MEMBERS ONLY

DP Show: Humble Beginnings - Amazon (AMZN) & Google (GOOGL)

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin look at a few recent DP Diamonds and present a review of other "in the news" stocks, including DIS, NHI, GE, AMZN and GOOGL. Additionally, the two analyze climactic readings on Advance/Declines and the VIX. This video originally aired...

READ MORE

MEMBERS ONLY

DP Diamonds - FOUR Healthcare "Diamonds in the Rough"

by Erin Swenlin,

Vice President, DecisionPoint.com

Carl and I discussed in today's DecisionPoint show that finding "diamonds" could be difficult if the market decides it is finally ready for a correction. However, the Healthcare sector is considered a somewhat "defensive" area of the market. I wanted to stay away from...

READ MORE

MEMBERS ONLY

Martin Pring's Monthly Market Roundup 2019-12-02

by Martin Pring,

President, Pring Research

The monthly Market Roundup videofor December is now available.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion of Pring Turner Capital Groupof Walnut Creek or its affiliates....

READ MORE

MEMBERS ONLY

The Complete Guide to Market Breadth Indicators

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

A few years ago StockCharts.com vastly updated not only its raw breadth database but now there are hundreds and hundreds of new market breadth indicators available to everyone. This is not really an article but an information piece about StockCharts.com's vast amount of breadth material and...

READ MORE

MEMBERS ONLY

This Group LOVES December Historically.......And It Just Broke Out Technically!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Welcome to December! It's hard to believe we're one month away from a new year and a new decade. While 2019 has been exciting for investors and traders, recovering from that massive Q4 2018 decline, I believe 2020 will be very solid as well. We'...

READ MORE

MEMBERS ONLY

Three Leading Stocks within the Payments Space - And Three Poised to Hit New Highs

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

As noted in ChartWatchers this weekend, the Mobile Payments ETF (IPAY) came to life in November with a 7% gain, which was almost twice the gain in the S&P 500 SPDR (+3.62%). IPAY was lagging in September and October, but is now leading the market as the...

READ MORE

MEMBERS ONLY

Ford v Ferrari. A Movie about Trading.

by Bruce Fraser,

Industry-leading "Wyckoffian"

During this Holiday shortened week go see the movie Ford vs. Ferrari. It is a movie about trading. No wait, it is a movie about an epic battle between two automotive titans to win the 24 Hours of Le Mans. There was and is no more prestigious an achievement, as...

READ MORE

MEMBERS ONLY

Week Ahead: RRG Shows Private Banks & Financials Rolling Over; Coming Days Crucial for NIFTY

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After healthy consolidation around the 12000 level over the past couple of weeks, the NIFTY has attempted to break above a year-long secondary trend that it was in by ending the week with gains. Throughout the week, the markets pushed hard to breach the double-top resistance on the shorter-term charts...

READ MORE

MEMBERS ONLY

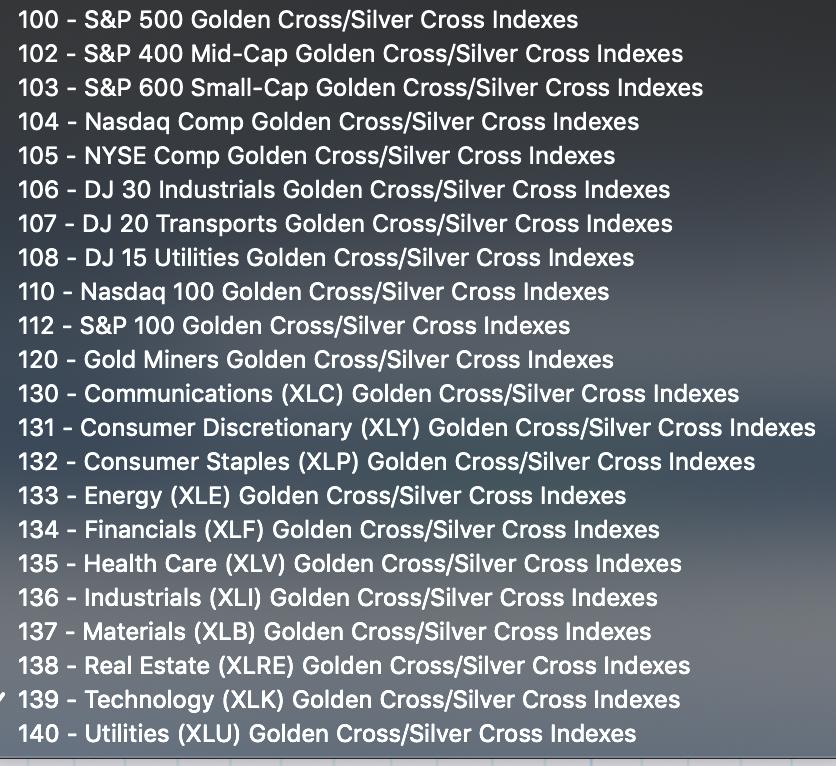

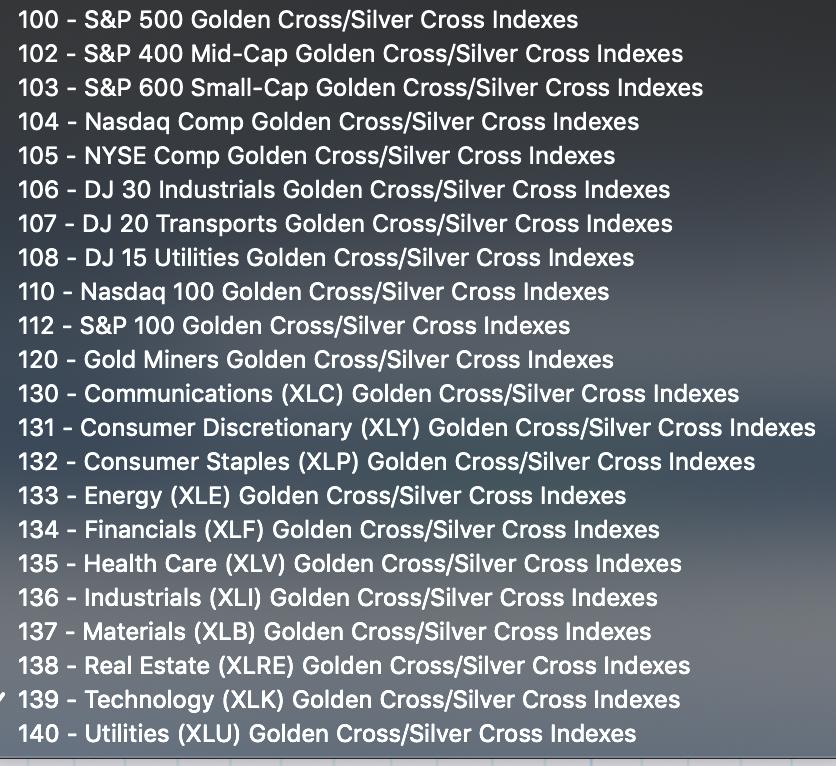

NEW! DecisionPoint Indicators: Golden Cross/Silver Cross Indexes

by Erin Swenlin,

Vice President, DecisionPoint.com

On our November 20, 2019 DecisionPoint show on StockCharts TV, Carl and I introduced the new Golden Cross and Silver Cross Indexes. The Golden Cross Index measures the percentage of components in an index or sector that are on LT Trend Model BUY signals (50-EMA > 200-EMA). The Silver Cross...

