MEMBERS ONLY

RETAILERS CONTINUE TO WEIGH ON CYCLICALS -- CONSUMER DISCRETIONARY SPDR FALLS BELOWS 50-DAY AVERAGE -- HOMEBUILDERS ARE ALSO WEIGHING ON CYCLICALS -- HOME CONSTRUCTION ETF FALLS TO LOWEST LEVEL IN A YEAR -- RISING BOND YIELDS ARE A BIG REASON WHY

by John Murphy,

Chief Technical Analyst, StockCharts.com

RETAILERS CONTINUE TO WEAKEN... Tuesday's message showed retail stocks under selling pressure. That selling is continuing today. Chart 1 shows the S&P Retail SPDR (XRT) nearing a test of its July/August lows and maybe even its 200-day moving average (red line). The Tuesday message also...

READ MORE

MEMBERS ONLY

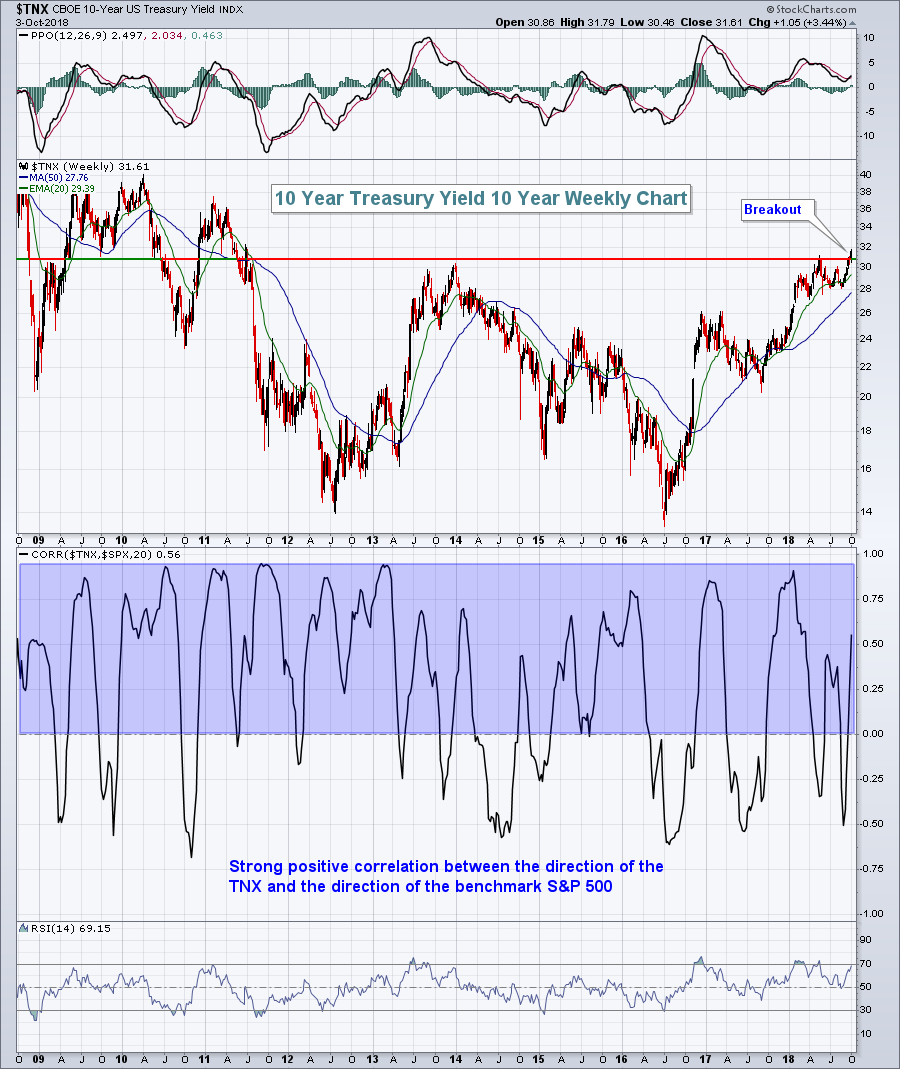

10 Year Treasury Yield Explodes To 7 Year High; Financials Lead

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, October 3, 2018

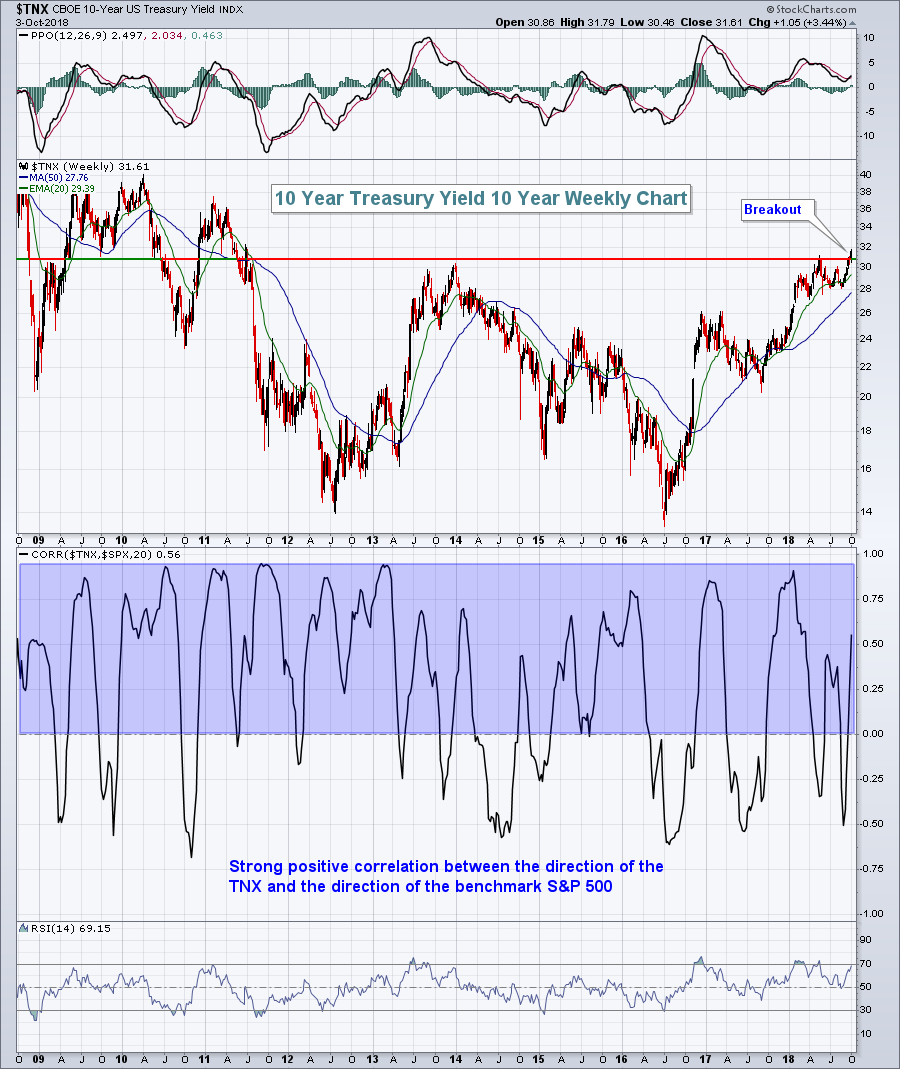

The 10 year treasury yield ($TNX) did the inevitable - it closed above 3.11% and the TNX now resides at a level not seen since 2011. There will be those who say that higher interest rates will be the beginning of our...

READ MORE

MEMBERS ONLY

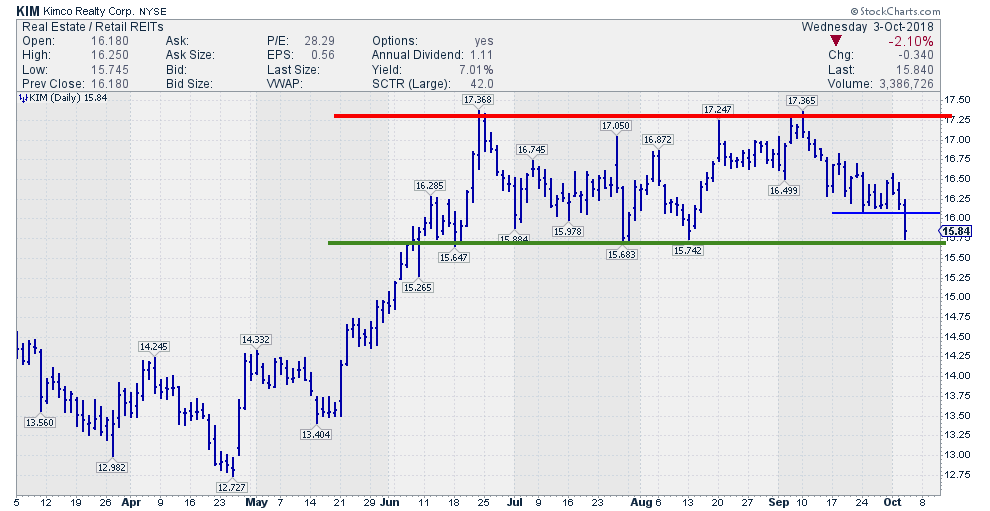

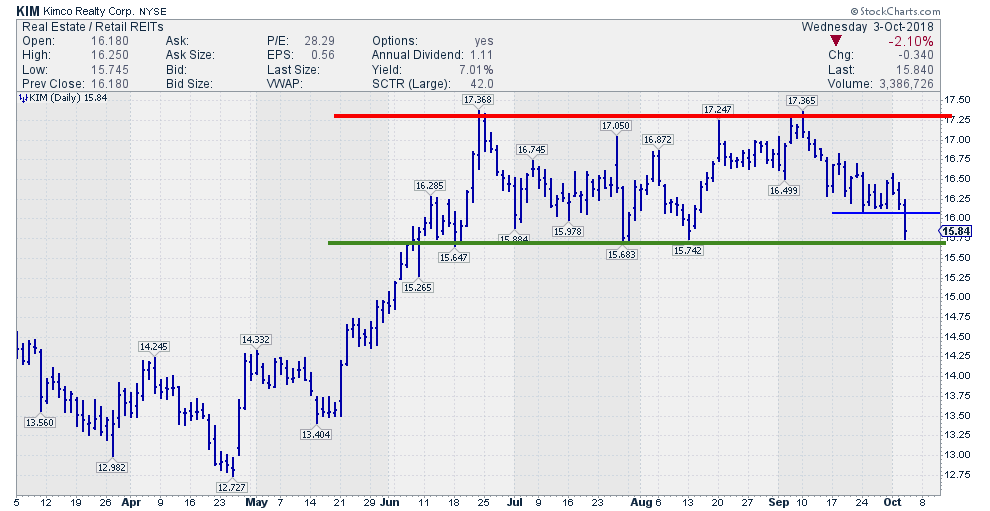

KIM at lower boundary of trading range

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

One of the names that popped up today on my alert for potential "Turtle Soup" setups is KIM. After opening up the chart for further inspection I noticed an interesting situation.

