MEMBERS ONLY

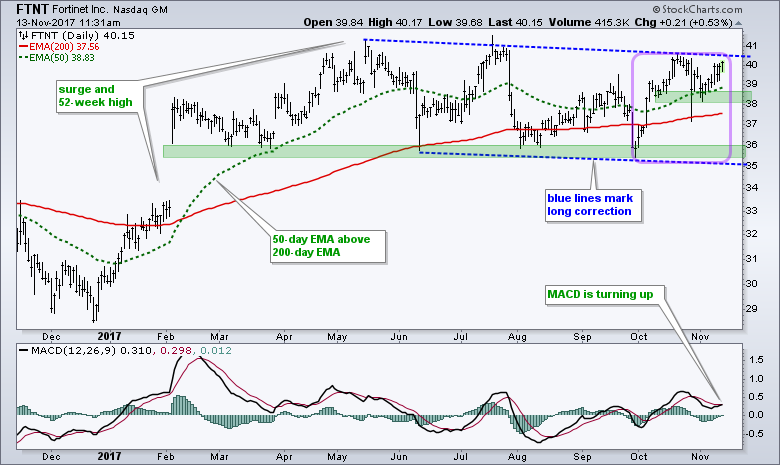

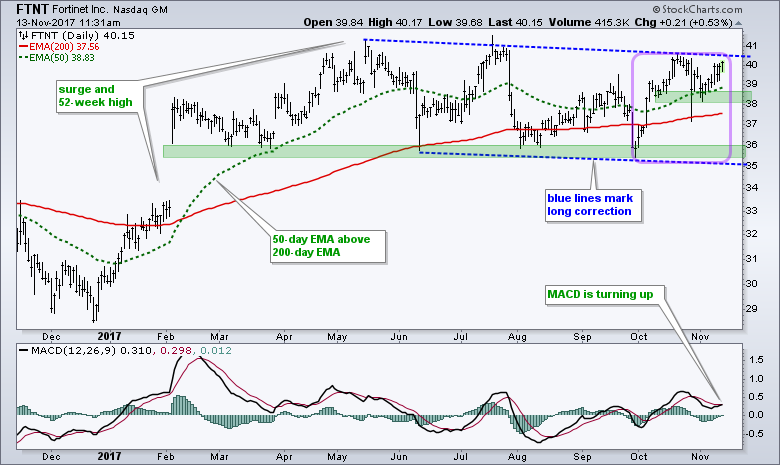

Fortinet Bids to End Long Correction

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks close to new highs are usually in uptrends and have a good chance of recording new highs in the near future. Fortinet looks poised for a new high as challenges a channel line after an upturn last week. First and foremost, Fortinet is in a long-term uptrend with the...

READ MORE

MEMBERS ONLY

Consumer Staples Finish Off Strong Week, Hold Trendline Support

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, November 10, 2017

Generally speaking, I'm not a big fan of defensive areas leading the market to the upside. But I'll make an exception for last week. Consumer staples (XLP, +1.02%) was not only the clear leader on Friday, but it&...

READ MORE

MEMBERS ONLY

Want To Know When To Sell? Terex Is A Perfect Example

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

In September, Terex Corp (TEX) saw big volume accompany a breakout of a bullish rectangular consolidation phase. After weeks of trending higher, momentum began to slow and TEX printed a "death" candle - a shooting star on big volume to end the uptrend. If there's one...

READ MORE

MEMBERS ONLY

Crude Oil Runs with the Bulls

by Bruce Fraser,

Industry-leading "Wyckoffian"

Crude Oil lends itself to Wyckoff Analysis and has the capacity to trend for long periods of time. Take some time now and review a case study on the long swings for this important commodity (click here for the study). Note how well the Point and Figure charts have been...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: Buy the Dip? What Dip?

by Carl Swenlin,

President and Founder, DecisionPoint.com

I should probably watch less business news, but I only have it on to catch any big news developments, and the sound is usually off. Nevertheless, I can't avoid some stuff that I'd rather filter out. For example, there was talk on Thursday and Friday about...

READ MORE

MEMBERS ONLY

TEN-YEAR TREASURY YIELD GAPS HIGHER -- 20-YEAR TREASURY BOND ISHARES GAP DOWN AND LOOK TOPPY -- THEIR LONGER-RANGE CHART ALSO SUGGESTS A MAJOR BOND TOP IN THE MAKING -- FINANCIAL SPDR AND SMALL CAPS ARE TESTING SUPPORT AT THEIR 50-DAY AVERAGES

by John Murphy,

Chief Technical Analyst, StockCharts.com

TEN-YEAR TREASURY YIELD BOUNCES OFF 200-DAY AVERAGE... My Wednesday message showed the 10-Year Treasury Yield ($TNX) testing its 200-day moving average. Chart 1 shows the TNX gapping 7 basis points higher today after finding support at its 200-day line. I also mentioned on Wednesday that the 10-Year Treasury yield was...

READ MORE

MEMBERS ONLY

WHY do Most Investors do so Poorly?

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

There are a number of companies that track performance for various asset classes, including the performance of investors. Table A, from J.P. Morgan, shows the Average Investor’s 20-year annualized returns of only 2.3%. I have reproduced the small print below the table because it explains the process...

READ MORE

MEMBERS ONLY

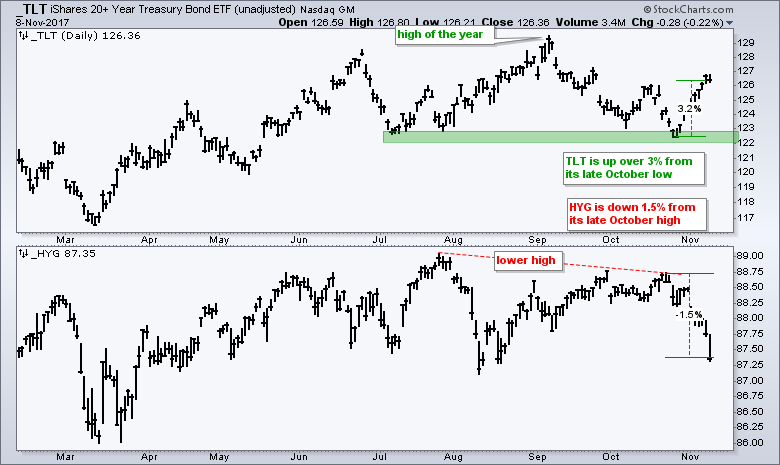

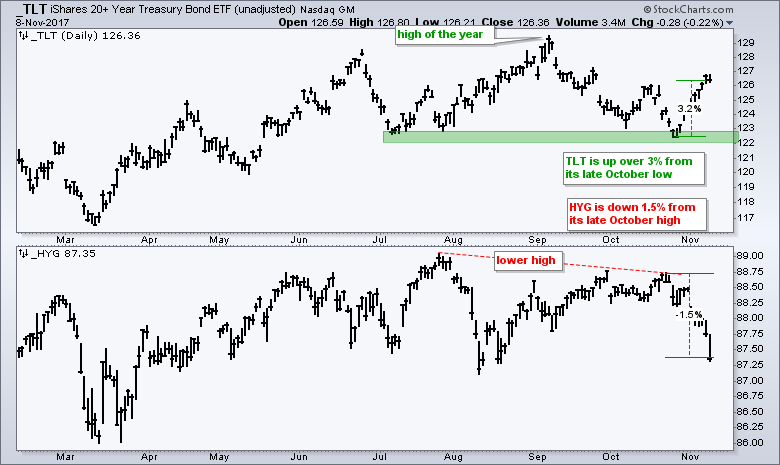

Weekly Market Review & Outlook (w/ video) - Junk Bonds Fall Hard

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Risk-on versus Risk-off on One PerfChart

.... Junk Bond ETF Falls Most Since August

.... The Oxymoronic Nature of Technical Analysis

.... SPY Hovers Near its Highs

.... RSI Moves into Oversold Zone for IJR

.... Finance, Industrials and Healthcare Lead Pullback

.... Utilities SPDR Hits 52-week High

.... Technology Remains a Leader (plus XLY)

.... Industrials and...

