MEMBERS ONLY

DOLLAR INDEX MAY BE NEARING AN UPSIDE BREAKOUT -- SEVERAL FOREIGN CURRENCIES HAVE FAILED TESTS OF 200-DAY AVERAGES -- THE EURO MAY RETEST NOVEMBER LOW -- THE RISING DOLLAR WEAKENS COMMODITY PRICES -- ESPECIALLY BASE METALS AND ENERGY

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOLLAR INDEX NEARS NEW HIGH... The recent upturn in the dollar is continuing today. The daily bars in Chart 1 show the Invesco U.S. Dollar Index Fund (UUP) jumping to the highest level in two months and nearing a challenge of its December high. A close above that chart...

READ MORE

MEMBERS ONLY

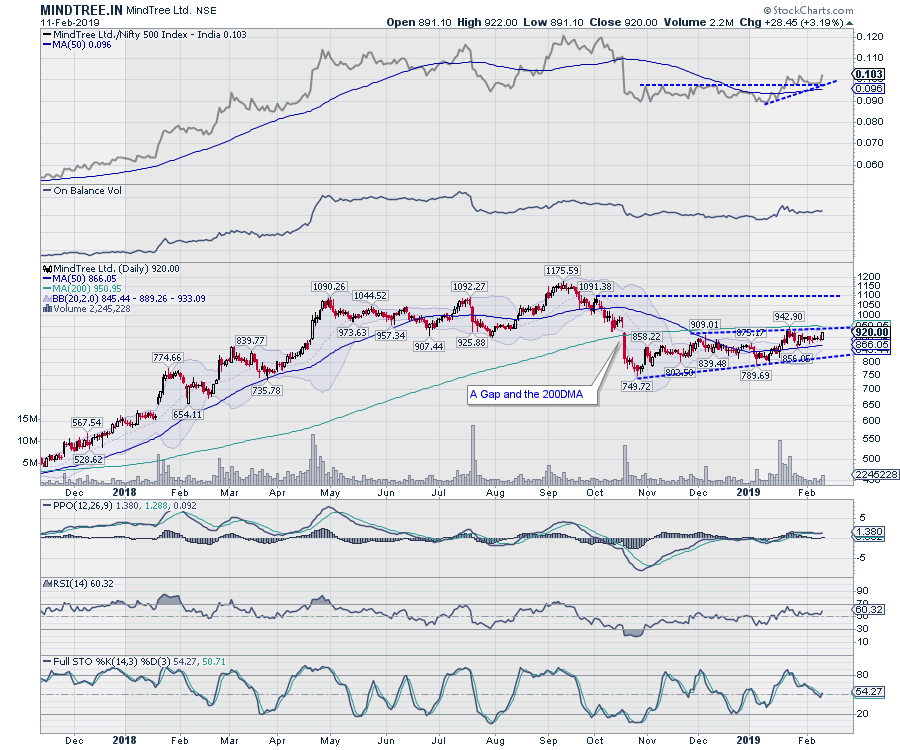

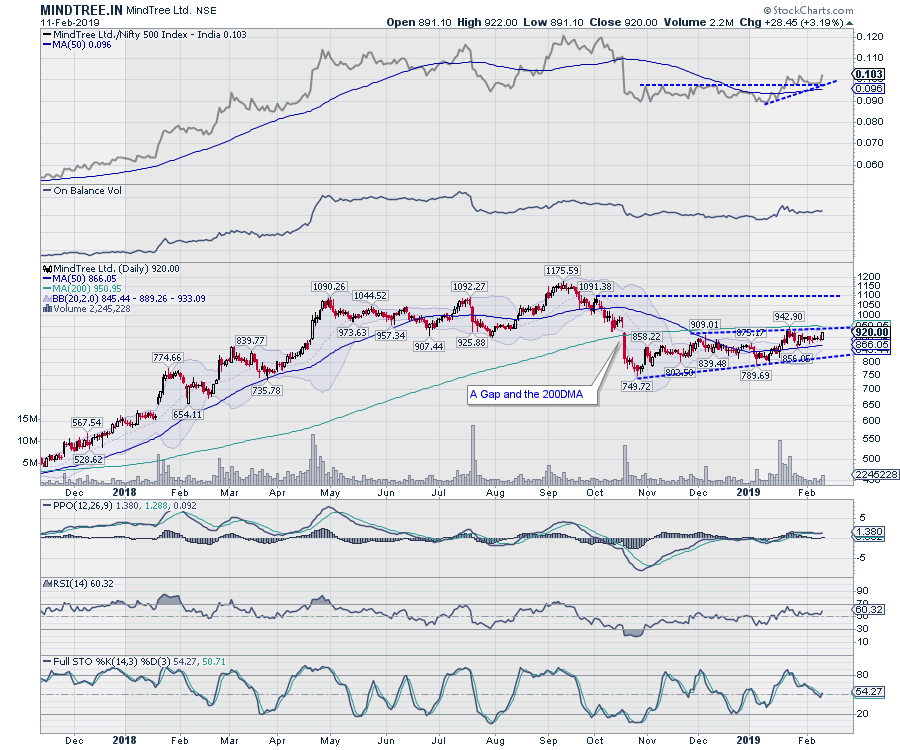

MINDTREE.IN: Good Up-Move In The Offing If This Level Is Crossed

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

While the markets have been suffering from fractured breadth and the NIFTY moved below 10950 (its breakout level) following a strong throwback, the CNXIT index has crawled back into the leading quadrant of the Relative Rotation Graph (RRG). This means that the IT pack is likely to relatively out-perform the...

READ MORE

MEMBERS ONLY

Bank Of America Looks Like A Winner

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, February 8, 2019

Friday was a solid day for the bulls. It wasn't because we saw large gains, because we didn't. In fact, it was bifurcated action where the S&P 500, NASDAQ and Russell 2000 barely closed higher with gains...

READ MORE

MEMBERS ONLY

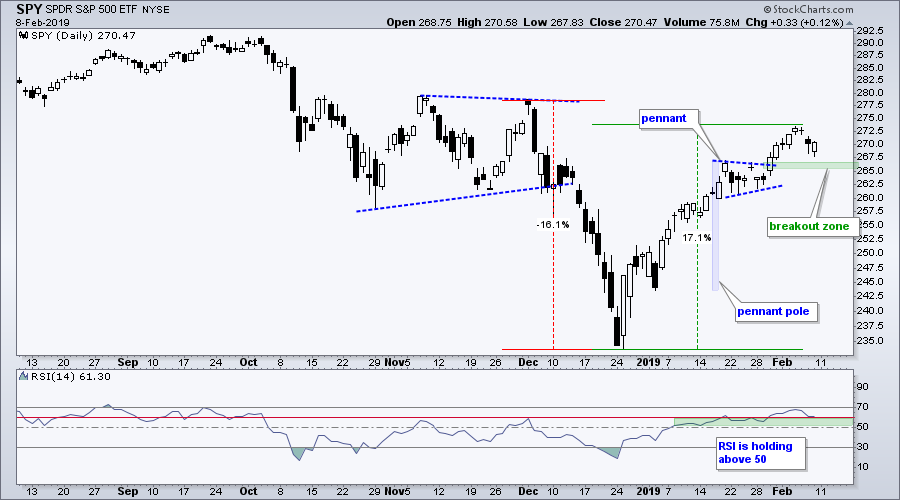

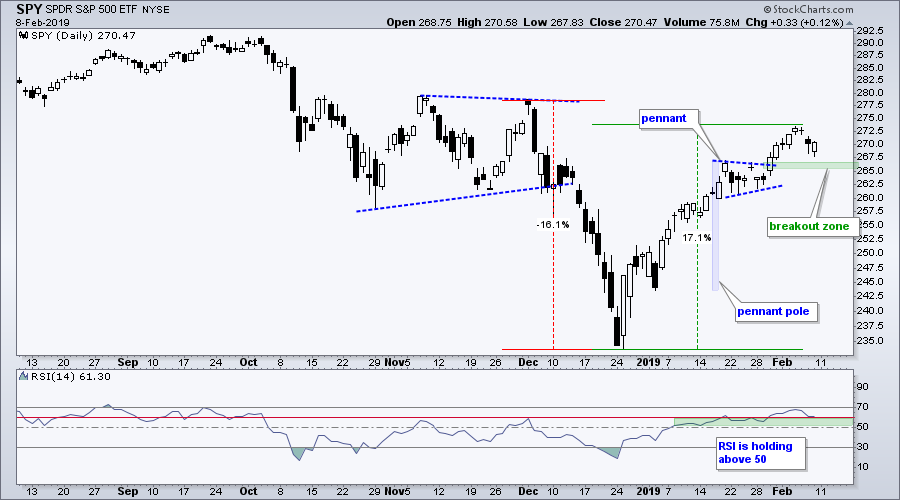

Pennant Breakouts Remain in Play for SPY and QQQ - Six Stocks Consolidating above their 200-day SMAs

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

... The stock market took a rest last week as the S&P 500 stalled in the 2708 area, which is just below the 200-day SMA. Note that the S&P 500 rose 24 of the last 31 days and gained around 15% in six weeks. It still looks...

