MEMBERS ONLY

Relative Rotation Graphs And Factor ETFs

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

It's Friday morning in Amsterdam and I just dropped my daughter off at school. On the way to my office, I usually stop at the local Coffee Company for a cappuccino and reading some, market-related, news, blogs etc.

For some reason, I noticed a lot of talk and...

READ MORE

MEMBERS ONLY

Correlation Suggests That We Monitor Treasury Yields Closely

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, January 10, 2019

There was both good and bad action on Thursday. Yes, the bulls should be excited as a short-term price and trendline breakdown did not result in panic or a Volatility Index ($VIX) that surged. Also, all of our major indices remained above their...

READ MORE

MEMBERS ONLY

Crude Oil Surges, Energy Paces Wall Street Advance; Negative Divergences Loom

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, January 9, 2019

Crude oil ($WTIC, +5.18%) continued rolling higher on Wednesday, buoyed at least in part from its positive divergence. Recently, I discussed the likelihood that crude oil prices would move back into the $50-$54 per barrel range and you can see from...

READ MORE

MEMBERS ONLY

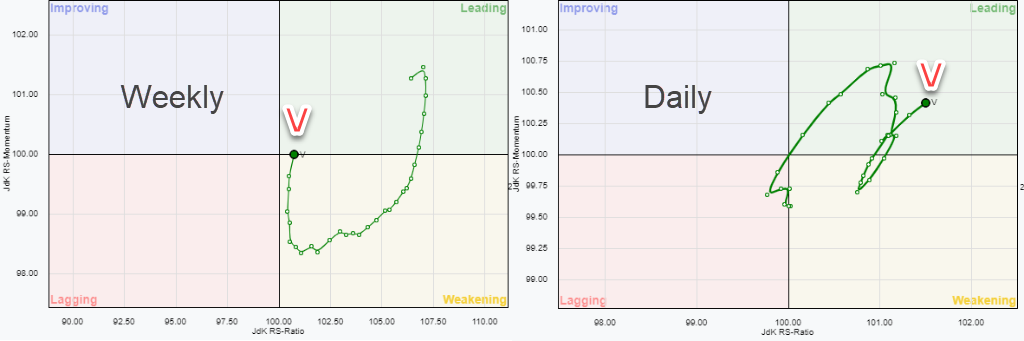

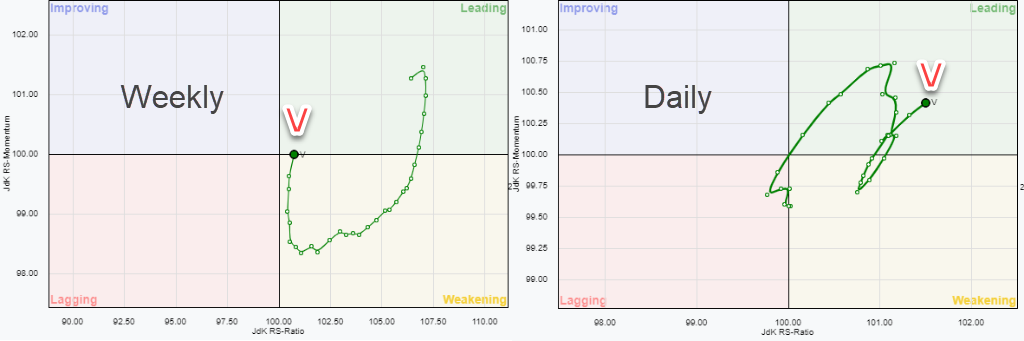

This DOW stock is pushing to new relative highs and rotates back into the leading quadrant on the Relative Rotation Graph

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Visa is showing up, just, inside the leading quadrant on the Relative Rotation Graph vs $INDU above. These images are zoomed in from the RRG holding all the 30 DJ Industrials stocks (benchmark $INDU).

The tail in the chart on the left above shows 30 weeks of rotation and as...

READ MORE

MEMBERS ONLY

Will PnF Light the Way in 2019

by Bruce Fraser,

Industry-leading "Wyckoffian"

As 2018 was getting underway, a January Buying Climax (BCLX) and a February Automatic Reaction (AR) turned a robust uptrend into a ‘Range-Bound’ market for most of the remainder of the year. Was this large trading range preparing to jump upward or cascade lower? In the fourth quarter the broad...

READ MORE

MEMBERS ONLY

DP Alert: New ST BUY Signals on DP Scoreboards - LT BUY for Gold

by Erin Swenlin,

Vice President, DecisionPoint.com

I took a peek at these new Short-Term Trend Model (STTM) BUY signals on the DP Scoreboards. After view the charts, I came to the conclusion that, as Pat Benatar once put it, "It's a little too little, it's a little too late." If...

READ MORE

MEMBERS ONLY

Perspective - 40 years of the Zweig Breadth Thrust - Weight of the Evidence

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Putting the Bounce into Perspective.

* 23-day Performance Overshadows 9-day Surge.

* 40 Years of the Zweig Breadth Thrust.

* AD Percent for $SPX, $MID and $SML.

* A Weight of the Evidence Approach.

... Putting the Bounce into Perspective

... As of Tuesday's close, the S&P 500 is up a whopping...

READ MORE

MEMBERS ONLY

DOLLAR INDEX FALLS TO THREE-MONTH LOW -- THAT'S BOOSTING COMMODITY PRICES WITH GOLD IN THE LEAD -- A WEAK DOLLAR IS ALSO BOOSTING RELATIVE PERFORMANCE OF FOREIGN SHARES -- ESPECIALLY EMERGING MARKETS

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOLLAR INDEX FALLS TO THREE MONTH LOW... The U.S. dollar has come under heavy selling pressure. Chart 1 shows the Dollar Index Fund (UUP) tumbing to the lowest level since last October. That's giving a boost to foreign currencies which are gaining ground today. That includes both...

