MEMBERS ONLY

GE's Wild Ride

by Bruce Fraser,

Industry-leading "Wyckoffian"

General Electric (GE) is a venerable old company in the Dow Jones Industrial Average. It was formed (Thomas Edison was the most famous of its founders) in 1892 and in 1896 it was among the first 12 stocks in the newly formed Dow Jones Industrial Average. Now GE is the...

READ MORE

MEMBERS ONLY

Here Are The Best Seasonal Stocks During November In The S&P 500

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

There are different ways to view best seasonal stocks depending on whether you're interested solely in average returns for a particular month or time period or if you're interested in the percentage times that a security rises for a particular month or time period. Thus, is...

READ MORE

MEMBERS ONLY

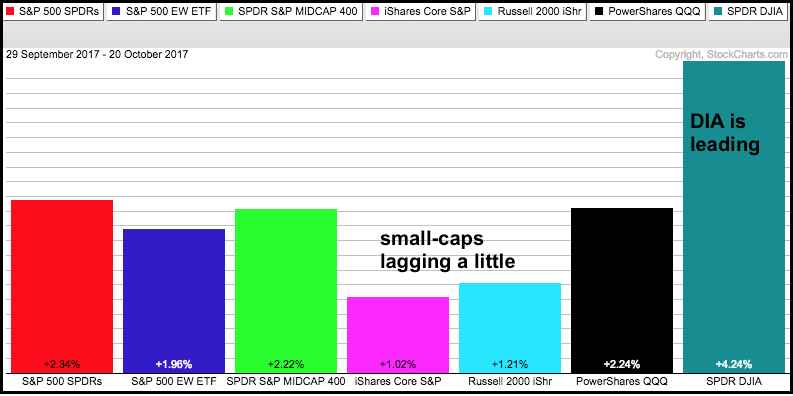

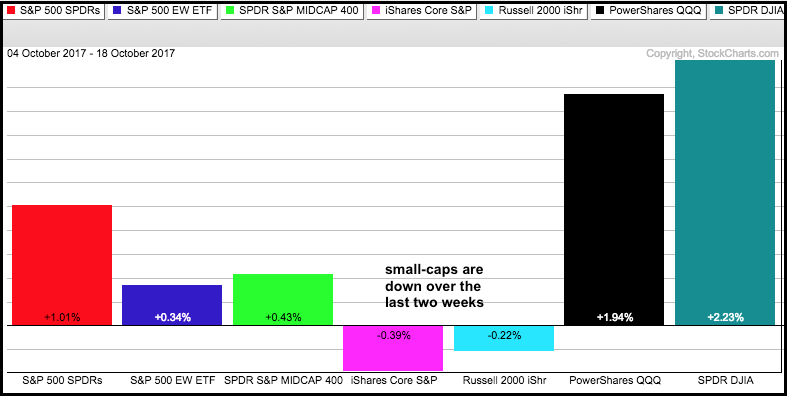

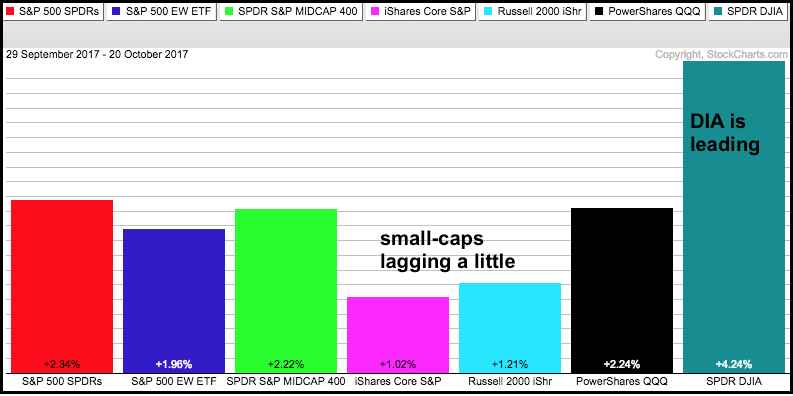

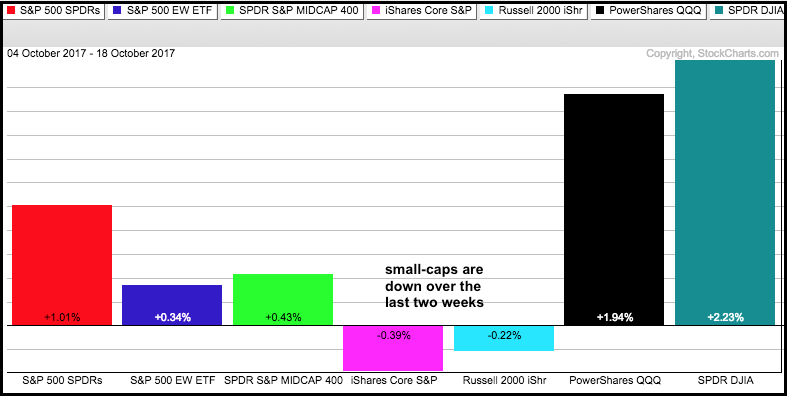

Small-cap ETFs Lag in October, but Break out of Flag Patterns

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The EW S&P 500 ETF, S&P MidCap SPDR and S&P 500 SPDR moved to new highs this week, but the S&P SmallCap iShares and Russell 2000 iShares are lagging and remain below their early October highs, which were 52-week highs. The PerfChart...

