MEMBERS ONLY

Brokers Weigh on Finance Sector, Staples Stay Strong and 4 Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* XLF Stalls at Resistance.

* IAI Breaks Triangle Line (plus key stocks).

* Regional Bank SPDR Falters.

* XLP goes from Laggard to Leader (plus key stocks).

* Checkpoint, Biomarin, Cerner and Walgreens.

* Interview with Financial Sense.

XLF Stalls at Resistance

The Financials SPDR (XLF) led the market higher from late June to early...

READ MORE

MEMBERS ONLY

Equities (SPY) is the only asset class at positive RRG Heading

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

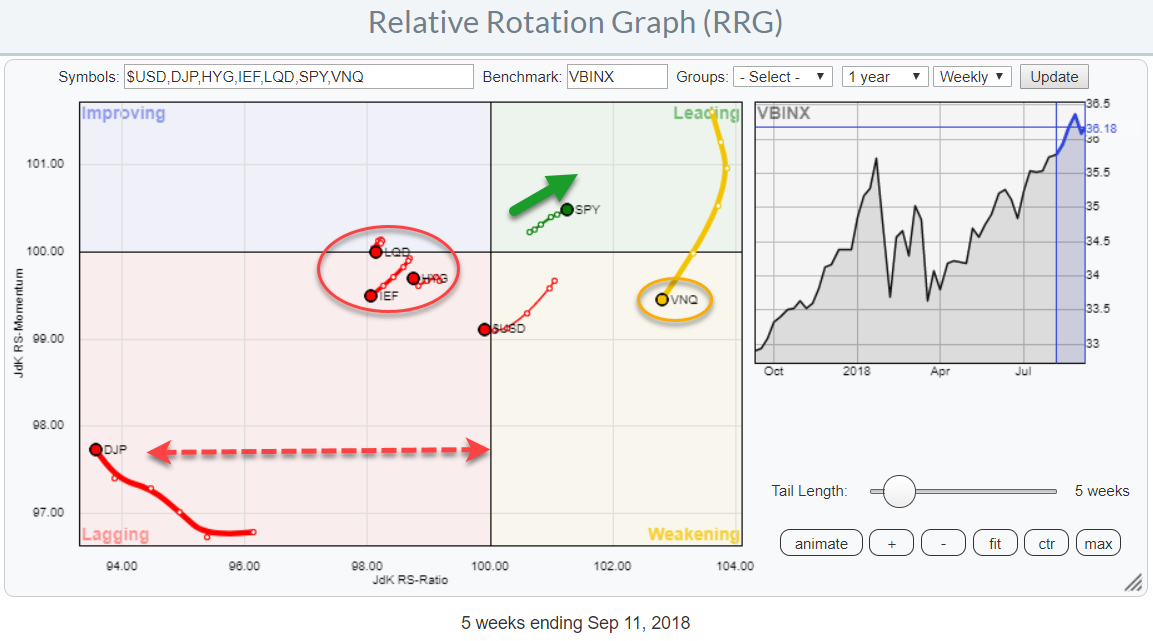

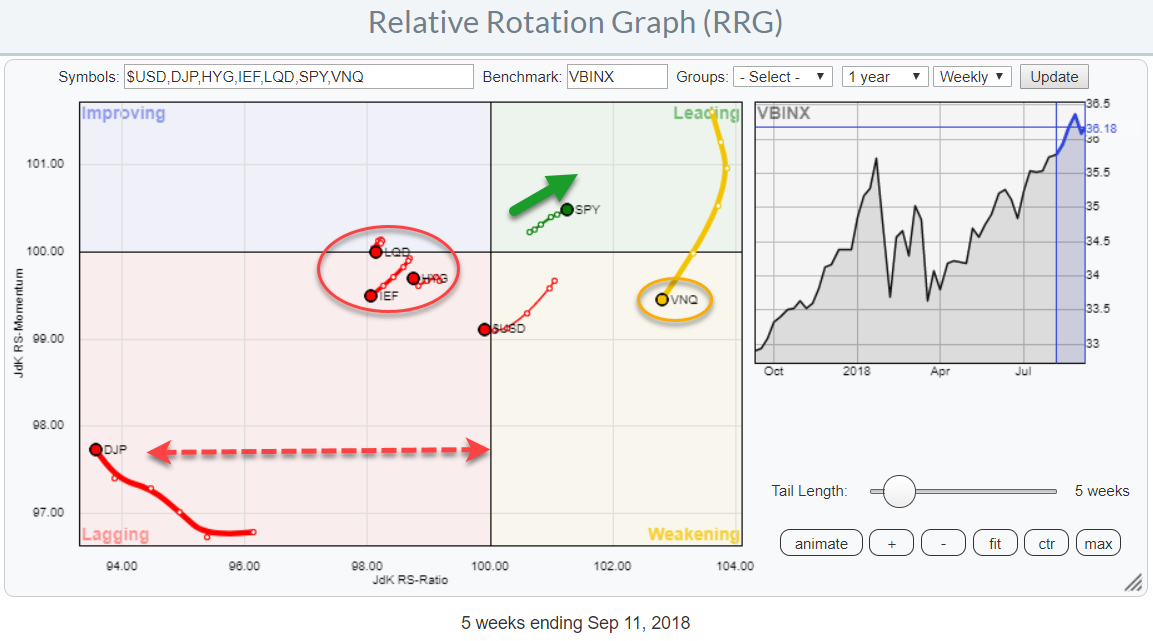

The Relative Rotation Graph shows the relative positions of various asset classes (ETFs) against VBINX, a Vanguard balanced index fund, as the benchmark.

The long tails for Real Estate and Commodities stand out, as well as the cluster of fixed income related asset classes inside the red oval.

The strongest...

READ MORE

MEMBERS ONLY

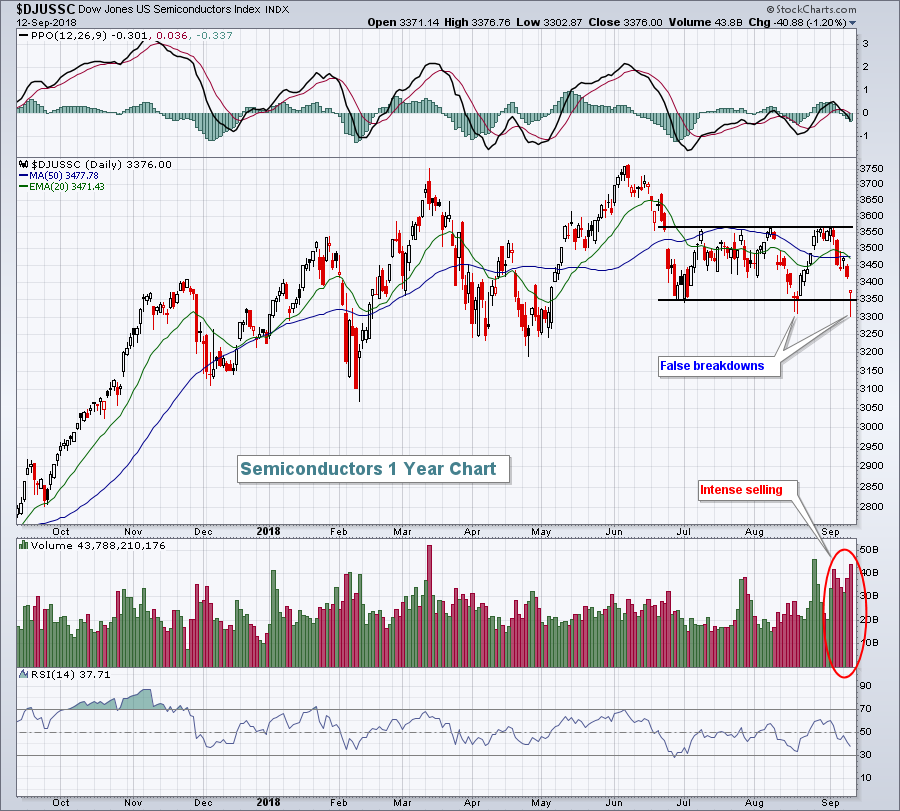

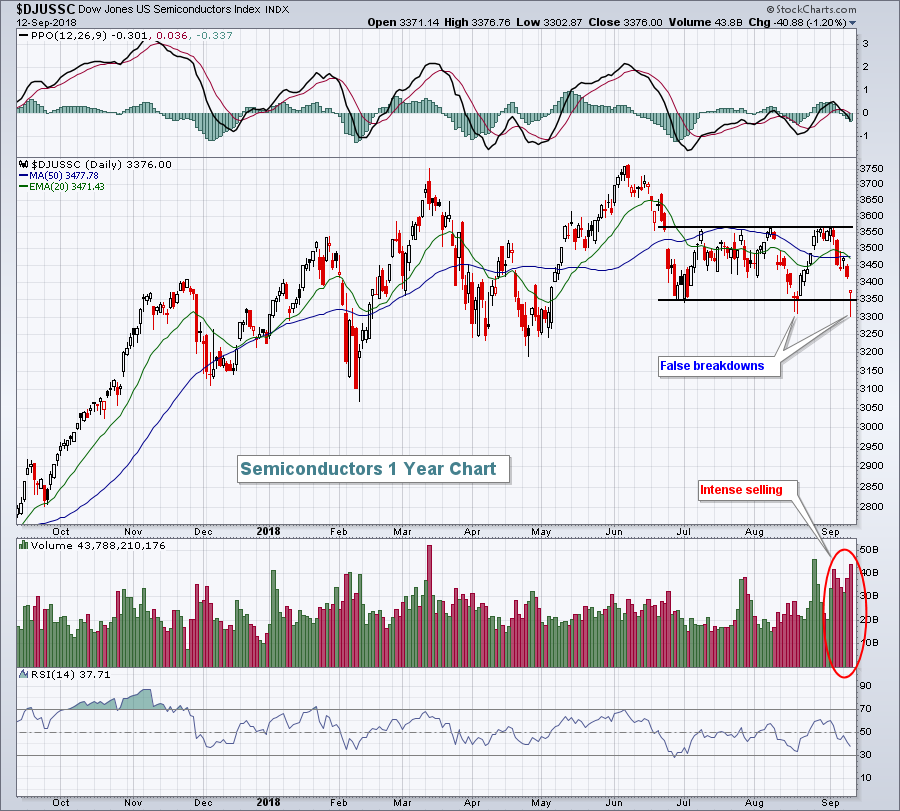

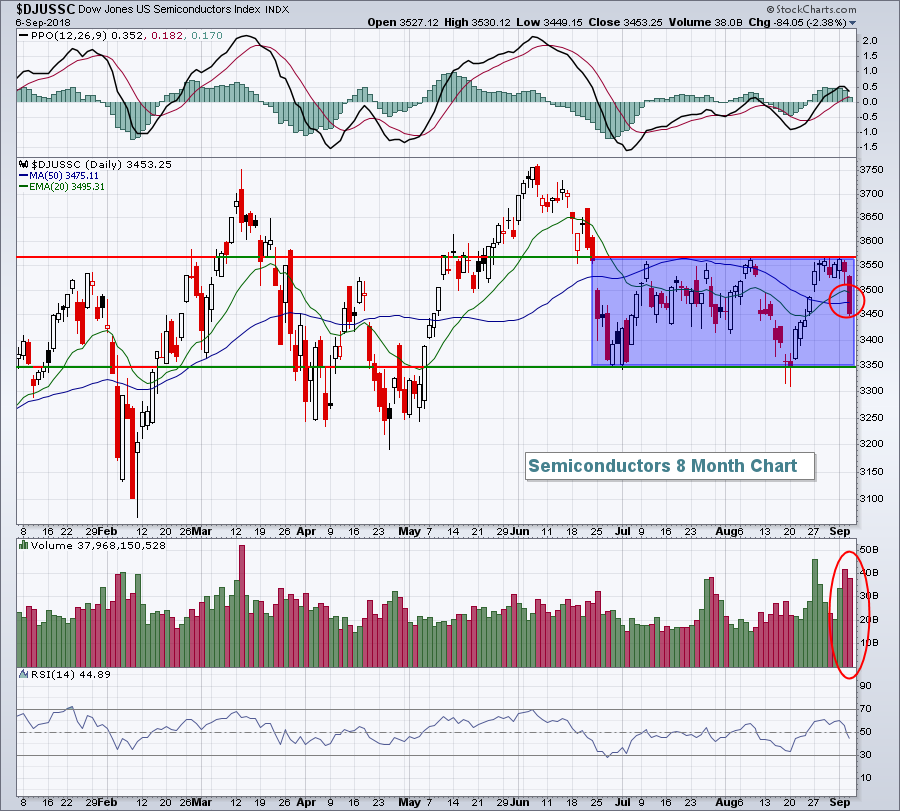

Would The Real Semiconductor Group Please Stand Up?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, September 12, 2018

It was a day of bifurcation as it's difficult to sustain a rally when your two worst sectors are financials (XLF, -0.92%) and technology (XLK, -0.42%). As you might expect, relative weakness was found on the NASDAQ and Russell...

