MEMBERS ONLY

DP Weekly Wrap: Double Bottoms Abound

by Carl Swenlin,

President and Founder, DecisionPoint.com

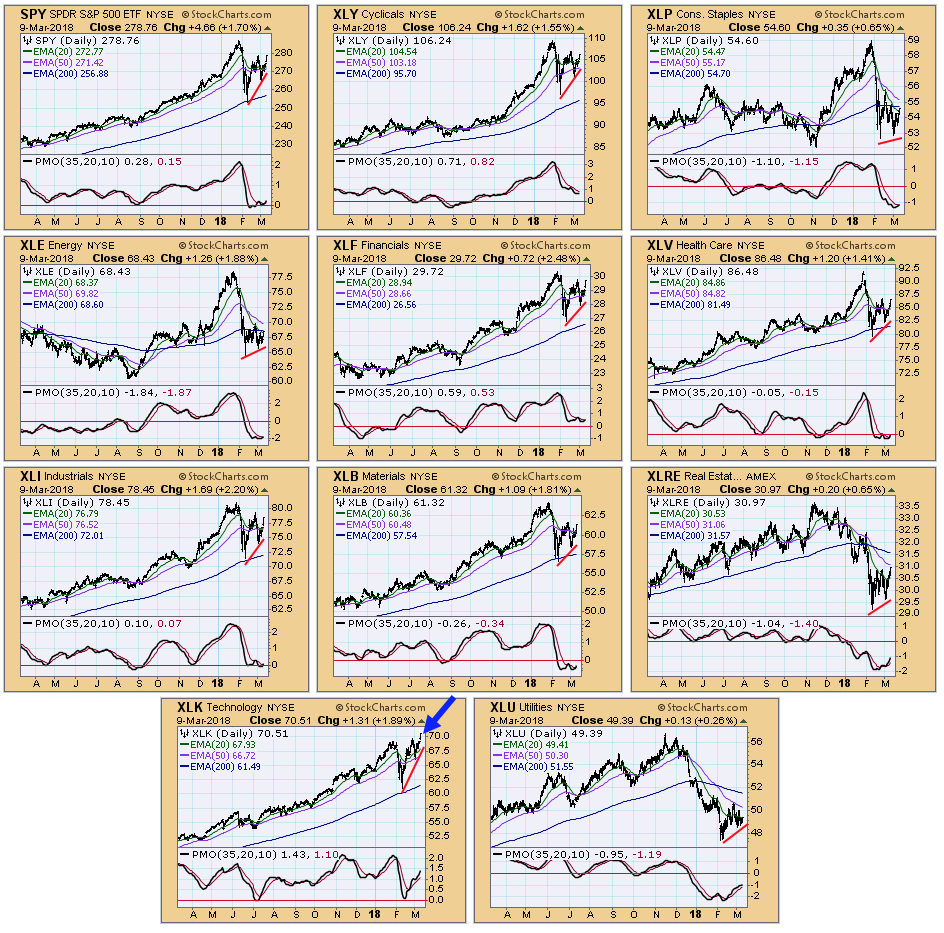

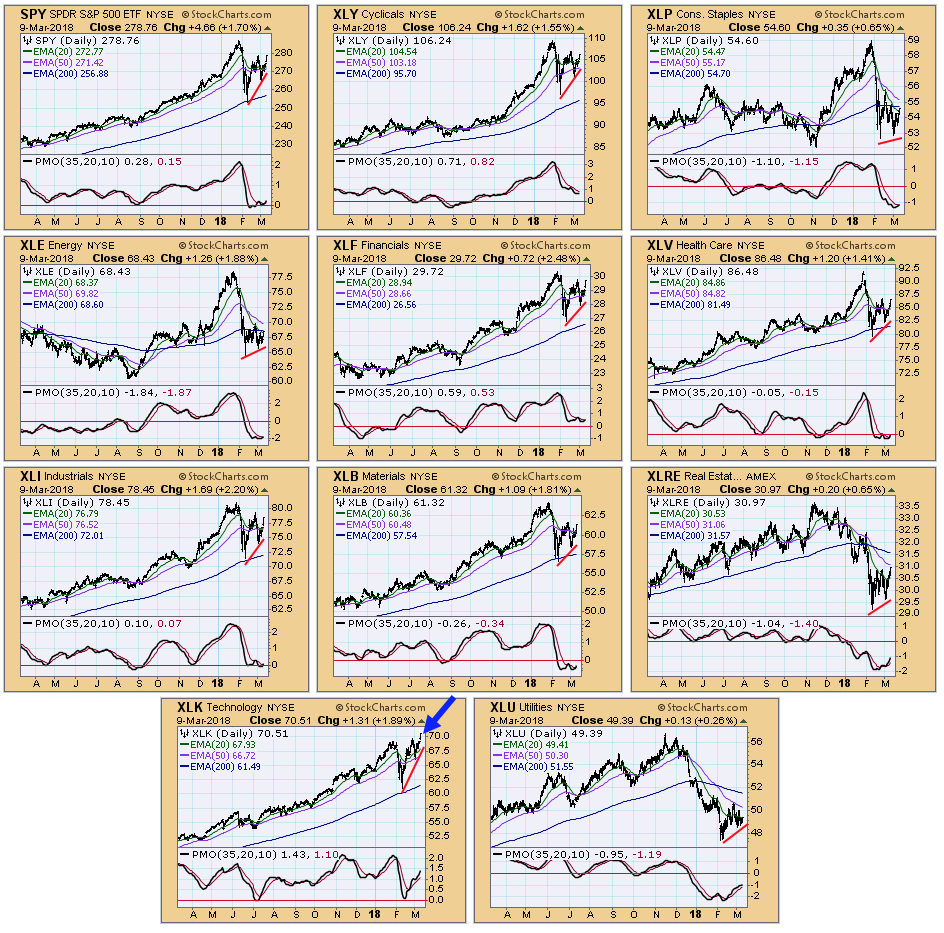

Friday was an exceptionally positive day, as prices advanced on good news regarding North Korea and jobs. Here are charts of the S&P 500 (SPY) and the 10 major sectors. The recurring theme we see is the double bottom. One exception is Utilities (XLU), which hasn't...

READ MORE

MEMBERS ONLY

STOCKS RALLY ON STRONG JOBS REPORT WITH SMALLER WAGE GAIN -- S&P 500 CLEARS 50-DAY AVERAGE -- NASDAQ 100 HITS NEW RECORD -- SEMICONDUCTOR ISHARES ARE LEADING THE QQQ INTO RECORD TERRITORY -- LAM RESEARCH AND INTEL HIT NEW RECORDS

by John Murphy,

Chief Technical Analyst, StockCharts.com

STRONG EMPLOYMENT REPORT BOOSTS STOCKS... A blockbuster employment report this morning is giving a big boost to stocks which were already in rally mode going into the report on easing tariff concerns from yesterday afternoon. U.S. employers added 313,000 jobs in February which was way above estimates and...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook (with Video) - Market Likes a Teenage VIX

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* VIX is a Teenager Again.

* $NDX and $SML AD Lines Lead.

* New Highs Still Dragging.

* Small-caps, Large-caps, Tails and Dogs.

* Six Leading Sectors (and Four Laggards).

* A Pop and Drop for Gold.

* Oil Forms Lower High.

* The Incredibly Shrinking Stock Market.

* Notes from the Art's Charts ChartList.

VIX...

READ MORE

MEMBERS ONLY

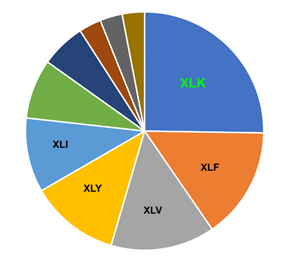

Defensive Stocks Lead Thursday's Rally; Warning Sign?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, March 8, 2018

It's never a great signal to see the stock market rally and the three defensive sectors - consumer staples (XLP, +0.91%), utilities (XLU, +0.74%) and healthcare (XLV, +0.67%) - sit atop the sector leaderboard. But we also shouldn&...

