MEMBERS ONLY

Bonds (TLT) IT BUY Signal Arrives Too Late to the Party

by Erin Swenlin,

Vice President, DecisionPoint.com

Bonds enjoyed quite a rally over the past two weeks which isn't a surprise given Bond Yields took a nose-dive. The daily chart of the $TYX shows how yields crashed. However, they are now bouncing off strong support at 2.95%. They may not be able to avoid...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: A Pullback Is Still Likely

by Carl Swenlin,

President and Founder, DecisionPoint.com

Last week I wrote: ". . . the market seems to be set up for a pullback or correction. . . . Recent declines have been very short-lived, so I can't make a case for anything too serious." What we got on the first trading day of this week was a sharp...

READ MORE

MEMBERS ONLY

How to Produce a 250% Run-Up

by Gatis Roze,

Author, "Tensile Trading"

In his Market Wizard books, Jack Schwager proved to investors that they could indeed significantly improve their own investing skill set by mimicking Wall Street’s greatest money managers. In this blog, I’ll show you how investing greatness can and should be built upon a similar parallel paradigm used...

READ MORE

MEMBERS ONLY

STRONG JOBS REPORT BOOSTS STOCKS -- S&P 500 NEARS MAY HIGH -- QQQ REACHES TWO-MONTH HIGH -- INTEL AND ALPHABET ARE LEADING IT HIGHER -- AMGEN LEADS UPTURN IN BIOTECH ISHARES -- HEALTHCARE SPDR APPEARS TO BE BASING

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 NEARS MAY HIGH... A stronger than expected jobs report for May is giving a boost to stocks today. So is the fact that European stocks are rising (as well as Italy's bond and stock markets). In addition, yesterday's stock selling in response...

READ MORE

MEMBERS ONLY

Weekly Market Review and Outlook (with Video) - 3 Big Sectors Dragging as June Starts

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* A Bullish Breadth Thrust, but...

* S&P 500 Toys with Triangle Breakout

* June can be a Rough Month

* Seasonality and the Turn of the Month

* QQQ Holds Up better than SPY

* Small-caps Hold Breakout

* XLK and XLY Hold Up the S&P 500

* Mind the Gap in XLF...

READ MORE

MEMBERS ONLY

Small Caps Enter Their Best Relative Strength Month On A Roll

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, May 31, 2018

The roller coaster ride of 2018 has suddenly re-emerged this week. After considerable weakness on Tuesday to open this holiday-shortened week, we saw a beautiful bounce-back rally on Wednesday. That felt pretty good from a bullish perspective.....until yesterday's renewed selling....

READ MORE

MEMBERS ONLY

Monthly Charts Go Final - Long-Term Outlook

by Erin Swenlin,

Vice President, DecisionPoint.com

With today's close, all of the monthly charts have 'gone final'. This means that any signals that appear on monthly charts are the final signals for the month. While we don't have any new monthly/long-term signals, it is always instructional to look at...