READ MORE

MEMBERS ONLY

MEM Edge TV: New Leadership Stays The Course

by Mary Ellen McGonagle,

President, MEM Investment Research

On this episode of StockCharts TV'sThe MEM Edge, Mary Ellen provides an up-to-the-minute review of the markets, revealing new groups coming into play and stocks that are poised to benefit. She takes a look at the new leadership stocks and discusses using history to guide you with price...

READ MORE

MEMBERS ONLY

DP WEEKLY WRAP: Santa Keeps Rocking; Monthly Chart Time

by Carl Swenlin,

President and Founder, DecisionPoint.com

The current rally was launched off the early-October low. Since then, the market has entered a period of very low volatility, characterized by a reluctance to decline, and a penchant for small, daily advances. There was a high volume spike on Tuesday that I will attribute to traders going flat...

READ MORE

MEMBERS ONLY

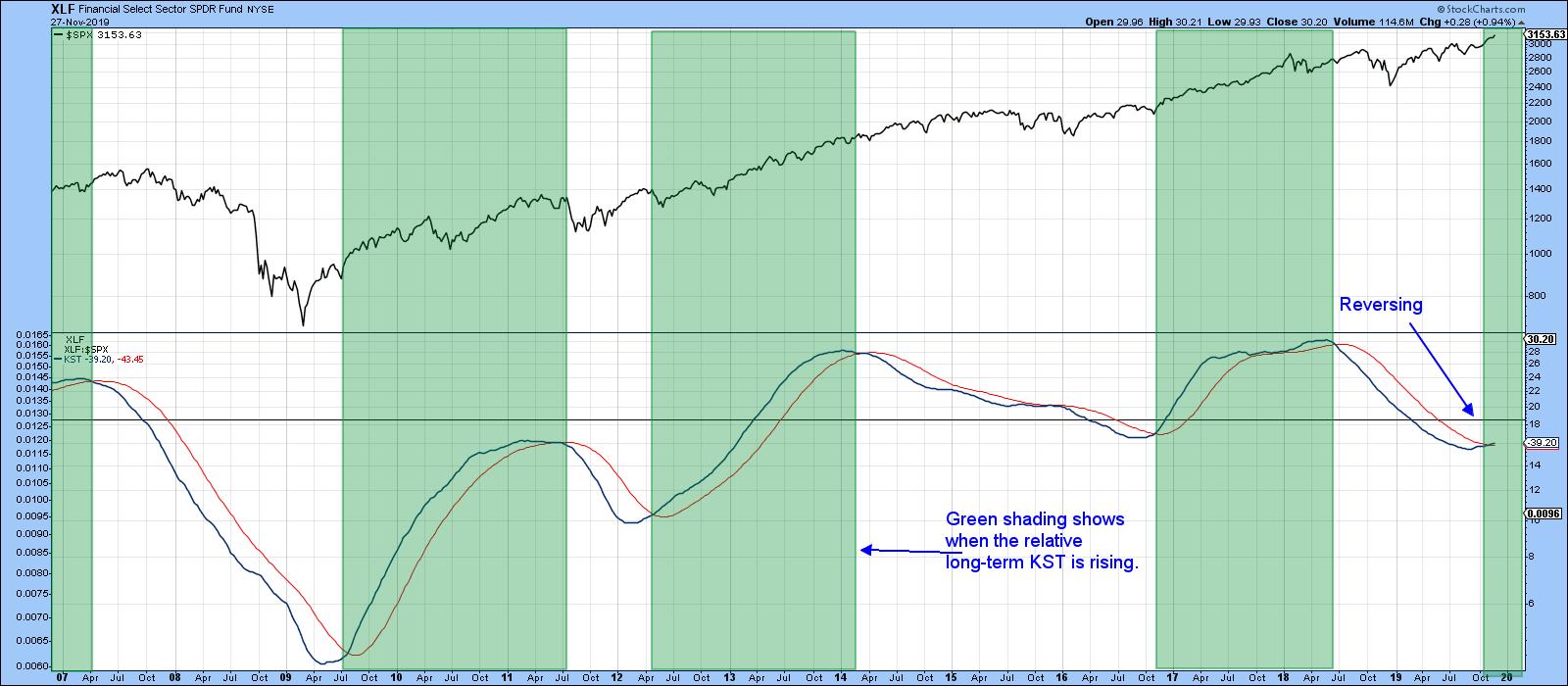

Three Good-Looking Sectors for the Ongoing Bull Market

by Martin Pring,

President, Pring Research

Editor's Note: This article was originally published in Martin Pring's Market Roundup on Thursday, November 28th at 4:08pm ET.

Chart 3 shows a long-term indicator that just went bullish for the market. It also points us in the direction of one of the sectors referred...

READ MORE

MEMBERS ONLY

This Impressive Market Could Require Patience

by John Hopkins,

President and Co-founder, EarningsBeats.com

The market has mostly been straight up since the October 3 bottom, when the S&P touched 2855 before heading north. Since then, the S&P has climbed more than 10%, with buyers ready and willing to buy on any dips.

If you are a bull, and especially...

READ MORE

MEMBERS ONLY

'Tis the Season for Mobile Payments

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Black Friday weekend is here and the holiday shopping season is just getting started. While I have no clue which retailers will be the big winners or losers this season, the mobile payments industry is likely to be a big winner. Mobile payments are expected to exceed $300 billion this...

READ MORE

MEMBERS ONLY

Market Correction Coming: Here's Your Action Plan

by Gatis Roze,

Author, "Tensile Trading"

If you don't really know yourself, the market is an expensive place to learn about your "Investor Self". This axiom is most essential and relevant during a market correction. This blog is an exercise to help us all understand our own nature — ideally during the calm...

READ MORE

MEMBERS ONLY

Finding The Best Stocks To Make Your Money Grow Faster

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I know it seems like a daunting task, but it's not nearly as hard as it seems. Obviously, the first step requires finding a method or strategy that works. At EarningsBeats.com, we've found what works for us. It's combining our strengths with StockCharts....

