MEMBERS ONLY

MONTHLY SECTOR RANKINGS SHOW DEFENSIVE LEADERSHIP THAT INCLUDES UTILITIES, HEALTH CARE, REAL ESTATE, AND CONSUMER STAPLES -- GOLD MINERS LED MATERIALS HIGHER -- HOMEBUILDERS ARE LEADING CONSUMER DISCRETIONARY SECTOR HIGHER TODAY

by John Murphy,

Chief Technical Analyst, StockCharts.com

MONTHLY PERFORMANCE SHOWS DEFENSIVE LEADERSHIP...Chart 1 is taken from the Sector Summary page for the past month. And it shows that investors are still gravitating toward defensive issues. Four of the top sectors are utilities, health care, real estate, and consumer staples. All four are defensive in nature. Even...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook - The Long and Rocky Road

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* The Long and Rocky Road.

* S&P 500 Maintains Bullish Bias.

* Index Breadth Table Improves.

* MDY and IWM Break Out of Wedges.

* Sector Breadth Table Gets Four New Signals.

* Healthcare Perking Up.

* Big Six Sectors Trigger Breakouts.

* Utes, REITs and Staples Remain Strong.

* Art's Charts ChartList Update....

READ MORE

MEMBERS ONLY

Transports Vs. Utilities Ratio Supports The Bearish Argument

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, June 13, 2019

A nice rally to end the session lifted all of our major indices into the close. The Russell 2000 led on a relative basis, gaining 1.05%. The NASDAQ, S&P 500 and Dow Jones climbed 0.57%, 0.41%, and 0....

READ MORE

MEMBERS ONLY

GOLD SHARES ARE RISING WITH THE METAL -- AND ARE NEARING A TEST OF 2019 HIGHS -- THE FACT THAT GOLD MINERS ARE RISING FASTER THAN BULLION IS ANOTHER POSITIVE SIGN

by John Murphy,

Chief Technical Analyst, StockCharts.com

GOLD MINERS ETF NEARS TEST OF 2019 HIGH...Yesterday's message wrote about the price of gold being in the late stages of a potential bottoming formation. It also suggested that three intermarket forces were working in gold's favor. They include a weaker dollar, falling interest rates,...

READ MORE

MEMBERS ONLY

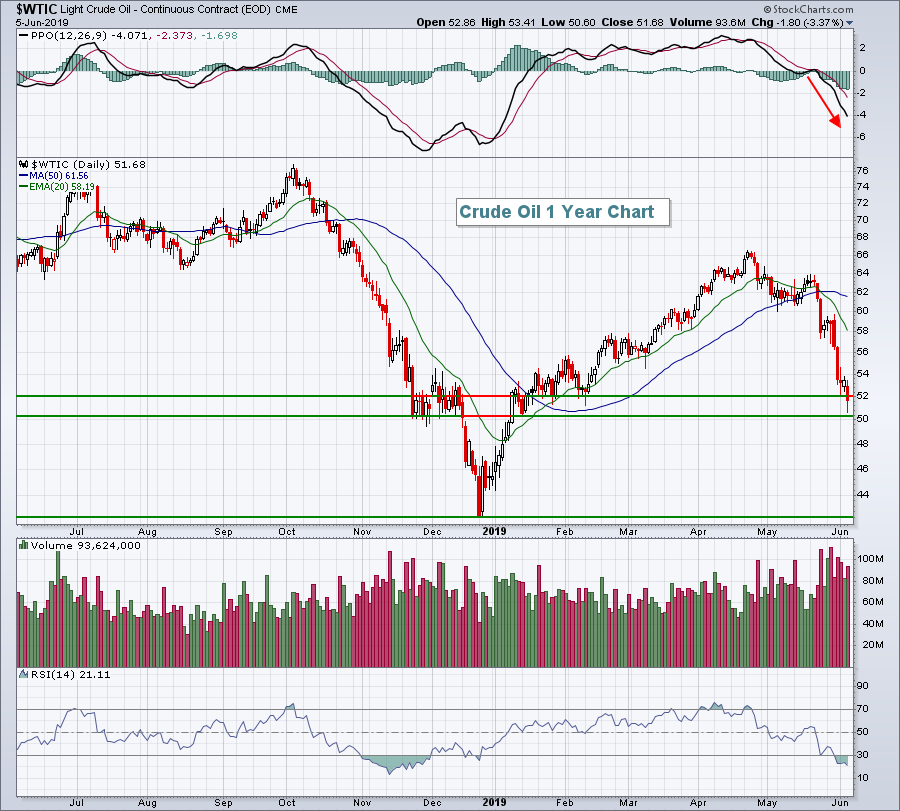

Big Drop In Crude Oil Prices Crush Energy Shares.....Again

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, June 12, 2019

We ended Wednesday with bifurcated action as the small cap Russell 2000 ($RUT, +0.05%) was able to eke out a tiny gain. The other major indices, however, were not so fortunate with the NASDAQ ($COMPQ, -0.38%) falling a bit more than...

READ MORE

MEMBERS ONLY

SPY Holds 50-day - Biotech ETFs Set Up - Chinese ETFs Diverge - ChartList Update

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Long-term Uptrend Still Dominates.

* SPY Holds Wedge Breakout and 50-day.

* Biotech ETFs Firm in Reversal Zones.

* Chinese ETFs Diverge.

* Art's Charts ChartList.

* On Trend on SCCTV and Youtube.

... Long-term Uptrend Still Dominates

... Let's break down the S&P 500 by starting with the bigger trend....

READ MORE

MEMBERS ONLY

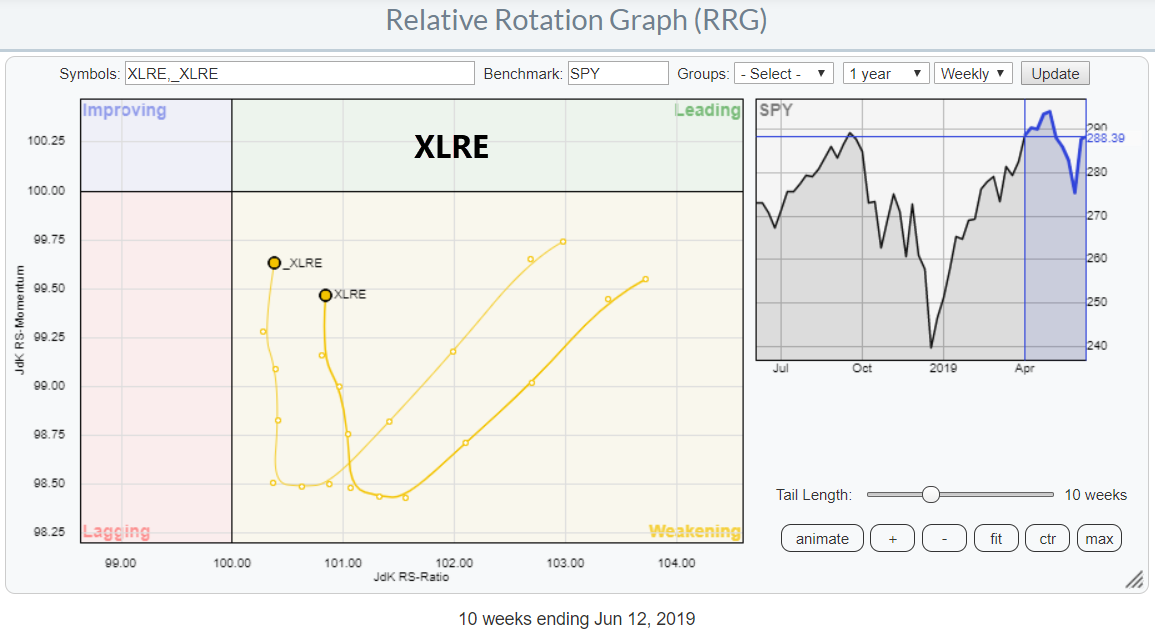

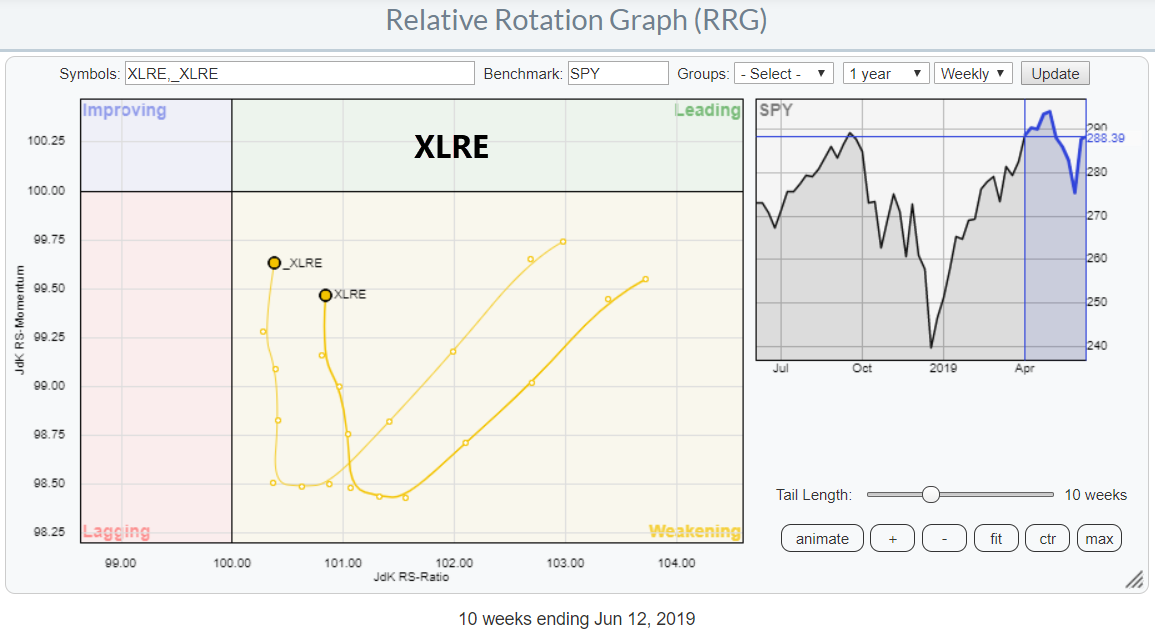

Real Estate Is Getting Back In Shape!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph for US sectors shows the sector Real Estate (XLRE) inside the weakening quadrant, but that sector moving upward (almost vertically) on the JdK RS-Momentum scale. This type of rotation usually indicates that a second (or third, etc.) leg of a relative uptrend is about to get...

