MEMBERS ONLY

Broadline Retailers Move To Two Month High To Lead Major Indices

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, October 11, 2017

A strange pair - utilities (XLU, +0.43%) and technology (XLK, +0.33%) - combined to lead our major indices higher on Wednesday with the NASDAQ rising 0.25% to close at another all-time high. Seven of the nine sectors ended the day...

READ MORE

MEMBERS ONLY

Microsoft and Alphabet Lead the Fab Five - Four Stock Setups - Bitcoin Index Hits New High

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Microsoft Leads Fab Five with New High

.... Alphabet Breaks Triangle Line

.... Apple Reverses after Oversold Reading

.... Amazon Breaks Wedge Line

.... Avago Pattern Evolves into Ascending Triangle

.... Cornerstone OnDemand Forms Double Bottom

.... Universal Display Firms at Support and Zoetis Turns Up

.... Understanding Cryptos and Blockchain

.... Bitcoin Index Hits New High ....

Microsoft...

READ MORE

MEMBERS ONLY

Gold Narrowly Avoids IT Trend Model Neutral but Not Out of the Woods

by Erin Swenlin,

Vice President, DecisionPoint.com

Carl and I have been watching the Gold chart carefully for a likely Intermediate-Term Trend Model (ITTM) Neutral Signal. However, with the rally of the last two days, both the 20-EMA and 50-EMA have slowed their descent. A negative 20/50-EMA crossover will trigger that ITTM Neutral signal. Why not...

READ MORE

MEMBERS ONLY

GOLD LOSES SAFE HAVEN APPEAL AS STOCKS HIT NEW RECORDS -- GOLD MINERS ARE LEADING BULLION LOWER -- STOCK/GOLD RATIO HAS DONE A GOOD JOB MARKING TURNING POINTS IN BOTH MARKETS -- AND IT'S STILL RISING

by John Murphy,

Chief Technical Analyst, StockCharts.com

GOLD SPDR FAILS TEST OF RESISTANCE LINE... A month ago it looked like gold might be on the verge of a bullish breakout. It didn't happen. My September 7 message showed gold nearing a test of a major "neckline" extending back three years. The weekly bars...

READ MORE

MEMBERS ONLY

Comcast Fails at a Key Moving Average

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

A recent double top and failure at the 200-day SMA point to lower prices for Comcast (CMCSA). The double top formed from May to early September with two highs around 42 and a low around 38. Comcast broke this low with a sharp decline and then became oversold. The stock...

READ MORE

MEMBERS ONLY

Late Day Buying Sends Dow Jones Into The Record Books Again

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, October 10, 2017

The Dow Jones finished 69 points higher on Tuesday to close at yet another all-time high. It's an illustration of how equities can remain overbought for an extended period of time. The Dow Jones moved into overbought territory (RSI 70+) 7-8...

