MEMBERS ONLY

S&P 500 Breaks Out To All-Time High

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, September 11, 2017

It was a very bullish day on Wall Street. First and foremost, the benchmark S&P 500 rose more than 1% to close at a fresh all-time high. Its previous closing high was approximately 2481. The bulls left no doubt about this...

READ MORE

MEMBERS ONLY

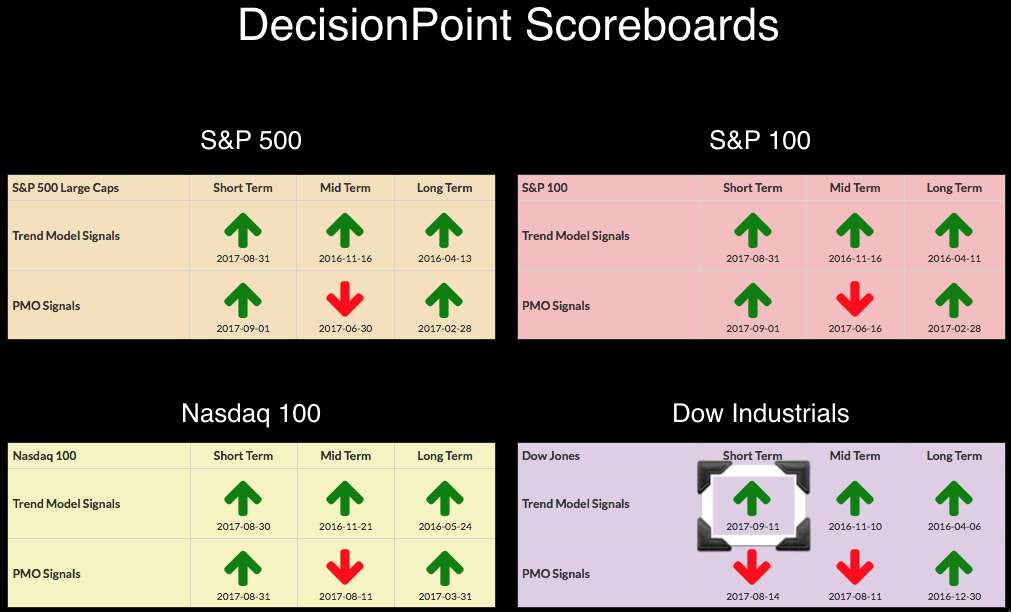

DP Bulletin: Whipsaw ST Trend Model BUY Signal on Dow Industrials ($INDU)

by Erin Swenlin,

Vice President, DecisionPoint.com

The Dow's 5/20-EMAs have been braiding and unfortunately that causes whipsaw signals. Today saw the recent 9/6 ST Trend Model Neutral signal fall away in favor of a new BUY signal. With the market hitting new all-time highs, this wasn't a surprise to anyone...

READ MORE

MEMBERS ONLY

Volatility Contracts as J&J Consolidates

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Johnson & Johnson (JNJ) appears to be ending its consolidation period with a surge and triangle breakout over the last three days. Overall, the stock is in a long-term uptrend because it hit a 52-week high in June and remains well above the rising 200-day moving average. JNJ consolidated after...

READ MORE

MEMBERS ONLY

Gurus and Experts

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Why do investors / traders like predictions? The prediction industry is not just Wall Street, there are business forecasting companies, economic analysis and forecasting, sales forecasting, on and on. However, Wall Street seems to have the least talent of the bunch. Here are some reasons I think investors / traders like predictions:...

READ MORE

MEMBERS ONLY

Bifurcated Friday Session For Major Indices, Sectors

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, September 8, 2017

The NASDAQ fell on Friday mostly due to a very weak technology sector (XLK, -0.82%). Computer hardware ($DJUSCR) tumbled as Apple (AAPL) closed well below its 20 day EMA on heavier than normal volume for the first time since its big drop...

READ MORE

MEMBERS ONLY

September StockCharts Outlook Webinar Begins At 11am EST

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Just a quick reminder that Greg Schnell and I will be hosting StockCharts Outlook webinar for September in one hour, beginning at 11am EST. Please join us if you're available. It's free and you can REGISTER HERE!

Happy trading!

