MEMBERS ONLY

FINANCIALS AND BANKS ACHIEVE BULLISH BREAKOUTS TO LEAD MARKET HIGHER -- A STEEPER YIELD CURVE MAY EXPLAIN RECENT ROTATION INTO FINANCIAL STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

STEEPER YIELD CURVE SUPPORTS STRONG FINANCIAL STOCKS...A lot of positive group rotations have taken place in the stock market over the past two months.We've seen new money moving into domestic small caps stocks, as well as economically-sensitive transports. We've also seen cheaper value stocks...

READ MORE

MEMBERS ONLY

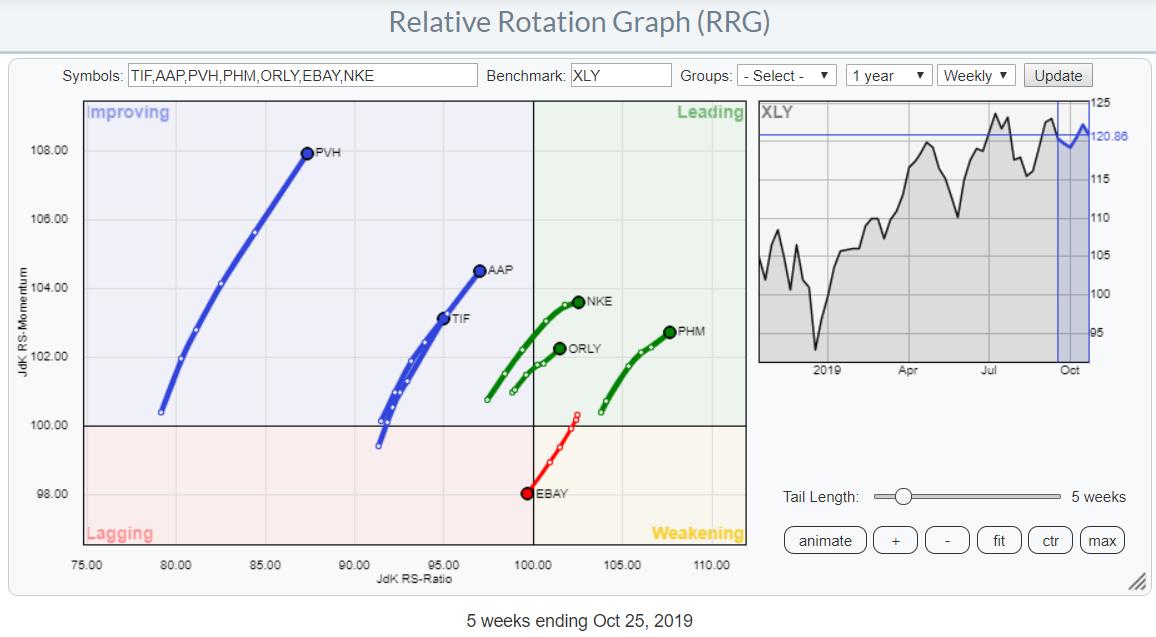

Ploughing Through Some Consumer Discretionary Stocks

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In last week's Sector Spotlight episode, I discussed the positive rotation of the Consumer Discretionary sector on RRG. During the live show, I focused (too much) on the sector and only managed to talk about a few individual stocks. This article will highlight some of the names in...

READ MORE

MEMBERS ONLY

Can You See An Earnings Report Before It's Announced?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I completely understand that it's really not possible, but Wall Street does provide us a number of clues. When a company is being accumulated and is outperforming its industry group peers plus the benchmark S&P 500, there's typically a reason for it. As I&...

READ MORE

MEMBERS ONLY

DP Daily Diamonds - More Momentum Sleepers

by Erin Swenlin,

Vice President, DecisionPoint.com

I found more "Momentum Sleepers" today with the scan of the same name. Quite a few have weekly charts that are encouraging. So, even though the stocks on this scan are "beat down" and likely best for shorter-term investors, I found stocks with bullish weekly charts...

READ MORE

MEMBERS ONLY

PHLX SOX INDEX SHOWS TWO ASCENDING TRIANGLES -- THE TECHNOLOGY SPDR AND QQQ SHOW SIMILAR BULLISH PATTERNS -- THE QQQ/SPX RATIO IS ALSO TRIANGULATING BETWEEN ITS APRIL HIGH AND MAY LOW

by John Murphy,

Chief Technical Analyst, StockCharts.com

SEMICONDUCTOR INDEX IS FORMING TWO TRIANGLES... A lot has been written lately about the formation of triangular patterns. Here are couple more applied to the same group. Chart 1 shows the Philadelphia Semiconductor Index ($SOX) moving up to test its flat trendline drawn over its July/September/October highs. The...

READ MORE

MEMBERS ONLY

Anatomy of a Classic a Bullish Continuation Pattern - And a Live Example

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Bullish continuation patterns are my favorite patterns when it comes to stocks and ETFs. As the name suggests, bullish continuation patterns, when confirmed, signal a continuation of the prior trend. Furthermore, because it is a "bullish" continuation, it means the prior trend was up and that trend is...

READ MORE

MEMBERS ONLY

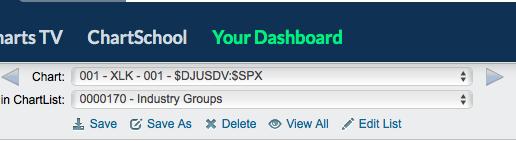

Check Out The New Leadership Over The Past Month

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

As a trader, I'm constantly watching my industry group relative strength charts. There are 104 of them, so I could look at each one individually....or I could use the cool StockCharts tools to do all the work for me. Once I am in the ChartList that I&...

