MEMBERS ONLY

DOW TRANSPORTS CLEAR THEIR 50-DAY AVERAGE -- JB HUNT AND CH ROBINSON ARE LEADING -- KANSAS CITY SOUTHERN, CSX, AND UNION PACIFIC ARE ALSO STRONG -- FEDEX CLEARS ITS 50-DAY AVERAGE -- THE DOW INDUSTRIALS ARE TESTING THEIR 50-DAY LINE AGAIN

by John Murphy,

Chief Technical Analyst, StockCharts.com

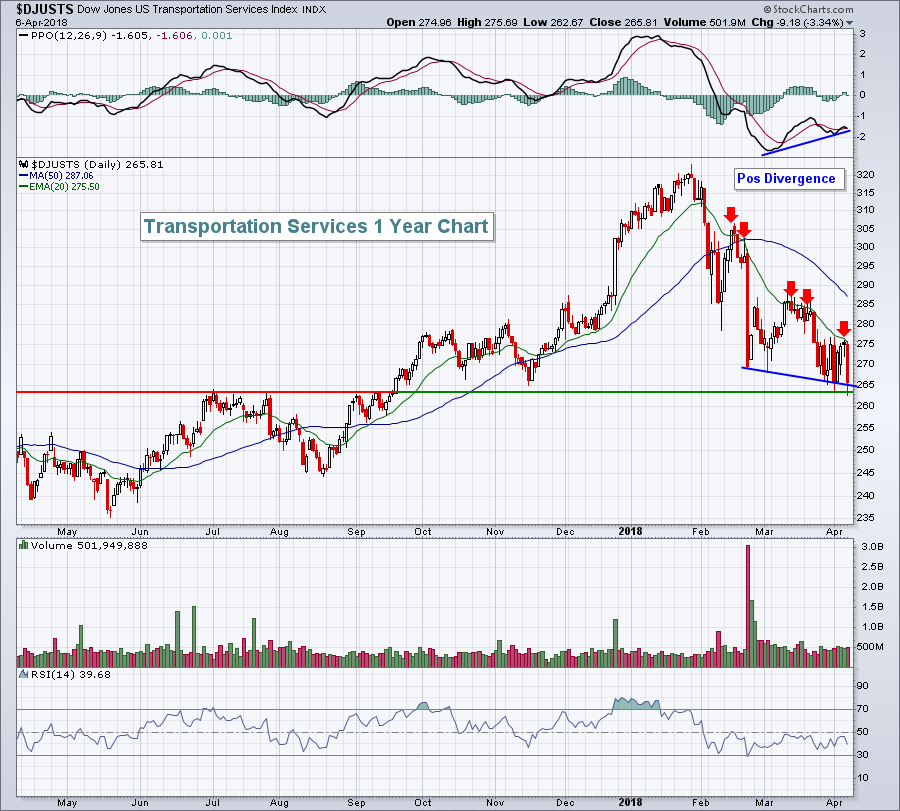

DOW TRANSPORTS EXCEED 50-DAY AVERAGE ... Stocks are opening the new week on a positive note. Transportation stocks are having an especially strong day. The daily bars in Chart 1 show the Dow Transports climbing 2% this morning. More importantly, the $TRAN is trading above its 50-day moving average (blue circle)...

READ MORE

MEMBERS ONLY

Energy Now Sports The Highest SCTR Among Sectors

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, April 13, 2018

U.S. stocks fell on Friday the 13th, but managed to cut intraday losses in half (or more) during the final 45 minutes of the session. Most of our major indices lost roughly 0.50%, except for the benchmark S&P 500,...

READ MORE

MEMBERS ONLY

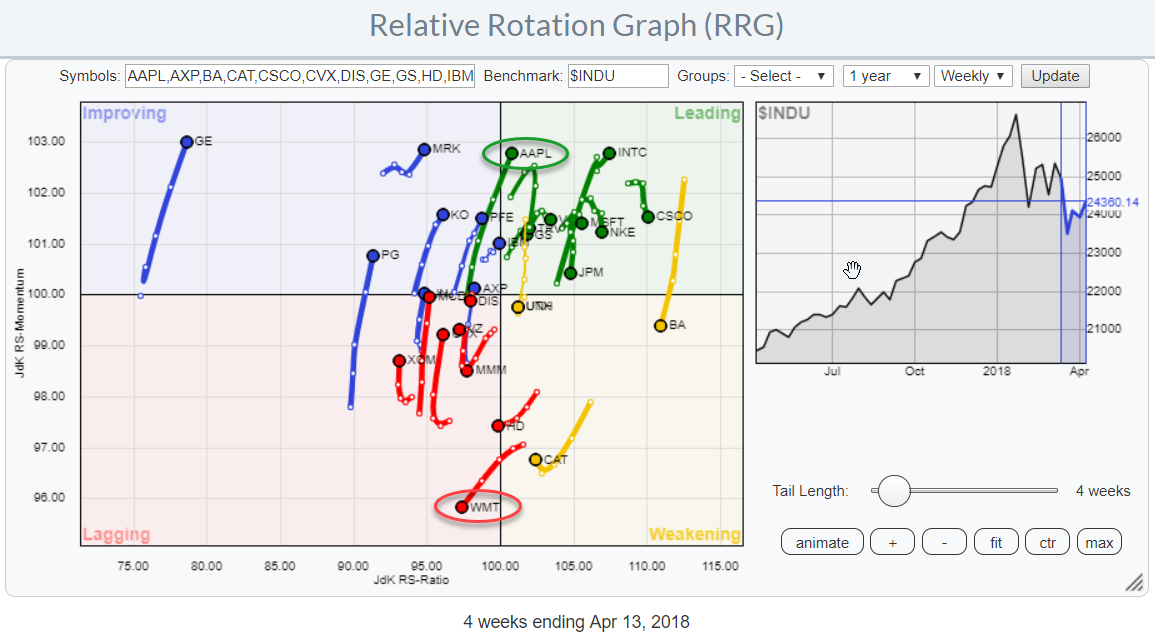

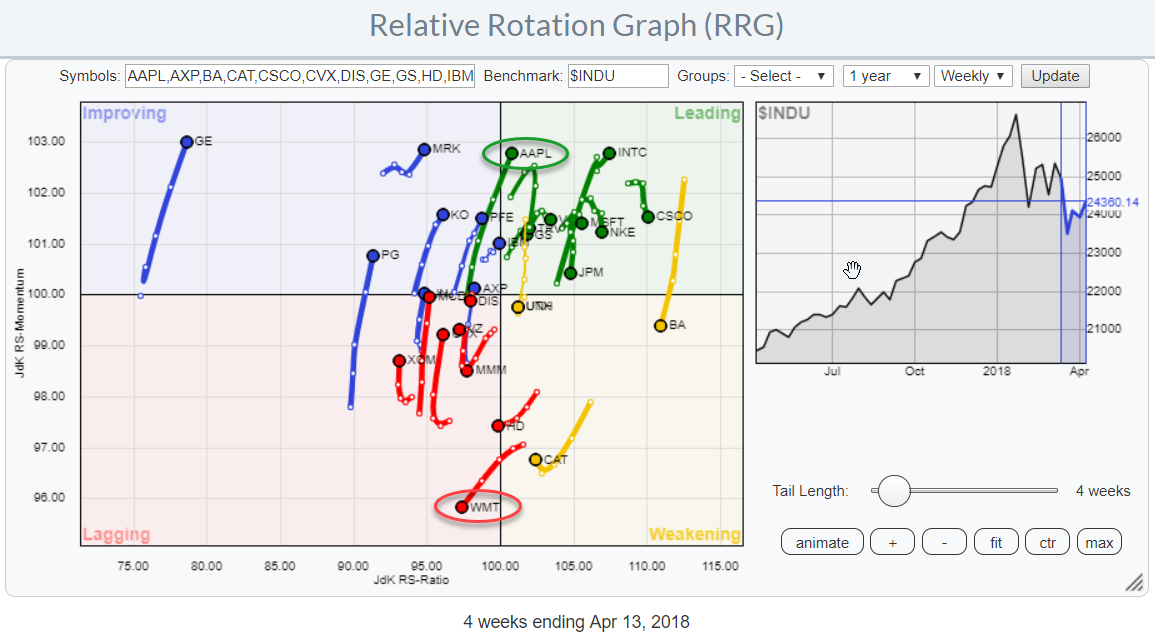

AAPL and WMT moving in opposite directions on Relative Rotation Graph

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Last week I attended the CMT Association’s annual symposium in New York City. One of the industry events that I visit each year.

On the one hand to learn from other industry professionals but very much also to catch up with friends and maintain relationships.

As I am writing...

READ MORE

MEMBERS ONLY

Win the Race with Relative Strength

by Bruce Fraser,

Industry-leading "Wyckoffian"

Fellow Wyckoffian, Dan, emailed a very good question this week. Dan is seeing the energy stocks move up and he observes that being a cyclical industry, these stocks typically move in unison. Dan is observing that some of the stocks are completing Accumulation phases while others are already in uptrends....

READ MORE

MEMBERS ONLY

DJIA Engulfing Pattern Suggests A Pause Before Higher Prices

by Martin Pring,

President, Pring Research

* A small correction ahead?

* Short-term oscillators are primed for a rally

* Bitcoin is breaking out again

A small correction ahead?

If you want to be bullish, Friday’s technical action was somewhat disappointing. That’s because it represented an engulfing pattern for the DIA, as shown in Chart 1.

Chart...