READ MORE

MEMBERS ONLY

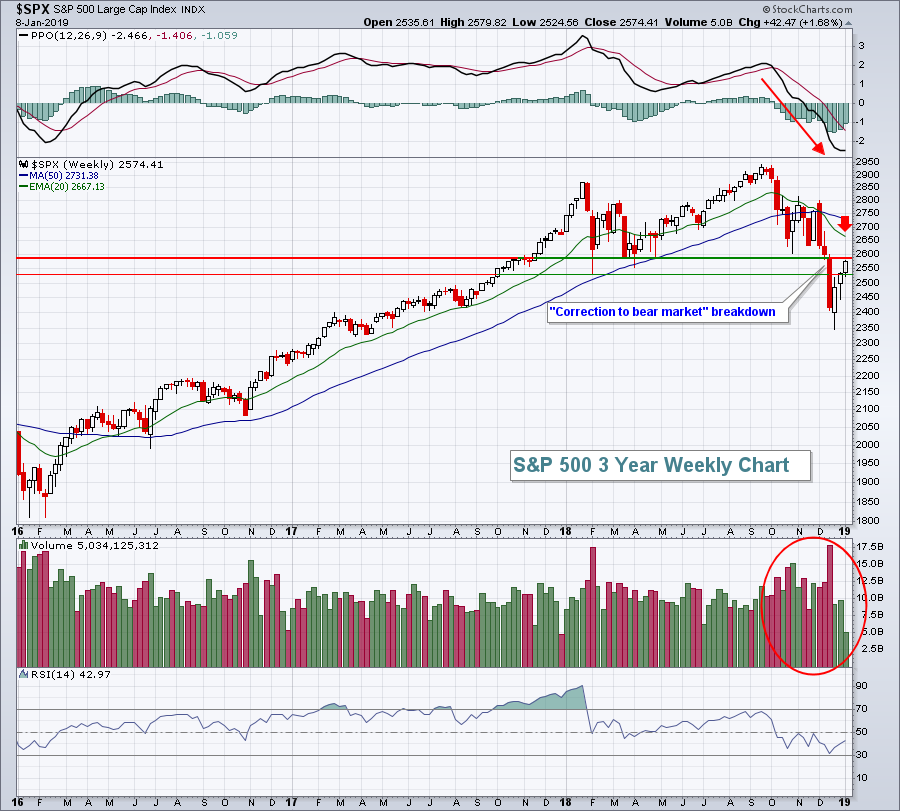

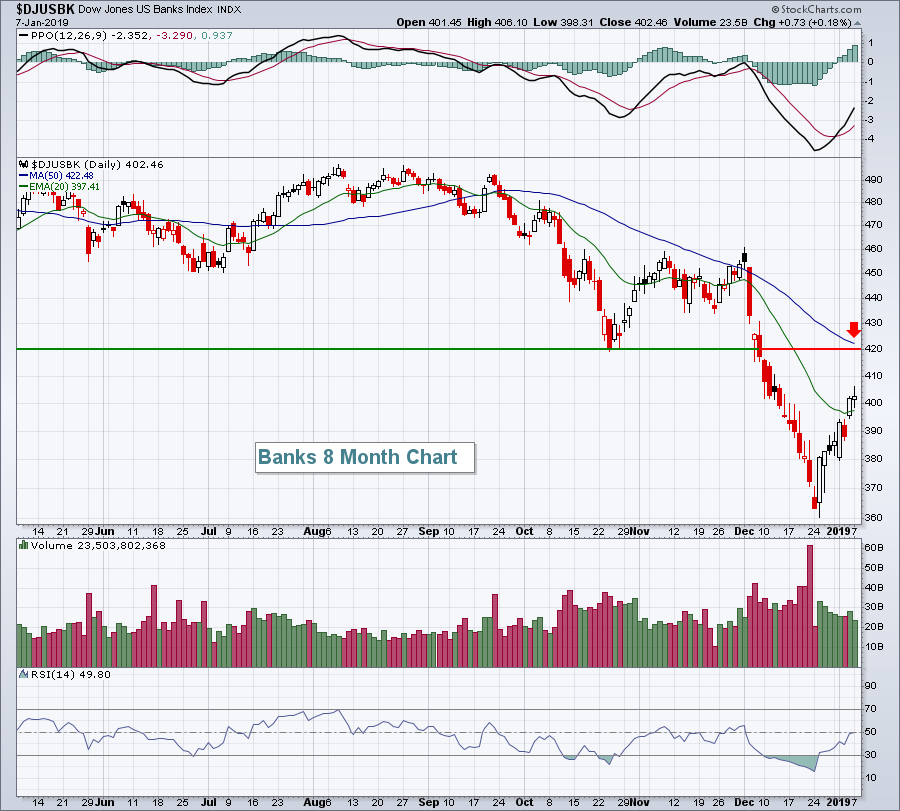

Bear Market Rally Likely Nearing Its End

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, January 8, 2019

It was another broad-based rally on Wall Street with 10 of 11 sectors finishing higher. Small caps powered ahead 1.53% to lead the action, but the Dow Jones, S&P 500 and NASDAQ gained 1.09%, 0.97% and 1.08%...

READ MORE

MEMBERS ONLY

Netflix Leads the FAANGs as Facebook Quietly Outperforms

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Netflix was the first of the five FAANG stocks to peak in June 2018 and is now the first of the five to break its December high. Thus, Netflix is leading the FAANGs here in January because it is the only one with a higher high. Note that Netflix reports...

READ MORE

MEMBERS ONLY

Exhausting Vixen Breath...(Or 'VIX and Breadth' Buying Exhaustion)

by Erin Swenlin,

Vice President, DecisionPoint.com

A few months ago, a viewer of MarketWatchers LIVE commented that, when I talk about my Climactic Indicator chart which includes both breadth and the $VIX, it often sounds like "vixen breath".

I promised viewers today that I would write about my thoughts on these climactic indicators, so...

READ MORE

MEMBERS ONLY

HDFC Standard Life - Preparing For A Move?

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

HDFC Standard Life Insurance Company Ltd. (HDFCLIFE.IN)

This stock has a rather short history. After listing in November 2017, it spent the first couple of months moving higher, then returned all those gains in the following months. It is said that chart patterns are fractal in nature; those patterns...

READ MORE

MEMBERS ONLY

An Intermediate Oversold Condition Suggests That The December Low Is Likely To Hold For Several Months

by Martin Pring,

President, Pring Research

* Short/Intermediate Oversold Condition

* High-Low Data Reaches an Extreme

* The Bear is Still With Us Until It Isn’t

As we all know, markets have a strong tendency to swing from excessive optimism to extremes of pessimism. During the last month, we have certainly seen a substantial amount of pessimism...

