MEMBERS ONLY

Building a Rules-Based Trend Following Model - 13

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I may seem to be wandering around when it comes to this series on model building, but I think that keeps the interest a little higher; maybe not. Rules and guidelines are a critical element to a good trend following model; in fact, any type of model. Once you have...

READ MORE

MEMBERS ONLY

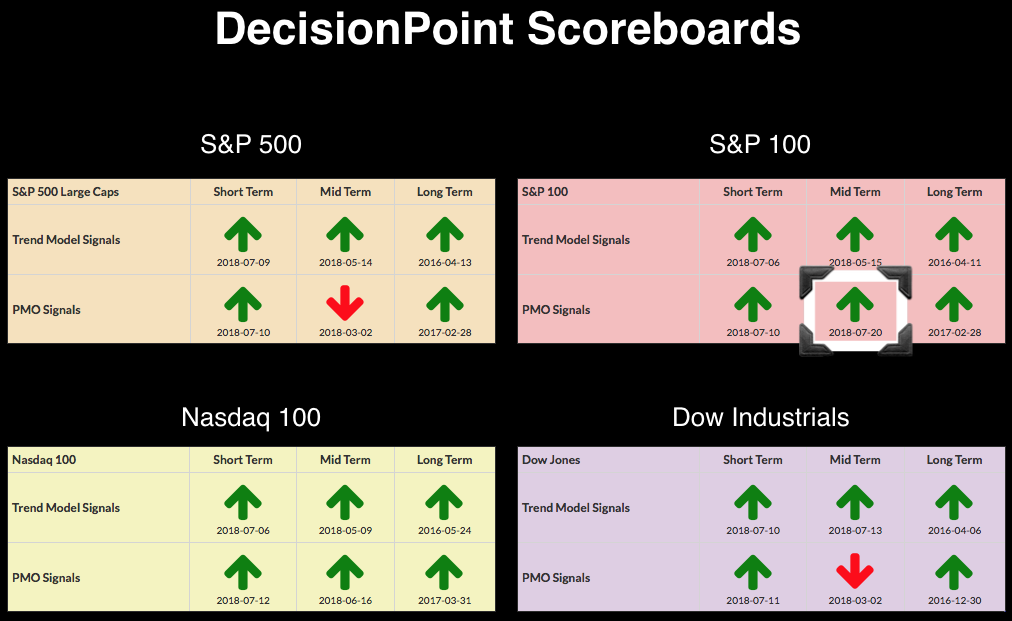

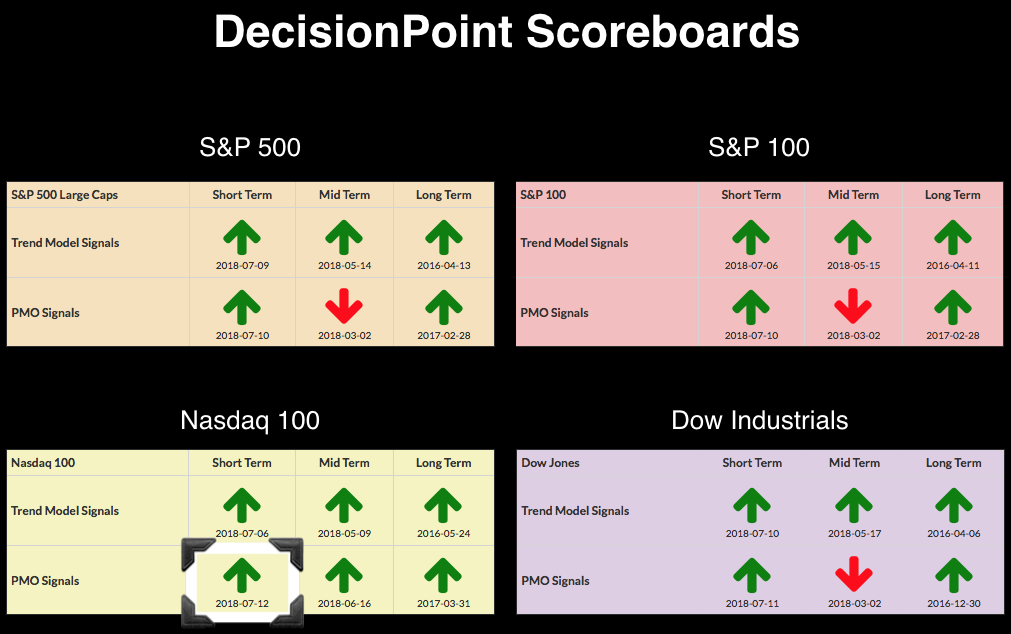

Stubborn Weekly Momentum SELL Signals SPX and Dow

by Erin Swenlin,

Vice President, DecisionPoint.com

My expectation for week end was two new weekly PMO BUY signals. Instead we got only one. The SPX missed its weekly PMO BUY signal by hair or technically, by two one-hundredths of a point. The OEX managed to squeak its out and the Dow is finally seeing a possible...

READ MORE

MEMBERS ONLY

Ten-Year Treasury Yield Is Still Testing Overhead Resistance

by John Murphy,

Chief Technical Analyst, StockCharts.com

Editors Note:This article was originally published in John Murphy's Market Message on Thursday, July 19th at 1:46pm ET.

The monthly bars in Chart 1 shows the 10-Year Treasury Yield ($TNX) forming a major bottoming pattern that started six years ago (2012). Its monthly MACD lines (bottom...

READ MORE

MEMBERS ONLY

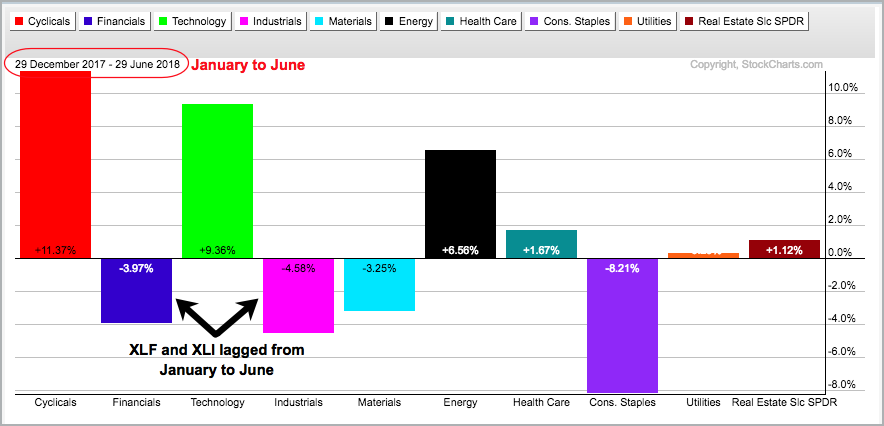

Two Key Sectors Move from Laggards to Leaders

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

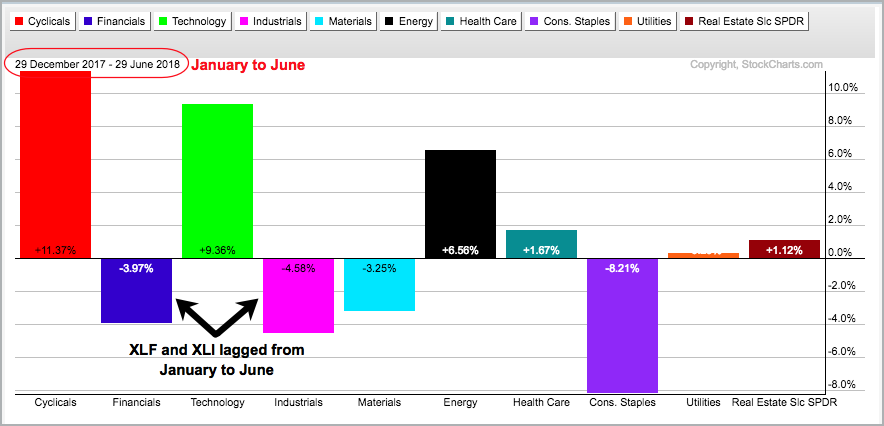

The Financials SPDR (XLF) and Industrials SPDR (XLI) weighed on the broader market the first six months of the year, but perked up in July and started to show some upside leadership.

The PerfChart below shows the percentage change for the ten sector SPDRs from December 29th to June 29th,...

READ MORE

MEMBERS ONLY

Fresh Trading Opportunities as Earnings Season Shifts into High Gear

by John Hopkins,

President and Co-founder, EarningsBeats.com

Traders have been waiting patiently for Q2 earnings season to begin and now they need to wait no longer. Already we've heard from some of the largest banks in the world and on Tuesday we heard from EBAY, who came up short and then Thursday from one of...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: Dull Options Expiration Week; Next Week May Be More Exciting

by Carl Swenlin,

President and Founder, DecisionPoint.com

I normally expect options expiration week to be dull, and with this week's range of less than one percent, I was not disappointed. I was also looking for a short-term pullback, but that did not materialize (probably because of options expiration); however, our array of indicators say that...

READ MORE

MEMBERS ONLY

CHART ANALYSIS STILL FAVORS A HIGHER TEN-YEAR TREASURY YIELD -- WEAKER FOREIGN YIELDS HAVE HELD THE TNX BACK -- RISING RATES HURT CONSUMER STAPLES WHILE FAVORING CYCLICALS -- FALLING COMMODITY PRICES HAVE BOOSTED BOND PRICES -- OVERBOUGHT DOLLAR WEAKENS

by John Murphy,

Chief Technical Analyst, StockCharts.com

THE MAJOR TREND STILL FAVORS HIGHER BOND YIELDS... Yesterday's message showed the 7-10 Year T-bond iShares (IEF) testing important overhead resistance at its spring highs and 200-day moving average, and the impact bond direction usually has on rate-sensitive sectors like financials, utilities, and REITS. Rising rates usually favor...

