MEMBERS ONLY

SPY returning to leading quadrant on Relative Rotation Graph!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The above Relative Rotation Graph holds some ETFs representing various asset classes and compares the against VBINX, a balanced index fund that holds 60% equities and 40% bonds.

The most striking observation is the fact that there is only one asset class on the right-hand side of the plot AND...

READ MORE

MEMBERS ONLY

The Best Industry Within The Best Sector Awaits Its Next Breakout

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

You might find it surprising, but healthcare (XLV, +15.51%) has posted the best six month performance among all sectors - even technology (XLK, +14.10%). All five industry groups within healthcare have gained 10% or more in the past six months with medical supplies ($DJUSMS, +23.32%) leading the...

READ MORE

MEMBERS ONLY

Campaigning Gold

by Bruce Fraser,

Industry-leading "Wyckoffian"

The Wyckoff Method is designed for the campaign oriented trader. Discipline, patience and vision are the skills required to conduct a bull or bear campaign from start to finish. Wyckoff provides outstanding tools for executing on such a trading orientation. Point and Figure offers a technique for estimating the extent...

READ MORE

MEMBERS ONLY

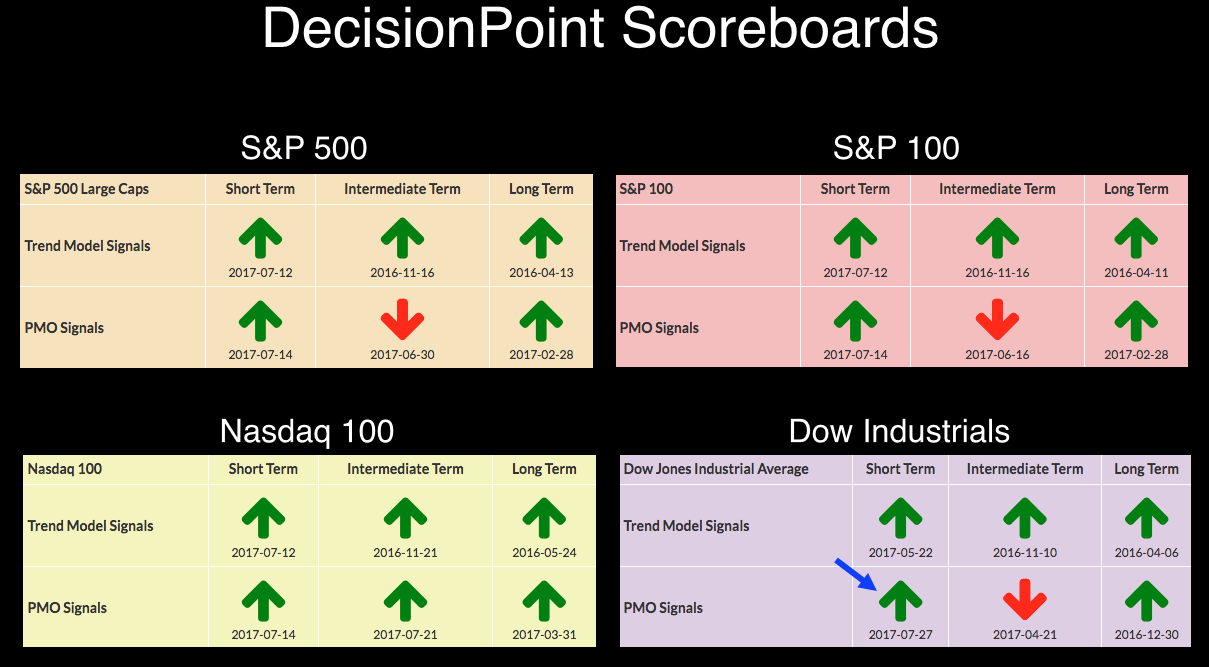

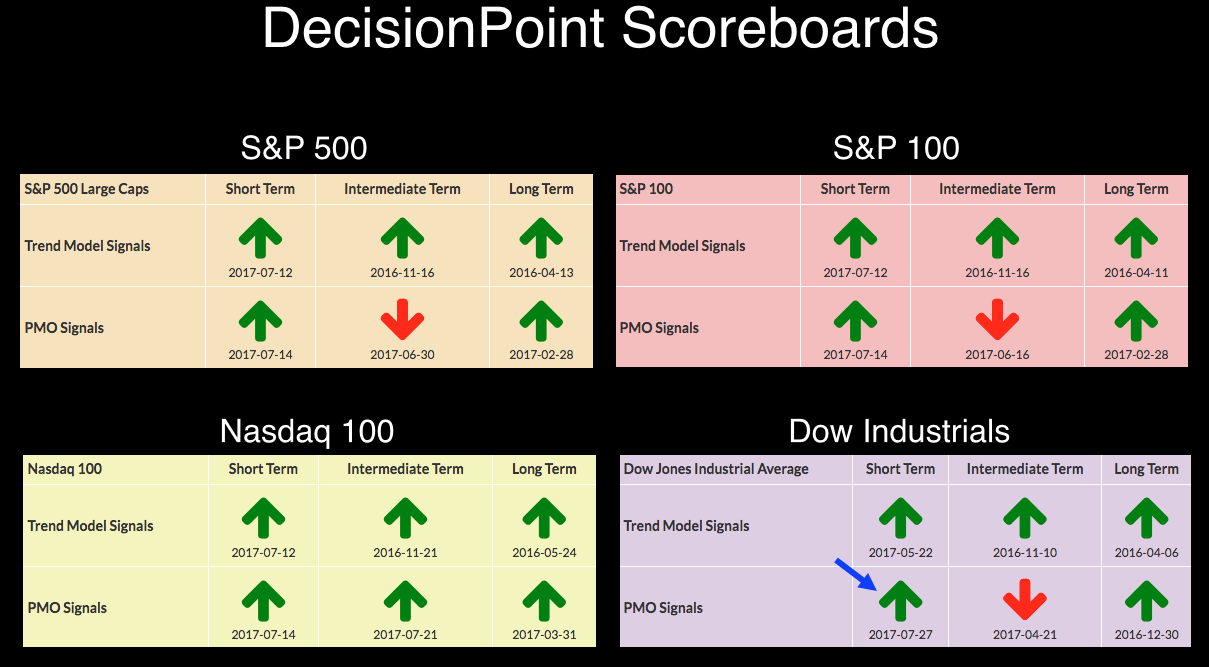

DecisionPoint Weekly/Monthly Wrap -- Possible Top

by Carl Swenlin,

President and Founder, DecisionPoint.com

There is always something for the market to wait for. Last week it was options expiration, and this week it was the Fed meeting. There was nothing new from the Fed, so there were no market hiccups as a result. SPY made new, all-time highs again this week. On Thursday...

