MEMBERS ONLY

The First Death Crosses Appear

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

A classic death cross occurs when the 50-day moving average moves below the 200-day moving average. On the flip side, a golden cross occurs when the 50-day SMA moves above the 200-day SMA. The 50-day SMAs have been above the 200-day SMAs for all major stock indexes this entire year...

READ MORE

MEMBERS ONLY

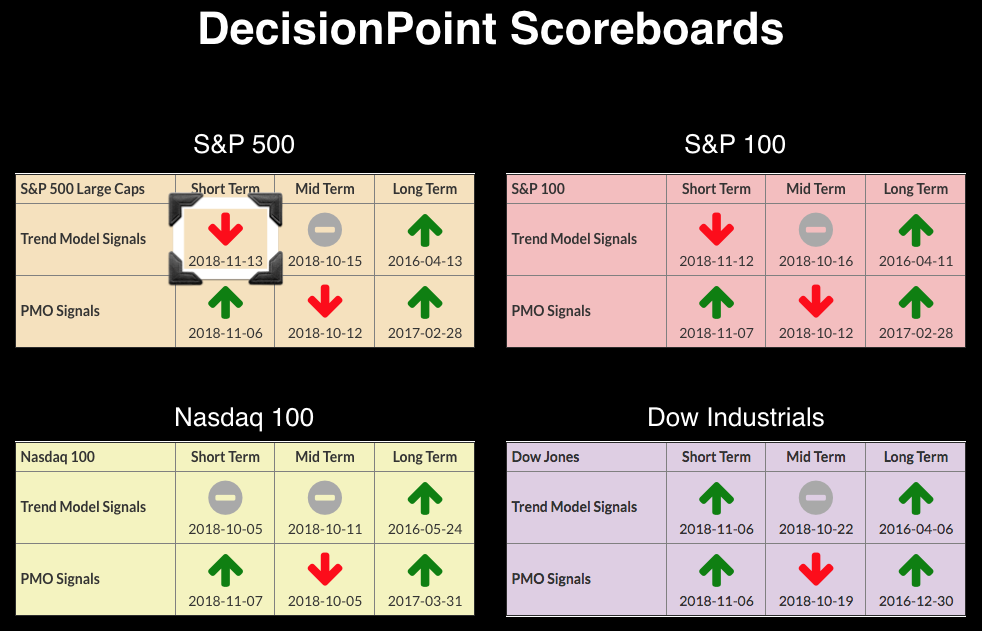

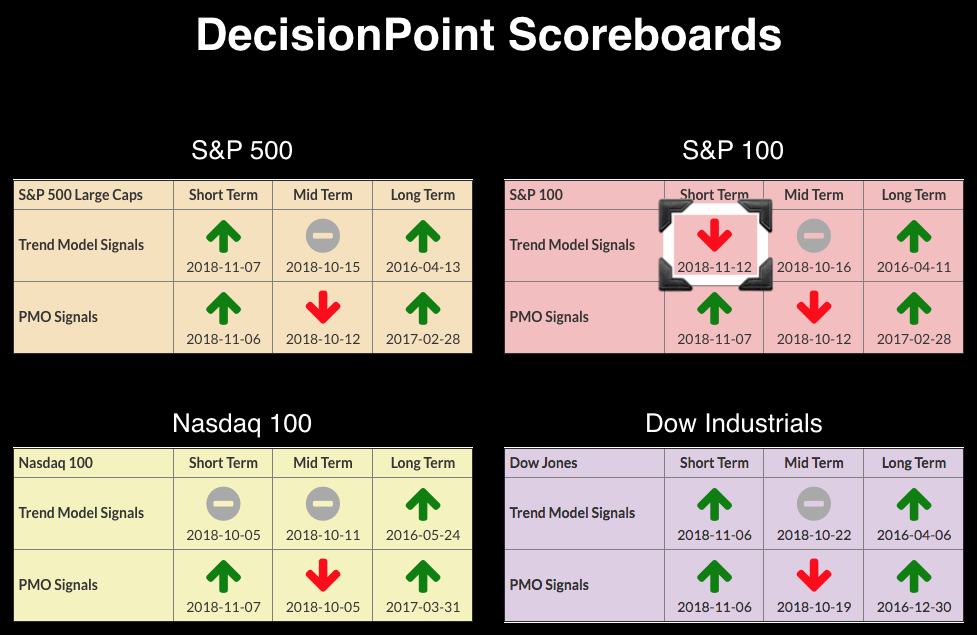

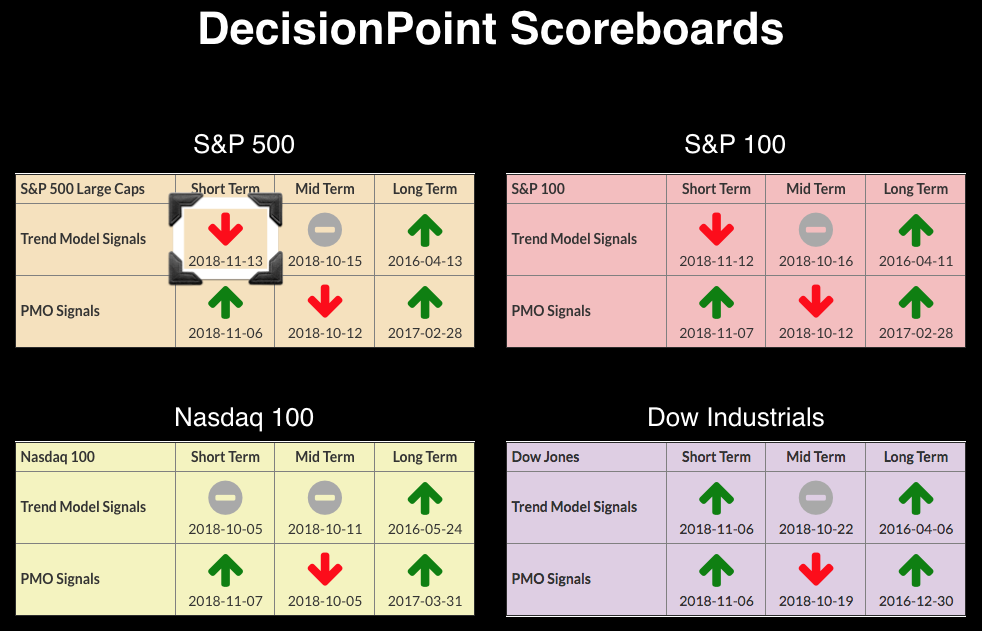

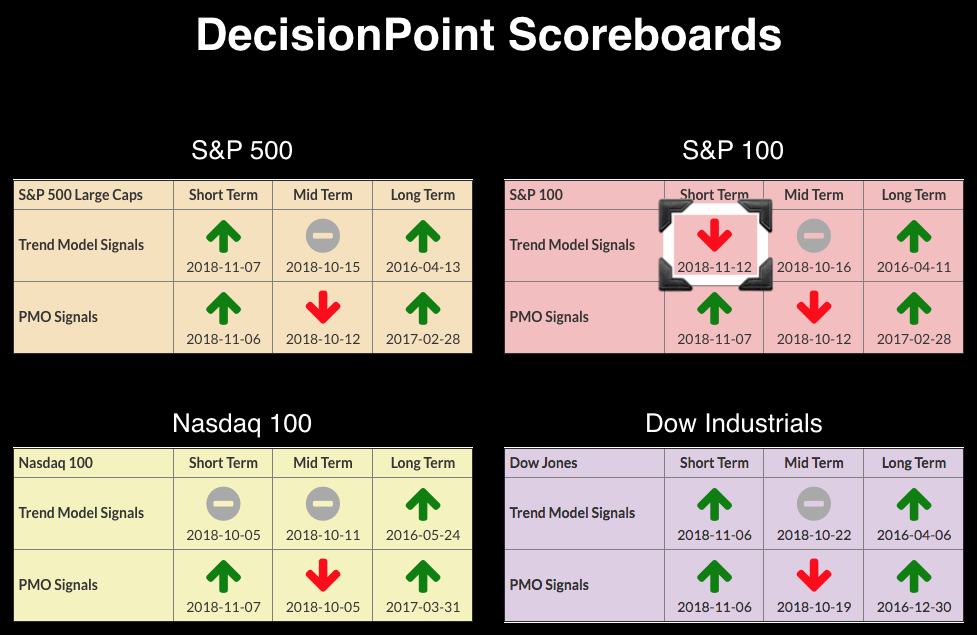

DP Bulletin #2: SPX Adds Short-Term Trend Model SELL Signal

by Erin Swenlin,

Vice President, DecisionPoint.com

The OEX added a ST Trend Model SELL signal yesterday, and today the SPX will join with its own ST Trend Model SELL signal. These signals are generated on 5/20-EMA crossovers. When it is a positive crossover, it is a BUY signal. When it is a negative crossover, the...

READ MORE

MEMBERS ONLY

Natural Gas Lights Up

by Bruce Fraser,

Industry-leading "Wyckoffian"

U. S. Natural Gas Fund (UNG) made an important ‘Spring’ low at the end of 2017. A Change-of-Character (CHoCH) emerged in the trading behavior of UNG in the new year. On the weekly chart UNG had been in a one year downtrend that concluded with a Spring and a Test....