READ MORE

MEMBERS ONLY

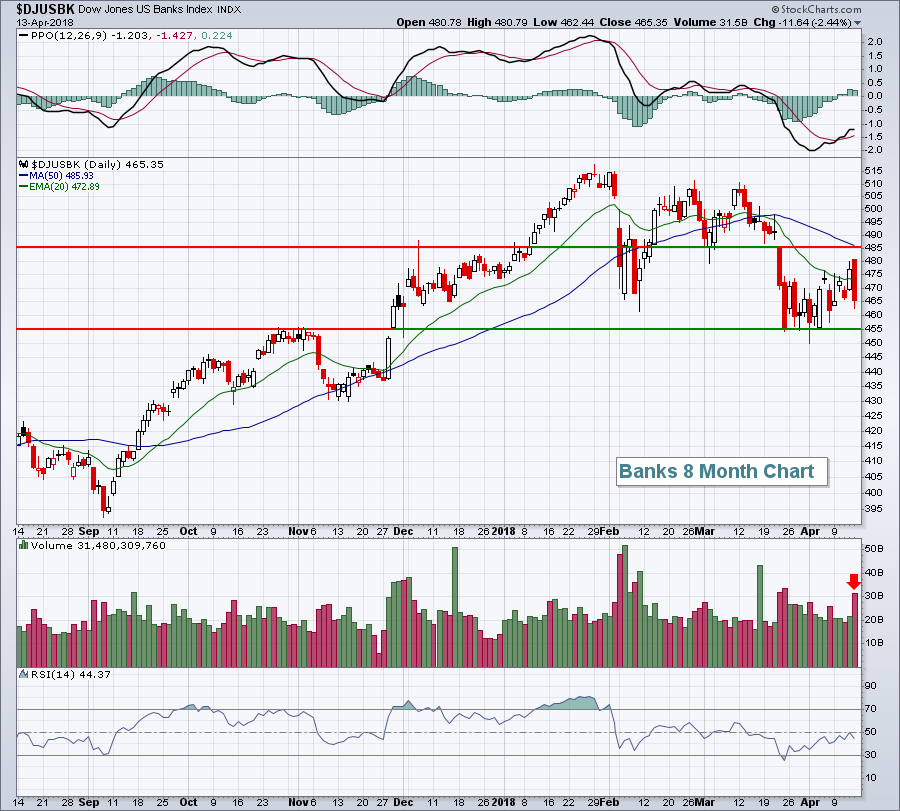

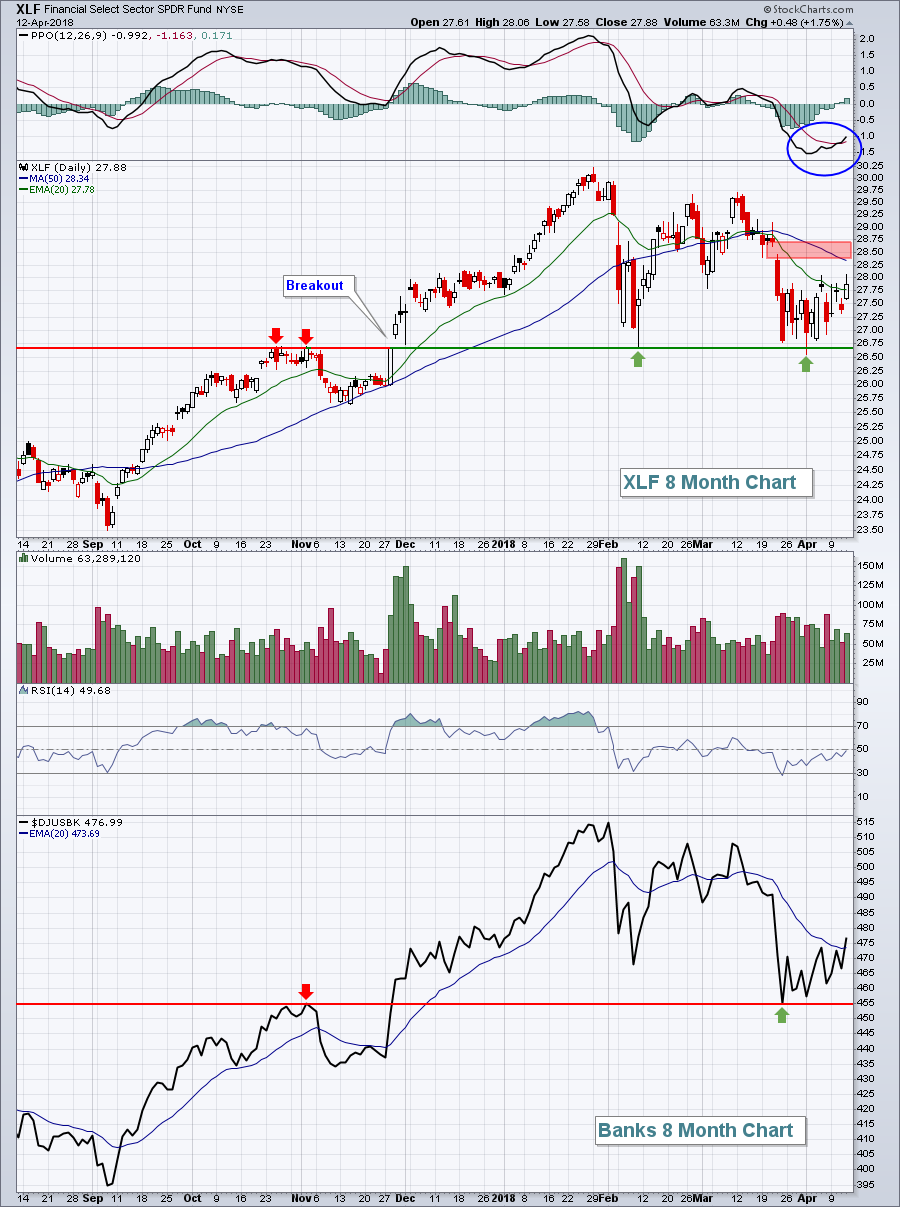

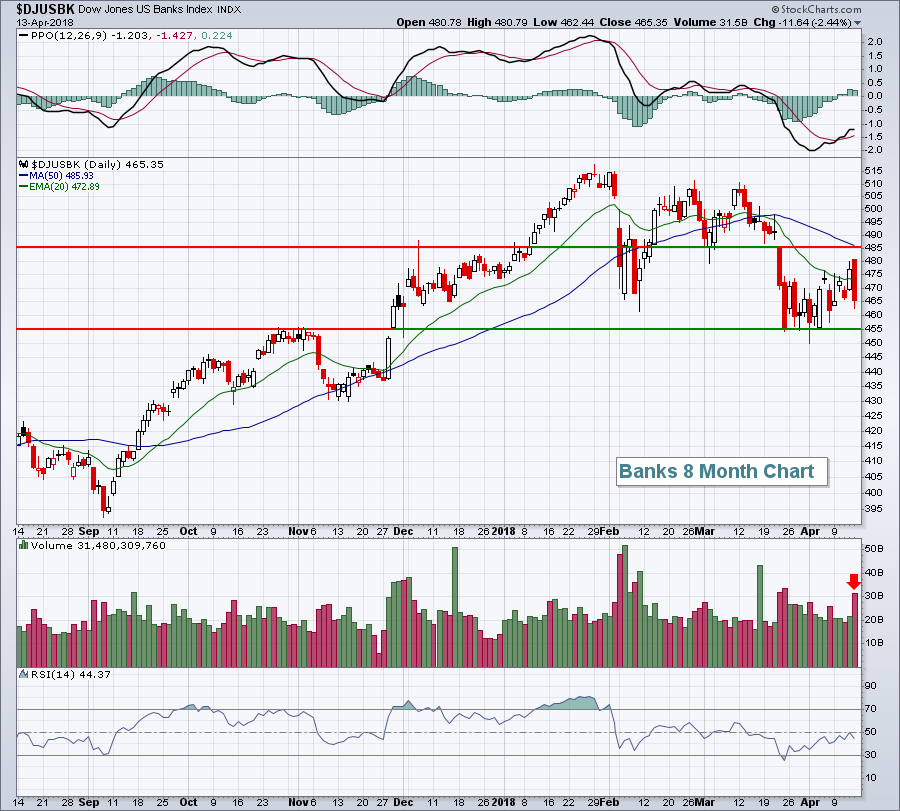

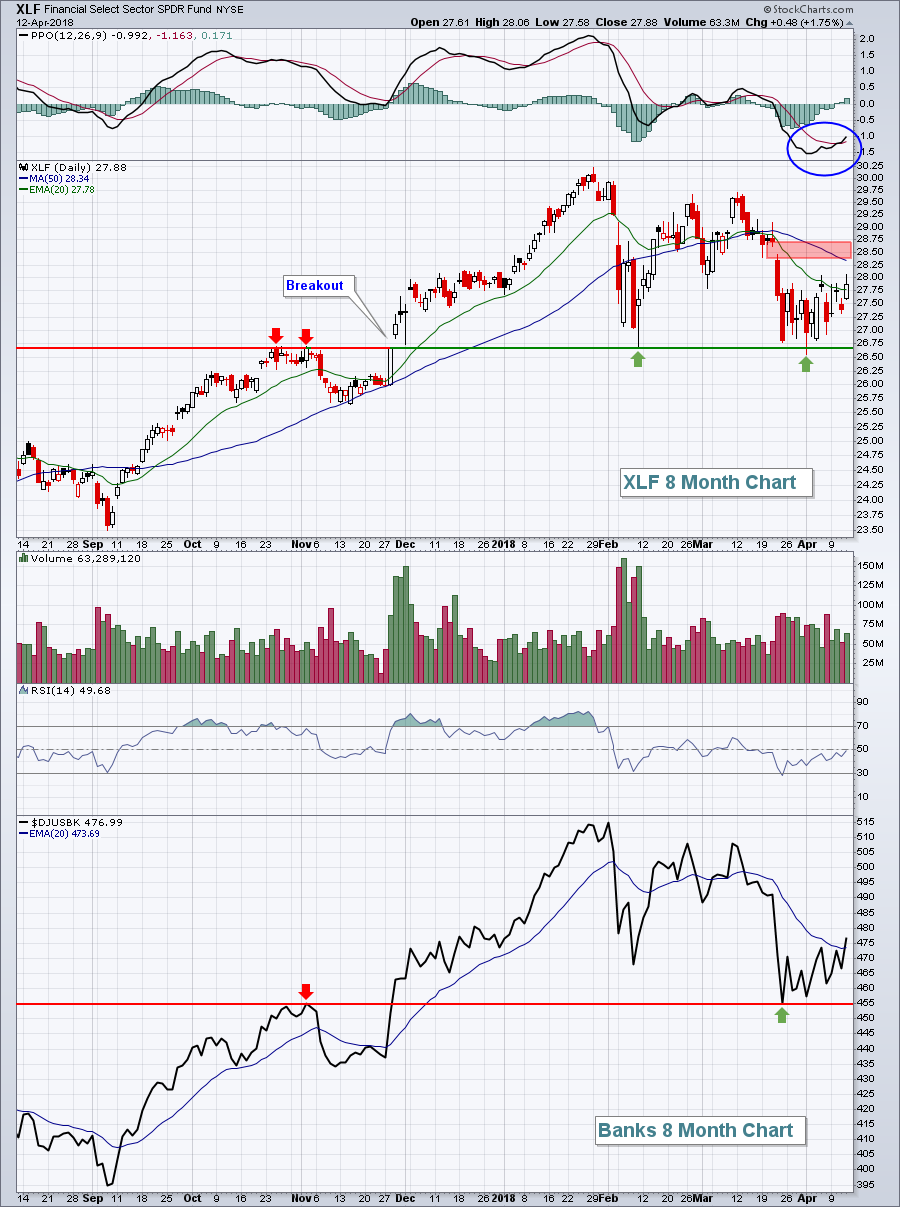

BANKS SUFFER BIG SELLOFF AFTER REPORTING STRONG EARNINGS -- JP MORGAN CHASE SUFFERS DOWNSIDE REVERSAL DAY -- FINANCIAL SPDR FAILS TEST OF 50-DAY AVERAGE -- STOCK INDEXES PULL BACK FROM 50-DAY AVERAGES BUT ON LIGHTEST TRADING OF THE YEAR

