MEMBERS ONLY

Airlines Begin Their Typical October Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Airlines ($DJUSAR) absolutely "took off" in today's action as buyers emerged to drive nearly every airline higher. Spirit Airlines (SAVE) surged 7.10%. JetBlue Airways (JBLU) popped 7.08%. Delta Air Lines (DAL) jumped 6.62%. One fundamental reason for the group's strength was...

READ MORE

MEMBERS ONLY

AIRLINES LEAD TRANSPORTS AND INDUSTRIAL SPDR TO NEW RECORDS -- DELTA AND AMERICAN AIRLINES RISE ABOVE 200-DAY LINES -- AUTOS AND HOMEBUILDERS LEAD CYCLICALS HIGHER -- HOME CONSTRUCTION ISHARES HIT NEW HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

AIRLINES TAKE OFF... Airlines stock are finally gaining some altitude. Previous messages have shown rails, truckers, and delivery service stocks leading the Dow Transports to record highs. My September 20 message described airlines as the weakest part of that sector, but showed them in an oversold condition and trying to...

READ MORE

MEMBERS ONLY

October Begins In Record-Setting Fashion

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, October 2, 2017

It was another record day on Wall Street. The Dow Jones, S&P 500, NASDAQ and Russell 2000 all closed at fresh all-time highs. Wide participation is a hallmark of a bull market rally and, make no mistake, there's been...

READ MORE

MEMBERS ONLY

Techs and Industrials Lead New High List - Metals-Mining and Steel ETFs Turn Up - Four Stock Setups

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... The Little Bull that Could

.... Industrials, Finance and Tech Lead New High List

.... Cyber Security and Networking ETFs Turn Up

.... Strategy Note - A New High in the Future

.... Metals-Mining and Steel ETFs Bid to End Pullbacks

.... Freeport McMoran Stalls within Uptrend

.... Nucor and Steel Dynamics Attempt to End Corrections...

READ MORE

MEMBERS ONLY

RISING RATES CONTRIBUTE TO ROTATIONS -- FINANCIAL SPDR HITS ANOTHER RECORD -- FAANG STOCKS ARE STILL LAGGING BEHIND -- SO IS THE TECHNOLOGY SECTOR -- S&P 500 VALUE ISHARES SHOW NEW LEADERSHIP -- S&P 400 MID CAP INDEX HITS NEW RECORD

by John Murphy,

Chief Technical Analyst, StockCharts.com

FINANCIALS CONTINUE TO LEAD ... Financial stocks continue to build on their strong September gains. Chart 1 shows the Financial Sector SPDR (XLF) hitting a new record high again today. Rising interest rates are the main force driving money into banks, brokers, and insurers. The black line just above the price...

READ MORE

MEMBERS ONLY

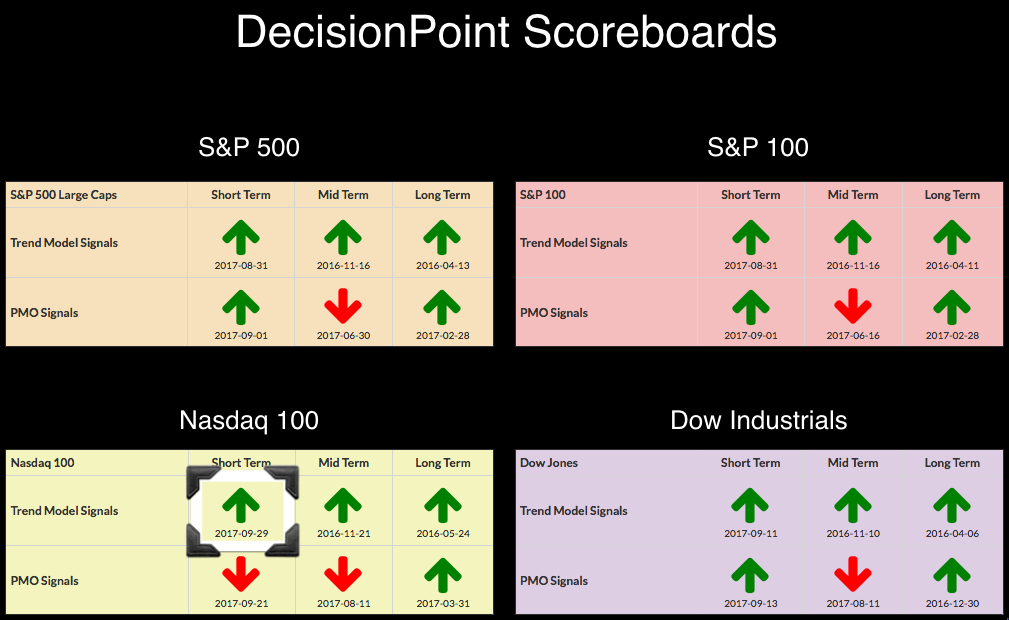

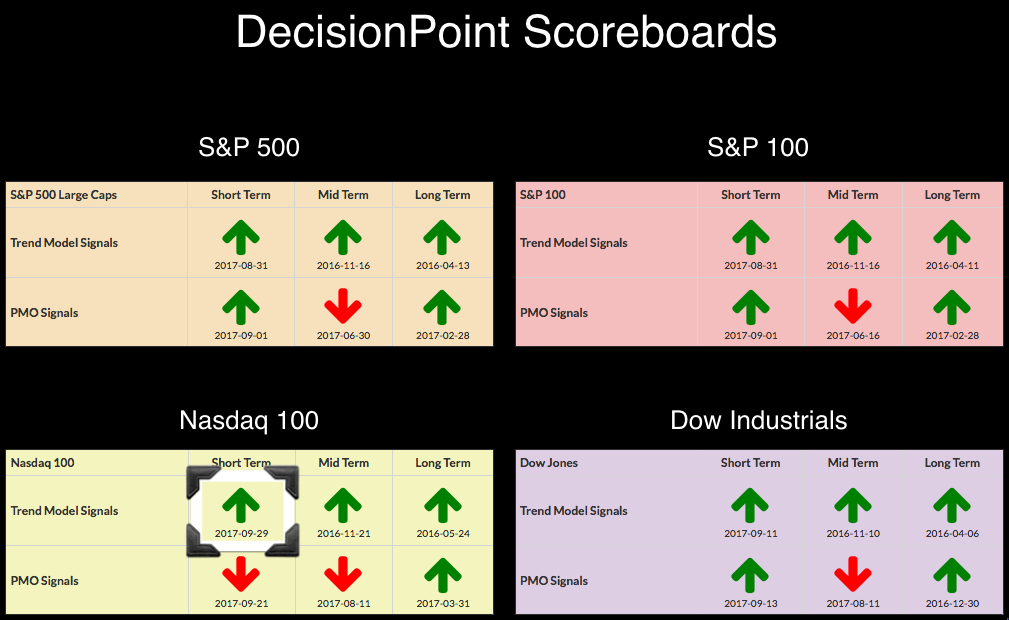

Signal Change Bulletin: New BUY Signals for NDX and Consumer Discretionary ETF (XLY)