It is very clear that the stock is in a trading range since June. The upper boundary...

READ MORE

MEMBERS ONLY

DP Alert: Head & Shoulders Pattern Activates on TLT Correction

by Erin Swenlin,

Vice President, DecisionPoint.com

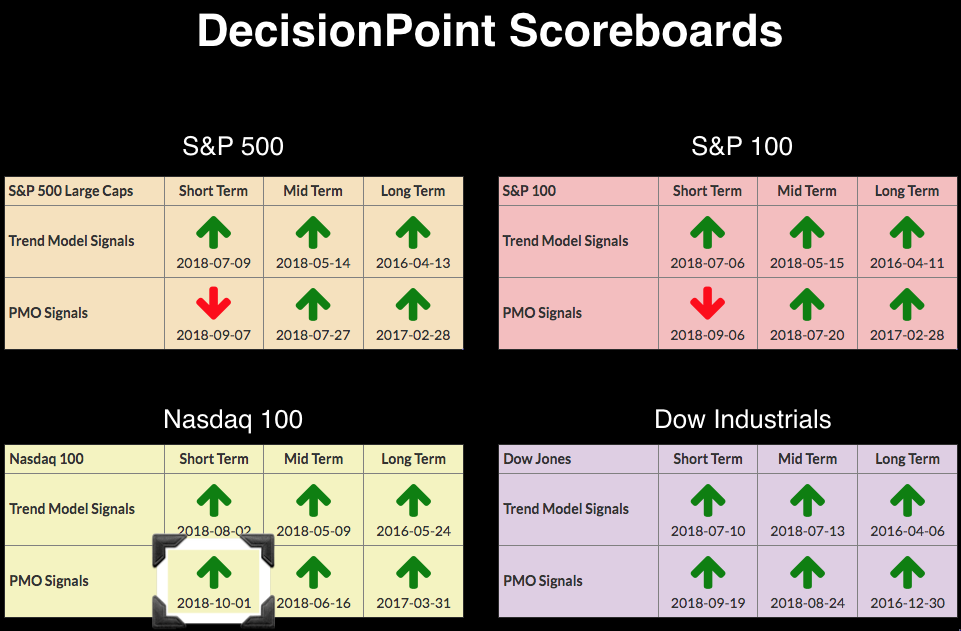

No new changes on the DecisionPoint Scoreboards since last week's PMO BUY signal on the NDX. Hard to believe the OEX and SPX haven't followed suit with the Dow and NDX. The OEX is nearing the BUY signal and should trigger tomorrow barring a large decline....

READ MORE

MEMBERS ONLY

TEN-YEAR TREASURY YIELD BREAKS OUT TO HIGHEST LEVEL SINCE 2011 ON STRONG ECONOMIC NEWS -- STOCKS RALLY WITH YIELDS AS BOND PRICES FALL -- THAT'S GIVING A LIFT TO BANKS AND OTHER FINANCIALS

by John Murphy,

Chief Technical Analyst, StockCharts.com

TEN-YEAR TREASURY YIELD ACHIEVES MAJOR BULLISH BREAKOUT... Treasury yields have finally achieved the upside breakout that many of us have been warning about. And it's doing it in pretty decisive fashion. The daily bars in Chart 1 show the 10-Year Treasury yield surging above its May peak near...

READ MORE

MEMBERS ONLY

Hindenburg Omen Update

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

The Hindenburg Omen has been touted often lately. I thought I’d share with you information about it that I obtained directly from its creator, James Miekka. Most of the below came from the second edition of my “The Complete Guide to Market Breadth Indicators.” It is only available from...

READ MORE

MEMBERS ONLY

Defensive Stocks Lead Bifurcated Market

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, October 2, 2018

The Dow Jones rallied for a fourth consecutive day to close in all-time record high territory, eclipsing the previous high set on September 21st. Unfortunately, the rest of the market didn't get the memo as small cap stocks, in particular, were...

READ MORE

MEMBERS ONLY

This Medical Devices Stock Looks Poised to Play Catchup

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Health Care SPDR (XLV) is the best performing sector over the last six months with a 21% gain and the Medical Devices ETF (IHI) is one of the top performing industry group ETFs with a 25% gain. There are dozens of healthcare stocks hitting new highs and showing big...

READ MORE

MEMBERS ONLY

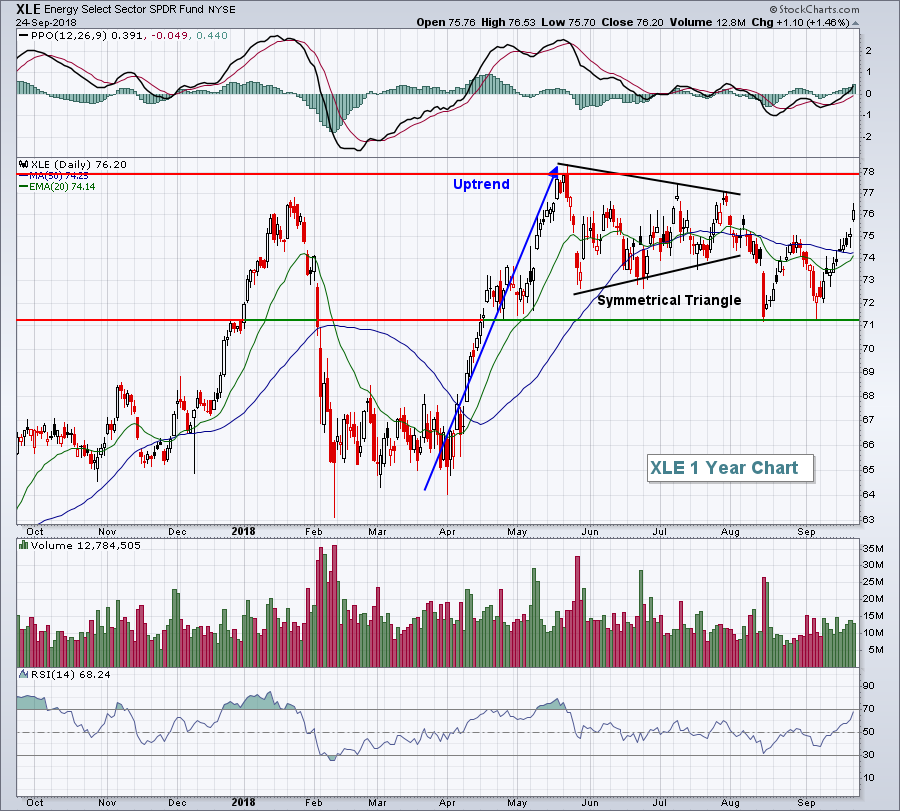

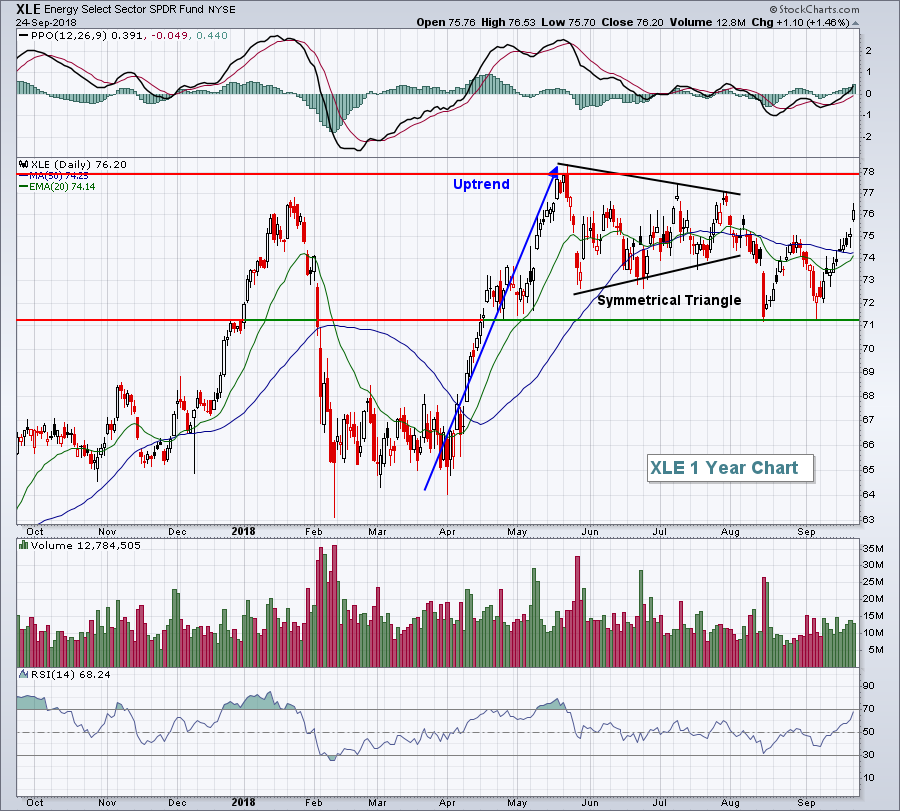

Getting Perspective on Small-caps, the Energy SPDR and the Oil & Gas Equip & Services SPDR - plus Six Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Small-caps Become More Oversold.

