MEMBERS ONLY

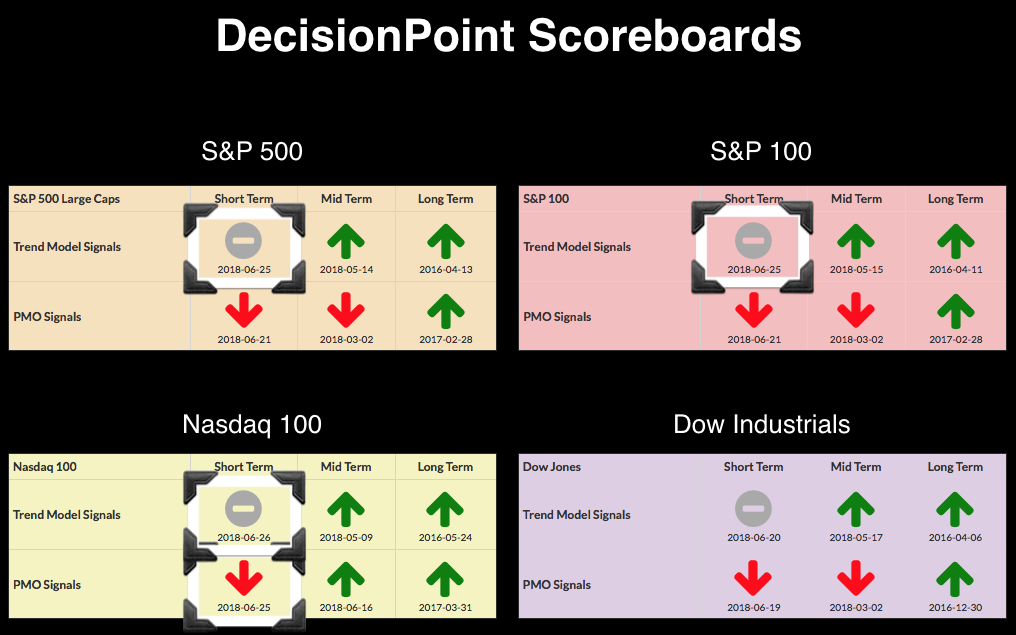

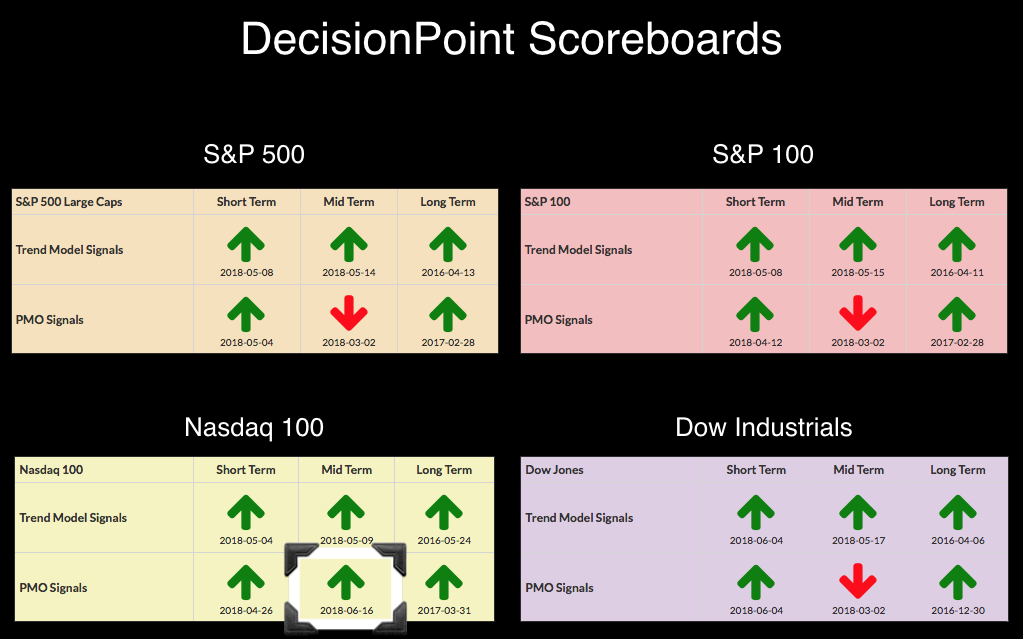

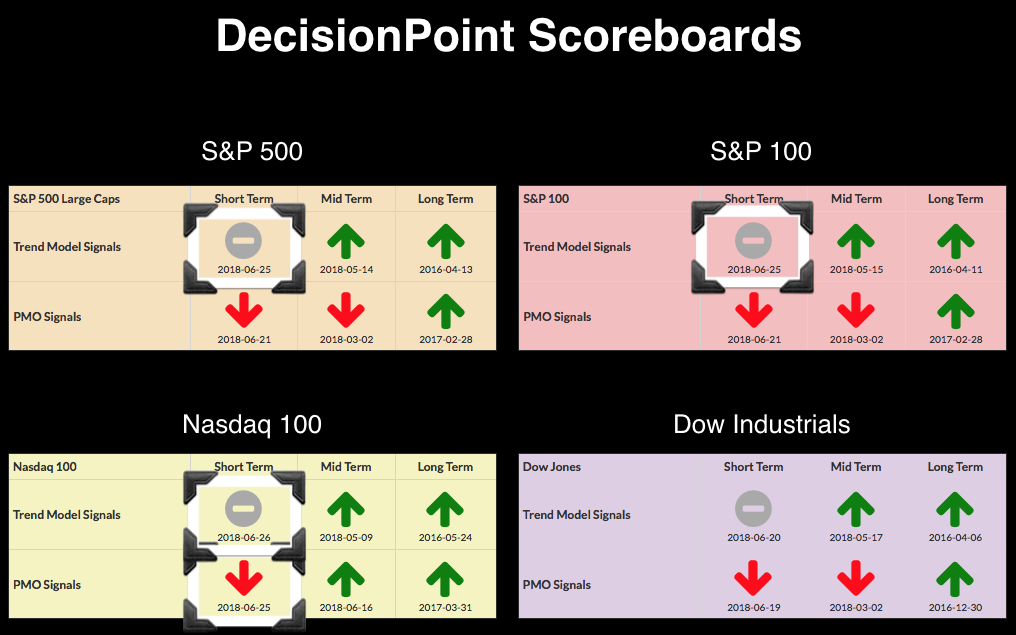

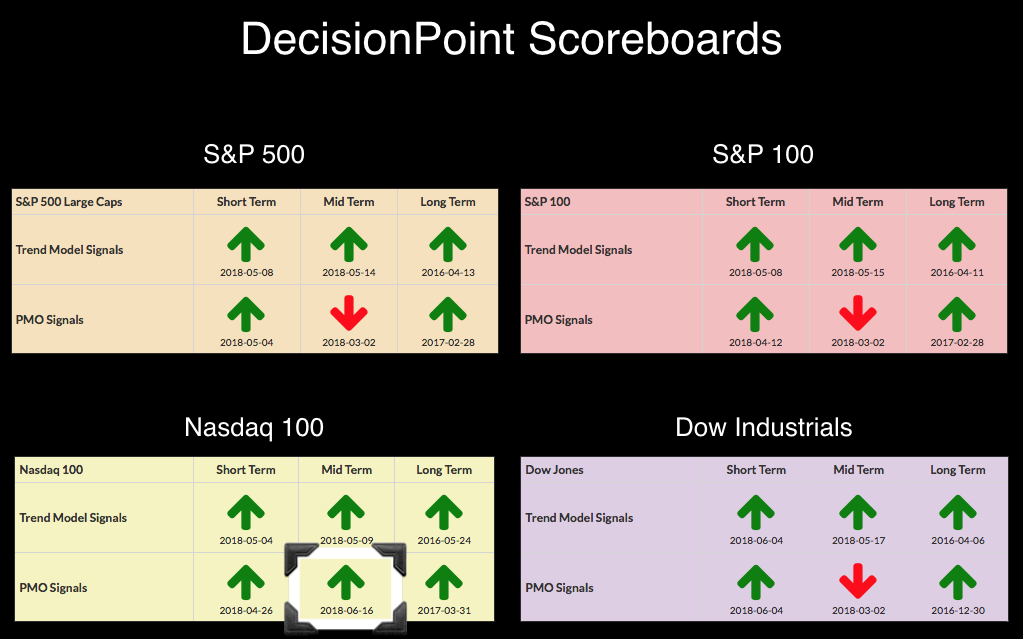

DP Scoreboards Shout Short-Term Weakness

by Erin Swenlin,

Vice President, DecisionPoint.com

Today and yesterday saw four new signal changes on the DecisionPoint Scoreboards. The NDX has now joined in on short-term weakness in price trend and condition. Our short-term market indicators are starting to get oversold, but they continue in their downward trend. I came into this week expecting the SPX...

READ MORE

MEMBERS ONLY

Comparing 2018 To The Two Previous Bull Market Tops

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, June 25, 2018

We ended a bearish historical period yesterday with.....well.....bearishness. It was an ugly start to the day on more trade threats and, with an hour left in the session, the Dow Jones was down nearly 600 points. Buyers did emerge in that...

READ MORE

MEMBERS ONLY

Measuring Participation During Big Moves - The State of the Market - XLF versus XLV

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Measuring Participation during a Big Move.

