MEMBERS ONLY

TRADE TENSIONS LEAD TO BAD WEEK FOR GLOBAL STOCKS -- CHINESE STOCKS LEAD GLOBAL RETREAT -- TRADE SENSITIVE SECTORS DROP THE MOST WHILE SAFE HAVENS LEAD -- A LATE FRIDAY REBOUND KEPT STOCK INDEXES ABOVE MOVING AVERAGE LINES

by John Murphy,

Chief Technical Analyst, StockCharts.com

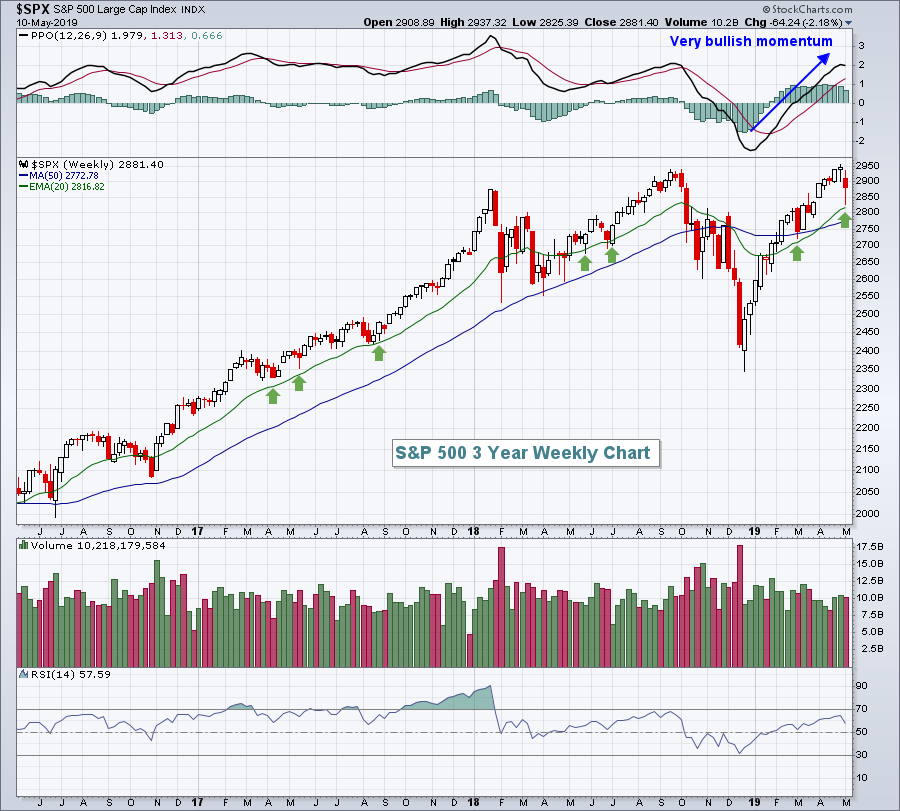

CHINESE STOCKS LEAD WEEKLY RETREAT ... An escalation in trade tensions between the U.S. and China pushed global stocks lower this past week. The S&P 500 lost -2.2% which was its biggest weekly drop this year. Canadian and U.S. stocks are meeting resistance at their 2018...

READ MORE

MEMBERS ONLY

Week Ahead: Amid Feeble Attempts To Pullback, These Sectors May Relatively Out-perform