READ MORE

MEMBERS ONLY

DP Alert: Market Rally Pop, No Follow-Through

by Erin Swenlin,

Vice President, DecisionPoint.com

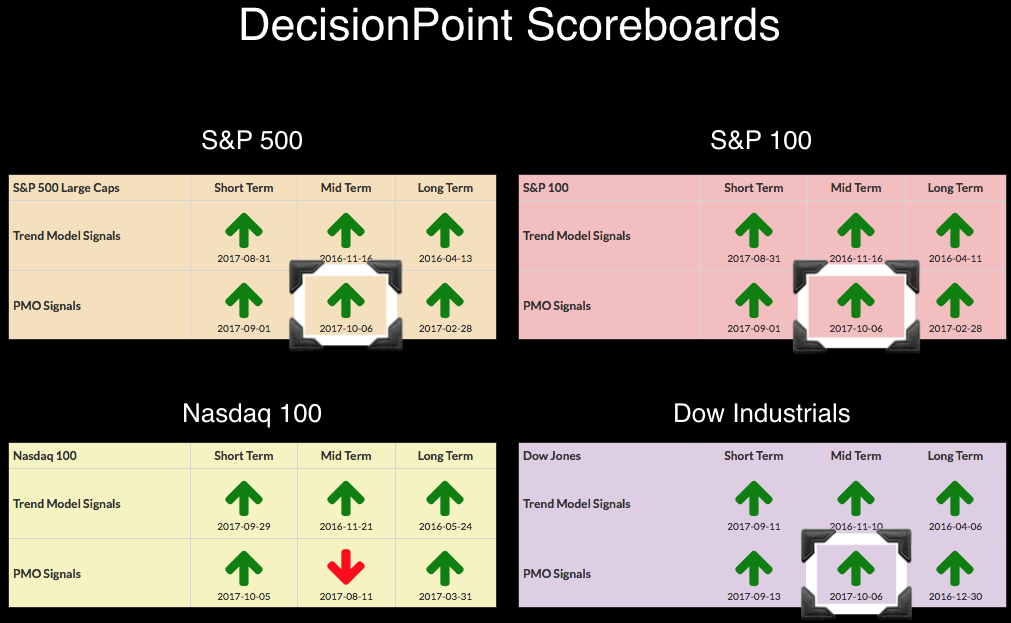

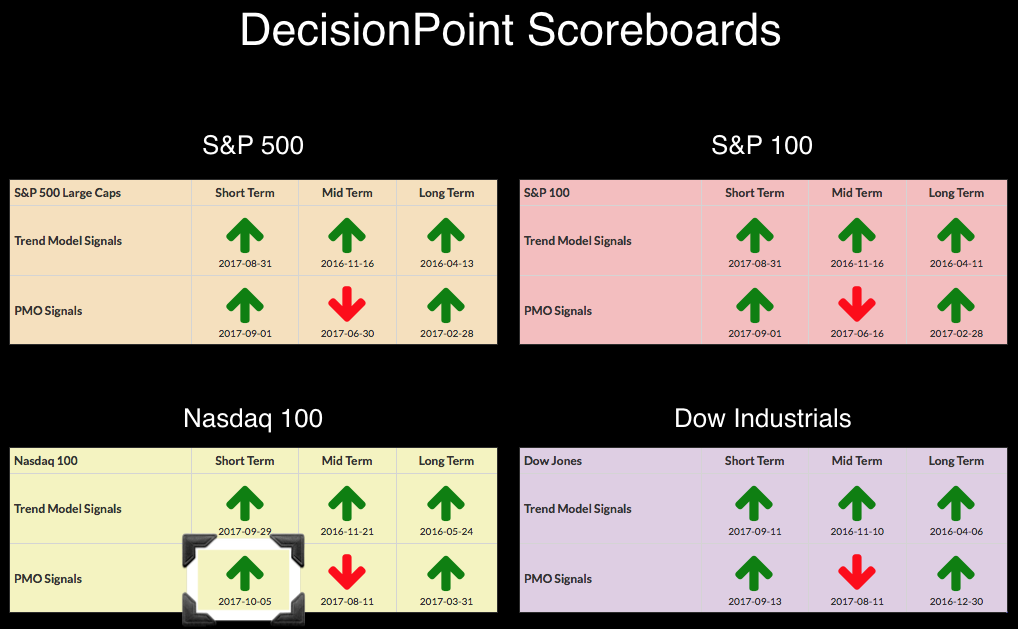

No changes to the DP Scoreboards today, but you can see that every signal is a BUY signal except the IT PMO signal on the NDX. Check out my ChartWatchers article to learn more about why that is the case. Ultra-short-term indicators had pointed to a possible "rally pop&...

READ MORE

MEMBERS ONLY

Is Now The Time To Jump In F5 Networks?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

F5 Networks (FFIV) has a seasonal history of performing extremely well in October and November, but technically the stock has been a wreck since topping in March 2017 and the early October returns haven't been very good either. There is hope, however, in the form of upcoming price...

READ MORE

MEMBERS ONLY

Maintain a Proper Perspective

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Watching the evening news can give you a misleading and often wrong perspective on the stock market. Most commentators mention whether the Dow Jones Industrial Average was up or down and by how much, and that is just about the complete financial report, even though the Dow Jones’ 30 large...

READ MORE

MEMBERS ONLY

Specialty Retailers Flash Short-Term Sell But Long-Term Buy

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, October 9, 2017

The U.S. major stock market indices took a breather - if you want to call it that - on Monday as the Dow Jones, S&P 500 and NASDAQ all fell less than 0.25%. Only the Russell 2000 lost more...

READ MORE

MEMBERS ONLY

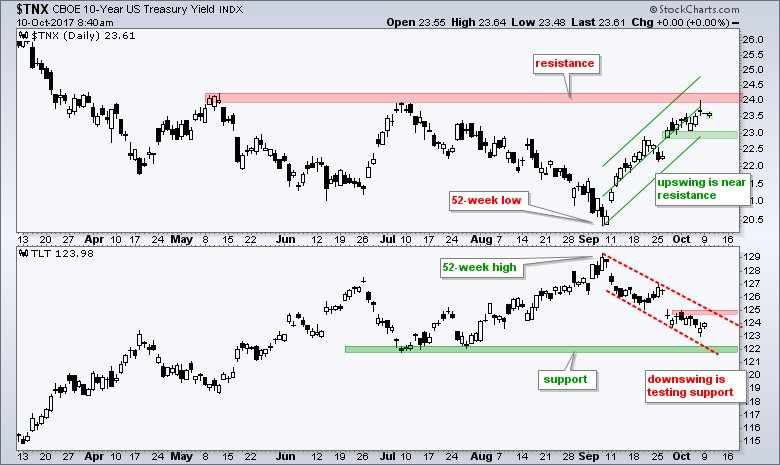

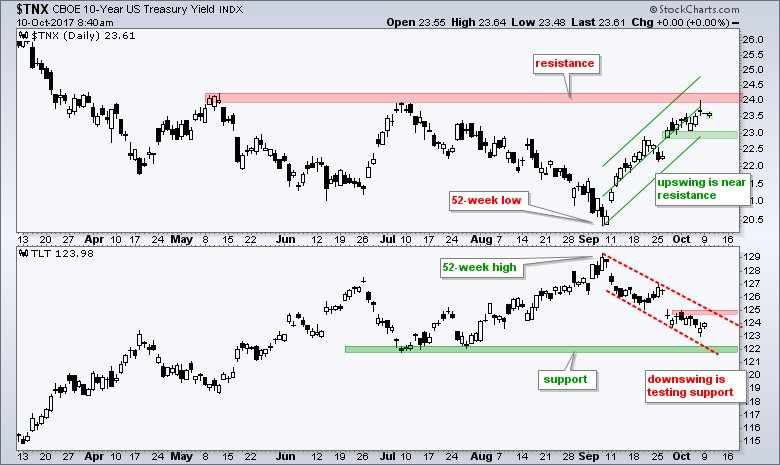

10-yr Yield and TLT Hit Moment-of-Truth - Gold, Silver and Gold Miners Reverse in Fib Zone

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Nearing the Moment-of-truth for TLT and $TNX

.... How the 10-yr Yield Affects other Names

.... Gold, Silver and Gold Miners Reverse Near Key Retracement

.... Newmont Forms Bull Flag

.... Working with High-Low Percent Indicators

.... Finance, Industrials, Tech and Materials Lead New High List

.... New Highs Expand for XLK

.... Three Different Sector Views...

READ MORE

MEMBERS ONLY

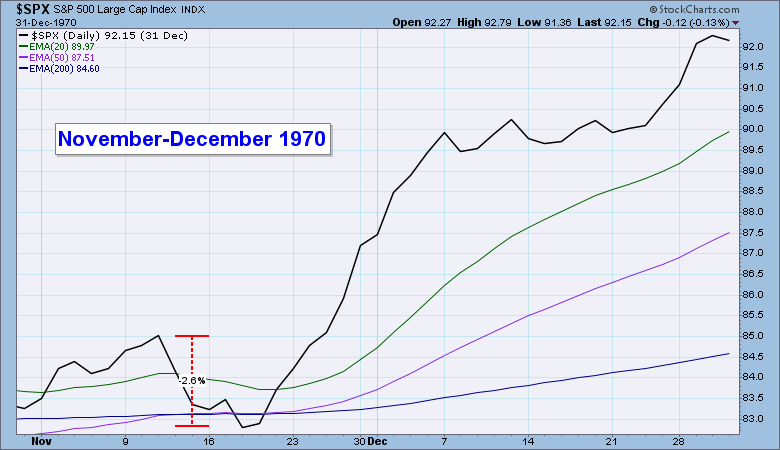

A Pause To Refresh Before A Year End Rally?

by Martin Pring,

President, Pring Research

* Short-term October stock market correction?