READ MORE

MEMBERS ONLY

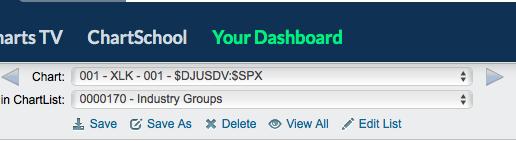

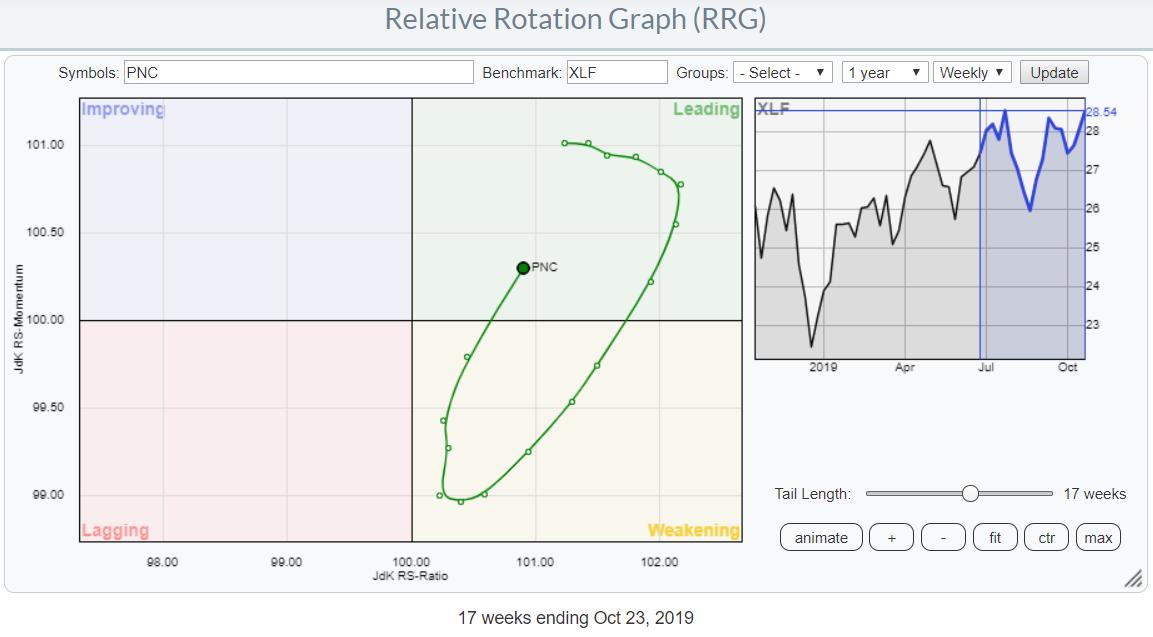

PNC Signals Strength As Its Tail Rotates Back Into The Leading Quadrant on RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Financial sector (XLF) continues to pick up relative strength. On the weekly RRG, XLF just moved into the improving quadrant and is positioned very close to the center of the chart. On the daily RRG, a very nice and strong rotation can be seen over the last three weeks....

READ MORE

MEMBERS ONLY

DP Alert Mid-Week: BUY Signal for Oil As Price Gushes Higher

by Erin Swenlin,

Vice President, DecisionPoint.com

It was a new top on the SPX as today's intraday was below yesterday's. This makes the third top of a possible triple-top, but, whether that pattern appears or not, this last price top is lower than the previous two. I am still considering the possibility...

READ MORE

MEMBERS ONLY

DP Daily Diamonds - Momentum Sleepers -- Shorter-Term Appeal

by Erin Swenlin,

Vice President, DecisionPoint.com

I ran my Momentum Sleepers Scan today. I previously found this one to be quite successful in the short-term on MarketWatchers LIVE. There appears to be momentum under the surface of some very rough diamonds. I'll tell you up front that the weekly charts for these stocks aren&...