by Erin Swenlin,

Vice President, DecisionPoint.com

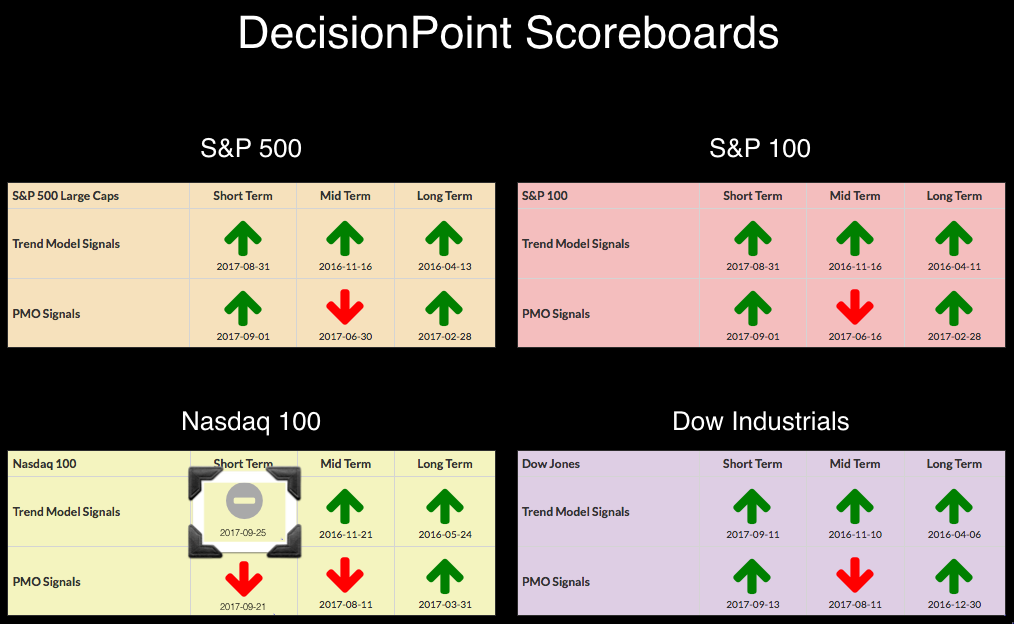

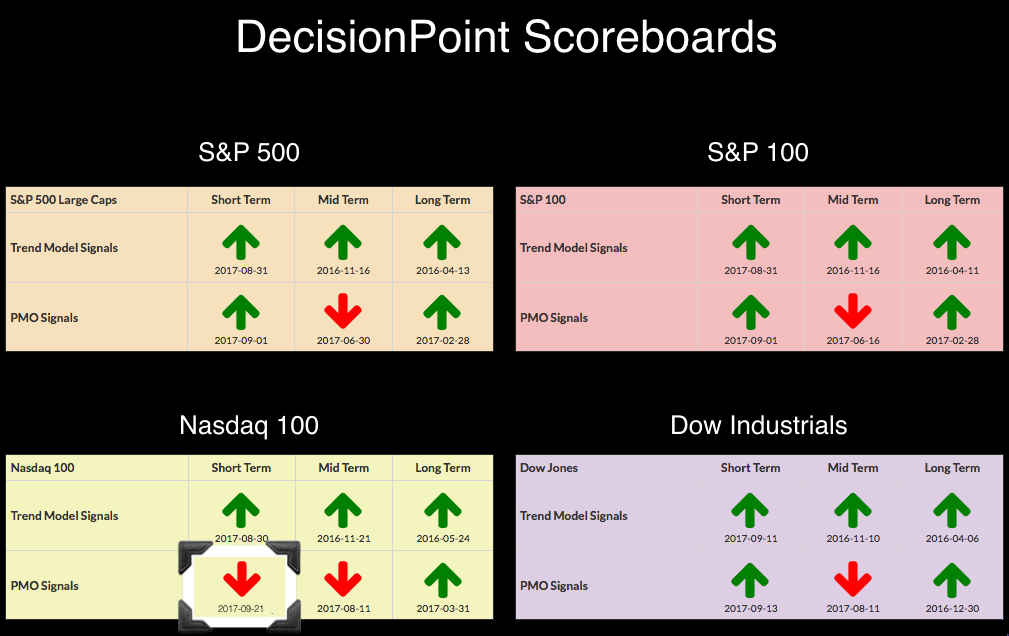

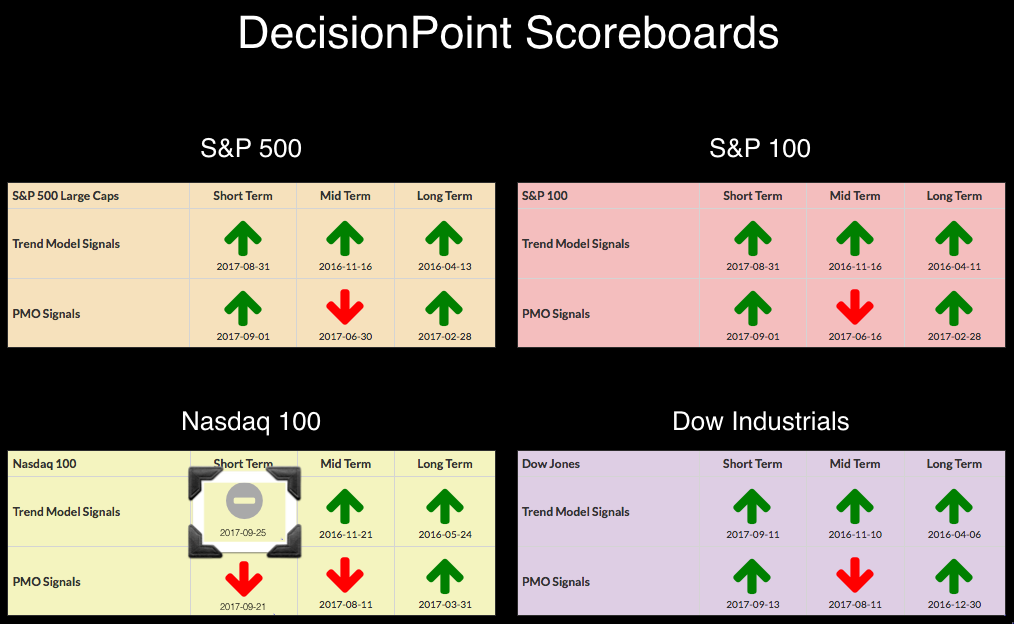

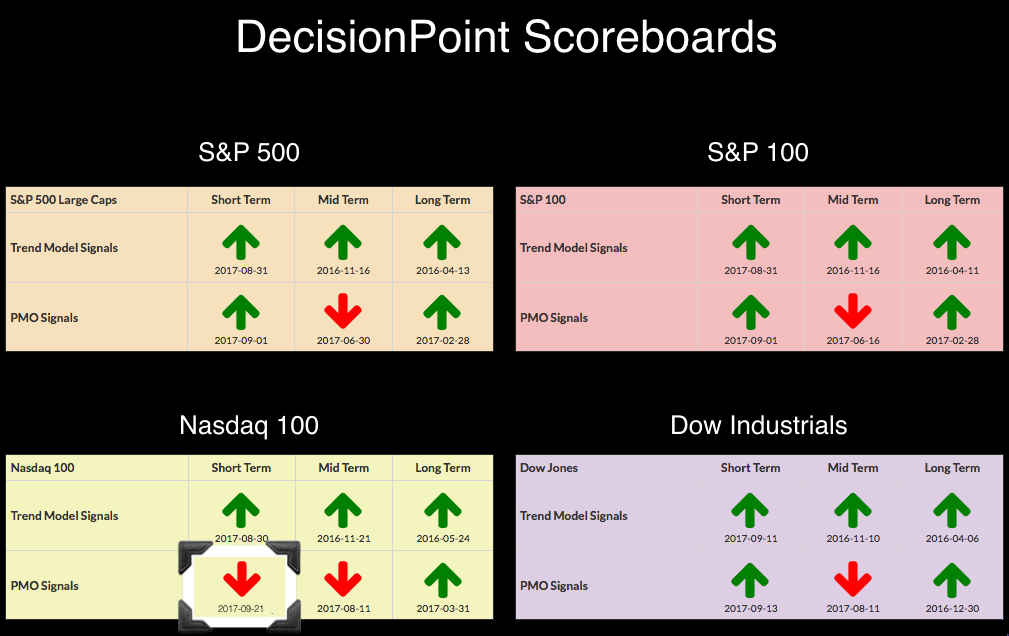

Wanted to update readers on two new signal changes that triggered after the close today. You'll see that the NDX DecisionPoint Scoreboard has logged yet another change for the NDX. This time a ST Trend Model BUY signal.

The NDX triggered an ST Trend Model BUY signal today...

READ MORE

MEMBERS ONLY

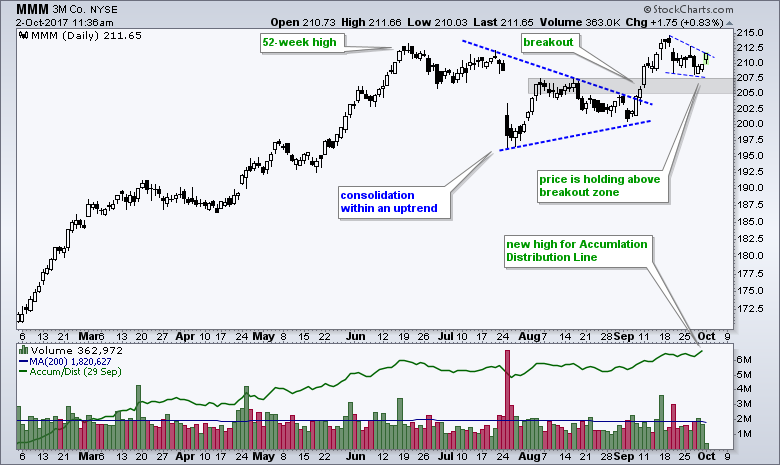

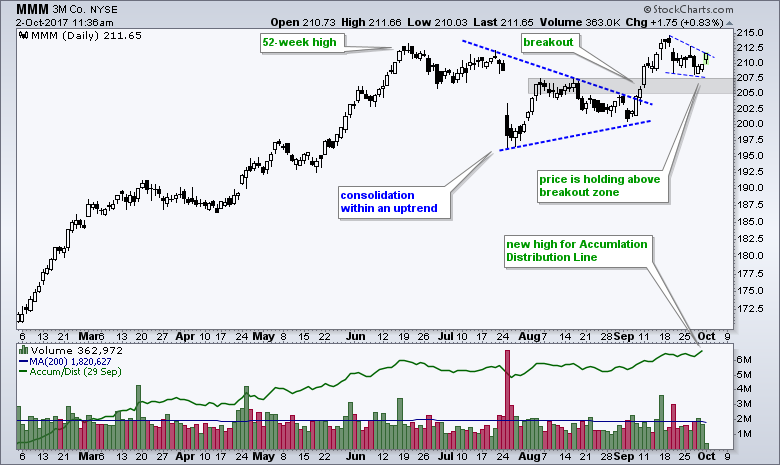

3M Holds the Breakout Zone $MMM

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

3M (MMM) is helping itself and the Dow Industrials with a breakout in mid September. As a price-weighted average, the stocks with the highest price carry the most weight and MMM, which is the third highest-priced stock, accounts for around 6.5% of the Dow. On the price chart, the...

READ MORE

MEMBERS ONLY

WHY Breadth?

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I have written often about market internals or market breadth. In fact, there was a whole series of articles as I was updating my “The Complete Guide to Market Breadth Indicators” book. The articles began with CGMBI; there were 10 of them, all back near the beginning of my article...

READ MORE

MEMBERS ONLY

The Fourth Quarter Begins With Seasonal And Technical Signals Aligning Bullishly

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, September 29, 2017

We wrapped up the third quarter on Friday with all-time highs showing up everywhere. There was a big buying push into the close on Friday, likely in anticipation of more strength during the fourth quarter. There was strength in most aggressive areas of...

READ MORE

MEMBERS ONLY

Four Implications Of A US Dollar Rally

by Martin Pring,

President, Pring Research

* Two bullish dollar charts

* Several dollar sympathy relationships are likely to reverse

In a couple of September articles on the dollar I suggested that the potential for a short-term rally existed, as bearish sentiment and other indicators appeared to have moved to an extreme. A rally of some kind does...