READ MORE

MEMBERS ONLY

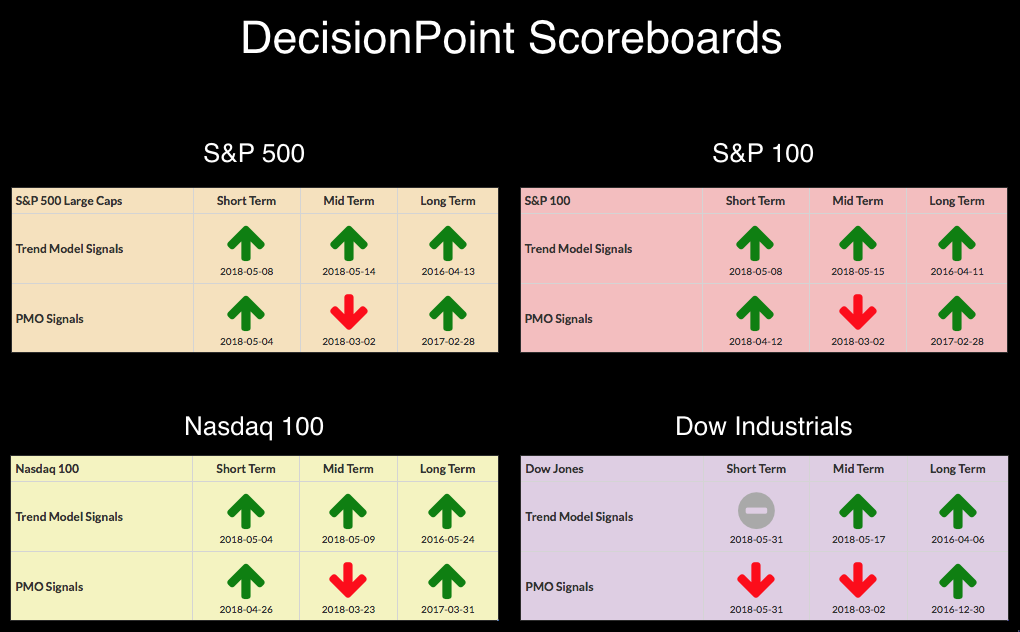

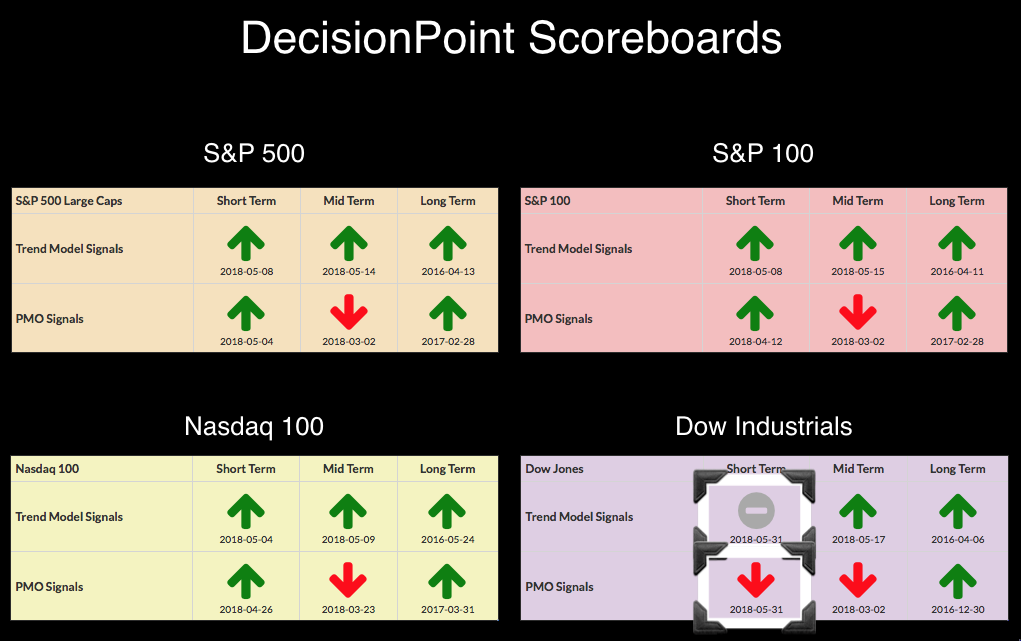

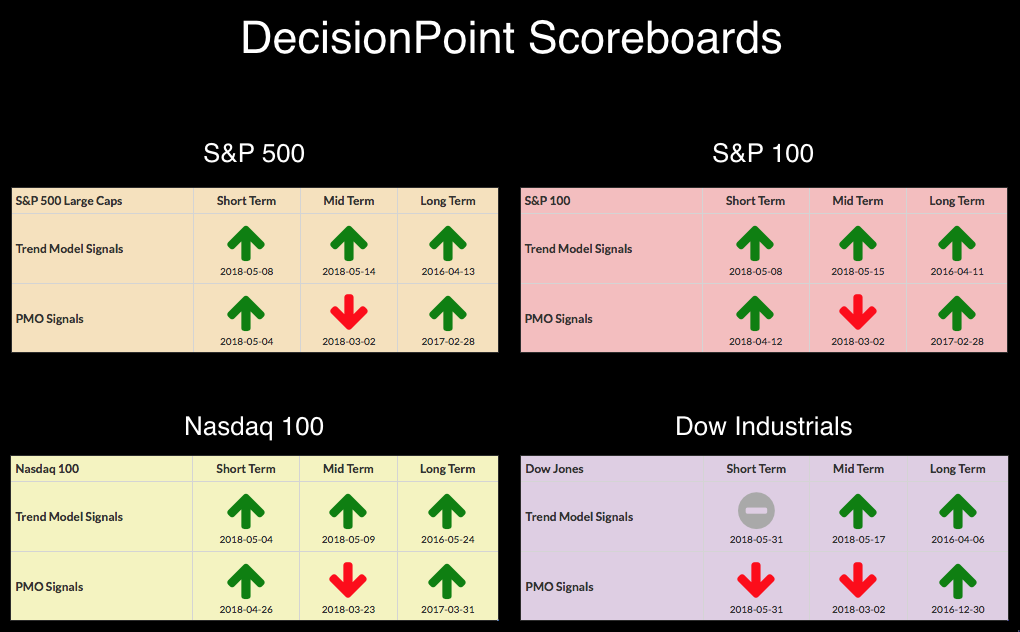

DP Bulletin #1: Dow Bearish with PMO SELL Signal and STTM Neutral Signal

by Erin Swenlin,

Vice President, DecisionPoint.com

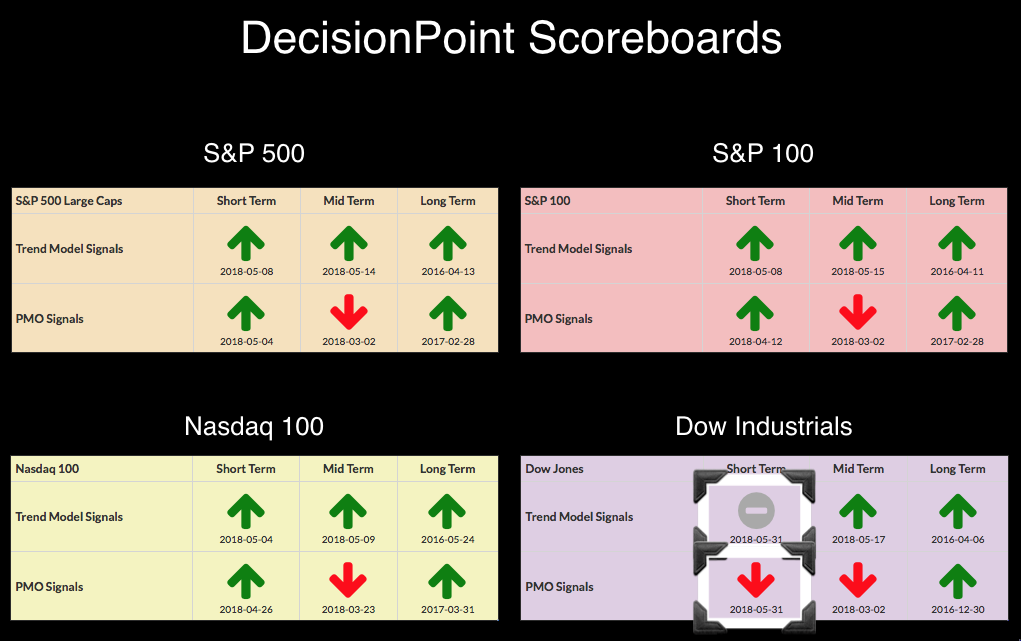

Clearly I spoke too soon about having no DP Scoreboard signal changes this week. Today the Dow triggered both a PMO SELL signal and a Short-Term Trend Model Neutral signal.

I'd prepare for some whipsaw. I've annotated a very small double-top that executed with Tuesday'...

READ MORE

MEMBERS ONLY

Health Care Providers Could Cure Your Portfolio Woes

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, May 30, 2018

Remember that Tuesday weakness? Yeah, I didn't think so. Poof!!! It took the U.S. stock market all of one day to essentially erase the scars of that Tuesday selling. The NASDAQ broke out of a bullish flag pattern and the...

READ MORE

MEMBERS ONLY

DP Alert: Small-Caps Bifurcate Market - Possible Buying Initiation Lining Up

by Erin Swenlin,

Vice President, DecisionPoint.com

Amazing! A week without any DP Scoreboard updates. All of these indexes came very close to new PMO SELL signals yesterday with the big decline, but today's rally pop changed that quickly with all four PMOs turning back up and away from their signal lines. While not a...

READ MORE

MEMBERS ONLY

STOCKS ARE REBOUNDING FROM YESTERDAY'S SELLING -- THE DOW AND S&P 500 BOUNCE OFF 50-DAY LINES -- SMALL CAPS HIT NEW HIGHS WHILE NASDAQ TESTS TOP OF TRADING RANGE -- FINANCIALS REBOUND TODAY WITH BOND YIELDS -- THE EURO IS TESTING IMPORTANT CHART SUPPORT

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW AND S&P 500 ARE BOUNCING OFF 50-DAY AVERAGES ... Stocks around the world sold off sharply yesterday (Tuesday) in a global flight from risk resulting mainly from a political crisis in Italy and, to a lesser extent, renewed threats of sanctions against China. A surge in Italian bond...

READ MORE

MEMBERS ONLY

Treasury Yields Tumble Amid European Political Uncertainty

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

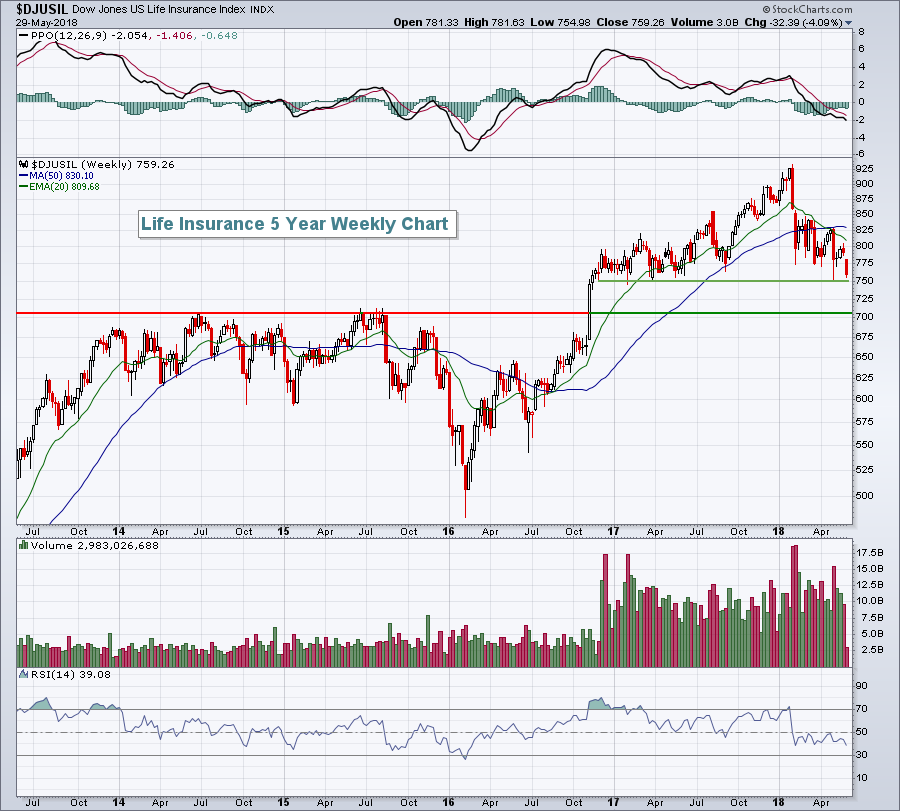

Market Recap for Tuesday, May 29, 2018

Political uncertainties in Italy and Spain rattled global markets on Tuesday, leaving the Dow Jones with a loss of nearly 400 points on the session. There was a clear flight to safety, underscored by a massive 16 basis point drop in the 10...

