MEMBERS ONLY

The State of the Stock Market - Bull Market Affirmed

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Bull Market Affirmed.

* Short-term Twilight Zone.

* Index Table Remains Bullish.

* YouTube Video.

* Small-cap Breadth Remains Weak.

* IWM: Bearish Trend line Break or Bull Wedge?

* Sector Table Remains Bullish.

* 83 Stocks in Strong and Steady Uptrends.

* Art's Charts ChartList Update.

... Bull Market Affirmed

... The S&P 500 advanced...

READ MORE

MEMBERS ONLY

The Challenge of Technical Analysis

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I put an image of the Moon on this article because we are approaching the 50-year anniversary of Neil Armstrong setting foot on the Moon - July 20, 1969. I was between my sophomore and junior year at the University of Texas majoring in Aerospace Engineering so was especially touched...

READ MORE

MEMBERS ONLY

REGIONAL BANKS SHOW LEADERSHIP -- THAT INCLUDES BB&T, SUNTRUST, AND U.S. BANCORP -- CITIGROUP AND JP MORGAN CHASE MAY BE NEARING UPSIDE BREAKOUTS OF THEIR OWN -- GOLDMAN SACHS HAS HIT NEW HIGH FOR YEAR TO REVERSE PREVIOUS DOWNTREND

by John Murphy,

Chief Technical Analyst, StockCharts.com

BANKS HELP BOOST FINANCIALS...Financials are one of the day's strongest sectors. And banks are a big reason why. The daily bars in Chart 1 show the KBW Bank Index finding support above its 50- and 200-day moving averages; as well as a rising trendline drawn under its...

READ MORE

MEMBERS ONLY

Netflix (NFLX) Gets Crushed And Here Was Our Clue

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Note

I'm on vacation this week so I'm writing brief articles and in a different format. There will be no article tomorrow, Friday, July 19th.

Netflix (NFLX) Hammered In After Hours

Despite topping both revenue and EPS estimates, NFLX is trading lower by nearly 11%...

READ MORE

MEMBERS ONLY

Forces Are Shifting in The Battle Between INTC and MSFT

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

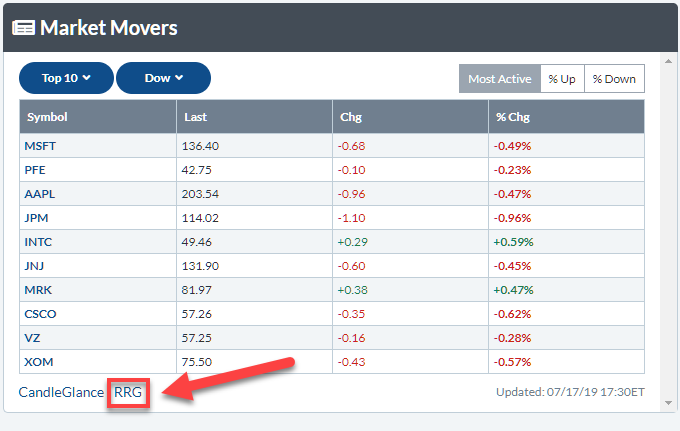

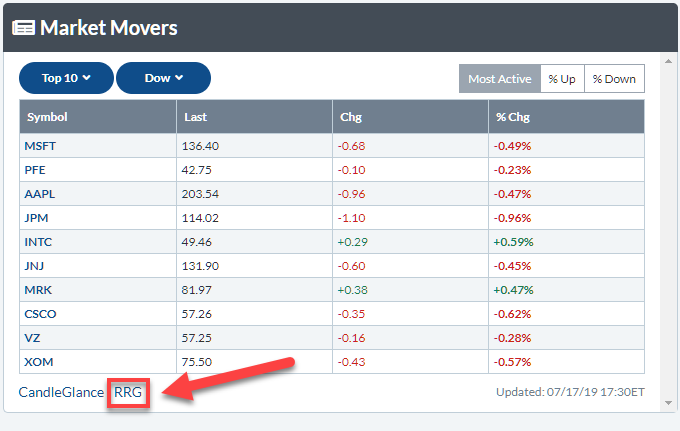

When you open up StockCharts.com and go to Your Dashboard, one thing you'll find is a section called "Market Movers", located in the top-right corner of your screen.

I currently have this section of the page set up so that it shows the top 10...

READ MORE

MEMBERS ONLY

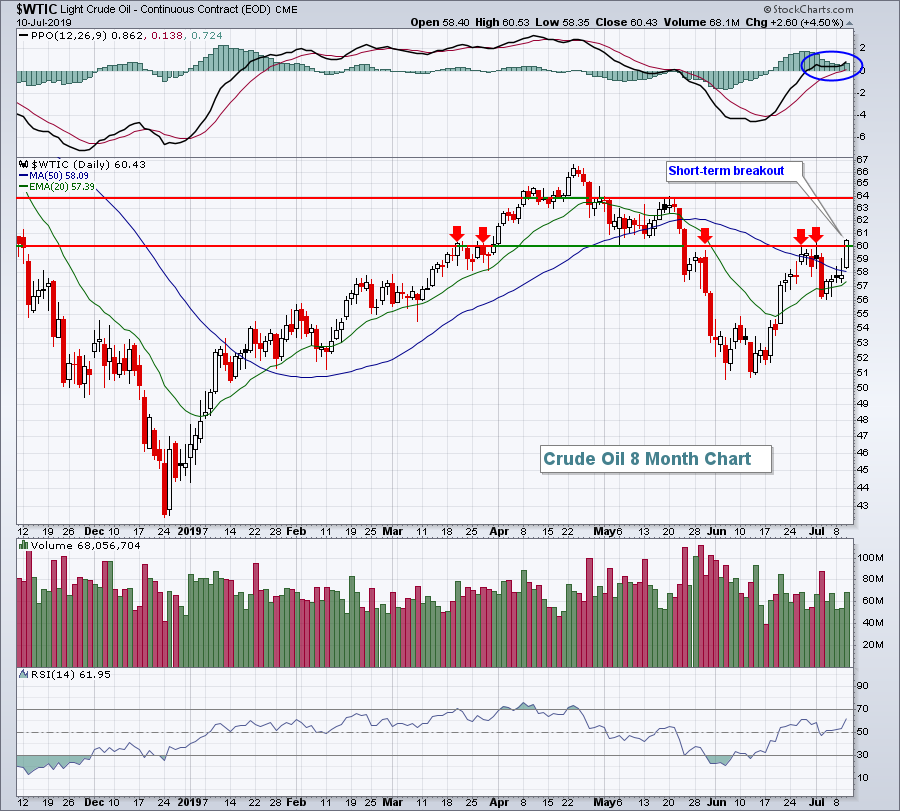

CSX AND OTHER RAIL STOCKS PULL TRANSPORTS SHARPLY LOWER -- THAT'S MAKING INDUSTRIALS THE DAY'S WEAKEST SECTOR -- FALLING PRICE OF OIL WEAKENS ENERGY STOCKS -- GOLD MINING ETF RESUMES UPTREND WITH THE COMMODITY NOT FAR BEHIND

by John Murphy,

Chief Technical Analyst, StockCharts.com

TRANSPORTS HAVING A VERY BAD DAY... Just a day after reaching a new two-month high, transportation stocks are the day's weakest group. The daily bars in Chart 1 show the Dow Jones Transportation Average falling more than 3% today. And it's being led lower mainly by...

READ MORE

MEMBERS ONLY

Four Stocks Poised to Continue their Uptrends

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The first step to finding great stocks is establishing the bigger trend for the market, the sector, the industry group and the stock. It is not as hard as it sounds. First, the S&P 500 is clearly in a long-term uptrend because it is above the rising 200-day...