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

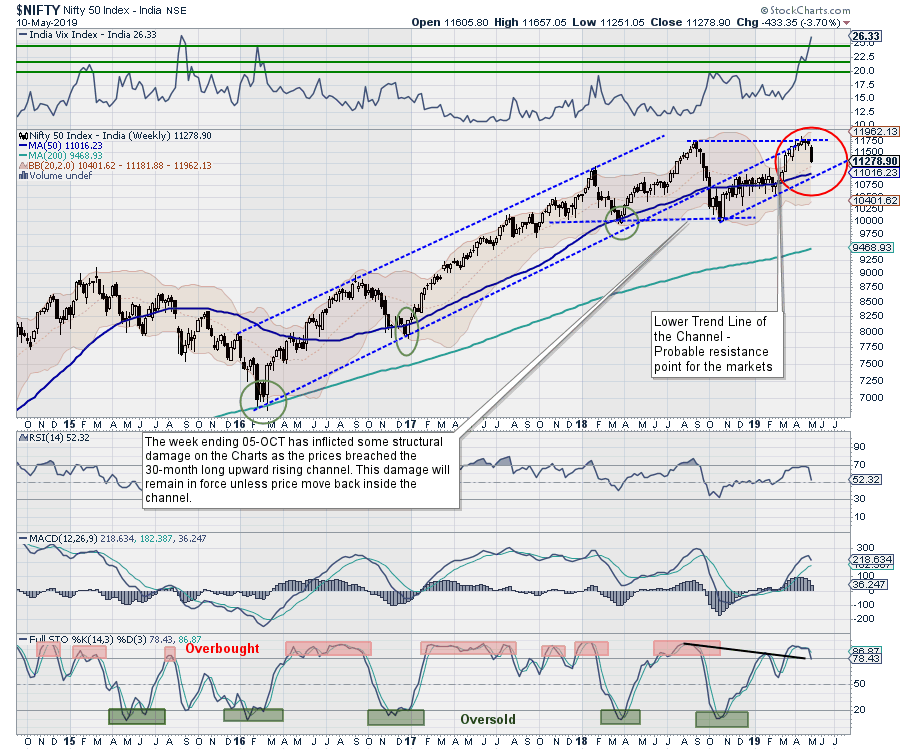

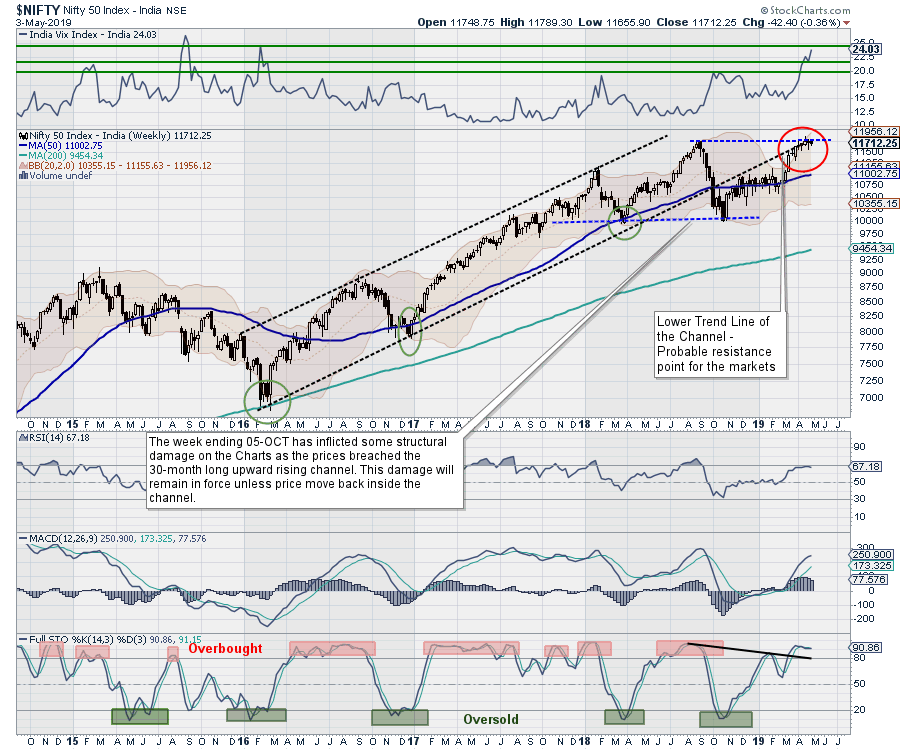

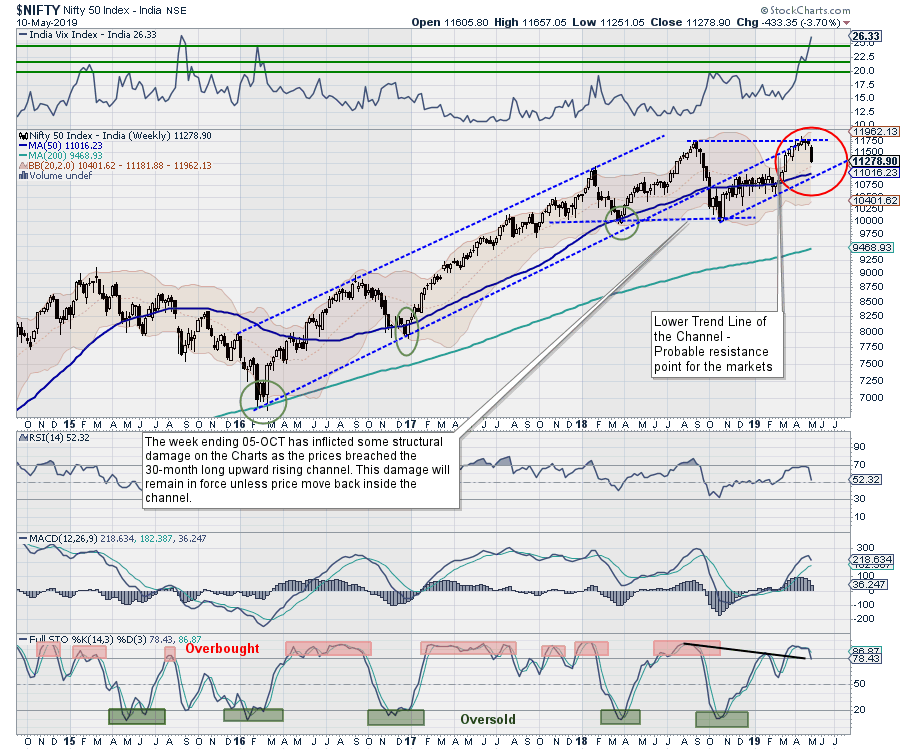

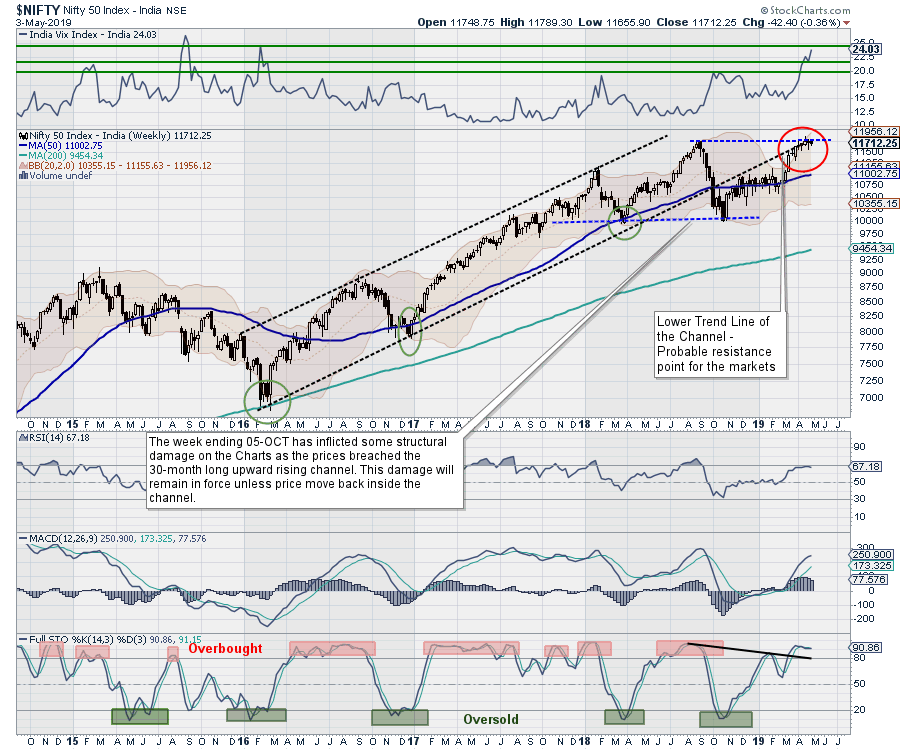

After having failed to give any sustainable breakout above the 11760 levels, as well as having resisted to the lower trend line of the upward rising channel (which was breached on the downside in October 2018), the NIFTY finally gave up and ended the week with a cut. The Indian...

READ MORE

MEMBERS ONLY

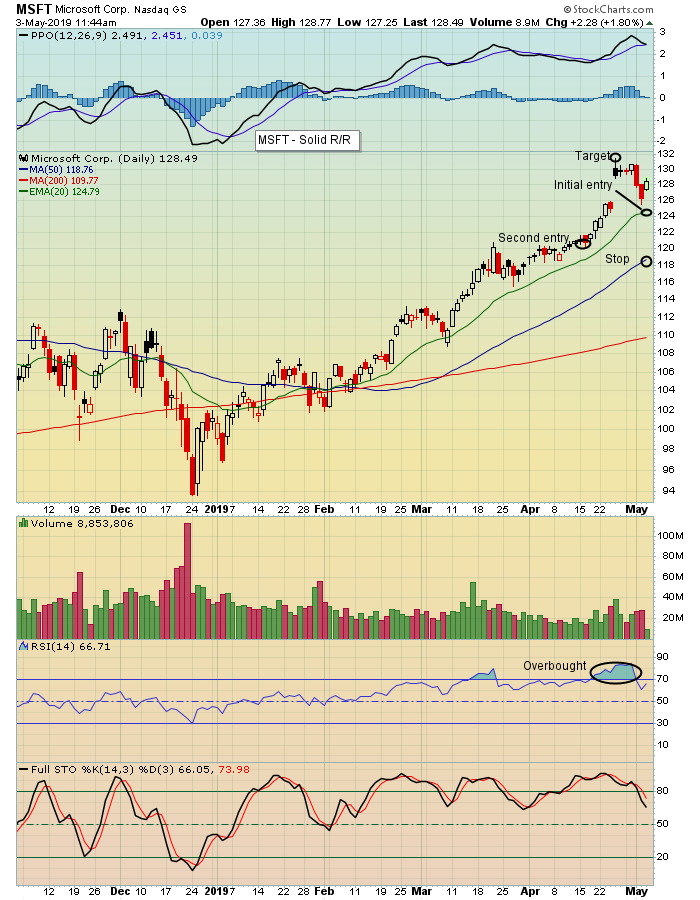

S&P 500 Reverses Off Key Support, New Leadership Emerging

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

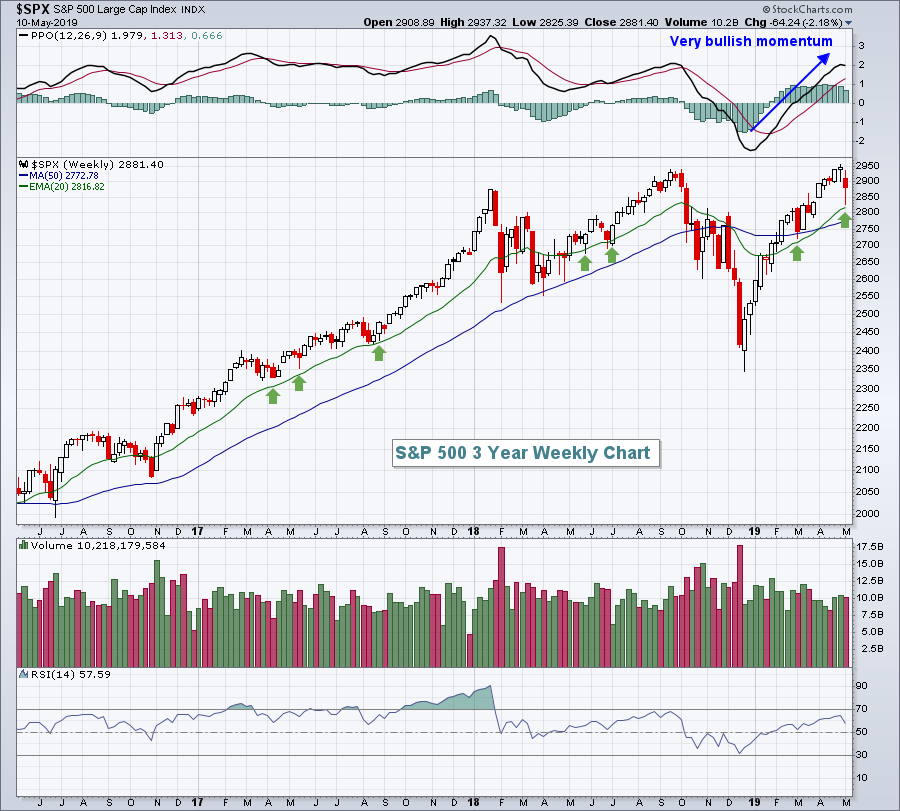

It was a brutal week, especially given the surging U.S. equity prices throughout 2019 thus far. The benchmark S&P 500 fell 2.18%, but intraweek losses were far steeper. There was a significant reversal on Friday as the Volatility Index ($VIX) appeared to confirm a near-term top...