READ MORE

MEMBERS ONLY

When Emotions Take Over

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I recently returned from a 10-day trip to Kuala Lumpur and Singapore. This was my first time in Malaysia, where I spoke at the IFTA Annual Conference along with my fellow StockCharts commentators Julius de Kempenaer and Martin Pring.

After the conference, when I was checking out of the hotel...

READ MORE

MEMBERS ONLY

Semiconductors Are In A Bear Market, Follow This Trading Range

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, November 12, 2018

Welcome back bears. Welcome back volatility. It was another day of steep losses on Wall Street, underscoring the likely end to what the bulls were hoping was a sustainable rally back to recent highs. There was a major test last week for the...

READ MORE

MEMBERS ONLY

Stock-in-Focus: Despite Some Consolidation, This Banking Stock is Likely to Make Decisive Moves

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Over the last four to five weeks, the NIFTY Bank Index ($BANKNIFTY) has not only out-performed the Public Sector Bank Index among the banking space, but it has also seen sharp improvement in relative momentum against the Broader Market Index $CNX500. Many of the Nifty Bank Index components are interestingly...

READ MORE

MEMBERS ONLY

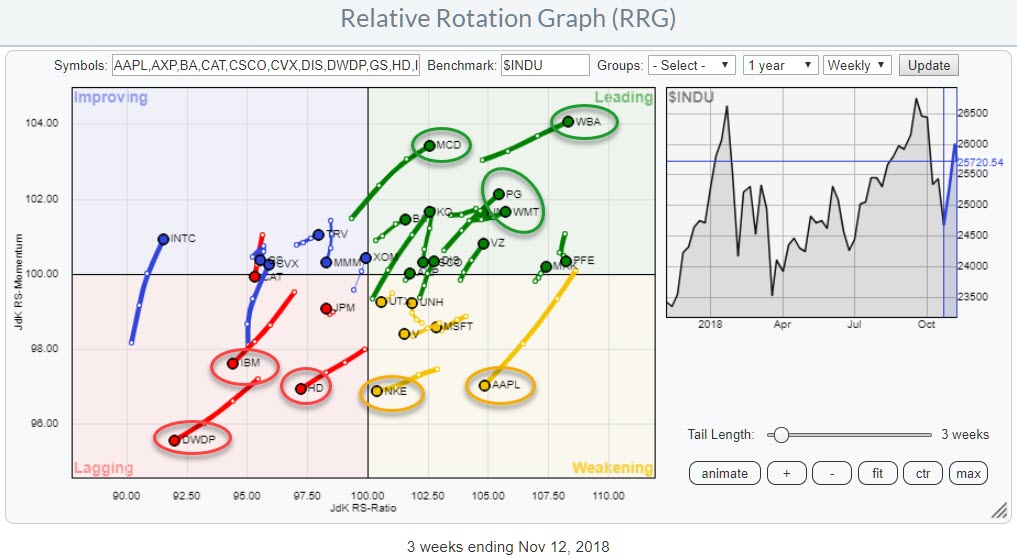

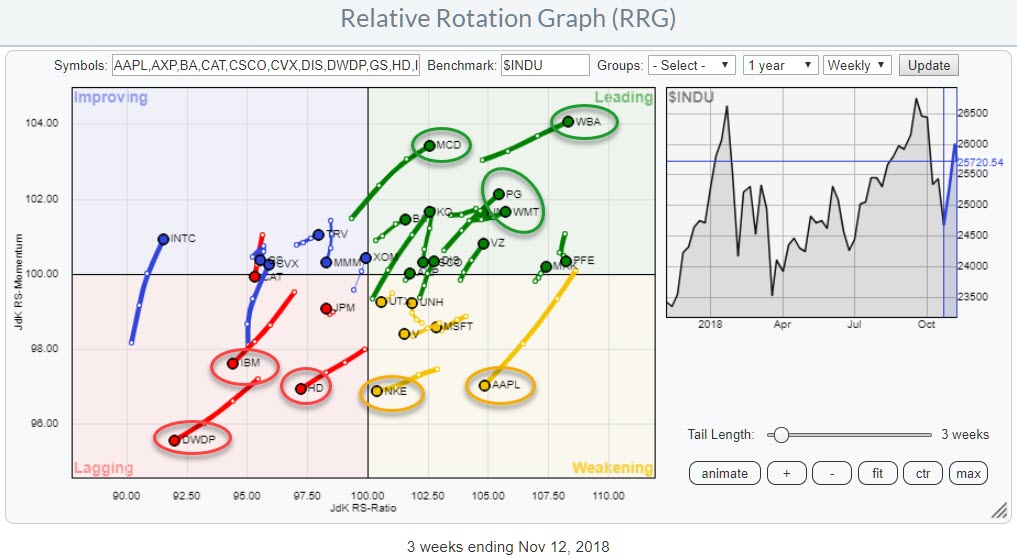

Using RRG to find some good and some not so good names inside the DJ Industrials index.

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The relative rotation graph above shows the rotation of the 30 DJ Industrials stocks. Watching the interaction on the canvas, a few rotations catch the eye.

Inside the lagging quadrant IBM, HD, and DWDP are clearly moving deeper into negative territory. On the opposite side inside the leading quadrant, we...

READ MORE

MEMBERS ONLY

DP Bulletin: OEX First to Log Short-Term SELL Signal

by Erin Swenlin,

Vice President, DecisionPoint.com

The whipsaw Short-Term Trend Model BUY signal generating on the OEX Friday below its 50-EMA was the culprit for today's ST Trend Model SELL signal. Remember that ST Trend Model signals are generated by 5/20-EMA crossovers in relation to the 50-EMA. A positive crossover is always a...