* Healthcare not looking so healthy

* Dollar likely to digest recent gains over the immediate short-term

* How about a rally in gold?

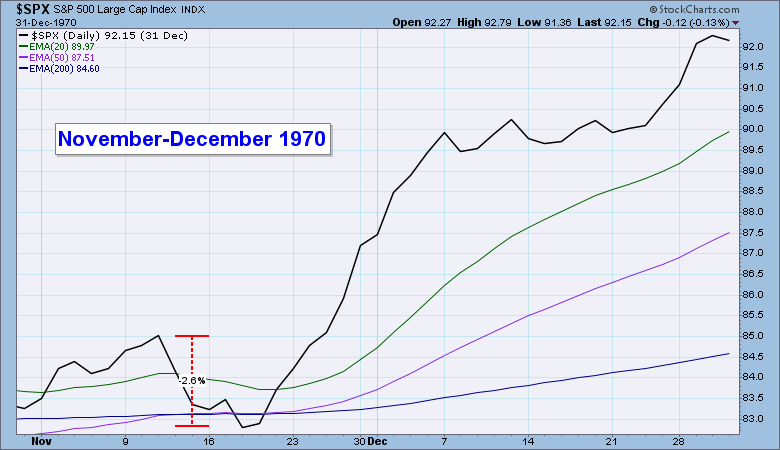

Short-term October stock market correction?

The strongest seasonal of the year for equities comes at year-end. Since this is a bull market, it seems...

READ MORE

MEMBERS ONLY

Lithium ETF (LIT) Looks Bearish

by Carl Swenlin,

President and Founder, DecisionPoint.com

This morning I saw a commercial for the Global X Lithium ETF (LIT), and I thought, "Hmmm, lithium . . . batteries for iPhones, MacBooks, etc." So I pulled up a chart of LIT, and all kinds of things jumped out at me.

First I saw the parabolic advance that got...

READ MORE

MEMBERS ONLY

One of the Weakest Stocks in the S&P 500 Looks Set to Get Even Weaker

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 is near all time highs and we are in a bull market, but Advance Auto Parts (AAP) did not get the memo and recent signals point to new lows. First and foremost, the long-term trend is down because the 50-day SMA is below the 200-day...

READ MORE

MEMBERS ONLY

Bull Market Resiliency Shines Through After Weak Jobs Report

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, October 9, 2017

Extremely overbought and extended conditions. Complacency in the form of a very low Volatility Index ($VIX) reading. Geopolitical tensions. Then a negative jobs report. The market was surely doomed on Friday, right? Wrong. That complacency, as evidenced by near record low readings in...

READ MORE

MEMBERS ONLY

This Tech Company Just Broke Out Of Bullish Pattern With Rising SCTR

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

While we've seen many indices, ETFs and individual stocks break out over the past several weeks, there are still many that are consolidating in bullish fashion and those, upon breakout, provide solid trading opportunities. Enter DXC Technology Company (DXC). Over the past two months, the S&P...

READ MORE

MEMBERS ONLY

Get Ready - Earnings Season is About to Begin

by John Hopkins,

President and Co-founder, EarningsBeats.com

They say how time flies; and it's true, especially from one earnings season to another, and starting this week we're going to start hearing from thousands of companies as they release their numbers. And boy, there's nothing traders and longer term investors care about...

READ MORE

MEMBERS ONLY

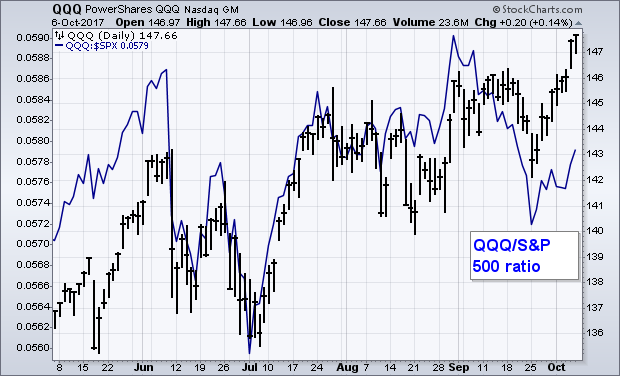

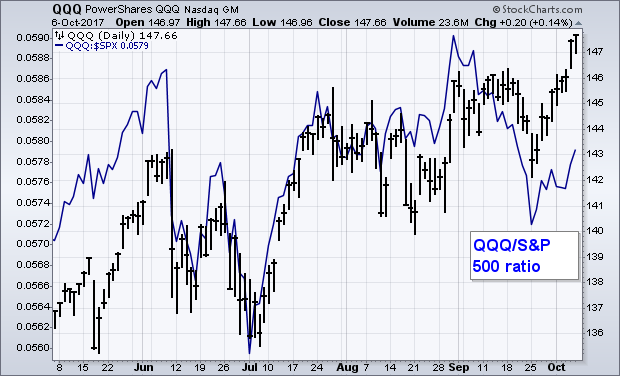

The NASDAQ 100 Hit a Record High This Week, But Still Lags The S&P 500

by John Murphy,

Chief Technical Analyst, StockCharts.com

Chart 1 shows the Powershares QQQ ETF hitting a record high this week. It was the last of the major stock indexes to do so, and its breakout is a positive sign for the market. It also did slightly better than the rest of the market. The QQQ, however, has...

READ MORE

MEMBERS ONLY

RRG says you need to keep an eye on Small Caps!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph above shows the rotation of the three size indices that make up the S&P Composite 1500 index.

Although the S&P 500 large cap index ($SPX) is still clearly on the right-hand side of the RRG, making very small rotations close to the...