Tom...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: Dollar Weak, Gold Strong

by Carl Swenlin,

President and Founder, DecisionPoint.com

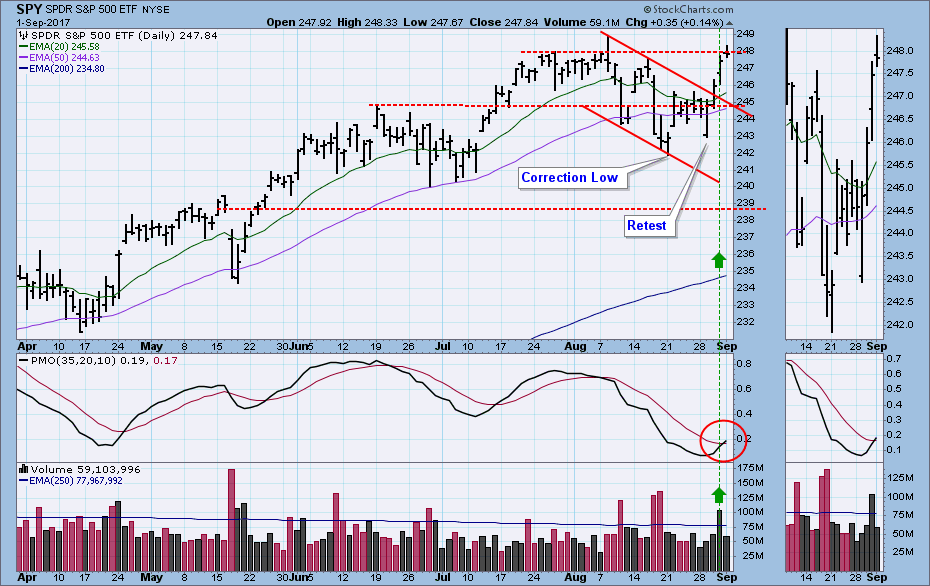

Last week there was a high-volume breakout above a declining tops line. This week price pulled back to the line, bounced somewhat higher, then moved sideways the rest of the week. S&P 500 total volume was fairly robust compared to the weaker SPY trading volume, so there was...

READ MORE

MEMBERS ONLY

How History Unlocks Deep Insights Within Today's Price and Volume Charts

by Gatis Roze,

Author, "Tensile Trading"

History matters because markets do indeed repeat themselves. John Kenneth Galbraith was interviewed in the PBS documentary, The Crash of 1929, and he observed that every 30 years or so we predictably have a major market correction because that seems to be the length of time it takes each generation...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook - New Highs Dwindle and Banks Fall Hard

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Large-techs Tower over Small-caps

.... September is a Coin Flip

.... High-Low Percent Indicators are Dragging

.... Fewer than 50% of Small-caps Above 200-day EMA

.... SPY and QQQ Hold Flag Breakouts

.... Monitoring the Upswing in IJR

.... Finance Weighs as Healthcare Leads

.... The Three Leaders (XLV, XLK and XLU)

.... XLB Breaks Out as XLI...

READ MORE

MEMBERS ONLY

Healthcare Strengthening With Medical Supplies And Pharmas Following Biotechs Lead

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Announcement

Tomorrow's StockCharts Outlook Webinar with Greg Schnell and me will be held at 11am EST. Please join us by registering HERE.

Market Recap for Thursday, September 7, 2017

Thursday's action was just further confirmation of a strengthening healthcare group (XLV, +1.11%). The group...

READ MORE

MEMBERS ONLY

Gambling Index Prints Reversing Shooting Star Candle

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Over the past six months, the Dow Jones U.S. Gambling Index ($DJUSCA) has gained 27.35% to lead all consumer discretionary groups. In fact, renewable energy ($DWCREE) is the only industry group among all sectors to outperform gambling stocks. But the short-term outlook for gamble stocks changed on Thursday...

READ MORE

MEMBERS ONLY

DP Bulletin: USO PMO BUY Signal - UUP PMO SELL Signal - XLF ITTM Neutral Signal

by Erin Swenlin,

Vice President, DecisionPoint.com

Signal changes keep coming in with three important new ones today. USO had already logged a new IT Trend Model BUY signal this week and today gets to add a PMO positive crossover BUY signal to the chart. The Dollar has struggled mightily and continues to fall so it was...

