MEMBERS ONLY

DP Alert: PMO BUY for NDX Finally - Gold Sentiment Suggests Rally

by Erin Swenlin,

Vice President, DecisionPoint.com

The only red arrow left on the DP Scoreboards was erased today as the NDX triggered a PMO BUY signal on the daily chart. The last time we saw no red on the Scoreboards, it lasted about two days. The bull winds are blowing hard, so I think this all...

READ MORE

MEMBERS ONLY

STEEL STOCKS LEAD MATERIALS TO NEW RECORD -- STEEL ETF NEARS FIVE-YEAR HIGH -- STEEL LEADERS INCLUDE NUCOR AND STEEL DYNAMICS -- S&P METALS AND MINING SPDR ACHIEVES BULLISH BREAKOUT -- STOCKS HAVE ANOTHER STRONG DAY

by John Murphy,

Chief Technical Analyst, StockCharts.com

MATERIALS SPDR HITS NEW RECORD ... In a strong market day, materials led stocks higher. Chart 1 shows the Materials Select SPDR (XLB) breaking out to a new record. The XLB has been finding support along its 50-day average. The XLB/SPX ratio (top of chart) has been lagging behing the...

READ MORE

MEMBERS ONLY

Analog Devices Turns at Key Retracement Zone

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is a certain ebb and flow in an uptrend where the advances consistently outpace the pullbacks. Think of it as two steps forward and one step backward. The chart for Analog Devices (ADI) shows a big move to new highs from August to November and then a 50-62% retracement...

READ MORE

MEMBERS ONLY

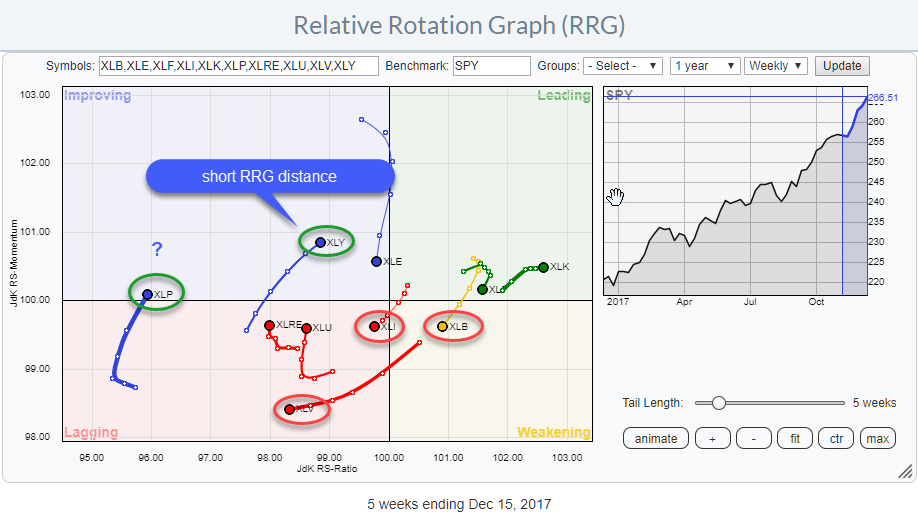

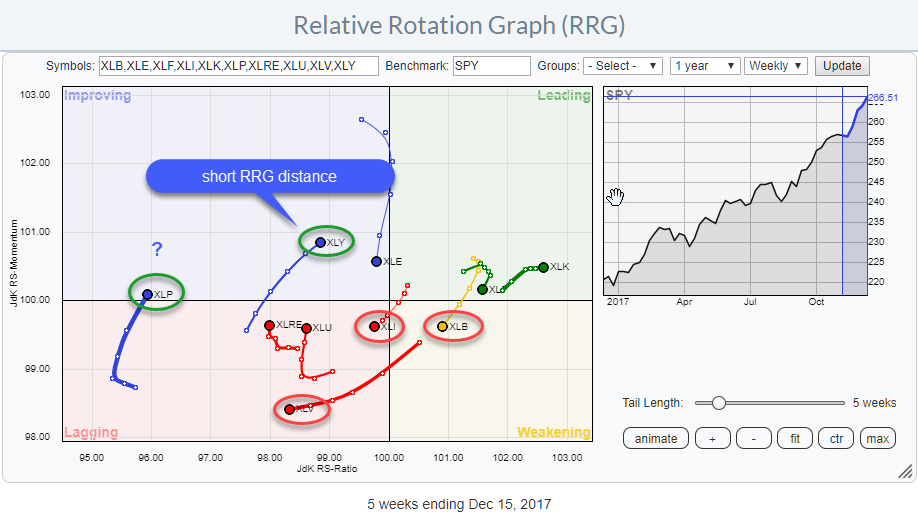

RRG shows two sectors continuing to carry SPY higher and three sectors to avoid going into the new year

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph for US sectors is showing us three sectors to avoid but also two which may offer good potential.