READ MORE

MEMBERS ONLY

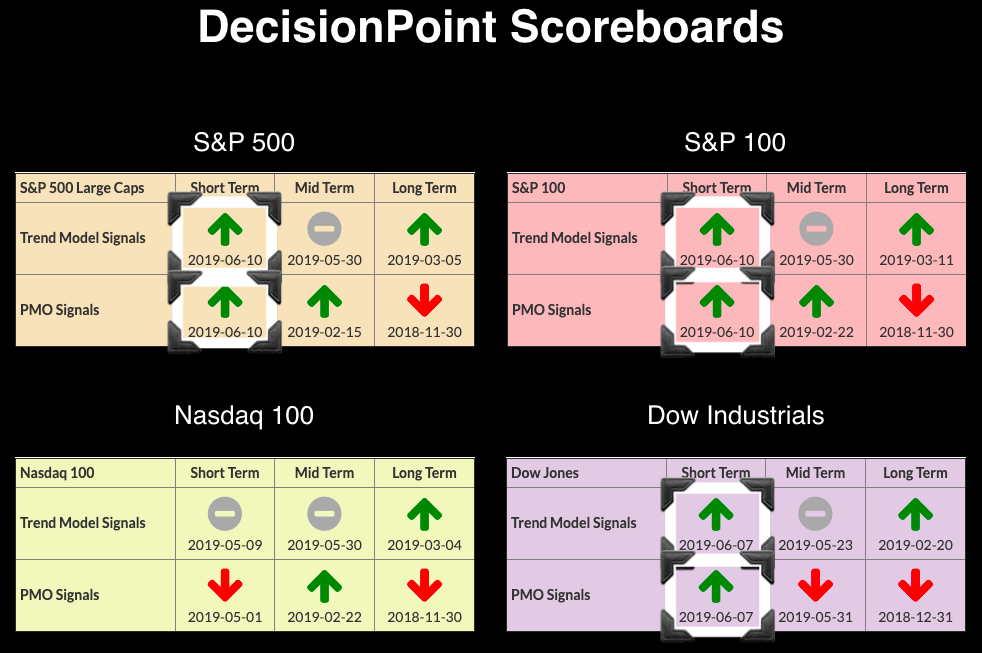

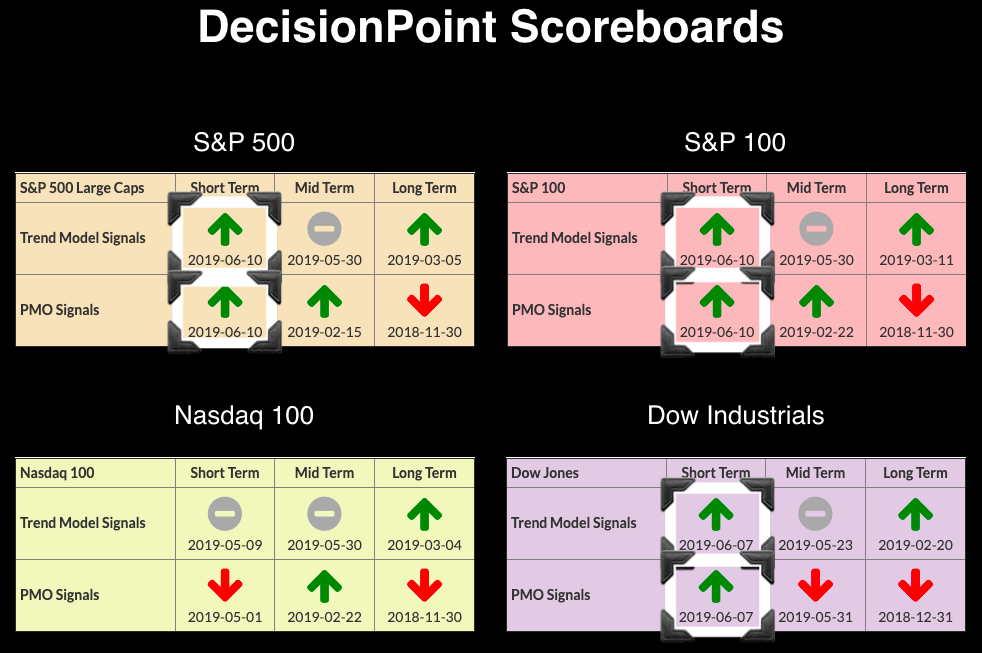

DP Alert Mid-Week: SPX IT Trend Model BUY Signal

by Erin Swenlin,

Vice President, DecisionPoint.com

Today's Scoreboard shows a few changes, but I'm afraid these new BUY signals are arriving late. The NDX finally caught up with short-term BUY signals, and today we saw the SPX click a new IT Trend Model BUY signal when the 20-EMA crossed above the 50-EMA....

READ MORE

MEMBERS ONLY

INTERMARKET TRENDS ARE STARTING TO FAVOR GOLD -- A WEAKER DOLLAR IS ONE OF THEM -- AND FALLING INTEREST RATES -- GOLD HAS DONE BETTER OVER THE LAST YEAR WHEN STOCKS HAVE WEAKENED -- GOLD IS TESTING MAJOR OVERHEAD RESISTANCE

by John Murphy,

Chief Technical Analyst, StockCharts.com

A WEAKER DOLLAR INCREASES APPEAL OF GOLD... The brown monthly bars in Chart 1 show the price of gold forming a potential bottoming formation that started nearly four years ago when it hit bottom in late 2015. Since then, the price of bullion has traded between that low and a...

