MEMBERS ONLY

Biotech and Defense-Aerospace Show Leadership - How to Create a ChartList from ETF Holdings

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Biotech and Defense/Aerospace Show Leadership.

* Creating a ChartList with ETF Holdings.

* 3 Defense-Aerospace Charts to Watch.

* 3 Biotech Charts to Watch.

Chartists looking for bullish stock setups can use industry group ETFs as the first filter. It is easy to find ETF components, upload them to a ChartList and...

READ MORE

MEMBERS ONLY

Wall Street Record High Winning Streak Stretches To Four

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, August 29, 2018

It was another ho-hum day of records on Wall Street with the S&P 500, NASDAQ and Russell 2000 all closing at all-time record highs for the 4th consecutive session. The Dow Jones has yet to clear its January 2018 record high...

READ MORE

MEMBERS ONLY

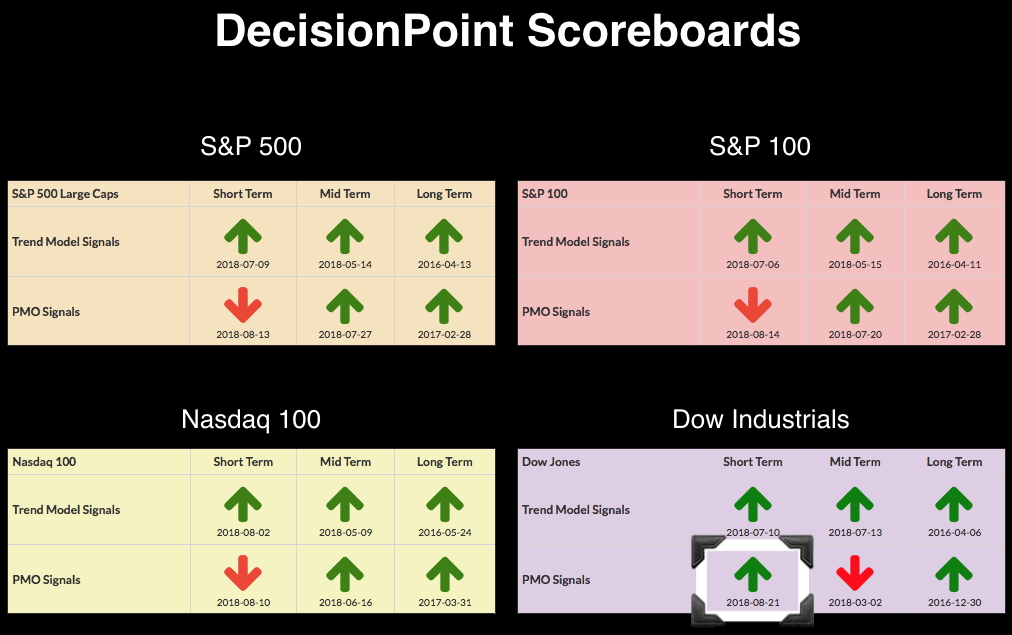

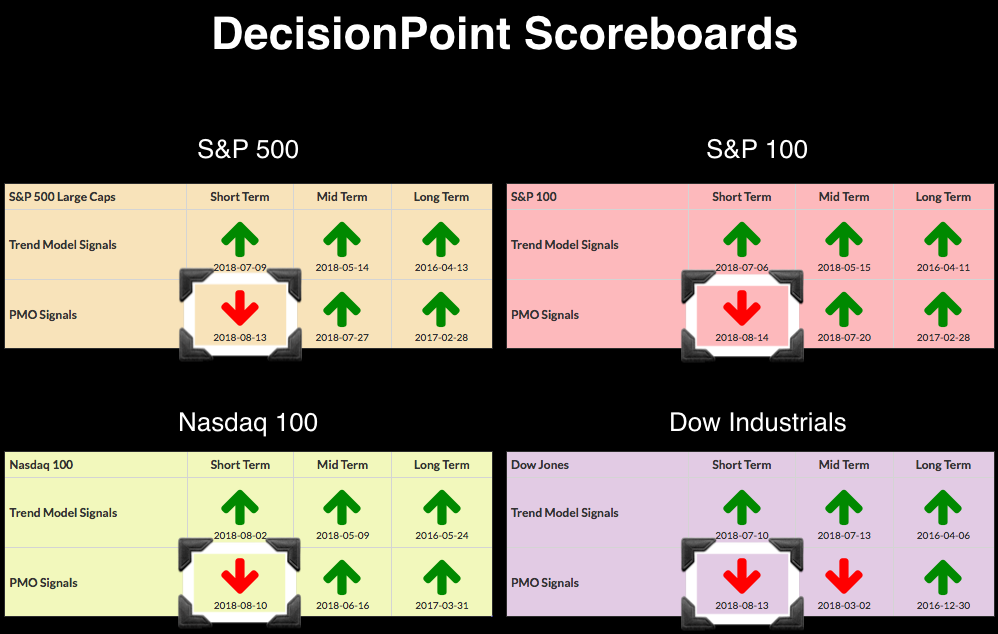

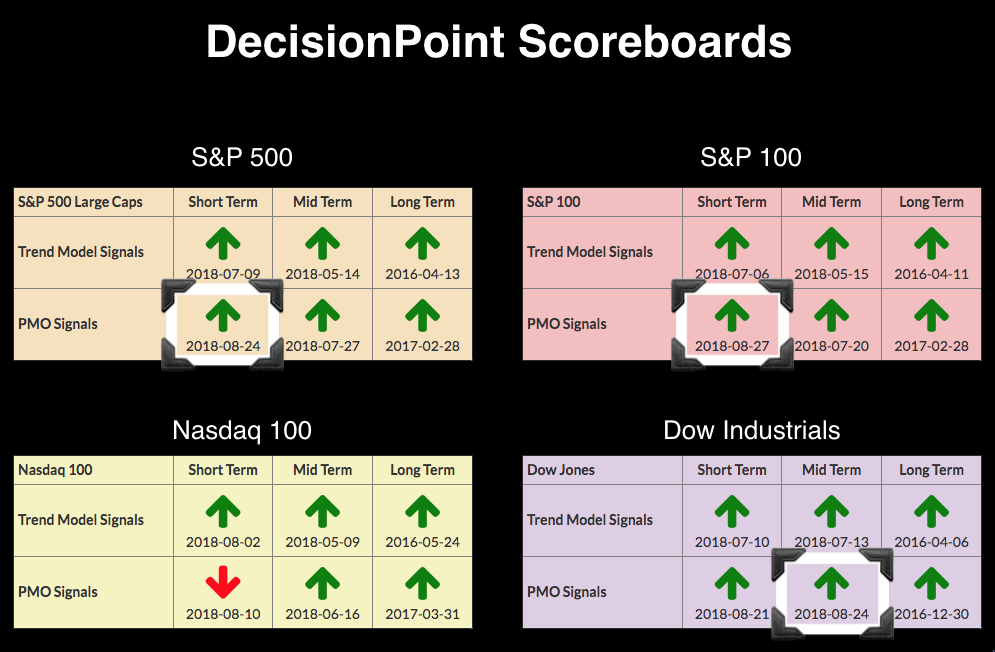

DP Alert: DP Scoreboards All "Green" - Dollar at a Decision Point

by Erin Swenlin,

Vice President, DecisionPoint.com

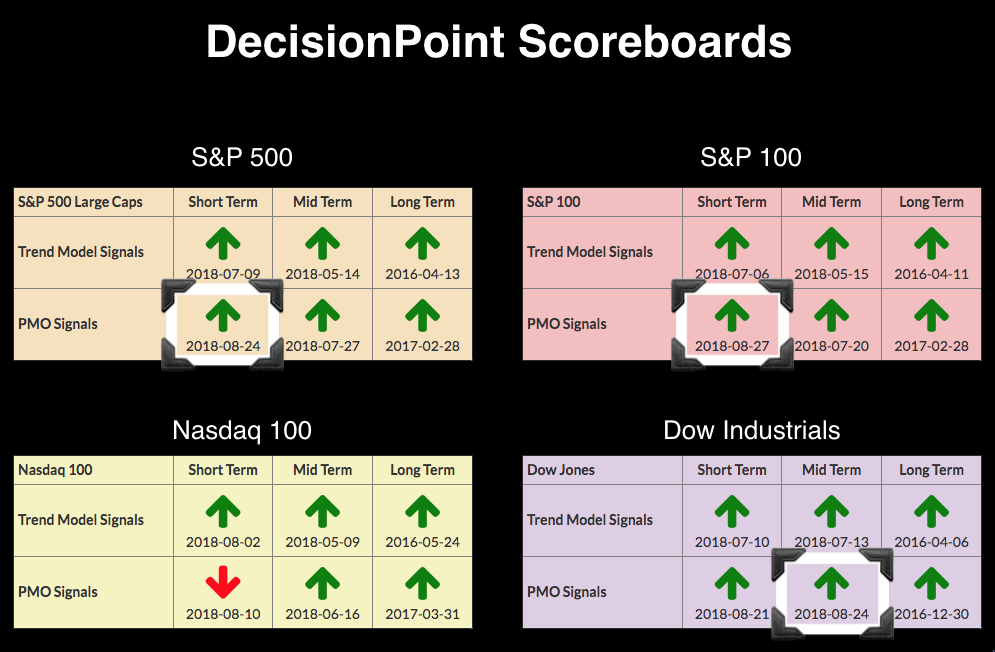

The last time all four of the DecisionPoint Scoreboards were completely "green" (or on BUY signals in all three time frames as far as price trend and momentum/condition) was back on 11/6/2017. It lasted only ONE day when the SPX whipsawed back into a PMO...