Inside the leading quadrant, we find XLK and XLF still being the strongest sector in US equity market based on their JdK RS-Ratio reading.

Energy (XLE) started heading...

READ MORE

MEMBERS ONLY

Russell 2000 Leads Friday's Strong Advance; Small Caps Ready To Explode

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, December 15, 2017

Friday's action was extremely bullish. I always love to see "trend days", where prices rise across the board from opening to closing bells. Strength was found in all of our major indices with the Russell 2000 (small caps) leading...

READ MORE

MEMBERS ONLY

NASDAQ and Microsoft Hit New Records, Russell 2000 Ishares Bounce

by John Murphy,

Chief Technical Analyst, StockCharts.com

The Nasdaq finally joined the Dow and S&P 500 in record territory on Friday. Chart 1 shows the PowerShares QQQ exceeding its November peak at week's end, and in heavy trading. The QQQ is based on the Nasdaq 100 index which includes the 100 largest non-financial...

READ MORE

MEMBERS ONLY

The Best Traders Have This One Common Trait And They Never Waver

by John Hopkins,

President and Co-founder, EarningsBeats.com

This may sound way too easy, but successful traders manage risk. They don't care about losing money on trades that don't work. They exit those trades and put their capital to work in a better trade. Many trading services will try to WOW you with a...

READ MORE

MEMBERS ONLY

Year-End Cleanup

by Bruce Fraser,

Industry-leading "Wyckoffian"

Two favorite tools of Wyckoffians are Relative Strength analysis and Point and Figure (PnF) charting (Horizontal Method). As the year comes to a conclusion let’s reflect back on some case studies and bring them up to date.

‘In Gear with Relative Strength’ (click here for a link) profiled two...

READ MORE

MEMBERS ONLY

Here Are Five Solid Small Cap Trades And A Powerful ChartList For 2018

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Happy holidays! I want to wish everyone a joyous holiday season and here's to a happy, healthy and prosperous 2018! Thank you so much for all your support of StockCharts.com in 2017!

To better understand the reasoning for the stocks selected below, you first need to understand...

READ MORE

MEMBERS ONLY

TECHNOLOGY IS WEEK'S STRONGEST SECTOR AND HITS NEW HIGH -- SO DOES THE NASDAQ 100 -- MICROSOFT WAS ONE OF THE BIG REASONS WHY -- RUSSELL 2000 ISHARES BOUNCE OFF 50-DAY AVERAGE -- SMALL CAPS SHOULD BENEFIT FROM TAX CUT

by John Murphy,

Chief Technical Analyst, StockCharts.com

TECHNOLOGY HAS A STRONG WEEK... After leading the market higher for most of the year, technology stocks saw some profit-taking near the end of November, and have lagged behind the rest of the market since then. This week, however, technology was the market's strongest sector. And that was...

READ MORE

MEMBERS ONLY

Overbought - And Built to Stay That Way

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Overbought and oversold are funny terms. Well, actually, they are not that funny when you really think about it. Overbought is often overused in an uptrend and oversold is over used in a downtrend. Let's focus on overbought because that seems to be the term du jour right...