READ MORE

MEMBERS ONLY

Your Dashboard to Navigating the Markets - ChartPack Update #20 (Q2, 2018)

by Gatis Roze,

Author, "Tensile Trading"

There’s a legendary tale in automobile circles how in the 1990s the executives at General Motors got their design engineers to focus on what was most important. They wanted to erase all their preconceived notions and assumptions about building cars. They blindfolded all the engineers and lead them into...

READ MORE

MEMBERS ONLY

Weekly Market Review and Outlook (with Video) - A Changing of the Guard?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Weekly Performance Review.

* Elevator Down and Stairs Up.

* The Big Four are in Sync.

* A Changing of the Guard?

* Big Wedges Remain for XLI and XLF.

* ITB and XHB Firm at Key Retracements.

* What is the Deal with Bonds?

* Notes from the Art's Charts ChartList.

...There is an...

READ MORE

MEMBERS ONLY

TREASURY PRICES ARE TESTING OVERHEAD RESISTANCE -- RISING BOND PRICES ARE BOOSTING UTILITIES AND REITS AT THE EXPENSE OF FINANCIALS -- FINANCIAL/UTILITY RATIO HAS BEEN FALLING THIS YEAR -- BUT IS TESTING TRENDLINE SUPPORT

by John Murphy,

Chief Technical Analyst, StockCharts.com

BOND ETF IS TESTING OVERHEAD RESISTANCE ... Treasury bond prices have been climbing since the middle of May. And they've reached an important chart point. Chart 1 shows the 7-10 Year Treasury Bond iShares (IEF) in the process of testing overhead resistance along their early April/late May peaks,...

READ MORE

MEMBERS ONLY

Financials Appear Poised To Regain Their Leadership

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, July 18, 2018

We were mostly higher on Wednesday, although gains were slight. One exception was the NASDAQ, which finished less than one point lower. Otherwise, we saw green. Despite mostly higher prices, leadership really came from just two sectors - financials (XLF, +1.60%) and...

READ MORE

MEMBERS ONLY

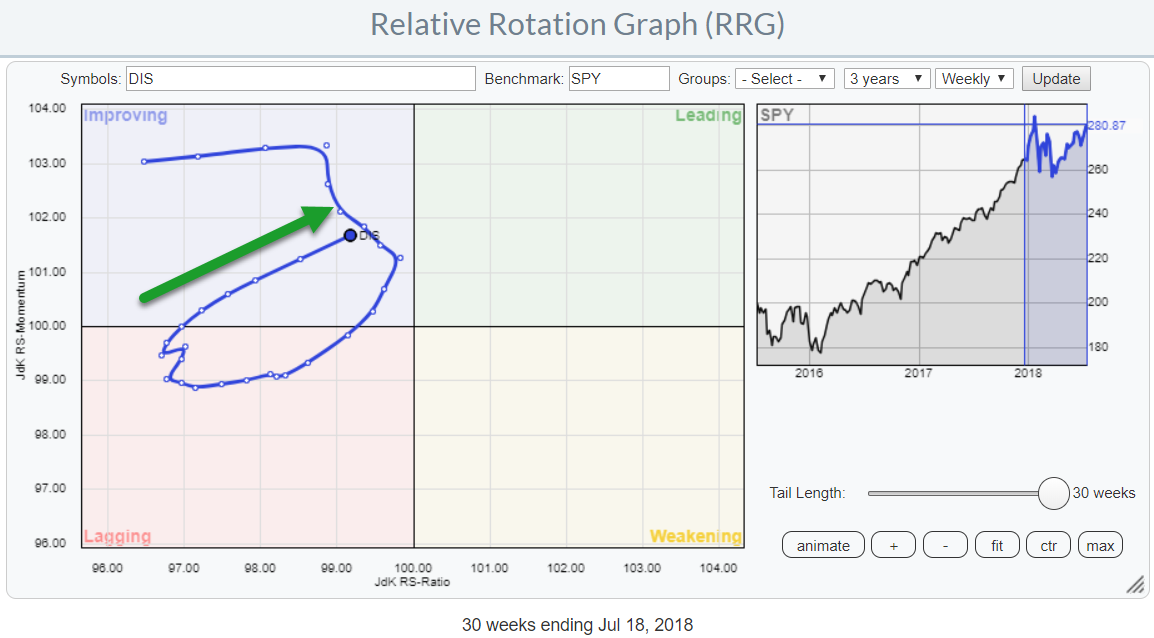

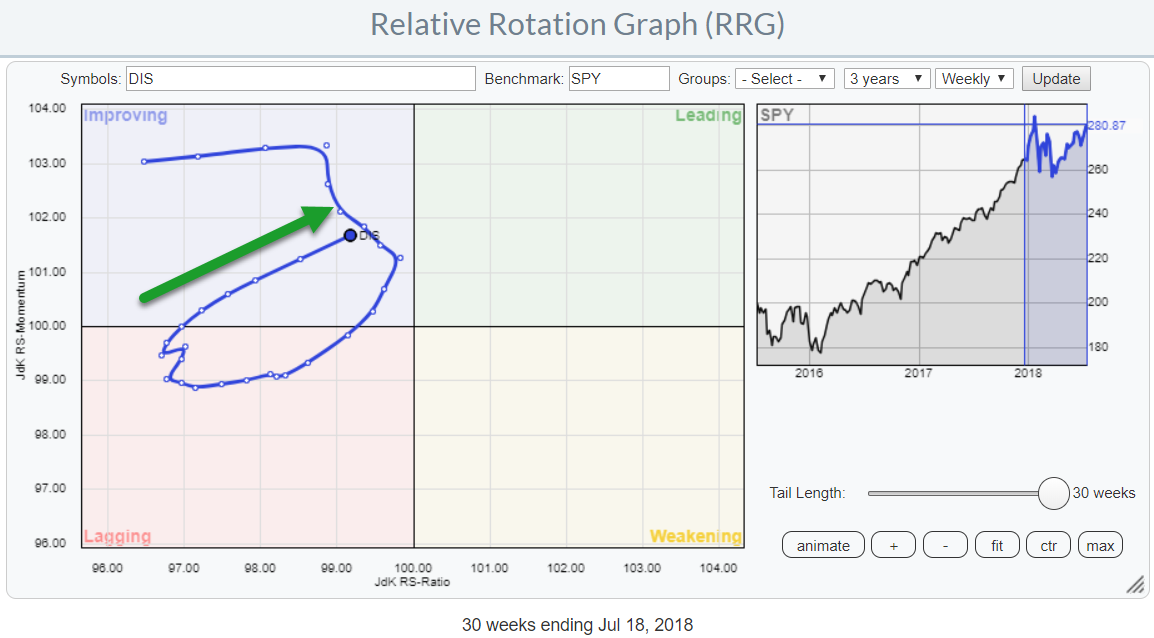

Is Walt Disney (DIS) ready to rumble?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

While working on my previous article, one stock, in particular, drew my attention. I only casually addressed it in that article as I wanted to do a more extensive review separately.

We are talking about Walt Disney (DIS).

In this post, I will try to build a longer-term picture with...

READ MORE

MEMBERS ONLY

Using the %Above Indicators for Signals and Sector Rankings

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* A Breadth Burst for the Finance Sector.

* Industrials and Finance Lead July Surge.

* Ranking by %Above 200-day EMA.

* Finding these Symbols.

... Signals from %Above Indicators

... The percentage of stocks above the 20-day EMA is a short-term breadth indicator that measures participation. StockCharts calculates and publishes this indicator for the major...

READ MORE

MEMBERS ONLY

DP Alert: Short-Term Indicators Back to Neutral - PMO SELL Signal for Bonds

by Erin Swenlin,

Vice President, DecisionPoint.com

The quick drop of short-term indicators is a case in point on how "oscillators must oscillate" and that overbought conditions in a strong bull market can unwind through consolidation and are therefore, not necessarily a precursor to doom and gloom. I've been writing about these indicators...

READ MORE

MEMBERS ONLY

Is Gold In A Bear Market Or A Buying Opportunity?

by Martin Pring,

President, Pring Research

* Long-term trends rolling over to the downside

* A rising dollar does not help gold

* Gold Under-performing stocks is not a good thing….for gold

* Gold showing bear market characteristics

Long-term trends rolling over to the downside

The recent sell off in the price of gold has quite frankly surprised me....

READ MORE

MEMBERS ONLY

A Momentum Divergence for the Regional Bank SPDR

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

I do not use bullish and bearish divergences with momentum indicators very often because they usually form in the direction of the bigger trend. For example, most bearish divergences form in uptrends and most bullish divergences form in downtrends. I trade in the direction of the bigger trend and prefer...