READ MORE

MEMBERS ONLY

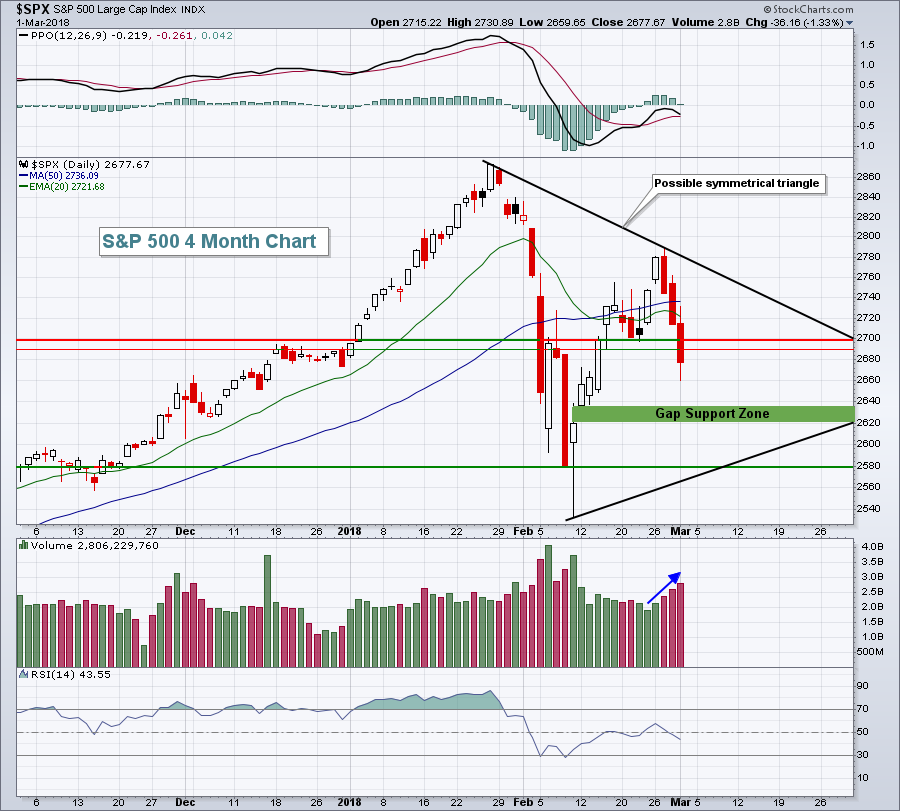

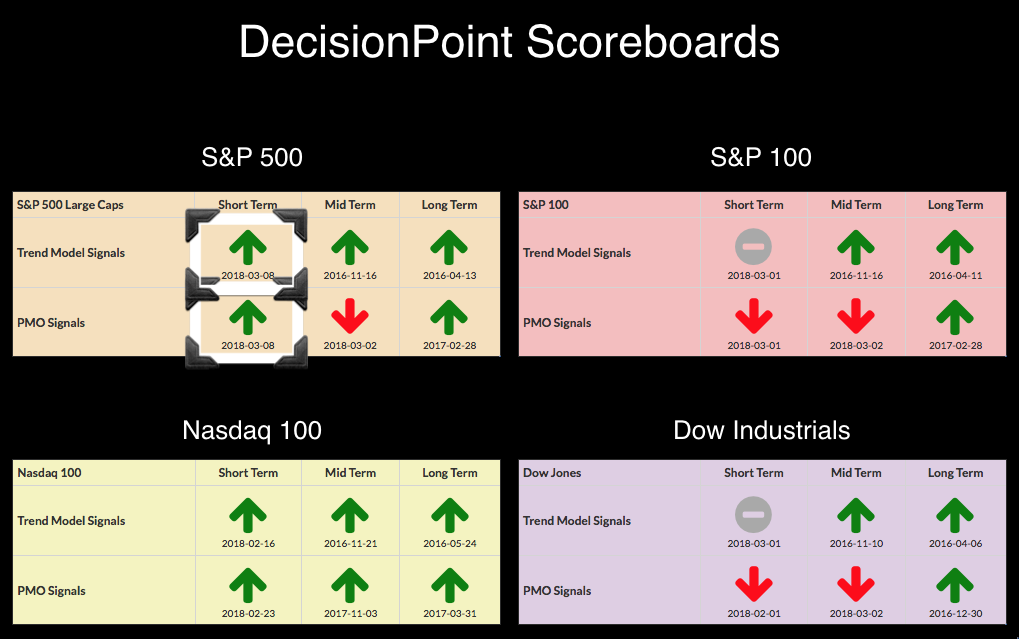

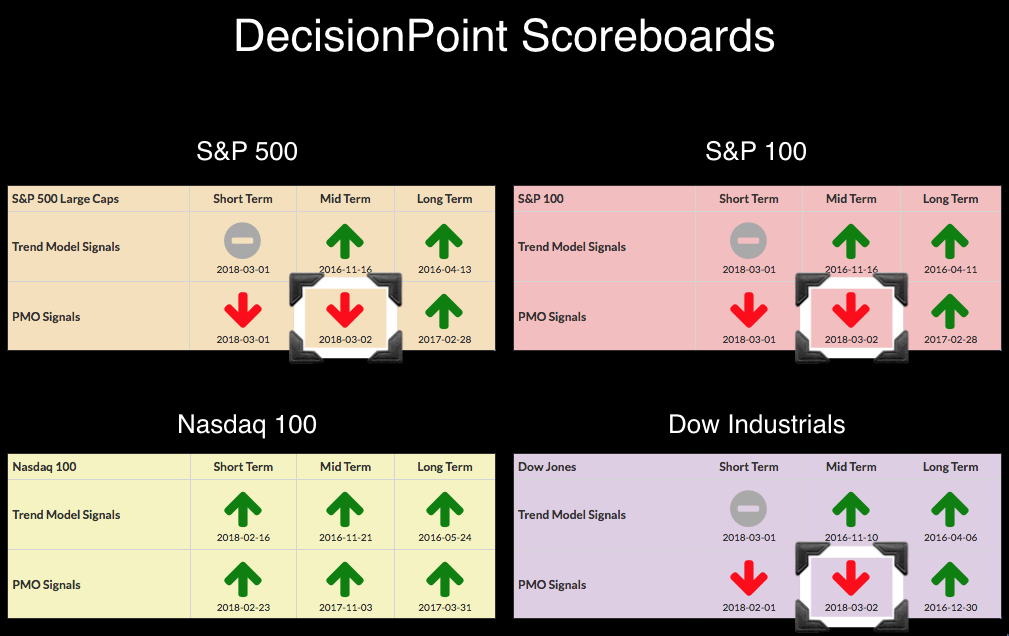

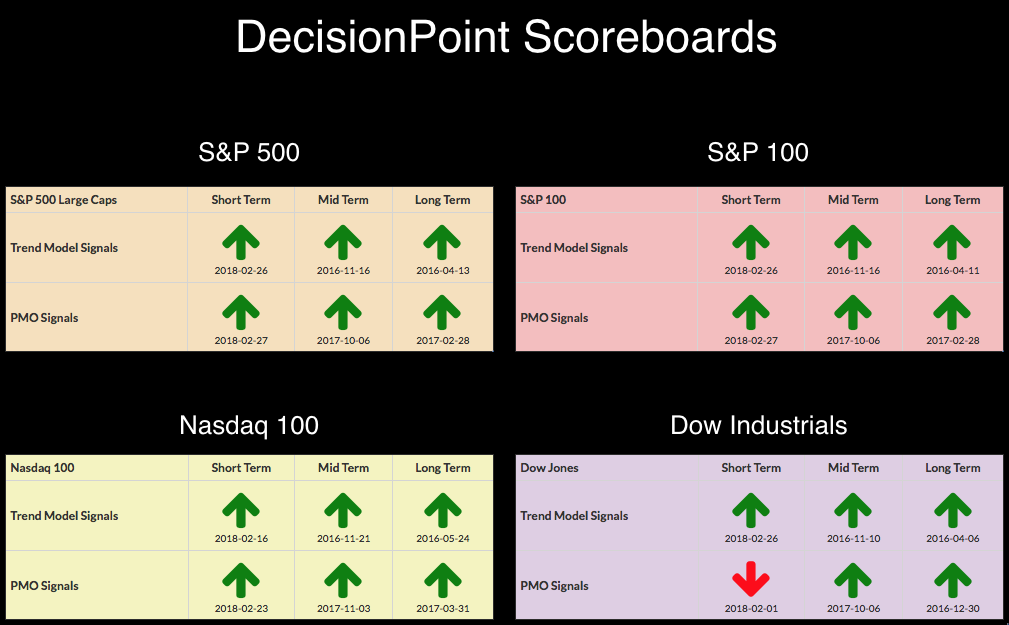

SPX Scoreboard Adds Buy Signals - Is Correction Over?