READ MORE

MEMBERS ONLY

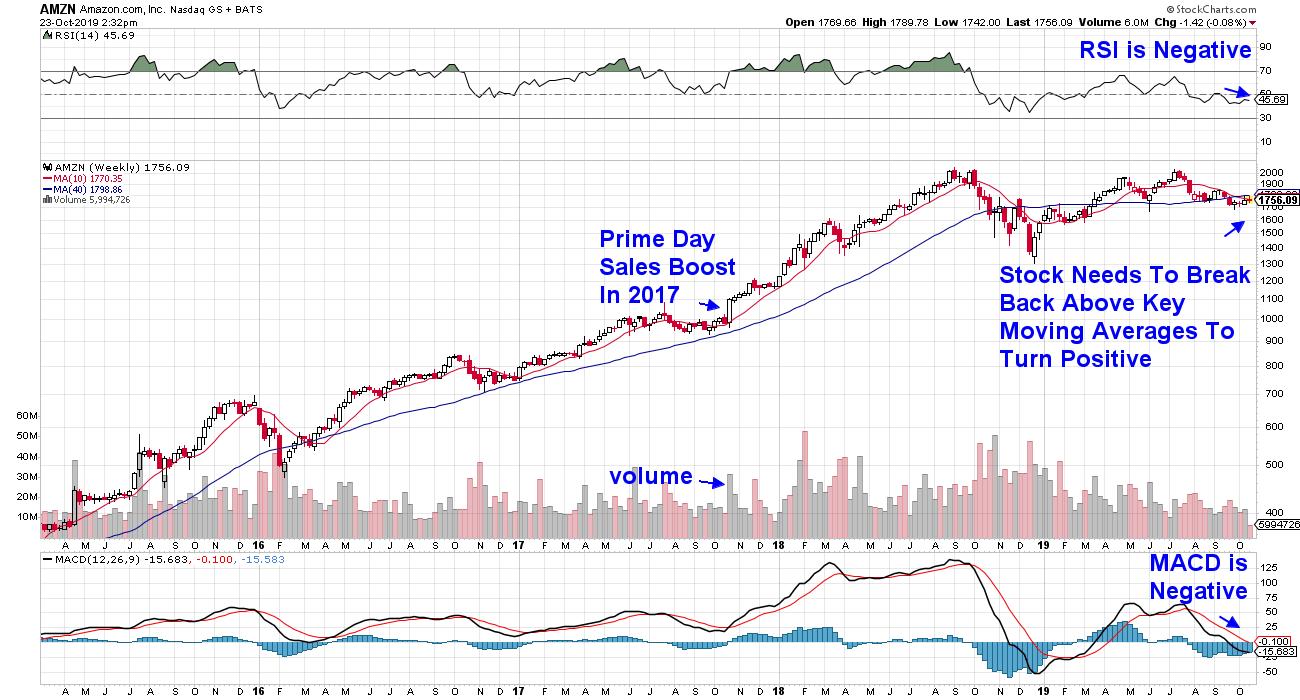

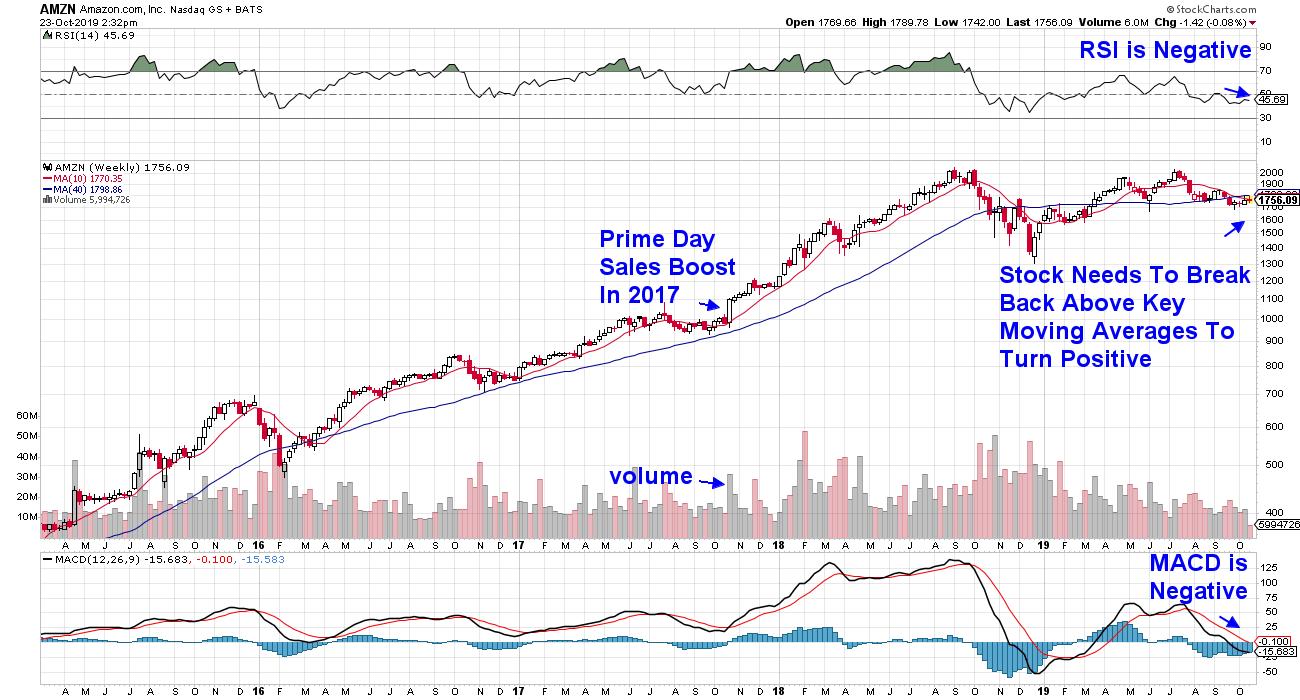

Is Amazon Ready For "Prime Time"?

by Mary Ellen McGonagle,

President, MEM Investment Research

Amazon.com Inc. (AMZN) has been struggling of late following a 12.5% drop from its peak in price during early July. As you can see in the chart below, the stock has been trading below its key 50-day moving average for the past 3 months. Tomorrow's release...

READ MORE

MEMBERS ONLY

EQUAL WEIGHT S&P 500 ETF IS ALSO NEARING A TEST OF ITS SUMMER HIGH -- AN UPSIDE BREAKOUT BY BOTH VERSIONS OF THE S&P 500 WOULD BE A POSITIVE SIGN -- RISING SMALL AND MID CAP STOCKS ARE GIVING A BOOST TO THE RSP AND MAY BE SENDING A POSITIVE SIGNAL

by John Murphy,

Chief Technical Analyst, StockCharts.com

BOTH S&P 500 ETFS ARE NEARING OLD HIGHS...Chart 1 shows the S&P 500 SPDR (SPY) moving closer to a test of its July/September highs. It would take a close above its September intra-day high at 301.24 to put it at a record high....

READ MORE

MEMBERS ONLY

XLI and XLF Zigzag Higher and Underpin Bullish Thesis - Grand Opening

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Industrials SPDR (XLI) and Finance SPDR (XLF) are two of the big six sectors in the S&P 500 and both are moving in the right direction: up.

The Industrials sector accounts for 9.32% of the S&P 500, while the Finance sector accounts for 13....

READ MORE

MEMBERS ONLY

Lock Into A Strengthening Industry For Great Earnings Results

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It works like a charm. Wall Street places their bets ahead of earnings season, then the solid results pour in. Shocking? Not really. That's a big advantage to have - to be able to meet with management teams ahead of earnings reports (before the "quiet period"...

READ MORE

MEMBERS ONLY

DP Daily Diamonds - Small-Caps Dominate Scans - A Look At Seasonality Too!

by Erin Swenlin,

Vice President, DecisionPoint.com

Recently, I received an email from a reader who basically said he found that, if he traded in a bull market, he made money, whereas when he traded in a choppy or bear market, he lost money. The lesson learned is that, despite the best attempts to find the best...

READ MORE

MEMBERS ONLY

DP Daily Diamonds - Bull Flags Appearing on Daily and Weekly Charts

by Erin Swenlin,

Vice President, DecisionPoint.com

Scan results were a mixed bag of different sectors today. The charts that I found the most interesting were those that had some bullish flag formations. Not every stock today is showing that bull flag formation, but the others still look enticing. I'm personally holding off on adding...

READ MORE

MEMBERS ONLY

Global Indexes Just Below Major Breakout Points

by Martin Pring,

President, Pring Research

* The Dow Jones and MSCI World Stock Indexes/ETF Poised to Move Higher

* Rest of the World Emerging

* Europe, Japan and Emerging Markets Looking Positive

The Dow Jones and MSCI World Stock Indexes/ETF Poised to Move Higher

US indexes have rallied sharply in the last week, but so have...

READ MORE

MEMBERS ONLY

DP Show: Anniversary of 1929 and 1987 Crashes - Does History Tell Us to Expect the Same?

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this episode of DecisionPoint, Erin covered the major indexes and DP indicators, taking a deeper look at the Rydex Ratio (which is showing very bearish sentiment in place). Meanwhile, with this week marking the anniversary of both the 1929 and 1987 market crashes, Carl took us back in time...

READ MORE

MEMBERS ONLY

MEM Edge TV: Take Advantage of Shifts in Strength

by Mary Ellen McGonagle,

President, MEM Investment Research

On this episode of StockCharts TV's The MEM Edge, Mary Ellen reviews new areas showing critical strength and the ways in which you can capitalize. Additionally, she discusses stocks that are setting up nicely going into earnings, as well as those that have already reported. This episode originally...

READ MORE

MEMBERS ONLY

S&P 500 NEARS TEST OF OVERHEAD RESISTANCE -- TRANSPORTS ARE OFF TO A STRONG START -- FINANCIALS LEAD MARKET HIGHER -- BANK OF AMERICA MAY BE BREAKING OUT -- STATE STREET SURGES -- STRONG FINANCIALS MAY BE BOOSTING SMALL CAPS

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK INDEXES NEAR OLD HIGH...Stocks around the world are trading higher this morning. Chart 1 shows the S&P 500 nearing a test of a trendline drawn over its July/September highs. All other major stock indexes are also trending higher. A big drop in Boeing (BA), however,...