READ MORE

MEMBERS ONLY

Henry Schein Starts to Shine

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Outside of company specifics, the broad market environment and the sector are the biggest influences of a stock's price. The S&P 500 hit a new high recently so we are in a bull market. The Health Care SPDR (XLV) also hit a new high recently and...

READ MORE

MEMBERS ONLY

The Little Engine that Could - A Mild Pullback - Risk Appetite and Six Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Large-Techs and Small-Caps Still Leading.

* QQQ Bounces as IJR Flags.

* Junk Bonds and International Indexes.

* Charts Worth Watching.

* On Trend on Youtube.

....QQQ and IJR Still Leading Year-to-Date...

...The major index ETFs are in long-term uptrends and short-term downtrends. There is no denying the long-term trend because we saw fresh...

READ MORE

MEMBERS ONLY

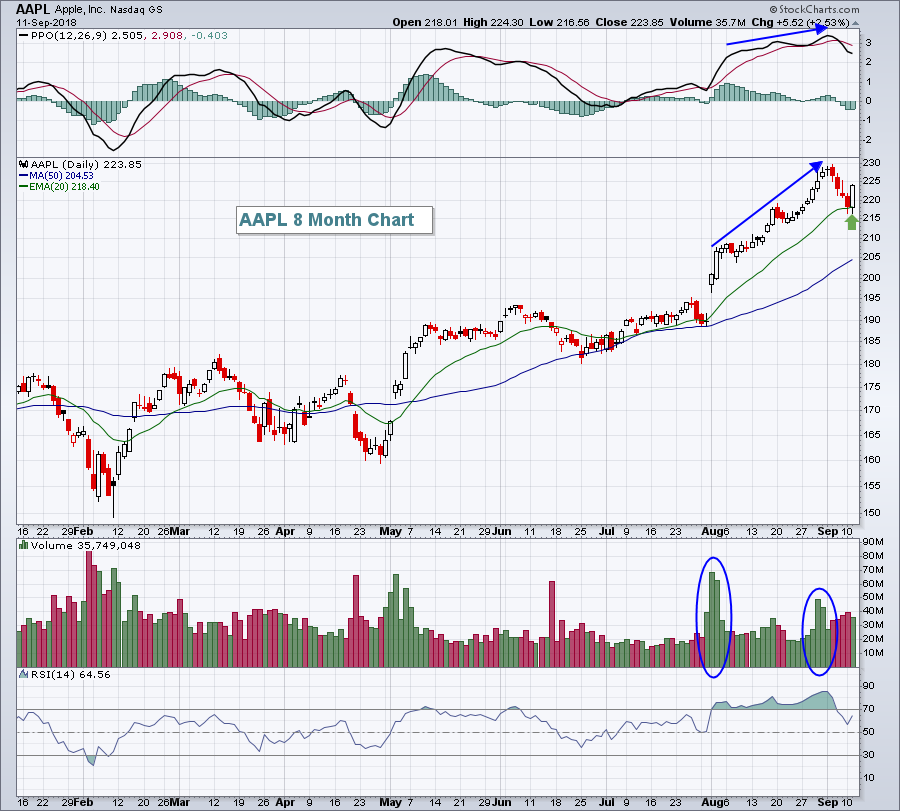

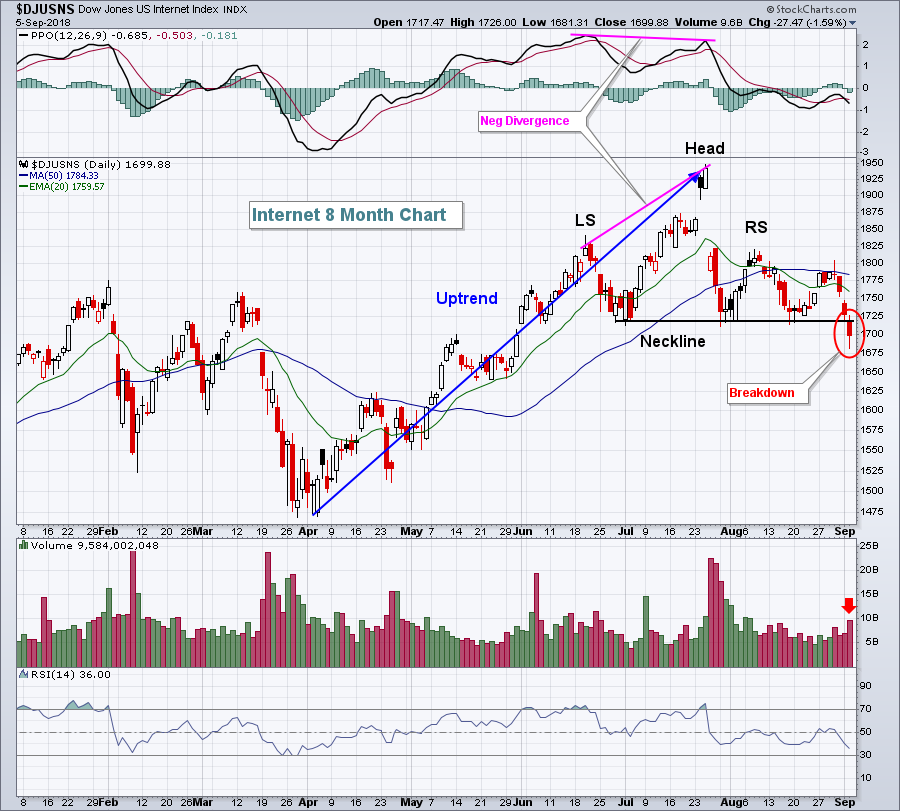

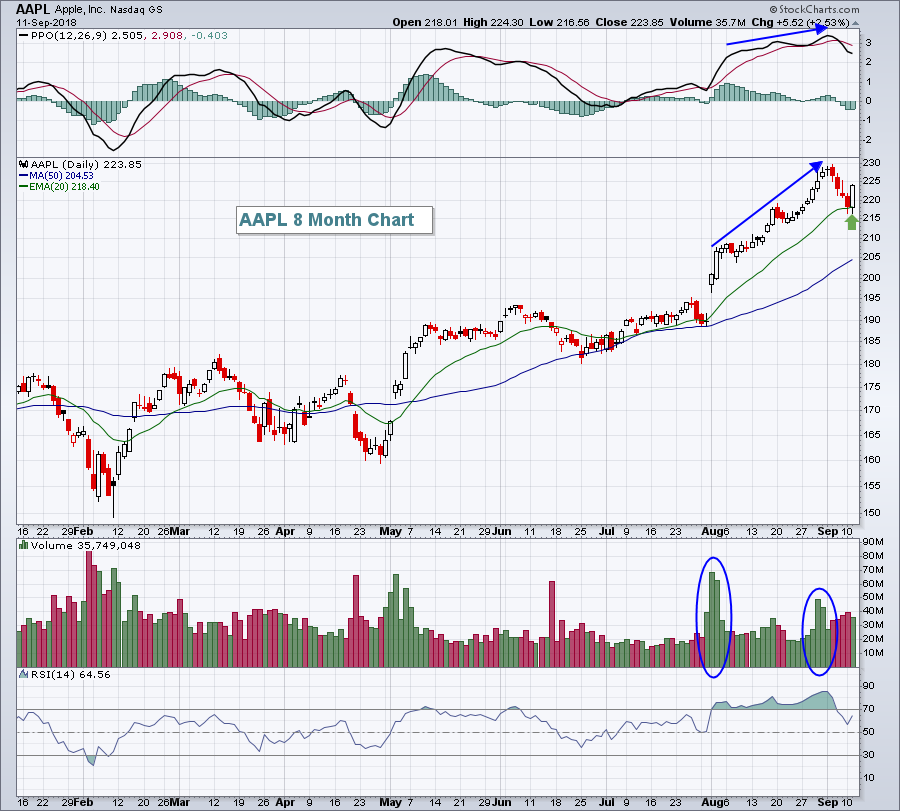

AAPL And AMZN Rebound, But Will Facebook Deliver Another Internet Blow?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, September 11, 2018

All of our major indices finished the day higher, although there was little back and forth action. The Dow Jones traded in a 50 point range most of the afternoon. Still, higher is higher. Strength on Tuesday came from three sectors - energy...

READ MORE

MEMBERS ONLY

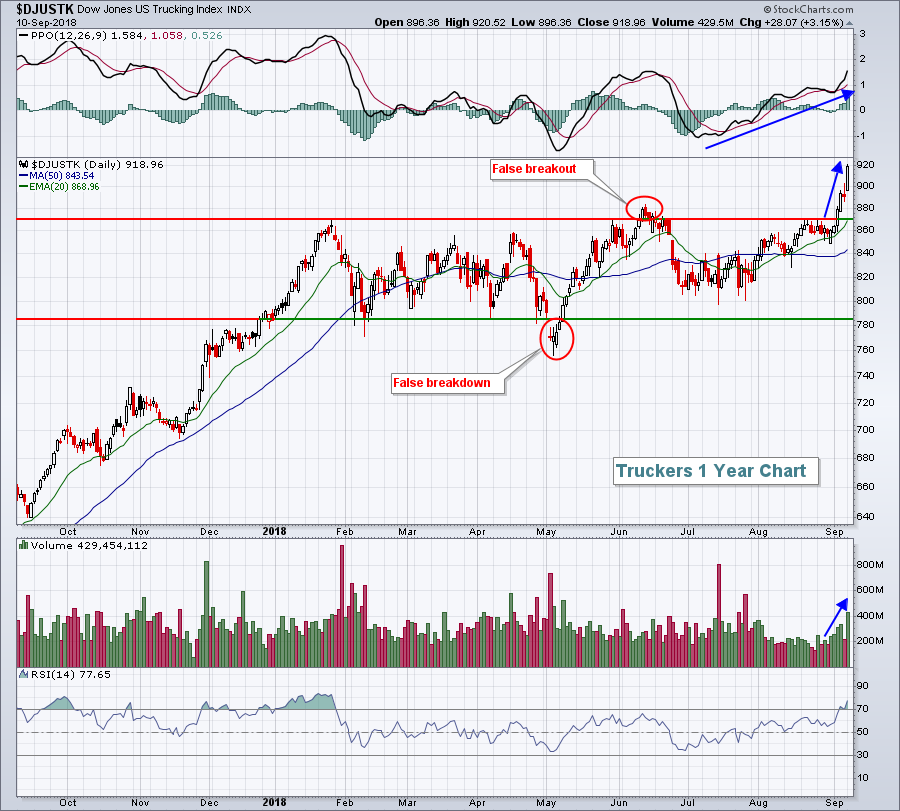

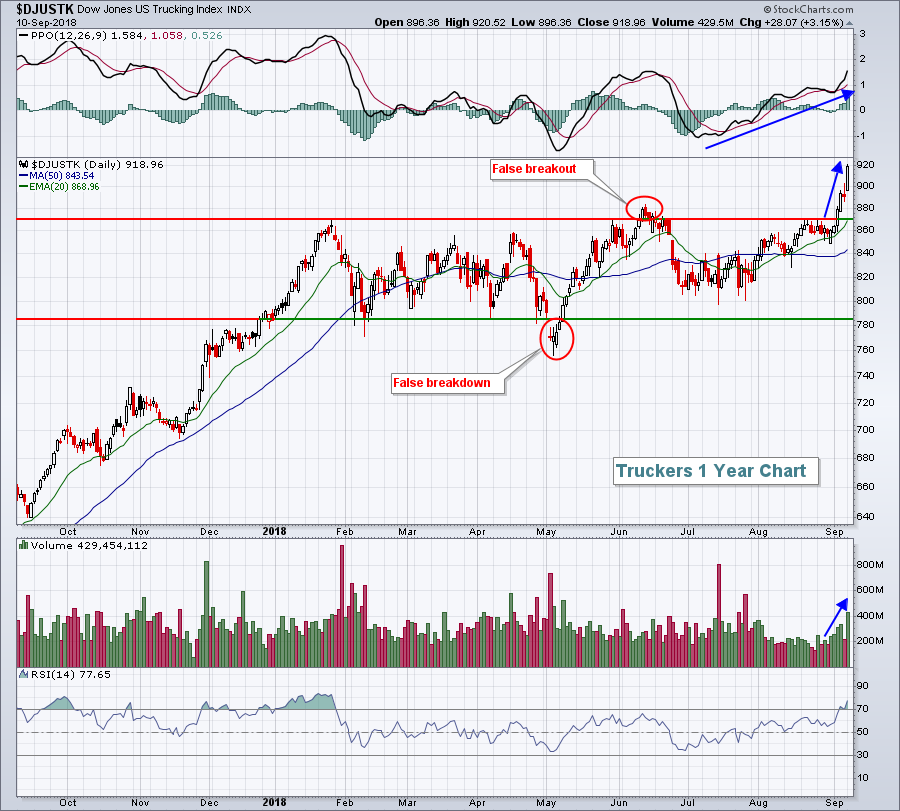

Industrials Hit 6 Month High To Lead; Get A Copy Of My Strong Earnings ChartList

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Offer

If you would like a copy of my Strong Earnings ChartList, simply follow these steps and I'll send it to you:

1. You MUST be a paid Extra or Pro member of StockCharts.com as that's the only way you can download my ChartList....

READ MORE

MEMBERS ONLY

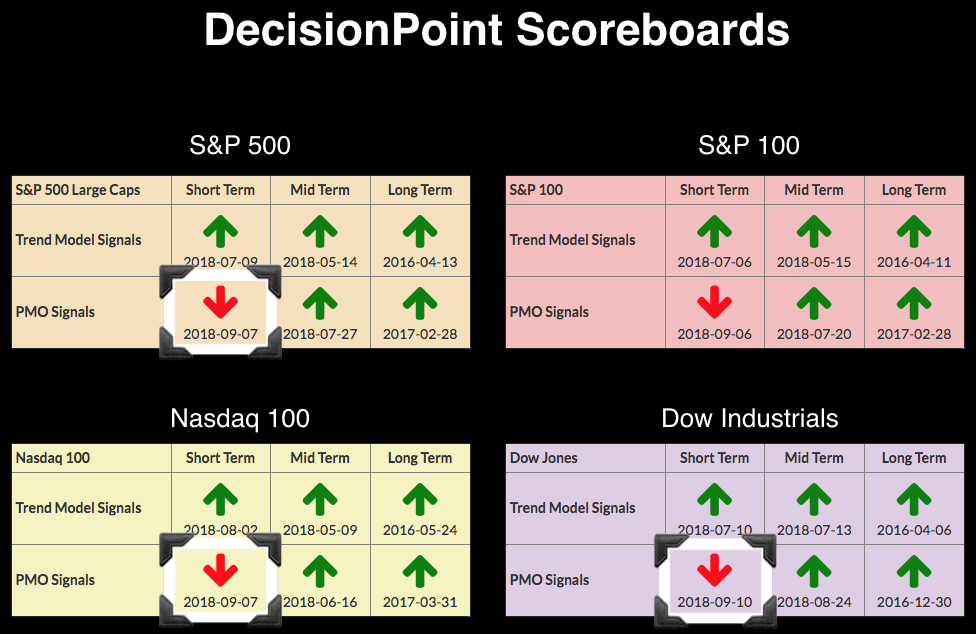

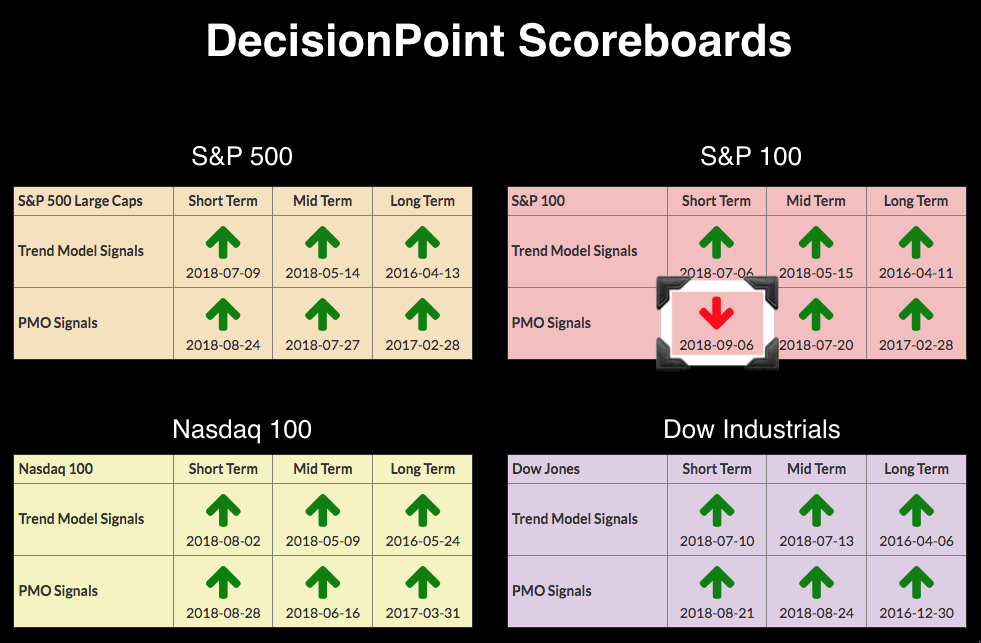

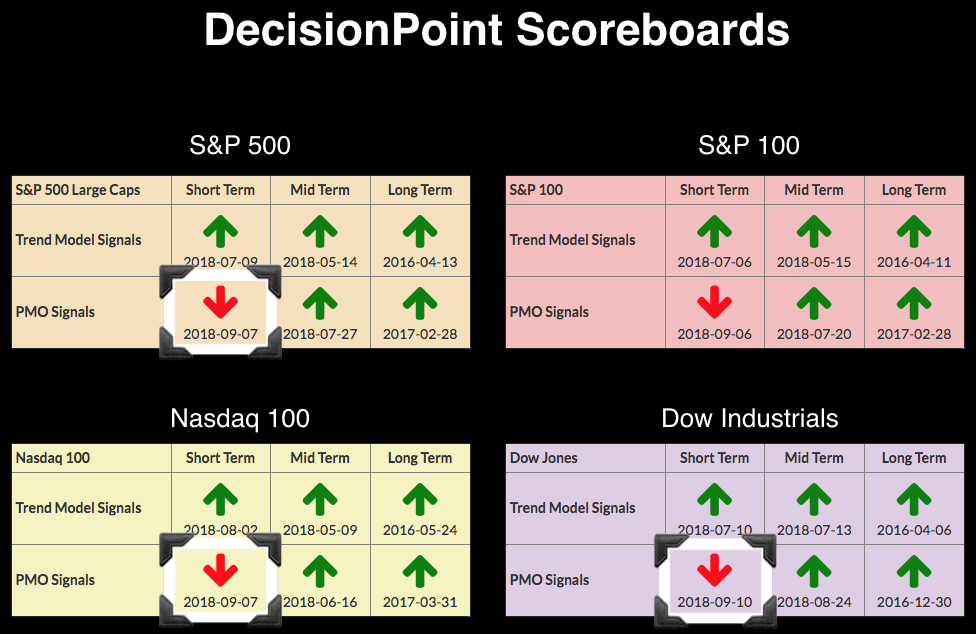

DP Bulletin #1: Momentum Moves Bearish on Scoreboard Indexes - SELL Signals Reinstated

by Erin Swenlin,

Vice President, DecisionPoint.com

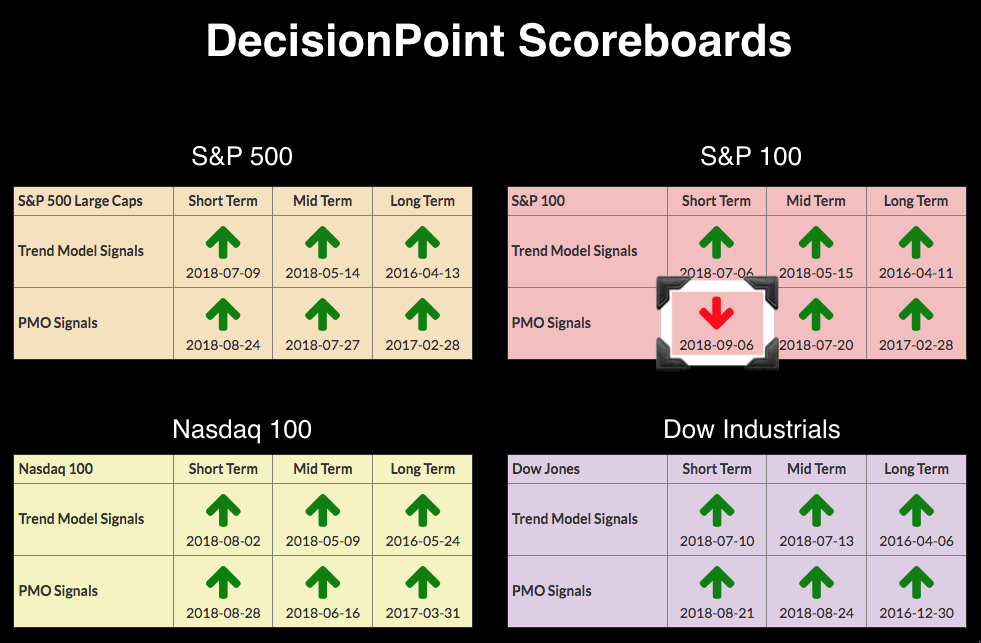

As of today's market close, all four Scoreboards have moved back to PMO SELL signals. The OEX was the first to go on Thursday, followed by the SPX and NDX on Friday and the Dow today.

Below are the daily charts for all four indexes with the new...

READ MORE

MEMBERS ONLY

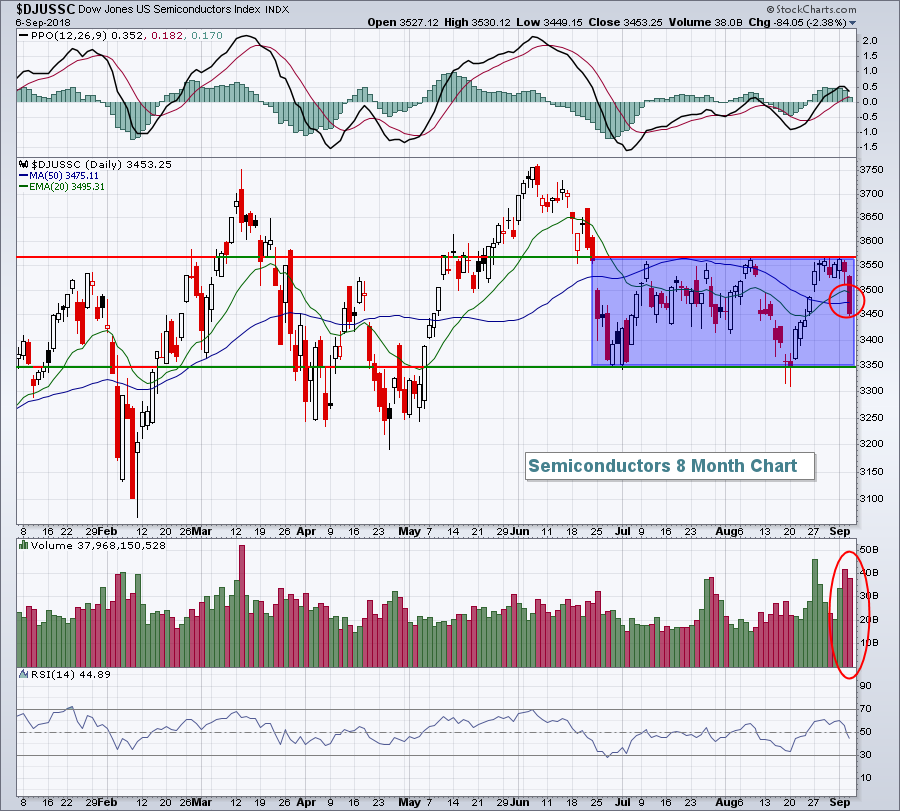

Semi-Tough

by Bruce Fraser,

Industry-leading "Wyckoffian"

Back in December of 2017 we asked ‘Do Semiconductors Still Compute?’. An epic rally that began in 2016 had Climactic qualities as SMH accelerated into year-end 2017. Two different PnF counts were fulfilled on that rally surge. After a sharp break on high volume it appeared the rally had run...