by Erin Swenlin,

Vice President, DecisionPoint.com

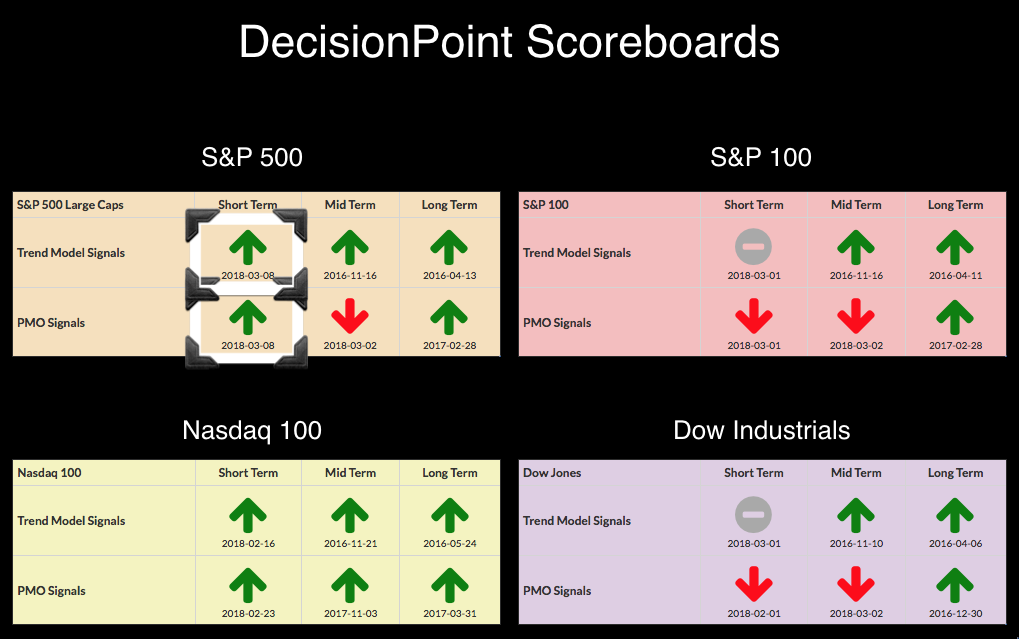

Let's get that title question answered right now...No, I don't think the correction is over. Yes, today we got both a ST Price Momentum Oscillator (PMO) BUY signal and an ST Trend Model BUY signal. The chart still has problems.

We had Tushar Chande on...

READ MORE

MEMBERS ONLY

What Will It Take To Trigger A Bull Market In The Dollar?

by Martin Pring,

President, Pring Research

* The indicated main trend is currently bearish

* What a more broadly-based Dollar index is saying

* Swiss Franc completes a small top

* Copper and the Dollar

The indicated main trend is currently bearish

The Dollar Index peaked in November 2016 and has so far bottomed in January of this year. If...

READ MORE

MEMBERS ONLY

LATE STOCK BUYING SHOWS POSITIVE REACTION TO TARIFF SPEECH -- S&P 500 CLOSES AT 50-DAY AVERAGE -- FIVE-MINUTE PRICE BARS SHOW STRONG BUYING IN FINAL MINUTES -- THE VIX NEARS TWO-WEEK LOW -- THE NASDAQ MARKET IS HEADED FOR ANOTHER TEST OF 2018 HIGHS

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 CLOSES JUST SHY OF ITS 50-DAY AVERAGE... Late buying today pushed stocks higher and on rising volume. The daily bars in Chart 1 show the S&P 500 rising 12 points today (0.46%) to end at 2738 which is one point shy of its...

READ MORE

MEMBERS ONLY

Railroads Hold One Of The Bull Market Keys

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, March 7, 2018

It was a day of bifurcation, but it was good bifurcation - if that makes any sense. When the stock market jury is split as we saw on Wednesday, I prefer that our aggressive market areas perform well and defensive areas lag. Well,...

READ MORE

MEMBERS ONLY

Finding Strong Stocks and Avoiding Weak Ones - Steel, Brokers, Defense and More

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Separating the Leaders from the Laggards.

* Flying Flags for Commercial Metals and Nucor.

* Broker-Dealer iShares Leads with New High.

* Morgan Stanley and the 3 Discount Brokers.

* Defense and Aerospace ETF Fully Recovers.

* General Dynamics and Lockheed Martin.

* Verisign, Bristol-Meyers and Fastenal.

Finding the Strongest Stocks....

When dealing with stocks, we...

READ MORE

MEMBERS ONLY

DP Alert: Mixed Messages Warrant Caution

by Erin Swenlin,

Vice President, DecisionPoint.com

It's days like today that I find it frustrating to write (probably why this is posted late). It's not really writers' block, but the many mixed messages or lack of messages I'm getting on the charts right now. I could probably make a...

READ MORE

MEMBERS ONLY

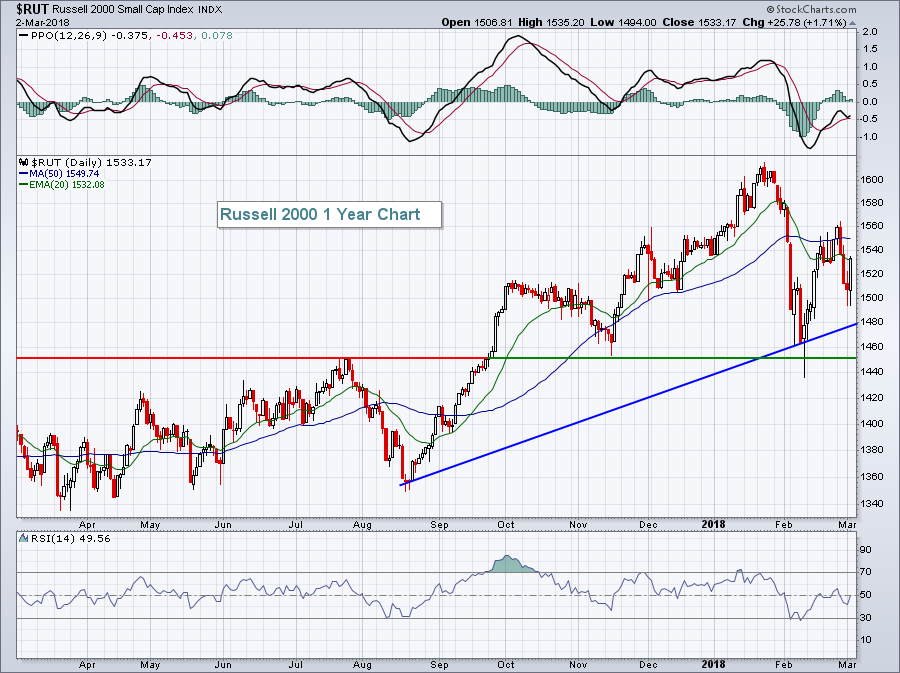

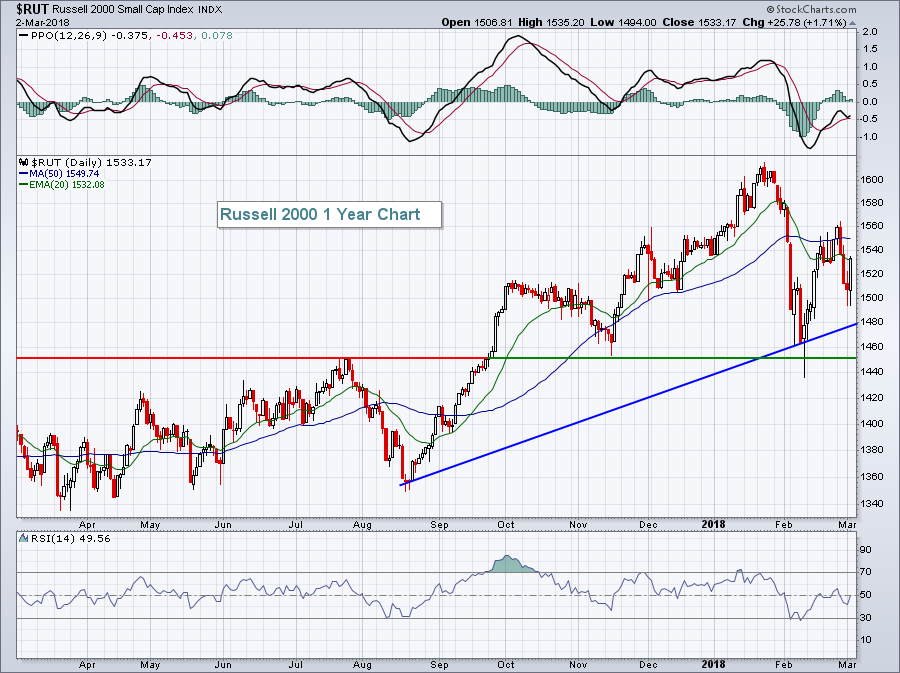

SMALLER STOCKS ARE LEADING THE MARKET HIGHER -- S&P SMALL AND MIDCAP INDEXES NEAR UPSIDE BREAKOUTS -- THE S&P 500 SHOULD FOLLOW THEM HIGHER -- NASDAQ STRENGTH IS ALSO A POSITIVE SIGN

by John Murphy,

Chief Technical Analyst, StockCharts.com

SMALL AND MIDCAP STOCKS INDEXES CLEAR 50-DAY AVERAGES... Last Wednesday's message pointed out that smaller stocks were leading large caps lower. Small and midcap indexes had fallen below their 50-day average which increased odds that the S&P 500 would do the same, which it did. Today,...

