MEMBERS ONLY

Railroads, Transports Lead Dow Jones To 6th Consecutive All-Time High

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, September 20, 2017

It was another stellar day for industrials (XLI, +0.73%) as this sector led the Dow Jones to a 6th consecutive record closing high. The gains have been fairly slow and methodical, but that's how bull market advances work. They tend...

READ MORE

MEMBERS ONLY

Equal-Weight ETFs Log New ITTM BUY Signals

by Erin Swenlin,

Vice President, DecisionPoint.com

DecisionPoint tracks not only the sector SPDRS, but we also follow the equal-weight versions. For more information about the benefits of trading equal-weight ETFs, you can read this article written by Carl. Today is a teachable moment with these three IT Trend Model BUY signals arriving on the same day....

READ MORE

MEMBERS ONLY

Fed Unwinding Triggers Rates To Rise, A Dollar Reversal And A Boost To Financials

by Martin Pring,

President, Pring Research

* Dollar begins a short-term rally

* Fed action boosts rates

* Financials set to move higher

Fed action on Wednesday had the effect of boosting rates, thereby causing short-term reversals in several markets and relationships. These inflexion points in the markets are expected to influence prices over the next few weeks.

Dollar...

READ MORE

MEMBERS ONLY

DOW TRANSPORTS RISE TO HIGHEST LEVEL IN TWO MONTHS -- FEDEX AND UNITED PARCEL SERVICE HIT NEW RECORDS -- NORFOLK SOUTHERN AND UNION PACIFIC LEAD DOW JONES US RAILROAD INDEX TO RECORD -- TRUCKING INDEX ALSO HITS NEW RECORD

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW TRANSPORTS RISE TO TWO-MONTH HIGH... Recent messages have described the gradual improvement in transportation stocks since mid-August. It started with their ability to reclaim their 200-day average in late August, followed by a move back above their 50-day average earlier this month. Chart 1 shows the Dow Jones Transportation...

READ MORE

MEMBERS ONLY

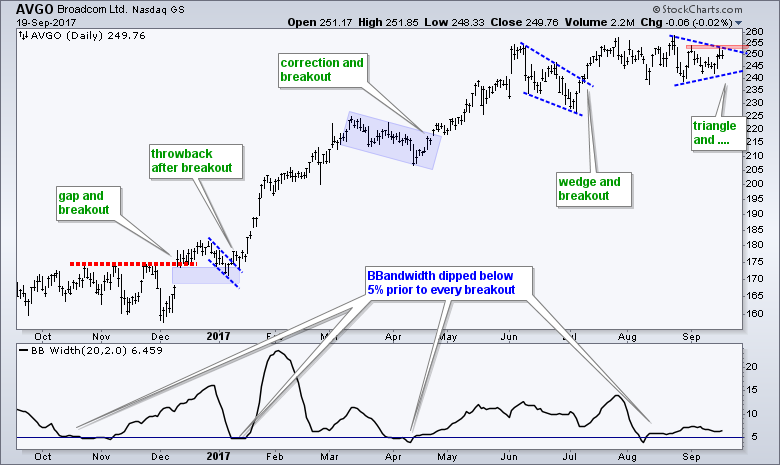

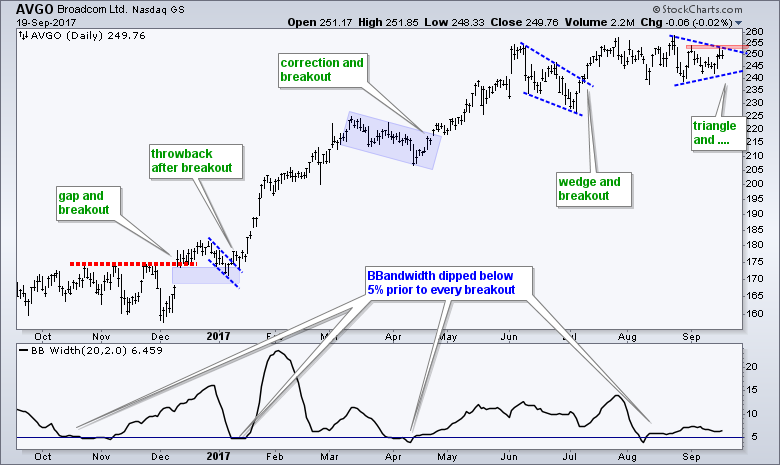

Broadcom Consolidates within Uptrend $AVGO

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

This is my third straight DITC posting with a semiconductor stock. The first featured Texas Instruments forming a cup-with-handle pattern and the second featured Intel with a surge towards long-term resistance. Today's chart focuses on Broadcom, which is actually lagging the S&P 500 SPDR over the...