READ MORE

MEMBERS ONLY

Two Bullish Charts In A Very Bullish Industry

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Delivery services ($DJUSAF) broke out of a bullish continuation cup with handle pattern a few weeks ago and appears poised for a further fourth quarter rally, albeit with some profit taking along the way. Bullish continuation patterns require a prior uptrend and the DJUSAF certainly had that. Check out the...

READ MORE

MEMBERS ONLY

DP Weekly/Monthly Wrap: Market Still Overbought

by Carl Swenlin,

President and Founder, DecisionPoint.com

Last week I thought that a market correction was beginning, but all we got was a one-day, downside blip that ended at the low on Monday. From there the market edged higher, closing at new, all-time highs on Thursday and Friday. Nevertheless, the gain for the week was less than...

READ MORE

MEMBERS ONLY

Charts I'm Stalking: Action Practice #21

by Gatis Roze,

Author, "Tensile Trading"

Most investors will admit that they have at some point been guilty of chasing yield. This is not surprising with the ultra low yields on money market accounts and the expanding Baby Boom generation’s needs for income. It’s a common refrain.

Problems arise when one does not completely...

READ MORE

MEMBERS ONLY

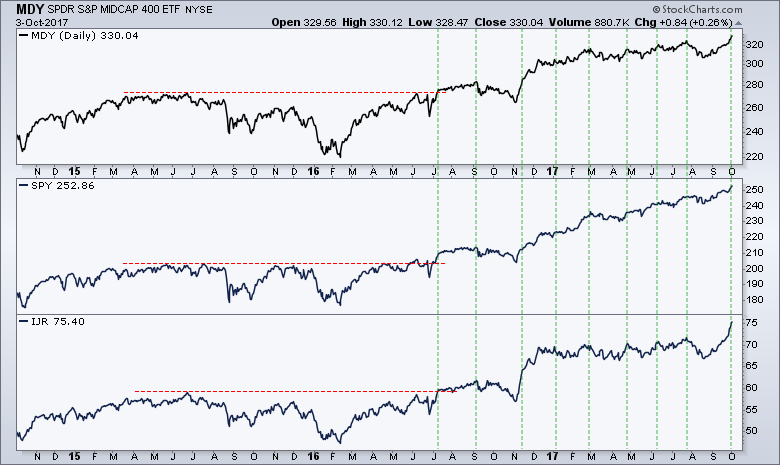

Weekly Market Review & Outlook (w/ Video) - Small and Micro Caps Make a Move

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... VIX Extends its Low Run

.... Revisiting Seasonality

.... QQQ Lags, but Doesn't Drag

.... Small-caps and Micro-caps Take the Lead

.... Biggest Momentum Surge in 10 Years for IJR

.... Sector Participation Supports Bull Market

.... Industrials and Finance Lead with Fresh Highs

.... Technology and Materials Not Far Behind

.... Healthcare and Utilities Correct...

