MEMBERS ONLY

ENERGY PRICES RISE AS OPEC DOESN'T BOOST OUTPUT -- DB ENERGY FUND RISES TO THREE-YEAR HIGH -- ENERGY SECTOR SPDR RISES TO TWO-MONTH HIGH -- SO DOES THE S&P OIL & GAS EXPLORATION AND PRODUCTION SPDR -- MARATHON PETROLEUM HITS NEW RECORD

by John Murphy,

Chief Technical Analyst, StockCharts.com

INVESCO DB ENERGY FUND REACHES THREE-YEAR HIGH ... This past weekend's meeting between OPEC and Russia ended with no agreement to boost output to counter rising oil price. As a result, oil and other energy prices are rising sharply today. Chart 1 shows the Invesco DB Energy Fund (DBE)...

READ MORE

MEMBERS ONLY

Regeneron Holds Break as Volume Picks Up

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Regeneron (REGN), a large-cap biotech stock, is part of the Health Care SPDR (XLV) and a top ten holding in the Biotech iShares (IBB), Both ETFs hit 52-week highs recently and show upside leadership. The stock is lagging in the 52-week high category, but the long-term trend is up and...

READ MORE

MEMBERS ONLY

This NASDAQ Support Zone Is Important And Needs To Hold

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, September 21, 2018

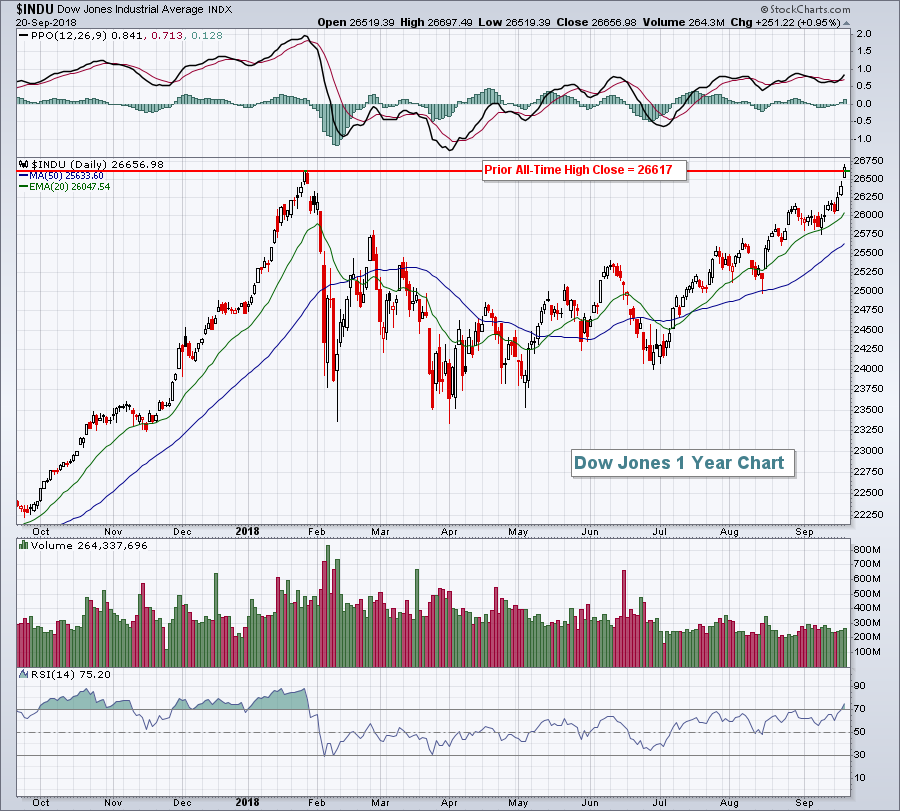

Bifurcation was once again apparent on Wall Street to close out last week. The Dow Jones was able to finish higher and extend its trek into record high territory, while the S&P 500 was essentially flat. The NASDAQ and Russell 2000,...

READ MORE

MEMBERS ONLY

WEEKLY RECAP SHOWS MATERIALS AND FINANCIALS LEADING MARKET HIGHER, WHILE TECHNOLOGY AND UTILITIES LAG BEHIND -- RECORD HIGH IN THE DOW MAY BE TIED TO EASING IN GLOBAL TENSIONS AND REBOUND IN FOREIGN CURRENCIES AND STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

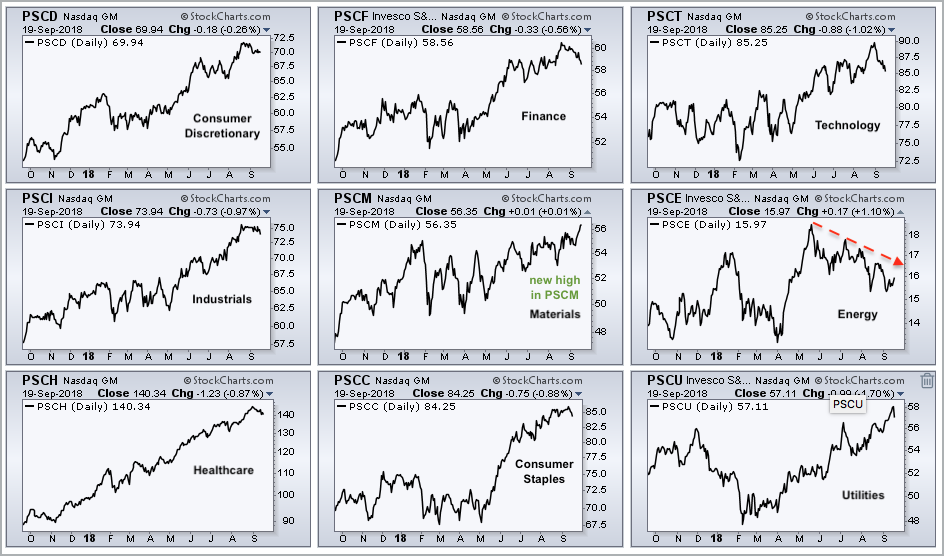

MATERIALS AND FINANCIALS LEAD, TECHS AND UTES LAG: The Dow and S&P 500 hit new records this past week, while the Nasdaq lost some ground. A rebound in chemicals and copper stocks made materials the weekly leader. Financials benefited from a jump in bond yields. That also explains...

READ MORE

MEMBERS ONLY

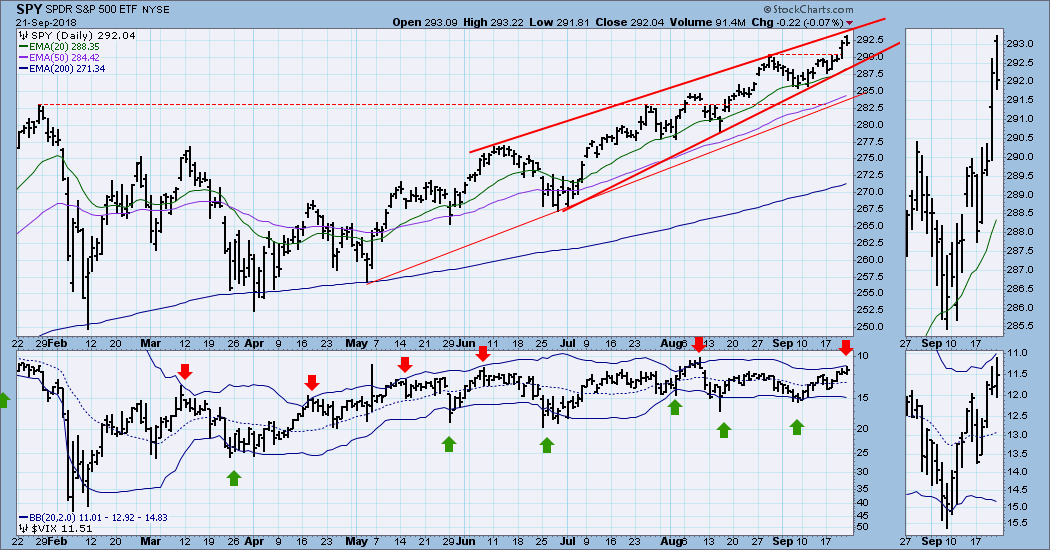

DP Weekly Wrap: Two Indications of a Short-Term Top

by Carl Swenlin,

President and Founder, DecisionPoint.com

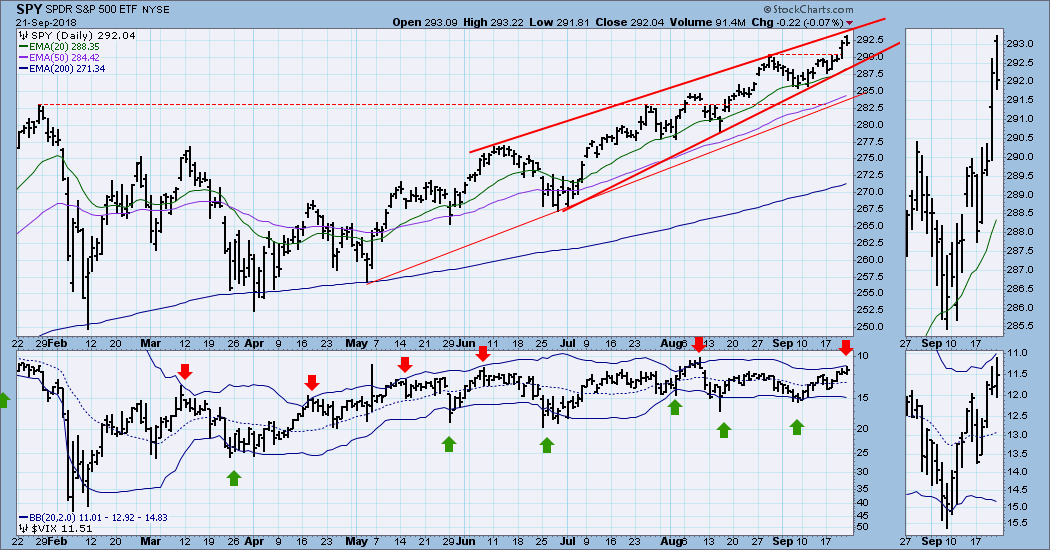

The market (represented by SPY) has nearly reached the top of a rising wedge formation, and the VIX has reached the top Bollinger Band on our reverse scale display. There is no guarantee, but there is a pretty good chance that a short-term top is very near. There is also...