READ MORE

MEMBERS ONLY

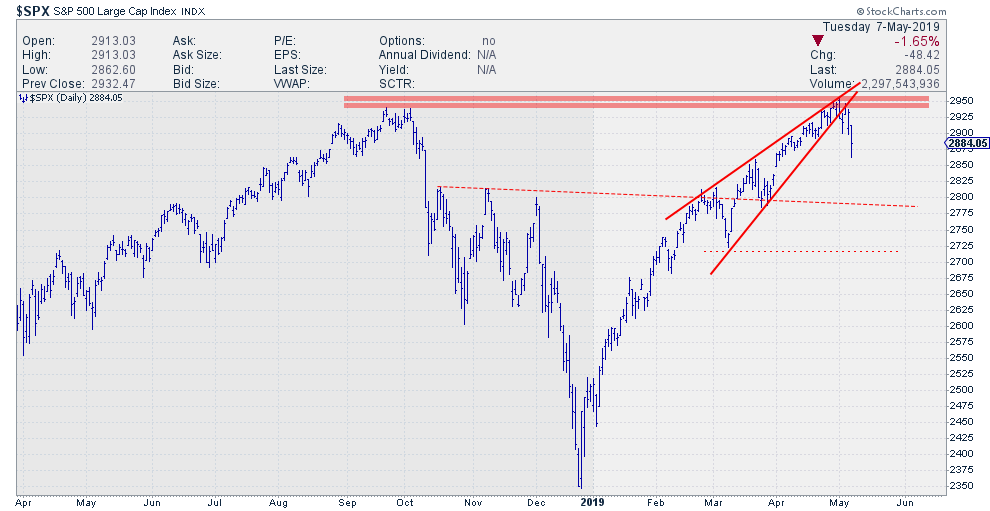

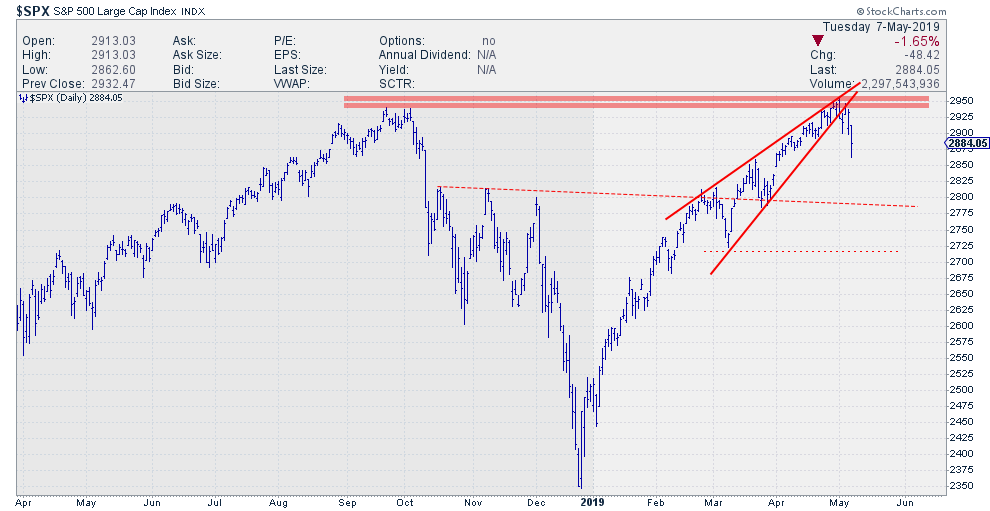

DP WEEKLY WRAP: Double Top In Progress

by Carl Swenlin,

President and Founder, DecisionPoint.com

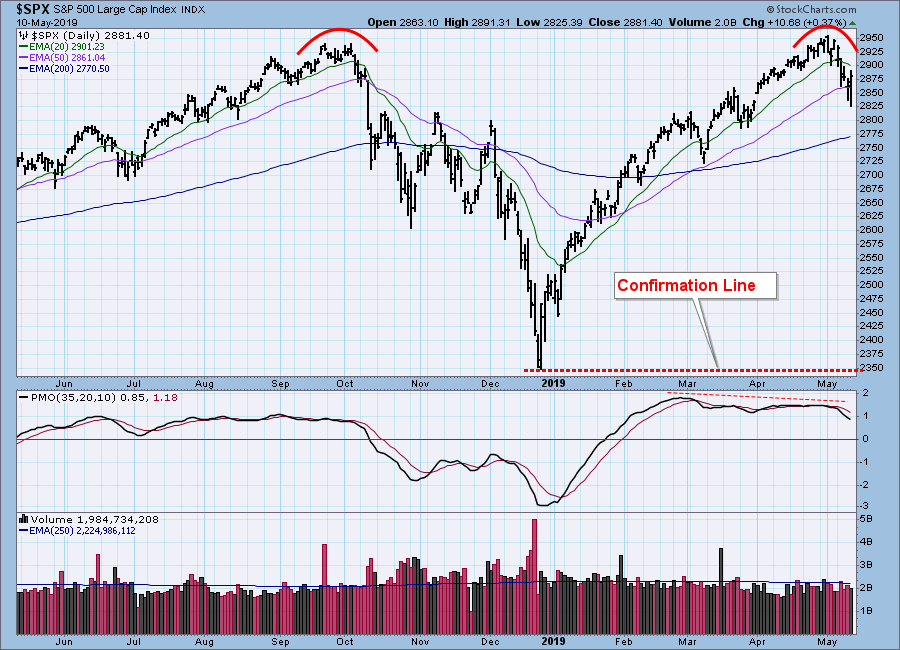

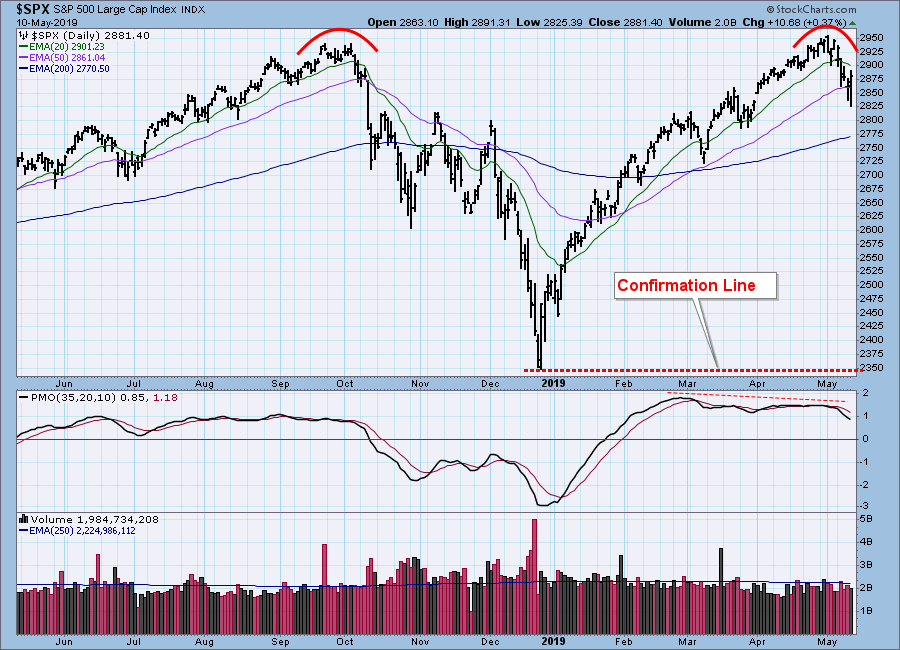

A few weeks ago, when the market began challenging the 2018 price highs, I pointed out that there was a potential for a double top. Since then, a second top has clearly formed, and the potential for more downside must be considered. The double top confirmation line is drawn across...

READ MORE

MEMBERS ONLY

Three Bright Spots Outside the United States

by David Keller,

President and Chief Strategist, Sierra Alpha Research

“The world is a book, and those who do not travel read only a page.” - Saint Augustine

I recently returned home after a 10-day trip to Scotland with my family for Spring Break. We rented a car in Glasgow, made our way up into the Highlands and took a...

READ MORE

MEMBERS ONLY

How To Play The Hot IPO Market - One Sound Approach Can Help You Navigate These Fast Movers

by Mary Ellen McGonagle,

President, MEM Investment Research

The number of IPOs listed in the U.S. has picked up this year. While some high-profile companies have already come public, there are more highly anticipated companies that are due to list shortly, such as the ride-share company Uber and workplace messaging app Slack.

Some of these recently public...

READ MORE

MEMBERS ONLY

Prices May Be Falling, But Bond Spreads (Confidence) are Holding in There

by Martin Pring,

President, Pring Research

Editor's Note: This article was originally published in Martin Pring's Market Roundup on Wednesday, May 8th at 6:37pm ET.

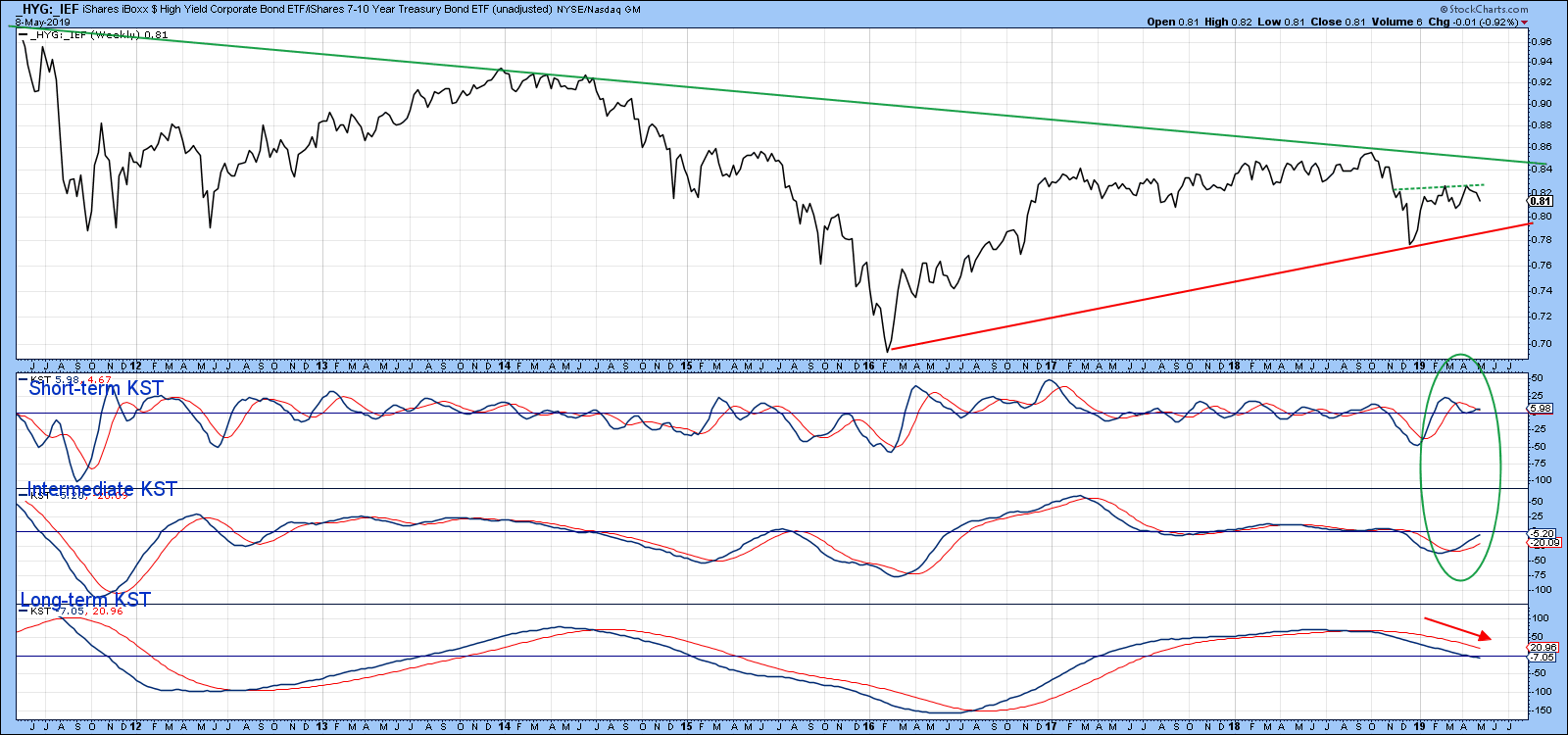

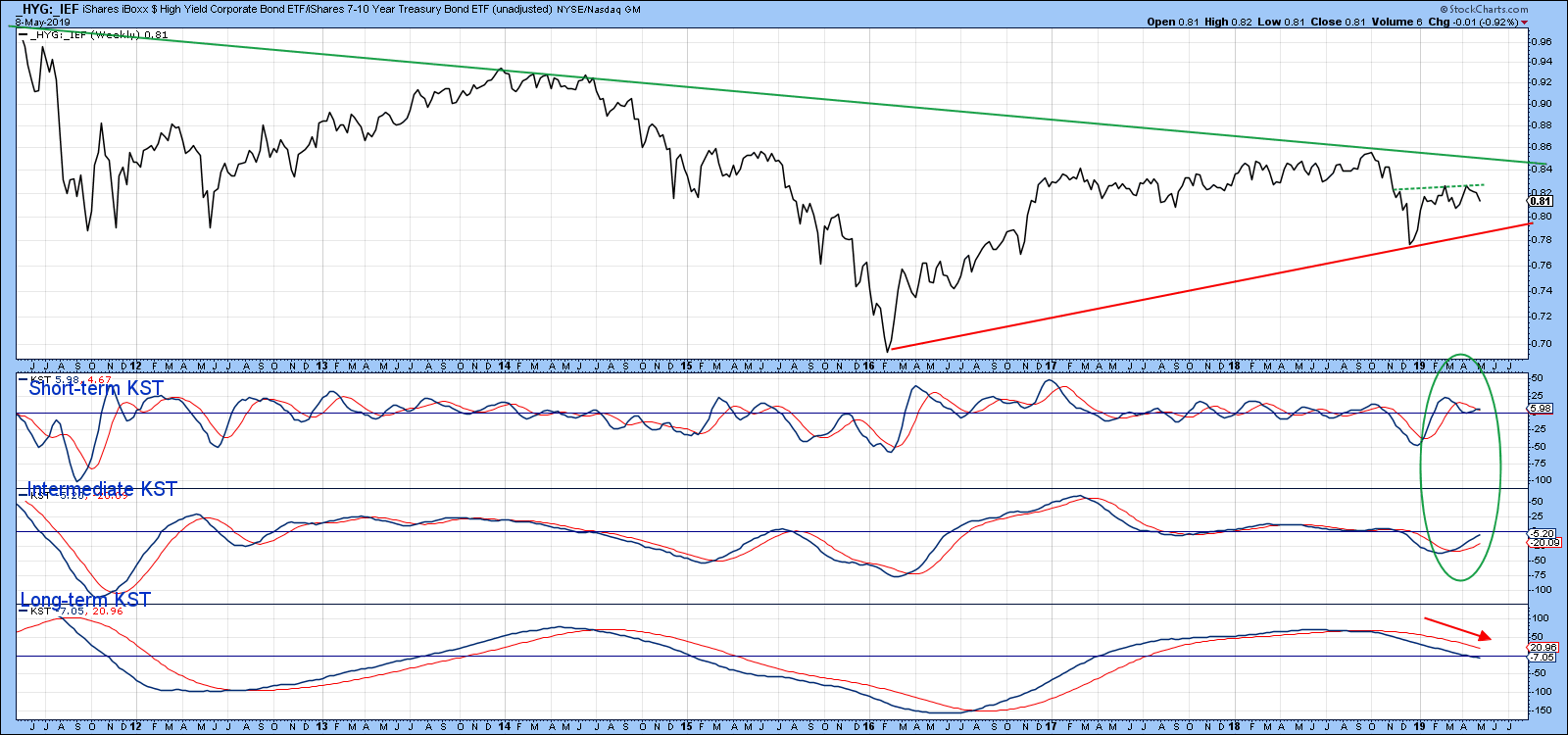

One area I monitor daily is the technical picture of bond spreads and other market relationships that reflect confidence. That’s because changes in their direction...

