MEMBERS ONLY

Tech-Dominated Nasdaq Leads Market Higher -- The Nasdaq and S&P 500 are Clearing Their November Highs

by John Murphy,

Chief Technical Analyst, StockCharts.com

Editor's Note: This article was originally published in John Murphy's Market Message on Friday, March 15th at 2:58pm ET.

Just a week after slipping below their 200-day averages, the Nasdaq Composite Index in Chart 1 and the S&P 500 in Chart 2 appear...

READ MORE

MEMBERS ONLY

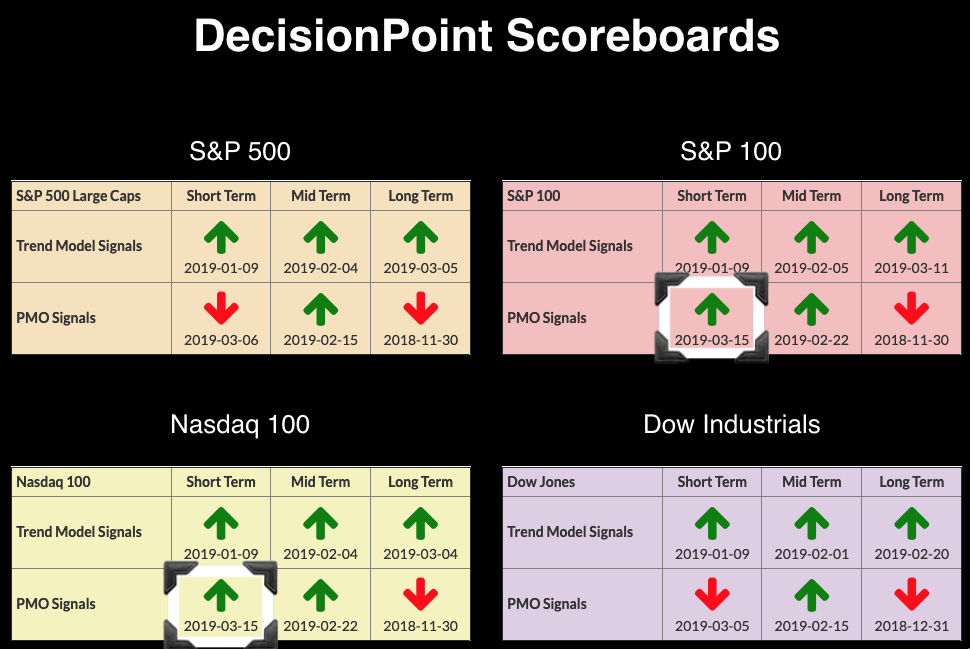

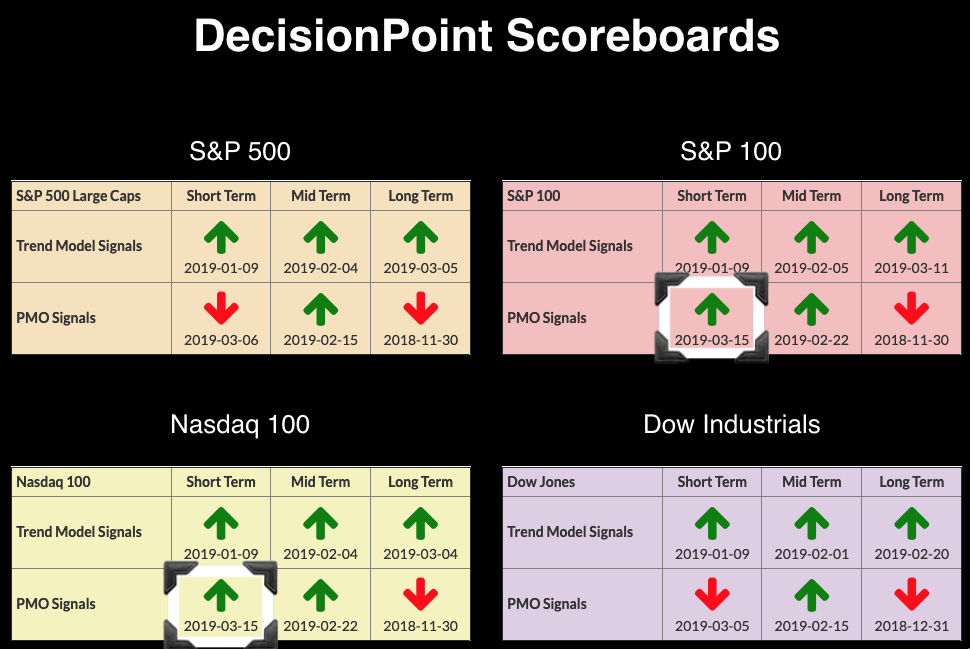

Unofficially a Bull -- PMO BUY Signals Appear on OEX and NDX

by Erin Swenlin,

Vice President, DecisionPoint.com

I have a chart at the bottom of this article that will explain my moving out of the bear market camp. Yes, it is delayed, but, as I explained before the December crash, I'd rather miss a bottom and rally than be hanging on for dear life during...