READ MORE

MEMBERS ONLY

THE NASDAQ 100 HIT A RECORD HIGH THIS WEEK, BUT STILL LAGS BEHIND THE S&P 500 OVER THE LAST MONTH -- RISING BOND YIELDS HAVE CAUSED THE QQQ TO LOSE MOST GROUND AGAINST FINANCIALS AND SMALL CAPS -- THE QQQ IS ALSO LAGGING BEHIND ITS EQUAL-WEIGHT VERSION

by John Murphy,

Chief Technical Analyst, StockCharts.com

NASDAQ 100 HITS NEW HIGH... Chart 1 shows the Powershares QQQ ETF hitting a record high this week. It was the last of the major stock indexes to do so, and its breakout is a positive sign for the market. It also did slightly better than the rest of the...

READ MORE

MEMBERS ONLY

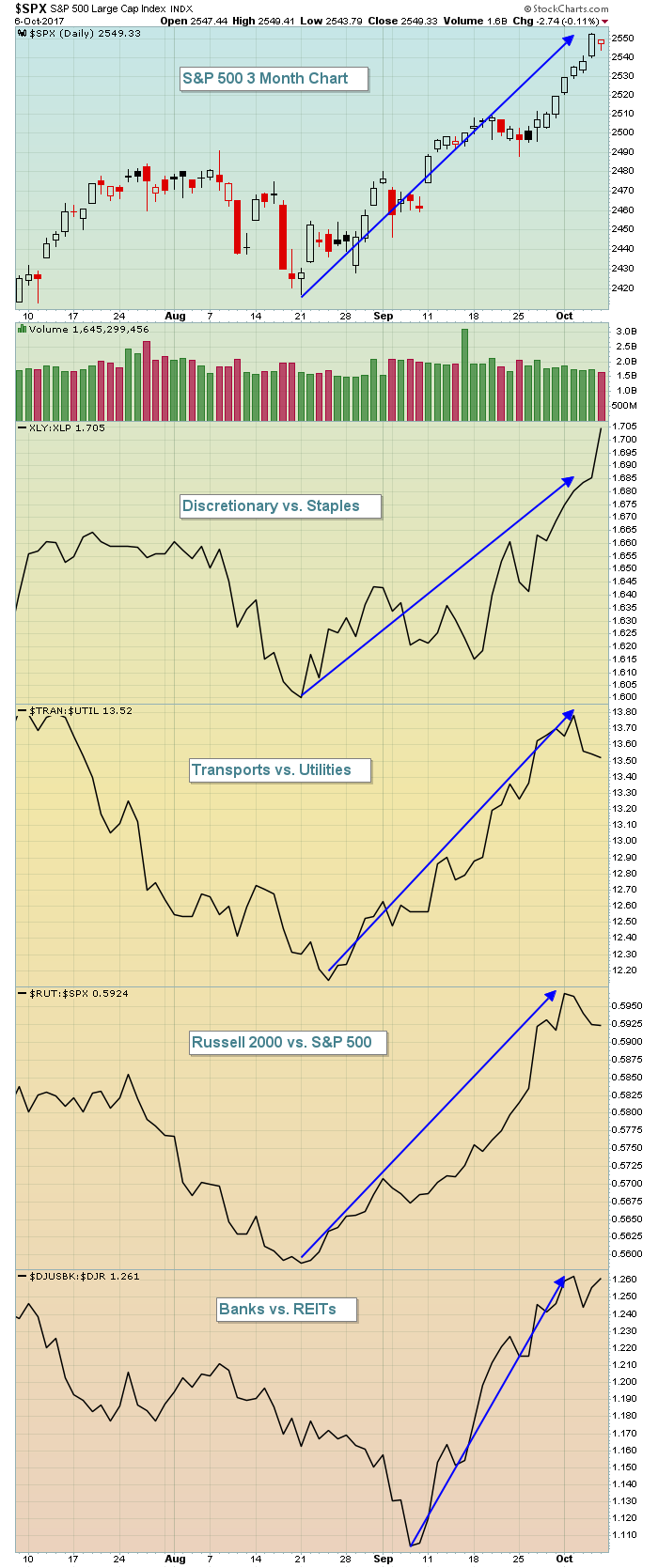

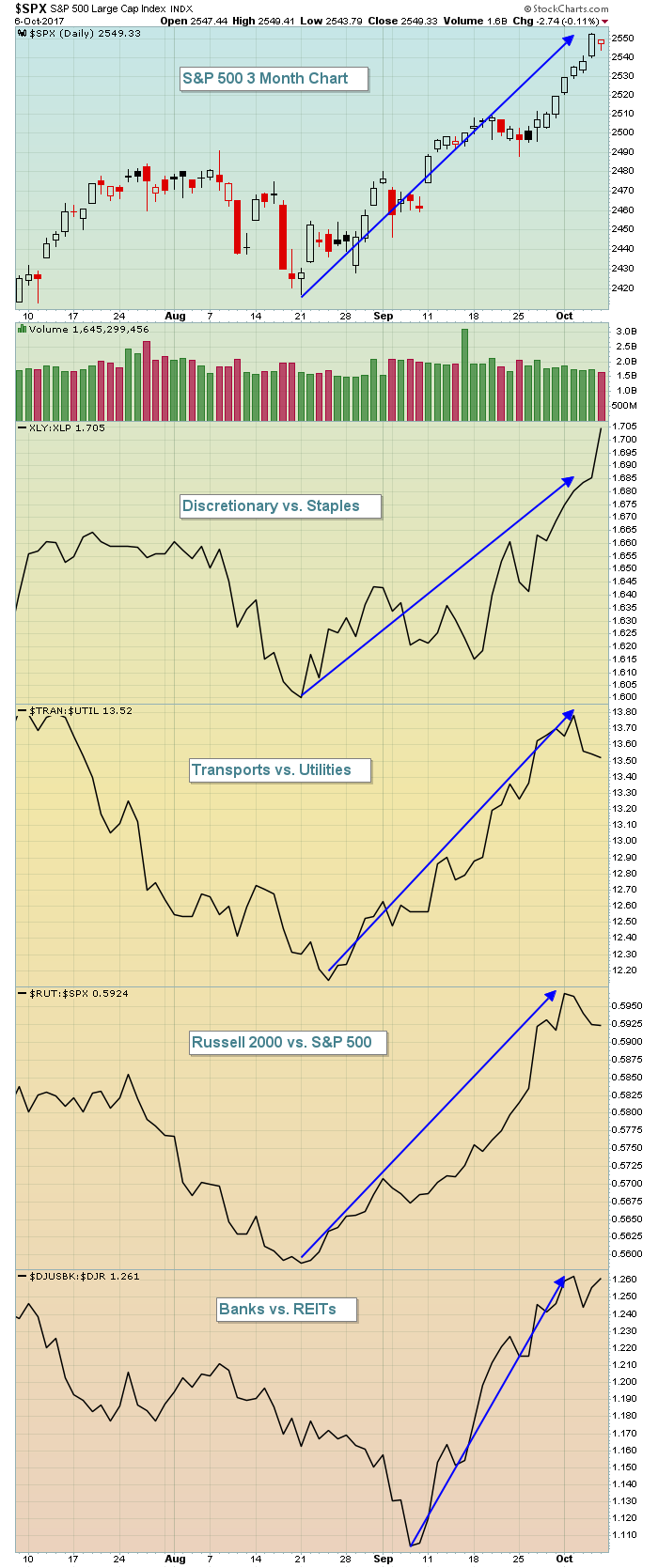

Four Critical Signals That Confirm It's Full Speed Ahead For Equities

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I've been following the stock market for a long time and I'm always searching for that perfect signal that never fails. I still haven't found it and there are never any guarantees in the stock market, BUT following the rotation of money to aggressive...

READ MORE

MEMBERS ONLY

A Pullback in the Energy SPDR? Here's What to Watch.

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Energy SPDR (XLE) is the top performing sector SPDR since mid August with a double digit advance over the last seven weeks. On the price chart, XLE broke out of the channel, exceeded its summer highs and pushed RSI above 70 for the first time this year. It was...

READ MORE

MEMBERS ONLY

Chemistry Experiment

by Bruce Fraser,

Industry-leading "Wyckoffian"

Two strong sectors in September were Materials (XLB) and Industrials (XLI). During the second half of a business cycle expansion these themes typically do well, and that is the case here. The economy has begun to expand at a faster rate. These industries develop pricing power which allows them to...

READ MORE

MEMBERS ONLY

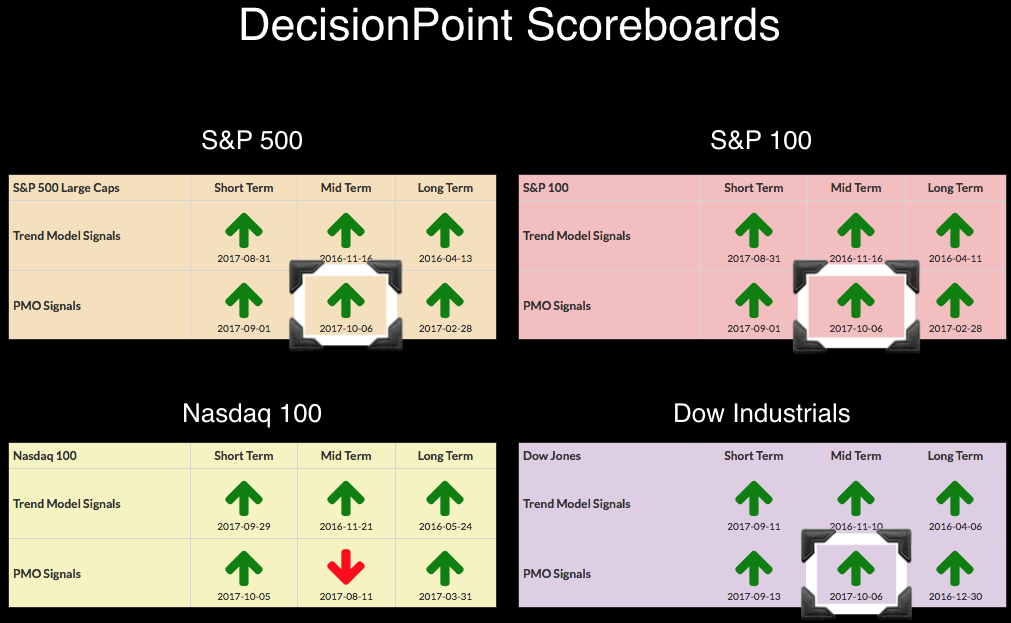

Weekly PMO BUY Signals Explode on DecisionPoint Scoreboards

by Erin Swenlin,

Vice President, DecisionPoint.com