READ MORE

MEMBERS ONLY

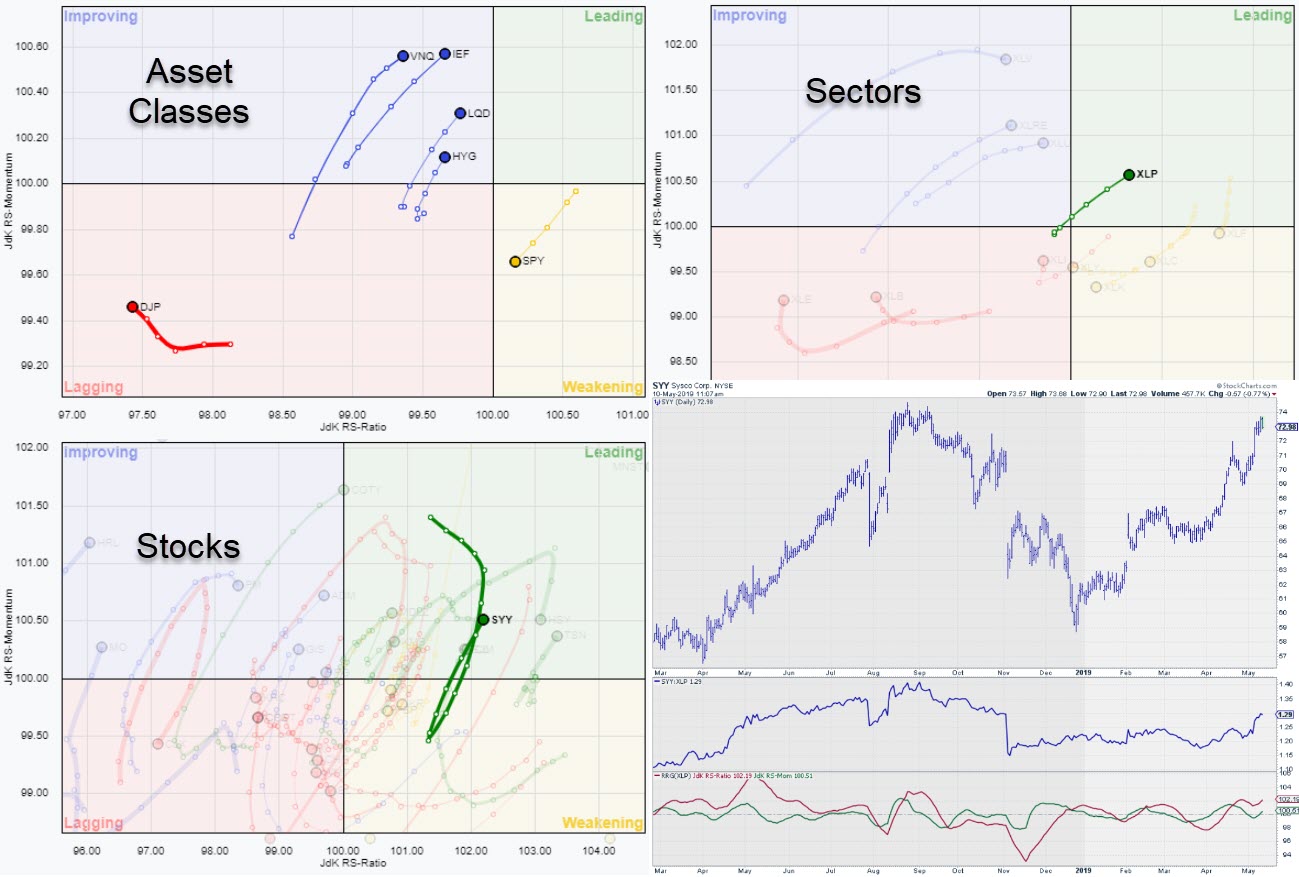

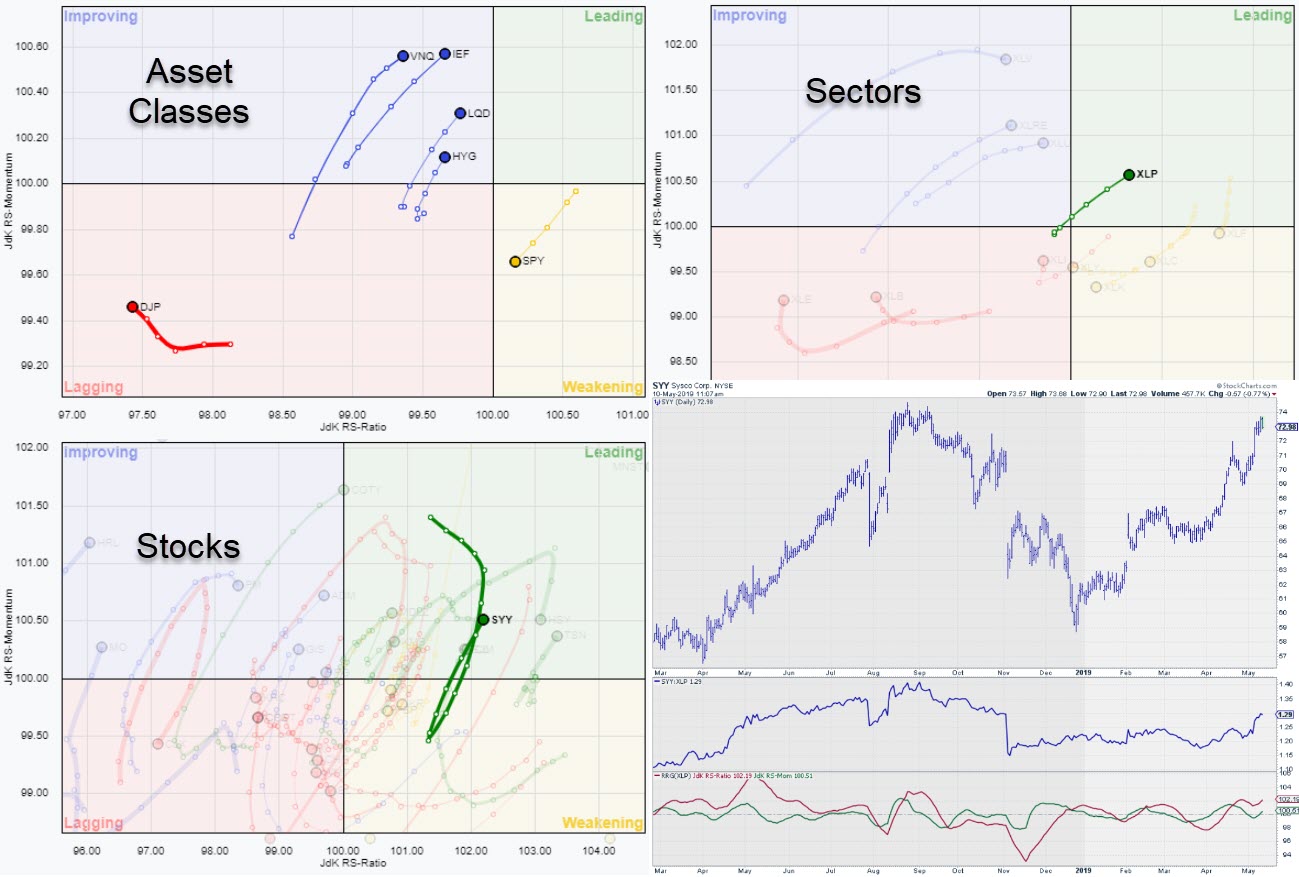

Building A Case For SYY In The Staples Sector Using Three Relative Rotation Graphs

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Relative Rotation Graphs can be a great asset in getting a high-level overview of what is going on in the markets and keeping an eye on the big picture. Beyond that, though, they can also help you to drill down to find new individual investment possibilities and trading ideas.

For...

READ MORE

MEMBERS ONLY

HEALTHCARE IS ONE OF THE DAY'S WEAKEST SECTORS AND NOT ACTING LIKE A SAFE HAVEN -- BIOTECHS ARE LEADNG THEM LOWER -- STAPLES, UTILITIES, AND REITS ARE THE REAL HAVENS -- SECTOR SUMMARY TABLE SHOWS A MORE DEFENSIVE SECTOR ALIGNMENT AS STOCK PRICES WEAKEN

by John Murphy,

Chief Technical Analyst, StockCharts.com

HEALTHCARE SECTOR DOESN'T LOOK VERY DEFENSIVE... During a guest appearance yesterday on StockChartsTV with Erin Swenlin and Tom Bowley, one of our viewers asked if healthcare was considered a defensive sector, and was it a good sector to hold in the current environment. My response was that some...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook - Weighing the Evidence and the Nerve

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Small-caps and 3 Sectors Weigh.

* Everywhere and Nowhere.

* Immediate Trend is Still Up.

* Another Possible Support Zone.

* Index Breadth Table Survives 90% Down Days.

* Yield Spread Remains Positive for Stocks.

* Mean-Reversion Setup Brewing.

* Art's Charts ChartList Update.

... Small-caps and 3 Sectors Weigh

Stocks came under broad pressure in...

READ MORE

MEMBERS ONLY

Here's A Defensive Health Care Stock That Loves The Next 3 Months

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, May 9, 2019

Here's my takeaway from yesterday's action. We had a solid recovery off of earlier intraday lows, but the downtrend remains firmly in place and we need to respect that. Volatility ($VIX) is important to watch because spikes in this...