READ MORE

MEMBERS ONLY

DOLLAR INDEX DROPS TO TWO--YEAR LOW -- EURO IS TRADING OVER 120 -- WHILE CANADIAN DOLLAR HITS TWO-YEAR HIGH -- GOLD IS RISING EVEN FASTER -- GOLD SPDR MAY BE NEARING A MAJOR UPSIDE BREAKOUT -- THAT WOULDN'T BE GOOD FOR STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOLLAR INDEX FALLS TO TWO-YEAR LOW... The weekly bars in Chart 1 show the PowerShares U.S. Dollar Index ETF (UUP) falling below its 2016 bottom to the lowest level since the start of 2015. Some of that has to do with the fact that bond yields in the states...

READ MORE

MEMBERS ONLY

Market Roundup Live With Martin Pring September 2017

by Martin Pring,

President, Pring Research

Here is the link to the Market Roundup Video Recording for September 2017.

Market Round Up Live With Martin Pring September 2017 from StockCharts.com on Vimeo.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily...

READ MORE

MEMBERS ONLY

Energy Rolling Higher, But Will It Last?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, September 6, 2017

Energy (XLE, +1.63%) has been the clear leader for the U.S. stock market the past week or so, but I'm not a fan just yet of the recent bounce continuing and morphing into an uptrend. Keep in mind that...

READ MORE

MEMBERS ONLY

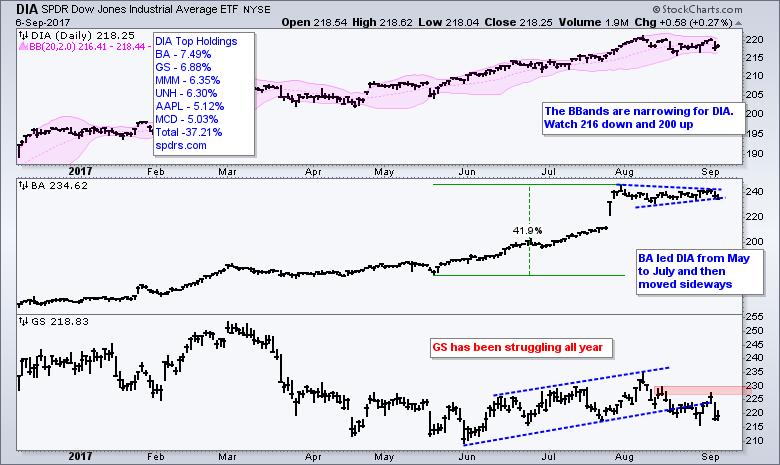

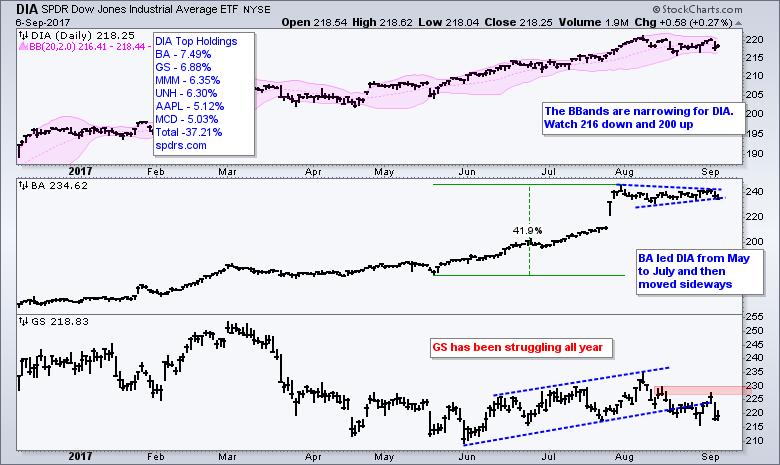

Bands Contract for DIA - QQQ Holds Breakout - Charts for Top 5 QQQ Stocks and More....

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Bollinger Bands Contract for Dow SPDR (plus BA and GS)

.... QQQ Holds Breakout Zone

.... Setting a Pullback Target for Apple

.... A Boring Uptrend for Microsoft

.... Facebook Breaks Wedge Line

.... Alphabet and Amazon are the Weakest Links

.... Mea Culpa on Intel and Target

.... Charts Worth Watching (CY, PFE, AMGN, AGU, POT)...

READ MORE

MEMBERS ONLY

DecisionPoint BULLETIN: New! IT Trend Model BUY for Oil and ST Trend Model Neutral for Dow

by Erin Swenlin,

Vice President, DecisionPoint.com

My email inbox presented two new important signals. First is the Intermediate-Term Trend Model (ITTM) BUY signal for USO. We've been watching it as it managed to find support and rallied strongly. Second is the Short-Term Trend Model (STTM) Neutral signal on the Dow Industrials. I've...

