPoint.com

I had quite a few email requests for symbols that readers are looking at as potential "Diamonds" - I looked at them all and picked my five favorites! What was truly impressive is that some of these requests came in a few days ago and, since then, the...

READ MORE

MEMBERS ONLY

STOCK INDEXES HIT NEW RECORDS ON REPORT OF TRADE AGREEMENT -- SMALL CAPS HIT NEW 52-WEEK HIGH -- WHILE FINANCIALS, TECH, AND HEALTHCARE HIT NEW RECORDS -- BIG JUMP IN BOND YIELDS BOOSTS FINANCIALS BUT HURTS BOND PROXIES -- MATERIALS SPDR HITS ANOTHER HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK INDEXES HIT NEW RECORDS...Reports of a trade agreement between the U.S. and China pushed global stock prices sharply higher today. Chart 1 show the S&P 500 reaching record territory. So did the Nasdaq. Small cap stocks continued to show relative strength. Chart 2 shows the...

READ MORE

MEMBERS ONLY

Learn From Larry

by Larry Williams,

Veteran Investor and Author

Larry's goal is to tell you what is going to happen, not what's already taken place. In this episode of Real Trading with Larry Williams, Larry presents a new Great Unknown Growth Stock, Badger Meter (BMI), and discusses the Gold forecast, the US stock market and...

READ MORE

MEMBERS ONLY

Reduces Ulcers

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

This article will continue the presentation of various performance metrics on our trend strategies. We showed Chart A previously but are including it again before we introduce Chart B. Chart A shows the correlation of our two strategies and several other indices, relative to the S&P 500 Index....

READ MORE

MEMBERS ONLY

CFG Rotates into Leading Quadrant on RRG while Breaking Resistance on Price Chart

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The financial sector is one of the stronger sectors at the moment. Opening up the Relative Rotation Graph showing the members of this sector against XLF (as the benchmark) shows a concentration of asset managers and banks with positive rotations that are either inside the leading quadrant or moving towards...

READ MORE

MEMBERS ONLY

DP Diamonds: Small-Cap, Mid-Cap and Large-Cap Selections

by Erin Swenlin,

Vice President, DecisionPoint.com

Today I modified the Diamond Scan to allow the PMO to rise only two days rather than three days. This opened up about 10 more stocks to view and, I have to say, it was easier to find diamonds in the rough using that technique. For those who love to...

READ MORE