READ MORE

MEMBERS ONLY

UNITED STATES OIL FUND IS TESTING SUMMER HIGH -- WHILE ENERGY SPDR TESTS AUGUST HIGH -- ENERGY LEADERS INCLUDE CONOCOPHILLIPS, HESS, AND MARATHON OIL -- EXXON MOBIL AT EIGHT-MONTH HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

UNITED STATES OIL FUND NEARS THREE-YEAR HIGH... The price of crude oil has reached a critical chart juncture. Chart 1 shows the United States Oil Fund (USO) in the process of testing its early July peak. A close through that barrier would put the USO at the highest level in...

READ MORE

MEMBERS ONLY

Weekly Market Review and Outlook (with Video) - Where's the Selling Pressure?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Where's the Selling Pressure? (RSP).

* Dow Theory Bull Market Confirmation

* New Leadership Emerges (XLV, XLI, XLF).

* QQQ Gets its Flow Back.

* IJR Flags and IWM Tests Breakout.

* Finance Sector Joins the Fray.

* Notes from the Art's Charts ChartList.

Where's the Selling Pressure?

There are...

READ MORE

MEMBERS ONLY

Can You Correctly Answer This Historical Tendencies Trivia Question? I Doubt It

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

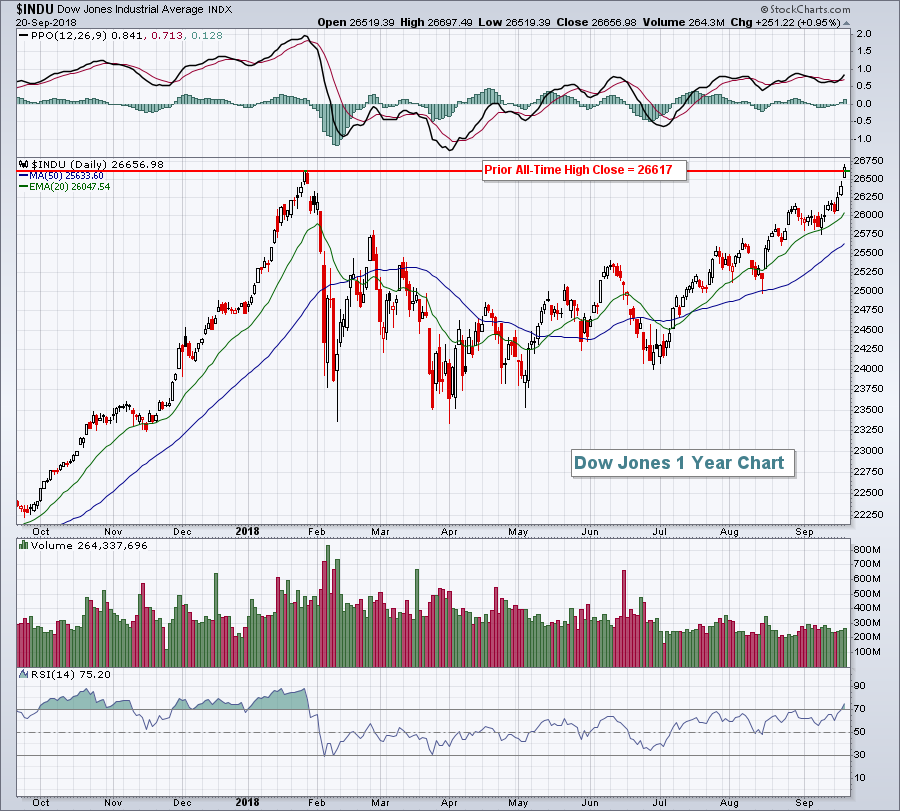

Market Recap for Thursday, September 20, 2018

Dow Jones, welcome to the party! It's been eight months since the Dow Jones could say it closed in record all-time high territory, but that's what happened at yesterday's close. The Dow Jones joined the S&...