READ MORE

MEMBERS ONLY

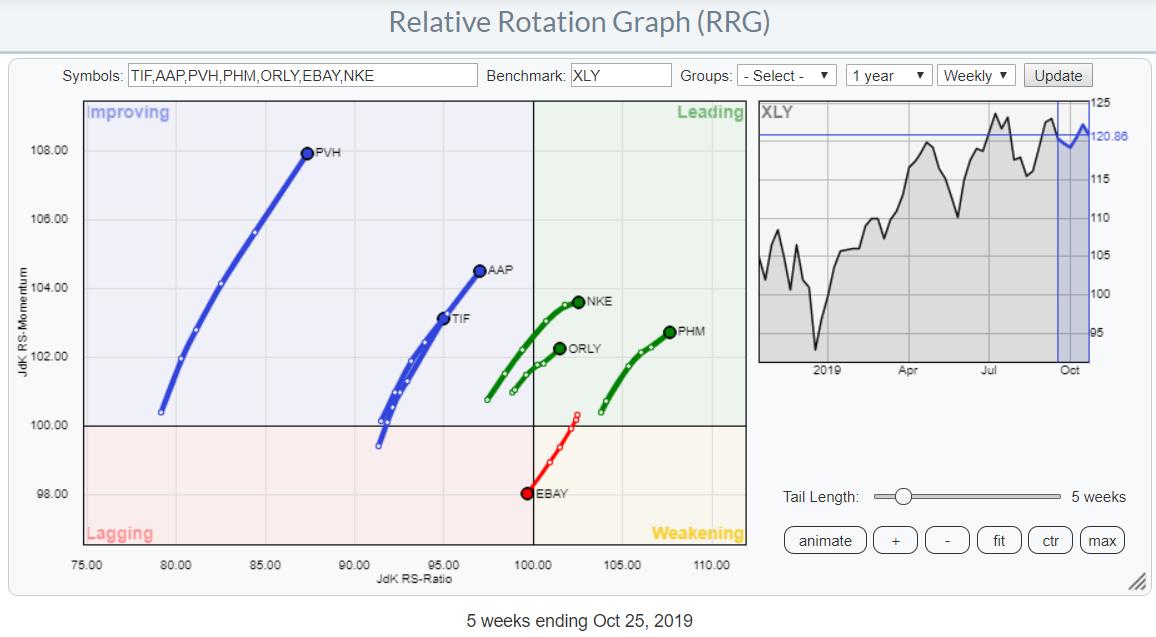

Consumer Discretionary On the Verge of Crossing Over Into The Leading Quadrant on RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