READ MORE

MEMBERS ONLY

Charts I'm Stalking: Action Practice #19: Sector Funds & Their Top Holdings Offer Many Profitable Insights

by Gatis Roze,

Author, "Tensile Trading"

It’s hard to believe but exchange-traded funds (ETFs) have been with us now for 24 years. Who would have guessed? Perhaps John Bogle.

As a rule, investors buy Sector ETFs to smooth out the ride and decrease volatility. The classic measurement of volatility is, of course, the statistical measurement...

READ MORE

MEMBERS ONLY

FALLING DOLLAR IS BOOSTING COMMODITIES -- THAT'S POTENTIALLY INFLATIONARY -- WHILE A RISING EURO IS HOLDING EUROZONE INFLATION DOWN -- A STRONGER EURO IS STARTING TO WEIGH ON EUROPEAN STOCKS -- A LOOK AT GOLD IN DIFFERENT CURRENCIES

by John Murphy,

Chief Technical Analyst, StockCharts.com

CURRENCIES HAVE AN IMPACT ON INFLATION RATES... Persistently low inflation is worrying central bankers around the globe. Even the Fed has expressed more concern of late. Central bankers in Australia, Canada, Europe, and Japan have also mentioned low inflation as restraining them from abandoning their ultra-loose monetary policies. So far,...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook (w/ Video) - Breadth is Bullish Enough

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Market Breadth is Bullish Enough

.... New Highs Still Outpacing New Lows

.... SPY Notches another New High

.... Equal-weights Keep Pace on the Chart

.... QQQ Surges to New High

.... Majority of Sectors Confirm New Highs

.... XLY and XLK Lead Recent Surge

.... Regional Banks Weigh on Finance Sector

.... 10-yr T-Yield Makes Breakout Attempt...

READ MORE

MEMBERS ONLY

Amazon Disappoints, Techs Look To Head Lower

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, July 27, 2017

The mostly unabated rise in technology shares off the early July low took a sudden turn lower on Thursday afternoon and the initial reactions to quarterly earnings reports from Amazon.com (AMZN) and Starbucks (SBUX) won't help this morning as they&...

READ MORE

MEMBERS ONLY

Tractor Supply May Have Set A Bottom

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The NASDAQ 100 has been quite strong in 2017, but it's not because of Tractor Supply's (TSCO) performance. TSCO had lost one third of its market value from the beginning of the year through early July, but a positive divergence emerged and that suggested that downside...

READ MORE

MEMBERS ONLY

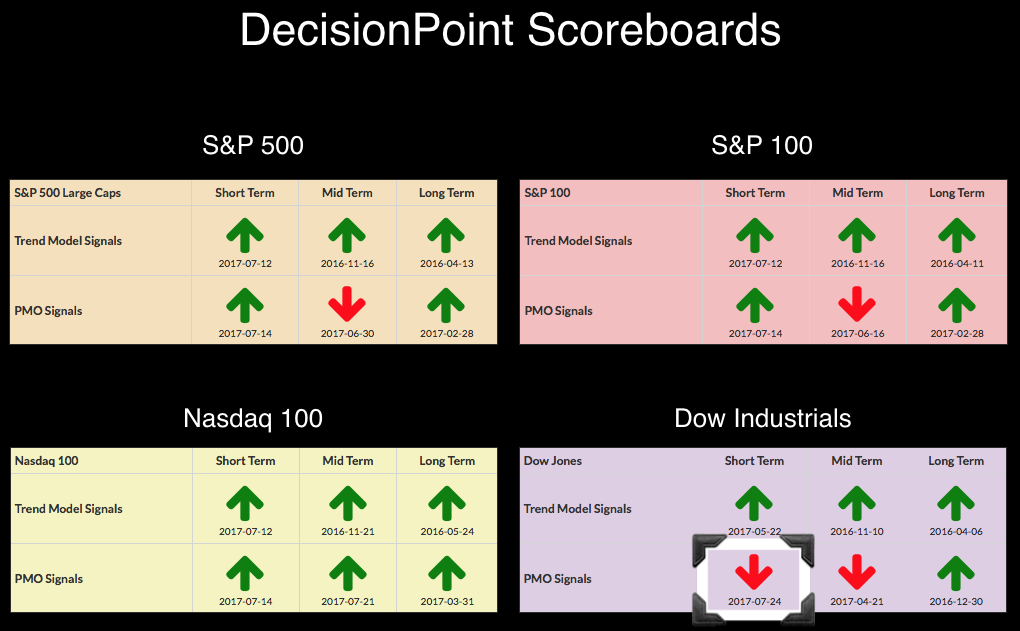

DP Bulletin: Dow Industrials ($INDU) Trigger PMO BUY Signal

by Carl Swenlin,

President and Founder, DecisionPoint.com

Today the Dow Industrials ($INDU) PMO signal changed from a SELL to a BUY.

The just retired SELL signal was only three days old because the daily PMO is currently very flat and close to its signal line. In this configuration the PMO is subject to frequent whipsaw signal changes....

READ MORE

MEMBERS ONLY

TRANSPORTS AND TECHS ARE HAVING A BAD DAY -- AIRLINES ARE DOWN 4% -- UPS IS ALSO HAVE A BAD DAY -- NASDAQ 100 IS SUFFERING DOWNSIDE REVERSAL ON SELLING OF BIG TECH STOCKS -- THAT INCLUDES APPLE AND GOOGLE -- SEMICONDUCTORS ARE ALSO TURNING SHARPLY LOWER

by John Murphy,

Chief Technical Analyst, StockCharts.com

TRANSPORTATION ISHARES FALL BELOW 50-DAY LINE... After hitting a new record earlier in the month, transportation stocks are being sold pretty hard today . Chart 1 shows the Transportation Average iShares (IYT) plunging 3% to the lowest level in nearly two months. The IYT has also fallen back below its 50-day...