READ MORE

MEMBERS ONLY

Early Losses Result In Successful Moving Average Tests; Overbought Conditions Unwinding

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, November 9, 2017

Energy (XLE, +0.30%) returned to the top of the leaderboard and this is what's likely to irritate the bears in the future. We now have another sector that's technical capable to take on new money as money rotates...

READ MORE

MEMBERS ONLY

Growth Is Breaking Out Against Value

by Martin Pring,

President, Pring Research

Growth versus value and a possible mega breakout favoring growth

* The technology/staples ratio supports the growth/value breakout

* Some credit spreads are looking shaky

* Are stocks finally breaking against commodities?

Growth versus value and a possible mega-breakout favoring growth

Chart 1 compares the performance of the S&P...

READ MORE

MEMBERS ONLY

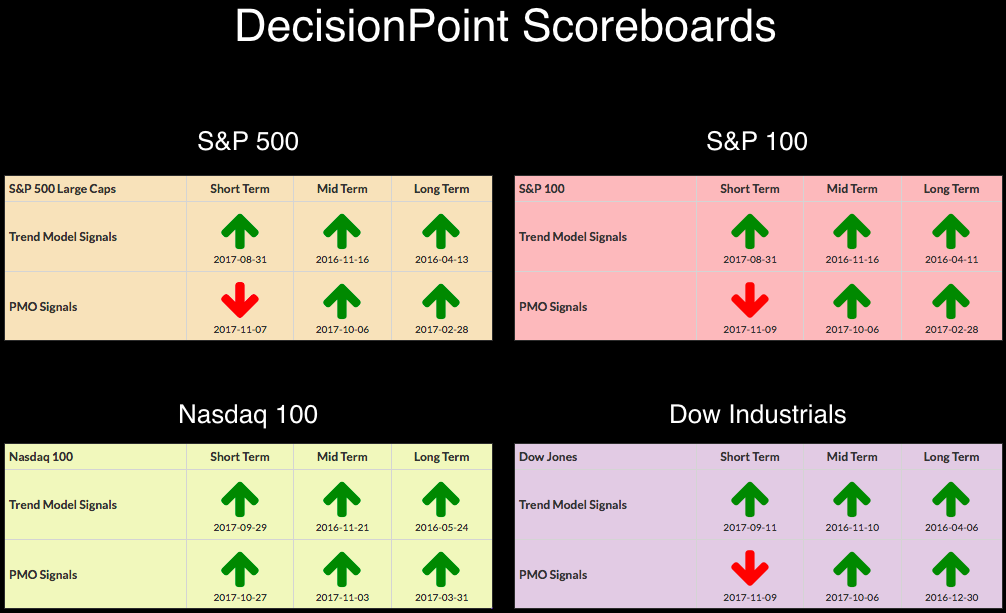

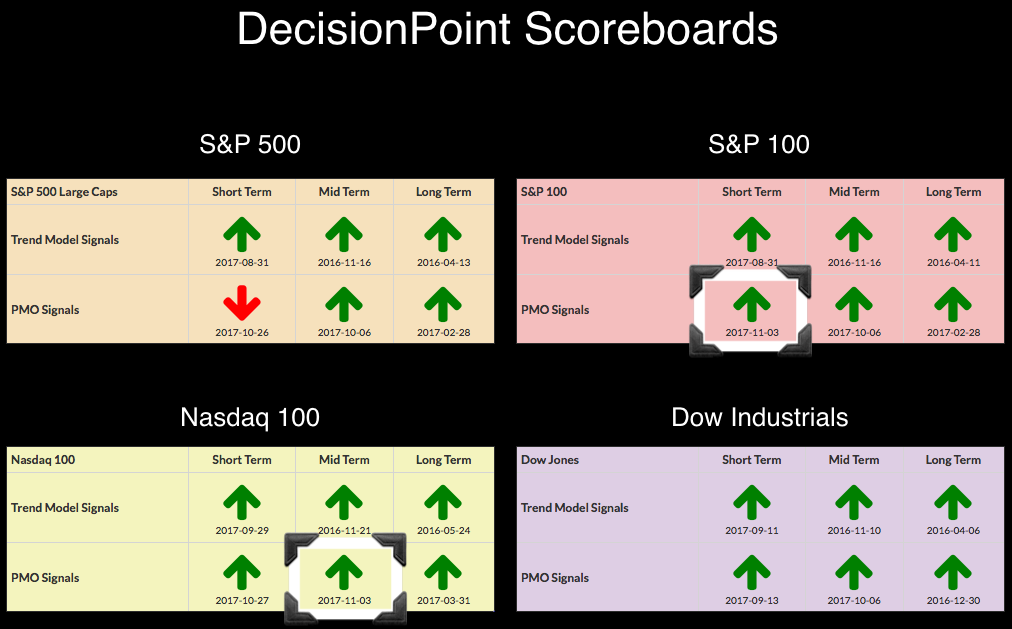

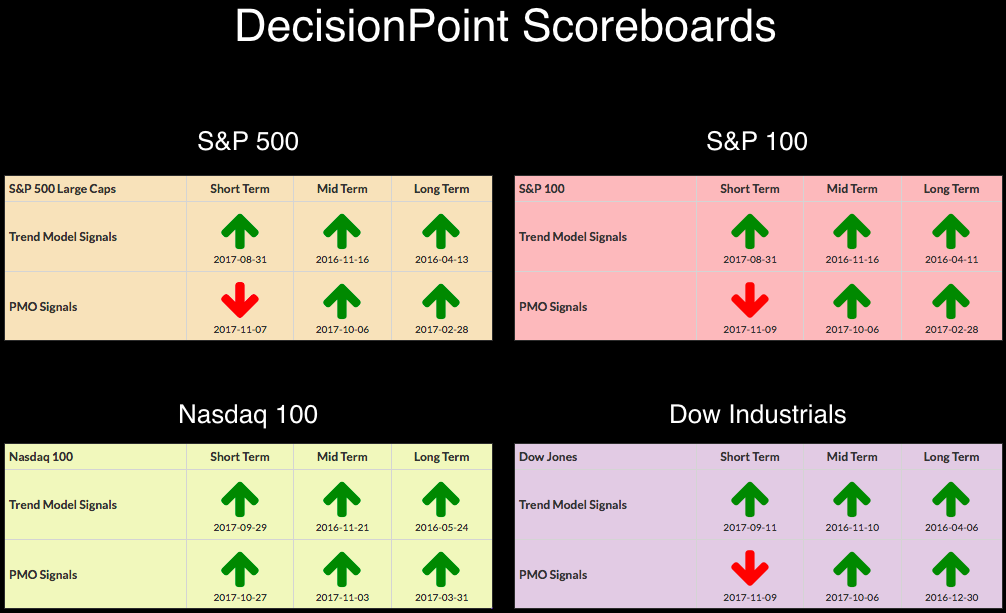

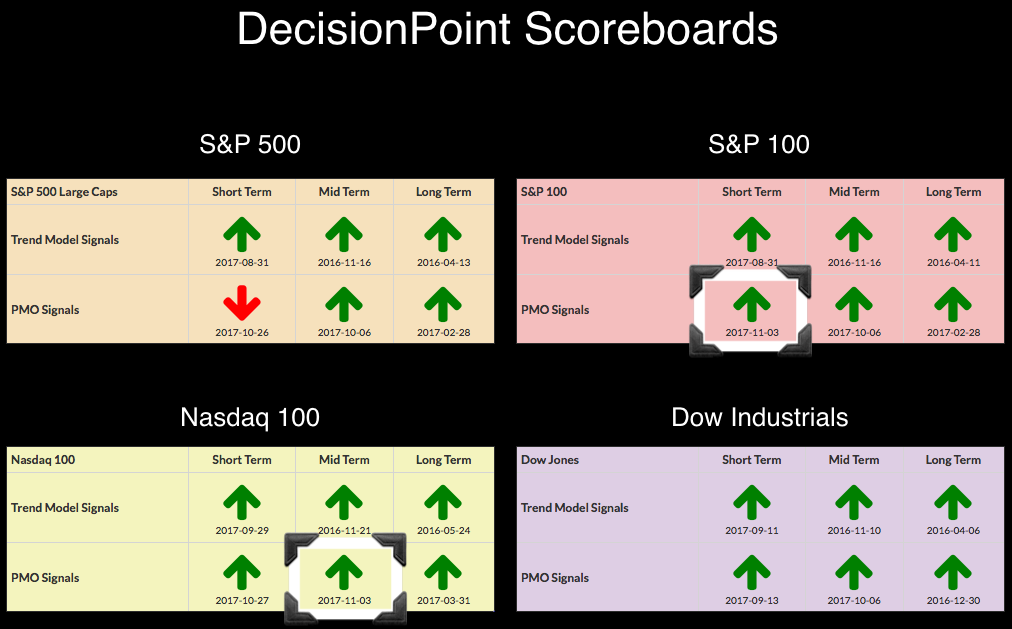

DP Bulletin: NDX Only PMO BUY Signal Left - Gold PMO BUY Signal

by Erin Swenlin,

Vice President, DecisionPoint.com

Today's decline was enough to push the OEX and Dow PMO BUY signals off the DP Scoreboards. The NDX is still looking good with the PMO actually rising right now. However, if the other indexes continue to decline, it is very likely the NDX will follow suit. Gold...

READ MORE

MEMBERS ONLY

Selling Allows PNC Financial To Unwind For Solid Reward To Risk Trade

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

While it would be great for the stock market to rise every day without any selling whatsoever, that's just not practical. As a trader, I await episodes of selling to set up much better reward to risk trades in stocks that remain in long-term uptrends. Enter PNC Financial...

READ MORE

MEMBERS ONLY

Futures Down Sharply; The 9th Calendar Day Of Month Strikes Again

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, November 8, 2017