READ MORE

MEMBERS ONLY

The Fed's On Deck And THIS Is Why We Want To See Interest Rates Rise

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Reminder

Be sure to scroll down to the bottom of my article and click the "Notify Me" button if you'd like to receive my article each morning before the stock market opens. The subscription is FREE and my article is a great way to start your...

READ MORE

MEMBERS ONLY

$COMPQ Up Close

by Bruce Fraser,

Industry-leading "Wyckoffian"

The NASDAQ Composite ($COMPQ) has consolidated since early June. Two very prominent Buying Climax peaks arrived, one in June and the next in late July. They are labeled on the vertical chart and the Point and Figure chart. This has slowed the advance of the $COMPQ to a crawl. Meanwhile...

READ MORE

MEMBERS ONLY

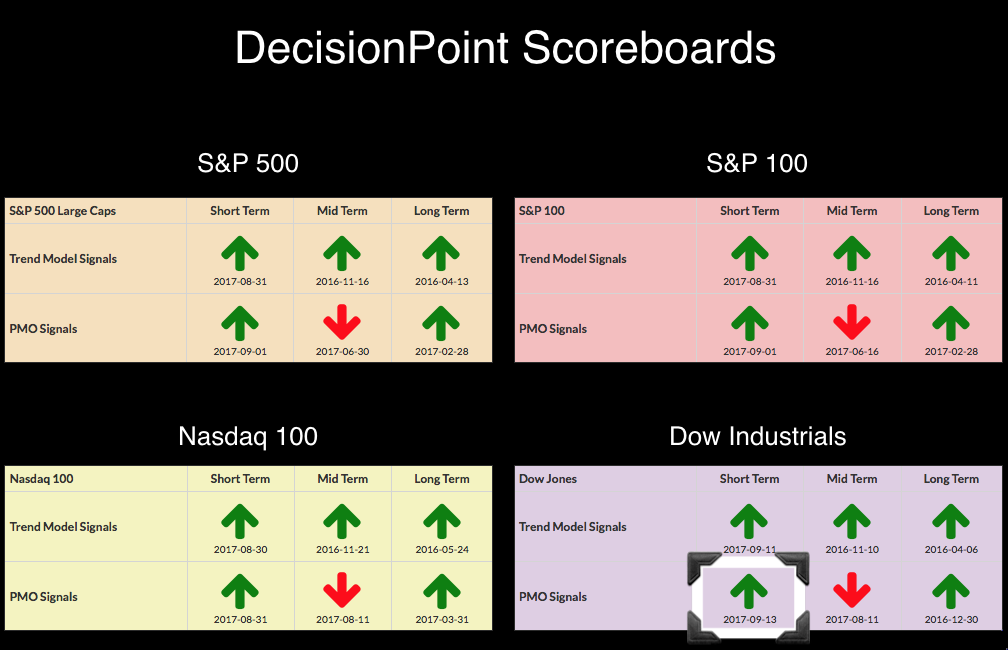

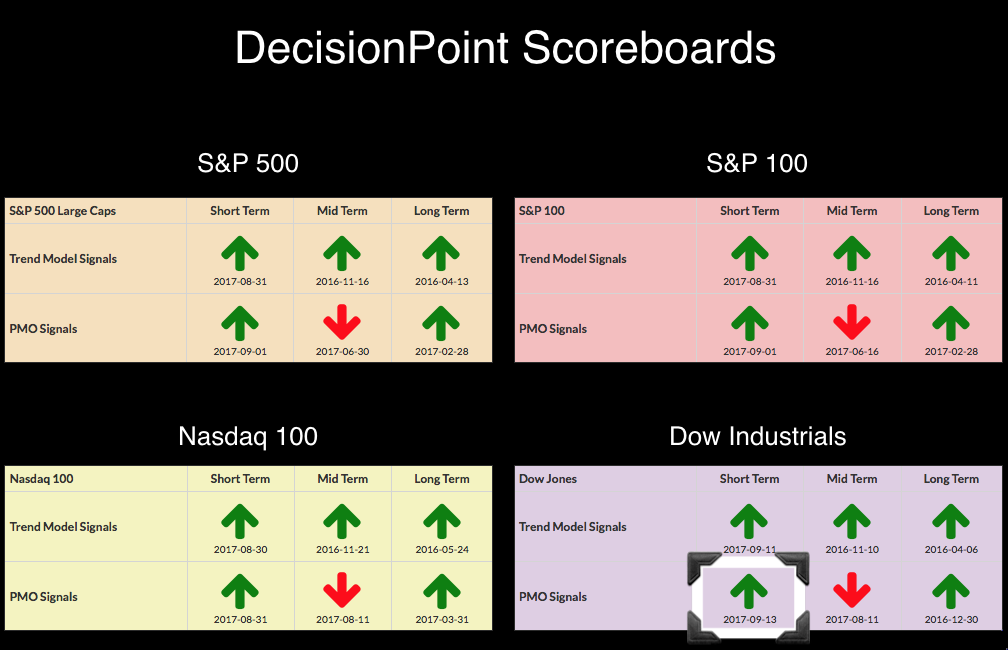

DP Alert: Short-Term Overbought Conditions Suggest Upcoming Pause/Pullback

by Erin Swenlin,

Vice President, DecisionPoint.com

It may seem strange that all of the Scoreboards are green except in the area of intermediate-term PMO signals. A look at the weekly charts for all four indexes reveals all but the NDX weekly PMO are rising up toward IT PMO BUY signals. The margin is still rather large...