READ MORE

MEMBERS ONLY

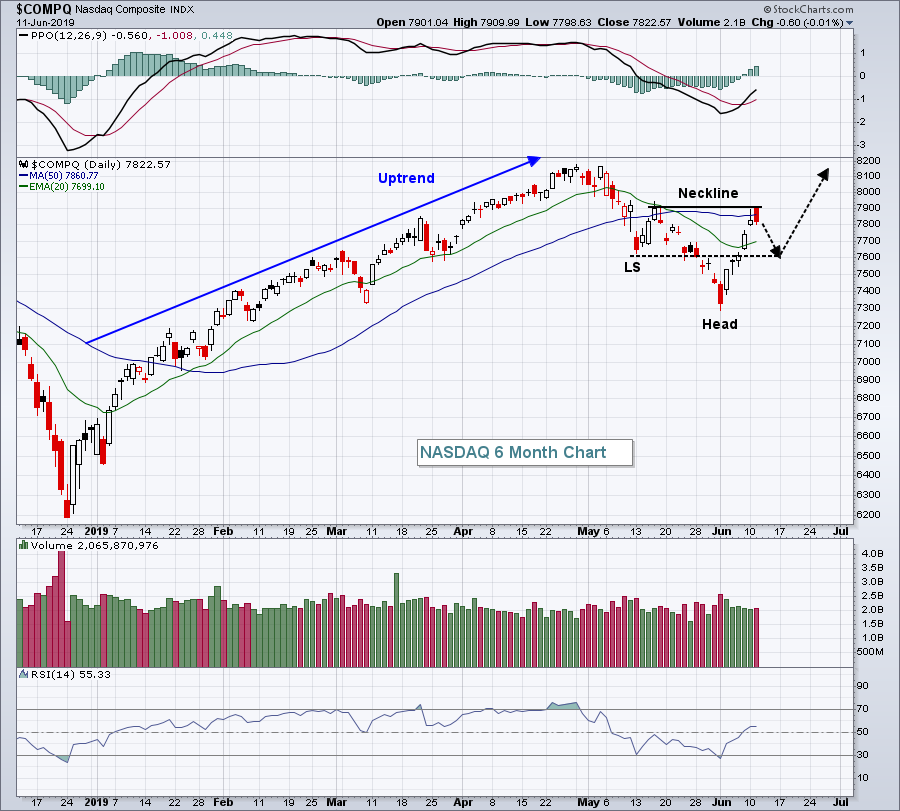

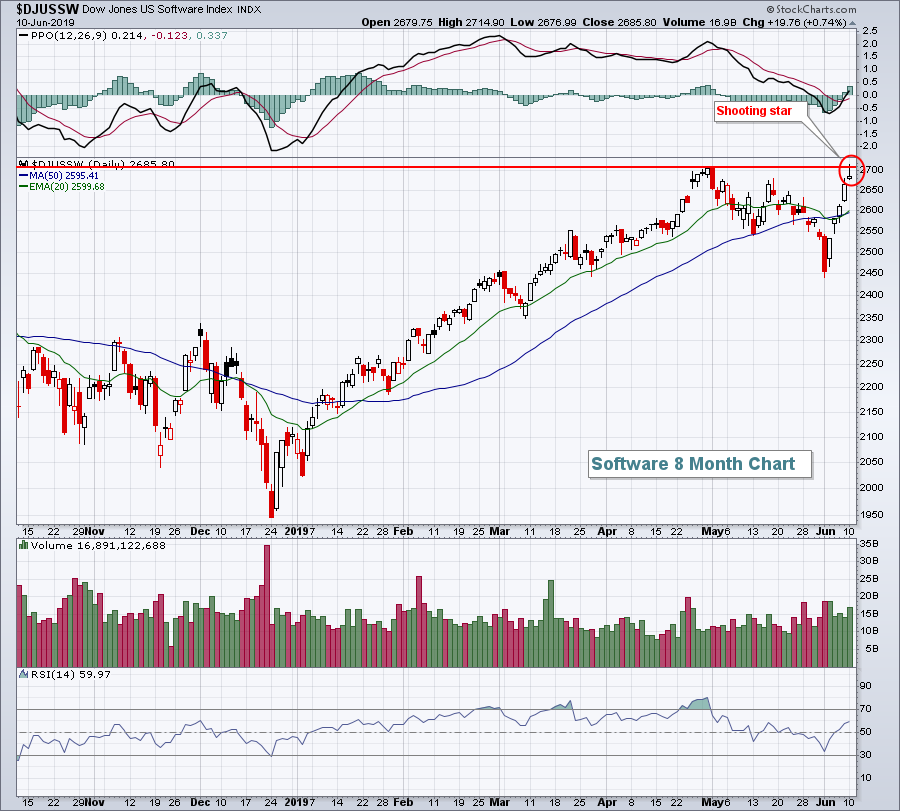

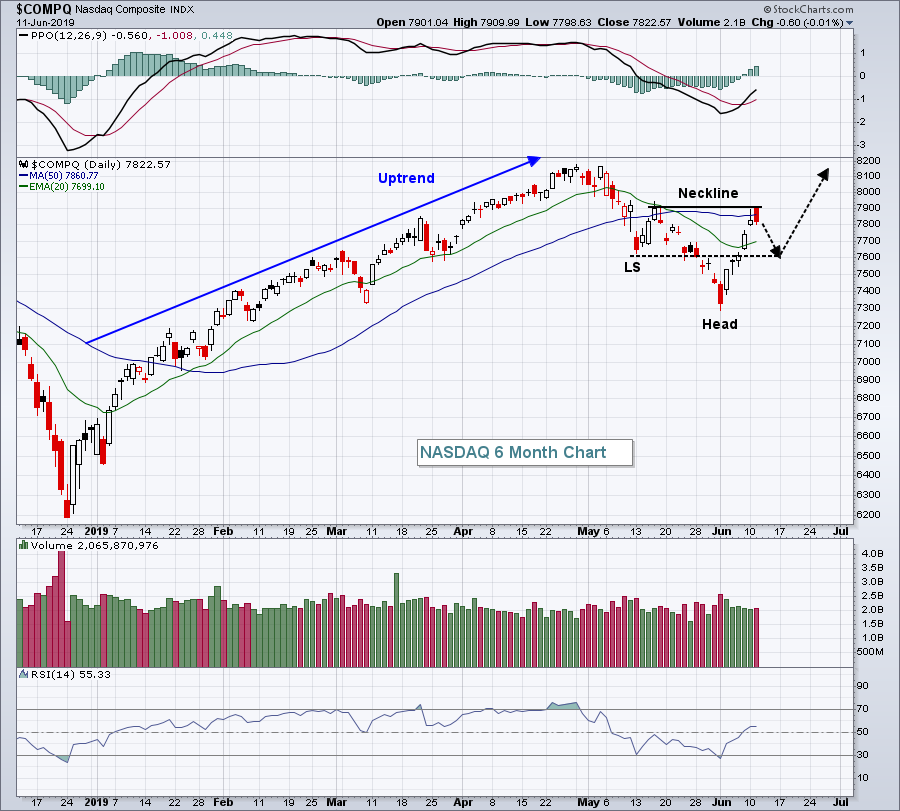

Big Reversal May Mark Short-Term Top

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, June 11, 2019

It wasn't a big down day, but it certainly felt like it. It started off so promising. Right out of the gate, the NASDAQ surged more than 1% in the opening minutes. However, by day's end, it closed in...

READ MORE

MEMBERS ONLY

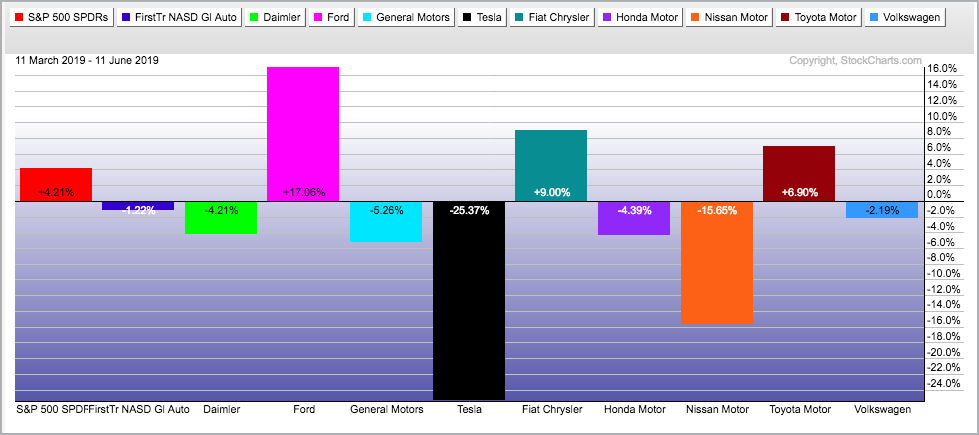

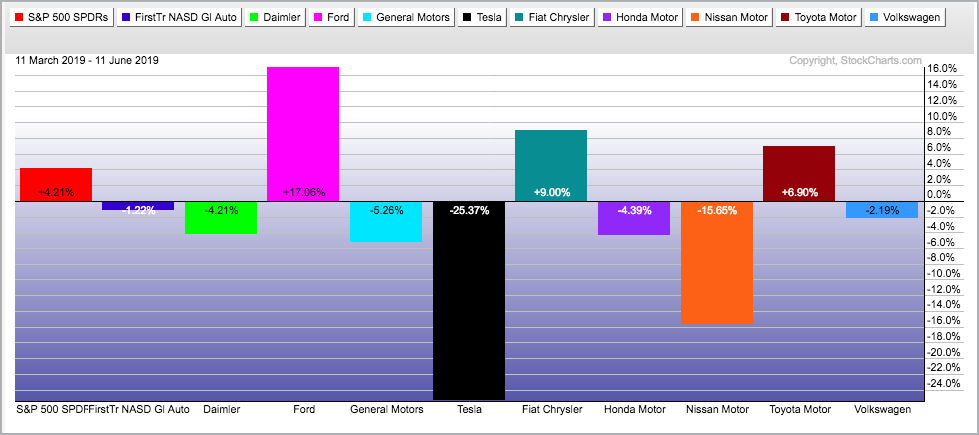

Ford Shines within a Rather Dull Auto Group

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It has been a tough three months for most auto stocks with the Global Auto ETF (CARZ) falling around 1.22%. In contrast, the S&P 500 SPDR (SPY) is up 4.21% since March 11th. Within the group, Ford (F) Daimler-Chrysler (DDAIF) and Toyota (TM) show gains during...

READ MORE

MEMBERS ONLY

THE McCLELLAN OSCILLATOR TURNED POSITIVE THIS WEEK -- THAT'S BOOSTING THE McCLELLAN SUMMATION INDEX AND KEEPING ITS 2019 UPTREND INTACT -- BOTH ARE MEASURES OF MARKET BREADTH

by John Murphy,

Chief Technical Analyst, StockCharts.com

BOTH McCLELLAN BREATH INDICATORS TURN UP... Chart 1 includes two breadth indicators that work together. Both are compared to the NYSE Composite Index (upper box). The dashed line in the lower part of the chart plots the McClellan Summation Index. That's a long term measure of market breadth....

READ MORE

MEMBERS ONLY

Mergers And Averting Mexico Tariffs Bolsters Stocks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, June 10, 2019

U.S. equities were buoyed by resolution to the 5% Mexico trade tariff announced recently by President Trump to encourage Mexico to slow the pace of illegal immigrants entering the U.S. That tariff was set to take effect yesterday, but never materialized....

READ MORE

MEMBERS ONLY

Gold v. Dollar

by Bruce Fraser,

Industry-leading "Wyckoffian"

Gold and the Dollar are natural adversaries. They both represent a store of value. When the Dollar is strong, in comparison to other currencies, gold tends to underperform. Recently the Dollar has been a dominant currency, largely as a result of the strong domestic economy and higher interest rates. There...

READ MORE

MEMBERS ONLY

DP Bulletin: New ST Buy Signals Galore on Scoreboards

by Erin Swenlin,

Vice President, DecisionPoint.com

On Friday, $INDU logged both a Short-Term Trend Model BUY Signal and a Price Momentum Oscillator (PMO) BUY signal. Today, the SPX and OEX joined the party. The NDX is extraordinarily close to those same BUY signals and should switch tomorrow.

Notice that, on price, today's high pierced...

READ MORE

MEMBERS ONLY

STOCKS START THE WEEK ON A STRONG NOTE

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK INDEXES CLEAR 50-DAY AVERAGES... Stocks are starting the week on a strong note. Charts 1 and 2 show the Dow and S&P 500 trading above their 50-day averages. The Dow has also cleared initial resistance at 26,000. Chart 2 shows the SPX also exceeding overhead resistance...

READ MORE

MEMBERS ONLY

Mind the Gap in JP Morgan

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks moved sharply higher last week with several bouncing off broken resistance levels with gap reversals. JP Morgan is one such stock and last week's gap becomes the first area to watch going forward.

The chart shows JPM breaking out in mid April with a surge to the...

READ MORE

MEMBERS ONLY

3 Monday Setups To Start The Week

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, June 7, 2019

U.S. indices capped off a very solid week with more gains on Friday. The more aggressive NASDAQ trounced the other key indices, climbing 1.66%. The S&P 500, Dow Jones, and Russell 2000 added 1.05%, 1.02%, and 0....

READ MORE

MEMBERS ONLY

What We Know That Isn't So - part 2

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Investment-Related “Believable” Misinformation Makes Successful Investing Hard Work

This article is a continuation of the previous article. You should read the preliminary information provided in that article first.

Diversification protects against losses. Harry Markowitz won a Nobel Prize in 1990 for his ground-breaking research on diversification (modern portfolio theory) in...

READ MORE

MEMBERS ONLY

Seven Reasons For Being Bullish

by Martin Pring,

President, Pring Research

* Financial Velocity Indicator Poised to Go Bullish

* Oversold NASDAQ Volume in a Position to Support a Rally

* Rapid Expansion of Net New Highs is Bullish

* Global Breadth Turning?

* When Stock Exchanges Break to the Upside, That’s Usually Bullish for Stocks

Financial Velocity Indicator Poised to Go Bullish

One of...

READ MORE

MEMBERS ONLY

Week Ahead: With Breakout Not Getting Confirmed, Chasing Technical Pullbacks Should Be Avoided

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Throughout the previous week, the Indian equity markets remained less volatile than expected, but, at the same time, marked some important technical events. After trading in a 350-point range, the index hit its key resistance zones, retraced and ended the week with a modest loss. The RBI Credit Policy largely...