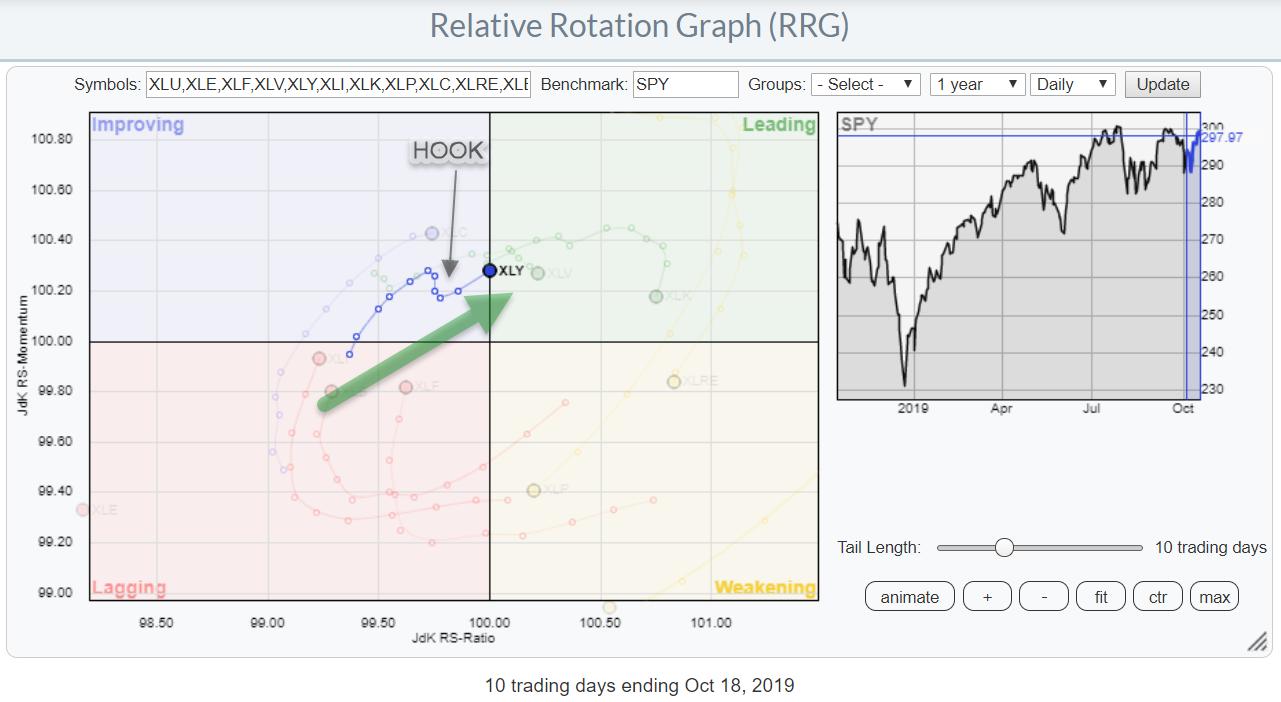

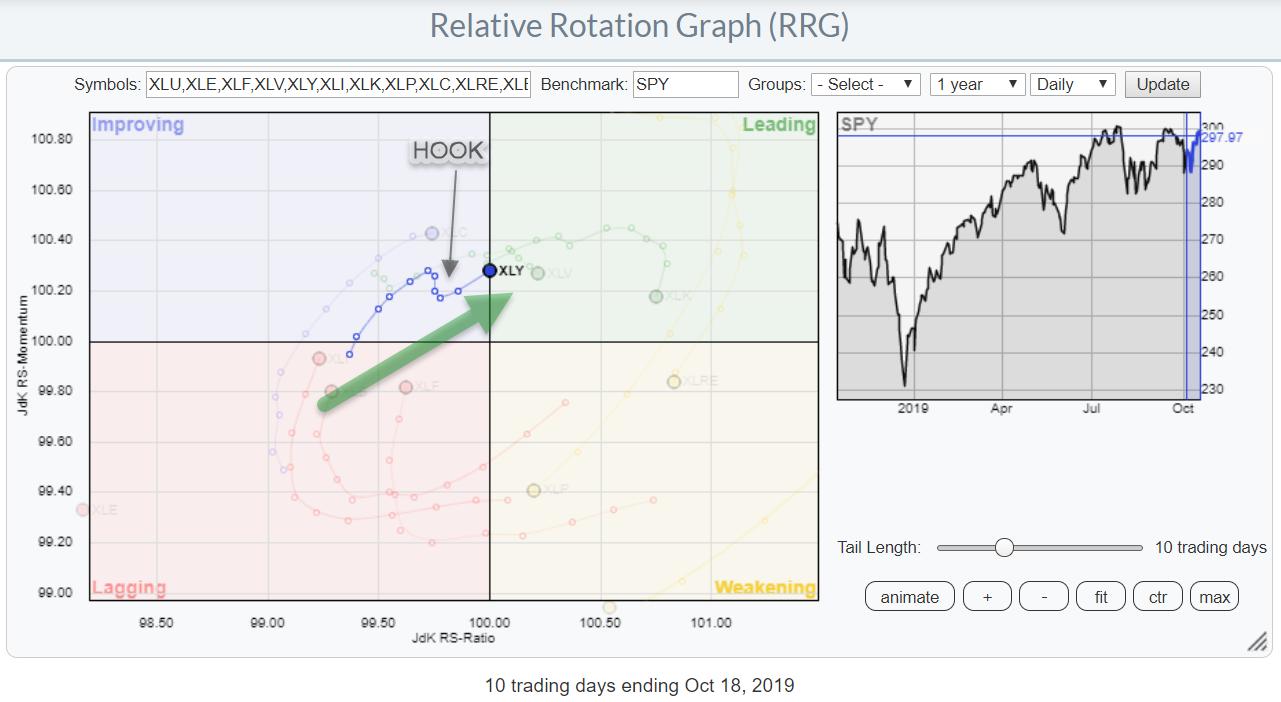

The RRG chart above shows the relative position for US sectors based on last Friday's close.

The sector that stands out most at the moment, at least for me, is Consumer Discretionary. After initially rolling over inside the improving quadrant, this sector "hooked" back on track...

READ MORE

MEMBERS ONLY

NFLX Dropped A Bomb, How Will The Other FAANG Stocks React To Earnings?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

There's been a lot said and written about the struggles of the FAANG stocks. Don't let any of it fool you. The only FAANG stock reeling in my view is Netflix (NFLX). In last week's "Q3 Earnings Sneak Preview", I said I...

READ MORE

MEMBERS ONLY

Dividends Rule!

by Bruce Fraser,

Industry-leading "Wyckoffian"

Growth stocks and Income (Value) stocks often perform in opposition to each other. When the growth theme is strong, the value theme is lagging. On a secular scale two time periods come to mind. From about 1977-83 growth stocks dominated with the raging IPO market signaling the conclusion of the...

READ MORE

MEMBERS ONLY

Week Ahead: This Zone Crucial for NIFTY to Navigate; Rotation Evident in Certain Sectors

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Indian equity markets had a strong week, making a steady upside move and ending the week with decent gains. In the week before this, the NIFTY had defended its crucial support levels of 200-DMA on the daily charts and the 50-Week MA on the weekly charts. After successfully defending...

READ MORE

MEMBERS ONLY

A Mixed Market as Earnings Season Hits

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

While the S&P 500 and large-caps hold up well, small-caps and mid-caps continue to trade mixed. This suggest that the average stock is trading mixed, some up and some down. Even though we are not in a bear market environment, stock picking is challenging right now and we...

READ MORE

MEMBERS ONLY

Why Pick Stocks Over ETFs or Mutual Funds? My Personal Five Most Compelling Reasons

by Gatis Roze,

Author, "Tensile Trading"

Yes, this is personal. I'll share my own portfolio experiences from the past 25 years. Feel free to embrace those elements that strike you as most appropriate to your investing style.

First, a few ground-floor definitions before I get specific on the five reasons that motivate me to...

READ MORE

MEMBERS ONLY

DP WEEKLY WRAP: Triple Top Now?

by Carl Swenlin,

President and Founder, DecisionPoint.com

The breakout above the short declining tops line last week was extended upward this week, and that has kind of messed up my double top scenario. Now it appears that a triple top may be in progress, and the expected outcome for that is really no different than for a...

READ MORE

MEMBERS ONLY

Earnings Season Presents TONS of Profit Opportunities

by John Hopkins,

President and Co-founder, EarningsBeats.com

On Friday morning, Tom Bowley, Chief Market Strategist of EarningsBeats.com, and Mary Ellen McGonagle, president of MEM Investment Research, conducted a webinar that included identifying stocks reporting earnings next week that could make significant moves. It was fascinating listening to these two seasoned pros as they displayed charts on...

READ MORE

MEMBERS ONLY

Few New Highs, but Even Fewer New Lows

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The lack of new highs may seem like a concern, but one cannot talk about new highs without also looking at new lows because there are two sides to the story. The S&P 500 is within 2% of an all time high and there were just 28 new...