READ MORE

MEMBERS ONLY

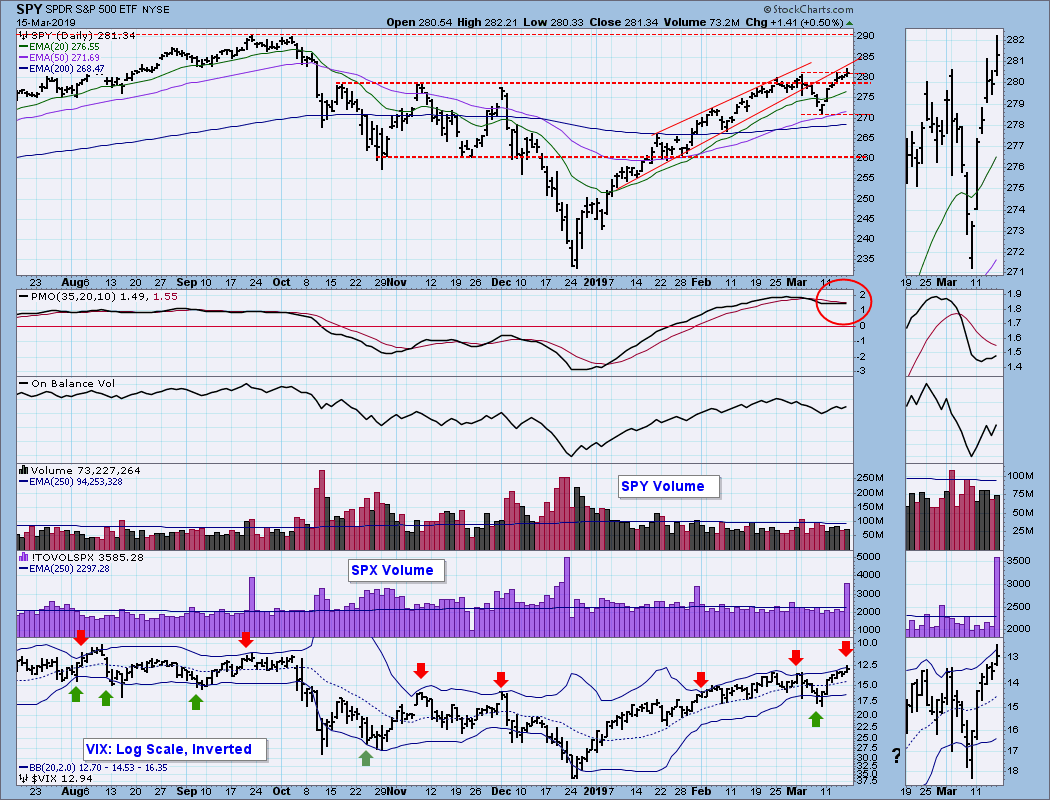

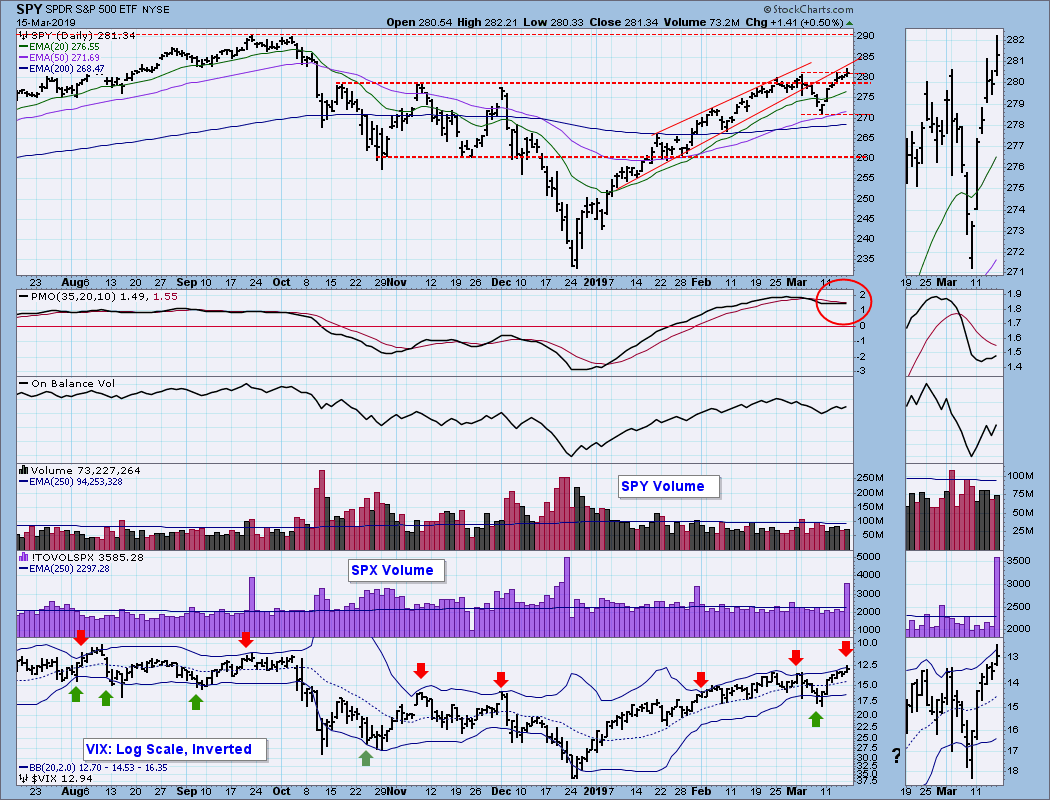

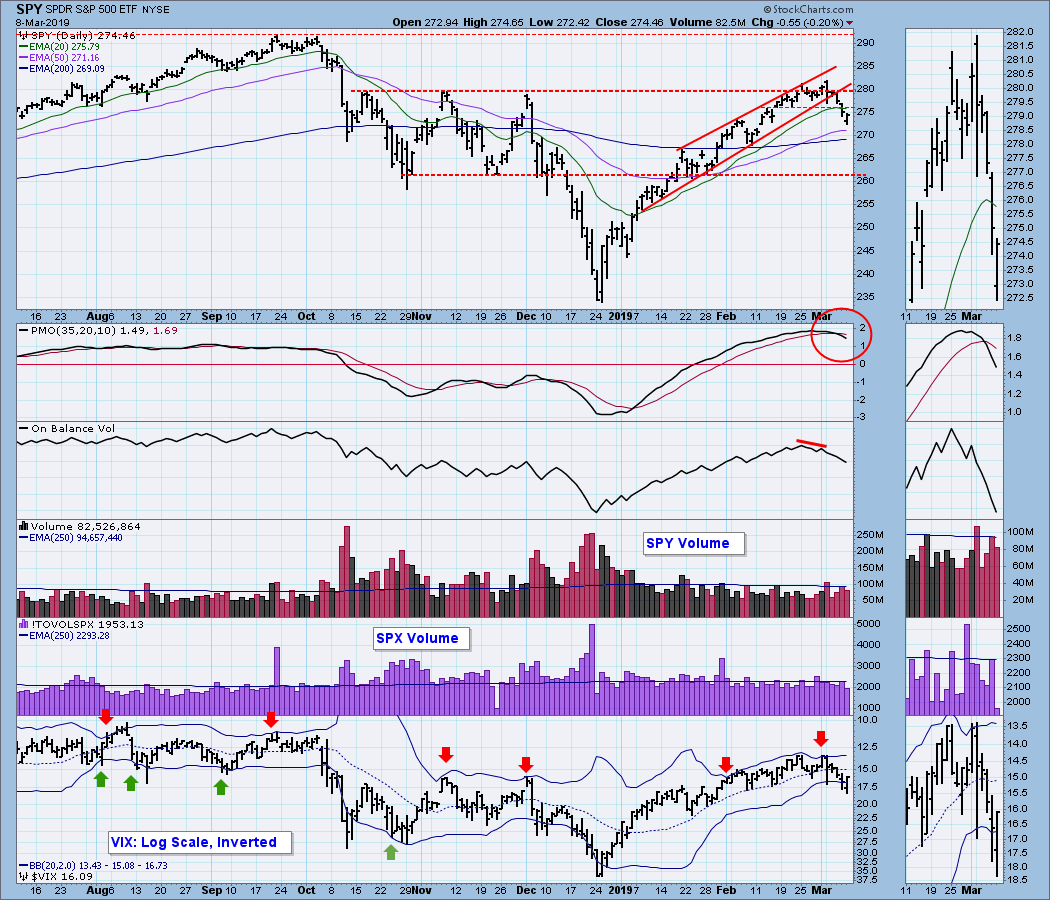

DP WEEKLY WRAP: Short-Term Top Soon?

by Carl Swenlin,

President and Founder, DecisionPoint.com

At the end of last week I was looking forward to some more selling to extend the decline that had started from the March 4 top. But no. Price rebounded off last Friday's low, eventually setting a new high for the rally off the December lows. However, on...

READ MORE

MEMBERS ONLY

The Strong Continue to Thrive

by John Hopkins,

President and Co-founder, EarningsBeats.com

The S&P is pretty much at the same level it was back in October of last year. However, it still remains well below its all-time high of 2939, which was also achieved in October of last year. Yet there are a number of stocks at their all-time highs,...

READ MORE

MEMBERS ONLY

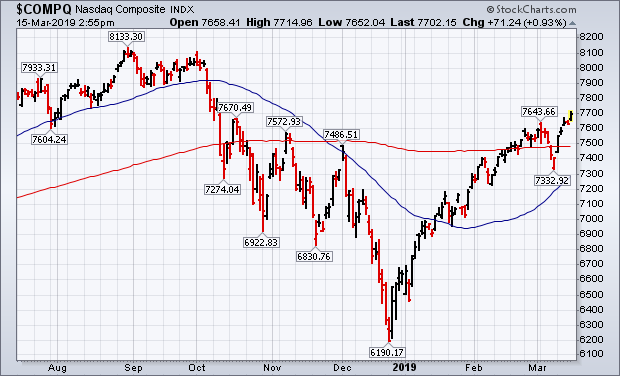

TECH-DOMINATED NASDAQ LEADS MARKET HIGHER -- THE NASDAQ AND S&P 500 ARE CLEARING THEIR NOVEMBER HIGHS -- FALLING BOND YIELDS HAVE HELPED BOOST STOCK AND BOND PRICES -- HIGH YIELD AND INVESTMENT GRADE BONDS ARE OUTPACING TREASURIES

by John Murphy,

Chief Technical Analyst, StockCharts.com

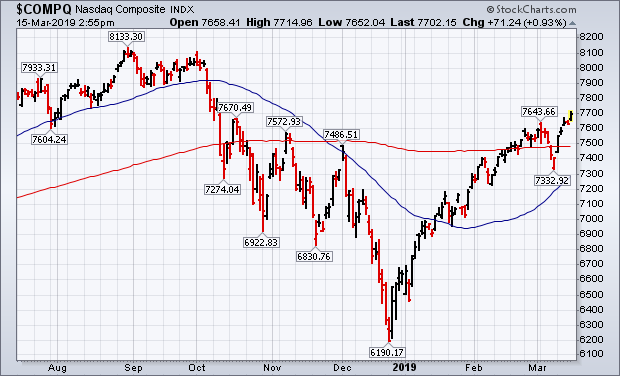

NASDAQ AND S&P 500 HAVE CLEARED THEIR NOVEMBER HIGH... Just a week after slipping below their 200-day averages, the Nasdaq Composite Index in Chart 1 and the S&P 500 in Chart 2 appear to be ending the week above their November highs. That's the...

READ MORE

MEMBERS ONLY

You Said It Fred: A Leading VC On The Value Of Routines, Plus An Overview Of My Weekly Checklist

by Grayson Roze,

Chief Strategist, StockCharts.com

Anytime I hear a successful, well-respected figure mention the importance of routines, my ears perk up. I firmly believe that routines (and the discipline to stick to them) are the secret to success, from investing to sports to business to music – you name it. When I hear that same opinion...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook - Large-caps Take the Lead

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

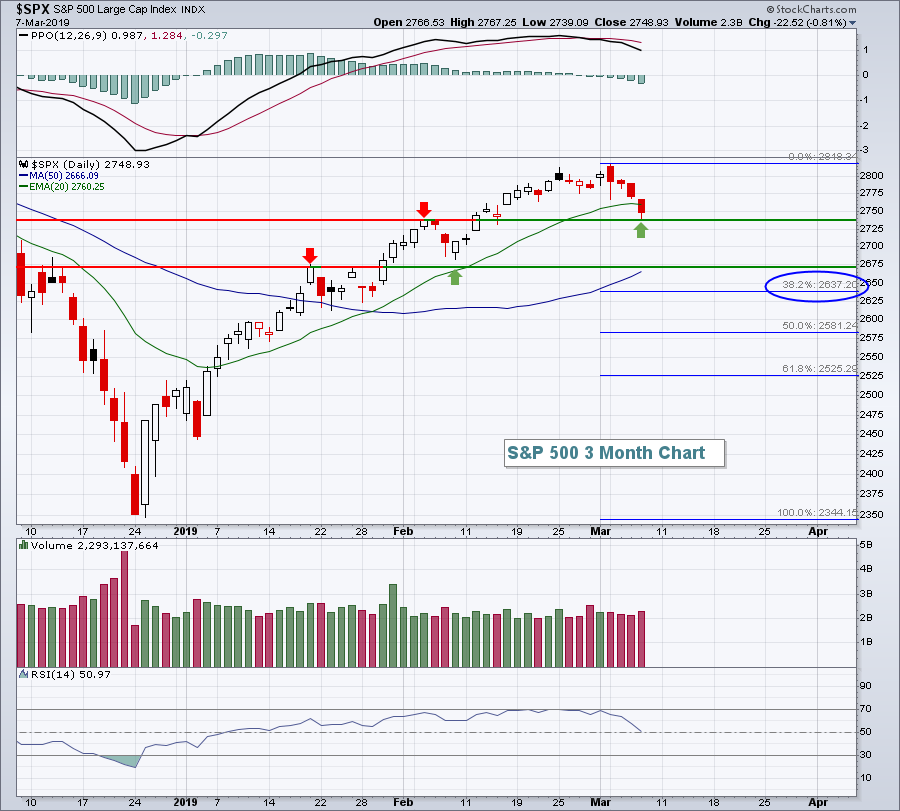

* 20-day Holds above 200-day for S&P 500

* Weekly RSI Holds above 50.

* Large-caps Lead Index Breadth.

* Tech, Utilities and REITs Lead Sector Breadth.

* The Dreaded Shakeout (VRTX).

* Consider Position Sizing (SCWX).

* Consider Profit Targets (PYPL).

* ChartList Updates.

... 20-day Holds above 200-day

... The S&P 500 sneezed last...

READ MORE

MEMBERS ONLY

Transports Going Along For The Ride

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, March 14, 2019

Thursday was a day of rest and bifurcated action. The Dow Jones gained ground, albeit a rather miniscule 7 points, but the other major indices fell. The Russell 2000, NASDAQ and S&P 500 dropped 0.40%, 0.16%, and 0.09%...