READ MORE

MEMBERS ONLY

STOCKS ENDING ON A STRONG NOTE -- AND REMAIN ABOVE MOVING AVERAGE LINES -- SAFE HAVENS LIKE BONDS, GOLD, AND YEN PULL BACK -- THREE-MONTH EXTENSION OF DEBT CEILING HELPS BOOST STOCKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS REMAIN ABOVE 50-DAY LINES... Stocks are ending the day on a strong note. Chart 1 shows the Dow Jones Industrial SPDR (DIA) remaining above its 50-day average. Chart 2 shows the S&P 500 SPDR (SPY) bouncing off its 50-day line as well. Chart 3 shows the PowerShares...

READ MORE

MEMBERS ONLY

Lowes Holds Support and Forms Potential Reversal Pattern

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Lowes (LOW) successfully tested the 71 area twice in July-August and surged above short-term resistance this week. At the risk of jumping the pattern, the two semi circles show a double bottom taking shape and a break above the August high would confirm this bullish reversal pattern. Also notice that...

READ MORE

MEMBERS ONLY

Financial Stocks Tumble Ahead Of Hurricane Irma

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, September 5, 2017

Hurricane Irma may still be well out in the Atlantic Ocean, but its bearish winds are being felt on the shores of Wall Street already. Irma is a monster and is now regarded as the most powerful Atlantic storm ever recorded and it&...