READ MORE

MEMBERS ONLY

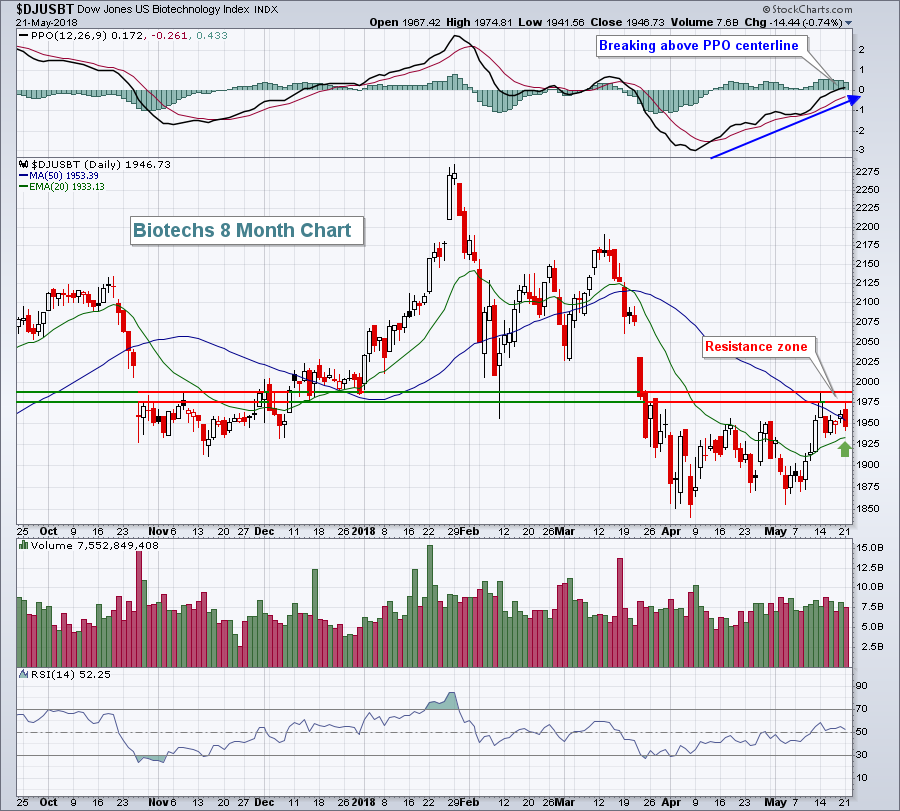

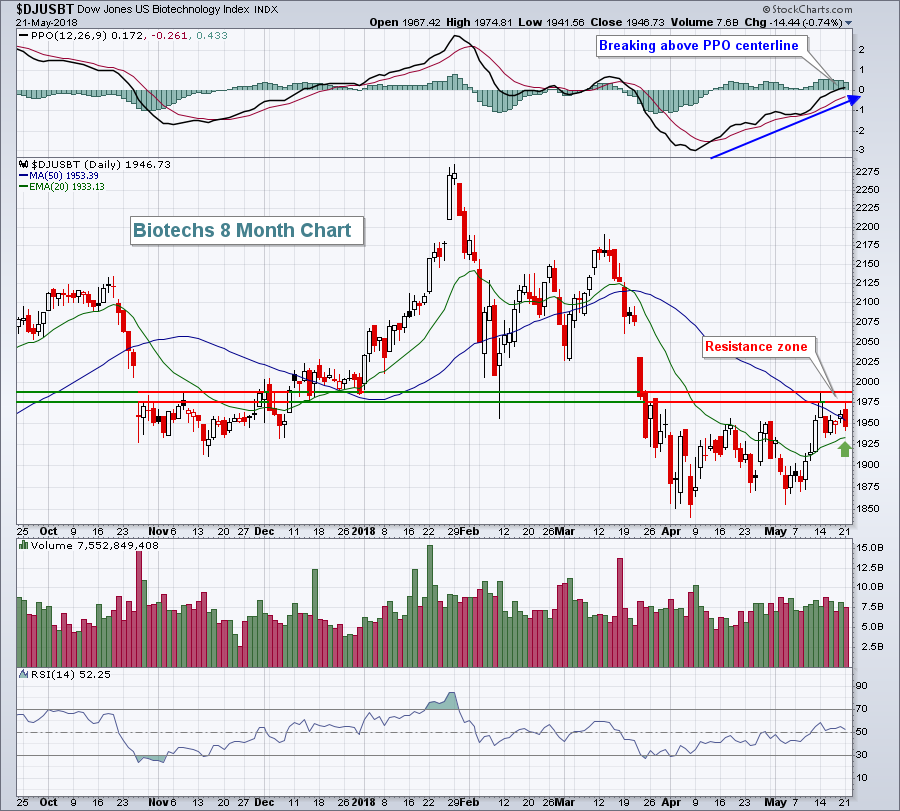

A Bullish Continuation Pattern Forms in the Biotech iShares

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Biotech iShares (IBB) surged off support in mid-May and then stalled the last two weeks with a bull flag taking shape.

A bull flag is a short-term bullish continuation pattern. These patterns form after a sharp advance and represent a rest or consolidation. This is often needed to digest...

READ MORE

MEMBERS ONLY

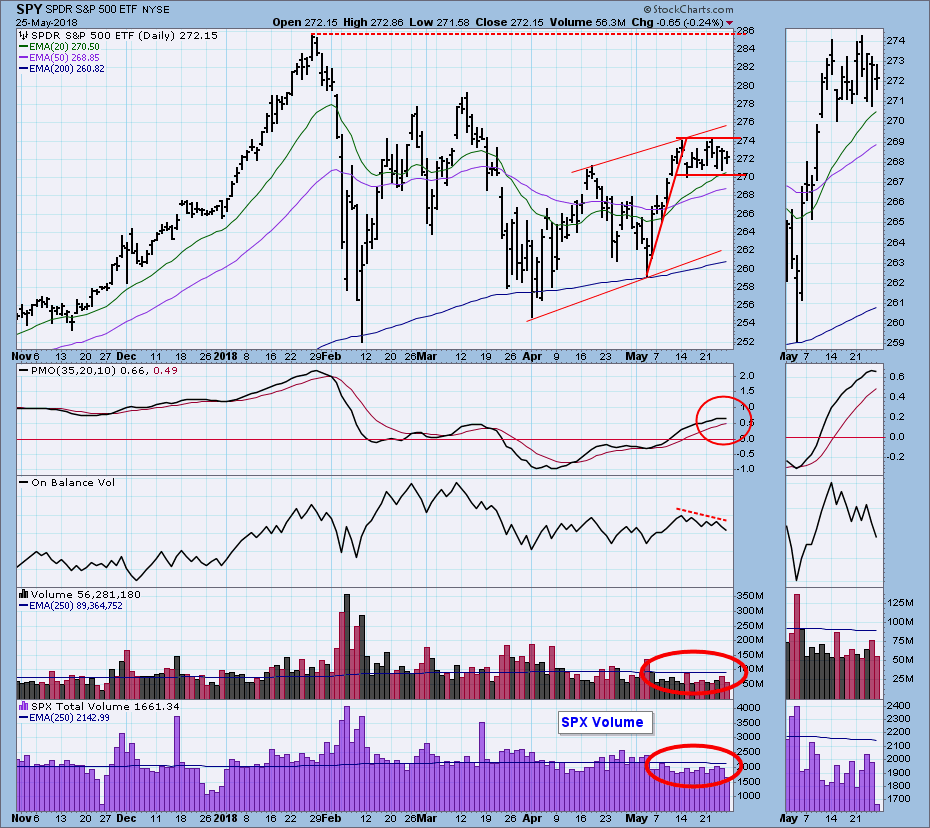

SPY Drags as Small-Caps and Large-Techs Lead - 6 Flags in the Nasdaq 100

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Small-caps and Large-Techs Still Leading.