* XLE Ends Another Long Correction.

* XES Forms Another Higher Low.

* Stocks to Watch: VZ, NOV, PSX, VLO, WMT, JPM.

... Small-caps are leading the market lower as the S&P SmallCap iShares (IJR) and Russell 2000 iShares (IWM) fell over 4% in the last five weeks....

READ MORE

MEMBERS ONLY

RETAIL STOCKS HAVE A BAD CHART DAY -- THAT'S STARTING TO WEIGH ON RELATIVE PERFORMANCE OF THE CONSUMER DISCRETIONARY SECTOR WHICH APPEARS TO BE LOSING UPSIDE MOMENTUM -- CYCLICAL STOCKS ARE ALSO LOSING GROUND VERSUS DEFENSIVE CONSUMER STAPLES

by John Murphy,

Chief Technical Analyst, StockCharts.com

RETAIL SPDR TUMBLES TO TWO-MONTH LOW... Retail stocks are having a bad chart day. The daily bars in Chart 1 show the S&P Retail SPDR (XRT) falling to the lowest level in two months, and trading below its 50-day average (blue line) by the widest margin since March....

READ MORE

MEMBERS ONLY

Evidence Of A Major Upside Dollar Breakout Is Growing

by Martin Pring,

President, Pring Research

* Dollar Index experiences a false downside breakout

* Euro encounters a false upside breakout

* Yen completes a bearish multi-year continuation formation

* Swiss franc completes a broadening wedge

Back in mid-September, I wrote an article where I pointed out that the Dollar was on a knife edge. This view was based on...

READ MORE

MEMBERS ONLY

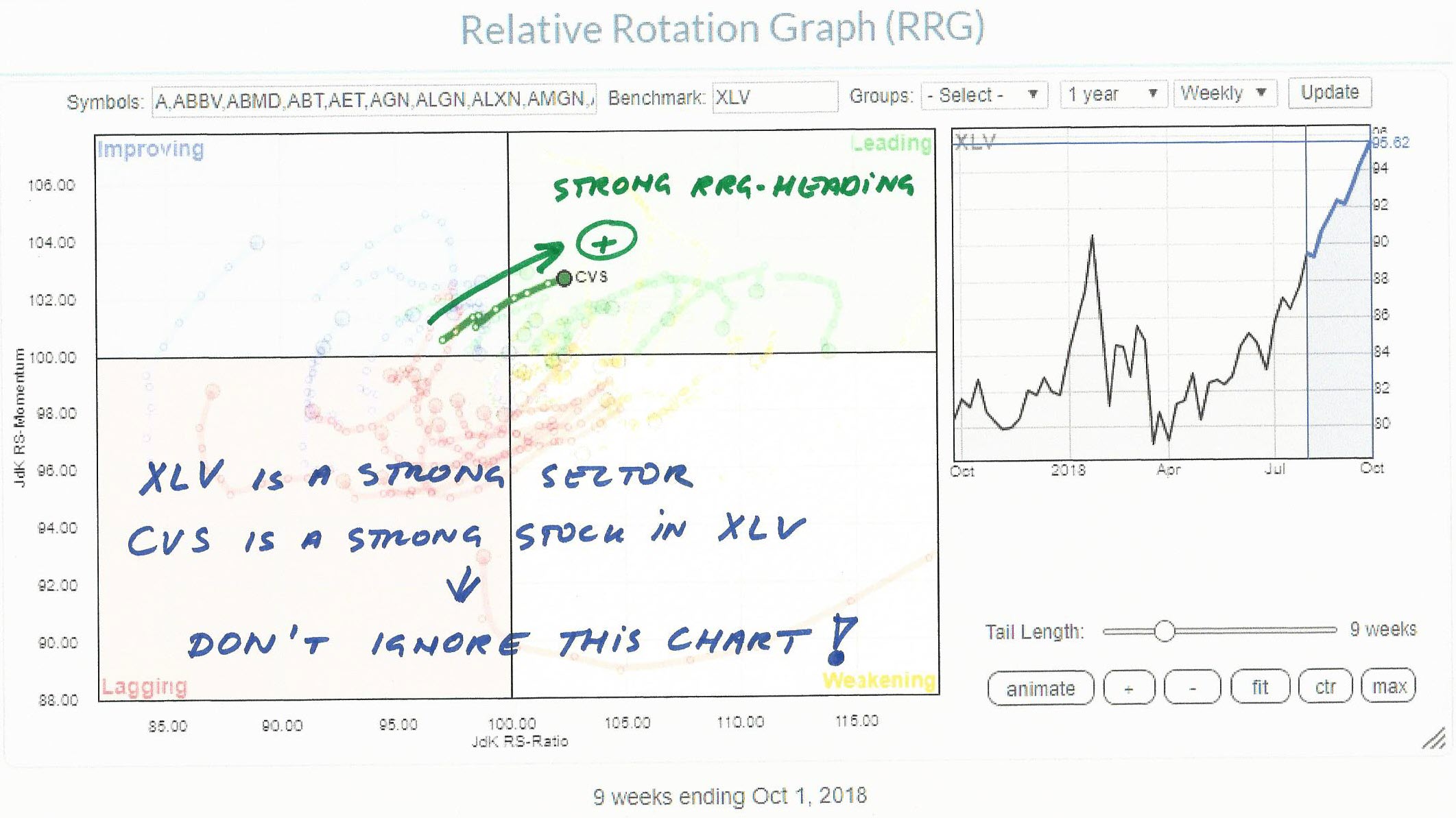

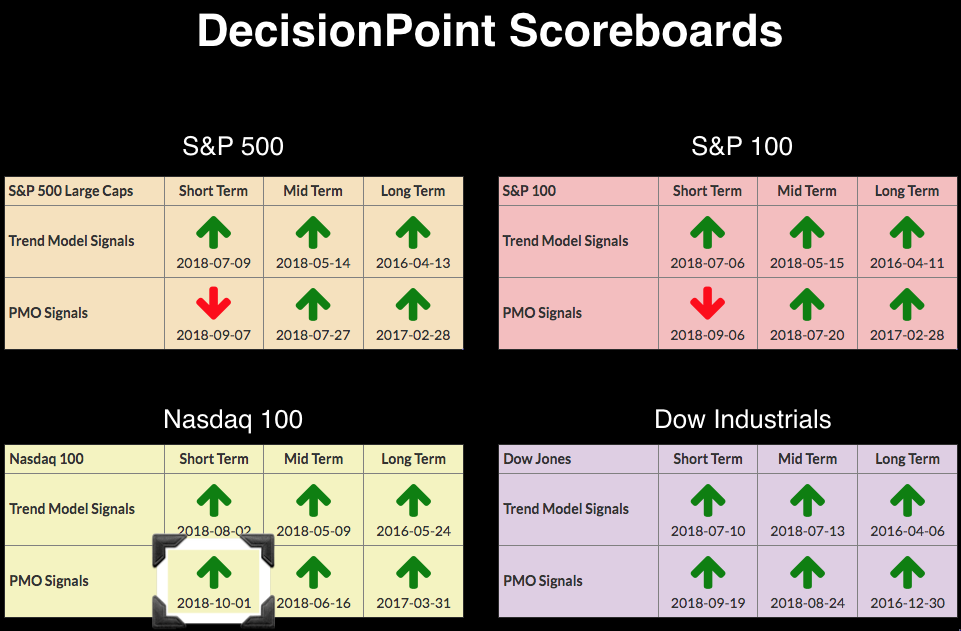

CVS: A healthy stock in a healthy sector

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Healthcare sector is getting a lot of attention lately. Not surprisingly as it is THE leading sector at the moment.

Yesterday when I was working on my most recent RRG blog, XLV made it to the headline. And for good reasons. At the moment it is the only sector...

READ MORE

MEMBERS ONLY

October 2018 Market Roundup With Martin Pring

by Martin Pring,

President, Pring Research

The Market Roundup Video For October is now available.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion ofPring Turner Capital Groupof Walnut Creek or its affiliates....

READ MORE

MEMBERS ONLY

New Trade Deal Leads Autos And Dow Jones Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, October 1, 2018

The big news was the United States, Canada and Mexico agreeing to replace the North American Free Trade Agreement (NAFTA) and automobile manufacturers ($DJUSAU, +5.84%) were the clear winners. The group also benefited from a quick settlement between the SEC and Tesla&...

READ MORE

MEMBERS ONLY

Beating Biases With Behavioral Checklists

by David Keller,

President and Chief Strategist, Sierra Alpha Research

During my ChartCon 2018 presentation entitled “The Mindless Investor and the Mindful Investor”, I shared the technical checklist that I use to teach a disciplined process for technical analysis.

I received a question after the session on whether I had a “behavioral checklist” to help minimize the impact of behavioral...

READ MORE

MEMBERS ONLY

UnitedHealth Powers Healthcare Providers to New High

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Health Care SPDR (XLV) is the strongest sector over the last six months (+19%) and the HealthCare Providers ETF (IHF) is one of the strongest industry groups (+27%). UnitedHealth (UNH) is the top holding in IHF and accounts for 12.5% of the ETF. UNH has a small bullish...

READ MORE

MEMBERS ONLY

Biotechs are Leading the Market - 3 to Watch

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* QQQ Leads with New High.

* IJR Firms Near Broken Resistance.

* 3 Biotechs To Watch.

