MEMBERS ONLY

Introducing Brian Livingston And His New StockCharts Blog, "Muscular Investing"

by Grayson Roze,

Chief Strategist, StockCharts.com

To kick off the new month, I'm thrilled to announce another all-star addition to our StockCharts commentary team. Brian Livingston, author of the recently-released book Muscular Portfolios, will be sharing his investing insights and money management wisdom through a new weekly blog, Muscular Investing.

Brian's background...

READ MORE

MEMBERS ONLY

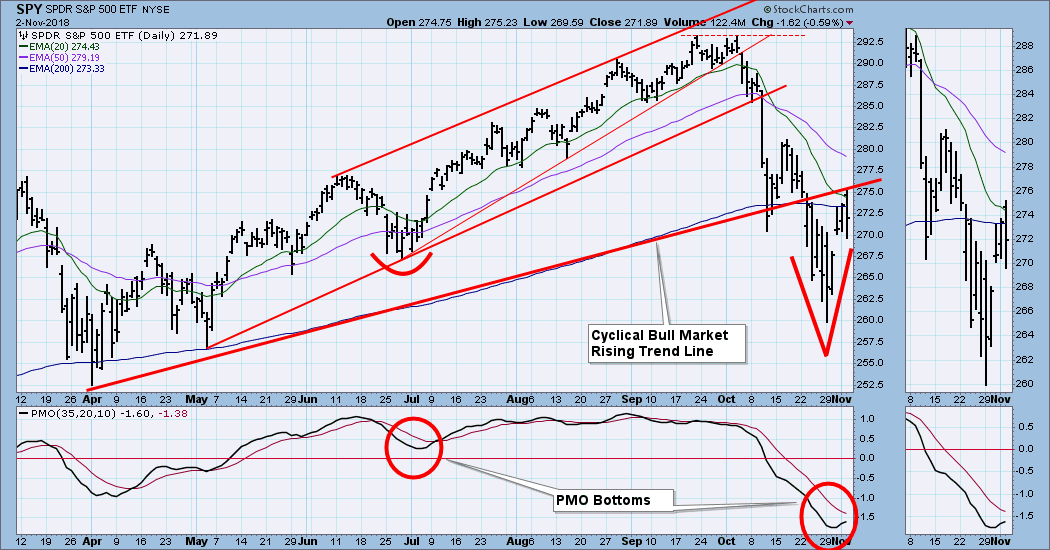

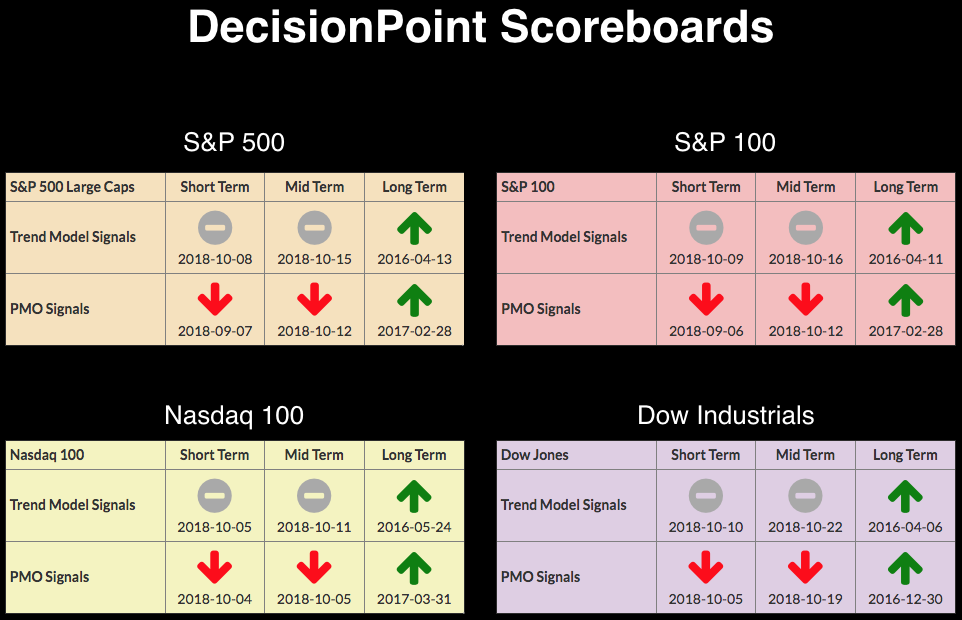

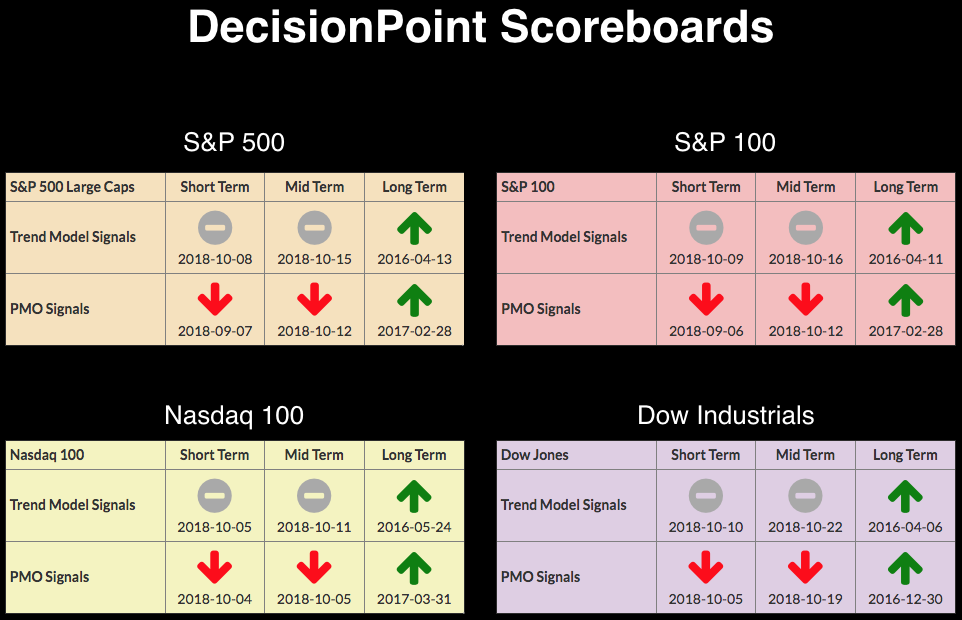

DP weekly Wrap: Not a Good BUY Signal

by Carl Swenlin,

President and Founder, DecisionPoint.com

In the Weekly Wrap I have been saying that a short-term buy of SPY should not be considered until the daily PMO turns up. As it happens, the PMO turned up on Thursday, but I must confess that I wasn't thrilled. When the Price Momentum Oscillator (PMO) turns...

READ MORE

MEMBERS ONLY

A Precious Metal that Actually Acts Precious

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Gold, silver and platinum suffered selling pressure over the last few years, but palladium attracted buying pressure and outperformed. It is one of the few precious metals trading near a 52-week high and in a long-term uptrend.

The first chart shows three year performance for the continuous futures contracts for...

READ MORE

MEMBERS ONLY

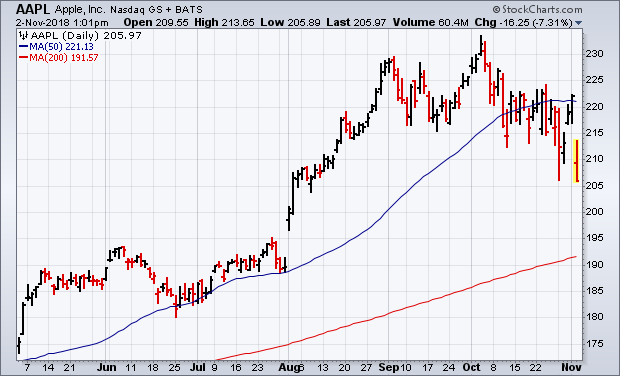

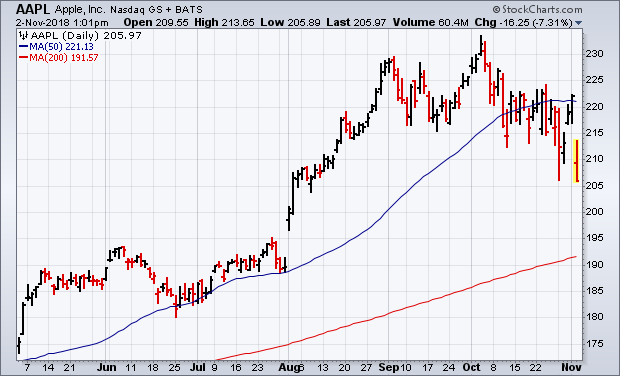

Big Drop in Apple Hurts Tech Sector and The Nasdaq Which Are Leading Today's Stock Retreat

by John Murphy,

Chief Technical Analyst, StockCharts.com

Editor's Note: This article was originally published in John Murphy's Market Message on Friday, November 2nd at 12:28pm ET.

It's usually not a good sign when the market's biggest stock takes a big hit. That's especially true when it...

READ MORE

MEMBERS ONLY

Be Prepared to Pounce on the "Best of the Best"

by John Hopkins,

President and Co-founder, EarningsBeats.com

We're deep into earnings season, which means patient traders can put themselves into a position to profit handsomely. The process starts by identifying those companies that beat earnings expectations and gap up sharply on strong volume, because these are the types of stocks that traders will be watching...