* The State of the Market

* QQQ Nears First Support Test

* IJR Corrects after Big Move

* XLV Stocks Versus XLF Stocks

* StockCharts TV and On Trend.

... Measuring Participation during a Big Move

... AD Percent is the first breadth indicator I check after a big up...

READ MORE

MEMBERS ONLY

TECHNOLOGY SECTOR LEADS NASDAQ LOWER -- SEMICONDUCTORS ARE LEADING THE TECH RETREAT -- MICRON AND NVIDIA ARE BIG LOSERS -- THE DOW AND S&P 500 ARE TESTING MOVING AVERAGE LINES -- THE VIX INDEX JUMPS TO ONE-MONTH HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

NASDAQ AND TECHS LEAD MARKET LOWER ... Tech stocks and the Nasdaq are leading the rest of the market lower. Chart 1 shows the Nasdaq 100 (QQQ) falling more than 2% today and bearing down on its 50-day average. The Nasdaq is the weakest of the major market indexes. Falling technology...

READ MORE

MEMBERS ONLY

Building a Rules-Based Trend Following Model - 11

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I’m going to continue discussing the ranking and selection of issues for trading. I cannot possibly go into great deal on each of the ranking measures I have used over the years, but future articles will discuss some of the more important ones.

Mandatory Measures

Once you have your...

READ MORE

MEMBERS ONLY

Here's An Overlooked Stock To Consider For Second Half 2018

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, June 22, 2018

Bifurcated market action once again permeated Wall Street, but with much different results this time. Instead of the Dow Jones lagging badly and finishing in negative territory, this large cap index broke its eight session losing streak and gained 119 points (+0.49%...

READ MORE

MEMBERS ONLY

Retail Roll-Reversal

by Bruce Fraser,

Industry-leading "Wyckoffian"

Internet retailers have not been required to charge sales tax for many online transactions. This has created a major advantage over the brick-and-mortar retailers. A recent court ruling could require internet retailers to include state sales tax on all purchases. Will this breathe new life into the traditional retailing stocks...

READ MORE

MEMBERS ONLY

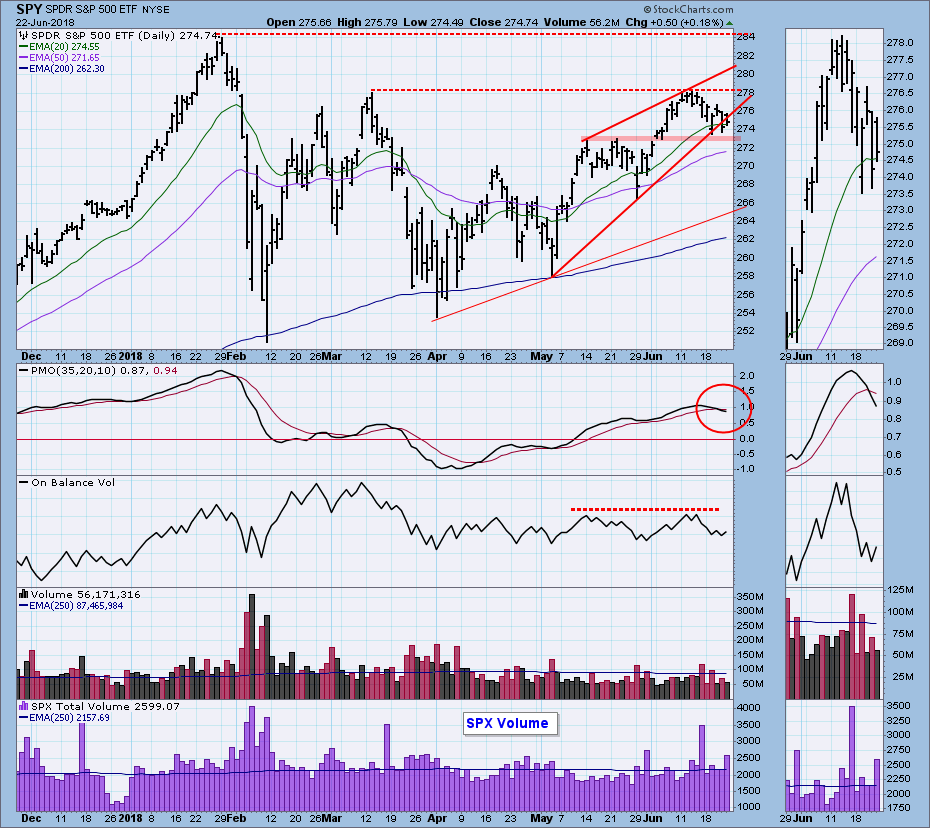

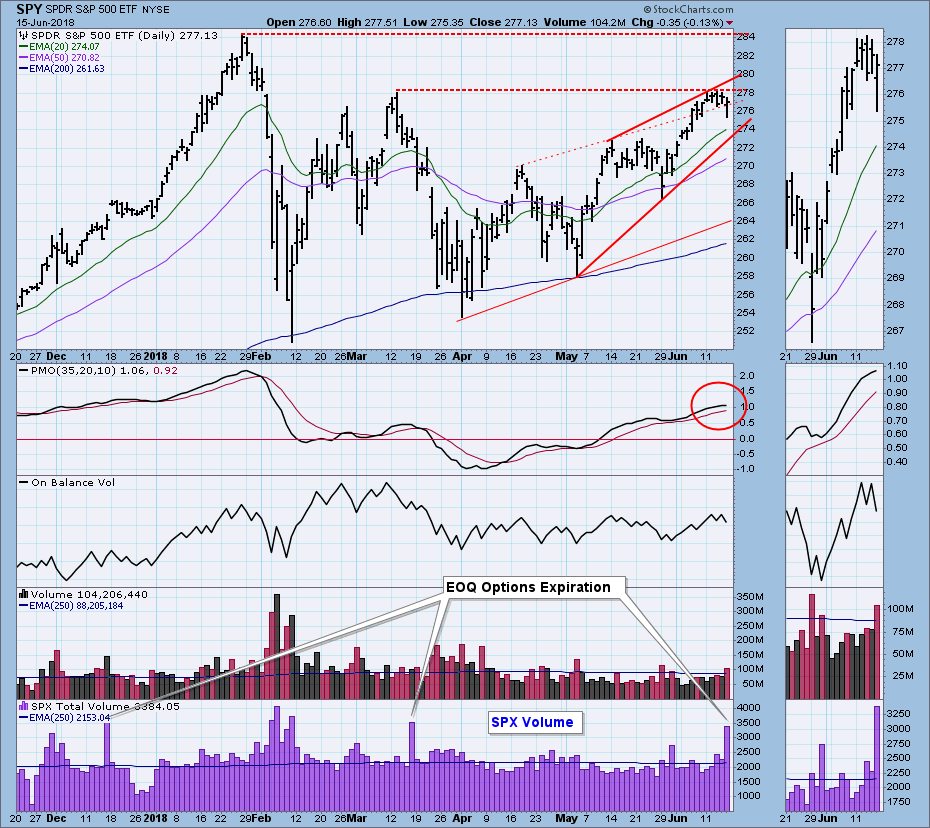

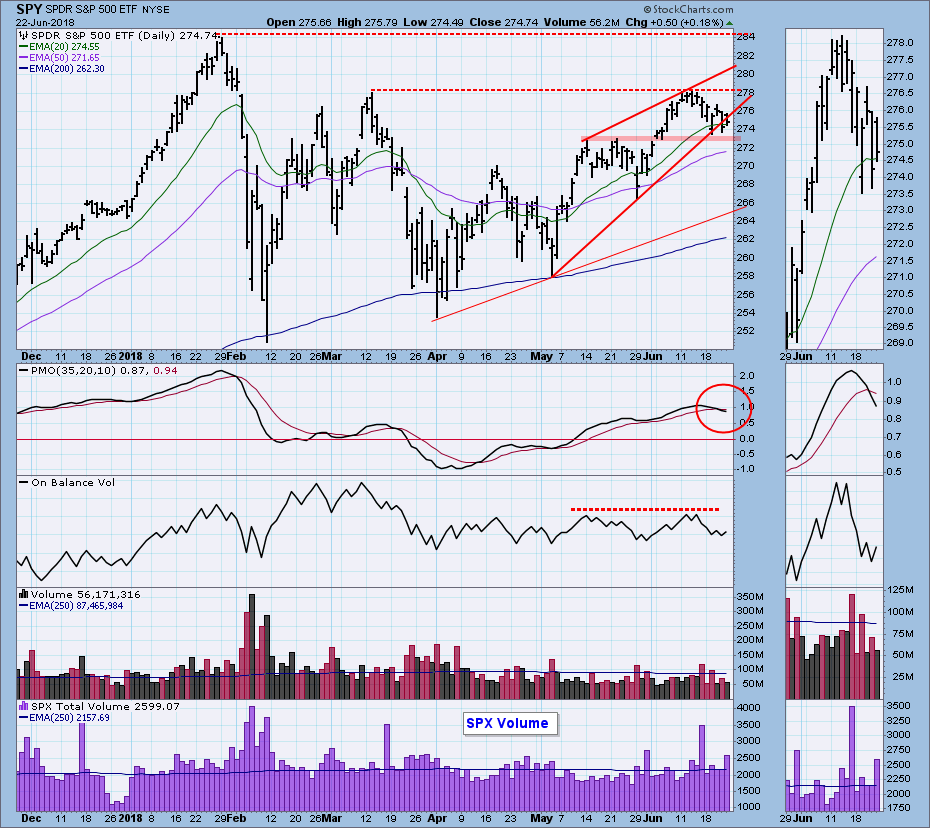

DP Weekly Wrap: Market Trying to Correct; Gold LT SELL Signal

by Carl Swenlin,

President and Founder, DecisionPoint.com

The market has been turned back from the horizontal resistance drawn across the March top, but it has managed to stay above the support drawn across the May tops. However, there is still the mechanism of the bearish rising wedge pattern, which is reinforced by an OBV negative divergence, and...