READ MORE

MEMBERS ONLY

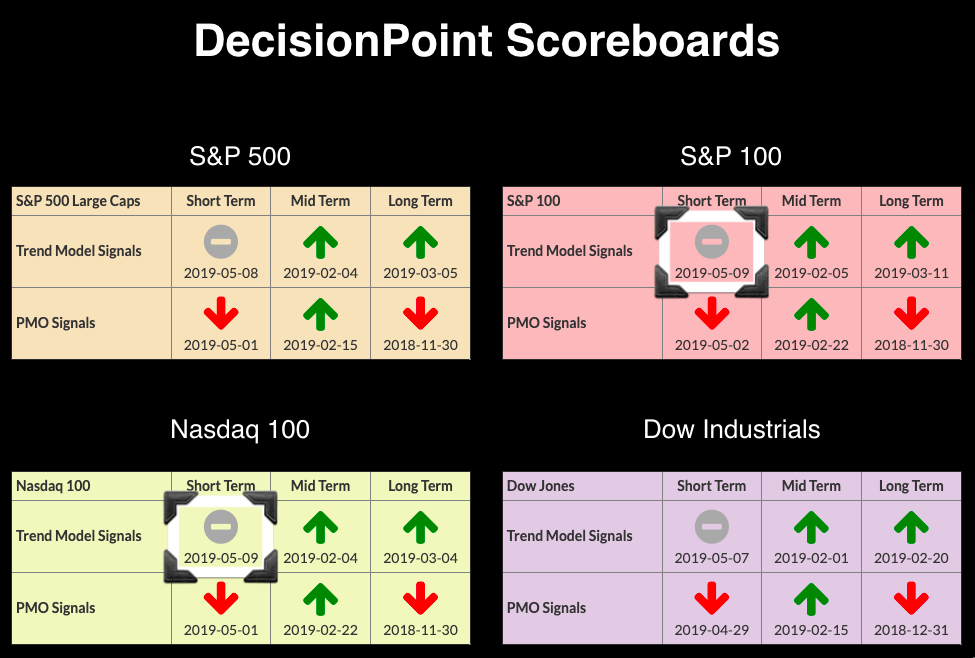

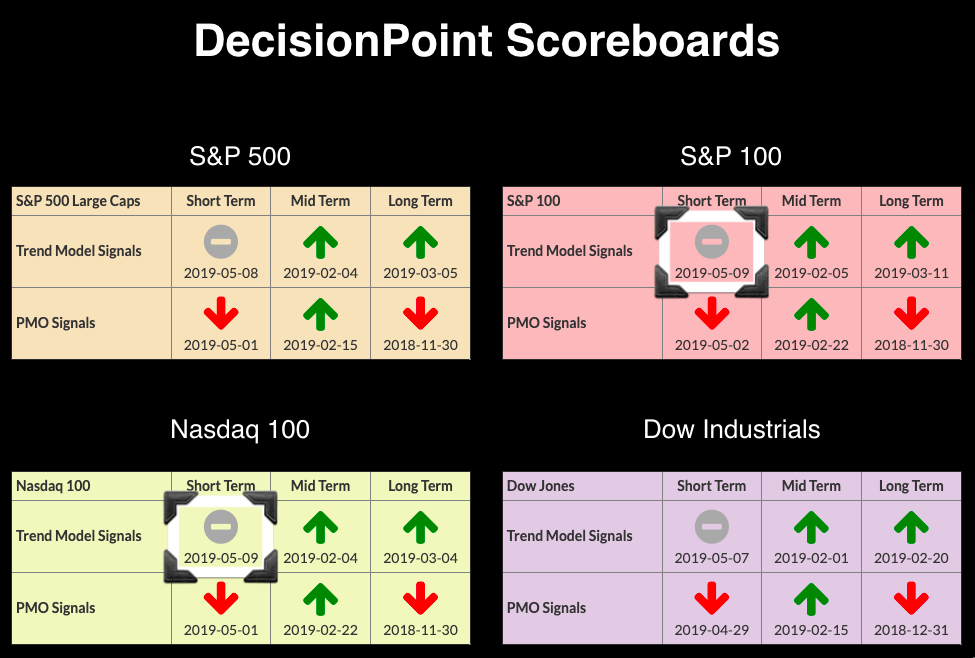

DP Bulletin: NDX and OEX New ST Trend Model Neutral Signals

by Erin Swenlin,

Vice President, DecisionPoint.com

Just a short note to alert readers to the two new Short-Term Trend Model Neutral signals on the NDX and OEX. These signals are triggered when the 5-EMA crosses below the 20-EMA while ABOVE the 50-EMA. If the crossover occurs BELOW the 50-EMA, then you have a STTM SELL signal....

READ MORE

MEMBERS ONLY

Wall Street Gets Reprieve But Futures Are Red Again

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, May 8, 2019

It was a much quieter day on Wall Street and it showed across our major indices and sectors. We finished with bifurcated action as the Dow Jones managed to finish with a minor 2 point gain. The other major indices ended with losses,...

READ MORE

MEMBERS ONLY

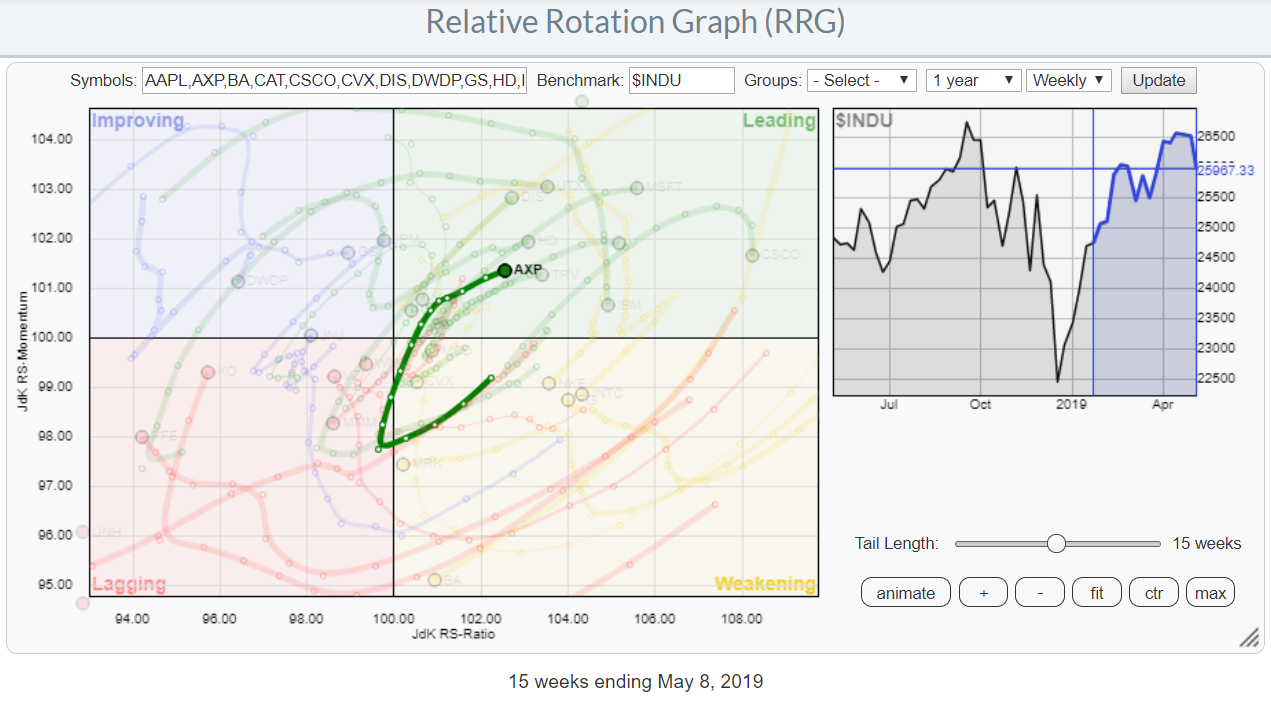

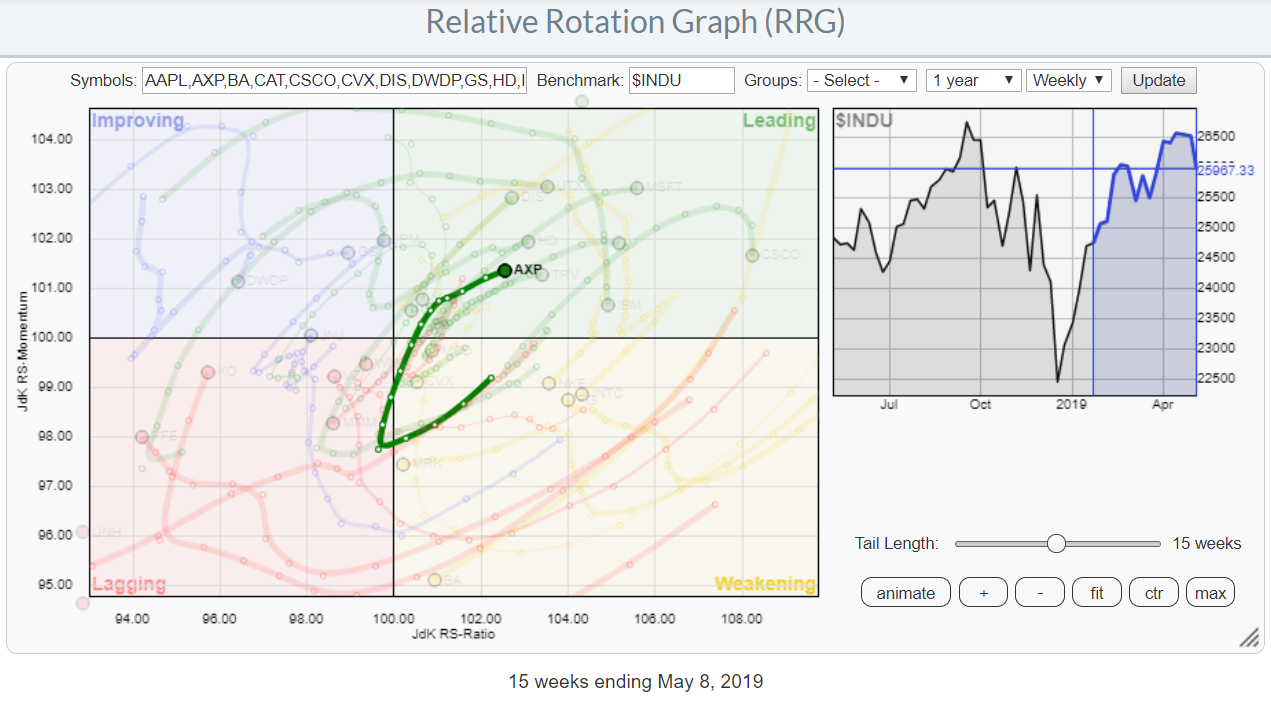

Strong Rotation For AXP on RRG vs DJ Industrials

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Watching the Relative Rotation Graph for the DJ-Industrials universe, you can see a few stocks, like AAPL, BA and WBA, that stand out immediately. Despite the current setback in the market, there are still some stocks that are worth approaching from a buyer's perspective.