Today all but the NDX garnered new PMO BUY signals in the intermediate term. The intermediate-term PMO signals are gathered from the weekly chart PMOs and their crossovers. I'll give you a peek at the NDX weekly chart too, but it is much further away from a new...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: Impervious Rally

by Carl Swenlin,

President and Founder, DecisionPoint.com

I awoke Monday morning to news of the outrage that had taken place in Las Vegas the night before, and I experienced the now all-to-familiar feelings of weariness at the state of the world. There has been enough rehash of this terrible event, and my purpose of mentioning it was...

READ MORE

MEMBERS ONLY

Here's How You Build a Super Bowl Champion Portfolio (Hint: Pick Your Correlations Carefully)

by Gatis Roze,

Author, "Tensile Trading"

Imagine a football coach who has the best eleven quarterbacks in the NFL altogether on the same team and puts them on field at the same time. This “dream team” would get clobbered. Without tight ends, tackles, guards, wide receivers and a center there to present a balanced attack, there...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook - Small-Caps and Finance Extend their Lead

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Small-caps Lead Broadening Rally

.... Small-caps High-Low Percent hits 2017 High

.... Death of QQQ Greatly Exaggerated

.... IJR Extends on Breakout

.... Sectors Reflect Broad Strength

.... Tech, Finance, Industrials and Materials Lead

.... HealthCare SPDR Turns Up after Pullback

.... XLY Catches a Strong Bid

.... XLU Goes for a Flag Breakout

.... Energy Stalls after Big...

READ MORE

MEMBERS ONLY

Right On Cue, Internet Stocks Break Out; NASDAQ 100 Soars

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, October 5, 2017

Well, if you were worried about an underperforming technology sector and the inability of the NASDAQ 100 ($NDX) to reach new highs, you can stop worrying. Both broke out on Thursday with emphatic moves to clear highs established over the summer. First, check...