READ MORE

MEMBERS ONLY

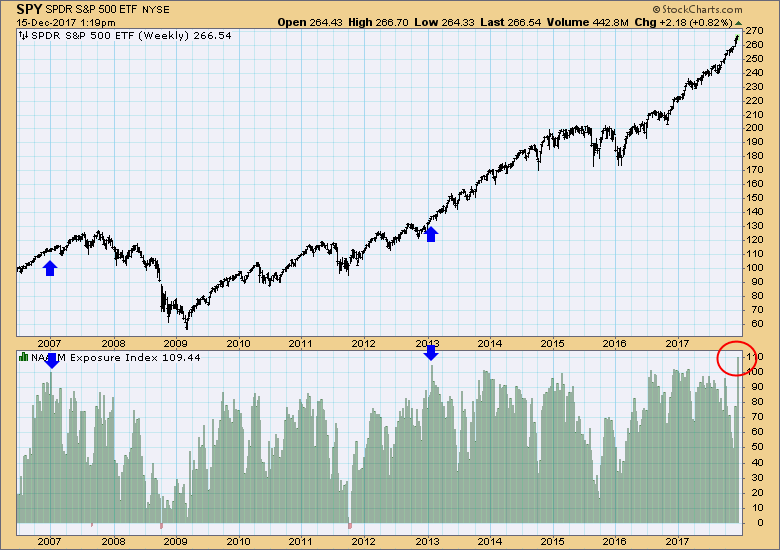

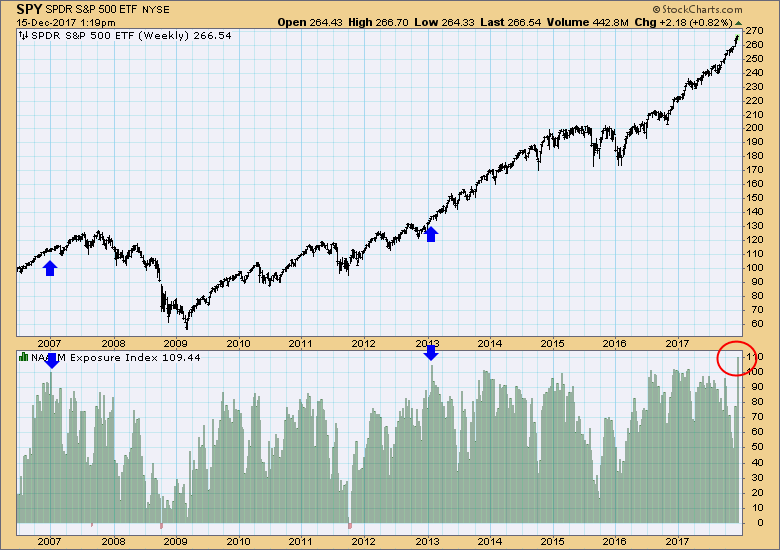

DP Weekly Wrap: NAAIM Exposure Index Highest Reading Ever

by Carl Swenlin,

President and Founder, DecisionPoint.com

This week the National Association of Active Investment Managers (NAAIM) Exposure Index reached the highest reading since its inception in 2006. Rather than stay 100% invested, NAAIM members will raise or lower their fund's market exposure based upon their assumptions regarding future market action. The potential range of...

READ MORE

MEMBERS ONLY

Charts I'm Stalking: Action Practice #24

by Gatis Roze,

Author, "Tensile Trading"

Put a man on a bicycle and he’ll surprise you.

Put a man on a machine and he’ll amaze you.

Teach him asset allocation and he’ll electrify you!

Due to the unusual number of new subscribers who read my Traders Journal blog about Asset Allocation, I’ve...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook (with Video) - Day 53 Since Becoming "Overbought"

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

---- Day 53 Since Becoming "Overbought"

---- Small-cap Underperformance Becomes Pronounced

---- IJR Forms Bull Flag

---- SPY Hits New High as QQQ Breaks Flag

---- What's Up (literally) with TLT?

---- Junk Bonds Continue to Weaken

---- XLU with Bull Flag and Oversold CCI

----...

READ MORE

MEMBERS ONLY

Disney-Fox Deal Lifts Broadcasting, Consumer Discretionary

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, December 14, 2017

Walt Disney (DIS) announced plans to purchase $52 billion of 21st Century Fox (FOXA) assets and that lifted both the broadcasting & entertainment index ($DJUSBC) and the consumer discretionary sector (XLY, +0.31%), not to mention both DIS (+2.75%) and FOXA (+6....

READ MORE

MEMBERS ONLY

Is Santa Claus Really Coming to Town for Small Caps?

by Erin Swenlin,

Vice President, DecisionPoint.com

I haven't talked Small Caps in quite awhile and I think there are some interesting points that need to be made--good and bad. First, the technicals on the S&P 600 are not looking good at all. However, Tom Bowley, my co-host on MarketWatchers LIVE and fellow...