READ MORE

MEMBERS ONLY

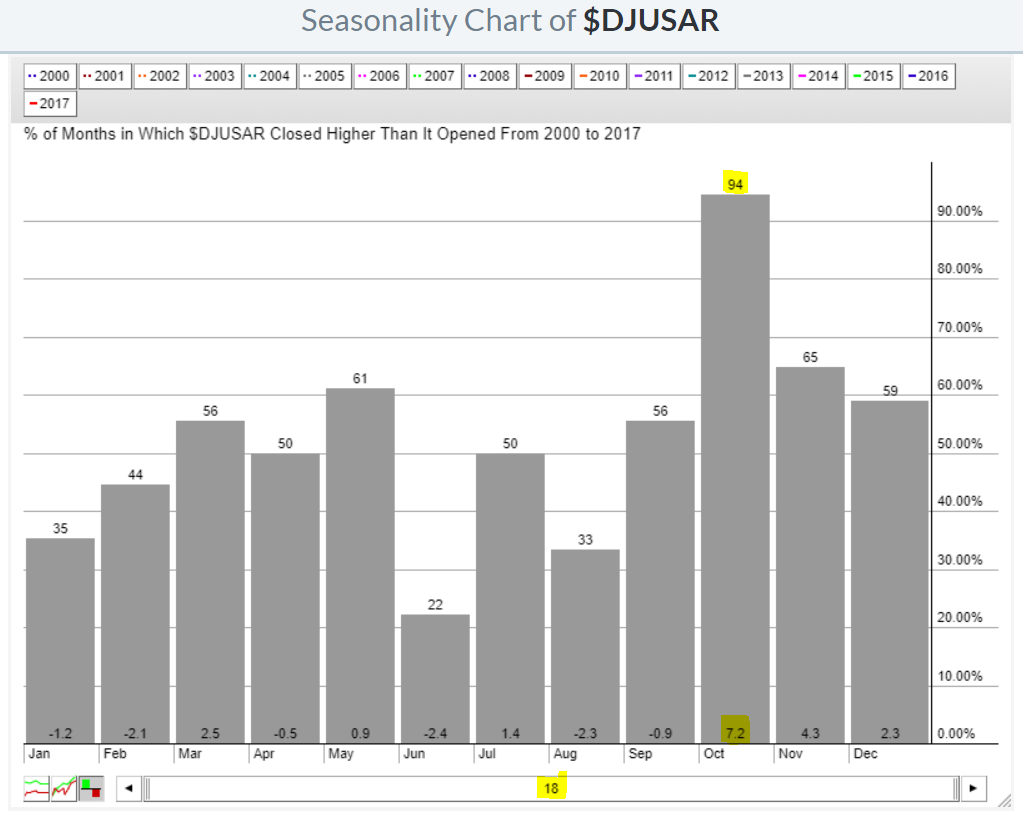

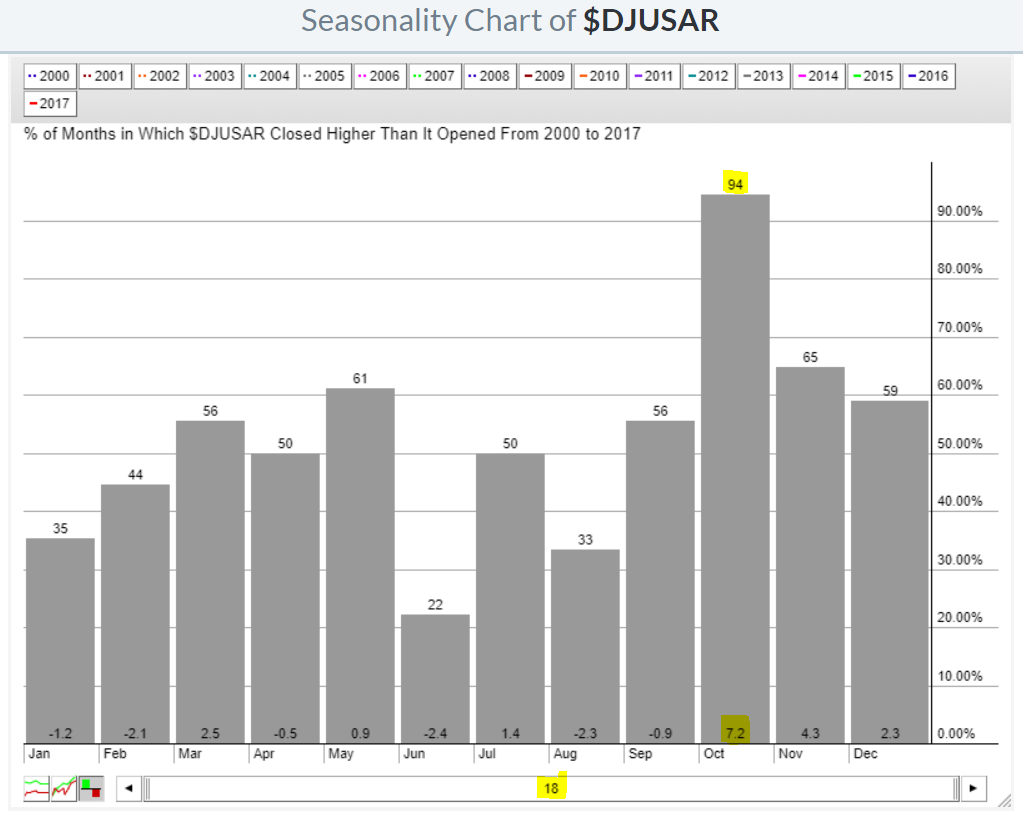

Airlines Looking To Rally In October?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, September 28, 2017

After early selling on Thursday, U.S. indices mostly rebounded throughout the balance of the day resulting in mostly slight gains by day's end. Materials (XLB, +0.71%) performed quite well after nearly testing its rising 20 day EMA on Wednesday....

READ MORE

MEMBERS ONLY

Nasdaq 100 vs. Equal-Weight NDX ETF (QQEW) - ETF Much Healthier

by Erin Swenlin,

Vice President, DecisionPoint.com

Within the past week, we've seen the $NDX beaten up. However, it really has been the result of a few large-cap stocks that have taken the NDX so low. I think this can be most clearly seen when you compare the equal-weight NDX ETF (QQEW) with the $NDX....

READ MORE

MEMBERS ONLY

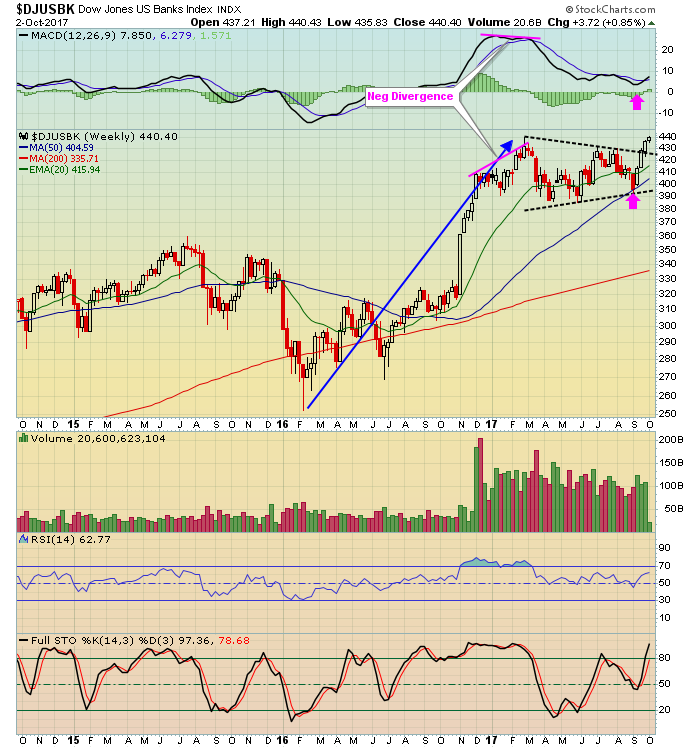

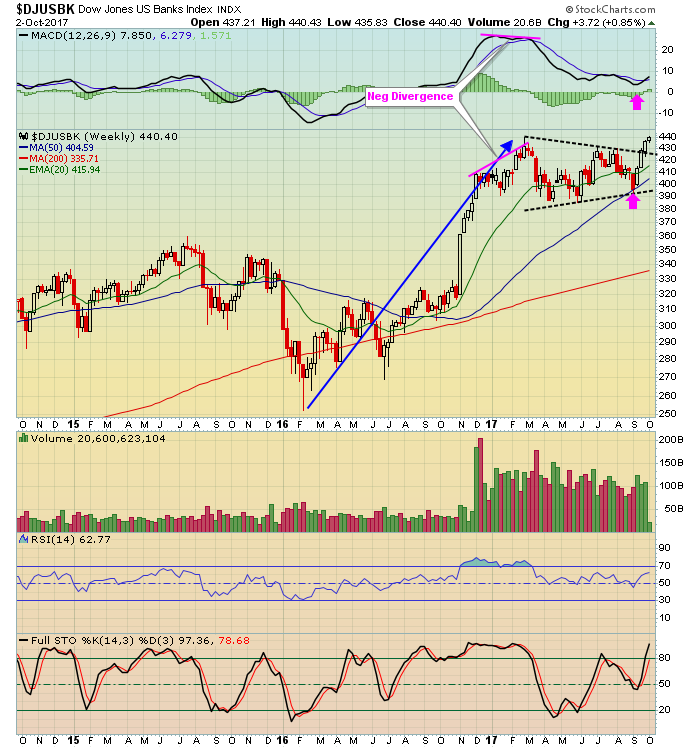

Momentum Divergences: Understanding, Knowing When to Ignore and Knowing When to Trade

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Most of us are familiar with positive and negative divergences in momentum indicators. These divergences suggest that directional momentum is slowing and there could be a trend reversal. There is just one problem. Most divergences are at odds with the bigger trend. Most negative divergences form in an uptrend and...