READ MORE

MEMBERS ONLY

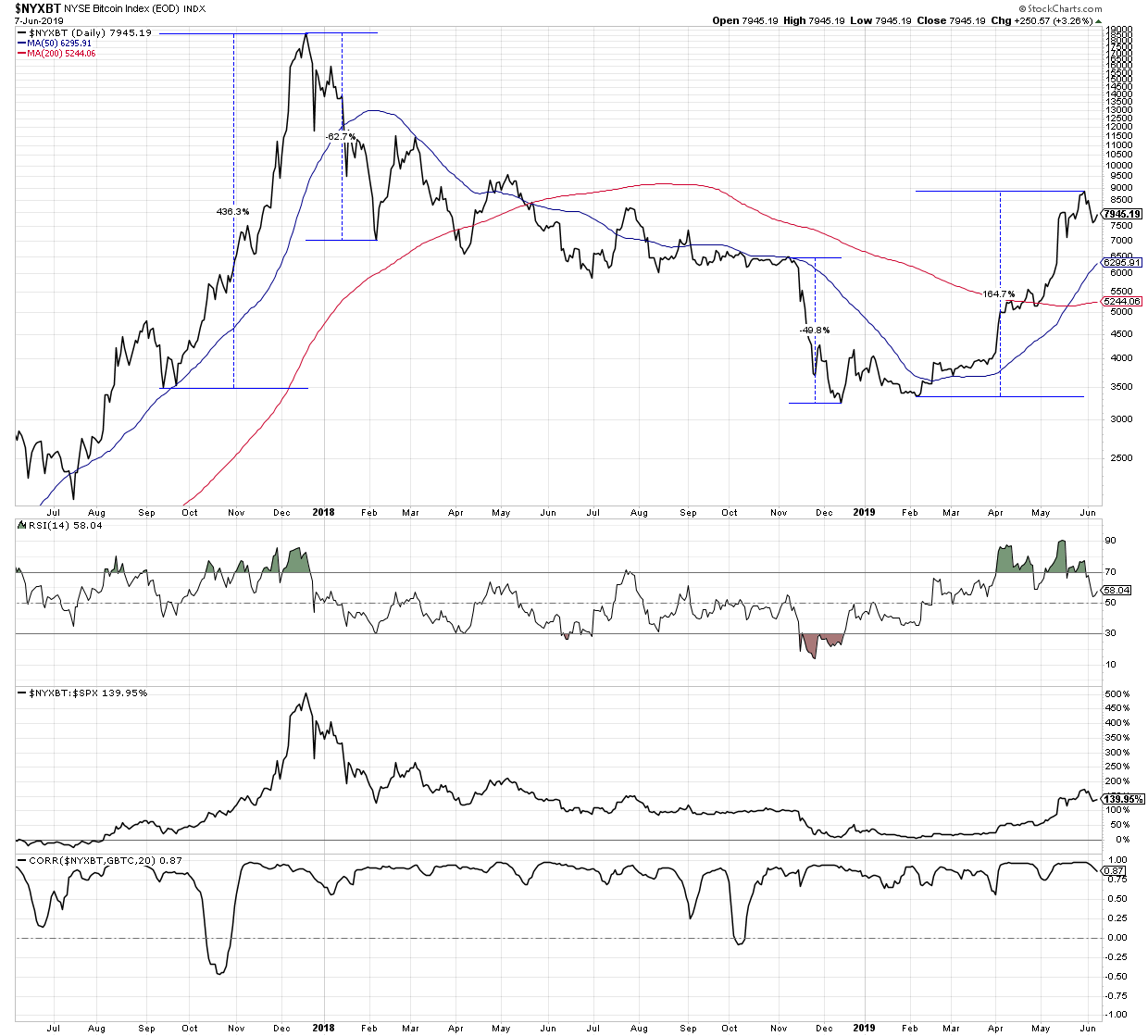

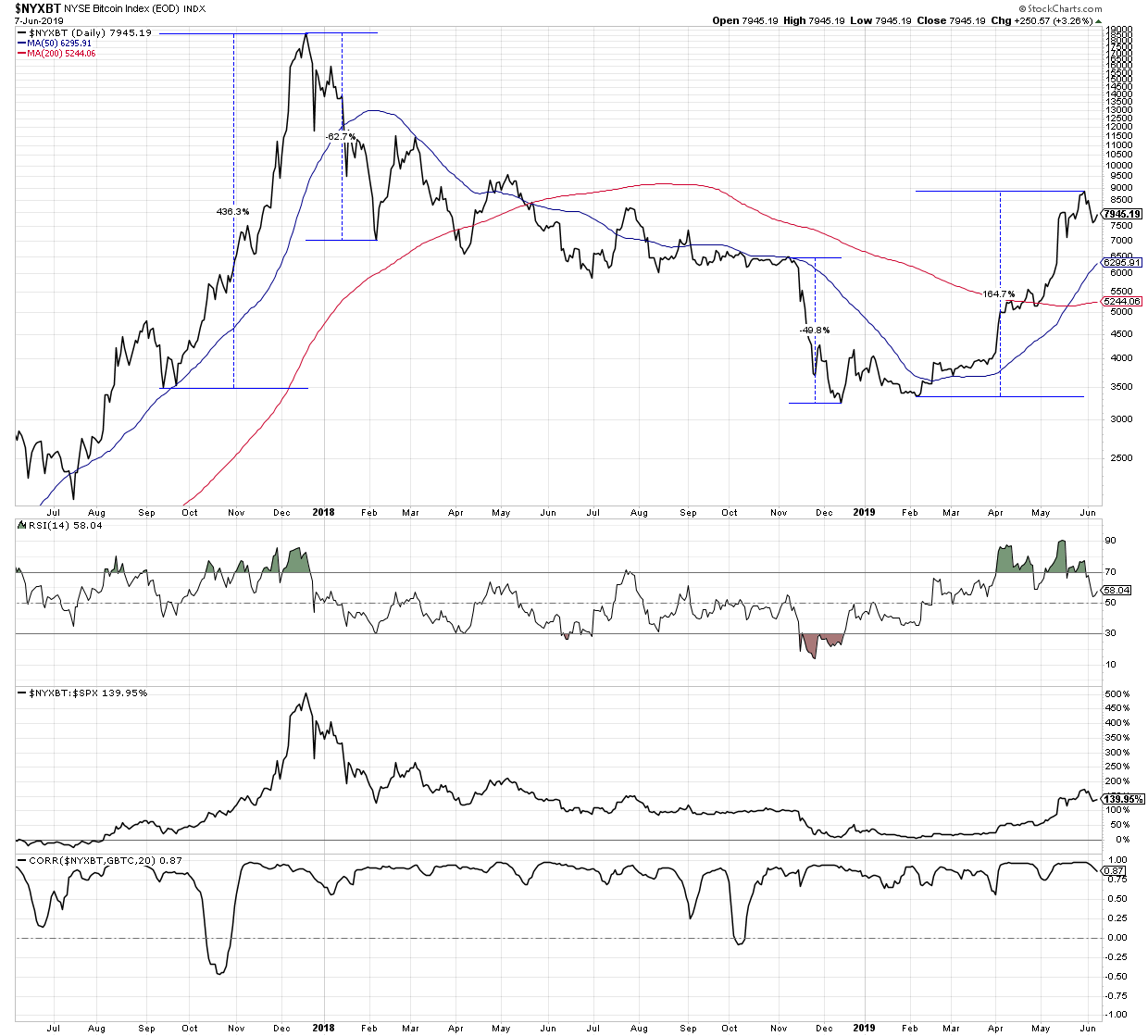

Banking on Bitcoin

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Yesterday, I had a great roundtable with Tom Bowley and Erin Swenlin on MarketWatchers Live, where Erin and I discussed comparisons between gold and Bitcoin.

Now, at first glance, that might seem like a bit of a spurious comparison. Gold has been around forever, while Bitcoin and other cryptocurrencies are...

READ MORE

MEMBERS ONLY

Relative Strength Or Diversification? You Better Choose Carefully

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'm going to say that you need elements of both, although you're going to want a much bigger helping of relative strength. Too much diversification can be extremely unhealthy, there needs to be a balance. Let me give you a quote about diversification from one of...