READ MORE

MEMBERS ONLY

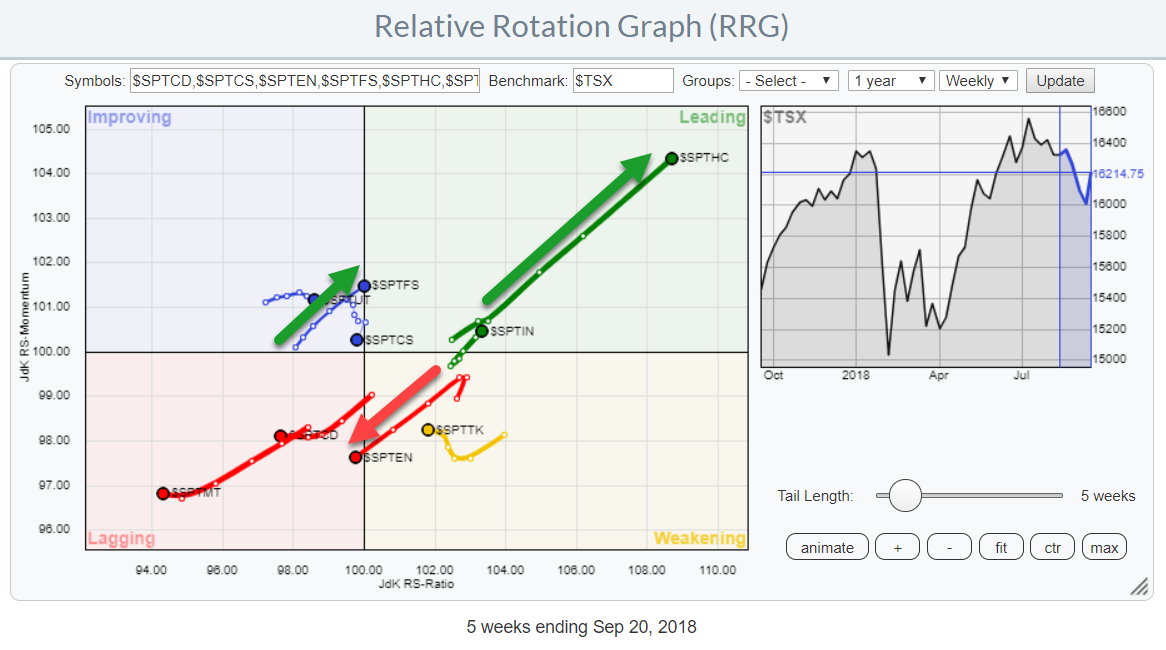

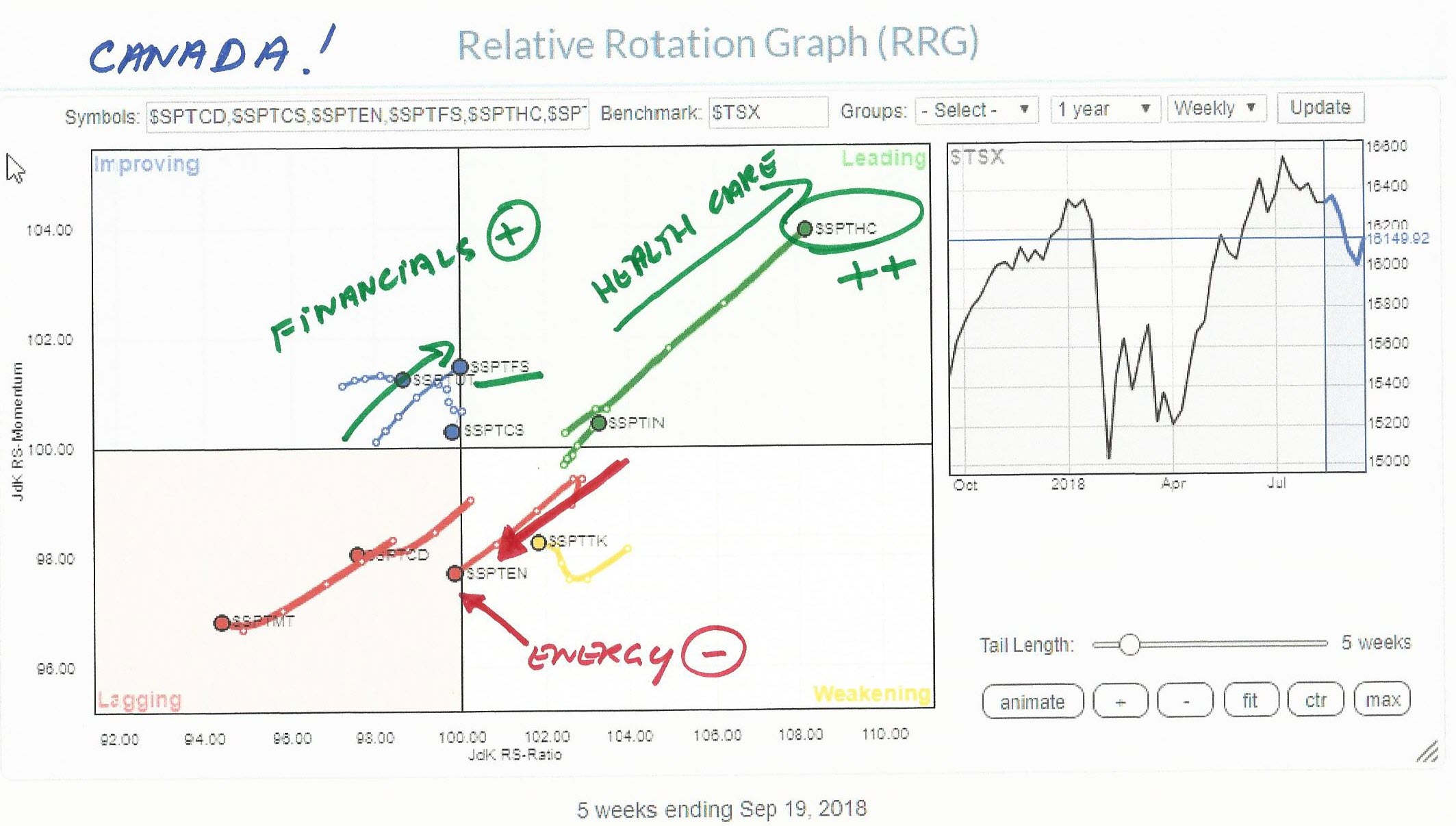

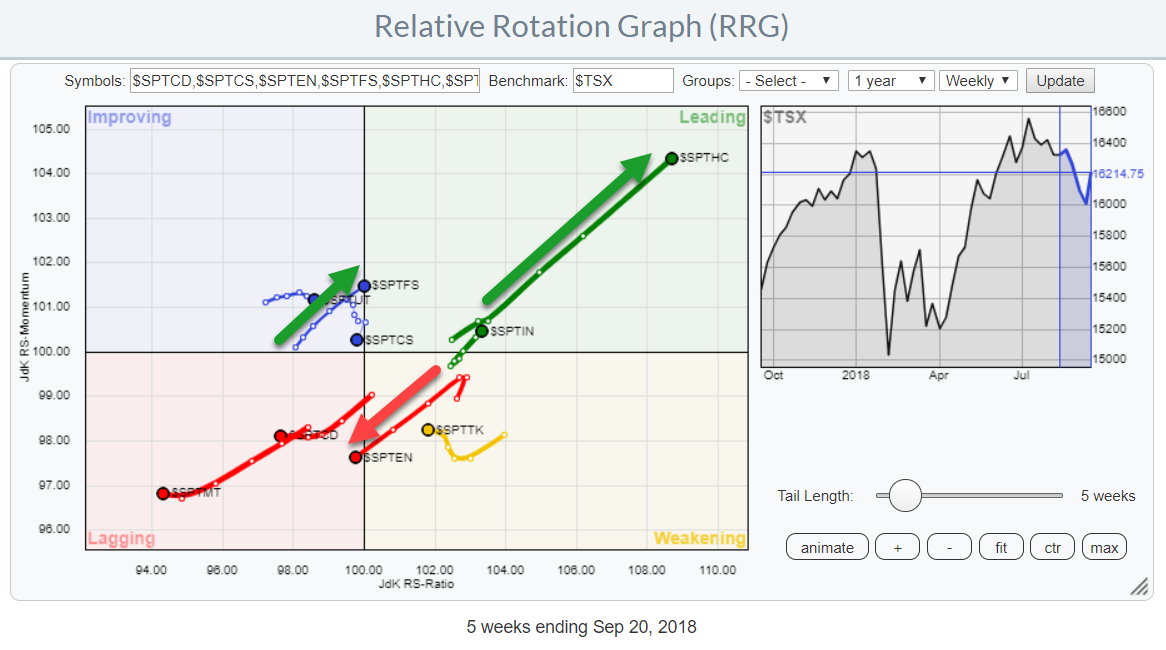

Canadian Health Care sector ($SPTHC) gunning for test of $ 155

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph for Canadian sectors is showing a very distinct move for the Healthcare sector. It is inside the leading quadrant and powering further into it at a strong RRG-Heading at a very long tail. All ingredients for more strength ahead and worth a closer look on a...

READ MORE

MEMBERS ONLY

Natural Gas (UNG) Ready to Catch Fire

by Erin Swenlin,

Vice President, DecisionPoint.com

Today I received two bullish email alerts on Natural Gas (UNG). First, the Short-Term Trend Model had triggered a BUY signal. This means the 5-EMA just crossed above the 20-EMA. Second, there was a Short-Term Price Momentum Oscillator (PMO) BUY signal that registered today as well. I hadn't...

READ MORE

MEMBERS ONLY

DOW AND S&P 500 HIT NEW RECORDS -- THE DOW IS THE LAST ONE TO CLEAR ITS JANUARY HIGH -- COMMODITY CHEMICALS HELP BOOST MATERIALS SPDR TO SIX MONTH HIGH -- SEMICONDUCTORS CONTINUE TO STABILIZE -- U.S. DOLLAR FALLS TO TWO-MONTH LOW

by John Murphy,

Chief Technical Analyst, StockCharts.com

THE DOW IS THE LAST TO CLEAR ITS JANUARY HIGH... Another day of rising stock prices has pushed the Dow and the S&P 500 to new records. In the case of the SPX (Chart 1), today's new high is enough to push it back above its...

READ MORE

MEMBERS ONLY

Welcome to The Mindful Investor

by David Keller,

President and Chief Strategist, Sierra Alpha Research

It is with great pleasure that I welcome you to my new blog on StockCharts.com entitled The Mindful Investor. I have been a StockCharts.com user for years but have become even more impressed as I’ve gotten to know the great people behind this website. I’m honored...

READ MORE

MEMBERS ONLY

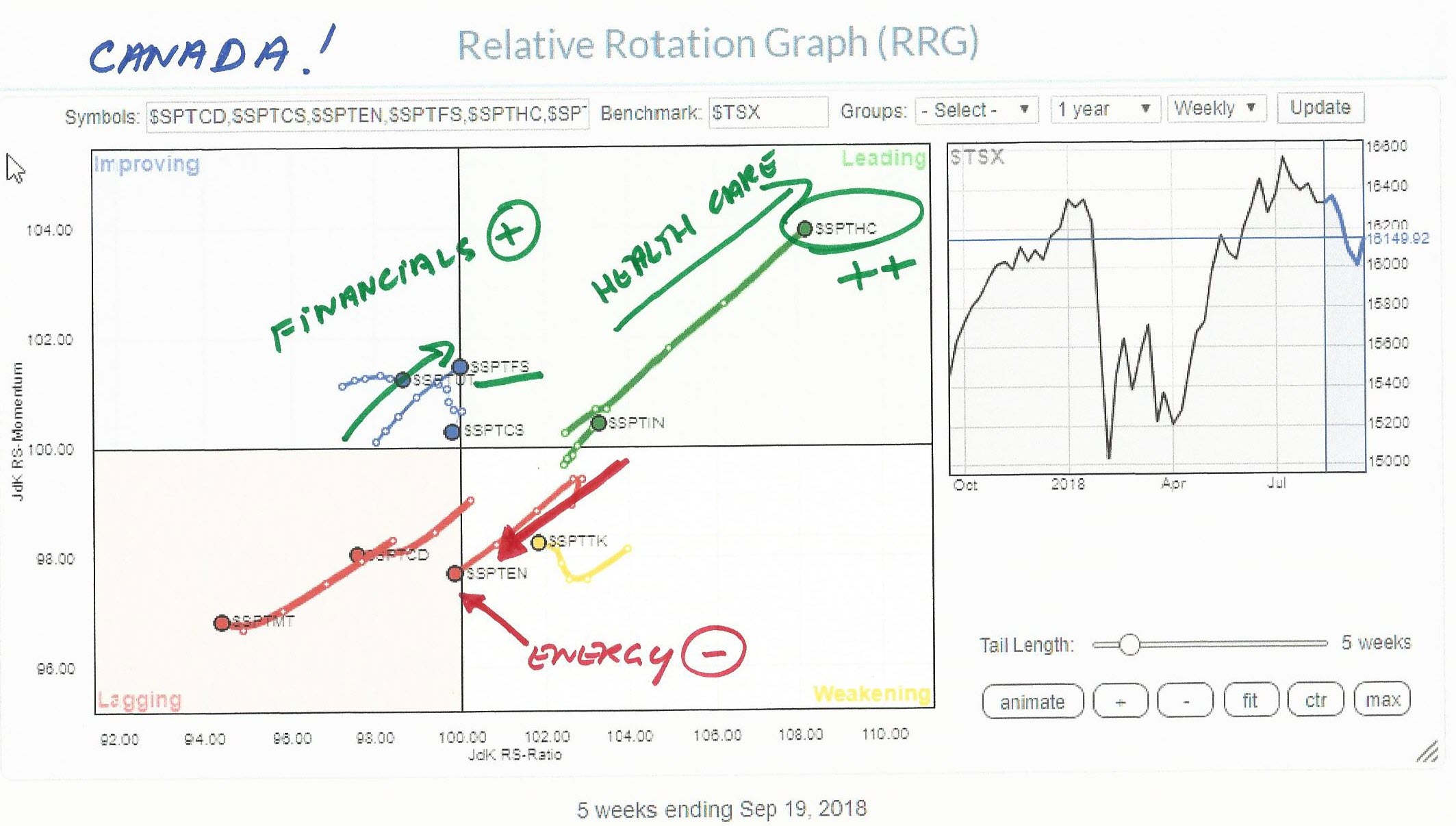

Canadian Healthcare and Financial Services winning over Energy

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

While browsing through some pre-populated RRGs on the site I stumbled upon the chart holding Canadian sectors.

What immediately triggered me was the sharp move of the Healthcare sector into the leading quadrant at almost 45 degrees which means that the sector is moving higher on both axes which is...

