MEMBERS ONLY

Long Awaited Bank Earnings Were A Dud.....Or Were They?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, July 14, 2017

JPMorgan (JPM), Citigroup (C), PNC Financial (PNC) and Wells Fargo (WFC) were a formidable sample of bank stocks ($DJUSBK) reporting earnings last Friday and it was set up to be a very interesting trading day - to see if the huge run up...

READ MORE

MEMBERS ONLY

Texas Roadhouse Might Whet Your Appetite

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

When money begins rotating to defense in a big way, I look for topping patterns in the market. But when we're in the midst of a full-fledged bull market - as we are now - I'd much rather search for stocks in bullish continuation patterns. That...

READ MORE

MEMBERS ONLY

Bond Yields Drop, Falling Rates Boost Technology Stocks

by John Murphy,

Chief Technical Analyst, StockCharts.com

BOND YIELDS DROP ON LACK OF INFLATION ... June's CPI report showed no change from the previous month, reflecting the absence of inflation. Its annual gain of 1.6% was the smallest since last October. Excluding food and energy, the core CPI saw a modest monthly bounce of 0....

READ MORE

MEMBERS ONLY

Risks Associated with Earnings Reports

by John Hopkins,

President and Co-founder, EarningsBeats.com

Q2 Earnings Season is underway with 4 of the nations largest banks reporting their numbers Friday and thousands of companies getting ready to report over the next few weeks.

Earnings season brings with it both the highs and lows of trading. We'll see companies that beat expectations and...

READ MORE

MEMBERS ONLY

Go Away In May? Let's Try July

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

As a stock market historian, if there's one thing that really annoys me, it's the talking heads saying to "go away in May". While the May through October period is clearly less bullish than its November through April counterpart, there are loads of reasons...

READ MORE

MEMBERS ONLY

DecisionPoint Weekly Wrap -- Dollar In Trouble

by Carl Swenlin,

President and Founder, DecisionPoint.com

Rounded top, schmounded top. This week the market couldn't have cared less as it broke through to new, all-time highs. The headline regarding the dollar is not exactly news, but the dollar is getting particularly weak. More on that below.

The DecisionPoint Weekly Wrap presents an end-of-week assessment...

READ MORE

MEMBERS ONLY

Point & Figure Diary

by Bruce Fraser,

Industry-leading "Wyckoffian"

Regular readers have been following the epic saga dating back to 2011, when Dr. Hank Pruden published his Point and Figure (PnF) count for the new bull market. This count projected to a range of 17,600 to 19,200 for the Dow Jones Industrial Average ($INDU). When this objective...