READ MORE

MEMBERS ONLY

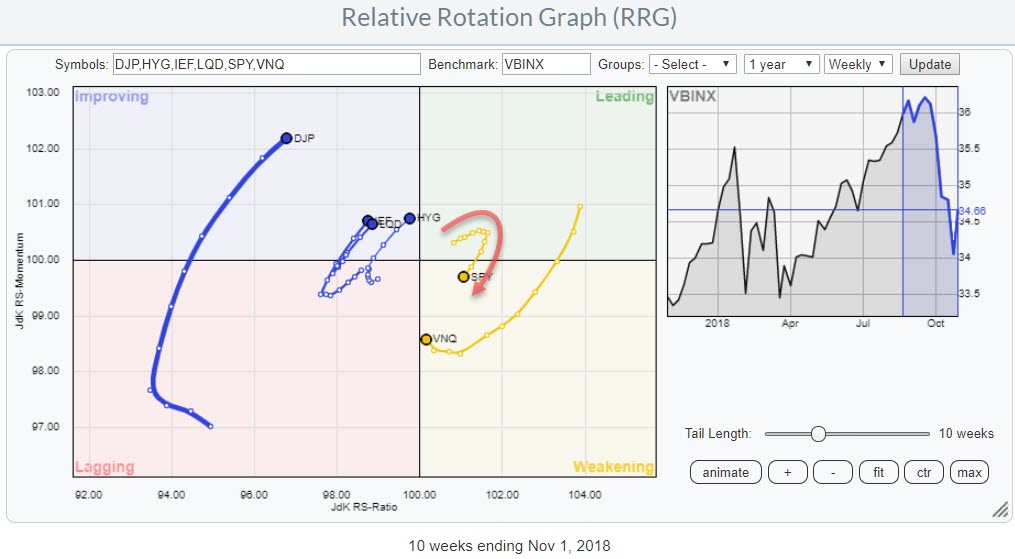

Two stocks in the Consumer Staples sector that could offer shelter when needed.

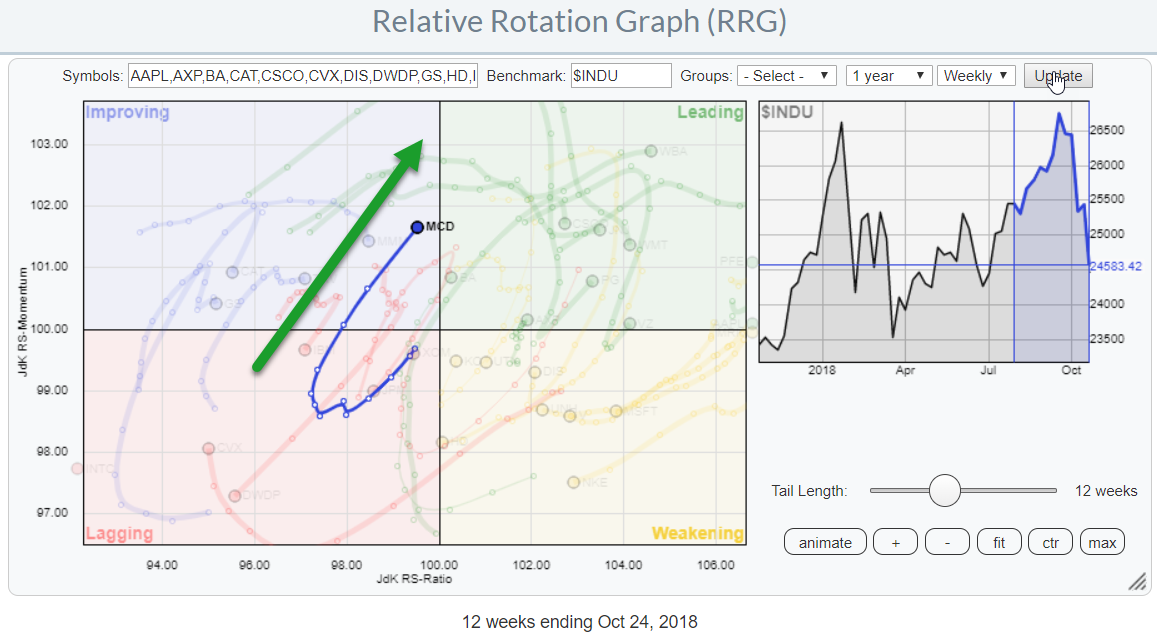

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

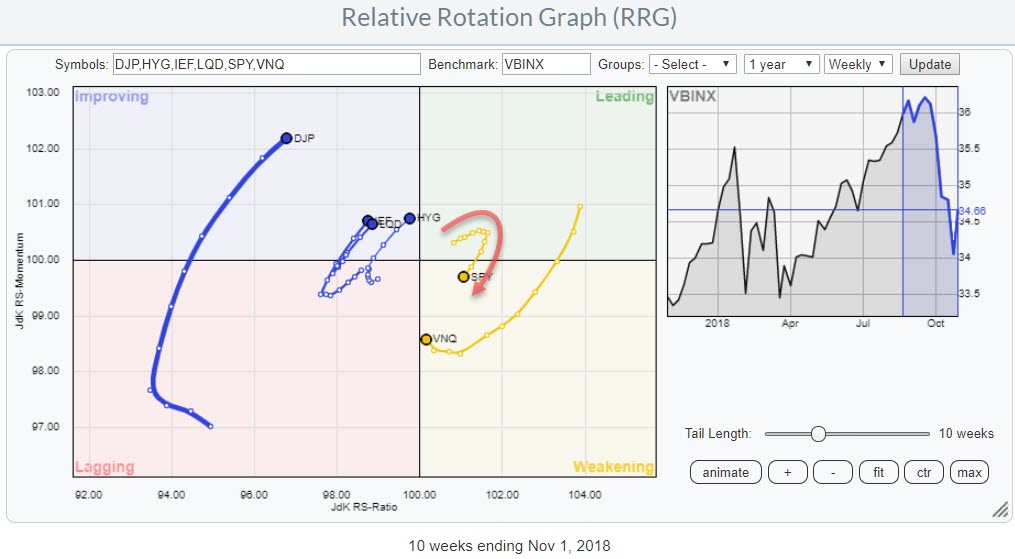

In this blog post, I want to do a quick top-down analysis to arrive at a few stocks that could help investors to provide shelter in case the current hiccup in the market is ..... well a "hiccup."

The Relative Rotation Graph above shows the rotation of various asset...

READ MORE

MEMBERS ONLY

BIG DROP IN APPLE HURTS TECH SECTOR AND THE NASDAQ WHICH ARE LEADING TODAY'S STOCK RETREAT -- BOTH MAY BE FAILING TESTS OF THEIR 200-DAY AVERAGES -- THE S&P 500 IS ALSO STALLING AT MOVING AVERAGE LINES -- HOURLY BARS SHOW OVERHEAD RESISTANCE BARRIERS

by John Murphy,

Chief Technical Analyst, StockCharts.com

APPLE FALLS ON GOOD NEWS ... It's usually not a good sign when the market's biggest stock takes a big hit. That's especially true when it happens the day after the company reported its fourth consecutive quarter of record revenue and profits. But that'...

READ MORE

MEMBERS ONLY

Survey Results: The Top 10 Reasons Investors Told Us Why Routines and Organized ChartLists Matter

by Gatis Roze,

Author, "Tensile Trading"

In our last Traders Journal blog, Grayson and I extended an invitation to our readers to share their experiences with the Tensile Trading ChartPack. The spectrum of responses was diverse, broad and extremely insightful. We found it motivational and encouraging that so many investors have “found their stride”, as one...