READ MORE

MEMBERS ONLY

10 For 25: Essential Lessons, Rules and Strategies From a Lifetime of Investing

by Grayson Roze,

Chief Strategist, StockCharts.com

Earlier this week, I joined Tom Bowley and Erin Swenlin on MarketWatchers LIVE for something a bit different. Instead of sharing the usual tips and tricks as part of the "Everything StockCharts" segment, I had a chance to join the show as a featured guest. In addition to...

READ MORE

MEMBERS ONLY

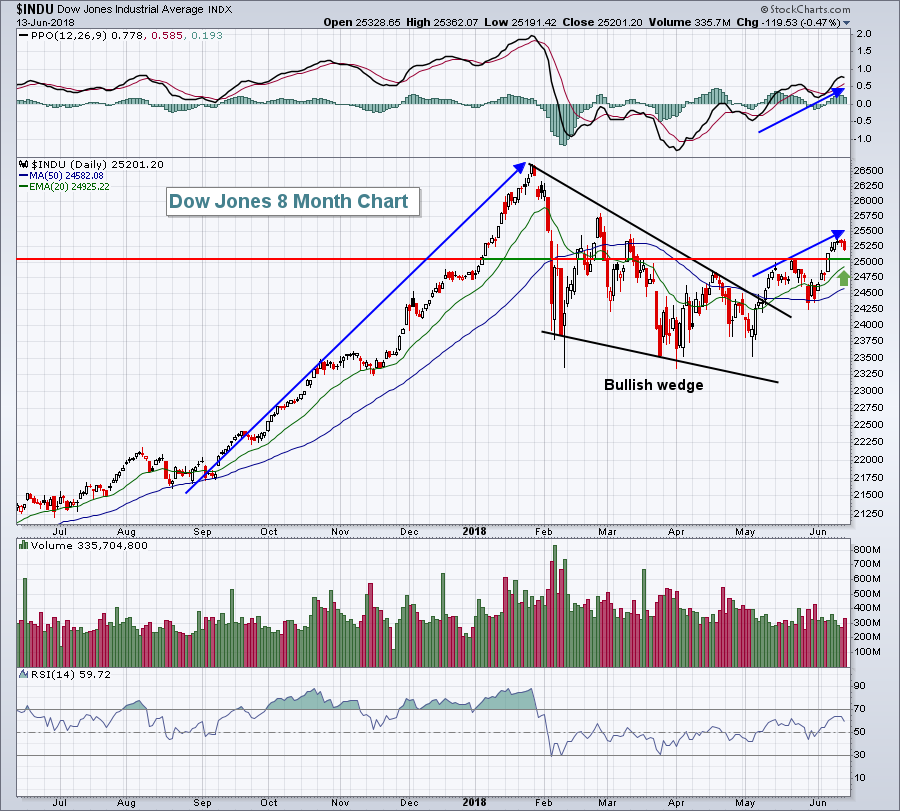

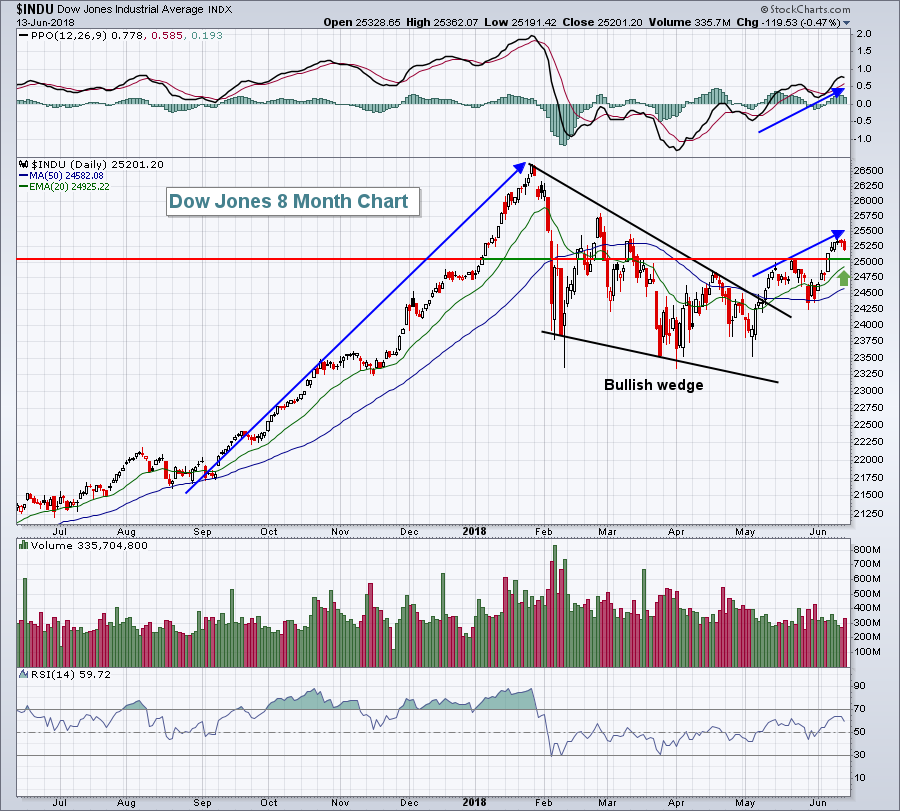

OVERSOLD DOW IS BOUNCING FROM CHART SUPPORT -- SO ARE BOEING AND CATERPILLAR -- OPEC AGREEMENT BOOSTS CRUDE OIL AND ENERGY SHARES -- CHEVRON AND EXXON MOBIL LEAD DOW HIGHER -- TECHNOLOGY SHARES EXPERIENCE SOME PROFIT-TAKING

by John Murphy,

Chief Technical Analyst, StockCharts.com

THE DOW IS BOUNCING OFF CHART SUPPORT ... The Dow Industrials have been the weakest part of the U.S. stock market over the last month. That's been due primarily to its heavier exposure to stocks with more vulnerability to any Chinese trade tariffs like Boeing and Caterpillar. Those...

READ MORE

MEMBERS ONLY

Weekly Market Review and Outlook - Still Net Bullish

by Arthur Hill,

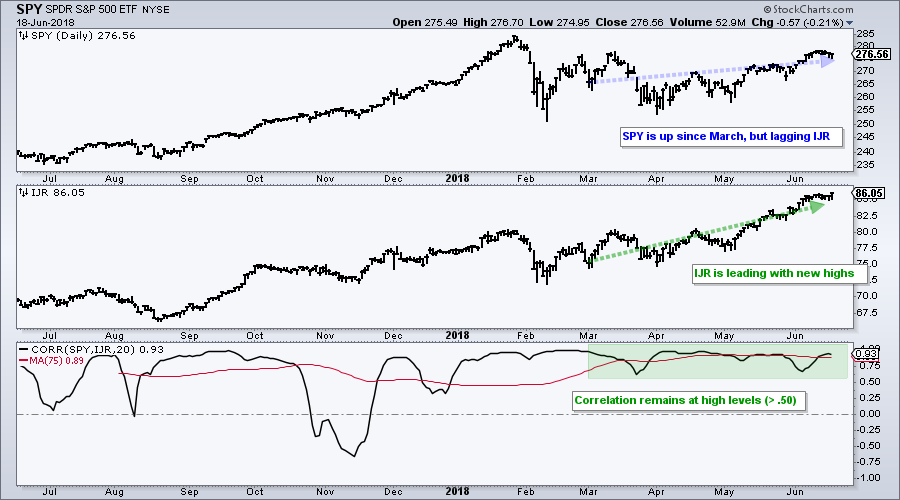

Chief Technical Strategist, TrendInvestorPro.com

* A Binary Approach to Indicators.

* Wobbly S&P Holds Breakout Zone.

* A Small Pullback in the E-Mini.

* The Dow? Fughedaboutit!

* QQQ and IJR Hit Fresh New Highs.

* Retail and Amazon Power XLY.

* XLV Holds Breakout.

* XLK Starts to Stall.

* XLF Tests a Big Support Zone.

* Oil Holds Support Near...

READ MORE

MEMBERS ONLY

Dollar Reversal Likely Points To Short-Term Shift In Trading Strategy

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, June 21, 2018

The Dow Jones closed lower for the 8th consecutive trading session, this time falling 196 points. It's been a steady decline, spurred by fears of a trade war with China and a rising U.S. Dollar Index ($USD). Trade tensions tend...