Inside The Leading Quadrant...

READ MORE

MEMBERS ONLY

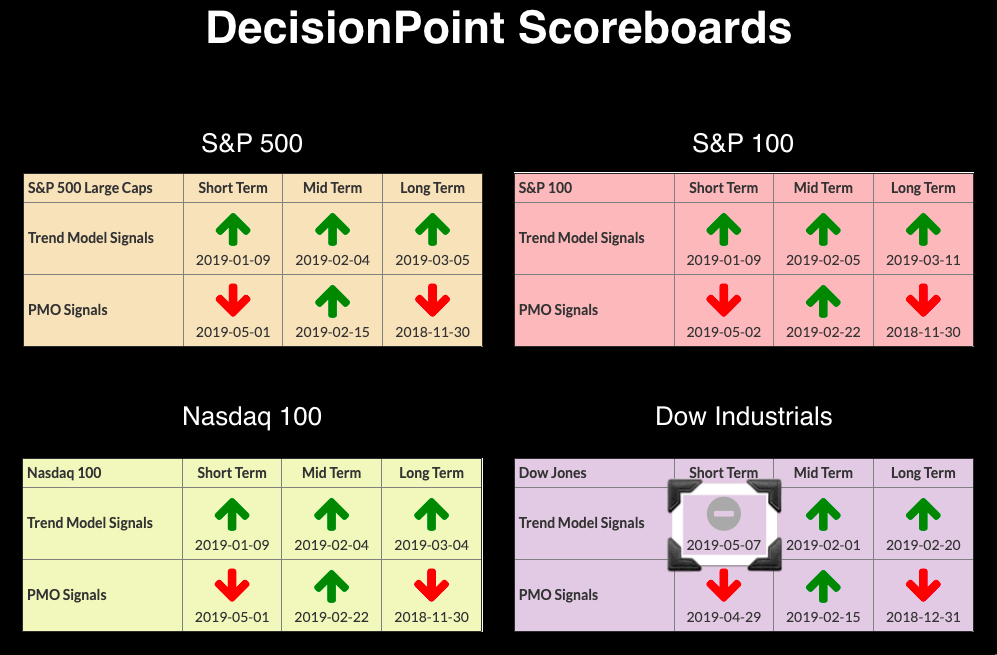

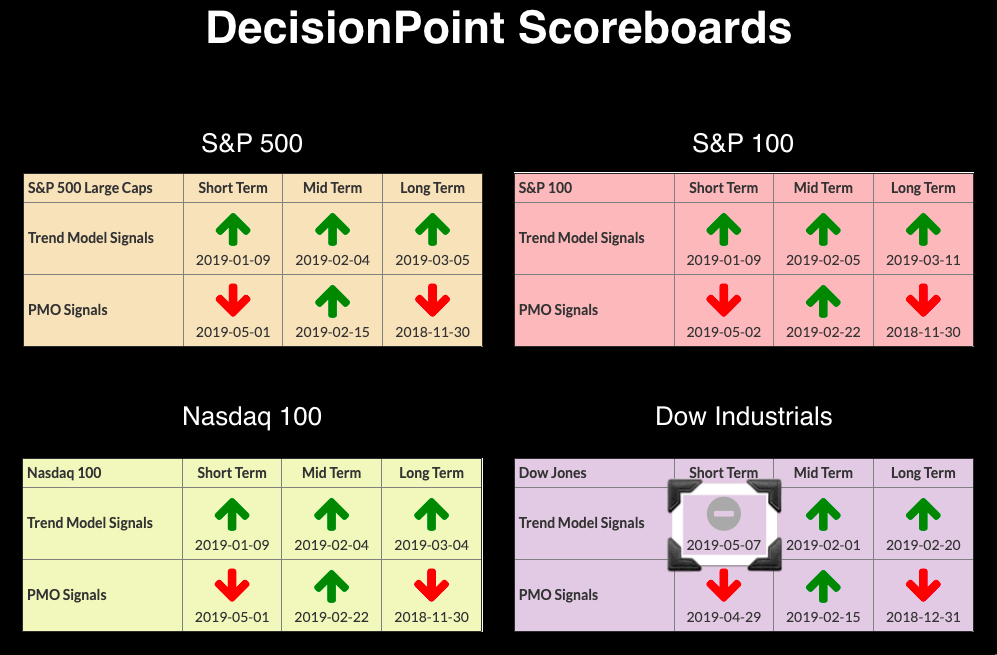

DP Alert: SPX Neutral Signal - I Spy a Bullish Falling Wedge on Gold - XLE ITTM SELL Signal

by Erin Swenlin,

Vice President, DecisionPoint.com

The Dow Industrials generated a ST Trend Model Neutral signal yesterday. Now, the SPX joins in with its own STTM Neutral signal. XLE triggered a new IT Trend Model SELL signal, the first to appear on the DecisionPoint Sector Scoreboard in some time. Gold may be forming a bullish declining...

READ MORE

MEMBERS ONLY

The China Trade Talks And The Technical Position Of The Equity Market

by Martin Pring,

President, Pring Research

* Long-Term Divergences

* Some Short-Term Technical Sell Signals Triggered in the Last Few Days

* Prices May Be Falling, But Bond Spreads (Confidence) are Holding in There

Long-Term Divergences

My first reaction to this week’s stock market tantrum (in response to the China trade talks) was to brush it off as...

READ MORE

MEMBERS ONLY

WORLD STOCK INDEXES ARE TESTING OVERHEAD RESISTANCE AND LOOKING OVER-EXTENDED -- THAT MAY EXPLAIN THEIR BAD REACTION TO TRADE TENSIONS -- WORLD STOCKS HAVE TO CLEAR RESISTANCE LEVELS TO RESUME THEIR 2019 UPTREND

by John Murphy,

Chief Technical Analyst, StockCharts.com

TRADE TENSIONS RATTLE OVEREXTENDED GLOBAL STOCKS ... Renewed trade tensions between the U.S. and China rattled global stocks this week. Stock prices are rising and falling with each news report. After falling sharply yesterday (Tuesday), stocks are rebounding today on more optimistic news reports about the meeting between U.S....

READ MORE

MEMBERS ONLY

S&P Executes Wedge And Rotation To Defensive Sectors Accelerates

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Since printing its high on 1 May, the S&P 500 has struggled to keep up and make its final push through resistance. Over the last three to four days, the bulls have capitulated, putting a reinforcement of the 2940-2950 resistance zone into place. The rising wedge formation that...

READ MORE

MEMBERS ONLY

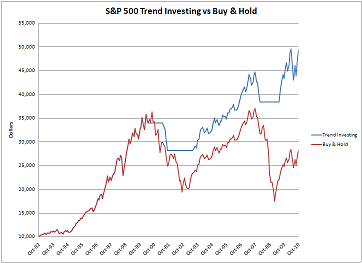

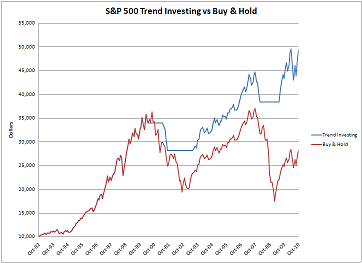

Friends Don't Let Friends Buy and Hold

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

The timing of this article is appropriate. Part of this was written by Tim Chapman who was a founder of PMFM, the company I worked with and later became Stadion. I liked its message so am updating it with this article. I remember back when I was managing money, I...

READ MORE

MEMBERS ONLY

How Much Selling Is Ok?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, May 7, 2019

It was a wicked day on Wall Street. It felt more like December 2018 than May 2019. Volatility surged for a second consecutive day and sellers swamped buyers. Volume accelerated as it generally does during market selloffs and a bit of panic was...

READ MORE

MEMBERS ONLY

Micron Fails at Break Zone

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

A basic concept of technical analysis is that broken support turns into future resistance. This concept is proving true for Micron (MU) as it returned to broken support in April and backed off the last two weeks.

The chart shows MU breaking down with a support break in September and...

READ MORE

MEMBERS ONLY

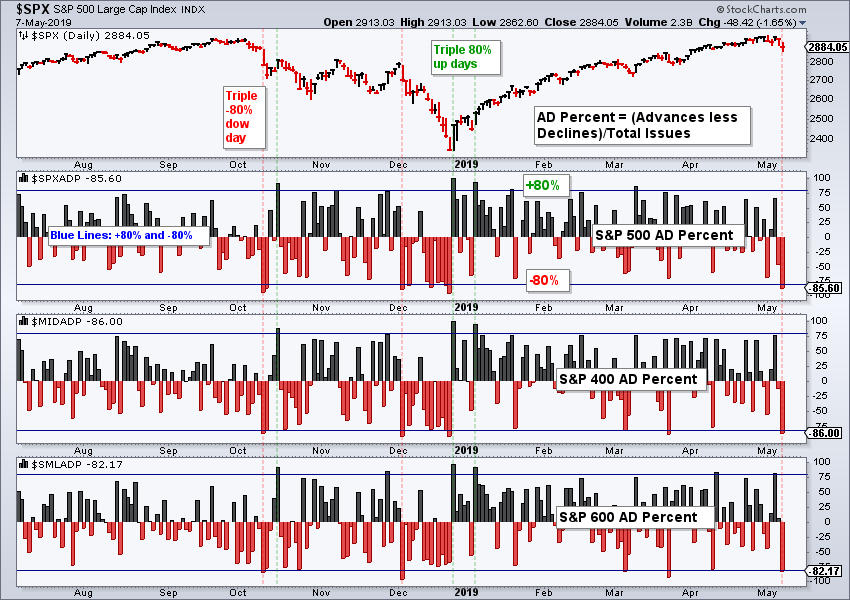

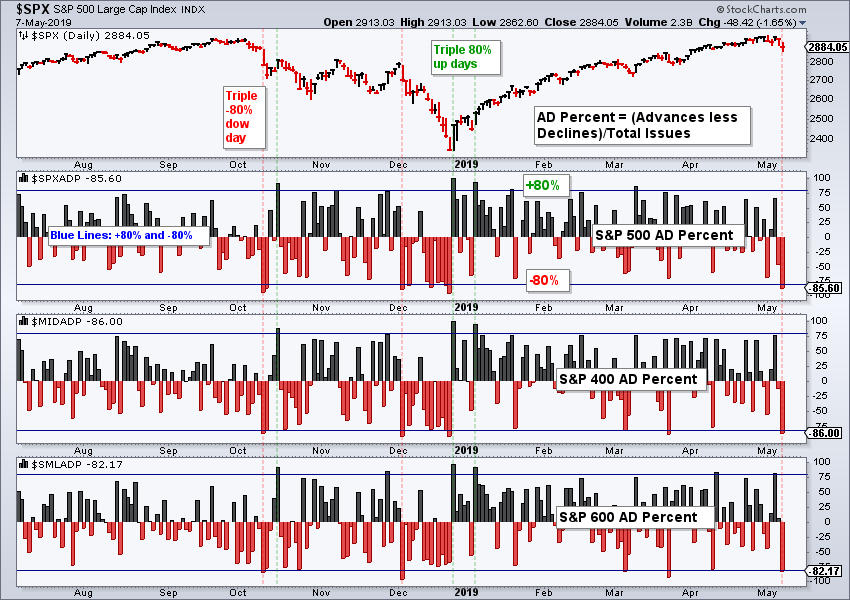

A Shot Across the Bow with a Triple 90% Down Day - What to Watch Next

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Triple 90% Down Day

It is way too early to call for a major top, but we do have a short-term breadth signal that points to further downside. The chart below shows AD Percent for the S&P 500, S&P Mid-Cap 400 and S&P Small-Cap...