* IJR Holds above Breakout Zone.

* QQQ Falls Back into Pennant.

* Six Flags over the Nasdaq 100.

* Strike One on SPY.

* Selling Pressure Concentrated in Large-caps.

* On Trend Highlights...

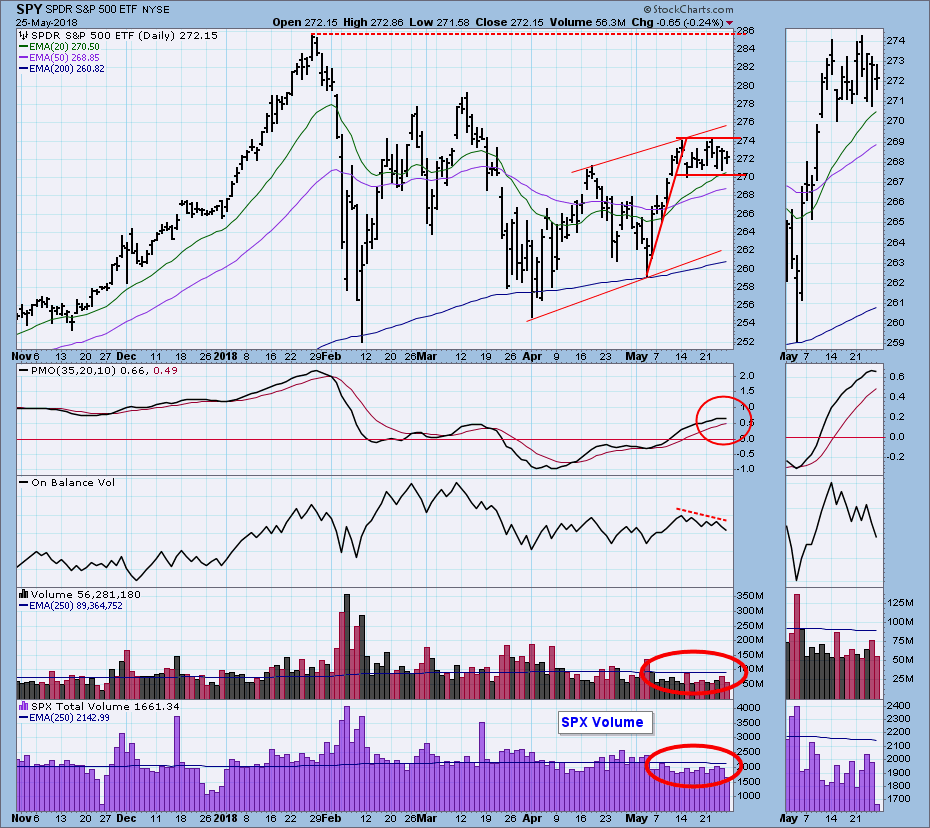

The S&P 500 SPDR (SPY) broke below its mid-May lows with a sharp decline, but...

READ MORE

MEMBERS ONLY

US Equities Are Breaking Out Against The World

by Martin Pring,

President, Pring Research

* SPY experiences important relative breakouts

* World A/D Line unexpectedly breaks trend

* European and Emerging markets ETF’s experience major breakdowns

SPY experiences important relative breakouts

Earlier this morning I had the idea of writing about the relationship between the US and international markets, as this ratio usually does well...