READ MORE

MEMBERS ONLY

Revenge of the Small Caps

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 SPDR (SPY) is pretty much unchanged over the last five trading days and the respective sector SPDRs are mixed. The story is a bit different for small-caps because the S&P SmallCap iShares (IJR) is up over 3% the last five days and the...

READ MORE

MEMBERS ONLY

SystemTrader - The Turn of the Month Strategy

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Turn of the Month Strategy.

* Testing the Last and First Days of the Month.

* Turn of the Month Results.

* Plotting the Equity Curve.

* Charting Recent Results.

* Conclusions and Takeaways.

The turn of the month shows a strong bullish bias, regardless of the broad market trend.

Today we will examine stock...

READ MORE

MEMBERS ONLY

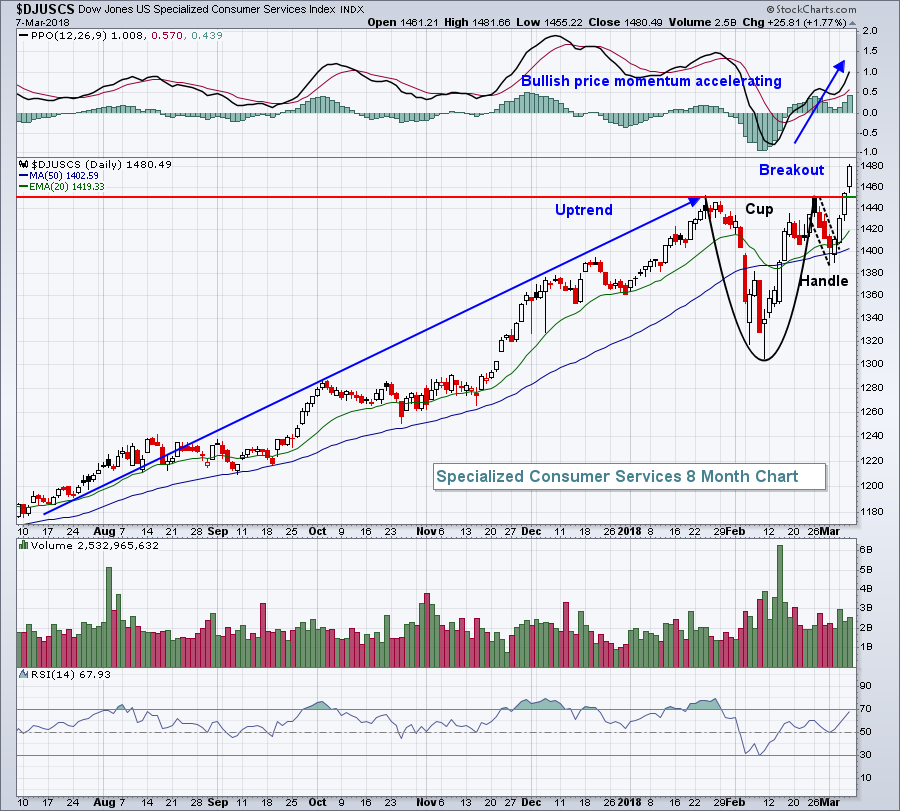

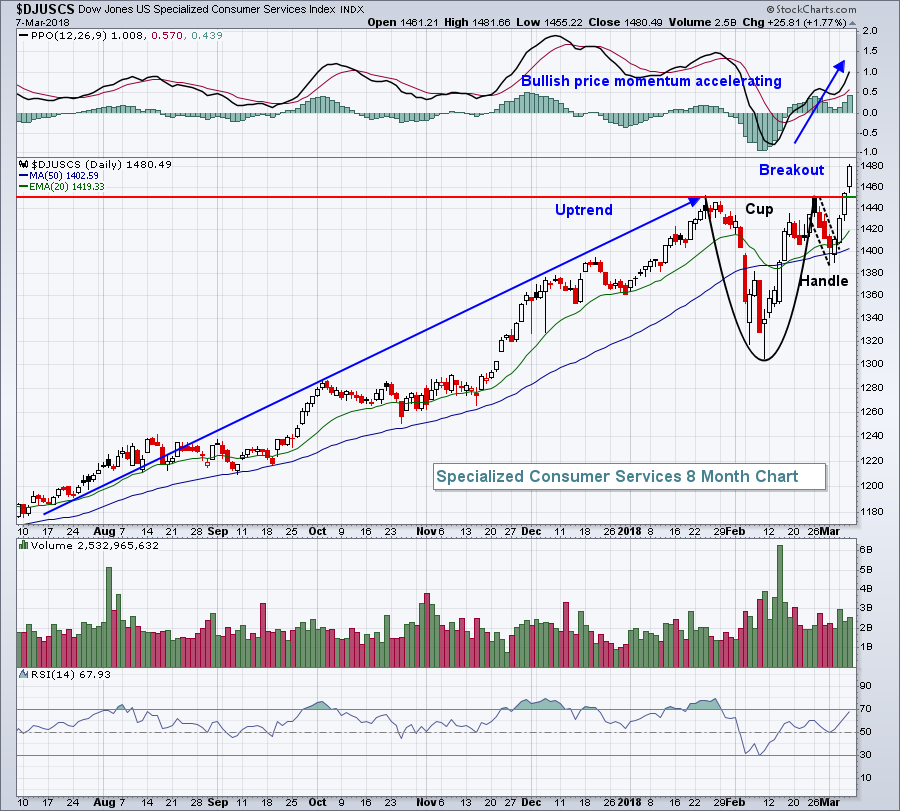

Retail Regaining Strength And In The Middle Of Its Seasonal Sweet Spot

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, March 6, 2018

Materials (XLB, +1.10%) and consumer discretionary (XLY, +0.69%) led a modest stock market rally here in the U.S. on Tuesday. The small cap Russell 2000 gained more than 1% to once again outperform its larger cap counterparts. The NASDAQ also...