READ MORE

MEMBERS ONLY

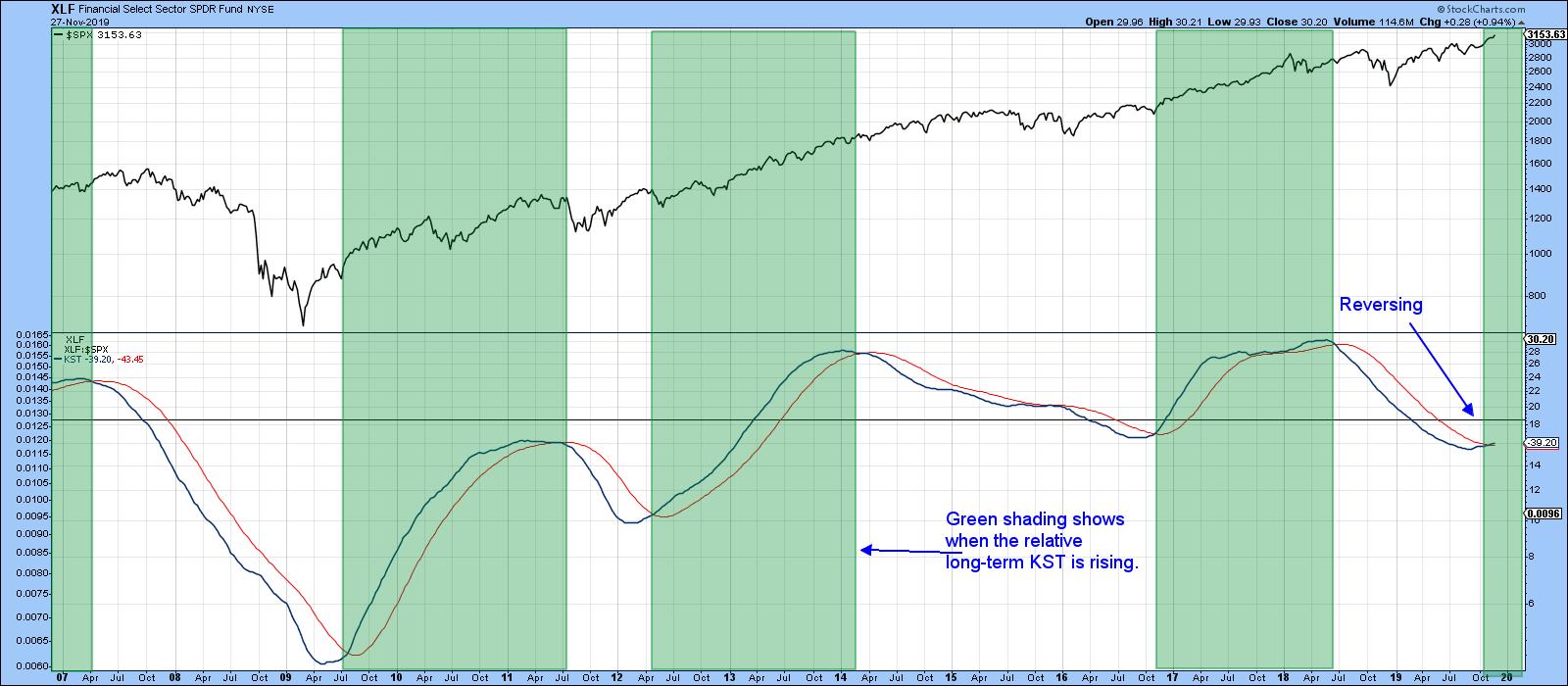

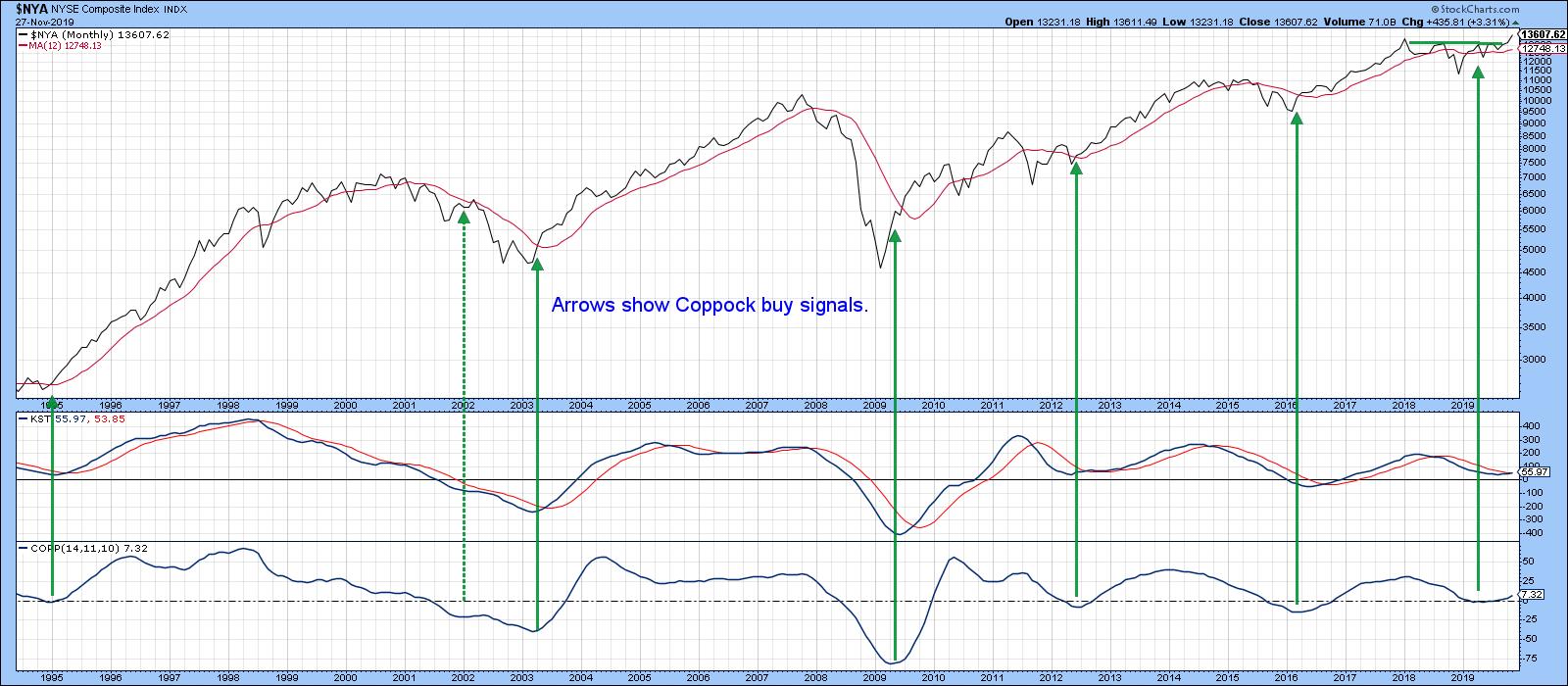

Three Good-Looking Sectors for the Ongoing Bull Market

by Martin Pring,

President, Pring Research

* The Game Has Just Begun

* Three Interesting Sectors