READ MORE

MEMBERS ONLY

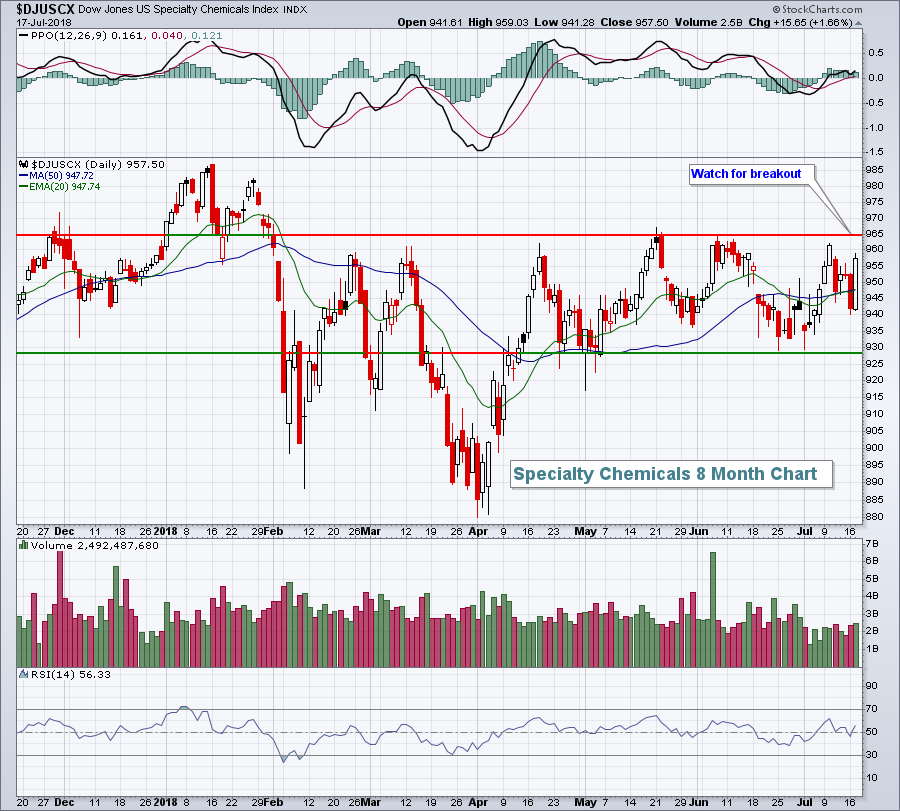

Consider This Materials Stock That Just Broke Out From Bullish Inverse Head & Shoulders Pattern

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Note

I will be on a short mini-vacation beginning Friday, July 20th. Therefore, I will not be writing a Trading Places blog article that day. I will be back on Monday, however, with my latest recap and thoughts on the stock market. If you enjoy my blog, please subscribe...

READ MORE

MEMBERS ONLY

Biotech ETFs Near New Highs, Fab Five Lead QQQ and Four Stock Setups

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Biotech ETFs Near New Highs

* Fab Five Lead QQQ Higher.

* SOXX Turns Up within Triangle.

* A Mean-Reversion Setup for Analog Devices.

* Two Inside Days for Cisco.

* A Flag Breakout for ICE.

* Perkin Elmer Perks Up.

... IBB and XBI Near New Highs

... The Biotech iShares (IBB) surged over 15% the last...

READ MORE

MEMBERS ONLY

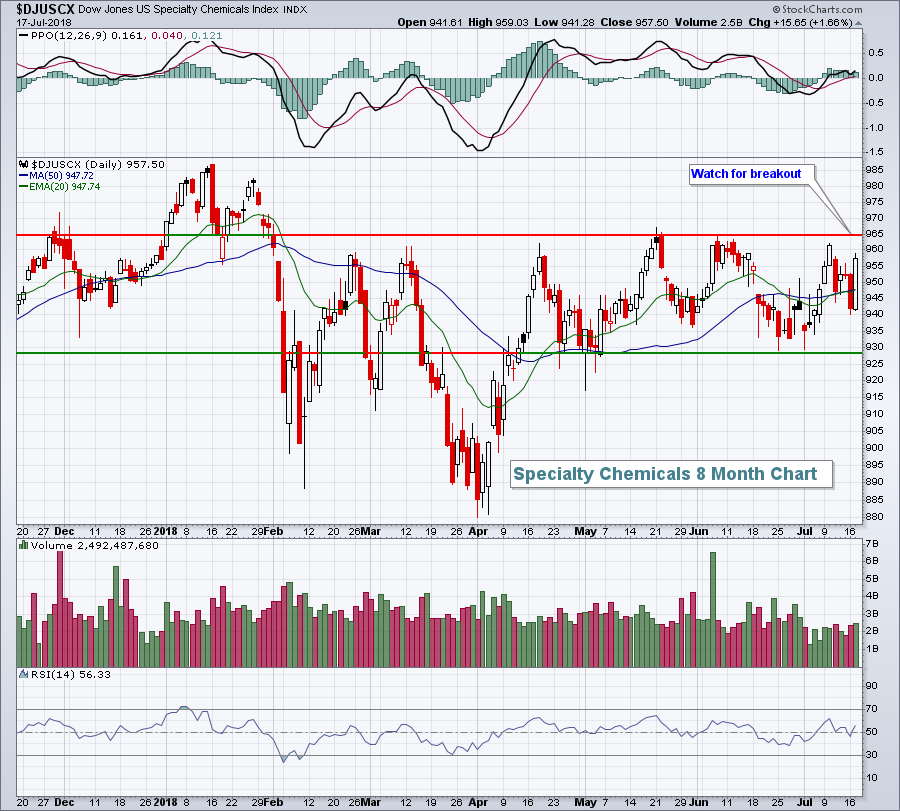

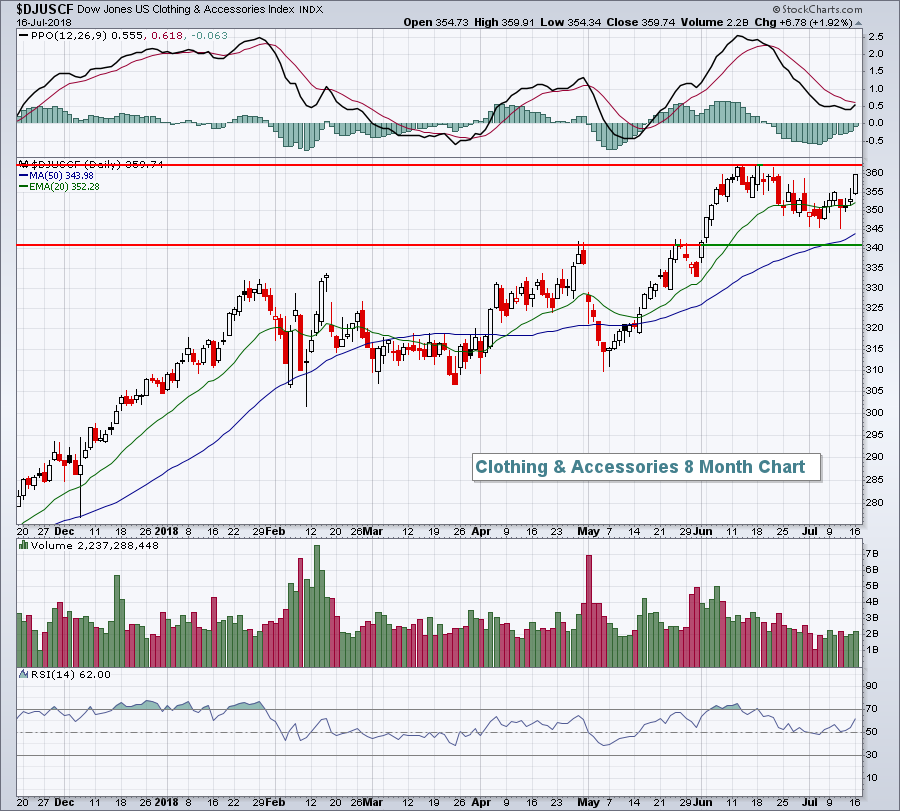

Materials Sector Picks Up Momentum

by Erin Swenlin,

Vice President, DecisionPoint.com

Today, both the Materials SPDR (XLB) and the equal-weight Materials ETF (RTM) posted new Price Momentum Oscillator (PMO) BUY signals. With talk of a trade war, many investors believe that the Materials sector could provide a decent hedge. I don't know if that is true, but I do...

READ MORE

MEMBERS ONLY

STOCK INDEXES ARE STILL CLIMBING -- NASDAQ HITS NEW RECORD -- S&P 500 TRADES AT FIVE-MONTH HIGH -- CHIP STOCKS FINDING SUPPORT ABOVE 200-DAY LINE -- FINANCIALS ARE BOUNCING AGAIN -- BANK OF AMERICA LEADS BANKS HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

MAJOR STOCK INDEXES ARE STILL CLIMBING ... All three of the major U.S. stock indexes are building on last week's gains. Chart 1 shows the Dow Industrials moving further above 25K and nearing a test of its June high. The Dow is being led higher by Johnson &...

READ MORE

MEMBERS ONLY

Netflix Slammed After Missing Revenue And Subscriber Estimates

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, July 16, 2018

The Dow Jones saw buying late in Monday's session, pushing this index of giants into positive territory. Leadership was clear. Large money center banks performed well and JP MorganChase (JPM) was easily the best perfoming Dow Jones stock, gaining nearly 4%...