READ MORE

MEMBERS ONLY

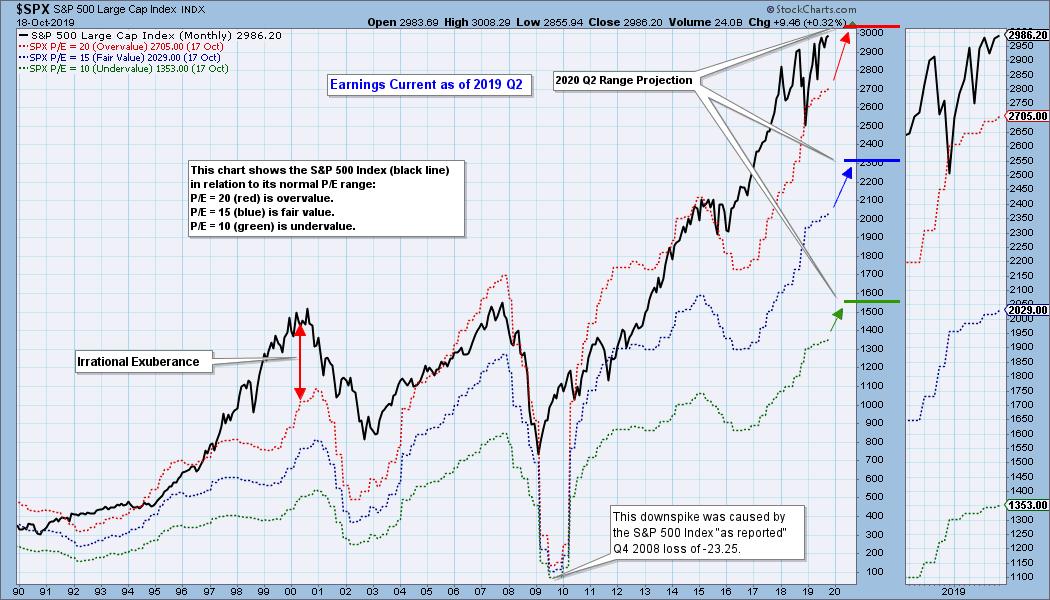

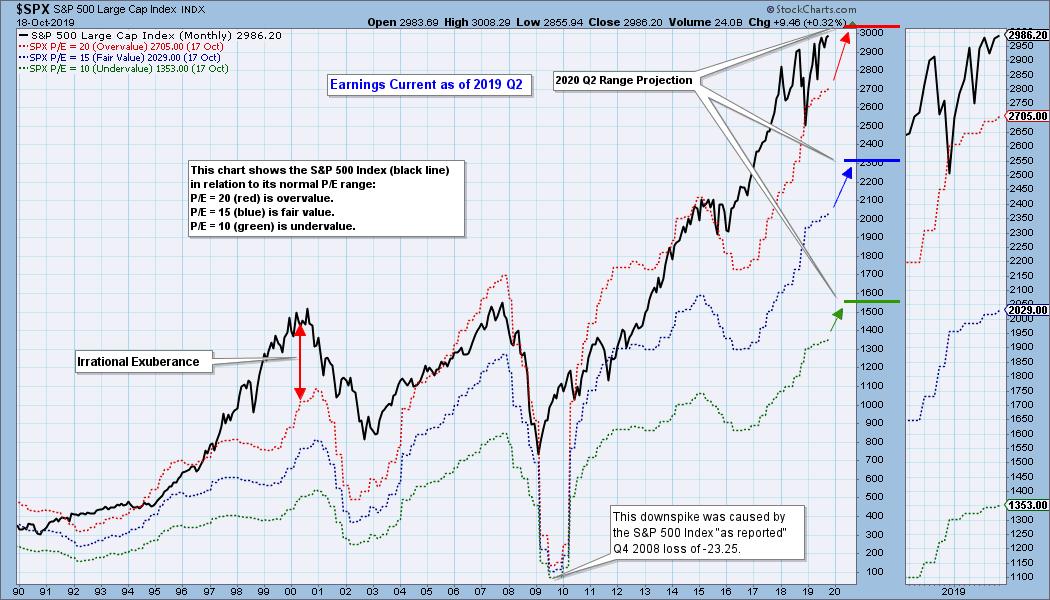

EARNINGS: 2019 Q2 Finalized; S&P 500 Still Overvalued

by Carl Swenlin,

President and Founder, DecisionPoint.com

The S&P 500 earnings for 2019 Q2 were finalized a few weeks ago. The following chart shows us the normal value range of the S&P 500 Index, indicating where the S&P 500 would have to be in order to have an overvalued P/E...

READ MORE

MEMBERS ONLY

The Dollar Has Fallen This Week Against the Euro and Pound

by John Murphy,

Chief Technical Analyst, StockCharts.com

Editor's Note: This article was originally published in John Murphy's Market Message on Friday, October 18th at 4:23pm ET.

Chart 1 shows the Invesco US Dollar Index Fund (UUP) falling this week to the lowest level in two months. Most of that drop has come...

READ MORE

MEMBERS ONLY

THE DOLLAR HAS FALLEN THIS WEEK AGAINST THE EURO AND POUND -- BOTH CURRENCIES HAVE RALLIED ON HOPES FOR BREXIT SETTLEMENT -- EUROPEAN STOCK ETFS HAVE ALSO BEEN RISING -- THOSE GAINS, HOWEVER, COULD DEPEND ON SATURDAY VOTE IN PARLIAMENT

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOLLAR FALLS AGAINST EURO AND POUND...Chart 1 shows the Invesco US Dollar Index Fund (UUP) falling this week to the lowest level in two months. Most of that drop has come against the Euro and British Pound. Chart 2 shows the British Pound rising to the highest level in...