It was another day of records for most of our major indices with the Dow Jones, S&P 500 and NASDAQ all closing at their highest levels ever. Consumer staples (XLP, +1.09%) led the advance and I feature this group in...

READ MORE

MEMBERS ONLY

Does the Bond Market Have a Message for the Stock Market? - Plus Mean-Reversion Setups for IJR, XLV and IBB

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Is the Bond Market Sending a Message?

.... IJR Triggers Mean Reversion Signal

.... RSI Turns Up for the Health Care SPDR

.... When Ugly Charts Provide Opportunities

.... Biotech iShares Dip for the Third Time ....

I wrote about the unadjusted High-Yield Bond ETF (_HYG) on October 31st and junk bonds fell rather sharply...

READ MORE

MEMBERS ONLY

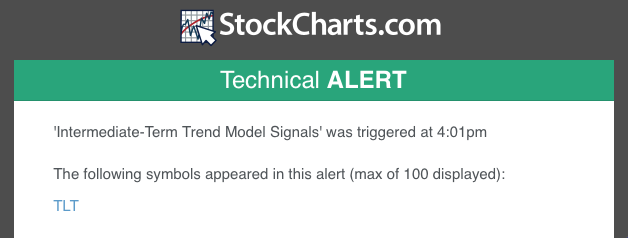

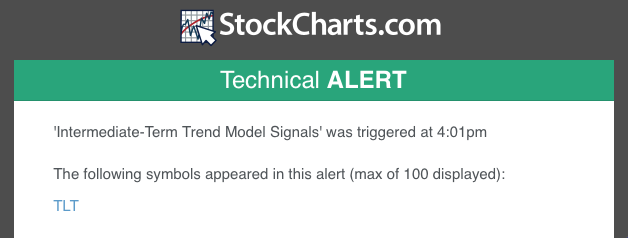

DP Bulletin: IT Trend Model BUY Signal for Bonds (TLT)

by Erin Swenlin,

Vice President, DecisionPoint.com

As noted, a new technical alert arrived in my email inbox this afternoon. I was surprised that I didn't receive word of any DP Scoreboard PMO signal changes, but seeing TLT grab an ITTM BUY signal wasn't surprising. I think TLT is at an interesting "...

READ MORE

MEMBERS ONLY

TEN-YEAR TREASURY YIELD REMAINS IN SHORT-TERM PULLBACK -- IT'S BEING HELD BACK BY EVEN WEAKER FOREIGN YIELDS -- THAT EXPLAINS RECENT WEAKNESS IN FOREIGN CURRENCIES -- COMMODITY PRICES CONTINUE TO STRENGTHEN

by John Murphy,

Chief Technical Analyst, StockCharts.com

TEN-YEAR TREASURY YIELD IS PULLING BACK ... After reaching the highest level in seven months during October, the 10-Year Treasury Yield ($TNX) has experienced a pullback. Chart 1 shows, however, that pullback in the TNX over the last two weeks hasn't been enough to reverse its general uptrend. It...

READ MORE

MEMBERS ONLY

Fiserve Shows Resilience with Move into Gap Zone

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Fiserv gapped down and fell on big volume last week, but the candlestick points to an accumulation day and the Accumulation Distribution Line hit a new high. First and foremost, the big trend is up because Fiserve hit a 52-week high with a move above 130 in late October. FISV...