READ MORE

MEMBERS ONLY

Apple (AAPL) Disappoints, But Nonfarm Payrolls Soar Past Estimates

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, November 1, 2018

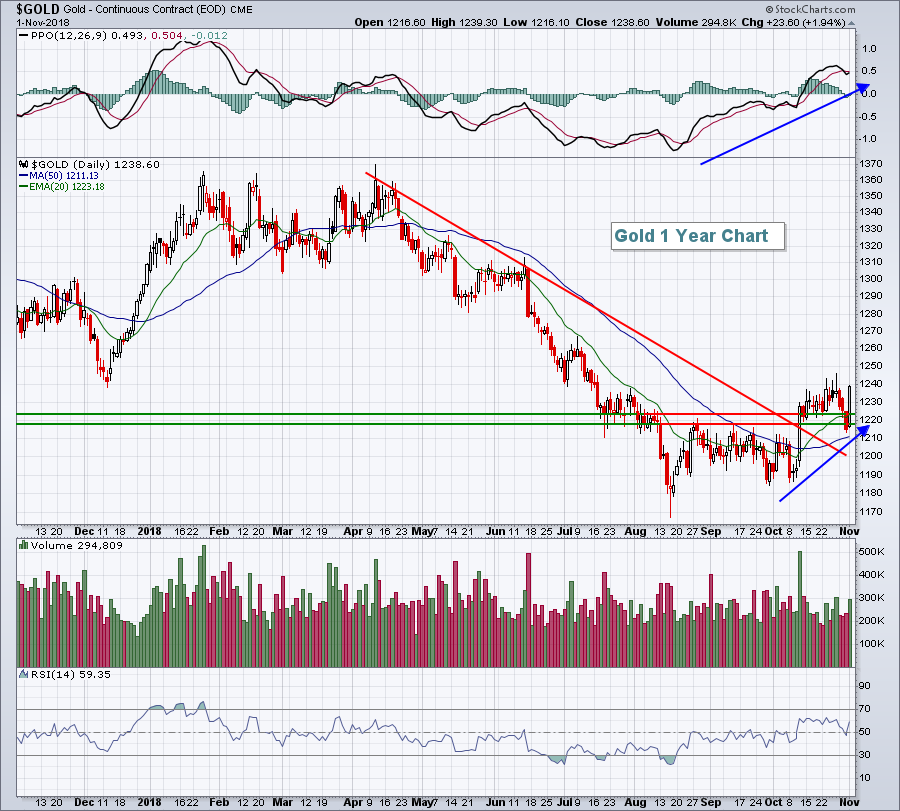

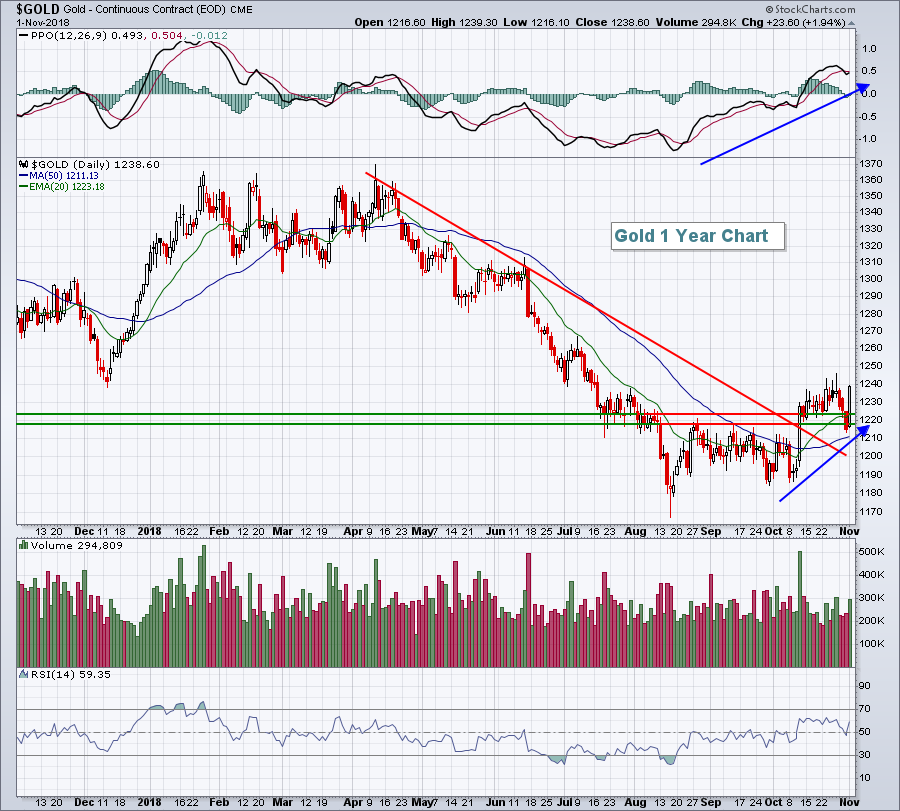

The U.S. Dollar Index ($USD) absorbed its largest decline in several months and that finally triggered buying in the materials sector (XLB, +2.81%). Gold ($GOLD) was a big beneficiary for sure as it climbed nearly 2%, one of its largest advances...

READ MORE

MEMBERS ONLY

Comparing The Differences Between The February And October Declines

by Martin Pring,

President, Pring Research

* Key moving averages violated in October

* The world peaked in January

* What happened to sectors and breadth?

* February versus October conclusion

* Those pesky bonds

Key Moving Averages Violated in October

So far, 2018 has seen two sharp shakeouts in the market, specifically the ten-day special in early February and the...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook (with video) - Assessing October

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Assessing the Damage in October.

* Testing the 10 and 12 Month MAs.

* S&P 500 Breaks Key Moving Average.

* Bonds Decline along with Stocks.

* Global Stocks Are Weak.

* REITs are Holding Up, But.

* Commodities Weaken.

* Gold Holds Breakdown on Monthly Chart.

* Dollar Strengthens against Euro.

* Note from the Art&...

READ MORE

MEMBERS ONLY

Advantages and Disadvantages of Using Breadth

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Consider a period of distribution (market topping process) such as 1987, 1999, 2007, 2011, etc. As an uptrend slowly ends and investors seek safety, they do so by moving their riskier holdings such as small cap stocks, into what is perceived to be safer large cap and blue-chip stocks. This...

READ MORE

MEMBERS ONLY

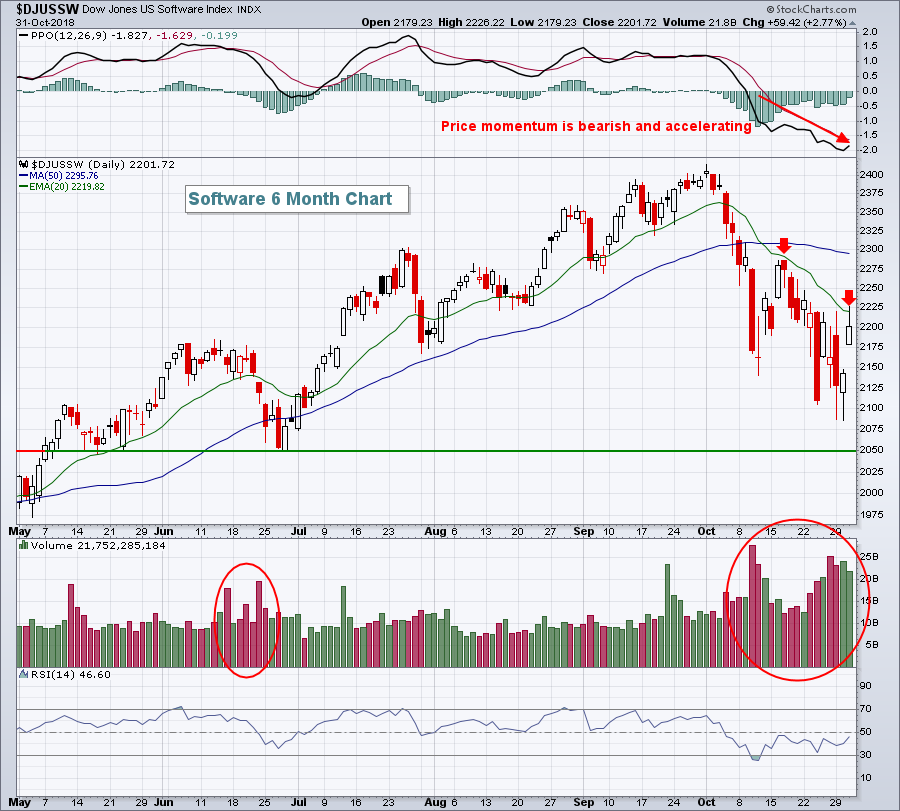

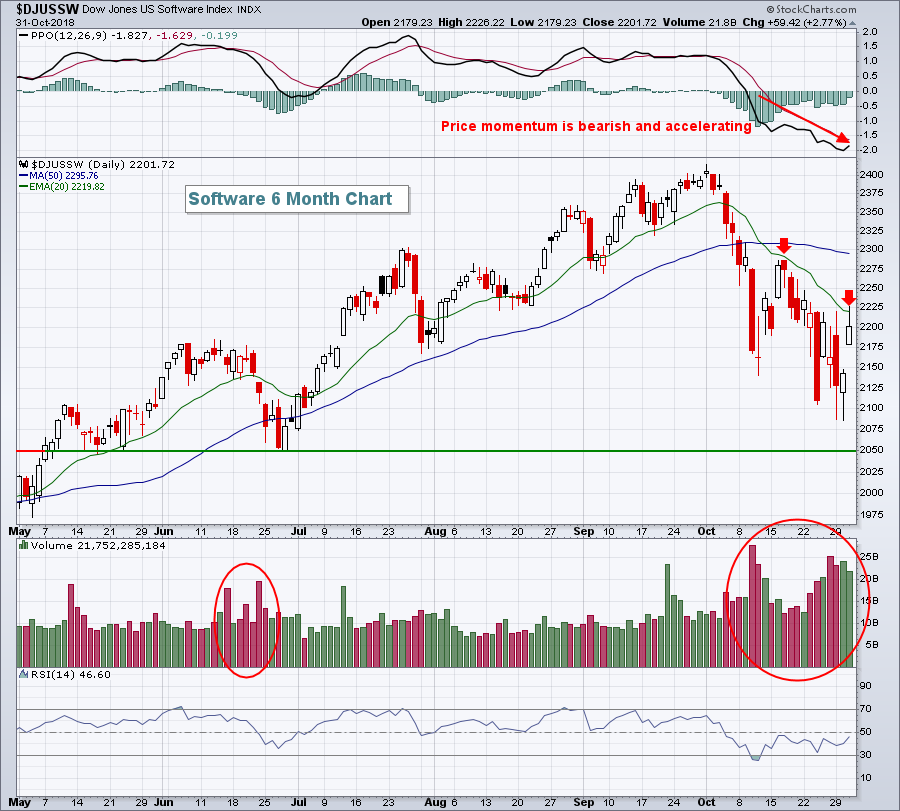

Software Hits Key Resistance....And Fails; S&P 500 Shares Similar Fate

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, October 31, 2018

Let's start with the positives from Wednesday's action. First, all of our major indices rebounded and finished higher on the session, led by the more aggressive NASDAQ and NASDAQ 100. These two indices had been crushed both on an...

READ MORE

MEMBERS ONLY

Follow-Up on Stock discussed on Oct 30 because of Corporate Action

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

On October 30, we discussed on three stocks on NIFTY Metal Index ($CNXMETAL) that deserved our attention. This note can be found here. There was a Corporate Action yesterday, i.e. on Oct. 31, in the stock Hindustan Zinc Limited (HINDZINC.IN) that of a Dividend payout. This has resulted...

READ MORE

MEMBERS ONLY

DP Alert: Monthly Charts Go "Final"

by Erin Swenlin,

Vice President, DecisionPoint.com

It's been some time since I've written about the monthly charts. Carl usually is the lucky one to cover them given the end of the month often hits on a Friday when he writes the Weekly Wrap. I thought today I'd cover the monthly...