...QQQ Leads with New High

...The Nasdaq 100 ETF (QQQ) advanced to a new high on Monday and continues to show upside leadership. Note that QQQ has been leading pretty much all year now and is...

READ MORE

MEMBERS ONLY

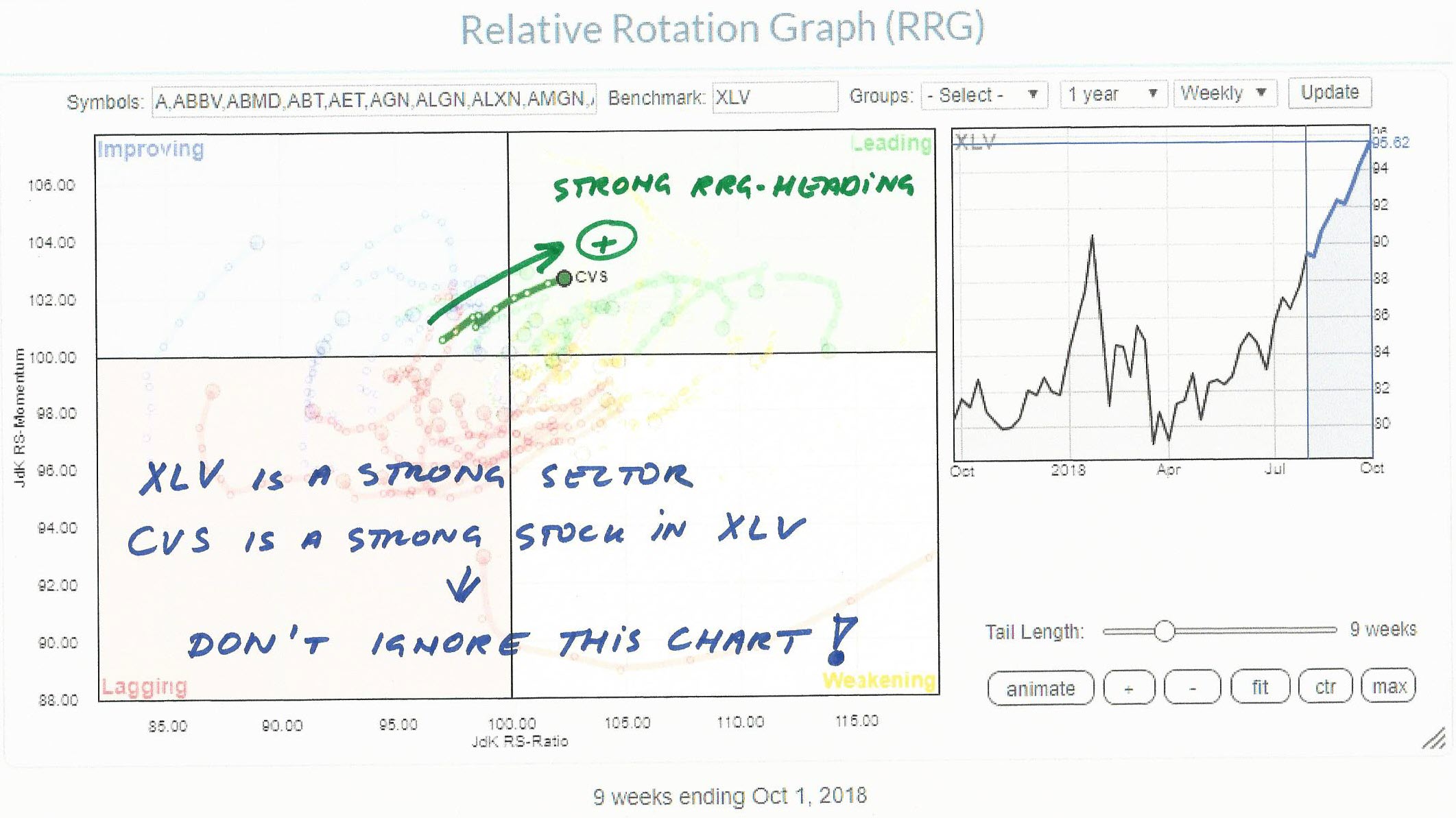

DP Bulletin: NDX Adds Short-Term PMO BUY Signal

by Erin Swenlin,

Vice President, DecisionPoint.com

On Friday, the Nasdaq 100 (NDX) switched to a Short-Term Price Momentum Oscillator (PMO) BUY signal. It joins the Dow which already had a PMO BUY signal that was logged on 9/19/18. The SPX and OEX are the laggards right now.

I've annotated the PMO BUY...