READ MORE

MEMBERS ONLY

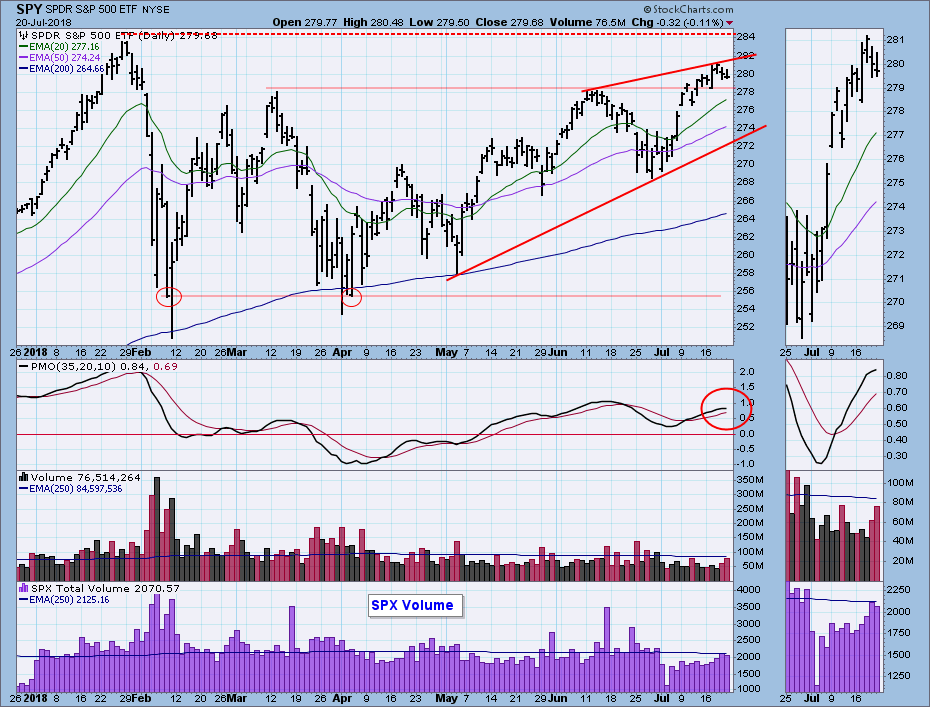

Healthcare Leads as Industrials and Finance Attempt Bounces

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

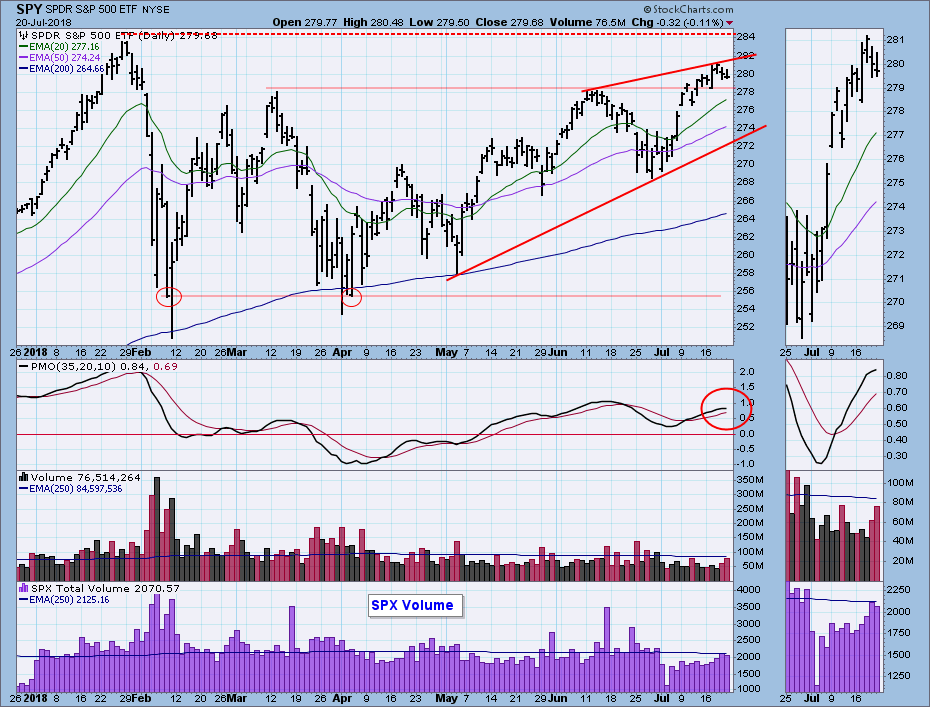

* SPY Extends Laborious Uptrend.

* Back in the Saddle.

* QQQ Maintains Leadership with New High.

* Healthcare Takes the Lead in July.

* Industrial Sector Pulls Ahead of Finance.

* Aerospace & Defense ETF Turns Up within Range.

* Mind the Gap in the Broker-Dealer iShares...

... The major index ETFs were in long-term uptrends and...

READ MORE

MEMBERS ONLY

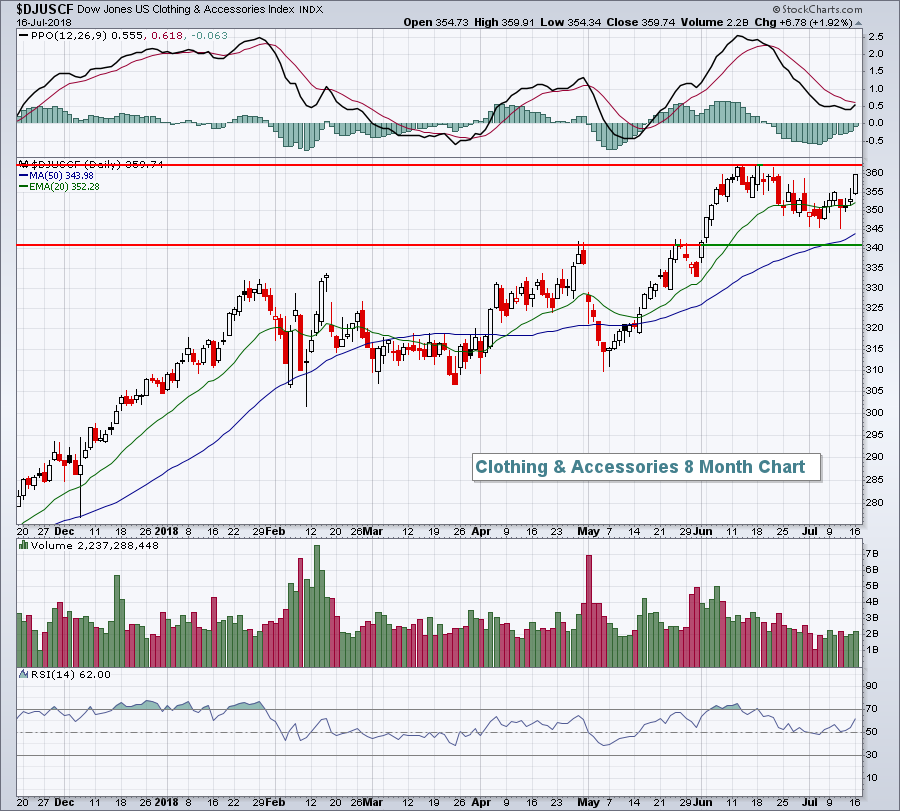

Newest Dow Jones Component Leads Market Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, July 13, 2018

The Dow Jones moved back above 25000 and the S&P 500 cleared 2800 for the first time since February 2nd on the backs of two unlikely heroes. Walgreens Boots Alliance (WBA), the newest member of the Dow Jones, and Walt Disney...

READ MORE

MEMBERS ONLY

Building a Rules-Based Trend Following Model - 12

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I’m going to return to discuss the final part of my Weight of the Evidence. As a reminder this is a collection of price and breadth measures designed to tell me if the Nasdaq Composite is in an uptrend or not. You might want to review some of the...