READ MORE

MEMBERS ONLY

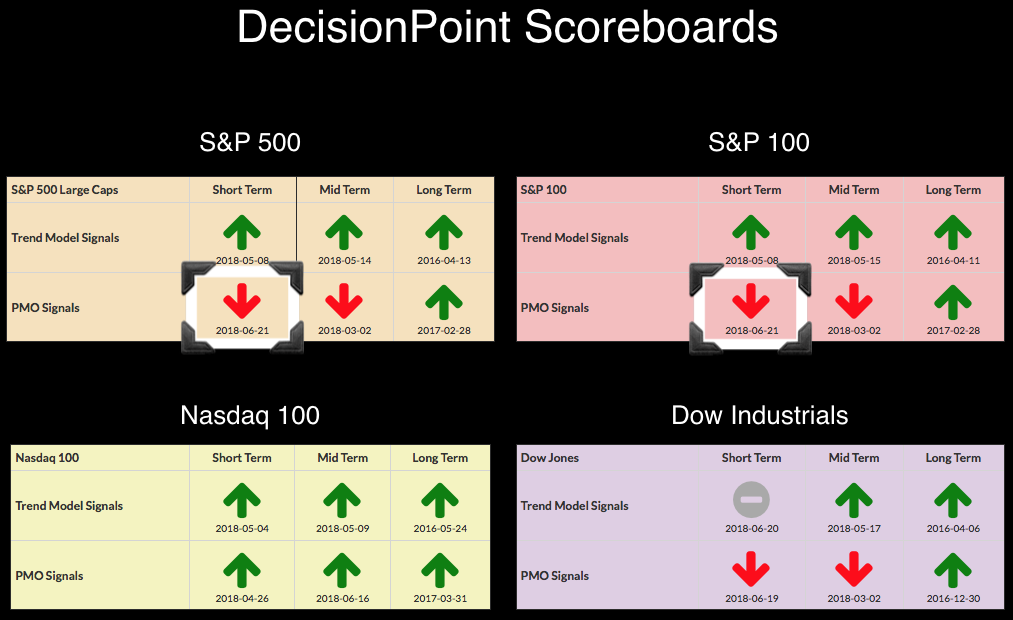

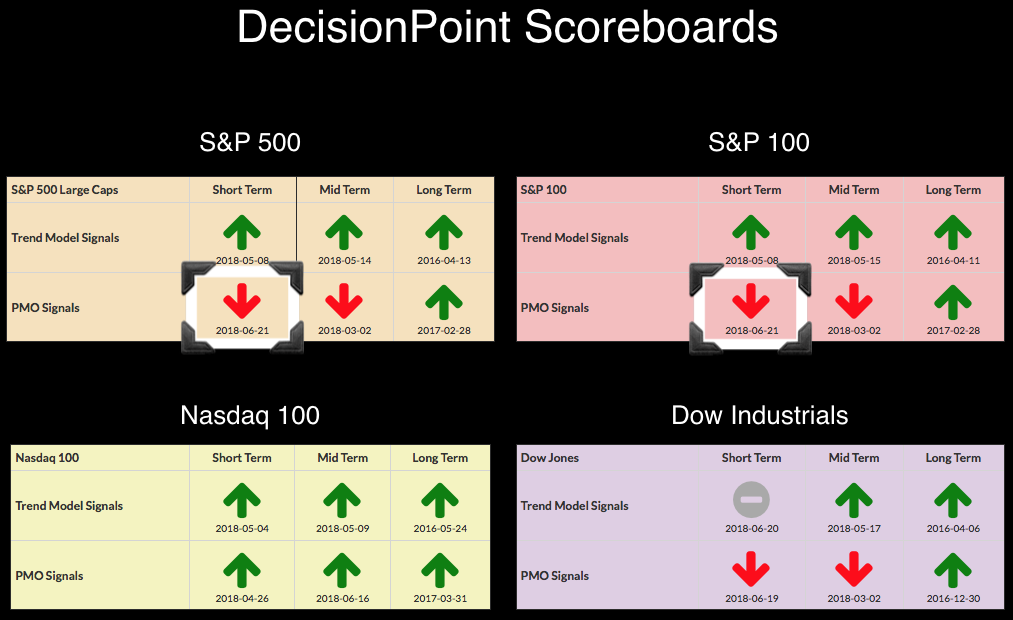

DP Bulletin: SPX and OEX Trigger PMO SELL Signals

by Erin Swenlin,

Vice President, DecisionPoint.com

We added two more SELL signals to the DecisionPoint Scoreboards. Both the SPX and OEX triggered Price Momentum Oscillator (PMO) SELL signals. Apparently someone forgot to tell the NDX that it was time to relinquish BUY signals. However, maybe its hearing the whispers given it tumbled a bit farther today...

READ MORE

MEMBERS ONLY

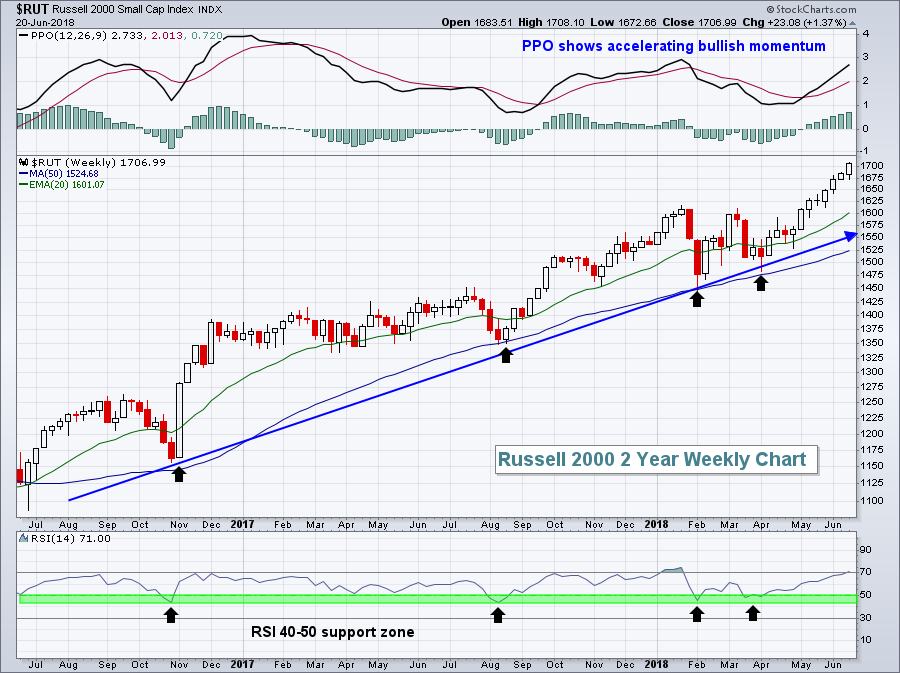

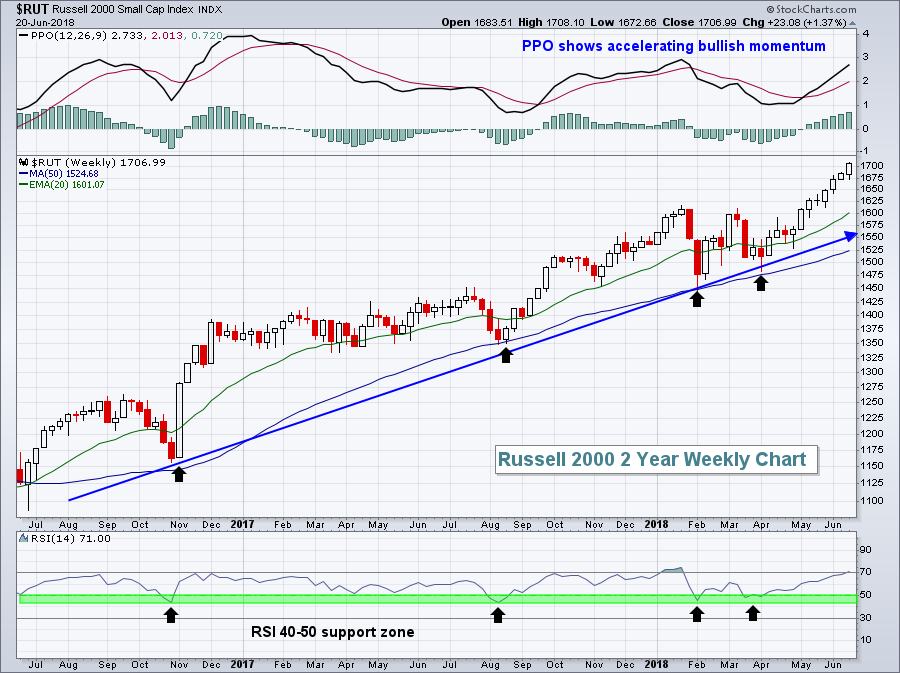

Rising Dollar Tide Lifting Small Cap Boats; Clearing This Level Could Create Bullish Tsunami

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Reminder

If you haven't already subscribed to my blog, I'd love to keep you up-to-date on the latest news and technical developments. It's FREE and simple. Scroll down to the bottom of this article and type in your email address in the space provided....