* Watch the DB Agriculture Fund

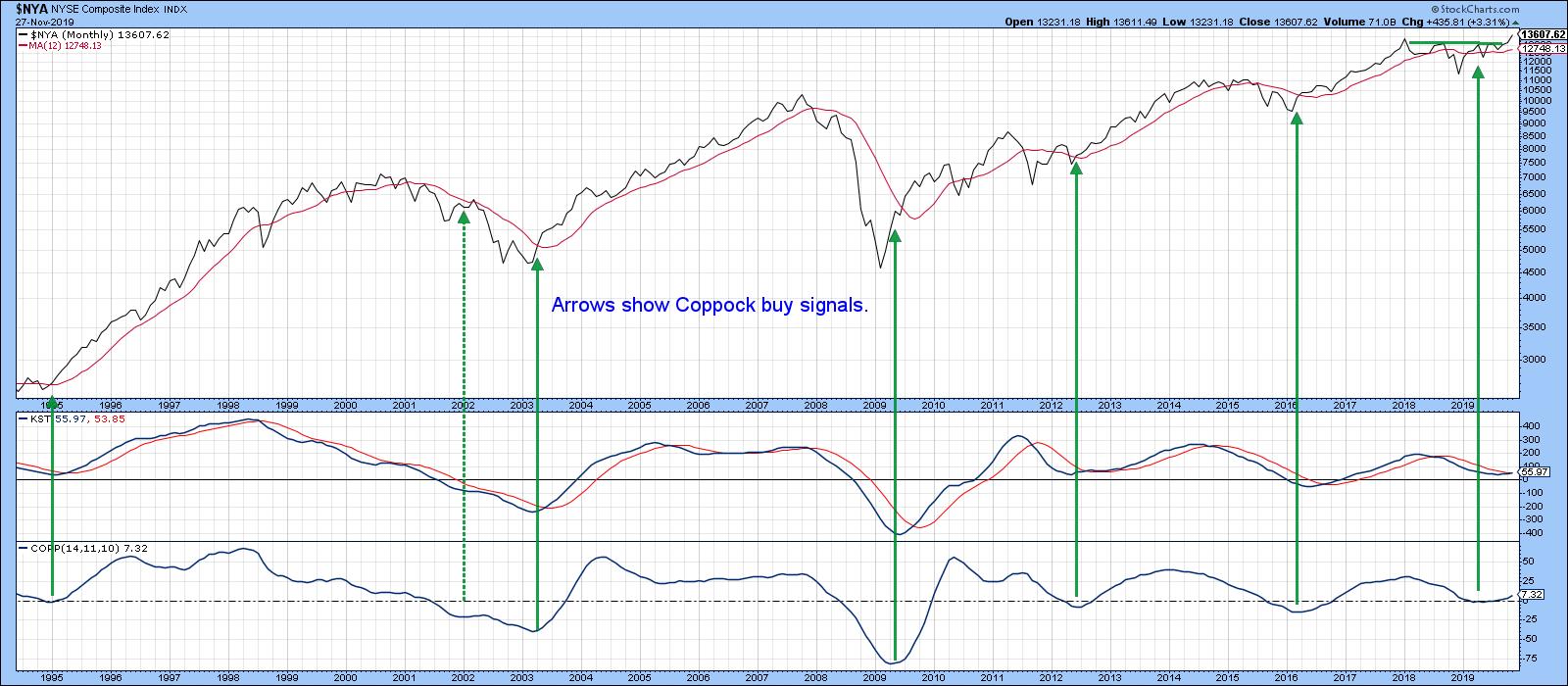

The Game Has Just Begun

It is fairly evident by now that the equity market has broken to the upside big time. Chart 1 sets the scene by demonstrating that first the Coppock Indicator and later the...