READ MORE

MEMBERS ONLY

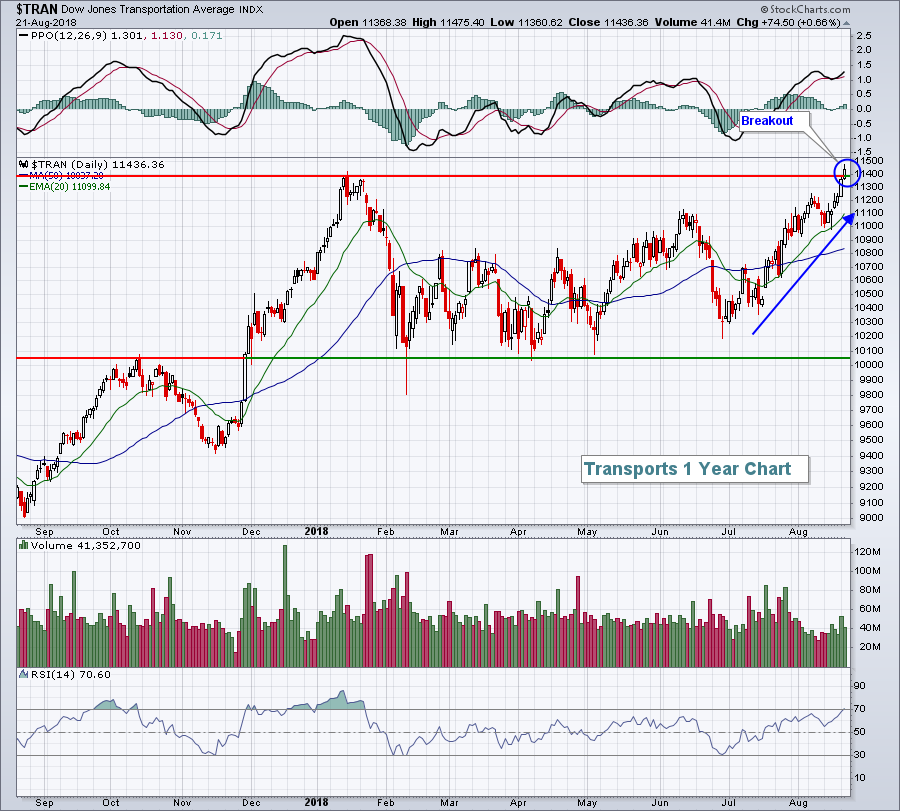

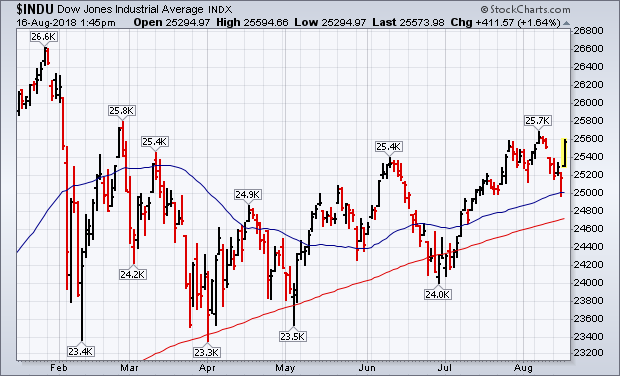

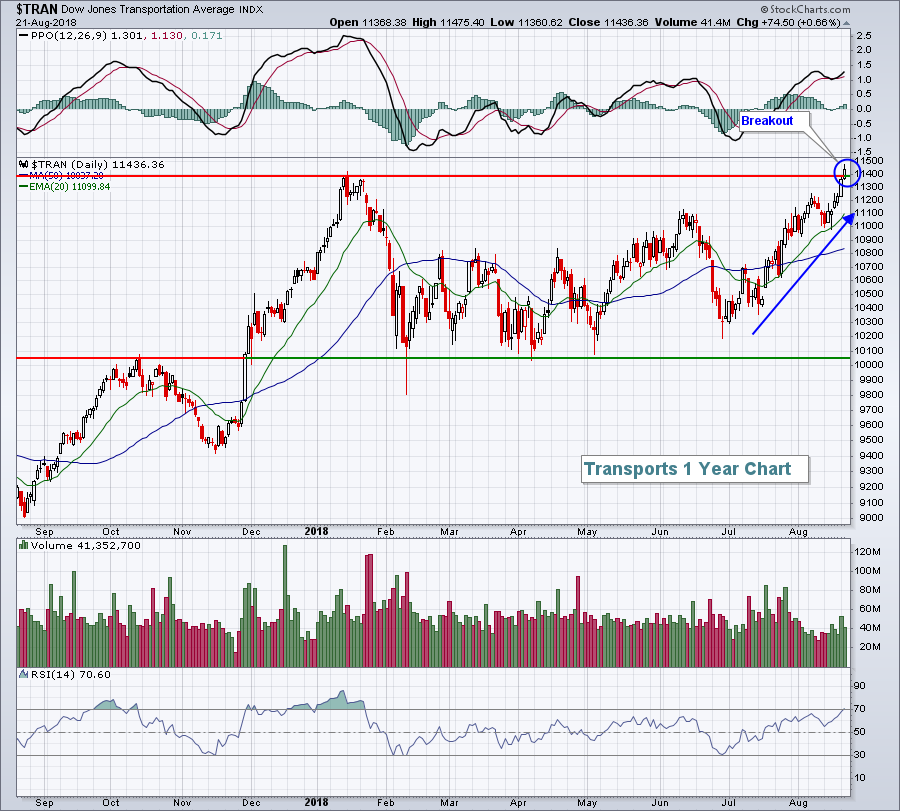

LATE AUGUST REBOUND IN FOREIGN STOCKS HELPED PUSH U.S. STOCKS TO NEW RECORD -- AND CONTRIBUTED TO UPSIDE BREAKOUTS IN GLOBAL STOCK INDEXES -- THE DOW INDUSTRIALS ARE HEADED TOWARD THEIR JANUARY PEAK -- THE DOW TRANSPORTS HIT A NEW RECORD

by John Murphy,

Chief Technical Analyst, StockCharts.com

FOREIGN STOCK ETFS ARE FINALLY BOUNCING ... Before leaving on vacation on August 15, I expressed concern about the fact that foreign stock ETFs were lagging too far behind the U.S. which could threaten the uptrend in the S&P 500 which was nearing a test of its January...