READ MORE

MEMBERS ONLY

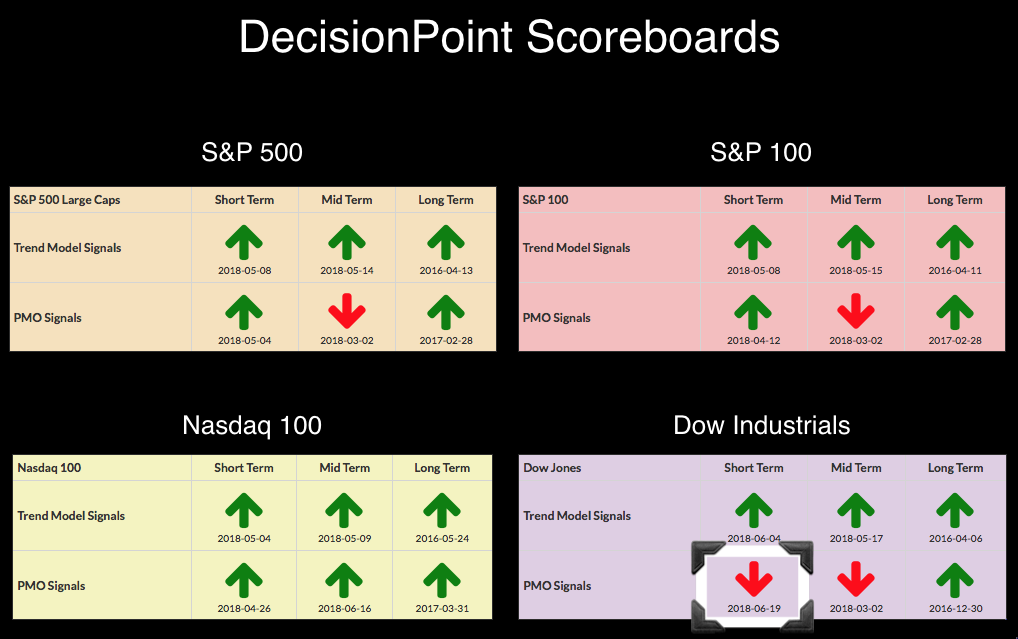

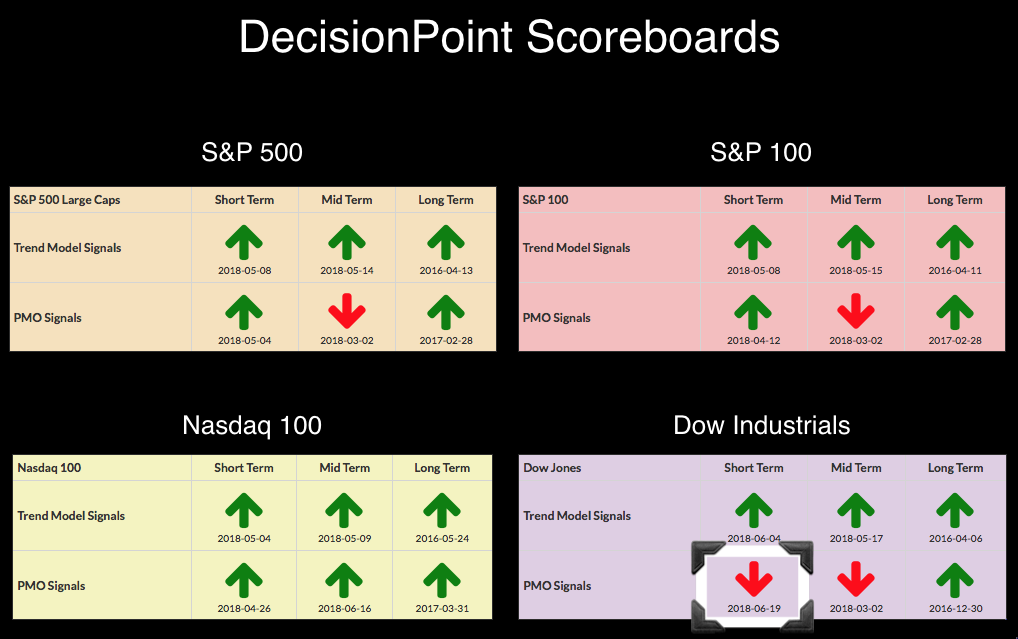

DP Alert: Dollar (UUP) PMO BUY Signal - Dow Loses Another BUY Signal

by Erin Swenlin,

Vice President, DecisionPoint.com

Yesterday the Dow lost its PMO BUY signal and today it's lost its Short-Term Trend Model BUY signal. Looking at the NDX Scoreboard sitting next to the Dow Scoreboard, a bifurcated market between NDX and Dow. Both the NDX and Russell 2000 continue to set new all-time highs...