READ MORE

MEMBERS ONLY

Transportation Services Ready To Breakout, Ryder Trucking Along

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, July 26, 2017

The small cap Russell 2000 index struggled, finishing down 0.56% on Wednesday's session, but it was another day of record high closes elsewhere as the Dow Jones, S&P 500 and NASDAQ all advanced. The FOMC provided its latest...

READ MORE

MEMBERS ONLY

Customizing CandleGlance with 6 Homebuilders, Diamonds are Not Bearish and 3 Asian ETFs Poised for an Upturn

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Steady Uptrends for Six Homebuilder Stocks

.... Flags, Throwbacks and Diamonds (plus DHI)

.... Several Asia Markets Hit New Highs

.... Philippines, Malaysia and Indonesia ETFs Turn Up ....

Steady Uptrends for Six Homebuilder Stocks

CandleGlance charts are great for comparing price charts of related stocks. Chartists can enter up to 12 symbols in...

READ MORE

MEMBERS ONLY

U.S. DOLLAR INDEX IS NEARING POTENTIAL MAJOR SUPPORT NEAR 2016 LOWS -- ELLIOTT WAVE ANALYSIS SUGGESTS DOLLAR UPTREND IS INCOMPLETE AND MAY HAVE FURTHER TO RUN -- THAT WOULD CALL INTO QUESTION A LOT OF CURRENT INTERMARKET TRENDS

by John Murphy,

Chief Technical Analyst, StockCharts.com

A LOT IS RIDING ON DOLLAR DIRECTION... After hitting a 14-year high at the end of 2016, the U.S. Dollar Index has lost 8% during 2017. A lot of that slide came from disappointment in the so-called Trump reflation trade which was supposed to boost the U.S. economy,...

READ MORE

MEMBERS ONLY

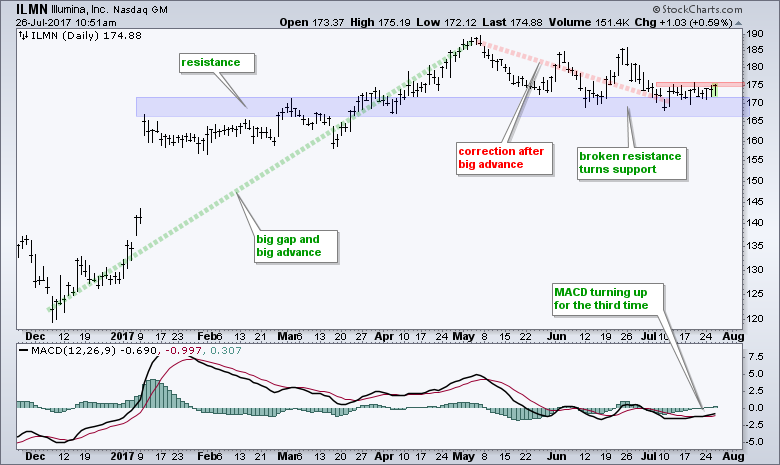

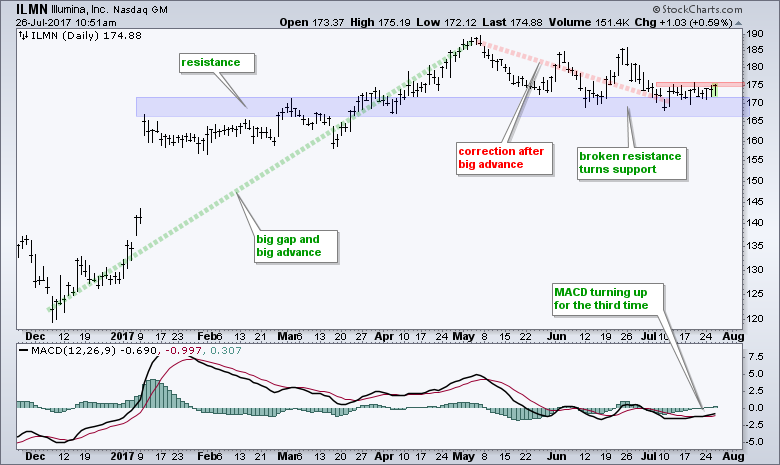

Illumina Makes a Bid to End its Correction

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Biotech stocks are leading the market with the Biotech iShares (IBB) and Biotech SPDR (XBI) hitting 52-week highs this week. Even though Illumina (ILMN) is lagging its benchmarks a bit, it is firming at support and could be poised to end its correction. The chart shows ILMN advancing from 120...

READ MORE

MEMBERS ONLY

Copper And Oil Surge; Materials Among Leaders

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, July 25, 2017

Energy shares (XLE, +1.26%) received another boost when crude oil prices ($WTIC) surged on Tuesday to close at $47.89 per barrel (+3.34%), its highest close in nearly two months. While the crude oil spike extends a very nice rally off...

READ MORE

MEMBERS ONLY

Erin's Hits: Customizing Gallery View Charts

by Erin Swenlin,

Vice President, DecisionPoint.com

** While Erin is away, we will be posting some of her "greatest hits" educational blogs. Some information may be dated **

One of the features that I used frequently on the DecisionPoint.com website was Gallery View in the ChartTool. I was happy to learn that you can not...

READ MORE

MEMBERS ONLY

US Equities Reach Critical Point In Their Battle With The Rest Of The World

by Martin Pring,

President, Pring Research

* The US versus the world

* Two reasons why US equities are likely to underperform

* What does the rest of the world say?

I have been writing for some time that, notwithstanding the inevitable but unpredictable near-term correction, the US market is in good technical shape and likely to work its...

READ MORE

MEMBERS ONLY

BOND YIELDS MAY BE BOTTOMING -- RISING OIL AND METAL PRICES MAY ALSO BE BOOSTING YIELDS -- COPPER STOCKS LEAD RALLY IN MINERS -- RISING BOND YIELDS ARE BOOSTING BANKS AND OTHER FINANCIAL STOCKS -- RISING YIELDS MAY BE HURTING TECHS

by John Murphy,

Chief Technical Analyst, StockCharts.com

BOND YIELDS MAY BE BOTTOMING... Bond yields are jumping today. Their chart patterns also suggest that yields may be bottoming. Chart 1 shows the 10-Year US Treasury YIeld ($TNX) jumping 6 basis points today to push it back above its (red) 200-day average. The trendline drawn over its May/July...