READ MORE

MEMBERS ONLY

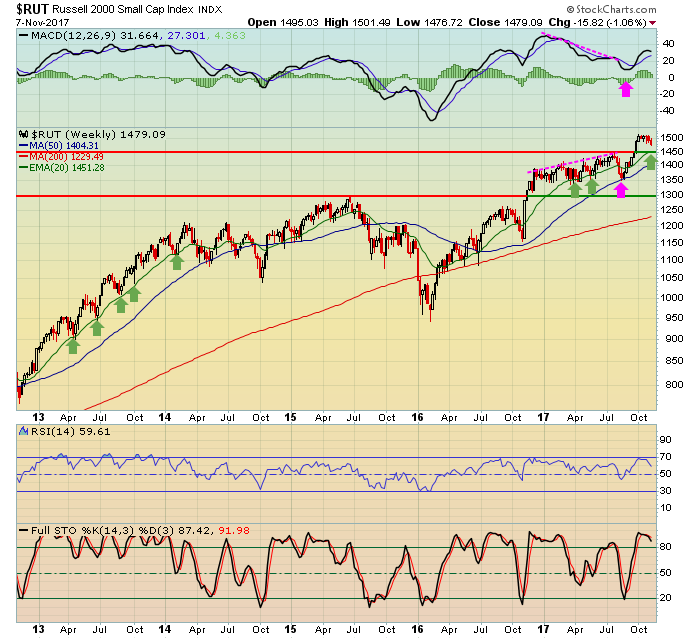

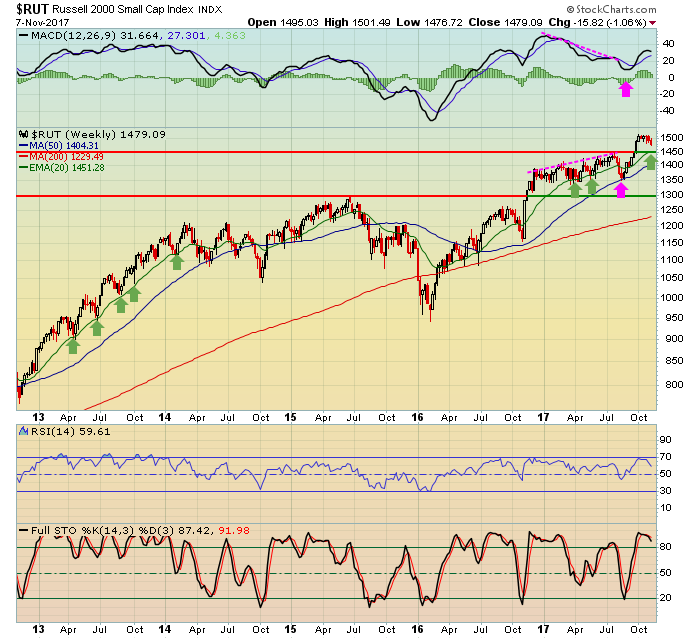

Russell 2000 Takes Biggest Hit In Three Months; Watch This Support Level

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, November 7, 2017

Small cap stocks felt a slight tremor on Tuesday as the Russell 2000 ($RUT, -1.26%) suffered its worst day in nearly three months. While losses never feel good, I believe the RUT is in a bullish advance similar to the one it...

READ MORE

MEMBERS ONLY

DecisionPoint Alert: SPX Back on PMO SELL - Oil Flourishes, Gold Support Holding Strong

by Erin Swenlin,

Vice President, DecisionPoint.com

Yes, the PMO BUY signal on the SPX has already disappeared. Unfortunately with the margin so thin between the PMO and its signal line (thousandths of a point), this likely will change again tomorrow if the SPX can close higher. What is interesting...the SPY never managed a PMO BUY...

READ MORE

MEMBERS ONLY

Energy Explodes Higher As Crude Oil Tops $57 Per Barrel; Time For Small Caps Again?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, November 6, 2017

Energy (XLE, +2.29%) shares made a huge advance on Monday as money rotated to this once-forgotten sector in a very big way. Bull markets thrive on broad participation in rallies and the XLE had been one sector not participating. That is no...

READ MORE

MEMBERS ONLY

Small Caps are Really Really Small - Gold Firms at Key Retracement - Plus DRI, FCX, GD, KEY, STT and TIF

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Mid-cap and Large-cap ETFs Hit New Highs

.... Checking the Mean-Reversion Trade for IJR

.... Small-caps are Really Really Small

.... Momentum ETF Extends its Lead

.... Gold Ignores Strength in TLT and UUP

.... Darden and Tiffany

.... Keycorp Consolidates after Surge

.... Two Mean-Reversion Setups (GD, STT)

.... Freeport McMoran Bounces off Support ....

Small-caps are leading...

READ MORE

MEMBERS ONLY

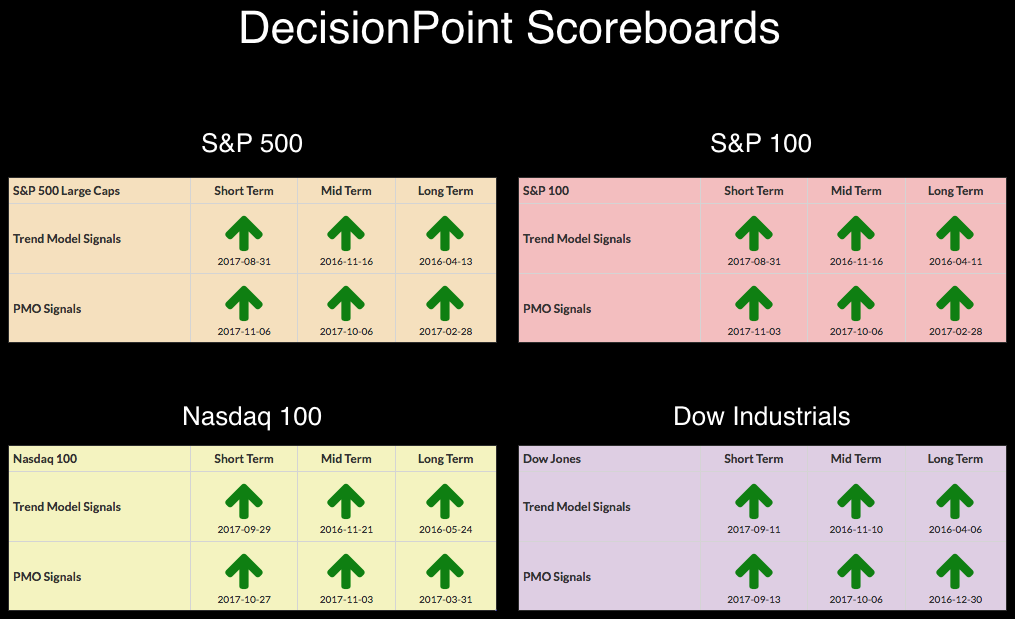

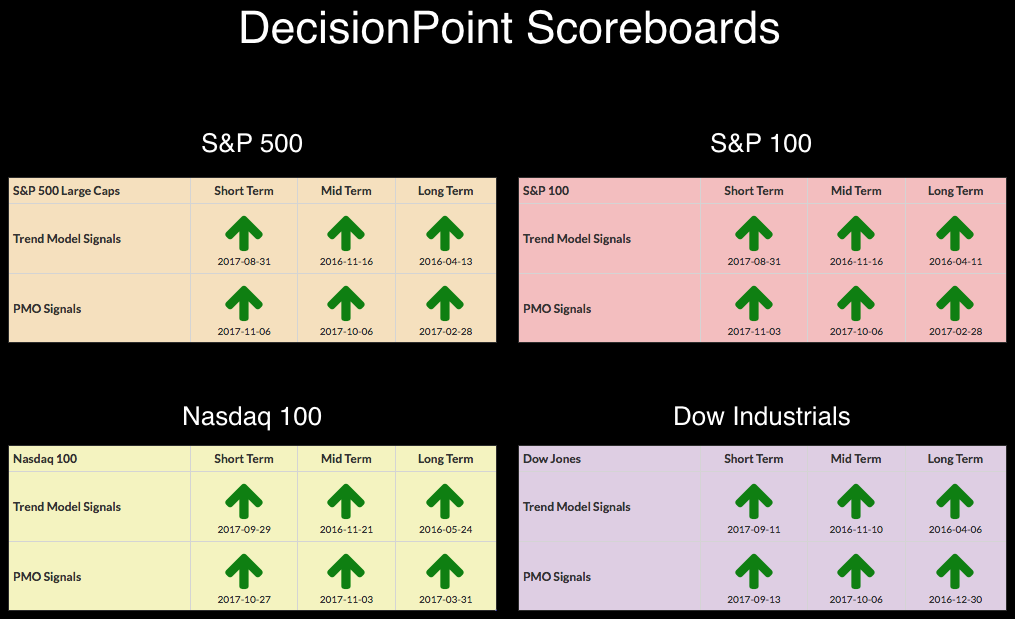

DP Bulletin: New PMO BUY Signal on SPX - Scoreboards All Green!