READ MORE

MEMBERS ONLY

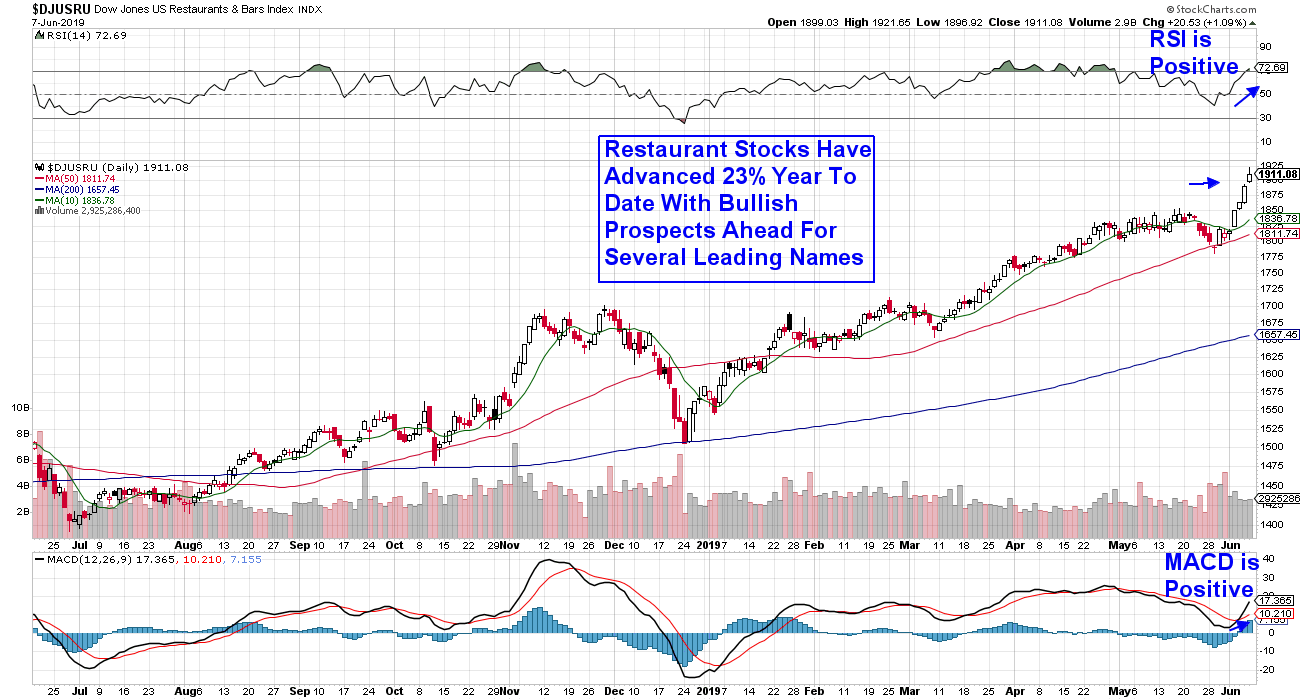

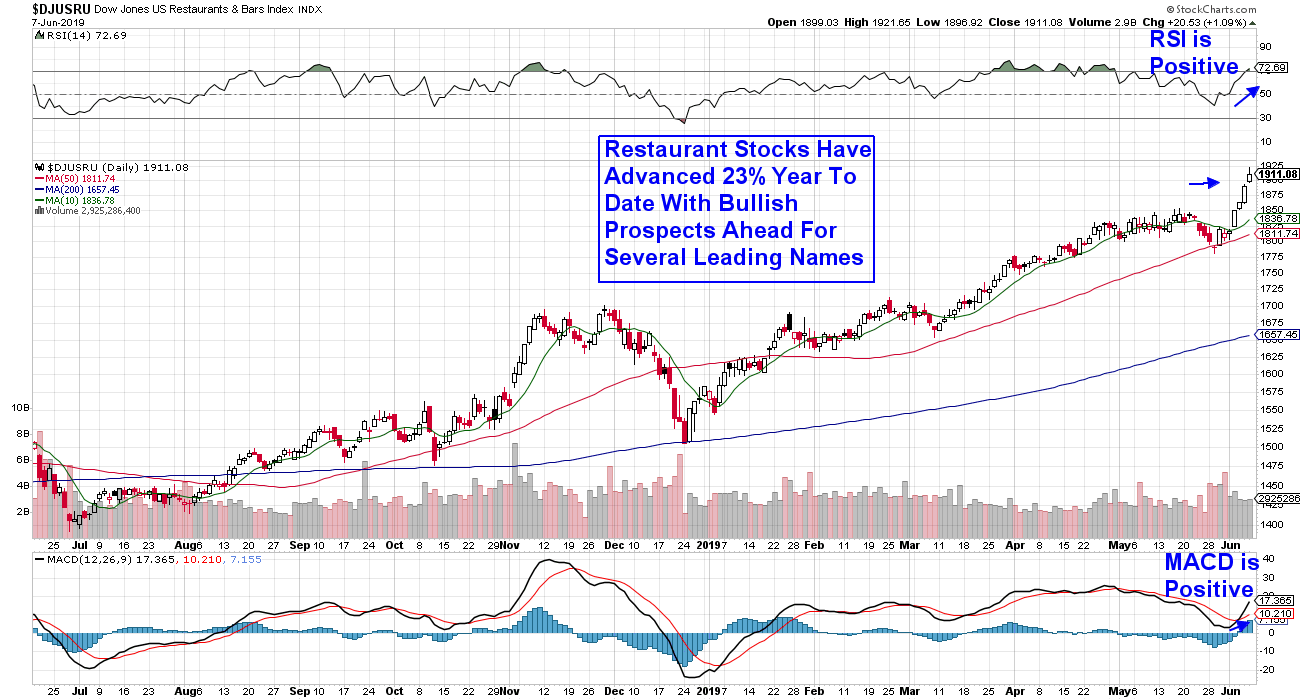

3 Tasty Restaurant Stocks to Sink Your Teeth Into

by Mary Ellen McGonagle,

President, MEM Investment Research

By all accounts, people enjoy eating out, with the National Restaurant Association projecting a record high in U.S. restaurant sales at $863 billion this year, up 3.6% from last year. From global expansion plans to technological advances, many restaurants are catering to consumer’s changing tastes while easing...

READ MORE

MEMBERS ONLY

DP WEEKLY WRAP: Volume Ratio Spikes Flag ST Market Turns

by Carl Swenlin,

President and Founder, DecisionPoint.com

Some time ago on StockCharts TV I discussed volume ratios and how higher than normal ratios help identify climactic events and possible turning points. This week on Tuesday we had such an event when the SPX up volume divided by down volume produced a ratio of over 15. I have...

READ MORE

MEMBERS ONLY

DOW ENDS WEEK ON A STRONG NOTE -- TECHNOLOGY LEADS FRIDAY RALLY

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW ENDS WEEKLY LOSING STREAK The Dow Industrials gained 263 points today (1.02%) to end the week on a strong note. That also ends a six-week losing streak for the blue chip index. Chart 1 shows the Dow regaining its 200-day average on Wednesday, and ending the week right...

READ MORE

MEMBERS ONLY

Long-Term Picture Shows Gold Close to a Breakout

by Martin Pring,

President, Pring Research

Editor's Note: This article was originally published in Martin Pring's Market Roundup on Tuesday, June 4th at 2:57pm ET.

From a long-term aspect, Gold looks as though it is in the process of duplicating its action at the turn of the century by forming a...

READ MORE

MEMBERS ONLY

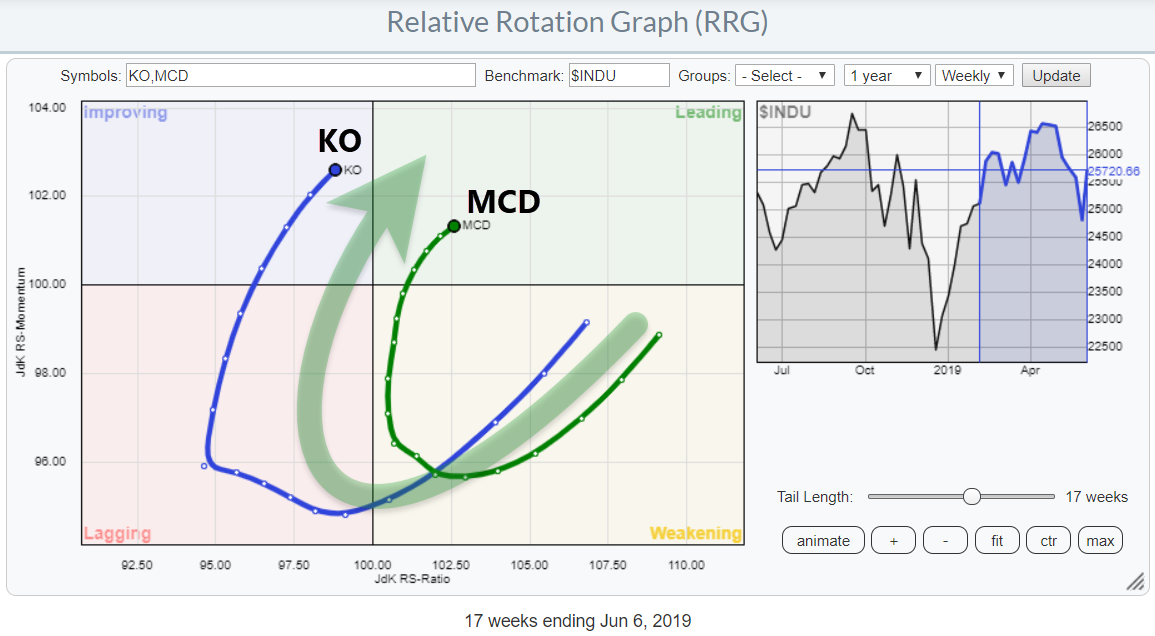

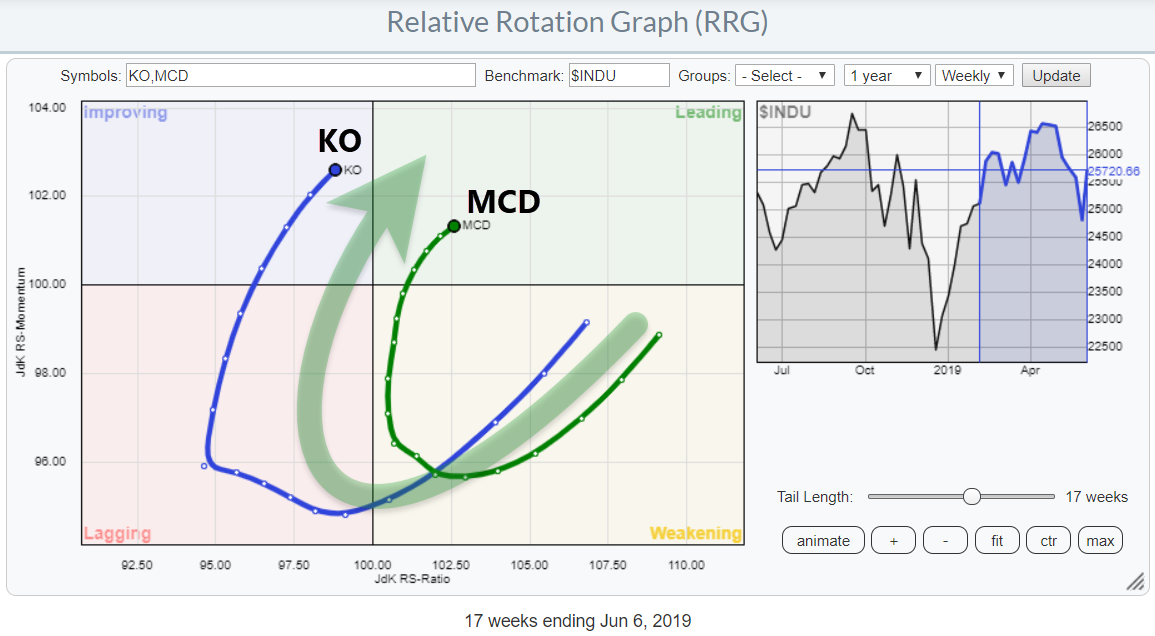

Can I Have A Coke (KO) With My Big Mac (MCD) Please?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

While browsing through the stocks in the DJ Industrials index, my attention was grabbed by the tails on KO and MCD, both in a positive way.

KO is making a wide rotation through lagging into improving and is now very close to crossing over into the leading quadrant. MCD, meanwhile,...