READ MORE

MEMBERS ONLY

COMPARISON OF BOND CATEGORIES SUPPORTS THE CASE FOR HIGHER BOND YIELDS -- HIGH YIELD BONDS ARE OUTPERFORMING INVESTMENT GRADE CORPORATES -- CORPORATE BONDS AND TIPS ARE OUTPERFORMING TREASURIES -- SHORTER-MATURITY BONDS ARE OUTPERFORMING LONGER MATURITIES

by John Murphy,

Chief Technical Analyst, StockCharts.com

HIGH YIELD BONDS ARE OUTPERFORMING INVESTMENT GRADE BONDS... One of the ways that we can tell which way interest rates are expected to trend is to compare the relative performance of various bond categories. Let's start with corporate bonds. Chart 1 is a ratio of the iBoxx High...

READ MORE

MEMBERS ONLY

U.S. Equities Rally As Treasury Yields Soar

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, September 27, 2017

U.S. stocks were lifted at least in part by rising treasury yields. The 10 year treasury yield ($TNX) spiked 8 basis points and that represents a significant selloff in treasuries. Those proceeds tend to be reinvested in equities and that was certainly...

READ MORE

MEMBERS ONLY

DP Alert: "Missed it By 'That' Much"

by Erin Swenlin,

Vice President, DecisionPoint.com

It's clear looking at the NDX Scoreboard that technology has been taking it on the chin. Today, tech titans like Micron (MU), Apple (AAPL) and Advanced Micro Devices (AMD) had a great day and consequently pushed the NDX upward. It wasn't enough to clear the ST...

READ MORE

MEMBERS ONLY

BIG JUMP IN BOND YIELDS IS PUSHING FINANCIAL SECTOR TO A RECORD HIGH -- BANKS AND BROKERAGE ETFS ARE ALSO ACHIEVING BULLISH BREAKOUTS -- UTILITIES ARE REITS ARE FALLING WITH BOND PRICES

by John Murphy,

Chief Technical Analyst, StockCharts.com

10-YEAR TREASURY YIELD SURGES TO TWO-MONTH HIGH... The green bars in Chart 1 show the 10-Year Treasury Yield ($TNX) jumping 8 basis points today to reach the highest level since the end of July. The chart also shows the TNX having risen above a falling trendline drawn along its March/...

READ MORE

MEMBERS ONLY

Bearish Seasonal Summer Period Coming To An End

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, September 26, 2017

Late day selling created a bifurcated U.S. market on Tuesday as small caps performed quite well ($RUT, +0.34%), while the Dow Jones finished slightly in negative territory. Technology (XLK, +0.36%) rebounded after Monday's selling to lead most of...

READ MORE

MEMBERS ONLY

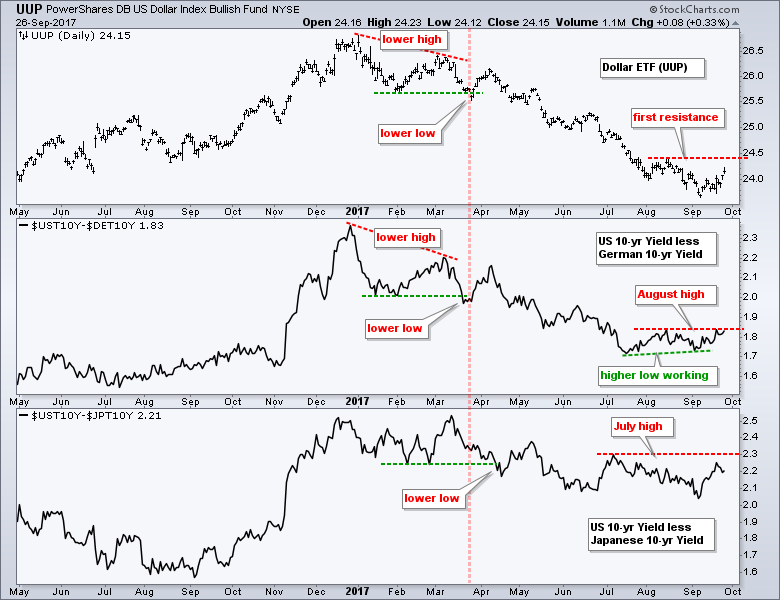

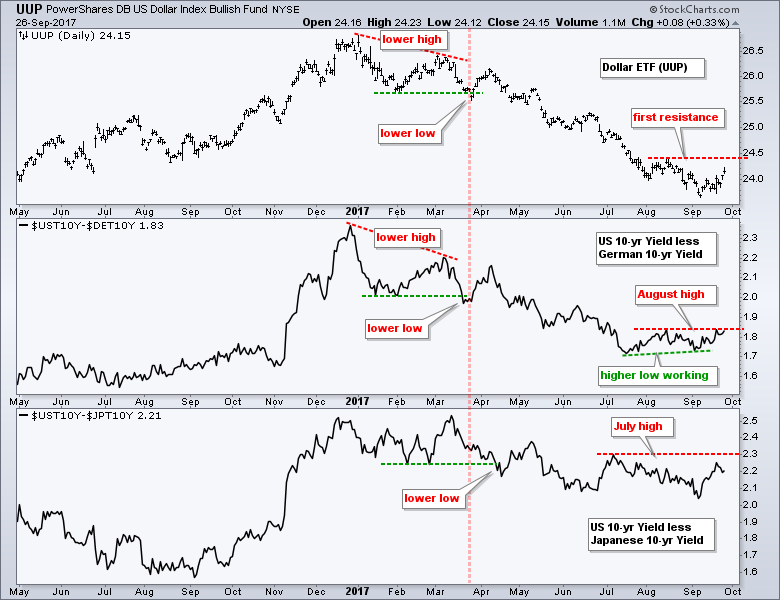

Watch these Yield Spreads for Clues on the Greenback

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The US Dollar ETF (UUP) is made of five currency pairings. The Dollar/Euro ($USDEUR) pair accounts for 57.6%, Dollar/Yen ($USDJPY) weighs 13.6%, Dollar/Pound ($USDGBP) is 11.9%, Dollar/Canadian ($USDCD) is 9.1% and Dollar/Swiss ($USDCHF) is 3.6%. Clearly, the Dollar/Euro relationship...