READ MORE

MEMBERS ONLY

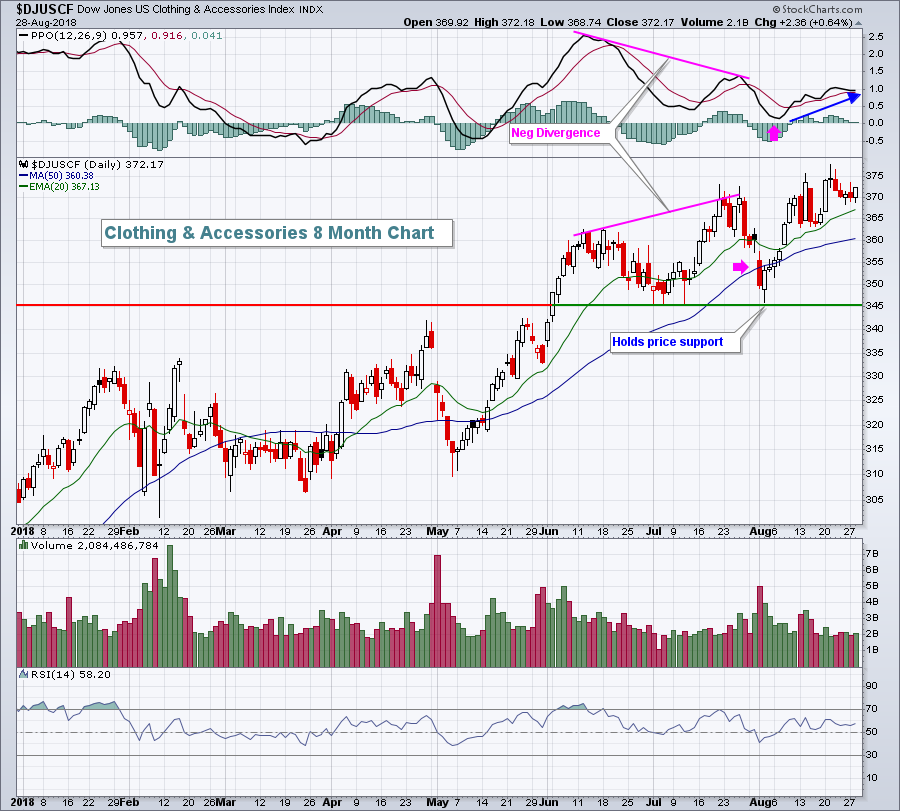

Retail Strength Is Likely Just Beginning

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

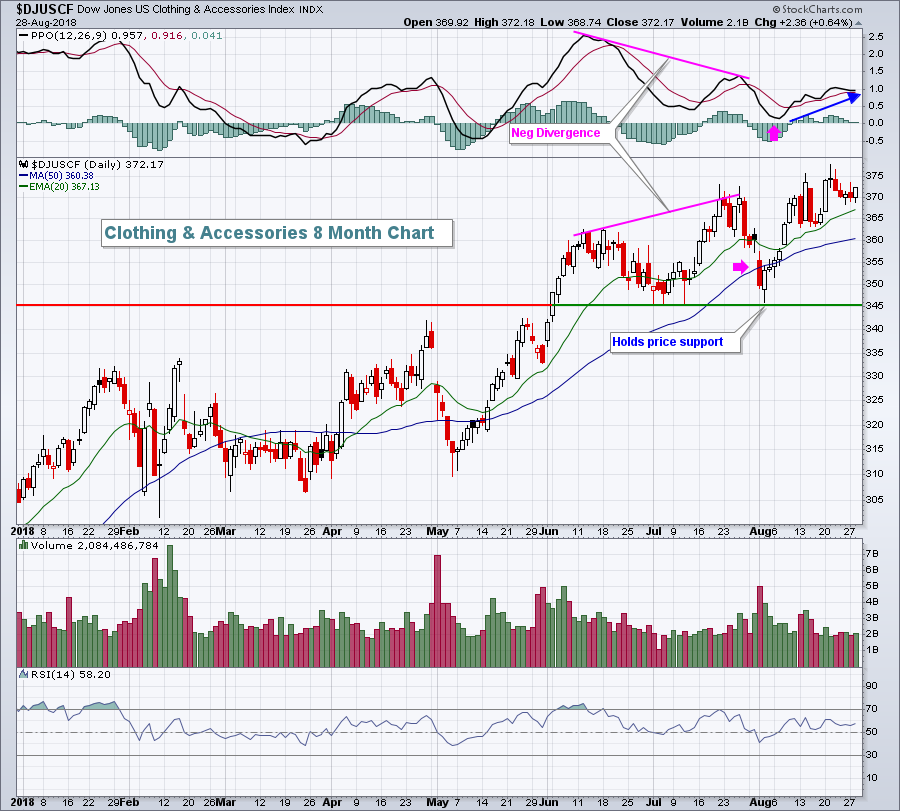

Market Recap for Tuesday, August 28, 2018

U.S. stocks extended their winning streak deeper into record territory on Tuesday. The S&P 500 closed in record territory for the third consecutive session. While the gain was very slight (+0.03%), it still keeps the bulls in charge -...

READ MORE

MEMBERS ONLY

Bottom Fishing for Broadcom - Plus Danaher and 3 Semiconductor Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* A Selling Climax and Retest for Broadcom.

* Analog Devices, Qorvo and Semtech.

* Danaher Extends String of Higher Lows.

A Selling Climax for Broadcom

Broadcom (AVGO) hit a potential reversal zone on a selling climax and could be poised for a rebound. First and foremost, I readily admit the Broadcom is...

READ MORE

MEMBERS ONLY

Semis Send a Message to the Market

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Chips are leading the market again as the broad-based Semiconductor SPDR (XSD) broke out of a triangle consolidation and hit a new high. A new high in this cyclical group is positive for the technology sector, the Nasdaq and the broader market.

First note that XSD has 34 components and...