READ MORE

MEMBERS ONLY

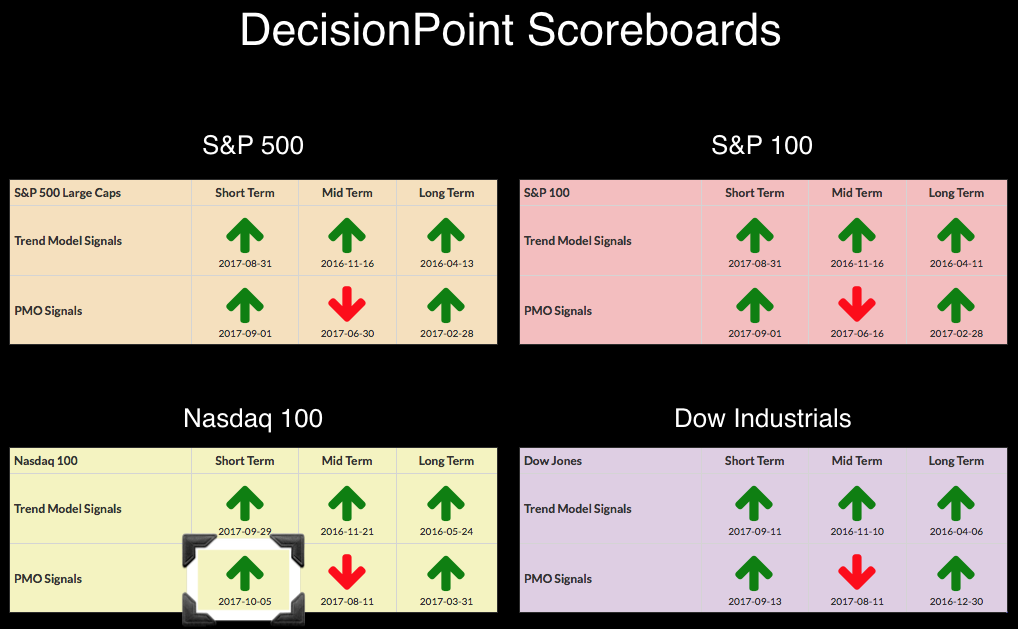

PMO BUY Signal on NDX Confirms Breakout - Commodities LT BUY - TLT IT Neutral Signal

by Erin Swenlin,

Vice President, DecisionPoint.com

It took the NDX two weeks to a month more to update its Short-Term PMO to a BUY signal in comparison to its peers. The dates underneath the signals on the Scoreboard tell the story of a difficult decline and then rally run for the NDX and technology in general....

READ MORE

MEMBERS ONLY

Why It's Important To Watch The Stock/Gold Ratio

by Martin Pring,

President, Pring Research

The relationship between Stocks and Gold

* Long-term Picture

* Three interpretive rules

* Looking at it the other way. The Gold/stock Ratio

* Two Politically troubled ETF’s, are so technically troubled

Long-term Picture

One of the areas I focused on in my latest Market Roundup Webinar was the tight trading range...

READ MORE

MEMBERS ONLY

COPPER PRICES ARE RISING -- SO IS THE GLOBAL X COPPER MINERS ETF -- S&P METALS & MINING ETF IS BEING HELD BACK BY GOLD, SILVER, AND STEEL STOCKS -- MSCI GLOBAL METALS AND MINING ETF OFFERS EXPOSURE TO STRONGER FOREIGN MINERS

by John Murphy,

Chief Technical Analyst, StockCharts.com

COPPER PRICES ARE REBOUNDING ... After rising to the highest level in three years a month ago, the price of copper experienced a modest correction during September. Chart 1 shows the metal pulling back to initial chart support along its August low and its 50-day moving average. But it's...

READ MORE

MEMBERS ONLY

BlackBerry: Will This Rally Be Any Different Than The Last Several?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Blackberry's (BBRY) demise from 2008 through 2012 has been well documented and I'm not really interested in dwelling in that past. More recently, however, BBRY has attempted on multiple occasions to clear price resistance in the 11-12 range. Clearing such resistance would be technically significant and...

READ MORE

MEMBERS ONLY

SystemTrader - Testing a Basic PPO System with a Profit Target and Momentum Filter

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Testing the Basic PPO Signal Line Cross

.... Setting the Benchmark

.... Consulting, Software and Data

.... System Ground Rules

.... PPO Signal Line System

.... A Winning Chart and a Losing Chart

.... Breaking a Tie and Favoring Momentum

.... Backtest Results Favor Large-caps

.... Profit Factor Metric

.... Conclusions and Caveat Emptor ....

Testing the Basic PPO Signal...

READ MORE

MEMBERS ONLY

Consumer Stocks, Healthcare Take Their Turn To Lead U.S. Equities To New Highs

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, October 4, 2017

This bull market advance continues to be about rotation. Index rotation. Sector rotation. Individual stock rotation. Few areas of the market are breaking down. It's mostly about gains, consolidation, then more gains. On Wednesday, the red hot Russell 2000 took a...