READ MORE

MEMBERS ONLY

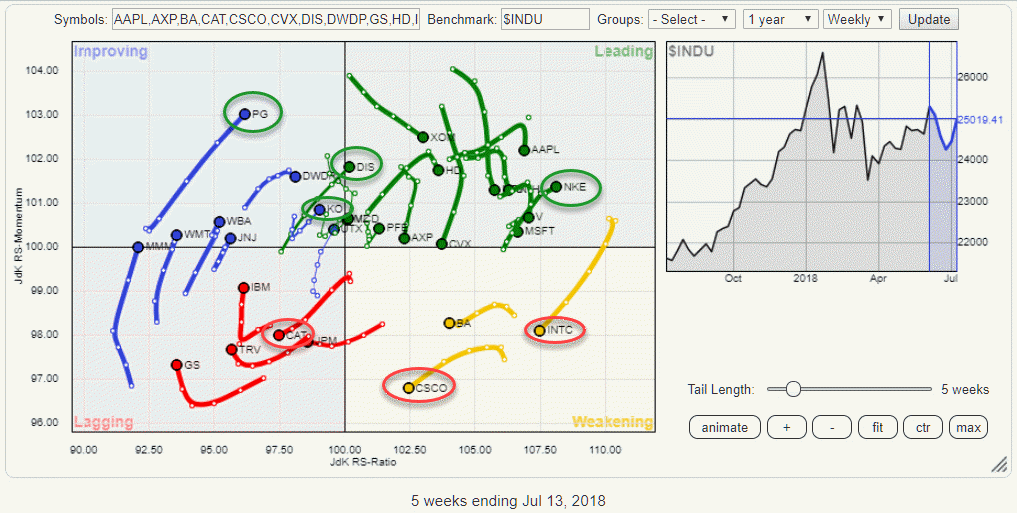

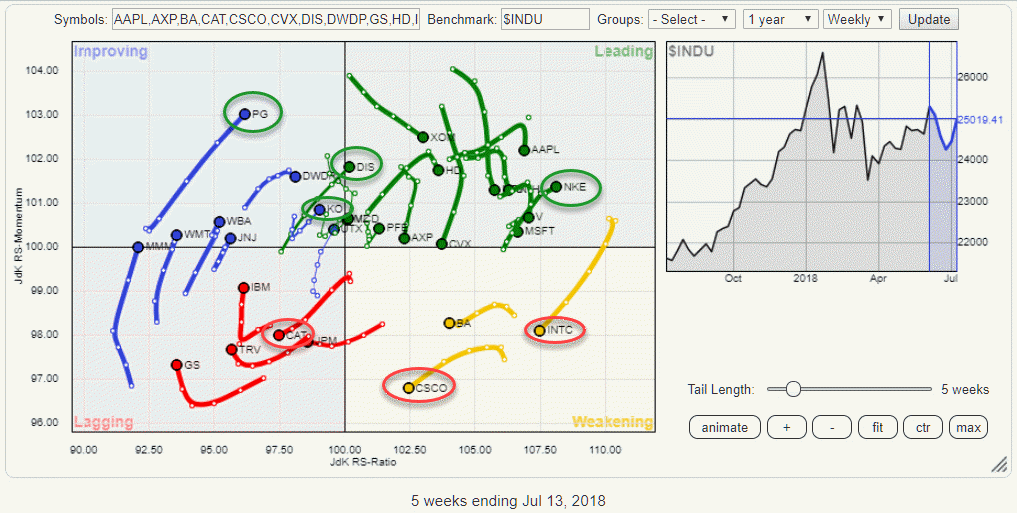

NKE poised for a further rally and outperformance vs $INDU

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Watching the Relative Rotation Graph of the 30 Dow stocks, there are a few observations that can be made.

To begin with, there is a high concentration of stock inside the leading quadrant, including some mega-cap names like AAPL and MSFT and in the improving quadrant. The bottom half of...

READ MORE

MEMBERS ONLY

Tactical Dilemma

by Bruce Fraser,

Industry-leading "Wyckoffian"

While some major indexes have pushed to new high ground recently, the Dow Jones Industrial Average ($INDU) has remained a notable laggard. This creates a tactical dilemma for Wyckoffians. Is the weaker Dow Jones Industrial Average offering a ‘tell’ by lagging the broad market? Or is the industrial (thirty) stock...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: Bonds Long-Term BUY Signal

by Carl Swenlin,

President and Founder, DecisionPoint.com

On Friday the Long-Term Trend Model (LTTM) for long bonds (TLT) generated a long-term BUY signal. How that happens is that the 50EMA crosses up through the 200EMA, an event more commonly known as the "Golden Cross," because big money is sure to follow (just kidding). When we...

READ MORE

MEMBERS ONLY

STOCKS ARE HAVING A POSITIVE WEEK -- THE DOW IS TRYING TO CLOSE OVER 25K -- THE S&P 500 IS CHALLENGING ITS MARCH HIGH - UNITED TECHNOLOGIES, ROCKWELL COLLINS, AND BOEING LEAD A STRONG AEROSPACE GROUP HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 IS CHALLENGING MARCH HIGH ... Stocks are ending the week on a positive note. The Nasdaq hit a new record high yesterday. Today's rally is being led by the Dow and S&P 500. Chart 1 shows the Dow Industrials trying to end above...

READ MORE

MEMBERS ONLY

Internet, Software Break Out To Lead NASDAQ To All-Time High

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, July 12, 2018

Those looking for a bear market to develop were dealt a serious blow on Thursday as the NASDAQ forged to yet another all-time high. The Russell 2000 was on the verge of doing so earlier this week as it reached an intraday all-time...

READ MORE

MEMBERS ONLY

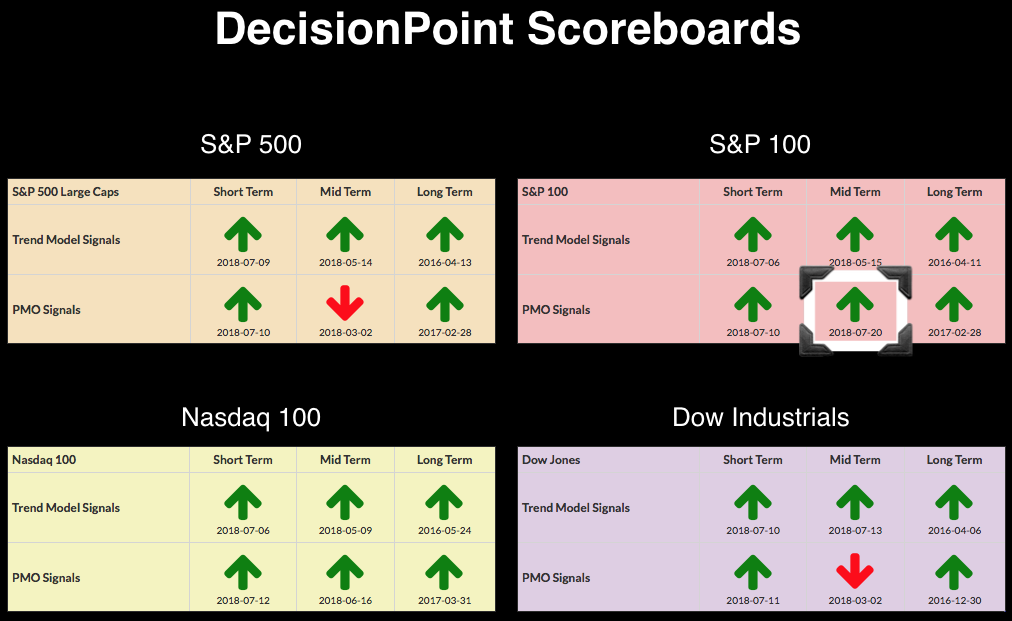

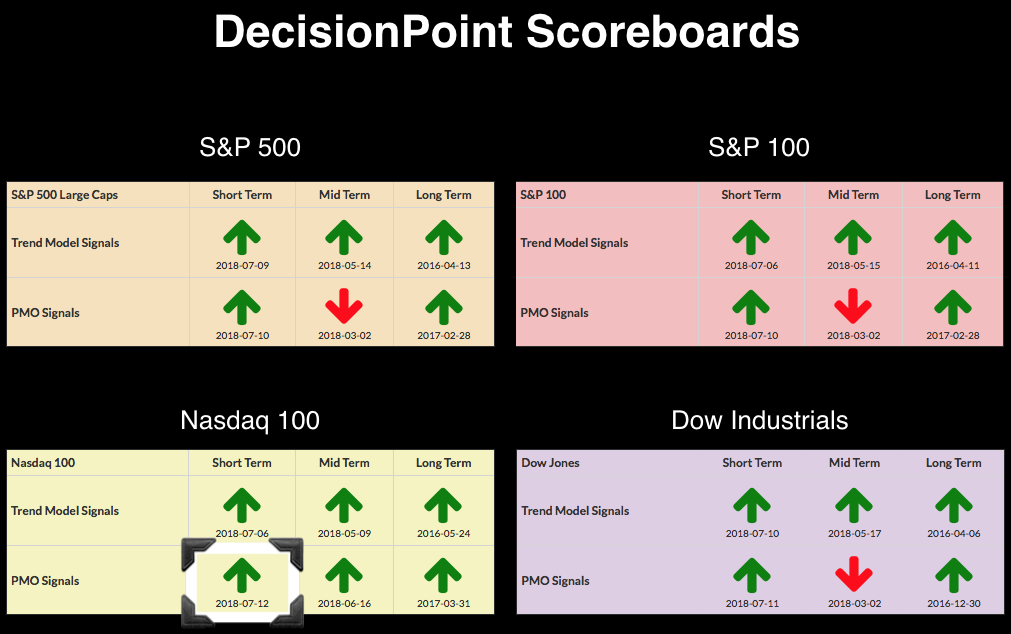

NDX Snags a PMO BUY Signal - NDX ST Indicators Still Very Overbought

by Erin Swenlin,

Vice President, DecisionPoint.com

The NDX killed it today with a 1.69% move higher and logging a new all-time high. The other major Scoreboard indexes managed good numbers, but none above 1% or logging all-time highs. At issue with all of the Scoreboard indexes are extremely overbought short-term indicators. These conditions need to...

READ MORE

MEMBERS ONLY

Bond Yields Showing Some Vulnerability

by Martin Pring,

President, Pring Research

* A look at the primary and secular trends

* Interesting momentum study points to lower bond yields

* Bond Net New Highs set to pounce in either direction

* Slight softening in confidence hints at lower yields

In the June and July editions of my Market Roundup webinars I pointed out the possibility...