READ MORE

MEMBERS ONLY

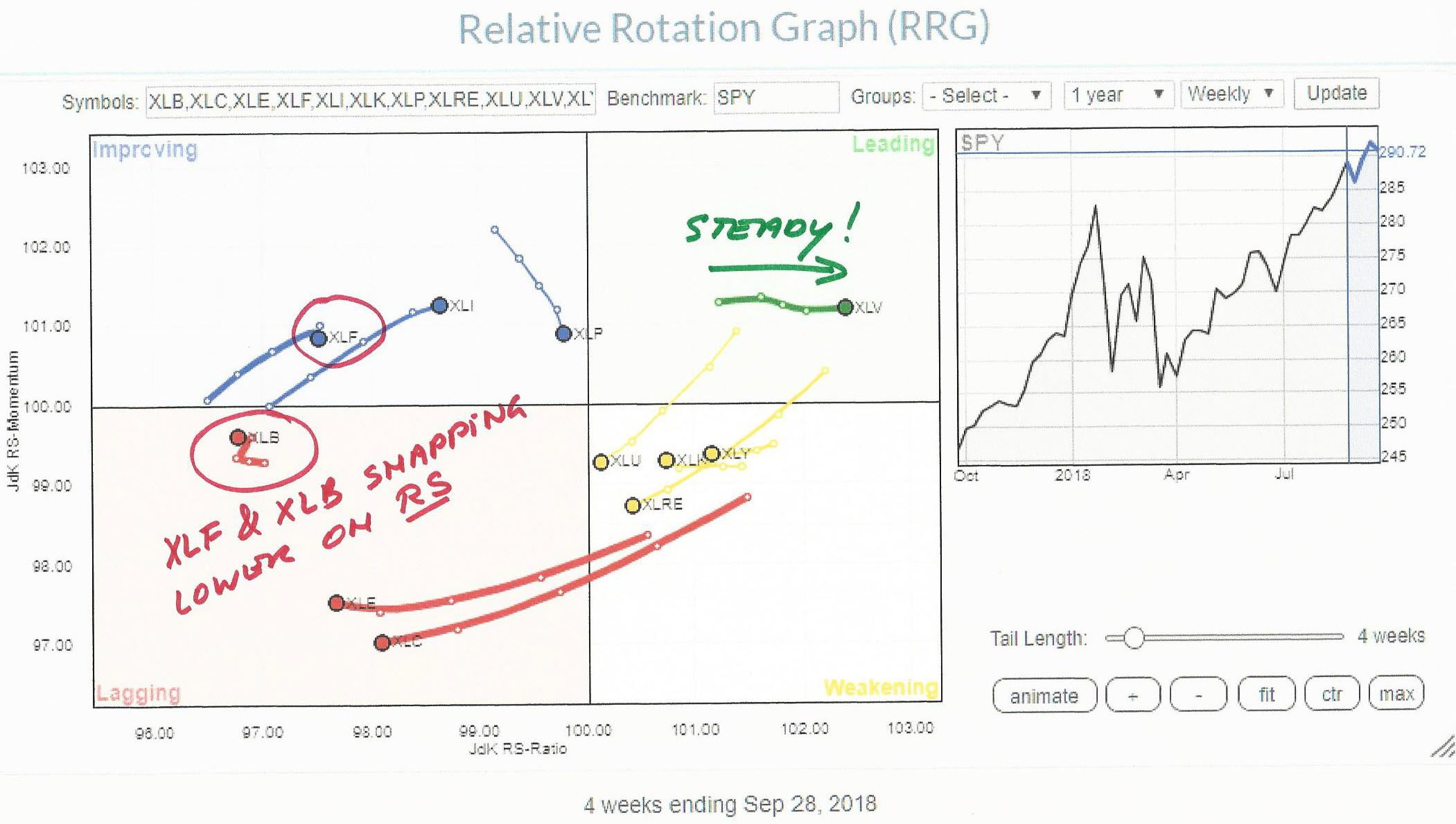

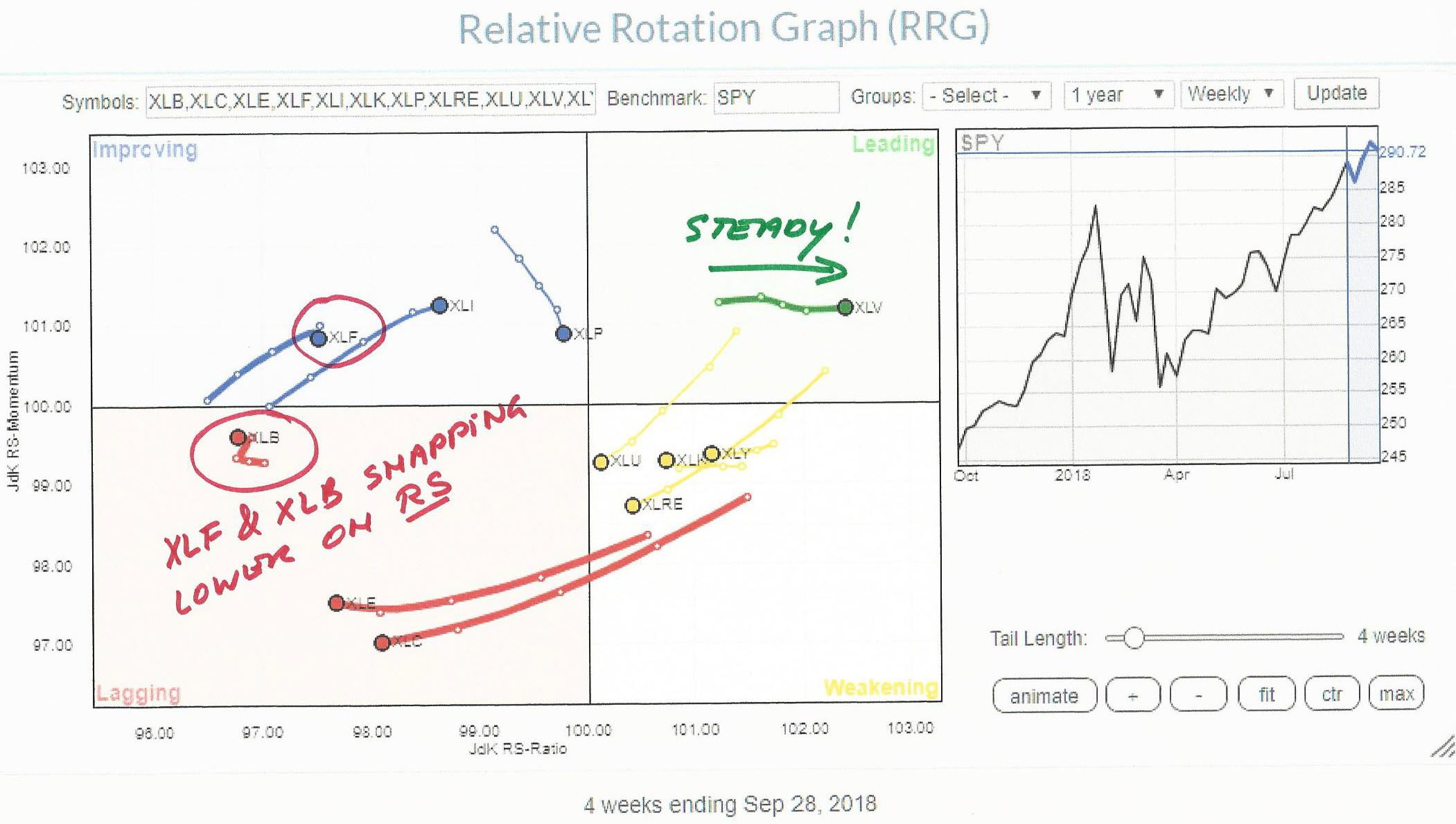

XLV continues strong in leading quadrant, XLF and XLB snap lower on Relative Strength

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the Relative Rotation Graph for US sectors, the Healthcare sector continues strong into the leading quadrant at a steady pace (RS Momentum). Two sectors that are showing a sudden weakness in relative strength, and therefore deserve our attention, are Materials (XLB) and Financials (XLF).

Summary

* Healthcare (XLV) moving further...

READ MORE

MEMBERS ONLY

This Software Company Blew Out Earnings In August, Could Be Bottoming Short-Term

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, September 28, 2018

Friday saw very choppy action to close out the 3rd quarter. The good news is that Q3 typically represents the U.S. market's weakest quarter in terms of performance. However, this year saw significant gains over the summer months as the...

READ MORE

MEMBERS ONLY

A Warm Welcome To Our Newest Contributing Author, David Keller, CMT

by Grayson Roze,

Chief Strategist, StockCharts.com

Okay, I’ll admit, this was just about the worst-kept secret of the year. That said, it doesn’t detract from the good news. Last week, we launched an expanded partnership with David Keller and officially introduced his new blog, The Mindful Investor.

As many of you know, David was...

READ MORE

MEMBERS ONLY

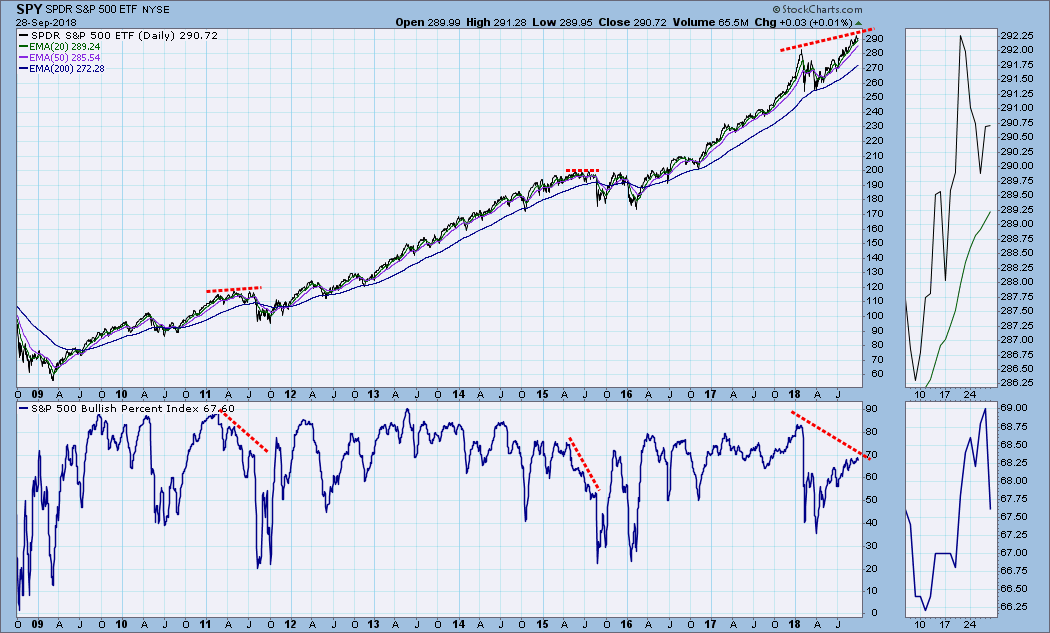

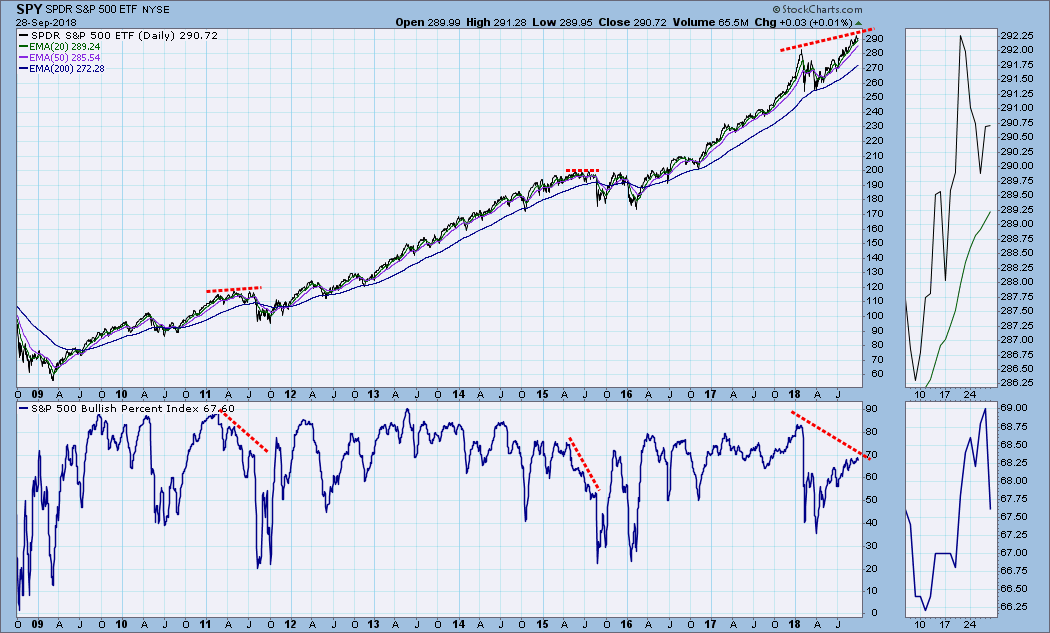

DP Weekly/Monthly Wrap: Failure to Thrive

by Carl Swenlin,

President and Founder, DecisionPoint.com

This chart was added almost as an afterthought in last Friday's DP Weekly Wrap, but throughout the week I kept thinking that it should elevated to the lead chart this week. The Bullish Percent Index (BPI) shows the percentage of S&P 500 stocks with point and...

READ MORE

MEMBERS ONLY

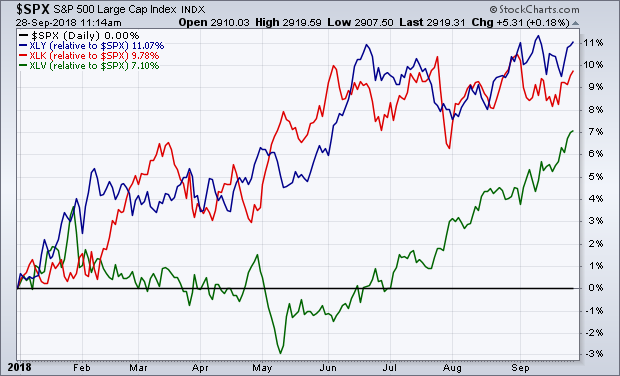

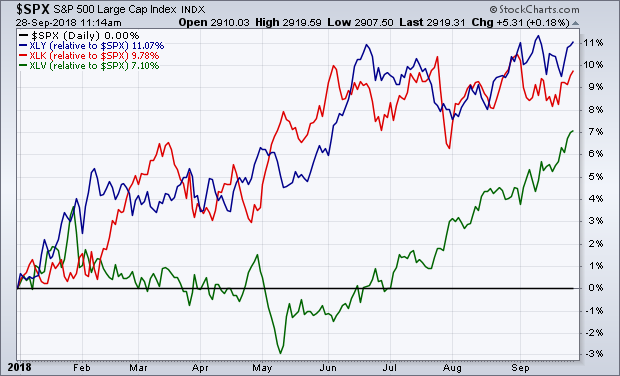

Health Care Has Become the New Market Leader

by John Murphy,

Chief Technical Analyst, StockCharts.com

Editor's Note: This article was originally published in John Murphy's Market Message on Friday, September 28th at 12:29pm ET.