READ MORE

MEMBERS ONLY

DP Bulletin: New ST Trend Model Neutral Signal on the DOW - First to Fall

by Erin Swenlin,

Vice President, DecisionPoint.com

Just a quick bulletin to let you know the Dow Industrials lost the Short-Term Trend Model BUY signal, meaning it has now moved to "Neutral."

The 5-EMA crossed below the 20-EMA, which is what triggered the signal change. Had the negative crossover occurred BELOW the 50-EMA, it would...

READ MORE

MEMBERS ONLY

Campaign Caravan

by Bruce Fraser,

Industry-leading "Wyckoffian"

For most investors Campaigning stocks is an acquired skill. A stock campaign is typically a multi-year endurance event. In a classic uptrend a stock will have trending periods followed by consolidations (Wyckoffians call them Reaccumulations). These pauses can last months to a year or more in duration. Wyckoff Campaigners resist...

READ MORE

MEMBERS ONLY

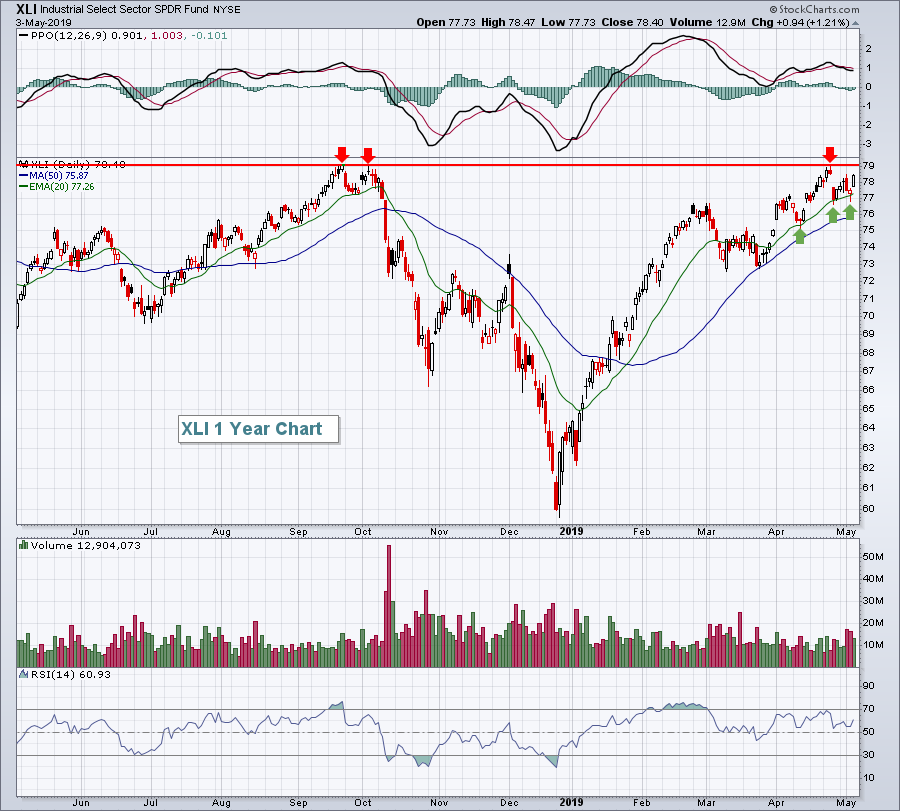

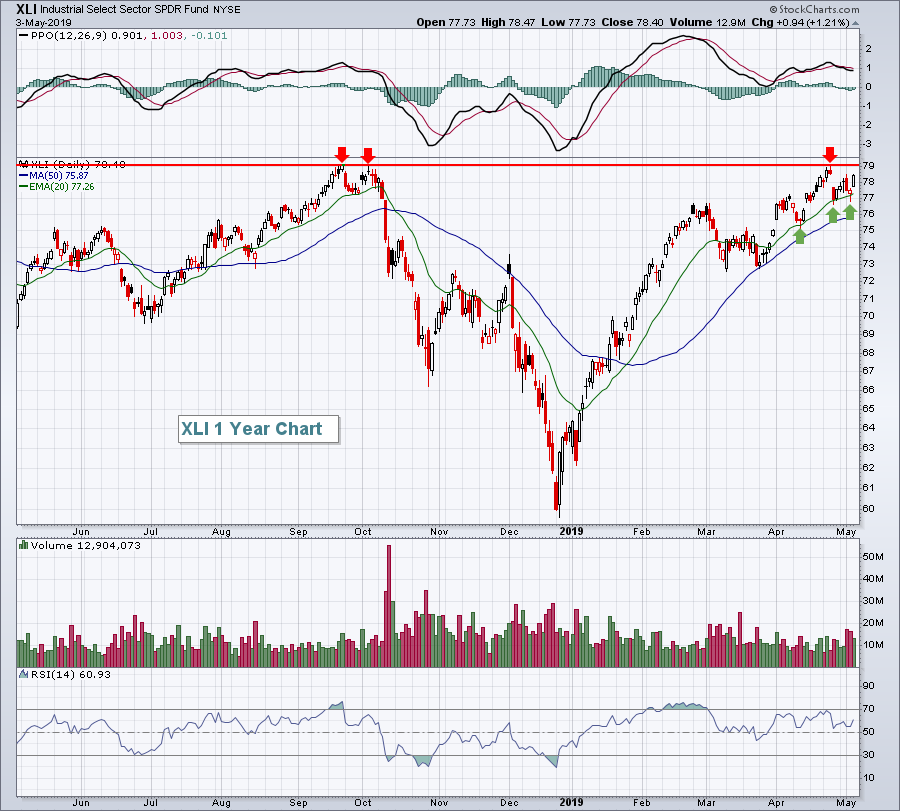

STOCK PULLBACK CONTINUES -- ALL MAJOR STOCK INDEXES ARE BACK BELOW LAST YEAR'S PEAK -- MOVING AVERAGE LINES ARE BEING TESTED -- ENERGY, MATERIALS, AND INDUSTRIALS ARE AMONG BIGGEST SECTOR LOSERS

by John Murphy,

Chief Technical Analyst, StockCharts.com

MAJOR STOCK INDEXES LOSE MORE GROUND ... The stock market pullback that started yesterday is continuing again today. And all three major stock indexes appear headed for a test of underlying moving average lines. First and foremost, it's where this pullback is starting from that's most concerning....

READ MORE

MEMBERS ONLY

Wall Street Shakes Off Trade Worries...For A Day

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, May 6, 2019

The session got off to a very rough start as global market were hit hard following word that US-China trade talks were off the tracks once again. President Trump warned of steeper tariffs and Chinese officials said they were considering abandoning talks altogether....

READ MORE

MEMBERS ONLY

Ebay Holds the Gap and the Break

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Ebay (EBAY) reversed its downtrend with a reversal pattern and break above the 200-day SMA in late January and early February. After digesting its gains with a corrective pattern in March-April the stock broke out again with a gap and appears headed higher.

The stock formed a rare island reversal...

READ MORE

MEMBERS ONLY

Jobs Strong On Friday But China Trade Weighs On Futures

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, May 3, 2019

April nonfarm payrolls were much stronger than expected, jumping to 263,000 and well ahead of the 180,000 consensus estimate. The unemployment rate fell to 3.6%, the lowest its seen in 50 years. The bond market wasn't impressed, however,...

READ MORE

MEMBERS ONLY

Week Ahead: This Zone Is Set To Act As Stiff Resistance Area For The Coming Week

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In a truncated 3-day working week, the Indian equity markets headed nowhere and ended the week on a flat note once again. In our previous weekly note, we had mentioned the possibility of the NIFTY failing to break resistance at 11760. In the week that went by, though the markets...

READ MORE

MEMBERS ONLY

Spring Savings Are Here, With A Very Special Twist...

by Grayson Roze,

Chief Strategist, StockCharts.com

Hello Fellow ChartWatchers!

The springtime sun is shining bright here in the Pacific Northwest, and we think that's cause for celebration. So, I'm coming to you this week with a very special announcement.

For a limited time only this month, we're giving you 2...

READ MORE

MEMBERS ONLY

Volume Ratio Charts - Climactic Attention Flags

by Erin Swenlin,

Vice President, DecisionPoint.com

My dad, Carl Swenlin, was a guest on MarketWatchers LIVE last Wednesday (here is a link to that show). He brought in some DecisionPoint indicator charts that I hadn't looked at in quite some time (truth be told, he hadn't looked at them in awhile either)...

READ MORE

MEMBERS ONLY

Interdisciplinary Investing: Combining Fundamentals and Technicals Increases Profits

by Gatis Roze,

Author, "Tensile Trading"

How does a return of 14% in six months sound to you? Last February, I wrote a blog about attending the unique interdisciplinary DENT Conference last year in Napa Valley. I credit my attendance there with directly re-energizing and reimagining my investing over the six months that followed. This past...