READ MORE

MEMBERS ONLY

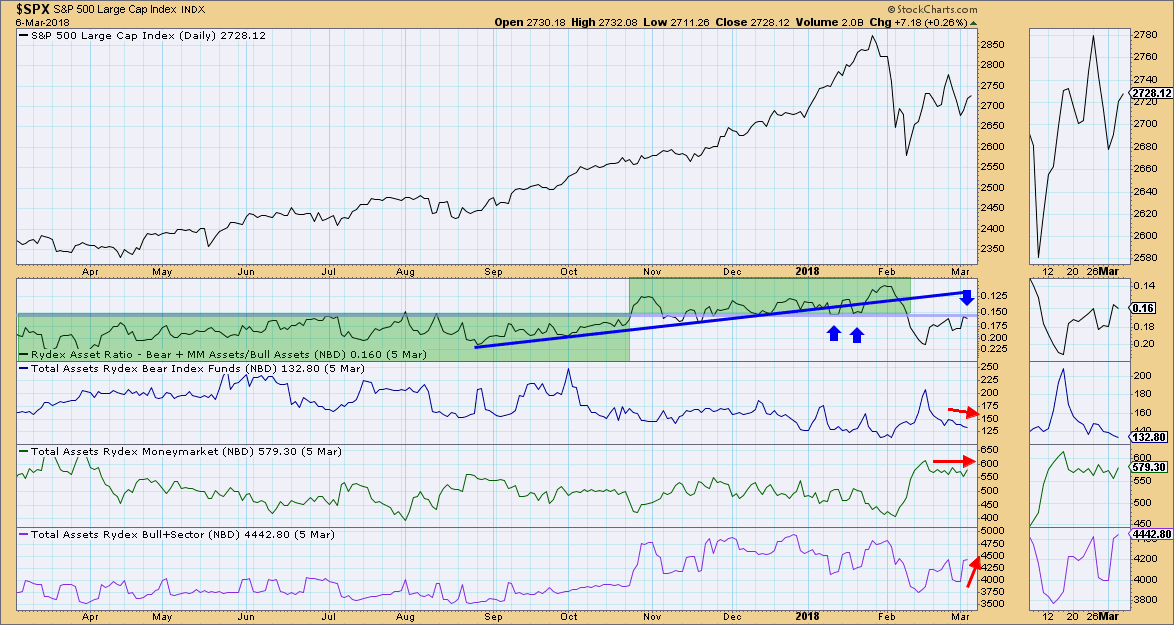

Rydex Ratio Turns Down - Bullish Sentiment = Bearish Implications

by Erin Swenlin,

Vice President, DecisionPoint.com

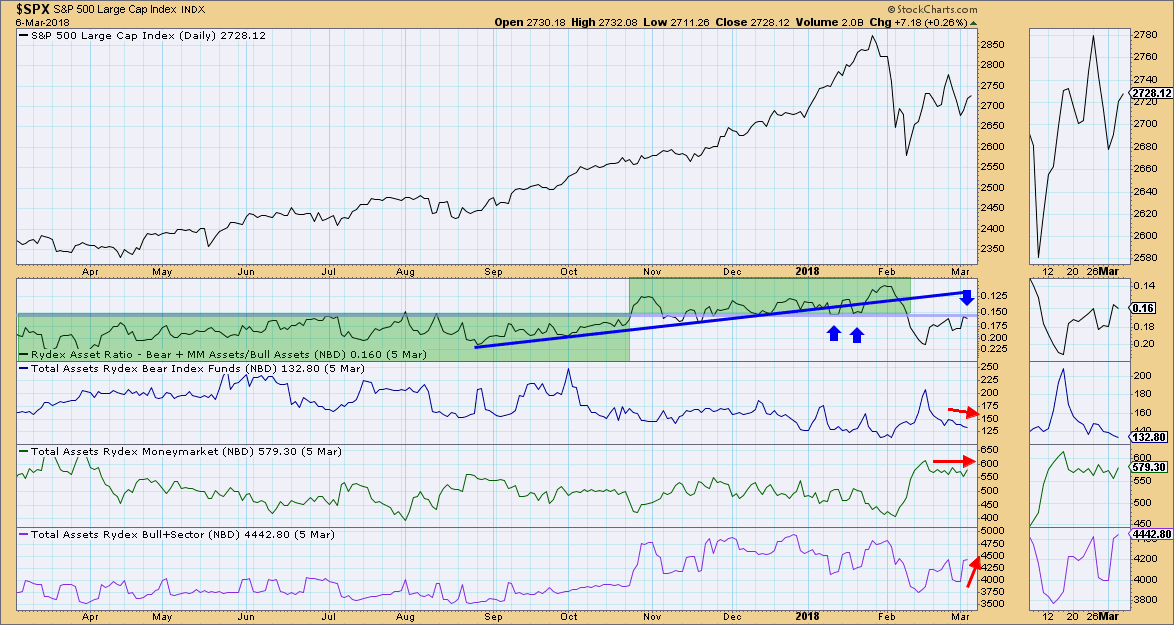

I decided to take a look at the Rydex Ratio today to see what the daily assets might be telling us as far as "actual money" sentiment. Here's a refresher for those new to the Rydex Ratio and sentiment readings in general. First, sentiment tells us...

READ MORE

MEMBERS ONLY

Execution!

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I am on record stating that most technical analysts do not trade with real money. I have no hard data to support that brash statement, rather it is my observation after speaking at hundreds of seminars and conferences and knowing hundreds of technical analysts. Many are famous. Many call themselves...

READ MORE

MEMBERS ONLY

GRAIN PRICES ARE FINALLY MOVING HIGHER -- A WEAKER DOLLAR IS INCREASING DEMAND FOR AGRICULTURAL EXPORTS -- COTTON ALSO APPEARS TO BE BOTTOMING -- RISING PRICES COULD BOOST FOOD AND CLOTHING COSTS -- TODAY'S DOLLAR DROP IS BOOSTING GOLD

by John Murphy,

Chief Technical Analyst, StockCharts.com

GRAIN PRICES ARE LEADING COMMODITY RALLY THIS YEAR ... My market message from January 6 expressed the view that commodity prices appeared to be bottoming, which could increase inflation pressures later this year. It also suggested that the chart of the CRB Index might actually be understating the inflation threat. That...

READ MORE

MEMBERS ONLY

The Strange Correlation between Gold and Silver - Plus Copper the Chopper

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* The Strange Correlation between Gold and Silver.

* Gold Looks Poised to Continue Trend.

* Silver ETF Breaks Wedge Line.

* Copper the Chopper Bounces.

Correlation between Gold and Silver...

Gold and silver have not been on the same page lately, but there is still a strong positive correlation between the two. The...

READ MORE

MEMBERS ONLY

Leading Industry Prints Reversing Candle; Dow Jumps Over 300 Points

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, March 5, 2018

The Dow Jones surged on Monday, gaining 337 points (+1.37%) to lead all of our major indices higher. Two stalwarts - Caterpillar (CAT, +3.24%) and Boeing (BA, +2.34%) - were the leaders, but we saw 29 of the 30 Dow...

READ MORE

MEMBERS ONLY

SPY Meanders, but Two Sectors Stand Out - 7 Bullish Stock Charts

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* SPY Continues to Meander.

* Sector Performance Remains Mixed.

* Seven Industry Group ETFs Stand Out.

* Regional Bank SPDR Forms Continuation Pattern.

* QQQ, Top Stocks and the 50-day SMAs.

* Leading Stocks with Bullish Charts.

SPY Continues to Meander

The S&P 500 SPDR (SPY) got a nice oversold bounce the last...