READ MORE

MEMBERS ONLY

Traders Are High On Cannabis Stocks, But Life Insurance Is the Safer Bet

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, September 19, 2018

The biggest news stories technically-speaking yesterday were the breakout in financials (XLF, +1.70%) and the rising 10 year treasury yield ($TNX), which closed at 3.08% and is just 3 basis points from testing a 7 year high. But September 19, 2018...

READ MORE

MEMBERS ONLY

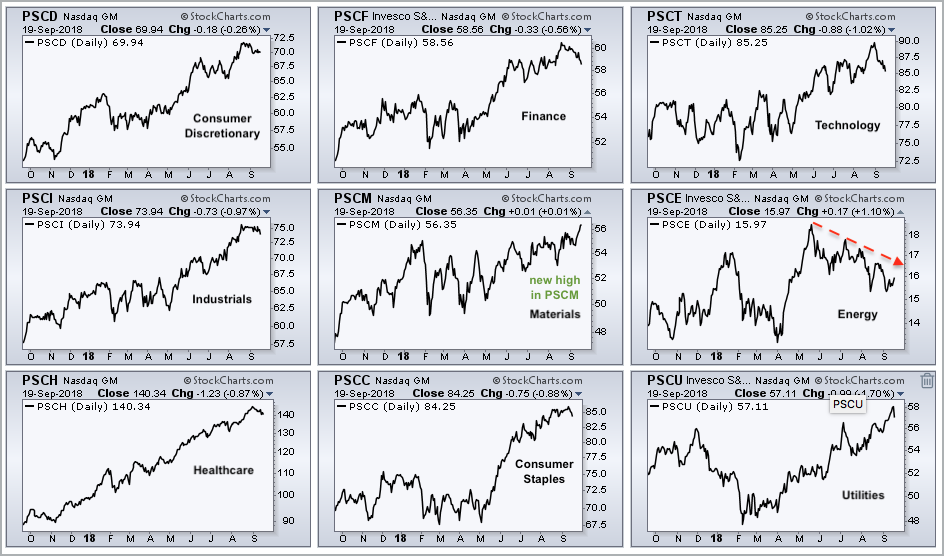

Materials Sector Heats Up, Watching SOXX and Two Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Small-cap Materials Take the Lead.

* An Abandoned Hammer in SOXX.

* FireEye, the Big Base and Volume.

* Arista Hits Support and Oversold Zone.

... Small-cap Materials Take the Lead

... There are nine small-caps sectors and the SmallCap Materials ETF (PSCM) is taking the lead. First, it is the only one of the...

READ MORE

MEMBERS ONLY

DP Alert: Dow Takes the Lead with New PMO BUY Signal

by Erin Swenlin,

Vice President, DecisionPoint.com

Big news today was a new Price Momentum Oscillator (PMO) BUY signal on the Dow. I've noticed the bifurcation of the markets. Today saw a positive close for the Dow, OEX and SPX, but the NDX, $MID and $SML all closed lower. In the case of mid- and...

READ MORE

MEMBERS ONLY

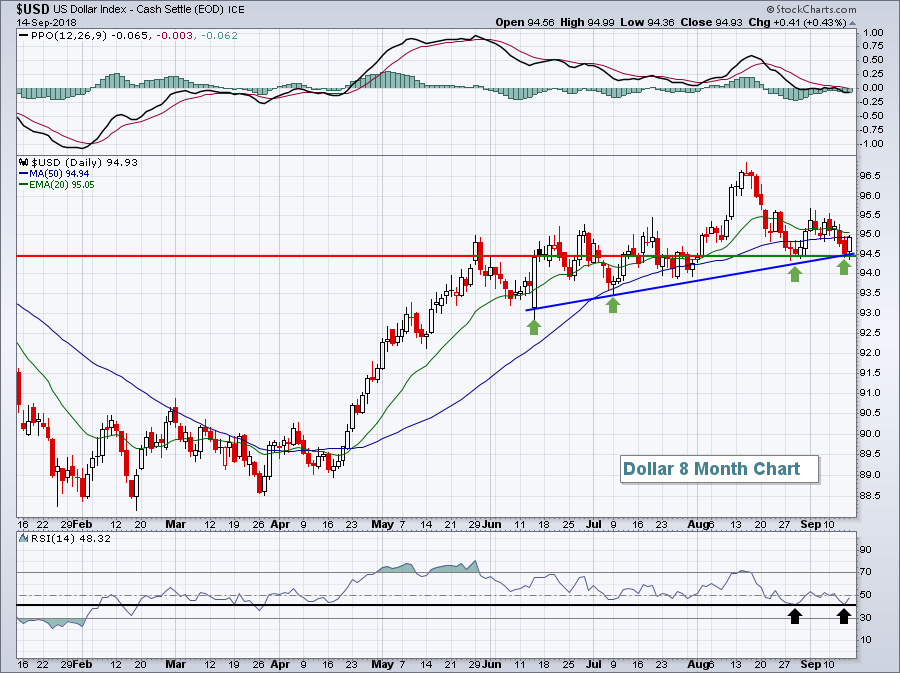

Dollar Index Is On A Knife Edge

by Martin Pring,

President, Pring Research

* Long-term dollar technical position

* Short-term picture bearish outcome

* Short-term picture bullish outcome

* Euro

* Yen

* Swiss franc

Long-term dollar technical position

I have been primary trend bullish on the dollar for several months. That opinion still stands because the Dollar Index is well above its 12-month MA and its long-term KST...

READ MORE

MEMBERS ONLY

FOUR-MONTH HIGH IN THE 10-YEAR TREASURY YIELD LIFTS FINANCIAL SPDR TO SIX-MONTH HIGH AND THE DAY'S STRONGEST SECTOR -- BUT MAKES UTILITIES THE DAY'S WEAKEST SECTOR

by John Murphy,

Chief Technical Analyst, StockCharts.com

RISING BOND YIELDS HELP FINANCIALS, BUT HURT UTILITIES... This morning's message suggested that this week's upside breakout in bond yields was helping financial stocks which were the day's strongest sector. The green bars on top of Chart 1 show the 10-Year Treasury yield surging...

READ MORE

MEMBERS ONLY

UPSIDE BREAKOUT IN BOND YIELDS IS BOOSTING FINANCIAL STOCKS -- CITIGROUP AND JP MORGAN NEAR UPSIDE BREAKOUTS -- INSURANCE ISHARES HIT SEVEN-MONTH HIGH TO LEAD XLF HIGHER -- PRUDENTIAL AND PRINCIPAL FINANCIAL GROUP ACHIEVE UPSIDE BREAKOUTS

by John Murphy,

Chief Technical Analyst, StockCharts.com

FINANCIALS GET A BOOST FROM RISING BOND YIELDS ... Yesterday's message showed the 10-Year Treasury yield rising to the highest level in four months. That probably explains why financials are leading the market higher today. Chart 1 shows the Financial Sector SPDR (XLF) bouncing sharply off its moving average...

READ MORE

MEMBERS ONLY

Rising Treasury Yields Portend Much Higher S&P 500, But Short-Term....

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, September 18, 2018

It was a solid day on Wall Street. One day after seeing weakness in key areas like technology, consumer discretionary and tranportation stocks and the increasing historical likelihood of further downside action, stocks rebounded....in a big way. Leading the charge were our...

READ MORE

MEMBERS ONLY

Will Rising Yields Boost the Finance Sector?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* 2-yr Treasury Yield Hits 10-yr High.

* The Mother of All Double Bottoms.

* Financials SPDR Extends Stall.

* Leaders and Laggards in Finance.

* Stocks to Watch: WMT, TRN and GILD.

...Big Moves in Treasury Yields

...Treasury yields moved sharply higher the last few weeks with the 2-yr T-Yield ($UST2Y) and the 5-yr...

READ MORE

MEMBERS ONLY

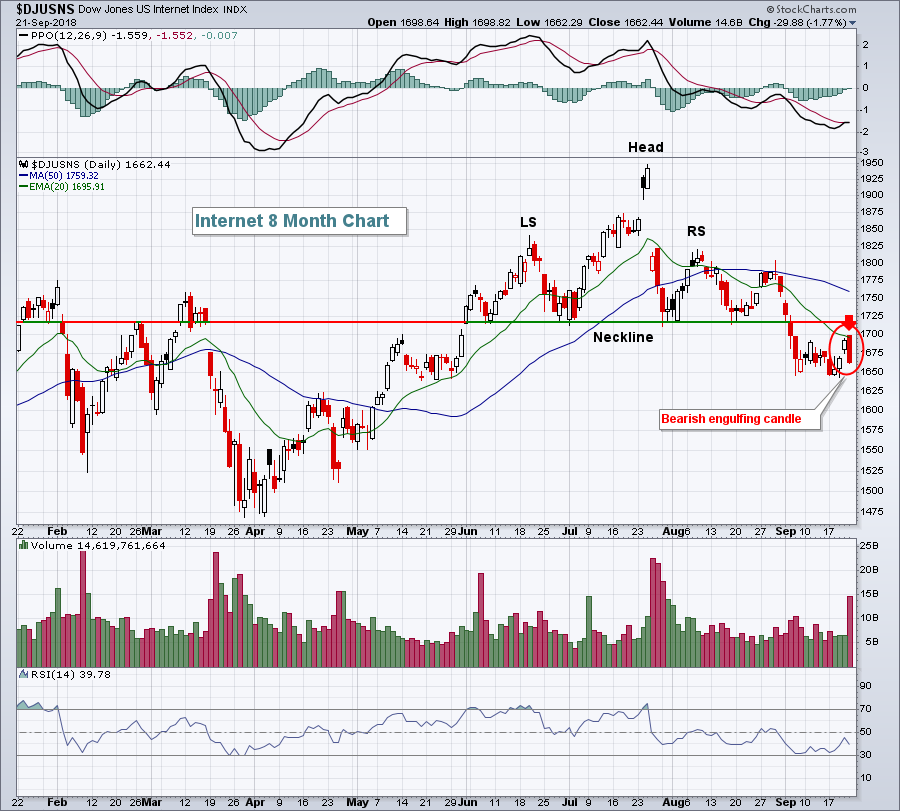

deFANG'd?