READ MORE

MEMBERS ONLY

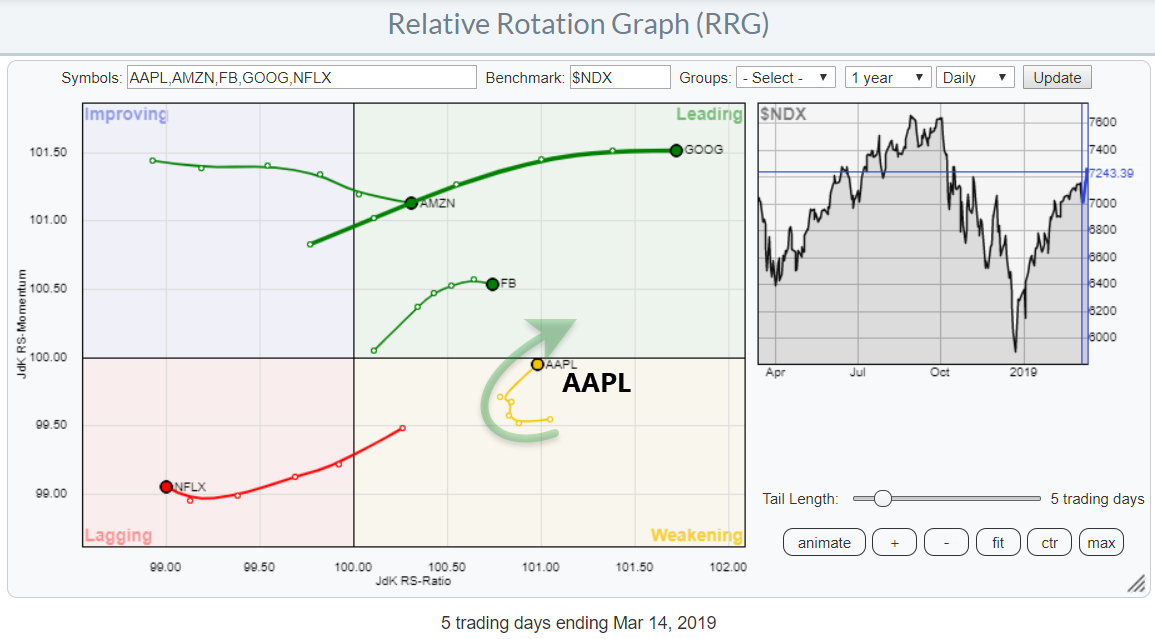

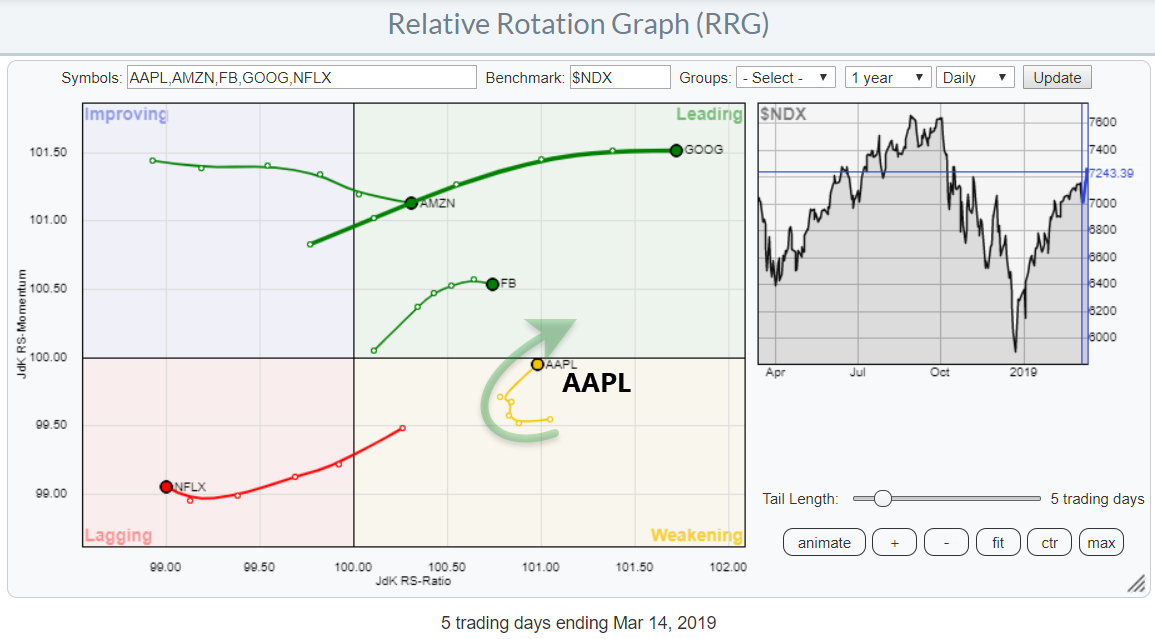

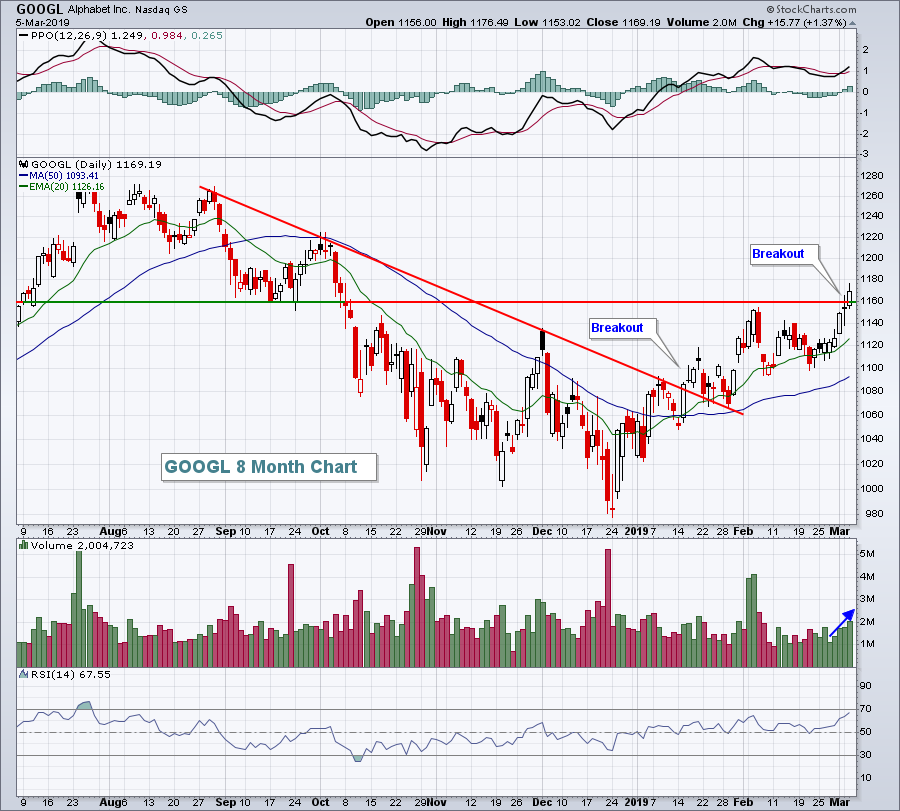

One A In FAANG Just Turned Back towards the Leading Quadrant

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

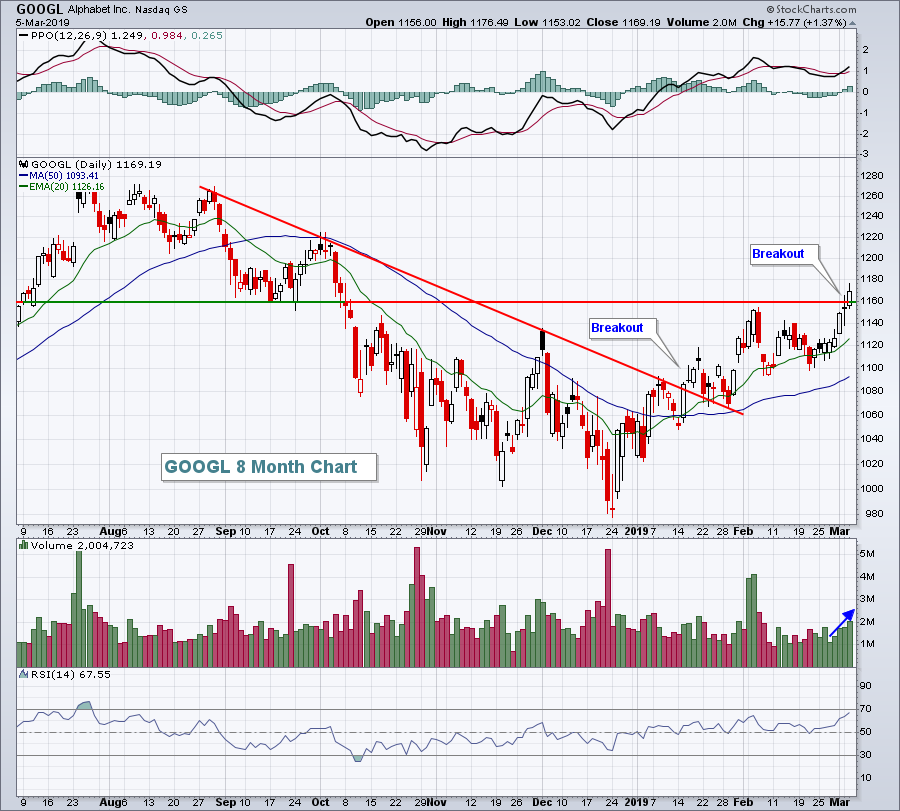

The Relative Rotation Graph shows the FAANG stocks against $NDX on a daily basis. The strong move of GOOG is evident and tracks the recent break of resistance.

Out of these five stocks, four are at the right-hand side of the graph, indicating a relative uptrend against the Nasdaq 100...

READ MORE

MEMBERS ONLY

Earnings Could Send ULTA Flying

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, March 13, 2019

It was another strong day on Wall Street. All 11 sectors moved higher for the second time this week. Industrials (XLI, +0.88%) represent the only sector to have posted a daily loss this week. The other 10 sectors have shown gains all...