READ MORE

MEMBERS ONLY

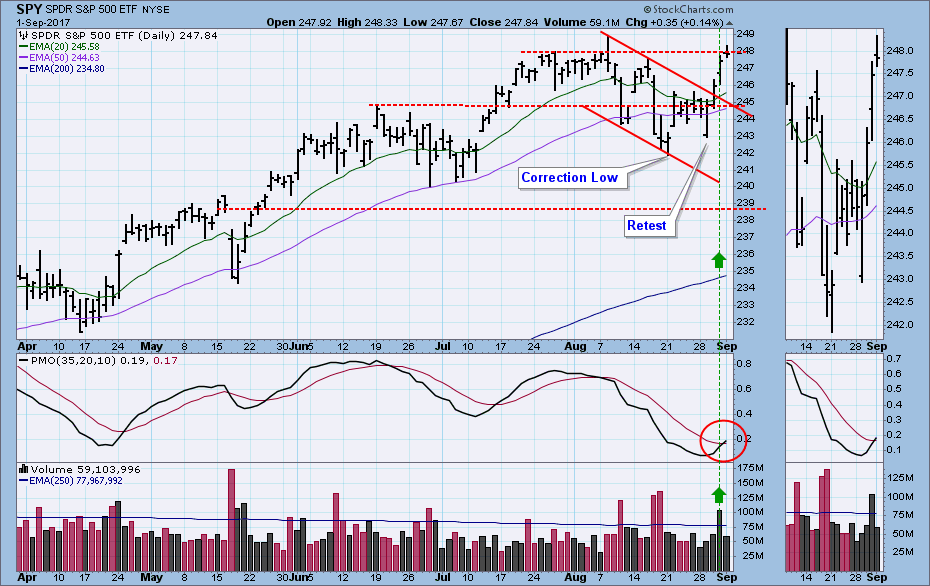

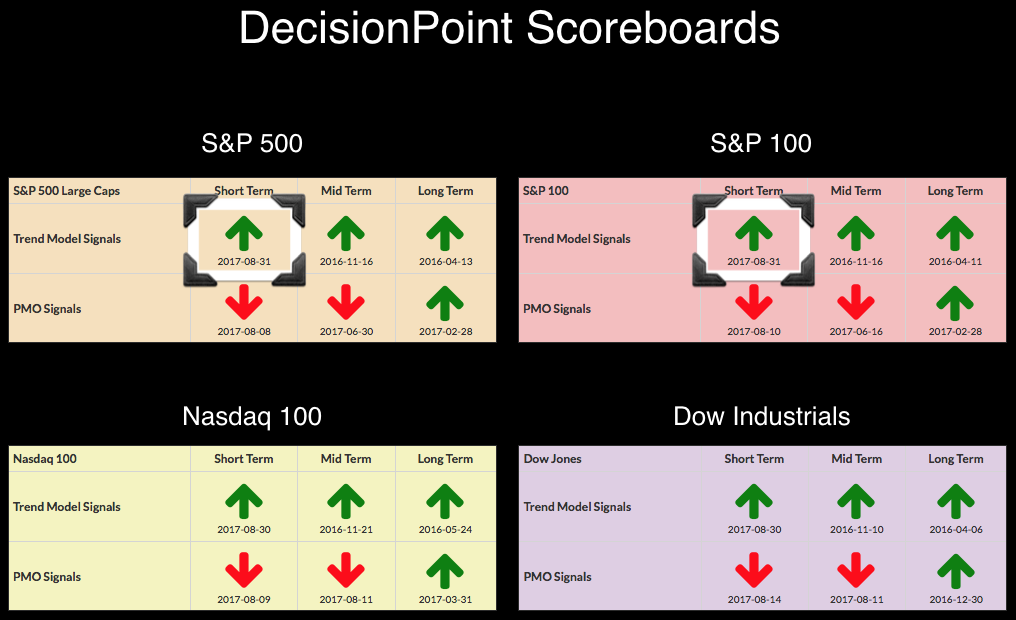

DP Alert: PMO BUY Signals on Scoreboards and SPY - Bonds Break Out, Holding Support

by Erin Swenlin,

Vice President, DecisionPoint.com

A few new Price Momentum Oscillator (PMO) BUY signals appeared on the DP Scoreboards Thursday and Friday. Friday, the SPY generated a PMO BUY signal as well. You'll note on the charts below the Scoreboards, that these three major indexes had difficult days, but price managed to stay...

READ MORE

MEMBERS ONLY

Gold And Silver Getting Close To A Major Breakout

by Martin Pring,

President, Pring Research

* Long-term technical structure looks solid

* Gold shares are solid

* Hail silver!

Back at the end of July in an article entitled Has $GOLD Got What It Takes For A Major Rally? I pointed out that gold was sporting some bullish characteristics to the extent that we would probably see a...

READ MORE

MEMBERS ONLY

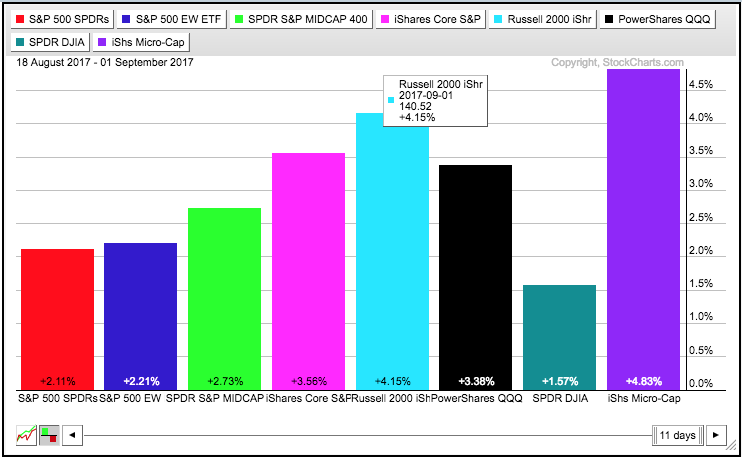

10-yr Yield Tests June Low - Correlations to the 10-yr Yield - A Breakout for Brent

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

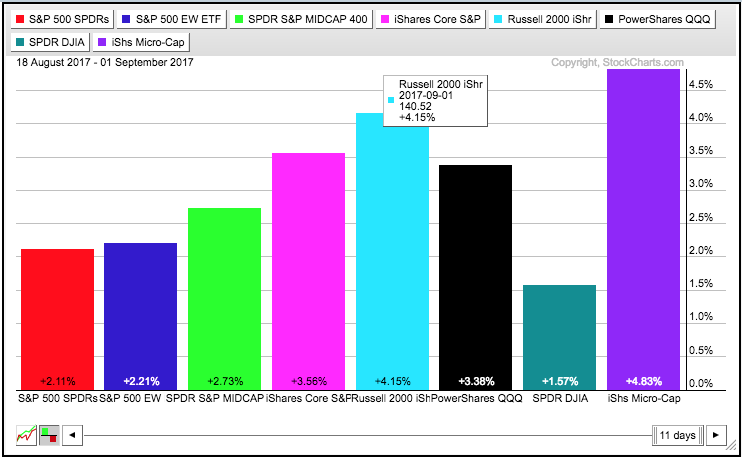

.... Small-caps Take the Short-term Lead

.... But Small-caps are Still Lagging Long-term

.... IJR Surges Toward Chandelier Exit

.... 10-yr T-Yield Firms Near June Lows

.... Correlations with the 10-yr Yield

.... Brent Stronger that WTI

.... Two Bearish Stocks and One Bull ....