READ MORE

MEMBERS ONLY

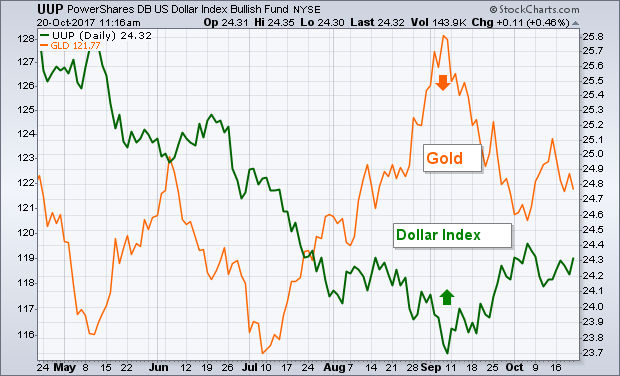

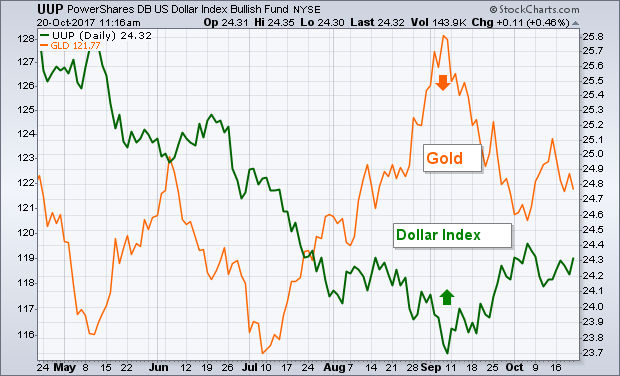

Bouncing Dollar Hurts Gold, Rising Rates Boost Copper

by John Murphy,

Chief Technical Analyst, StockCharts.com

The fact that U.S. rates are rising faster than elsewhere on the globe is boosting the dollar. A rising dollar usually hurts the price of gold. And it is. Chart 1 shows the upturn in the Dollar Index (UUP) near the start of September (when Treasury yields turned up)...

READ MORE

MEMBERS ONLY

Gold Losing Its Shine - New IT Trend Model Neutral Signal Arrives

by Erin Swenlin,

Vice President, DecisionPoint.com

I recently wrote about Gold in the DecisionPoint blog. We saw the 20-EMA pull out of its decline to keep its ITTM BUY signal. However, the gravitational pull of price after it couldn't hold support at 1300 was too much and the 20-EMA finished just below the 50-EMA...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: If You Blinked, You Missed It!

by Carl Swenlin,

President and Founder, DecisionPoint.com

Back in September the market had a small pullback that took all of three days (blue circle on chart below). This week I was expecting at least something similar, but all that happened was an intraday dip on Thursday that disappeared by the time the market closed! Then on Friday...

READ MORE

MEMBERS ONLY

Earnings Season Full Speed Ahead

by John Hopkins,

President and Co-founder, EarningsBeats.com

Earnings season is in full swing now and so far so good. How do I know this? All you have to do is look at the overall market reaction. And it doesn't hurt when a giant tech company left for dead knocks it out of the park.

Take...

READ MORE

MEMBERS ONLY

NEW ChartPack Updates (Q3, 2017) with Actionable Info and Major Additions!

by Gatis Roze,

Author, "Tensile Trading"

When is the last time someone offered to give you a couple hundred hours of “time”? We are here to do precisely that! You’ve all heard the cliche that “even the richest man has only the same 24 hours in a day as the poorest man.” Regardless of what...

READ MORE

MEMBERS ONLY

BOND YIELDS GAP HIGHER AND NEAR UPSIDE BREAKOUT -- THAT'S HELPING PUSH FINANCIAL SPDR TO NEW RECORD -- BANKS AND INSURERS ARE LEADING XLF HIGHER -- INDUSTRIAL SPDR ALSO NEARS NEW RECORD WITH HELP FROM TRANSPORTS -- MATERIAL SPDR NEARS NEW RECORD

by John Murphy,

Chief Technical Analyst, StockCharts.com

UPSIDE BREAKOUT IN BOND YIELDS MAY BE IMMINENT... Bonds yields are jumping again today. That may be based on increased chances for a tax reform package. Chart 1 shows the 10-Year Treasury Yield ($TNX) gapping 6 basis points higher in Friday trading. That puts the TNX within striking distance of...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook - Flag and Consolidations Abound

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Large-caps and Mid-caps Hit New Highs

.... SPY has been "Overbought" Since mid September

.... QQQ Hits Another New High

.... Flags, Pennants and Short-term Consolidations

.... IWM and IJR Remain with Falling Flags

.... XLY Forms Bullish Pennant

.... XLF and XLI Consolidate after Big Moves

.... XLE Tests Flag Lows

.... Tech, Healthcare and...

READ MORE

MEMBERS ONLY

Want To Know Which Stocks In The S&P 500/NASDAQ Perform Best In November/December? Here They Are....

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Reminder:

If you enjoy my blog, please look for the green "Notify Me" button at the bottom of this article and subscribe! Simply type in your email address and hit that button and VOILA! You'll receive my articles the moment they're published. And don&...

READ MORE

MEMBERS ONLY

Using RRG to pick Ford from "most active" table

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In the top-right corner of the homepage at StockCharts.com, there is a table that holds "Market Movers". It defaults to the top10 "most active" in the S&P 500 but you can change that using the buttons and drop-downs.

Below the table, you will...

READ MORE

MEMBERS ONLY

Applied Optoelectronics Lengthens Downtrend, Approaches Next Major Support

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Applied Optoelectronics (AAOI) was one of the darlings of Wall Street in 2017.....until early August. Since that time, AAOI has declined nearly 60% in less than three months and has shown no signs of a reversal. The most recent drop a little over a week ago was as a...

READ MORE

MEMBERS ONLY

Healthcare Sector Feeling Better

by Erin Swenlin,

Vice President, DecisionPoint.com

Tom Bowley and I have been talking on MarketWatchers LIVE about sector rotation and how the healthcare sector is getting more "healthy". Today I got confirmation that this sector is back in favor. A PMO BUY signal was generated on both the Healthcare SPDR (XLV) and on the...

READ MORE

MEMBERS ONLY

U.S. Equities Power Forward Amid Very Overbought Conditions

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, October 18, 2017

The Dow Jones sliced through 23000 like a hot knife through butter. Many times, these round numbers represent a psychological challenge for traders, but that was not an issue for this bull market. Instead, the Dow Jones soared 160 points to yet another...