by Erin Swenlin,

Vice President, DecisionPoint.com

It's official! All four DecisionPoint Scoreboards are on BUY signals in all three timeframes on the PMO and Trend Models. Tom Bowley and I continue to discuss during the MarketWatchers LIVE show about the hurricane force bull market winds. If these Scoreboards don't convince you, I&...

READ MORE

MEMBERS ONLY

Schlumberger Springs a Bear Trap with Big Volume

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Schlumberger (SLB) broke support with a surge in volume, but this support break did not hold as the stock surged with strong volume the last two weeks. The decline below 62 looks like a selling climax because of high volume and the gap down. The surge in volume flushes out...

READ MORE

MEMBERS ONLY

Familiar Names Pace Healthcare, Technology; Major Indices Rise Again

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Notes

First, please join me and Erin Swenlin for MarketWatchers LIVE every day from Noon EST to 1:30pm EST. We discuss key technical developments that you need to be aware of as you manage your wealth. Previously, MarketWatchers LIVE aired just three days a week, but beginning today,...

READ MORE

MEMBERS ONLY

Tesla Recharging?

by Bruce Fraser,

Industry-leading "Wyckoffian"

Tesla is proving to be an excellent ongoing case study. We suspect that the Composite Operator (CO) is very active in the electric automobile manufacturer. Please take a few minutes and review two prior posts; ‘The Point and Figure Distribution Paradox’ (click here) and ‘Shorts Find Tesla Shocking’ (click here)...

READ MORE

MEMBERS ONLY

IBM Fails To Hold Moving Average Support, Now Looks To This Key Level

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

IBM has been a very interesting stock to watch, but not to own. After 23 consecutive quarters of declining revenues, traders finally found something to be excited about in IBM's latest quarterly earnings report. Five years ago, IBM traded near 165. At Friday's close, it was...

READ MORE

MEMBERS ONLY

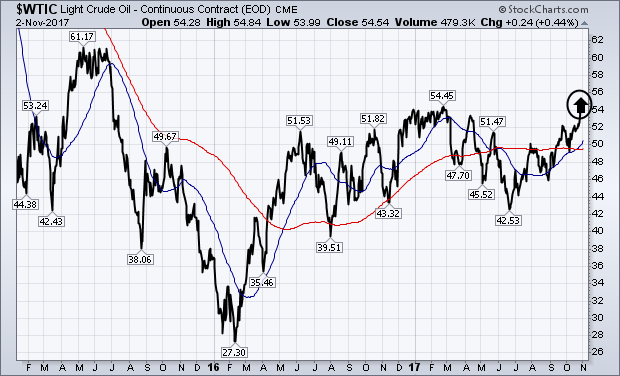

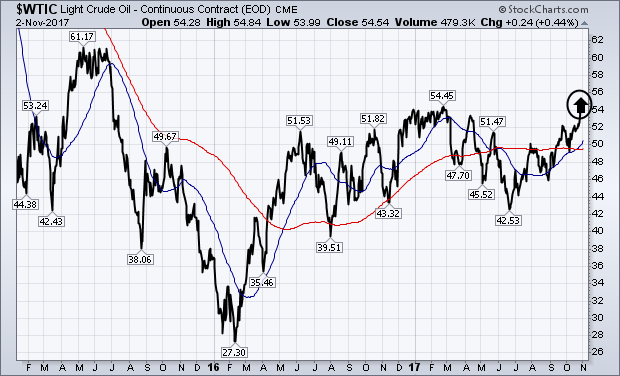

WTIC CRUDE OIL CLOSES AT TWO-YEAR HIGH -- ENERGY SHARES WERE THIS WEEK'S STRONGEST SECTOR -- ENERGY SHARES ARE LAGGING TOO FAR BEHIND THE RISING COMMODITY -- THE WTIC/XLE RATIO ALSO BREAKS OUT TO TWO-YEAR HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

WTIC COMPLETES BULLISH BREAKOUT... The weekly bars in Chart 1 show WTIC Light Crude Oil ending the week above its early 2017 peak near $55 for the first time in more than two years. That upside breakout puts WTIC in sync with Brent Crude Oil which rose over $60 for...