READ MORE

MEMBERS ONLY

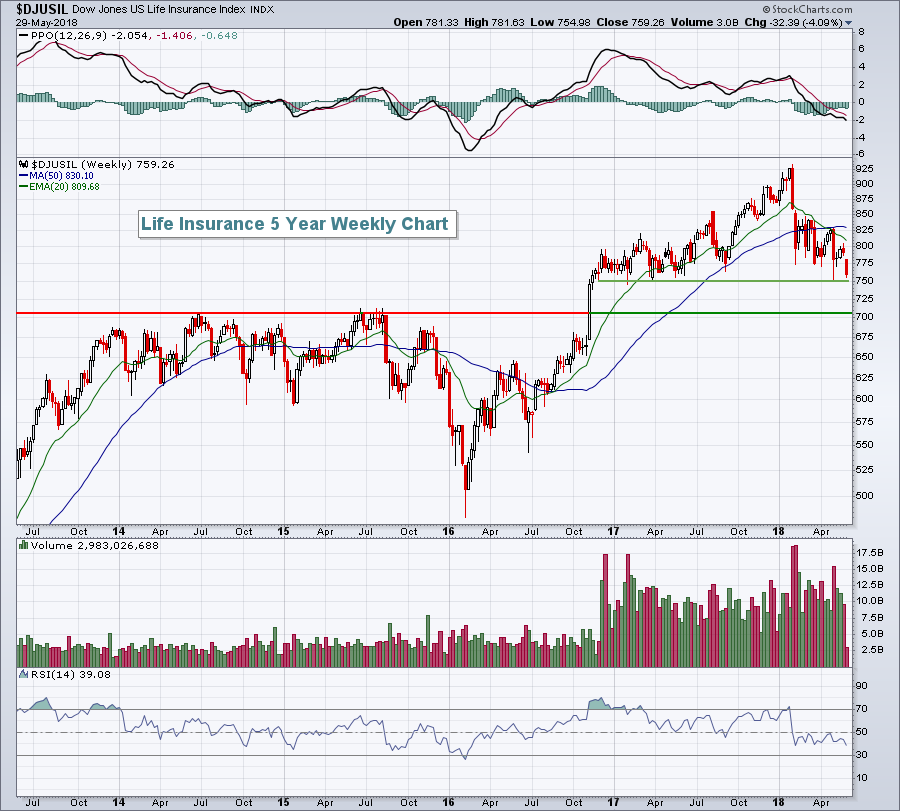

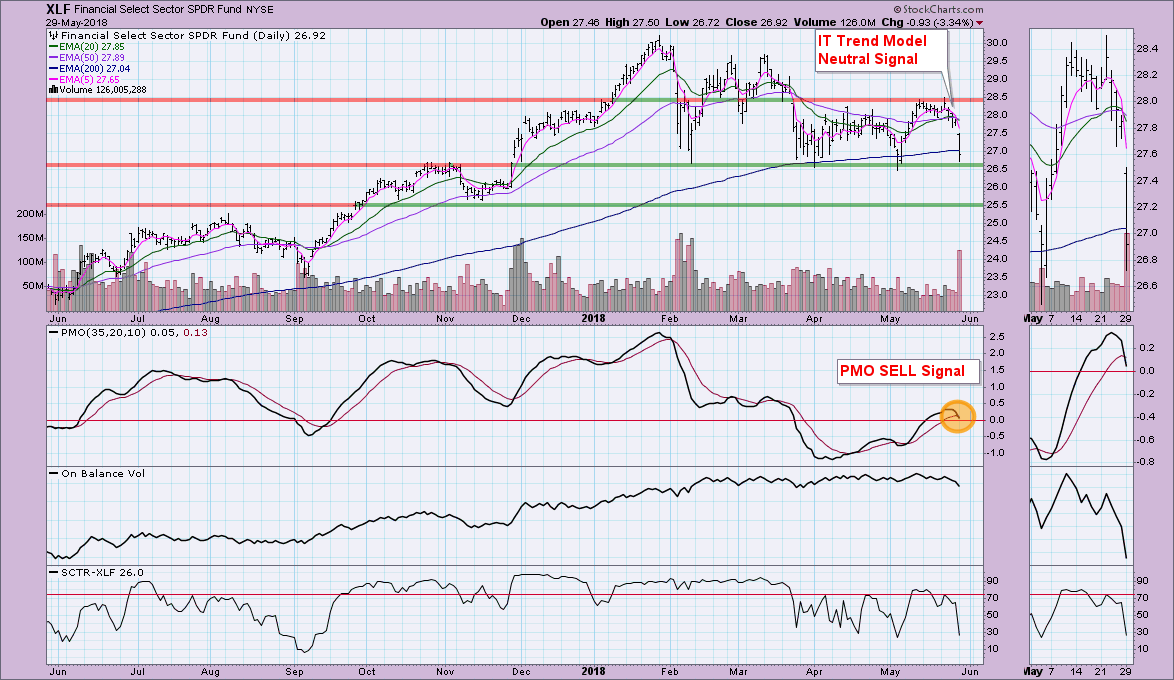

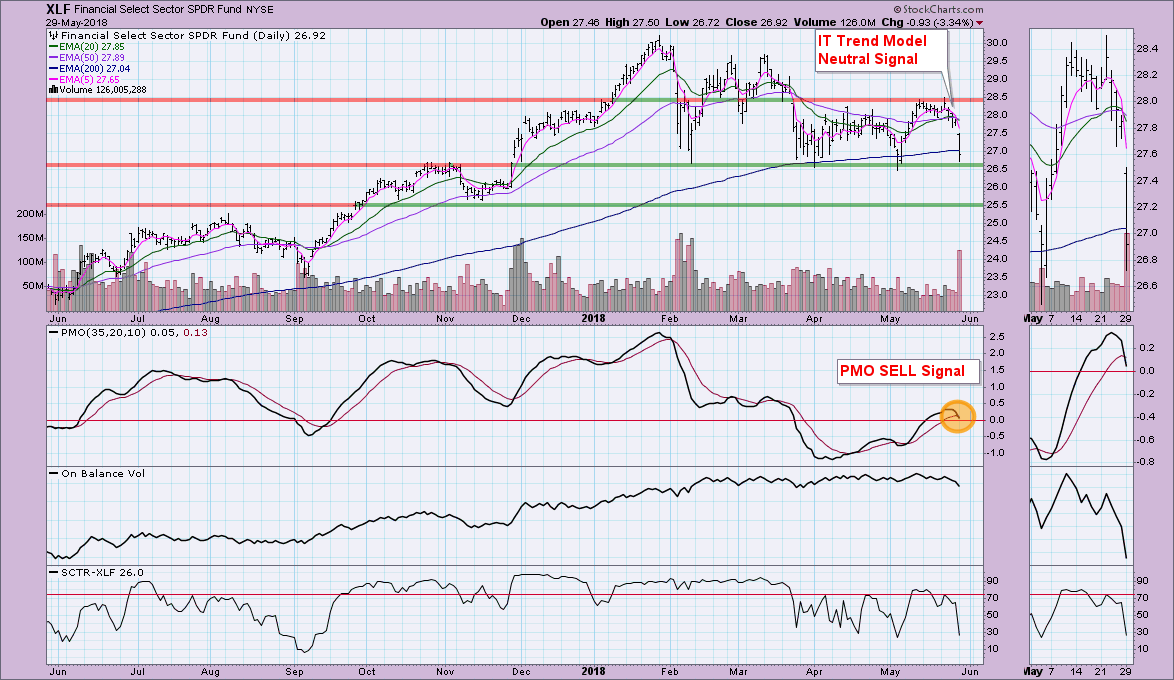

Financial SPDR (XLF) Triggers PMO SELL Signal AND Trend Model Neutral Signal!

by Erin Swenlin,

Vice President, DecisionPoint.com

The markets spent much of last week consolidating or pulling back. The Financial sector was no exception. As with many of the major markets, XLF was hit especially hard today with a decline of over 3.3%. This was a more than decisive breakdown which would suggest lower prices ahead....

READ MORE

MEMBERS ONLY

NASDAQ 100 Subscribes To NFLX And INTC Breakouts

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, May 25, 2018

The NASDAQ 100 ($NDX) led the action on Friday and last week, thanks in large part to Netflix (NFLX) and a couple of chipmakers - Intel Corp (INTC) and Micron Technology (MU). NFLX surged to an all-time high earlier in the week, easily...

READ MORE

MEMBERS ONLY

Risk-Off Assets Get a Bounce as Euro Breaks Down

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Is the Dollar Strong or the Euro Weak?

* Yen Bounces as Euro Falls.

* A Big Surge for Treasuries.

* Gold is Oversold in an Uptrend.

* Italy and Spain Lead Europe Lower.

* Looking for International Indexes?

* On Trend: Tuesdays at 10:30 AM ET.

Dollar Strength or Euro Weakness? ...

I am starting...

READ MORE

MEMBERS ONLY

Ship in a Bottle

by Bruce Fraser,

Industry-leading "Wyckoffian"

A model ship in a bottle reminds me of the intricate detail, on a minature scale, available with the Wyckoff Method. Wyckoff analysis scales up, into very large timeframes, and down into the shortest of timeframes. Those who study and trade on an intra-day basis should consider adding these Wyckoff...

READ MORE

MEMBERS ONLY

STOCKS TRADE SIDEWAYS BUT END WEEK SLIGHTLY HIGHER -- FALLING CRUDE OIL MADE ENERGY THE WEAKEST SECTOR -- WHILE FALLING BOND YIELDS MADE UTILITIES THE STRONGEST -- INTERMARKET ANALYSIS SUGGESTS THOSE TWO TRENDS ARE LINKED

by John Murphy,

Chief Technical Analyst, StockCharts.com

UTILITIES WERE WEEK'S STRONGEST SECTOR WHILE ENERGY WAS THE WEAKEST... Stocks ended the week with small gains while continuing to trade in a sideways consolidation pattern. Technology stocks showed relative strength thanks to a strong semiconductor group. So did consumer cyclicals which were led higher by apparel retailers....