There was a shift in leadership over the last two weeks with small-caps...

READ MORE

MEMBERS ONLY

Semiconductors Fail At Key Resistance, Cause NASDAQ To Fail

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, September 1, 2017

The latest government nonfarm payrolls report came and went. The number was a bit disappointing, but the U.S. stock market handled it quite well and the bond market surprisingly sold off. Normally, you'd see traders move into bonds on weak...

READ MORE

MEMBERS ONLY

Working up WDAY

by Bruce Fraser,

Industry-leading "Wyckoffian"

The Wyckoff Method is well suited to the concept of campaigning stocks. When a campaign works, a stock may be held for months to years while participating in a major uptrend. Mr. Wyckoff’s goal was to hold the campaign stock until the chart (tape) indicated selling by the large...

READ MORE

MEMBERS ONLY

Are Australian Stocks Flat or Trending Higher? - Weak USD Boosts Australian ETF

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Australia All Ords Index ($AORD) is trading well below its April-May highs and stuck in a long and tight consolidation. In contrast, the Australian iShares (EWA) hit a 52-week high in late July and remains close to this high. Which one are we to believe? Are Australian stocks lagging...

READ MORE

MEMBERS ONLY

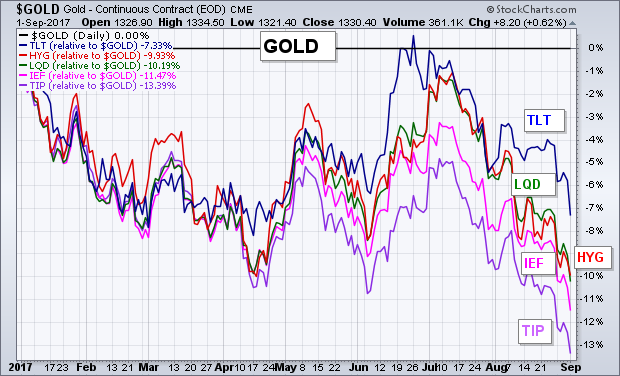

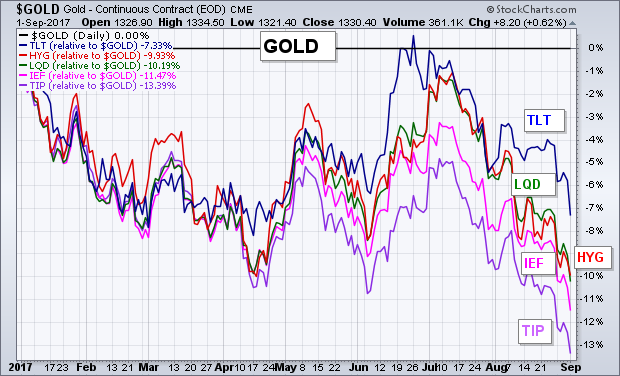

All Bond Categories Are Underperforming Gold In 2017

by John Murphy,

Chief Technical Analyst, StockCharts.com

During the week, I wrote about gold (and gold miners) achieving upside breakouts and outperforming stocks for the first time since 2011. Gold, however, is also doing better than bonds for the first time in six years. Not just some bond categories, but all of them. The chart below plots...

READ MORE

MEMBERS ONLY

GOLD IS OUTPERFORMING BOND PRICES -- THAT INCLUDES ALL BOND CATEGORIES -- GOLD/BOND RATIOS ARE BREAKING OUT TO THE UPSIDE OR ARE CLOSE TO DOING SO -- THAT SUGGESTS THAT INVESTORS ARE BUYING GOLD ASSETS AS A HEDGE AGAINST EXPENSIVE BOND AND STOCK MARKETS

by John Murphy,

Chief Technical Analyst, StockCharts.com

ALL BOND CATEGORIES ARE UNDERFORMING GOLD IN 2017... During the week, I wrote about gold (and gold miners) achieving upside breakouts and outperforming stocks for the first time since 2011. Gold, however, is also doing better than bonds for the first time in six years. Not just some bond categories,...

READ MORE

MEMBERS ONLY

Trade Strength; Here Are The Best Industry Groups In The Aggressive Sectors

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

One of my trading strategies is to trade the best stocks in the best industries at the best price. Sounds easy enough, right? But what does this mean exactly? Well, first I take a top down approach and review every industry group within each aggressive sector - technology, industrials, financials...