READ MORE

MEMBERS ONLY

SHORT-TERM STOCK BOTTOM APPEARS TO BE IN PLACE -- SMALL AND MIDCAP INDEXES BOUNCE OFF FEBRUARY LOWS -- S&P 500 BOUNCES OFF SUPPORT -- AND MAY BE HEADING FOR A RETEST OF ITS 200-DAY AVERAGE

by John Murphy,

Chief Technical Analyst, StockCharts.com

SMALL AND MIDCAP STOCKS INDEXES BOUNCE OFF FEBRUARY LOWS... A lot of technical signs point to a short-term bottom in place for stocks. That suggests that major stock indexes will try to regain some of their October losses. The big question is how much of those losses. Before getting to...

READ MORE

MEMBERS ONLY

Campbell Soup is Looking Rather Bland

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Soup season is upon us, but Campbell Soup ($CPB) is having none of it as the stock trends lower and lags its sector, the Consumer Staples SPDR (XLP).

First and foremost, the long-term trend is down with a 52-week low in June, the 50-day below the 200-day and the 200-day...

READ MORE

MEMBERS ONLY

Relief Rally Begins, How Long Might This Last?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, October 30, 2018

Today's article will be limited as I'm having technical difficulties sharing charts, but I'll give you my thoughts. Yesterday's action and reversal was important as our volatility measures - VIX and VXN - are at...

READ MORE

MEMBERS ONLY

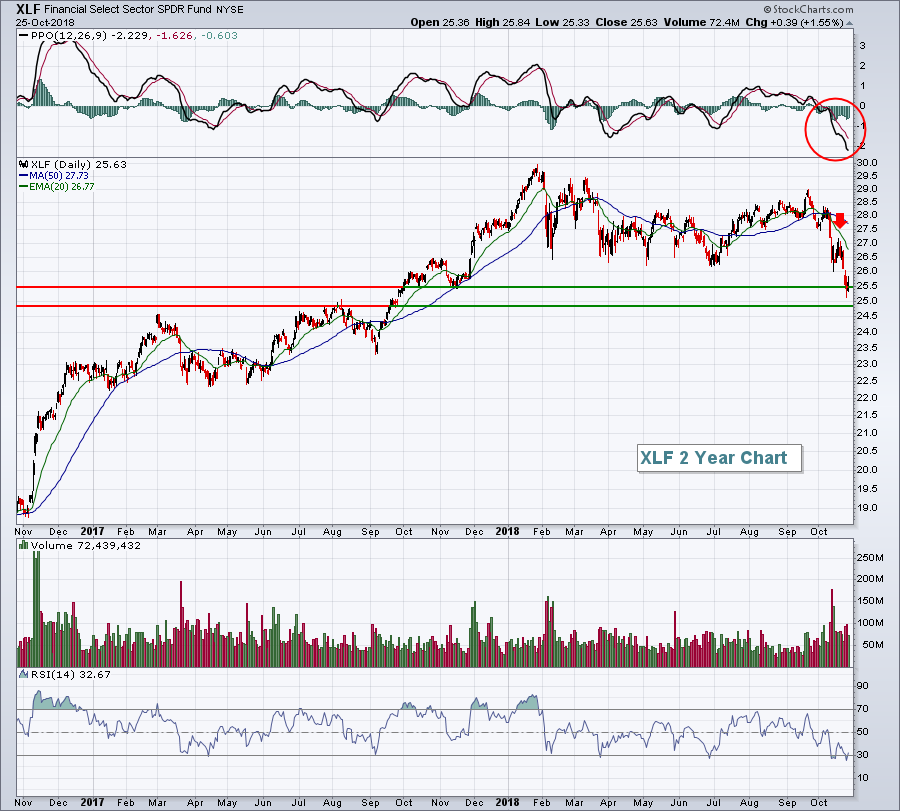

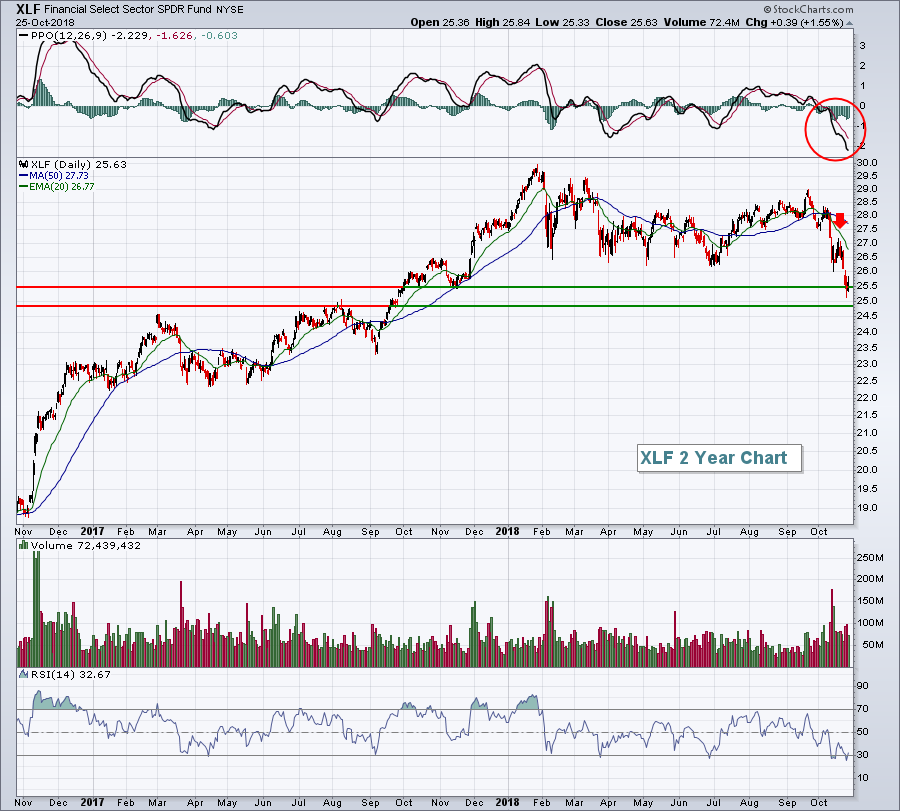

"DecisionPoint" Sector CandleGlance - Finding PMO Clues - XLF, XLB and XLV

by Erin Swenlin,

Vice President, DecisionPoint.com

I'm going to show you one of the ways you can use a "DecisionPoint" CandleGlance ChartStyle to immediately see, on one page, the health of all market sectors. I have written about how to use CandleGlance for sifting scans and how to set-up a "DecisionPoint&...

READ MORE

MEMBERS ONLY

Impulsive Selling Returns, More Rotation To Defensive Areas

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, October 29, 2018

Early on Monday morning, it looked like stocks were trying to carve out a bottom, but by the afternoon, big time selling resumed and prior support levels were lost - all with rapidly rising volatility. That is a recipe for short-term stock market...

READ MORE

MEMBERS ONLY

Three Stocks from CNX Metal Index (NIFTY Metal Index) That Deserve Attention

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

On October 29, 2018, we issued a note on NIFTY Metal Index likely to start relatively out-performing the general markets. Within this sector, there are couple of Stocks that deserves our attention. They have resilient technical set-up and are poised for respectable upsides. While likely to out-perform the Metal Index,...

READ MORE

MEMBERS ONLY

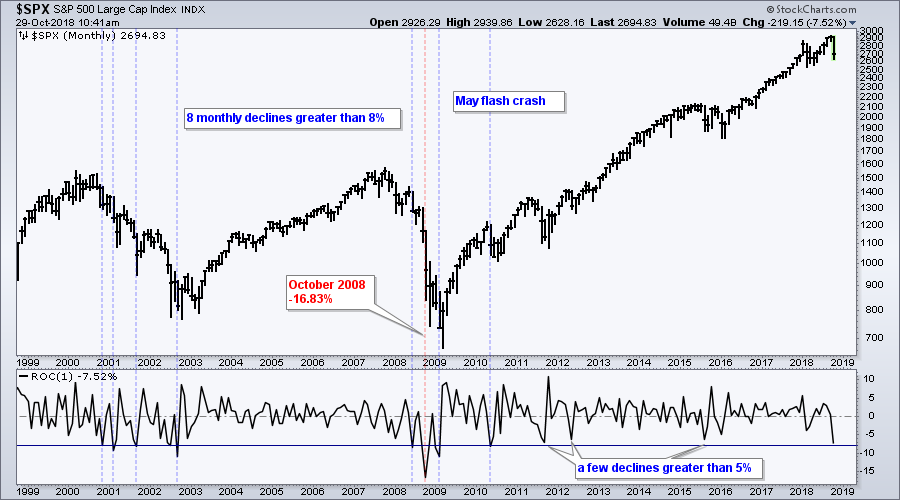

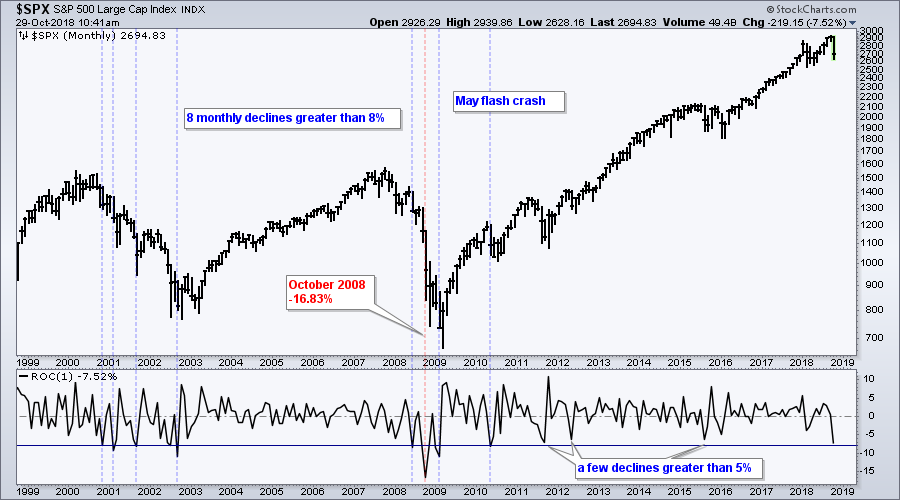

Comparing the Current Month with the Last 20 Years

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 is down around 7.5% so far this month and this is shaping up to be the worst monthly decline in over five years. Keep in mind that there are still a few days left in October and the last monthly bar will not complete...