READ MORE

MEMBERS ONLY

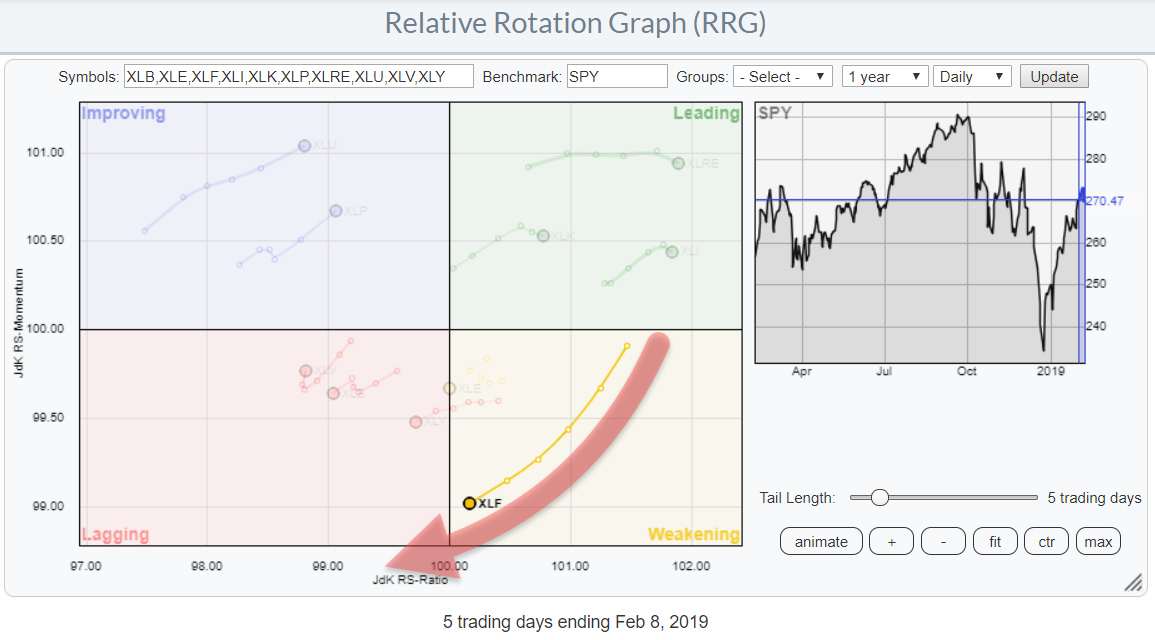

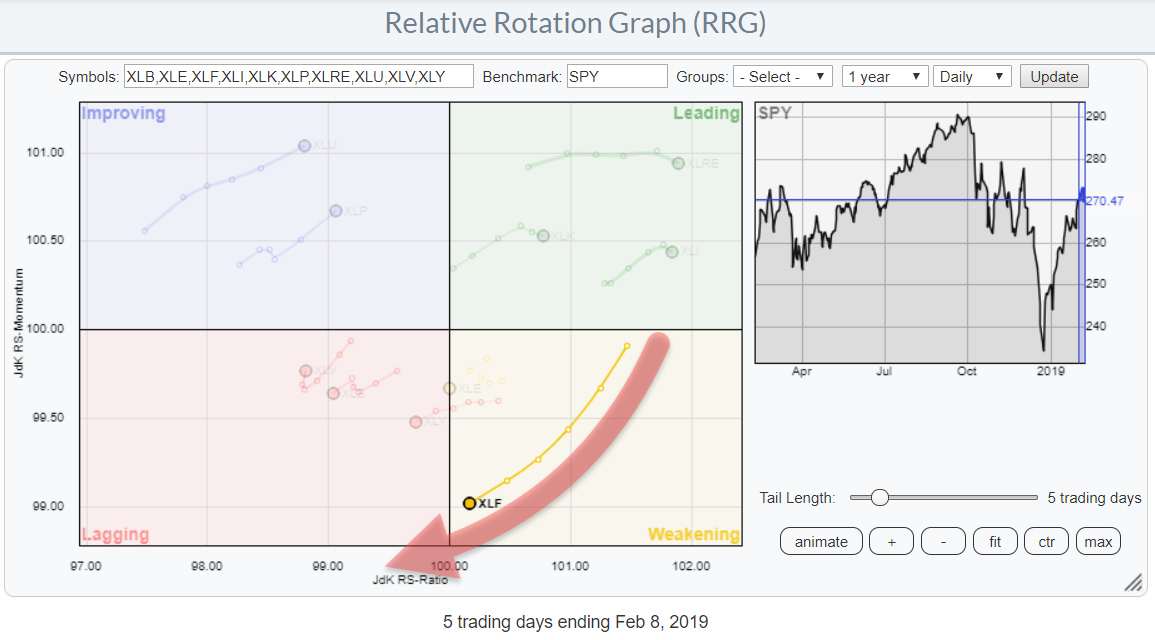

Watch Out For More Weakness In Financials This Week!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the daily Relative Rotation Graph for US sectors, the rotation of Financials stands out. The tail is relatively long, indicating that there is good momentum behind this move,

The bad news is that the rotation is taking place inside the weakening quadrant and has almost reached the lagging quadrant....

READ MORE

MEMBERS ONLY

Microsoft Bids for a Momentum Shift

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Microsoft is battling the rising 200-day moving average and making a bid to shift momentum back to the bulls.

The chart shows MSFT falling along with the market from October to December and then rebounding sharply in January. The stock is currently consolidating around the 200-day SMA with a pennant,...

READ MORE

MEMBERS ONLY

This Stock May Out-Perform The Broader Markets

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Indian market suffered a severe throwback, having broken out above the 10950 mark on Wednesday but returning all those gains by end of the week. The market breadth has not been healthy at all and remains a matter of concern. Amid such turbulence, this stock deserves some attention, as...

READ MORE

MEMBERS ONLY

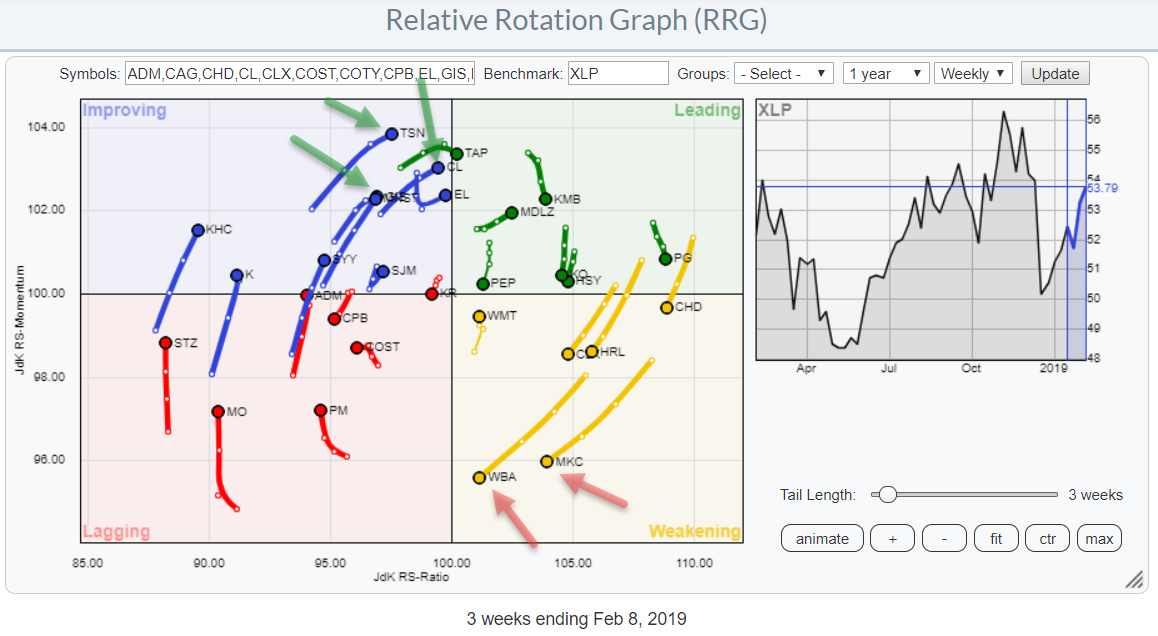

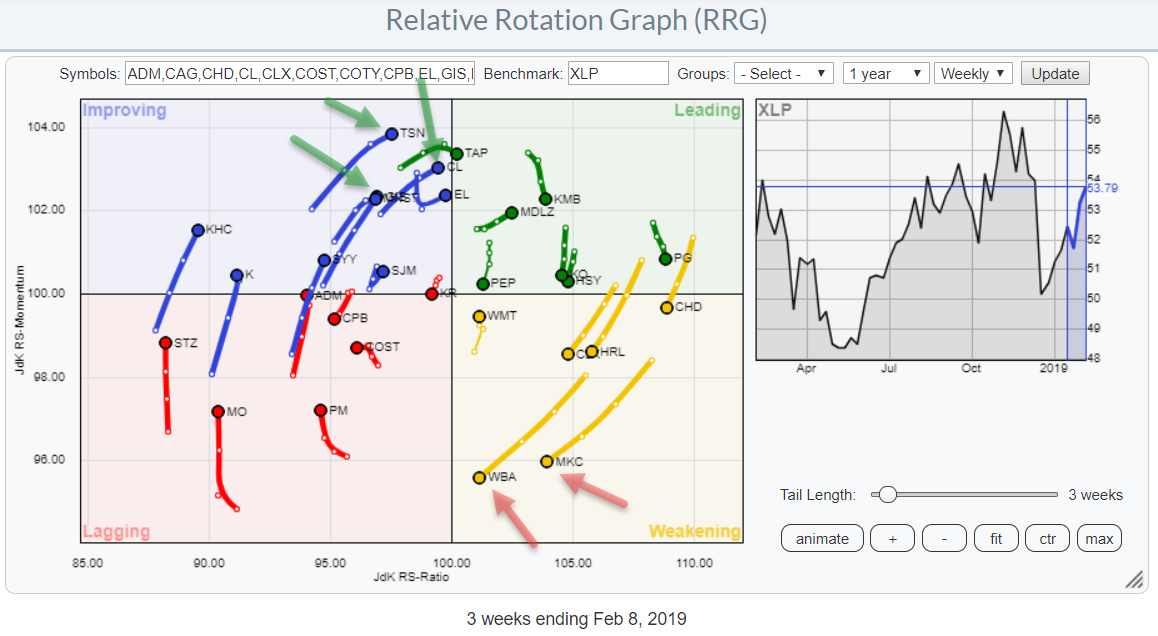

The Staples Sector Is Improving, But Which Stocks Deserve Attention?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph shows the rotation of the stocks in the Consumer Staples sector against XLP, the Consumer Staples sector index.

Keen observers may notice that I have left out COTY and CAG because they are very disconnected and distorting the picture. If you click on the image and...