READ MORE

MEMBERS ONLY

Prospecting for a Low in Gold

by Bruce Fraser,

Industry-leading "Wyckoffian"

Gold began an uptrend in 2001 which persisted for more than 10 years. At the conclusion of that trend, gold had a classic Buying Climax (BCLX) which led to a Change of Character. For the last 5 years gold has made no upward progress. Is gold getting ready to resume...

READ MORE

MEMBERS ONLY

It's Looking Like You Want To Be Overweight Two Key Sectors Now

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, August 27, 2018

It was an all-around solid day on Wall Street to begin the final week of August. And it all occurred on Monday, which historically has been the worst calendar day of the week, particularly Mondays that fall during the second half of calendar...

READ MORE

MEMBERS ONLY

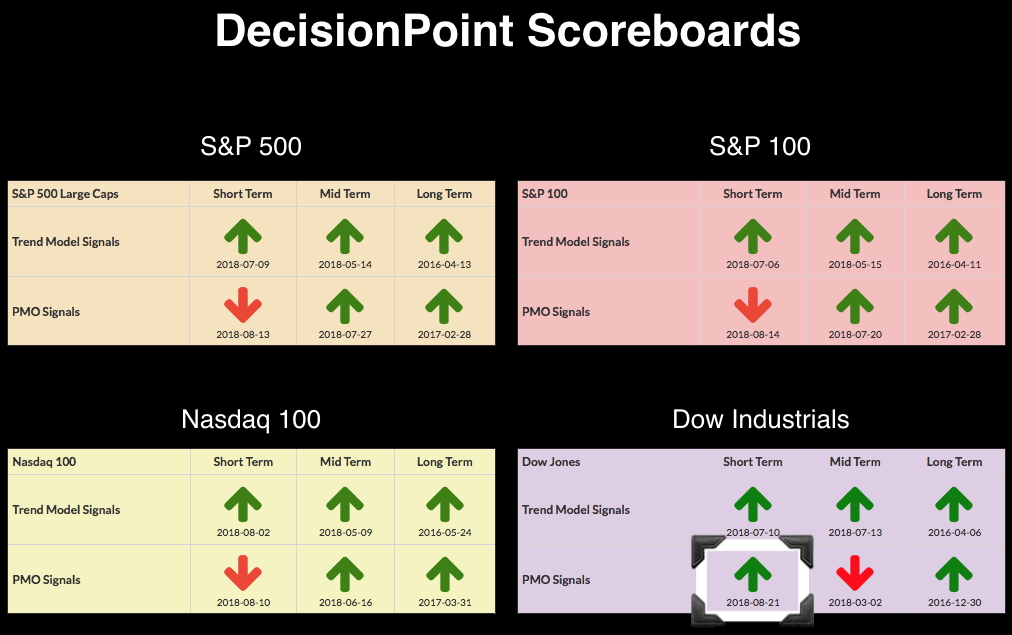

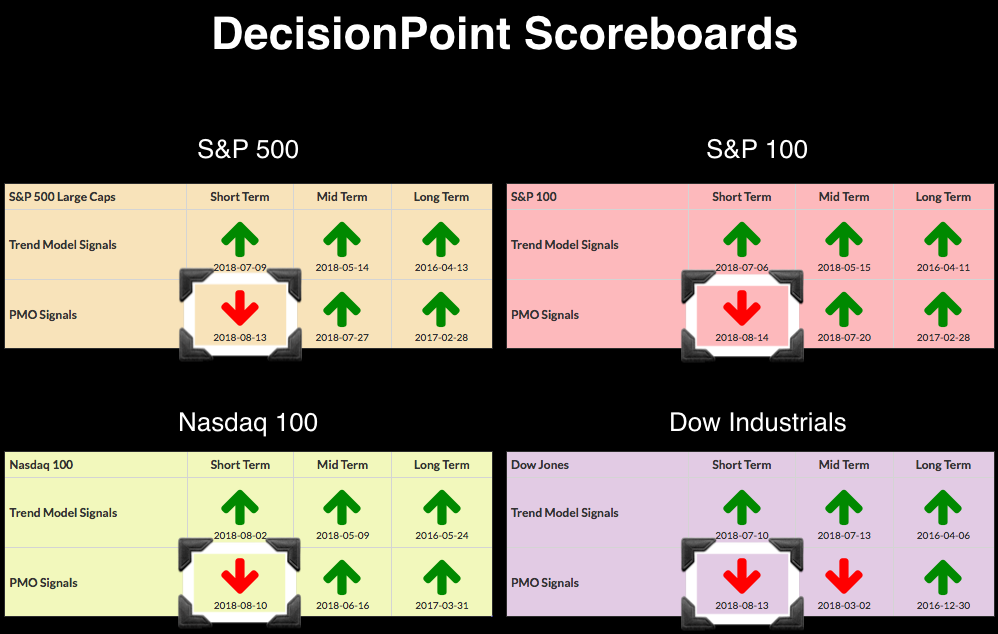

DP Bulletin: Weekly PMO BUY Signal on Dow; PMO BUY Signals for OEX and SPX...NDX Lags

by Erin Swenlin,

Vice President, DecisionPoint.com

On Friday, the Dow finally saw its weekly PMO cross above its signal line and trigger a long awaited BUY signal. The SPX also added a new PMO BUY signal on its daily chart on Friday. Today, the OEX generated a ST PMO BUY signal. I had thought the NDX...