READ MORE

MEMBERS ONLY

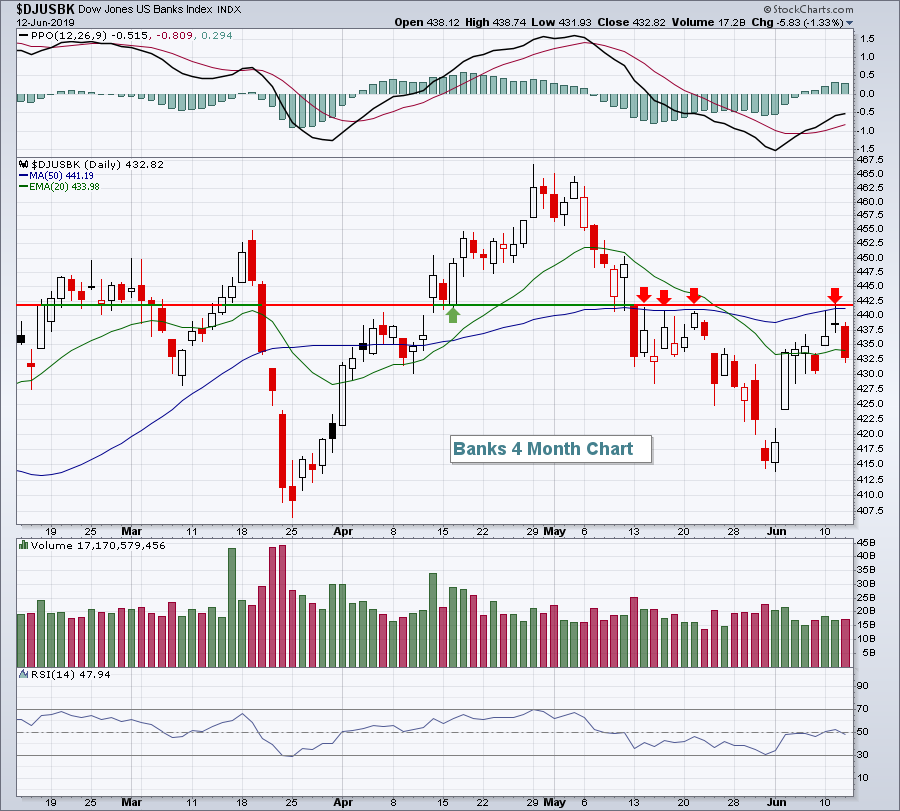

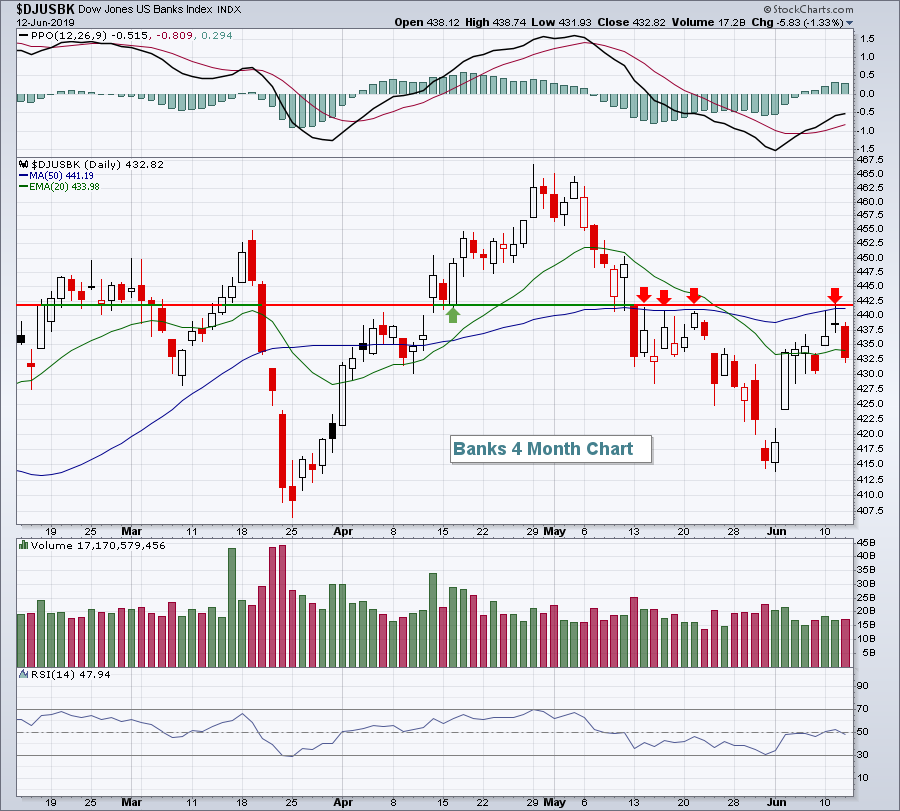

10-YEAR TREASURY YIELD HEADED TOWARD TEST OF 2017 LOW -- THAT'S HELPING PUSH DIVIDEND PAYING STOCK SECTORS INTO RECORD TERRITORY -- BUT IS CAUSING BANKS TO LAG BEHIND

by John Murphy,

Chief Technical Analyst, StockCharts.com

10-YEAR TREASURY YIELD NEARS TEST OF 2017 LOW... The 10-Year Treasury yield is falling another 6 basis points today to 2.06% which is drawing dangerously close to its 2017 low. The weekly bars in Chart 2 show that year's intra-day yield low at 2.03%. Its lowest...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook - Assessing the June Rebound

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Small-caps Still Lagging.

* S&P 500 Establishes Clear Support Zone.

* Breadth Falls Short and Fades.

* $SPX Close + 200-day SMA = NOISE!

* A Mixed, but Bullish, Indicator Table.

* Sector Table Remains Firmly Bullish.

* New Highs Surge within S&P 500.

* New Highs in Finance Sector.

* Medical Devices, Defense and Solar...

READ MORE

MEMBERS ONLY

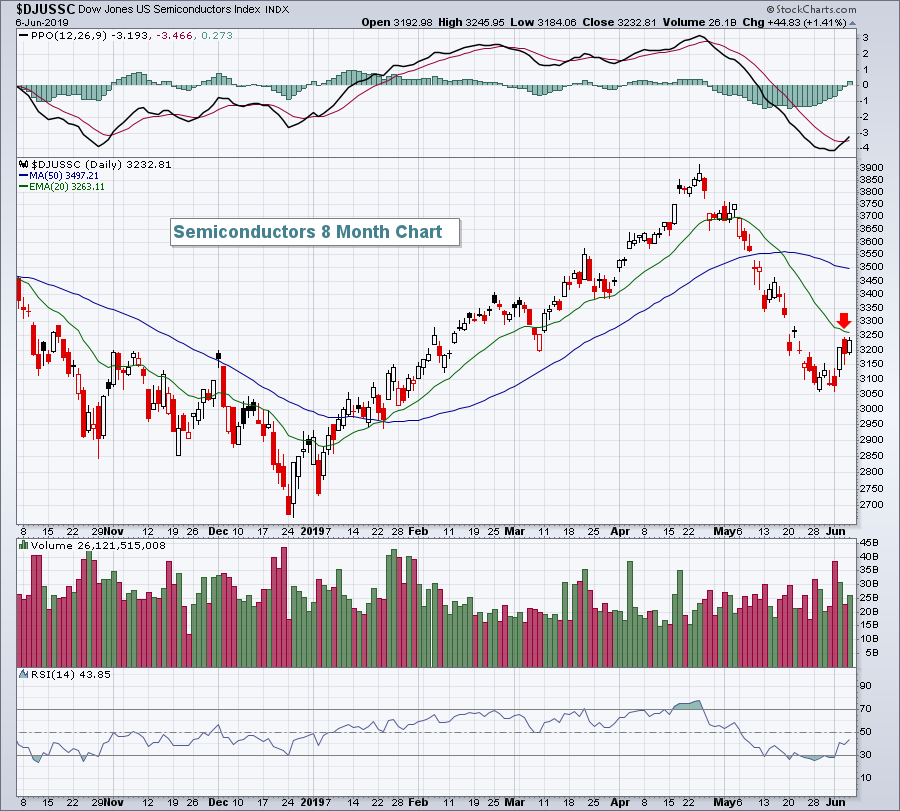

Advanced Micro Devices (AMD) Loves June, But What's Going On With Transports?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, June 6, 2019

It was another solid day on Wall Street as the recent bounce continued. Unfortunately, it was also another day where investors/traders were seeking some safety. It's like ordering pizza, but adding a diet coke to watch your weight. The Dow...

READ MORE

MEMBERS ONLY

PHARMACEUTIALS LEAD HEALTH CARE SPDR TO POSSIBLE UPSIDE BREAKOUT -- DRUG LEADERS ARE ABBOTT LABS, MERCK, AND PFIZER -- MEDICAL EQUIPMENT STOCKS ALSO LOOK STRONG -- THAT INCLUDES BOSTON SCIENTIFIC, MEDTRONIC, AND THERMO FISHER SCIENTIFIC

by John Murphy,

Chief Technical Analyst, StockCharts.com

HEALTHCARE SPDR MAY BE TURNING UP ... The health care sector may be nearing an upside breakout. The daily bars in Chart 1 shows the Health Care SPDR (XLV) trading above its 200-day average in today's trading; and testing its late May intra-day peak at 90.18. A close...