READ MORE

MEMBERS ONLY

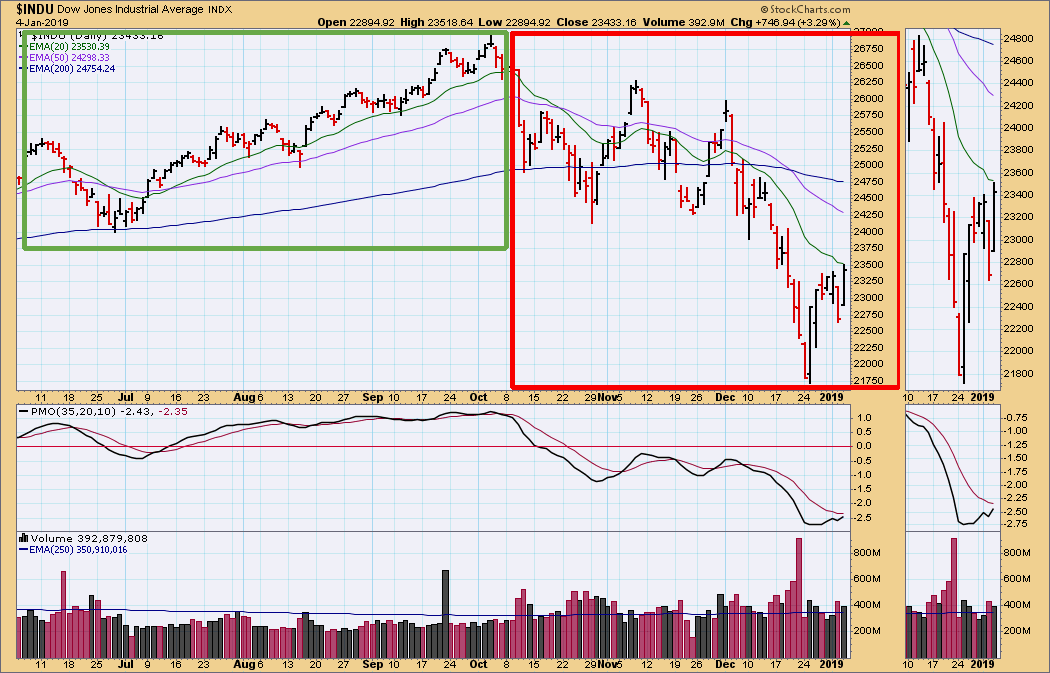

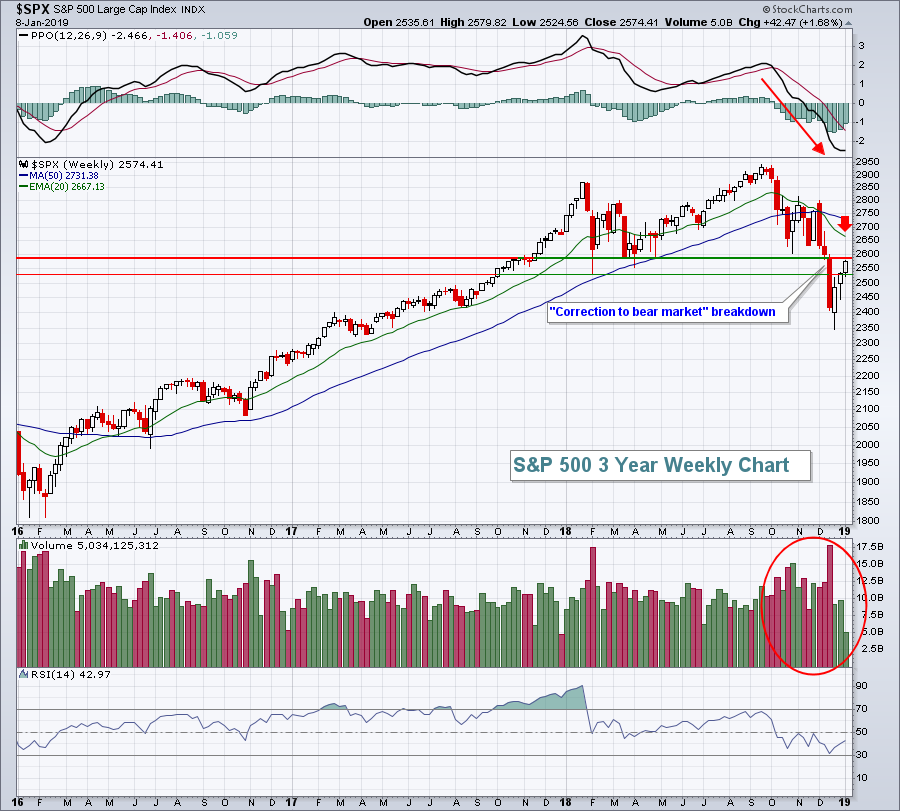

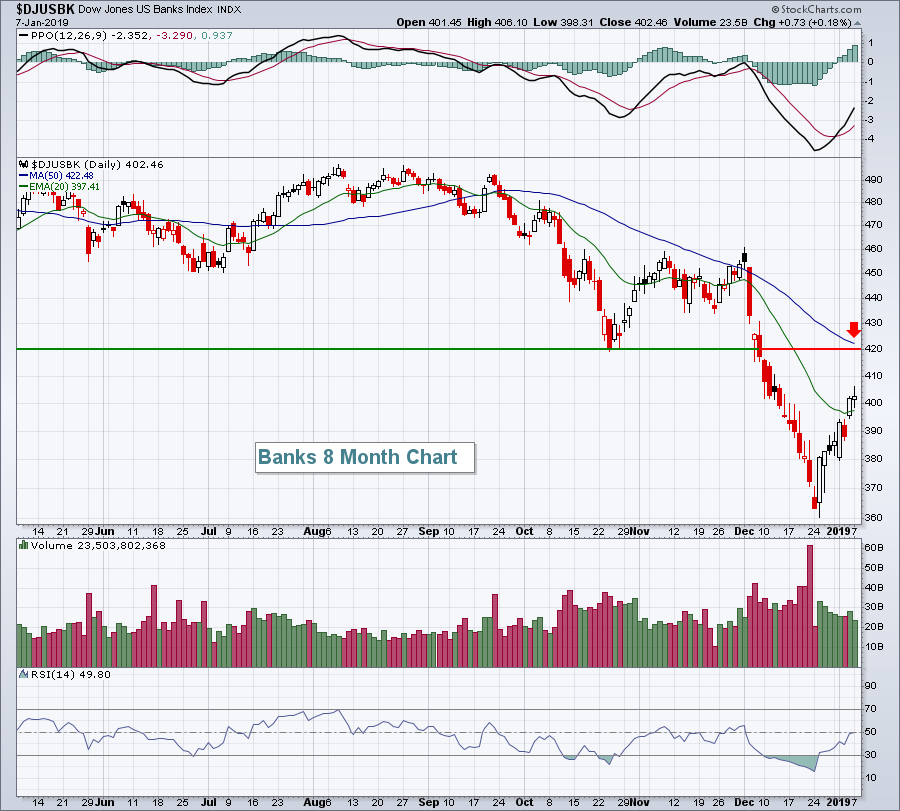

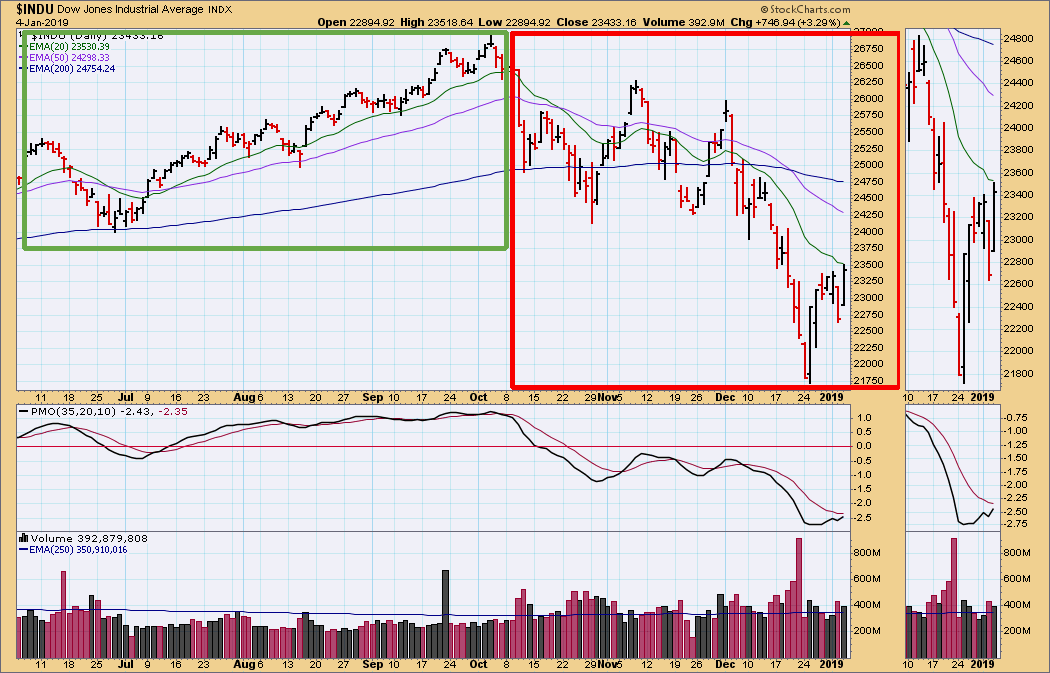

STOCK REBOUND CONTINUES -- PRICES RECOVER SOME LOSSES SUFFERED OVER THE LAST THREE MONTHS BUT REMAIN IN DOWNTRENDS -- STOCK INDEXES APPROACH POTENTIAL OVERHEAD RESISTANCE BARRIERS

by John Murphy,

Chief Technical Analyst, StockCharts.com

U.S. STOCK INDEXES CONTINUE JANUARY REBOUND ... Stock prices are trending higher again this morning which continues the rebound that started right after Christmas. Today's three price charts reflect that short-term improvement, while keeping them in a longer-range perspective. The main point of the charts is that all...

READ MORE

MEMBERS ONLY

Consumer Discretionary Makes Relative Breakout, Poised To Lead In 2019

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, January 7, 2019

Crude oil prices ($WTIC, +1.17%) rallied on Monday, helping energy (XLE, +1.49%) continue its recent surge, but the day clearly belonged to consumer discretionary stocks (XLY, +2.26%) as retail (XRT, +3.10%) and home construction ($DJUSHB, +2.43%) were among...

READ MORE

MEMBERS ONLY

VerSign Holds One Key Moving Average and Retakes Another

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The broad market environment remains rather negative overall with the S&P 500 well below its falling 200-day SMA and volatility increasing over the last few months. Note that the different environments were highlighted in ChartWatchers this weekend. After a sharp decline into Christmas, stocks rebounded over the last...