The three strongest sector leaders since the start of this year have been consumer cyclicals, technology, and healthcare (in that order). But those numbers don'...

READ MORE

MEMBERS ONLY

Peter Lynch Nailed It; The French Nailed It; Sally Nailed It; You Can Too!

by Gatis Roze,

Author, "Tensile Trading"

Peter Lynch was the portfolio manager for Fidelity’s Magellan Fund for 13 years. His performance results were legendary, and when he retired, he wrote a number of books based on his winning investing principles.

To paraphrase and blend a few of those together, Lynch felt that individual investors could...

READ MORE

MEMBERS ONLY

CONSUMER CYCLICALS AND TECHNOLOGY ARE THE YEAR'S STRONGEST SECTORS -- BUT HEALTHCARE HAS BECOME THE NEW MARKET LEADER -- AND REMAINS MUCH CHEAPER THAN THE OTHER SECTOR LEADERS

by John Murphy,

Chief Technical Analyst, StockCharts.com

HEALTHCARE HAS BECOME NEW SECTOR LEADER... The three strongest sector leaders since the start of this year have been consumer cyclicals, technology, and healthcare (in that order). But those numbers don't reflect the fact that healthcare has become the strongest market sector over the past three and six...

READ MORE

MEMBERS ONLY

Weekly Market Review and Outlook (with Video) - Split within Market Widens

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* %Above 200-day EMA.

* IJR and MDY Correct as QQQ Breaks Out.

* XLC and XLF are Lagging.

* XLF and Treasury Yields.

* Utes and REITs become Short-term Oversold.

* Big Biotechs are Leading Again.

* JAZZ Hits Reversal Area.

* Notes from the Art's Charts ChartList.

...The stock market as a whole remains...

READ MORE

MEMBERS ONLY

Apple Nears Breakout, Leads NASDAQ; Small Caps Lag

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, September 27, 2018

Utilities (XLU, +1.03%) rebounded solidly on Thursday after trending lower most of September. The group appeared to benefit from the failure of the 10 year treasury yield ($TNX) to break out. 3.11% is yield resistance on the TNX from the May...

READ MORE

MEMBERS ONLY

Campaigning Crude Oil

by Bruce Fraser,

Industry-leading "Wyckoffian"

It is time to update the blog post, 'Crude Oil Runs with the Bulls', of November 11, 2017 (click here). Our Crude Oil ($WTIC) odyssey began in December of 2015 with a study of the Distributional Top touching $112. A Distribution Point and Figure (PnF) count produced an...

READ MORE

MEMBERS ONLY

The Fed Takes A Stand....And It's Not Accommodative

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, September 26, 2018

The FOMC raised its fed funds rate a quarter point at 2pm EST yesterday as expected, but as usual, it's not what the Fed does, it's what it says. Perhaps the most significant part of the Fed's...

READ MORE

MEMBERS ONLY

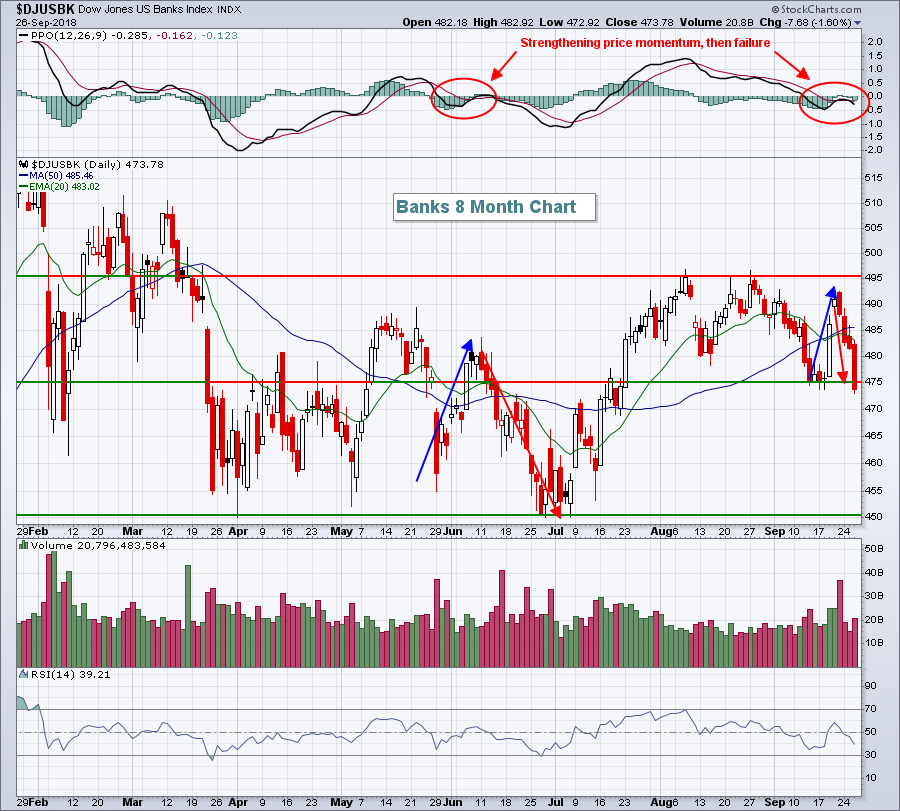

QQQ Holds Up as Small-caps Extend Pullback

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* QQQ Holds Up as Small-caps Fall.

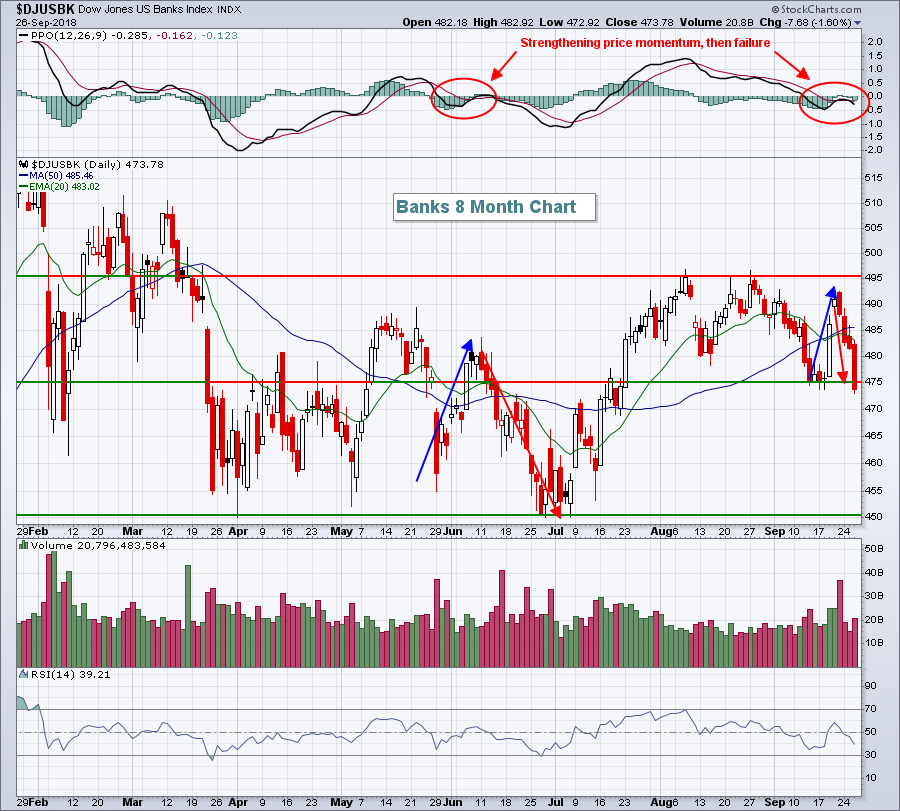

* Finance Sector Fails to Hold Breakout.

* Defining the Upswing in XLF.

* Regional Banks and Brokers Break.

* Home Construction Breaks Triangle Line.

...QQQ Holds Up as Small-caps Fall

...Stocks were hit with selling pressure late Wednesday and this pushed some key groups modestly lower. The...