READ MORE

MEMBERS ONLY

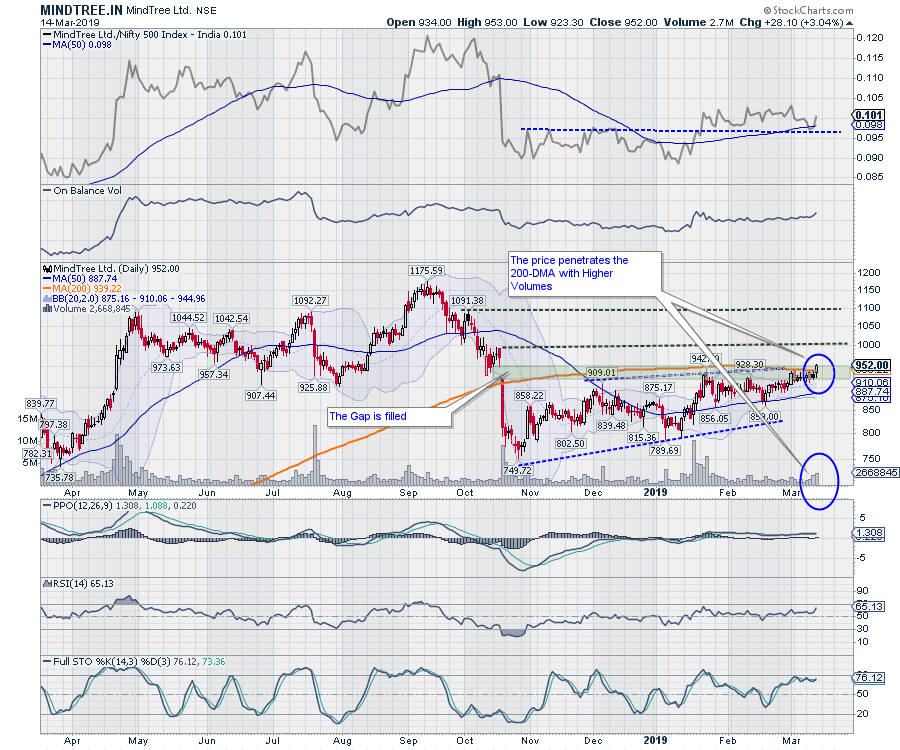

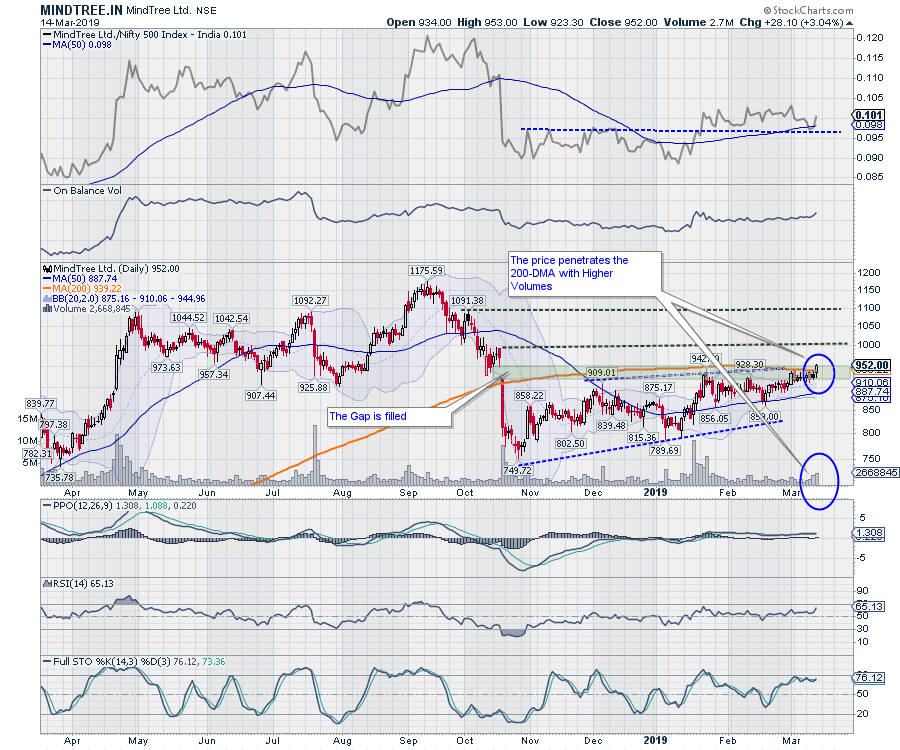

MINDTREE.in: Looking To Edge Higher

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

MindTree Limited's stock price ended with gains of Rs. 23.20 (+2.84%) in Wednesday's session on March 14, 2019. This price move appears very important from the technical perspective, as it has thrown up several signals that point towards MINDTREE.IN inching higher over the...

READ MORE

MEMBERS ONLY

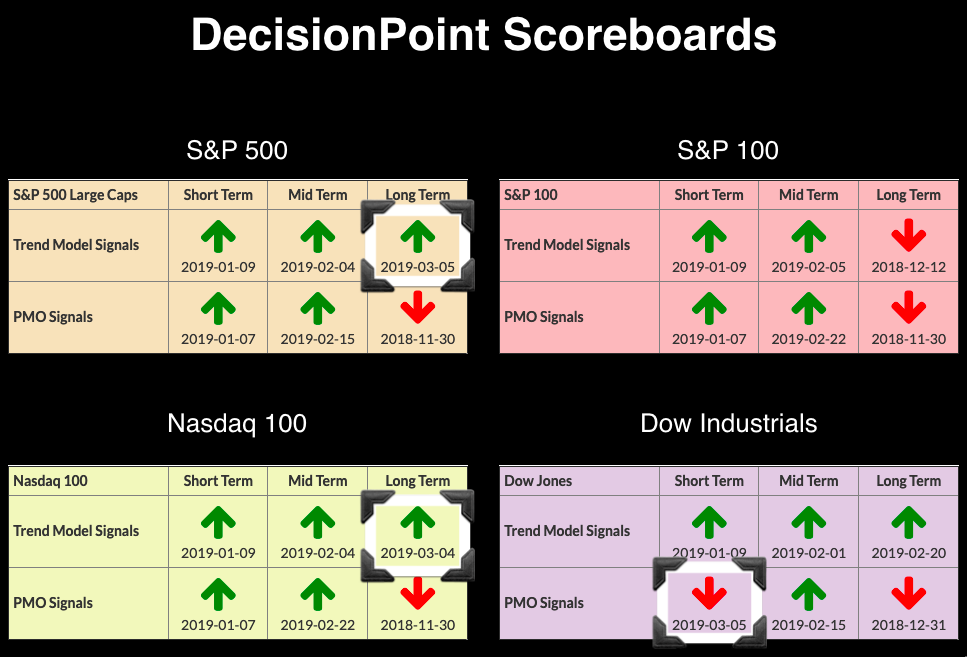

DP Alert: Oil (USO) and Bonds (TLT) Trigger New PMO BUY Signals

by Erin Swenlin,

Vice President, DecisionPoint.com

We have a new signal to add to the DecisionPoint Scoreboards, as the OEX triggered a Long-Term BUY signal on Monday. All of the large-cap Scoreboard indexes are now on Trend Model BUY signals in three timeframes. Additionally, we acquired two new BUY signals on Oil and Bonds, which I&...

READ MORE

MEMBERS ONLY

Diodes Returns to the Trend Mean

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Diodes (DIOD), a semiconductor stock, is returning to the trend mean and this could provide a bullish setup to take part in the long-term uptrend.

The chart below shows DIOD with a breakout and surge to new highs in February. Note that the stock also recorded new highs in autumn...

READ MORE

MEMBERS ONLY

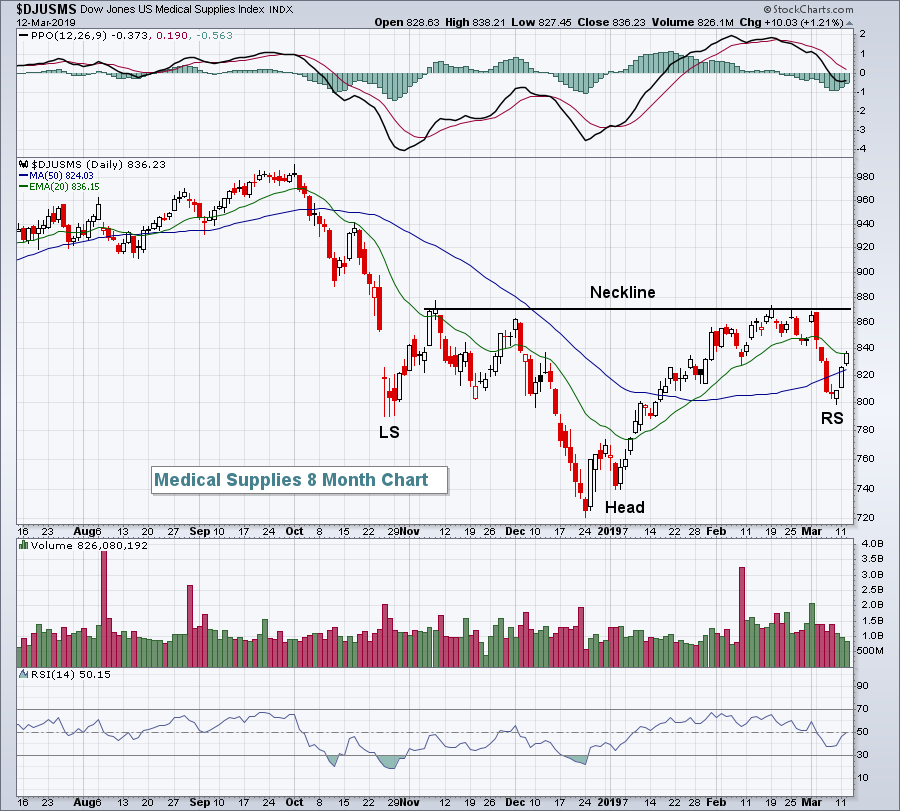

Internet Goes 'Round The (RRG) World In 20 Days

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

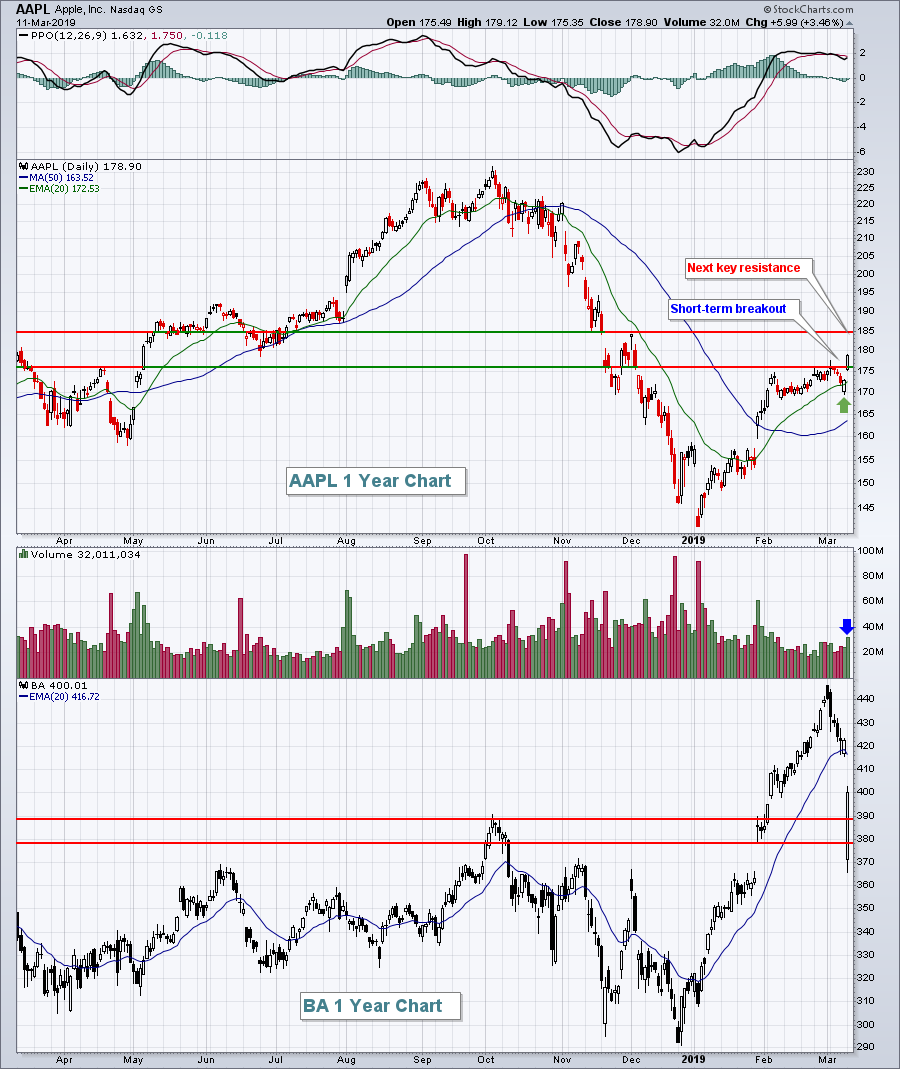

Market Recap for Tuesday, March 12, 2019

Boeing (BA, -6.15%) was once again a major drag on the Dow Jones as that index ended the session in negative territory (-0.38%), while our other indices were positive. The NASDAQ (+0.44%) was the best performing index as 10 of...