READ MORE

MEMBERS ONLY

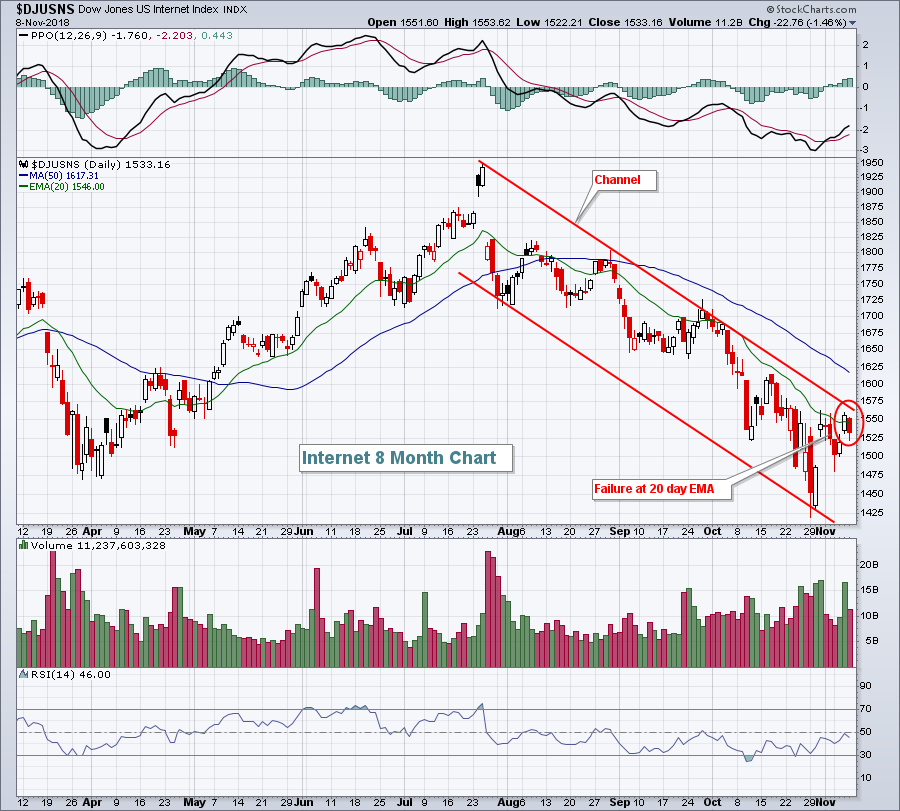

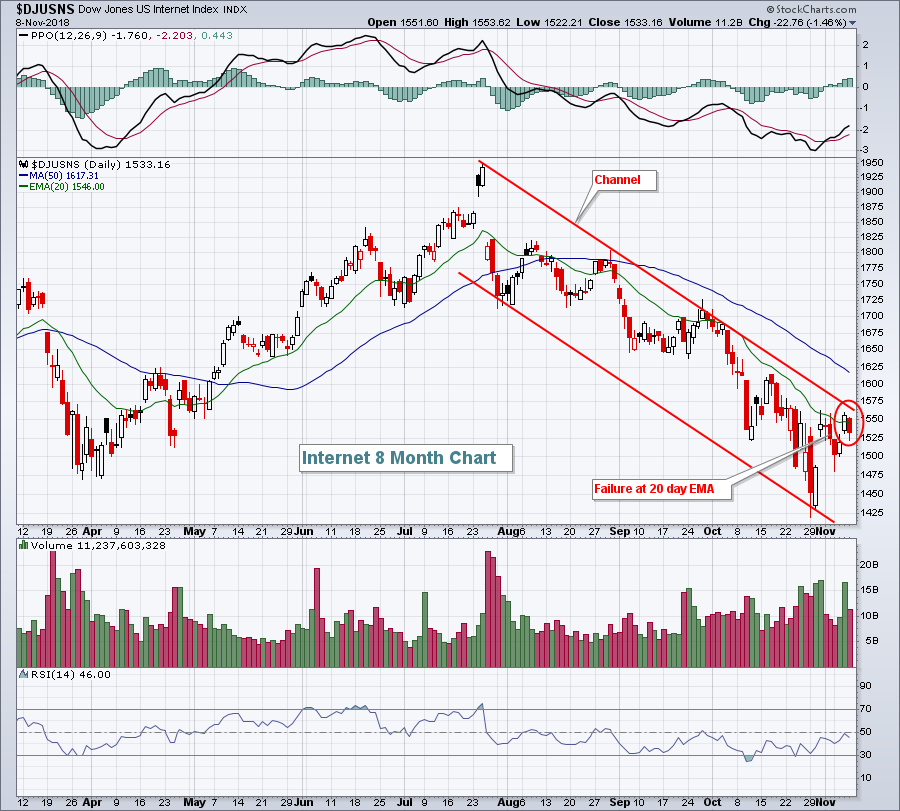

TECH STOCKS CONTINUE TO LEAD MARKET LOWER -- TECHNOLOGY SPDR SLIPS FURTHER BELOW ITS 200-DAY AVERAGE -- APPLE DROPS TOWARD ITS 200-DAY LINE AS MICROSOFT WEAKENS -- BROADCOM AND INTEL LEAD CHIP STOCKS SHARPLY LOWER -- S&P 500 IS BACK BELOW ITS 200-DAY LINE

by John Murphy,

Chief Technical Analyst, StockCharts.com

TECHNOLOGY SPDR FALLS FURTHER BELOW ITS 200-DAY AVERAGE ... Technology stocks continue to lead the stock market lower today. The Technology Sector SPDR (XLK) fell back below its 200-day average on Friday, and is falling further below it today (Chart 1). To get an idea of how much the techs have...

READ MORE

MEMBERS ONLY

Are Copper Prices Signaling S&P 500 Bear Market Like In Prior Years?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, November 9, 2018

There was a return of strength in defensive sectors on Friday as consumer staples (XLP, +0.58%), utilities (XLU, +0.15%) and real estate (XLRE, +0.12%) were the only sectors to finish the session in positive territory. There was also significant relative...

READ MORE

MEMBERS ONLY

Goldman Continues to Struggle

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Goldman Sachs is the premier investment bank and a key component of the Financials SPDR (XLF), as well as the Broker-Dealer iShares (IAI). The stock has struggled since March and lagged the market for over six months now. While the S&P 500 moved to a new high in...

READ MORE

MEMBERS ONLY

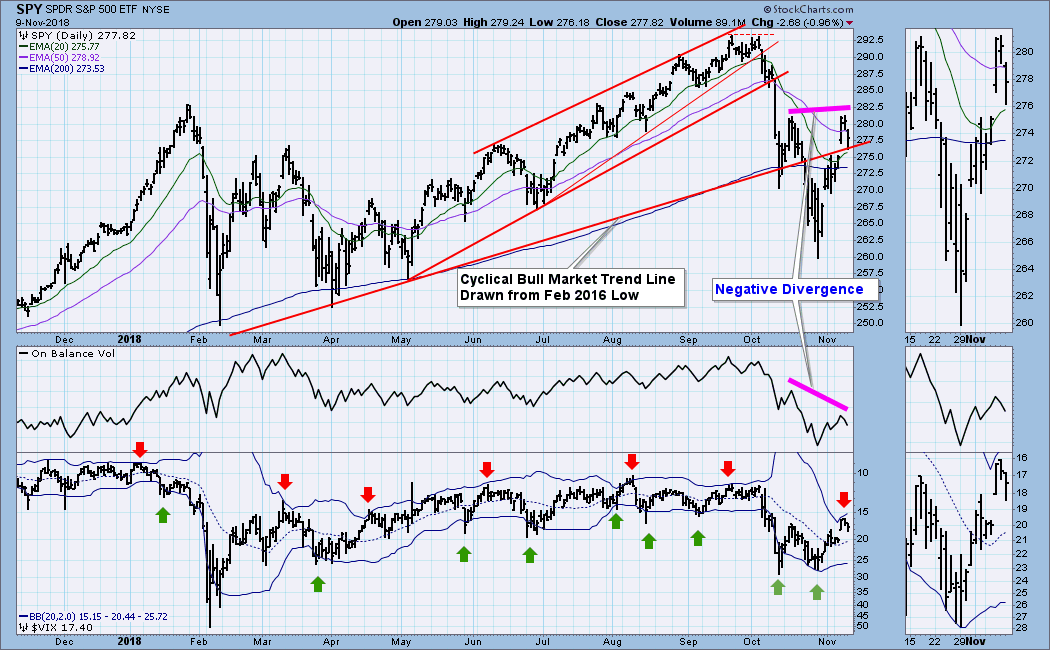

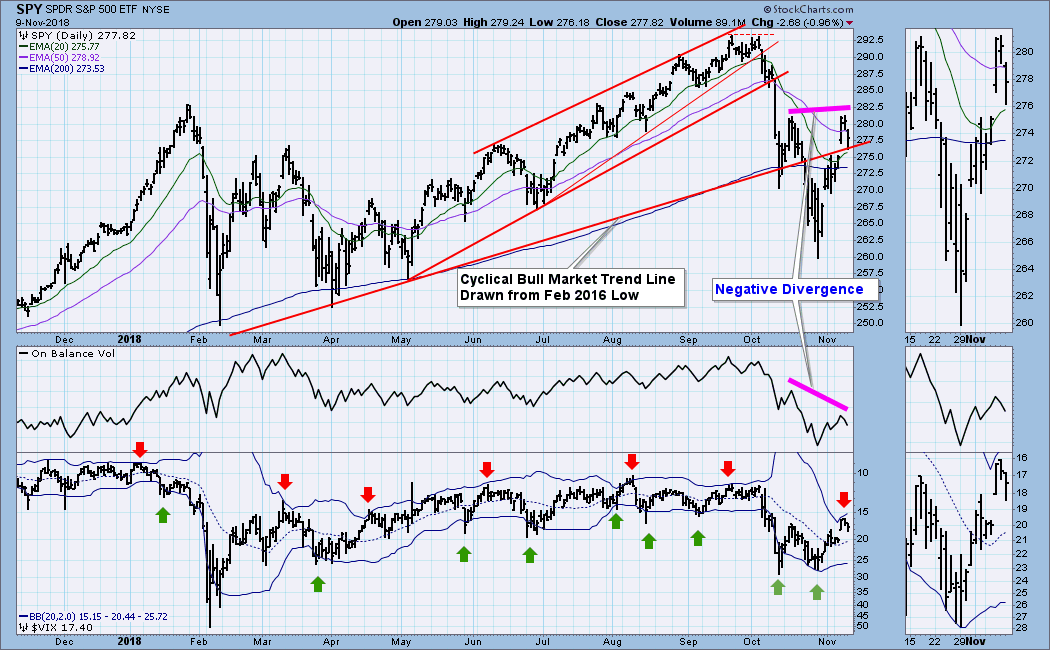

DP Weekly Wrap: Break or Fake?

by Carl Swenlin,

President and Founder, DecisionPoint.com

Last week SPY was below the cyclical bull market rising trend line. This week there was a post-election pop on Wednesday that caused SPY to recapture that rising trend line. Will that breakout hold, or is it a fakeout? There are two features on the daily chart that say to...