READ MORE

MEMBERS ONLY

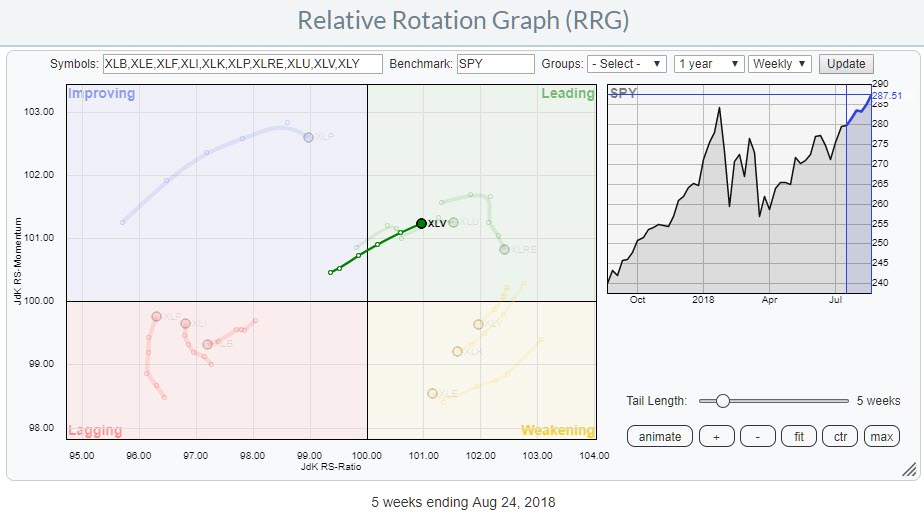

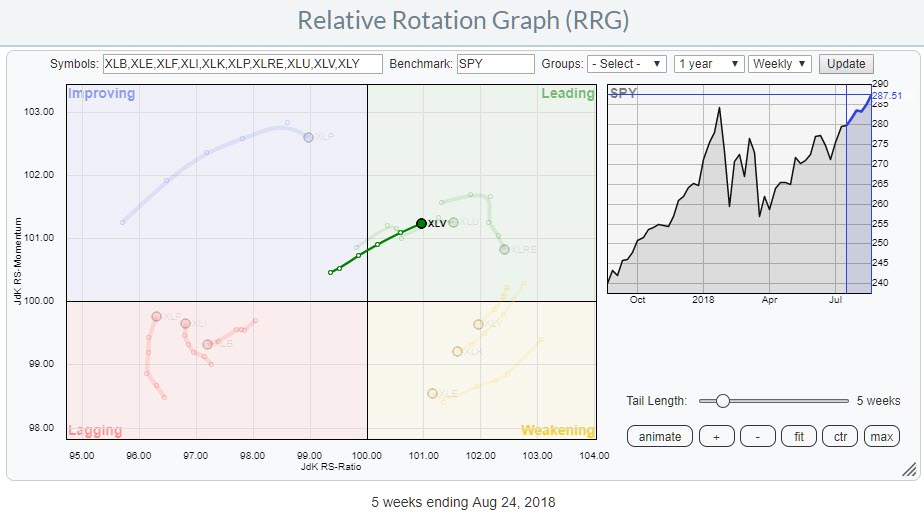

PFE takes the lead in Health Care sector rotation

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph shows the rotation of the Health Care sector over the last five weeks against SPY. The dimmed trails are the other US sectors.

The strong rotation from improving into leading at a steady positive RRG-Heading (0-90 degrees) suggests that further improvement against SPY is likely.

In...

READ MORE

MEMBERS ONLY

Treasury Bond ETF Hits Major Road Block

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The unadjusted 20+ YR T-Bond ETF (_TLT) surged to resistance on Friday and backed off on Monday. The long-term trend is down and this resistance level could mark a near term top.

First note that the chart shows unadjusted prices for TLT by preceding the symbol with an underscore (_TLT)...

READ MORE

MEMBERS ONLY

Bond Yields Reach A Critical Support Zone

by Martin Pring,

President, Pring Research

* The longer-term picture argues for lower yields

* Deflationary forces gain the upper hand

* Bond yields at crucial short-term support

* UK Yields in a life or death struggle

The longer-term picture argues for lower yields

Earlier in the month I wrote an article pointing out that many bond yields had reached...

READ MORE

MEMBERS ONLY

Article Summaries: 5/2018 - 8/2018

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Periodically I write an article that reviews the past few months of articles. Why on Earth would I do this? Primarily for two reasons. One is that many new readers are involved and often they do not go back and look at the past articles. Two is that my articles...

READ MORE

MEMBERS ONLY

Software Stocks and Cyber Security Lead Technology Sector

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Software Is Red Hot.

* Microsoft, ServiceNow and Tableau.

* HACK Hits a New High.

* Qualys and Proofpoint Bounce off Support.

Software Is Red Hot

The software group is part of the technology sector and this industry group is red hot. Several key stocks in this group hit 52-week highs last week...

READ MORE

MEMBERS ONLY

Software Stocks Soar On Solid Earnings, S&P 500 Sets Record High

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, August 24, 2018

The boring stock market months of July, August and September just got a lot more exciting. Yesterday, the benchmark S&P 500 did something it's never done before. It closed above 2873. The NASDAQ and Russell 2000 also closed at...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: SPY New All-Time Highs; Crude New BUY Signal; Has Gold Bottomed?

by Carl Swenlin,

President and Founder, DecisionPoint.com

On Friday SPY made new, all-time intraday and closing highs, exceeding the records set on Tuesday. The daily PMO has been very flat and holding at around +1 since the end of July. This summarizes the steady price rise during that period and does not present a problem. There is,...