READ MORE

MEMBERS ONLY

SPY Hits Another New High - Are Rates Turning Up? - Regional Banks Lead Market Higher

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Long-term Uptrends Resume (SPY)

.... Back in the Saddle without News

.... Are Rates Turning Up and Bonds Turning Down? ($TNX, TLT, IEF)

.... Regional Banks Surge (plus USB, FITB, ZION)

.... Vulcan Materials and Martin Marietta Turn Up ....

Long-term Uptrends Resume (SPY)

Stocks resumed their long-term uptrends with solid advances over the last...

READ MORE

MEMBERS ONLY

Banks Bounce Off Support, Financials Lead

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, July 24, 2017

It was another bifurcated session as the more aggressive NASDAQ and Russell 2000 led while the Dow Jones and S&P 500 took a breather. That's been the theme of late and as long as the more aggressive indices lead,...

READ MORE

MEMBERS ONLY

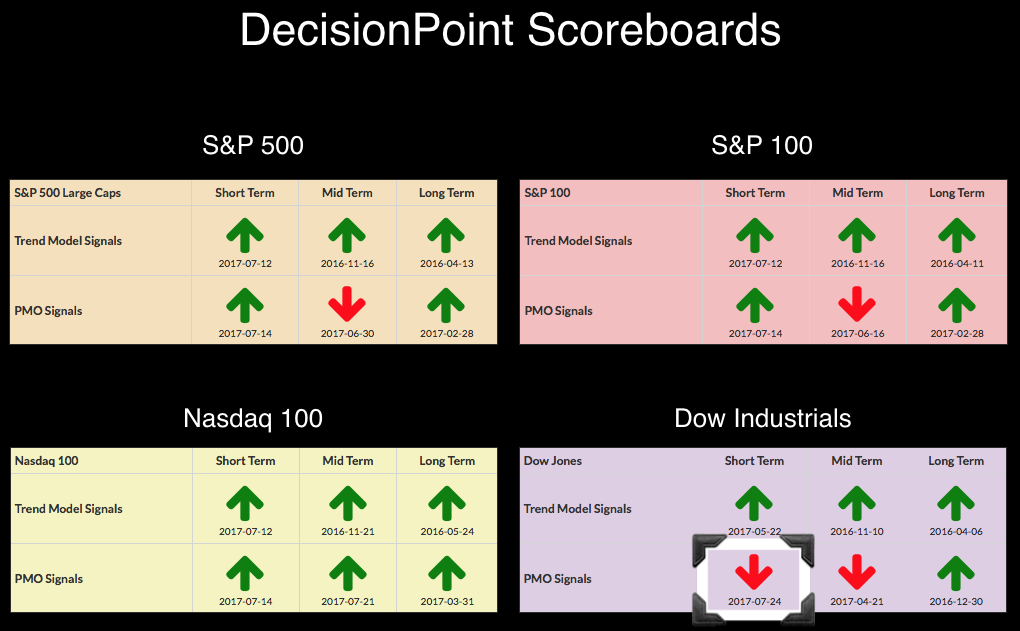

DP Bulletin: Dow Industrials ($INDU) Trigger PMO SELL Signal

by Erin Swenlin,

Vice President, DecisionPoint.com

Today the Dow Industrials ($INDU) lost its recent PMO BUY signal from 7/14 and has logged a PMO SELL signal on the DP Scoreboard. The chart is below.

It looks like a short-term double-top in the thumbnail. Support is holding at 21500, but this recent PMO SELL signal and...

READ MORE

MEMBERS ONLY

U.S. Stocks Finish A Strong Week With A Flat Friday

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, July 21, 2017

Friday was definitely a boring kind of day, but the bulls will generally take boring - especially after a nice push higher and a huge slate of earnings about to be released this week. While all of our major indices finished Friday on...

READ MORE

MEMBERS ONLY

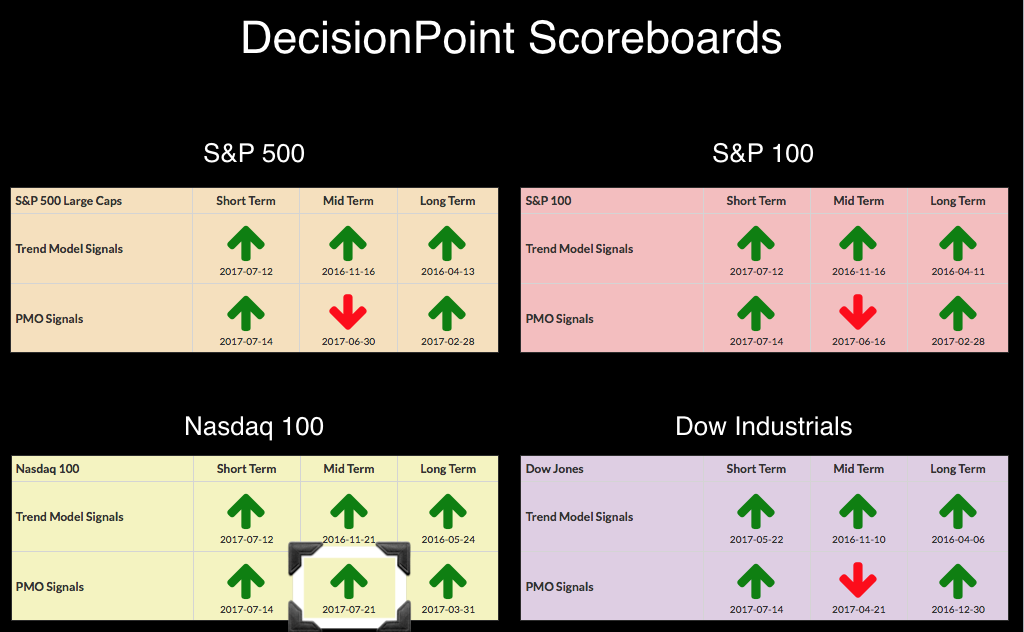

DP Bulletin: NDX Triggers IT PMO BUY Signal - Equal-Weight Consumer Discretionary (RCD) IT Trend Model BUY Signal