READ MORE

MEMBERS ONLY

Bearish Sentiment Suggests Market Will Move Higher

by Erin Swenlin,

Vice President, DecisionPoint.com

As I prepared for the MarketWatchers LIVE segment on sentiment today, I was surprised to see investors and money managers are getting very bearish. Put/Call ratios show a bearish bias as well. It is important to remember that sentiment is a "contrarian" indicator. It works a bit...

READ MORE

MEMBERS ONLY

Patience, Patience, Patience

by John Hopkins,

President and Co-founder, EarningsBeats.com

Q2 earnings season has come and gone and traders liked what they heard and saw. This is the primary reason the market has come to life, in spite of some things going on out there that might normally spook the market.

For those of you out there who don'...

READ MORE

MEMBERS ONLY

DP Weekly Wrap: Water, Water, Everywhere . . .

by Carl Swenlin,

President and Founder, DecisionPoint.com

Greg Morris gave us an article on "Fake News!" this week, and it prompted me to reflect on how much "Flood News" we have gotten: Reporters standing in water, reporters standing in front of water, reporters standing in the rain in front of water and in...

READ MORE

MEMBERS ONLY

Academics Agree: Asset Allocation is the Only Free Lunch in the Investing Arena

by Gatis Roze,

Author, "Tensile Trading"

Upfront, it’s important to note that unlike most investors who hear asset allocation and conjure up three asset baskets (stocks, bonds, cash), Tensile Trading presents an exhaustive all-inclusive buffet of 59 different asset classes from which you choose. Our book also shows to what extent each of these various...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook (w/ Video) - Tech and Healthcare Lead as Finance Lags

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... QQQ Leads with Breakout and New High

.... Higher Highs > Weakening Momentum

.... Small-caps Leading for Two Weeks

.... Tech, Utes and Healthcare Lead Sector SPDRs

.... Materials and Industrials Break Flag Lines

.... Consumer Discret. SPDR Bounces off Support

.... Financials Still Dragging

.... Regional Bank SPDR Tests 2017 Lows

.... Consumer Staples Show Internal Weakness...

READ MORE

MEMBERS ONLY

Fake News!

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I have written about how inept the news is when it comes to the financial and stock markets before. Since I am retired I am trying to wean myself from the news. It isn’t easy as I’ve been a news junky for decades. In this article, I’m...

READ MORE

MEMBERS ONLY

NASDAQ 100 Closes At All-Time High....Are We Bullish Or Bearish? That Depends On The Chart

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Note

Today marks my 2 year anniversary of writing daily articles here in Trading Places. It's spanned some 500 articles. I love what I do and am completely blessed to be able to write about something I'm very passionate about. I'd like to...