by John Murphy,

Chief Technical Analyst, StockCharts.com

JP MORGAN CHASE SUFFERS DOWNSIDE REVERSAL ON FRIDAY... Friday had to be a very discouraging day for investors in bank stocks. After reporting first quarter earnings that were much higher than expected, bank stocks opened higher before plunging in heavy trading. Chart 1 shows JP Morgan Chase (JPM) suffering a...

READ MORE

MEMBERS ONLY

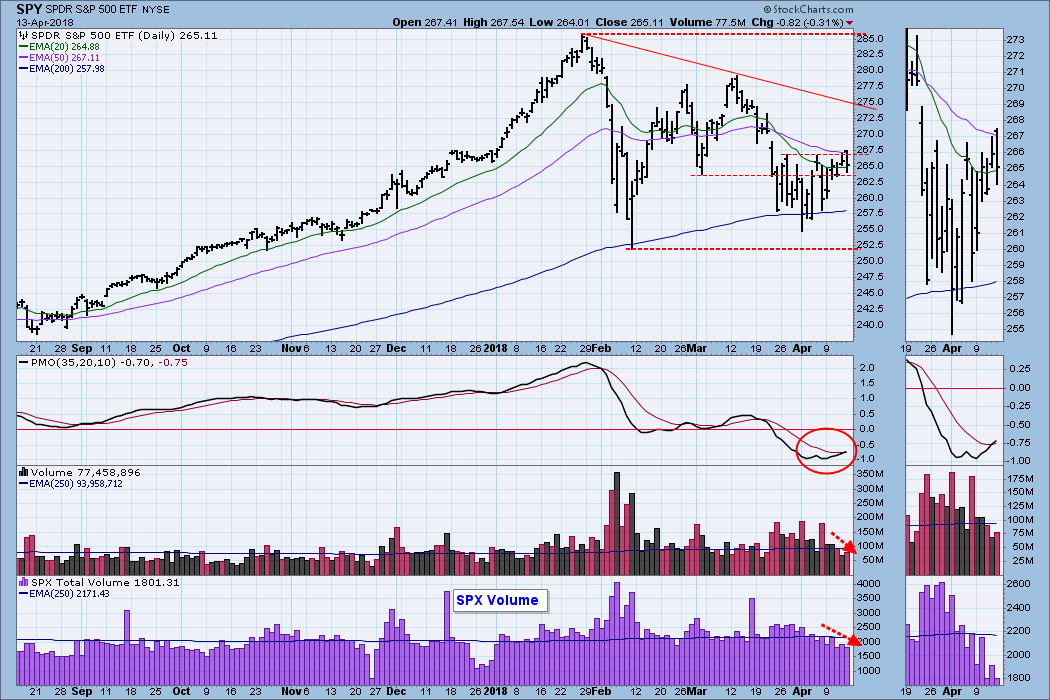

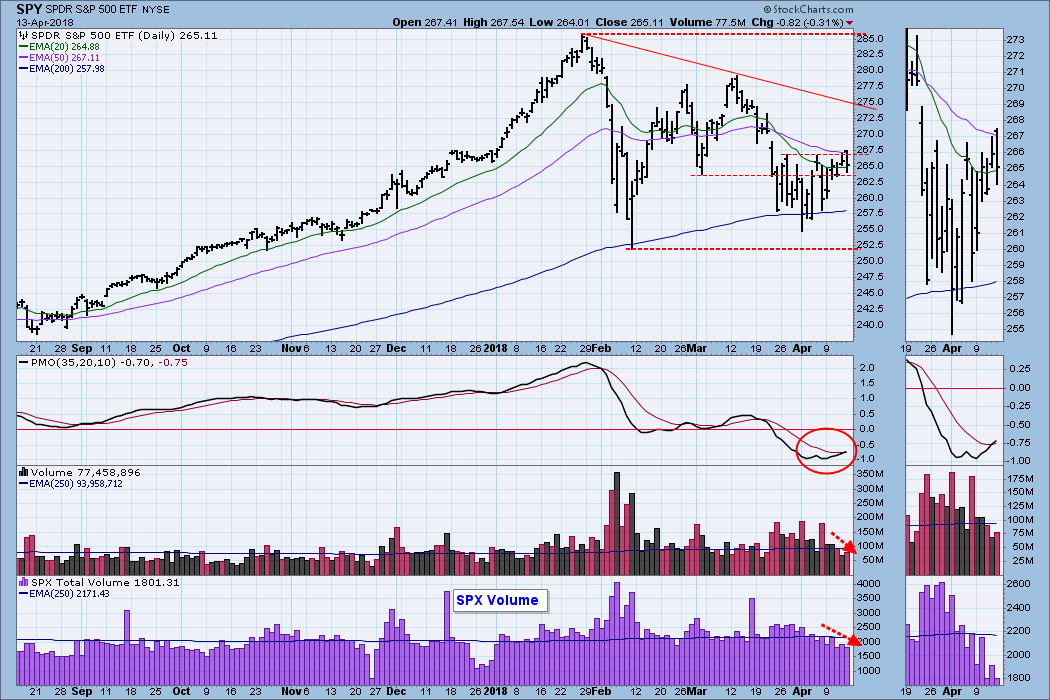

DP Weekly Wrap: Weak Volume Undermines Rally

by Carl Swenlin,

President and Founder, DecisionPoint.com

Market action was a little choppy this week, but SPY managed to eke out a small gain; unfortunately, volume was weak and did not confirm the rally. The PMO bottomed and crossed up through the signal line, giving a PMO BUY signal. But the PMO is running kind of flat,...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook (with Video) - Tech Springs Back and High-Low Lines Turn

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Three Strikes and your Out - But Not Yet.

* SPY Attempts to Reverse Downswing.

* IJR Leading in April.

* QQQ Springs to Life.

* High-Low Lines Turn Up.

* Tech-Related ETFs Break Out in Unison.

* XBI, SLX and the Problem with Reversal Patterns.

* Bear Market Bounce for Bonds, Utes and REITs.

* Gold Stays...

READ MORE

MEMBERS ONLY

CNBC Won't Tell You When The Market Is Topping, But This Chart Will

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Note

I write an article here in this blog each and every morning that the stock market is open. It's typically published during pre-market action, between 8:30am-9:00am EST. I've been doing it since September 2015 and I do my best to keep you up-to-date...

READ MORE

MEMBERS ONLY

Building a Rules-Based Trend Following Model - 8

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Another price-based measure I use in my weight of the evidence is called Adaptive Trend. This was modeled after an indicator from the Bloomberg service called Trender. Adaptive Trend identifies price swings based on the daily trading range. It uses Average True Range (ATR), exponential smoothing, and standard deviation as...