READ MORE

MEMBERS ONLY

Did Mylan's Shooting Star Candle Mark A Near-Term Top?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

We'll soon find out. But, as a short-term trader, I'd have sold Mylan (MYL) into the close today. A close above 40.09 on heavy volume would confirm a breakout. Today, MYL hit 41.59 intraday, but fell all the way back to close at 40....

READ MORE

MEMBERS ONLY

What's The Market Going To Do When The Tax Bill Is Passed?

by Martin Pring,

President, Pring Research

* General thoughts on the discounting process

* Short-term indicators poised for, but not yet signalling a decline

General thoughts on the discounting process

There is an old adage on Wall Street to the effect that traders should, in the case of war, sell the rumor and buy on the sound of...

READ MORE

MEMBERS ONLY

DISNEY AND FOX SURGE TOGETHER -- TIFFANY BREAKS OUT WHILE NIKE CONTINUES TO RUN -- DELTA AND SOUTHWEST CLIMB TO NEW HIGHS

by John Murphy,

Chief Technical Analyst, StockCharts.com

DISNEY AND FOX SURGE ... The announcement that Walt Disney was buying $66 billion worth of assets from Fox sent both stocks surging today. And they helped make cyclical stocks the day's biggest gainer. Chart 1 shows Disney (DIS) surging more than 3% to the highest closing level since...

READ MORE

MEMBERS ONLY

Finisar Forges an Island Reversal (What now?) - Lumentum Hits Retracement and II-VI Corrects within Uptrend - Plus 4 More

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Selectively Consuming News

.... Finisar and VCSELs

.... Narratives are Dangerous

.... Finisar Forges an Island Reversal

.... Lumentum Firms near Key Retracement

.... II-VI Corrects within Uptrend

.... Stocks to Watch (CENX, JJU, PRGO, LH) ....

I do follow the financial press on a regular basis, but on a very selective basis. I am mostly interested...

READ MORE

MEMBERS ONLY

Fed Rate Hike Slams Financials; Biotechs Picking Up Steam

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, December 13, 2017

It was a simple case of "buy the rumor, sell the news". Financials (XLF, -1.24%) slumped on Wednesday after the Fed decided to raise interest rates another quarter point. Higher 10 year treasury yields ($TNX) typically result in money rotating...

READ MORE

MEMBERS ONLY

DP Alert: Short-Term Head & Shoulders Still Viable on Dollar (UUP)

by Erin Swenlin,

Vice President, DecisionPoint.com

No new changes to the DecisionPoint Scoreboards. The NDX is holding onto its PMO SELL signal and it still has some margin to cover before the new PMO BUY signal can generate. Of particular interest today, and of course coming on the heels of a very bullish blog on the...

READ MORE

MEMBERS ONLY

Consumer Stocks Look To Lead The Bull Market Into 2018

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, December 12, 2017

It was mixed and bifurcated action on Tuesday. The Dow Jones and S&P 500 continued their assault on the record books, but the NASDAQ and Russell 2000 both paused and pulled back. With the 10 year treasury yield ($TNX) moving back...