READ MORE

MEMBERS ONLY

Flag Failure in Oil & Gas Equipment & Services ETF Could Bode Ill for Oil and XLE - Small-caps Correct - Oracle Bounces

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Small-cap ETFs Form Falling Flags

.... XLE Stalls as XES Breaks Down

.... Watching Two Timeframes for Oil

.... Shipping ETF Turns Up

.... Oracle Bounces off Support ....

There are lots of small consolidations on the charts as the market digests the gains from mid August to early October. The S&P 500...

READ MORE

MEMBERS ONLY

New PMO SELL Signal on Small-Cap ETFs, IJR and IWM

by Erin Swenlin,

Vice President, DecisionPoint.com

The short-term rally in large-cap indexes like the SPX, OEX and INDU was not contagious for the S&P 600 or Russell 2000. Below I've annotated their associated ETFs, IJR and IWM to show you the new PMO SELL signals. Although these SELL signals arrived today, a...

READ MORE

MEMBERS ONLY

BOND YIELDS ARE JUMPING AGAIN -- THAT'S GIVING A BOOST TO FINANCIAL STOCKS -- RISING STOCK/BOND RATIO SHOWS MONEY ROTATING FROM TREASURIES INTO STOCKS -- THE MSCI ALL COUNTRY WORLD EX US ETF IS RISING FASTER THAN THE U.S.

by John Murphy,

Chief Technical Analyst, StockCharts.com

TEN-YEAR TREASURY YIELDS IS RISING AGAIN... After a modest setback last week, global bond yields are rising again. Chart 1 shows the 10-Year Treasury Yield ($TNX) climbing four basis points today. The TNX appears headed for another test of its July/early October peaks formed near 2.40%. An eventual...

READ MORE

MEMBERS ONLY

Green Shoots Are Starting To Appear For The Dollar

by Martin Pring,

President, Pring Research

* Special K offers a trend reversal signal

* Euro looks toppy

* Gold could be vulnerable

* Watch those commodities

Special K offers a trend reversal signal

The Dollar Index ETF, the UUP, remains below its long-term moving averages and most long-term smoothed momentum, such as the KST also continues to drop. That...

READ MORE

MEMBERS ONLY

Healthcare ETF Breaks Out Of Bullish Ascending Triangle Pattern, Leads U.S. Equities Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, October 17, 2017

Healthcare stocks (XLV, +1.34%) led the Dow Jones to yet another all-time high close as the Dow traded above 23000 on an intraday basis for the first time in its history, closing just beneath that psychological level at 22997. It was really...

READ MORE

MEMBERS ONLY

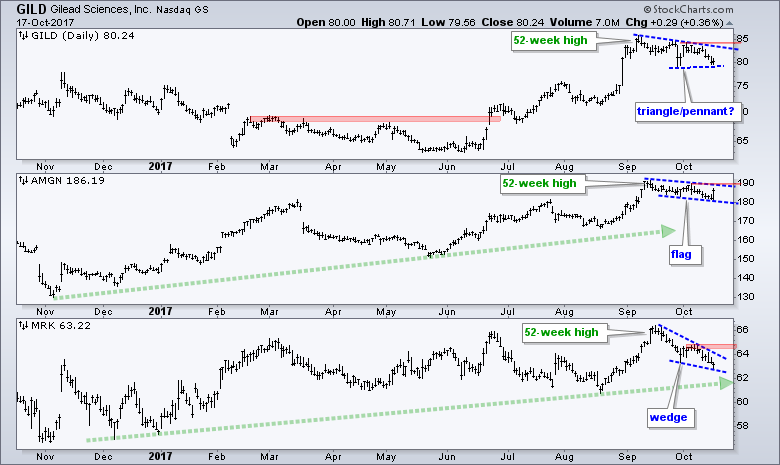

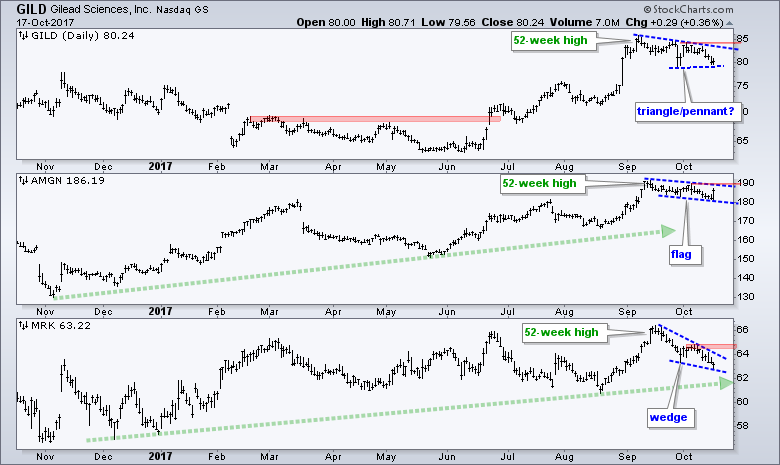

Three Pullbacks for Three Healthcare Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Chartists should watch Gilead (GILD), Amgen (AMGN) and Merck ($MRK) because all three are forming bullish continuation patterns. First and foremost, all three hit new highs in September so it is safe to assume that the long-term trends are up. AMGN and MRK have been trending higher the last 12...