by Erin Swenlin,

Vice President, DecisionPoint.com

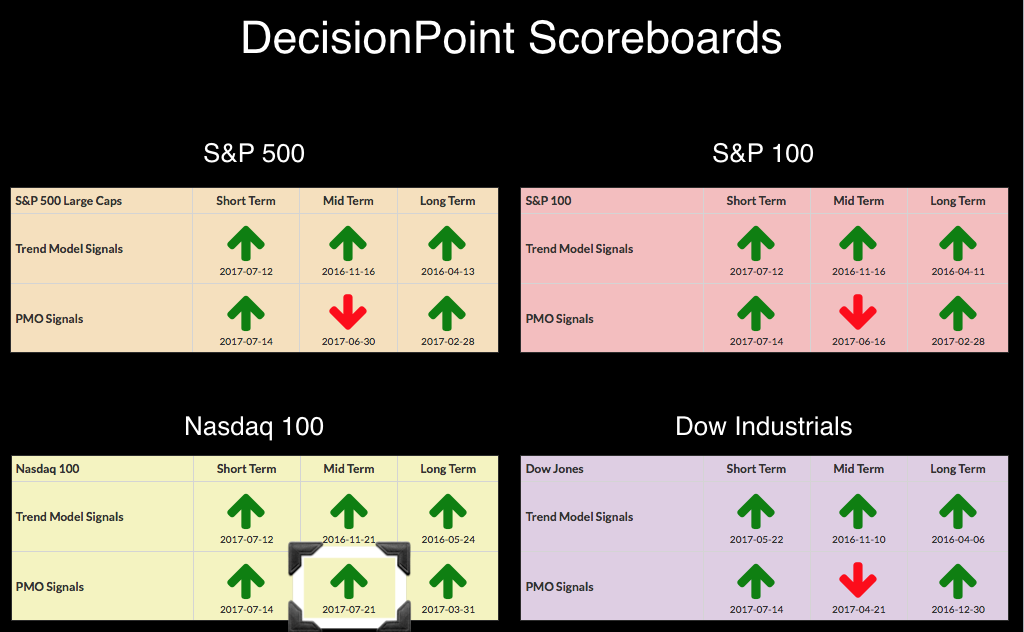

Today the Nasdaq 100 Scoreboard turned completely green. Well, it lost the only red arrow it was clinging to on the intermediation-term Price Momentum Oscillator (PMO). The equal-weight Consumer Discretionary ETF (RCD) also triggered a new Intermediate-Term Trend Model (ITTM) BUY signal. The charts are below for your review.

With...

READ MORE

MEMBERS ONLY

The Hustling Russell

by Bruce Fraser,

Industry-leading "Wyckoffian"

Wyckoffians need to stay flexible and be willing to change their minds. It is an acquired skill to re-analyze charts with fresh eyes. We should practice this each day. Recently we studied the mid-capitalization and the small-capitalization indexes (click here for a link to the post). Here let’s re-analyze...

READ MORE

MEMBERS ONLY

DecisionPoint Weekly Wrap -- Another Breakout to New, All-Time Highs

by Carl Swenlin,

President and Founder, DecisionPoint.com

Last week the market broke out of a month-long rounded top to new, all-time highs. This week there was a short snapback to the point of breakout, then on Wednesday it once again broke to new, all-time highs. Thursday and Friday it again pulled back to the point of breakout....

READ MORE

MEMBERS ONLY

New ChartPack (Q2 - 2017) Providing Timely Tradeable Insights to Help You Invest Smarter

by Gatis Roze,

Author, "Tensile Trading"

Remember the bygone advertisements from years past about hair replacement? The gentleman stares into the camera and says “I’m not just the president of the Men’s Hair Club, but I am also a client.” Our ChartPack deserves a similar endorsement. “I’m not just the creator of the...

READ MORE

MEMBERS ONLY

DP Alert: SPY Closes on All-Time High - Utilities ETFs ITTM BUY Signals - PMO BUY Signal on Gold

by Erin Swenlin,

Vice President, DecisionPoint.com

No new changes on the DecisionPoint Scoreboards although I happen to know there is an intermediate-term PMO BUY signal waiting in the wings on the NDX. That signal will not go final until after Friday's trading. Utilities SPDR (XLU) and the equal-weight Utilities ETF (RYU) both garnered IT...