READ MORE

MEMBERS ONLY

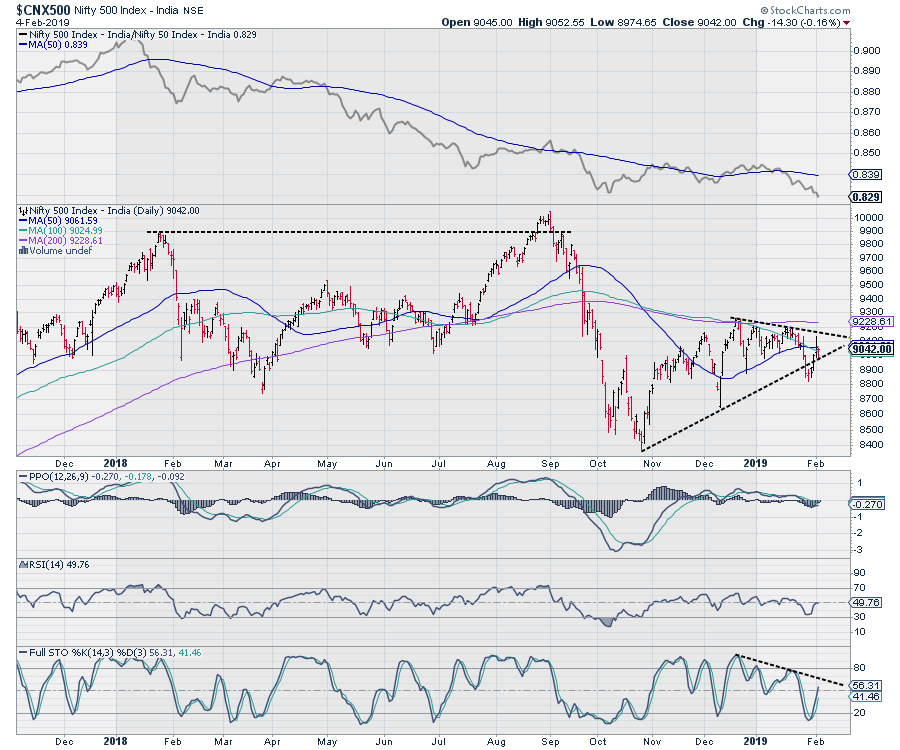

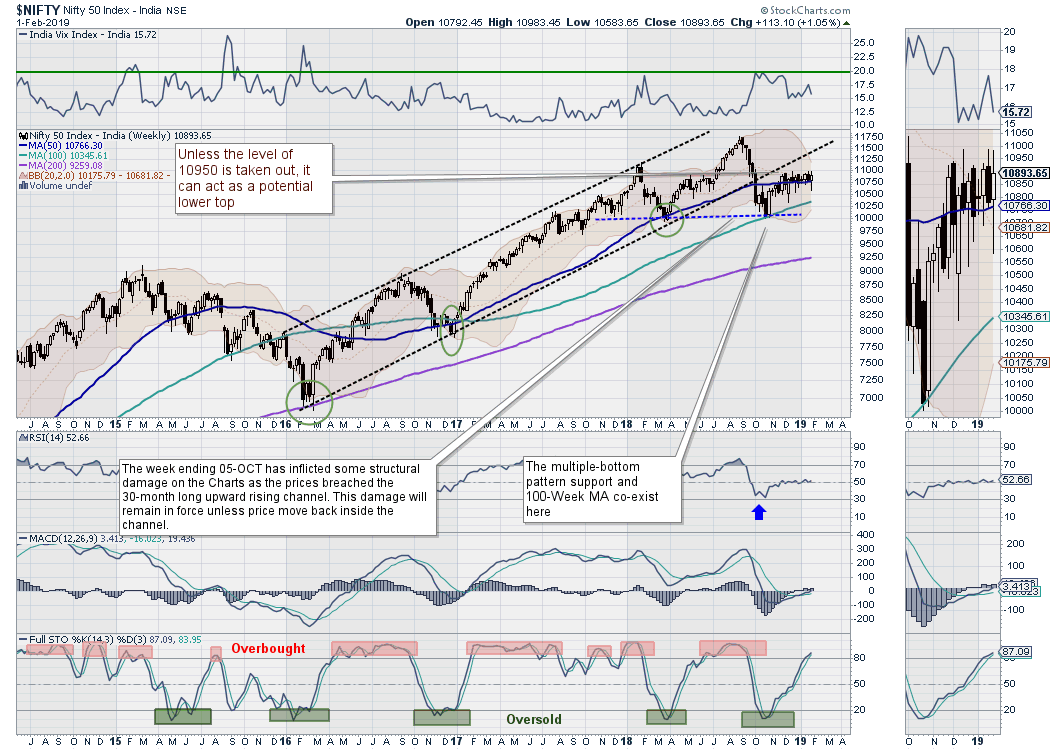

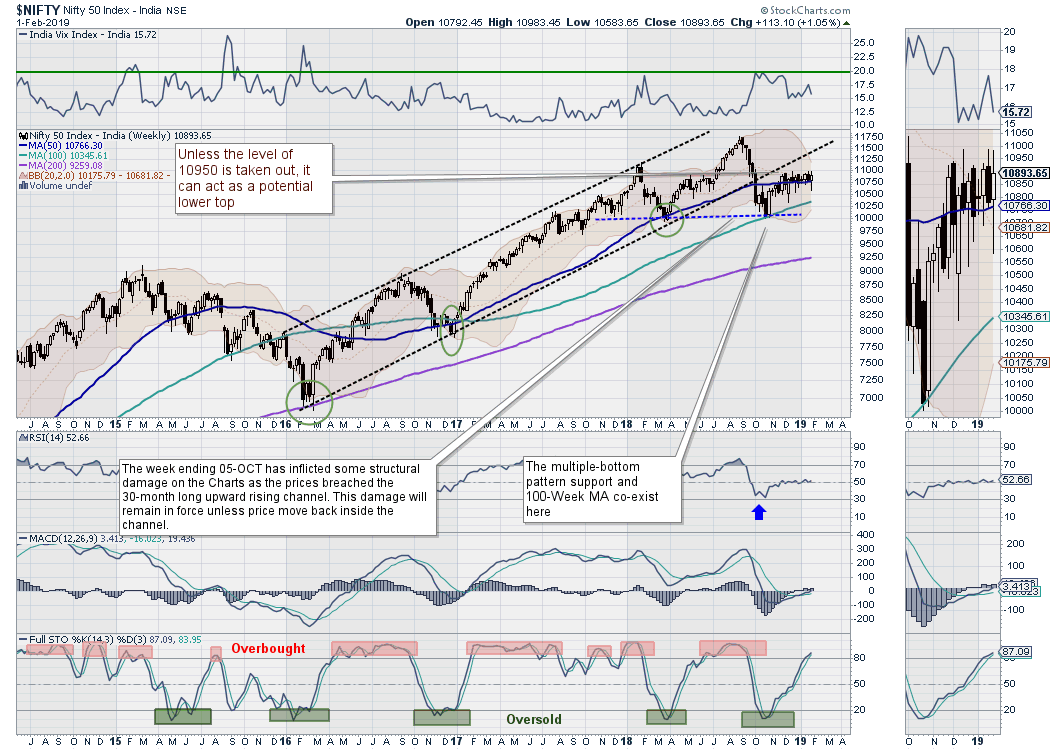

Week Ahead: Staying Afloat 50-Week MA Crucial; Market Breadth Remains A Concern

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

With the last day of the trading week remaining a drag, the NIFTY returned all its weekly gains and ended on a negative note. If we look at the daily charts, we can see the NIFTY achieved a breakout by moving past the 10950 level, but had returned all those...

READ MORE

MEMBERS ONLY

DP WEEKLY WRAP: The Pleasure/Pain Cycle

by Carl Swenlin,

President and Founder, DecisionPoint.com

I have a theory about the market that I'm thinking of tuning up for submission to the Nobel Prize committee. It goes like this: (1) Things get better and better until they are as good as they are going get. (2) Then they get worse and worse until...

READ MORE

MEMBERS ONLY

STOCK INDEXES ARE FAILING TEST OF 200-DAY MOVING AVERAGES -- THE DOW MAY ALSO SLIP BACK BELOW ITS RED LINE -- FALLING BOND YIELDS ARE BOOSTING UTILITIES AND OTHER DEFENSIVE SECTORS -- WHILE A RISING DOLLAR IS HURTING ENERGY AND MATERIAL STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

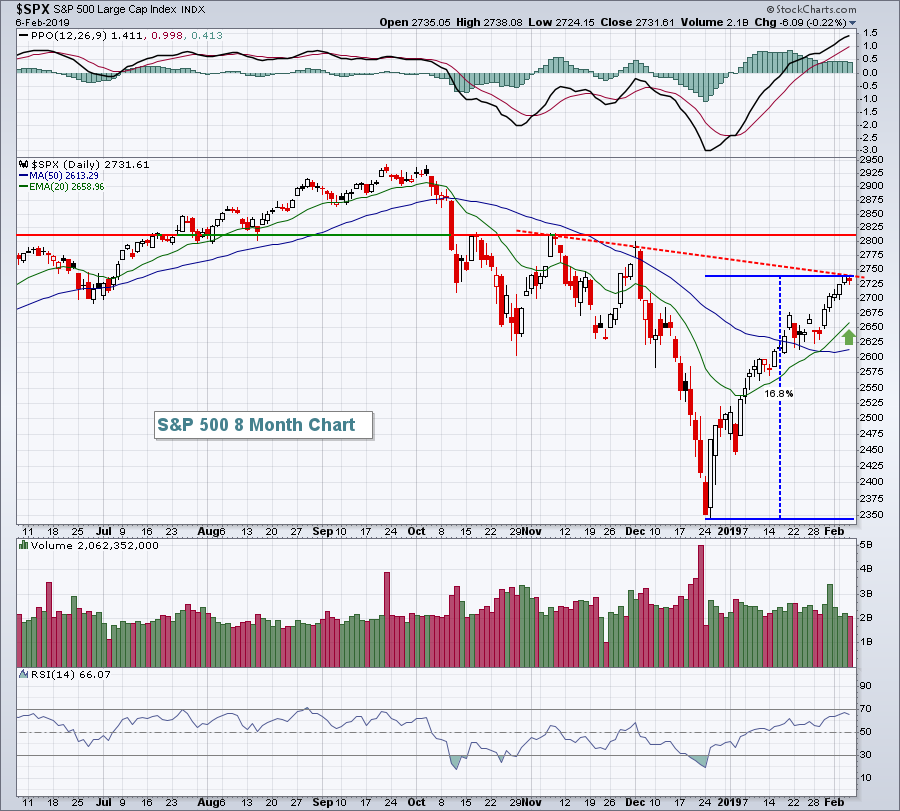

200-DAY MOVING AVERAGES CONTAIN THE RECENT RALLY... With stocks losing ground over the past two days, it looks like the 200-day averages that we've all been watching have managed to contain the 2019 rally. Chart 1 shows the S&P 500 pulling back from that red overhead...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook (with Video) - When to Tread Carefully

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Breadth Indicators Fall Short.

* S&P 500 Backs off the 40 Week.

* When to Tread Carefully.

* Offensive Sectors Weigh.

* Sector with Lowest Correlation to $SPX.

* Utes Lead the Market.

* Bond ETFs Consolidate within Uptrends.

* ChartList Notes, Additions and Deletions.

... Breadth Indicators Fall Short

... The advance from late December to...

READ MORE

MEMBERS ONLY

Negative Divergences Stymie Advance

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, February 7, 2019

The bears have been waiting for a day like yesterday, which featured a bit of impulsive selling and an accelerating Volatility Index ($VIX). Unfortunately, the bulls may have already inflicted too much damage upon the bears for them to recover fully. I view...

READ MORE

MEMBERS ONLY

Finance Sector Hits Moment-of-truth - Chart, Scan and Analyze the Bollinger Band Squeeze

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* XLF Goes from Leader to Laggard.

* XLF Hits Resistance and Retracement.

* Bollinger Band Squeeze Chart.

* Bollinger Band Squeeze Scan Code.

* On Trend on StockChartsTV

...XLF Goes from Leader to Laggard

...The Financials SPDR (XLF) went from leader to laggard over the last six weeks as the broad market advance narrowed....