READ MORE

MEMBERS ONLY

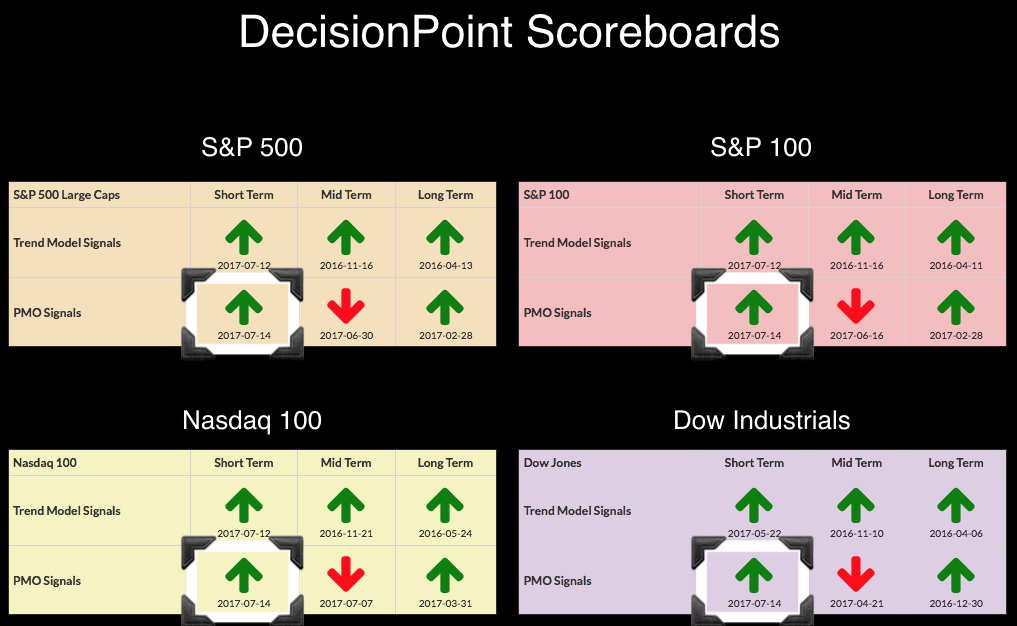

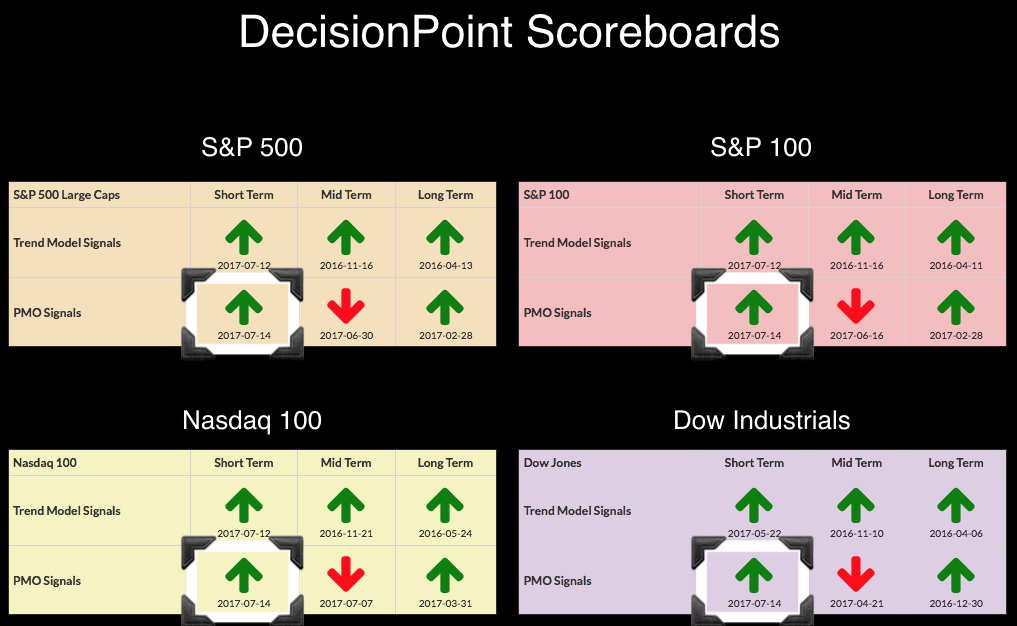

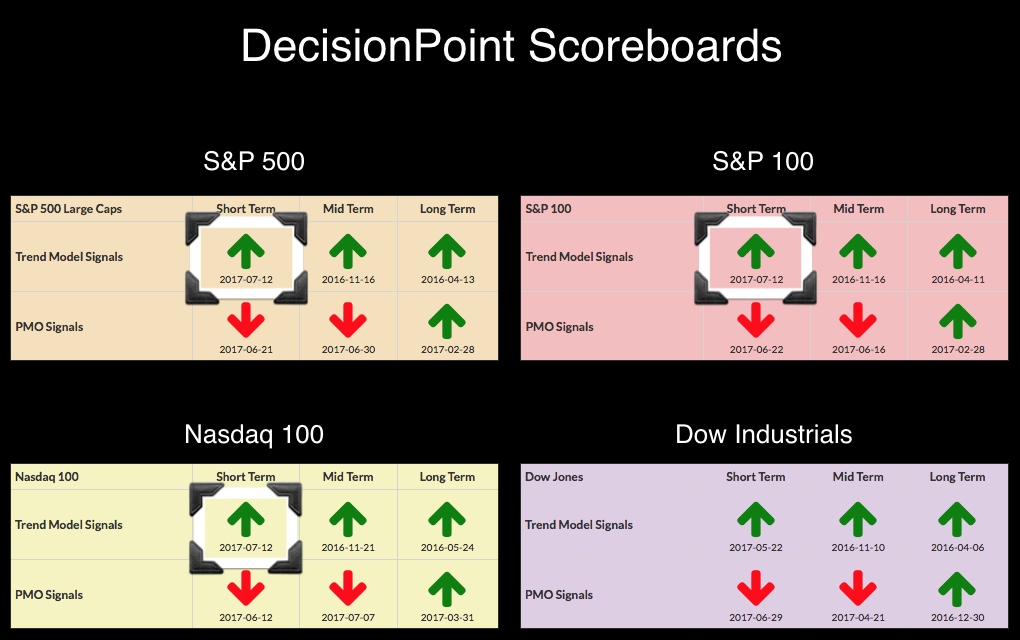

DP Bulletin: FOUR New Short-Term PMO BUY Signals on All Scoreboards

by Erin Swenlin,

Vice President, DecisionPoint.com

There were four new Short-Term PMO BUY signals generated on the DecisionPoint Scoreboards today. The new signal summary is below as well as the charts for your review. Have a great weekend!