READ MORE

MEMBERS ONLY

A Disciplined Approach to Technical Analysis

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I’ll never forget the first time I did a simulated engine cutout at altitude. I was up in the air with my instructor, preparing to do some maneuvers, when he unexpectedly reached over and pulled out the throttle. The plane lurched forward, rapidly losing altitude, while my instructor turned...

READ MORE

MEMBERS ONLY

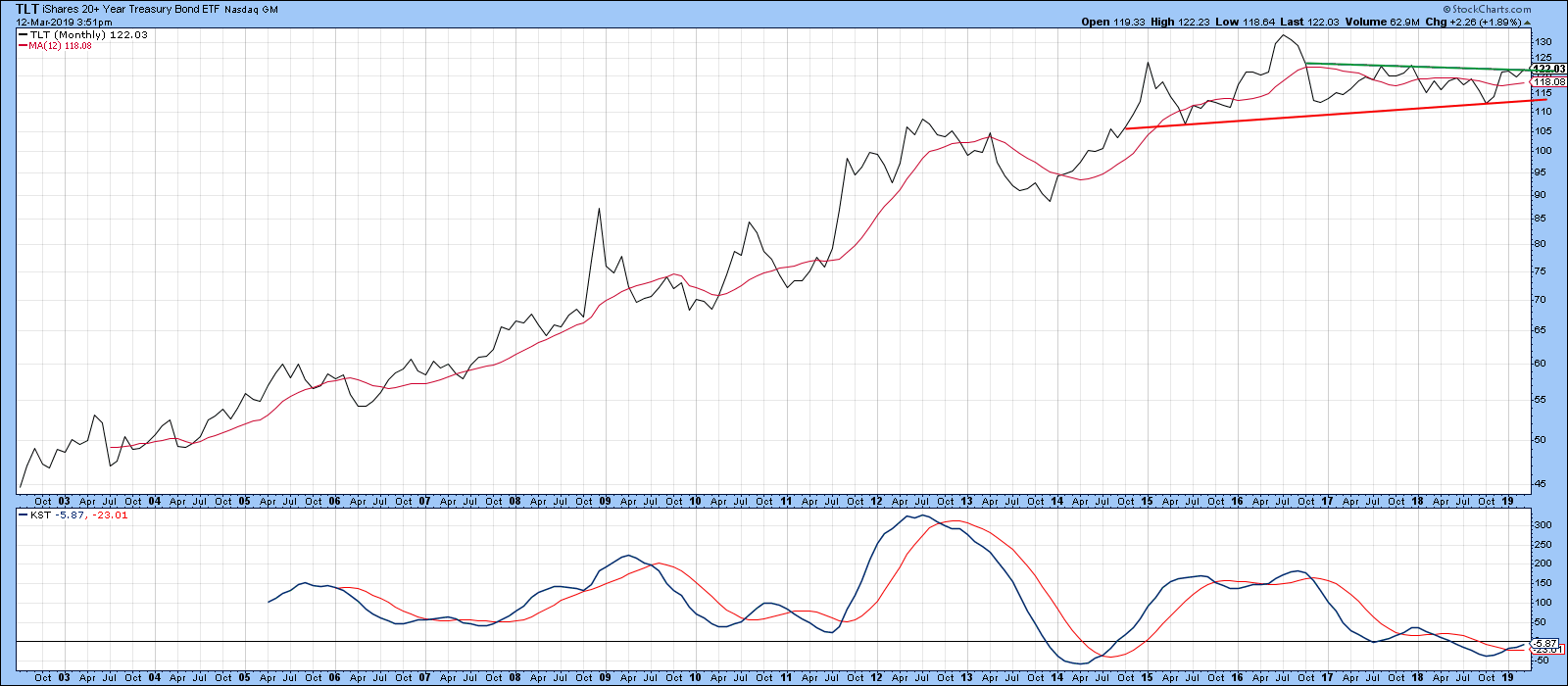

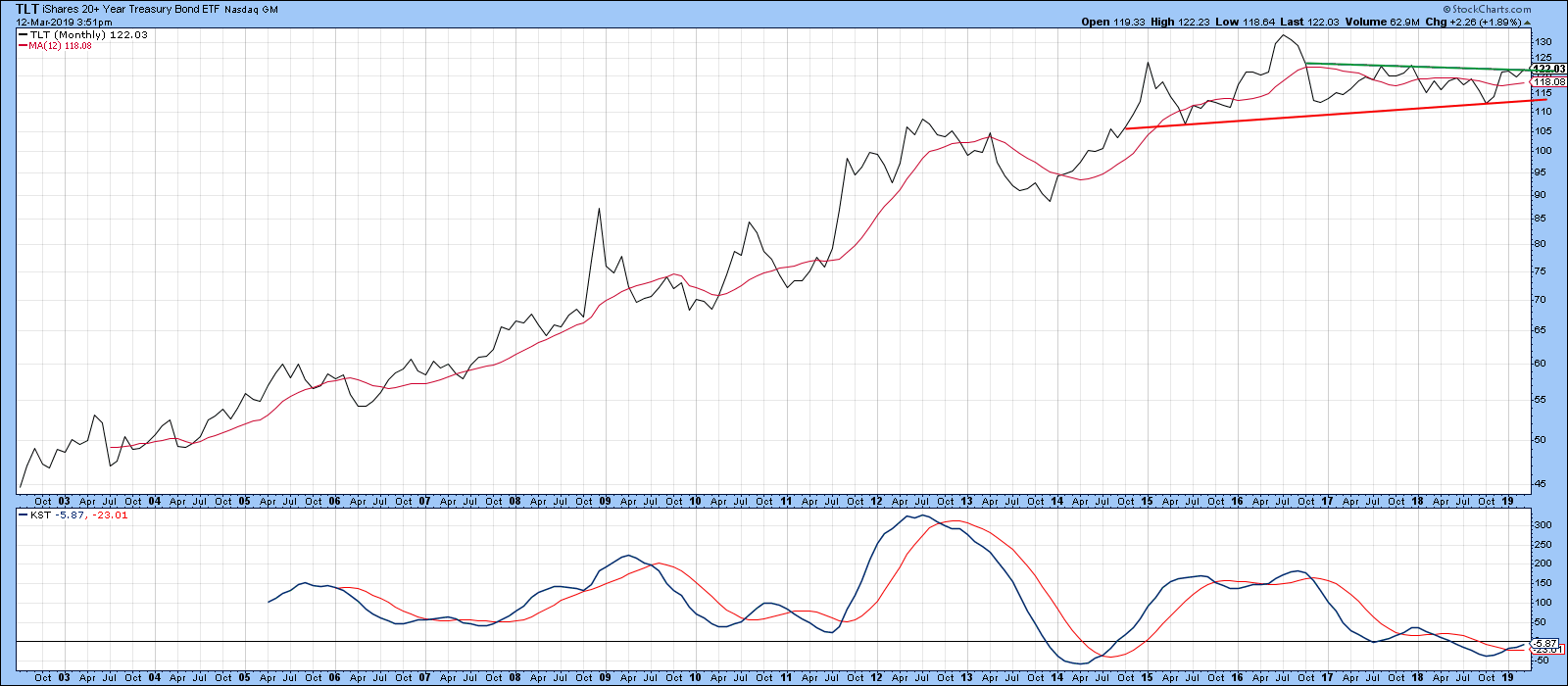

Bond Prices Poised For A Major Breakout, But Will They?

by Martin Pring,

President, Pring Research

* Adjusted vs. Unadjusted Prices

* Bonds Reflect the Fine Current Balance Between Inflationary and Deflationary Forces

Adjusted vs. Unadjusted Prices

Chart 1 shows that the iShares 20-year Trust ETF, the TLT, has been in a trading range since late 2014. Currently, the price is above its 12-month MA and the long-term...

READ MORE

MEMBERS ONLY

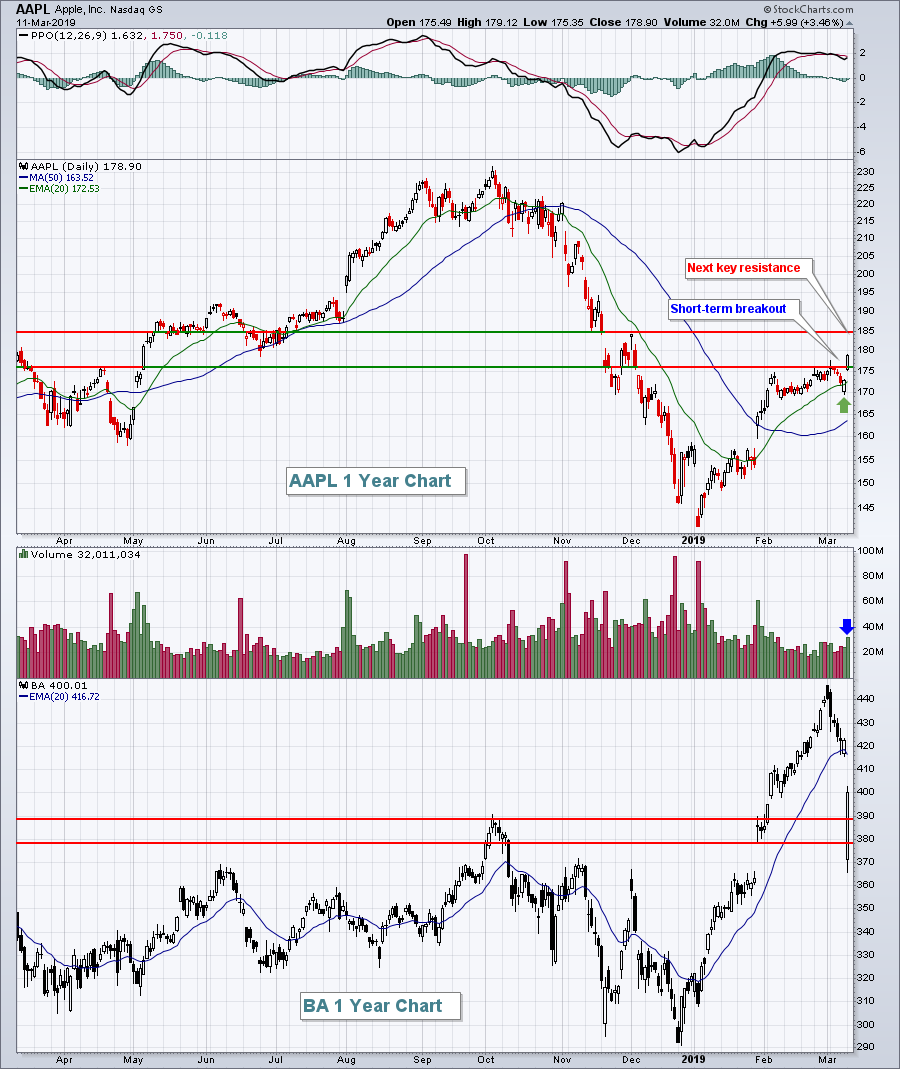

Market Rallies But Yield Spread Continues To Hurt Banks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, March 11, 2019

It never hurts to have Apple, Inc. (AAPL, +3.46%) breakout and that's what happened on Monday. It not only lifted the technology sector (XLK, +2.15%), but it provided a spark to our major indices as we experienced a "...