READ MORE

MEMBERS ONLY

Restaurants Remain A Fan Favorite

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, February 6, 2019

All of our major indices closed lower on Wednesday and we haven't seen that very often in 2019. The losses were minimal and traders continued to have an appetite for the riskier sectors, so it certainly wasn't a huge...

READ MORE

MEMBERS ONLY

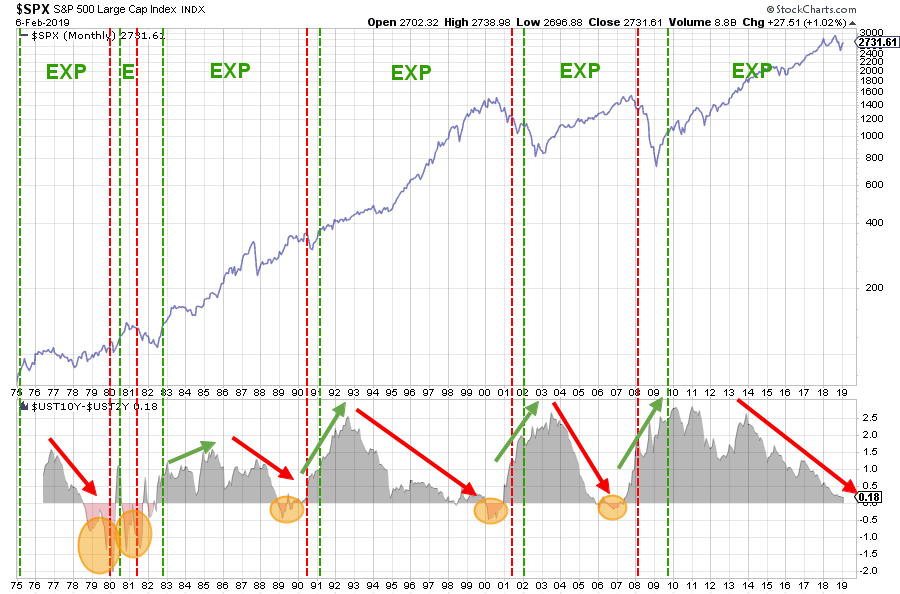

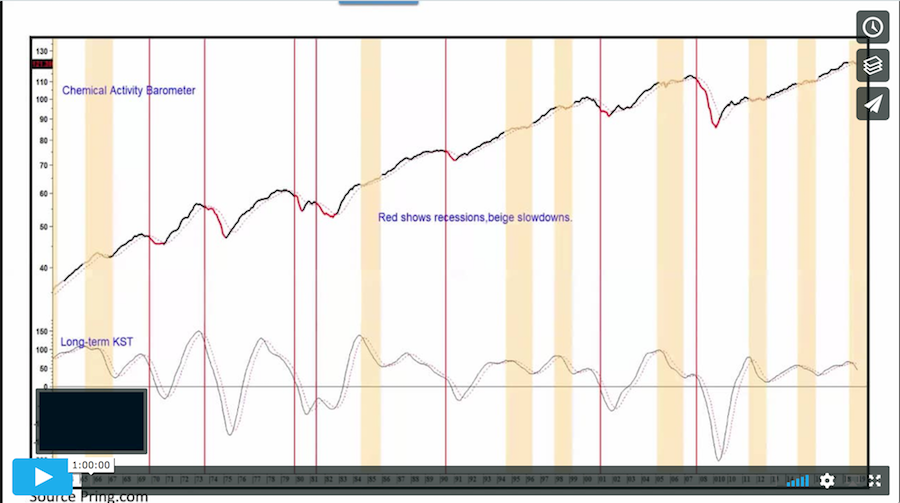

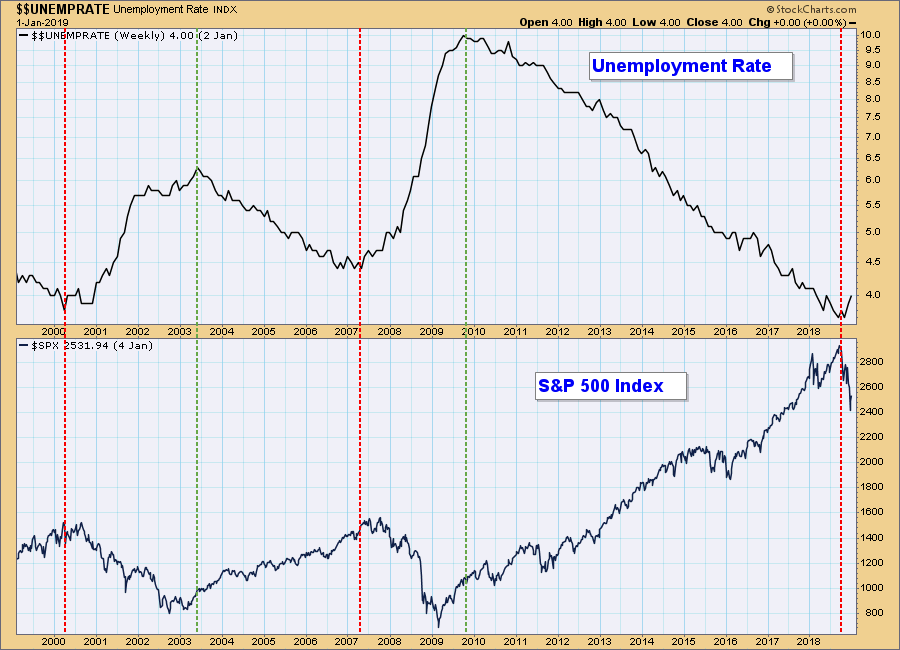

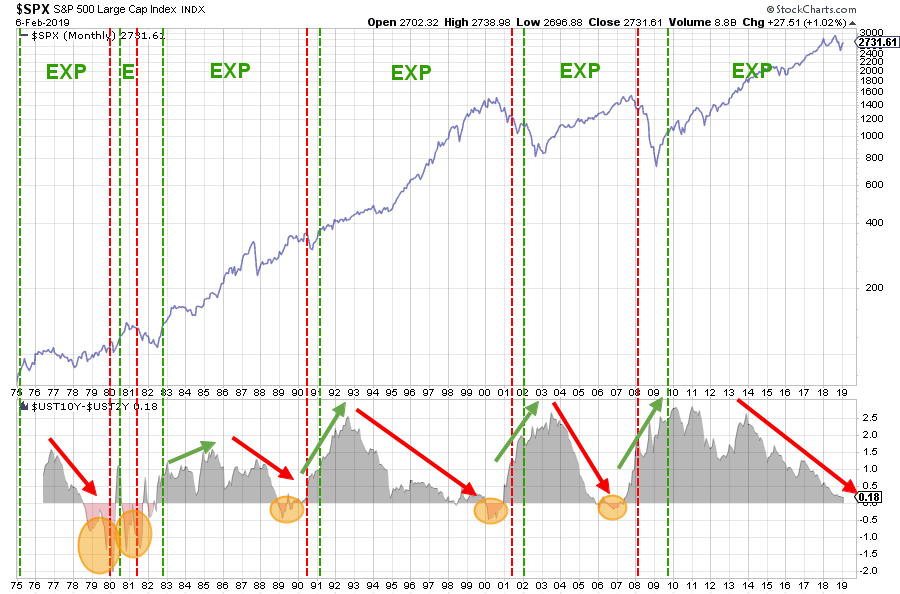

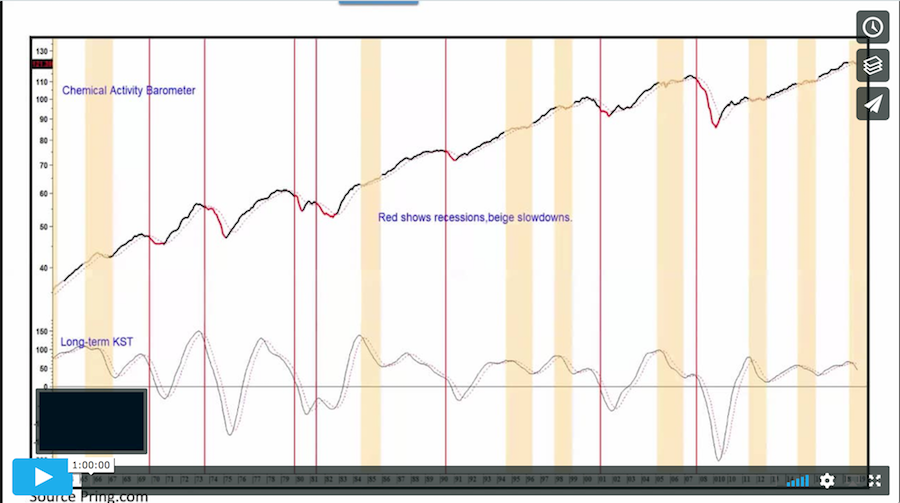

Save This Chart To Keep Track Of The Yield Curve Interaction With The Economic Cycle

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The chart that I want to share with you today is part of a (bigger) research project that I am doing with regard to the various phases in economic cycles and their relation to the (shape of) yield curve.

The chart above shows the S&P Index in the...

READ MORE

MEMBERS ONLY

DP Alert: Dollar Scores Three New BUY Signals

by Erin Swenlin,

Vice President, DecisionPoint.com

Yesterday, I wrote about the new IT Trend Model BUY signals that are now resident on all four Scoreboards. I also noted that what used to be bearish rising wedges have become rising trend channels. Today, the Dollar posted an ST PMO BUY signal, an ST Trend Model BUY signal...

READ MORE

MEMBERS ONLY

Bad Overbought Or Good Overbought?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Question: When can “overbought” be a good thing?

Answer: When something becomes really overbought.

Allow me to explain. The Relative Strength Index (RSI) is one of the most common ways to measure price momentum, ranging from 0 to 100. When the RSI becomes overbought, the price has risen too high...

READ MORE

MEMBERS ONLY

TESTING OF 200-DAY AVERAGES CONTINUES -- THE SPX AND QQQ ARE TESTING IT NOW -- XLI AND XLY ARE ALREADY ABOVE -- WHILE THE XLC IS STALLING AT ITS RED LINE -- TREASURY YIELDS AREN'T FOLLOWING STOCKS HIGHER WHICH GIVES MIXED MESSAGE ON INVESTOR CONFIDENCE

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 AND NASDAQ ARE TESTING 200-DAY AVERAGES ... It seems that everyone is watching 200-day moving averages. That's because the strong rebound since the end of December has pushed major U.S. stock indexes back to that overhead resistance line. What they do there should help...