READ MORE

MEMBERS ONLY

Short-Term Warning Signs Popping Up Everywhere

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, August 23, 2018

Technology (XLK, +0.22%) was the only sector to finish in positive territory on Thursday. The remaining sectors were lower, led by materials (XLB, -0.68%), energy (XLE, -0.47%) and financials (XLF, -0.46%). The result was losses on all of our...

READ MORE

MEMBERS ONLY

Weekly Market Review and Outlook (with Video) - Removing Some of the Guesswork

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Market Overview

* Majority of Stocks in Up Trends

* New Highs Expand in $SPX, $MID and $SML

* An Unenthusiastic, but Steady Advance

* Current Uptrend > January High

* Small-caps Continue to Lead

* Retail Powers Consumer Discretionary

* XLK Edges above Flag Line (plus XLC)

* Regional Banks Lead Finance Sector

* XLI Extends Upswing (plus...

READ MORE

MEMBERS ONLY

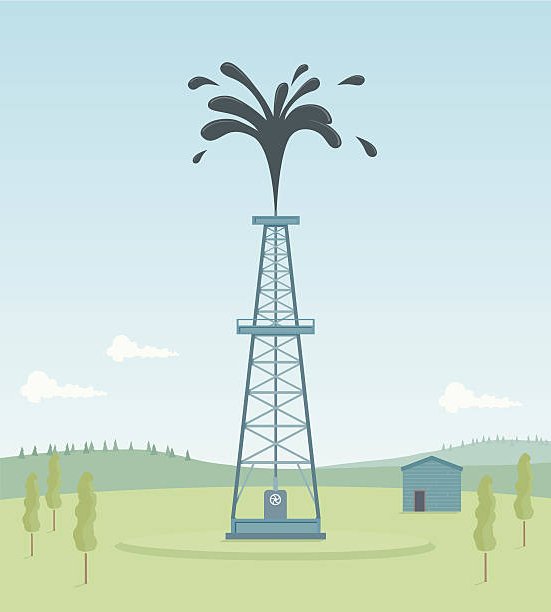

Is Oil Ready to Gush?

by Erin Swenlin,

Vice President, DecisionPoint.com

Today I was alerted to a new Short-Term Trend Model BUY signal on USO. This signal is triggered when the 5-EMA crosses above the 20-EMA. When I went to take a look at the chart, I noted some very bullish characteristics that I thought I'd share.

You'...

READ MORE

MEMBERS ONLY

Weight of the Evidence - 2

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

In my previous article called Weight of the Evidence (WoEv) I compared my Weight of the Evidence with Tushar Chande’s Chande Trend Meter (CTM). I also mentioned I was happy that Tushar had this indicator since I cannot divulge the exact details of my Weight of the Evidence. A...

READ MORE

MEMBERS ONLY

S&P 500 Stymied At Major Price Resistance; Short-Term Top?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, August 22, 2018

Stock market action was bifurcated here in the U.S. on Wednesday as NASDAQ stocks led to the upside. The small cap rally continued with the Russell 2000 closing at a second consecutive all-time high. But both the Dow Jones and S&...

READ MORE

MEMBERS ONLY

DP Alert: Market Indicators Suggest Short-Term Weakness - PMO SELL for Dollar

by Erin Swenlin,

Vice President, DecisionPoint.com

We've now entered the longest bull market on record when counted from the 2009 lows to the highs of yesterday. While there are mixed opinions whether it will hold up much longer, our DP Scoreboards and intermediate-term indicators are still far too bullish to put me in the...

READ MORE

MEMBERS ONLY

Semiconductor ETF Forges a 4 Candlestick Reversal

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Semiconductor iShares (SOXX) has been locked in a trading range the last few months, but the big trend is still up and a recent candlestick reversal could signal the start of an extended advance.

It is important to keep perspective, even when looking at a short-term pattern. In the...

READ MORE

MEMBERS ONLY

Oil Bounces off Support - XLE and XES Bounce after Becoming Oversold - Four Stocks to Watch

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Oil Bounces off Support

* XLE: Support Break or Oversold Opportunity?

* Biotechs Get a Bounce (IBB, XBI)

* Schwab Firms at Support

* Stocks to Watch: GSP, FFIV, TXN

* On Trend Highlights and Link

Oil Bounces off Support

The Light Crude Continuous Contract ($WTIC) fell over 10% from early July to mid August,...

READ MORE

MEMBERS ONLY

Russell 2000 Breaks Out Of Bullish Pattern To Lead U.S. Equities Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, August 21, 2018

Despite some selling late in the day, it was mostly a bullish day on Wall Street. The two sectors that lagged were defensive sectors - utilities (XLU, -0.72%) and consumer staples (XLP, -0.71%). Leading the market higher were consumer discretionary (XLY,...

READ MORE

MEMBERS ONLY

DP Bulletin: Dow Recovers PMO BUY Signal

by Erin Swenlin,

Vice President, DecisionPoint.com

The NDX's PMO is still in decline. The SPX and OEX have rising PMOs, but no short-term PMO BUY signals. However, the Dow has recaptured its PMO BUY signal on the daily chart.

The Dow may seem to be recovering more quickly, but honestly it didn't...

READ MORE

MEMBERS ONLY

Think AAPL's Been A Great Performer? Here's One In Its Space Even Better

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, August 20, 2018

Leadership from technology (XLK, -0.15%) was lacking, but strength in consumer discretionary (XLY, +0.71%), materials (XLB, +0.70%), energy (XLE, +0.67%) and industrials (XLI, +0.67%) was more than enough to offset areas of weakness as all of our major...