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Trend Models

Price Momentum Oscillator (PMO)

On Balance...

READ MORE

MEMBERS ONLY

Update on Sentiment - AAII, NAAIM and Rydex Ratio

by Erin Swenlin,

Vice President, DecisionPoint.com

On Fridays during the MarketWatchers LIVE show (12:00p - 1:30p EST), I do a regular segment that checks what weekly sentiment charts are telling us. Three of the best sentiment charts from DecisionPoint are the American Association of Individual Investors (AAII) sentiment poll, the National Association of Active...

READ MORE

MEMBERS ONLY

100% of Investors from Lake Wobegon Are Above Average

by Gatis Roze,

Author, "Tensile Trading"

Ninety percent (90%) of Americans believe that they are above average drivers. Multiple studies have corroborated this impossibility over the years. I’m certain that the equivalent surveys of American investors would yield a similar fanciful number.

It reminds me of Garrison Keillor’s radio show featuring Lake Wobegon — the...

READ MORE

MEMBERS ONLY

ANOTHER WEAK CPI REPORT BOOSTS BONDS AND STOCKS -- BOND YIELDS DROP ON EXPECTATIONS FOR LESS AGGRESSIVE FED -- RISING BOND YIELDS CAN BE BAD FOR TECHNOLOGY STOCKS -- FALLING DOLLAR REDUCES NEED TO HEDGE FOREIGN CURRENCY RISKS

by John Murphy,

Chief Technical Analyst, StockCharts.com

BOND YIELDS DROP ON LACK OF INFLATION ... June's CPI report showed no change from the previous month, reflecting the absence of inflation. Its annual gain of 1.6% was the smallest since last October. Excluding food and energy, the core CPI saw a modest monthly bounce of 0....

READ MORE

MEMBERS ONLY

Large Banks Kick Off Earnings Season

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, July 13, 2017

Financials (XLF, +0.60%) rebounded to lead the market action on Thursday, in anticipation of large bank earnings scheduled to be reported this morning. The Dow Jones U.S. Banks Index ($DJUSBK) remains in a strong technical pattern, but has room to the...

READ MORE

MEMBERS ONLY

DP Alert: Indicators Looking Bullish in Short and Intermediate Terms - XLU Triggers IT Trend Model Neutral Signal

by Erin Swenlin,

Vice President, DecisionPoint.com

No changes on the DecisionPoint Scoreboards. They all look the same which might be a little confusing given the bifurcated market we have witnessed over the past few weeks. While most indexes are testing all-time highs, the NDX needs more help and today it couldn't get past the...

READ MORE

MEMBERS ONLY

CANADA RATE HIKE BOOSTS CURRENCY BUT WEAKENS STOCKS WHICH ARE WEAKEST IN G7 -- HIGHER COMMODITIES PRICES COULD HELP -- LIVESTOCK PRICES ARE RISING -- DROUGHT IN THE MIDWEST AND RAIN IN GERMANY BOOST GLOBAL WHEAT PRICES -- FOOD AND SERVICES BOOST JUNE PPI

by John Murphy,

Chief Technical Analyst, StockCharts.com

CANADA RATE HIKE BOOSTS THE LOONIE... Canada warned that it was about to hike rates, and did it yesterday for the first time in seven years. The Bank of Canada raised its short-term policy rate 25 basis points to 0.75%. That's still below the rate of 1....

READ MORE

MEMBERS ONLY

Global Stocks Break To The Upside

by Martin Pring,

President, Pring Research

1. Some Global Equity Markets Getting Lift-off Again

2. US equities trying to follow the global lead

3. Relative trends favor emerging and Europe

4. Technology poised to move higher

In terms of price, global equities have been in a corrective mode since late May, but now appear to be...

READ MORE

MEMBERS ONLY

Equities Surge On Dovish Fed Remarks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, July 13, 2017

Fed Chair Janet Yellen provided the Fed's semiannual monetary policy to the House Financial Services Committee on Wednesday morning, just prior to the opening of the stock market and both the bond market and stock market loved what it heard. The...