READ MORE

MEMBERS ONLY

Core Rotation Strategy

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

This article expands on the pair analysis discussed in the previous article. In that article I showed a simple process of trading a ratio of non-correlated ETFs, in particular the S&P 600 Small Cap (IJR) and the BarCap 7 to 10-year Treasury ETF (IEF). Using a 4% trigger...

READ MORE

MEMBERS ONLY

Evaluating Energy And Renewable Energy

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, February 5, 2019

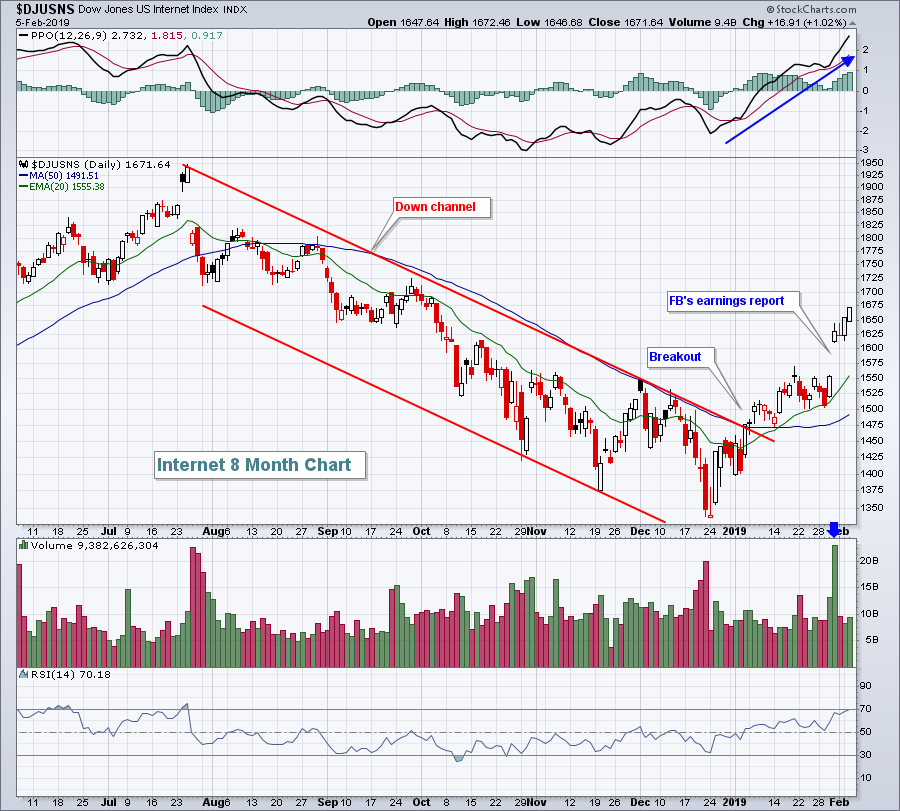

Tuesday was Groundhog Day for those that have seen the movie starring Bill Murray. It was a repeat of what we've seen throughout earnings season. We heard a somewhat disappointing outlook from a market leader, in this case Alphabet (GOOGL, +0....

READ MORE

MEMBERS ONLY

The Broker-Dealer iShares and Top Holdings Stall - Plus three Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Broker-Dealer iShares (IAI) led the market rebound from December 24th to January 18th and then stalled out over the last two weeks.

As with the broader market, we can see two conflicting trends. The long-term trend is down because IAI hit a 52-week low in late December, remains below...

READ MORE

MEMBERS ONLY

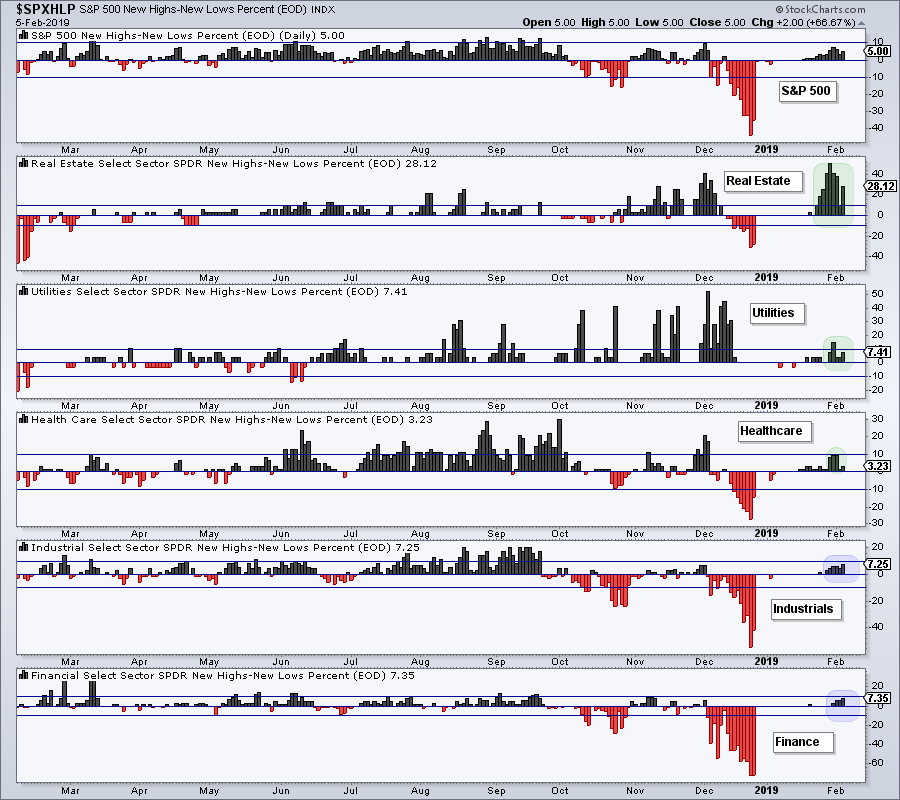

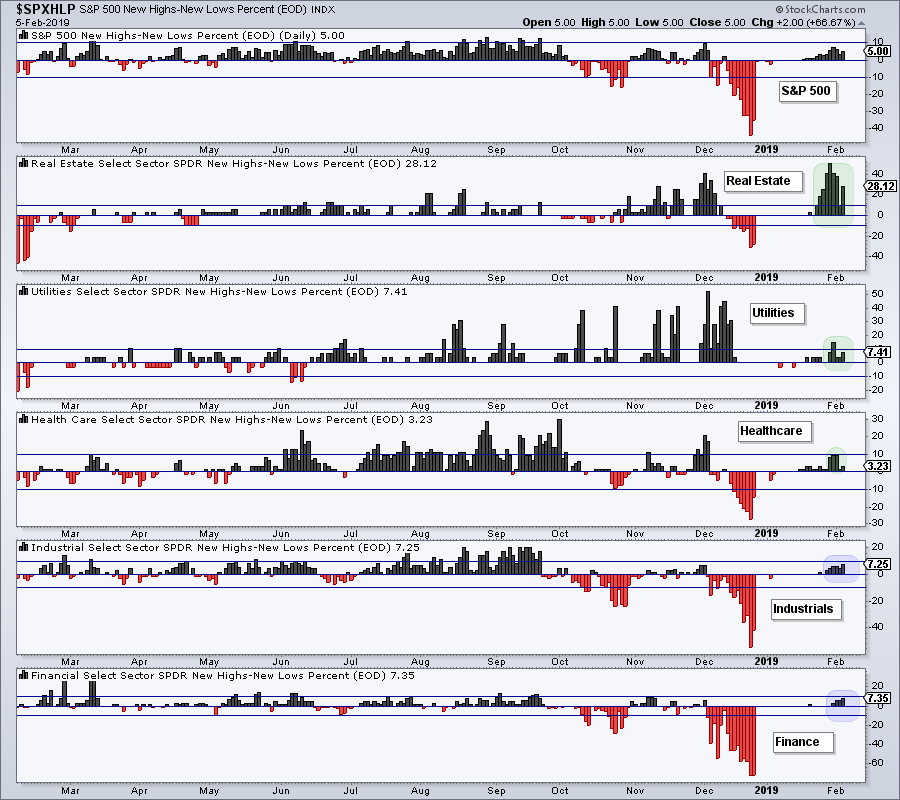

REITs, Utes and Healthcare Lead New High List

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Chartists looking for the sectors with the most stocks in strong uptrends can turn to the High-Low Percent indicators. High-Low Percent equals new 52-week highs less new 52-week lows divided by total issues. This indicator is positive when new highs outnumber new lows and negative when new lows outnumber new...