READ MORE

MEMBERS ONLY

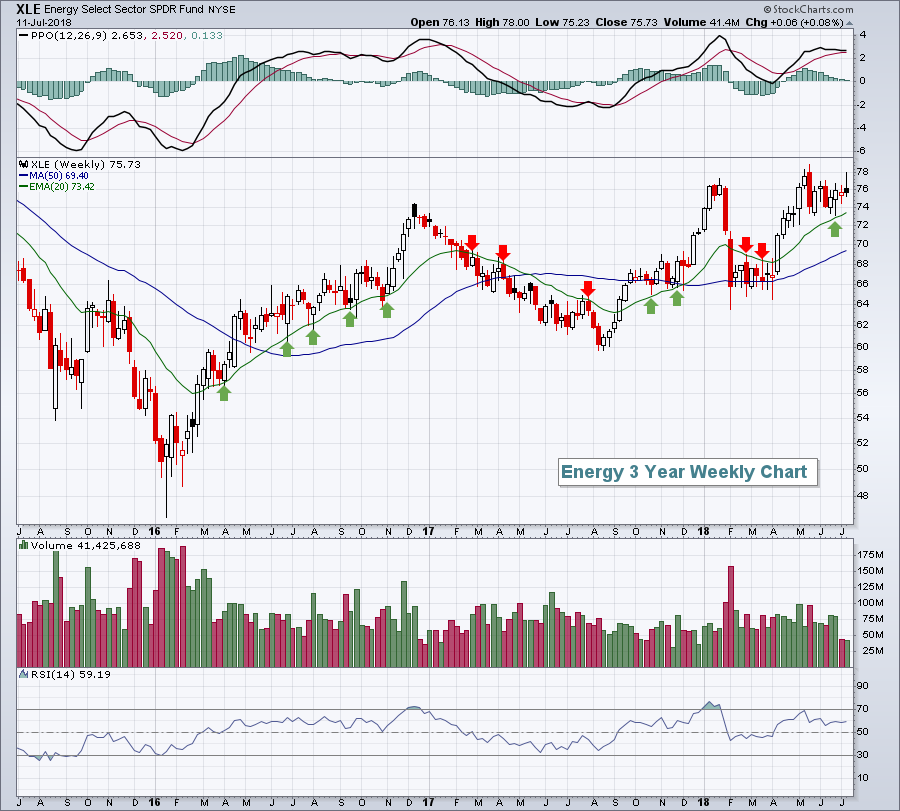

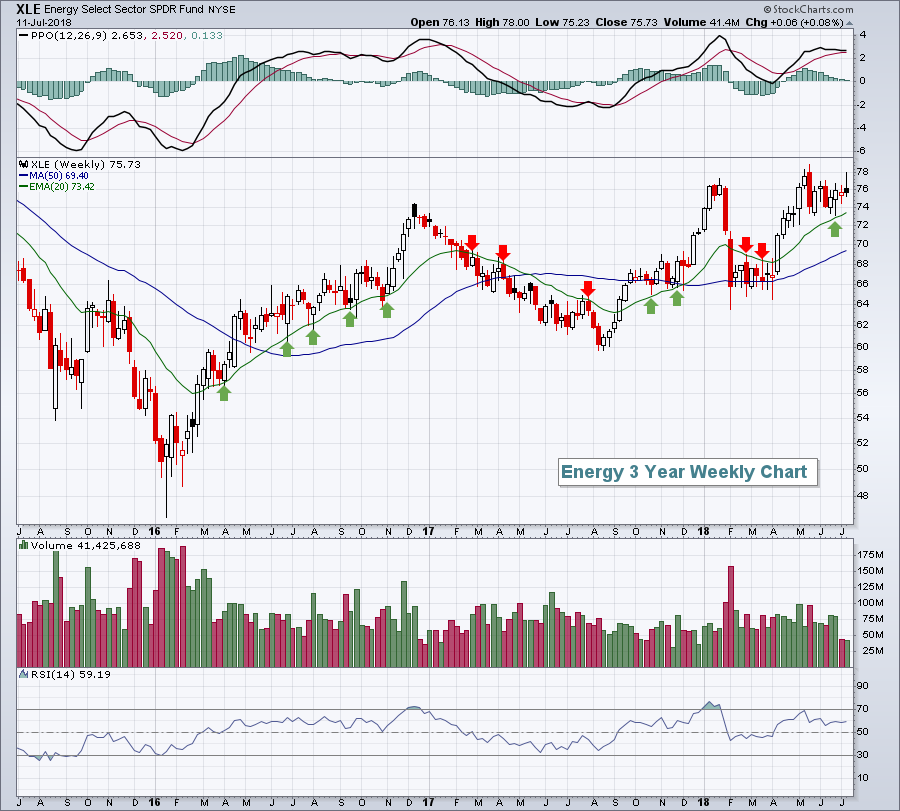

Trade Headlines Spook Traders, But Weak Energy Sector Remains Bullish

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, July 11, 2018

Utilities (XLU, +0.90%) moved higher in an otherwise down day, highlighted by the latest trade headlines in which the U.S. announced another $200 billion in Chinese imports to be subject to a 10% tariff. While the initial reaction was obviously negative,...

READ MORE

MEMBERS ONLY

DP Alert: Dow Squeaks a PMO BUY Signal - ST Indicators Very Overbought

by Erin Swenlin,

Vice President, DecisionPoint.com

I mentioned in yesterday's blog that I was expecting the PMO BUY signals to come in on the Dow and NDX. Well, NDX missed the positive crossover by less than a tenth of a point, but I suspect it'll come in tomorrow barring a particularly bad...

READ MORE

MEMBERS ONLY

DROP IN CHINESE MARKET STARTED WITH JUNE 15 TARIFFS -- SINCE THEN CHINESE STOCKS AND CURRENCY HAVE FALLEN TOGETHER -- AGRICULTURAL COMMODITIES AND BASE METALS PEAKED IN JUNE WITH CHINESE MARKET

by John Murphy,

Chief Technical Analyst, StockCharts.com

MOST COMMODITIES ARE IN THE RED ... Commodity prices have been falling sharply over the last month. And Chart 1 shows where most of the selling has taken place. The black line shows the Invesco Commodity Tracking Fund (DBC) still 4% higher since the start of the year. That's...

READ MORE

MEMBERS ONLY

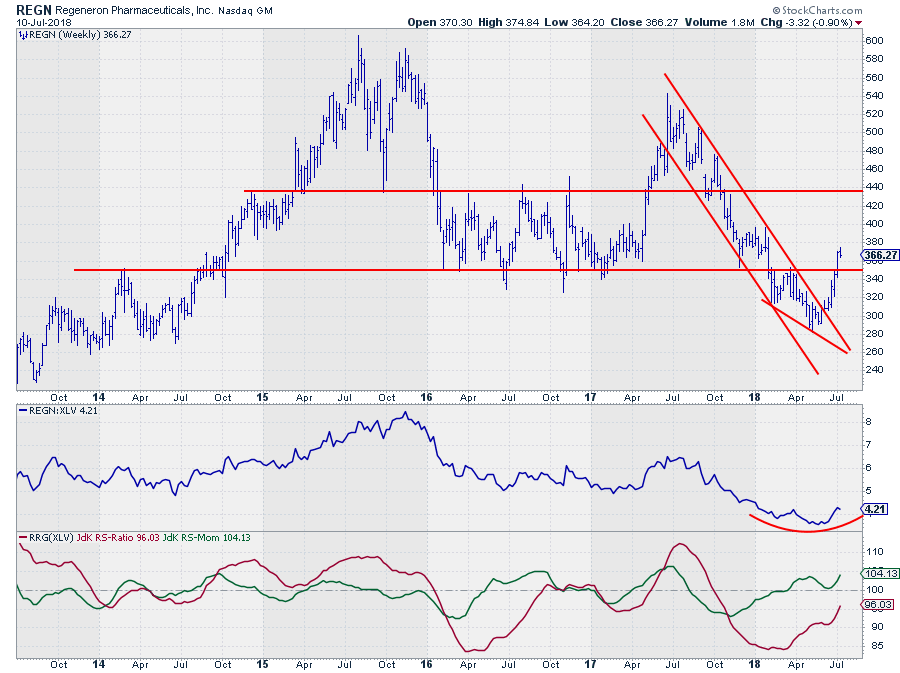

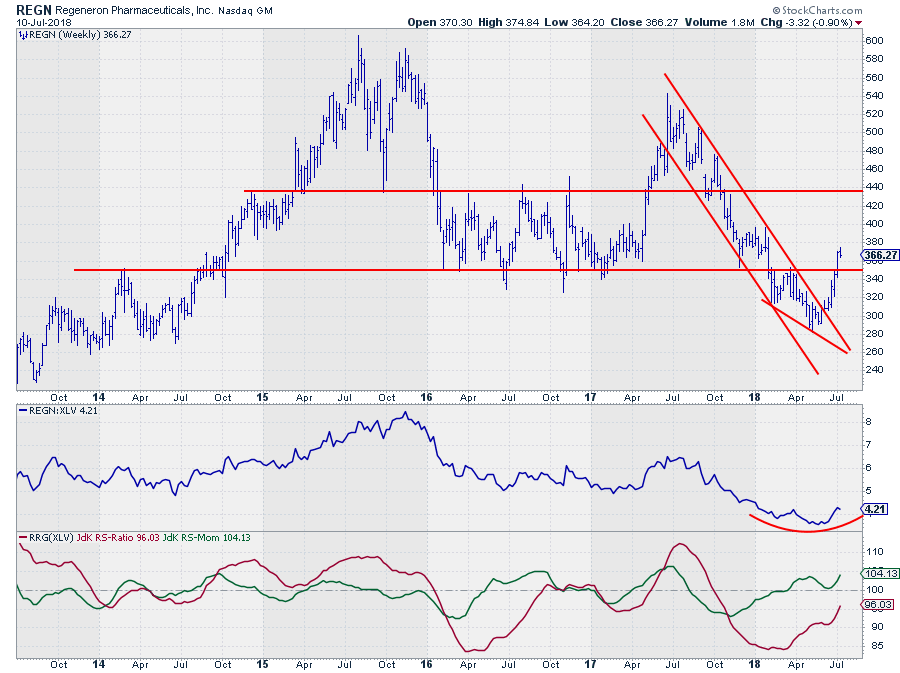

REGN reversing its downtrend?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On the Relative Rotation Graph that shows all members of the Health Care sector (XLV) against the XLV benchmark, REGN stands out in a positive way.