READ MORE

MEMBERS ONLY

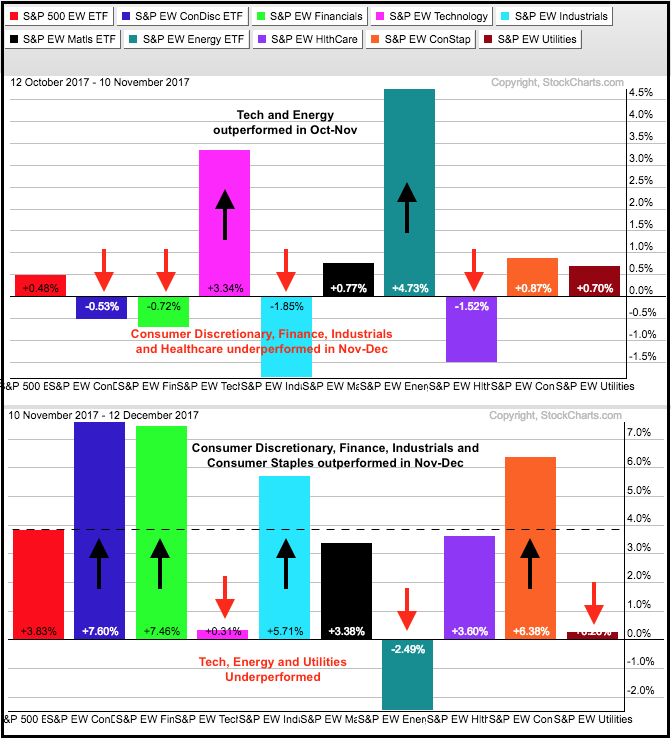

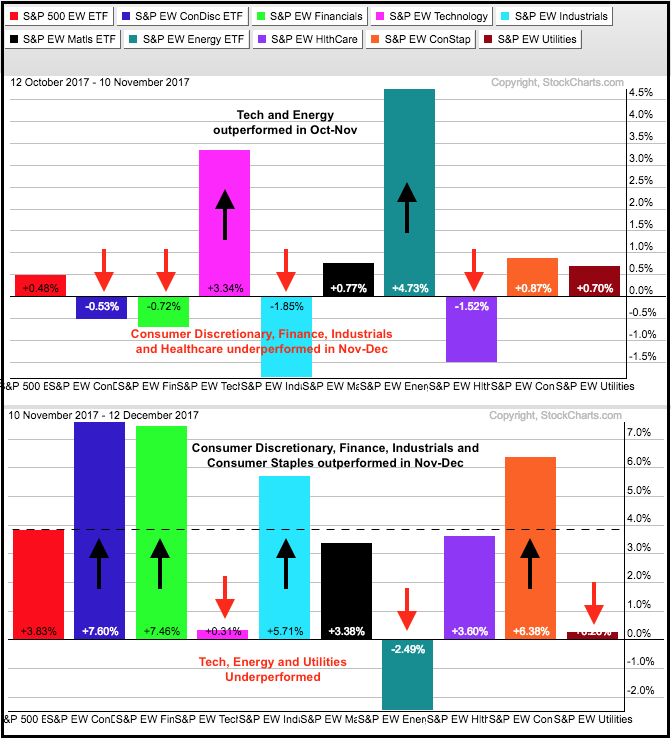

What a Difference a Month Makes for Sector Performance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The two sector Performance charts below show a rather dramatic shift in market leadership over the last two months. First, note that these PerfCharts are using the nine equal-weight sector ETFs. In contrast to the cap-weighted sector SPDRs, these equal-weight ETFs provide us with a performance picture for the "...

READ MORE

MEMBERS ONLY

Utilities Sector Dimming - UUP Garners a New IT Trend Model BUY

by Erin Swenlin,

Vice President, DecisionPoint.com

We've seen some very interesting sector rotation this past year as the market continues to climb higher. Money doesn't seem to really be leaving the market, just rotating from one sector to the next. The Utilities sector was a good run through October and into November....

READ MORE

MEMBERS ONLY

RISING BOND YIELDS BOOSTS FINANCIAL STOCKS -- FINANCIAL SPDR LEADS MARKET HIGHER -- GOLDMAN SACHS SETS A NEW RECORD -- VERIZON SURGE LEADS TELECOM HIGHER -- AT&T CLEARS ITS 200-DAY AVERAGE -- EDISON INTL WEIGHS ON UTILITY SECTOR

by John Murphy,

Chief Technical Analyst, StockCharts.com

BOND YIELD IS CLIMBING... The daily bars in Chart 1 show the 10-Year Treasury Yield climbing 2 basis points to 2.40%. The 5-year Treasury Yield (not shown) has climbed to the highest level in six years. Today's strong PPI report may have something to do with that....

READ MORE

MEMBERS ONLY

Historically Low VIX Is Very Bullish For Equities; Check Out These Numbers

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, December 11, 2017

The Russell 2000 remained in true December form as it continues to struggle during the first half of the month, despite records being set on both the Dow Jones and S&P 500 on a daily basis. It truly is an anomaly....