READ MORE

MEMBERS ONLY

DOW JONES INTEGRATED OIL & GAS INDEX IS TRADING OVER ITS 200-DAY AVERAGE AND MAY BE ON VERGE OF UPSIDE BREAKOUT -- CHEVRON TOUCHES THREE-YEAR HIGH -- PHILLIPS 66 NEARS ALL-TIME HIGH -- CONOCOPHILLIPS RISES TO HIGHEST LEVEL IN FOUR MONTHS

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW JONES US INTEGRATED OIL & GAS INDEX MAY BE BREAKING OUT... Energy stocks have been the market's weakest performers during 2017. They're starting, however, to take a turn for the better, both in absolute and relative terms. Energy has been the market's strongest...

READ MORE

MEMBERS ONLY

Banks Strengthen To Lead Financials, Major Indices Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, September 18, 2017

It was another very bullish day on Wall Street as most indices finished with gains once again. The Russell 2000 ($RUT) led the charge with a 0.65% rise. Gains in the Dow Jones and S&P 500 were more modest, but...

READ MORE

MEMBERS ONLY

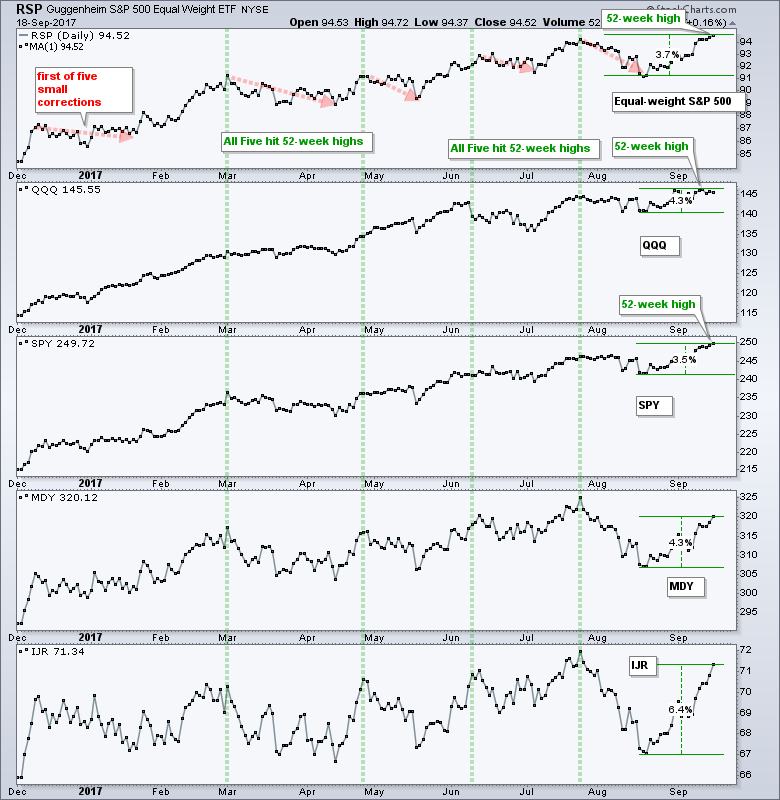

Materials, Industrials and Tech Lead New High List - GOOGL, AMZN and FB Weigh - Five Stock Setups

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... 52-week Highs Reflect Broad Strength

.... Materials, Industrials and Technology Lead New High List

.... Alphabet, Amazon and Facebook are Dragging

.... CSCO Hits Multi-Month High

.... Fiserv Turns Up after Pullback

.... AMD Bounces off Key Retracement

.... CHD and CL Start Turning UP

.... How to Handle Overvalued Stocks ....