READ MORE

MEMBERS ONLY

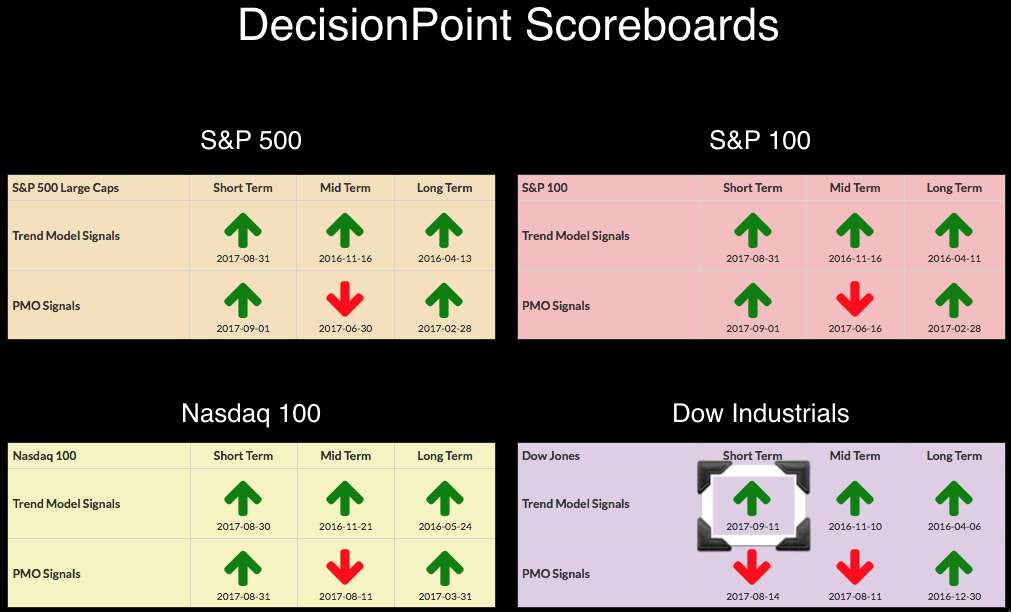

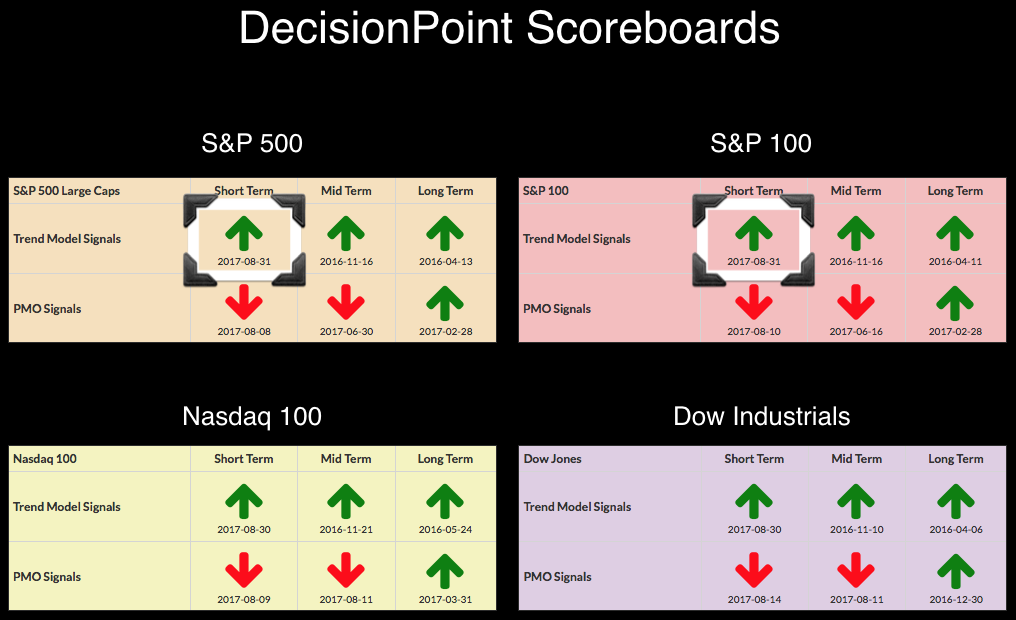

Scoreboard Indexes and "Big Four" Monthly Chart Analysis

by Erin Swenlin,

Vice President, DecisionPoint.com

It's the last day of the month so all of our monthly charts have "gone final". First, here are the DecisionPoint Scoreboards currently (you can add these to your member dashboard!). You'll note two new Short-Term Trend Model (STTM) BUY signals arrived on the...

READ MORE

MEMBERS ONLY

Growth Breaks Out Against Value As The NASDAQ Top Fails To Complete

by Martin Pring,

President, Pring Research

* NASDAQ is leading on the upside again

* The Technology/Staples ratio continues to signal the all-clear for the whole market

* Growth versus value is tipping towards growth

NASDAQ is leading on the upside again

Back in July the NASDAQ Composite was the epicenter for the coming market weakness, as it...

READ MORE

MEMBERS ONLY

STOCK INDEXES ARE ENDING AUGUST ON A STRONG NOTE -- WITH THE NASDAQ BACK IN THE LEAD -- TECHNOLOGY AND BIOTECH ETFS HIT NEW HIGHS -- HEALTHCARE IS WEEK'S STRONGEST SECTOR -- SMALL CAPS AND TRANSPORTS ARE REBOUNDING

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCKS ARE ENDING THE MONTH ON A STRONG NOTE ... Although the month of August will still go down as the weakest month of the year, stock indexes appear to be ending the month on a strong note. And all of them are showing short-term technical improvement. Chart 1, for example,...

READ MORE

MEMBERS ONLY

Auto Parts Getting Its Engine Revving; Approaching MAJOR Breakout

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I have to admit I love breakouts of long-term basing patterns and the Dow Jones U.S. Auto Parts Index ($DJUSAP) is currently in the midst of the mother of all basing patterns. Dating back to 2014, we've seen a number of price resistance tests that all finished...

READ MORE