READ MORE

MEMBERS ONLY

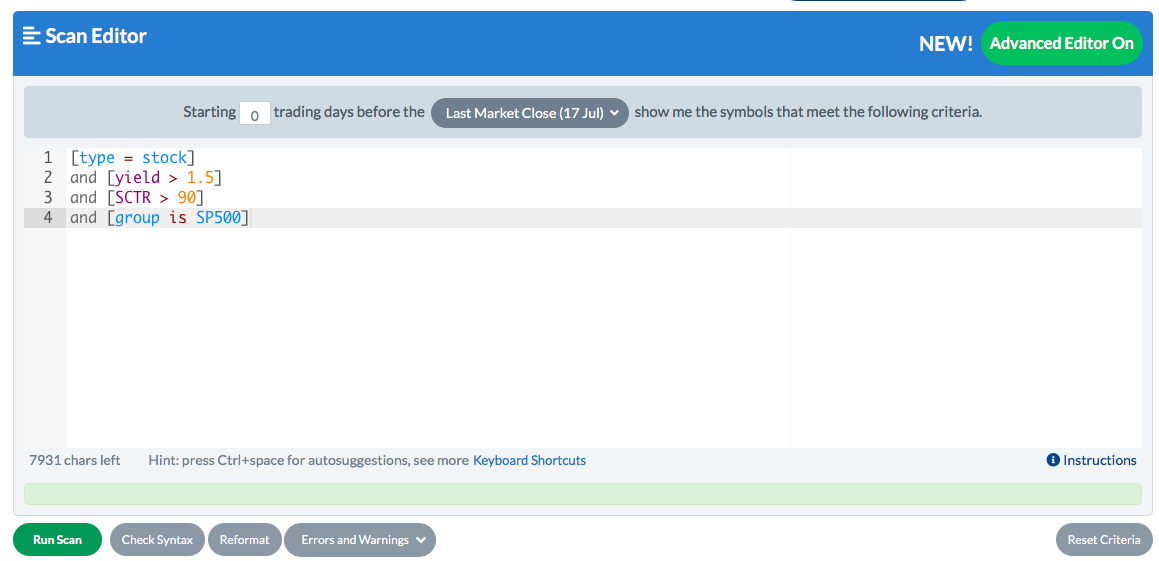

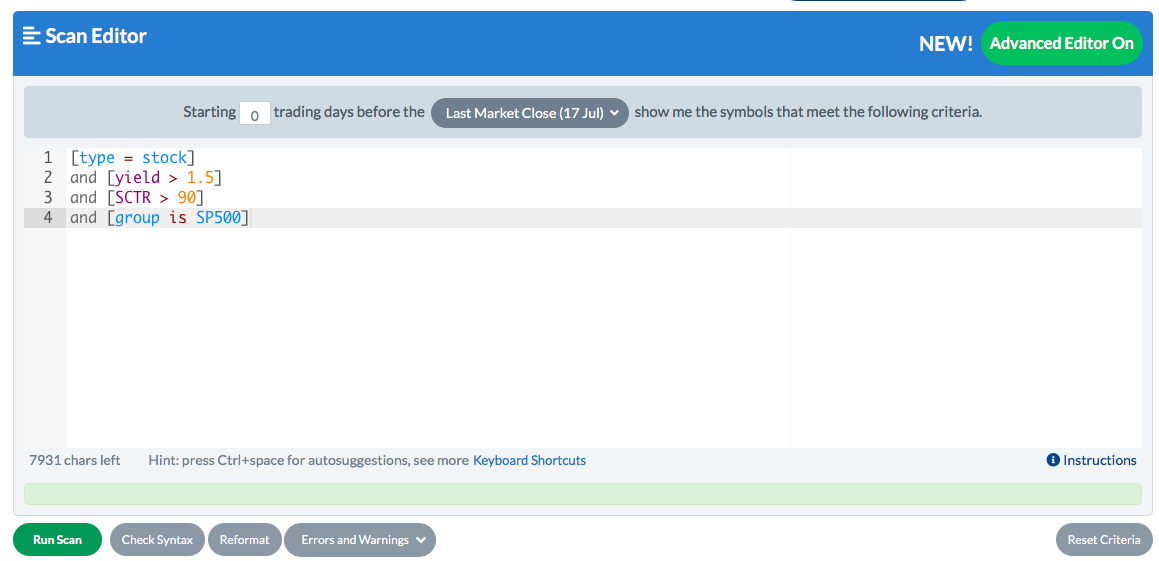

Scanning For High SCTRs And Dividend Yield

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Note

I'm on vacation this week, so my articles are in a different format and generally shorter. There will be no blog article on Friday.

I've created three portfolios over the past year. My Model Portfolio began on November 19, 2018 and my Aggressive Portfolio...

READ MORE

MEMBERS ONLY

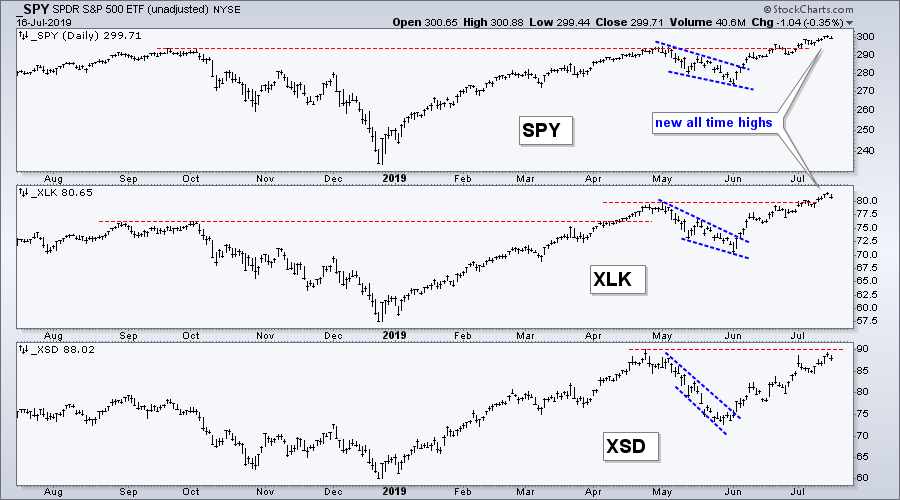

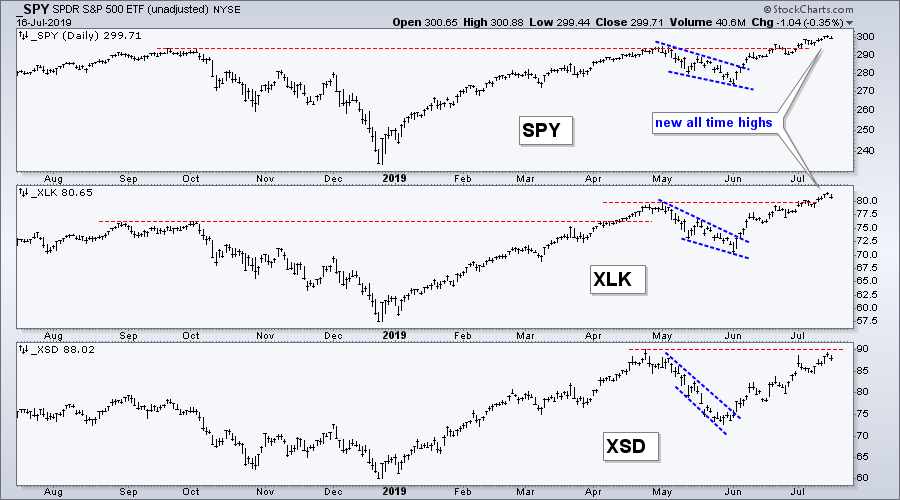

Semis are Back in Gear and this Stock is Poised to Extend Higher

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 SPDR and Technology SPDR (XLK) hit new highs this month. Thus, the S&P 500 is signaling a bull market and the technology sector is leading. The Semiconductor SPDR (XSD), which is a broad-based semiconductor ETF, is also showing leadership as it challenges its...