READ MORE

MEMBERS ONLY

Residential Constructive

by Bruce Fraser,

Industry-leading "Wyckoffian"

In August of 2018 we studied the Residential Construction industry group (click here to view). This group was very weak throughout 2018. After a sharp January decline a long period of Redistribution set in. Rising interest rates during the year became a headwind for the group. In September, the redistribution...

READ MORE

MEMBERS ONLY

TECHNOLOGY SECTOR LEADS TODAY'S REBOUND AND HOLDS ITS 200-DAY LINE -- SEMICONDUCTORS ARE HAVING AN EVEN STRONGER DAY -- THE NASDAQ AND S&P 500 REGAIN THEIR 200-DAY LINES -- THE DOW SHRUGS OFF BIG BOEING LOSS

by John Murphy,

Chief Technical Analyst, StockCharts.com

TECHNOLOGY SPDR HOLDS ITS 200-DAY LINE ... Stocks are off to a strong start for the week. All stock sectors are in the green today led by technology, energy, communications, financials, and cyclicals. All stocks sectors are also in the green with the technology-dominated Nasdaq in the lead. The Dow Industrials...

READ MORE

MEMBERS ONLY

Are We In For An Improved Market Breadth? The Level Of 9200 Holds The Key

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Indian markets saw a strong start to the week as the headline index ended with a robust gain of 132.65 points (+1.20%). With this move, the index has once again begun to attempt a breakout. This being said, over the past several weeks, the market breadth has...

READ MORE

MEMBERS ONLY

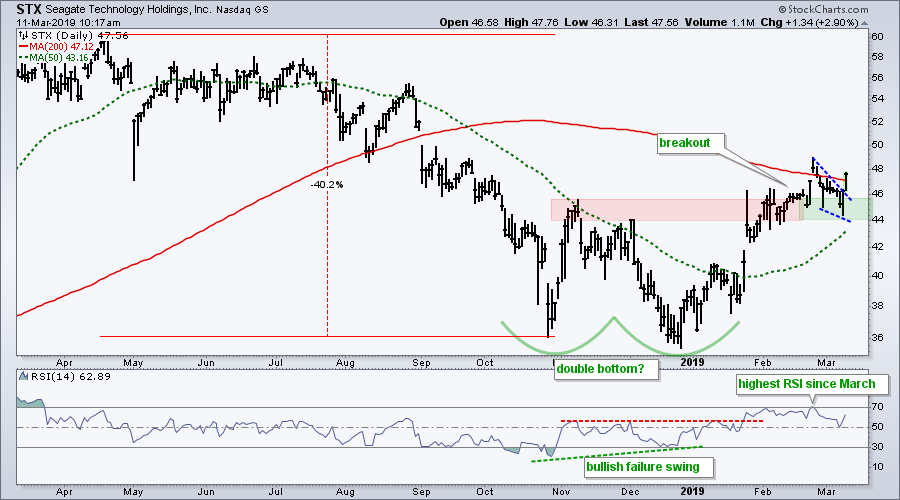

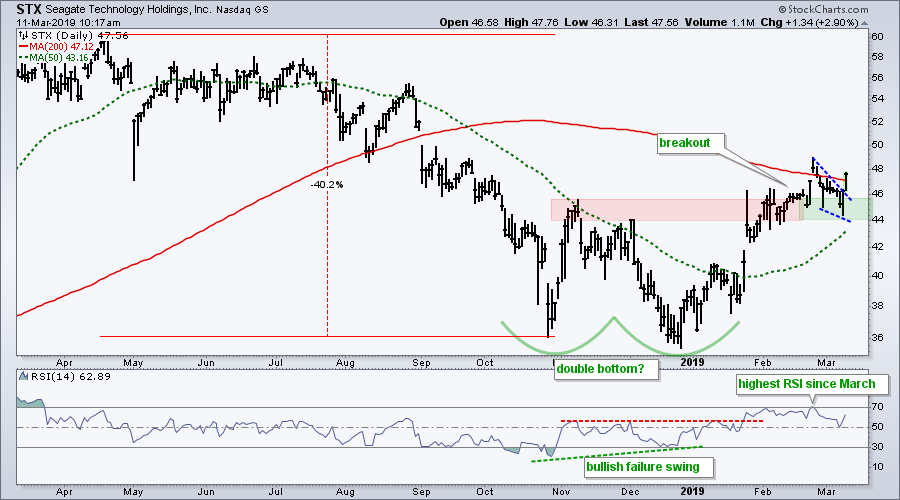

Seagate Rises from the Ashes

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Seagate Technology was one of the weakest tech stocks in 2018 as it fell around 40% from the April high to the October low. Things appear to be turning about here in 2019 as stock finds its footing and triggers two breakouts.

The chart below shows STX with two lows...

READ MORE

MEMBERS ONLY

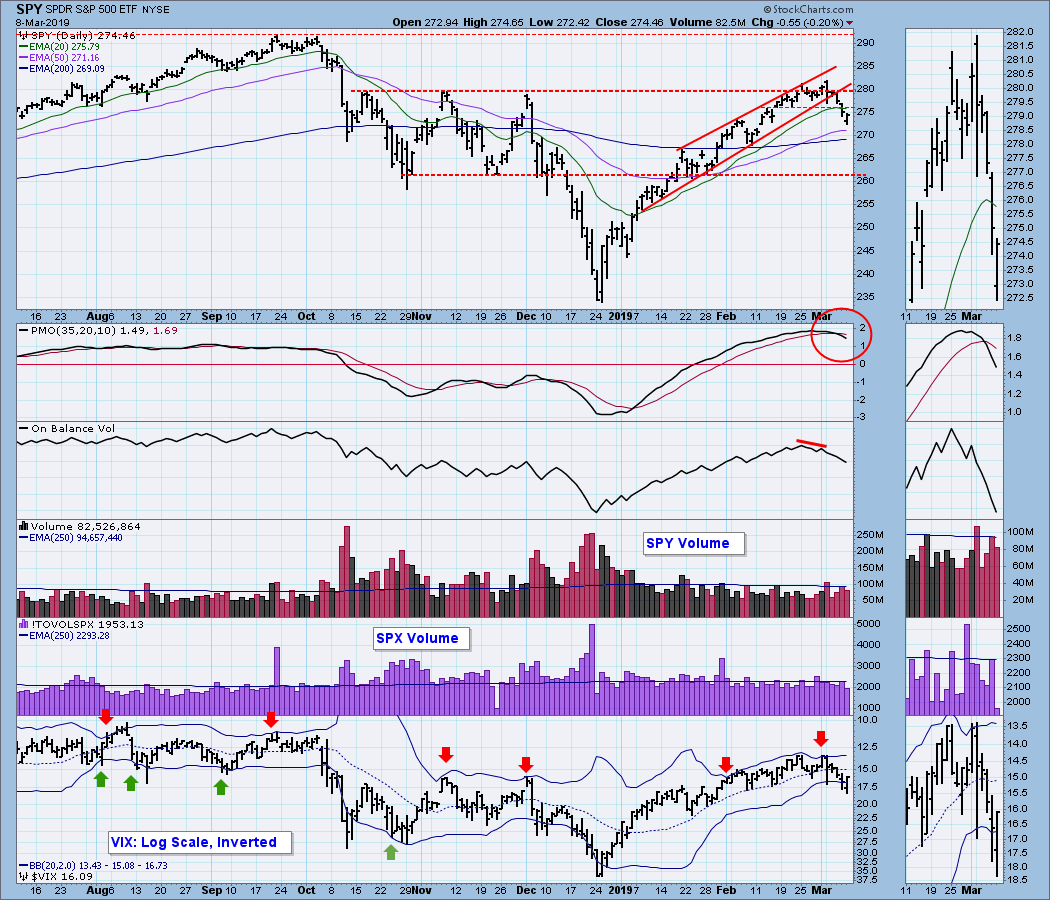

Poor Jobs, Big Reversal, What's Next?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, March 8, 2019

Friday started ugly. There's no way to sugar coat the worst jobs report in 18 months. Nonfarm payrolls fell way short of expectations, 20,000 actual vs. 175,000 consensus estimate. Slowing job growth was an excellent predictor of the last...

READ MORE

MEMBERS ONLY

BULL MARKET IN STOCKS REACHES ITS TENTH ANNIVERSARY TODAY -- AND IS THE LONGEST IN HISTORY -- THE ECONOMIC EXPANSION WILL HIT ITS TENTH ANNIVERSARY IN JUNE -- AND IS NEARING A NEW RECORD AS WELL

by John Murphy,

Chief Technical Analyst, StockCharts.com

HAPPY TENTH ANNIVERSARY... Today marks the tenth anniversary of the bull market in stocks that started on March 9, 2009. It's already the longest in history, and the first bull market to last ten years. According to the Wall Street Journal, the S&P 500 has gained...

READ MORE

MEMBERS ONLY

Week Ahead: Markets May Remain Tentative; These Pockets Likely To Relatively Outperform

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The past week fared better than the one prior as the market added more to its gains. A major portion of the weekly gains was posted in the first half, while the last two sessions were spent amid consolidation. In a 4-day week, the headline index NIFTY50 ended with weekly...

READ MORE

MEMBERS ONLY

DP WEEKLY WRAP: Market Breaks, Gold Fakes

by Carl Swenlin,

President and Founder, DecisionPoint.com

It took over two weeks, but the market top we've been looking for finally materialized. Price broke down through a rising bottoms line that goes back to the beginning of January. Also violated was the bottom of the trading range that has lasted over two weeks. At very...

READ MORE

MEMBERS ONLY

CONSUMER DISCRETIONARY SPDR FALLS BACK BELOW 200-DAY AVERAGE -- APPAREL RETAILERS ARE LEADING THE S&P 500 RETAIL SPDR LOWER -- AMAZON.COM ISN'T DOING MUCH BETTER -- CONSUMER CYCLICALS/STAPLES RATIO IS ALSO WEAKENING

by John Murphy,

Chief Technical Analyst, StockCharts.com

CONSUMER DISCRETIONARY SPDR IS BACK BELOW ITS 200-DAY AVERAGE... As of today, the Nasdaq Composite Index and the S&P 500 are trading back below their 200-day averages. That leaves only the Dow Industrials still above that long-term support line. A number of sector ETFs have either failed a...

READ MORE

MEMBERS ONLY

Reliability of Pattern Recognition

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I developed this method primarily for candle pattern identification when I wrote my book, Candlestick Charting Explained (the book was first published in 1992 and now is in its third edition). The reliability concept equally applies to any type of pattern, including the many chart patterns widely used in technical...