READ MORE

MEMBERS ONLY

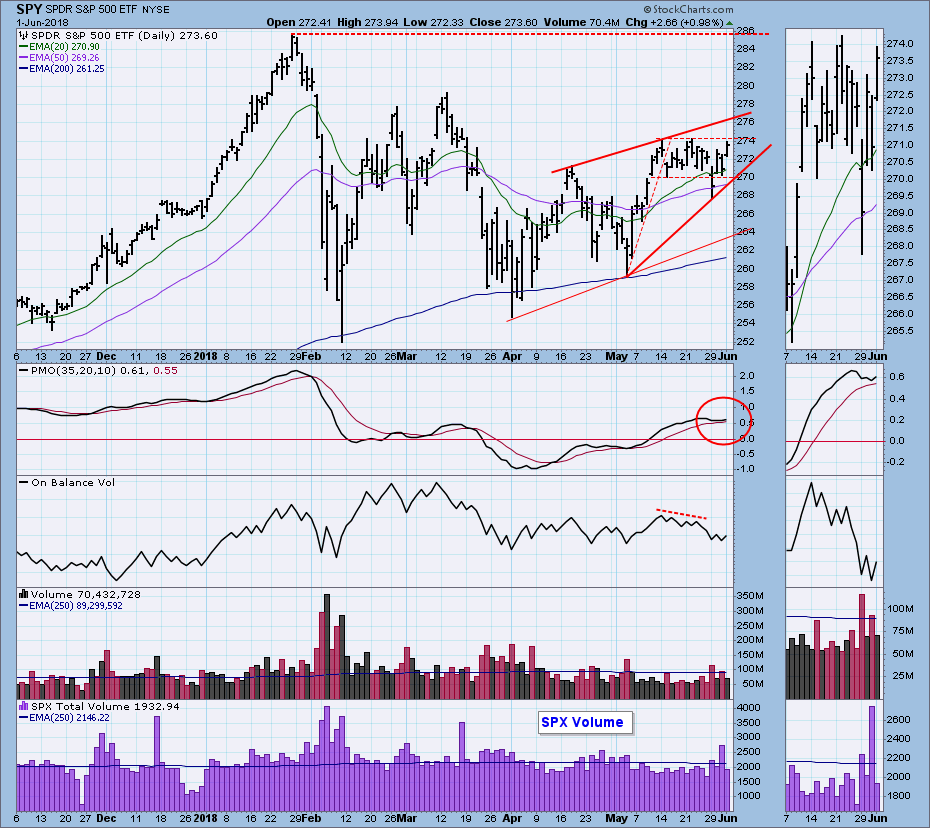

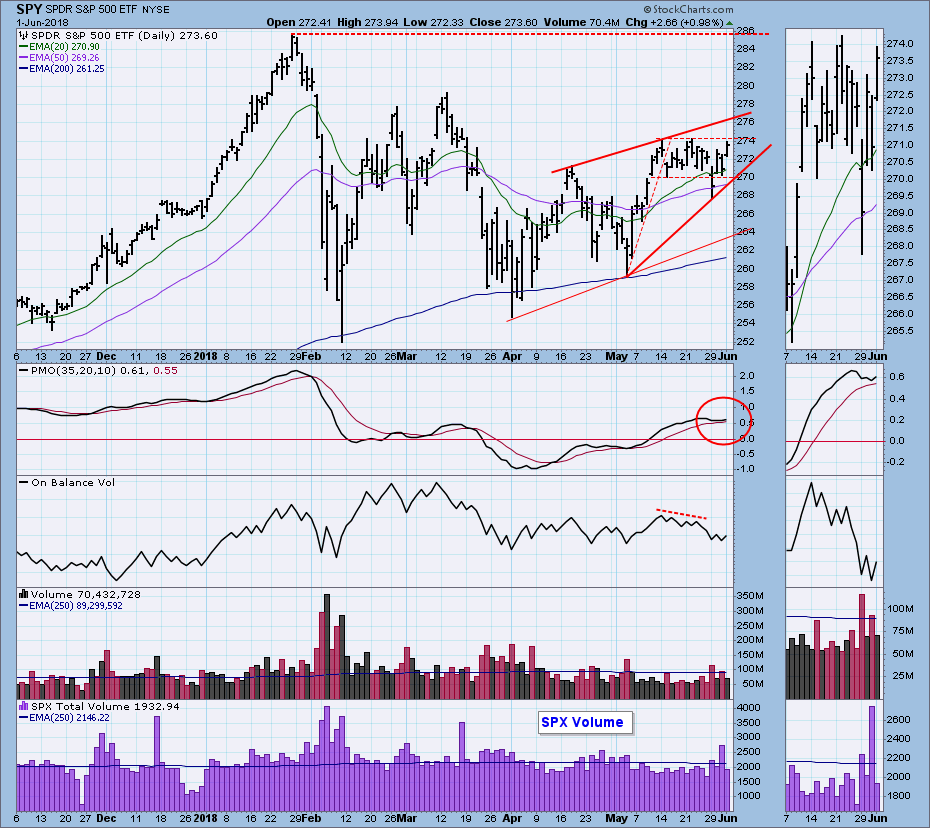

DP Weekly Wrap: From Flag to Churn

by Carl Swenlin,

President and Founder, DecisionPoint.com

Last week I thought we had a good outlook based upon a bullish flag formation, but this week the market just added more sideways movement. We could still make a case for a flag being in place, but a good flag should slant down off the flagpole as a sign...

READ MORE

MEMBERS ONLY

Two Markets Close To Basket Case Status

by Martin Pring,

President, Pring Research

* Commodities looking short-term toppy

* Copper close to a bear market signal that it may escape

* Oil trend is still positive but vulnerable

* Two markets close to a major breakdown

In a global stock market of predominantly long-term bullish charts, two country funds stand out as being on the verge of...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook - As Divided as Ever

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* SPX New Highs Continue to Drag.

* Triangle Breakout Holds.

* Bulls and Bears Fight to Go Nowhere.

* Watching the Swing within the Wedge.

* IJR Holds above Breakout Zone.

* QQQ and XLK Form Tight Consolidations.

* XLF Stalls Near April High.

* XLI Stays Strong as XLV Hits Make-or-Break Level.

* Semis are Leading and...

READ MORE

MEMBERS ONLY

Retail Says We're Going Higher.....Much Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, May 24, 2018

The U.S. stock market will be closed on Monday in observance of Memorial Day. Thanks to all of the veterans, current and past, for their service to our country. :-)

Wall Street traded much lower in the opening 90 minutes, then spent...

READ MORE

MEMBERS ONLY

APPAREL RETAILERS ARE HAVING A STRONG DAY -- TODAY'S RETAIL LEADERS ARE GAP, FOOT LOCKER, AND KOHLS -- CONSUMER DISCRETIONARY SPDR CONTINUES TO SHOW RELATIVE STRENGTH -- SO DO THE TRANSPORTS -- MICRON TECHNOLOGY LEADS CHIP STOCKS HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

APPAREL RETAILERS ARE GETTING MORE EXPENSIVE... My message on Wednesday of last week showed the S&P Retail SPDR (XRT) hitting a four-month high and becoming a new market leader. Yesterday's message showed the XRT rebounding enough to stay above its recent breakout point. Retailers are continuing...

READ MORE

MEMBERS ONLY

Software, Internet Stocks Bounce Off 20 Day EMAs, Lead Technology Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, May 23, 2018

Technology (XLK, +0.74%) rallied on Wednesday to move back near two month highs and creep closer to its all-time high close. Both software ($DJUSSW) and internet stocks ($DJUSNS) performed well to lead the rally:

The green arrows highlight the rising 20 day...

READ MORE

MEMBERS ONLY

DP Alert: Intermediate-Term Indicators Remain Bullish - Worst Could Be Over

by Erin Swenlin,

Vice President, DecisionPoint.com

It looks like I may actually have a week without a signal change on the DecisionPoint Scoreboards. Currently all trends are bullish, although momentum isn't positive in the intermediate term. The IT PMO signals are derived from the weekly PMO. The weekly PMOs are mostly flat and directionless...

READ MORE

MEMBERS ONLY

STOCK INDEXES END HIGHER AFTER HOLDING CHART SUPPORT -- DOW LEADERS ARE BOEING, INTEL, AND MICROSOFT -- RETAILERS LEAD S&P 500 HIGHER -- NASDAQ 100 IS DAY'S STRONGEST INDEX -- NETFLIX HITS NEW RECORD

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW BOUNCES OFF SHORT-TERM CHART SUPPORT... An early morning pullback for the Dow found support along the lows of last week before ending the day higher. That was the same story for the other major stock indexes. The black line in Chart 1 shows the Dow Industrials staying above that...