READ MORE

MEMBERS ONLY

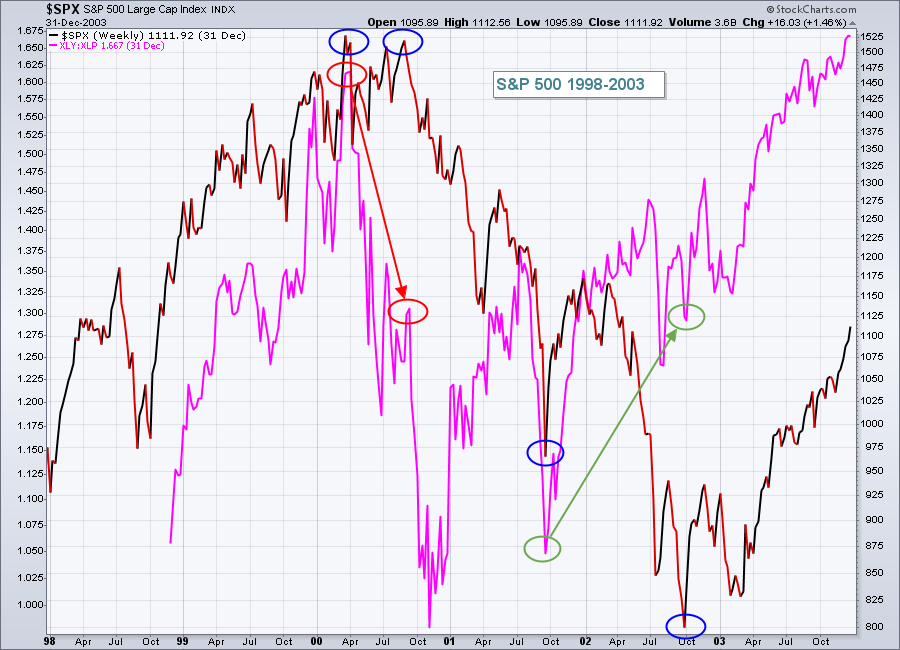

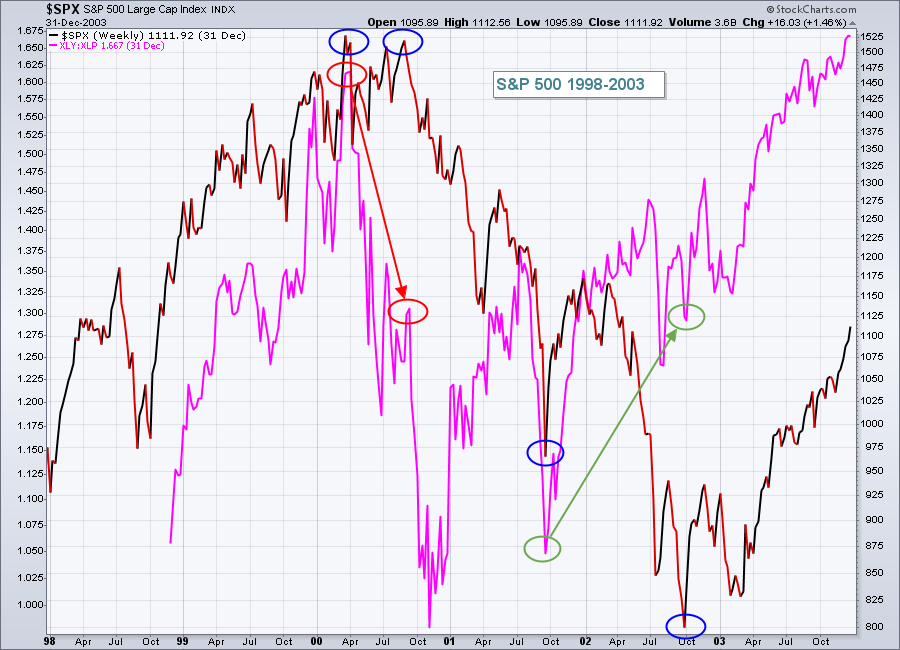

They Just Built A New Wall Of Worry For The US Stock Market

by Martin Pring,

President, Pring Research

* Two bullish piercing white lines

* A sector spread that predicts new stock market highs

* Two sectors affected by the proposed tariffs

Last week I wrote that the indicators seemed to be calling for a test of the early February low. My expectation was for a sharper and more prolonged decline...

READ MORE

MEMBERS ONLY

DOW AND S&P 500 BOUNCE IMPRESSIVELY OFF 100-DAY MOVING AVERAGES -- NASDAQ RISES FURTHER ABOVE 50-DAY LINE -- ALL SECTORS ARE IN THE GREEN -- WHILE THE VIX INDEX FALLS BACK BELOW 20 -- BLOOMBERG COMMODITY INDEX REGAINS ITS 50-DAY AVERAGE

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 BOUNCES OFF 100-DAY AVERAGE... Last Friday's midday message showed the S&P 500 testing chart support near 2640 and in a short-term oversold condition (black line). After rallying off that support level on Friday afternoon, stocks built on those gains today. The daily...

READ MORE

MEMBERS ONLY

Electronic Arts Leads and Stalls at the Same Time

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Electronic Arts (EA) is one of the leading stocks in a strong video game industry group. Note that Activision (ATVI), one of its main competitors, hit a 52-week high in late January and is challenging this high here in early March. Take-Two (TTWO) is the weakest of the big three,...

READ MORE

MEMBERS ONLY

Medical Supplies Print Reversing Candle, Small Caps Surge And Monday Setups

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, March 2, 2018

The Dow Jones finished with a 71 point loss on Friday, thanks in part to another very weak performance by McDonalds (MCD). Apparently, their $1, $2, $3 menu is falling short of expectations and it's clearly reflected in recent price action....

READ MORE

MEMBERS ONLY

Divining Distribution

by Bruce Fraser,

Industry-leading "Wyckoffian"

In last Thursday’s MarketWatchers LIVE (recording available here) we discussed the Wyckoff Distribution concept of the Upthrust After Distribution (UTAD). Distribution and Accumulation adhere to a logical path or sequence of price and volume. During Distribution the Composite Operator (C.O.) has determined the area of price where they...

READ MORE

MEMBERS ONLY

Stocks Remain On The Defensive

by John Murphy,

Chief Technical Analyst, StockCharts.com

Editor's Note: This article was originally published in John Murphy's Market Message on Friday, March 2nd at 12:26pm ET

Wednesday's message showed the PowerShares QQQ (representing the Nasdaq 100 Index) pulling back from overhead resistance at its late January peak. That suggested profit-taking...