READ MORE

MEMBERS ONLY

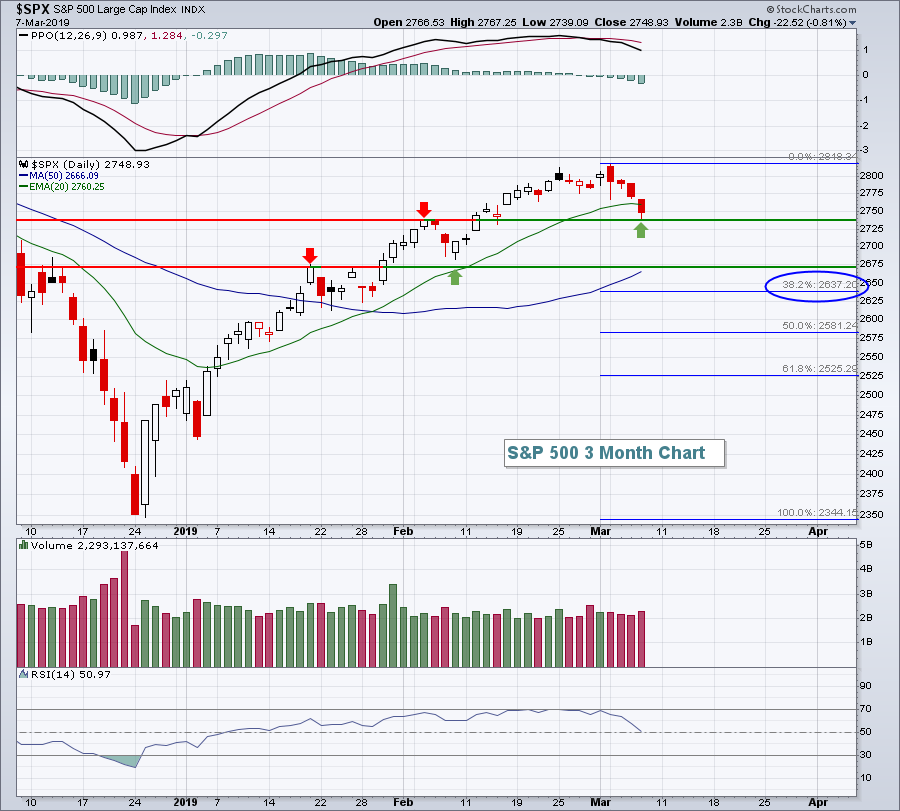

Weekly Market Review & Outlook - Everywhere and Nowhere for SPX

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* The First Pullback of the Year.

* A Big Drawn-out Range.

* Index Breadth Table Update.

* Sector Table Update.

* Finance Fails below November High.

* Retail and Banks Get Pummeled.

* A Bullish Continuation for Bonds.

* ChartList Updates.

... The First Pullback of the Year

... The S&P 500 fell the last four days...

READ MORE

MEMBERS ONLY

Jobs Disappoint; Dollar Breakout Bad For Energy, Materials

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, March 7, 2019

Selling in U.S. equities continued for a fourth consecutive session as this is easily the most difficult period in 2019 for the equity bulls. The first technical breakdown occurred on daily charts as all of our major indices closed beneath their respective...

READ MORE

MEMBERS ONLY

Dollar Breaks To New Highs As Several Stock Averages Drop Below Their 200-Day Moving Averages

by Martin Pring,

President, Pring Research

* Dollar Diffusion Gives a Buy Signal

* Differential Interest Rates Turn Bullish for the Dollar

* $NYA and $COMPQ Drop Below Their 200-Day MAs

One would think that a record trade deficit would be bearish for the dollar. However, the market does not agree, as the Invesco Bullish Dollar ETF (UUP) just...

READ MORE

MEMBERS ONLY

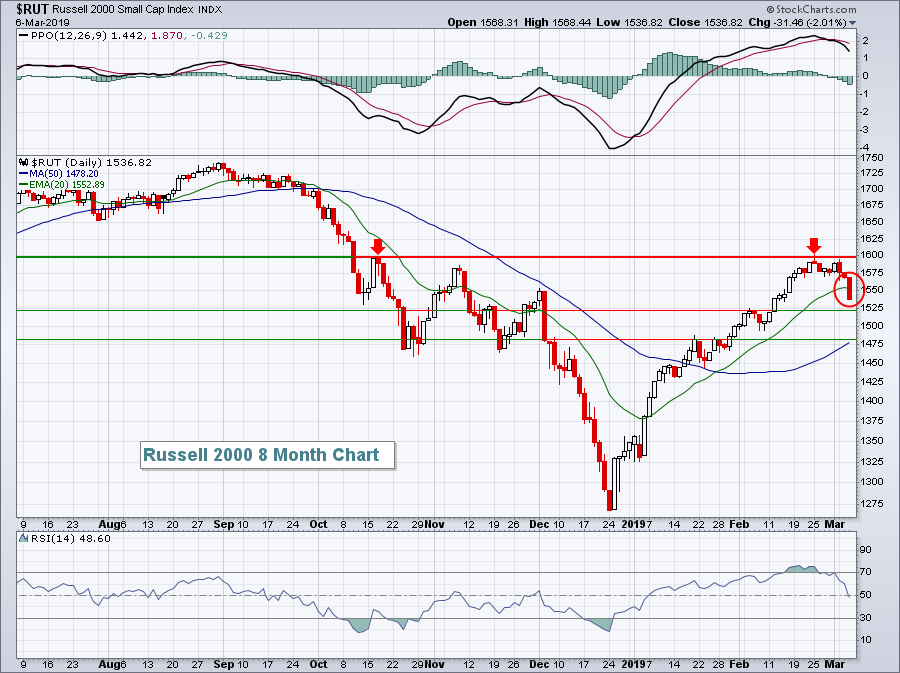

SMALL CAPS AND TRANSPORTS CONTINUE TO LEAD STOCKS LOWER -- STOCK INDEXES UNDERCUT 20-DAY AVERAGES -- AND ARE THREATENING 200-DAY LINES -- BOND PRICES RALLY -- EUROZONE BOND PRICES RISE ON MORE DOVISH ECB -- A PLUNGING EURO PUSHES DOLLAR TO TWO-YEAR HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

GLOBAL STOCKS TURN DOWN FROM OVERBOUGHT TERRITORY... Several of the writers on this site have been pointing out that the strong 2019 stock rally had become over-extended, and was up against formidable chart resistance at their November high. So it's not a big surprise to see some profit-taking...

READ MORE

MEMBERS ONLY

VIX Clears First Key Level, Bears Regain Grip

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

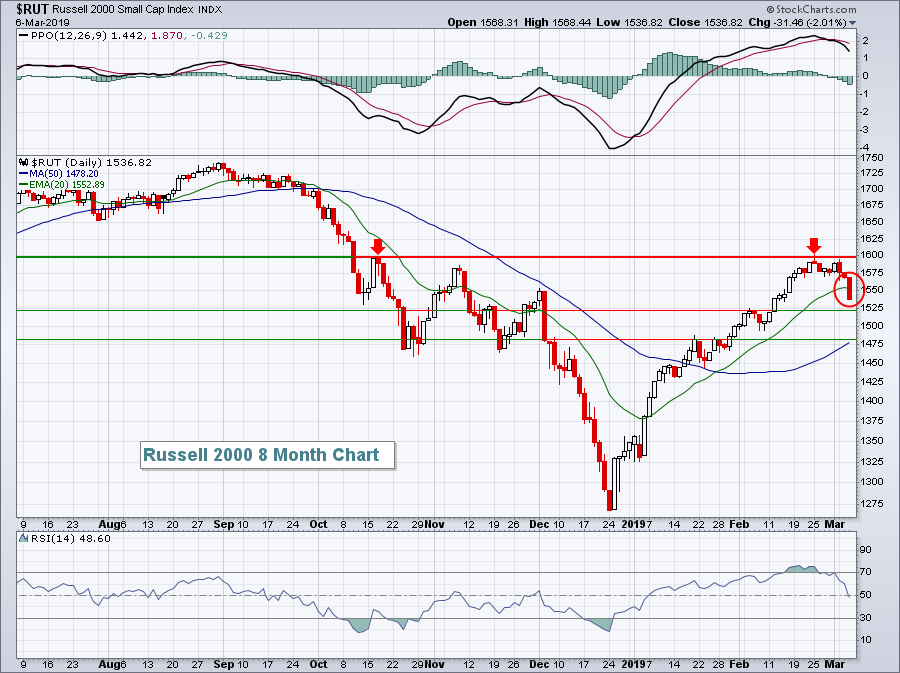

Market Recap for Wednesday, March 6, 2019

All of our major indices took a hit yesterday, including the small cap Russell 2000 ($RUT), which once again lagged badly and dropped another 2.01%. The RUT was easily the worst performer as the Dow Jones, S&P 500 and NASDAQ...