READ MORE

MEMBERS ONLY

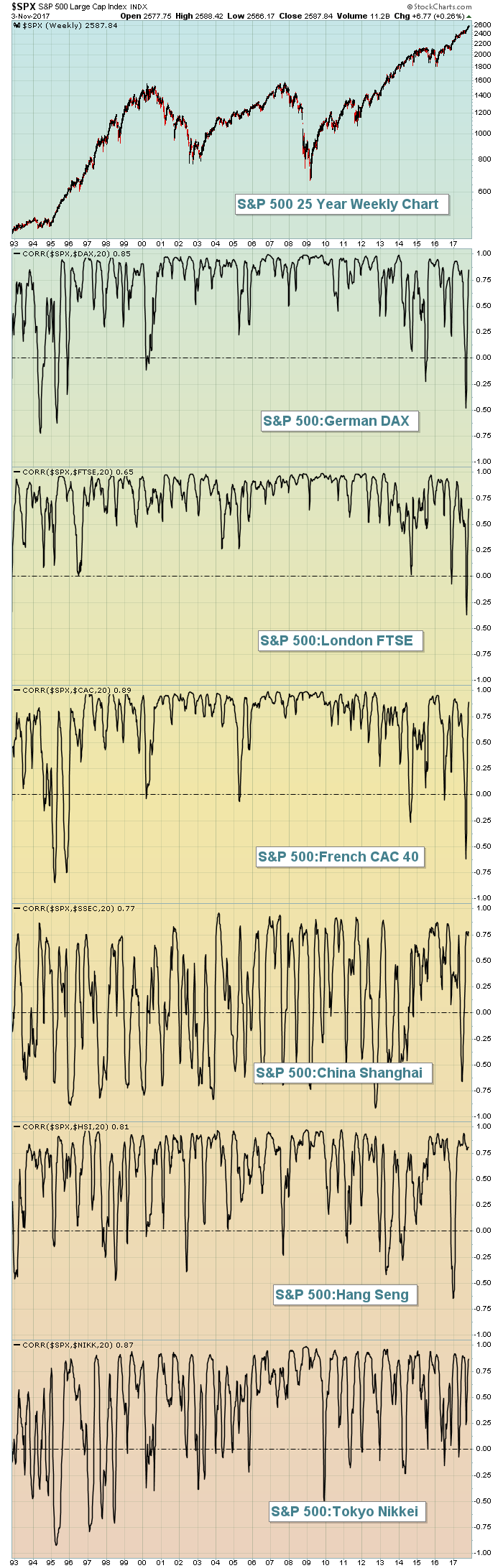

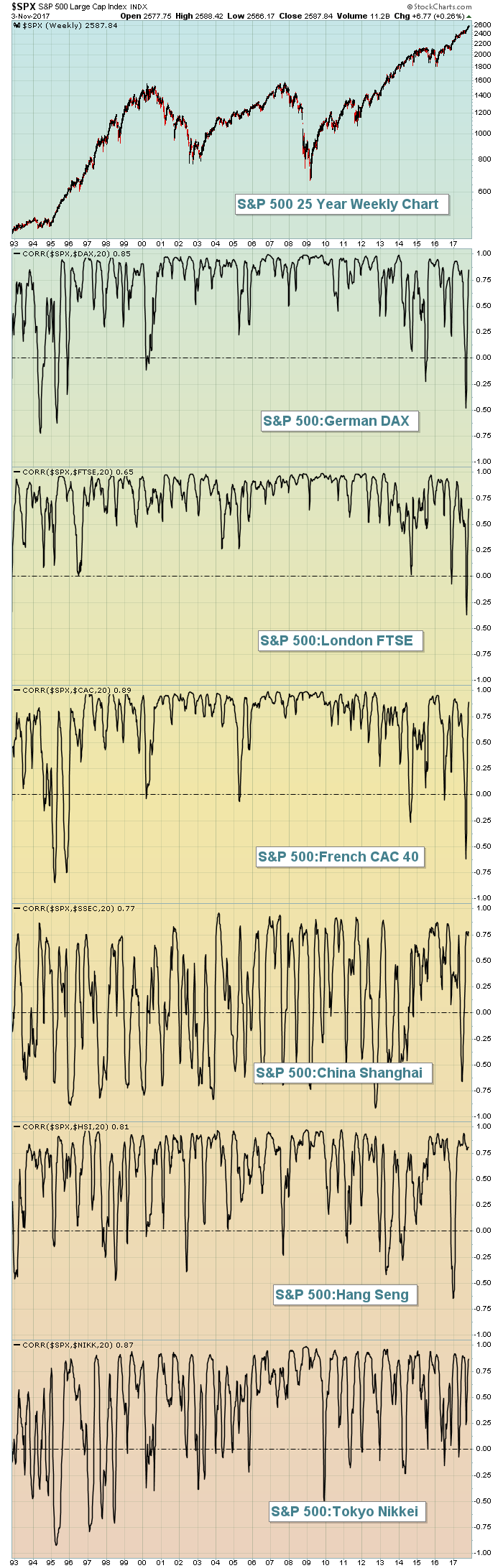

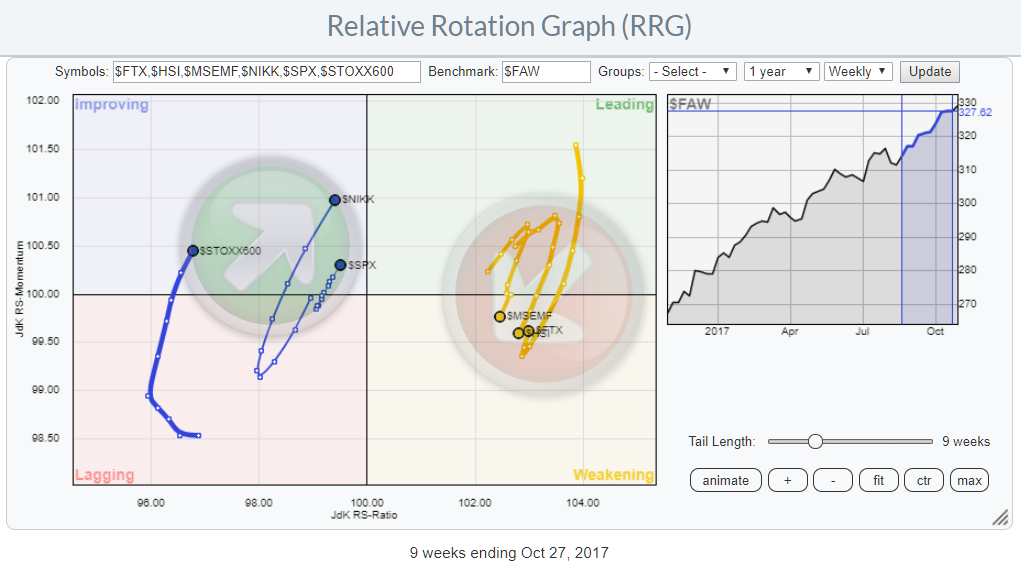

Which Global Markets Have The Biggest Influence On The U.S. Market And Why?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

When considering this question, I believe the correlation indicator tells us most of what we need to know. After all, we're pondering which global market movements tend to be reflected in similar movements in the U.S. market. For purposes of the U.S. market, I'll...

READ MORE

MEMBERS ONLY

Uptrends: What to Ignore and What to Watch?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

An uptrend means prices are advancing and higher highs are the order of the day. We do not know how long a trend will persist, but there is clear evidence that trends persist. Just look at the S&P 500 since early 2016 for a recent example. The 50-day...

READ MORE

MEMBERS ONLY

Crude Oil is Trading Over $55 For First Time in Two Years

by John Murphy,

Chief Technical Analyst, StockCharts.com

My Wednesday message showed Brent Crude Oil trading over $60 for the first time in more than two years. Brent is trading over $62 today. It also showed West Texas Intermediate Crude Oil (WTIC) trying to break through overhead resistance at $55. Chart 1 shows WTIC trading slightly above that...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: Not Out of the Woods Yet

by Carl Swenlin,

President and Founder, DecisionPoint.com

Of my comment, "Not out of the woods yet," you might ask, "What woods?" The market, after all, did manage to grind higher this week, so what's the problem? The problem that I see is a persistent weakness in our intermediate-term indicators, but we...

READ MORE

MEMBERS ONLY

New BUY Signals on DP Scoreboards for NDX and OEX - LTTM BUY Signal for USO

by Erin Swenlin,

Vice President, DecisionPoint.com

I've been expecting a new PMO BUY signal on both the SPX and the OEX. The OEX managed to wrangle the PMO above its signal line, but the SPX is struggling to garner its PMO BUY signal. Big news on Oil! We just got a new Long-Term Trend...

READ MORE

MEMBERS ONLY

CRUDE OIL IS TRADING OVER $55 FOR FIRST TIME IN TWO YEARS -- THAT'S BOOSTING ENERGY SHARES -- OIL & GAS EXPLORATION AND PRODUCTION SPDR IS ENERGY LEADER -- XOP LEADERS INCLUDE CONCHO RESOURCES, EOG RESOURCES, AND DIAMONDBACK ENERGY

by John Murphy,

Chief Technical Analyst, StockCharts.com

WTIC CRUDE OIL ATTEMPTING BULLISH BREAKOUT OVER $55... My Wednesday message showed Brent Crude Oil trading over $60 for the first time in more than two years. Brent is trading over $62 today. It also showed West Texas Intermediate Crude Oil (WTIC) trying to break through overhead resistance at $55....

READ MORE

MEMBERS ONLY

Earnings Opportunities - No Chasing Allowed

by John Hopkins,

President and Co-founder, EarningsBeats.com

Earnings Season is winding down. So far it's been quite positive. How do I know? Just look at the overall market.