READ MORE

MEMBERS ONLY

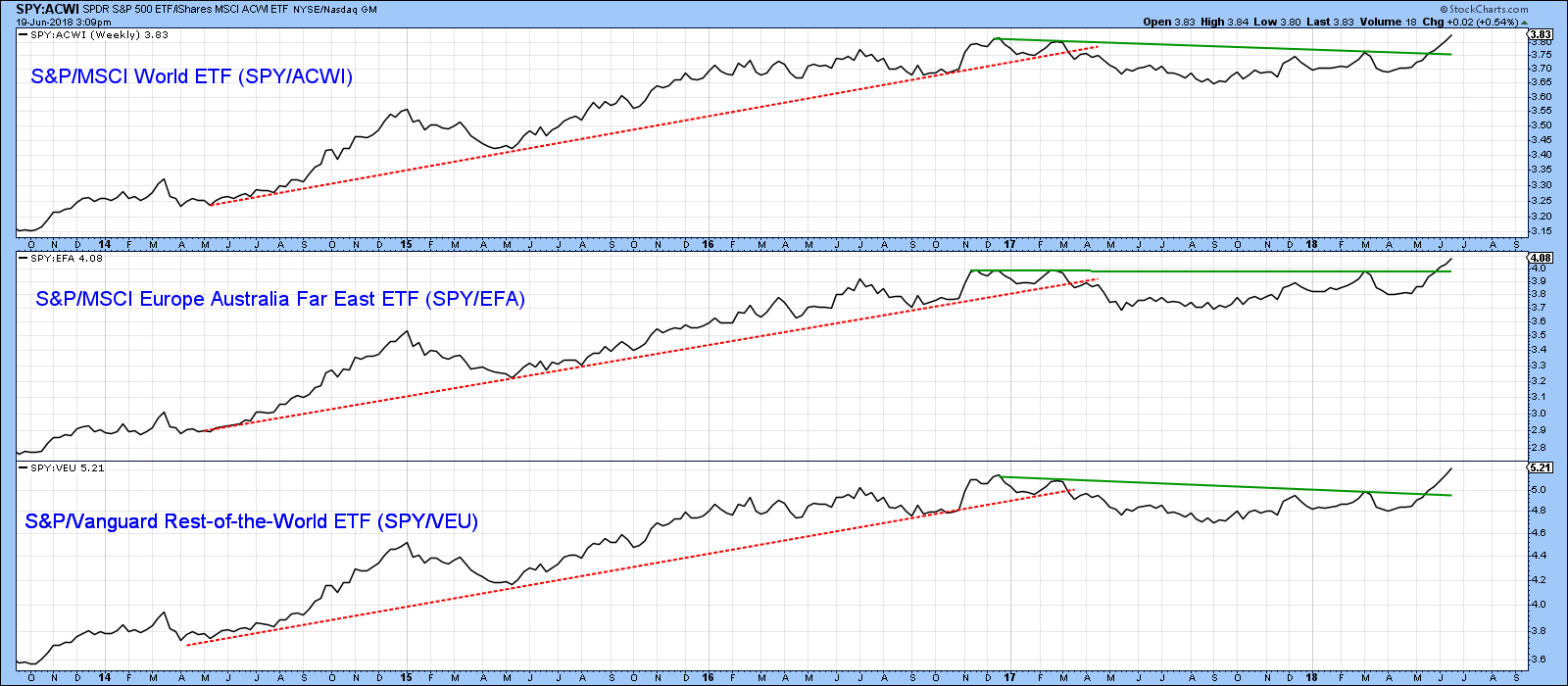

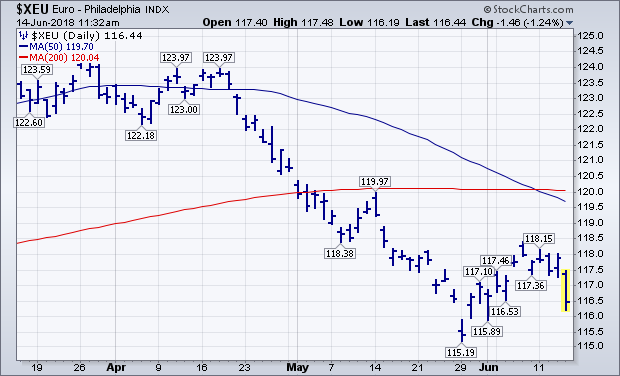

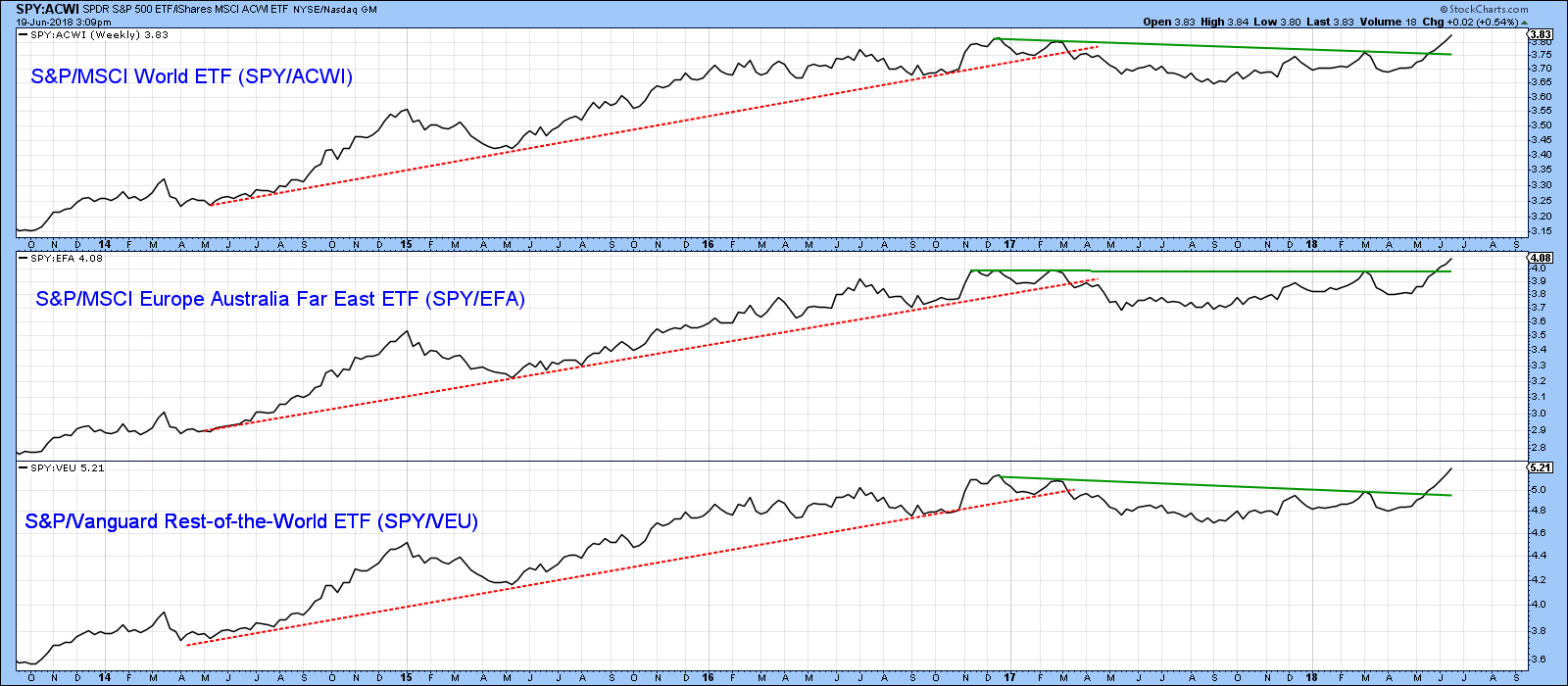

RISING DOLLAR IS CAUSING FOREIGN STOCKS TO UNDERPERFORM THE U.S -- BUT THE U.S. USUALLY DOES BETTER WHEN FOREIGN STOCKS ARE ALSO RISING -- THE VANGUARD EX-USA ETF IS TESTING ITS FEBRUARY LOW -- WHILE EMERGING MARKETS ISHARES TEST LONG-TERM SUPPORT LINES

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOLLAR HAS BIG IMPACT ON GLOBAL MONEY FLOWS ... The direction of the U.S dollar has a big impact on how U.S. stocks perform relative to foreign stocks. As a rule, a stronger dollar favors U.S. stocks, while a weak dollar favors foreign stocks. Chart 1 shows how...

READ MORE

MEMBERS ONLY

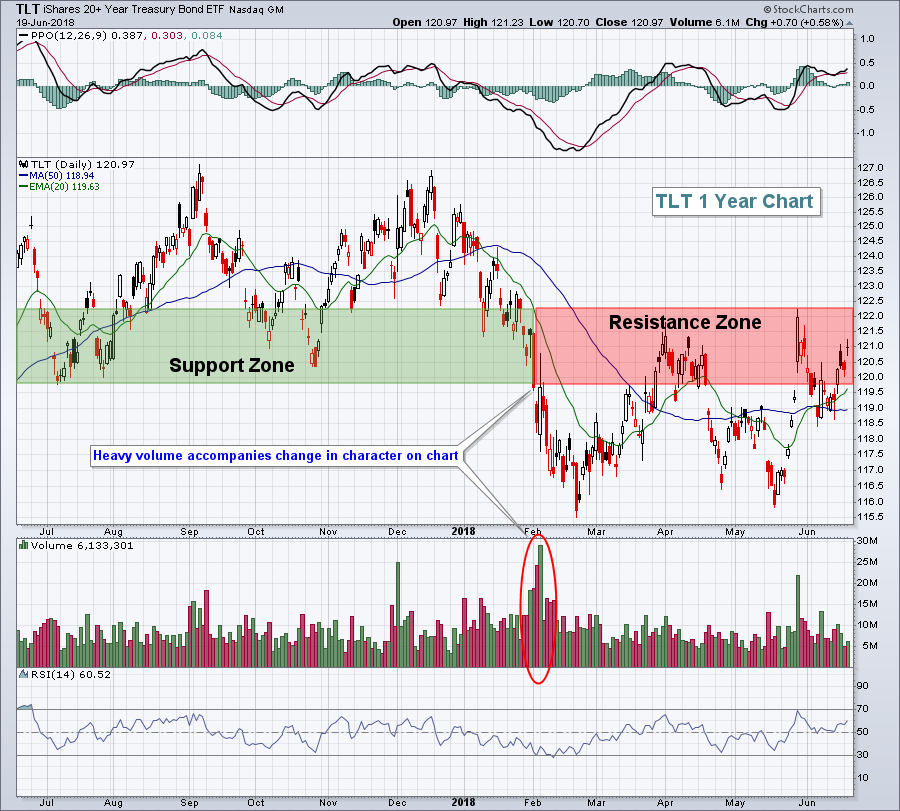

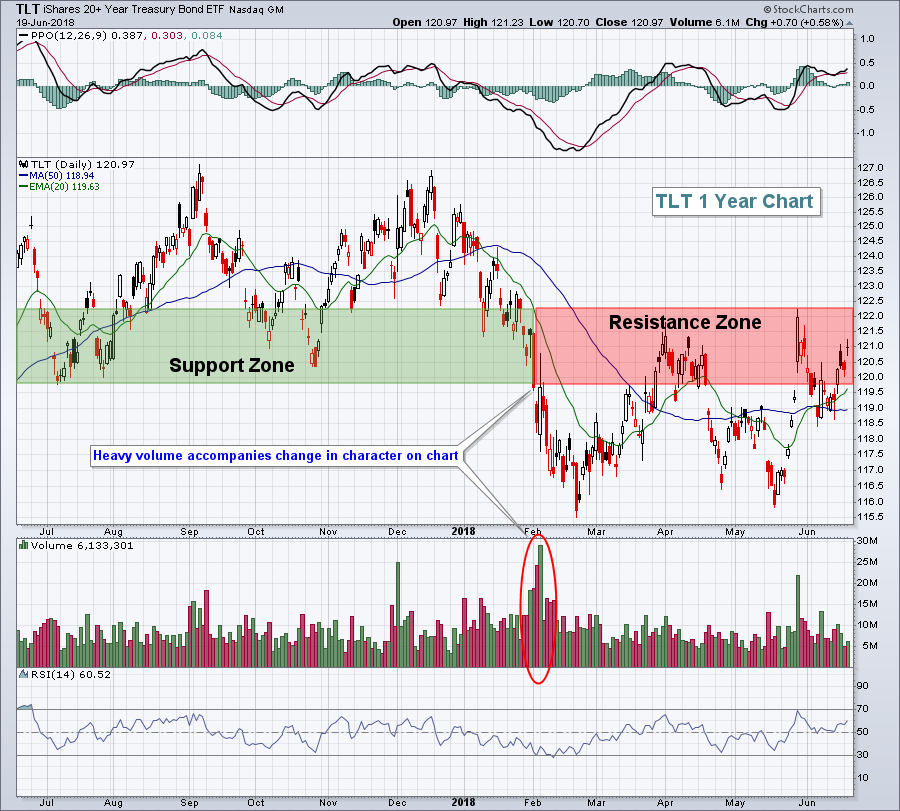

Defensive Areas Shine As Investors Seek Out Safety; Netflix Clears 400

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, June 19, 2018

Treasuries (TLT, +0.58%), utilities (XLU, +0.99%), consumer staples (XLP, +0.53%) and healthcare (XLV, +0.26%) highlighted the strength on Tuesday. Wall Street suffered painful losses at the opening bell for a second straight day, but also rallied off those early...

READ MORE

MEMBERS ONLY

Paypal Guns for a New High

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks making new 52-week highs are clearly in uptrends and leading. Even though Paypal is just shy of a 52-week high, the bigger uptrend and wedge point to new highs in the near future.

First and foremost, Paypal is in a long-term uptrend because the 50-day EMA is above the...