READ MORE

MEMBERS ONLY

Here's A Monday Setup With A Strong Reward To Risk Opportunity

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Note

I'm still traveling so my blog article today will focus on my Monday Setups for this week. I'll return to my "normal" blog postings regarding market action, outlook, historical tendencies, etc. tomorrow.

Monday, August 20th

Since reporting excellent quarterly earnings results in mid-June,...

READ MORE

MEMBERS ONLY

Healthcare Sector Takes the Lead

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Health Care SPDR (XLV) moved into the sector lead with a 52-week high this week. As far as the charts are concern, the Real Estate SPDR (XLRE) and XLV are the only two sector SPDRs hitting fresh highs. XLV gets the edge because it is up around 11% year-to-date,...

READ MORE

MEMBERS ONLY

Weekly Market Review and Outlook - Defensive Sectors Lead in August

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Market Overview.

* A Bull Market for the S&P 500.

* IJR Leads IWM and the Rest.

* S&P 500 Leads New High List.

* Tech, Healthcare and Industrials Lead New High List.

* XLC Starts Trading.

* XLU and IYR Extend Breakouts.

* Cloud Computing ETF Forms Bull Flag.

* Regional Bank SPDR...

READ MORE

MEMBERS ONLY

Facebook: Next Stop Is $150

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Facebook (FB) has been an internet and stock market leader for the last five years, but I believe the run is over. Not only did FB report quarterly revenues that missed Wall Street consensus estimates for the first time in more than four years, but they also lowered future operating...

READ MORE

MEMBERS ONLY

This Week's Scoreboard Shake Up - Momentum Weakens

by Erin Swenlin,

Vice President, DecisionPoint.com

This week the market was rocking and rolling with large price swings. The DecisionPoint Scoreboards reflect new negative momentum for each of the indexes, but after logging those Price Momentum Oscillator (PMO) SELL signals, the market did an about-face and began to pull PMOs back up or slow their descent....

READ MORE

MEMBERS ONLY

Residential Deconstruction

by Bruce Fraser,

Industry-leading "Wyckoffian"

Charts are sometimes a mish-mash of contrary messages. As a general rule Wyckoffians will attempt to avoid these situations. But they can be valuable case studies. Residential Construction has been a Relative Strength (RS) laggard during all of this year after a surging climactic run in 2017. See the classic...

READ MORE

MEMBERS ONLY

Staying on the Right Side of the Market

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The first rule of trading is to stay on the right side of the broad market trend. There are different indexes and indicators we can use to determine the broad market trend, but few are as efficient as the S&P 500 and its 12-month EMA.

The chart below...

READ MORE

MEMBERS ONLY

Life After Earnings

by John Hopkins,

President and Co-founder, EarningsBeats.com

p.p1 {margin: 0.0px 0.0px 15.0px 0.0px; font: 12.0px Helvetica; color: #000000; -webkit-text-stroke: #000000} p.p2 {margin: 0.0px 0.0px 0.0px 0.0px; line-height: 14.0px; font: 12.0px Helvetica; color: #000000; -webkit-text-stroke: #000000} p.p3 {margin: 0.0px 0.0px 0.0px...

READ MORE

MEMBERS ONLY

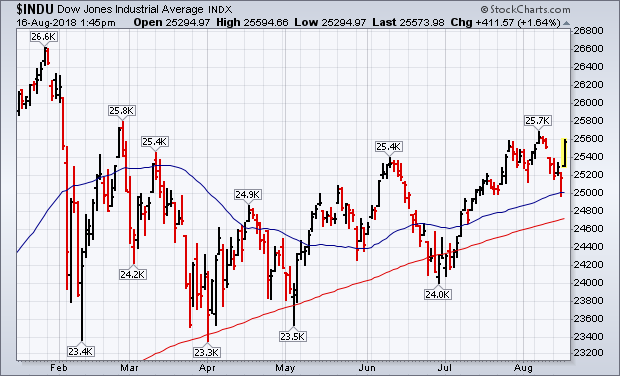

Stocks in Strong Rebound After Surviving Test of 50-Day Averages Yesterday

by John Murphy,

Chief Technical Analyst, StockCharts.com

Editor's Note: This article was originally published in John Murphy's Market Message on Thursday, August 16th at 2:12pm ET.

U.S. stock indexes are having an unusually strong day. Chart 1 shows the Dow Jones Industrial Average climbing more than 400 points (1.6%) in...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: Pushing New Highs, but Volume Not Impressive

by Carl Swenlin,

President and Founder, DecisionPoint.com

On an options expiration week we normally expect low volatility, and that is what we got this week. Despite somewhat dramatic, but opposite, moves on Wednesday and Thursday, the SPY trading range for the week was a little over two percent, and the difference between the weekly closing high and...

READ MORE

MEMBERS ONLY

Five Advantages Individual Investors Have Over Institutional Investors

by Gatis Roze,

Author, "Tensile Trading"

The walls of advantage once held by institutional traders over individual investors have come crashing down. Emerging from the dust, there now marches an entire army of real advantages that individual investors hold over their formerly superior big brothers.

In the worlds of fundamental information, charting tools and trading costs,...

READ MORE

MEMBERS ONLY

Trading Losses Are Not A Problem, But BIG Trading Losses Are

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Note

I'll be traveling and on vacation this week, so my blog articles will focus on very brief topics regarding current market themes or my own trading strategies. I'll return to my "normal" blog postings regarding market action, outlook, historical tendencies, etc. when I...

READ MORE