READ MORE

MEMBERS ONLY

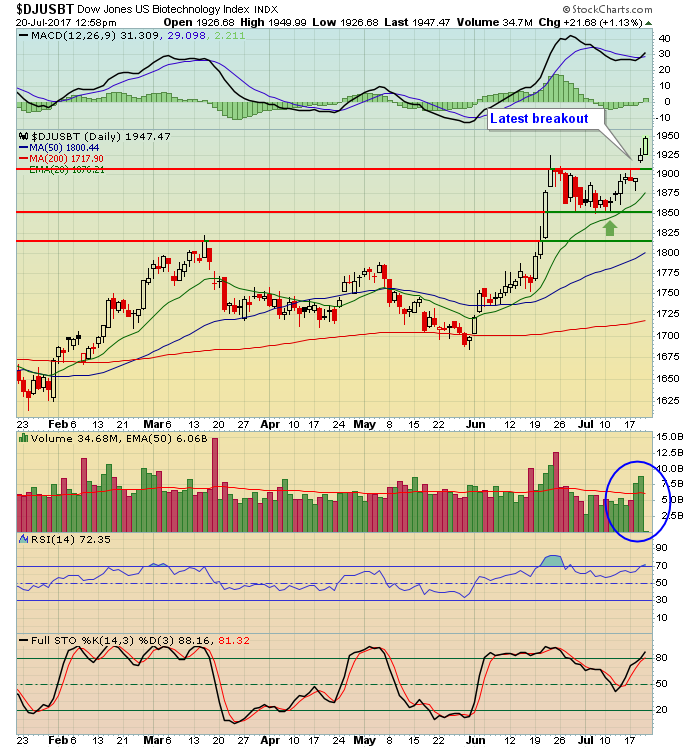

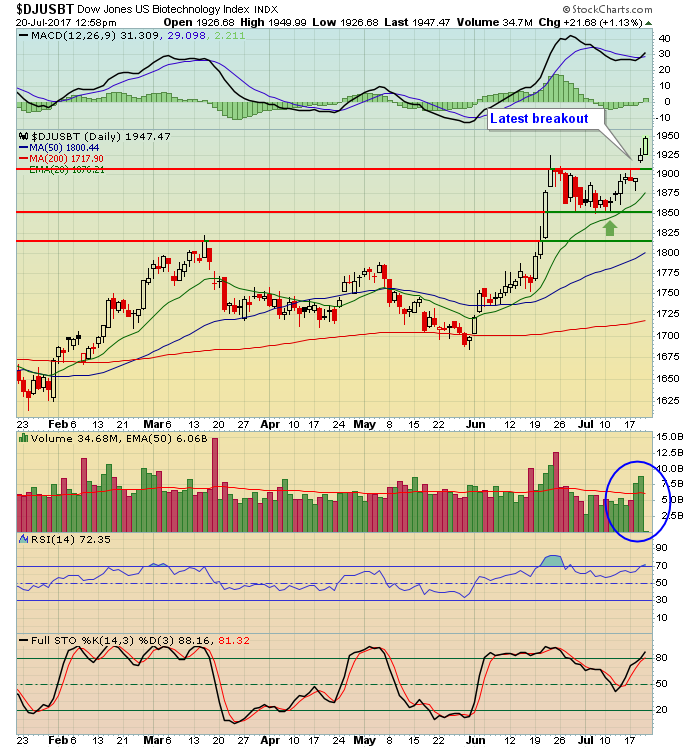

Biotechs Surge Again To New Highs

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Biotechnology stocks ($DJUSBT) are among the best performing stocks since the beginning of June with an approximate 16% gain over the past seven weeks. It's not unusual for biotechs to remain on a tear for an extended period of time so pullbacks should be considered for entry. The...

READ MORE

MEMBERS ONLY

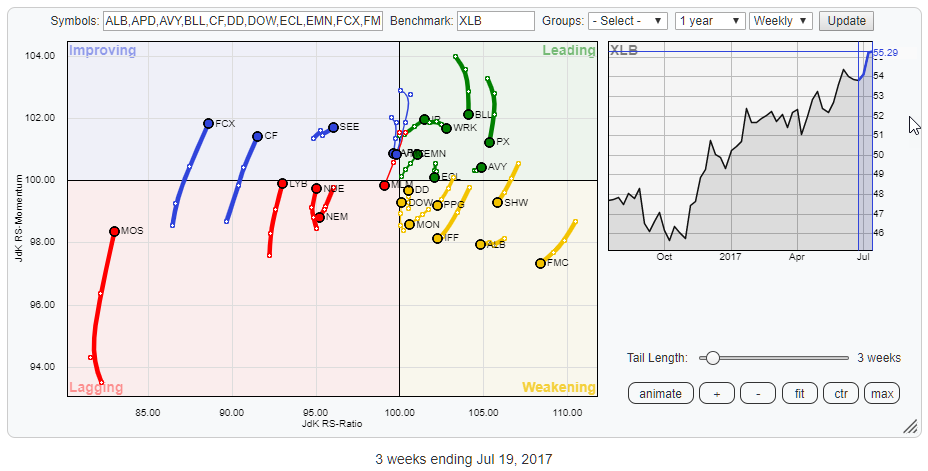

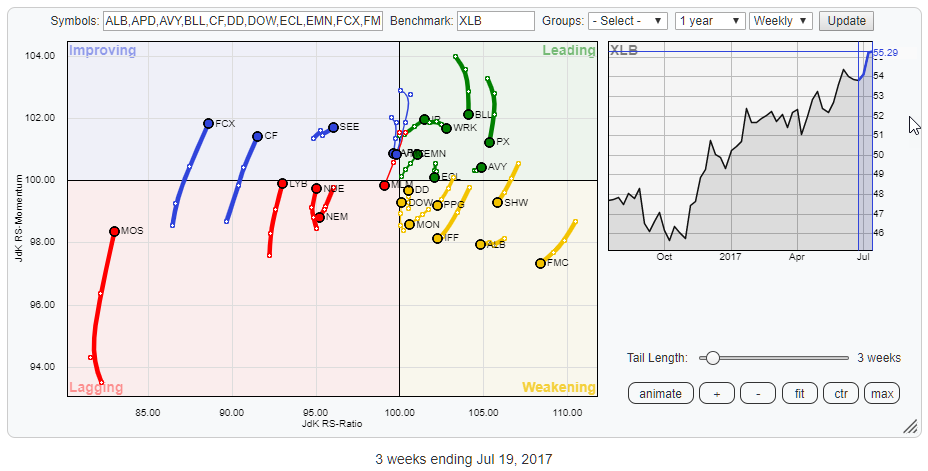

What's going on in Materials? (XLB)

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph above holds the constituents of the Materials sector (XLB). The picture shows a fairly evenly distributed pattern with no real stocks standing out, maybe with the exception of MOS as it has the longest tail of all stocks on the graph while being at the lowest...

READ MORE

MEMBERS ONLY

Coal And Renewable Energy Surge To Lead U.S. Equities To Fresh Highs

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, July 19, 2017

Energy (XLE, +1.46%) and materials (XLB, +0.96%) led the major U.S. indices to all-time highs on Wednesday, with particular strength in coal ($DJUSCL) and renewable energy ($DWCREE), which rose 6.36% and 3.08%, respectively. The former's strength...