READ MORE

MEMBERS ONLY

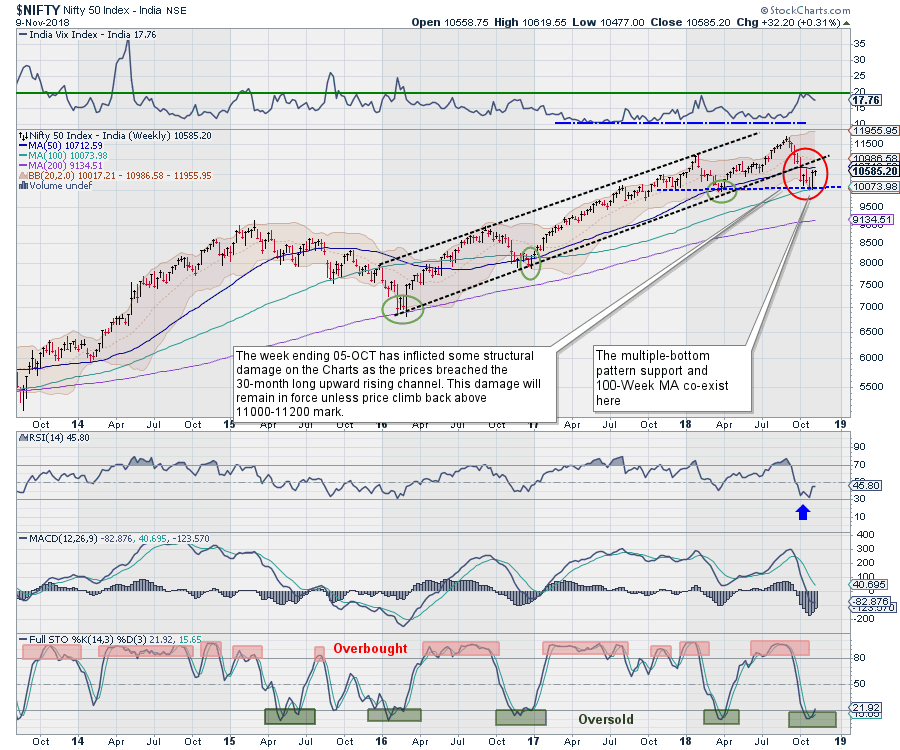

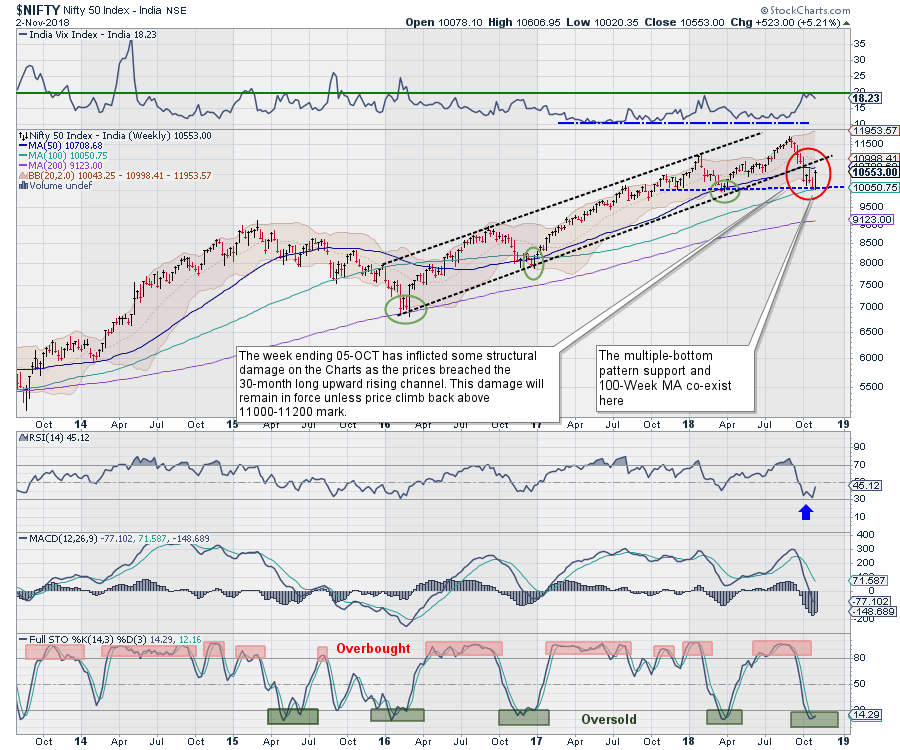

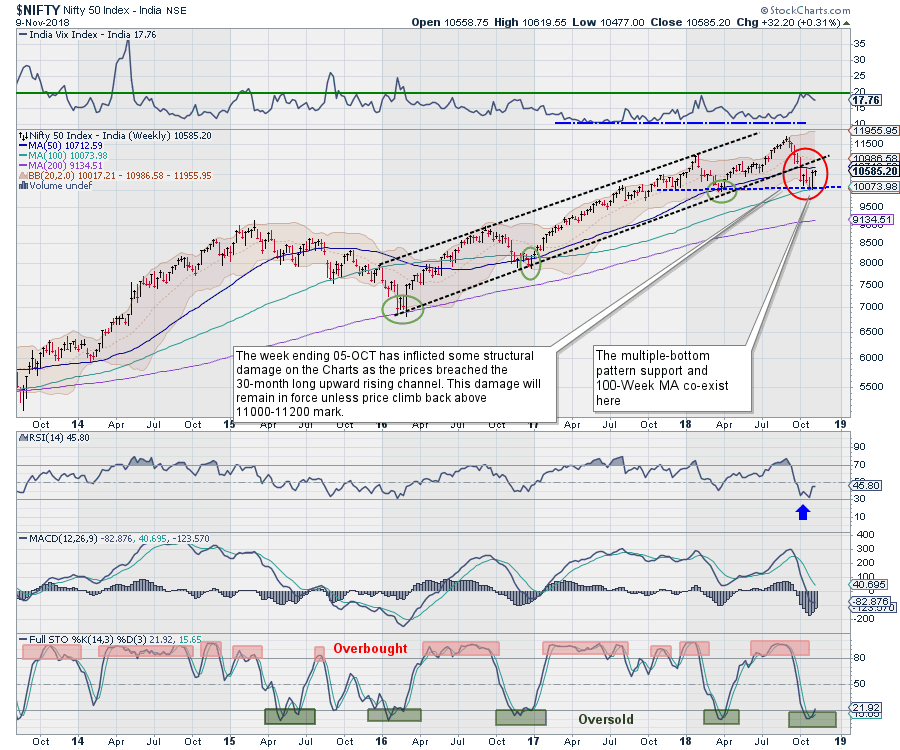

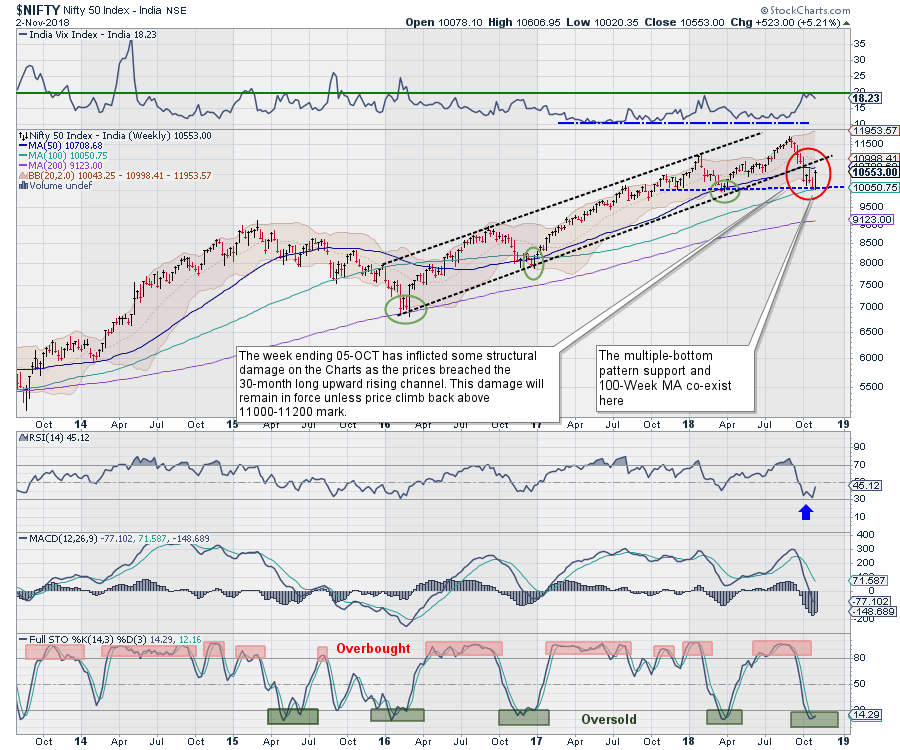

Weekly Outlook: Important for NIFTY to Move Past the 10600-10750 Zones; May Remain Turbulent At Higher Levels

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In ourprevious Weekly note, we forecasted that the markets would not make any major headway in the truncated week due to the holiday festivities. As expected, the NIFTY spent the week in a narrow range and showed no directional bias. The benchmark index ultimately went nowhere, ending the week on...

READ MORE

MEMBERS ONLY

The Intellectual Void

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I’m always trying to come up with new ideas for articles and don’t mind if I cross the line a little bit even if it offends a few – I just don’t want to offend everyone; certainly not all at once. This one is going to do just...

READ MORE

MEMBERS ONLY

ENERGY STOCKS FOLLOW CRUDE OIL LOWER -- RISING DOLLAR IS PUSHING COMMODITY PRICES LOWER -- DEFENSIVE SECTORS ARE STILL IN THE LEAD -- CYCLICALS RUN INTO RESISTANCE WHILE TECHOLOLOGY SECTOR WEAKENS

by John Murphy,

Chief Technical Analyst, StockCharts.com

CRUDE OIL ENTERS BEAR MARKET... Commodities as a group have been under a lot of selling pressure for several months. But the weakest part of that group over the past month has been energy. Chart 1 shows the price of WTIC Light Crude Oil (through yesterday) falling to the lowest...

READ MORE

MEMBERS ONLY

Several Indicators Point To A Test Of The October Lows

by Martin Pring,

President, Pring Research

* Indexes Reach Resistance and Retrace 61.8% of the Decline

* Hourly Charts Offer the First Domino

* Short-Term Breadth is Overstretched

* NASDAQ Sports a Series of Declining Peaks and Troughs

Indexes Reach Resistance and Retrace 61.8% of the Decline

The market has been on a tear for the last couple...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook (with video) - When Trends Lose Consistency

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Performance Overview.

* When Uptrends Lose Consistency.

* Only One Breadth Thrust.

* Not A Lot of Strong Uptrends.

* Majority of Stocks below 200-day EMA.

* S&P 500 Hits Moment-of-truth.

* On-Trend versus NOT On-Trend.