READ MORE

MEMBERS ONLY

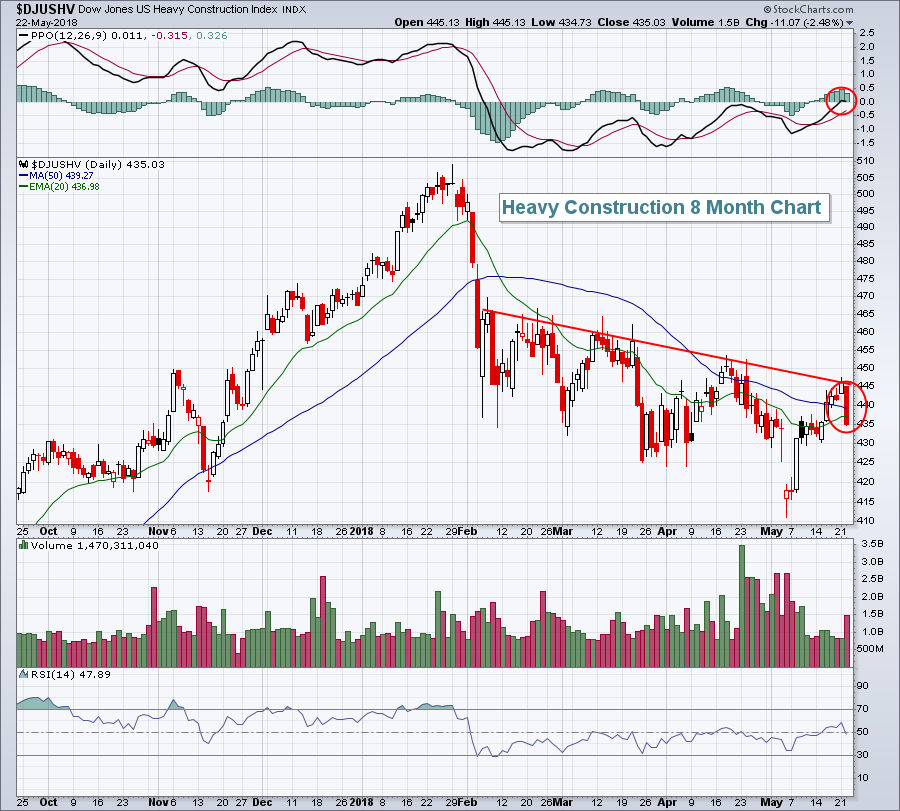

Here's A Seasonal Winner For June And July

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

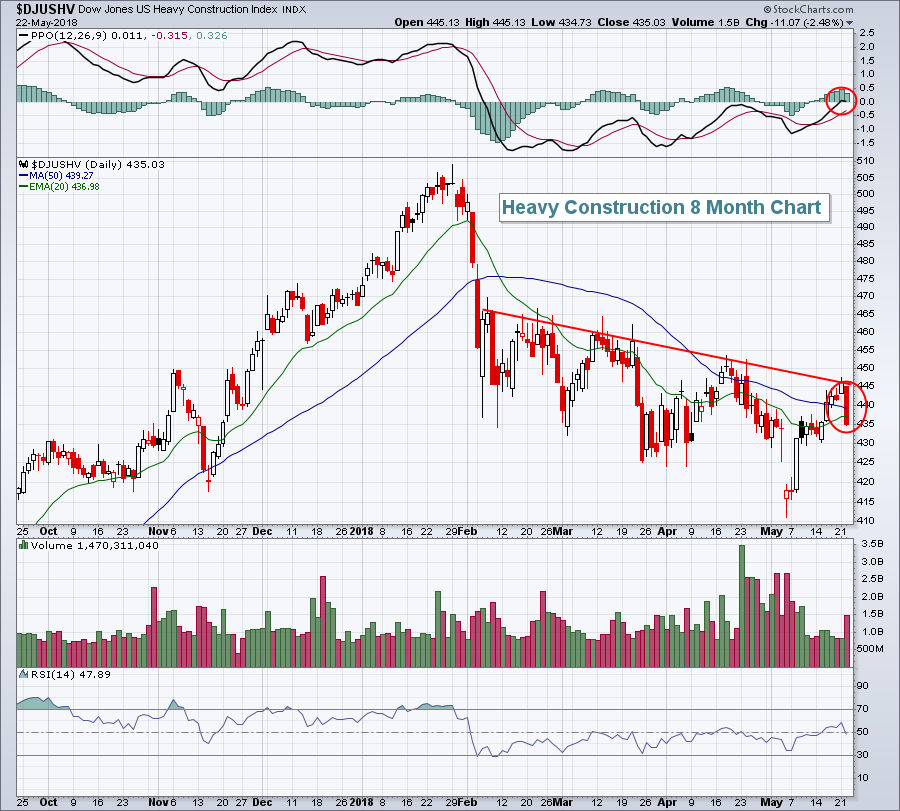

Market Recap for Tuesday, May 22, 2018

After early morning strength, Wall Street sellers returned and took their toll on many areas of the market, but most notably energy (XLE, -1.33%) and industrials (XLI, -1.23%). Heavy construction ($DJUSHV) was a key casualty in the industrials after trying to...

READ MORE

MEMBERS ONLY

Bull Flags in JP Morgan and Morgan Stanley

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

I highlighted a number of bull flags in Tuesday's show (On Trend), and there were some breakouts. These breakouts, however, were not very convincing because stocks closed weak and gave back their early gains.

Today I will highlight the flags in JP Morgan (JPM) and Morgan Stanley (MS)...

READ MORE

MEMBERS ONLY

Preparing for that Doh! Moment - The Triangle versus another Wedge

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* The Last Thing You Expect ....

* Another Ominous Wedge Takes Shape.

* $SPX-$SML Correlation is High.

* QQQ Shows Short-term Weakness.

* Regional Banks Outperform Big Banks.

* Highlights from On Trend.

The Last Thing You Expect ....

... is probably what will happen. Even though I cannot quantify this expression, we have all experienced such...