READ MORE

MEMBERS ONLY

One Industry Group Has Quietly Been "Building" Relative Strength

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, January 4, 2019

Friday was a HUGE day for the bulls as nonfarm payrolls came in well ahead of expectations (312,000 vs 180,000), which in no way reflects what the stock market has been saying since Q4 2018 began - that we were heading...

READ MORE

MEMBERS ONLY

2019 Stock Market Forecast And My Report Card For 2018 Forecast

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Before I look ahead to what we might expect in 2019, let me rewind for a bit and check out last year's forecast. Here's a recap, summarizing a few of my "expectations". I've graded my predictions with a slight curve. Feel free...

READ MORE

MEMBERS ONLY

EARNINGS: S&P 500 P/E Overvalued, But Back In Normal Range

by Carl Swenlin,

President and Founder, DecisionPoint.com

S&P 500 earnings for 2018 Q3 have been finalized. The following chart shows us the normal value range of the S&P 500 Index. It shows us where the S&P 500 would have to be in order to have an overvalued P/E of 20...

READ MORE

MEMBERS ONLY

Understanding and Adapting to the Broad Market Environment

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The broad market environment is perhaps the single most important factor to consider when selecting a trading or investing strategy for stocks. As with the weather, the broad market environment is subject to change and we need to adapt to current conditions. We should take extra precautions when it is...