READ MORE

MEMBERS ONLY

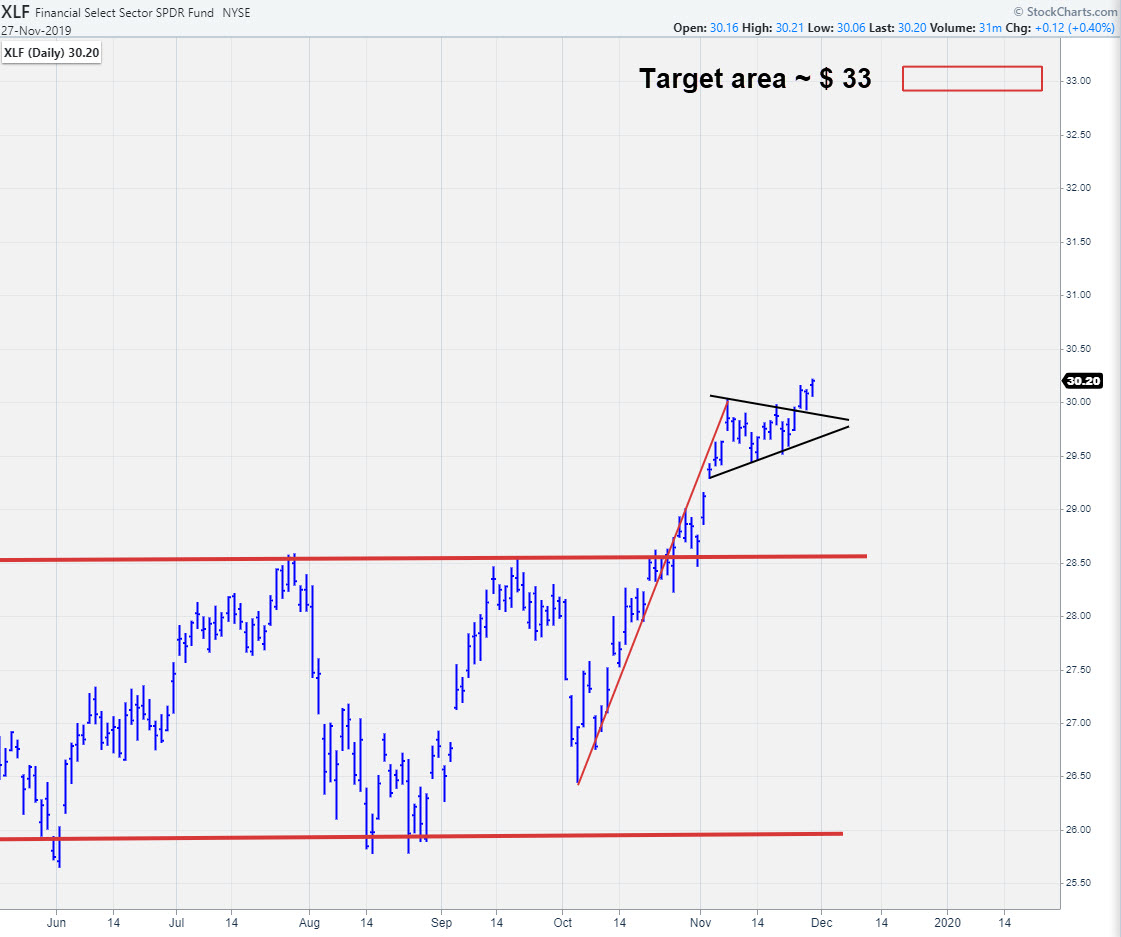

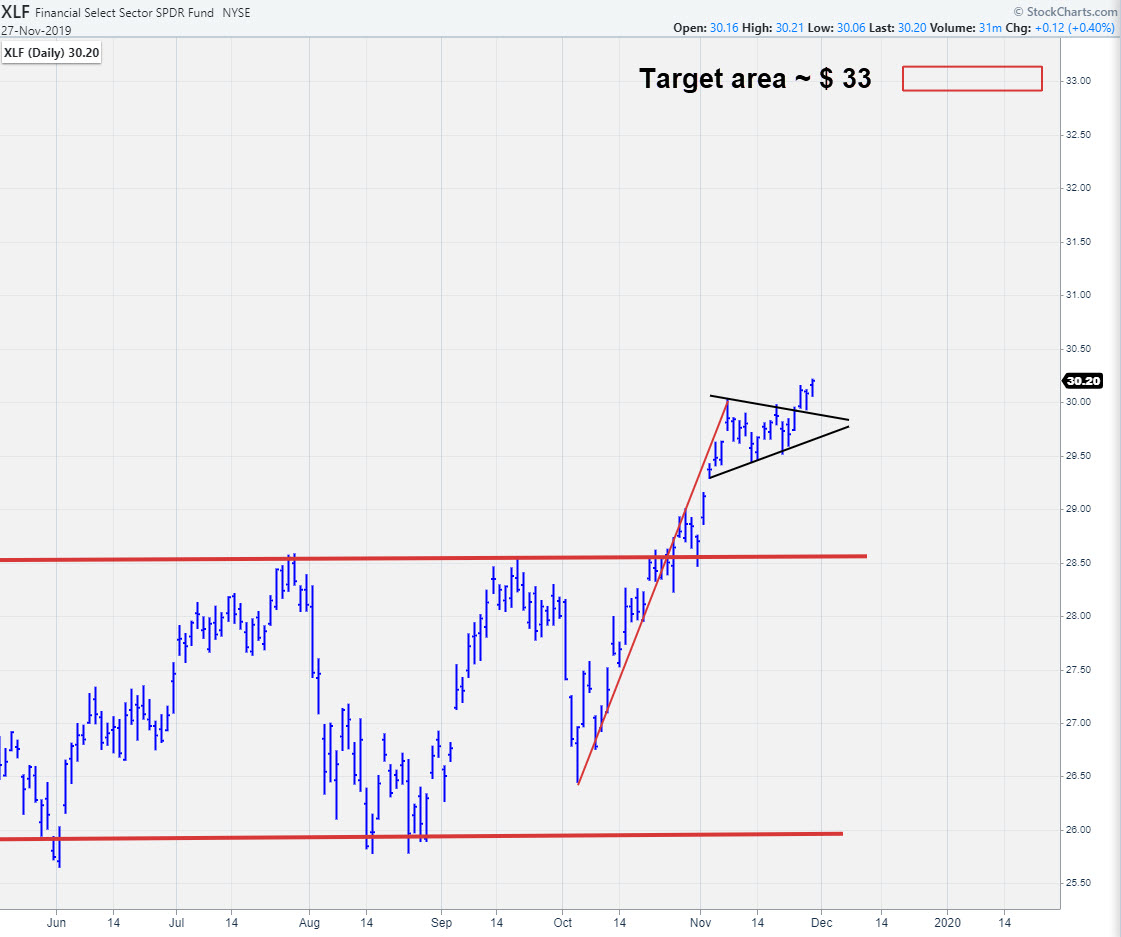

Completed Pennant in XLF Points to $33 Area

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the Relative Rotation Graph for US sectors, Financials are in good shape. They are inside the leading quadrant and, despite a little loss of momentum in the last week, still at a good RRG-heading.

Together with Technology and Industrials, Financials is a leading sector at the moment.

A Pennant...

READ MORE

MEMBERS ONLY

DP Alert Mid-Week: Golden Cross/Silver Cross Indexes Confirming New All-Time Highs

by Erin Swenlin,

Vice President, DecisionPoint.com

We are finally seeing indicators that are rising as they should as the market continues to make new all-time highs. I believe the market is still in need of a correction, but, at this point, I can't argue with the charts. My advice is to tread lightly and...

READ MORE

MEMBERS ONLY

Diamond Scan Results Picking Up - Check Out NVIDIA (NVDA)

by Erin Swenlin,

Vice President, DecisionPoint.com

The Diamond PMO Scan is starting to pick up more results as we start seeing more market participation. The market is very overbought and needs a correction, but it doesn't seem interested. For more information on my thoughts about the market, read today's "DP Alert...

READ MORE

MEMBERS ONLY

Practicing What I Preach

by Dave Landry,

Founder, Sentive Trading, LLC

Being taught a methodology is great, but seeing it work in real markets is key. In this edition of Trading Simplified, Dave shows the ways in which he uses the various techniques he's taught on this show in the real world, including protective stops, TKOs and understanding market...