READ MORE

MEMBERS ONLY

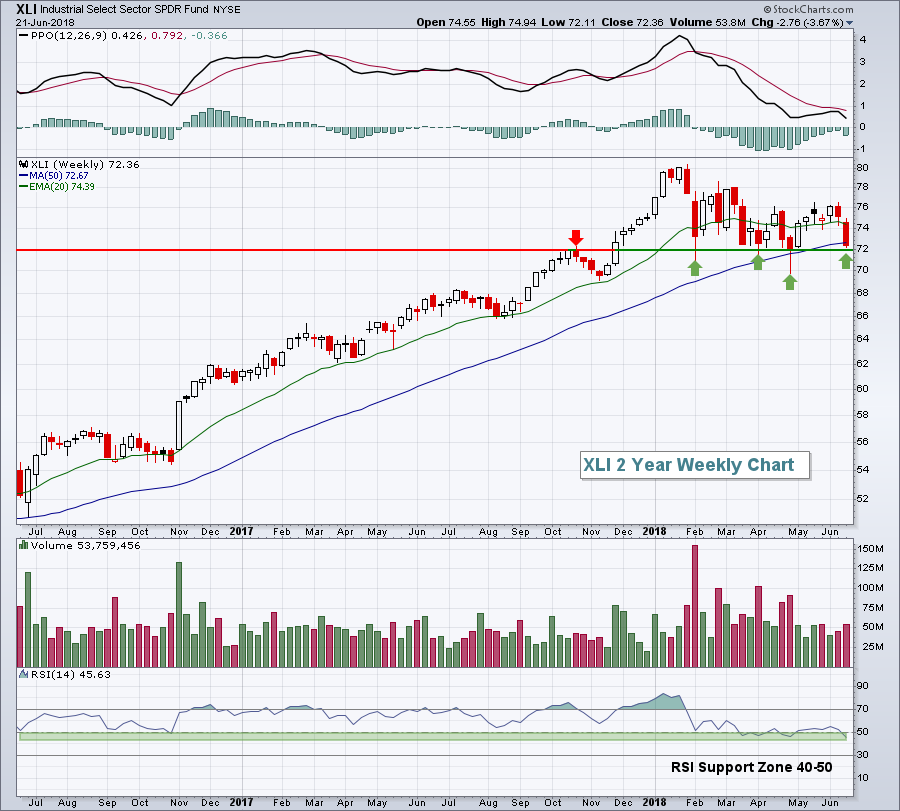

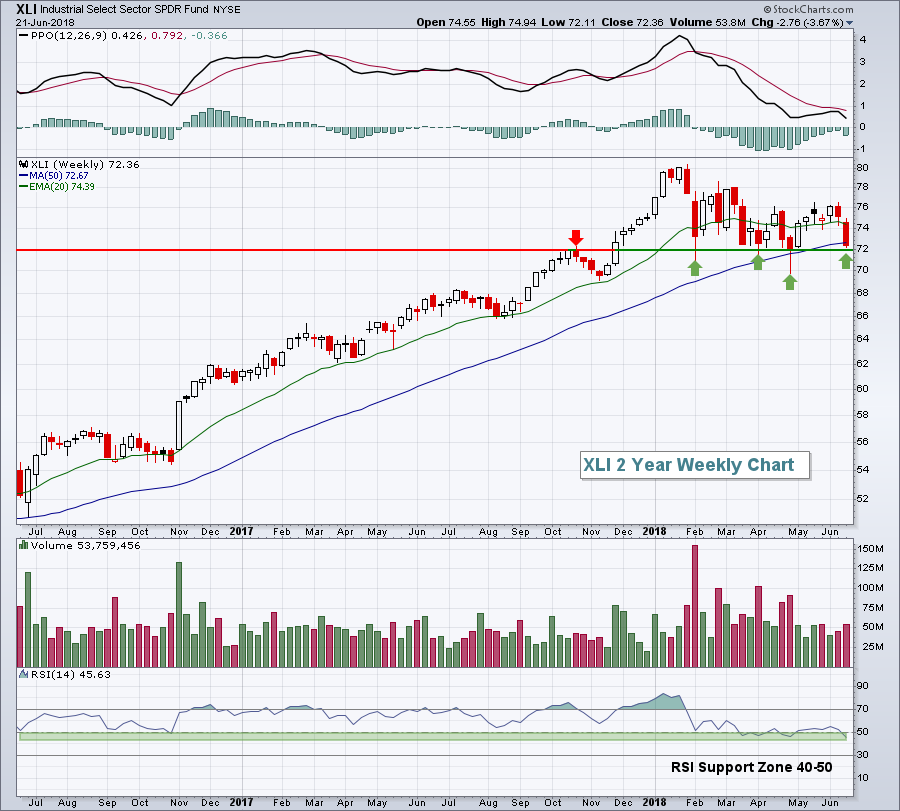

Regional Banks and Biotechs are Leading - Plus 4 Healthcare Stocks to Watch

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

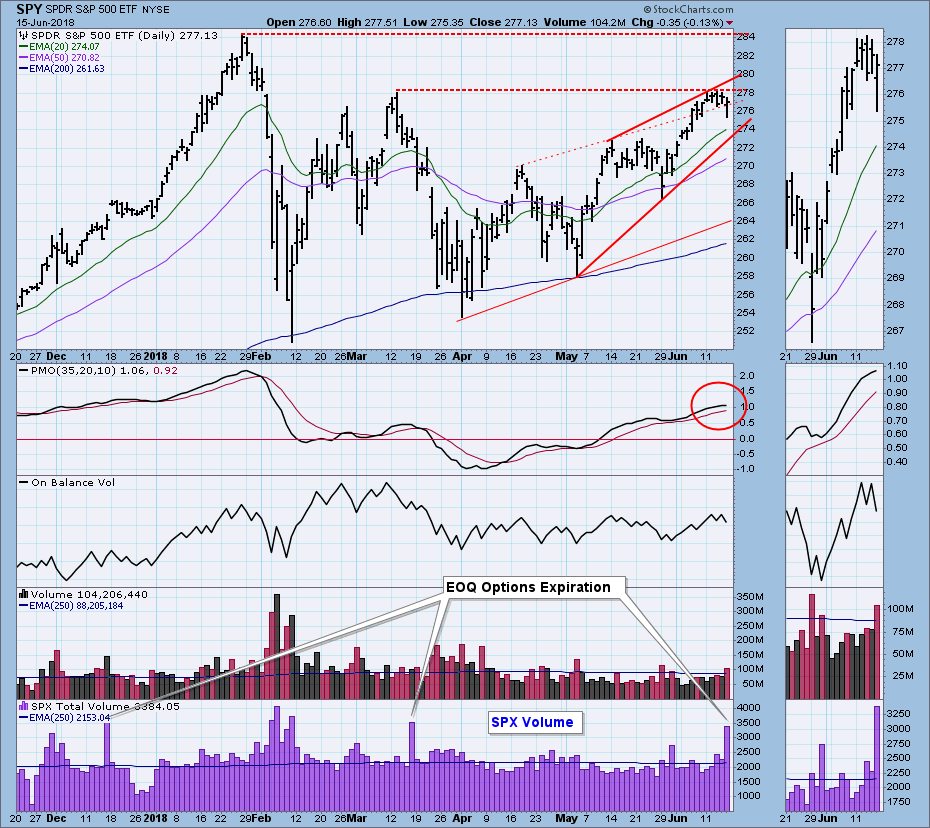

* Remember the Failed Flag in SPY?

* XLI Fails and Breaks Support.

* KRE Holding Up Well.

* USB Forges Island Reversal.

* Biotech ETFs Breakout.

* 4 Healthcare Stocks to Watch.

* On Trend on Youtube.

... Remember the Failed Flag in SPY?

... Not too long ago, the S&P 500 SPDR (SPY) surged and...

READ MORE

MEMBERS ONLY

DP Bulletin: Dow First to Lose Its PMO BUY Signal - Will Others Follow?

by Erin Swenlin,

Vice President, DecisionPoint.com

The DecisionPoint Scoreboards nearly made it to "all green" as the NDX was the first to manage a PMO crossover on the weekly chart and the others seemed sure to follow until this recent pullback. To make matters worse, the Dow which had just managed a PMO BUY...

READ MORE

MEMBERS ONLY

Global Equities Are Falling Apart But It's MAGA For US Relative Action

by Martin Pring,

President, Pring Research

* New bull market high for US equity relative action

* International markets are breaking down

* Commodities lose some upside momentum

US equities have been hit hard so far this week, but that’s nothing compared to China, Emerging Markets, Europe and other markets around the globe. As a result, we are...

READ MORE

MEMBERS ONLY

Solar Stocks Go Dark

by Bruce Fraser,

Industry-leading "Wyckoffian"

Since mid-May the renewable energy stocks have tumbled. This may have come as an unexpected surprise to many. Let’s do a mini-blog case study of the Dow Jones Renewable Energy Equipment Index ($DWCREE) to determine if there was advance warning of trouble brewing.

As Wyckoffians we are really in...

READ MORE

MEMBERS ONLY

This Industry Group Tries To Clear Resistance For The 23rd Time; Dow Futures Tumble

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, June 18, 2018

Trade war fears are picking up again this morning and it's rattling equities worldwide. It created a bit of a stir on Monday morning as futures were weak, signaling a rough start for U.S. equities. That's exactly what...

READ MORE

MEMBERS ONLY

The BIG picture in ONE picture

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Note 1: This article was posted earlier as part of the ChartWatchers newsletter last weekend. One paragraph and an up-to-date daily version of the Relative Rotation Graph for asset classes has been added to the bottom of this article.