READ MORE

MEMBERS ONLY

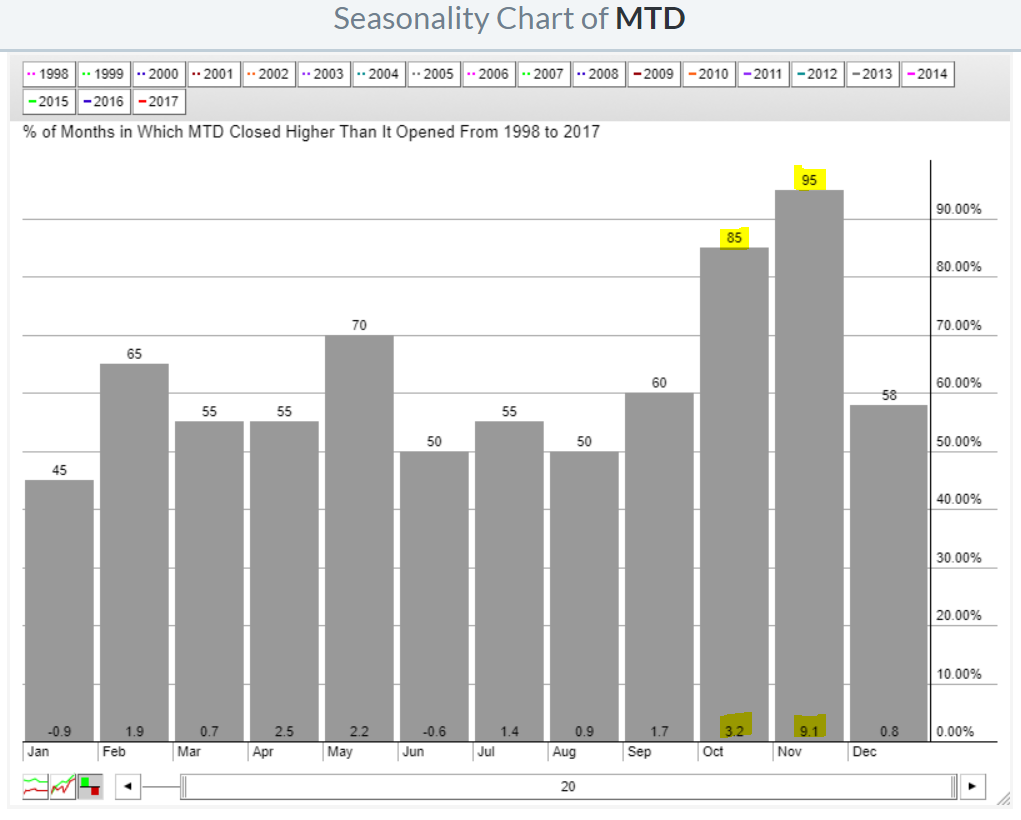

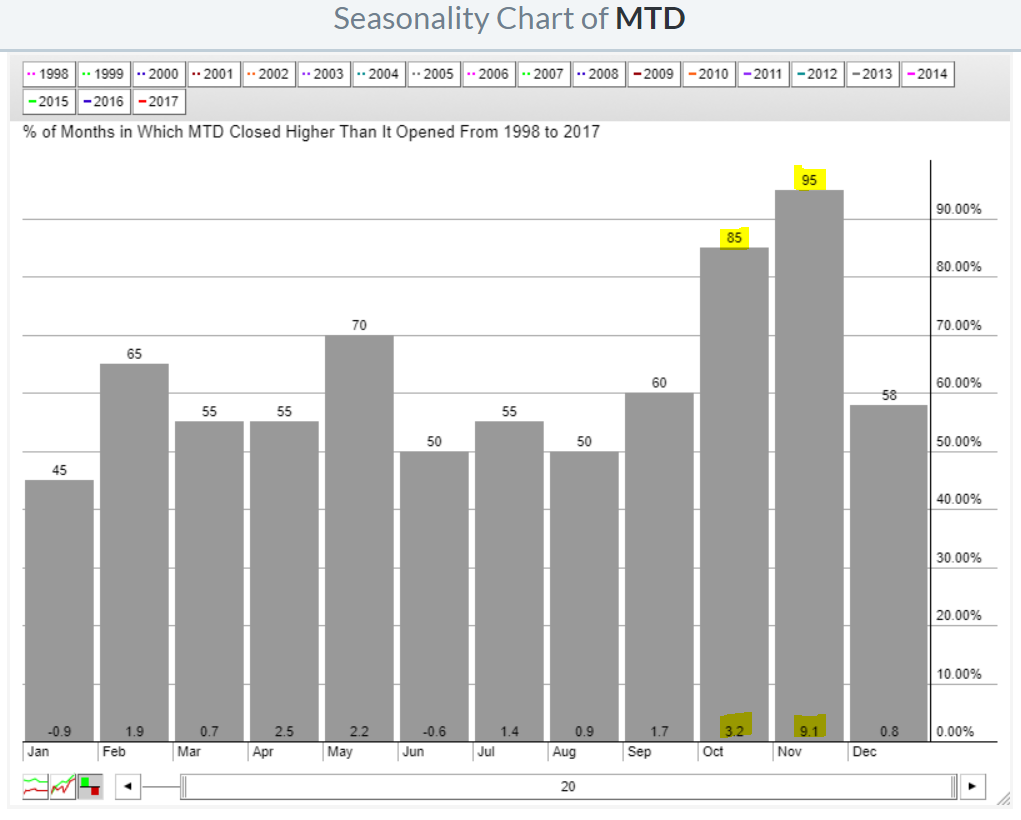

Here's A Medical Equipment Company With A Near Perfect Seasonal Track Record In October And November

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Over the past twenty years, Mettler Toledo Intl (MTD) has averaged gaining 23% per year, but that's not the most impressive performance stat for the company. During the months of October and November, MTD has risen 85% and 95% of the time, gaining an average of 3.3%...

READ MORE

MEMBERS ONLY

DP Alert: Is the Rally Exhausted? - PMO BUY Signal on Bonds

by Erin Swenlin,

Vice President, DecisionPoint.com

Teflon rally, perma-rally, overbought rally, irrational exuberance...whatever you call it, our indicators are suggesting at a least pause in the action, if not a pullback. Looking at the DP Scoreboards, we see all green arrows (buy signals) except for the IT PMO signal on the NDX. Although the NDX&...