READ MORE

MEMBERS ONLY

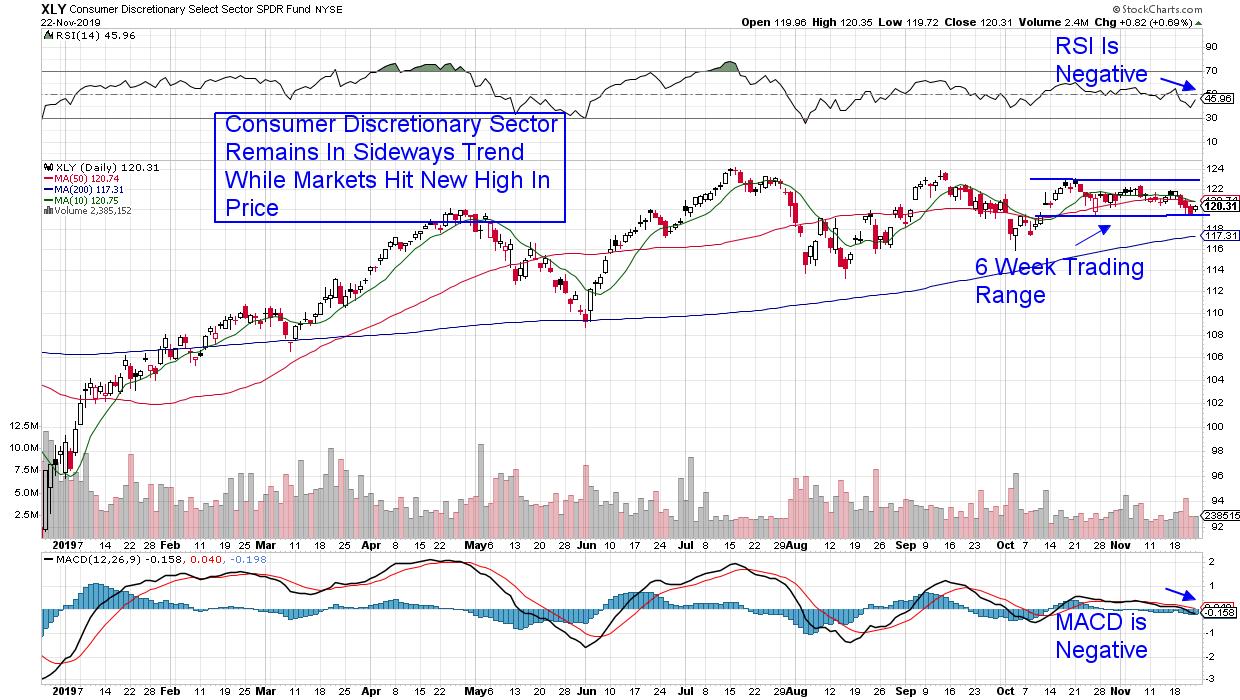

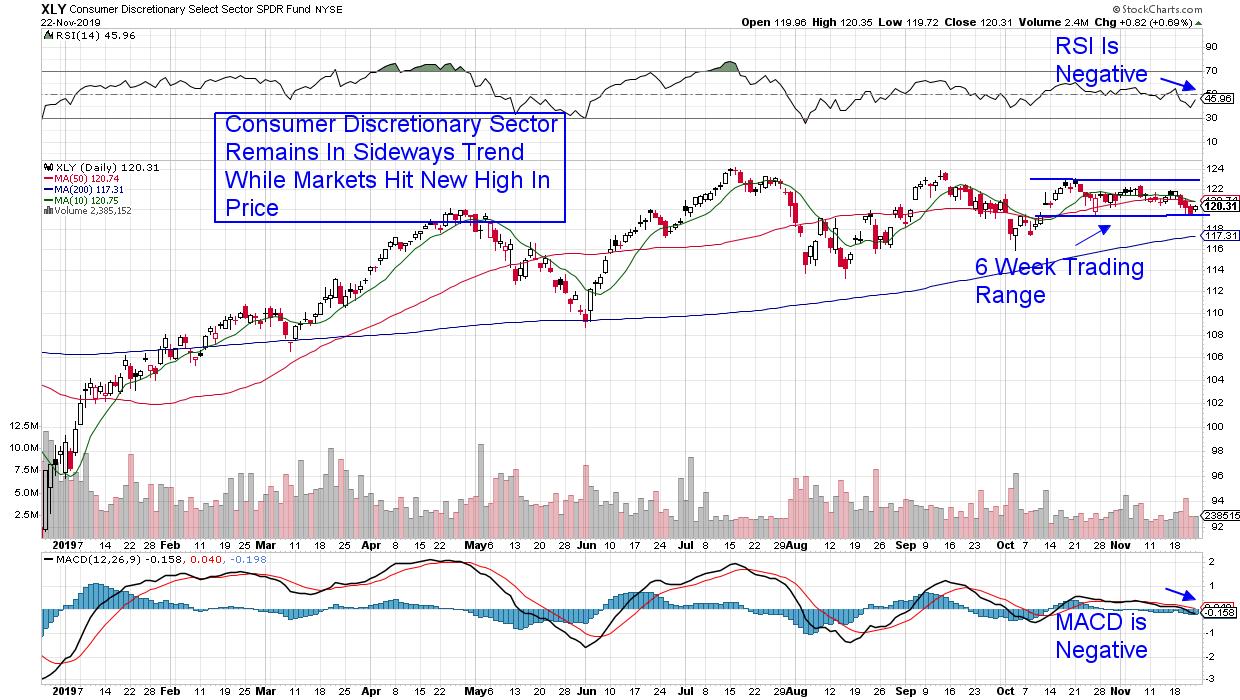

RETAILERS HELP LEAD CONSUMER DISCRETIONARY SPDR HIGHER -- XLY IS NEARING TEST OF OVERHEAD RESISTANCE LINE IN BULLISH SYMMETRICAL TRIANGLE -- CLOTHING AND APPAREL RETAILERS ARE HELPING LEAD IT HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

CONSUMER DISCRETIONARY SPDR SHOWS NEW LEADERSHIP... Chart 1 shows the Consumer Discretionary SPDR (XLY) rising today to the highest level in six weeks. That's setting up a possible test of its declining trendline drawn over its July/September peaks. The overall shape of its pattern since July looks...

READ MORE

MEMBERS ONLY

To Chase Or Not To Chase? The Truth Behind Earnings Gaps

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

For years, this question was left unanswered. Honestly, I couldn't figure out this answer for a long, long time. I've come to realize through years of experience, however, that I simply needed to watch the action after the gap and show a little patience. It seems...

READ MORE

MEMBERS ONLY

Sector Spotlight: Sector Rotation Continues in Favor of Tech and Financials

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of Sector Spotlight, I take a look at current sector rotation and find that Tech and Financials are still the strong sectors in the US. From an international perspective, I also observe that the Indian $CNX500 index is definitely worth keeping an eye on.

This episode of...

READ MORE

MEMBERS ONLY

Small-Cap Retailer That's In Rally Mode

by Mary Ellen McGonagle,

President, MEM Investment Research

Today's highlighted stock has already had an impressive rally over the last several months; however, it didn't make my screens until the stock's price went above my $5.00 threshold, which it hit today. Struggling department store operator Stage Stores (SSI) peaked in price...

READ MORE

MEMBERS ONLY

DP Daily Diamonds - Amazon (AMZN) Comes In as a Momentum Sleeper

by Erin Swenlin,

Vice President, DecisionPoint.com

Today's results come from Carl's Scan and the Momentum Sleepers Scan. Usually, when I review these scan results, they don't come with good weekly charts. Today's weekly charts look pretty good so far, but I'll point out any weaknesses I...