READ MORE

MEMBERS ONLY

Healthcare Stocks Appear Stretched; Top Monday Trade Setup Candidates

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

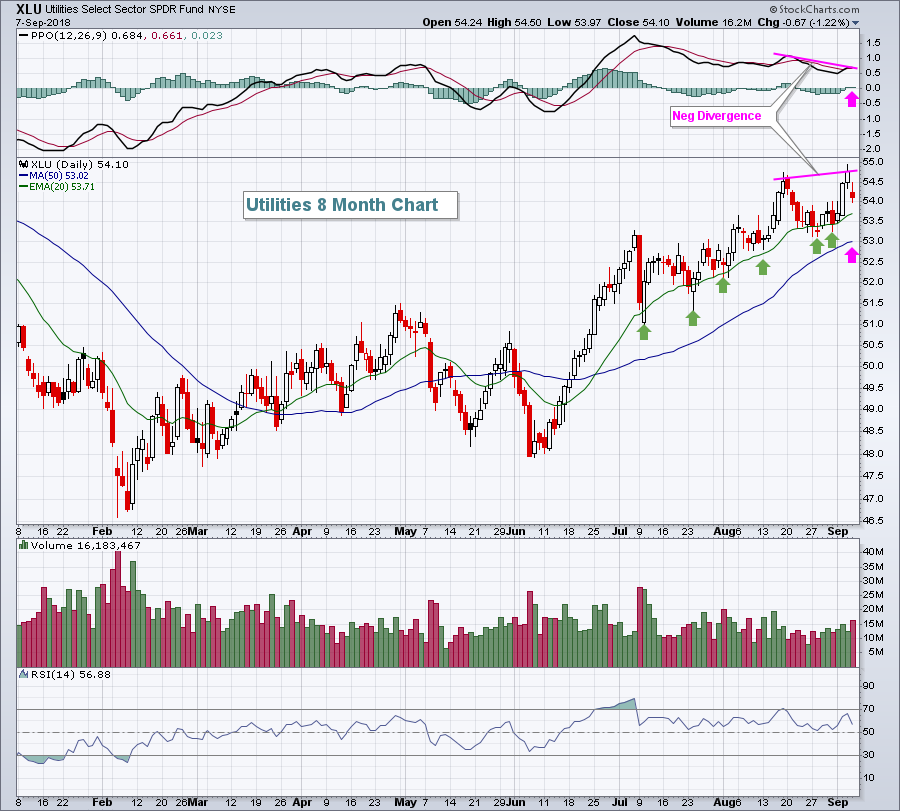

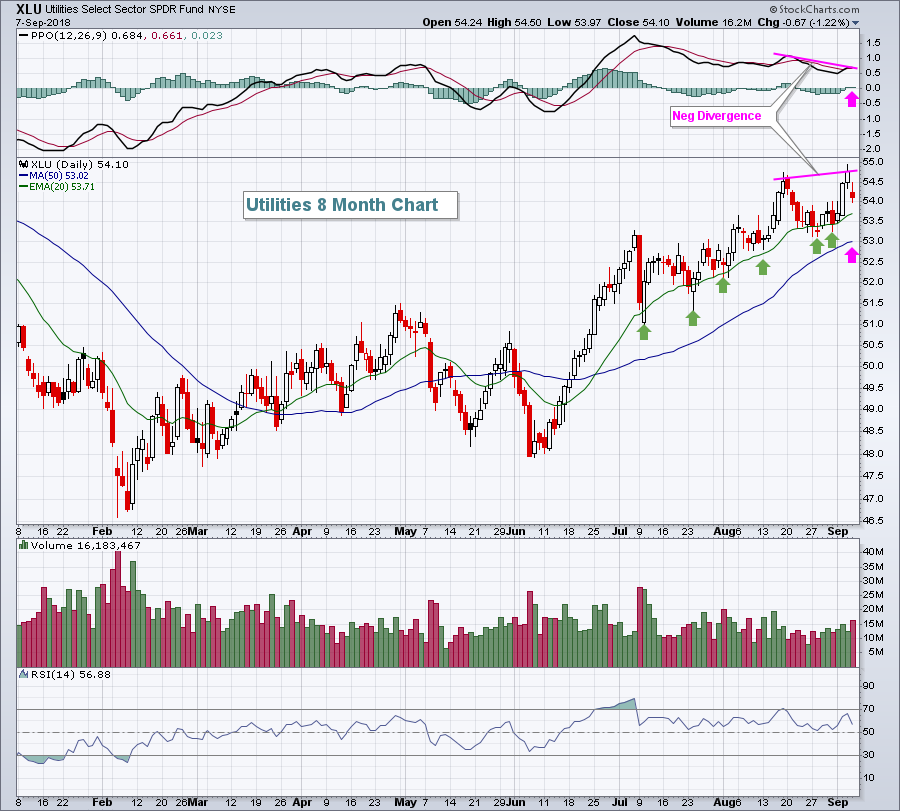

Market Recap for Friday, September 7, 2018

U.S. stock indices and most sectors were flat to slightly lower to close out last week. The small cap Russell 2000 was down just 0.08%, while the Dow Jones was the biggest loser, dropping 0.30%. Among sectors, utilities (XLU, -1....

READ MORE

MEMBERS ONLY

Facebook Does An About Face, But What About The Other FAANG Stocks?

by Martin Pring,

President, Pring Research

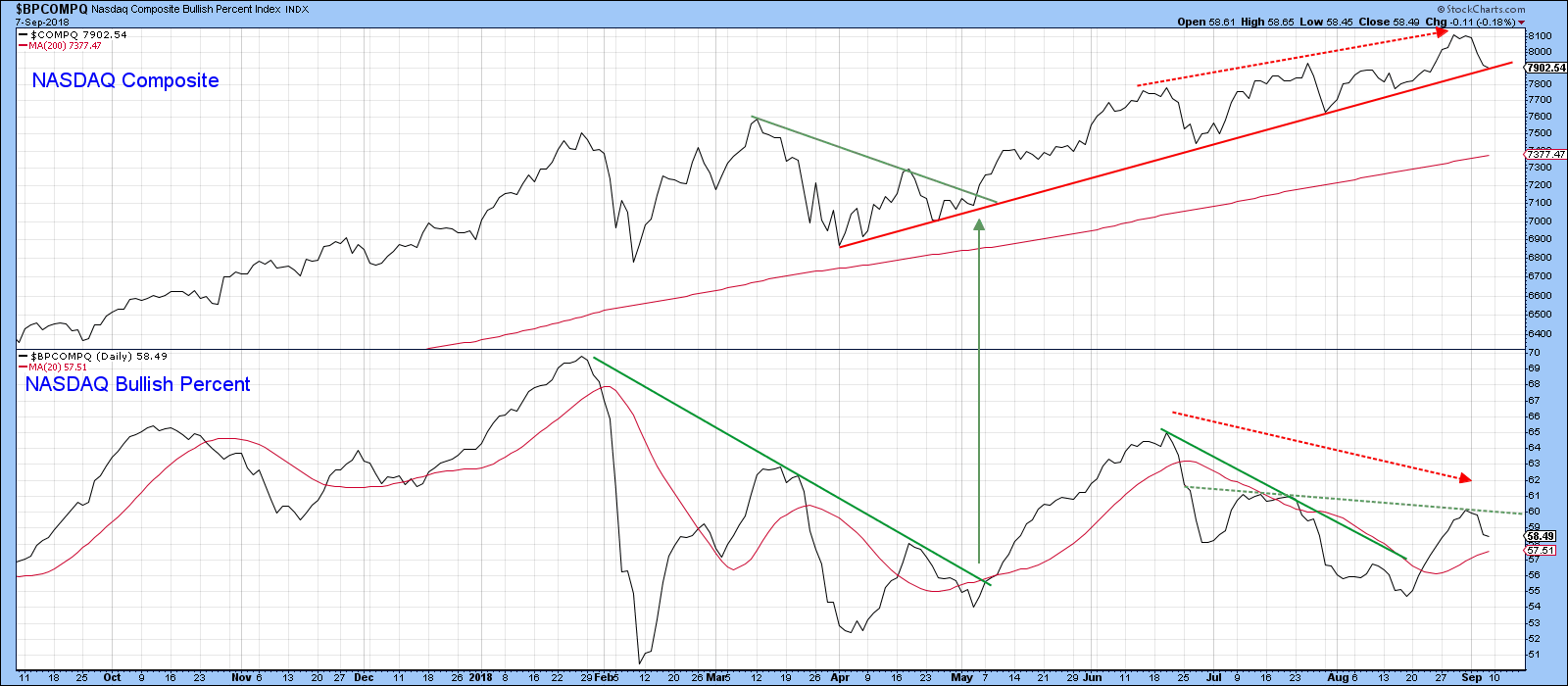

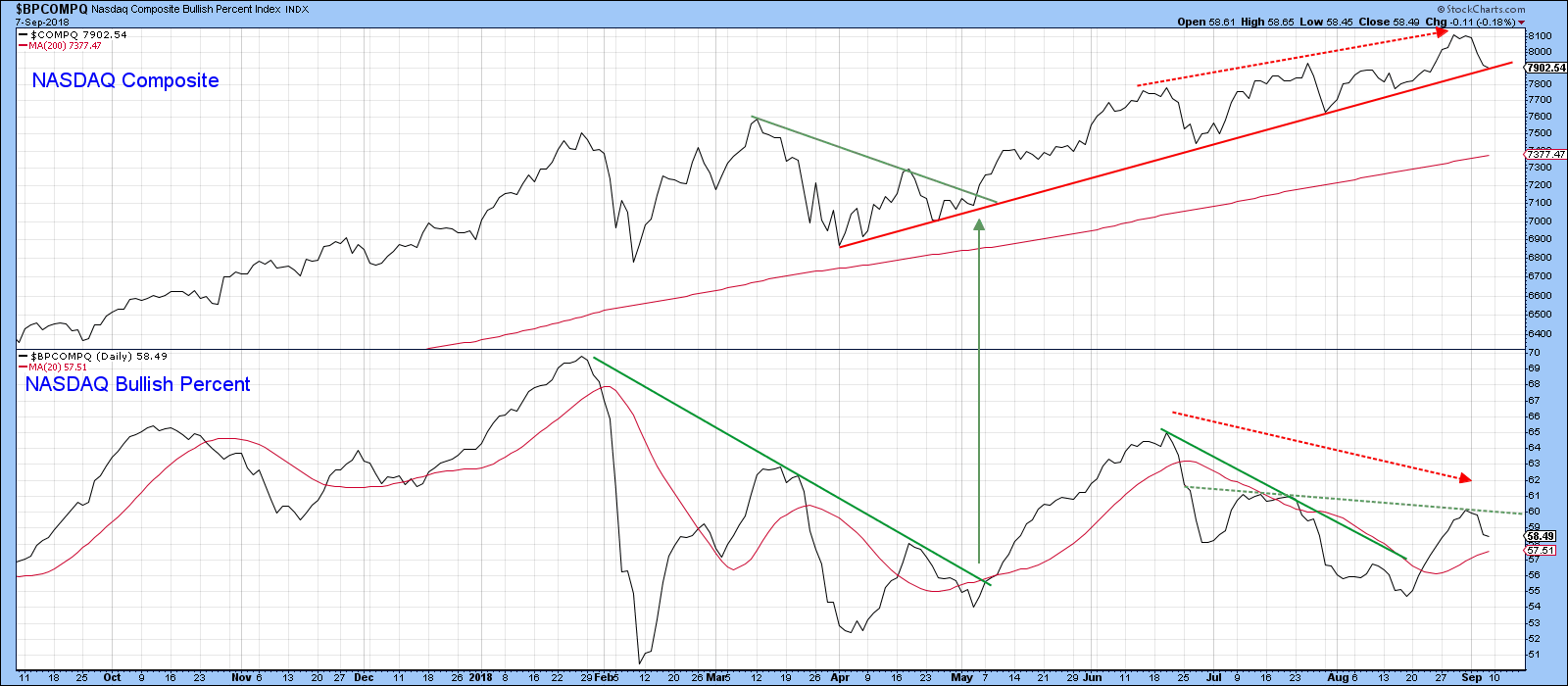

* NASDAQ breadth data offers conflicting signals

* Bullish FAANG Stocks

* De-fanged stock

NASDAQ breadth data offering conflicting signals

We have seen some attention paid to tech stocks as they have corrected in the last week or so. The so called FAANG (Facebook, Apple, Amazon, Alphabet’s Google and Netflix) have been...