READ MORE

MEMBERS ONLY

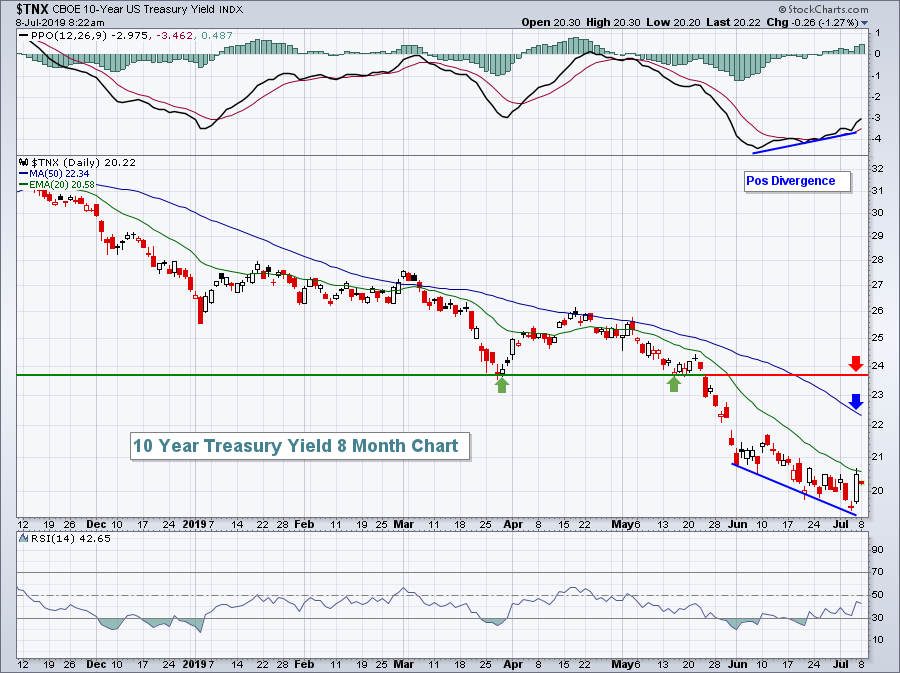

Bond Yields May Not Be Headed Lower After All

by Martin Pring,

President, Pring Research

* Money Market Yields Continue to Look Vulnerable

* The 5-Year Yield is in a Secular Uptrend

* Longer-Dated Maturities Overstretched on the Downside

Money Market Yields Continue to Look Vulnerable

Everybody and their dog thinks that short-term rates will be cut by the Fed later this month. Count me in with the...

READ MORE

MEMBERS ONLY

We're Off To The Races If These 3 Break Out

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Note

I'm on vacation this week so I'll post mostly abbreviated articles. There will be no blog article on Friday.

Current Outlook

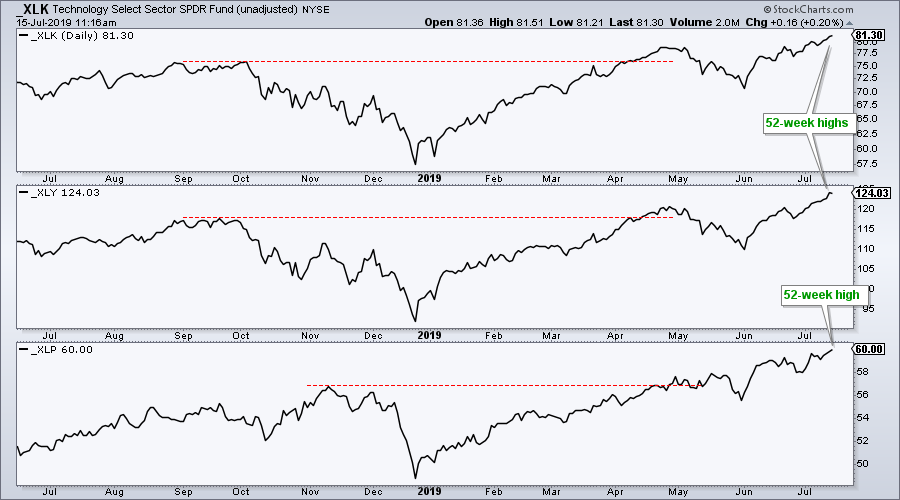

One confirmation signal that I always look for during a bull market is leadership from our 5 aggressive sectors - technology (XLK), consumer...

READ MORE

MEMBERS ONLY

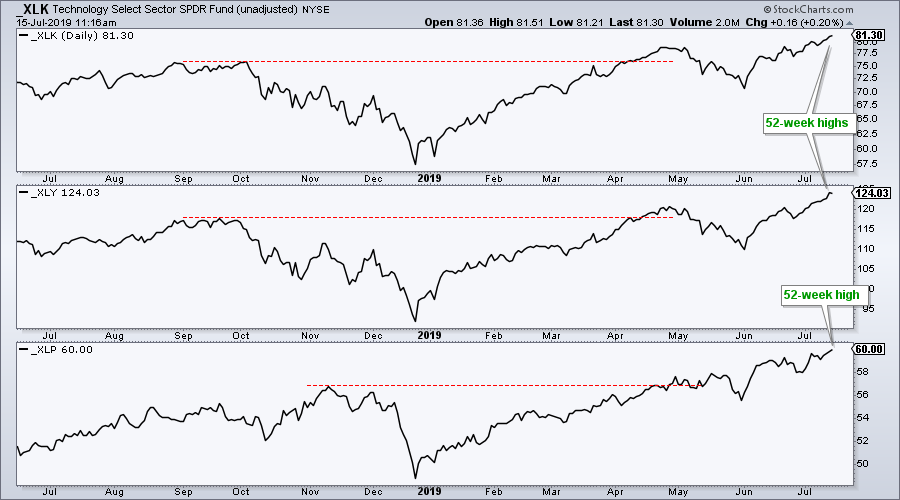

The Consumer Staples Sector is Leading and this Stock is About to Break Out

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 hit a new 52-week high last week and three sectors joined the index with new highs of their own: the Technology SPDR, the Consumer Discretionary SPDR and the Consumer Staples SPDR. Note that I am basing the new highs on price chart using unadjusted prices,...

READ MORE

MEMBERS ONLY

Transports Soar To Lift Wall Street To Yet Another Record

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Note

I am on vacation this week so I'll post mostly abbreviated blog articles. There will be no blog article on Friday morning.

Market Recap for Friday, July 12, 2019

Industrials (XLI, +1.75%) powered our major indices to fresh new all-time highs. Transports ($TRAN) were particularly...

READ MORE

MEMBERS ONLY

STOCK INDEXES END WEEK AT RECORD HIGHS -- SECTOR RECORDS WERE SET BY CONSUMER DISCRETIONARY AND TECHNOLOGY -- INDUSTRIALS MAY BE GETTING CLOSE TO A RECORD AS WELL -- TRANSPORTATION STOCKS END ON A STRONG NOTE -- FINANCIALS HIT NEW HIGH FOR THE YEAR

by John Murphy,

Chief Technical Analyst, StockCharts.com

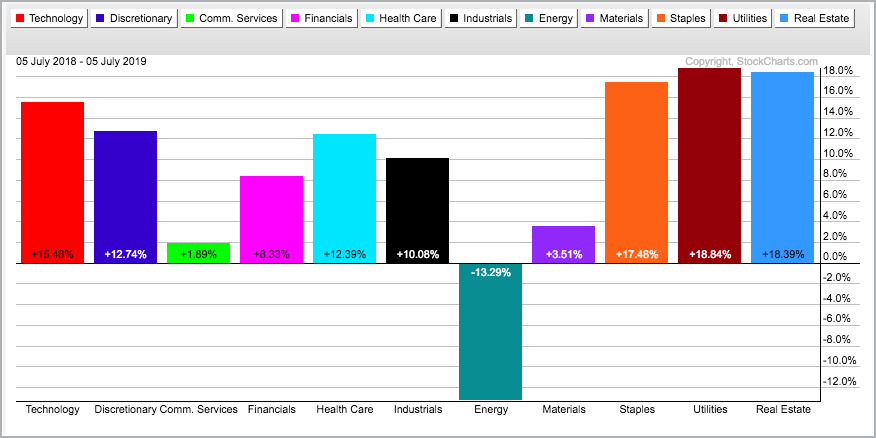

U.S. STOCK INDEXES SET NEW RECORDS...The three major U.S. stock indexes ended the week in record territory. A number of sectors hit records as well, or are getting close to doing so. Consumer discretionary and technology SPDRs hit new records. Financials hit a new high for the...

READ MORE

MEMBERS ONLY

Week Ahead: Mild Pullbacks Likely; NIFTY Continues To Remain Vulnerable To Sell-Offs At Higher Level

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After meeting resistance around 11800-11840 for seven weeks, the markets loosened up a bit over the past week while ending with losses. NIFTY spent the previous couple of weeks in a defined range as it remained indecisive and did not make any convincing directional call. This week, the NIFTY witnessed...

READ MORE

MEMBERS ONLY

Chartwise Women's "Pink Line"

by Erin Swenlin,

Vice President, DecisionPoint.com

Chartwise Women is a new show on StockCharts TV featuring myself and Mary Ellen McGonagle. Our mission is encompassed in three "E's": Engagement, Education and Empowerment. During each show, we talk conversationally about our "Wisdom of the Week", followed by "What's...