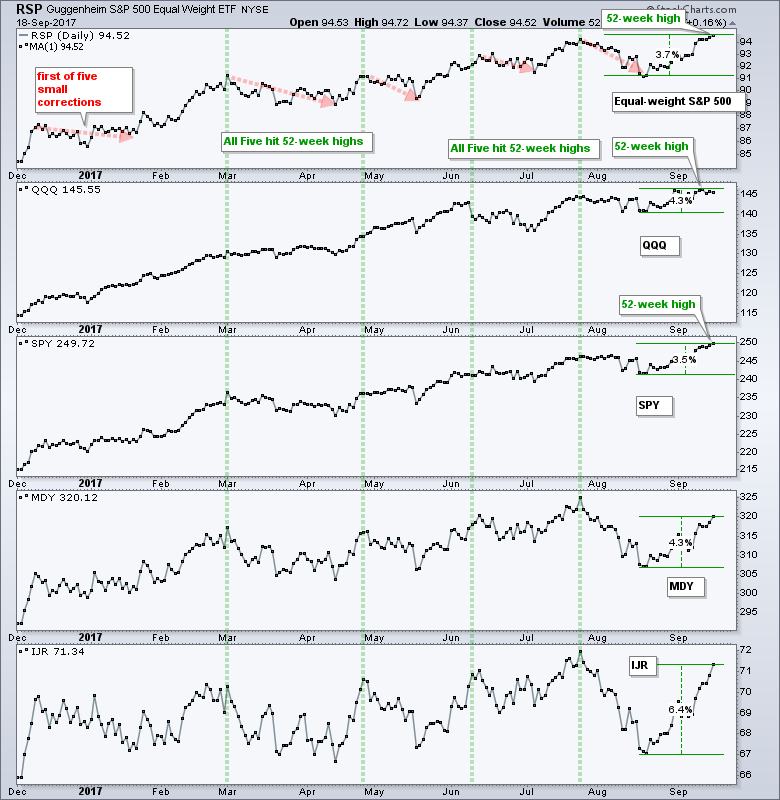

52-week Highs Reflect Broad Strength

Large-caps,...

READ MORE

MEMBERS ONLY

On Fire! Energy, Small- and Mid-Caps, Financials All Trigger ITTM BUY Signals

by Erin Swenlin,

Vice President, DecisionPoint.com

The last two days have issued SIX new Intermediate-Term Trend Model (ITTM) BUY signals. It shouldn't be a surprise that the Energy SPDR (XLE) and Natural Gas (UNG) triggered given the buzz around that sector last week on MarketWatchers LIVE and headlines on our StockCharts.com Blogs page....

READ MORE

MEMBERS ONLY

Aerodynamics for Investors

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Oh no! He is losing it! I have stated a few times that the well seems to be running low; this article might confirm that. Here is an attempt to turn basic aerodynamics into an investment process.

Where:

CL is the coefficient of Lift

p is the density of air...

READ MORE

MEMBERS ONLY

BANKS ARE LEADING FINANCIAL SECTOR HIGHER -- BANK LEADERS INCLUDE CITIGROUP, BANK OF AMERICA, AND JP MORGAN -- FIVE-YEAR TREASURY YIELD CLEARS 50-DAY AVERAGE -- 7-10 YEAR TREASURY BOND ISHARES ARE TESTING SUPPORT -- UTILITIES WEAKEN ALONG WITH BONDS

by John Murphy,

Chief Technical Analyst, StockCharts.com

FINANCIAL SPDR CLEARS 50-DAY AVERAGE... Financial stocks are helping lead the market higher today. Chart 1 shows the Financial Sector SPDR (XLF) trading at the highest level in five weeks after clearing its 50-day average. Its relative strength ratio (top of chart) continues its September rebound. Banks are leading the...