READ MORE

MEMBERS ONLY

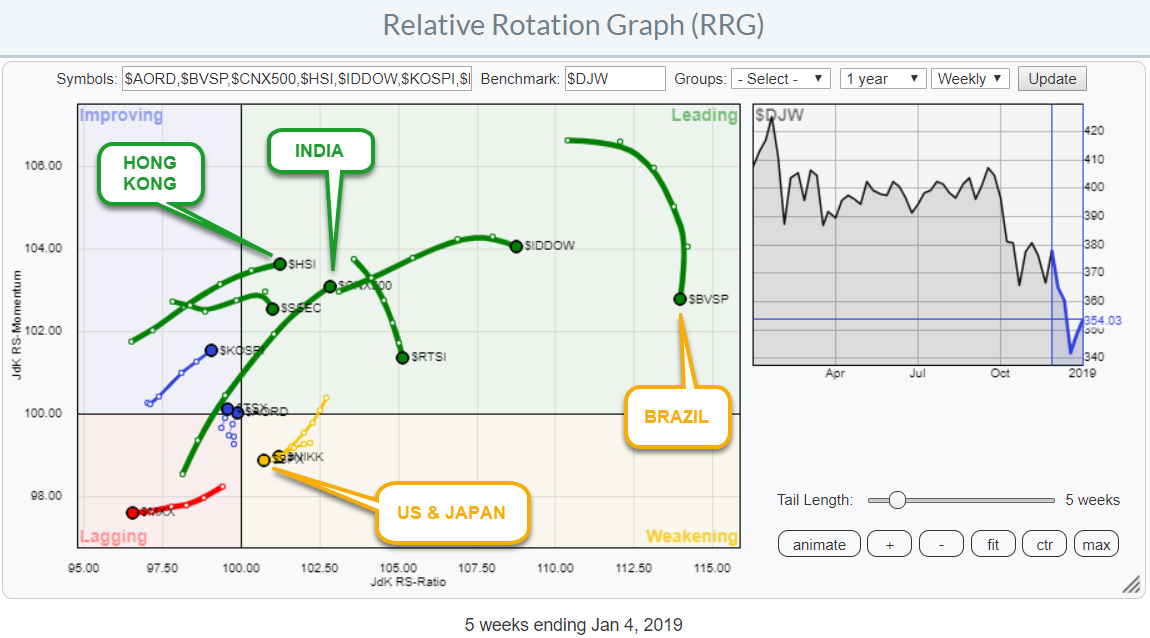

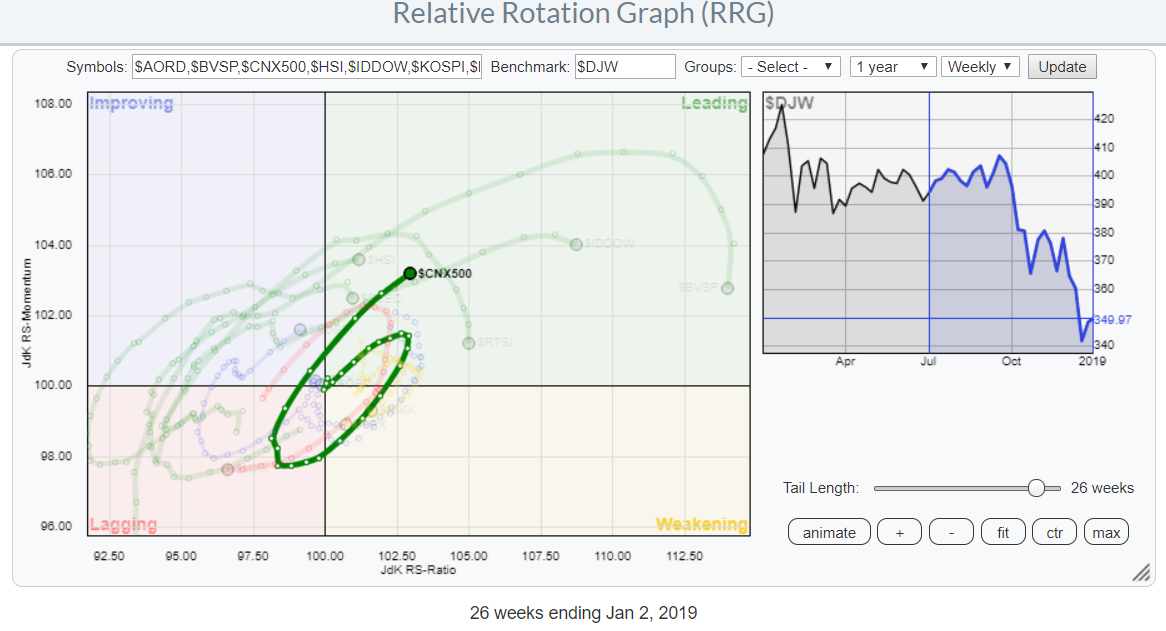

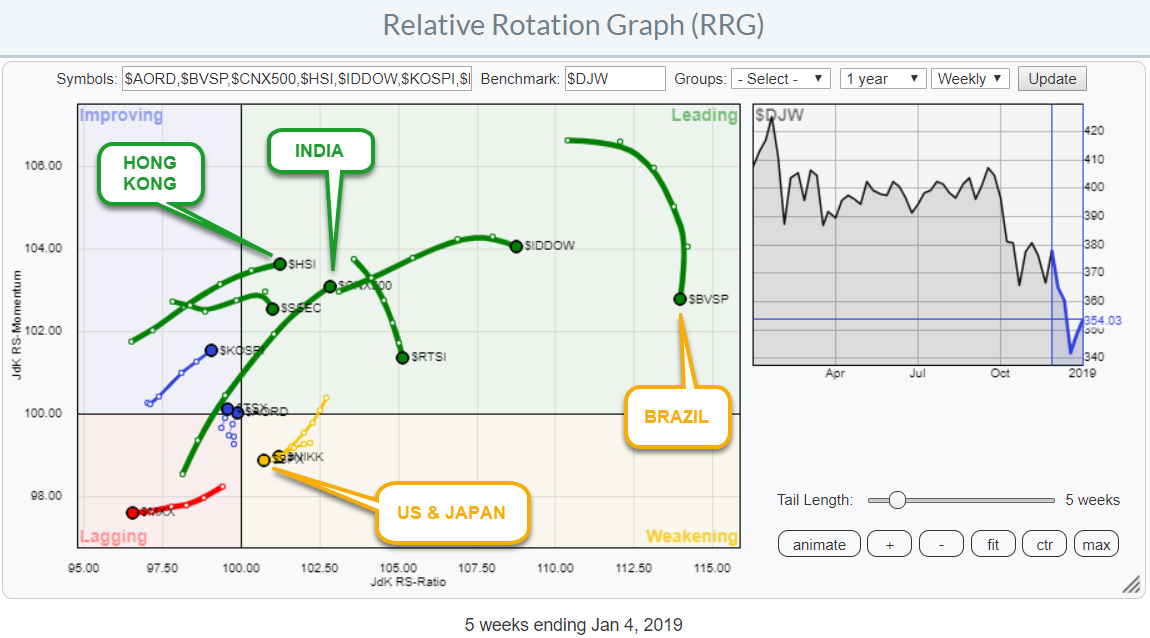

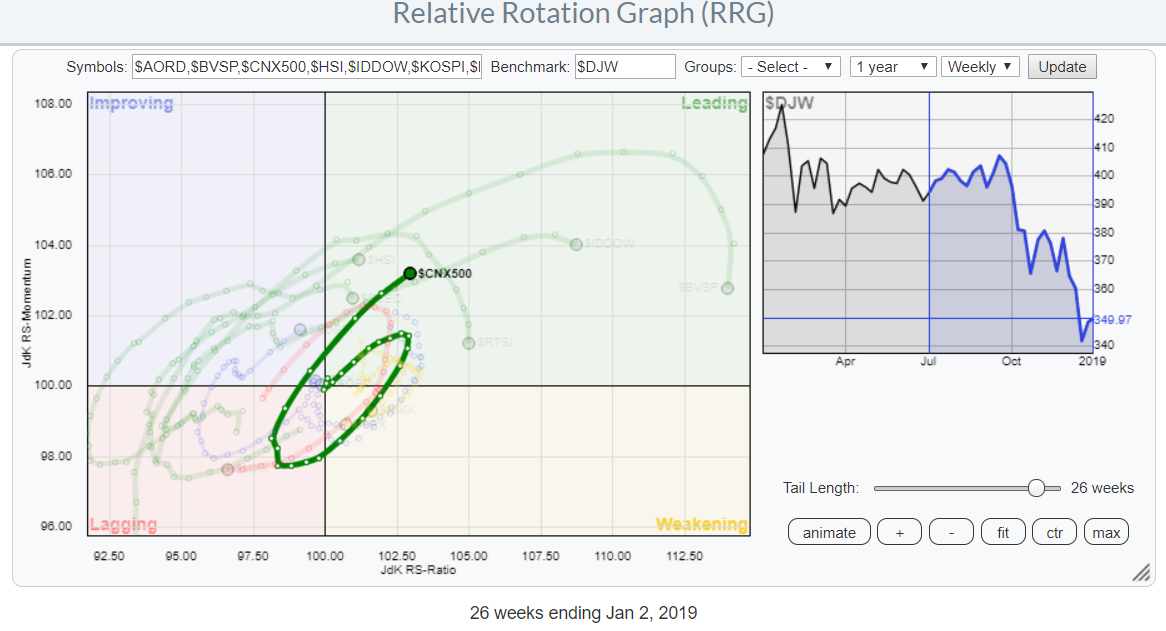

Use Relative Rotation Graphs To Get A Handle On International Markets

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

With the US stock market declining investors (may) need to look for alternatives in order to preserve capital. Sure enough, there are good opportunities in the US with bonds, IEF is doing very well, and cash is a very viable alternative if you do not "need" to be...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: The Market Eats the Shorts Again, but Context Helps Preserve Sanity

by Carl Swenlin,

President and Founder, DecisionPoint.com

With another short-covering rally, I am reminded that the primary benefit of using price charts is that they provide context. For example, I look at the TV and see that the Dow is up 800+ points, and I think holy cow what is going on? Do I need to completely...

READ MORE

MEMBERS ONLY

Earning Misses - Profiting from Weakness

by John Hopkins,

President and Co-founder, EarningsBeats.com

Most of you who read my blog know the name of our service is EarningsBeats.com. The name makes sense since, for many years during the bull market, we've zeroed in on those companies that beat earnings expectations that could be prime long candidates. Fast forward to today...

READ MORE

MEMBERS ONLY

100% Guaranteed Prediction for The New Year: I'll Be a Better Investor - Here's How!

by Gatis Roze,

Author, "Tensile Trading"

“The only way you get a real education in the market is to invest cash, track your trade, and study your mistakes…The examination of a losing trade is torturous but necessary to ensure that it will not happen again.”

— Jesse Livermore

This is the quote that introduces Chapter 10...

READ MORE

MEMBERS ONLY

Apple Plunges on Sales Warning

by John Murphy,

Chief Technical Analyst, StockCharts.com

Editor's Note: This article was originally published in John Murphy's Market Message on Thursday, January 3rd at 1:59pm ET.

The price of Apple is plunging today after issuing a sales warning for the first quarter. The stock was already in trouble before that announcement. The...

READ MORE

MEMBERS ONLY

Can the NIFTY Move Past its 50-Week MA in the Coming Week?

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Throughout the past week, the markets continued to follow the falling trend line pattern resistance. Though no major downsides were witnessed, the NIFTY did not make any major up moves either. The larger part of the previous week saw a significant number of shorts being added, but no short covering...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook (with Video) - Until Proven Otherwise

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* It is What it Is

* Breadth Indicator Review

* High-Low Percent Rebounds

* Vast Majority in Long-term Downtrends

* Volatility is Increasing, Not Decreasing

* Absolute Performance vs Relative Performance

* Risk-Off Environment

* Suggestions for Art's Charts ChartList

... It is What it Is

... There is no forecast to start 2019 because the signals...

READ MORE

MEMBERS ONLY

Apple's (AAPL) Guidance Wasn't As Shocking As Facebook's (FB)

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, January 3, 2019

Just about every market-related discussion since Wednesday's close has centered around Apple (AAPL, -9.96%)....and for good reason. AAPL is a U.S. stock market icon. Some might argue it is THE icon. When they lowered their revenue guidance substantially...