READ MORE

MEMBERS ONLY

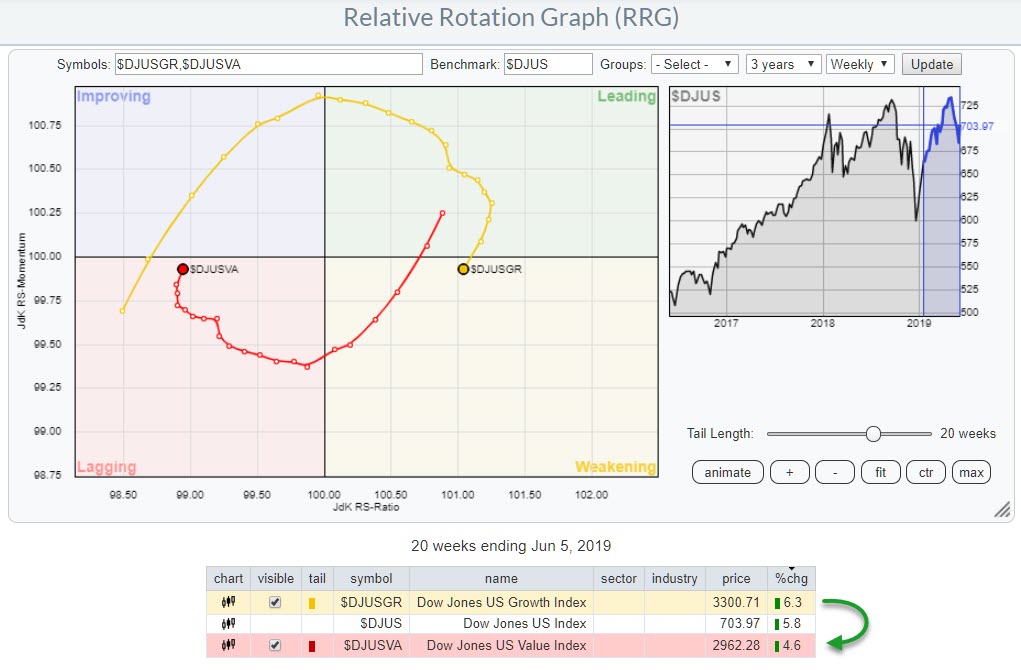

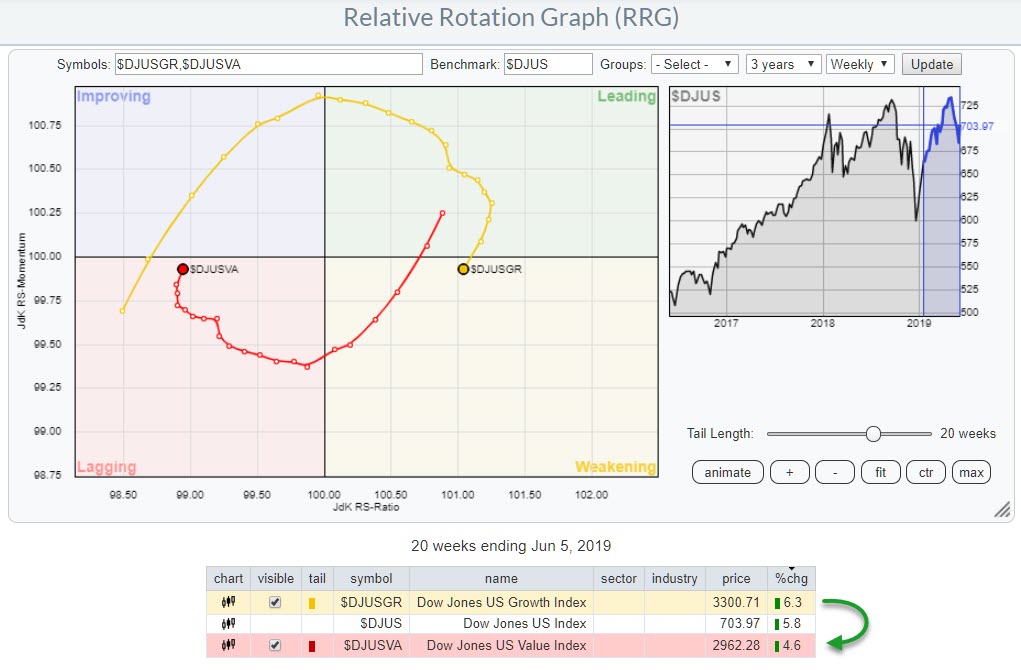

Value Is Taking Over From Growth And Shows Positive Rotation On RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

One of the Relative Rotation Graphs that I like to follow, as a way of keeping a handle on the bigger picture, is the one that shows the rotation of growth- versus value stocks.

This RRG is predefined in the dropdown box under the header "US MARKETS" and...

READ MORE

MEMBERS ONLY

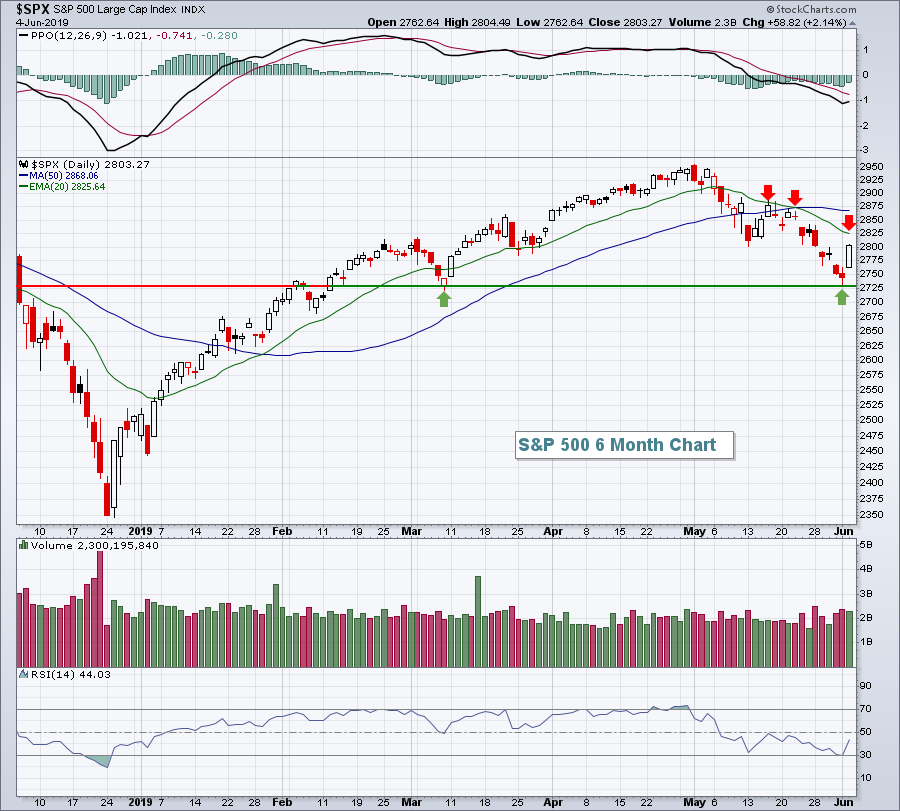

Defensive Sectors Power S&P 500 Back Above 20 Day EMA

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, June 5, 2019

The good news is that the U.S. stock market advanced on Wednesday and that both the Dow Jones (+0.82%) and S&P 500 (+0.82%) were able to clear their respective declining 20 day EMAs. Another piece of good news...

READ MORE

MEMBERS ONLY

DP Alert Mid-Week: Gold Already at Resistance - Record Breaking New Highs

by Erin Swenlin,

Vice President, DecisionPoint.com

The number I've heard tossed around over the past few weeks regarding a gold rally is a move to $1340. Well, in just a few days, we have popped above that, and the chart suggests we will continue to see more rallying. This week's climactic indicator...