READ MORE

MEMBERS ONLY

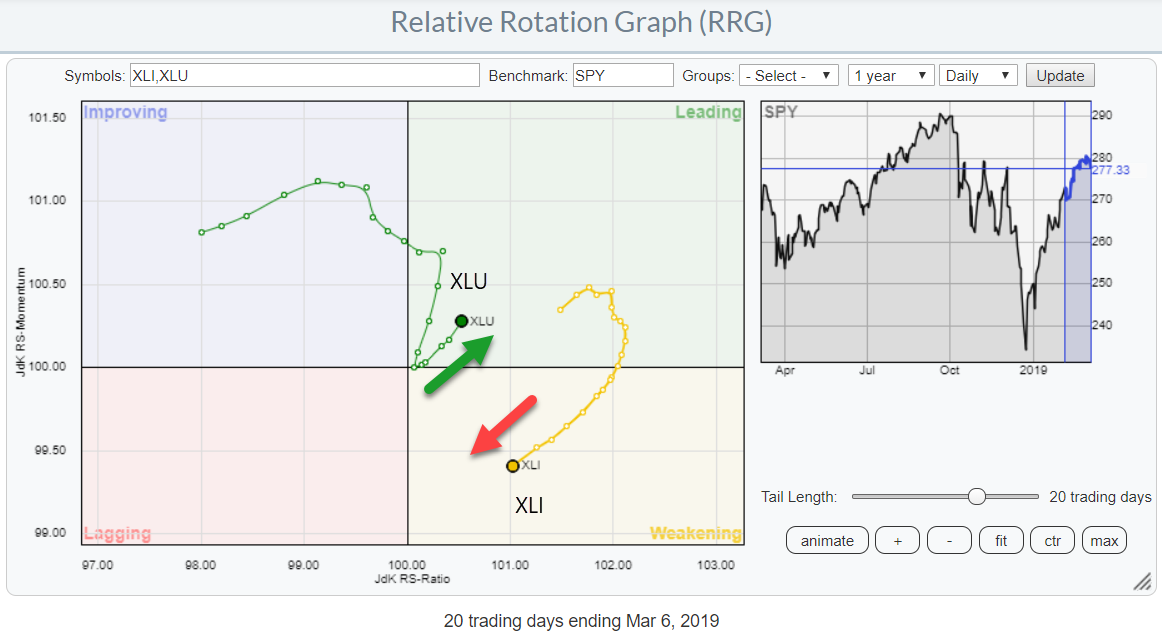

Spotting A Pair Trade On Relative Rotation Graph Of US Sectors

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

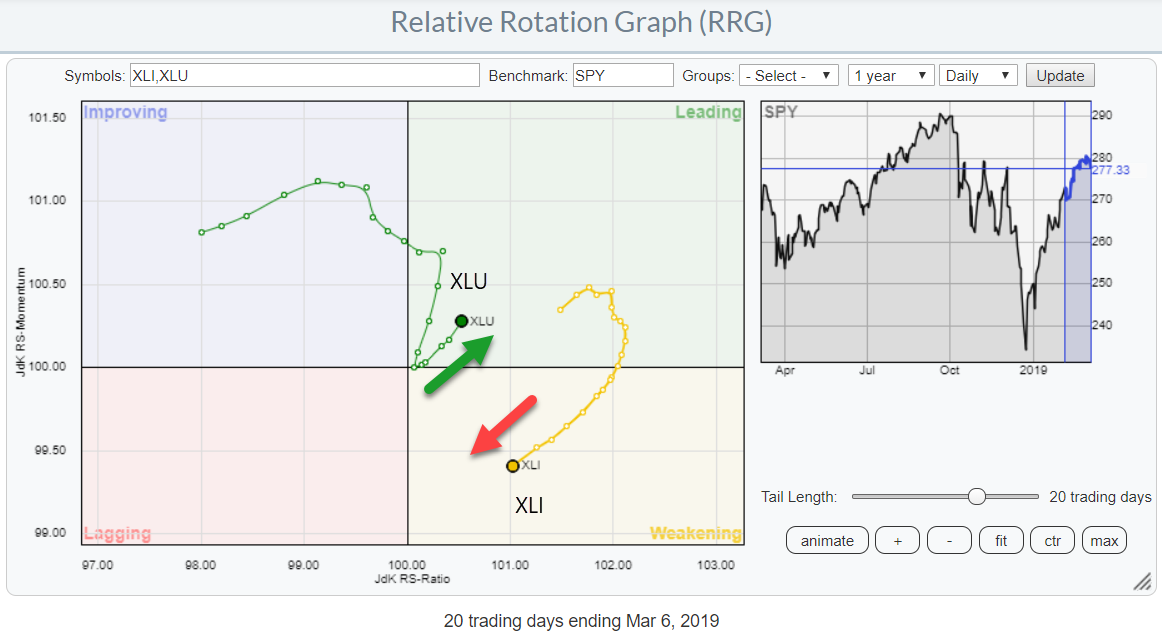

The above Relative Rotation Graph shows the daily rotation over the past 20-days for the Utilities and Industrials sectors.

I have isolated the tails of these two sectors to be able to show them in more detail and highlight the opposite directions that they started moving in.

When you bring...

READ MORE

MEMBERS ONLY

DP Alert: SPX Triggers New Short-Term PMO SELL Signal - Wedge Finally Breaks Down

by Erin Swenlin,

Vice President, DecisionPoint.com

This will be fairly brief today, as I am in the process of moving to a new home and it's a bit crazy over here. It's important to note the new ST PMO BUY signal, which occurred on a PMO positive crossover on the SPX daily...

READ MORE

MEMBERS ONLY

Relative Strength Says We're Going Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, March 5, 2019

Another weak start and the inability to finish well contributed to minor losses across our major indices on Tuesday. Relative weakness in the small cap Russell 2000 resulted in a 0.45% loss there, while our other major indices fell more modestly -...

READ MORE

MEMBERS ONLY

Tilray Goes from Most Exciting to Most Boring

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Tilray (TLRY) listed on the Nasdaq at $17 with an IPO in July and promptly surged above $300. The stock then worked its way below 100 over the next few months and managed to stabilize in the 65 to 80 zone this year.

The chart below shows the Bollinger Bands...

READ MORE

MEMBERS ONLY

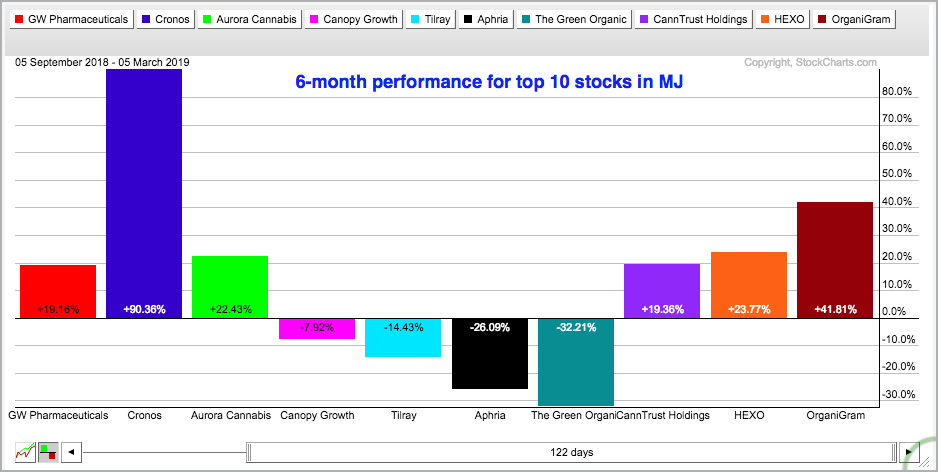

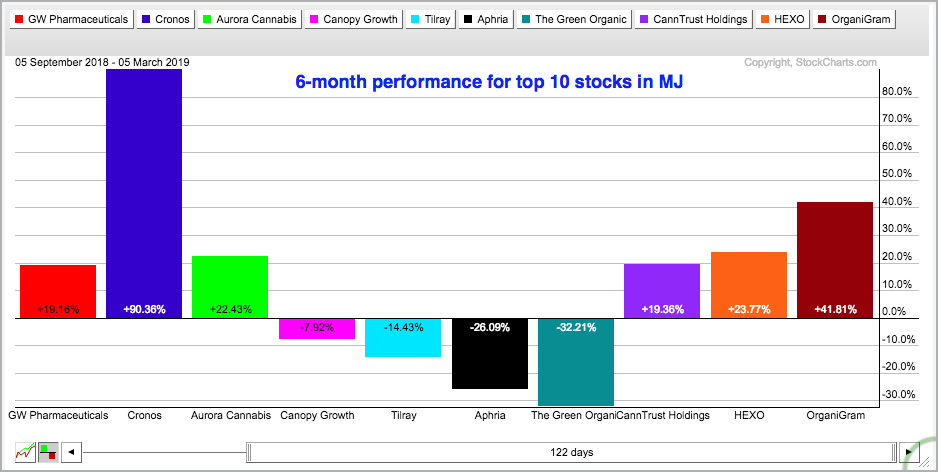

Are Cannabis Stocks Poised to Go Higher?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Sorry, I could not resist that title. Today's commentary will focus on the Alternative Harvest ETF (MJ) and six of its components. I am sure there are other cannabis-related names out there, but I would like to focus on the purer plays. For example, the Advisor Shares Vice...

READ MORE

MEMBERS ONLY

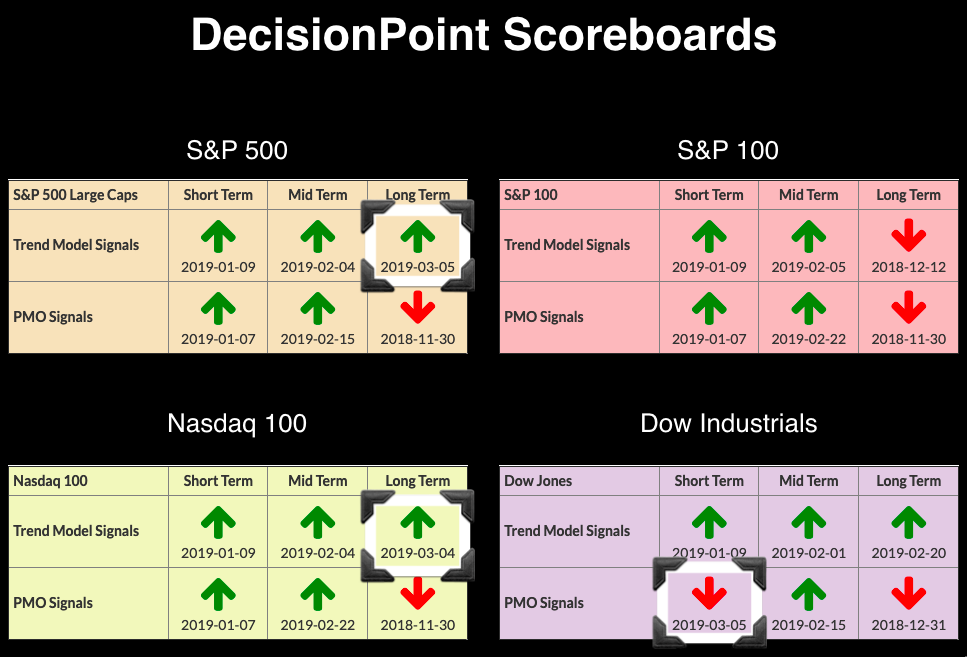

DP Bulletin: LT Trend Model BUYs on SPX and NDX - ST PMO SELL on Dow

by Erin Swenlin,

Vice President, DecisionPoint.com

The new Long-Term Trend Model (LTTM) BUY signals triggered on the SPX yesterday (3/4) and on the NDX today (3/5). We are probably seeing these just in time for a pullback or correction ahead. The Dow seems to agree, as it generated a new ST PMO SELL signal....

READ MORE

MEMBERS ONLY

Beware The Ides of March - and an Overstretched Stock Market

by Martin Pring,

President, Pring Research

* Strong Broadly-Based Rally

* NYSE Declining Peaks and Troughs Still in Force

* Several Short-Term Indicators Starting to Point South

Strong Broadly-Based Rally

The rally dating from Christmas Eve has been a powerful one, generating an approximate 20% gain from its low. It has also been broad, not only enabling the NYSE...

READ MORE

MEMBERS ONLY

KOHLS AND TARGET LEAD RETAILERS HIGHER -- RETAIL SPDR REMAINS BELOW 200-DAY LINE -- HOME CONSTRUCTION ISHARES FALL BELOW ITS 200-DAY LINE -- SO DO LENNAR AND DR HORTON -- STOCK INDEXES HOLD STEADY AFTER MODEST PROFIT-TAKING

by John Murphy,

Chief Technical Analyst, StockCharts.com

KOHLS AND TARGET LEAD RETAILERS HIGHER ... Chart 1 shows Kohls (KSS) surging 7% to clear its 200-day average and trade at the highest level since November. Chart 2 shows Target (TGT) up nearly 5% and also trading at the highest level in three months. The broadline retailer is also trading...

READ MORE