READ MORE

MEMBERS ONLY

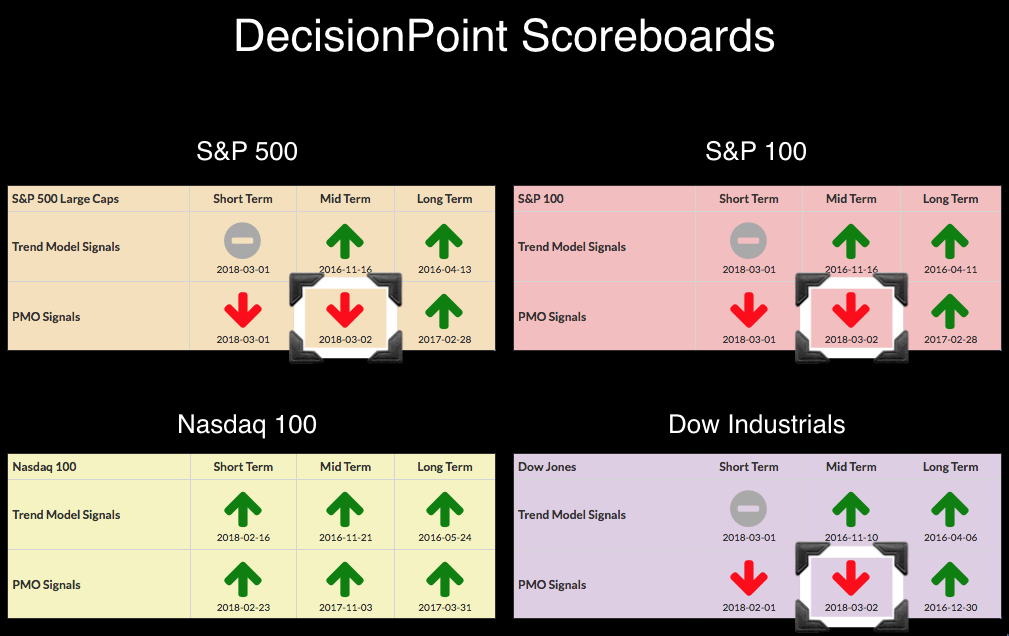

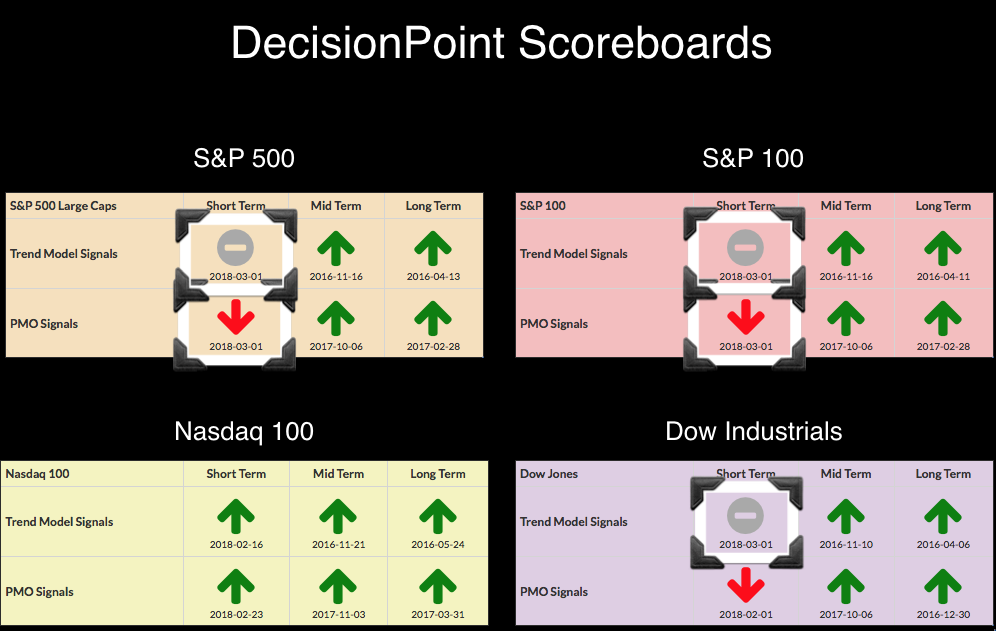

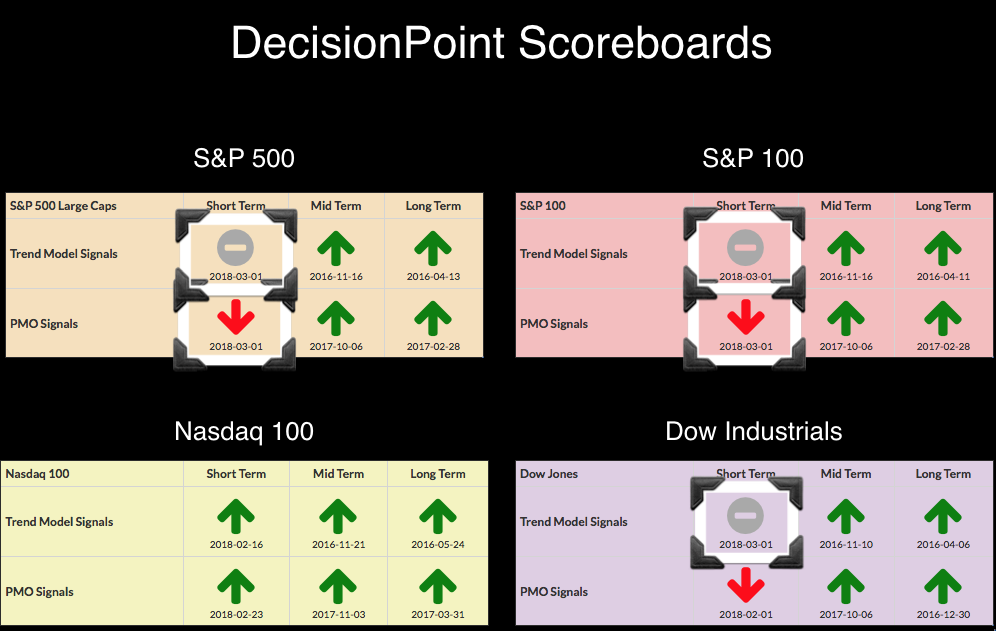

Bearish Bias - Weekly PMOs Log New SELL Signals on DP Scoreboards

by Erin Swenlin,

Vice President, DecisionPoint.com

I did a review of the monthly charts Wednesday and noticed a bearish bias. Today three new Intermediate-Term Price Momentum Oscillator (PMO) SELL signals arrived. The weekly PMOs crossed below their signal lines which triggered these signals. Weekly charts are presenting bearish characteristics.

After looking at all three of these...

READ MORE

MEMBERS ONLY

Is A Bear Market Underway? No And Here's My Argument

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

THE Question

Is this a correction within a bull market or is it the beginning of a bear market? That is THE question that everyone is debating and hoping to answer correctly. There's no crystal ball to know for sure the correct answer. However, the market does provide...

READ MORE

MEMBERS ONLY

Applying Dow Theory to the Top Sectors for Broad Market Analysis

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The principle of confirmation is important to the application of Dow Theory. This principle asserts that the Averages, Dow Industrials and Dow Transports, should confirm each other when making new highs. In other words, both should make new highs to affirm the broad market trend. Failure by one results in...

READ MORE

MEMBERS ONLY

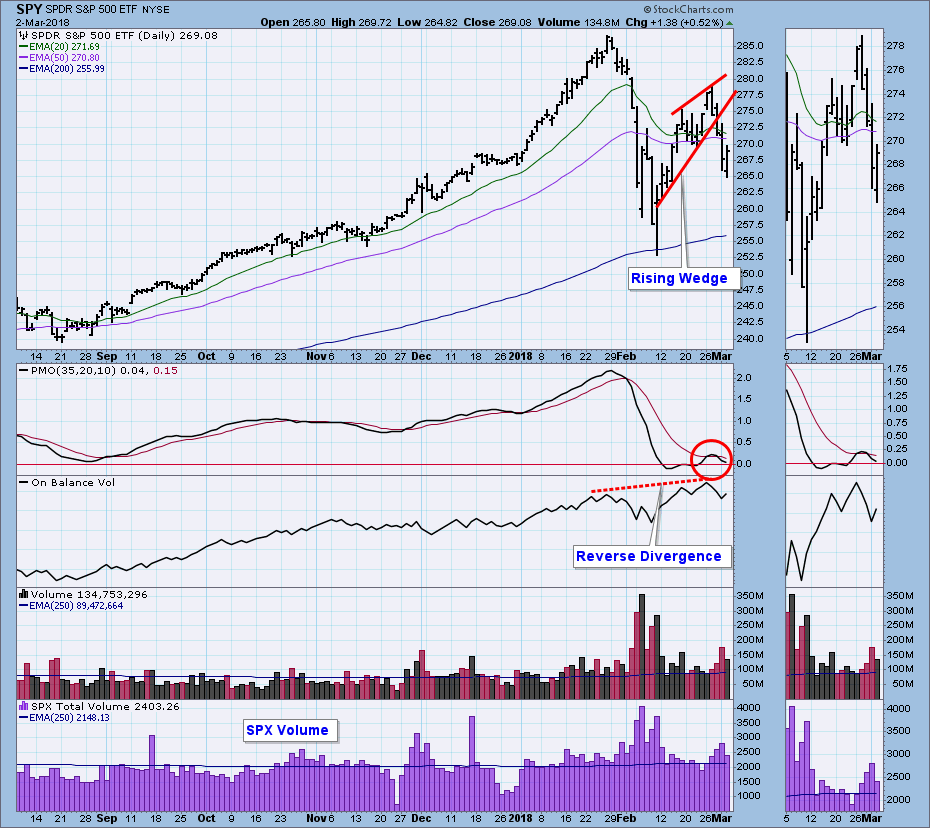

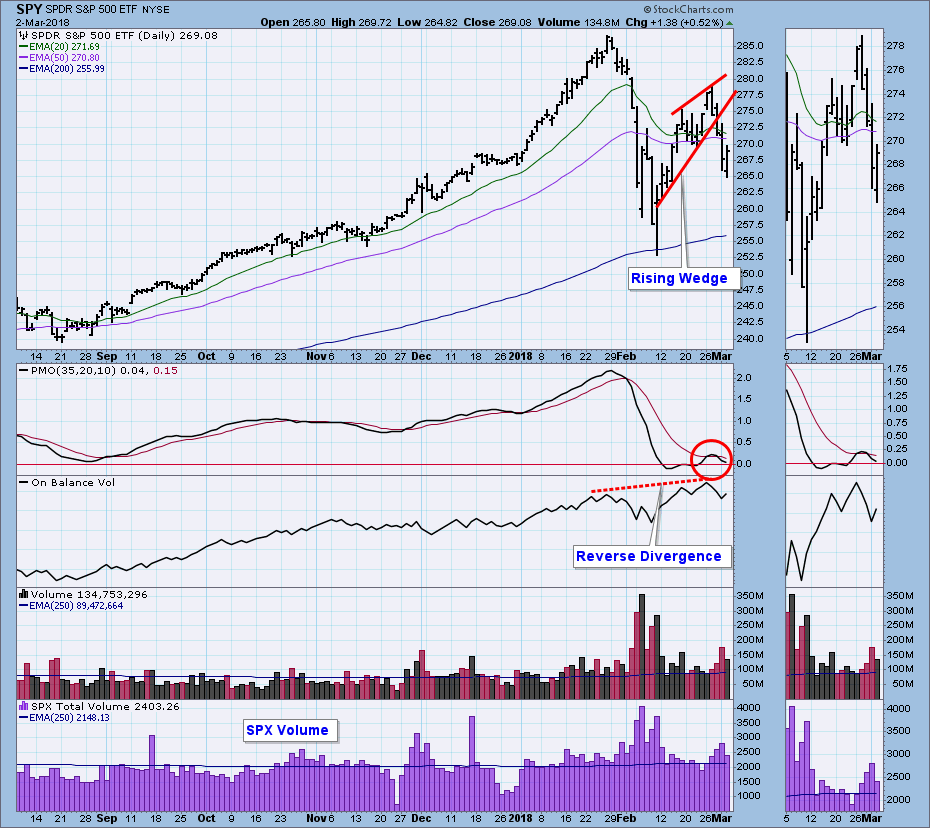

DP Weekly Wrap: Breakout Fakeout and Broken Wedge

by Carl Swenlin,

President and Founder, DecisionPoint.com

At last Friday's close we were faced with SPY pushing at the top of a bullish flag formation (not annotated). On Monday there was a strong breakout that proved to be a fakeout. On Tuesday price topped and fell back to the top of the flag, and at...

READ MORE

MEMBERS ONLY

The Dark Side of Earnings

by John Hopkins,

President and Co-founder, EarningsBeats.com

Most analysts would agree that overall, 2017 Q4 earnings were superb. For quite a while we saw one company after another beat earnings expectations and they were rewarded for those results as well. But recently, as the market has come under fire, responses to many earnings reports have been brutal....

READ MORE

MEMBERS ONLY

Charts I'm Stalking: Action Practice #25

by Gatis Roze,

Author, "Tensile Trading"

p.p1 {margin: 0.0px 0.0px 0.0px 0.0px; font: 14.0px Helvetica; color: #000000; -webkit-text-stroke: #000000} span.s1 {font-kerning: none} span.s2 {text-decoration: underline ; font-kerning: none; color: #0000ff; -webkit-text-stroke: 0px #0000ff}

I confess!I’m messing with you a bit with respect to Action Practice #24. On...