READ MORE

MEMBERS ONLY

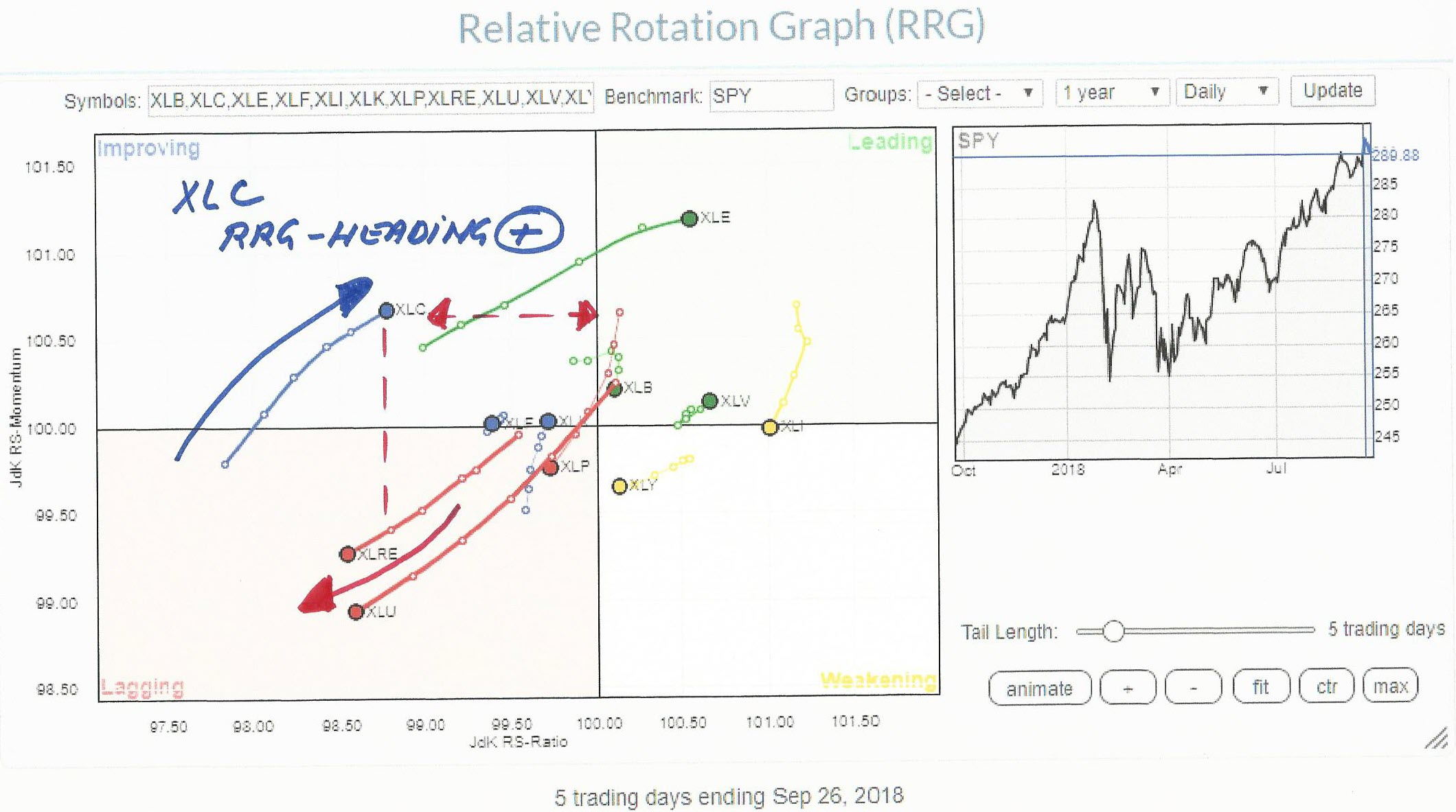

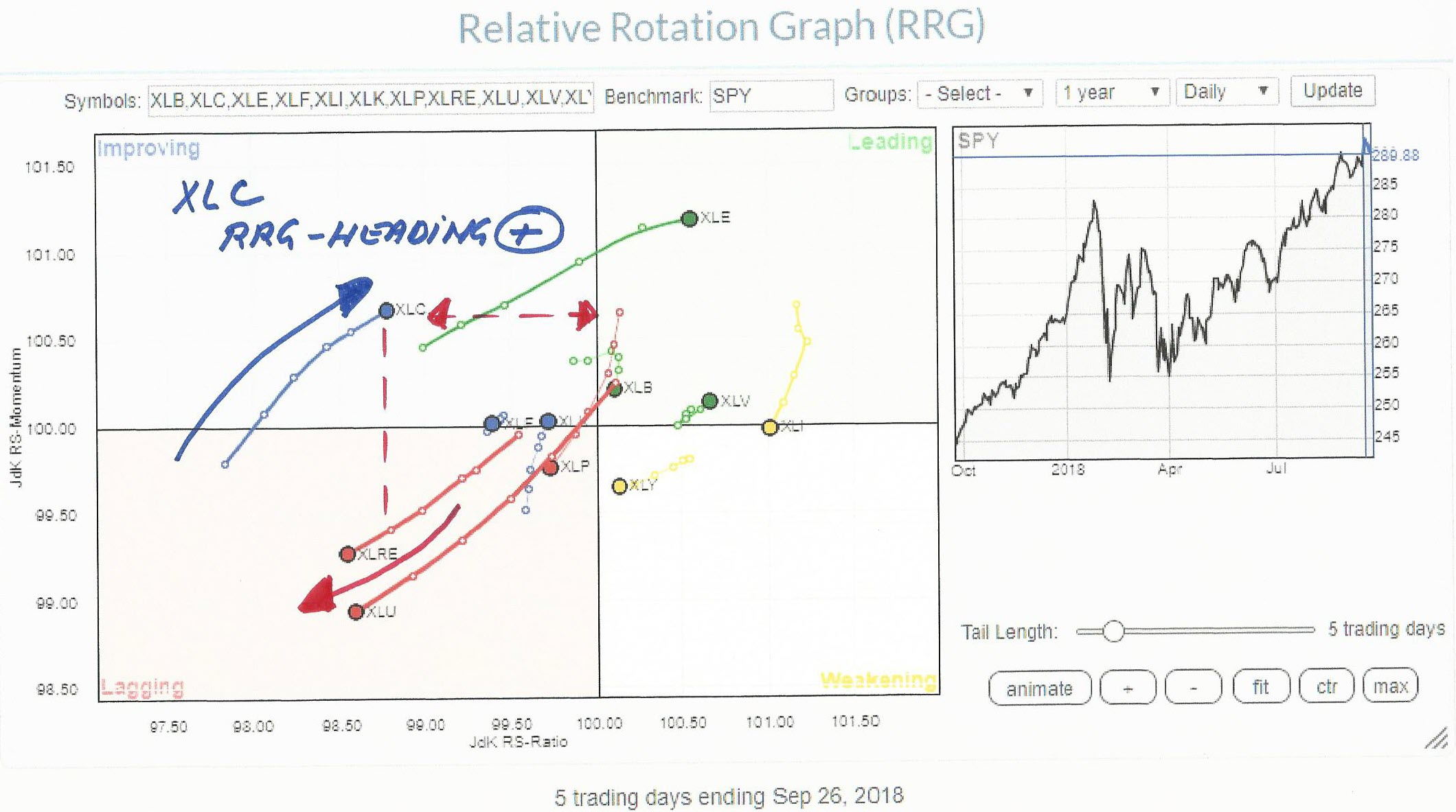

XLC recovering on Relative Rotation Graph, but for how long?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the daily Relative Rotation Graph above, the new XLC sector is positioned inside the improving quadrant. XLC moved into the improving from lagging 5 trading days ago and is now heading higher on both scales at a positive RRG-Heading.

Measured on the JdK RS-Ratio scale (horizontal axis), XLC is...

READ MORE

MEMBERS ONLY

DP Alert: Possible Selling Exhaustion in Very Short Term - Stubborn Gold

by Erin Swenlin,

Vice President, DecisionPoint.com

Advances minus declines readings over the past few days are suggesting a short-term selling exhaustion. And, what's up with Gold? It's been poised to breakout for some time and we're still waiting. There were no changes to the Scoreboards this past week, but, there...