by Bruce Fraser,

Industry-leading "Wyckoffian"

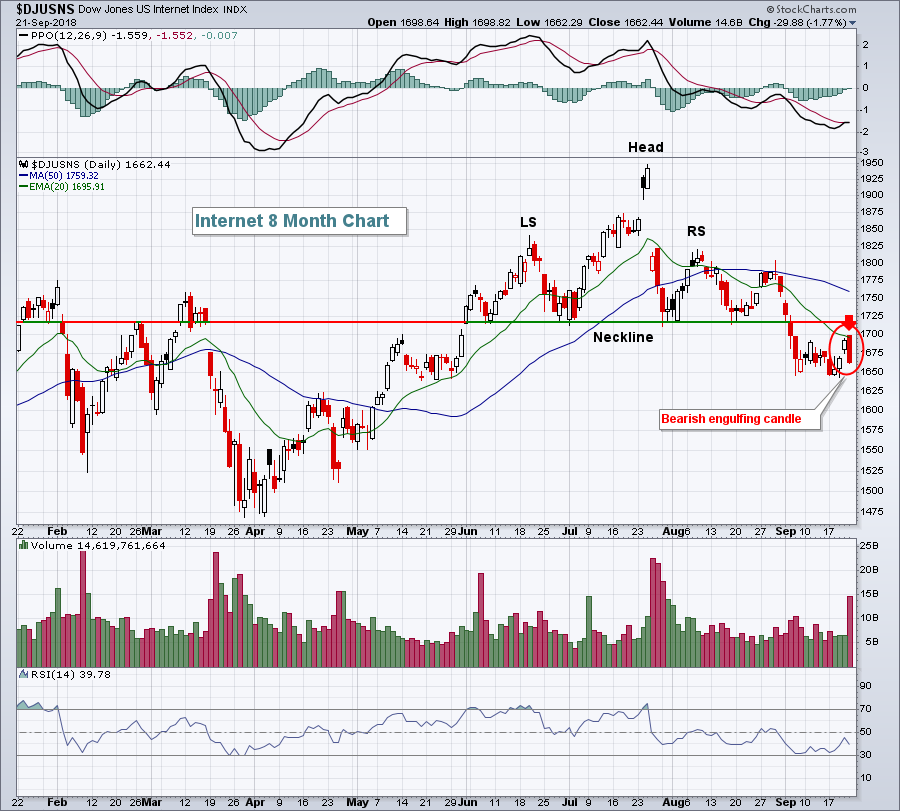

In June we studied the First Trust Dow Jones Internet Index Fund (FDN). This ETF is our proxy index for the FANG stocks. At that time FDN had accelerated into an overbought condition by throwing over its trend channel. Almost immediately weakness set in and FDN tumbled to the lower...

READ MORE

MEMBERS ONLY

Disney Hits Potential Reversal Zone

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Disney hit a new high in early August and pulled back into September. The stock is part of a strong sector, consumer discretionary, and this pullback reached a potential reversal area.

First and foremost, the long-term trend is up because the stock formed a higher low from October to April...

READ MORE

MEMBERS ONLY

20-Year Bonds ETF (TLT) is "Officially" in a Bear Market

by Erin Swenlin,

Vice President, DecisionPoint.com

I've been trumpeting the bearish horn on TLT for some time, but today marked a series of unfortunate events for TLT. Just last week we saw a new IT Trend Model Neutral signal and today, we got the LT Trend Model SELL signal. Add to that the execution...

READ MORE

MEMBERS ONLY

TEN-YEAR TREASURY YIELD EXCEEDS 3% -- 20-YEAR T-BOND ISHARES BREAK SUPPORT -- THE DOW NEARS ITS JANUARY HIGH -- BOEING AND CATERPILLAR CLEAR RESISTANCE -- QQQ HOLDS 50-DAY LINE -- SEMICONDUCTORS CONTINUE TO STABILIZE ABOVE 200-DAY AVERAGE

by John Murphy,

Chief Technical Analyst, StockCharts.com

TEN-YEAR TREASURY YIELD REACHES FOUR-MONTH HIGH ... Chart 1 shows the 10-Year Treasury Yield ($TNX) rising above its twin summer peaks near 3.00% and reaching the highest level in four months. That upside move breaks the TNX out of the three-month sideways pattern that it had been trading in; and...

READ MORE

MEMBERS ONLY

Technology Is Teetering; How Much More Selling Is Healthy?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

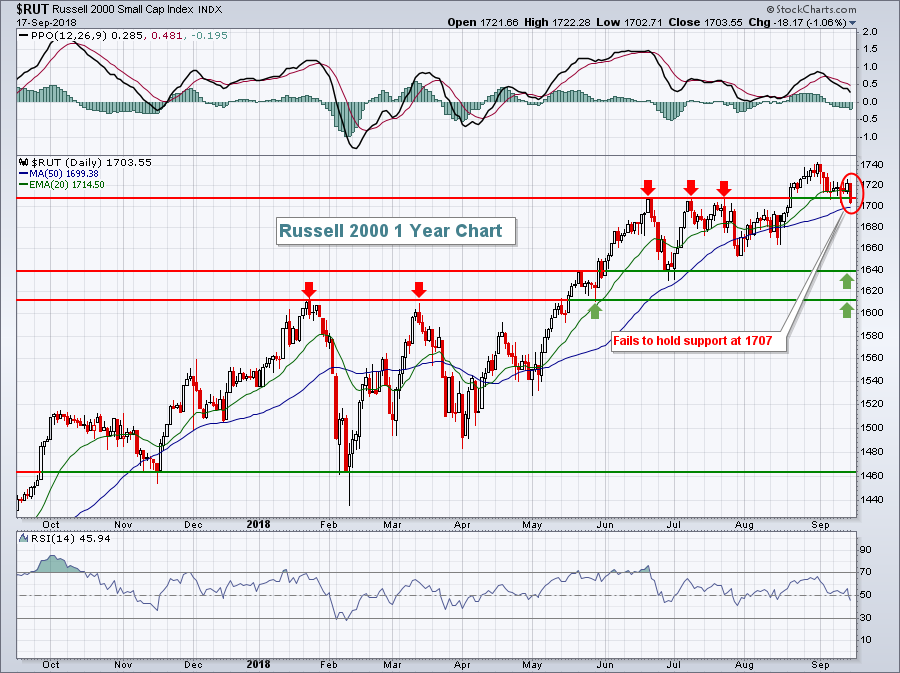

Market Recap for Monday, September 17, 2018

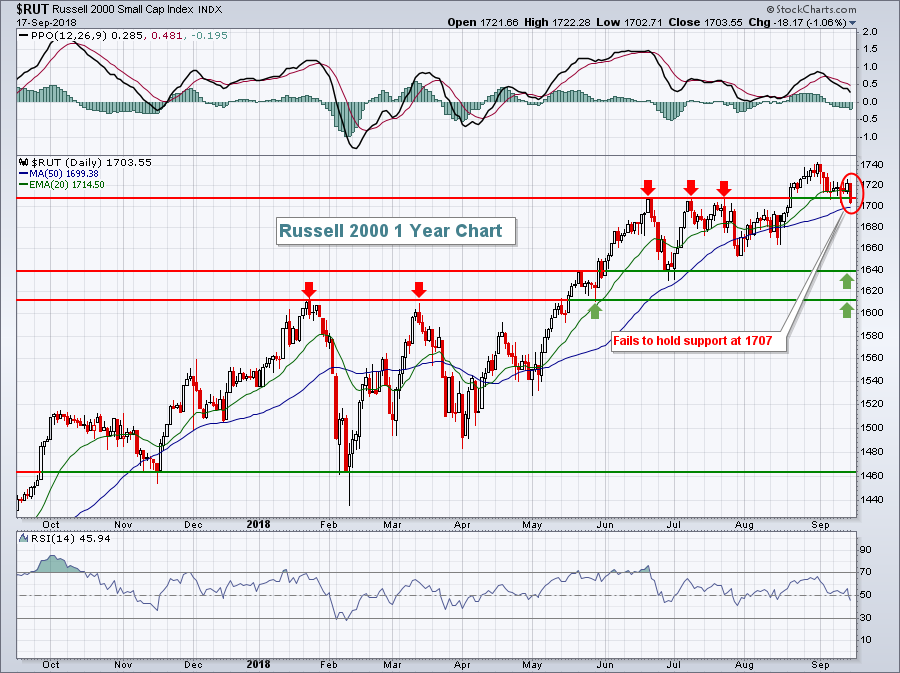

Selling in technology (XLK, -1.25%) and consumer discretionary (XLY, -1.24%) resulted in losses across our major indices on Monday. The NASDAQ, understandably, felt the brunt of the selling as this tech-laden index dropped 1.43%. The Russell 2000 ($RUT) suffered the...

READ MORE

MEMBERS ONLY

STOCKS LOSE SOME UPSIDE MOMENTUM --AMAZON AND MCDONALDS PULL CYCLICALS LOWER -- INDUSTRIALS CONTINUE TO RALLY -- LED BY FEDEX, HARRIS CORP, AND PACCAR -- TEN-YEAR YIELD TESTS 3% AGAIN

by John Murphy,

Chief Technical Analyst, StockCharts.com

SHORT-TERM SIGNS OF WEAKNESS ... The uptrend in U.S. stocks remains very much intact. However, upside momentum is weakening a bit. Chart 1, for example, shows the S&P 500 trading sideways over the past couple of weeks which is not unusual. The daily MACD lines (which are overlaid...