* Breakdowns Followed by Sharp Rebounds.

* This Week in Art's Charts.

* Notes from the Art's...

READ MORE

MEMBERS ONLY

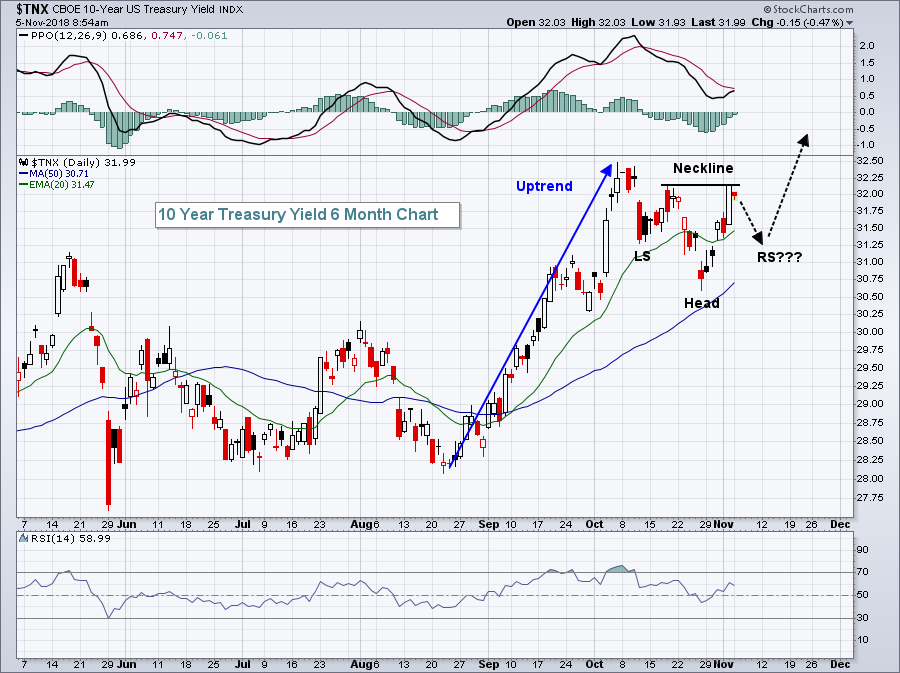

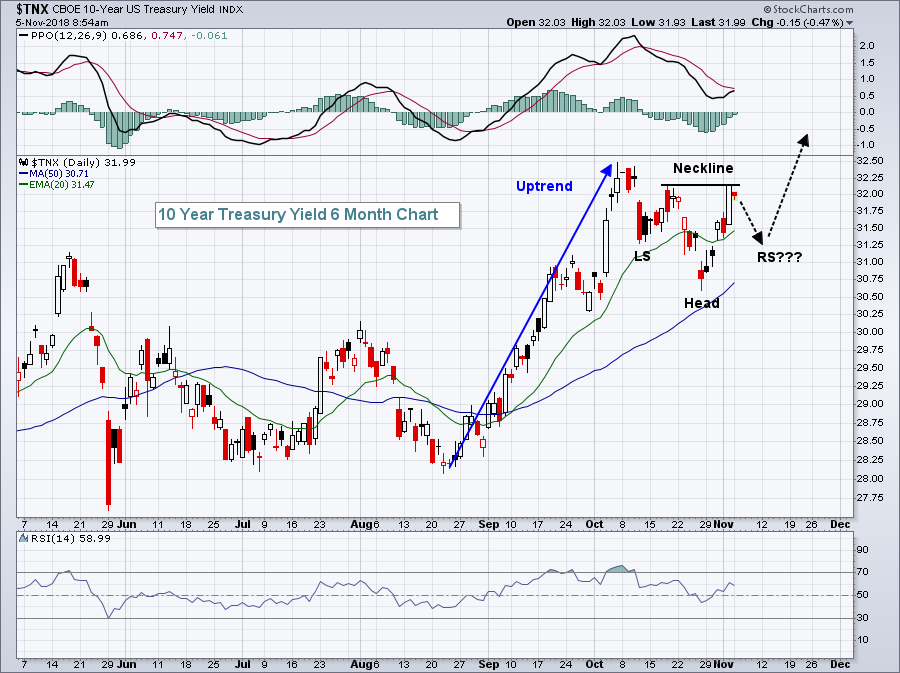

S&P 500 Hesitates At Next Key Price Resistance

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, November 8, 2018

Well, another Fed day has come and gone. The FOMC ended its two day meeting and left rates unchanged, as expected. It promised, however, further gradual increases. If you recall, the spike in the 10 year treasury yield ($TNX) to 3.25%, a...

READ MORE

MEMBERS ONLY

Very Bullish Sector Rotation Underscores Dow's 500 Point Gain

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, November 7, 2018

The Dow Jones surged 545 points, or 2.13%, yesterday and that index of conglomerates was a laggard. NASDAQ stocks exploded nearly 200 points higher, or 2.64%, to extend what's been a very impressive rally after October's massacre....

READ MORE

MEMBERS ONLY

Healthcare Sector Stands Out - Plus HealthCare Providers, Medical Devices, a New High Scan and Nine Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Healthcare Sector Shows Leadership.

* Big Moves in %Above 50-day EMA.

* Healthcare Providers and Medical Devices Break Out.

* HealthCare Providers Lead New High List.

* Nine Healthcare Stocks to Watch.

... Strong Breadth within Healthcare

... The chart below shows the %Above 200-day EMA indicator for nine of the sector SPDRs. Note that we...

READ MORE

MEMBERS ONLY

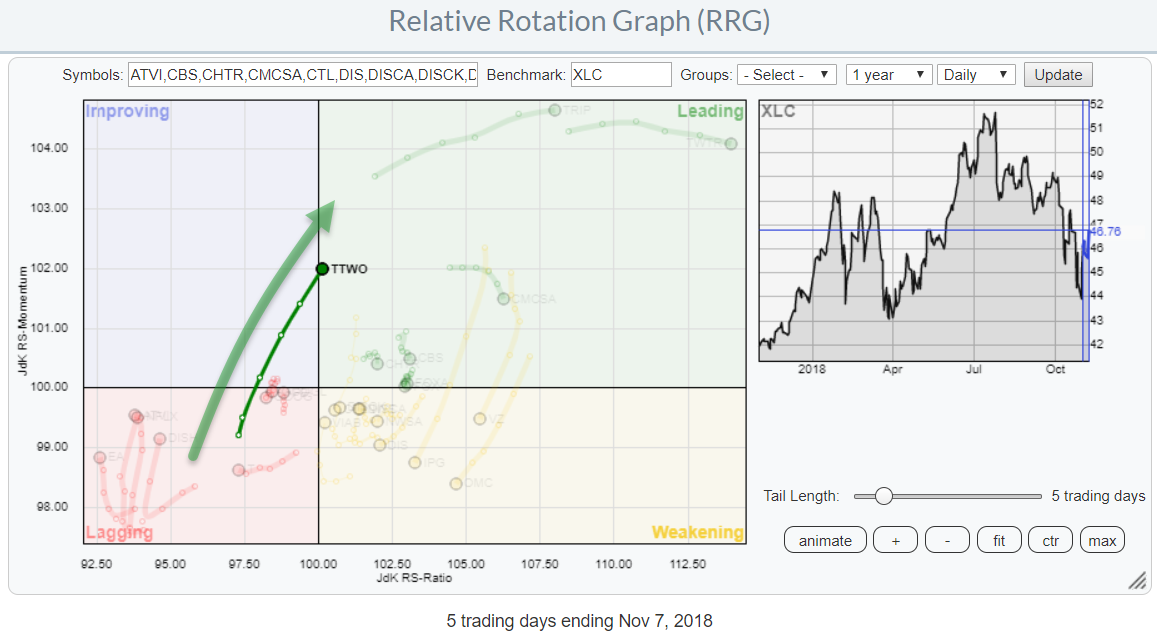

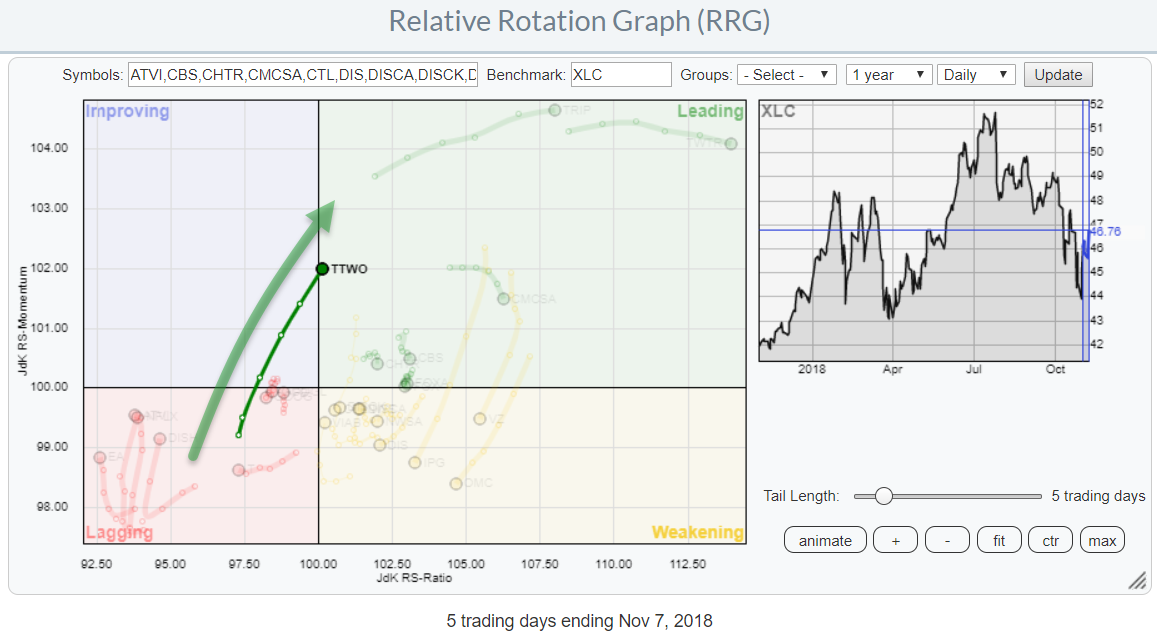

It takes two to tango for TTWO

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

While browsing through some Relative Rotation Graphs, looking for DITC candidates, my eye fell on TTWO inside the Communications Services sector.