We certainly saw strong earnings from the tech giants including Amazon, Apple, Facebook and Google. In fact all of these are ripe for nice trades IF you...

READ MORE

MEMBERS ONLY

Charts I'm Stalking: Action Practice #22

by Gatis Roze,

Author, "Tensile Trading"

A note to my readers: It is with great pride that I have written The Traders Journal blog every week since 2012 — 52 weeks a year. I am deeply grateful for the support and loyal following of all my readers throughout that time. However, I must announce that today marks...

READ MORE

MEMBERS ONLY

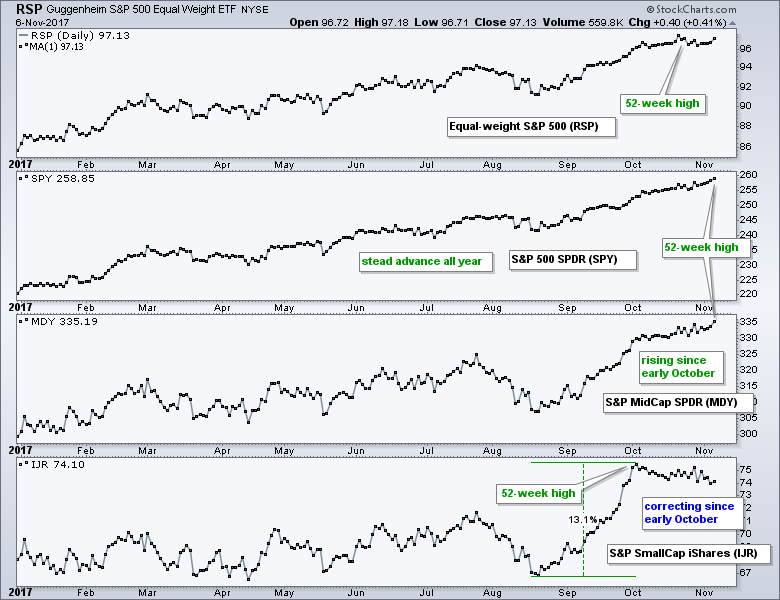

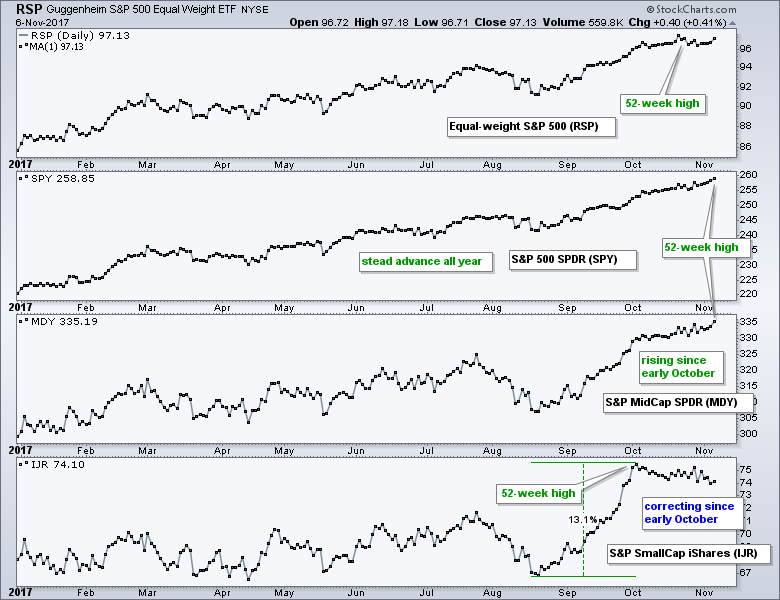

Weekly Market Review & Outlook - Are Small Caps Leading or Lagging?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Those Pesky Timeframes

.... SPY Notches another New High

.... Broad Advance Lifts QQQ to New Highs

.... IJR Fluctuates within Bullish Consolidation

.... Finance and Technology Lead

.... Consumer Discretionary Struggles Internally

.... Utilities and Materials are Close to 52-week Highs

.... Industrials and Healthcare Pull Back within Uptrends

.... XLE Breaks Flag Resistance as Oil Hits...

READ MORE

MEMBERS ONLY

Facebook Falters After Earnings, NASDAQ Now Looks To Apple's Strong Report

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, November 2, 2017

Financials (XLF, +0.94%) and industrials (XLI, +0.57%) led a Dow Jones rally on Thursday. Goldman Sachs (GS) paced the financial stocks in the Dow with more than a 1% gain, while Boeing (BA) was the best performing Dow component and the...

READ MORE

MEMBERS ONLY

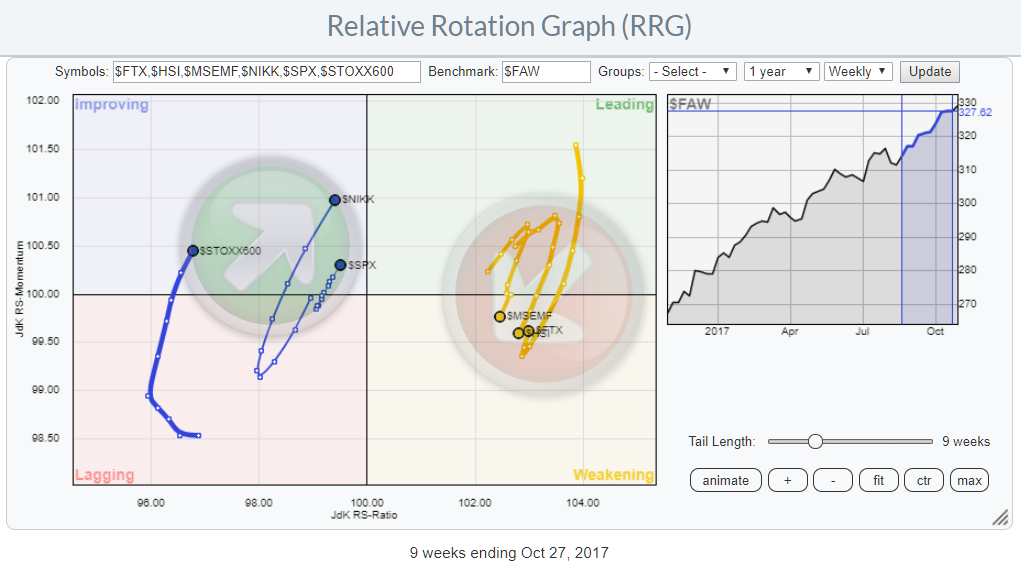

S&P 500 in nose bleed area? ... Not from this perspective!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph above plots a number of world equity markets against the FTSE all-world index and shows their relative rotation around this benchmark.

With all the chatter going around on the S&P 50o index camping in the nose-bleed area this gives a refreshing angle to look...