READ MORE

MEMBERS ONLY

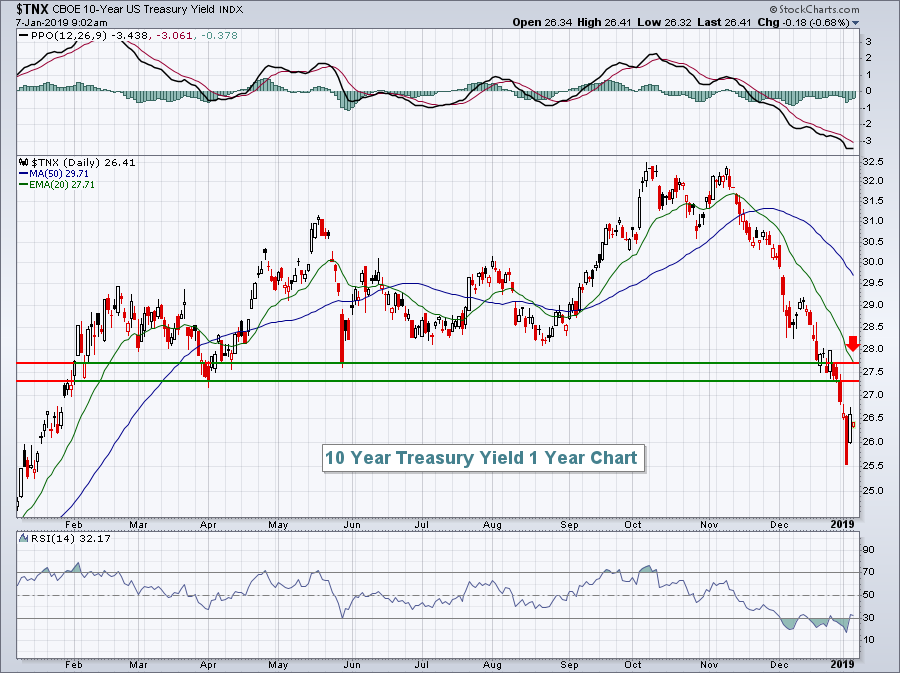

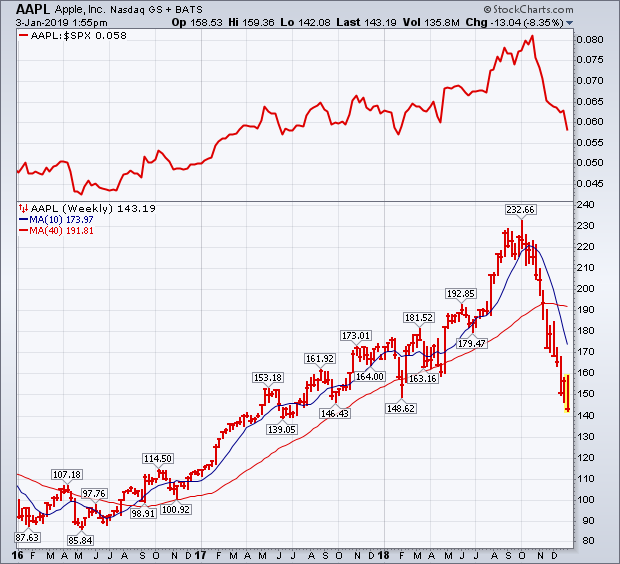

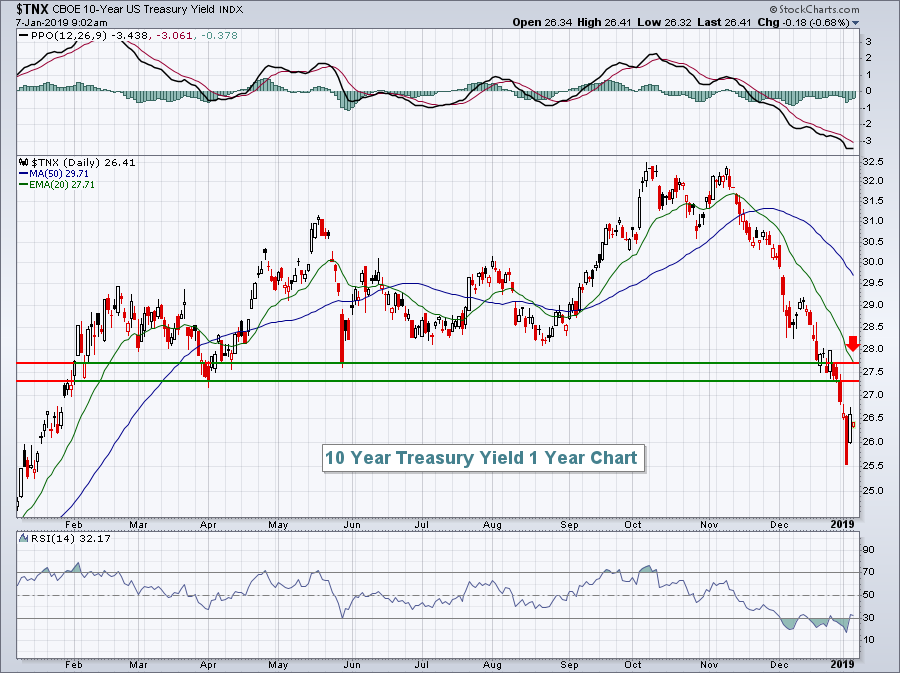

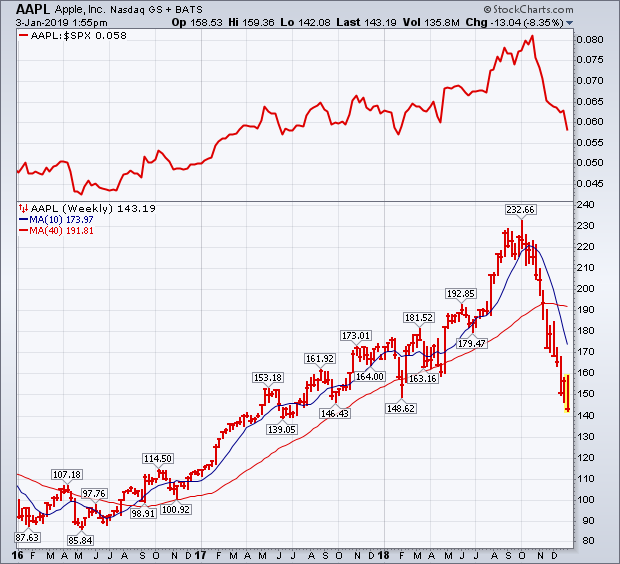

APPLE PLUNGES ON SALES WARNING -- STOCK INDEXES ARE FAILING AT OVERHEAD RESISTANCE LEVELS -- TREASURY YIELD FALLS TO LOWEST LEVEL IN A YEAR AS BOND PRICES SURGE -- GOLD AND YEN BENEFIT FROM SAFE HAVEN BUYING

by John Murphy,

Chief Technical Analyst, StockCharts.com

APPLE PLUNGES ON FIRST QUARTER WARNING ... The price of Apple is plunging today after issuing a sales warning for the first quarter. The stock was already in trouble before that announcement. The weekly bars in Chart 1 show Apple (AAPL) falling today to the lowest level since the middle of...

READ MORE

MEMBERS ONLY

January 2019 Market Roundup with Martin Pring

by Martin Pring,

President, Pring Research

The Market Roundup Video For January is now available.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion ofPring Turner Capital Groupof Walnut Creek or its affiliates....

READ MORE

MEMBERS ONLY

Did 2018 Meet Your Expectations?

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Welcome to 2019! I was born in the 1940s and am delighted to be here. If you were a trend follower with reasonable stop placement, 2018 was a tough year. If you were a trend follower without reasonable stop placement, you are scared, if not panicky. If you were a...

READ MORE

MEMBERS ONLY

Just Two Days After The Ball Drops, The Bomb Drops

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, January 2, 2019

On a day filled with hope, as traders rang in the new year on Wall Street, the biggest news came after the market closed as Apple (AAPL) warned regarding its upcoming quarter. During the trading day, we saw resiliency for one of the...

READ MORE

MEMBERS ONLY

NIFTY (India) As An Alternative For SPY (US Stocks)

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

With the US stock market declining investors (may) need to look for alternatives in order to preserve capital. Sure enough, there are good opportunities in the US with bonds, IEF is doing very well, and cash is a very viable alternative if you do not "need" to be...

READ MORE

MEMBERS ONLY

DP Alert: Signal Changes Galore! Dow, UUP, USO, TLT

by Erin Swenlin,

Vice President, DecisionPoint.com

**Special Announcement** Don't miss this Friday's DecisionPoint show at 4:30pm EST on StockCharts TV, where Carl will be joining me to discuss our outlook for 2019!

During today's MarketWatchers LIVE show, I showed viewers what the DP Scoreboards looked like at the beginning...

READ MORE

MEMBERS ONLY

The Relationship between Trend Direction and Risk

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With December complete, chartists can now examine monthly close-only charts for an assessment of the long-term trend and stock market risk. Spoiler: it is not a pretty picture.

Before looking at the chart, let's review the concept behind Price Channels. Chartists can use Price Channels to mark the...