READ MORE

MEMBERS ONLY

My Personal Story And Why I Ask For Your Help

by Gatis Roze,

Author, "Tensile Trading"

This is a true story about someone whom I’ll refer to as an investing “refutenik”. But first, a bit of background. The long-term financial viability of Social Security is questionable, yet some politicians like to toss around the idea of delegating more accountability to John Q. Public for taking...

READ MORE

MEMBERS ONLY

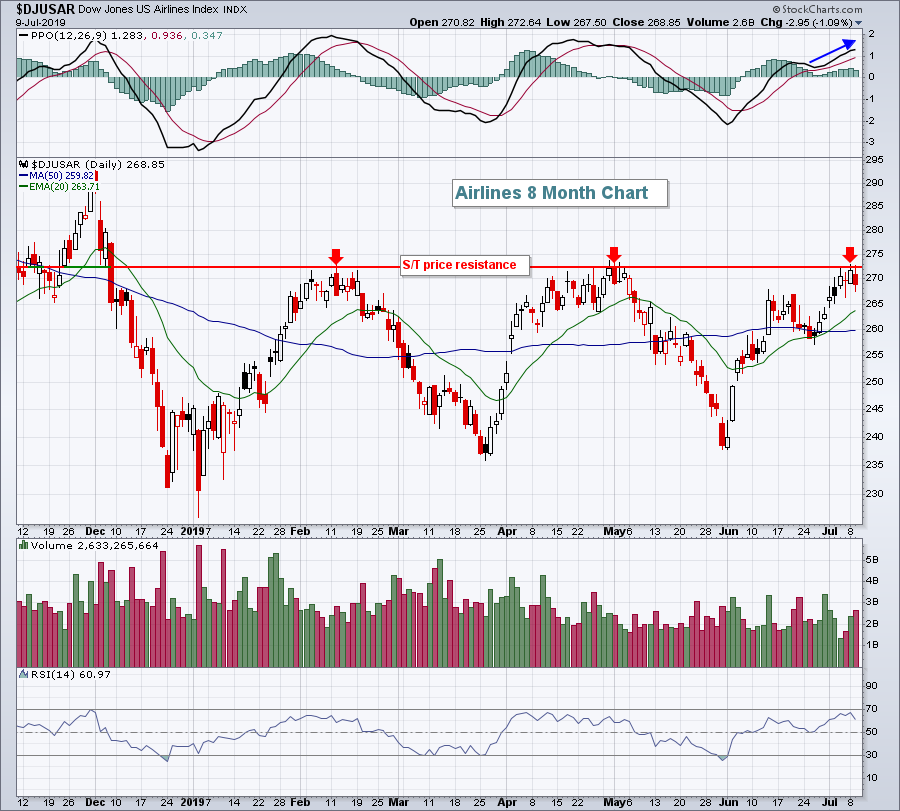

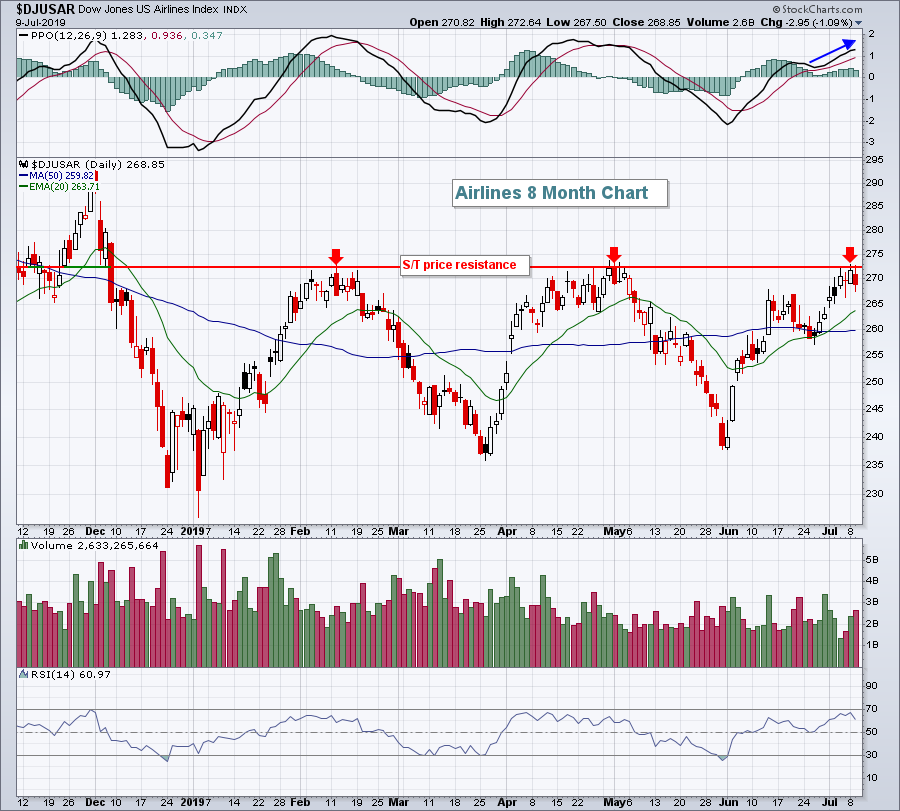

Two Stocks Setting Up To Report Blowout Earnings Next Week

by John Hopkins,

President and Co-founder, EarningsBeats.com

On Thursday morning, Delta Airlines (DAL) blew past revenue and EPS estimates, despite a challenging environment for airline stocks ($DJUSAR) in 2019. While DAL's results may have surprised quite a few people, they didn't surprise me. The best way to follow where Wall Street is placing...

READ MORE

MEMBERS ONLY

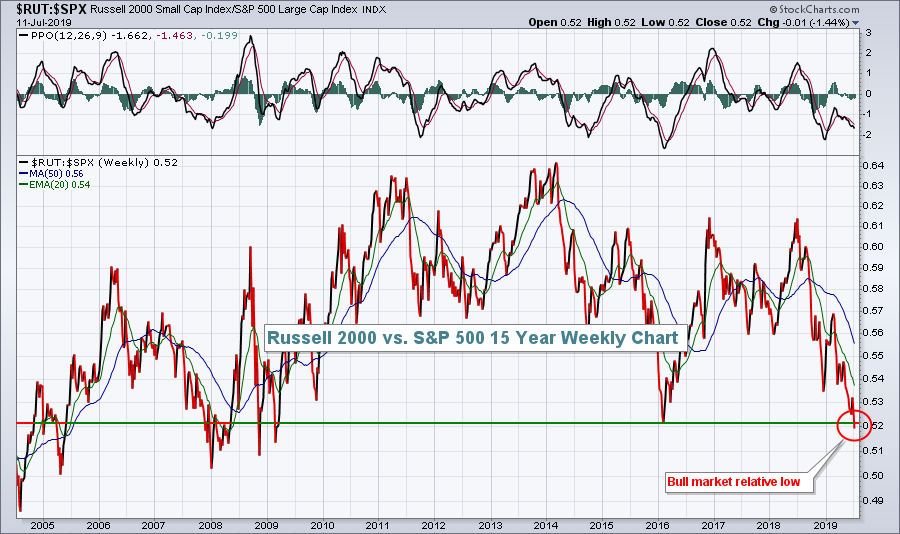

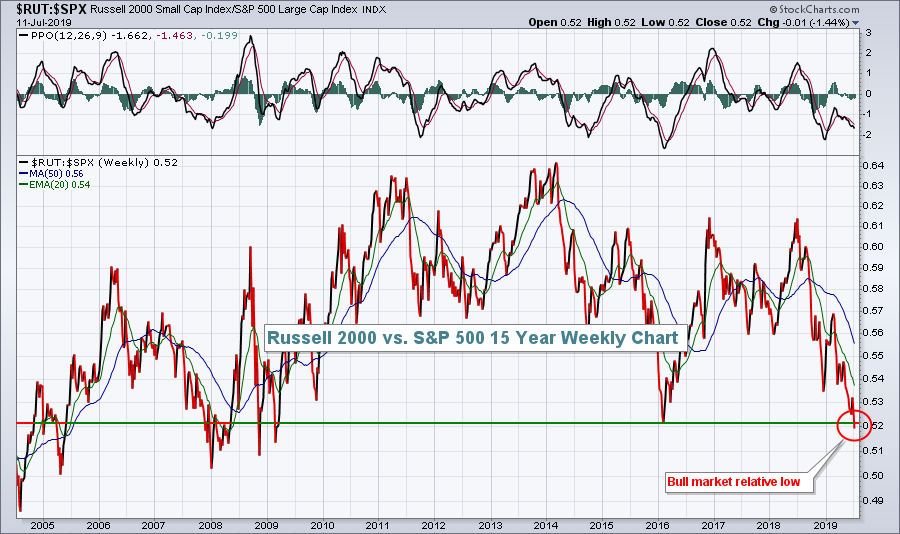

DP WEEKLY WRAP: New All-Time Highs, but Not for Small-Cap Stocks

by Carl Swenlin,

President and Founder, DecisionPoint.com

While the broad market indexes are currently making all-time highs, the S&P 600 Small-Cap Index (IJR) is struggling and remains about -14% below its all-time highs. This lack of small-cap participation is a concern, because the large-caps can't carry the market forever. The OBV is currently...