READ MORE

MEMBERS ONLY

SystemTrader - Update to RSI Mean-Reversion Strategy and Dealing with the Dreaded Drawdown

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Dealing with Drawdowns.

* Mean-Reversion with RSI, Chandelier and PPO.

* Universe, Market Regime and Ground Rules.

* Sample Signals for IJR.

* Testing the Big Four.

* Plotting the Drawdowns.

* Setting a Risk-of-Ruin Stop.

* Conclusions.

.... Dealing with Drawdowns.

The S&P 500 is currently in the midst of its worst monthly decline since...

READ MORE

MEMBERS ONLY

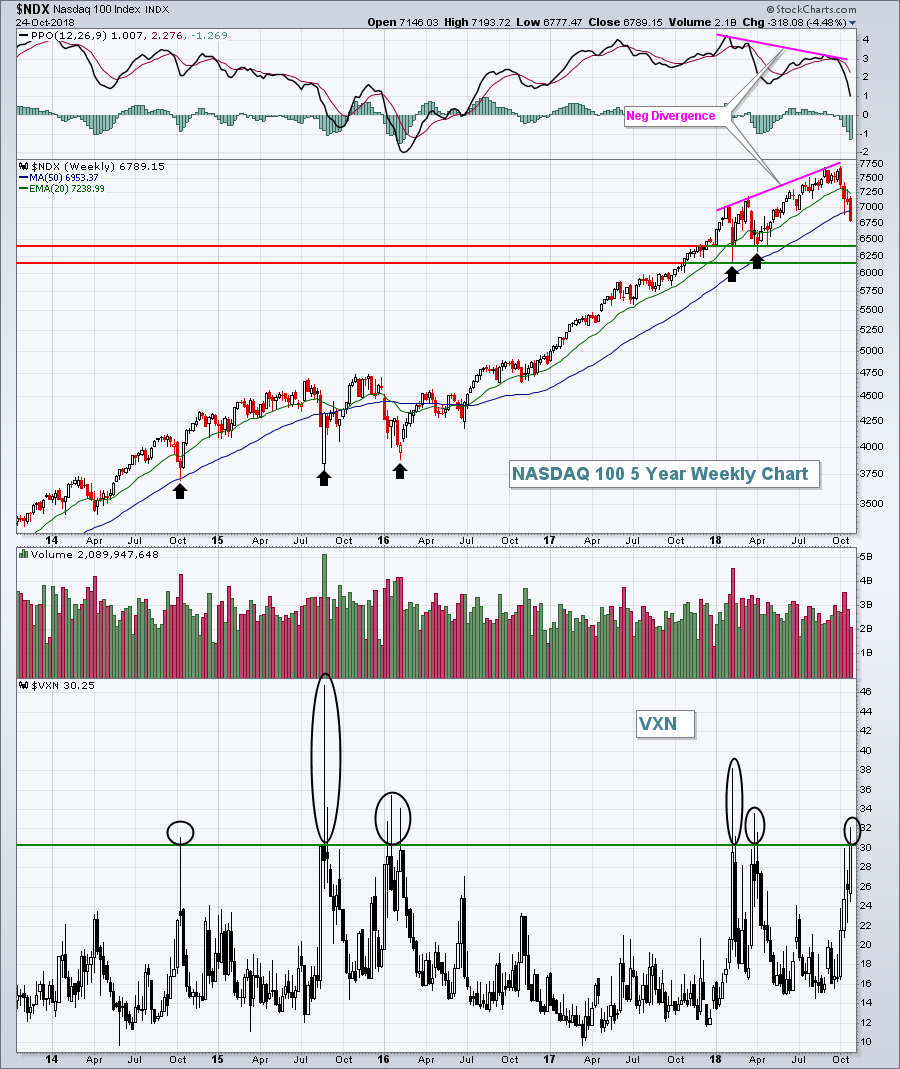

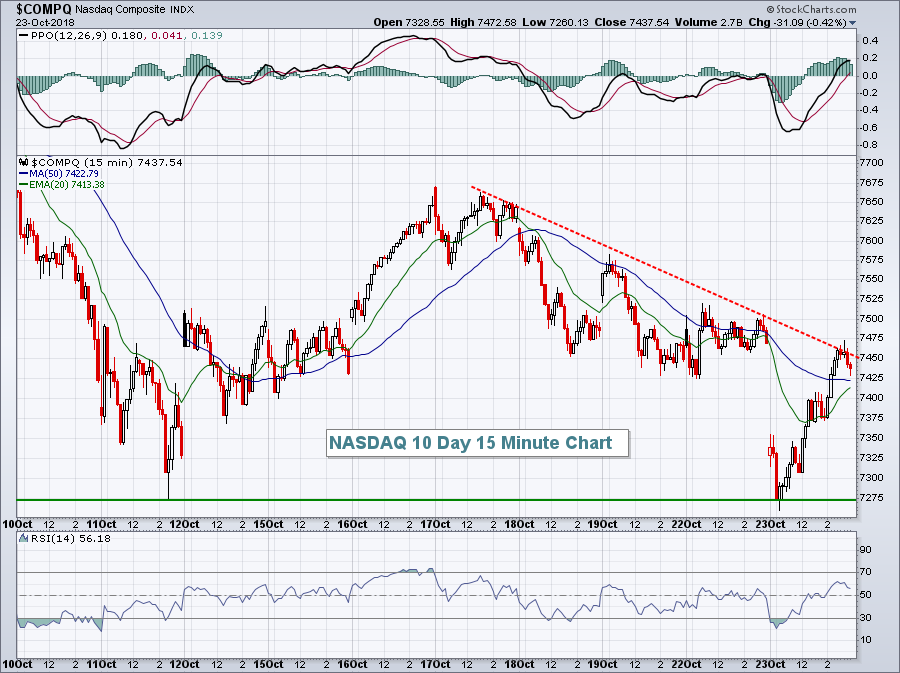

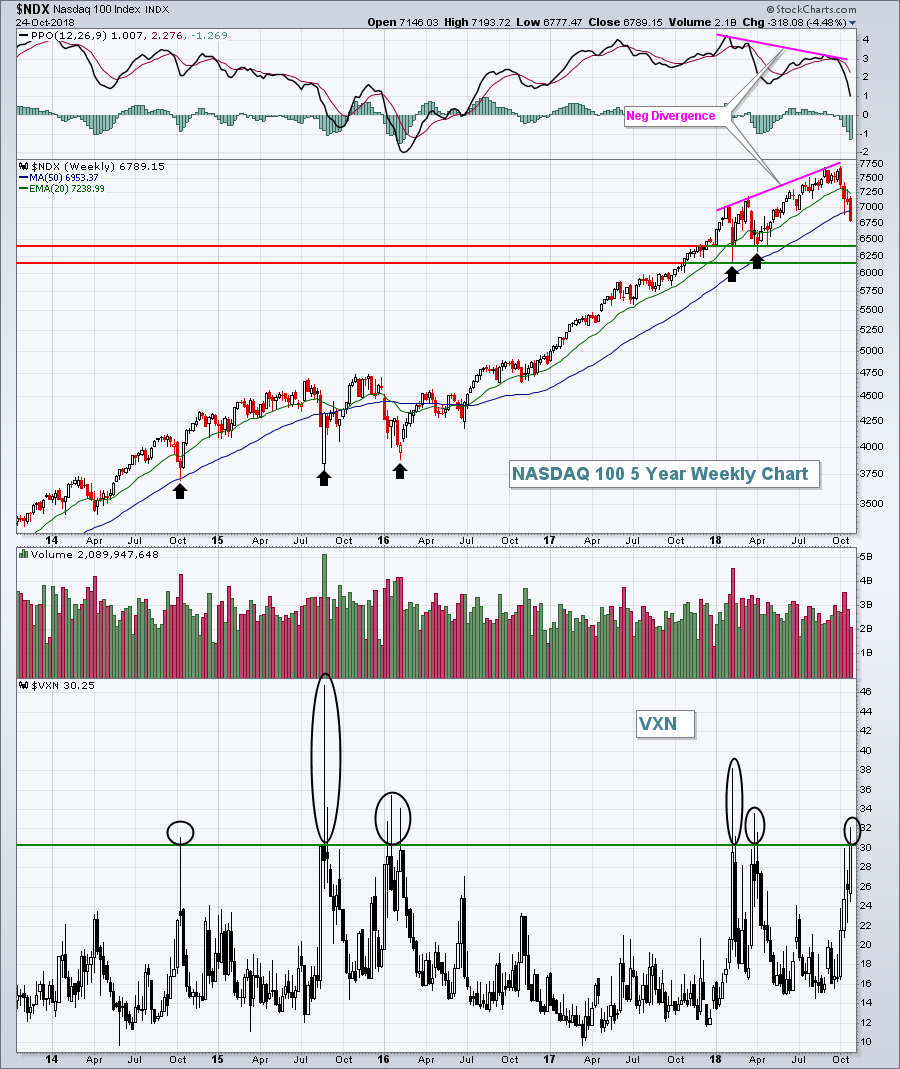

NASDAQ Volatility Measure Suggests Market Bottom

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, October 26, 2018

All of our major indices finished lower on Friday and all of our major sectors did the same. It's difficult to paint a bullish picture after such selling, but I'm going to do just that. On Friday, despite selling...