READ MORE

MEMBERS ONLY

Banks, Insurance And Apple Lift Dow Jones Near 23K

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, October 16, 2017

In true bull market fashion, U.S. stocks rose once again in rather boring action. The Dow Jones, S&P 500 and NASDAQ gained 0.37%, 0.18% and 0.28%, respectively, to each finish at all-time closing highs. The record levels...

READ MORE

MEMBERS ONLY

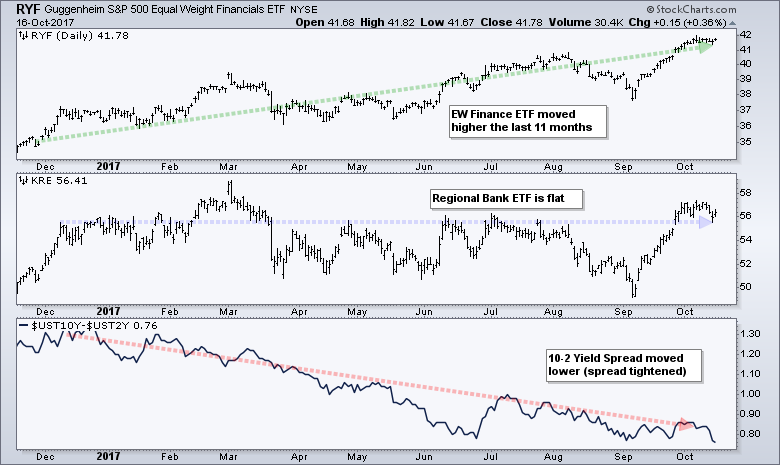

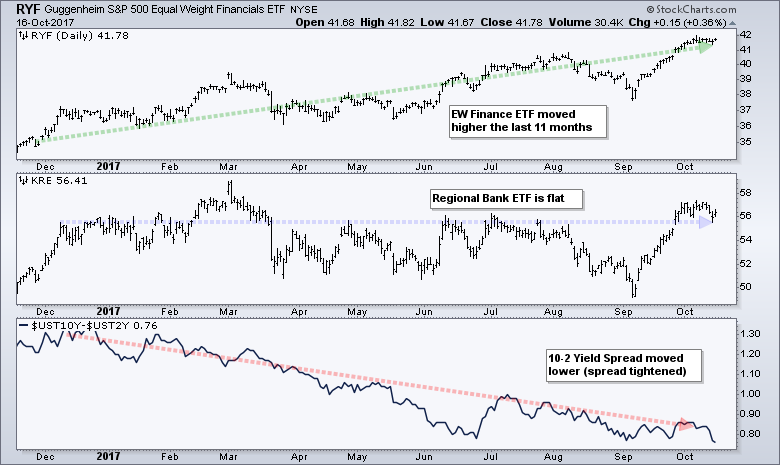

Finance Sector Ignores Flattening Yield Curve - A Deeper Dive into Correlation

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Finance Sector Ignores Flattening Yield Curve

.... 2-yr Yield Hits New High

.... Yield Curve is not a Problem Until

.... Correlation between KRE and the 10-yr Yield

.... Correlation is Not Everything

.... Back to Chart Basics

.... Play the Pullback ....

Finance Sector Ignores Flattening Yield Curve

What would happen to the EW Finance ETF...

READ MORE

MEMBERS ONLY

The Wisdom of Montier

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I honestly do not know when or where I first heard of James Montier but believe it was a turning point in my investing and money management. Behavioral Finance / Investing is a relative newcomer to the world of investing, or at least the identification and writing about it. The human...

READ MORE

MEMBERS ONLY

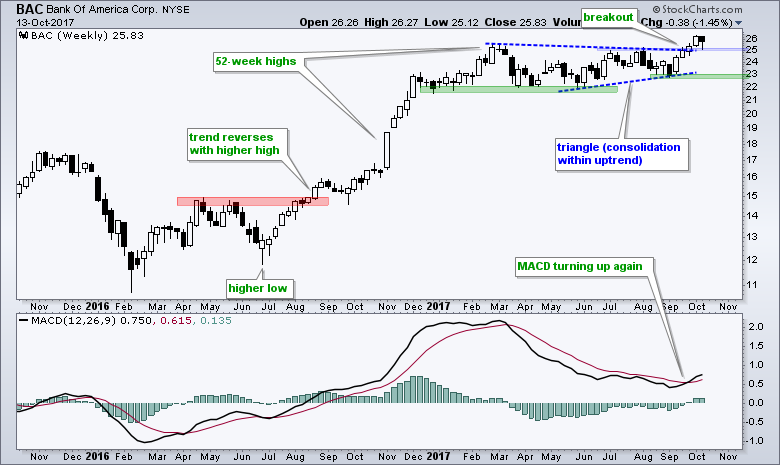

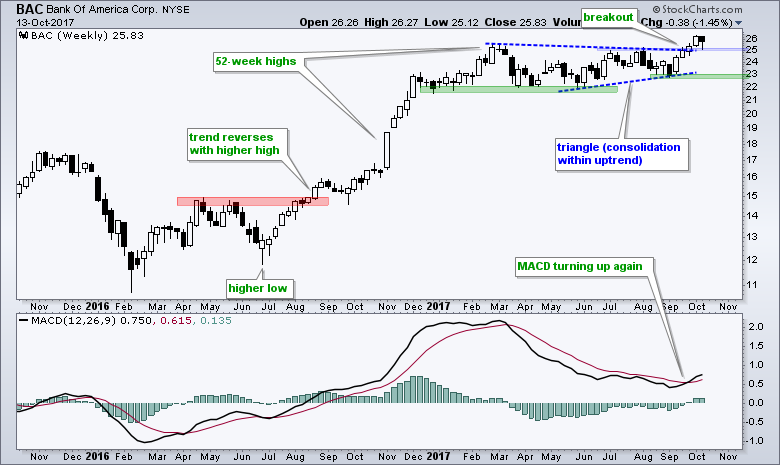

Bank of America Holds above Breakout Zone $BAC

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Bank of America (BAC) broke out of a large bullish continuation pattern three weeks' ago and this breakout is holding. Overall, BAC surged from June 2016 to February 2017 and then consolidated with a large triangle pattern. A consolidation within an uptrend is a bullish continuation pattern and the...