READ MORE

MEMBERS ONLY

Charting Robust AD Lines that Truly Reflect the Broader Market

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The NYSE and Nasdaq are fine as exchanges, but their AD Lines do not tell the entire story when it comes to breadth. The major stock indexes, such as the S&P 500 and S&P Small-cap 600, contain stocks from both exchanges. As such, robust breadth indicators...

READ MORE

MEMBERS ONLY

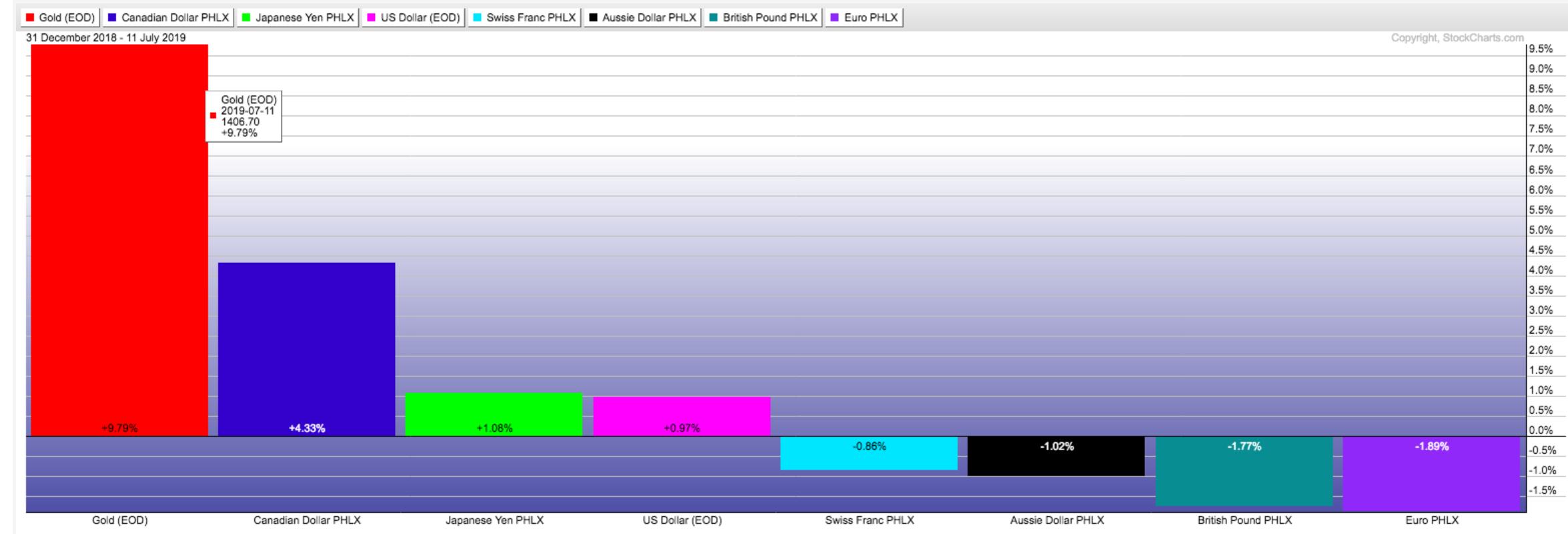

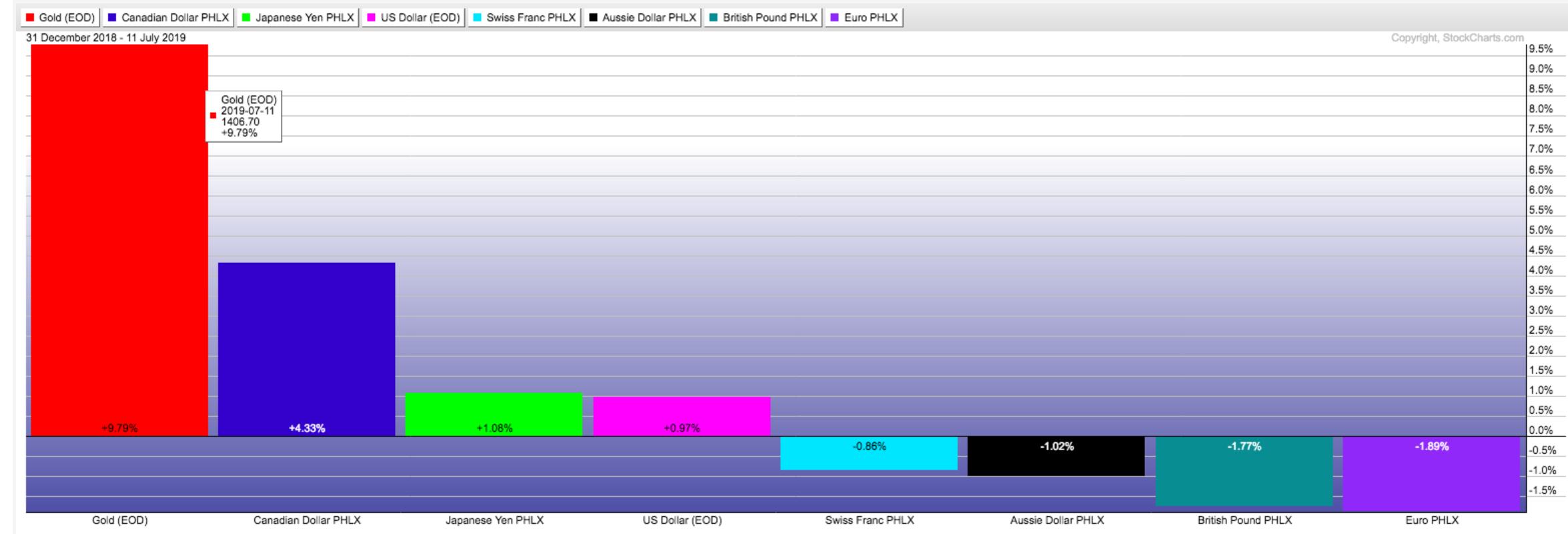

Gold is Doing Better Than The World's Major Currencies

by John Murphy,

Chief Technical Analyst, StockCharts.com

Editor's Note: This article was originally published in John Murphy's Market Message on Friday, July 12th at 11:39am ET.

Gold is more than just a commodity. Gold is sometimes also viewed as an alternate currency. When global traders lose confidence in their currency, they often...

READ MORE

MEMBERS ONLY

GOLD IS THE WORLD'S STRONGEST CURRENCY -- GOLD HAS HIT A SIX-YEAR HIGH QUOTED IN DOLLARS -- AND IS HITTING MULTI-YEAR HIGHS WHEN QUOTED IN MAJOR FOREIGN CURRENCIES AS WELL

by John Murphy,

Chief Technical Analyst, StockCharts.com

GOLD IS DOING BETTER THAN THE WORLD'S MAJOR CURRENCIES... Gold is more than just a commodity. Gold is sometimes also viewed as an alternate currency. When global traders lose confidence in their currency, they often turn to gold as an alternative store of value. Since gold is quoted...

READ MORE

MEMBERS ONLY

The State of the Stock Market - Large Getting Larger

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Large-caps Continue to Lead.