READ MORE

MEMBERS ONLY

Now We Head Into The Most Bearish Half Of September

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

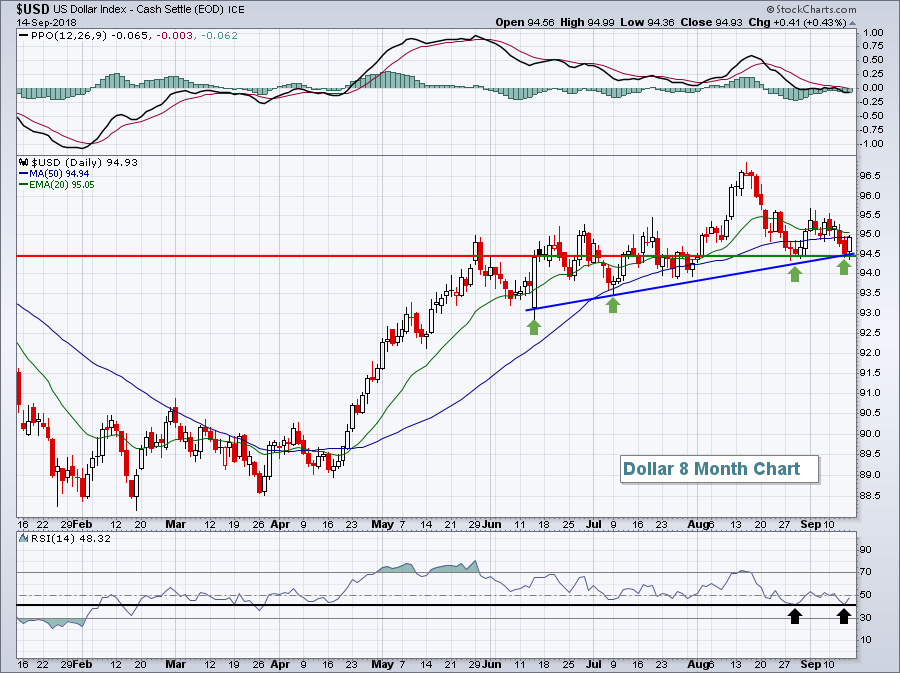

Market Recap for Friday, September 14, 2018

The NASDAQ struggled on Friday, while the Dow Jones and S&P 500 managed to finish with slight, fractional gains. The Russell 2000 was the clear outperformer, a bullish development as the U.S. Dollar Index ($USD) bounced off its recent price...

READ MORE

MEMBERS ONLY

Procter & Gamble Attempts to Turn

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Consumer Staples SPDR (XLP) has been leading the market since early May and Procter & Gamble is the largest stock in the sector (12.58%). On the price chart, PG is in the midst of a long-term trend change and the short-term trend is also turning up.

First and...

READ MORE

MEMBERS ONLY

Three Great Stocks And An Offer To Download My Strong Earnings ChartList

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Offer

If you would like a copy of my Strong Earnings ChartList, simply follow these steps and I'll send it to you:

1. You MUST be a paid Extra or Pro member of StockCharts.com as that's the only way you can download my ChartList....

READ MORE

MEMBERS ONLY

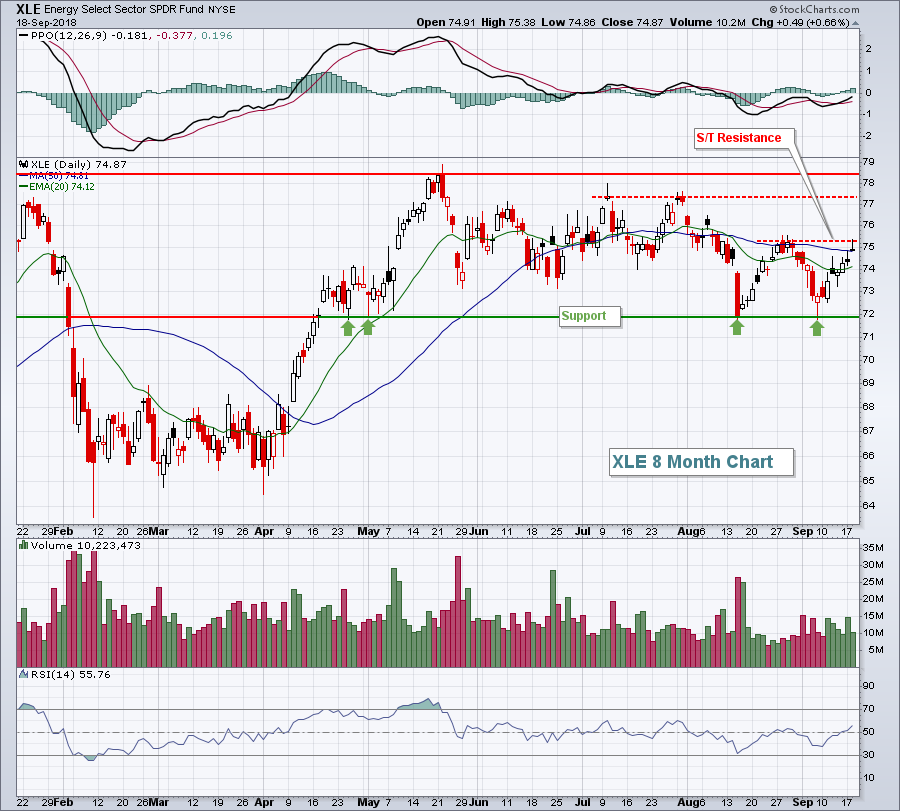

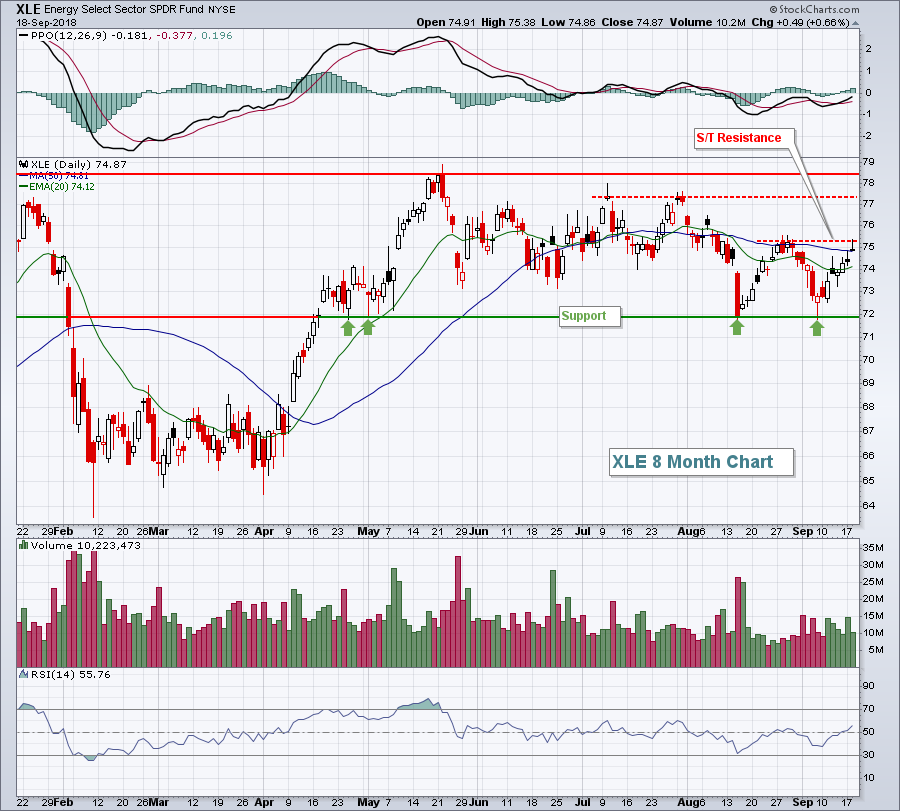

XLE Gains PMO BUY Signal - Still Too Many Negatives in Intermediate Term

by Erin Swenlin,

Vice President, DecisionPoint.com

If you look at our DecisionPoint Sector Scoreboard below you'll see that the Energy is the only sector carrying an Intermediate-Term Trend Model Neutral signal. All other sectors have BUY signals in both the intermediate term and long term. While Energy did log a new Price Momentum Oscillator...