READ MORE

MEMBERS ONLY

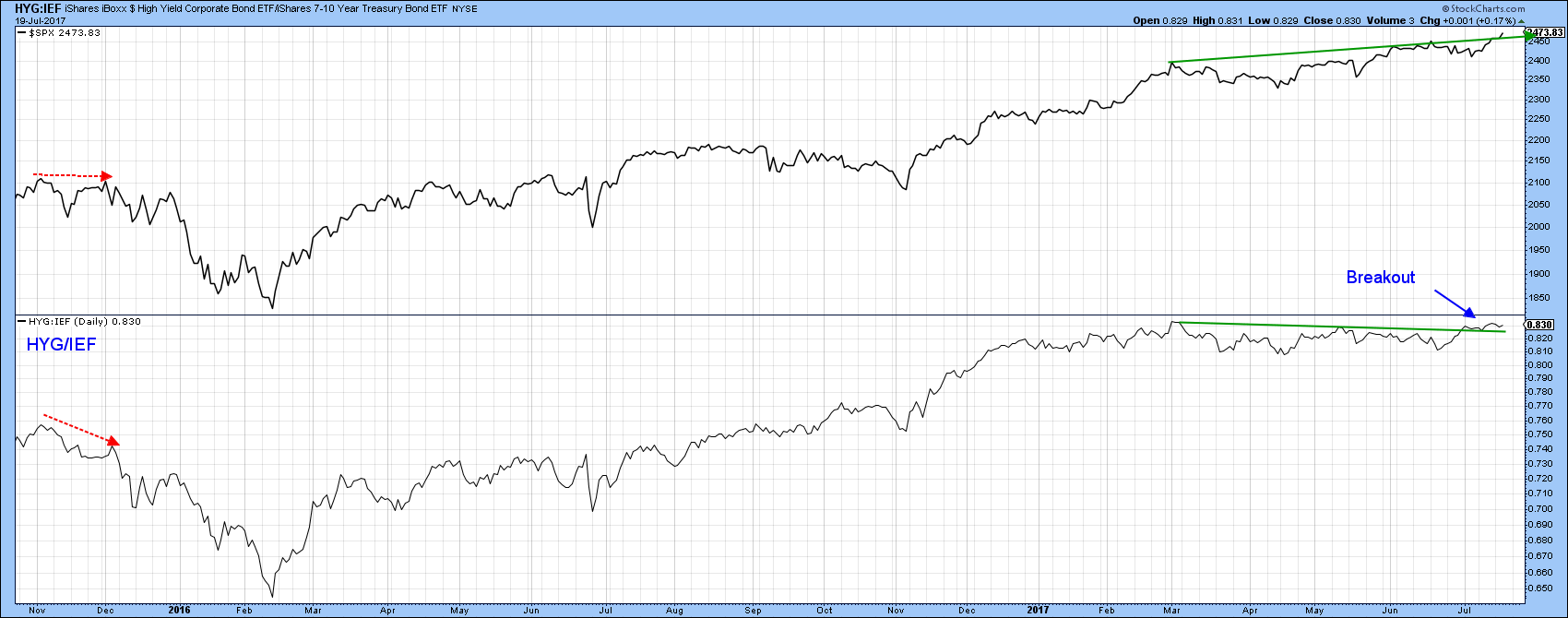

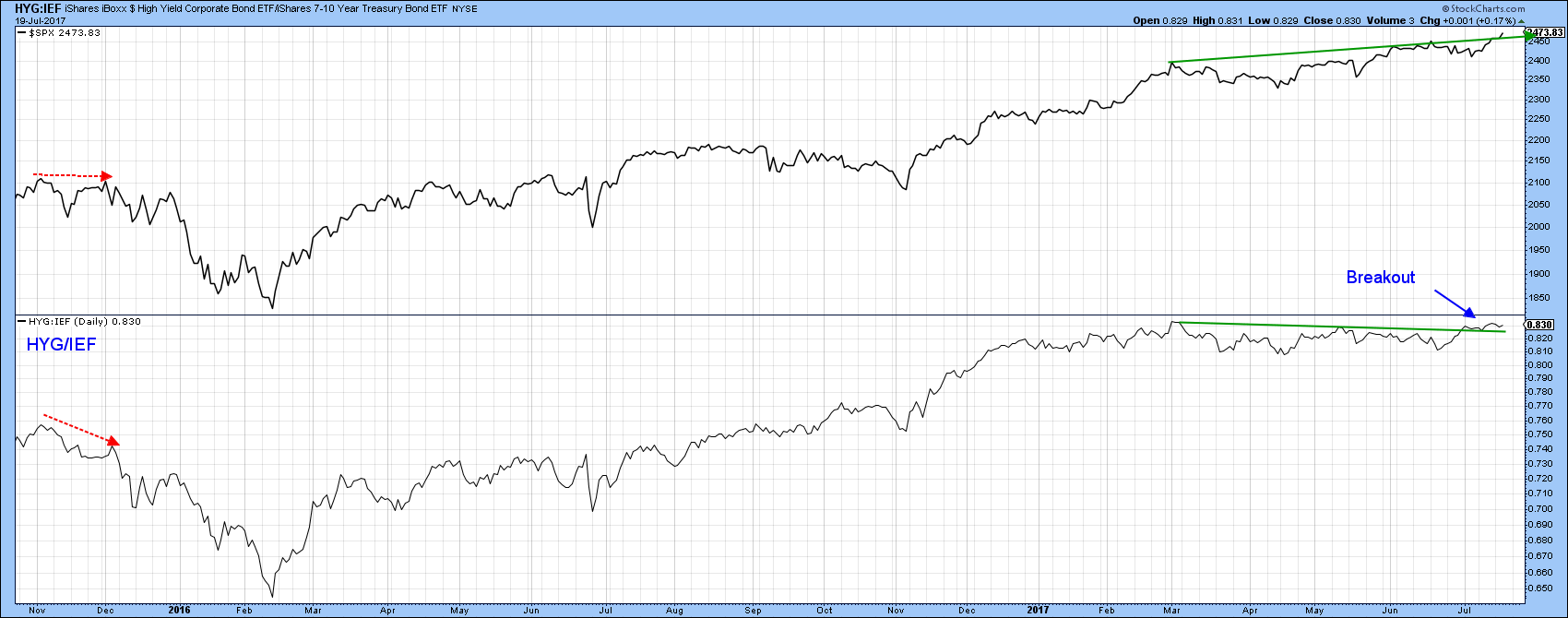

Confidence Indicators And Small Caps Point To Higher Stock Prices

by Martin Pring,

President, Pring Research

* What is a confidence indicator?

* Credit Spreads to the rescue

* Equity market spreads

* Growth versus Value

* Small caps: Are we there yet?

Washington may be suffering from acute dysfunction but Wall Street doesn’t seem to care, or perhaps knows something that we mere mortals do not. Failure to agree...