* New Highs Follow Moving Average Signals.

* Index Breadth Table Remains Bullish.

* Sector Breadth Table Remains Bullish.

* Tech-Related ETFs Continue to Lead.

* Biotech ETFs Stutter after Breakouts.

* Art's Charts ChartList Update.

... Large-caps Continue to Lead

The week so far is mixed for stocks with small-caps...

READ MORE

MEMBERS ONLY

Volatility and Emotions

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

This is part of a client letter I wrote when running MurphyMorris Money Management about 20 years ago. The message is the same today. Market volatility has an emotional cost. It causes investors to make irrational decisions that are usually based on either fear or greed. Volatility also carries a...

READ MORE

MEMBERS ONLY

It Was A Record-Breaking Day On Wall Street

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, July 11, 2019

Dow Jones ($INDU, +0.85%) 27000 is in the record books as another milestone has been reached on Wall Street. The S&P 500 ($SPX, +0.23%) also set another record high close, but fell just short of closing above the psychological...

READ MORE

MEMBERS ONLY

The Most Productive Stock in My Portfolio...and How I Found It

by Erin Swenlin,

Vice President, DecisionPoint.com

Sometimes, you get more than you bargained for. That said, you stand a much better chance of finding those successful (and many times parabolic) stocks when you start with a good analysis process. The DecisionPoint Analysis Process does just that. I find my prospective investments using various technical scans, but...

READ MORE

MEMBERS ONLY

Why The Bullish Argument REQUIRES Strengthening Of Transportation Stocks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

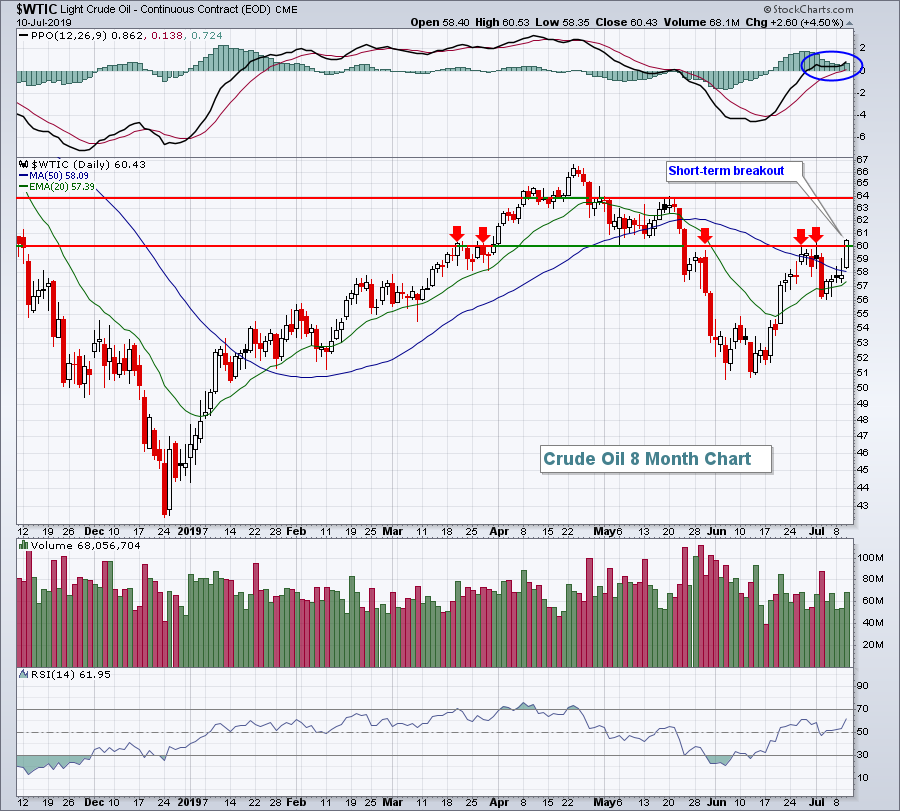

Market Recap for Wednesday, July 10, 2019

The S&P 500 ($SPX, +0.45%) surpassed 3000 on an intraday basis for the first time in history on Wednesday, although it failed to close there. Permabears don't understand how this is even possible, with the ongoing trade war...

READ MORE

MEMBERS ONLY

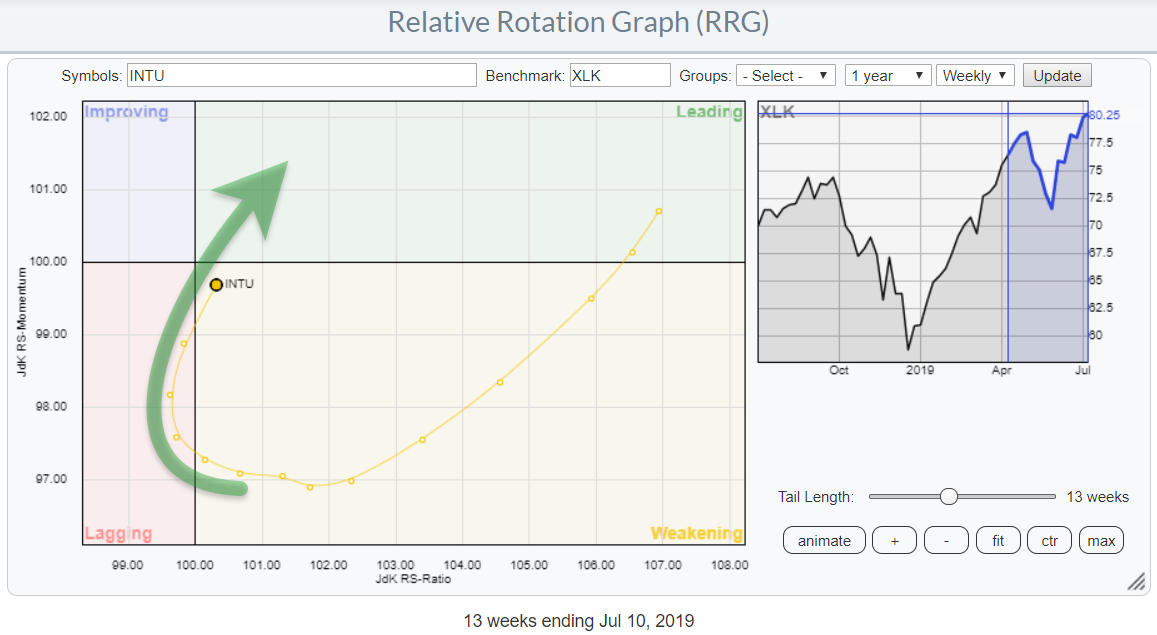

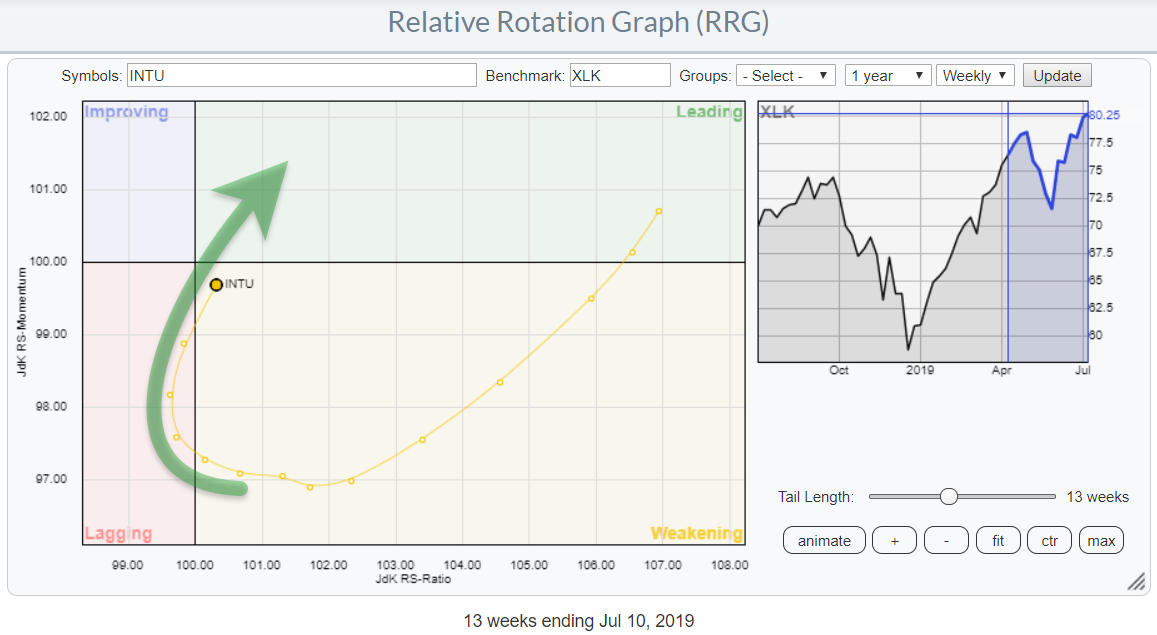

A Strong Rotation on RRG and a Break to New Highs Make For a Killer Combination

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

At present, the Technology sector is rotating through the weakening quadrant on the Relative Rotation Graph. Following a strong move in the first months of this year, relative strength for XLK started to level off and has remained more or less flat since April. We'll have to wait...