READ MORE

MEMBERS ONLY

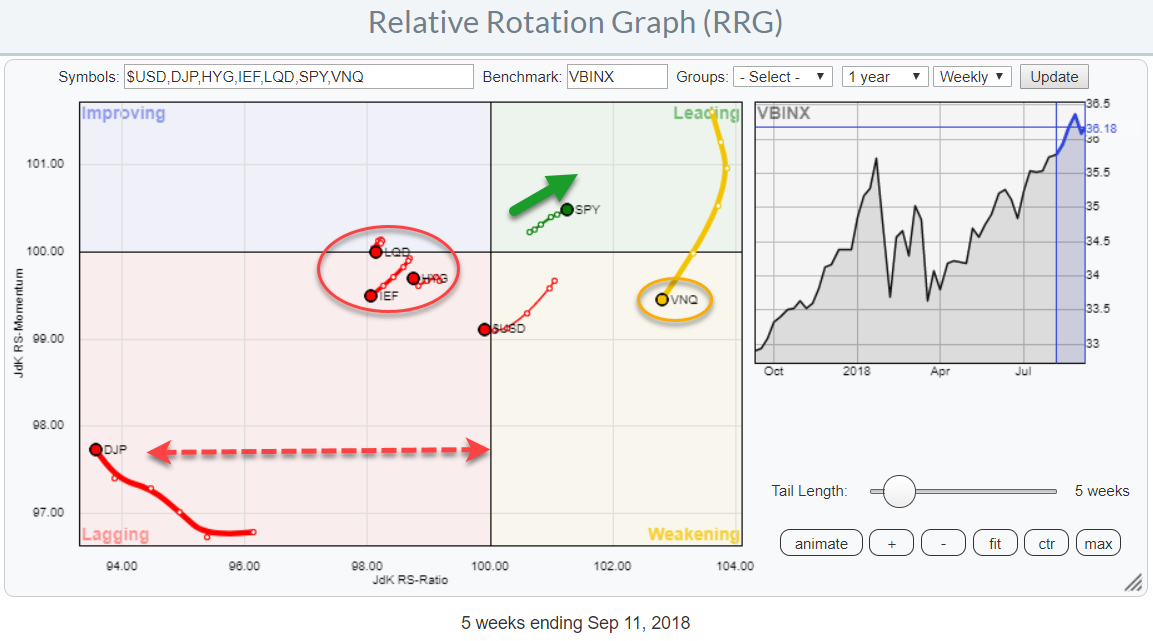

Equities (SPY) is the only asset class inside the leading quadrant AND it is at a positive RRG Heading

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

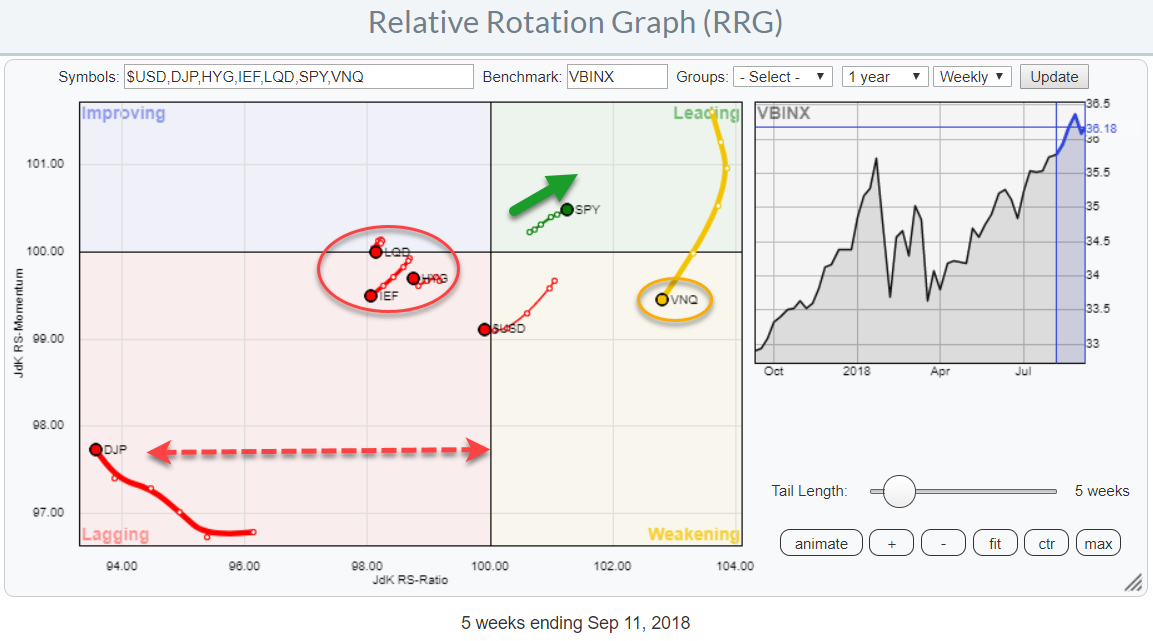

The Relative Rotation Graph shows the relative positions of various asset classes (ETFs) against VBINX, a Vanguard balanced index fund, as the benchmark.

The long tails for Real Estate and Commodities stand out, as well as the cluster of fixed income related asset classes inside the red oval.

The strongest...

READ MORE

MEMBERS ONLY

The Single Best Thing a Stock Can Do

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There are lots of indicators out there, but one metric stands head and shoulders above the rest. No, it is not a head-and-shoulders pattern. There are hundreds, if not zillions, of ways to measure the trend and identify trend reversals. Over the years, I have found trend reversals to be...

READ MORE

MEMBERS ONLY

Traders Still Attracted to Strong Earnings

by John Hopkins,

President and Co-founder, EarningsBeats.com

The bulls have remained in charge for a long time now in large part due to continuing, strong earnings. Even with the constant daily noise surrounding the market it almost always comes down to the bottom line. Thus when traders are looking for high reward to risk trades it makes...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: Gap Cleared. What's Next?

by Carl Swenlin,

President and Founder, DecisionPoint.com

Last week I was concerned that the VIX had topped but had failed reach the top band on the chart -- a similar configuration occurred in January before the crash. This week the VIX moved close to the top of the channel, so I think we can consider that the...

READ MORE

MEMBERS ONLY

Weekly Market Review and Outlook - Large-caps Take the Lead

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Market Overview - New Highs Are?

* Breadth Remains Strong Enough.

* Large-caps Lead New High List.

* SPX Turns Up after Mild Pullback.

* Small-caps Lag on Upturn.

* QQQ Bounces from Oversold Level.

* XLY and XLV hit new highs as XLK turns Up.

* XLI Continues to Lead as XLF Lags.

* Bond Correlations Break...

READ MORE

MEMBERS ONLY

"Believable" Misinformation Is a Danger to Long-Term Retirement Goals

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Many investment "truths" seem to go unchallenged but are in fact, very clearly just myths. Buy and hold investing is a good long-term strategy, economists are good at predicting the markets, diversification will protect you from losses, compounding is the eighth wonder of the world, missing the best...