READ MORE

MEMBERS ONLY

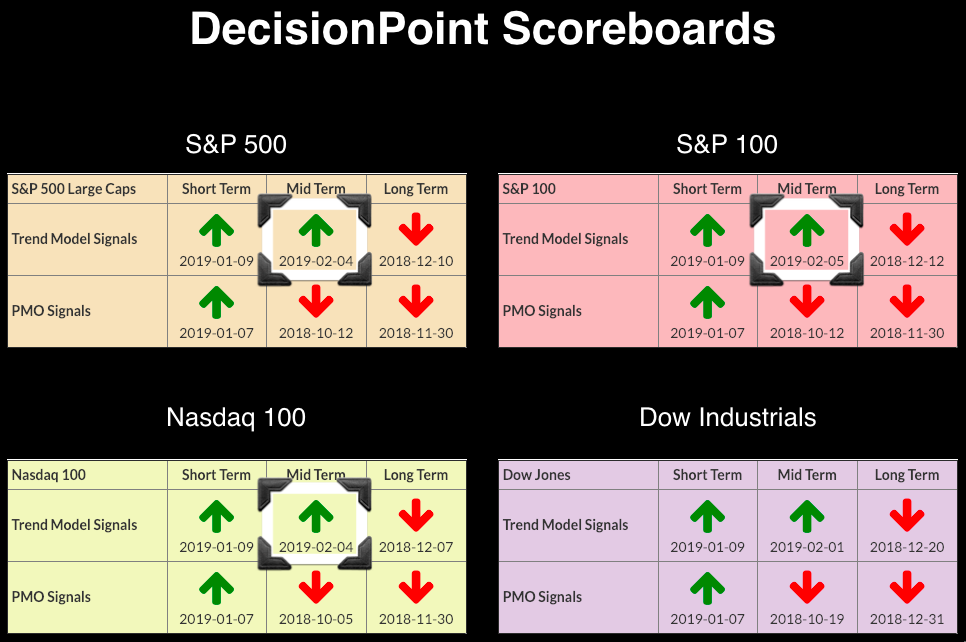

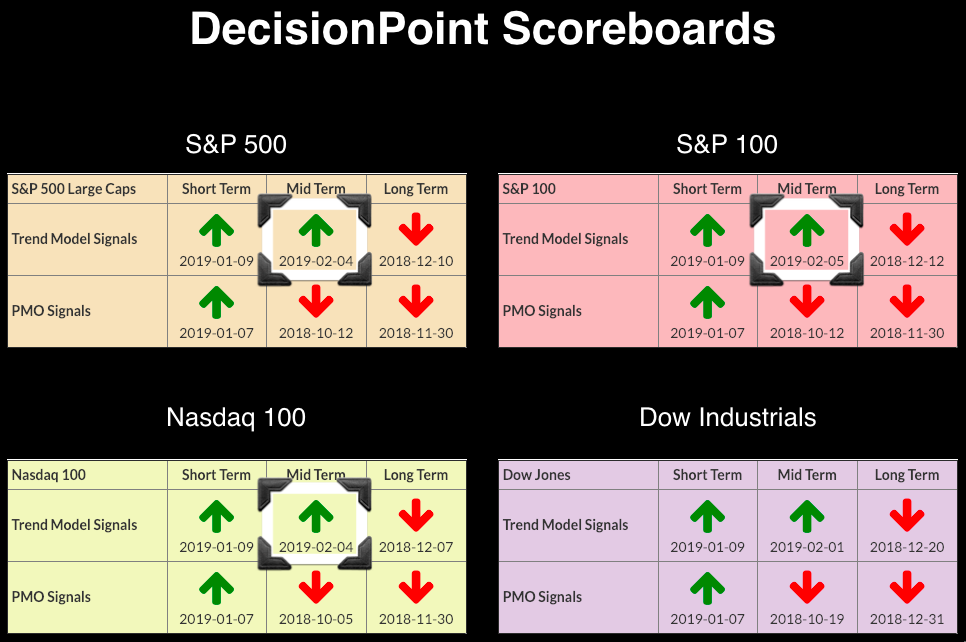

DP Bulletin: New IT Trend Model BUY Signals on Scoreboards - Rising Trend Channels

by Erin Swenlin,

Vice President, DecisionPoint.com

Just a quick bulletin to let you know that the SPX, OEX and NDX have triggered new IT Trend Model BUY signals. Though Dow got off to a head start, they are now all in line. The weekly PMO determines the IT PMO signal, which are not quite close enough...

READ MORE

MEMBERS ONLY

The State Of The 200-Day Moving Average

by Martin Pring,

President, Pring Research

* Three Major Averages are at their 200-Day MAs

* The NYSE Has Been Declining for a Year

* Will There Be Another Whipsaw?

Today, of course, is the State of the Union Address, but for the markets it might well be the “State of the 200-Day Moving Average,” as that’s the...

READ MORE

MEMBERS ONLY

WHAT TO MAKE OF THE 2019 REBOUND -- BEAR MARKET RALLY OR START OF A NEW UPLEG? -- OR PART OF A TOPPING PROCESS -- S&P 500 NEARS TEST OF 200-DAY AVERAGE AND MAYBE ITS DECEMBER HIGH -- WEEKLY CHARTS ALSO SHOW IMPROVEMENT

by John Murphy,

Chief Technical Analyst, StockCharts.com

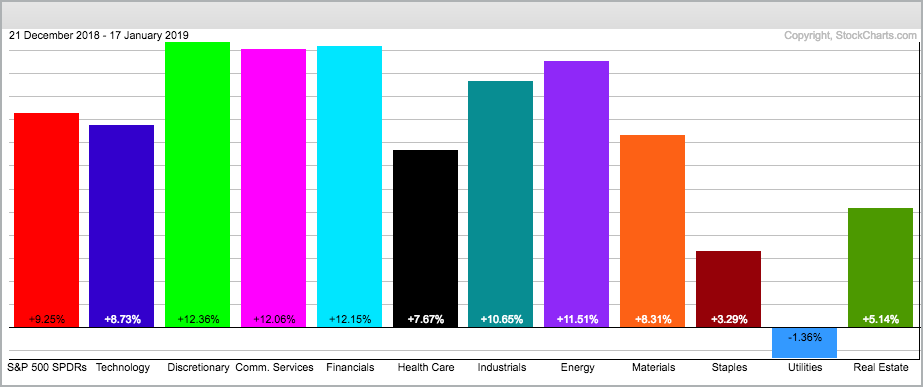

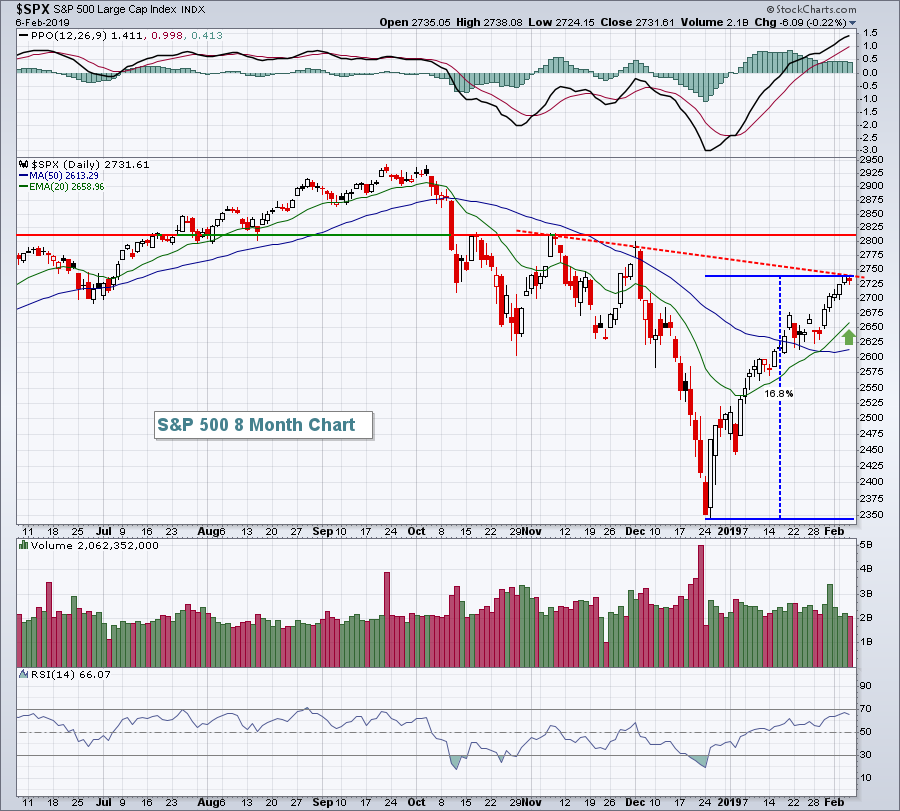

S&P 500 NEARS TEST OF 200-DAY MOVING AVERAGE... The daily bars in Chart 1 show the S&P 500 nearing a test of its 200-day moving average (red line). That's an important test for it and rest of the stock market. A strong stock market...

READ MORE

MEMBERS ONLY

Looking At The Dollar And Defense

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

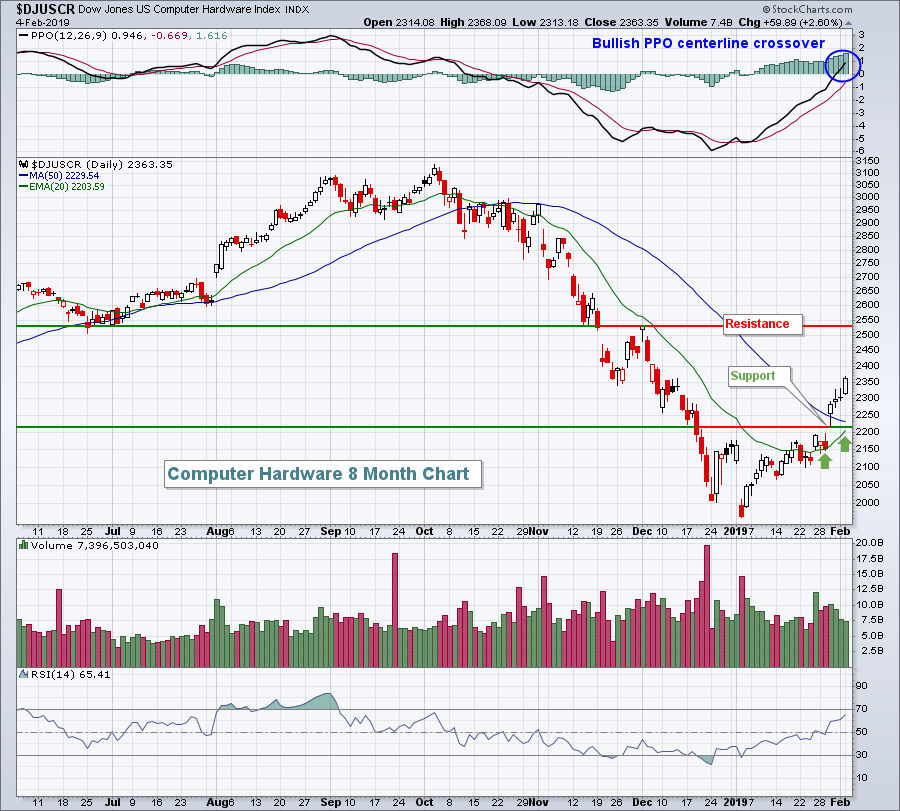

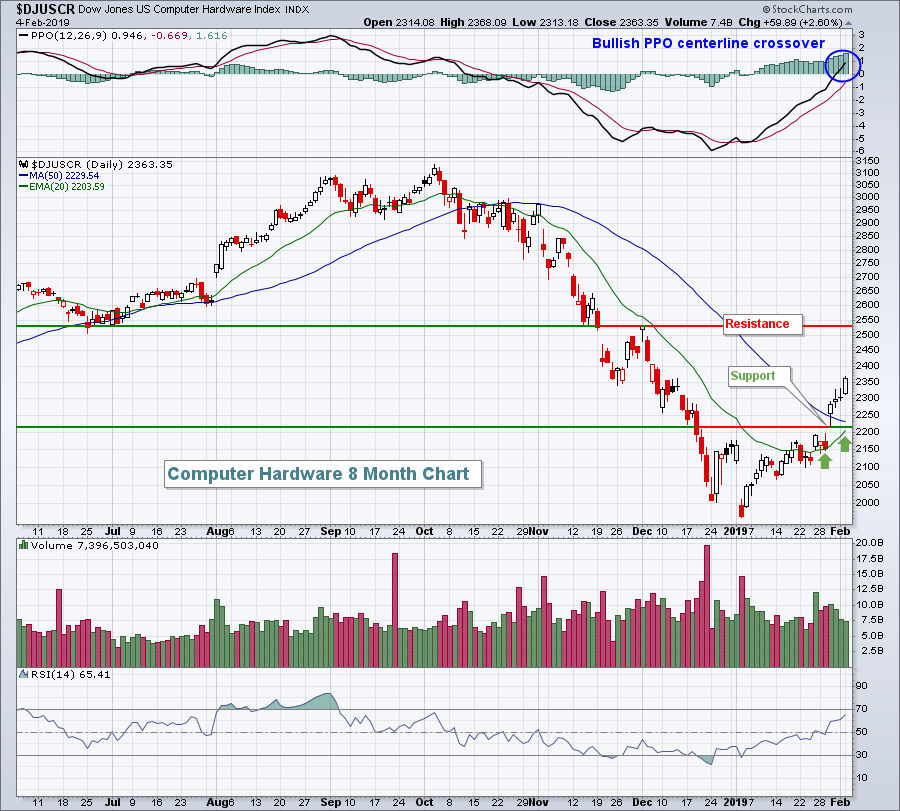

Market Recap for Monday, February 4, 2019

Technology (XLK, +1.60%) led another broad-based rally on Wall Street Monday as all of our major indices closed higher. There was particularly strong action on the aggressive NASDAQ and Russell 2000 as they gained 1.15% and 1.03%, respectively. 9 0f...