READ MORE

MEMBERS ONLY

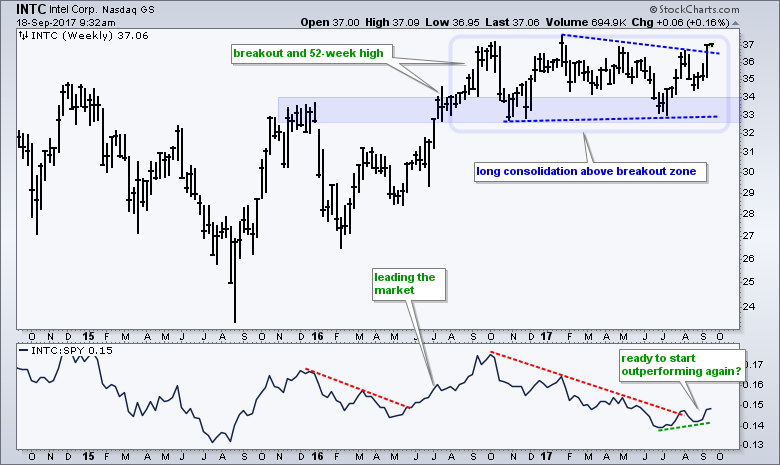

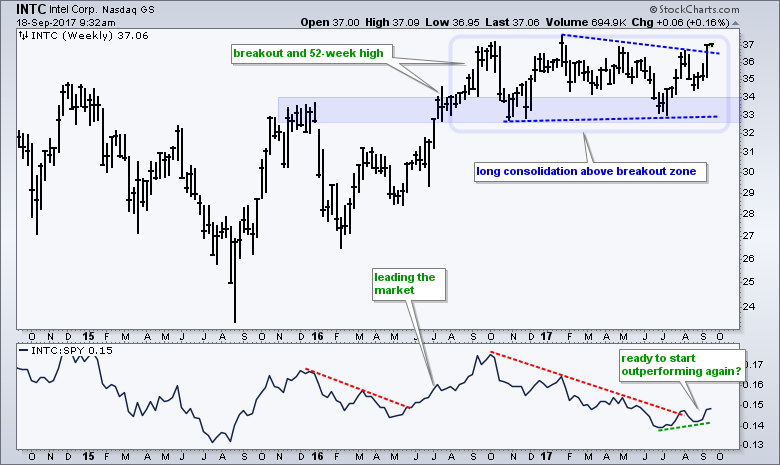

Intel Goes for a Big Breakout $INTC

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Some sixty stocks in the S&P 500 were up 5% or more last week, and Intel was one of them. Intel's importance seems to have diminished over the years, but it is still an industry gorilla that accounts for around 11% of the Semiconductor ETF (SMH)...

READ MORE

MEMBERS ONLY

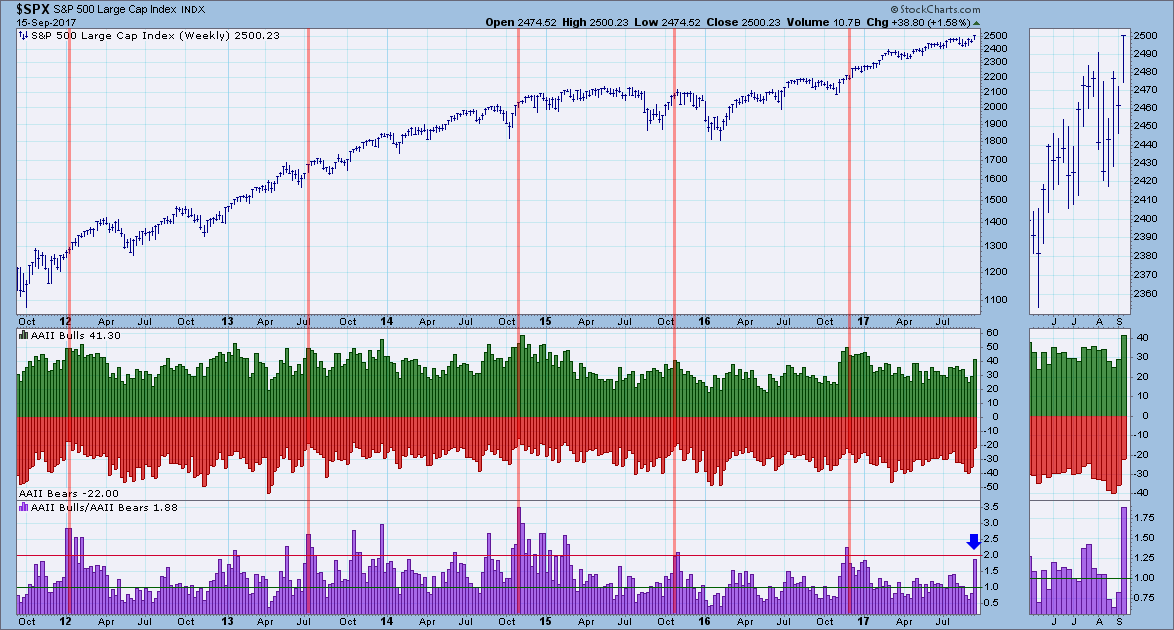

S&P 500 Tops 2500 For First Time; Monday Trade Setups

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, September 15, 2017

It was another day of records on Wall Street to close out the week. Despite the peak of seasonal summer weakness approaching, buyers stepped up to the plate once again, this time driving S&P 500 prices to another all-time high close...