READ MORE

MEMBERS ONLY

Weight of the Evidence - 3

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

In the past two articles on Weight of the Evidence my goal was to show you how you can use Tushar Chande’s Chande Trend Meter (CTM) in a trend model. I stated previously that my digital weight of the evidence also provides levels that define buying parameters, stop loss...

READ MORE

MEMBERS ONLY

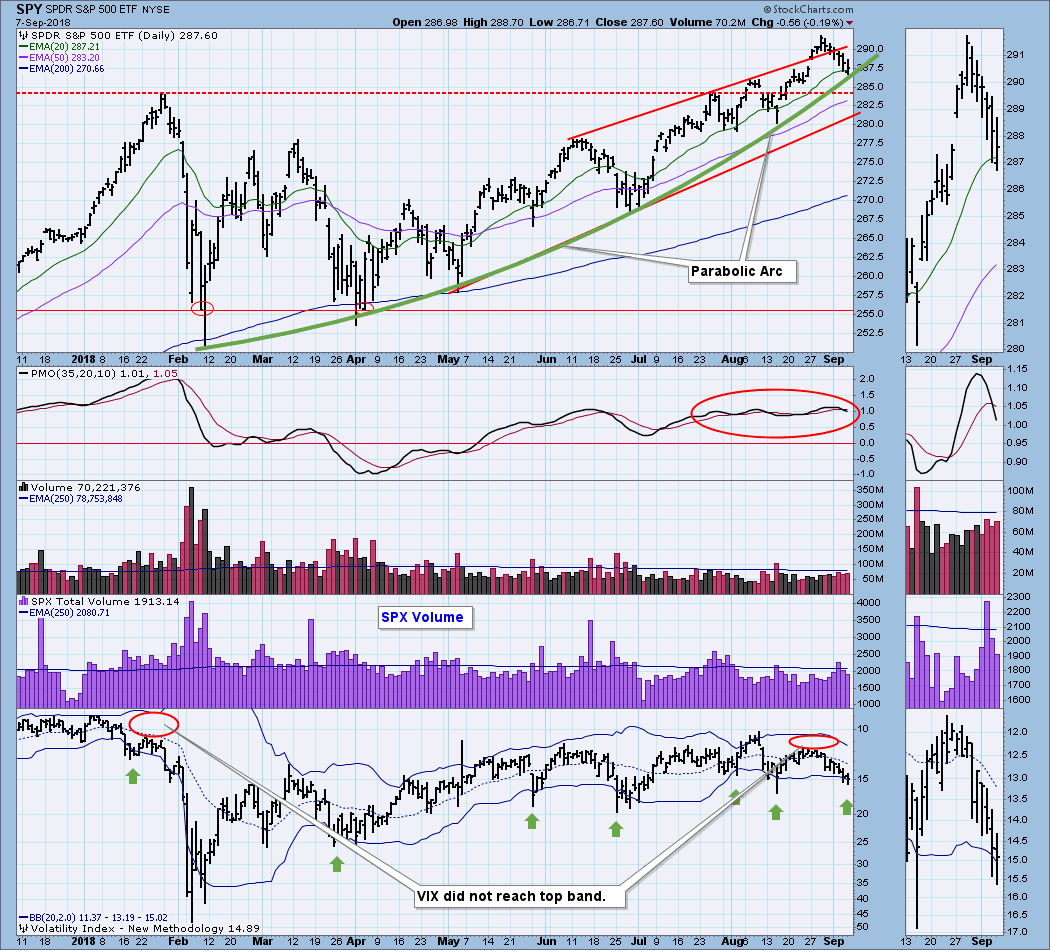

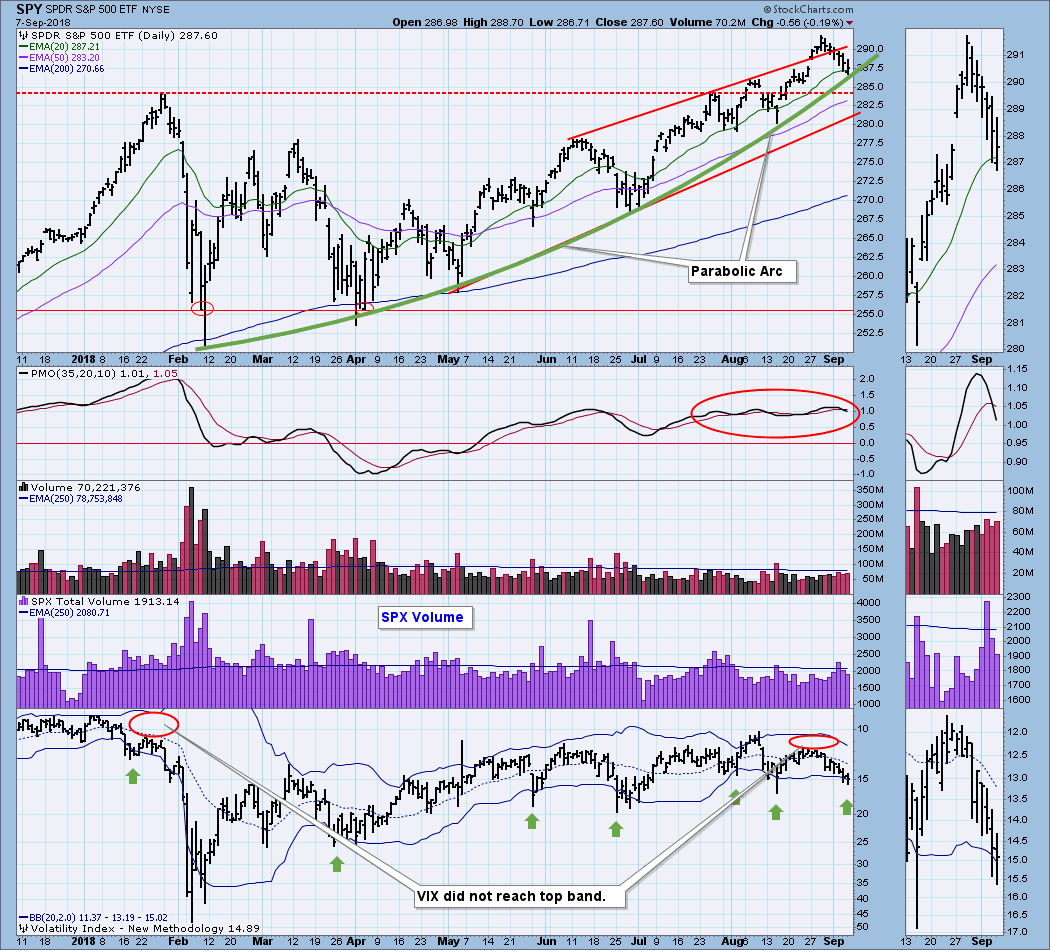

DP Weekly Wrap: A Gap I Don't Like

by Carl Swenlin,

President and Founder, DecisionPoint.com

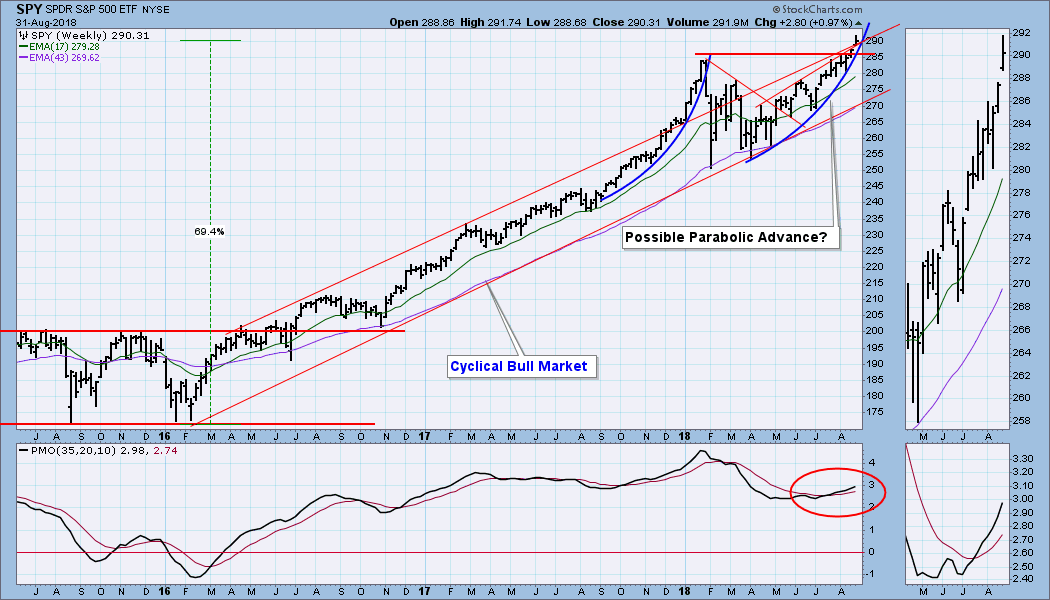

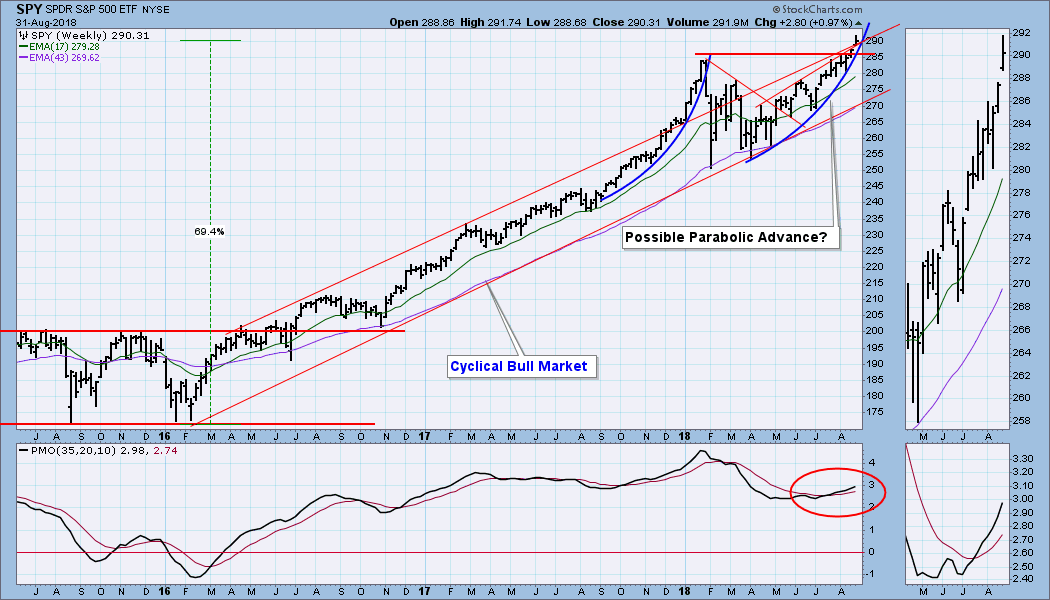

Last week we were looking at a possible bearish island reversal on one hand, and nascent parabolic advance on the other. This week's decline filled the island gap, making the island proposition moot. The decline also reached down to touch the parabolic arc, but so far that '...

READ MORE

MEMBERS ONLY

Weekly Market Review and Outlook (with Video) - Industrials Perk up as Defense Leads

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Market Overview.

* S&P 500 Retreats from All Time High.

* Would you have the Nerve?

* Selling Pressure Contained.

* XLI Exceeds Late August High.

* Aerospace & Defense iShares Hits New High.

* Lockheed Martin and Raytheon Break Out.

* XLU and XLP Lead and Lag.

* Always Defer to the Price Chart.

* Utilities,...