READ MORE

MEMBERS ONLY

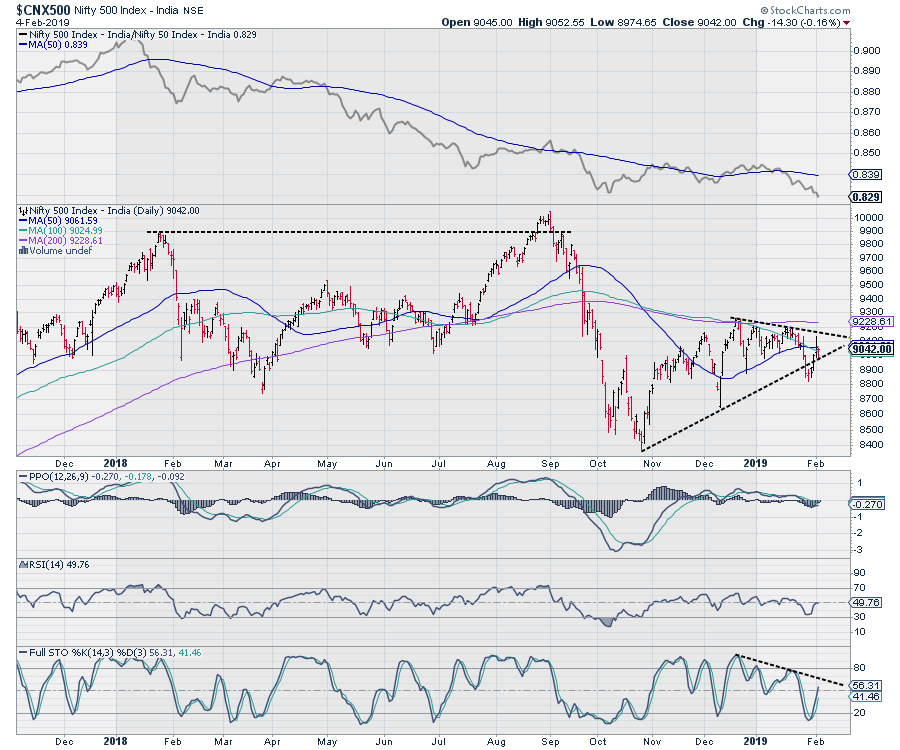

A Look At Broader Market Charts As Market Breadth Remains A Concern

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After experiencing a brutal decline that began in September 2018, the NIFTY found support just below the 10000 mark and witnessed a technical pullback. This technical pullback halted near the 10950 level in early December 2018. Over the following two months, the index hit resistance multiple times and has remained...

READ MORE

MEMBERS ONLY

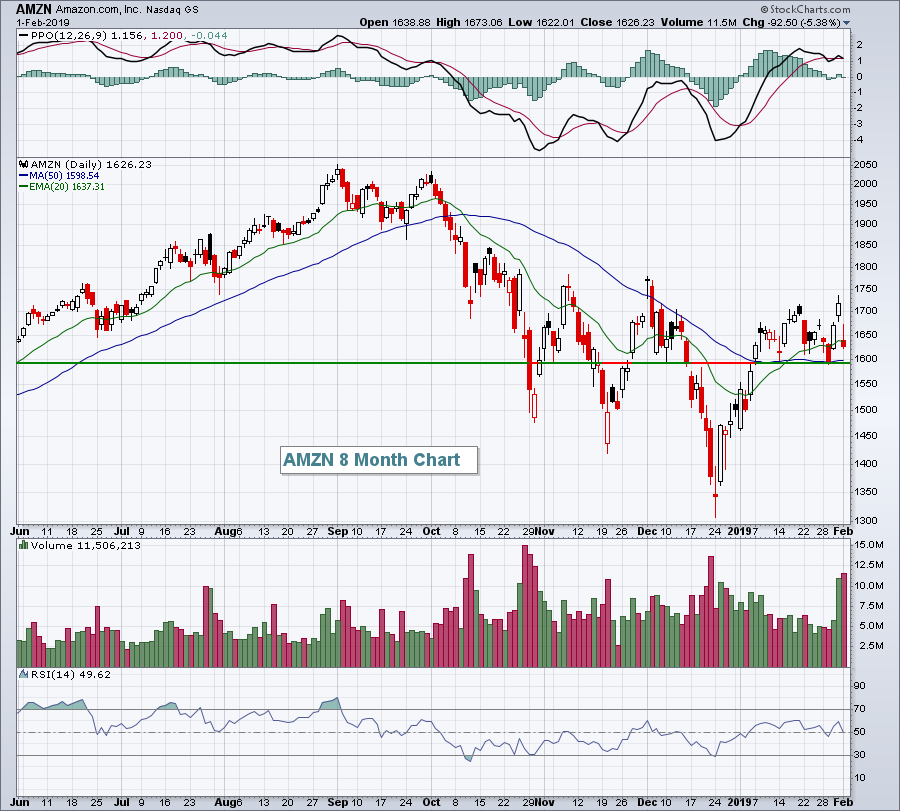

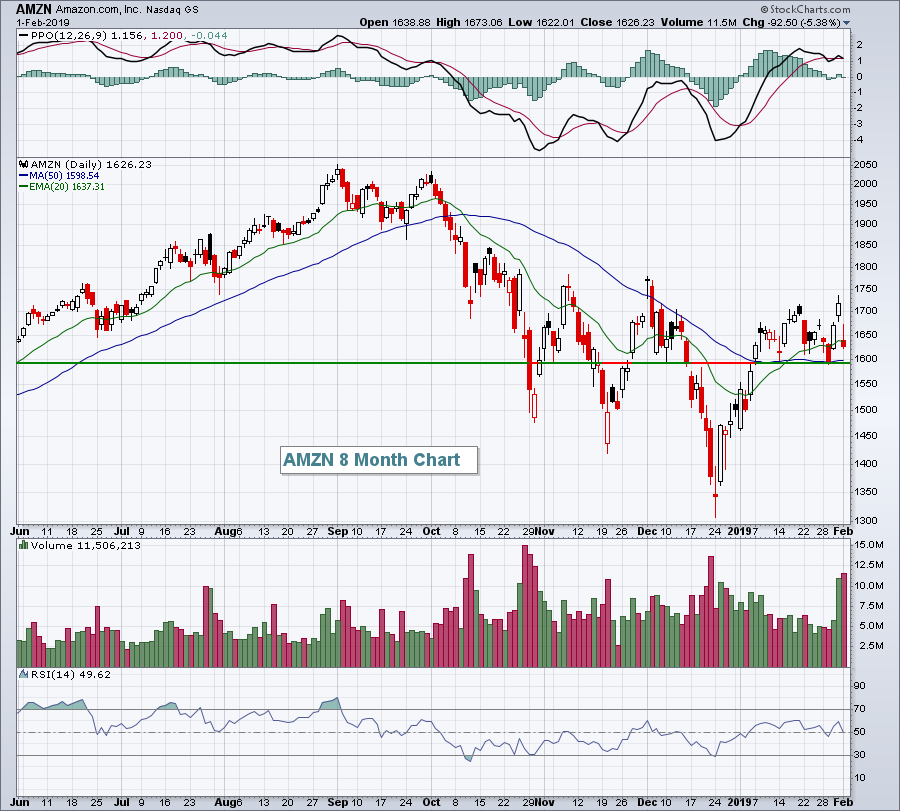

Amazon and the Seismic RSI Shift

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The overall trend for Amazon shifted from bullish to bearish in October and RSI caught this shift.

Before looking at RSI, let's review price action and the bigger trend at work. The chart shows Amazon moving to a new high in early September, forming a lower high in...

READ MORE

MEMBERS ONLY

Amazon Slammed But Fails To Trigger Panicked Selling

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, February 1, 2019

I'm sure I wasn't the only one thinking that the market was doomed on Friday after Amazon.com (AMZN, -5.38%) disappointed traders with its outlook during Thursday's after hours trading. After all, AMZN is a Wall...

READ MORE

MEMBERS ONLY

Between a Rock and a Hard Place

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Extended but Not Overbought.

* SPY and QQQ Form Doji.

* %Above 20-day EMA Holds Strong.

* 4 Sector SPDRs above their 200-day SMAs.

* On Trend on StockChartsTV.

... The stock market is in a tricky spot because the short-term uptrends are quite extended and the long-term trends are still down. The chart below...

READ MORE

MEMBERS ONLY

Golden Ticket

by Bruce Fraser,

Industry-leading "Wyckoffian"

In August of 2018 Wyckoff Power Charting published a monthly chart of the continuous contract of Gold ($GOLD). A very large Accumulation structure appeared to be forming after a cyclical bear market. Meanwhile a downtrend (see the Supply Line) had been in control for more than seven years. In that...

READ MORE

MEMBERS ONLY

Weekly Market Roundup with Martin Pring 2019-02-02

by Martin Pring,

President, Pring Research

The Market Roundup Video For February is now available.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion ofPring Turner Capital Groupof Walnut Creek or its affiliates....