READ MORE

MEMBERS ONLY

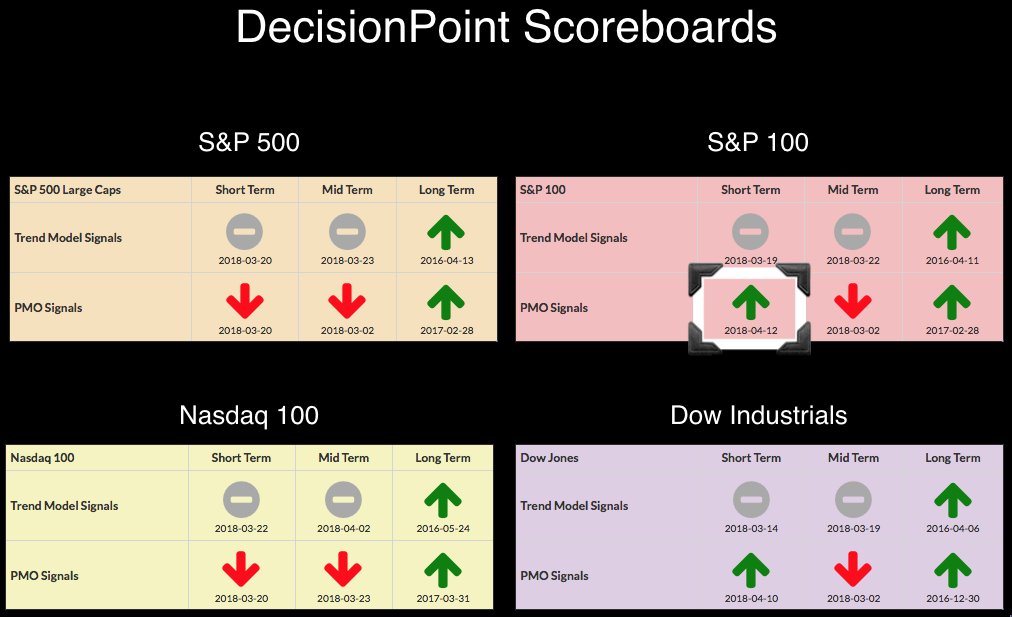

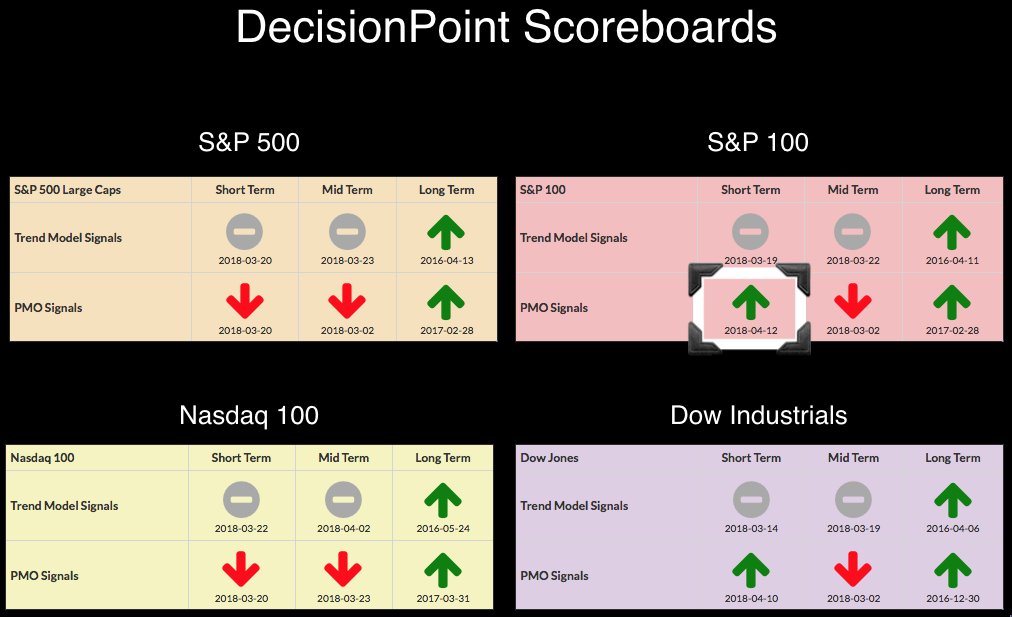

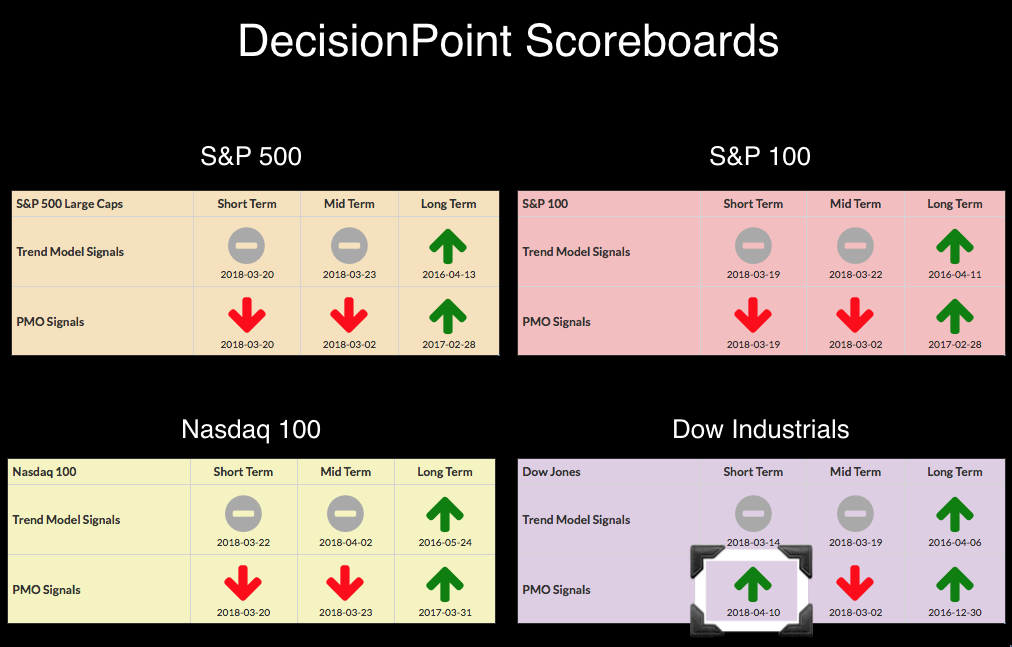

DP Bulletin #2: OEX Hops Aboard the PMO BUY Signal Train

by Erin Swenlin,

Vice President, DecisionPoint.com

Another new signal to report on the DecisionPoint Scoreboards, the OEX has logged a Price Momentum Oscillator (PMO) BUY signal to join the Dow which triggered its PMO BUY signal yesterday. The NDX PMO has some distance to close before we'll see its signal change. Tomorrow, the SPX...

READ MORE

MEMBERS ONLY

BOND YIELDS MAY BE TURNING BACK UP AGAIN -- THAT'S BOOSTING FINANCIALS AND HURTING UTILITIES -- JP MORGAN AND GOLDMAN SACHS CLEAR 50-DAY AVERAGES -- BOEING AND INTEL LEAD DOW HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

TEN YEAR BOND YIELD MAY BE TURNING BACK UP AGAIN... After hitting a four-year high during January, the 10-Year Treasury Yield saw a modest decline from mid-February until the end of March. Some of that decline in yields was probably based on safe haven buying of Treasuries during the first...

READ MORE

MEMBERS ONLY

Small Caps May Be Breaking Out But Not All Are Created Equal

by Martin Pring,

President, Pring Research

* The technical position of small caps in general

* Small cap sectors

The technical position of small caps in general

Small caps, as represented by the Russell 2000 ETF (IWM), have outperformed the market since late March and have now broken out in their own right. We can see this from...

READ MORE

MEMBERS ONLY

SystemTrader - Putting the 200-day Moving Average through the Wringer

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Introduction and Overview.

* How Many Crosses in the Last 25 Years?

* Crunching the Numbers.

* Putting the Dow Industrials to the Test.

* SPY, SPX and Dividends.

* Slowing Down the Trigger.

* Reduce Risk and Get on the Right Side.

* Summarizing the Results.

* Consulting, Software and Data.

The S&P 500 is...

READ MORE

MEMBERS ONLY

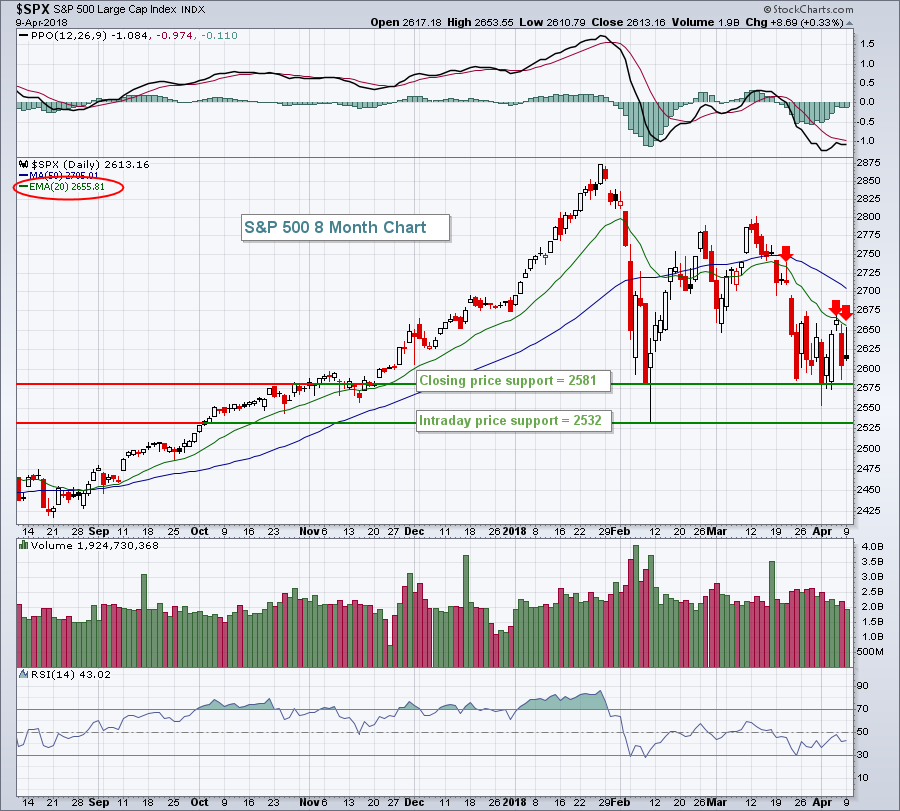

One Day Ahead Of 4 HUGE Bank Earnings Reports, Let's Delve Into The Group

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, April 11, 2018

Well, the S&P 500 tried to clear its 20 day EMA again. And it failed....again. That marks the 5th consecutive day of failed 20 day EMA breakouts. Given that futures are higher this morning, this benchmark index appears headed for...

READ MORE

MEMBERS ONLY

Bulls and Bears Slug it Out within Trading Range

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* SPY Challenges Short-term Resistance.

* Small-caps Continue to Act Well.

* Retail Comes Alive.

* Kohls, Nordstrom and Michael Kors.

* Cyber Security, Networking and Software Show Leadership.

* Copper Miners ETF Breaks Out within Consolidation.

SPY Challenges Resistance...

The S&P 500 is flirting with the 200-day simple moving average as it consolidates...