READ MORE

MEMBERS ONLY

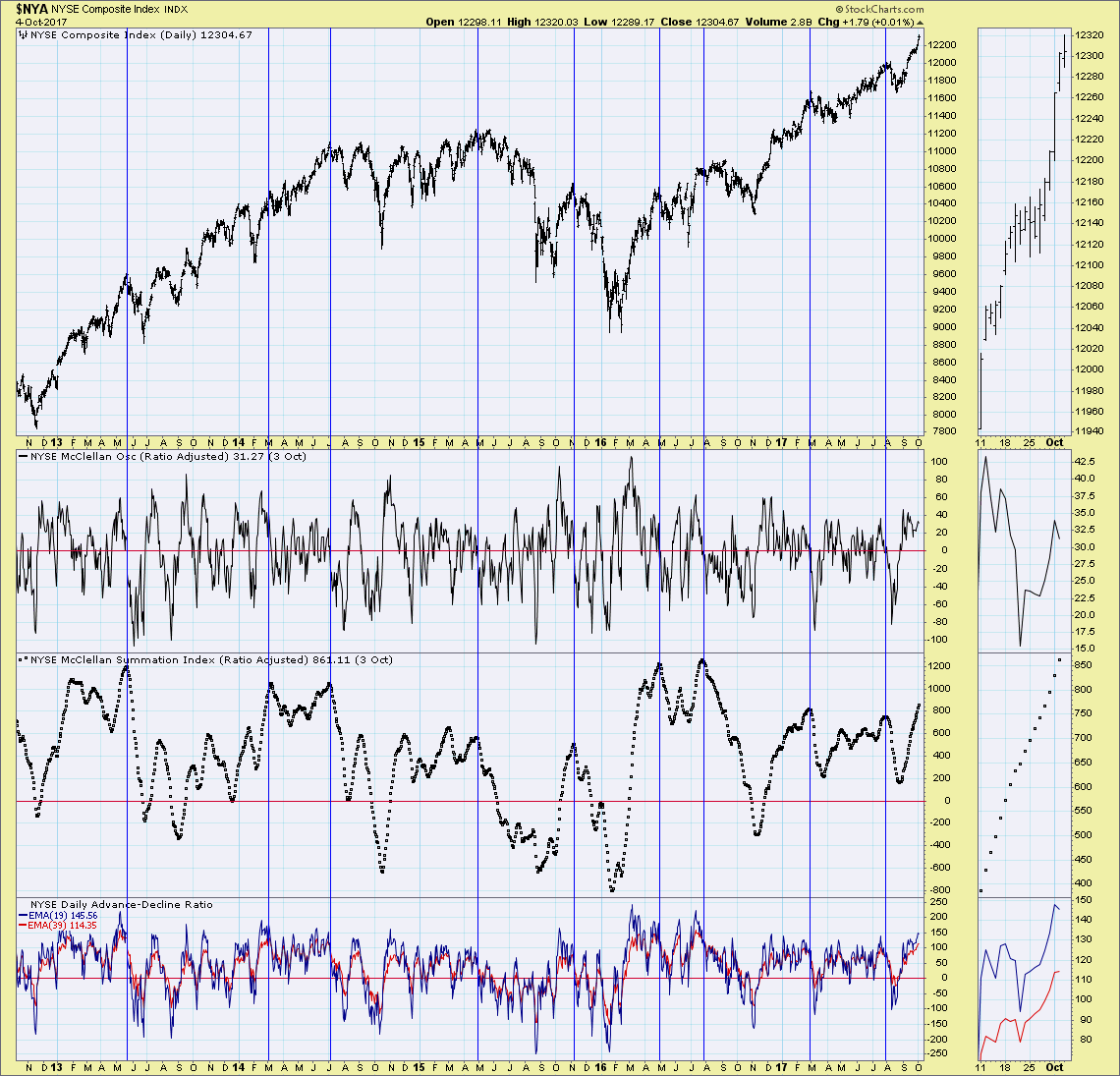

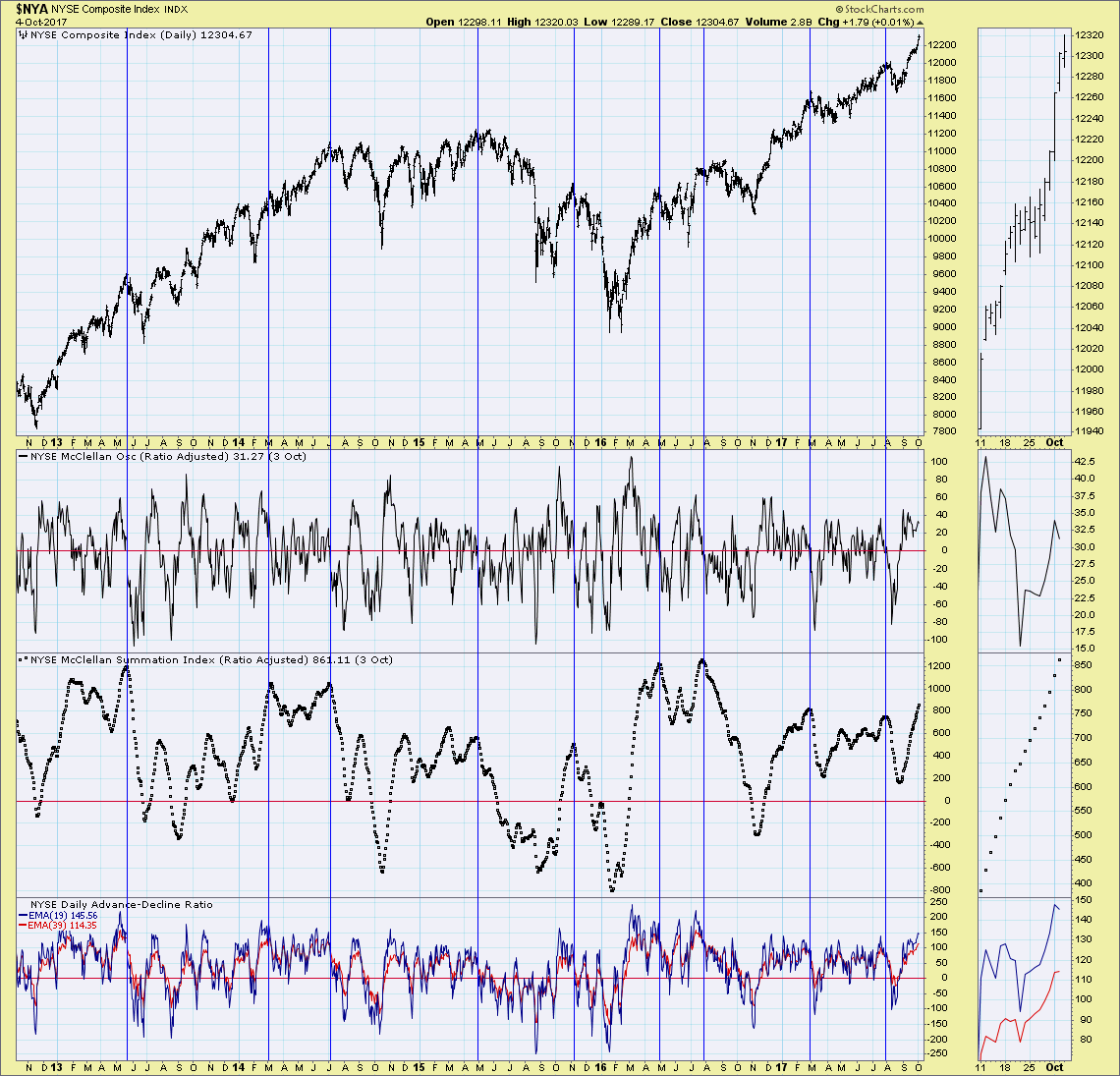

DP Indicator Spotlight: McClellan Summation Index Overbought and Rising on Major Indexes