READ MORE

MEMBERS ONLY

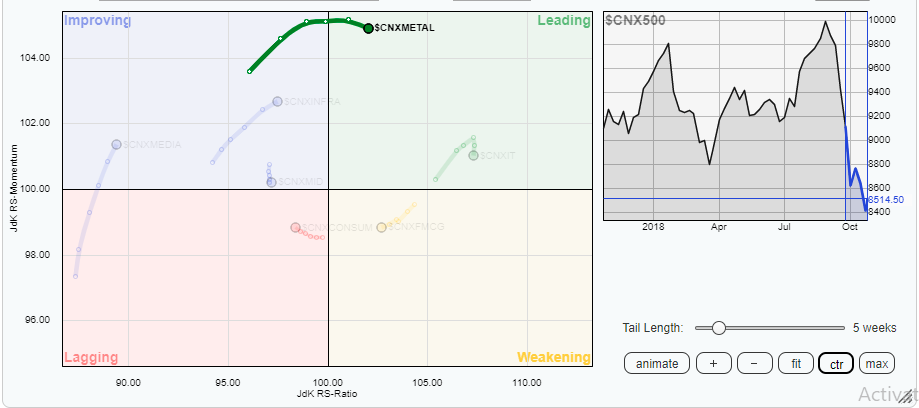

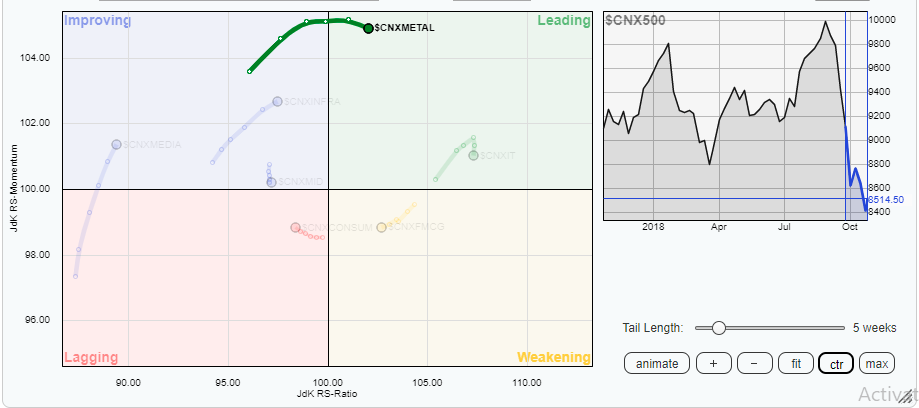

Sector in Focus: NIFTYMetal Index ($CNXMETAL) staring at some meaningful upside

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

NIFTY Metal Index ($CNXMETAL) has under-performed the broader Markets since many months. The Index marked its high at 4256 in January of 2018 and since then it has continued marking lower tops while remaining under a formation. Presently, it has shown some important technical developments which warrants our attention.

As...

READ MORE

MEMBERS ONLY

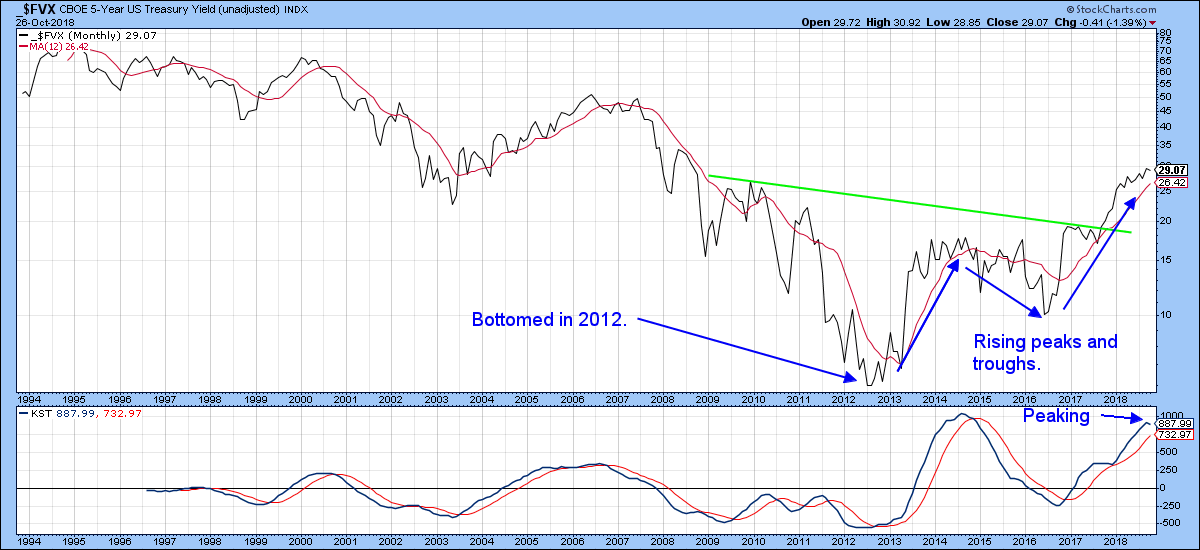

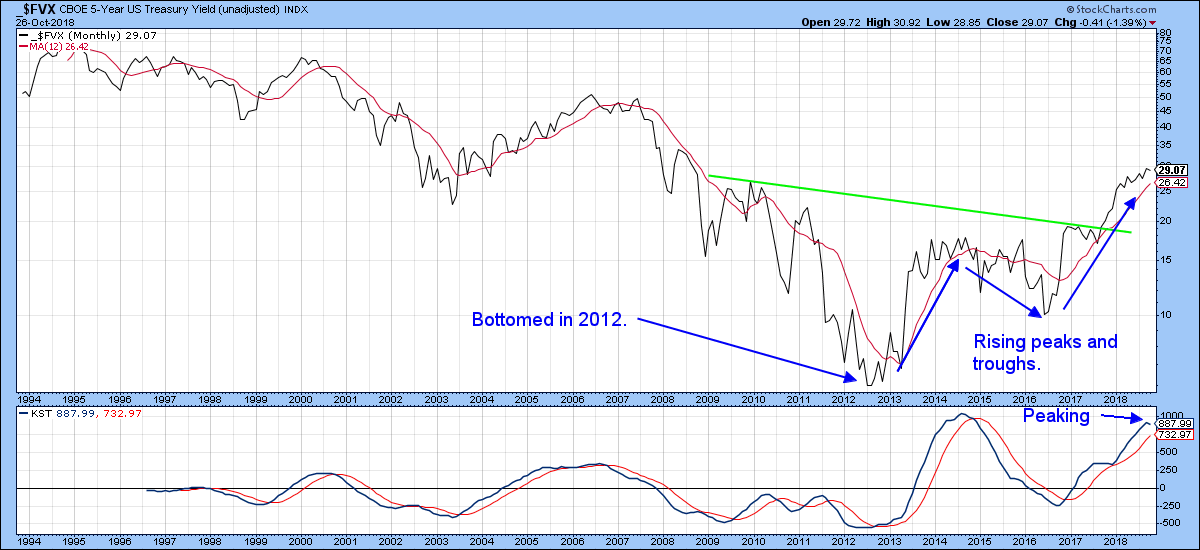

Tentative Signs That Bond Yields May Be Peaking

by Martin Pring,

President, Pring Research

* A few observations about the secular trend

* Short-term technical position

* Junk bonds peak out

* Credit spreads argue for lower government yields

A Few Observations About the Secular Trend

The 5-year yield, shown in Chart 1, has formed and broken out from a major base. It touched a low point in...

READ MORE

MEMBERS ONLY

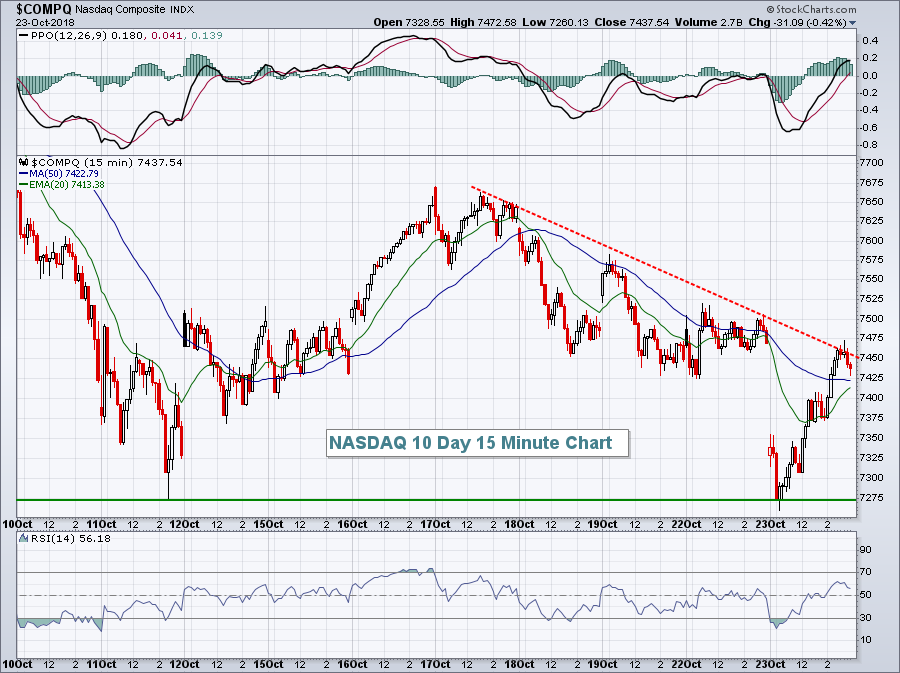

Nasdaq Composite. Down for the Count?

by Bruce Fraser,

Industry-leading "Wyckoffian"

The current decline was accompanied by a large increase in volatility and volume. Can the Wyckoff Method help guide our thinking and improve our tactics? A recent parallel is the decline in January and February of this year and the market action that followed in its aftermath.