READ MORE

MEMBERS ONLY

WEAK DOLLAR HELPS BOOST EMERGING MARKETS -- EM CURRENCIES AND STOCKS ARE RISING TOGETHER -- THIS ISN'T A COMMODITY STORY -- IT'S A TECHNOLOGY ONE -- TECHNOLOGY STOCKS IN ASIA ARE DRIVING THE EM RALLY -- FALLING TREASURY YIELDS ARE ALSO HELPING

by John Murphy,

Chief Technical Analyst, StockCharts.com

FALLING DOLLAR BOOSTS EMERGING MARKET CURRENCIES... One of my recent messages explained that a weak dollar was contributing to money flows into foreign markets. That's because American investors get the dual benefit of rising foreign currencies as well as stocks. That's been especially true in emerging...

READ MORE

MEMBERS ONLY

Internet Stocks Break Out, Lead Technology And NASDAQ

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, July 18, 2017

It was a rough June for technology stocks and, more specifically, internet stocks ($DJUSNS), but they've both rebounding during an exceptional July. It appears that traders have re-entered this space in anticipation of very strong upcoming quarterly earnings reports. It'...

READ MORE

MEMBERS ONLY

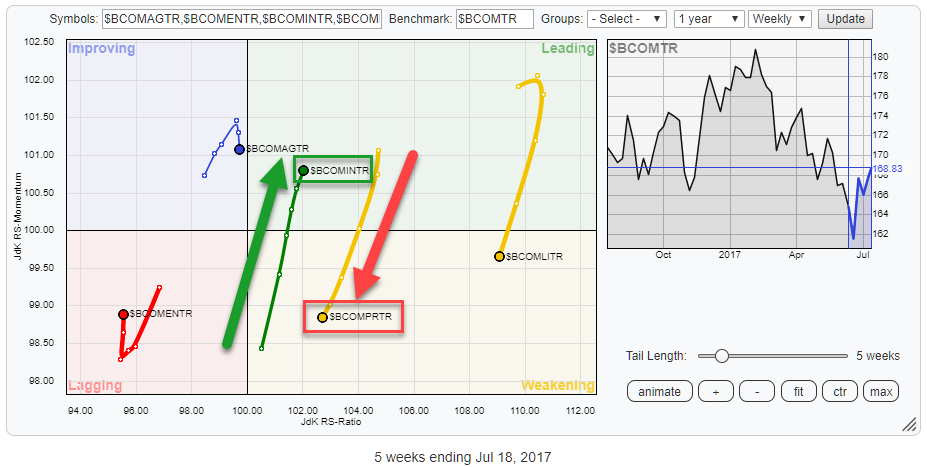

Which metals hold the most value at the moment?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

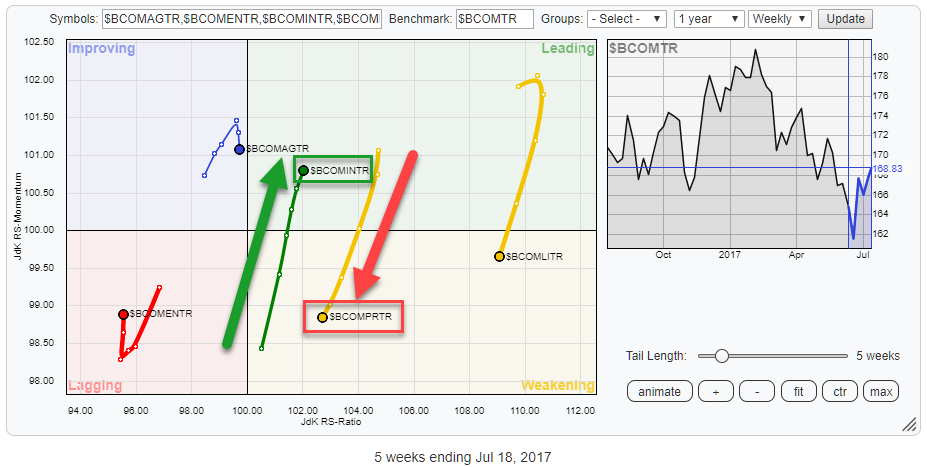

The above Relative Rotation Graph holds the main commodity groups (BCOM family) and uses the Bloomberg Commodity Index as the benchmark.

The opposite directions in the rotations of Industrial metals ($BCOMINTR) and Precious metals ($BCOMPRTR) stand out for me.

As they are both on the right-hand side of the graph...

READ MORE

MEMBERS ONLY

DP Alert: All-Time Highs Create New Support Level for SPY

by Erin Swenlin,

Vice President, DecisionPoint.com

No new changes to report on the DecisionPoint Scoreboards, although if you didn't read about it last Friday, we did see FOUR new PMO BUY signals on all four indexes. The only "red" on the Scoreboards are on the IT PMO signals which are found on...

READ MORE

MEMBERS ONLY

Small Stocks Close At Fresh All-Time High

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, July 17, 2017

It seems that every major U.S. index is taking its turn at all-time highs and on Monday small cap stocks stepped up to the plate, closing at 1431.60, its highest close ever. It's interesting because it did so on...

READ MORE

MEMBERS ONLY

WHY Standard Deviation is a Poor Measure of Risk

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I will attempt to show that high sigma is a much more frequent event than modern finance thinks it is. A few examples using the Dow Industrials back to 1885 on a daily basis are shown. Each begins with determining a look-back period to determine the average daily return and...

READ MORE

MEMBERS ONLY

STRONG ECONONIC NEWS IN CHINA BOOSTS BASE METALS -- MINING ETFS ARE HAVING A STRONG DAY -- SO ARE IRON ORE MINERS BHP BILLITON AND RIO TINTO -- CHINA MAY IMPORT MORE AGRICULTURAL COMMODITIES TO OFFSET SHORTAGES -- HIGHER FOOD PRICES MAY BE IN THE PIPELINE

by John Murphy,

Chief Technical Analyst, StockCharts.com

CHINESE ECONOMY EXCEEDS EXPECTATIONS... China's economy grew by 6.9% during the second quarter which exceeded market expectations. That's one of the explanations behind today's jump in industrial metals like copper, iron ore, and zinc. Mining stocks that produce those commodities are also having...

READ MORE

MEMBERS ONLY

Long Awaited Bank Earnings Were A Dud.....Or Were They?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, July 14, 2017

JPMorgan (JPM), Citigroup (C), PNC Financial (PNC) and Wells Fargo (WFC) were a formidable sample of bank stocks ($DJUSBK) reporting earnings last Friday and it was set up to be a very interesting trading day - to see if the huge run up...

READ MORE