READ MORE

MEMBERS ONLY

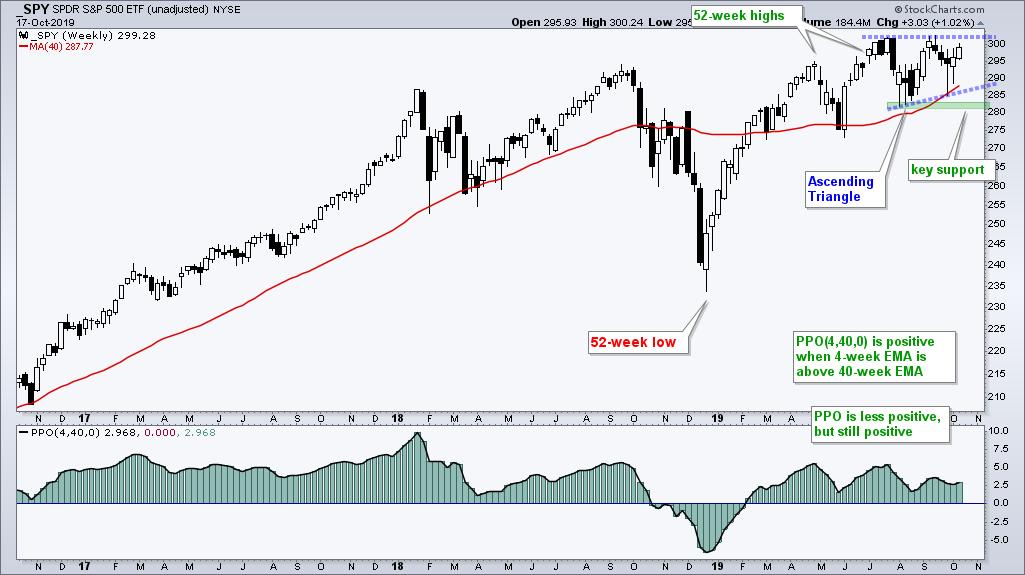

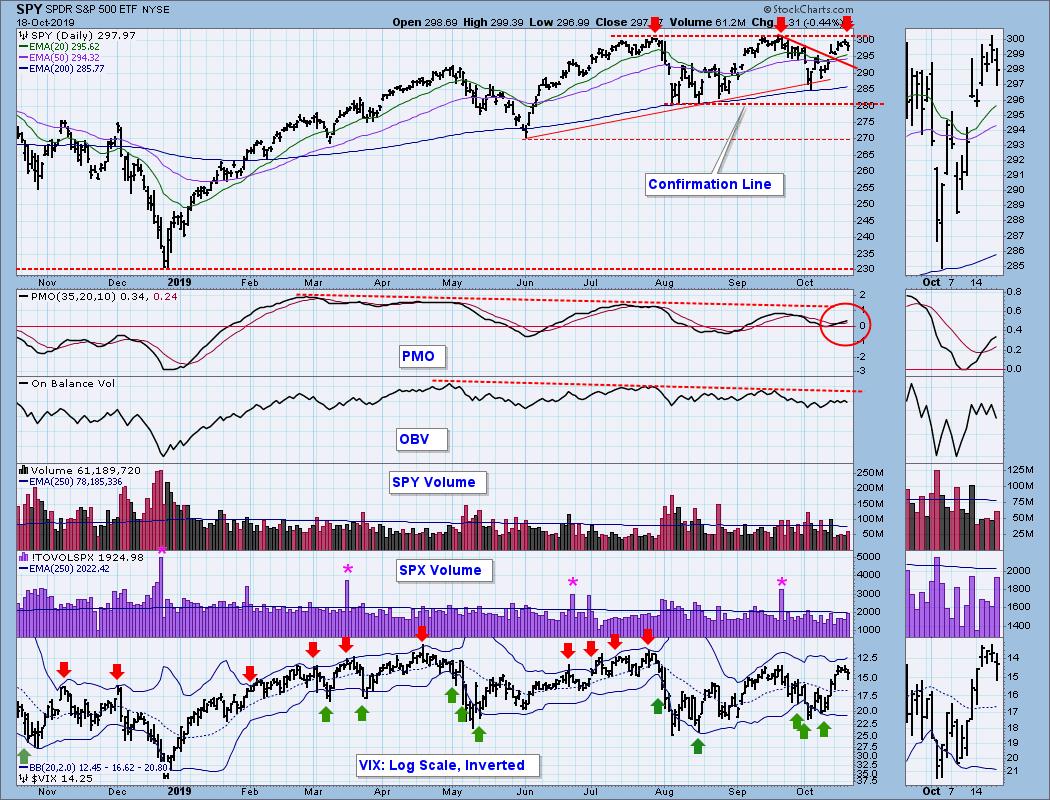

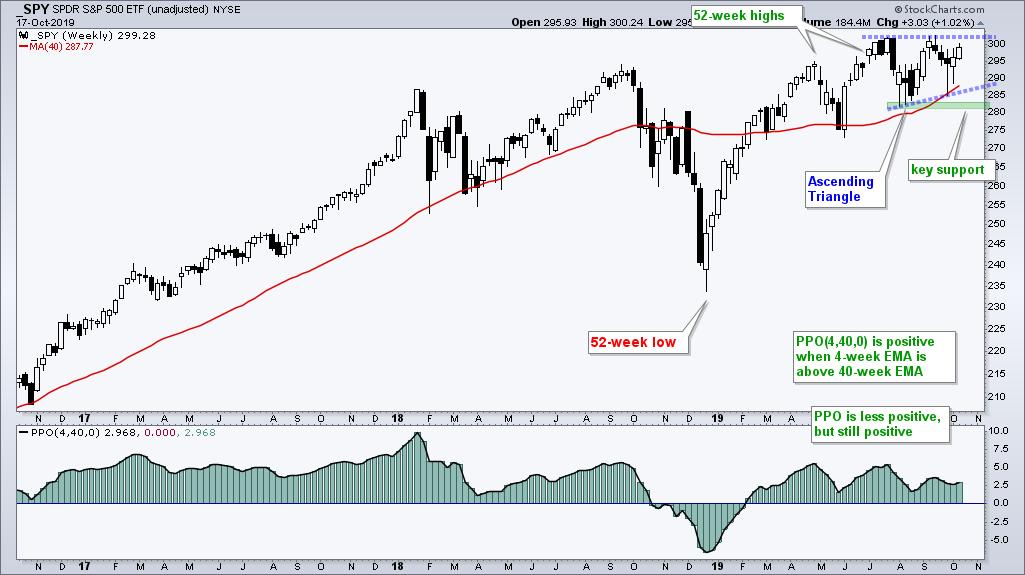

The State of the Stock Market - Waning Upside Momentum is Normal - A Special Announcement

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

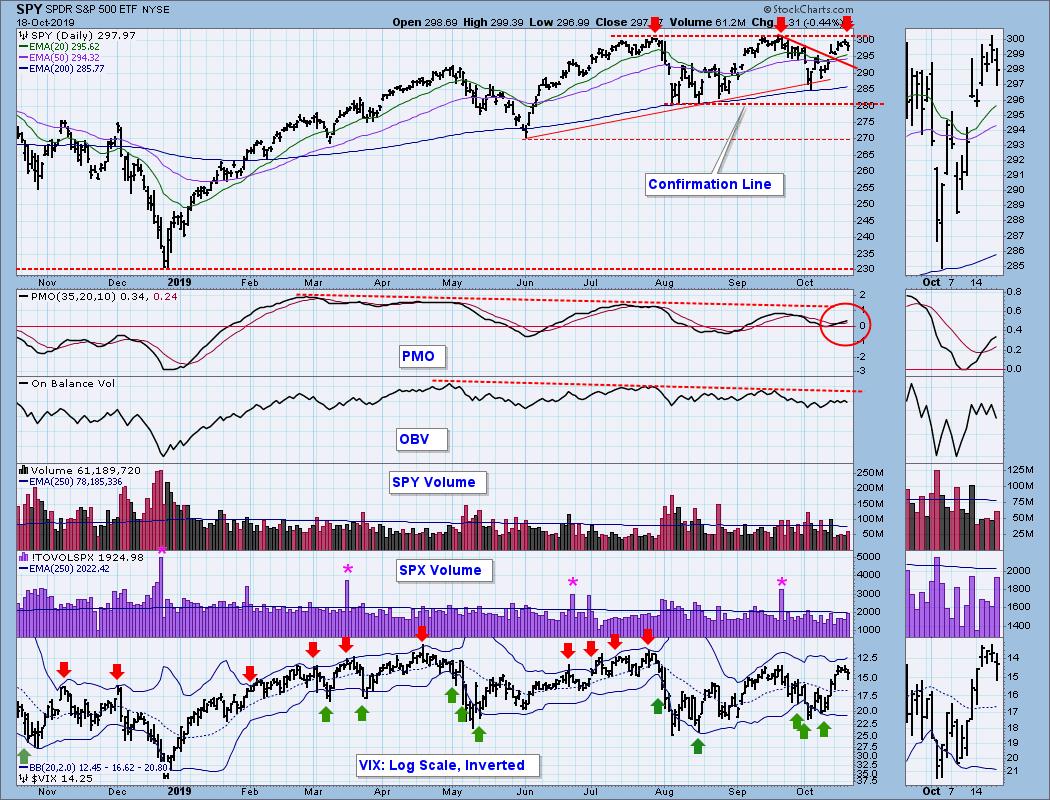

The S&P 500 SPDR (SPY) hit a new high in July and then moved into a trading range the last few months. Momentum turned down during this trading range and this is perfectly normal during a consolidation. Today will look at a weekly chart pattern taking shape and...

READ MORE

MEMBERS ONLY

Earnings-Related Gaps - How To Profit From Them

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Earnings season is, by far, my favorite time of the year. It occurs four times a year and provides a significant number of trading opportunities if you know what you're looking for. My first piece of advice is this: Not all gaps are created equal. Many traders consider...

READ MORE

MEMBERS ONLY

A Watershed Moment For This Strong Earner - Here's The Time Frame Chart To Use

by Mary Ellen McGonagle,

President, MEM Investment Research

Earnings season began this week with over 95 companies reporting their most recent earnings reports. By all accounts, it's been quite a positive season so far, with most companies coming in ahead of estimates and the markets responding warmly.

One of the biggest winners has been a small-cap...