READ MORE

MEMBERS ONLY

There's No Spooking The Bulls As Friday The 13th Results In New Record Highs

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, October 13, 2017

There are plenty of superstitious folks out there, but apparently the majority of stock traders don't fall under that umbrella. U.S. equities again rose on Friday with the Dow Jones, S&P 500 and NASDAQ all climbing to all-time...

READ MORE

MEMBERS ONLY

Dear Point and Figure Diary

by Bruce Fraser,

Industry-leading "Wyckoffian"

Dear Point and Figure Diary,

As you know, I made an entry into your pages on July 15th of this year (click for a link). At the time, it appeared that two Reaccumulation Point and Figure Counts (PnF) were stacking up. This suggested another rally phase ahead in the Dow...

READ MORE

MEMBERS ONLY

Will Seasonal Tailwinds Stem The Tide Of Selling In This Technology Company?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Juniper Networks (JNPR) was under heavy selling pressure last week to open October, a seasonally bullish month for JNPR as the stock has averaged gaining more than 13% each October over the past two decades. The irony here is that we've seen JNPR twice in recent years open...

READ MORE

MEMBERS ONLY

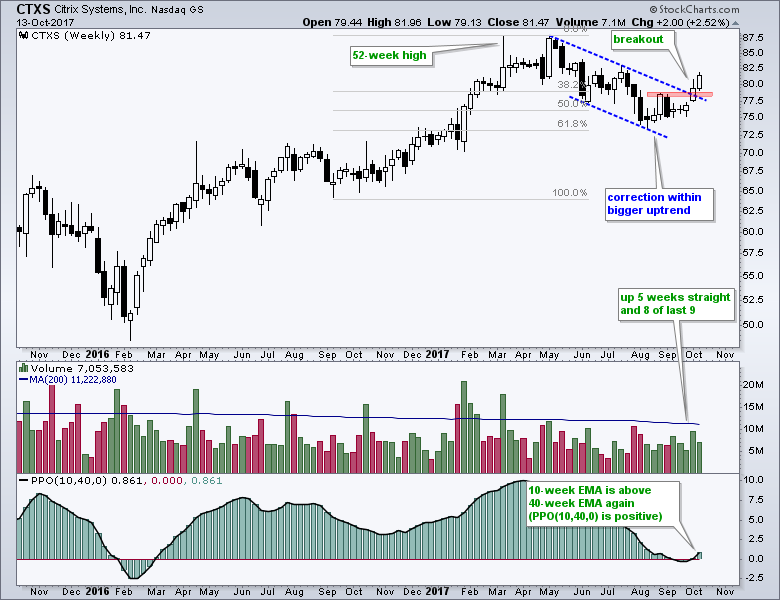

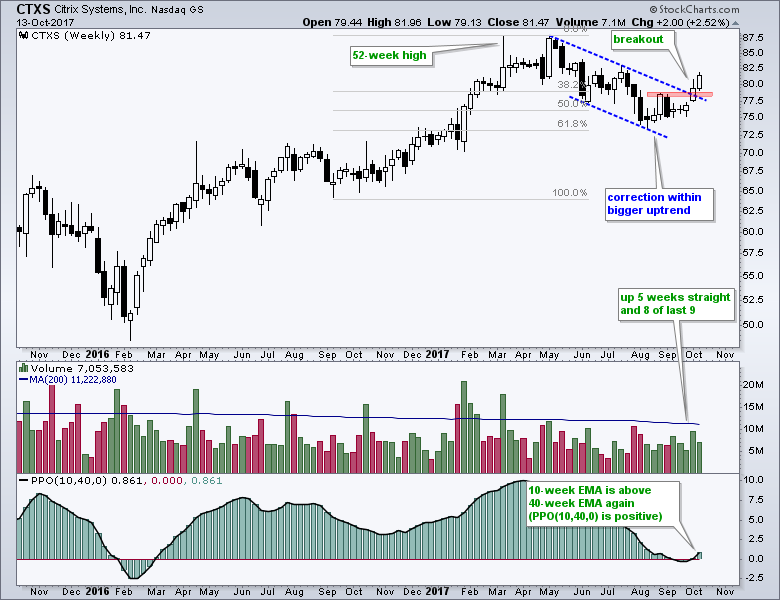

Citrix Ends Correction with Five Week Surge

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Citrix (CTXS), which is part of the Internet ETF (FDN) and Software iShares (IGV), appears to have ended its correction and resumed its long-term uptrend. The stock hit a 52-week high in early 2017 and then declined from May to August. CTXS underperformed the market and its peers during this...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: Parabolic Neutralized

by Carl Swenlin,

President and Founder, DecisionPoint.com

Last week I identified a short-term parabolic advance, a pattern in which price advances in an ever-steepening upward curve. Typically parabolics become too steep and they collapse. In this case price moved sideways through the curve, effectively neutralizing the bearish implications of the formation. We currently have a small rising...

READ MORE

MEMBERS ONLY

3 Investors, 3 Blind Spots, 3 Solutions

by Gatis Roze,

Author, "Tensile Trading"

Picture this: I am at a cocktail party chatting with three people about investing. The first person says, “I could be a really successful investor if only I could emotionally tolerate a bit more risk.” The second person claims, “I could be a world-class investor too if I had access...

READ MORE

MEMBERS ONLY

PULLBACK IN BOND YIELDS CAUSES PROFIT-TAKING IN BANKS -- BUT KBE CHART PATTERN REMAINS POSITIVE -- WEAKER DOLLAR BOOSTS COMMODITIES -- BASE METALS ETF HITS NEW HIGH -- STEEL ETF LEADS MATERIALS RALLY -- PICK ETF NEARS ANOTHER THREE-YEAR HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

BOND YIELDS WEAKEN... Chart 1 shows the 10-Year Treasury Yield ($TNX) pulling back today to the lowest level for the month. The TNX is backing off from a test of its July peak near 2.4% which isn't too surprising. Its 14-day RSI line (top of chart) had...