READ MORE

MEMBERS ONLY

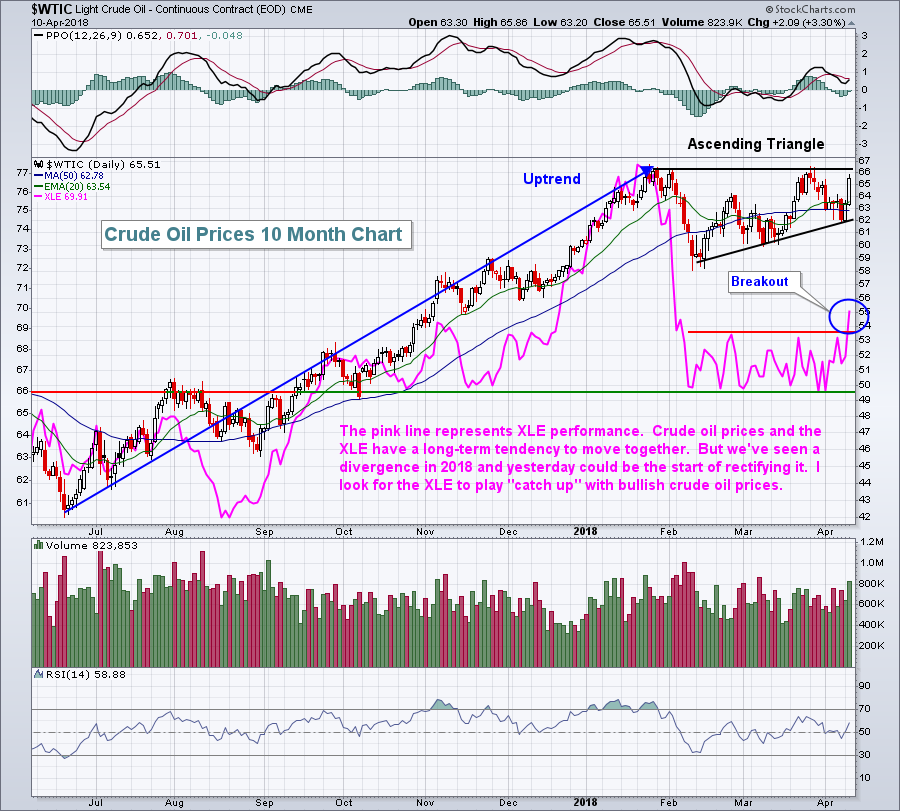

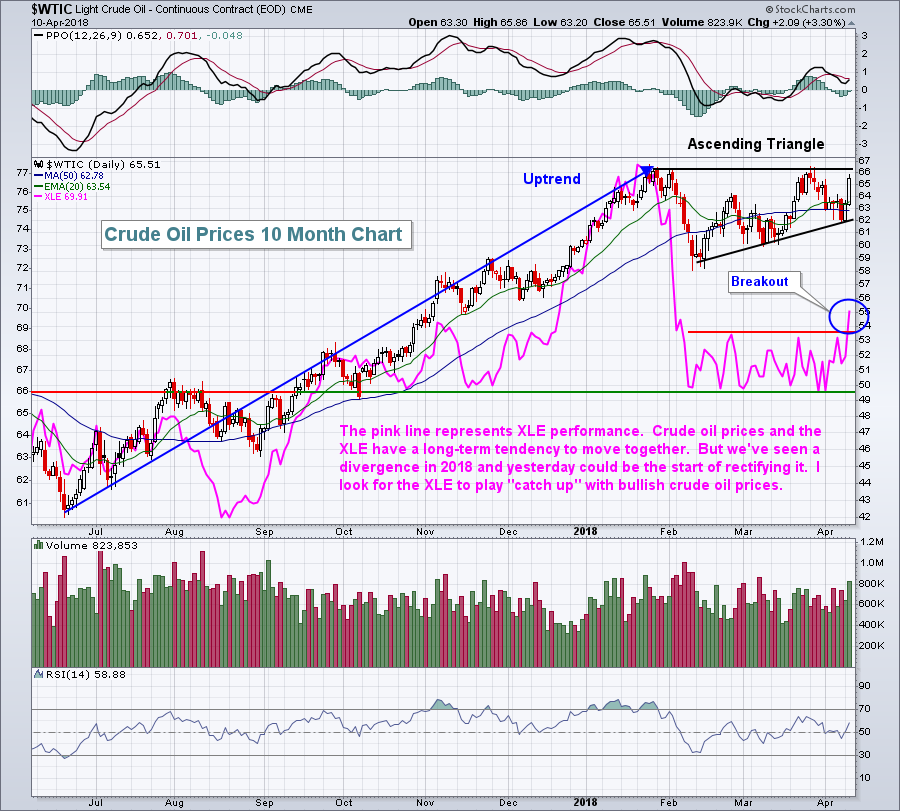

COMMODITY PRICES ARE RISING -- CRUDE OIL BREAKOUT IS GIVING A BIG BOOST TO ENERGY SHARES -- SMALL CAPS CONTINUE TO SHOW RELATIVE STRENGTH -- S&P 500 STILL NEEDS TO CLEAR RESISTANCE -- STRENGTH IN HIGH YIELD BONDS IS ANOTHER POSITIVE SIGN

by John Murphy,

Chief Technical Analyst, StockCharts.com

CRUDE OIL LEADS BLOOMBERG COMMODITY INDEX HIGHER... The daily bars in Chart 1 show the Bloomberg Commodity Index rising to the highest level in two months. The index recently bounced off its 200-day moving average (red line) and a rising trendline drawn under its June/December lows. The commodity rally...

READ MORE

MEMBERS ONLY

Energy Finally Breaks Out, Fuels S&P 500 Advance

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, April 10, 2018

It seems like forever, but the energy sector ETF (XLE, +3.31%) finally did it - it closed above 69.00! Can we please say goodbye to the 66-69 trading range? I didn't realize this until yesterday, but the XLE'...

READ MORE

MEMBERS ONLY

DP Bulletin: Dow is First to Regain Short-Term PMO BUY Signal

by Erin Swenlin,

Vice President, DecisionPoint.com

The Dow is the first to shed it's previous Price Momentum Oscillator (PMO) SELL signal. The SELL signal had been in place since 2/2/18. Found it interesting that the earliest PMO SELL signal on the DP Scoreboards managed to move to a BUY signal before all...

READ MORE

MEMBERS ONLY

Here's A Beaten Down Industry Group Where I'd Look For A 6-7% Rebound

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, April 9, 2018

Once again, Monday was the tale of two markets. The first half of the day was quite bullish, but it was all for naught as sellers stampeded the bulls in the afternoon session. Our major indices finished with across-the-board gains so if you...

READ MORE

MEMBERS ONLY

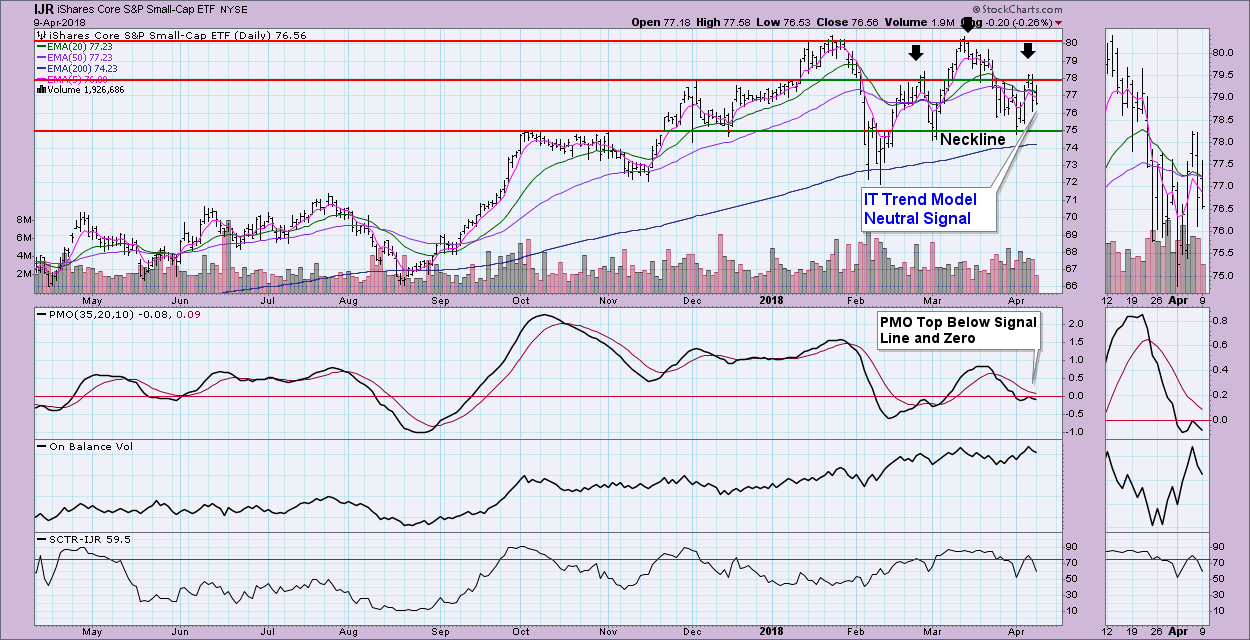

Small-Cap ETFs In Trouble - Possible Head and Shoulders Formations

by Erin Swenlin,

Vice President, DecisionPoint.com

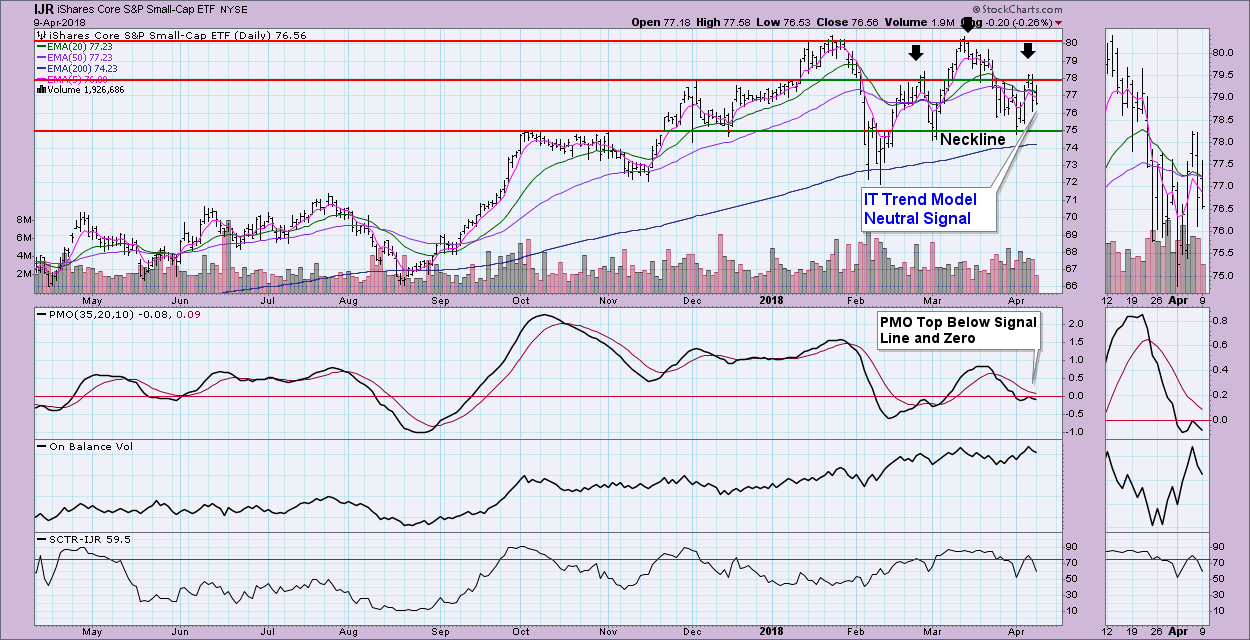

After the market close, my technical alert activated on IJR, the S&P 600 ETF with a new Intermediate-Term Trend Model Neutral signal. I noted that this same signal has already been hit on IWM, the Russell 2000 ETF. While I believe we are in a consolidation or shake...