READ MORE

MEMBERS ONLY

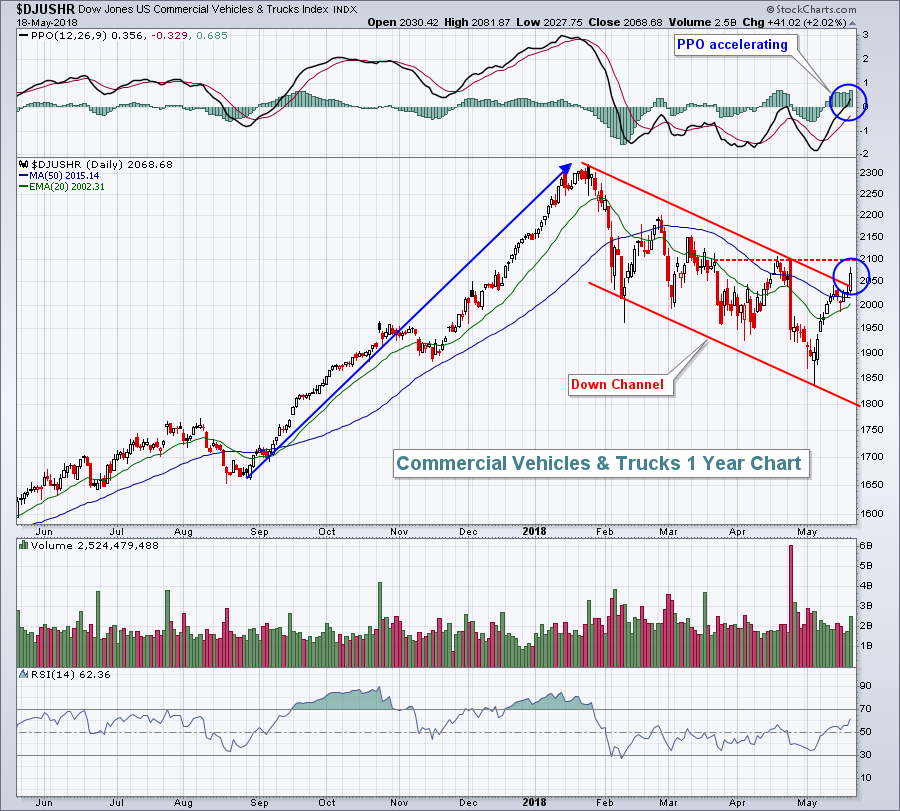

Aerospace, Transports Lead Surge In Industrials

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

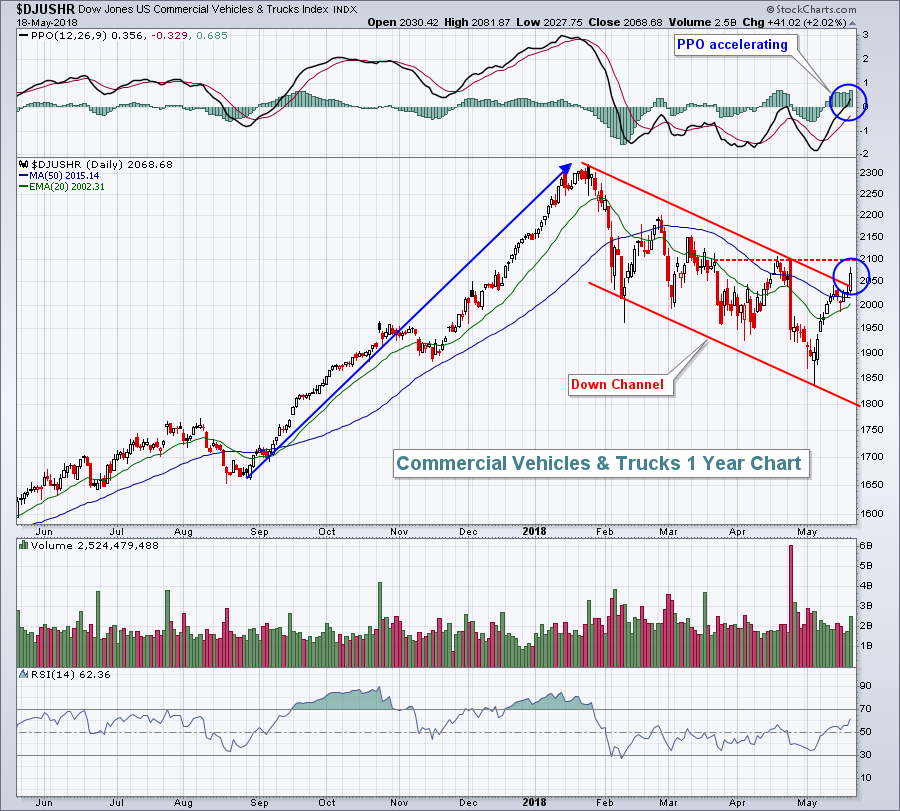

Market Recap for Monday, May 21, 2018

Until recently, the industrials (XLI, +1.51%) had been lagging its aggressive sector counterparts rather badly. That has definitely changed in May and we now have all key sectors with buy signals. Relative weakness remains in the defensive healthcare (XLV, +0.10%), consumer...

READ MORE

MEMBERS ONLY

Hasbro Hits Stiff Resistance Zone

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

I do not often highlight stocks with bearish setups during a bull market, but Hasbro shows some serious weakness over the past year and looks poised to peak again.

First and foremost, the chart shows Hasbro (HAS) hitting a 52-week low in early April and this means the long-term trend...

READ MORE

MEMBERS ONLY

BOEING AND CATERPILLAR LEAD INDUSTRIAL SPDR HIGHER -- THE DOW INDUSTRIALS ARE BREAKING OUT TO THE UPSIDE -- SO ARE THE TRANSPORTS -- THAT SIGNALS A DOW THEORY BUY SIGNAL IN THE MAKING

by John Murphy,

Chief Technical Analyst, StockCharts.com

INDUSTRIAL SPDR IS BREAKING OUT ... Good news on the tariff dispute with China is giving a big lift to stocks today. While all sectors are gaining ground, the day's leader is the industrial sector. Chart 1 shows the Industrial SPDR (XLI) rising pretty decisively above a falling four-month...

READ MORE

MEMBERS ONLY

Building a Rules-Based Trend Following Model - 10

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I’m going to change the focus for a while; for my own sanity and probably for yours. We have talked about a weight of the evidence approach and some of the indicators used in that approach. This approach tells us when to invest in the market and how much;...

READ MORE

MEMBERS ONLY

Monday Trade Setup - Garmin Fills Gap, Looks To Head Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, May 18, 2018

Last week ended with plenty of bifurcation. Strength was once again seen across the small cap universe as the S&P 600 SmallCap Index and Russell 2000 both finished the week at all-time high closing levels. The larger cap Dow Jones and...

READ MORE

MEMBERS ONLY

Two Way Markets

by Bruce Fraser,

Industry-leading "Wyckoffian"

Since 2016 the broad stock market has been in a robust uptrend. Corporations have enjoyed an environment of stable and low interest rates with moderate rates of inflation. Such a backdrop of business conditions allows companies to efficiently manage their costs and grow earnings. Investors are willing to pay higher...

READ MORE

MEMBERS ONLY

When the Market is Choppy Search for the Best of the Best

by John Hopkins,

President and Co-founder, EarningsBeats.com

The S&P hit its all time high of 2872 on January 26, less than 4 months. ago. Two weeks later, on February 9, it touched 2532, having fallen almost 12% before recovering some. But since then the bulls have struggled to make progress with the S&P...

READ MORE

MEMBERS ONLY

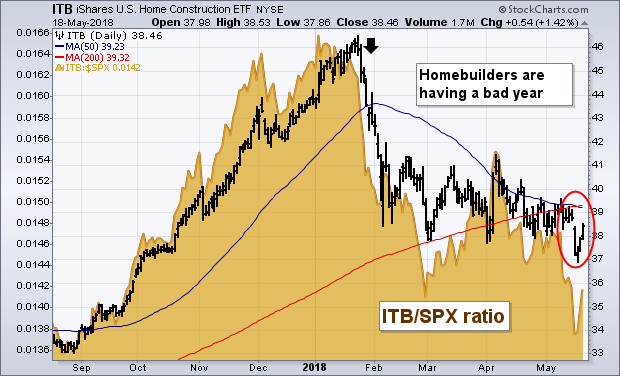

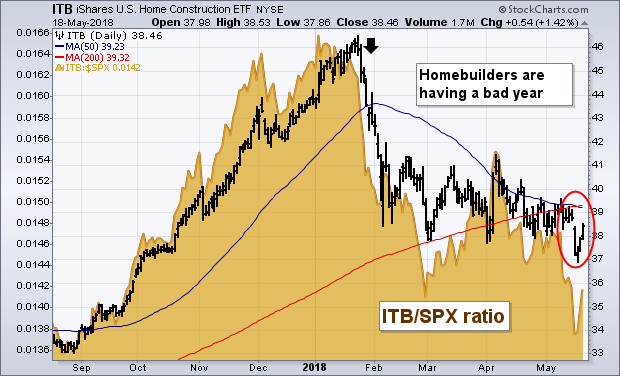

Rising Mortgage Rates Are Weighing On Homebuilders

by John Murphy,

Chief Technical Analyst, StockCharts.com

Editors Note: This article was originally published in John Murphy's Market Message on Saturday, May 18th at 9:17am EST.

The first page of today's Wall Street Journal carries the headline: "Era of Ultracheap Mortgages Ends as Rates Hit 7-Year High". The article goes...

READ MORE

MEMBERS ONLY

Rising Treasury Yields And Dollar Completely Change Investment Themes

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

There's a raging bull market going on right now, but you might not realize it if you're stuck in the S&P 500. Take a look at the chart below of the large cap benchmark S&P 500 and its small cap counterpart, the...

READ MORE