READ MORE

MEMBERS ONLY

Sectors Mixed, But That Doesn't Slow Down U.S. Equities

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, October 12, 2017

It was certainly a bifurcated day among sectors. Four sectors advanced, including industrials (XLI, +0.53%) and utilities (XLU, +0.52%), while five declined. Financials (XLF, -0.76%) were hardest hit as the 10 year treasury yield ($TNX) has struggled to gain any...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook (with Video) - Consumer Discretionary Weighs on Market

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Consumer Discretionary Weighs on Market

.... SPY and QQQ Hit Fresh New Highs

.... IJR Edges Lower after Big Run

.... A Hat Trick in the Technology Sector

.... Industrials Pick up the Slack

.... Materials Sector Leads with More New Highs

.... Finance Sector Stalls Near New High

.... Bullish Continuation Patterns Form in Energy

.... XLU...

READ MORE

MEMBERS ONLY

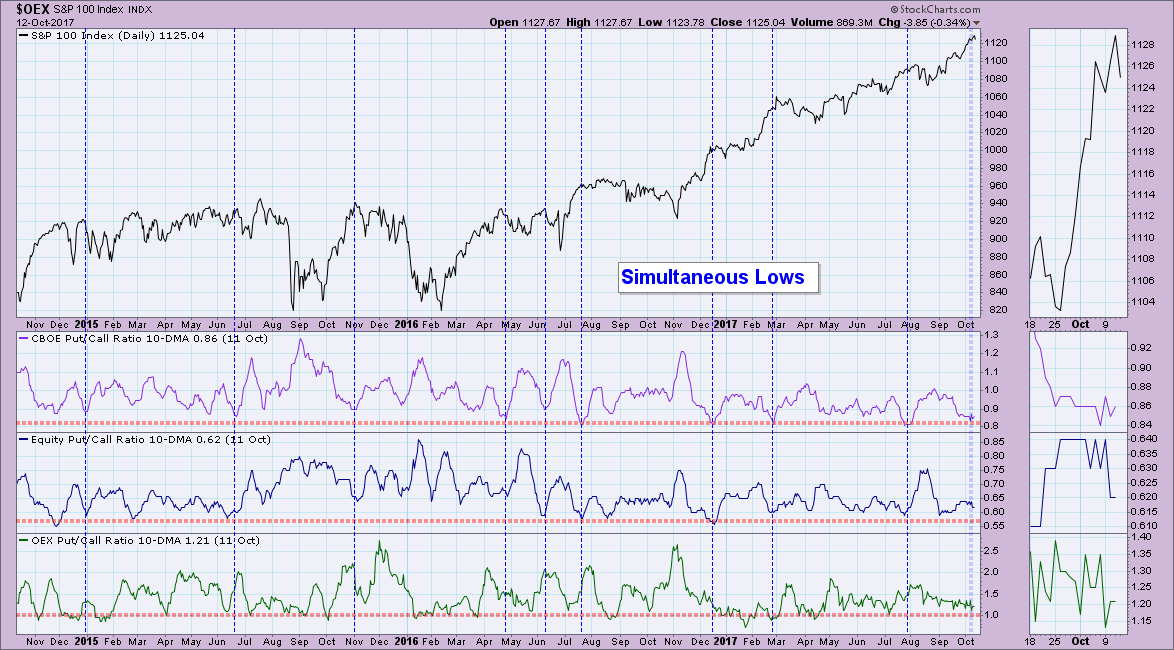

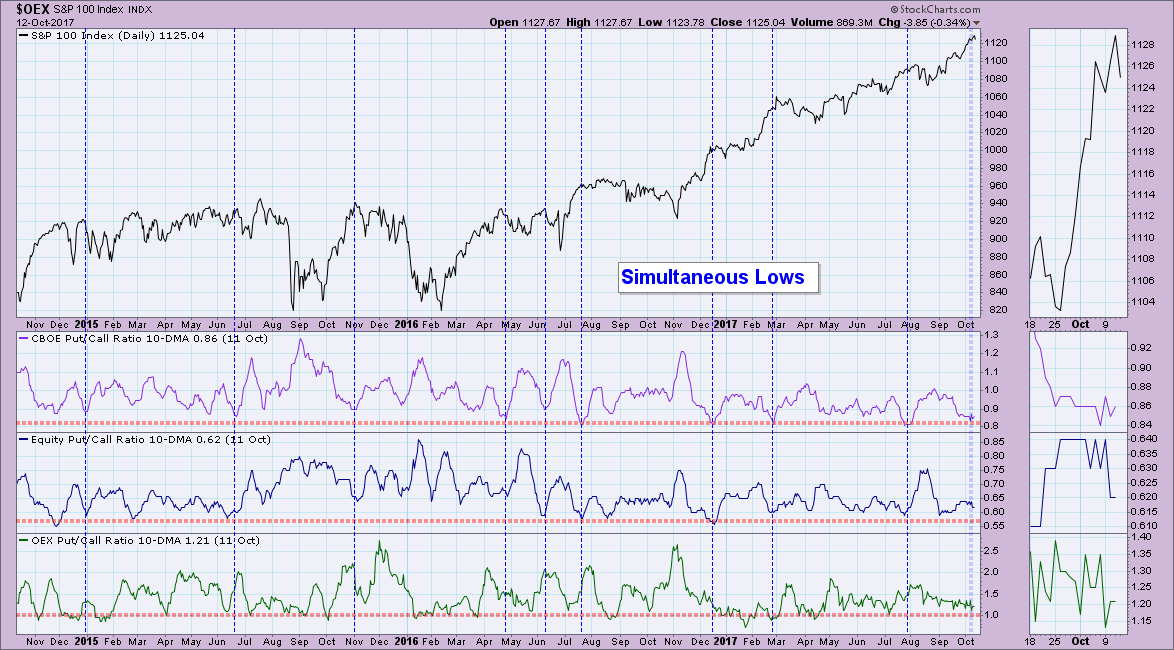

Put/Call Ratios At Simultaneous Lows - Bearish for the Market

by Erin Swenlin,

Vice President, DecisionPoint.com

A MarketWatchers LIVE viewer emailed me today and suggested I revisit the Put/Call Ratio chart. Upon recommendation, I did just that and was glad that he pointed it out to me so that I could point it out to you. I'll be talking about it in more...