READ MORE

MEMBERS ONLY

RENEWED HOPE FOR JULY RATE CUT PUSHES STOCK INDEXES TO RECORD HIGHS -- TECHNOLOGY LEADS NASDAQ HIGHER -- UTILITIES HIT NEW HIGH WITH STAPLES AND REITS RIGHT BEHIND -- HOMEBUILDERS LEAD CYCLICALS TO NEW RECORD -- WEAK DOLLAR BOOSTS EMERGING MARKETS

by John Murphy,

Chief Technical Analyst, StockCharts.com

POWELL TESTIMONY MAKES JULY RATE CUT MORE LIKELY...Last Friday's strong jobs report raised concerns about a July rate cut later this month, which boosted interest rates and caused some profit-taking in stocks. Mr. Powell today put the July rate cut back on the table. Traders are now...

READ MORE

MEMBERS ONLY

Will The FAANG Stocks Report Blowout Earnings? 2 Will, But Not This One

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, July 9, 2019

Despite the Dow Jones ($INDU, -0.08%) finishing in negative territory, I'd argue it was a pretty solid day on Wall Street. All of our major indices opened lower, but there was buying throughout the session, much like Friday. We saw...

READ MORE

MEMBERS ONLY

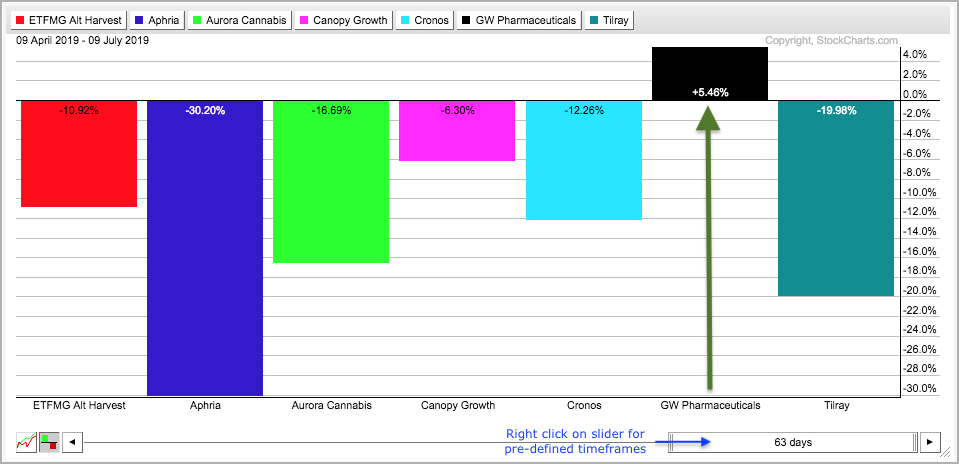

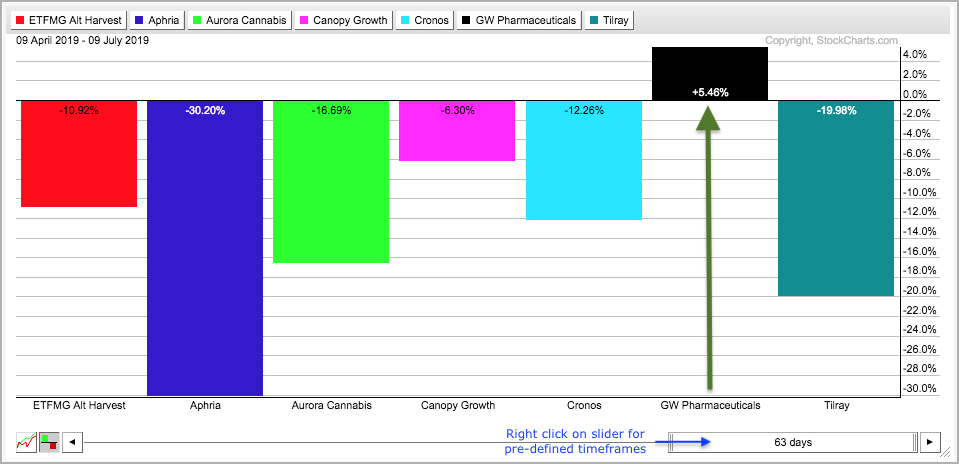

This Cannabis Stock is Higher than the Rest

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Sorry, I could not resist the pun in that head line. Relative and absolute strength is often dependent on timeframe. One stock may show upside leadership on a one month timeframe, but be lagging on the three and six month timeframes. For example, Tilray (TLRY) is up 16.37% over...

READ MORE

MEMBERS ONLY

Four Growth Stocks with Bullish Chart Setups

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Finding stocks with strong uptrends is the first step to stock selection during bull markets, and we are in a bull market. The S&P 500 hit a new all time high just last week, the largest sector (technology) is leading with XLK also hitting a new high last...

READ MORE

MEMBERS ONLY

Apple Downgraded To Sell, Likely Becomes A Buy

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, July 8, 2019

Materials (XLB, -1.15%) led the Monday decline as the U.S. Dollar Index ($USD, +0.10%) extended its recent gains, climbing for the 7th time in the last 9 sessions. Given the strong jobs report on Friday, fewer market participants are expecting...

READ MORE

MEMBERS ONLY

Three Sectors And Five Industry Groups Poised To Move Higher

by Martin Pring,

President, Pring Research

Market Tentatively Triggers a Long-Term Buy Signal

Chart 1 features a Coppock indicator for the NYSE Composite, which triggers buy signals by reversing to the upside from a position at or below the equilibrium level. Since 1970, there have been thirteen such signals and only one failure (in 2002). That&...

READ MORE

MEMBERS ONLY

Martin Pring's Monthly Market Roundup 2019-07-03

by Martin Pring,

President, Pring Research

The monthly Market Roundup video for July is now available.

Good luck and good charting, Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion of Pring Turner Capital Group of Walnut Creek or its affiliates....

READ MORE

MEMBERS ONLY

Team USA Wins the Soccer Final, But Three International Markets Beat the S&P

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Last night (Sunday 7/7) the Dutch women's soccer team played the World Cup final against Team USA. I am not a huge soccer fan but, as a Dutchie, you have to catch at least part of that event! It did not work out for us, so congrats...

READ MORE

MEMBERS ONLY

Various Strategies

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

This article follows the concepts laid out in the previous article about Passive versus Active Management. The comments below give brief pro, con, and comments on the various strategies. With the benefit of hindsight, the market can seem predictable; however, many of these strategies are more useful in describing the...