READ MORE

MEMBERS ONLY

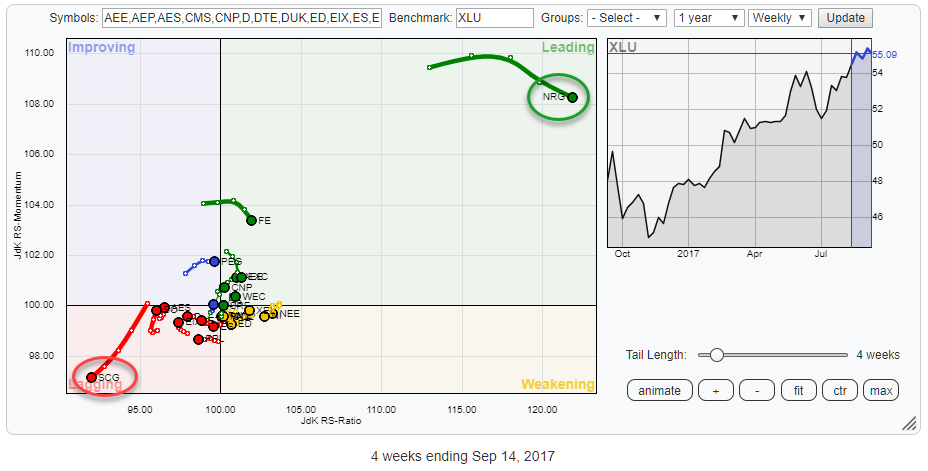

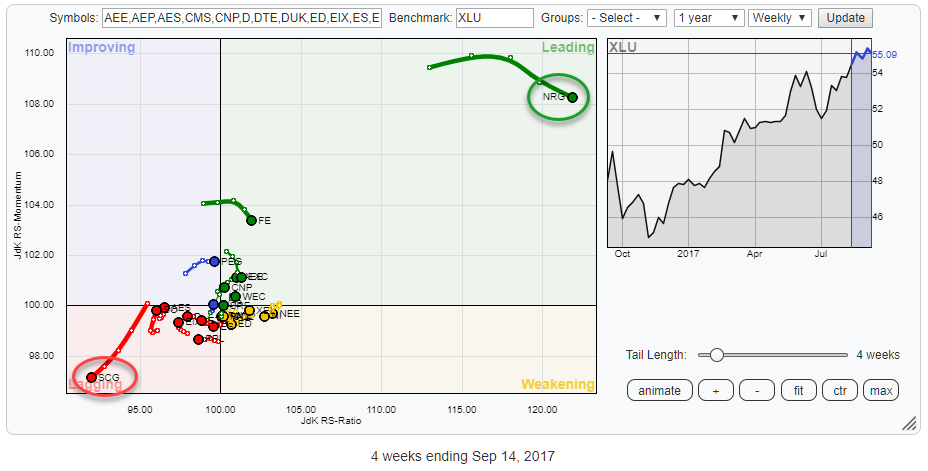

"Boring" Utilities moving up to main stage

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Bringing up the Relative Rotation Graph that holds all members of the Utilities sector (XLU) gives the picture above. With NRG all the way up in the top-right corner of the leading quadrant and SCG in the lower left-hand corner of the lagging quadrant, the remaining stocks in the sector...

READ MORE

MEMBERS ONLY

Rising Energy Prices Help Boost August CPI, British Pound Surges to Yearly High

by John Murphy,

Chief Technical Analyst, StockCharts.com

ENERGY ETF REACHES FIVE-MONTH HIGH ... It was reported Thursday that the headline CPI for August rose 0.4% from the previous month, which was its biggest monthly gain since January. That boosted its year-over-year comparison to 1.9%, which is just shy of the Fed's target of 2%...

READ MORE

MEMBERS ONLY

Finding Stocks Poised To Begin A Pre-Earnings Run Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

If only it was that easy, right? The problem many times is that a company that reports great results one quarter fails to do so the next. But my strategy is to find companies that not only reported great results in the prior quarter, but also showed major accumulation at...

READ MORE

MEMBERS ONLY

What Does a Trend Line Really Tell Us?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

We all know what a trend line is, but does a trend line actually dictate the trend? In other words, does a trend line break actually signal a trend reversal? Or, is a trend line break telling us something else? We cannot use a tool unless we fully understand it...