READ MORE

MEMBERS ONLY

DP Daily Diamonds - Short- and Intermediate-Term Ideas

by Erin Swenlin,

Vice President, DecisionPoint.com

I've begun to incorporate the weekly charts in the Diamond Reports. When I get a large amount of scan results, I find that it helps to narrow down the field by looking at a CandleGlance of the entire list and deleting the obvious "not ready for primetime&...

READ MORE

MEMBERS ONLY

HEALTH INSURERS AND DRUG DISTRIBUTORS PUT HEALTHCARE SPDR NEAR THREE-MONTH HIGH -- UNITEDHEALTH GROUP AND HUMANA CLEAR 200-DAY LINES -- AMERISOURCEBERGEN, CARDINAL HEALTH, AND MCKESSON ARE HAVING A VERY STRONG CHART WEEK

by John Murphy,

Chief Technical Analyst, StockCharts.com

HEALTHCARE CONTINUES STRONG WEEK...Healthcare is the day's strongest sector for the second time this week. Chart 1 shows the Health Care SPDR (XLV) trading above a falling trendline drawn over its July/September highs; and putting the XLV close to the highest level in nearly four months....

READ MORE

MEMBERS ONLY

Ranking and Grouping ETFs - Emerging Markets ETF Challenges Key Level - Big Announcement

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Today's report on StockCharts is short because the full report can be found at my new website, TrendInvestorPro.com. More details below. For now, I will leave you with the Core Emerging Markets ETF (IEMG) as its technical picture improves. The chart for IEMG looks similar to the...

READ MORE

MEMBERS ONLY

Semiconductors Have NOT Broken Out (Yet), But Here's a Pair Trade That May Offer an Opportunity

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In the past week or so, I've seen a few headlines flying by mentioning the semiconductor index ($SOX) and an alleged breakout. In response, I checked out the chart of $SOX, as printed above, in combination with relative strength versus SPY.

What I see is a pretty big...

READ MORE

MEMBERS ONLY

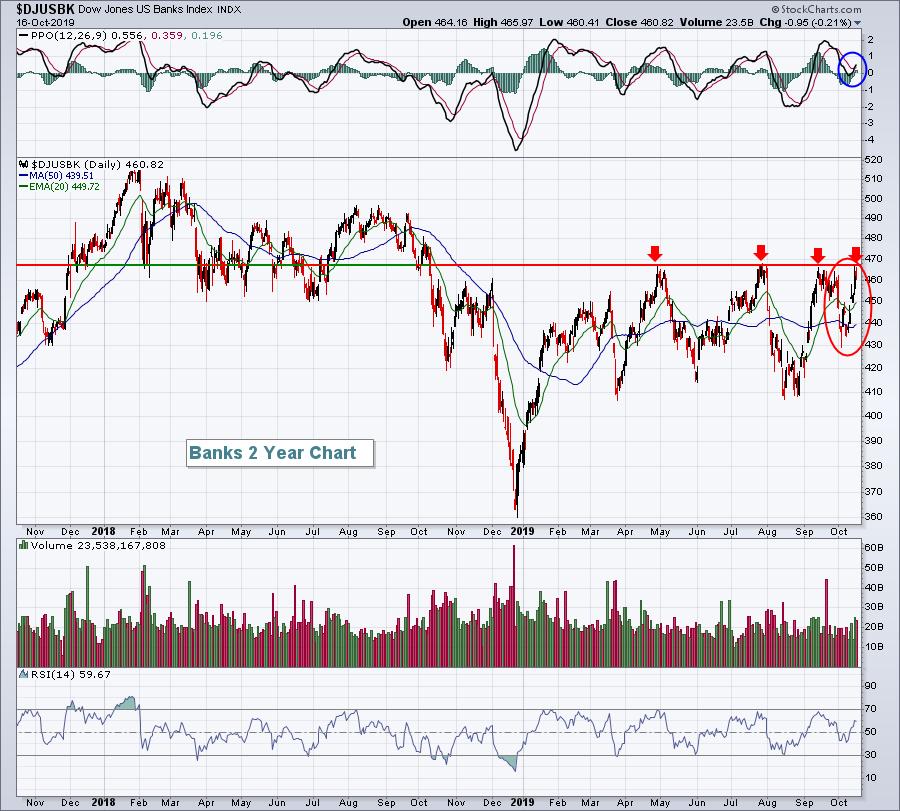

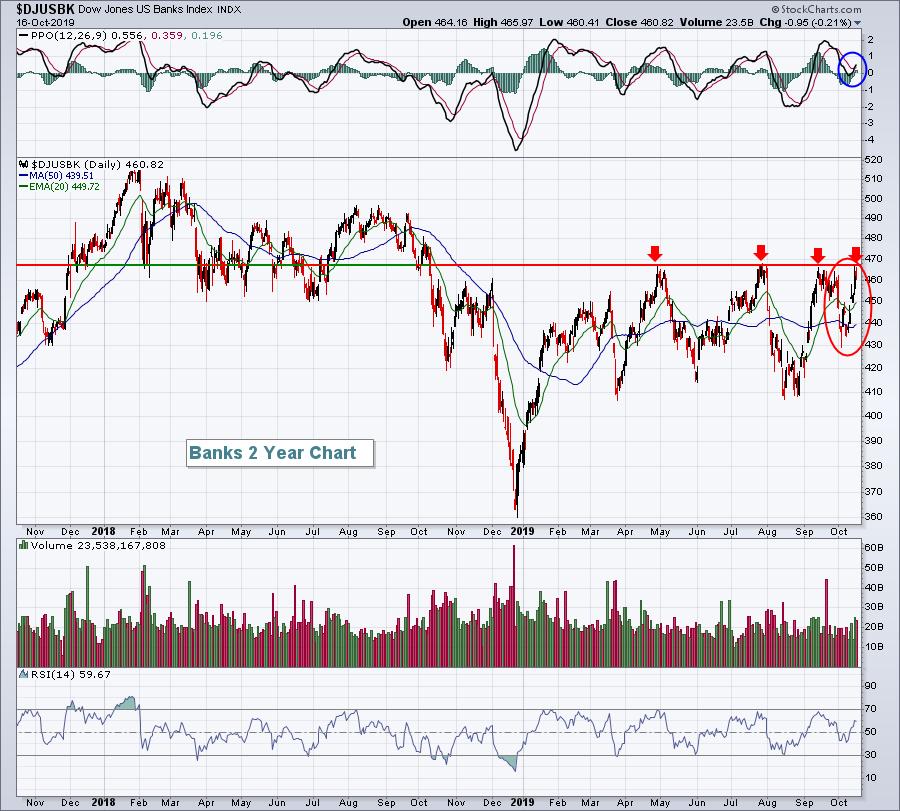

What A Month For The Banks So Far!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

October volatility in the banking industry ($DJUSBK) has been nothing short of crazy! On September 30th, the DJUSBK stood at 457.39. A little more than two weeks later, we show an index value of 460.82. No big deal, right? Well, October began with that infamous ISM manufacturing number...

READ MORE