On the weekly RRG, the stock is positioned inside the improving quadrant, close to leading and moving at a strong RRG-Heading while the week-to-week...

READ MORE

MEMBERS ONLY

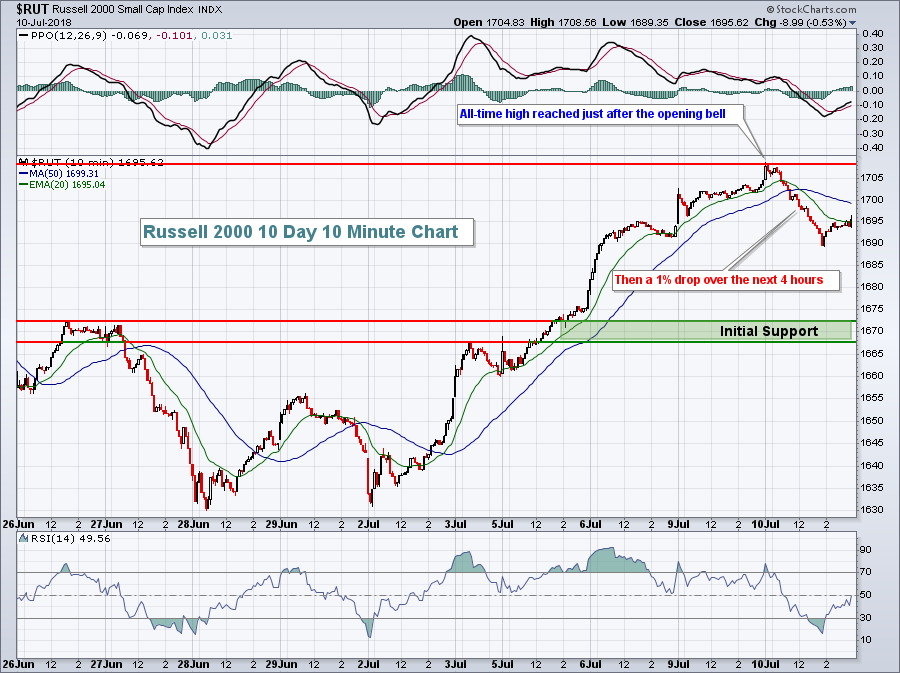

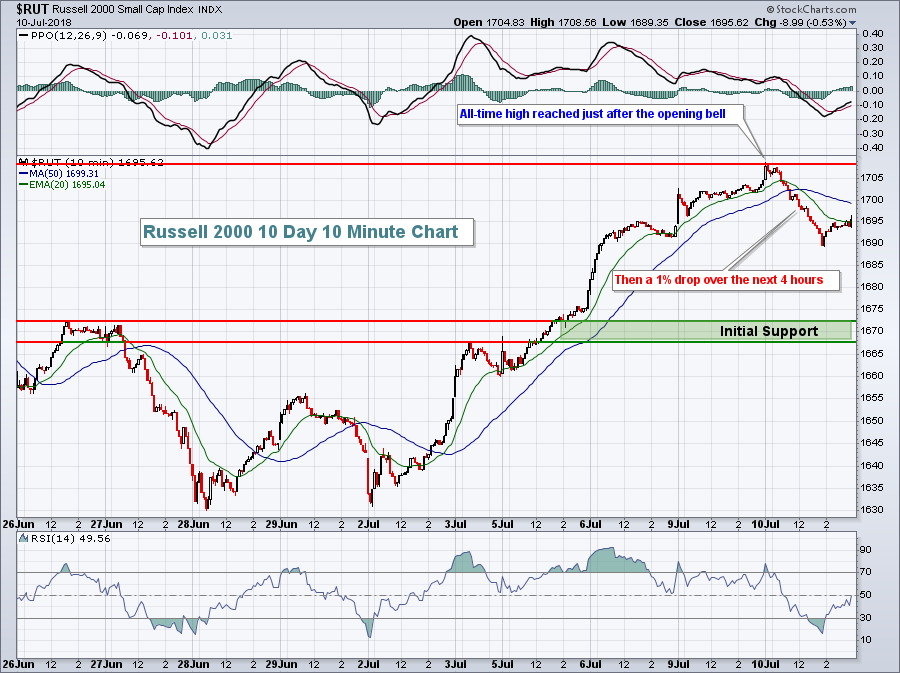

Stocks Reach Key Resistance, Could Be Poised For Selling

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, July 10, 2018

The good news from yesterday is that the Russell 2000 hit an intraday all-time high at 1708.56, edging out intraday highs from June 20th and 21st. The bad news? Sellers took over from there. The record took place in the opening minutes...

READ MORE

MEMBERS ONLY

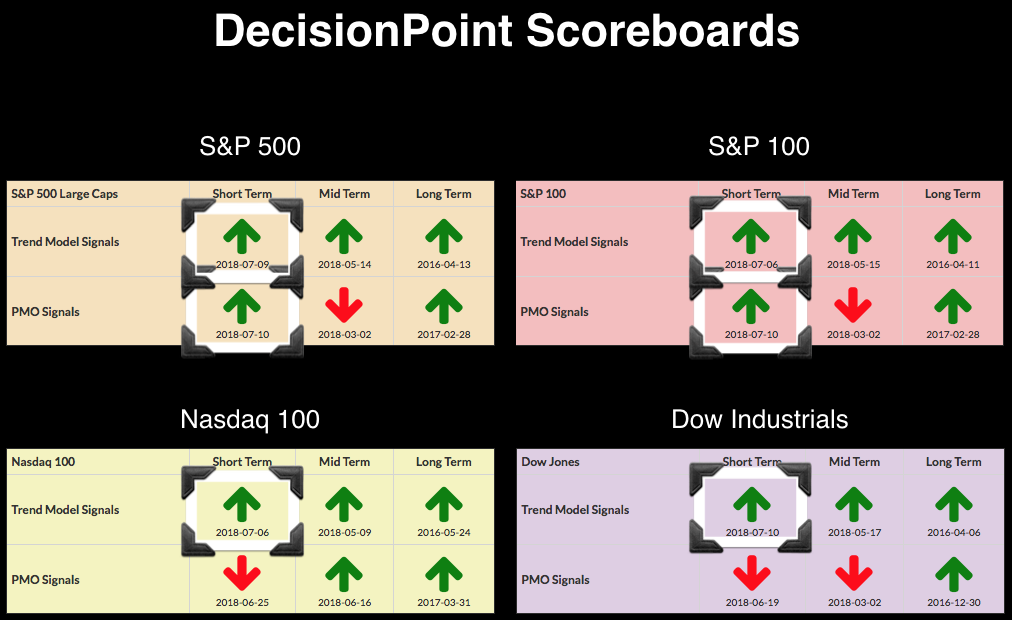

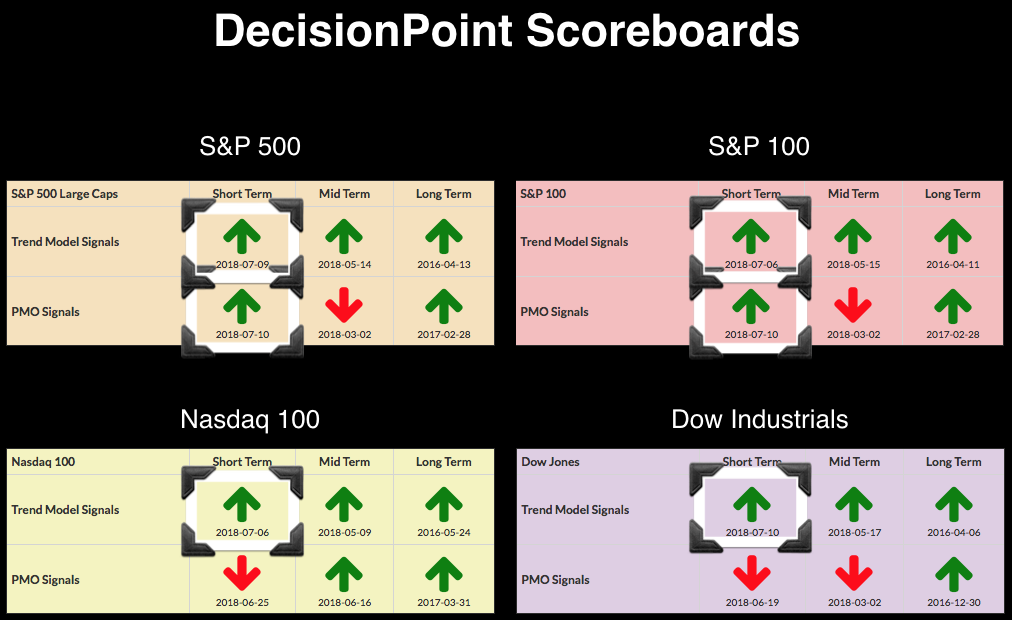

DP Scoreboards Turning Green, But Beware Short-Term Weakness

by Erin Swenlin,

Vice President, DecisionPoint.com

We've had a few signal changes arrive the past few trading days that you should be aware of. While these new green arrows look promising, the DecisionPoint Swenlin Trading Oscillators (STOs) suggest we may experience some short-term weakness before pushing past overhead resistance at June price tops. The...