READ MORE

MEMBERS ONLY

I Am WILDLY Bullish Long-Term And Here's Why

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Reminder

If you'd like to subscribe to my blog, simply scroll down to the bottom of this article, type in your email address and click the green "Subscribe" button. It's completely FREE, spam-free and the best way to let me know you enjoy my...

READ MORE

MEMBERS ONLY

No More All "Green" Scoreboards - OEX Loses PMO BUY Signal

by Erin Swenlin,

Vice President, DecisionPoint.com

The market in general is pulling back since making all-time highs last week so it isn't surprising to see PMOs now in decline. The OEX couldn't hold on to its PMO BUY signal and I suspect another decline will start flipping the other three indexes'...

READ MORE

MEMBERS ONLY

CONSUMER DISRETIONARY SPDR IS YEAR'S STRONGEST SECTOR -- BUT IT MAY BE OVERSTATING SECTOR'S STRENGTH -- ITS EQUAL WEIGHTED ETF IS LAGGING THE XLY BY AN USUALLY WIDE GAP OF 11% -- OUTSIZED GAINS IN AMAZON AND NETFLIX MAY EXAGGERATING ITS 2018 PERFORMANCE

by John Murphy,

Chief Technical Analyst, StockCharts.com

CONSUMER DISCRETIONARY SPDR IS YEAR'S STRONGEST SECTOR ... Chart 1 shows the Consumer Discretionary SPDR (XLY) trading near a new record. Its 2018 gain of 18% makes it the year's strongest sector. That puts the XLY ahead of technology (16%) and healthcare (12%) for the year. In...

READ MORE

MEMBERS ONLY

Technology-Driven Selloff Isn't A Concern....Yet

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

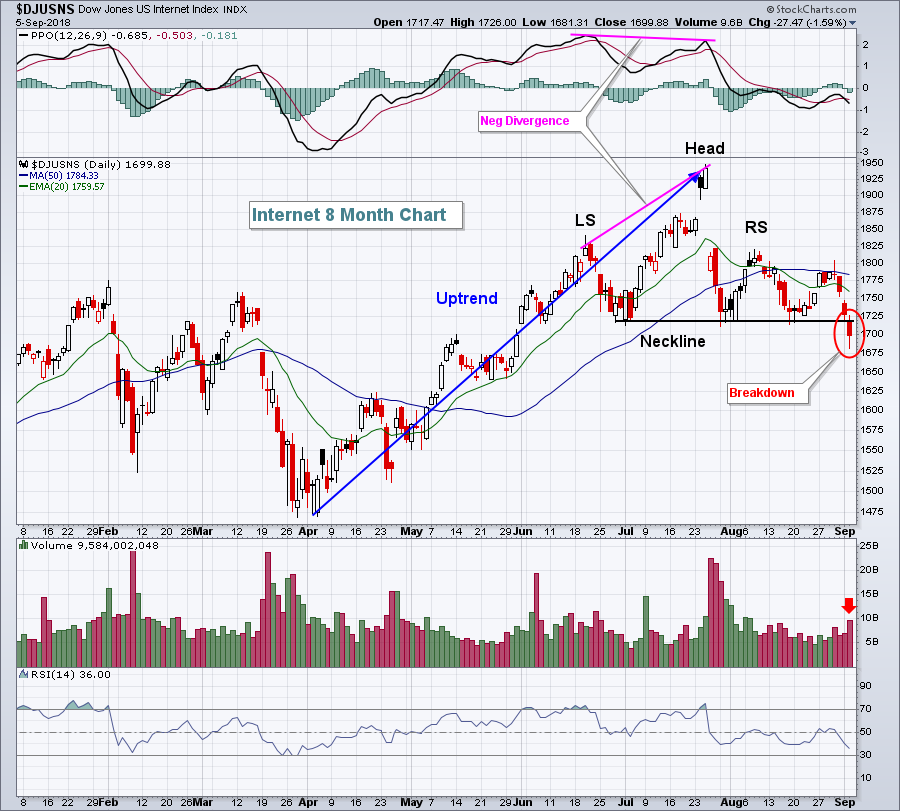

Market Recap for Wednesday, September 5, 2018

There were a couple things that stood out to me regarding Wednesday's action. First, the recovery off the intraday low wasn't insignificant. However, the stocks driving most of the recovery were in defensive areas. Utilities (XLU, +1.40%) and...

READ MORE

MEMBERS ONLY

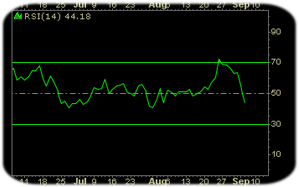

SystemTrader - Finding Established Uptrends and Quantifying Pullbacks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Introduction.

* RSI for Trend Identification.

* RSI to Quantify Pullbacks.

* Scan Code Progression.

* Conclusions and Tweaks.

Introduction

Stocks making big upside moves and higher highs are clearly in uptrends, but this says little about the length of the trend or the depth of the pullbacks. Trends have a tendency to persists...

READ MORE

MEMBERS ONLY

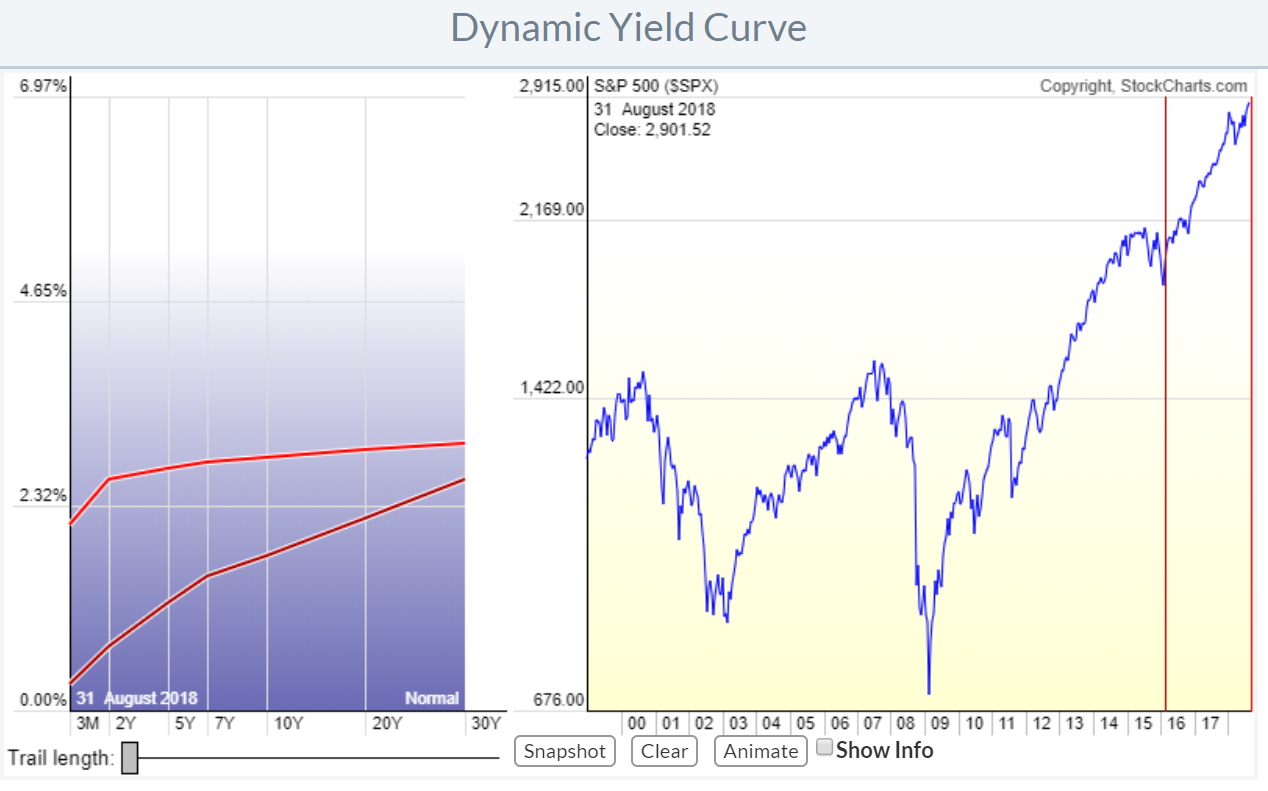

Combining RRG and the (dynamic) yield curve tool extended

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

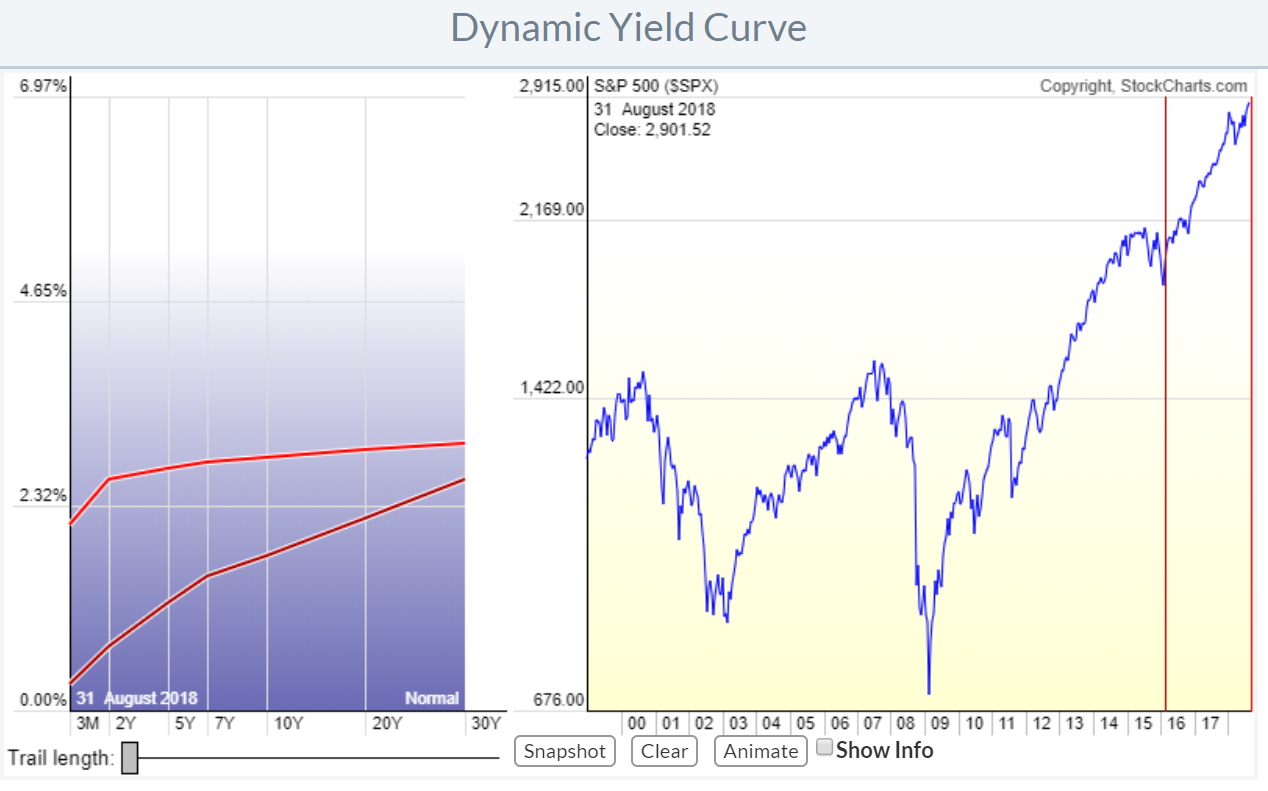

In one of my recent articles, I high lighted that Relative Rotation Graphs can do (much) more than just show equity sector rotation by showing how RRG can be used to analyze rotation among the different commodity groups against a broad commodity index.

This post expands on a recent article...

READ MORE

MEMBERS ONLY

DP Alert: Short-Term Weakness Continues - Bonds Continue to Suffer But Holding Support

by Erin Swenlin,

Vice President, DecisionPoint.com

The DecisionPoint Scoreboards remain completely green, meaning all four indexes are on BUY signals in all three timeframes as far as price trend and condition. While it seems a condition we would want to celebrate, it suggests to me that the market is overextended. The consolidation and small decline on...