READ MORE

MEMBERS ONLY

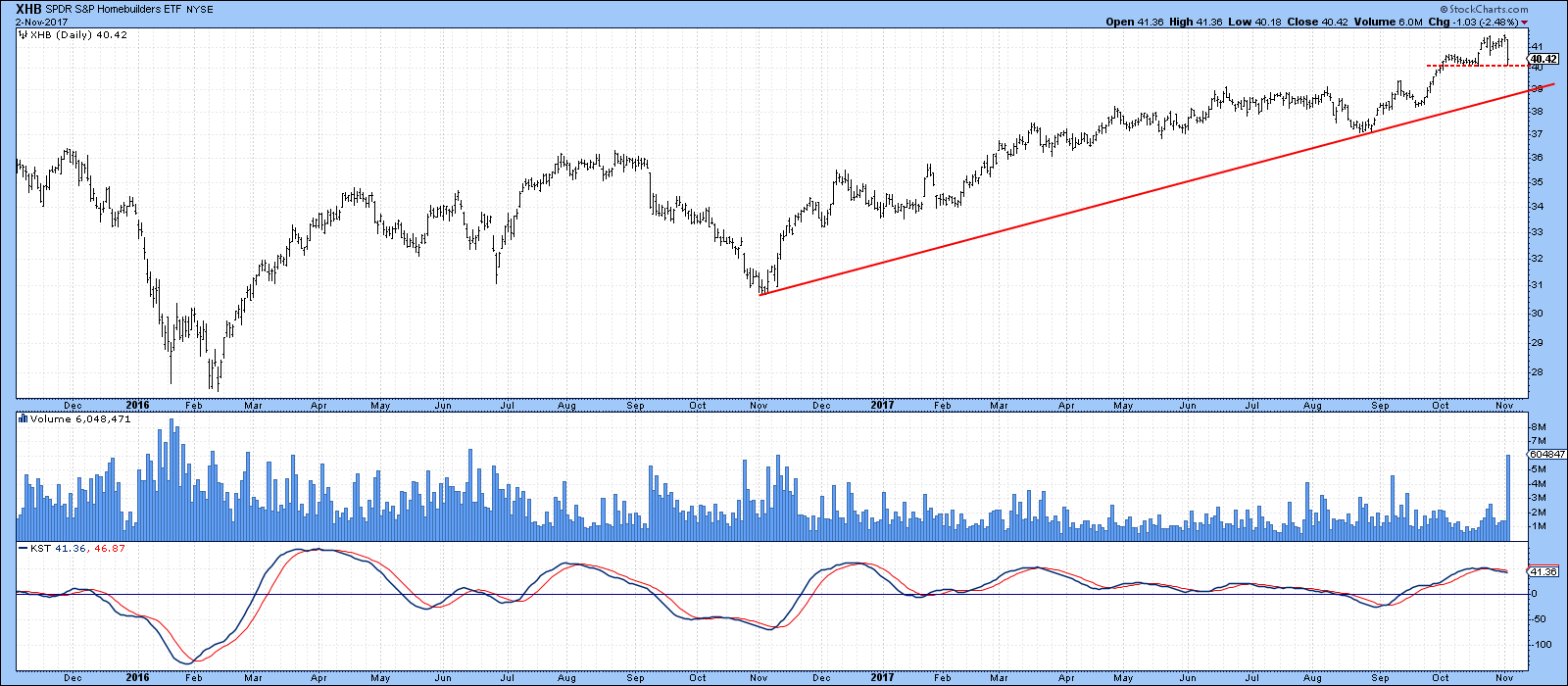

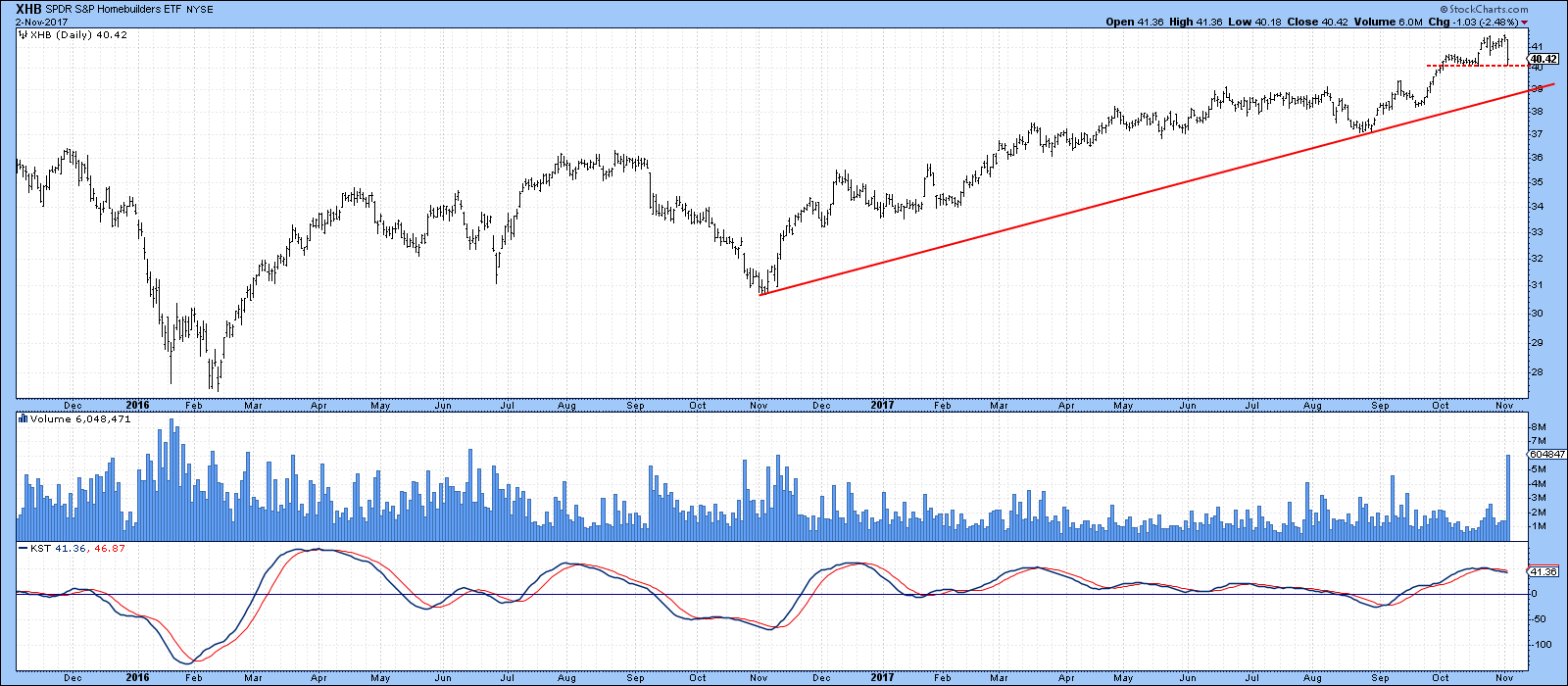

Homebuilders Hit By Tax Reform

by Martin Pring,

President, Pring Research

* SPDR Homebuilder ETF (XHB)

* iShares Home Construction ETF (ITB)

* Euro and yen looking vulnerable

Limitations being proposed for the popular interest rate deduction on tax filings hit the two homebuilder ETF’s for six on Thursday. These are the SPDR Homebuilder ETF (XHB) and the iShares Home Construction ETF (ITB)...

READ MORE

MEMBERS ONLY

Don't Trust the Headlines: "This Stock is Going to Soar!"

by Erin Swenlin,

Vice President, DecisionPoint.com

I know we all have seen the commercials for the newest or best investment of the decade. Now we are getting emails flooding our inboxes claiming to have an "investment of a lifetime"! I'm not saying that these are traps or always bad, but I can...

READ MORE