READ MORE

MEMBERS ONLY

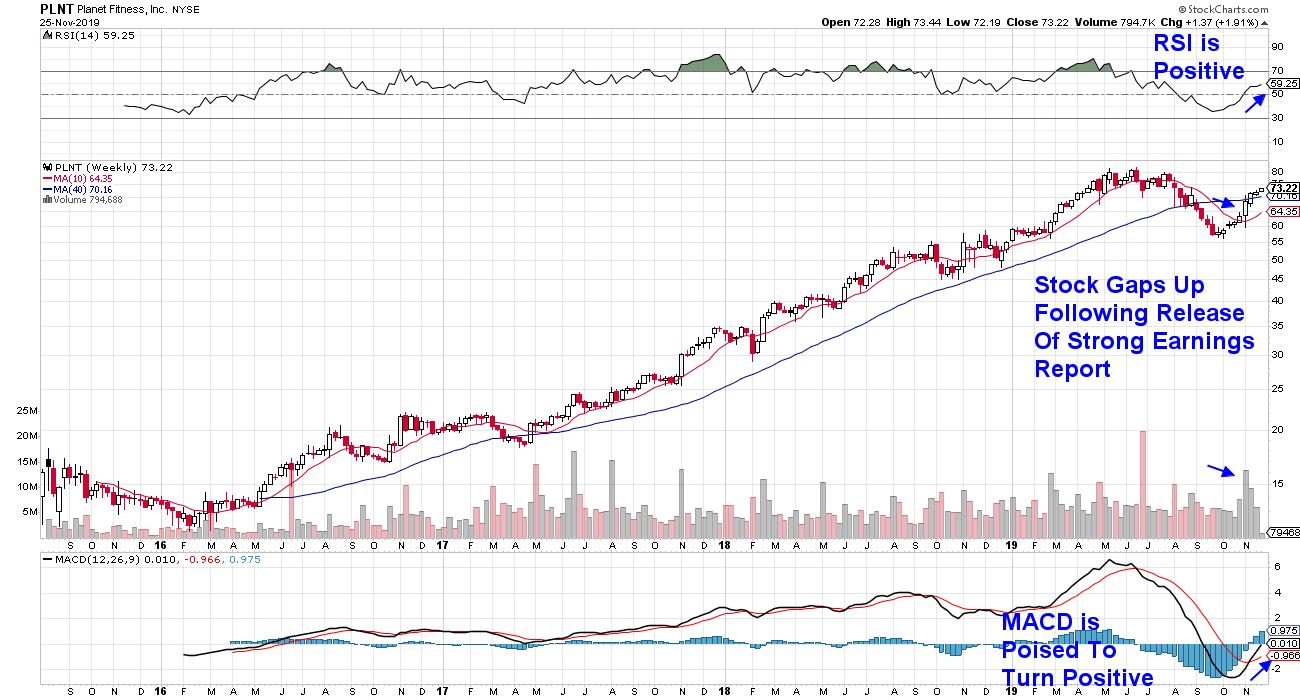

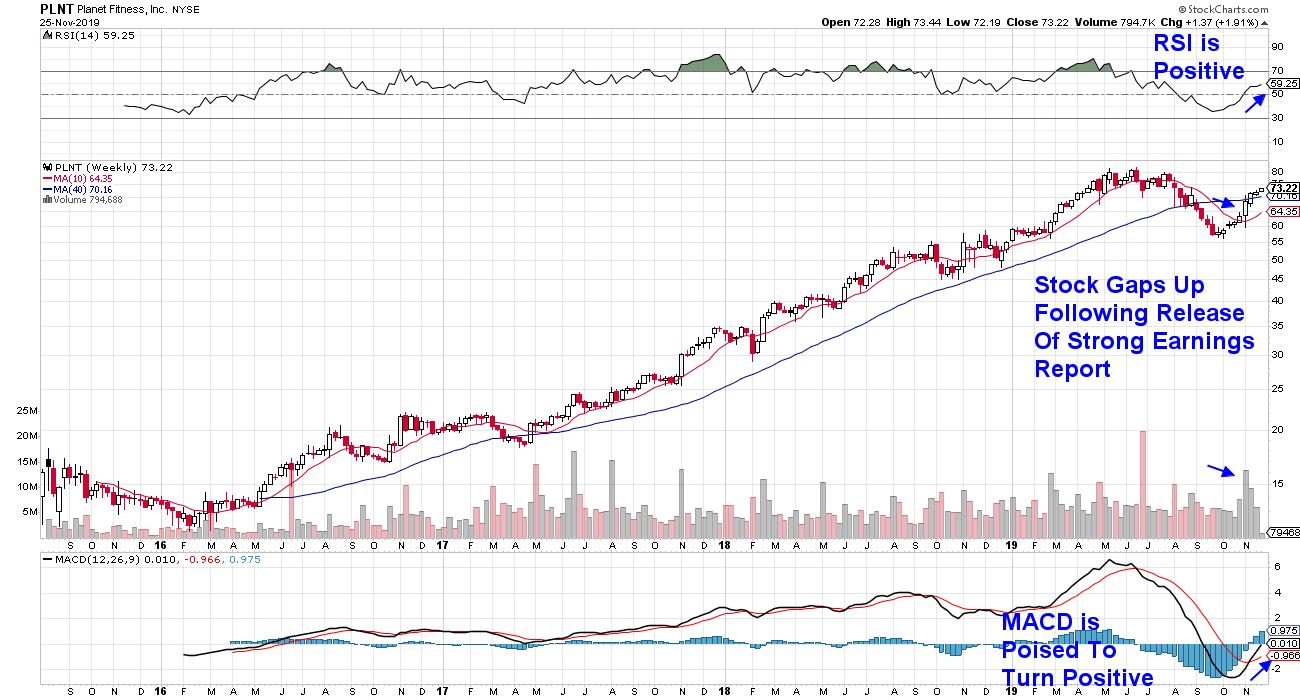

This Stock Is Back In Shape...! A Former Leaders Regains Its Footing

by Mary Ellen McGonagle,

President, MEM Investment Research

Not too many businesses can point to consistent, recurring revenue from a well-priced product that has broad appeal. Sure, steady membership income has pushed many streaming media stocks higher recently, but let's take a look at another, consumer-driven area that's been around even longer then Internet...

READ MORE

MEMBERS ONLY

DP Show: Sector Golden Cross/Silver Cross Indexes - Watch for Parabolic Moves

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Carl and Erin kick off with a review of the broad markets and DecisionPoint indicators, before following up with an in-depth look at the new Golden and Silver Cross Indexes for each of the sectors. Carl takes a close look at the parabolic price move...

READ MORE

MEMBERS ONLY

DP Daily Diamonds - Software Makes an Appearance

by Erin Swenlin,

Vice President, DecisionPoint.com

Today's scan results include two Technology - Software companies. I highlighted Microsoft (MSFT) some time ago and it has since performed well. Overall, the past week has been difficult with regard to finding the right "diamonds in the rough," but I have to say that today...

READ MORE

MEMBERS ONLY

NASDAQ AND S&P 500 HIT NEW RECORDS -- RUSSELL 2000 ISHARES HIT 52-WEEK HIGH AND HAVE BREAKOUT DAY -- LED BY SMALL CAP GROWTH ISHARES THAT ARE DOING THE SAME -- STRONG HEALTHCARE SECTOR MAY HAVE A LOT TO DO WITH SMALL CAP BREAKOUTS

by John Murphy,

Chief Technical Analyst, StockCharts.com

RUSSELL 2000 HAS BREAKOUT DAY...Stocks around the world are off to a strong start to the week. The Nasdaq and S&P 500 are hitting new records; while the Dow isn't far behind. Most stock sectors are also rising led by technology, healthcare, cyclicals, industrials, and...

READ MORE

MEMBERS ONLY

MEM Edge TV: The Power of ETFs to Uncover Strength in the Markets

by Mary Ellen McGonagle,

President, MEM Investment Research

On this episode of StockCharts TV'sThe MEM Edge, Mary Ellen shares shortcuts for finding money flows into groups and uncovering the top stocks within. She also reviews the divide in Consumer Stocks, as well as top companies that are due to report earnings. This video originally aired November...

READ MORE

MEMBERS ONLY

Uncovering "Value" In Uptrending Stocks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Last week when I identified the Top 10 stocks in our Model, Aggressive, and Income portfolios, I provided a bonus to EarningsBeats.com members when I unveiled my first ever Value Portfolio. I'm primarily a momentum trader and you rarely associate momentum stocks with value stocks. But the...