Wyckoff provides a...

READ MORE

MEMBERS ONLY

S&P 500 APPEARS HEADED FOR TEST OF ITS EARLY 2018 LOWS -- THE BREAKING OF ITS THIRTY-MONTH SUPPORT LINE IS ANOTHER NEGATIVE SIGN -- THE LAST TWO MARKET PEAKS STARTED IN OCTOBER -- A PLUNGE IN ASSET MANAGERS MAY BE ANOTHER SIGN OF MARKET WEAKNESS

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 HEADED FOR A RETEST OF EARLY 2018 LOWS ... I keep hearing on CNBC that stocks are down sharply but "off their lows". They never seem to mention that they're even further "off their highs". After losing nearly 4% over the...

READ MORE

MEMBERS ONLY

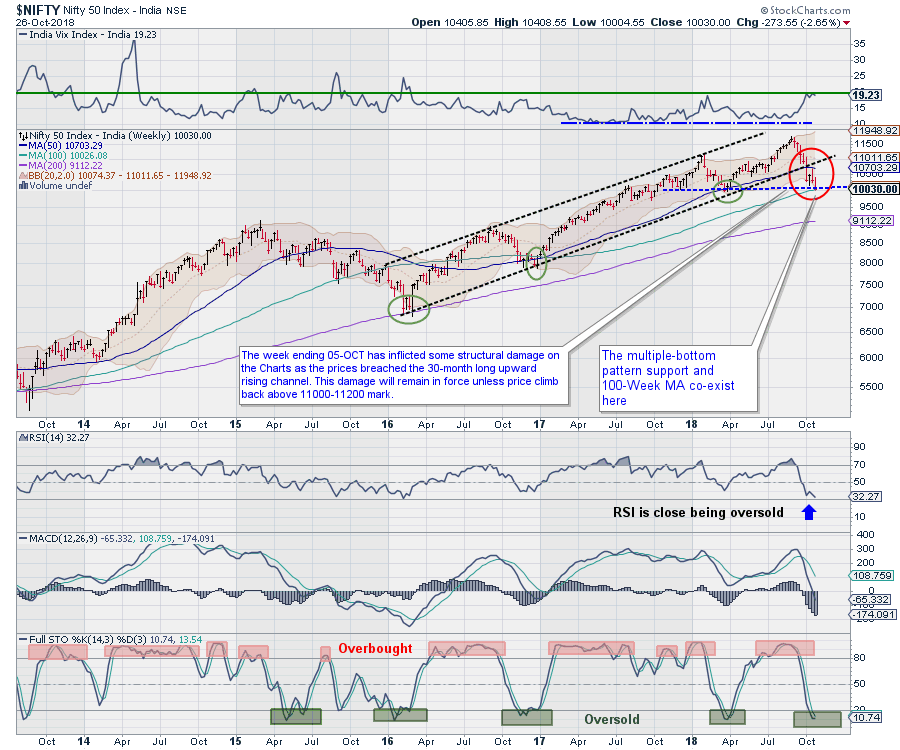

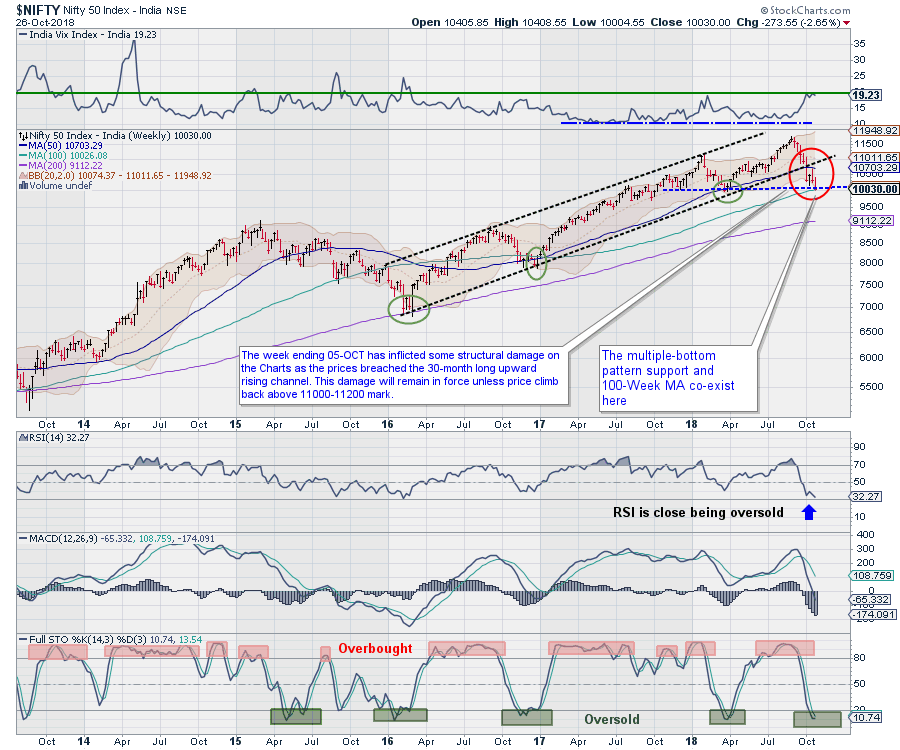

Indian Markets Critically Poised for the Coming Week - Sectors to watch for are these!

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Indian Equity Markets had a troubled week. It showed no inclination to pullback and extended its losses. The benchmark Index NIFTY50 ($NIFTY) ended the week losing 273.55 points or 2.65% on weekly basis.

The week that ended October 05th had inflicted some structural damage on the Charts...