READ MORE

MEMBERS ONLY

Frontier Markets are Outperforming US Market

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Frontier Markets ETF (FM) has been outperforming the S&P 500 SPDR (SPY) since summer and held up much better than the US market in March-April. FM recently broke out of a consolidation and it looks like the bigger uptrend is continuing.

The chart below shows FM with...

READ MORE

MEMBERS ONLY

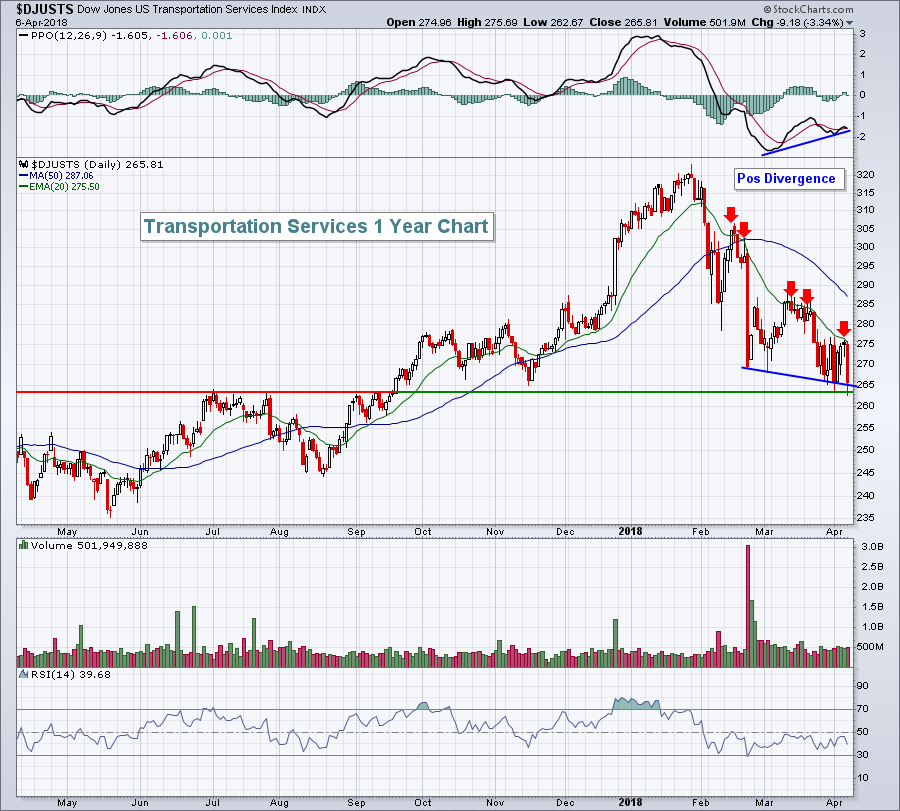

Despite Friday's Selloff, My Most Reliable Signal Remains Bullish

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

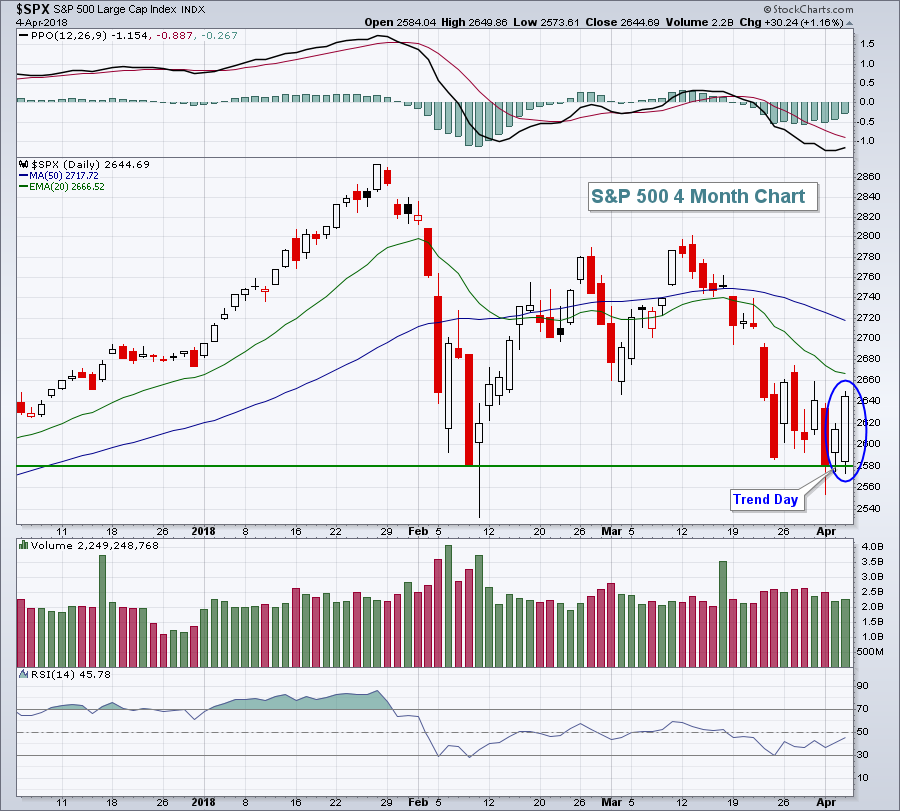

Market Recap for Friday, April 6, 2018

All nine sectors fell on Friday as the Dow Jones tumbled 572 points amid more threats of China tariffs by the White House. China has promised further retaliation if the U.S. remains adamant about imposing tariffs on China imports. This rhetoric back...

READ MORE

MEMBERS ONLY

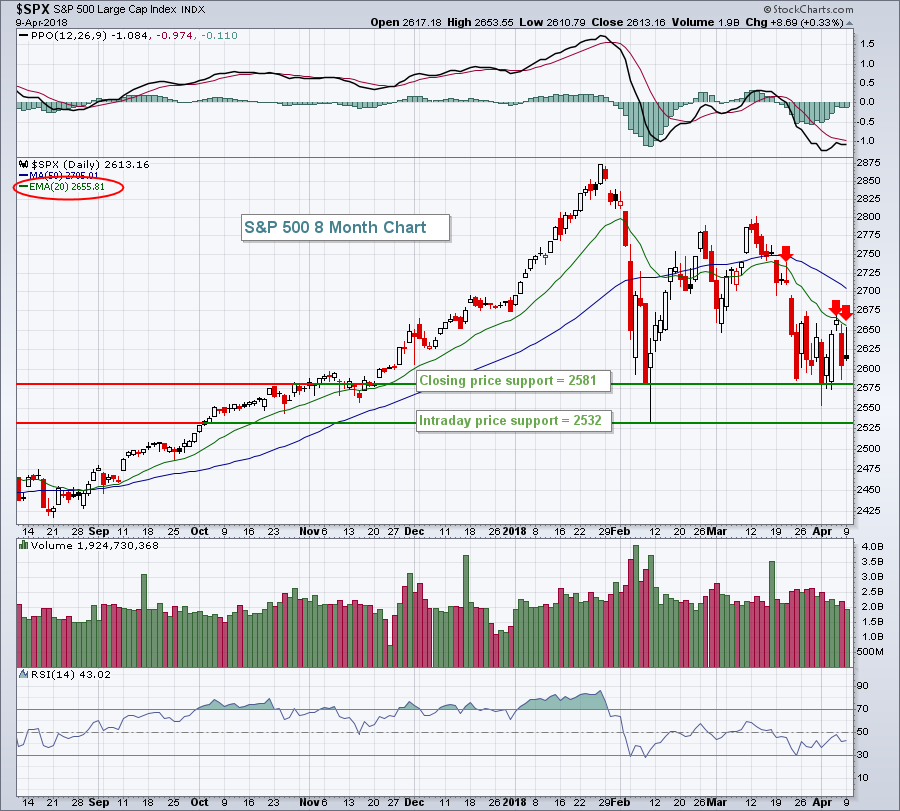

S&P 500. Zooming In.

by Bruce Fraser,

Industry-leading "Wyckoffian"

Wyckoff Method tools can be used in multiple time frames. We can often gain clarity by evaluating larger or smaller chunks of time. We recently studied the daily bars of the S&P 500 as it approached important Support. So far, this Support has been respected. Let’s review...