READ MORE

MEMBERS ONLY

STOCKS REMAIN ON THE DEFENSIVE -- QQQ IS TESTING 50-DAY AVERAGE -- WHILE S&P 500 TESTS SHORT-TERM SUPPORT NEAR 2640 -- FALLING DOLLAR BOOSTS GOLD -- JAPANESE YEN SURGES TO 15-MONTH HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

POWERSHARES QQQ IS TESTING 50-DAY AVERAGE ... Wednesday's message showed the PowerShares QQQ (representing the Nasdaq 100 Index) pulling back from overhead resistance at its late January peak. That suggested profit-taking in the technology-dominated QQQ and the rest of the market. It also suggested a retest of its 50-day...

READ MORE

MEMBERS ONLY

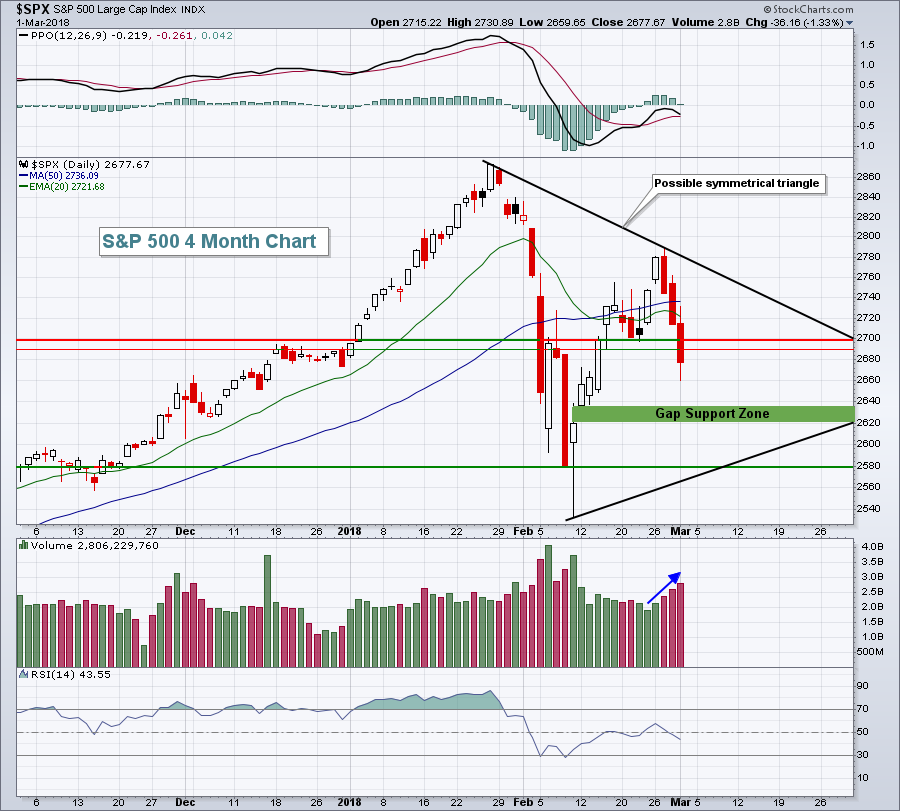

S&P 500 Loses Key Support, Odds Of A Bottom Retest Grow

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, March 1, 2018

Any time the Volatility Index ($VIX) rises 13%, it's not going to be a great day on Wall Street. Fear equals selling and selling is exactly what we saw on Thursday. There was a bit of a late day rally, but...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook (with Video) - Bull Markets, Corrections and Pullbacks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Pullbacks versus Corrections versus Bull Markets.

* Objective Uptrend and Subjective Correction.

* VIX Moves Back above 20.

* Gold Firms at Support Zone.

* Legendary Trader Sounds the Alarm.

* Trend Followers Know What they Don't Know.

* CNBC Interview with Tobias Levkovich.

* Notes from the Art's Charts ChartList.

Pullbacks, Corrections...

READ MORE

MEMBERS ONLY

Market Round Up Monthly Video 2018-03-01 With Martin Pring

by Martin Pring,

President, Pring Research

Here is the market analysis reviewing the current market outlook. There is a host of information on commodities, bonds and US equities.

Market Roundup With Martin Pring 2018-03-01 from StockCharts.com on Vimeo.

Chartcon 2018 registration is now open! Registration kicked off today, February 1st!

Chartcon 2018! Follow the link...

READ MORE

MEMBERS ONLY

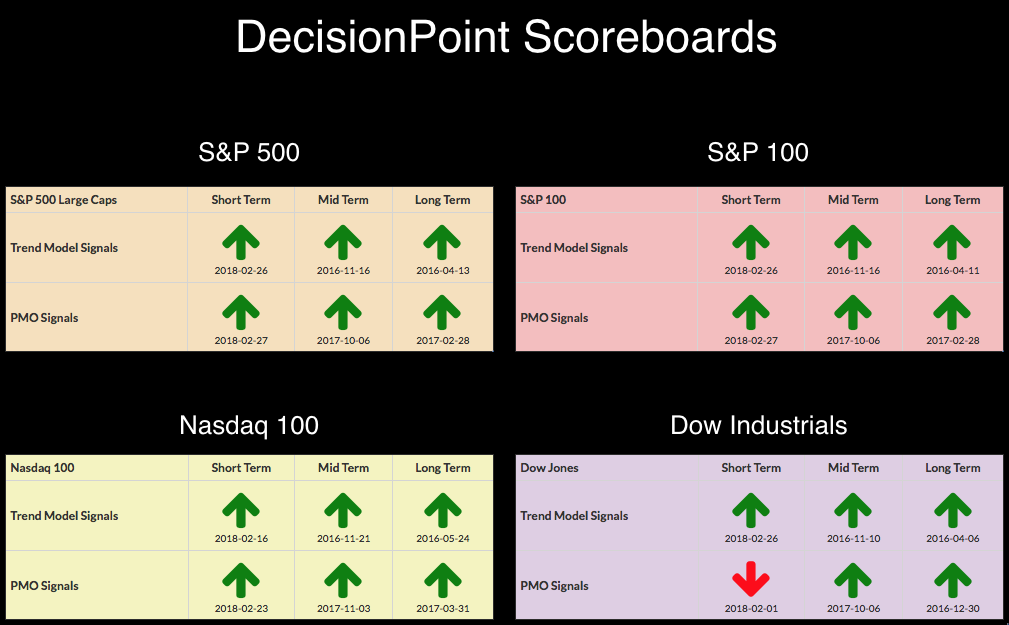

DP Bulletin: Scoreboards Lose BUY Signals

by Erin Swenlin,

Vice President, DecisionPoint.com

After deep declines today, the DP Scoreboards lost most of their short-term BUY signals. Rising wedges had appeared on the daily charts and today's decline confirmed it. The expectation is a breakdown from the wedge. The NDX is showing the most relative strength as it continues to cling...

READ MORE

MEMBERS ONLY

Looking For Seasonal Strength? Check Out This Leading Stock From A Leading Industry

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, February 28, 2018

Outside of the final two hours on Wednesday, it was a fairly boring day. We gapped higher at the open, sold off to fill the gap, and then moved back into positive territory.....until the final two hours. Selling returned in a big...

READ MORE

MEMBERS ONLY

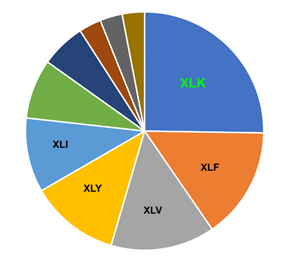

And Then There was One - Applying a Dow Theory Principle to the Top Sectors

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* XLK is Near Top of 2018 Range.

* XLE is Near Bottom of 2018 Range.

* Year-to-date Ranks for Equal-Weight Sectors.

* And Then There was One.

* EW Consumer Discretionary ETF Underperforms.

* Scanning the Major Indexes.

* Majority of Stocks are Struggling.

* Non-Confirmation Among the Offensive Sectors.

XLK is Near Top of 2018 Range....

READ MORE

MEMBERS ONLY

Monthly Chart Review of Major Indexes, Dollar, Gold, Oil and Bonds - Good, Bad & Ugly

by Erin Swenlin,

Vice President, DecisionPoint.com

The market has closed on the final day of February. This means that DecisionPoint monthly indicators have "gone final" which is the perfect time to review those signals and take a long-term view of the markets and the DecisionPoint "Big Four"- $USD, $GOLD, $WTIC &...

READ MORE