READ MORE

MEMBERS ONLY

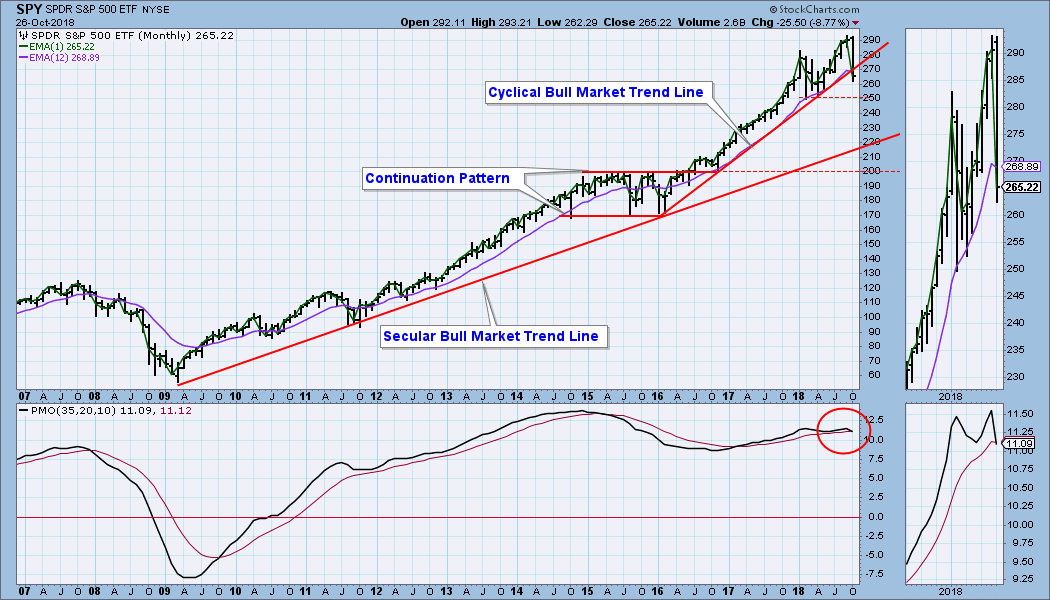

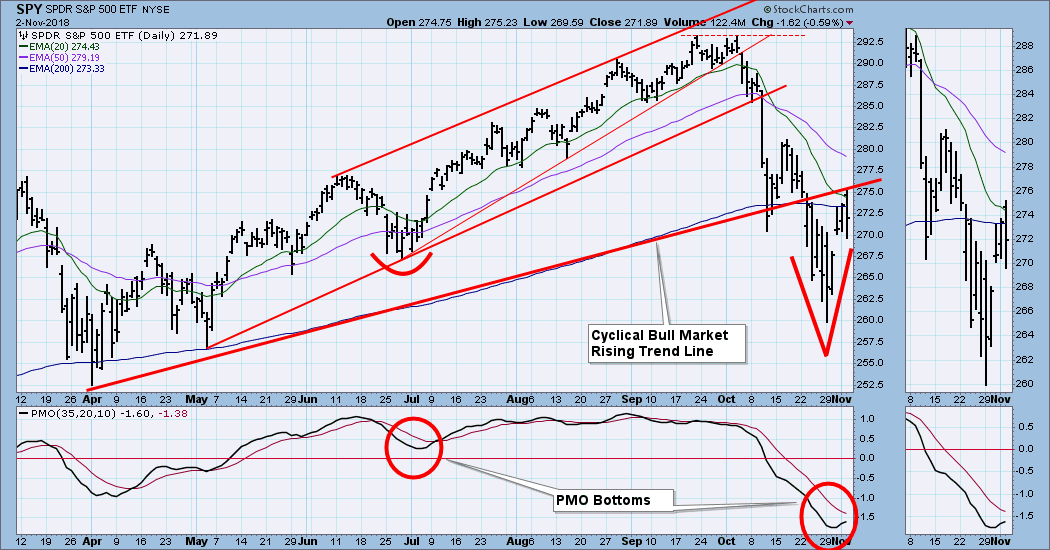

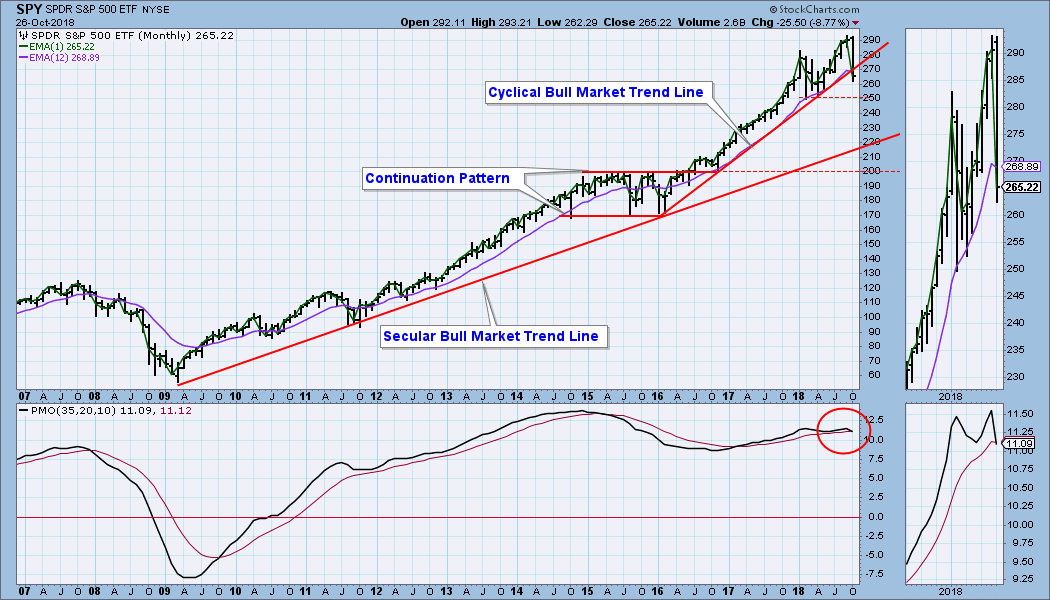

DP Weekly Wrap: Bull Market Trend Line Broken

by Carl Swenlin,

President and Founder, DecisionPoint.com

I normally don't show an in-progress monthly chart because a monthly chart isn't final until the end of the month, but this week's market action was so severe, I thought that a 'big picture' view would be most helpful. The cyclical bull...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook (with video) - Oversold, But Broadsided

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Performance Overview.

* Oversold, But Broadsided.

* First Target for S&P 500.

* Nasdaq 100 Breaks 40-week SMA.

* FAANG Stocks Lead NDX Lower.

* Mid-caps and Small-caps Bear the Brunt.

* Downside Participation Expands Furthers.

* Utilities Buck the Selling Pressure.

* REIT ETF Remains with Breakdown.

* Treasuries Gets Some Safe-haven Love.

* Dollar Remains Strong...

READ MORE

MEMBERS ONLY

History Says BUY NOW, But Here's When The Charts Say To Buy

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, October 25, 2018

Obviously, the numbers from Thursday tell us that we had a very strong day. But the "under the surface" signals really underscored that strength. Transports ($TRAN) gained 1.88% after nearly touching the February low. Technology (XLK, +3.44%), communication services...

READ MORE

MEMBERS ONLY

Fear Gauge Soars As Dow Jones Posts 600 Point Loss

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for October 24, 2018

When the Volatility Index ($VIX, +21.83%) is elevated, like it's been throughout much of October, it should be no shock when Wall Street has a day like it did yesterday. There was a buyers strike and the Dow Jones lost 500...

READ MORE

MEMBERS ONLY

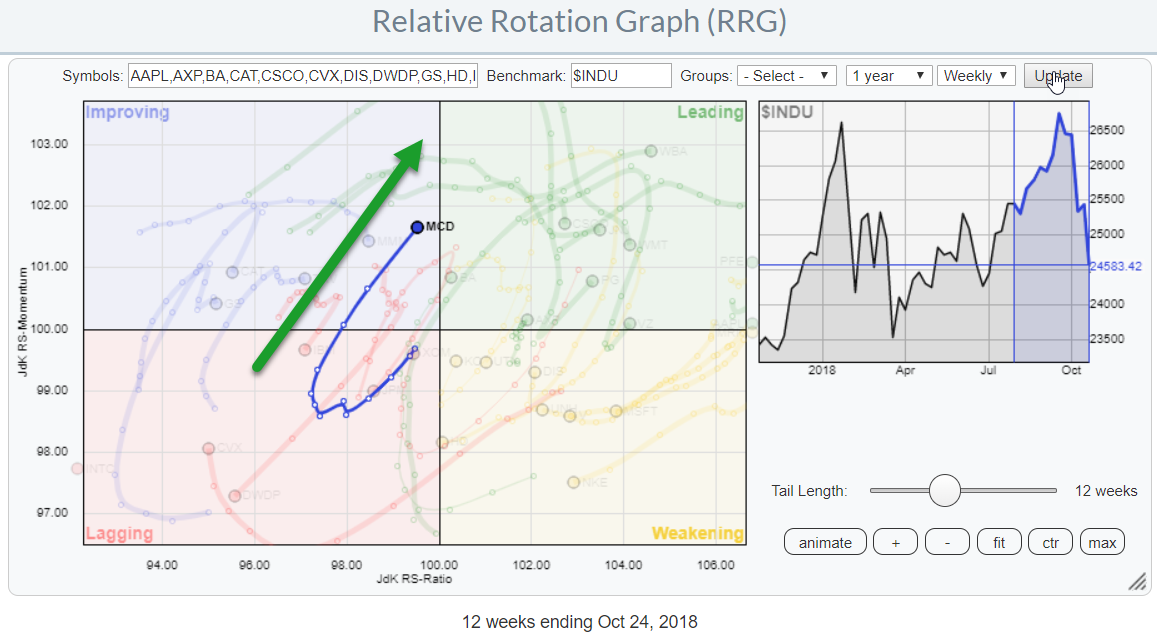

Can I have some fries with that please?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the Relative Rotation Graph holding the 30 stocks in the DJ Industrials index, McDonald's (MCD) is one of the names that pop up as potentially interesting. The stock is positioned inside the improving quadrant for a few weeks now and moving towards the leading quadrant at a...

READ MORE

MEMBERS ONLY

India and Brazil Hold Up, but Strong Dollar Hits Foreign Index ETFs

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* India and Brazil Remain Positive.

* The All Ords Index versus the Aussie ETF.

* Rupee Extends Decline Relative to US Dollar.

* Rupee Weighs on India ETF.

* Symbols for Currency Crosses.

... India and Brazil Remain Positive

... A few foreign stock indexes are holding up, but their Dollar denominated ETFs are underperforming because...

READ MORE

MEMBERS ONLY

DP Alert: Afternoon Sell-Off - Indicators Oversold, Not at Extremes

by Erin Swenlin,

Vice President, DecisionPoint.com

Today's sell-offs (over 3% on the SPX , almost 4.5% on the Nasdaq and 3.79% drop on the Russell 2000) were deep and painful, but you don't need me to tell you that. I would like to be the bearer of good news, but I...

READ MORE

MEMBERS ONLY

FOREIGN STOCKS ARE LEADING U.S. STOCKS LOWER -- EUROPE AND ASIA ARE ALREADY IN DOWNTRENDS -- THE ALL COUNTRY WORLD INDEX IS FALLING TO THE LOWEST LEVEL IN A YEAR -- THAT SUGGESTS THAT GLOBAL STOCKS ARE PEAKING -- THAT INCLUDES THE U.S.

by John Murphy,

Chief Technical Analyst, StockCharts.com

FOREIGN STOCKS ARE LEADING THE U.S. LOWER... U.S. stocks are under pressure for a lot of reasons that have been described in previous messages. There's been the rotation over the last month out of economically-sensitive stock groups like cyclicals, industrials, energy, materials, and technology into defensive...

READ MORE

MEMBERS ONLY

Wild Ride On Wall Street Ends With Minor Losses

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap For October 23, 2018

It was a crazy day on Wall Street which, quite honestly, we should expect with a Volatility Index ($VIX) in the 20s. Jitters in global markets saw U.S. futures plunge yesterday morning. Our major indices opened more than 2% lower and it appeared...

READ MORE

MEMBERS ONLY

This Software Stock is Holding up Well in October

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The pickings are getting slim after sharp declines in October, but some stocks are holding up better than others. The Software iShares (IGV), in particular, held up better than most industry group ETFs and Adobe (ADBE) is a leader in this group.

The chart below shows Adobe falling sharply in...

READ MORE

MEMBERS ONLY

Watching Benchmark Lows for Clues on Performance - New Lows Expand in Indexes and Key Sectors

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Setting Benchmark Levels for Comparison.

* Analyzing the Top Sectors and Benchmark Lows.

* New Lows Expand on Latest Dip.

* Discretionary, Finance and Industrials Lead New Low List.

* Software and Cyber Security Hold Up.

* CheckPoint, Fortinet and FireEye.

* Food and Charts for Thought.

... Setting Benchmark Levels

.... Chartists can set benchmark highs and...

READ MORE