READ MORE

MEMBERS ONLY

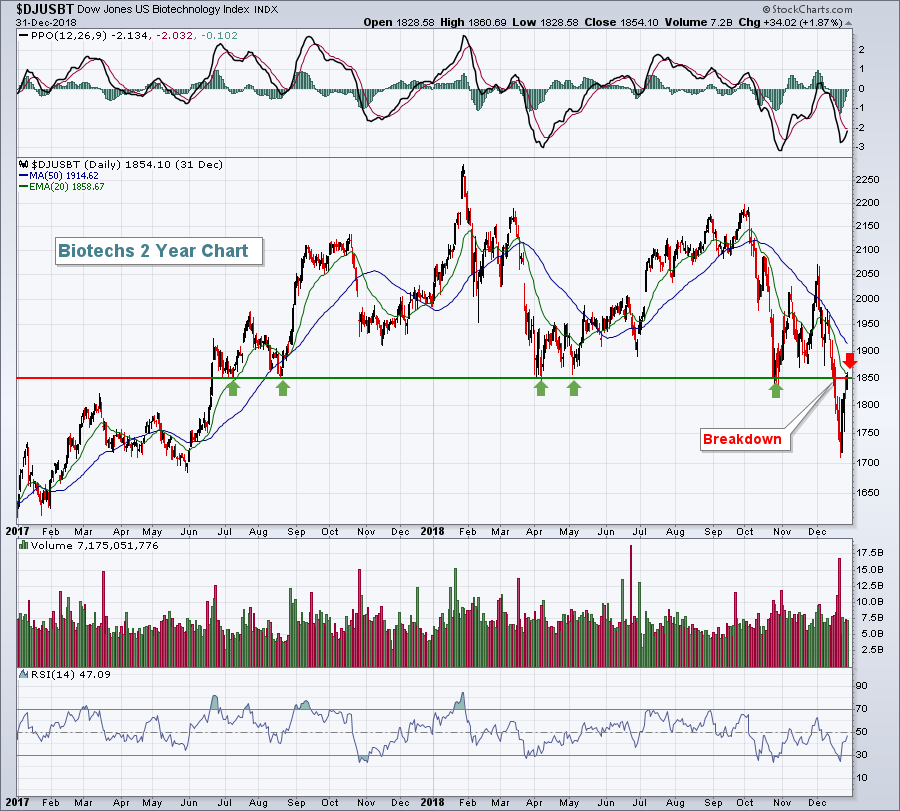

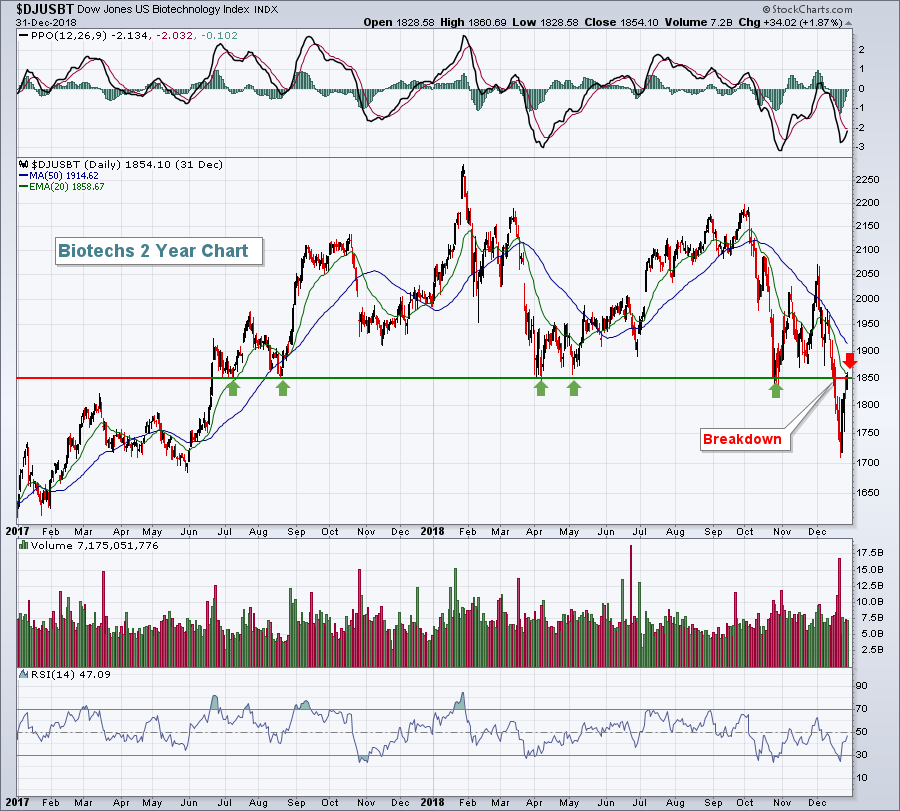

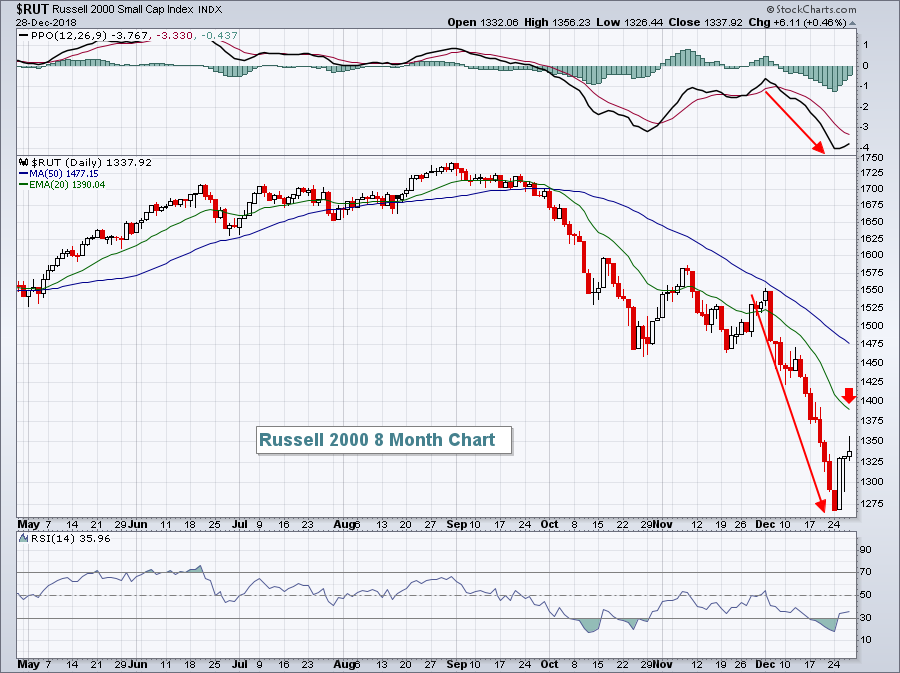

2019 Will Be A Cyclical Bear Market Within A Secular Bull Market

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, December 31, 2018

December 2018 was a rough month to end a very difficult Q4. It was very unusual in terms of historical perspective as we're accustomed to seeing mostly solid action in early December followed by a Santa Claus rally into year end....

READ MORE

MEMBERS ONLY

Could Gold Be The Big Winner In 2019?

by Martin Pring,

President, Pring Research

* Two Failed Outside Bars

* Long-Term Indicators Tipping to the Bullish Side

* Gold and the Shares Perking Up Against Equities in General

* Silver Setting Up for a Possible Major Breakout

Just before Christmas, I pointed out that the gold price, especially the shares, had experienced an outside day. Going by that...

READ MORE

MEMBERS ONLY

Interesting Technical Set-Ups on Container Corp of India and SBI

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The PSUBank Index has a shown sharp surge in its relative momentum against the broader CNX500 index. This keeps this index firmly in the leading quadrant of the Relative Rotation Graph, where it accompanies the NIFTY Infrastructure Index. The Container Corporation of India (CONCOR.IN) from the Infrastructure index and...