READ MORE

MEMBERS ONLY

Rising Dollar Will Provide Further Leadership In Small Caps

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

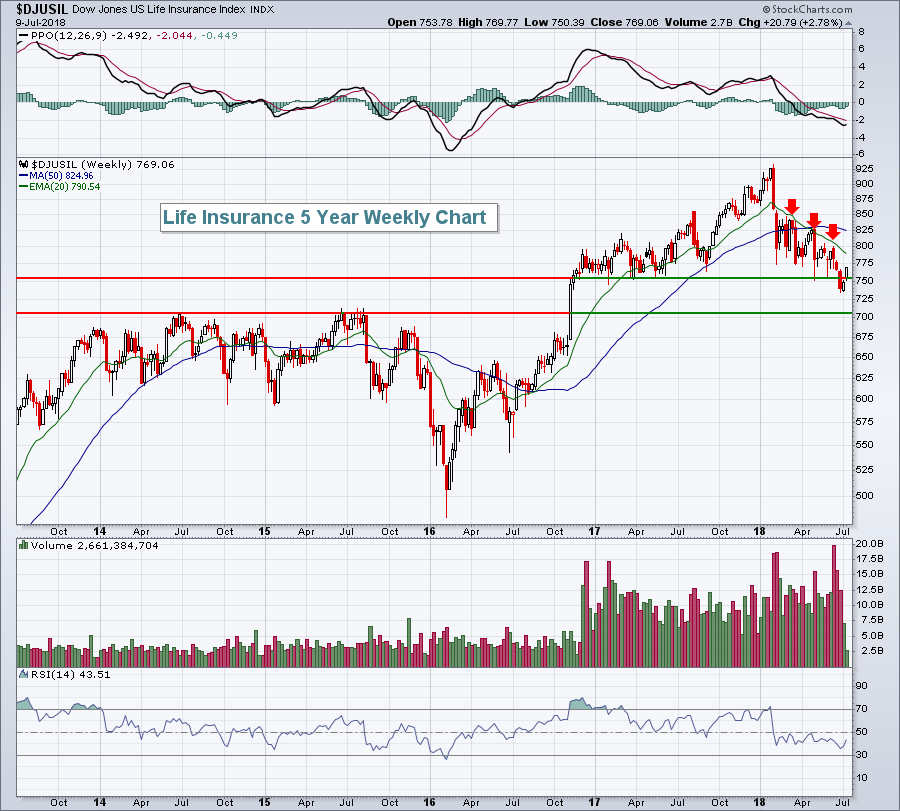

Market Recap for Monday, July 9, 2018

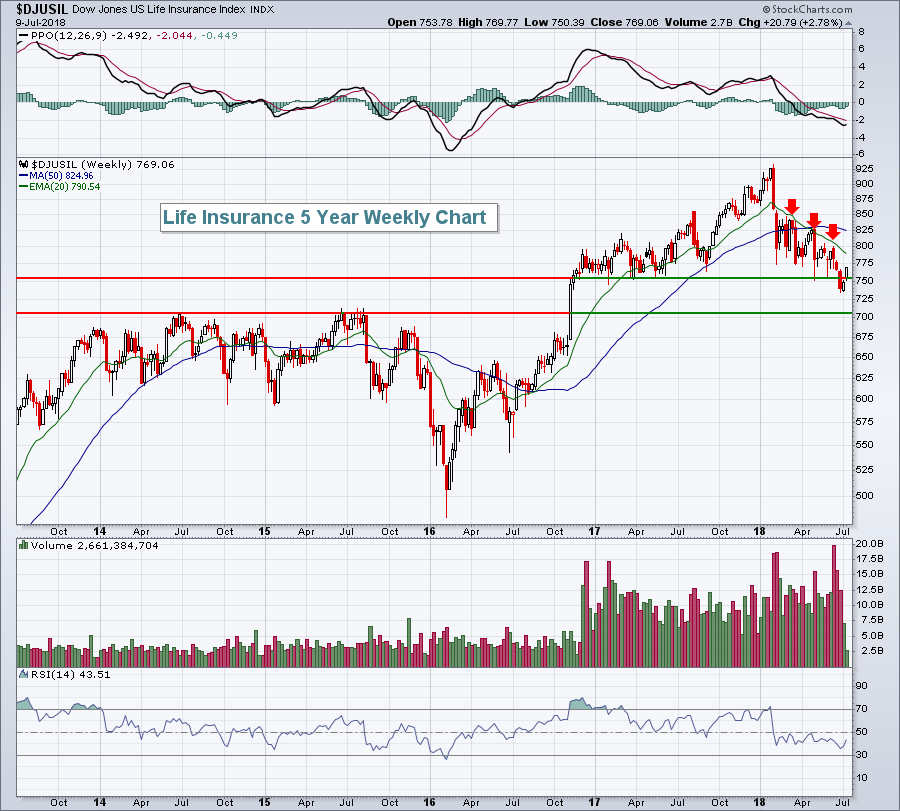

In the famous words of Yogi Berra, it was "deja vu all over again" as financials (XLF, +2.29%) and industrials (XLI, +1.86%) returned to the top of the sector leaderboard. Life insurance ($DJUSIL, +2.78%) and banks ($DJUSBK, +2....

READ MORE

MEMBERS ONLY

FINANCIALS LEAD THE MARKET HIGHER -- FINANCIAL SPDR BOUNCES OFF CHART SUPPORT -- BANK ETFS DO THE SAME WITH REGIONALS IN THE LEAD -- DOW INDUSTRIALS CLEAR THEIR 50-DAY LINE TO LEAD MAJOR STOCK INDEXES HIGHER -- TRANSPORTS ARE ALSO HAVING A STRONG DAY

by John Murphy,

Chief Technical Analyst, StockCharts.com

FINANCIALS ARE THE DAY'S STRONGEST SECTOR ... My June 30 message suggested that the market needed more help from financial stocks and industrials if it was going to gain ground during the second half of the year. It's getting help from both today. Let's start...

READ MORE

MEMBERS ONLY

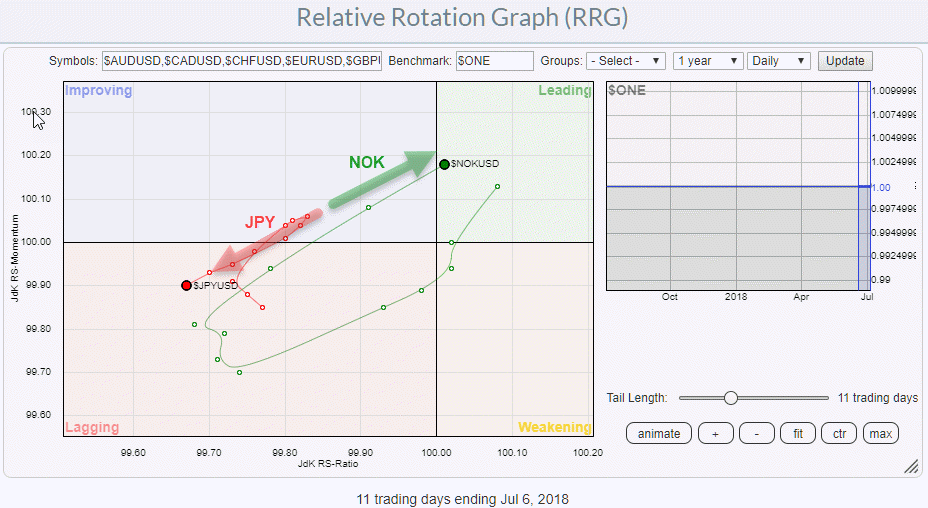

NOK/JPY, a FOREX pair trade from RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

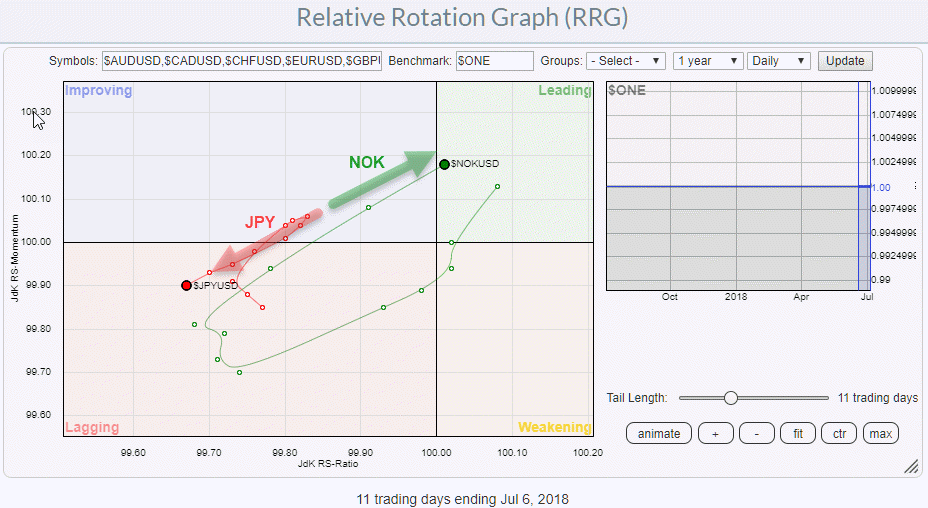

Relative Rotation Graphs are not only used to look at sector-rotation or help with asset allocation decisions but can also help you to pinpoint potential forex trades.

Most currency traders are short-term orientated so the RRG above is a daily chart showing the rotation of the Norwegian Krone and the...

READ MORE