READ MORE

MEMBERS ONLY

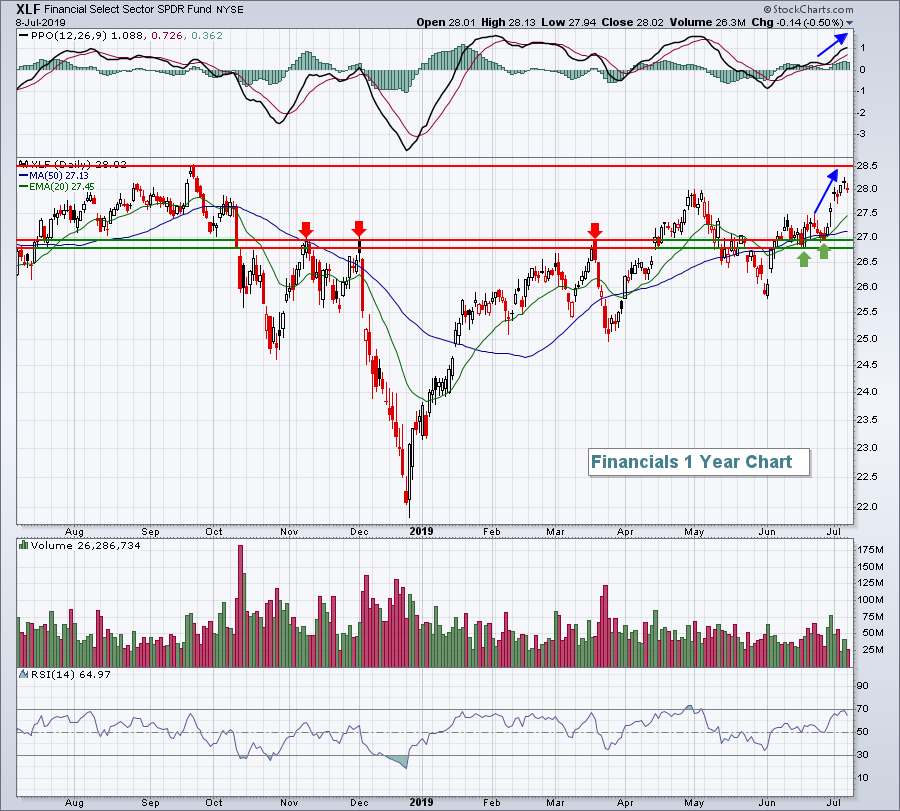

Leading 1st Half Industry Group Breaks Out Again

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

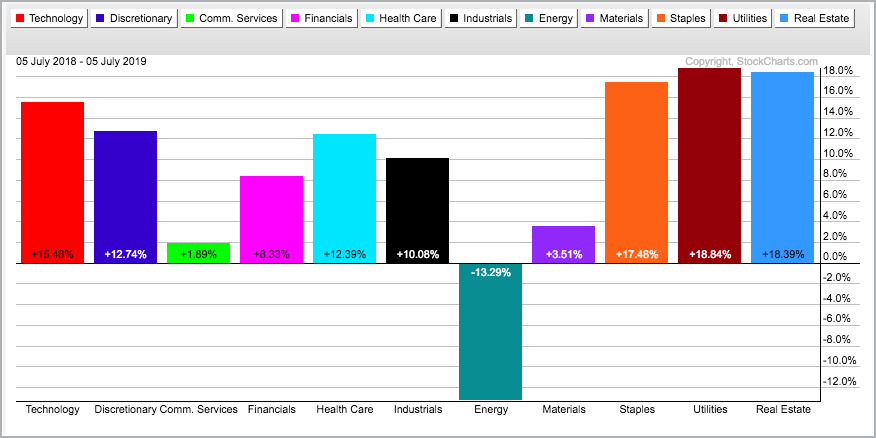

Market Recap for Friday, July 5, 2019

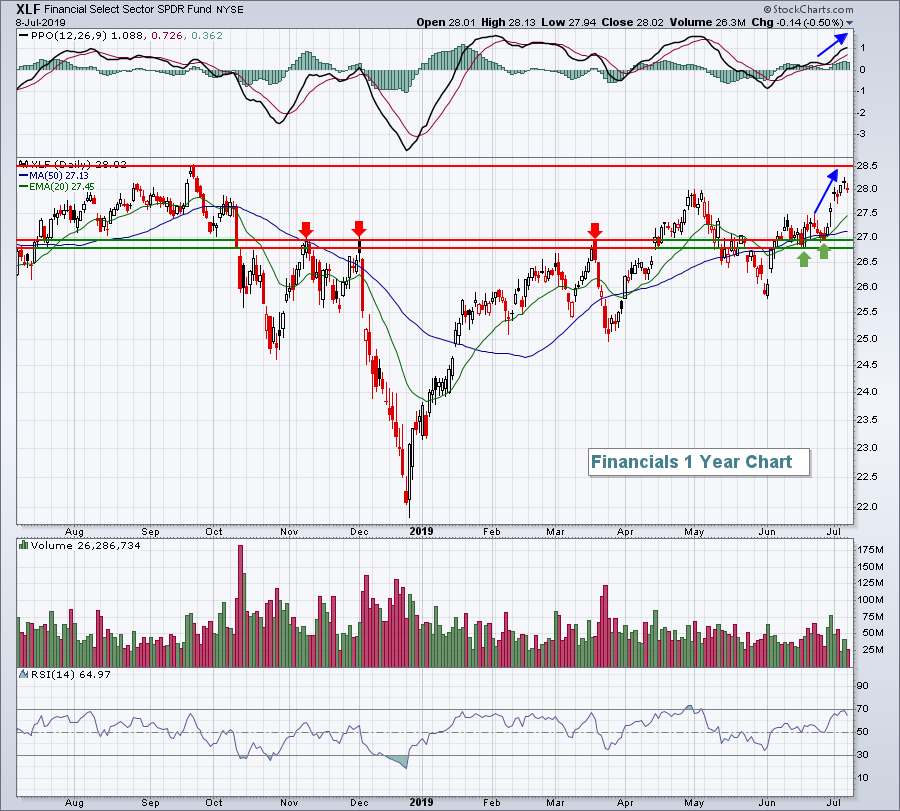

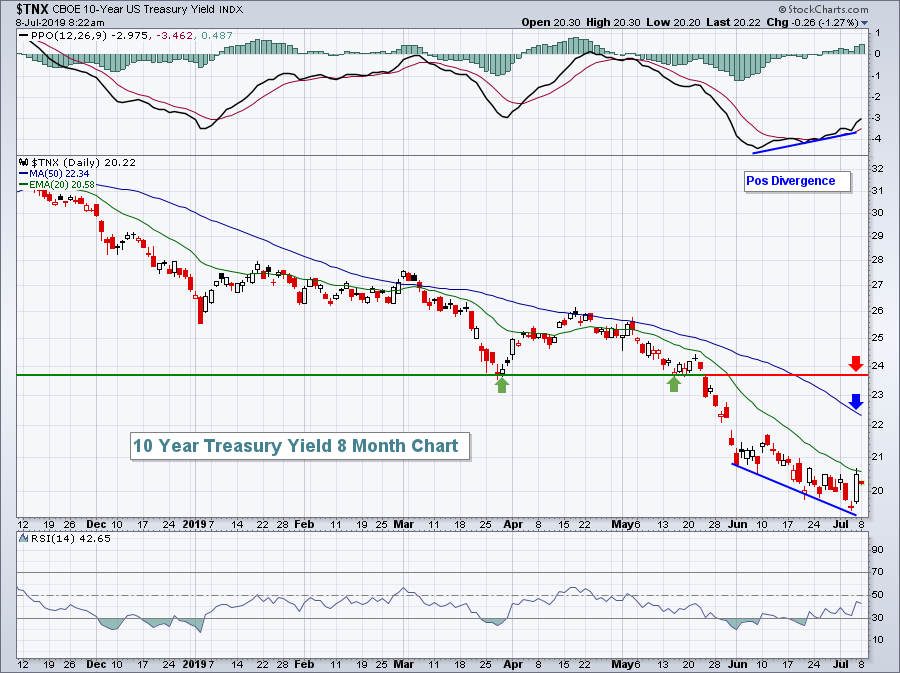

The small cap Russell 2000 ($RUT, +0.22%) led bifurcated action on a very quiet Friday as many market participants were on an extended vacation spanning the July 4th holiday. Strength was seen in financials (XLF, +0.28%) as the 10 year treasury...

READ MORE

MEMBERS ONLY

This Stock has a New High in its Sights

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks that hit new highs are in clear uptrends and show upside leadership. A new high does not have to be within a few days or even a few weeks. Sometimes stocks hit new highs and then correct for a few months to digest prior gains. It is all part...

READ MORE

MEMBERS ONLY

On the Razor's Edge

by Bruce Fraser,

Industry-leading "Wyckoffian"

The S&P 500 Index appreciated 17.35% in the first half of 2019. But from the climax high close in January 2018 the S&P 500 has risen only 2.4%. Despite the stellar performance during 2019 the large capitalization indexes have remained ‘range-bound’ during the past...

READ MORE