READ MORE

MEMBERS ONLY

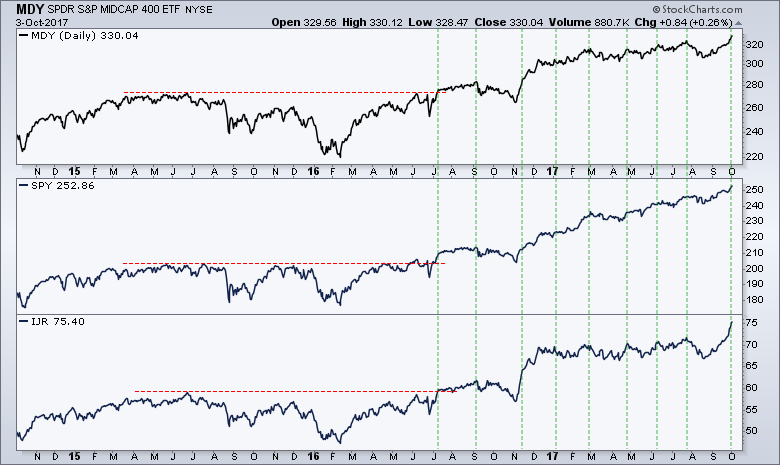

SMALL CAP VALUE ETF LEADS RUSSELL 2000 TO RECORD HIGH -- INDUSTRIAL SPDR HITS NEW RECORD -- SO DO THE DOW TRANSPORTS -- RYDER NEARS UPSIDE BREAKOUT -- BANKS CONTINUE TO RISE -- FINANCIAL SPDR NEARS A NEW RECORD

by John Murphy,

Chief Technical Analyst, StockCharts.com

RUSSELL 2000 ISHARES LEAD SMALL CAPS TO RECORD HIGHS... The S&P Small Cap Index ($SML) and the Russell 2000 Small Cap Index ($RUT) are hitting record highs today. Small cap value stocks are the main driver behind the breakout. Chart 1 shows the Russell 2000 Value iShares (IWN)...

READ MORE

MEMBERS ONLY

Group Dynamics

by Bruce Fraser,

Industry-leading "Wyckoffian"

Let’s have a peak at some interesting sectors. At times, sectors can tip us off to the motives of the market. Sectors and Industry Groups have a general tendency to be either early, coincident or late business cycle beneficiaries. This business expansion has certainly been a long one and...

READ MORE

MEMBERS ONLY

Staples And Materials: Which Sector To Hold And Which One To Fold?

by Martin Pring,

President, Pring Research

The relationship between Staples and Materials

* Long-term relative trends

* Breakouts and breakdowns

* Which of the materials sub-components are breaking out?

* Euro looks short-term toppy

The relationship between Staples and Materials

Most of the time I concentrate on the trend of the overall market, but some sector charts for Consumer Staples...

READ MORE

MEMBERS ONLY

Technology Slumps As Facebook Falls On Heavy Volume

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, September 25, 2017

Technology (XLK, -1.18%) was the only real problem on Monday, but it was a big problem. Mobile telecommunications ($DJUSWC) and internet stocks ($DJUSNS) were the big losers with the latter slammed by Facebook (FB), which dropped nearly 5% on extremely heavy volume....

READ MORE

MEMBERS ONLY

Broad Selling in Nasdaq 100 - Biotechs Buck Selling - TLT Turns Up - Five Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Small-caps Extend to New Highs

.... Broad Selling in the Nasdaq 100

.... XBI and IBB Edge Higher

.... COPX and JJC Correct within Uptrends

.... TLT Turns Up within Uptrend

.... Charts to Watch: DAL, CB, LEN, RMD, SBAC ....

Small-caps Extend to New Highs

The S&P SmallCap iShares (IJR) and the Russell...

READ MORE

MEMBERS ONLY

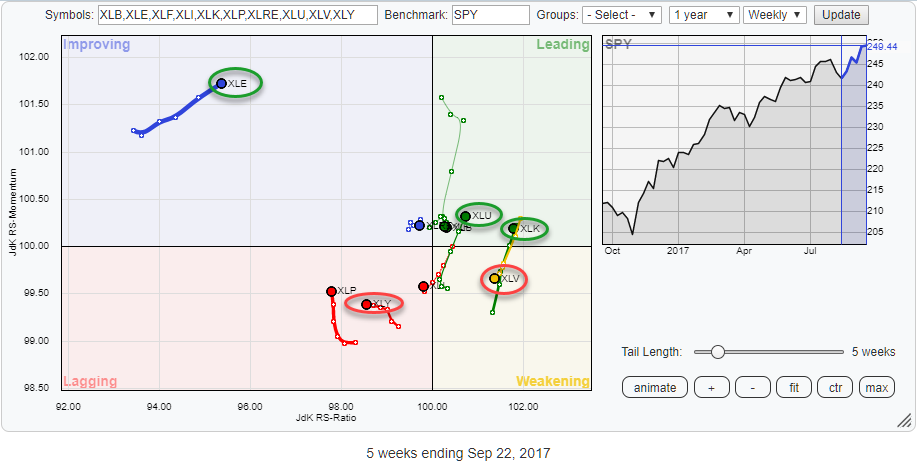

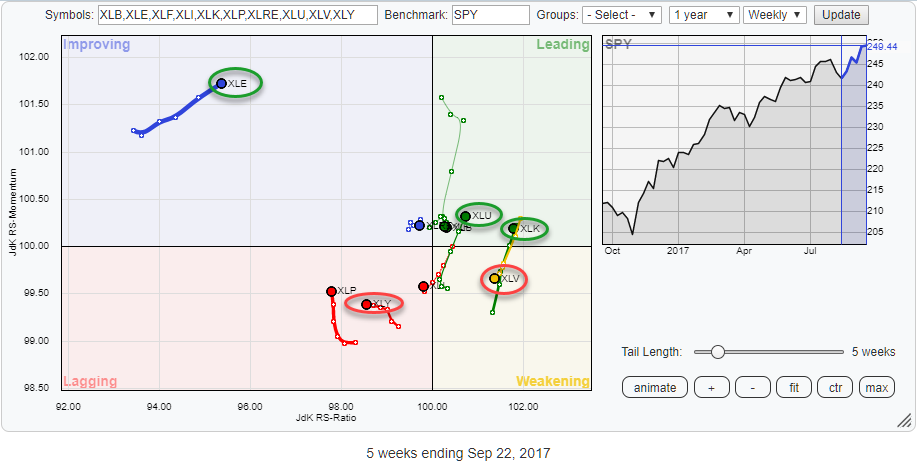

Pair trade opportunity in XLV/XLK and potentially strong (rare) rotational pattern for XLI

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph above holds the ten sector SPDR ETFs that make up the complete S&P 500 index (SPY).

At the moment the positioning of the various sectors and their rotational patterns are relatively evenly spread over the RRG canvas except for XLE which is far away...

READ MORE

MEMBERS ONLY

Another BUY Signal Bites the Dust for the NDX - New ITTM SELL Signal for UNG

by Erin Swenlin,

Vice President, DecisionPoint.com

The Nasdaq 100 lost its PMO BUY signal on Friday and today it loses its ST Trend Model BUY signal (along with important support!). Natural Gas (UNG) had just picked up an IT Trend Model BUY signal, but it has whipsawed away into an ITTM SELL signal.