by Erin Swenlin,

Vice President, DecisionPoint.com

Developed by Sherman and Marian McClellan, the McClellan Summation Index is a breadth indicator derived the McClellan Oscillator, which is a breadth indicator based on Net Advances (advancing issues less declining issues). The Summation Index is simply a running total of the McClellan Oscillator values. Even though it is called...

READ MORE

MEMBERS ONLY

Alphabet Turns up with Increase in Volume

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Alphabet, which some of you may know as Google, surged off a support zone with good volume and broke short-term resistance. This breakout could evolve into more because the big picture is also bullish. GOOGL advanced to a new high in May and then consolidated with a long consolidation. The...

READ MORE

MEMBERS ONLY

Airlines Catch Seasonal Jet Stream To Lead Transports, Market Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, October 3, 2017

It didn't take long for the seasonal tailwinds to kick in for airlines ($DJUSAR). I posted last Friday that airlines were poised to breakout technically and highlighted Alaska Air Group (ALK) as one airline that has performed extremely well during the...

READ MORE

MEMBERS ONLY

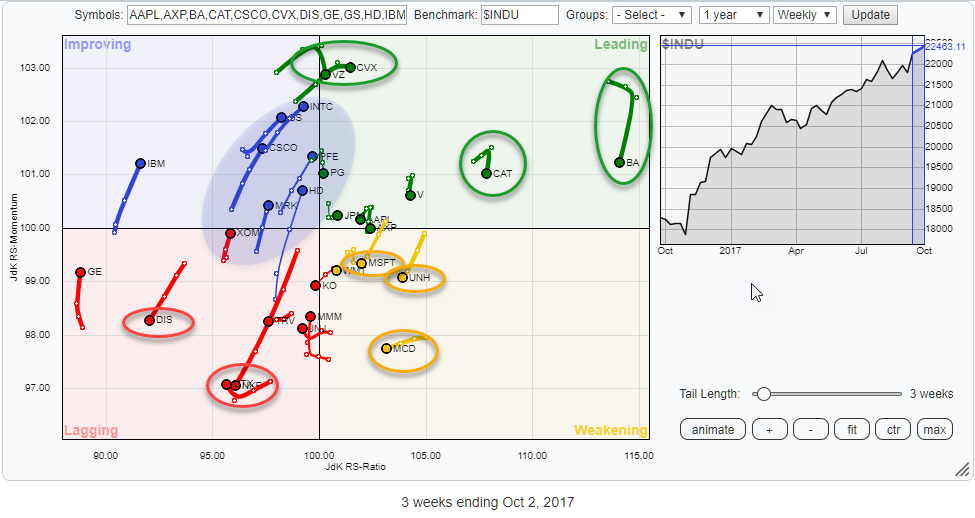

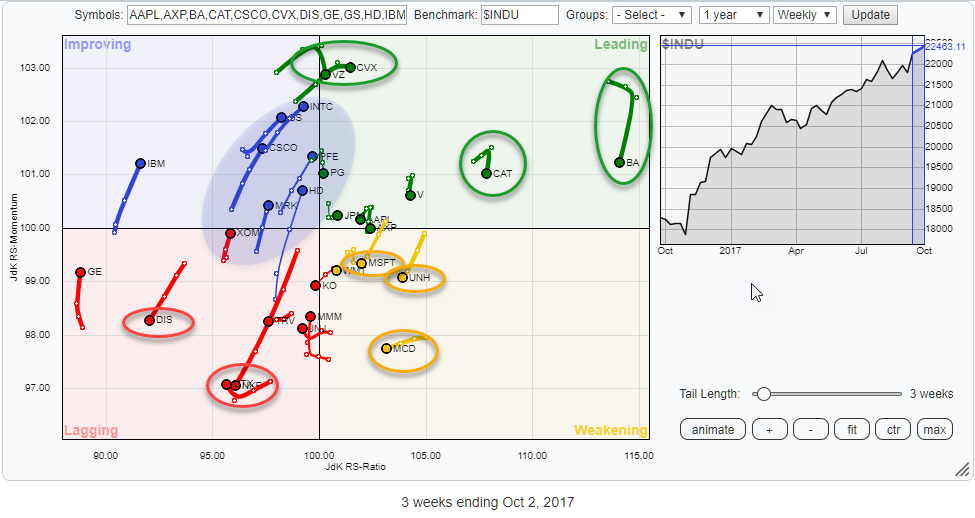

INTC and PFE expected to dominate relative rotation in $INDU while NKE, DIS, and TRV are lagging

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Plenty of actionable rotation towards the edges of the Relative Rotation Graph above. The RRG holds the 30 members of the Dow Jones Industrials index. Scanning around the outside of the chart the following stocks draw the attention.

In the weakening quadrant, MCD is at the lowest JdK RS-Momentum reading...

READ MORE

MEMBERS ONLY

Market Roundup Video Recording With Martin Pring 2017-10-04

by Martin Pring,

President, Pring Research

The Market Round Up Video Recording for October is available. Use the HD button for better clarity when viewing.

Market Round Up Live With Martin Pring 2017-10-04 from StockCharts.com on Vimeo.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the...

READ MORE

MEMBERS ONLY

DP Alert: Island Formations and Gaps - More All-Time Highs - RYU Signal Change

by Erin Swenlin,

Vice President, DecisionPoint.com

No new changes on the DecisionPoint Scoreboards at this time, but we should see the IT PMO signals change on Friday. I was notified by my Technical Alert that weekly PMO crossovers occurred on all but the NDX. These signals will need to stay intact at the end of trading...

READ MORE