Note 2: A pre-populated universe for Asset Allocation has been added...

READ MORE

MEMBERS ONLY

The Single Biggest Influence on Individual Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Correction Time?

* XLI and XLF Resume their Lagging Ways.

* Charting the Big Five Sectors.

* Watch the Risk-Off Assets.

* On Trend and Stocks to Watch.

... The Single Biggest Influence on Individual Stocks

There are several influences on the price of an individual stock, but one influence rises far above the others....

READ MORE

MEMBERS ONLY

Energy Leads Market Lower, Watch These Two Support Levels

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, June 15, 2018

We finished Friday's action with lower major indices, primarily the result of a very weak energy sector (XLE, -2.15%). Unfortunately, that masked one of the best absolute and relative performance days in consumer staples (XLP, +1.28%) since the January...

READ MORE

MEMBERS ONLY

Ross Stores Stalls after Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Ross Stores was hit hard with a high volume gap down in late May, but immediately firmed and recovered. The stock broke out of a long triangle in early June and then stalled with a small flag last week. Basically, we have two bullish continuation patterns at work.

The long-term...

READ MORE

MEMBERS ONLY

Historic High on NAAIM Exposure - NDX Scoreboard All Buy Signals

by Erin Swenlin,

Vice President, DecisionPoint.com

On Friday, the weekly charts went "final". With that finalization, the NDX which had been carrying a positive Price Momentum Oscillator (PMO) crossover throughout the week, finally posted the IT PMO BUY signal on its DP Scoreboard. Additionally, sentiment charts were very interesting this week. The National Association...

READ MORE

MEMBERS ONLY

Relative Strength Is Your Guide To A Winning Stock Portfolio

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It seems simple enough. Buy stocks/ETFs that are outperforming the benchmark S&P 500. Well, that's part of it for sure. But it really goes a lot deeper than that. StockCharts.com provides you a myriad of ways to evaluate relative strength. I tend to use...

READ MORE

MEMBERS ONLY

Two Continuation Patterns Take Shape in XLI

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Industrials SPDR (XLI) has struggled in 2018 and is pretty much unchanged year-to-date. Despite flat performance this year, a pair of bullish continuation patterns are taking shape. Let's look at the key levels to watch going forward.

Long-term, the trend is still up because the PPO(50,...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: Market Still Strong

by Carl Swenlin,

President and Founder, DecisionPoint.com

The bearish rising wedge formation we had been watching resolved upward last week, though not by a decisive margin. This week price reached, then retreated from horizontal resistance, forming a top which created a new rising wedge formation. In spite of the modest pullback early Friday, price was virtually unchanged...

READ MORE

MEMBERS ONLY

Dovish ECB Offsets Hawkish Fed

by John Murphy,

Chief Technical Analyst, StockCharts.com

Editors Note: This article was originally published in John Murphy's Market Message on Thursday, June 14th at 11:39am EST.

The Fed raised its short-term rate by a quarter point yesterday as expected. But it also added a fourth rate hike this year which gave its announcement a...

READ MORE

MEMBERS ONLY

Shorting Stocks that Miss Earnings Expectations

by John Hopkins,

President and Co-founder, EarningsBeats.com

I have found over many years of trading that it is so much more difficult to make money shorting stocks than going long. With the exception of the Dot.com bubble between 2000-2002 and the bear market of 2008-2009 during the Great Recession we've been in a bull...

READ MORE

MEMBERS ONLY

Tale of the Tape

by Bruce Fraser,

Industry-leading "Wyckoffian"

As Wyckoffians we often generate a hypothesis regarding the forces that propel stocks and industry groups higher (or lower). Homebuilders enjoyed a major uptrend in 2016-17.

In this case study from 2016; interest rates were near historically low levels, thus we could conclude that home purchases would be stimulated. And...

READ MORE

MEMBERS ONLY

Stop! Don't Touch It! Let It Go! Quit Tinkering!

by Grayson Roze,

Chief Strategist, StockCharts.com

I’ve seen this play out time and time again at seminars, conferences, lectures, and courses. Remarkably, the conversation always begins with the exact same seemingly harmless five-word question: “But what if you just…”

Those five words prompt me to step up on the soapbox and launch into the “tinkering...

READ MORE

MEMBERS ONLY

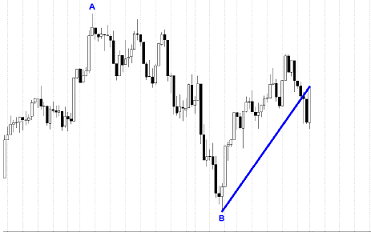

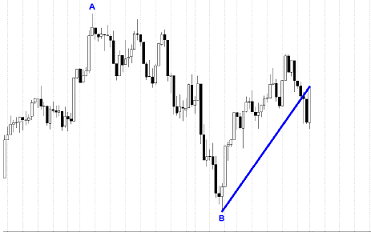

Pullback Rally Analysis

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

The Pullback Rally Analysis is not a ranking measure but a technique for determining the relative strength of issues by looking at the most recent rally from a previous pullback. Measure the amount of the pullback in percent, then measure the current rally up to the current date in percent....

READ MORE

MEMBERS ONLY

Talk About Hot? This Sector Has Risen Every Day In June

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, June 14, 2018

Utilities (XLU, +1.24%) led a bifurcated market on Thursday, but the real story of June has been consumer discretionary (XLY, +1.04%). The XLY has not only posted gains each of the 10 trading days in June thus far, but it'...

READ MORE

MEMBERS ONLY

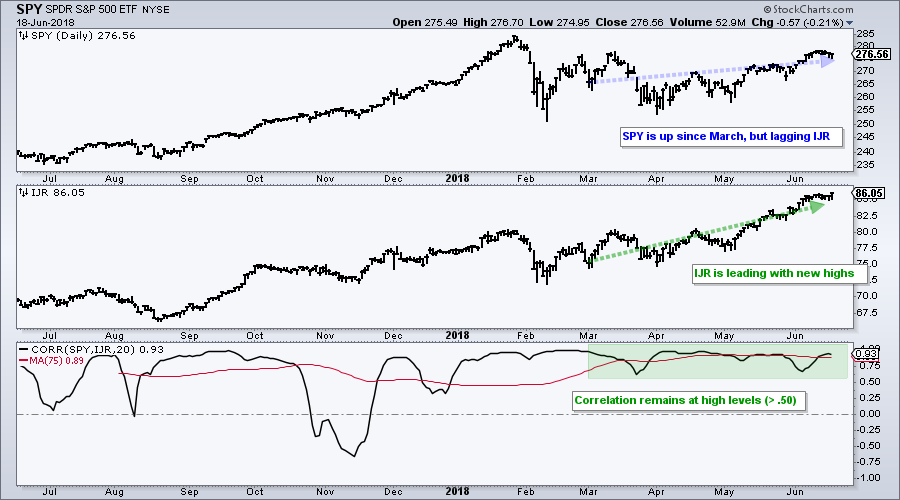

Weekly Market Review and Outlook (w/ Video) - Summer Doldrums for Stocks, but Not Bonds

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* S&P 500 Digest Short-term Gains.

* QQQ Leads with New High Expansion.

* IJR Stalls above Breakout Zone.

* Three Big Leaders and Two Laggards.

* XLF Turns Down from Resistance.

* XLI Tests Flag Breakout.

* XLV Extends on Breakout.

* Bonds Get a Bounce.

* USO Slowly Bounces off Key Retracement.

* The Noose Tightens...

READ MORE

MEMBERS ONLY

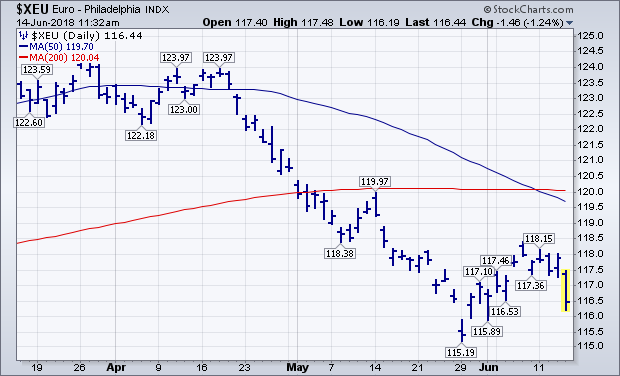

DOVISH ECB OFFSETS HAWKISH FED -- DROP IN EURO BOOSTS DOLLAR -- GOLD AND DOLLAR WON'T BOUNCE TOGETHER FOR LONG -- FINANCIALS FAIL TO RESPOND TO FED RATE HIKE -- REITS TRY TO HOLD 200-DAY LINE -- S&P 500 NEARS TEST OF ITS MARCH HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

ECB WON'T RAISE RATES FOR ANOTHER YEAR ... The Fed raised its short-term rate by a quarter point yesterday as expected. But it also added a fourth rate hike this year which gave its announcement a more hawkish tilt. That had the immediate effect of boosting Treasury bond yields...

READ MORE

MEMBERS ONLY

Netflix Jumps To Record, But Fed Rate Hike Weighs On Stocks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, June 13, 2018

Another Fed day is in the rear view mirror and now we know the following. The Fed expects to raise interest rates two more times in 2018, bringing the total number of hikes to 4, as opposed to the 3 they discussed in...

READ MORE