READ MORE

MEMBERS ONLY

Biotechs, Computer Hardware, And Semiconductors Among Leaders On Thursday

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, September 13, 2018

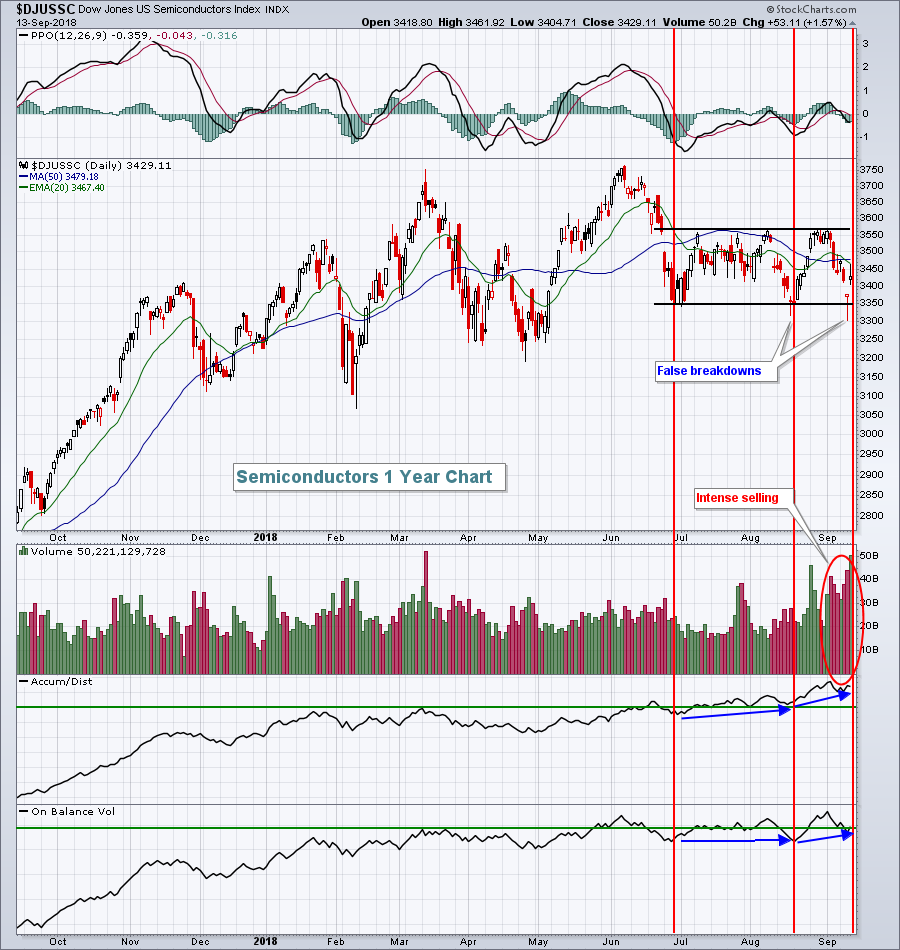

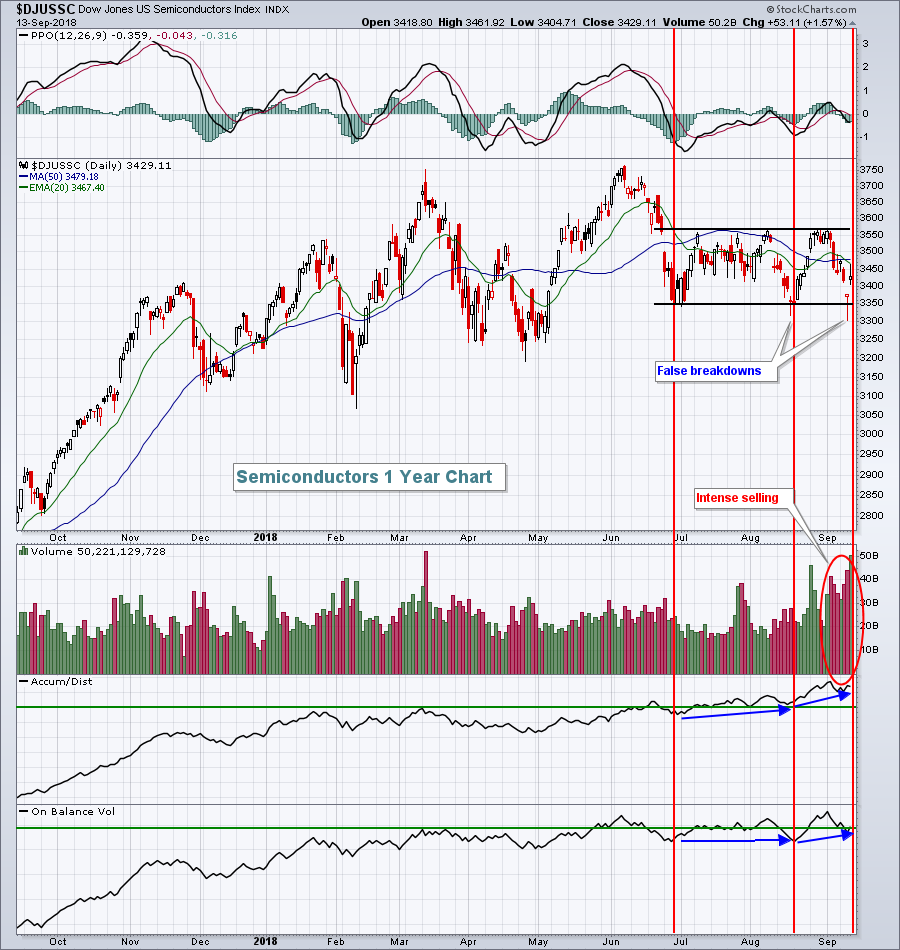

Thursday was a strong day for U.S. equities aside from lackluster performance from small caps (Russell 2000). The NASDAQ led the rally, gaining 0.75% as a rebound in biotechs ($DJUSBT) and semiconductors ($DJUSSC) provided some confidence for traders in those two...

READ MORE

MEMBERS ONLY

DP Alert: Swenlin Trading Oscillators Are Perking Up - TLT IT Trend Model Neutral Signal

by Erin Swenlin,

Vice President, DecisionPoint.com

No changes to the DecisionPoint Scoreboards since the past week's PMO SELL signals were added. We've seen a slight rebound in the market the past few days and consequently, our short-term indicators are beginning to turn up from somewhat oversold territory. Unfortunately, intermediate-term indicators are still...

READ MORE

MEMBERS ONLY

Is It A Bubble When ...

by Martin Pring,

President, Pring Research

* A few thoughts on bubbles

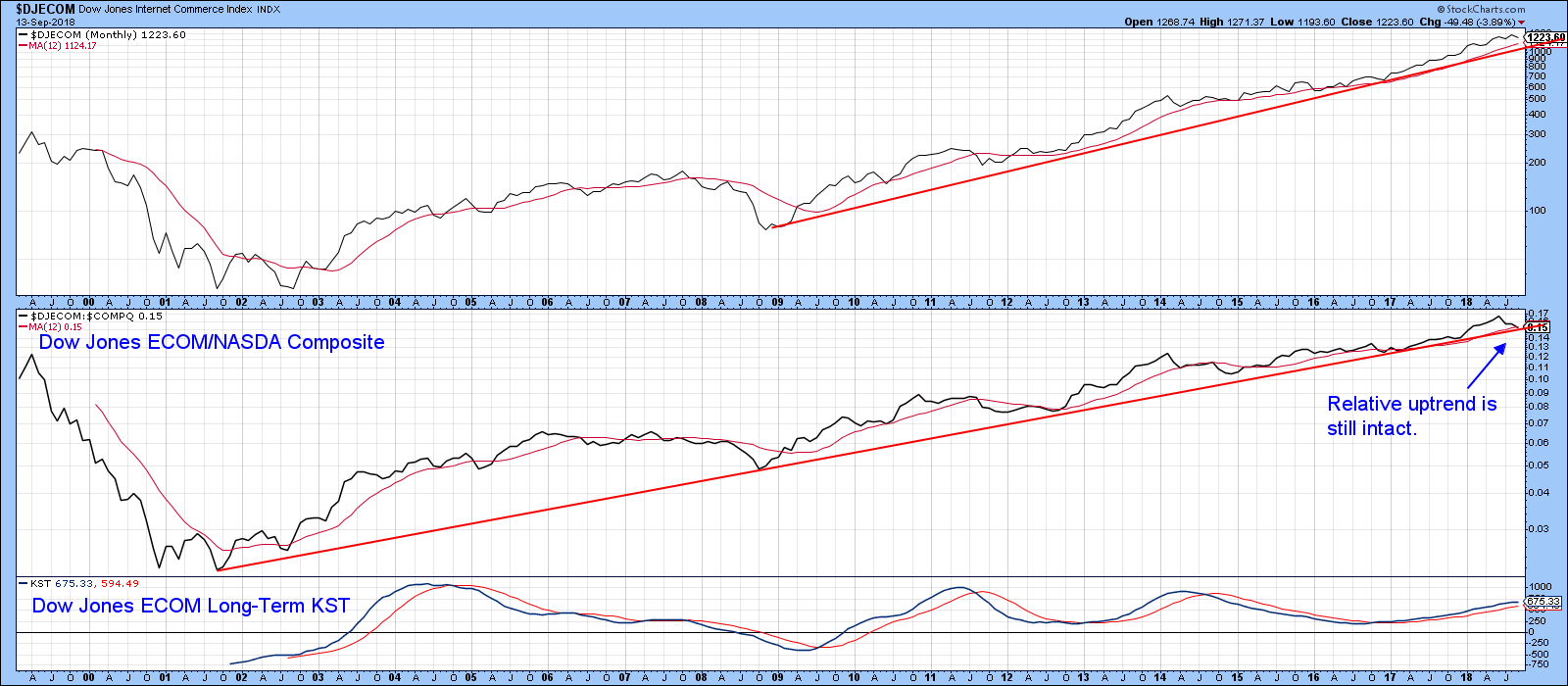

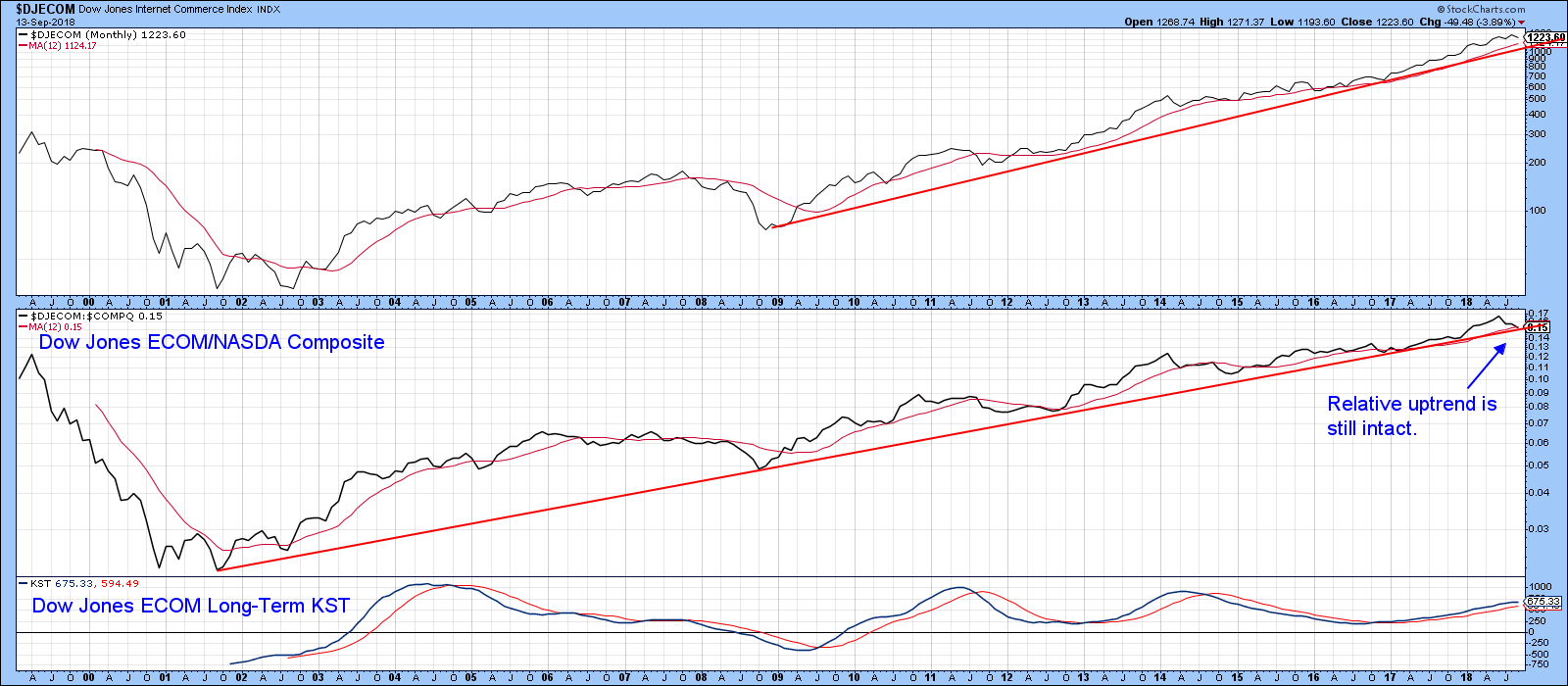

* Technical comments on the Dow Jones Internet Commerce Index

* China on the brink

A few thoughts on bubbles

Last week, I pointed out that most of the FAANG stocks remained in uptrends, with the possible exception of Netflix and the confirmed bear market in Facebook....

READ MORE