READ MORE

MEMBERS ONLY

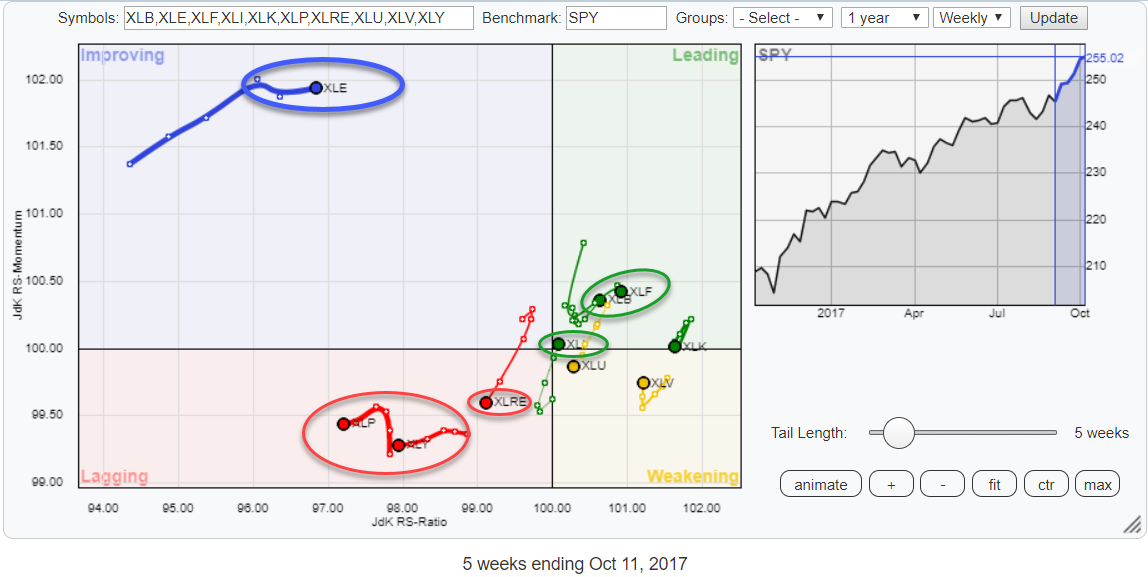

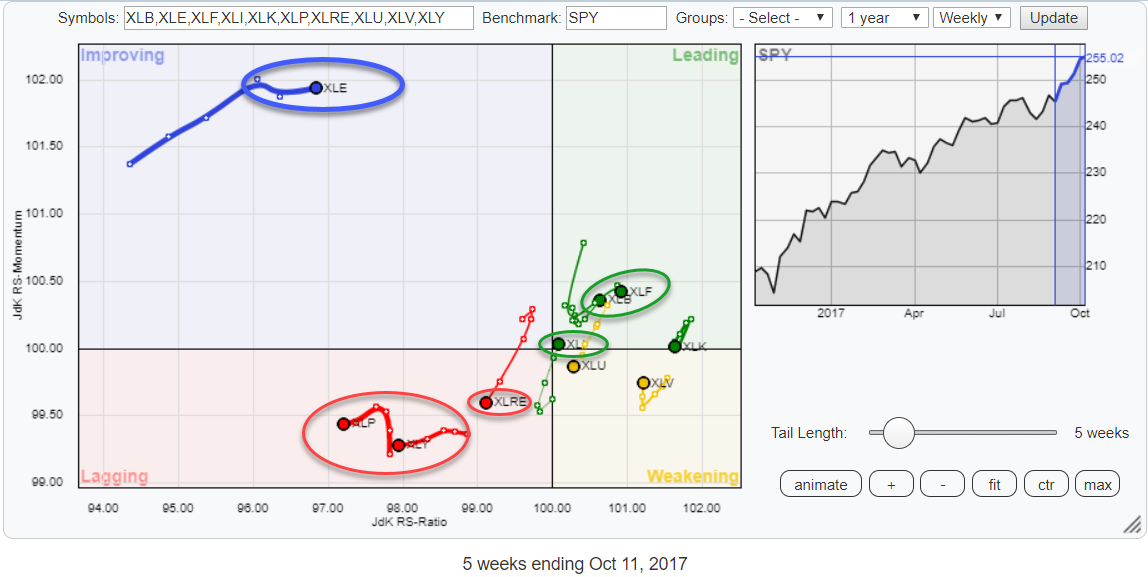

RRG suggests sector rotation out of Real Estate (XLRE) into Industrials (XLI)

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph for US sectors shows seven sectors clustered around the benchmark in the middle of the graph (SPY) and three of them further away.

XLE is more or less detached from the rest of the universe while XLP and XLY are breaking away together and heading deeper...

READ MORE

MEMBERS ONLY

Bullish Momentum Building Again On AMD

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Advanced Micro Devices (AMD) spent over a year with its SCTR among the highest of all individual stocks. It was an impressive rally for sure as its stock price rose from below $2 to above $15 in 13 months. But even the hottest stocks need to evenually consolidate to unwind...

READ MORE

MEMBERS ONLY

Broadline Retailers Move To Two Month High To Lead Major Indices

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, October 11, 2017

A strange pair - utilities (XLU, +0.43%) and technology (XLK, +0.33%) - combined to lead our major indices higher on Wednesday with the NASDAQ rising 0.25% to close at another all-time high. Seven of the nine sectors ended the day...

READ MORE