READ MORE

MEMBERS ONLY

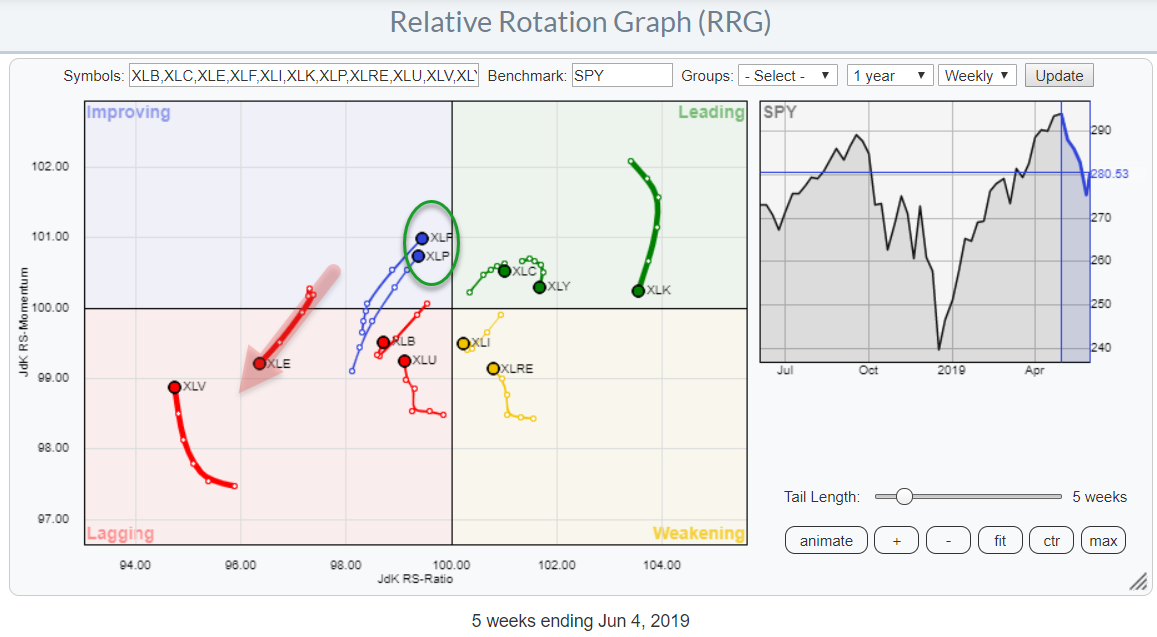

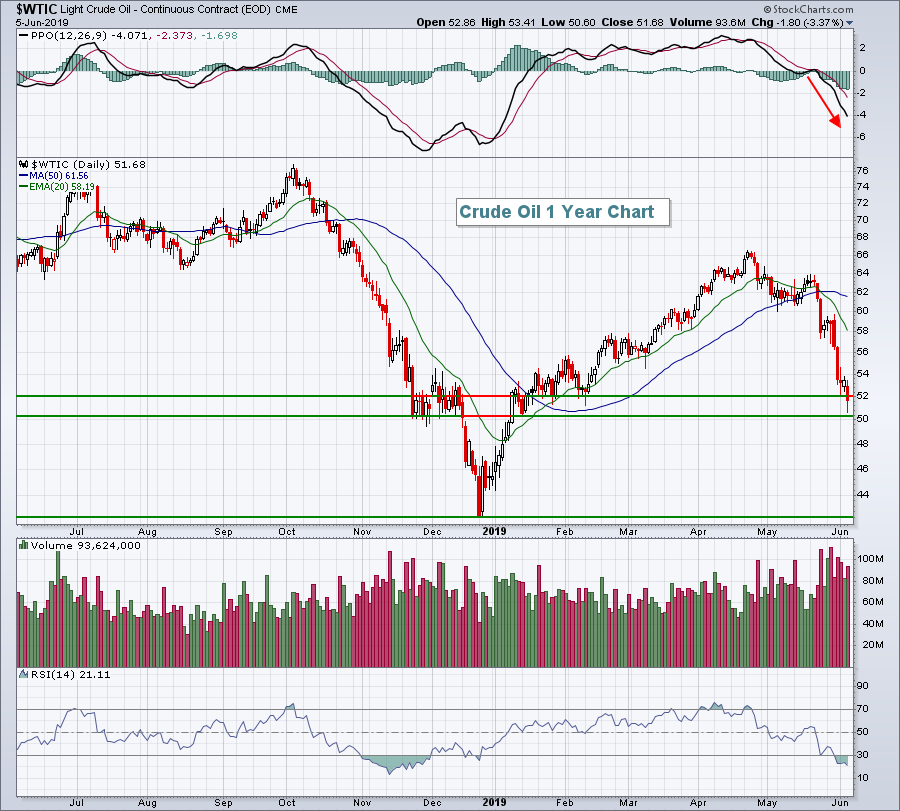

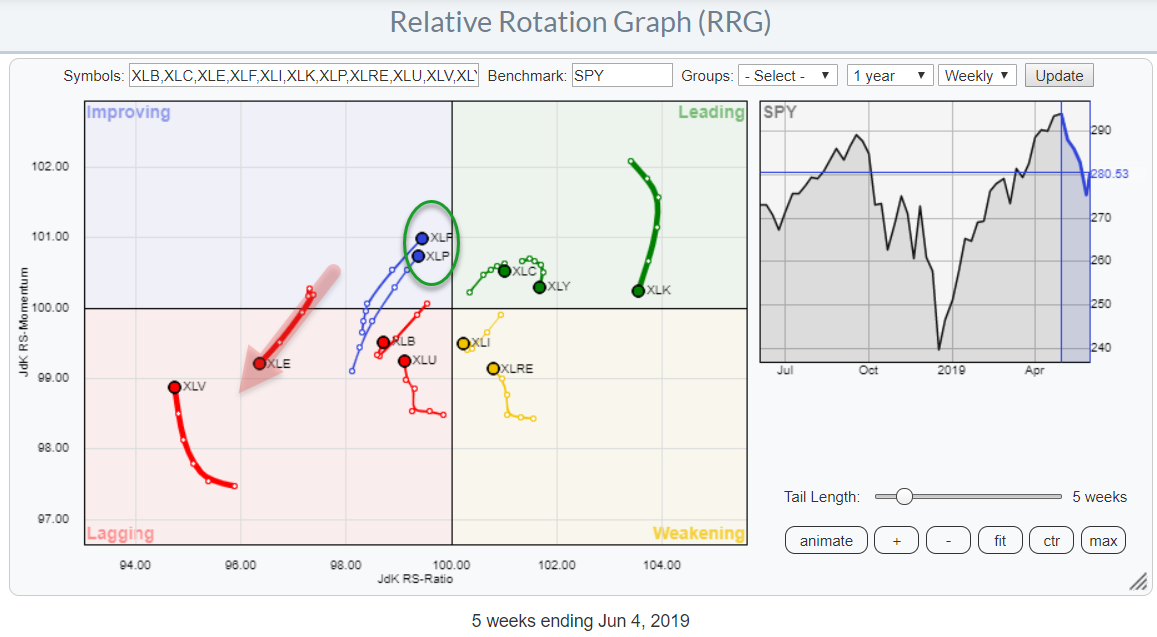

Staples and Financials Head Towards the Leading Quadrant While Energy Rolls Back into Lagging

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The chart above shows the relative rotation for US sectors against the benchmark S&P 500. Over the last five weeks, the tails for Consumer Staples (XLP) and Financials (XLF) started to move in a similar fashion. Both are heading towards the leading quadrant.

The Energy sector, on the...

READ MORE

MEMBERS ONLY

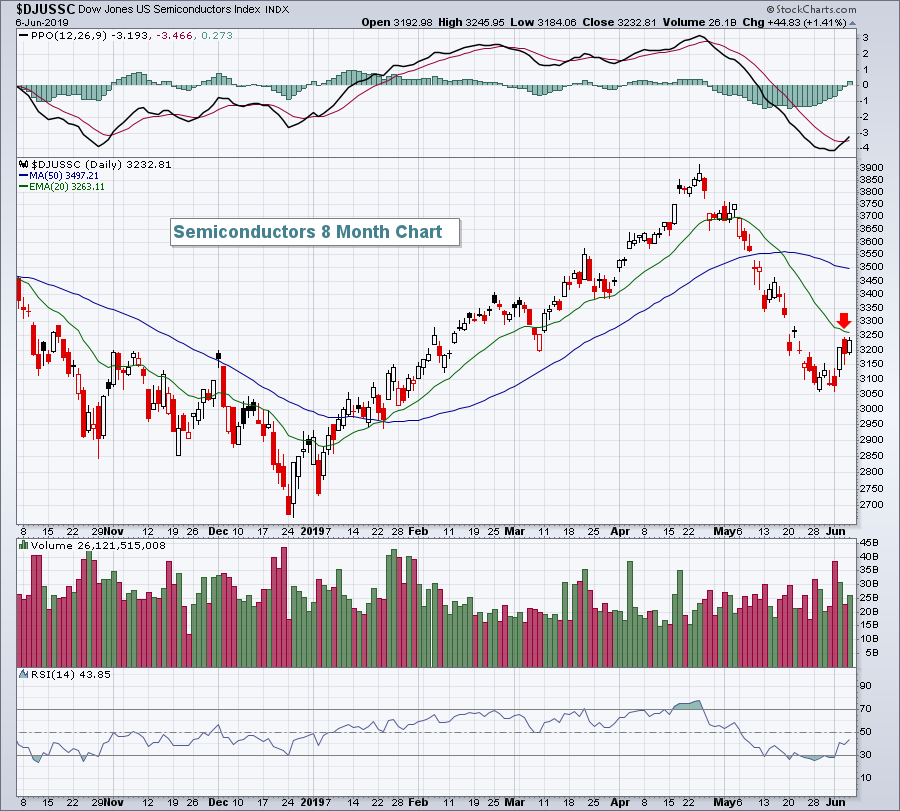

An Industry Group To Buy And One To Avoid

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

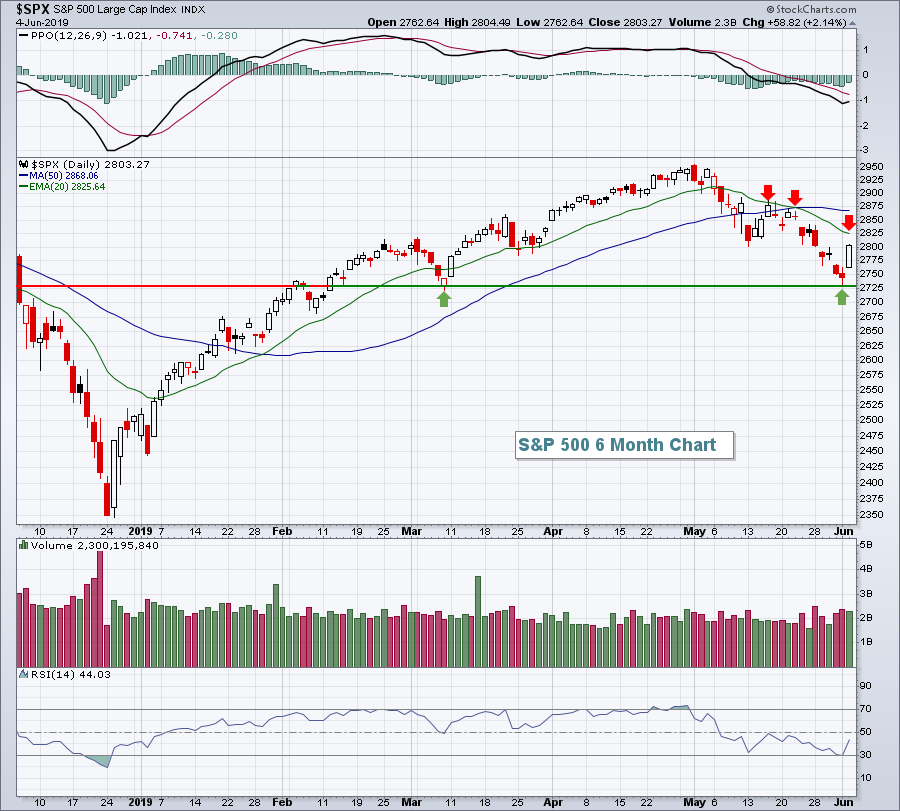

Market Recap for Tuesday, June 4, 2019

A big turnaround occurred on Tuesday as many beaten-down stocks and industries from the May drubbing led a market rally. The NASDAQ and Russell 2000 led the rally with gains of 2.65% and 2.62%, respectively, but it was a wide-participation advance...

READ MORE

MEMBERS ONLY

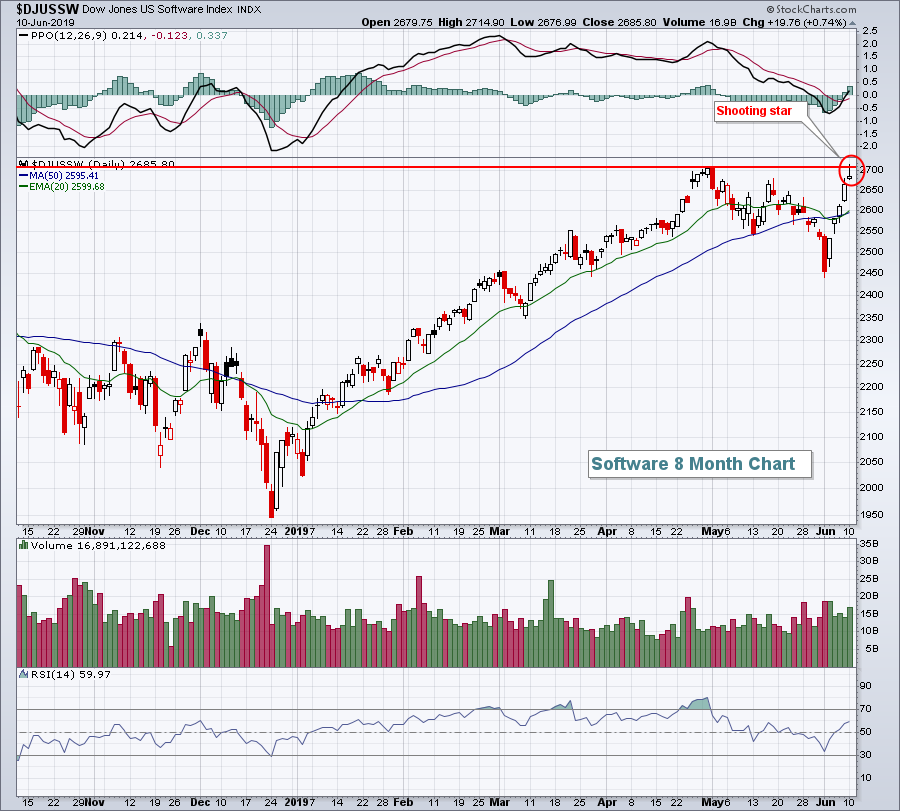

A Bullish Continuation Pattern Evolves for Accenture

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Semiconductor stocks fell hard in May, but many software names held up quite well in May and simply consolidated. Accenture is one such name as the stock held above the breakout zone and simply consolidated the last five weeks.

First and foremost, the long-term trend is up because Accenture (ACN)...

READ MORE

MEMBERS ONLY

Martin Pring's Monthly Market Roundup 2019-06-03

by Martin Pring,

President, Pring Research

The monthly Market Roundup video for June is now available.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion of Pring Turner Capital Group of Walnut Creek or its affiliates....

READ MORE

MEMBERS ONLY

Can They Pull The Trigger On Gold And The Yen?

by Martin Pring,

President, Pring Research

* Long-Term Picture Shows Gold Close to a Breakout

* The Shares Are on the Cusp As Well

* Short-Term Indicators for Gold Go Bullish

* Yen Emerging From a Breakout

I like to use an indicator that I call “Risk On Risk Off,” which combines an index comprising several risky entities with another...

READ MORE