READ MORE

MEMBERS ONLY

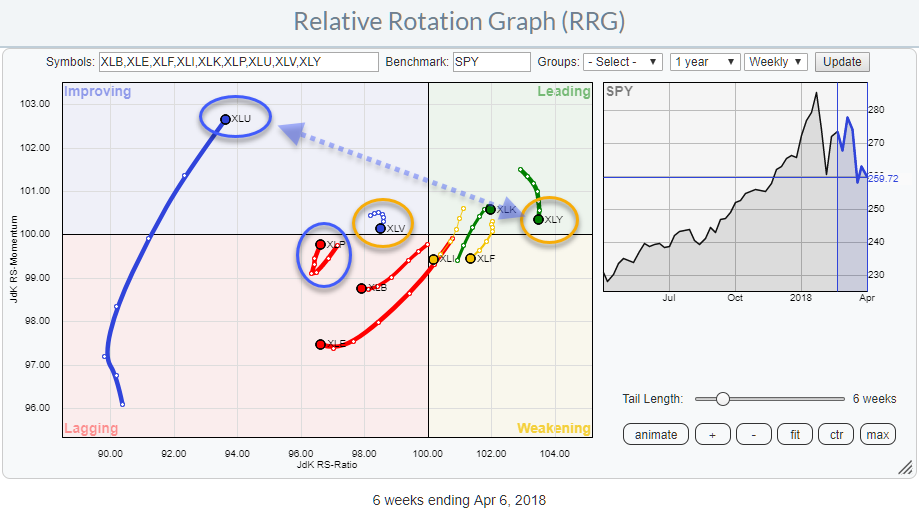

Relative Rotation Graph shows near term strength for Utilities and Staples

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

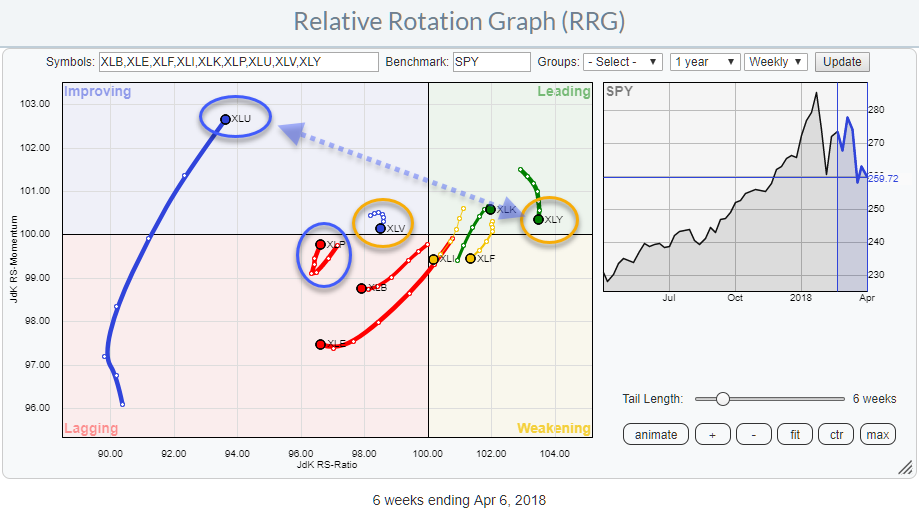

The Relative Rotation Graph for US sectors is showing us a few interesting rotational patterns for the week ending 4/6.

Studying the RRG above, there are two sector pairs which rotations I want to investigate a bit further.

The first one is Consumer Discretionary vs Utilities because they are...

READ MORE

MEMBERS ONLY

Identifying The Tapestry Of A Market Top

by Martin Pring,

President, Pring Research

* The importance of identifying the direction of the primary trend

* The Shiller P/E

* The four-way test

The importance of identifying the primary trend

Sometimes it’s a good idea to step back from the everyday trading of daily charts and short-term activity and look at the big picture. If...

READ MORE

MEMBERS ONLY

Third Tariff Threat Sinks Market

by John Murphy,

Chief Technical Analyst, StockCharts.com

Editor's Note: This article was originally published in John Murphy's Market Message on Saturday, April 7th at 7:55am ET

Just when it looked like the stock market was about to recover from the first two rounds of tariff threats, stocks were hit with a third...

READ MORE

MEMBERS ONLY

Making Money on Earnings Reports

by John Hopkins,

President and Co-founder, EarningsBeats.com

Earnings season is about to get underway with thousands of companies scheduled to report their Q1 numbers. It's an exciting time each quarter when companies are rewarded or punished depending on their results.

It's always interesting to watch how traders react to a specific earnings report...

READ MORE

MEMBERS ONLY

Identifying Solid Reward To Risk Trades For A Big Pre-Earnings Advance

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The start of every quarter represents a big opportunity to me and the reason is simple. Historically, the odds favor a bullish move into earnings season. Before we consider which individual stocks might be poised for a solid advance, let's take a look at history and the Volatility...

READ MORE

MEMBERS ONLY

MARKETS GET TRUMPED FOR THE THIRD TIME -- WEEK'S STOCK GAINS ARE WIPED OUT ON FRIDAY AS TARIFF THREATS INTENSIFY -- ANOTHER TEST OF UNDERLYING CHART SUPPORT NOW APPEARS LIKELY

by John Murphy,

Chief Technical Analyst, StockCharts.com

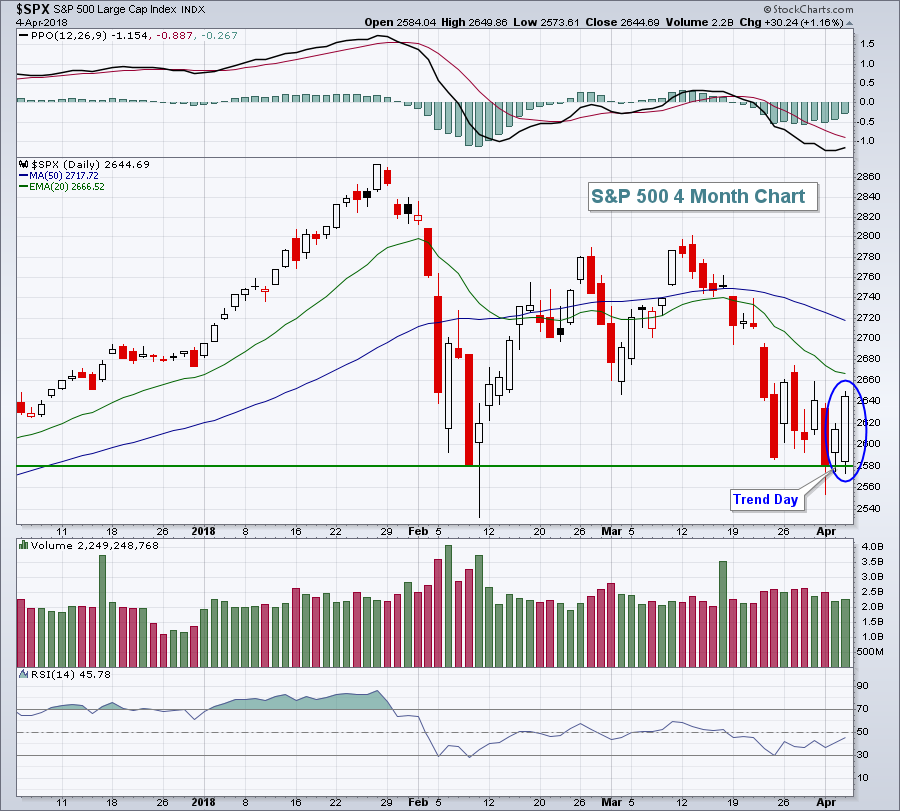

THIRD TARIFF THREAT SINKS MARKET... Just when it looked like the stock market was about to recover from the first two rounds of tariff threats, stocks were hit with a third and bigger $100 billion tariff threat after the close on Thursday. As a result, stock market indexes fell more...

READ MORE

MEMBERS ONLY

The 800-pound Gorilla Continues to Struggle

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The percentage of stocks above the 50-day EMA is a breadth indicator that measures internal performance. Chartists can compare this indicator across indexes to identify the leaders and laggards. The Nasdaq 100 is the weakest of the major indexes and weighing on the broader market.

The chart below shows %Above...