READ MORE

MEMBERS ONLY

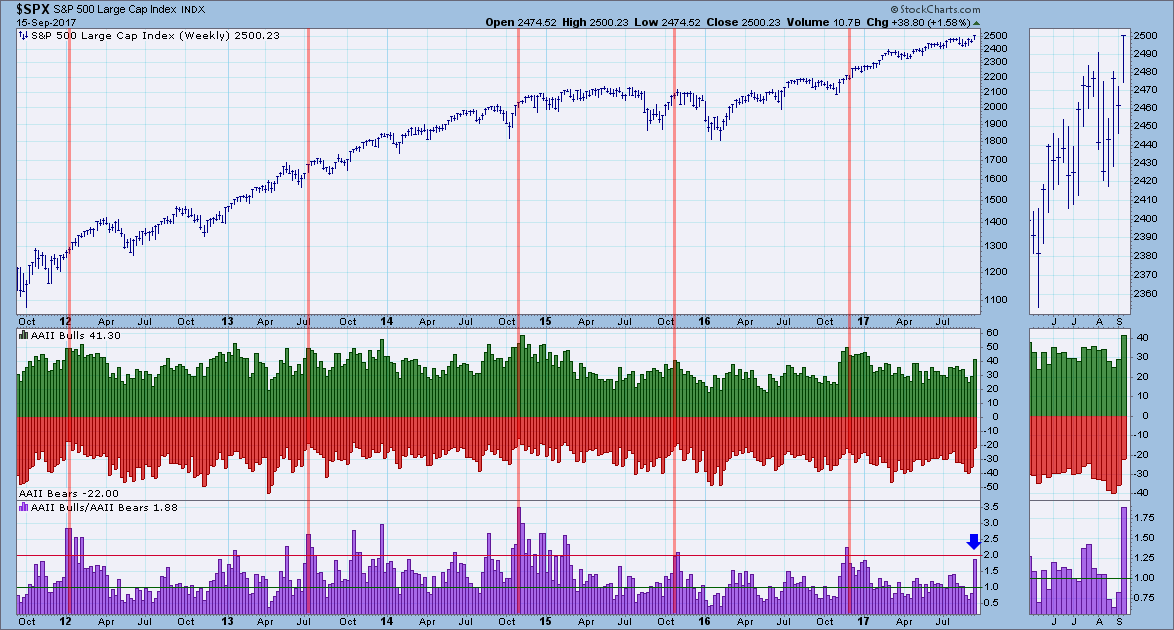

Who Do You Trust More? Active Money Managers or Individual Investors?

by Erin Swenlin,

Vice President, DecisionPoint.com

This week sentiment was mixed. Typically we see the American Association of Individual Investors (AAII) and National Association of Active Investment Managers (NAAIM) exposure index give the same message. However when I pulled up the charts to present during the sentiment segment of MarketWatchers LIVE, I saw the dissonance.

The...

READ MORE

MEMBERS ONLY

A Picture tells a Thousand Words

by John Hopkins,

President and Co-founder, EarningsBeats.com

One of the benefits of technical analysis is being able to look at a chart to help determine if a stock is a viable trading candidate. In other words, what does a technician see in a chart that would lead to the conclusion that a specific stock is or isn&...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: Climax and Options Expiration Slow Advance

by Carl Swenlin,

President and Founder, DecisionPoint.com

For a few weeks I have been expecting an upside breakout, and on Monday the breakout finally happened. The internal action on that day indicated that a buying climax had taken place, an event that very often leads to some post-climax churning or pullback. Also, this was an options expiration...

READ MORE

MEMBERS ONLY

Investor Seminar Season: Can The Speakers Walk the Talk?

by Gatis Roze,

Author, "Tensile Trading"

I attend investment seminars as half-monk, half-hit man. My time is a precious commodity, so if you are a speaker and see me in the audience, be prepared. My hot button is when speakers show a few elaborate slides, “share” their four favorite tenets to successful investing and then launch...

READ MORE

MEMBERS ONLY

RISING ENERGY PRICES HELP BOOST AUGUST CPI -- ENERGY ETF REACHES HIGHEST LEVEL IN FIVE MONTHS -- THAT'S HELPING BOOST BOND YIELDS -- SO ARE RISING YIELDS IN THE UK -- THE POUNG SURGES TO HIGHEST LEVEL IN A YEAR

by John Murphy,

Chief Technical Analyst, StockCharts.com

ENERGY ETF REACHES FIVE-MONTH HIGH ... It was reported yesterday that the headline CPI for August rose 0.4% from the previous month, which was its biggest monthly gain since January. That boosted its year-over-year comparison to 1.9%, which is just shy of the Fed's target of 2%...

READ MORE

MEMBERS ONLY

Is It Time To Buy The US Dollar?

by Martin Pring,

President, Pring Research

* A few words on sentiment

* The long-term technical remains bearish but…

* Short-term is almost bullish

* What about the euro?

* Conclusion

A few words on sentiment

The Dollar Index has been in a virtual free fall since the end of last year. No market goes down forever, because traders exhaust their...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook (w/video) - Small-caps and Energy Lead Late Summer Rally

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Small-caps Extend Newfound Leadership Role

.... AD Lines Hit New Highs

.... RSI Notches another Overbought Reading for SPY

.... IJR Continues to Grind Higher

.... Tech, Industrials, Healthcare and Materials Lead

.... XLI and XLB Extend after Breakouts

.... XLF Fully Recovers with Flag Line Break

.... XLY Puts Double Top on the Back Burner

.... XLE...

READ MORE

MEMBERS ONLY

Autos And Auto Parts Continue To Strengthen After Their Recent Breakout

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, September 14, 2017

Consumer discretionary (XLY, -0.54%) was the worst performing sector on Thursday, but you'd never know it from looking at the automobiles or auto parts stocks. The Dow Jones U.S. Automobiles & Parts Index ($DJUSAP) is featured below in the...

READ MORE

MEMBERS ONLY

After Long Basing Period, Pharmas Look To Break Out

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Sometimes the best moves higher occur after an extended period of sideways price action, or basing. We recently saw a breakout in biotechs ($DJUSBT) and that industry quickly became one of the strongest. The healthcare sector (XLV) also has been among the strongest sectors. It makes sense that other healthcare...

READ MORE

MEMBERS ONLY

DP Alert: Market Takes a Pause

by Erin Swenlin,

Vice President, DecisionPoint.com

A day passed with no signal changes for the DP Scoreboards, but also for the SPDRs and their equal-weight counterparts that DecisionPoint follows. The market is taking a short pause. I suspect with options expiration tomorrow, we will see more flat trading though with higher volume.