READ MORE

MEMBERS ONLY

TWITTER LEADS TECH STOCKS LOWER -- DEFENSIVE CONSUMER STAPLES, UTILITIES, AND REITS CONTINUE TO ATTRACT NEW MONEY -- NETFLIX WEIGHS ON CONSUMER DISCRETIONARY STOCKS -- AMAZON IS A QUARTER OF THE XLY AND MAY BE OVERSTATING THIS YEAR'S CYCLICAL LEADERSHIP

by John Murphy,

Chief Technical Analyst, StockCharts.com

OVERBOUGHT TECH SECTOR SEES SOME PROFIT-TAKING ... Chart 1 shows the Technology Sector SPDR (XLK) losing more than 1% today to lead the market lower. Its 9-day RSI line (top chart) had reached overbought territory above 70 suggesting that the XLK was due for a pullback. It's now testing...

READ MORE

MEMBERS ONLY

September 2018 Market Roundup With Martin Pring

by Martin Pring,

President, Pring Research

The MarketRoundup Video For September is now available.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion ofPring Turner Capital Groupof Walnut Creek or its affiliates....

READ MORE

MEMBERS ONLY

Selling In Medical Supplies Opens The Door For Entry Into This Stock

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, September 4, 2018

Our major indices rallied to end the day well off their intraday lows. All did finish in negative territory, however, as healthcare (XLV, -0.80%) and materials (XLB, -0.69%) were the weakest sectors. The XLV was led lower by biotechs ($DJUSBT, -1....

READ MORE

MEMBERS ONLY

One Semiconductor Equipment Stock Stands Out

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Semiconductor SPDR (XSD) broke out to new highs last week and hit another new high on Tuesday. Despite strength in this broad-based semiconductor ETF, there are still pockets of weakness within the group.

Namely, the semiconductor equipment stocks have been weak in 2018. These include Applied Materials (AMAT), Lam...

READ MORE

MEMBERS ONLY

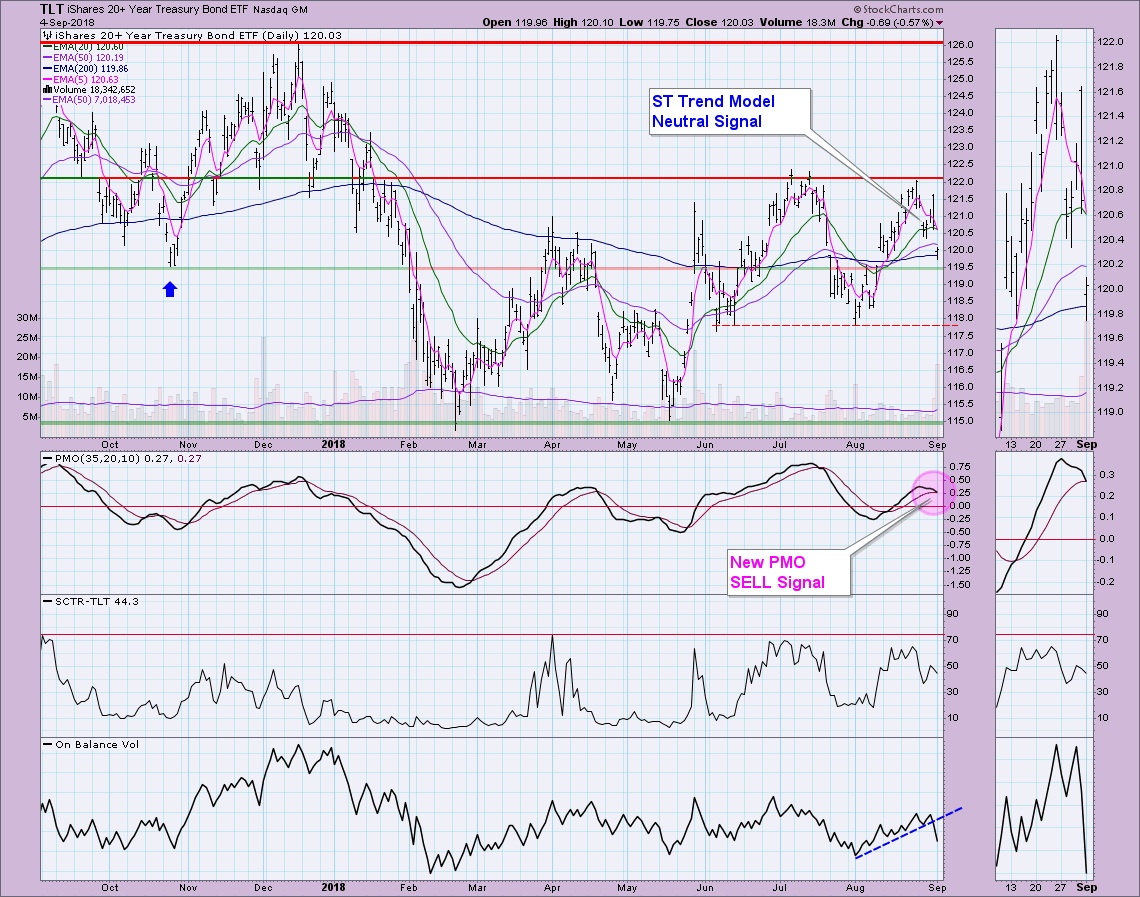

Banks, Bonds, Cyber Security and On Trend

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* XLF Shows a Little Leadership.

* Stocks to Watch in XLF.

* TLT Backs off Resistance.

* Two Cyber Security Stocks Bounce off Support.

* Ametek Ends Consolidation.

* Video Food for Thought.

* On Trend on Youtube.

...XLF Shows a Little Leadership

... The Financials SPDR (XLF) led the sector SPDRs on Tuesday with a .49%...

READ MORE

MEMBERS ONLY

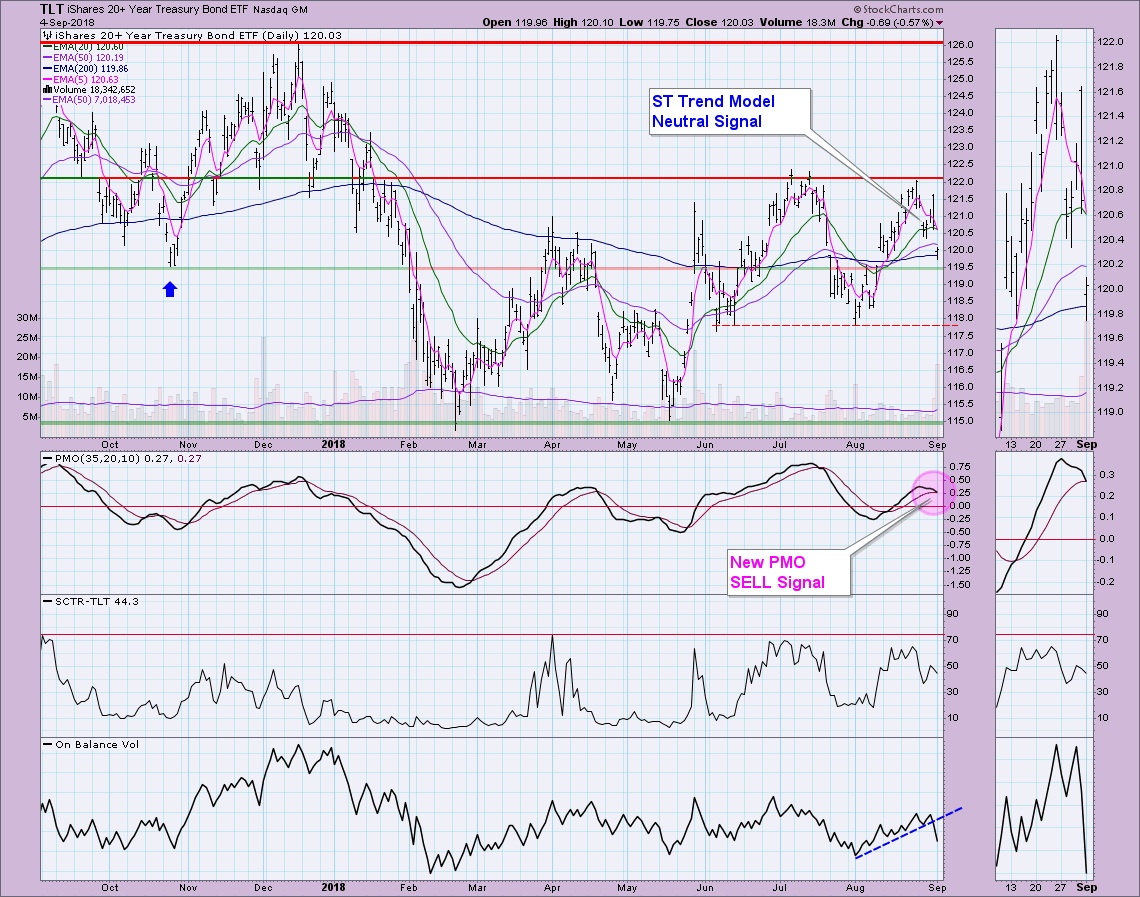

TLT Looking More and More Bearish - PMO SELL Signal - IT and LT Head & Shoulders

by Erin Swenlin,

Vice President, DecisionPoint.com

There were some new developments on the 20-year Bond ETF (TLT) that are tipping the scales bearish. We were already noticing some problems for Bonds in general, but volatile trading had made it difficult to decipher. Today there is no denying the negative bias as both a Short-Term Trend Model...

READ MORE

MEMBERS ONLY

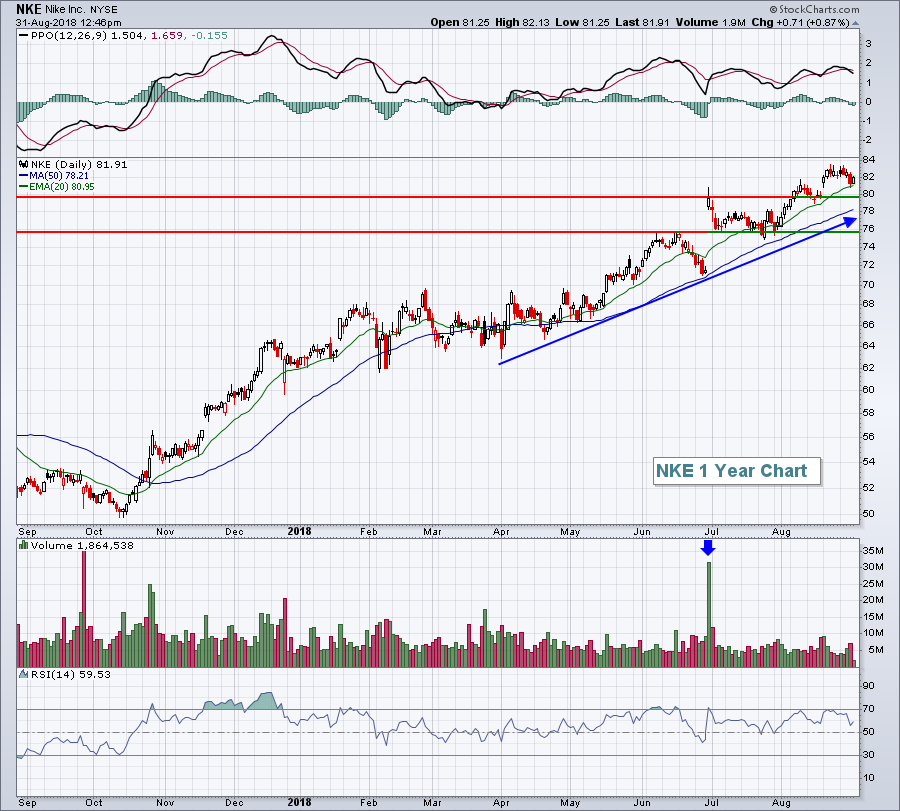

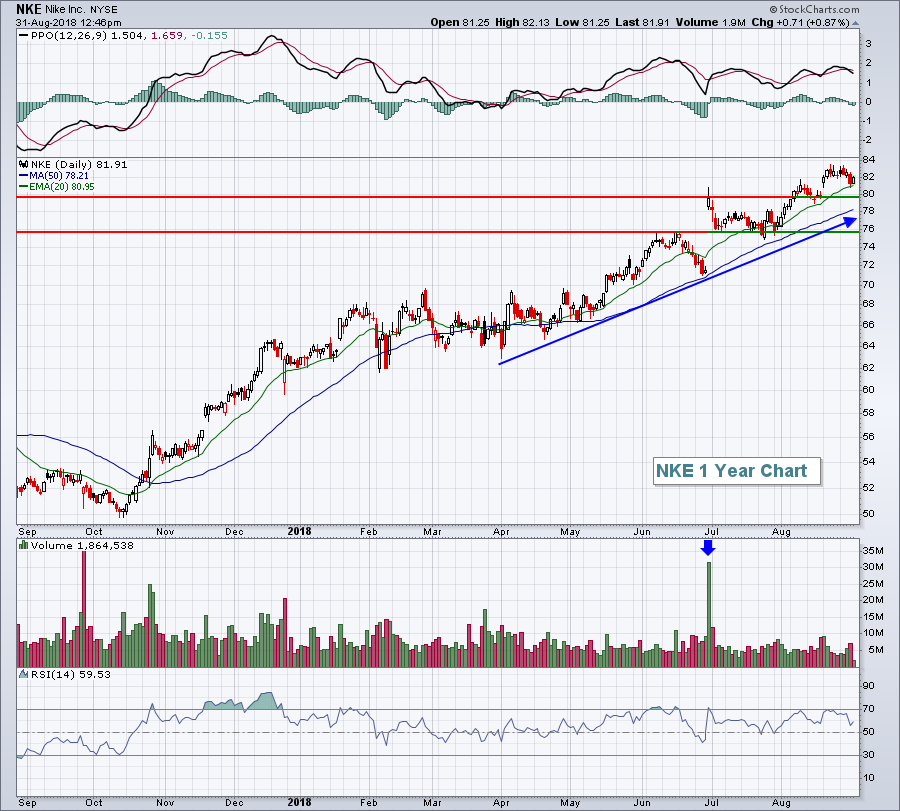

5 Monday Trade Setups As We Welcome In September

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, August 31, 2018

Friday's action was underscored by bifurcation. The NASDAQ and small cap Russell 2000 turned in solid gains of +0.26% and +0.48%, respectively, while the Dow Jones ended the day in negative territory. The S&P 500 was essentially...