READ MORE

MEMBERS ONLY

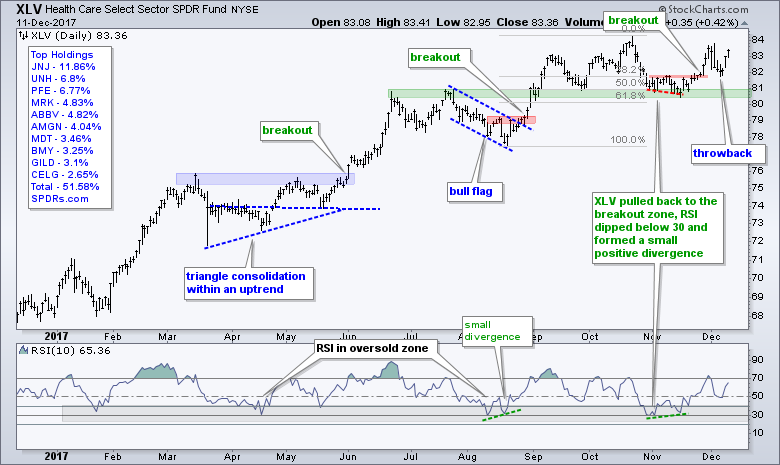

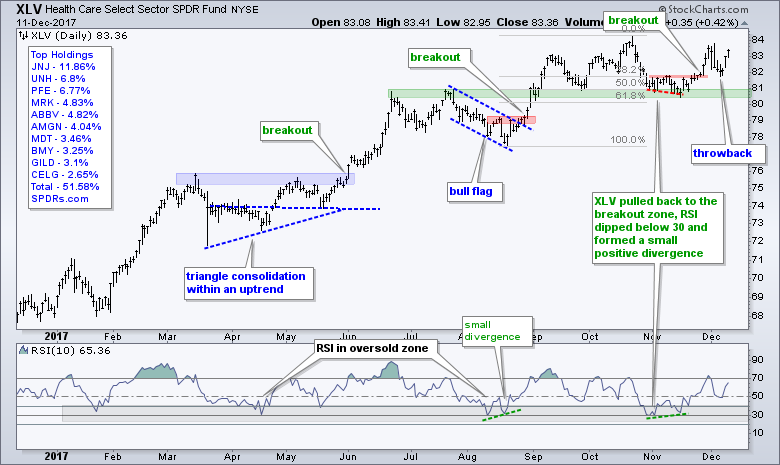

Healthcare Springs to Life - Five Healthcare Stocks - Two New Tech ETF Leaders - Telsa Bounces off Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Health Care SPDR Renews its Breakout

.... Pfizer and Bristol-Meyers Bounce off Support

.... HACK and IGN Confirm Big Continuation Patterns

.... Cisco and Fortinet Lead their Groups

.... Copper Gets Oversold Bounce (plus COPX)

.... Tesla Surges off Support Zone

.... Short-term Ugliness with Long-term Bullishness ....

Health Care SPDR Renews its Breakout

The Health Care...

READ MORE

MEMBERS ONLY

DP Alert: Short-Term and Intermediate-Term Indicators Bullish - NDX STTM BUY Signal

by Erin Swenlin,

Vice President, DecisionPoint.com

On Friday, the NDX logged a new ST Trend Model BUY signal. Currently DP indicators are looking bullish and seeing improvement in the technology sector is encouraging for the market in general.

I did point out on today's MarketWatchers LIVE show that one could make a case for...