READ MORE

MEMBERS ONLY

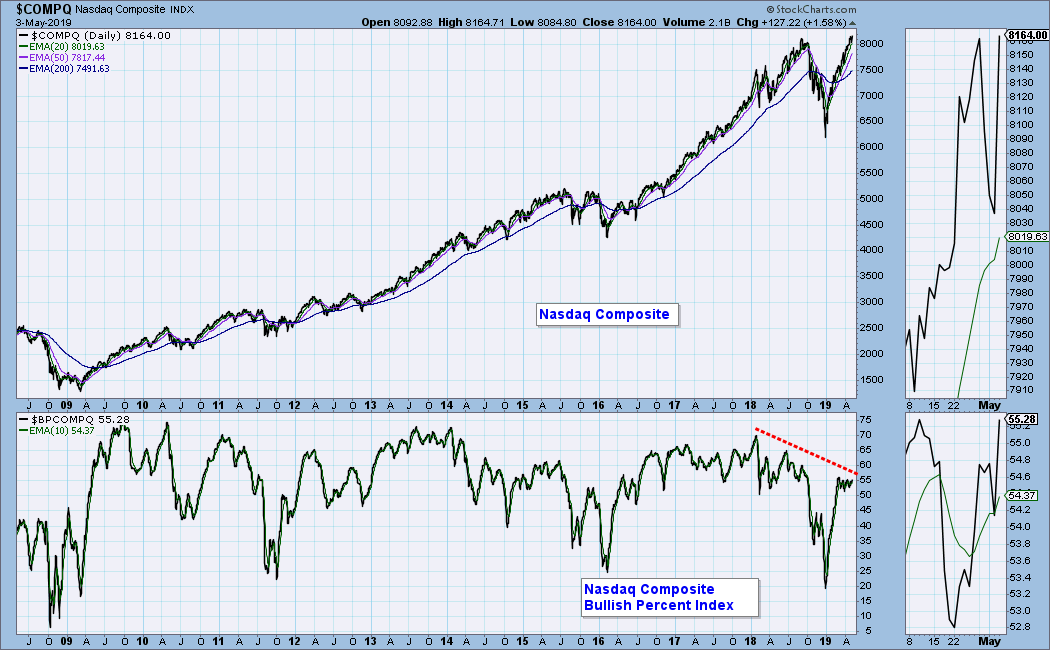

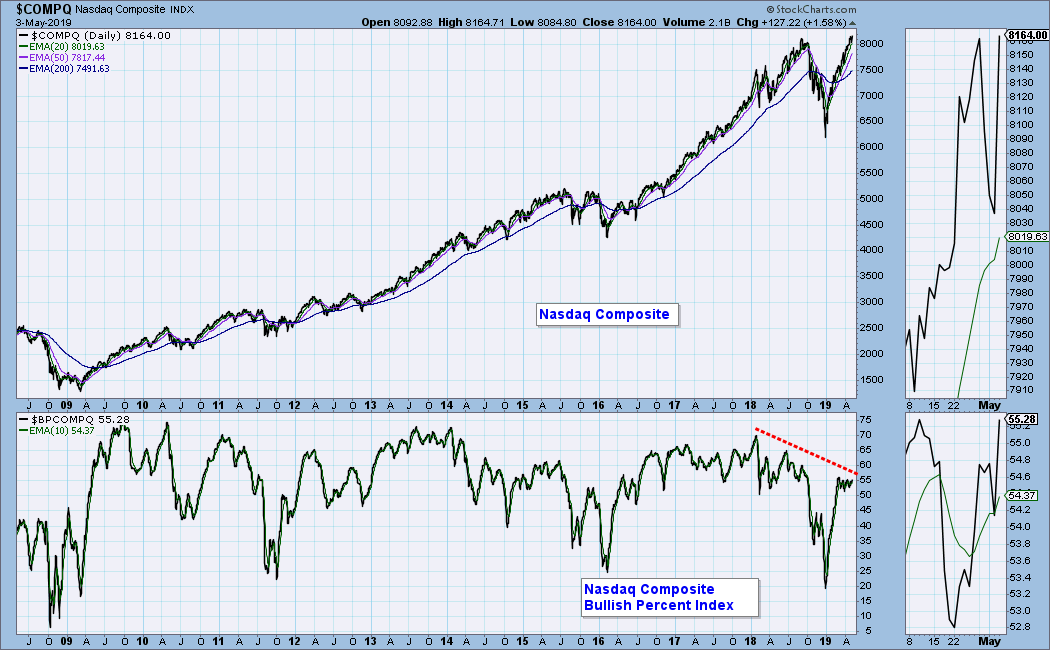

DP WEEKLY WRAP: Nasdaq Composite Record High Not Supported by Internals

by Carl Swenlin,

President and Founder, DecisionPoint.com

This week the Nasdaq Composite Index closed at a new, all-time high, but the Bullish Percent Index (BPI) is a long way from confirming that. The BPI is the percentage of Nasdaq Composite stocks that are on point and figure BUY signals, and Friday's reading is 55%. That...

READ MORE

MEMBERS ONLY

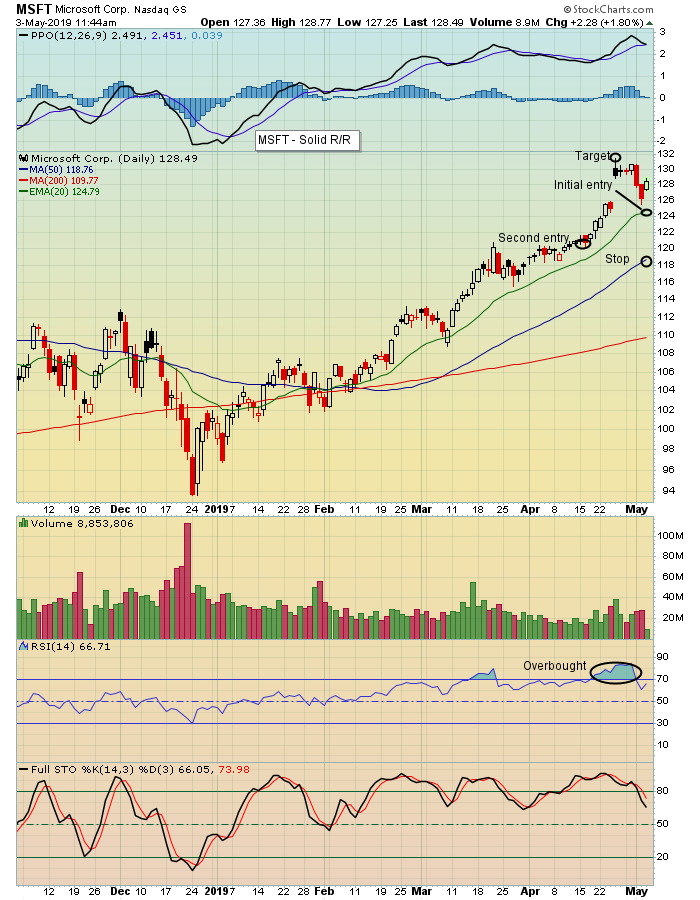

Profiting from Pullbacks

by John Hopkins,

President and Co-founder, EarningsBeats.com

When you're a bull, the last thing you want to see is a pullback in stocks you own. This is understandable - who wants to see something they own lose value? But, at some point, the market and individual stocks will get overheated, so instead of worrying about...

READ MORE

MEMBERS ONLY

Investors Never Say Never

by David Keller,

President and Chief Strategist, Sierra Alpha Research

“The market will pull back about 5% before continuing higher.”

“Banks always do well with a steeper yield curve.”

“If the market moves higher, then gold will definitely pull back.”

“I’m sure we’ll see a correction in the next two weeks.”

When I was in college, one of...

READ MORE

MEMBERS ONLY

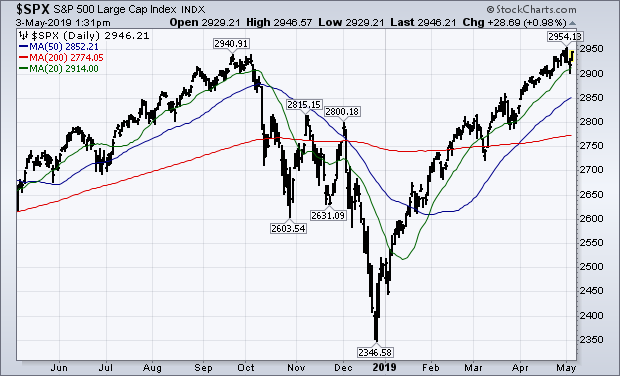

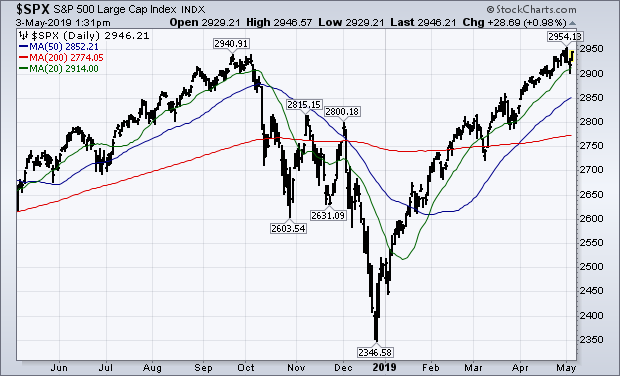

Strong Jobs Report Boosts Stocks - S&P 500 Nears Another Record

by John Murphy,

Chief Technical Analyst, StockCharts.com

Editor's Note: This article was originally published in John Murphy's Market Message on Friday, May 3rd at 1:34pm ET.

A surprisingly strong jobs report this morning has given stocks a big boost today. All major indexes are having a strong day with the Nasdaq and...

READ MORE

MEMBERS ONLY

STRONG JOBS REPORT BOOSTS STOCKS -- TRANSPORTS CONTINUE TO SHOW NEW LEADERSHIP -- S&P 500 NEARS ANOTHER RECORD -- INSURANCE STOCKS LEAD FINANCIALS HIGHER -- METLIFE NEARS MAJOR UPSIDE BREAKOUT

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 TRIES TO REGAIN RECORD HIGH ... A surprisingly strong jobs report this morning has given stocks a big boost today. All major indexes are having a strong day with the Nasdaq and small caps in the lead (more on that shortly). Transports are also having an especially...

READ MORE

MEMBERS ONLY

Improving the Best Six Months Strategy by Adding Months and Timing

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The "Best Six Months" strategy suggests that the best time to own stocks is from November to April, and the worst time is from May to October. Testing over the last 25 years confirms the performance differences between these two periods, but this strategy still leaves money on...

READ MORE

MEMBERS ONLY

Energy Remains A Drag And Seasonality Suggests It Could Get Worse

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, May 2, 2019

Energy (XLE, -1.74%) took yet another tumble on Thursday, which dampened an otherwise decent recovery from intraday morning lows in our major indices. The Dow Jones was the big loser, dropping 0.46%, while the small cap Russell 2000 index rebounded nicely,...

READ MORE