READ MORE

MEMBERS ONLY

US Stocks Take On Global Equities, Gold, Commodities And Bonds

by Martin Pring,

President, Pring Research

* US Equities versus the world

* Stocks versus Commodities

* Stocks and bonds

* Stocks compared to gold

There are lots of seasonal reasons to be bearish on the stock market, such as September being the weakest month and mid-term election years having a downward bias. However, if you compare the S&...

READ MORE

MEMBERS ONLY

U.S. STOCKS HAVE A STRONG AUGUST -- TECHNOLOGY, CONSUMER CYCLICALS, AND HEALTHCARE ARE SECTOR LEADERS -- U.S. STOCK UPTREND IS STRETCHED BUT STILL INTACT -- MEXICAN PESO STEADIES ON TRADE DEAL -- CANADIAN DOLLAR DROPS ON FRIDAY'S LACK OF AGREEMENT

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS HAVE A STRONG AUGUST ... U.S. stocks had a strong August with the Nasdaq, S&P 500, Russell 2000, and Dow Transports hitting record highs. Technology, Consumer Cyclicals, and Healthcare saw the biggest percentage gains and hit record highs. The three weakest sectors were Energy, Materials, and Industrials....

READ MORE

MEMBERS ONLY

Three Stocks To Bolster Your September Returns

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It's widely known that September historically has been a difficult month for U.S. equities. Since 1950, the S&P 500 has risen during the month of September 30 times and moved lower 38 times. It's the only calendar month where the bears have had...

READ MORE

MEMBERS ONLY

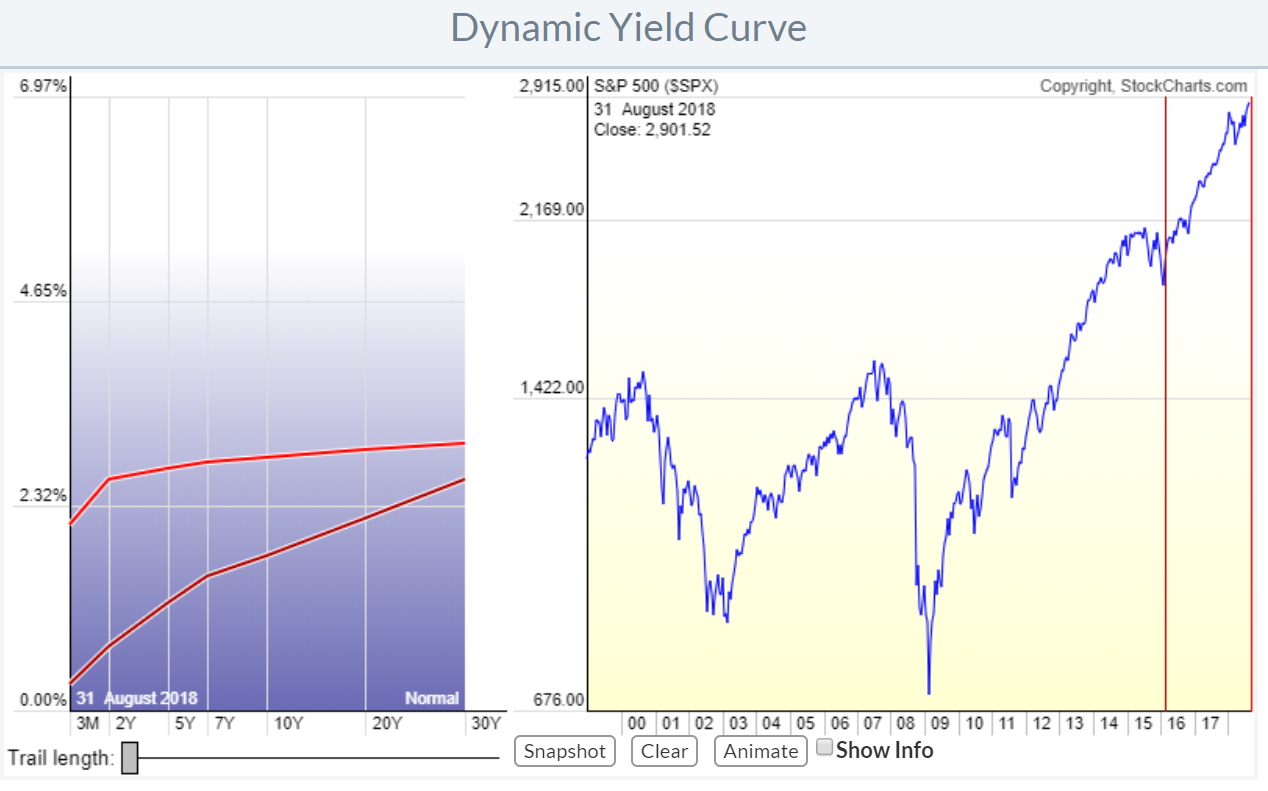

Combining Relative Rotation Graphs and the (dynamic) yield curve tool

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In one of my recent articles, I high lighted that Relative Rotation Graphs can do (much) more than just show equity sector rotation by showing how RRG can be used to analyze rotation among the different commodity groups against a broad commodity index.

In this post, I want to expand...

READ MORE

MEMBERS ONLY

When the Minority becomes the Majority - Weighting the Sectors

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

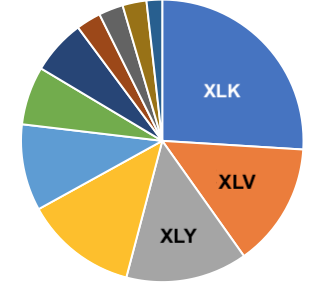

The S&P 500 hit a new high in August, but only four of the ten sector SPDRs joined in on this high: the Consumer Discretionary SPDR, the Technology SPDR, the Health Care SPDR and the Real Estate SPDR. This suggests that the other six are lagging in some...

READ MORE

MEMBERS ONLY

DP Weekly/Monthly Wrap: Is Another Parabolic Advance Beginning?

by Carl Swenlin,

President and Founder, DecisionPoint.com

This week, as the market once again broke out of the cyclical bull market rising trend channel, it occurred to me that perhaps another parabolic advance was getting under way. On Wednesday I was a guest of Erin and Tom on MarketWatchers LIVE, and I gave a more detailed account...

READ MORE

MEMBERS ONLY

Climactic Indicators and Sentiment Suggest Weakness in Week Ahead

by Erin Swenlin,

Vice President, DecisionPoint.com

The market made new all-time highs this week, but with the upcoming holiday and short trading week, look for consolidation or continued sell-off. The indicators in the very short term and short term are suggesting a selling initiation. Add to that the highly bullish sentiment charts and it spells weakness...

READ MORE

MEMBERS ONLY

Late August Rebound in Foreign Stocks Helped Push U.S. Stocks to New Record

by John Murphy,

Chief Technical Analyst, StockCharts.com

Editor's Note: This article was originally published in John Murphy's Market Message on Wednesday, August 29th at 12:33pm ET.

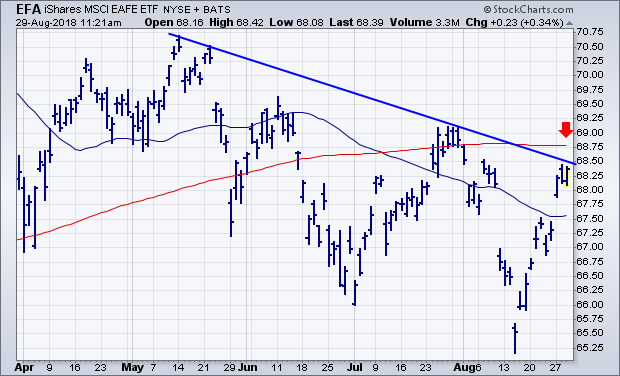

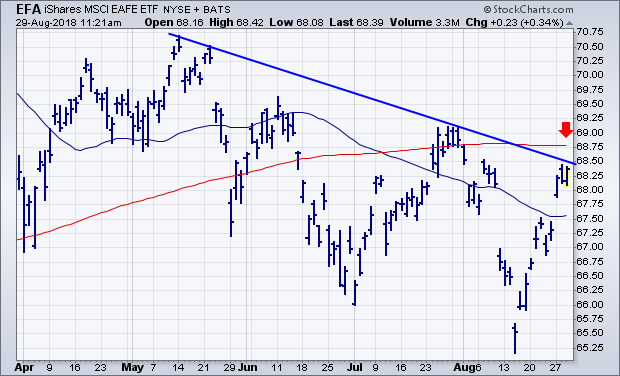

Before leaving on vacation on August 15, I expressed concern about the fact that foreign stock ETFs were lagging too far behind the U.S. which...

READ MORE

MEMBERS ONLY

Powerhouse Earnings Power Market Higher

by John Hopkins,

President and Co-founder, EarningsBeats.com

Here's a fact: Traders gravitate towards companies that beat earnings expectations. Why? Because they know they are putting their money to work in companies that outperform.

Here's another fact. MANY companies that report and beat earnings expectations often gap up - move higher - on positive...

READ MORE

MEMBERS ONLY

If You Only Read One Blog This Year...Make It This One!

by Gatis Roze,

Author, "Tensile Trading"

After two conferences in the past three weeks (ChartCon 2018 and TSAA - San Francisco), it is abundantly clear that individual investors want to challenge my portfolio strategy. Therein lies the risk of 100% candid exposure on my holdings and investing approach.

Rather than engaging in arm wrestling over whether...

READ MORE

MEMBERS ONLY

Weekly Market Review and Outlook (with video) - Ebb, Flow and September

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Small-caps Stall as Large-cap Techs Lead

* More Strength than Weakness

* S&P 500 Notches a New High

* Seasonal Patterns are Mixed

* The Ebb and Flow of QQQ

* Big Flows in SKYY, HACK and IGV

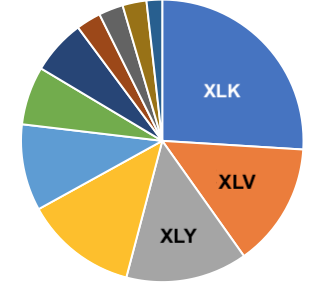

* Big Three are Up Big (XLK, XLY, XLV)

* Notes from the Art's Charts...

READ MORE

MEMBERS ONLY

Biotechs Continue Their Winning Streak But Have Price Challenges Ahead

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, August 30, 2018

Record Wall Street action was temporarily suspended on Thursday as all of our major indices fell in the final two hours to finish the day in negative territory. Utilities (XLU, +0.04%) managed to eke out a small gain, but the remaining sectors...

READ MORE