READ MORE

MEMBERS ONLY

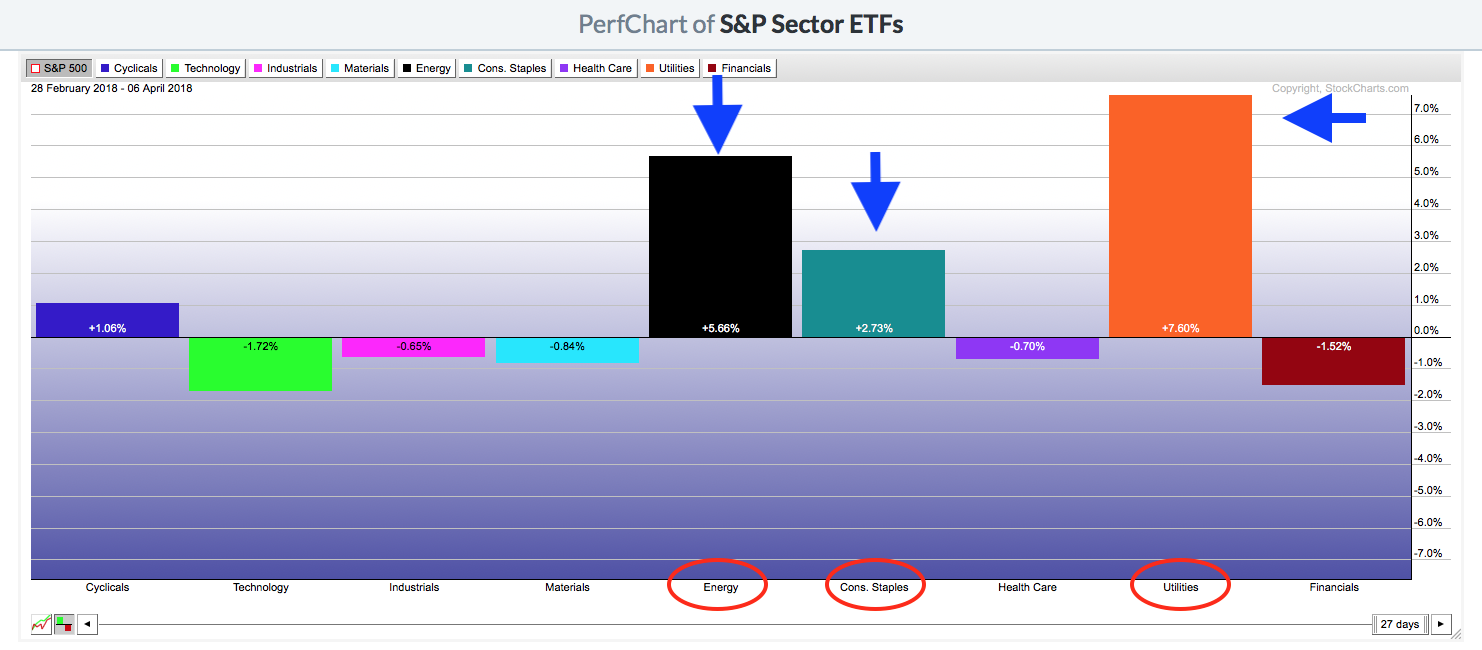

Defensive Sectors Performing - Utilities Only IT Trend Model BUY Signal

by Erin Swenlin,

Vice President, DecisionPoint.com

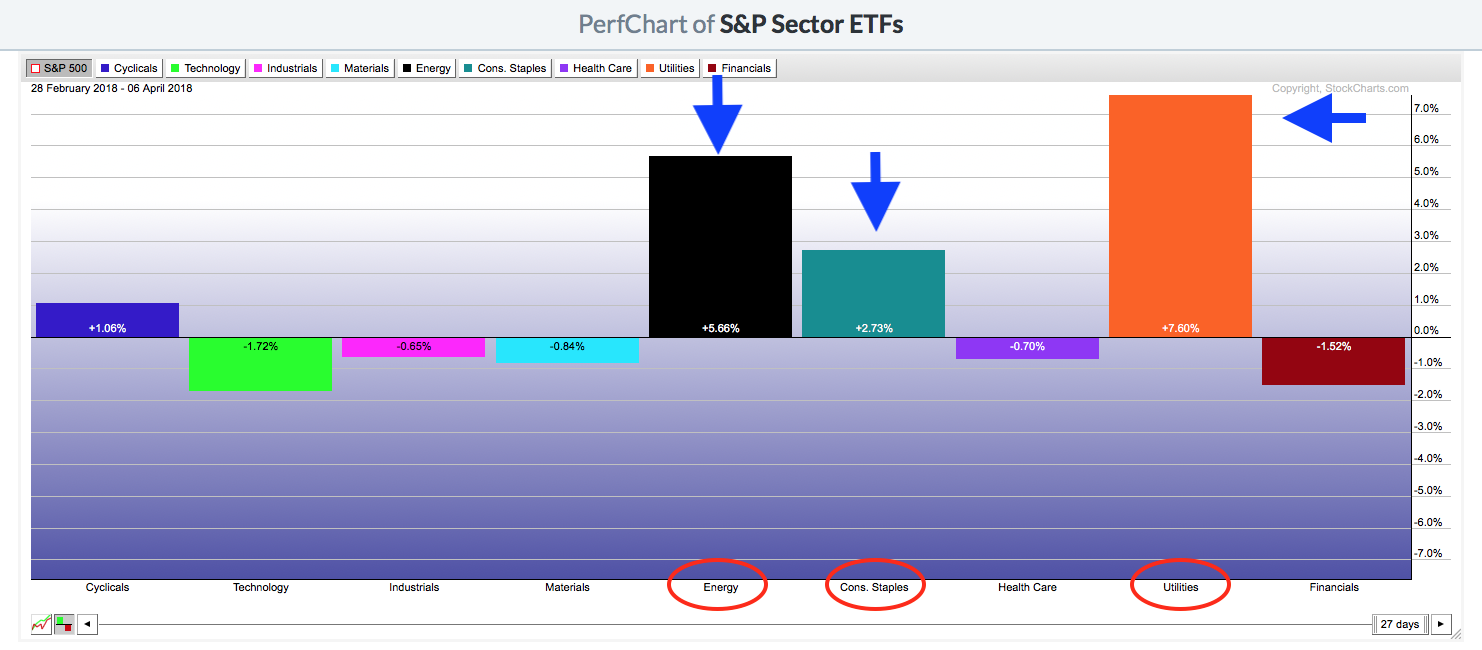

If you've been reading the DecisionPoint Blog lately or watching the MarketWatchers LIVE show on StockCharts TV, you know that I have been expressing concern over the sector rotation over the past few weeks and month. Over the past month, the worst performer is the Technology sector, followed...

READ MORE

MEMBERS ONLY

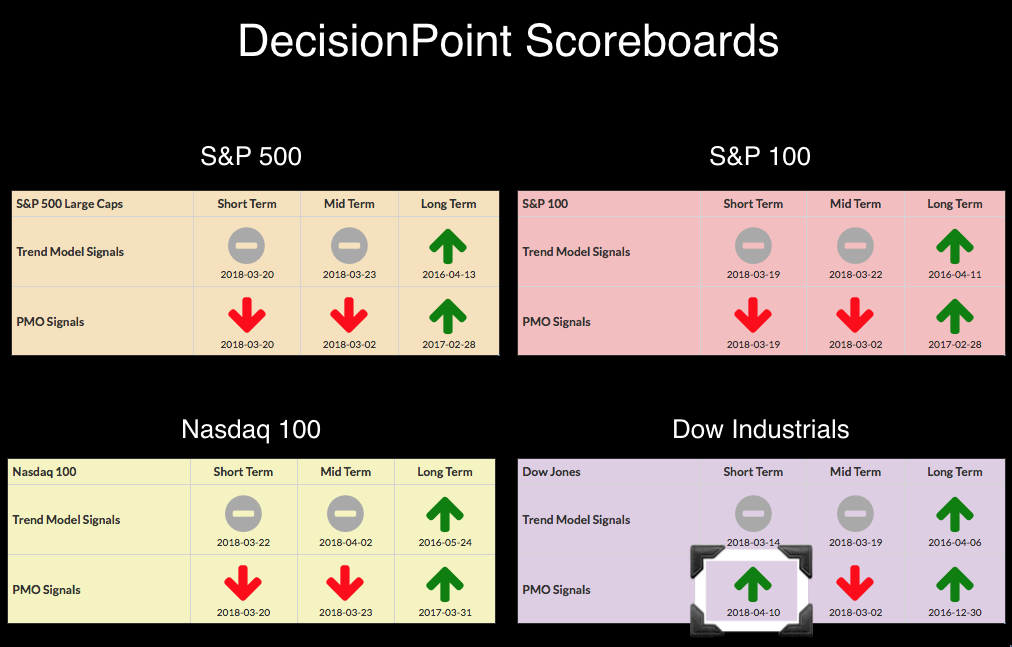

DP Weekly Wrap: Choppy Week Closes Down

by Carl Swenlin,

President and Founder, DecisionPoint.com

On the SPY chart last week I thought I saw a reverse flag formation, although it was not as tightly defined as I would like. This week the market thrashed around pretty badly, and although the flag didn't become more visible, there is still a ragged cluster of...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook (with Video) - Two Down and One to Go

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Two Down, One To Go.

* QQQ: Bruised, but not Quite Broken.

* Small-caps Continue to Show Relative Strength.

* Small-cap Consumer Discretionary and Industrials Lead.

* Housing and Retail Lead CD.

* Tech-related ETFs Remain Subdued.

* Watching the Channel in Oil.

* Notes from the Art's Charts ChartList.

Trends depend on timeframes and...

READ MORE

MEMBERS ONLY

I Cannot Own Commodities And Here's Why

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, April 5, 2018

The latest recovery attempt continued into Thursday of this week, but weak futures this morning will provide yet one more obstacle for the bulls to overcome. I'll talk more about that in the Pre-Market Action section below.

In the meantime, eight...

READ MORE

MEMBERS ONLY

Indicators - ST Overbought with Negative Divergences Sprinkled on Top

by Erin Swenlin,

Vice President, DecisionPoint.com

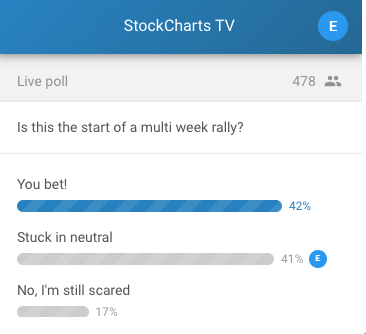

It was heady to feel the bullish exuberance pulsing around the MarketWatchers LIVE show, but now that the day is over and the indicators are ready for review. I was seriously disappointed not to see the supporting evidence I wanted so I too could enjoy some bullish exuberance. Our poll...

READ MORE

MEMBERS ONLY

REBOUND IN BOEING PUTS THE DOW IN THE LEAD FOR THE DAY -- THE DOW CLEARS INITIAL RESISTANCE BARRIER -- ENERGY AND MATERIAL SPDRS REGAIN 200-DAY AVERAGES -- FREEPORT MCMORAN AND MARATHON OIL HAVE A STRONG DAY -- S&P 500 NEARS TEST OF OVERHEAD RESISTANCE

by John Murphy,

Chief Technical Analyst, StockCharts.com

BOEING BOUNCES OFF 100-DAY AVERAGE ... The Dow Industrials led today's follow-through rally in stocks. Today's bounce in Boeing is a big reason why. The daily bars in Chart 1 show the aerospace giant gaining 2.74% today after bouncing off its 100-day moving average (green line)...

READ MORE

MEMBERS ONLY

Consumer Discretionary Leads And Remains On A Very Bullish Track

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, April 4, 2018

Welcome back consumer stocks! One day certainly doesn't make a fresh new trend, but it's been awhile since consumer stocks led a rally. Consumer discretionary (XLY, +1.84%) and consumer staples (XLP, +1.56%) were atop the sector leaderboard...

READ MORE

MEMBERS ONLY

DP Alert: Bounce Back for Cyclicals and Technology Eases Bear Market Fears

by Erin Swenlin,

Vice President, DecisionPoint.com

I was concerned earlier this week when we lost the IT Trend Model BUY signals in the aggressive technology and cyclicals sectors. However, both of these sectors have surged over the past two days which does allay fears of a bear market setting up. You'll see below the...

READ MORE

MEMBERS ONLY

STOCKS SURGE 3% AFTER A WEAK OPEN -- AND 200-DAY AVERAGES HOLD ONCE AGAIN -- SMALL CAPS ARE HOLDING UP BETTER THAN LARGE CAPS -- HOMEBUILDERS AND RETAILERS MADE CYCLICALS THE DAY'S STRONGEST SECTOR

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS SCORE BIG UPSIDE REVERSAL FROM 200-DAY AVERAGES ... The stock market staged an impressive upside turnaround today. After opening 500 points lower this morning, the Dow Industrials ended the day 230 points (0.96%) higher. That's a gain of more than 700 points from its opening price. Stock...

READ MORE