READ MORE

MEMBERS ONLY

Big Banks Hold Big Breakouts and this Laggard May Play Catchup

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Several finance-related ETFs and stocks broke out with big moves from early October to early November. Many of these then stalled over the last two weeks and this rest could be the pause that refreshes. Today we will look at performance for the finance-related ETFs and the bull flags taking...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY May Find it Difficult to Deal with Stiff Overhead Resistance; Watch these Sectors

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

As I complete this weekly technical note, I have just wound up the inaugural CMT India Summit at Mumbai yesterday. Insights shared by the Association's co-founder Ralph Acampora, Martin Pring and Julius de Kempenaer were the key takeaways of the event.

Coming back to the markets, although they...

READ MORE

MEMBERS ONLY

There is (almost) Always Cause for Concern

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 SPDR and Nasdaq 100 ETF recorded new all time highs this past week, while the S&P MidCap 400 SPDR hit a new 52-week high in November. Sounds bullish, but the S&P SmallCap 600 SPDR and Russell 2000 ETF are still well...

READ MORE

MEMBERS ONLY

U.S. Consumer Sentiment Rose Again Last Month. Here are 3 Forward-Thinking Retailers That Are Benefitting

by Mary Ellen McGonagle,

President, MEM Investment Research

The University of Michigan's Index of Consumer Sentiment hit its 4th straight monthly gain with a 96.8 level that was above estimates. Driven by an increasingly optimistic spending outlook among Americans amid a backdrop of record highs in the stock market and reduced trade tensions, the news...

READ MORE

MEMBERS ONLY

Rotation is Yielding New Leaders; Here are Two of My Favorites

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Over the past few months, we've seen some new market leadership emerge. If you're simply following the S&P 500, then you probably haven't noticed much difference. We consolidated a bit in August and September before then resuming the uptrend. It's...

READ MORE

MEMBERS ONLY

Never Confuse the Bottom of the Page With Support

by David Keller,

President and Chief Strategist, Sierra Alpha Research

When I worked for a large asset management firm, we had a number of fantastic digital displays that allowed us to view stock charts on a massive scale. The size of the screens made the work of identifying trends and inflection points much easier - and also way more fun....

READ MORE

MEMBERS ONLY

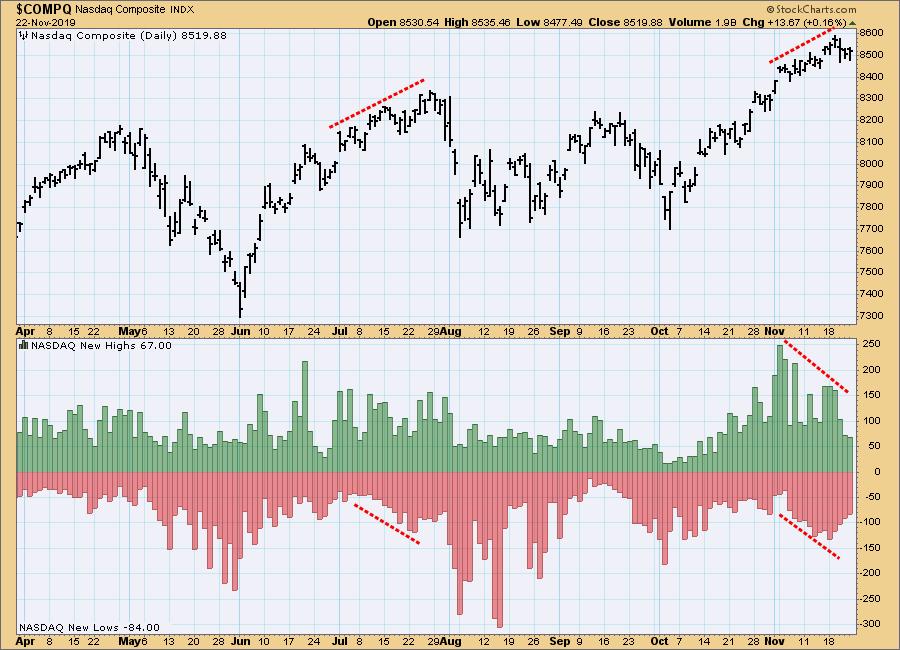

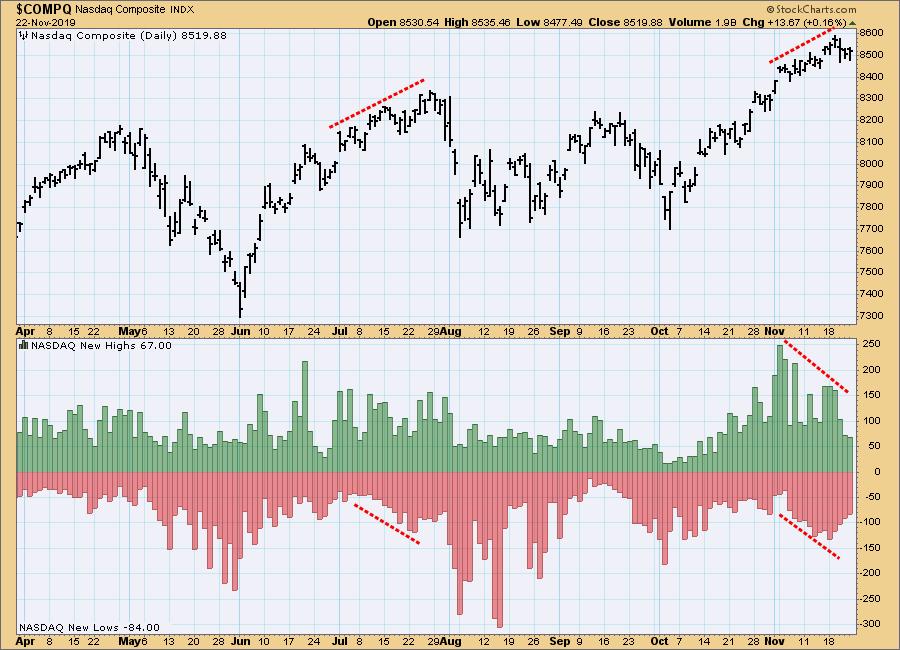

DP ALERT WEEKLY WRAP: New Highs/Lows Moving In Wrong Direction

by Carl Swenlin,

President and Founder, DecisionPoint.com

When the market goes up, we normally expect new highs to expand and new lows to contract. So far this month, for Nasdaq Composite stocks, the opposite is happening, and that is a negative signat, at least for the short term. We should also note that an expansion of new...

READ MORE

MEMBERS ONLY

Healthcare is the Week's Strongest Sector

by John Murphy,

Chief Technical Analyst, StockCharts.com

Editor's Note: This article was originally published in John Murphy's Market Message on Friday, November 22nd at 12:01pm ET.

Last Friday's message wrote about healthcare stocks going from one of the market's weakest sectors to one of the strongest. During the...

READ MORE