READ MORE

MEMBERS ONLY

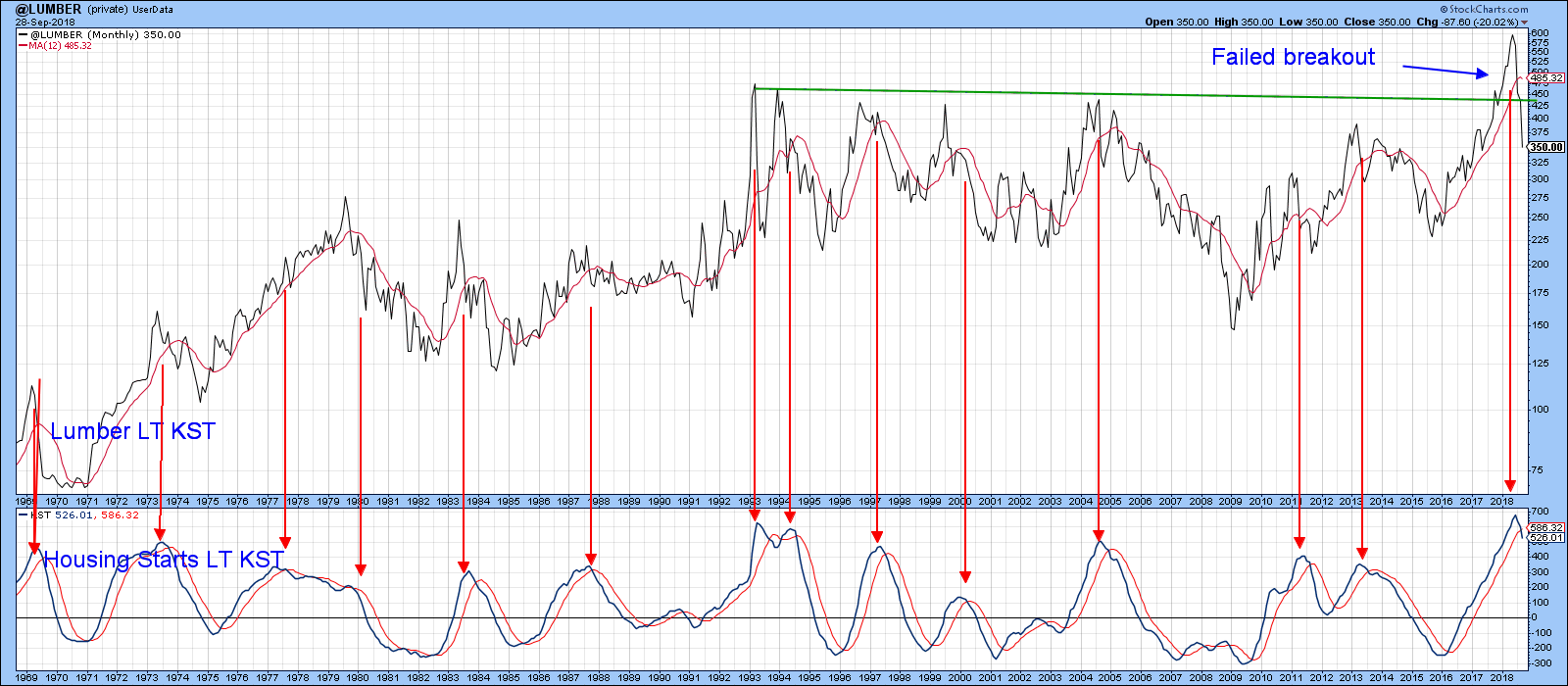

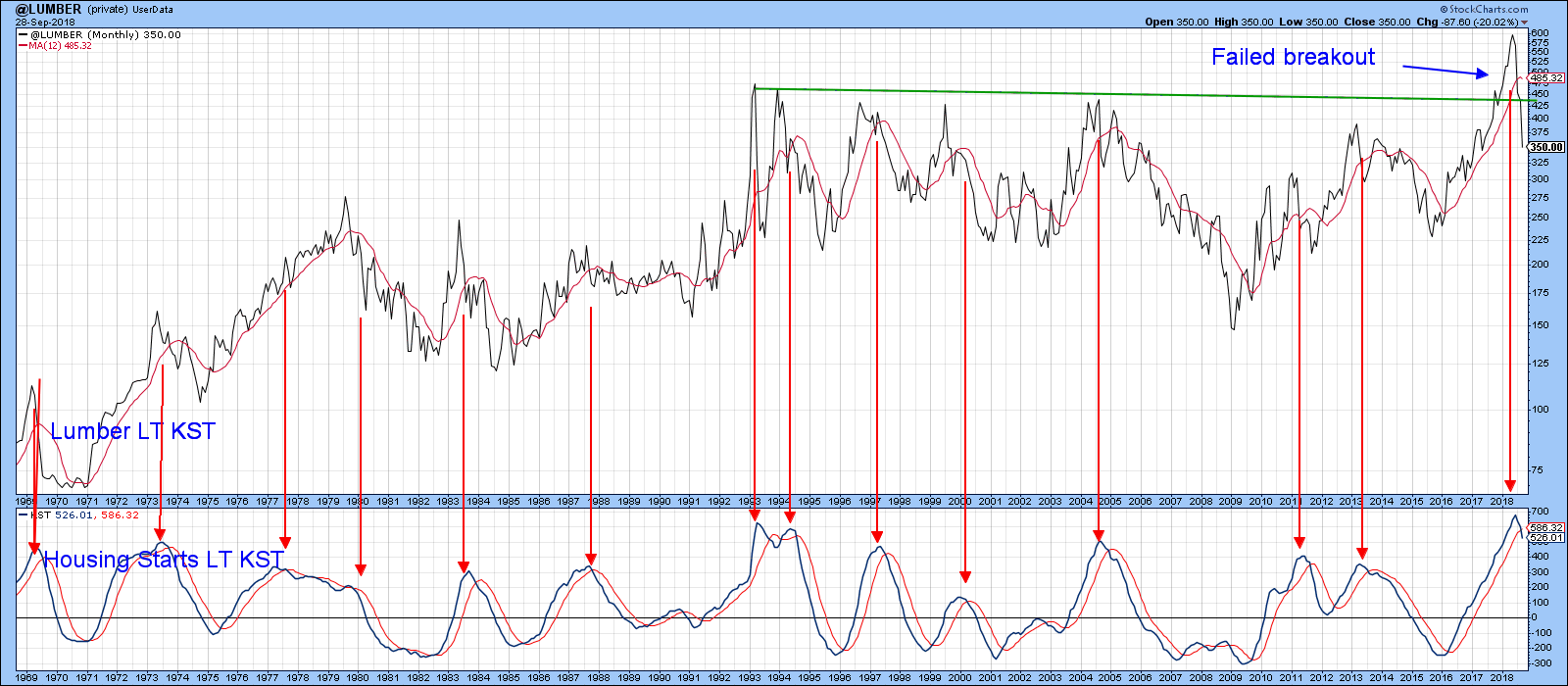

Recent Weak Lumber Prices Are Not A Good Sign For Housing Stocks

by Martin Pring,

President, Pring Research

* The connection between lumber and housing starts

* What the homebuilding ETF’s are saying

Nonfarm payrolls are an economic series that is widely followed by the investment community. However, it’s a coincident indicator, meaning it tells you what is going on now, not what might happen in the future....

READ MORE

MEMBERS ONLY

Building a Rules-Based Trend Following Model - 14

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I spent a great deal of time working on an asset commitment model using the Chande Trend Meter (CTM) and believe I have something worth sharing. Tushar defines ranges for CTM based on the degree of trendiness and I have assigned Asset Commitment percentages to those pre-defined ranges. Table A...

READ MORE

MEMBERS ONLY

TEN-YEAR TREASURY IS TESTING ITS MAY HIGH -- A CLOSE ABOVE THAT LEVEL WOULD CONSTITUTE A MAJOR BULLISH BREAKOUT -- RISING TREASURY YIELDS ARE BEING SUPPORTED BY HIGHER FOREIGN YIELDS -- UK BOND YIELD HAS REACHED A TWO-YEAR HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

TEN-YEAR TREASURY YIELD IS AT A CRUCIAL CHART POINT ... Treasury bond yields are going through an important test of overhead resistance. Chart 1 shows the 10-Year Treasury yield ($TNX) challenging its May 2018 intra high near 3.11%. After pulling back from its May high, the TNX entered a sideways...

READ MORE

MEMBERS ONLY

Alphabet (aka Google) Hits Potential Reversal Zone

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Alphabet (GOOGL) fell around 10% from a recent high and this decline looks like a pretty normal correction within a bigger uptrend. Note that GOOGL is the biggest component (23.15%) in the new Communication Services SPDR (XLC). Facebook (FB) is the second largest weighting (17.69%) and Disney (DIS)...

READ MORE

MEMBERS ONLY

Energy Leads; Exploration & Production Stocks Test Major Resistance

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, September 25, 2018

Almost. That's the word that came to mind while watching energy stocks into the close on Tuesday. Yes, the group is in the midst of a significant short-term rally, but when given the opportunity to clear multi-month price resistance, they came...

READ MORE

MEMBERS ONLY

QQQ Perks Up as Tech-Related ETFs Stay Strong (sans SOXX)

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Short-term Divided, but Long-term Bullish

* Small-caps Still Struggling

* SPY Leads as QQQ Breaks Wedge

* Tech-Related ETFs Hold Strong (sans SOXX)

* Chart Setups: ANET, QLYS, NFLX, LMT, RTN

More Uptrends than Downtrends

Large-caps continue to lead as SPY hit a new high last week and QQQ edged higher the last two...

READ MORE

MEMBERS ONLY

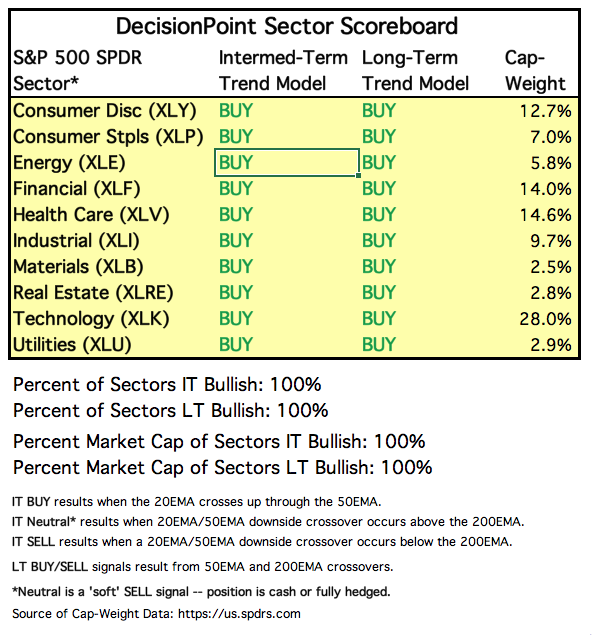

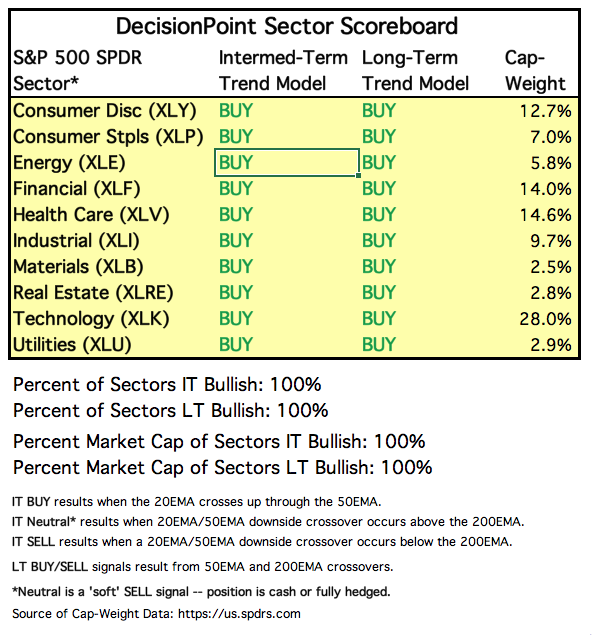

Energy Sector Moves to IT BUY Signal - All Sectors, All on BUYs IT and LT

by Erin Swenlin,

Vice President, DecisionPoint.com

When I look at the DecisionPoint Sector Scoreboard, it is near impossible to be bearish in the longer term. When we see participation in all of the sectors that results in BUY signals across the board, the market is not generally vulnerable to a correction. Price shocks happen, but typically...

READ MORE

MEMBERS ONLY

Steel Quietly Resting, But Looking Solid For Q4 Run

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, September 24, 2018

Energy (XLE, +1.46%) had a very strong day on Monday, helping to offset what was otherwise a rather poor day for U.S. equities. Technology (XLK, +0.50%) was aided by its four key components - computer hardware ($DJUSCR, +1.17%), internet...

READ MORE