READ MORE

MEMBERS ONLY

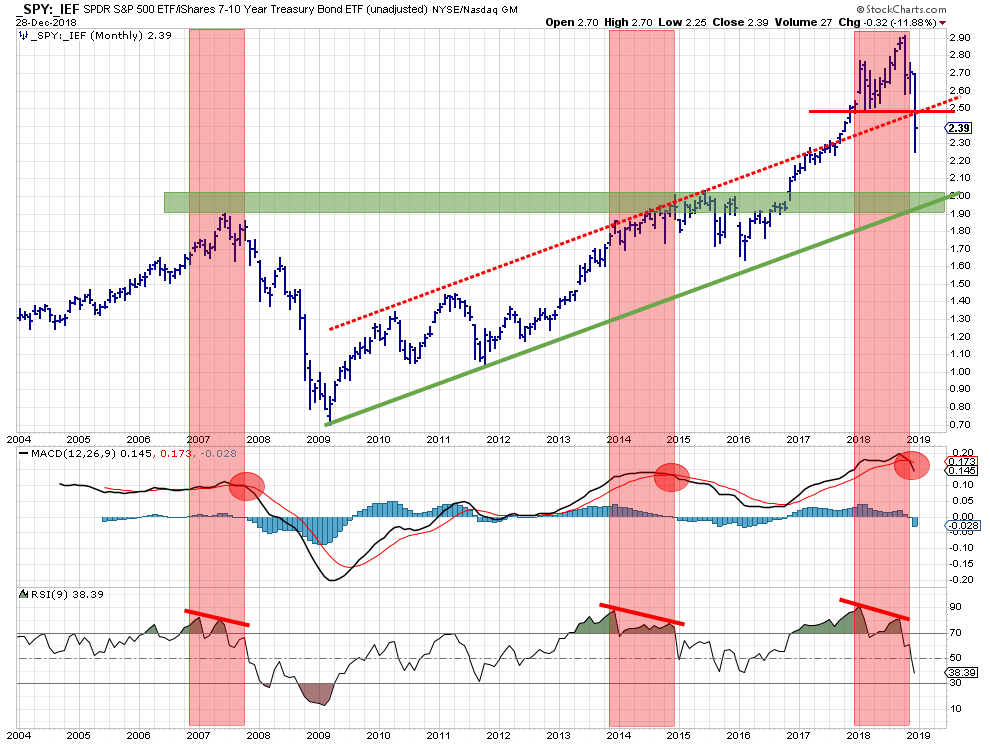

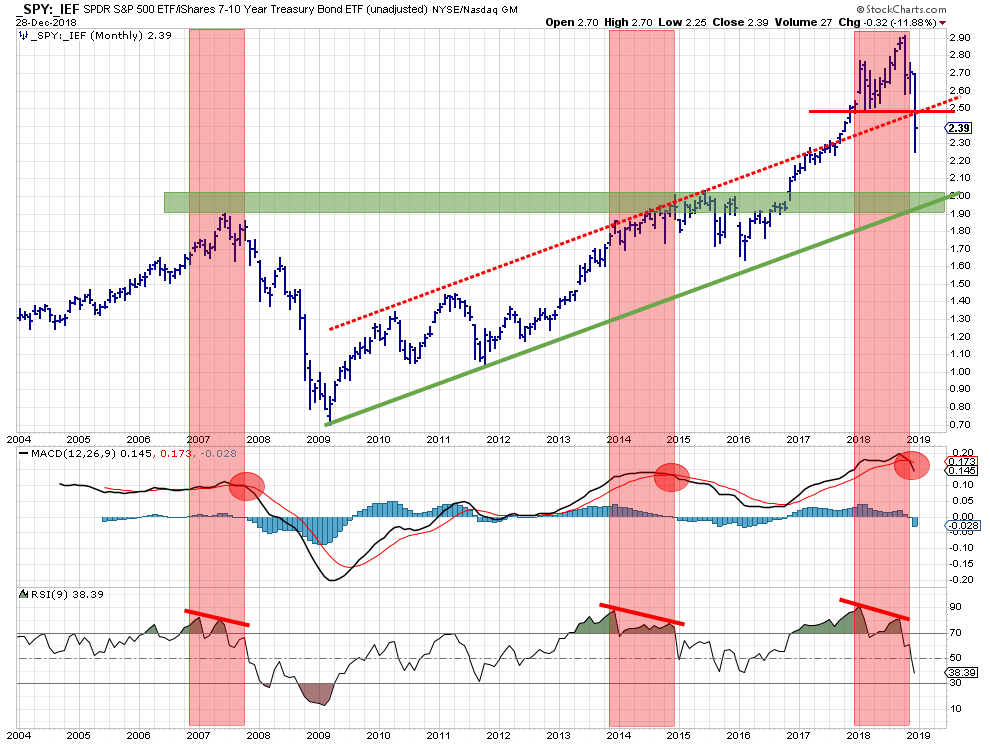

If the SPY:IEF ratio is going to test its support at the 2015 peaks where do SPY and IEF prices need to go?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The above chart shows the stocks/bonds ratio using monthly bars since 2004. IMHO this is one of the most useful charts to decide on an important portion of the asset allocation in your portfolio. Should you invest in stocks or in bonds. In other words, "Risk ON"...

READ MORE

MEMBERS ONLY

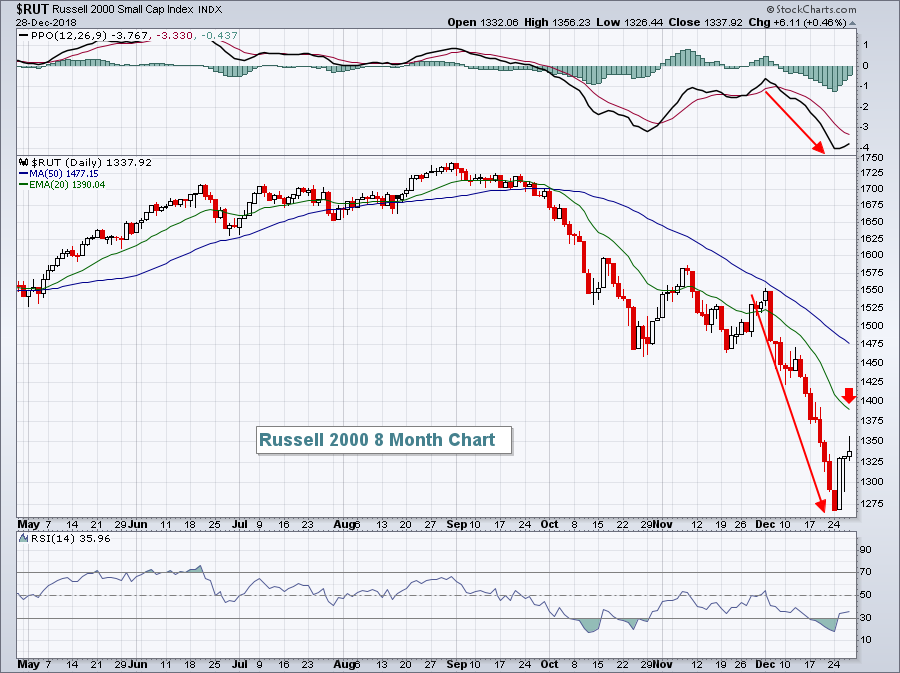

Utilities Is The Lone Bullish Sector As We Move Into 2019

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, December 28, 2018

Let's start with the bright spots from Friday's market action. The more aggressive NASDAQ and Russell 2000 ended the session in positive territory, gaining 0.08% and 0.46%, respectively. They both closed higher for the third consecutive day...

READ MORE