READ MORE

MEMBERS ONLY

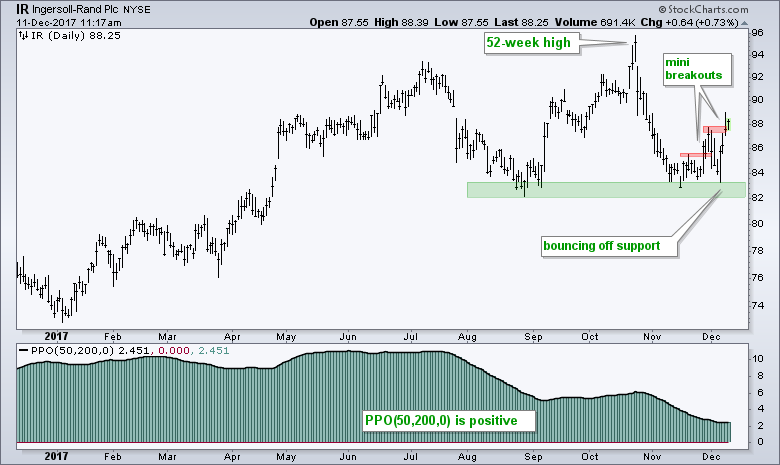

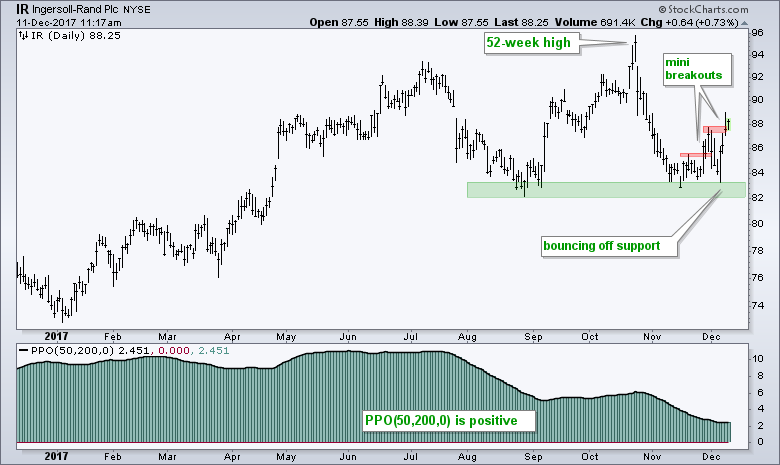

Ingersoll-Rand Surges off Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Ingersoll-Rand (IR) is showing renewed signs of life with a surge off support and two mini breakouts. Note that IR is part of the industrials sector and this sector is showing upside leadership with a 52-week high recently. First and foremost, Ingersoll-Rand is in a long-term uptrend with a 52-week...

READ MORE

MEMBERS ONLY

9 Trade Setups To Consider After Recent Selling

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, December 8, 2017

While we didn't set intraday all-time highs, we did manage to close at record levels on both the Dow Jones and S&P 500, which rose 0.49% and 0.55%, respectively, on Friday. The NASDAQ tacked on 0.40%...

READ MORE

MEMBERS ONLY

Intel Testing Key Short-Term Support

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

On October 26th, Intel (INTC) posted quarterly earnings results and beat both revenue and EPS estimates. It resulted in a very strong gap higher the next morning and then INTC continued rising, tacking on another 10% within a week. But INTC became very overbought with an RSI above 90 and...

READ MORE

MEMBERS ONLY

Dow Jones Industrials PnF Dilemma

by Bruce Fraser,

Industry-leading "Wyckoffian"

Horizontal Point and Figure (PnF) analysis offers a method for estimating the potential extent of a move. The dilemma is what to do when the price objective has been met. Should there be an automatic response of reducing position size in the price objective zone? Are there more dynamic strategies...

READ MORE

MEMBERS ONLY

INDUSTRIAL SECTOR CONTINUES TO SHOW NEW LEADERSHIP -- DOW JONES HEAVY CONSTRUCTION INDEX MAY BE NEARING UPSIDE BREAKOUT -- QUANTA SERVICES AND JACOBS ENGINEERING HAVE ALREADY BROKEN OUT -- AMONG RETAILERS, BEST BUY HITS A NEW RECORD

by John Murphy,

Chief Technical Analyst, StockCharts.com

INDUSTRIAL SECTOR CONTINUES NEW LEADERSHIP ROLE... Industrial stocks assumed a new market leadership role during November and remained in that role again this week. Chart 1 shows the Industrial Sector SPDR (XLI) gaining 1.4% during the week which made it second only to the financial sector's gain...