Today's...

READ MORE

MEMBERS ONLY

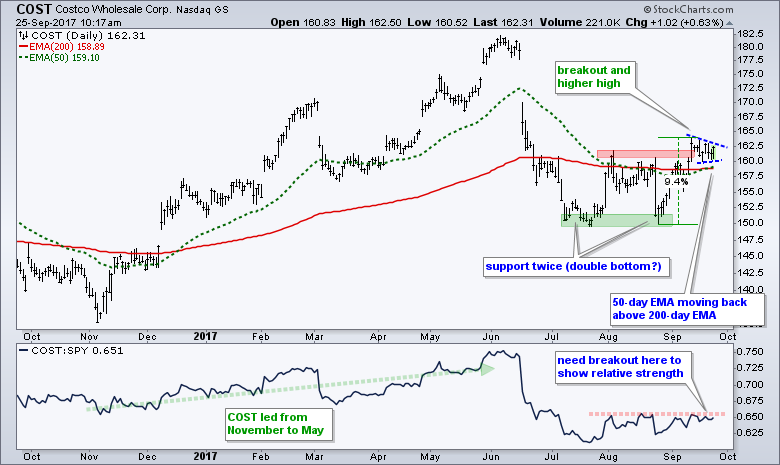

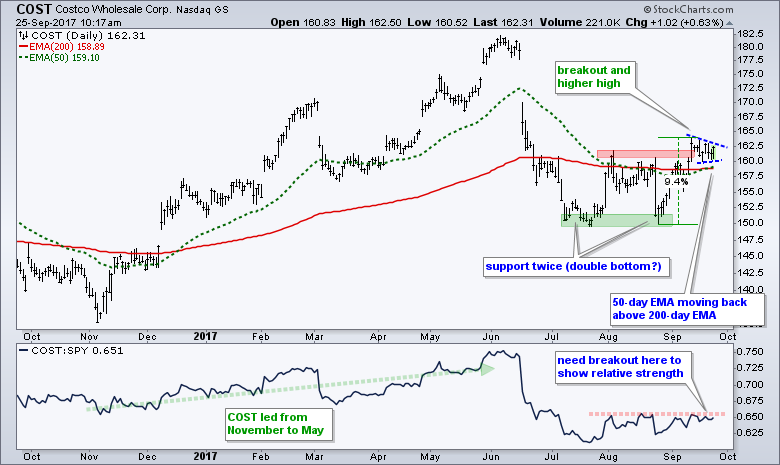

Costco Forms Bullish Pennant Near Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Costco (COST) fell on hard times this summer with a plunge from the low 180s to the 150 area. Despite this gap and sharp decline, the stock firmed in July-August and surged above the red resistance zone in September. Notice that the stock found support in the 150 area with...

READ MORE

MEMBERS ONLY

Russell 2000 Tests Key Resistance, Primed To Lead In 4th Quarter

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, September 22, 2017

Friday was a bifurcated kind of day on Wall Street. We saw a small loss on the Dow Jones, while there were slight gains on the other major indices. The Russell 2000, in particular, saw relative strength and gained nearly 7 points to...

READ MORE

MEMBERS ONLY

Tesla Weakens But Chart Is On Cruise Control

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Tesla (TSLA) remains a crowd favorite as the stock's 2017 advance has been accompanied by extremely heavy volume. I see major accumulation when I look at TSLA's chart. But like every other stock, momentum can become an issue from time to time and TSLA appears to...

READ MORE

MEMBERS ONLY

RISING BOND YIELDS MAY BE PULLING MONEY OUT OF TECHNOLOGY INTO CHEAPER PARTS OF THE MARKET -- APPLE, AMAZON, AND GOOGLE LOSE GROUND -- RISING OIL PRICES MAY CONTRIBUTE TO HIGHER BOND YIELDS -- RISING YIELDS ARE BOOSTING SMALL CAPS

by John Murphy,

Chief Technical Analyst, StockCharts.com

APPLE, AMAZON, AND GOOGLE WEIGH ON TECH SECTOR... While the stock market is holding up okay, some rotations are going on beneath the surface. One is the rotation out of large cap tech stocks, former market leaders, into cheaper parts of the market like financials, small caps, and transports. Let&...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: AAPL Leads Market Top

by Carl Swenlin,

President and Founder, DecisionPoint.com

We usually feature a SPY chart in this space, but Apple (AAPL) has really grabbed my attention recently. I have been watching it for a few weeks as it formed a rounded top, and finally broke down through horizontal support on Thursday. AAPL is important to the broad market because...

READ MORE

MEMBERS ONLY

Do Investors Love Their Children Too?

by Gatis Roze,

Author, "Tensile Trading"

The Public Relations industry has crisis simulation firms that actually come into corporations and compress a hypothetical month-long disaster into a few stressful hours in order to see how management responds. I’d like to do something similar, but in the family financial arena with parents and children. Sadly, however,...

READ MORE

MEMBERS ONLY

Technology Hit Hard, Results in PMO SELL Signal on Nasdaq 100

by Erin Swenlin,

Vice President, DecisionPoint.com

As you can see below, the NDX's steep decline has thrown the Price Momentum Oscillator (PMO) below its signal line. I don't expect to see similar readings from the other indexes as they haven't been hit as hard as techs on the latest declines....

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook (w/ Video) - An Abrupt Change in Leadership

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... An Abrupt Change in Leadership

.... News and No Man's Land

.... New High Parade Continues

.... Uptrends are Slowing, Not Reversing

.... A Strong Surge for Small-caps

.... Finance, Tech, Industrials and Materials Lead

.... Healthcare and Utilities Take a Dip

.... Consumer Discretionary Gets Anemic Bounce

.... Energy SPDR Breaks Summer Highs

.... Strong Selling...

READ MORE

MEMBERS ONLY

Taking A Look At Near-Term Downside Risk For The S&P 500

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, September 21, 2017

We are in one of the most bearish historical periods of the year and I've provided a bit more information about it in the Historical Tendencies section below. I'm pointing this out because equities took a break on Thursday...

READ MORE

MEMBERS ONLY

Let Interest Rates Soar If You're Long Equities!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Fed Chair Janet Yellen suggested there'd be another interest rate hike in 2017 and the Fed's overall tone was a bit more hawkish than was anticipated by Wall Street. That resulted in a big spike in the 10 year treasury yield at 2pm EST yesterday, the...

READ MORE