XLC itself is inside the weakening quadrant vs SPY but very close to the benchmark, meaning that the performance of the sector is very close to that of SPY....

READ MORE

MEMBERS ONLY

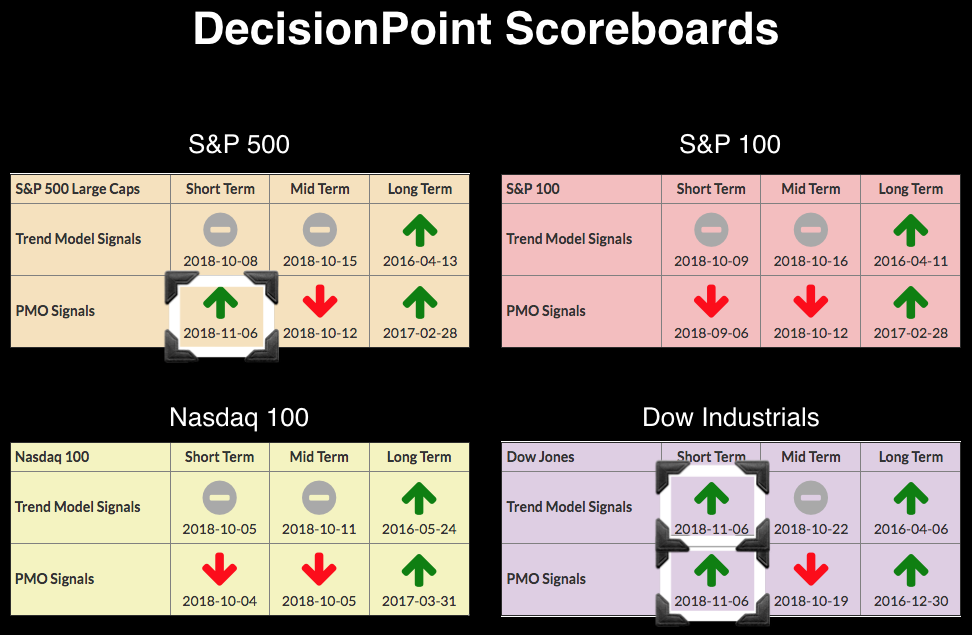

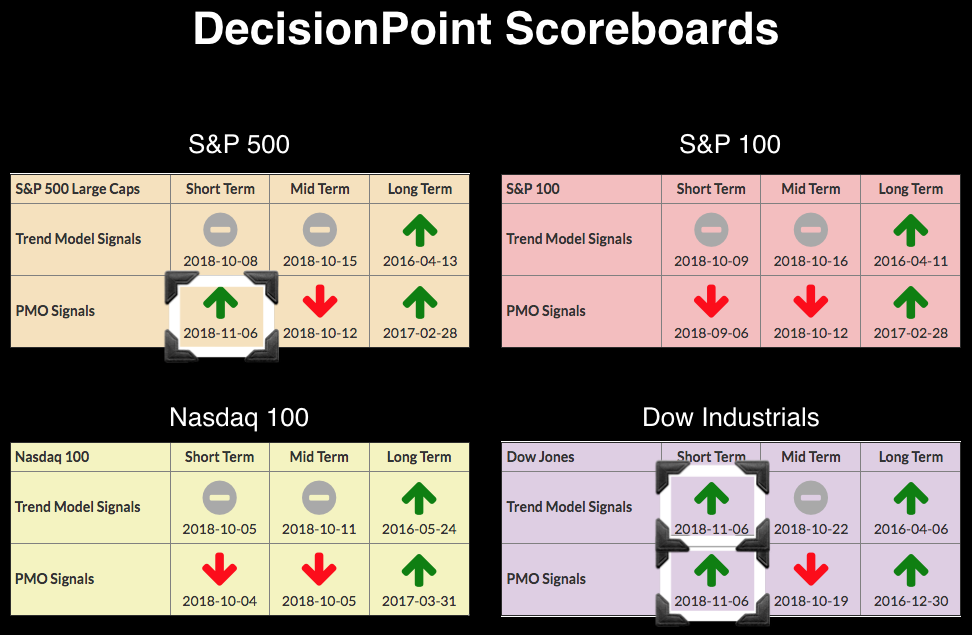

DP Alert: Momentum Shift - New PMO BUY Signals on DP Scoreboards

by Erin Swenlin,

Vice President, DecisionPoint.com

Lots of new BUY signals are appearing on the DecisionPoint Scoreboards in the short-term timeframe. This is good news for bulls, but I don't think they can breathe easy just yet. This rally reminds me of the last big rally we had in October that was not fueled...

READ MORE

MEMBERS ONLY

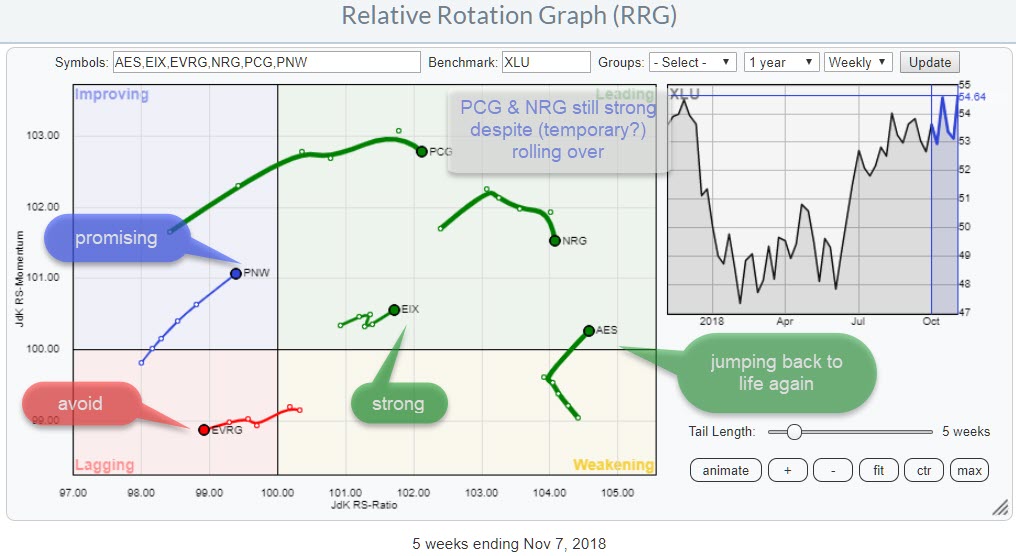

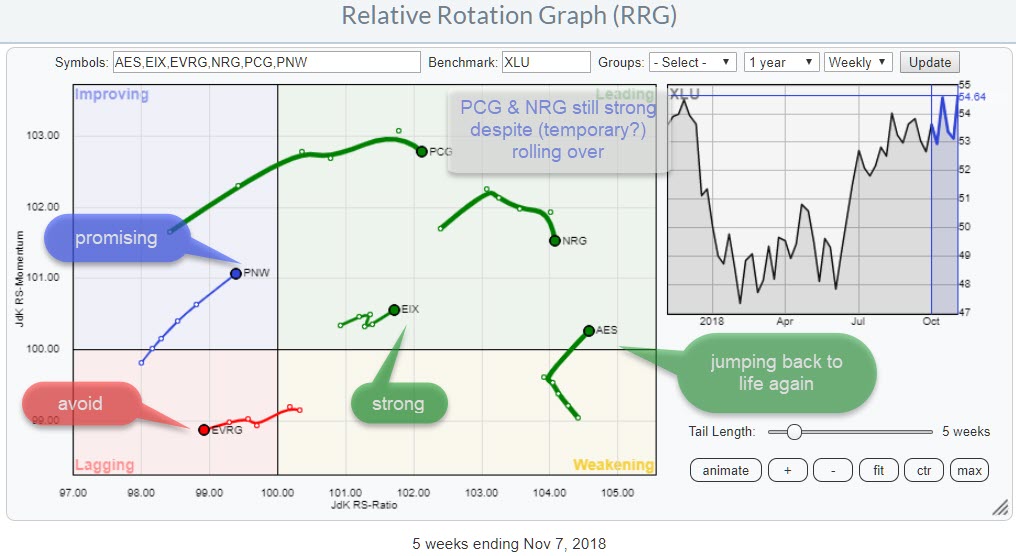

Some utility stocks worth paying attention to

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The relative rotation graph above shows a selection of stocks in the utilities sector. I have created this zoomed in version for better visibility. The fully populated RRG can be found here.