READ MORE

MEMBERS ONLY

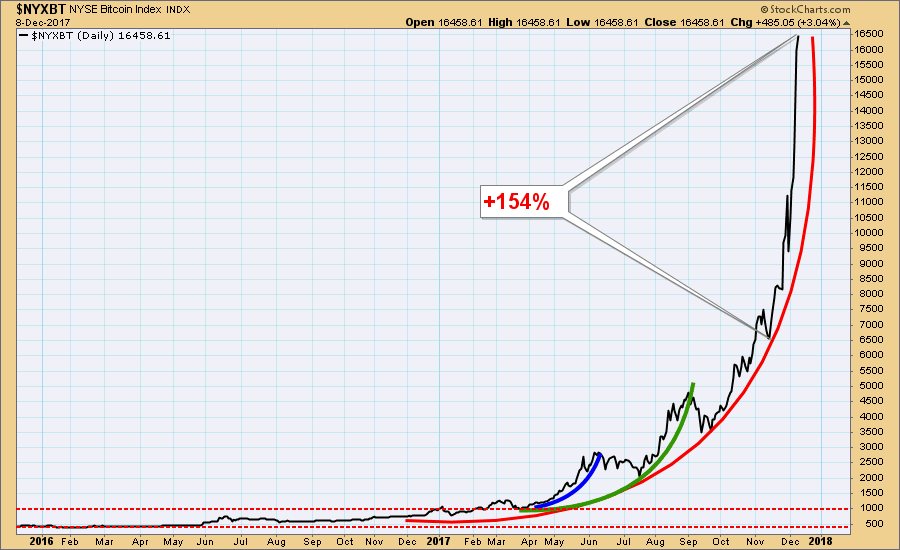

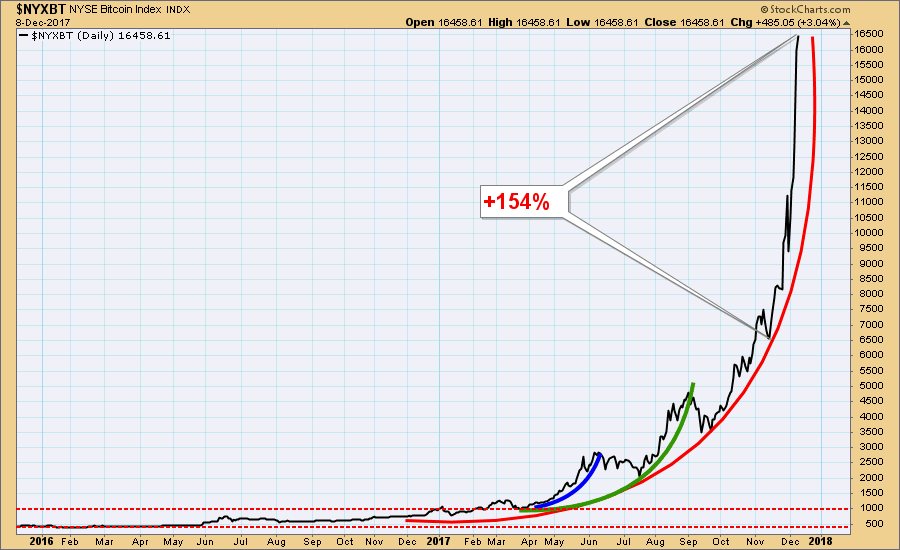

DP Weekly Wrap: BitBubble

by Carl Swenlin,

President and Founder, DecisionPoint.com

In the DP Weekly Wrap I normally lead with a chart of the market, but this week Bitcoin was so prominent in the news, I thought a chart of the Bitcoin Index would be more appropriate. What we have here is a classic parabolic advance (the red arc), with price...

READ MORE

MEMBERS ONLY

U.S. Equities Post Strongest Day In December

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, December 7, 2017

December began with a huge intraday selloff and recovery and since then, it's been mostly down action. Yesterday was the first day this month that the bulls could celebrate and feel good. Eight of nine sectors advanced with many of the...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook - Breadth Confirms Price (with Video)

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Breadth Indicators Confirm Chart Strength

.... SPY Stalls as QQQ Edges Lower

.... Watch TLT for Clues on IJR

.... Three New Highs and One Stall

.... XLE Stalls, but Holds its Breakout

.... Getting Perspective on XME

.... Steel ETF Forms Big Continuation Pattern

.... IEF and TLT Remain Divergent

.... Gold Breaks as Dollar Turns Up...

READ MORE

MEMBERS ONLY

Responding to comments and answering questions from MWL last week

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Last week Wednesday (29 November) I was the guest of Tom and Erin in the Market Watchers Live show.

During the show, we talked a lot about RRG, Relative Rotation Graphs, covering some basics and some new(er) techniques and interpretations that I have been working on.

If you missed...

READ MORE

MEMBERS ONLY

Guess What? Short Term Indicators Are Saying That Bitcoin Is Getting A Bit Frothy!

by Martin Pring,

President, Pring Research

* 18-month ROC is literally off the charts

* Bitcoin and short- term momentum

* Comparing Bitcoin to the Bitcoin Trust

* Conclusion

* Links to videos on Bitcoin

18-month ROC is literally off the charts

There are two Bitcoin directly related vehicles that are available on the StockCharts platform. These are the NYSE Bitcoin...

READ MORE

MEMBERS ONLY

Here's A Pharma Printing A Hammer After Filling Gap

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'm constantly looking for short-term trading opportunities and Perrigo (PRGO) fits the bill. After reporting better-than-expected results in its latest quarter, PRGO gapped up strongly and today filled its gap before finishing on a solid note to print a hammer (blue circle below) - many times a signal...

READ MORE