READ MORE

MEMBERS ONLY

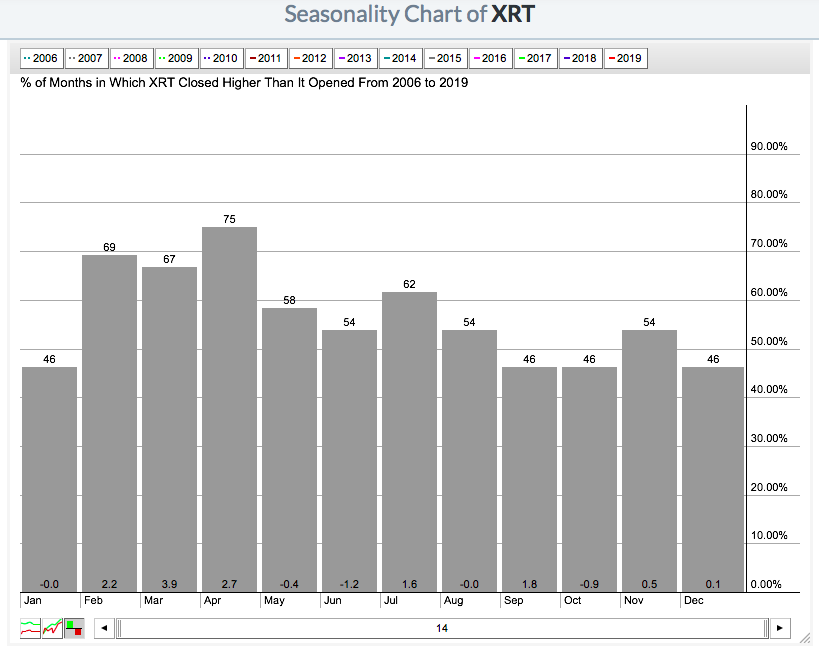

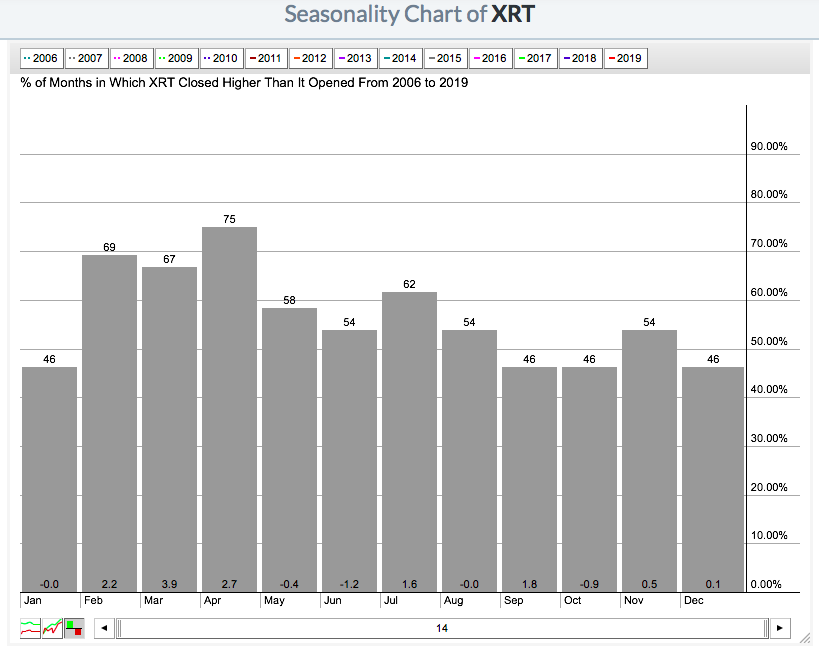

Combining Earnings Strength And Seasonal Tendencies

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I love the seasonality tool here at StockCharts.com. It can potentially give you an advance notification of a price move before it happens. One of the more striking seasonal tendencies that I've seen has been the unbelievable historical performance of Bookings Holdings (BKNG) from January through May,...

READ MORE

MEMBERS ONLY

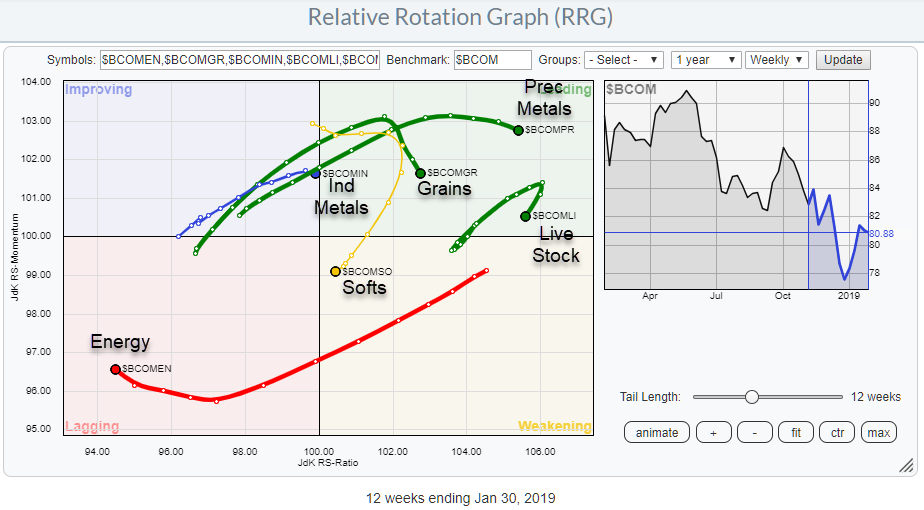

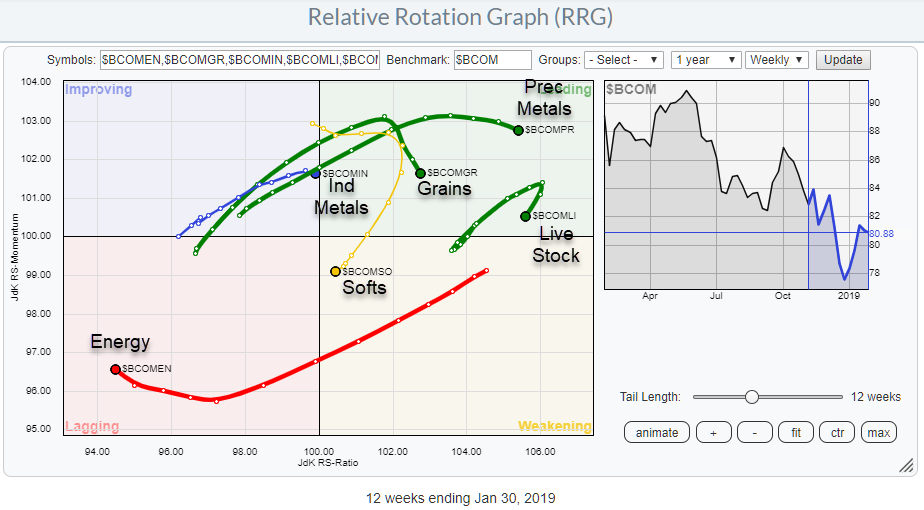

Using Relative Rotation Graphs To Break Down The Bloomberg Commodity Index Family

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

This article was published in the RRG blog on 31 January and takes a look at the Bloomberg Commodity Index Groups through the lens of a Relative Rotation Graph.

When possible, I prefer to use data-sets that come from the same family and creating a "closed universe." This...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Set To React On These Lines Post Interim Budget

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

We mentioned in our previous weekly note that, due to expiry of the January series and interim budget, the markets would remain more volatile than usual over the past week. While the expiry day did not bring in any volatility, the last session of the week remained immensely volatile on...

READ MORE

MEMBERS ONLY

Putting January Into Perspective

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

One's outlook often depends on one's timeframe. This outlook can also be influenced by recent price action or a recency bias. The S&P 500 surged 7.87% in January and recorded its biggest monthly advance since October 2015. This surge, however, was preceded by...

READ MORE

MEMBERS ONLY

Cyclicals and Biotechs are Trading Above Their 200-Day Lines

by John Murphy,

Chief Technical Analyst, StockCharts.com

Editor's Note: This article was originally published in John Murphy's Market Message on Thursday, January 31st at 12:34pm ET.

Chart 4 shows the Consumer Discretionary SPDR (XLY) trading above its 200-day line in today's trading. That a positive sign for the economically-sensitive sector...

READ MORE

MEMBERS ONLY

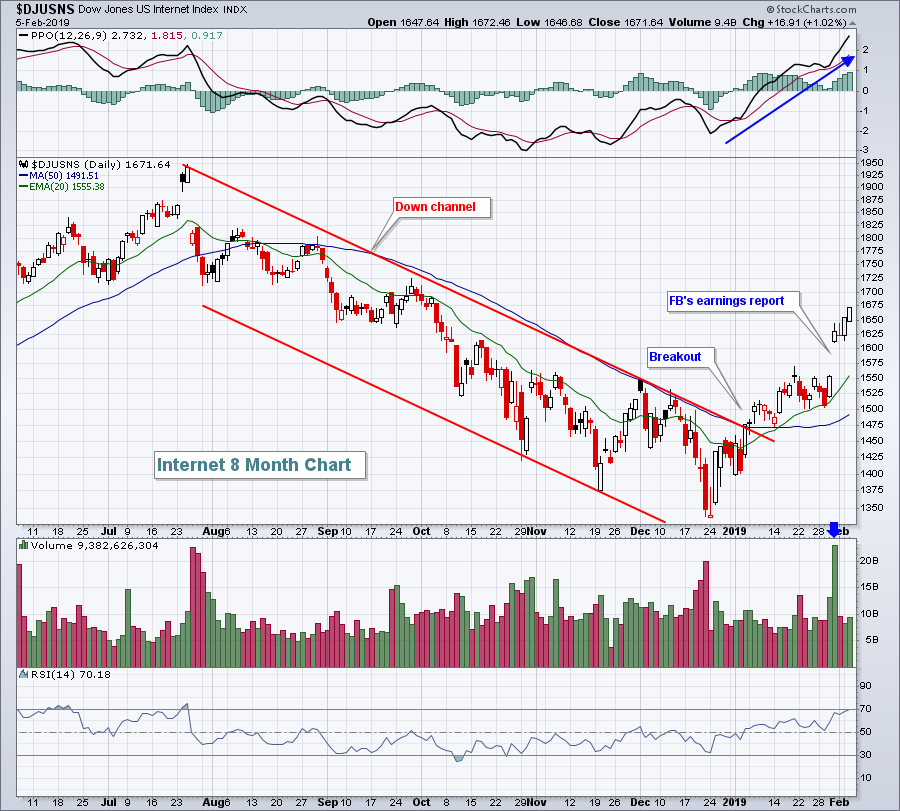

DP WEEKLY WRAP: SPY Breakout and New BUY Signal

by Carl Swenlin,

President and Founder, DecisionPoint.com

On Thursday, on expanding volume, SPY broke above the declining tops line drawn from the October Top, and at the same time it broke above the 200EMA. Then on Friday the SPY 20EMA crossed up through the 50EMA causing the IT Trend Model to change from NEUTRAL to a BUY...

READ MORE

MEMBERS ONLY

Earnings Season Brings with it Lots of Trading Candidates

by John Hopkins,

President and Co-founder, EarningsBeats.com

We're now deep into earnings season, with hundreds of companies reporting last week alone. The reaction to earnings so far has been mostly positive - witness the nice move higher in the market. But we've also seen some earnings misses, with those companies taking it on...

READ MORE