The purpose of the...

READ MORE

MEMBERS ONLY

RSI(5) versus RSI(10) - Working with Zones, Alerts and Price Action

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Price Characteristics and Indicator Effectiveness

There is NO SUCH thing as the perfect indicator. Further more, even if you find the almost perfect indicator, there is no such thing as the optimal setting. A 50-day SMA works great for one stock and lousy for another. 14-day RSI nails the oversold...

READ MORE

MEMBERS ONLY

All-Time High Virus Spreads; NASDAQ And Dow Jones Catch It

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, September 13, 2017

Wide participation is a key to sustaining a bull market advance. We want as many indices, sectors and stocks on a buy signal as possible. That makes it nearly impossible for bears to regain control of the market as technical buyers show up...

READ MORE

MEMBERS ONLY

It's Steady As She Goes For Global And US Equities

by Martin Pring,

President, Pring Research

* Many positive indicators

* Strong showing outside the US as well

The last time I focused on the US stock market I pointed out that I liked the fact that the market was shrugging off bad news in the form of numerous widely circulated articles calling for a correction. While not...

READ MORE

MEMBERS ONLY

DP Bulletin: PMO BUY Signal Finally Triggers on $INDU - New PMO Signals TLT, UUP - ITTM BUY Signals IWM, XLP

by Erin Swenlin,

Vice President, DecisionPoint.com

Lots of new signals today! Three important PMO signals arrived on the Dow, Bonds (TLT) and Dollar (UUP); not to mention two important Intermediate-Term Trend Model BUY signals on Russell 2000 ETF (IWM) and Consumer Staples SPDR (XLP). Feast your eyes on these charts!

First and foremost, I must talk...

READ MORE

MEMBERS ONLY

STOCK INDEXES ARE DRAWING SUPPORT FROM WEAKER PARTS OF THE MARKET -- THAT INCLUDES ENERGY, FINANCIALS, RETAILERS, SMALL CAPS, AND TRANSPORTS -- GOLD PULLS BACK FROM OVERBOUGHT CONDITION, BUT REMAINS ABOVE BREAKOUT POINT

by John Murphy,

Chief Technical Analyst, StockCharts.com

SMALL CAPS ARE RISING AGAIN ... With the three major stock indexes hitting record highs yesterday, attention remains focused on market leaders. To me, the bigger story may be the resurgence of weaker parts of the market that have been holding it back. Small caps are at the top of the...

READ MORE

MEMBERS ONLY

Texas Instruments Traces out Bullish Continuation Pattern $TXN

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Texas Instruments (TXN), the semiconductor behemoth, formed a bullish cup-with-handle pattern and a classic volume-based indicator points to a breakout. The chart shows TXN hitting resistance in the 83-84 area from June to September (red zone). In between these resistance points, the stock dipped to the 76 area in June...

READ MORE

MEMBERS ONLY

Banks Lead Follow Through Rally As They Bounce Off Key Support

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, September 12, 2017

Financials (XLF, +1.18%) were the primary beneficiary on Tuesday as treasury yields rose. That typically leads to strength in this sector, with particular strength usually seen in banks ($DJUSBK) and life insurance ($DJUSIL). Yesterday was no exception and the DJUSBK is featured...

READ MORE

MEMBERS ONLY

DP Alert: IT Trend Model BUY Signal for equal-weight Industrials ETF (RGI) - Gold & Bonds Pullback

by Erin Swenlin,

Vice President, DecisionPoint.com

No changes to the DP Scoreboards. We're just waiting on the Dow to log a PMO BUY signal. Reviewing the chart of the Dow we can see that a PMO BUY signal should trigger on the next positive close, if not sooner. Today's breakout to new...

READ MORE

MEMBERS ONLY

Dr. Henry O. (Hank) Pruden 1936-2017

by Bruce Fraser,

Industry-leading "Wyckoffian"

Technical analysis education suffered a great loss with the recent passing of Dr. Henry O. (Hank) Pruden. A consummate educator, in 1976, Hank combined his incredible capacity for inspiring students with his personal passion for Technical Market Analysis. The result was the very first graduate course, at an accredited university,...

READ MORE

MEMBERS ONLY

TDAmeritrade and Etrade Lead Broker-Dealer ETF - Delta and American Lead Airlines

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Sticking with a Strategy (IJR)

.... Finance Sector Rebounds

.... Broker-Dealer ETF Holds Up Better

.... TD Ameritrade and Etrade Lead Brokers

.... Industrials Sector Breaks Out

.... Airlines Finally Perk Up

.... Delta and American Lead Bounce

.... Cisco, Teradata and Skyworks ....

Sticking with a Strategy (IJR)

Sticking with a strategy is perhaps the hardest part...

READ MORE