In this post, I will highlight a few of the stocks shown in the picture. As XLU is...

READ MORE

MEMBERS ONLY

DP Bulletin: Dow and SPX Log New BUY Signals

by Erin Swenlin,

Vice President, DecisionPoint.com

The Dow and SPX both triggered PMO BUY signals after the close yesterday. In addition, the Dow printed a ST Trend Model BUY signal. I will be writing a more comprehensive blog this evening on these signal changes that occurred on the close yesterday. I just wanted to give everyone...

READ MORE

MEMBERS ONLY

THE DOW LEADS NOVEMBER REBOUND -- THE S&P 500 IS BACK ABOVE ITS 200-DAY LINE -- SO ARE THE QQQ AND XLK -- HEALTH CARE PROVIDERS LEAD THE XLV -- SO ARE ABBOTT LABS, JOHNSON & JOHNSON, AND MERCK

by John Murphy,

Chief Technical Analyst, StockCharts.com

THE DOW LEADS STOCK UPTURN ... Major stock indexes are building on their November gains on the day after the midterm elections. The Dow is leading on the upside. Chart 1 shows the Dow Industrials already trading above chart resistance at 25,800 and trying to clear its 50-day average. Chart...

READ MORE

MEMBERS ONLY

Railroads Provide Us Market Clues And Right Now They're Bullish

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, November 6, 2018

All eleven sectors rose on Tuesday with materials (XLB, +1.64%) leading as the U.S. Dollar Index ($USD) closed at its lowest level in nearly two weeks. All of our major indices had similar gains, from 0.55% to 0.68%, as...

READ MORE

MEMBERS ONLY

This Big Pharma Stock is Closing in on a New High

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Johnson & Johnson (JNJ) started the year on the wrong foot with a double digit decline the first six months. After hitting a 52-week low in late May, the stock turned around and advanced some 20% the next four months. Even though the stock remains below the January high, the...

READ MORE

MEMBERS ONLY

Monitoring the Bounce in the Major Index ETFs, key Sectors, Tech-related ETFs and a Dozen Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Short-term Bounce Extends.

* XLY and XLF Lead Rebound.

* SKYY and SOXX Lead Tech-related ETFs.

* Gold Holds Breakout.

* Crude Hits Moment-of-Truth.

* Bonds Continue to March South.

* Stocks to Watch: DIS, VZ, CSCO, MSFT, MA, V and JNJ.

... Short-term Bounce Extends

Stocks were deeply oversold in late October and there were several...

READ MORE

MEMBERS ONLY

Last Chance For Gold To Rally?

by Martin Pring,

President, Pring Research

* The Long-Term Picture

* Price Action Characteristics are Bearish

* Gold Share Breadth is Negative

* The Now or Never Chart

The Long-Term Picture

Gold was in a secular bull market between 2001 and 2011. It then sold off into 2014 and has been essentially range bound ever since. Chart 1 shows that...

READ MORE

MEMBERS ONLY

November 2018 Market Roundup with Martin Pring

by Martin Pring,

President, Pring Research

The Market Roundup Video For November is now available.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion ofPring Turner Capital Groupof Walnut Creek or its affiliates....

READ MORE

MEMBERS ONLY

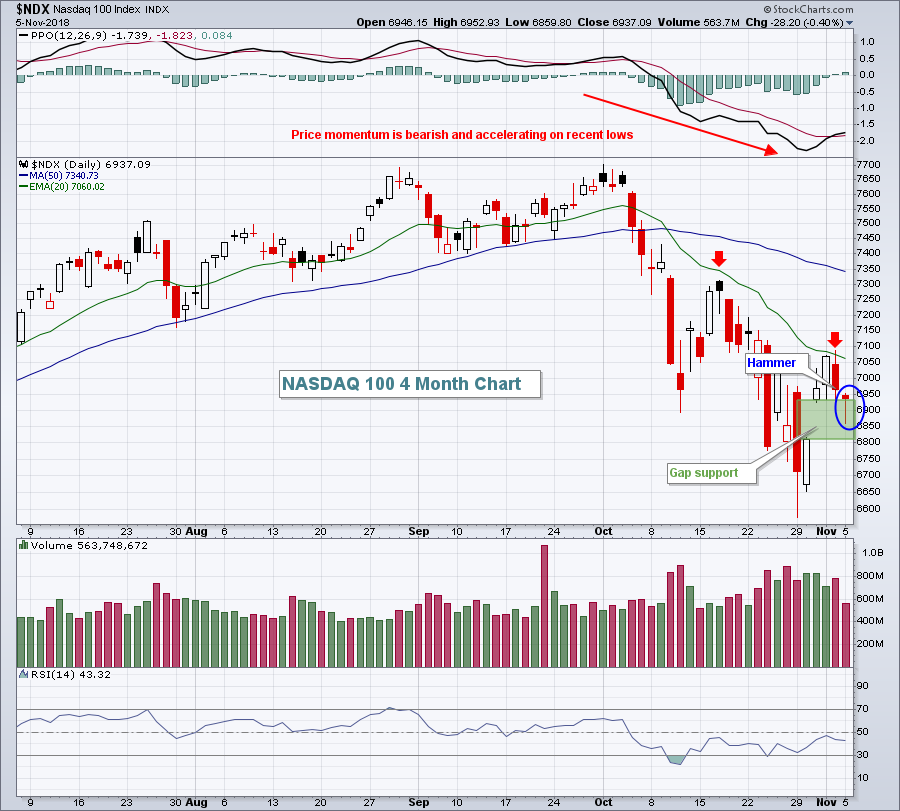

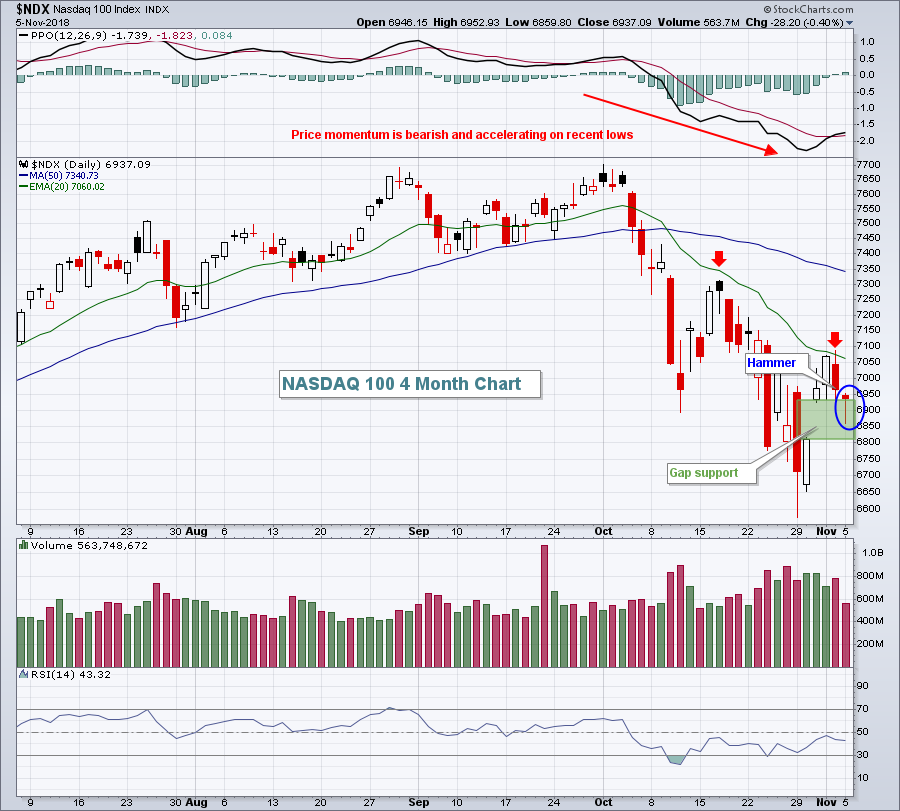

Bulls Avert Near-Term Breakdown But Caution Prevails

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, November 5, 2018

Bifurcated market action dominated on Monday. The Dow Jones and S&P 500 gapped higher and traded higher throughout nearly all of the session. The NASDAQ and Russell 2000, on the other hand, struggled throughout most of the day with an afternoon...

READ MORE

MEMBERS ONLY

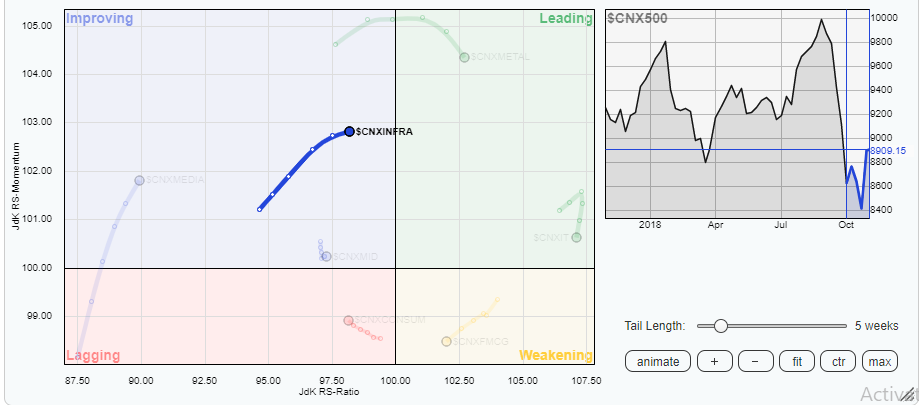

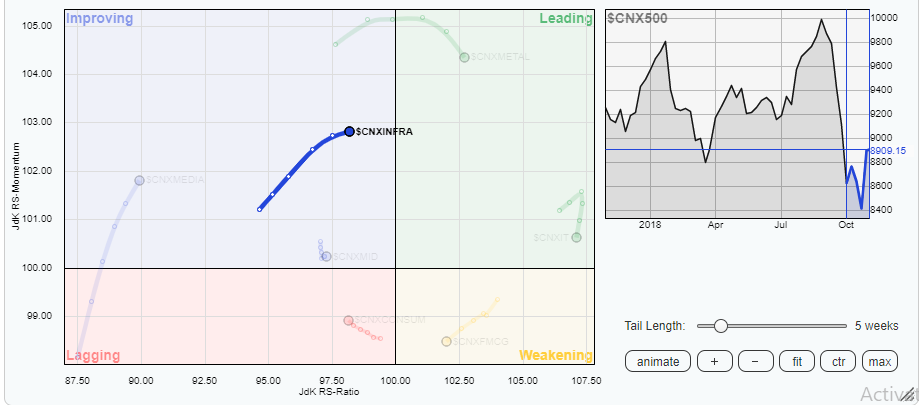

Interesting Trade Set-up; Breakout expected

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

NIFTY Infrastructure Index ($CNXINFRA) has seen considerable improvement in its performance over past couple of weeks. After relatively under-performing for the most part of 2018, this Sector Index has shown strong improvement in its Relative Momentum when bench-marked against the broader Index NIFTY500 ($CNX500). It is seen continuing with its...

READ MORE

MEMBERS ONLY

Using PnF Charts for Intraday Trading

by Bruce Fraser,

Industry-leading "Wyckoffian"

Point and Figure charts are useful tools for more than calculating price objectives. Many Wyckoffians start their analysis with PnF charts and then turn to vertical bar charts when and if needed. Classic Wyckoff analysis uses a combination of vertical and PnF charts. But it is excellent practice to develop...

READ MORE

MEMBERS ONLY

AAPL: Another Parabolic Breakdown

by Carl Swenlin,

President and Founder, DecisionPoint.com

Apple, Inc. (AAPL) is nothing if not repetitive. AAPL experiences frenzied, parabolic advances that are followed by equally dramatic corrections. This has happened no less than three times in the last 11 years with an average correction of -48%. Now it appears to be happening again, as price has recently...

READ MORE

MEMBERS ONLY

How to (not) Trade the Elections

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The US elections are on Tuesday and the financial press is full of tips based on possible outcomes. Basing a financial decision on a news event means we must get two things right. First, we must successfully predict the news (election results). Second, we must then successfully predict the market&...

READ MORE

MEMBERS ONLY

Transports Are A Big Deal And Here's What The Chart Is Saying

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, November 2, 2018

Traders were anxiously awaiting jobs data last week. First, it was a solid ADP employment report on Wednesday morning that helped to lift U.S. equities. But the biggie was on Friday and we all held our collective breath as the numbers were...

READ MORE

MEMBERS ONLY

Markets, News and the Percentage of Stocks above the 50-day EMA

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Markets and News.

* S&P 500 Gets Oversold Bounce.

* %Above 200-day EMA Plunges.

* Range Change for %Above 20-day EMA.

* %Above 50-day EMA Forms Small Divergence.

... Markets and News

...Writing a market commentary before the election seems a bit foolhardy, but the election results do not figure into my analysis....

READ MORE

MEMBERS ONLY

3 Upcoming Earnings Reports I Can't Wait To See

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'm not a fan of buying (or short selling) stocks and holding them into quarterly earnings reports. It's simply too difficult to manage risk. Yes, there are options strategies that you can employ to reduce risk so we could debate back and forth the merits of...

READ MORE

MEMBERS ONLY

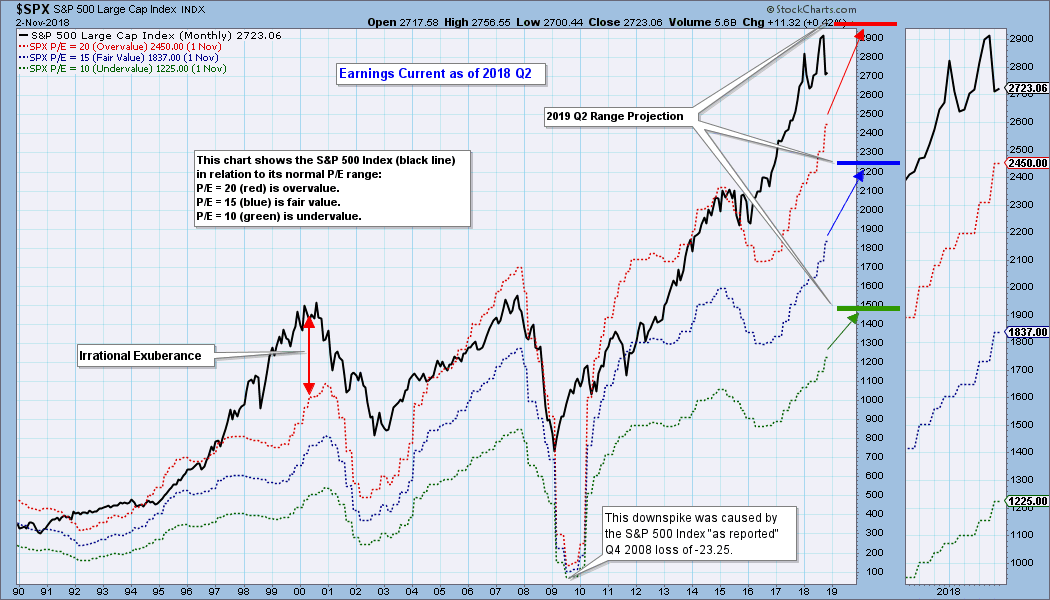

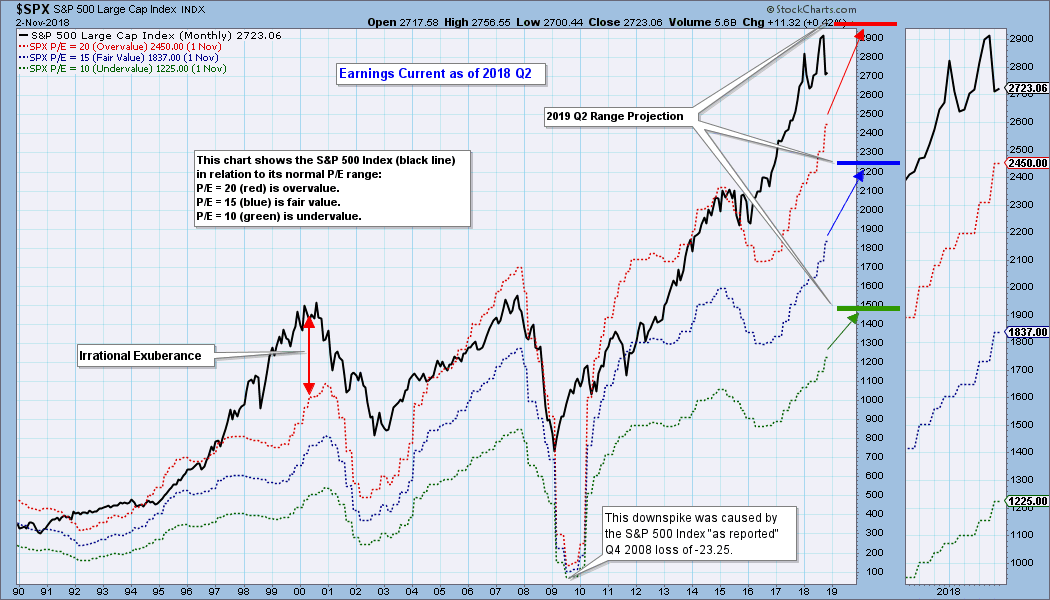

Market Overvalued Even on Forward Earnings

by Carl Swenlin,

President and Founder, DecisionPoint.com

Charts of fundamental data are as useful as price charts in helping us visualize fundamental context and trends. In the case of earnings, the following chart shows us where the S&P 500 would have to be in order to have an overvalued P/E of 20 (red line)...

READ MORE

MEMBERS ONLY

Week Ahead for Nifty: Markets likely to remain broadly range bound amid truncated week and festivities

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In our previous Weekly Note, we had mentioned that despite remaining structurally damaged, the Equities might witness a technical pullback. The levels of 10026 which was the Weekly 100-Week MA last week (which is 10050 presently), acted as a support for the Markets. The benchmark Index NIFTY50 witnessed a much...

READ MORE