READ MORE

MEMBERS ONLY

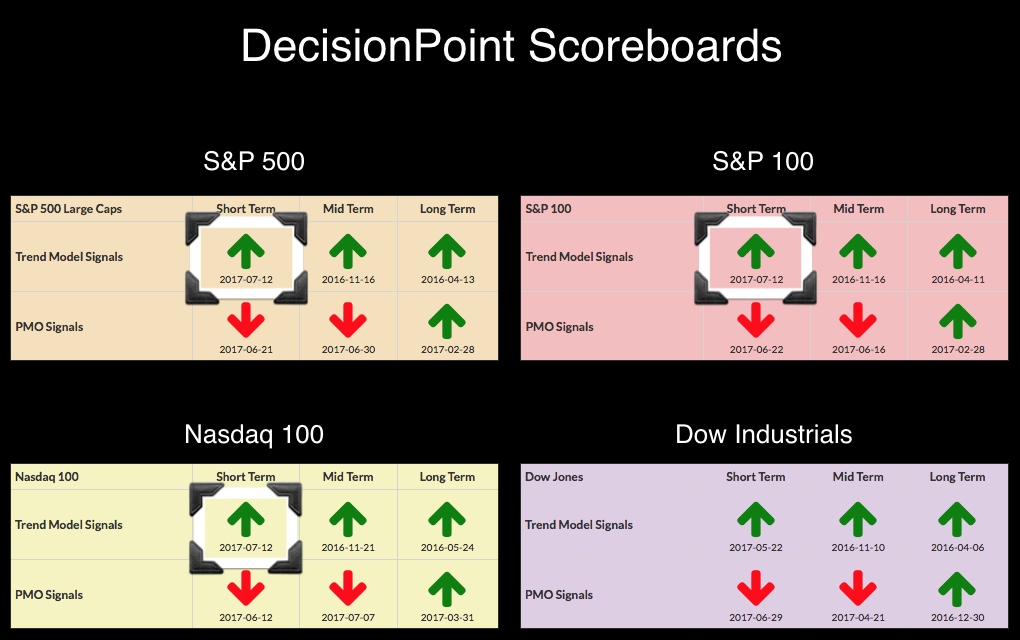

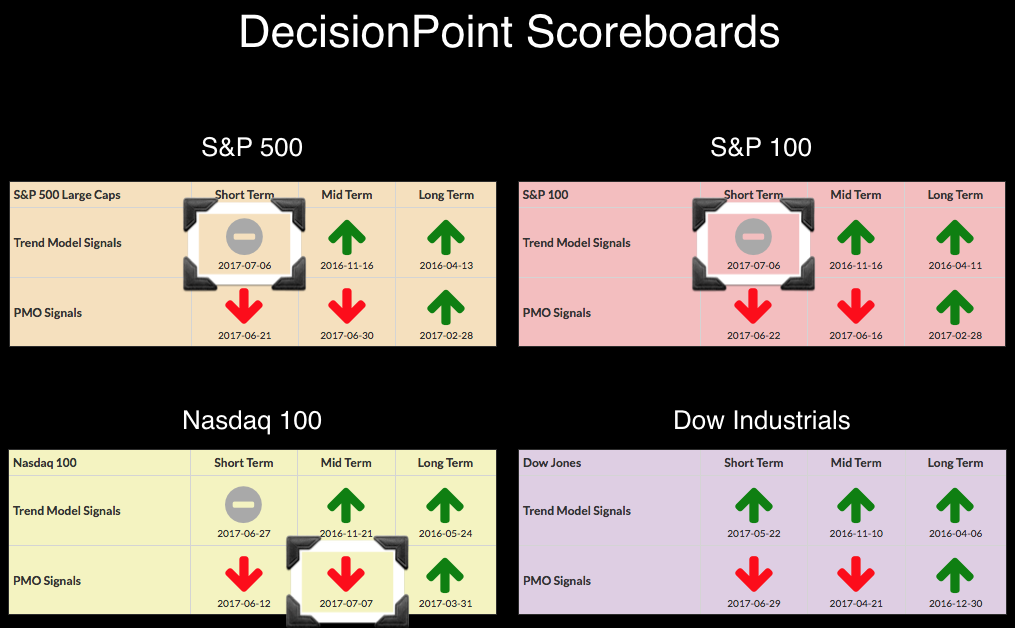

Short-Term Trend Model Whipsaws Plague DecisionPoint Scoreboards

by Erin Swenlin,

Vice President, DecisionPoint.com

Yet again, more whipsaw on the DecisionPoint Scoreboards. The Short-Term Trend Model (STTM) is highly sensitive given that it is based on 5/20-EMA crossovers. However, the main problem we have is consolidation. Price hit all-time highs, but has continued to meander sideways. This will draw the EMAs together and...

READ MORE

MEMBERS ONLY

BONDS AND STOCKS LIKE DOVISH SOUNDING FED -- LOW INFLATION IS KEEPING THE FED CAUTIOUS -- A WEAKER DOLLAR MAY BE HELPING COMMODITIES -- LONG-TERM CHARTS SUGGEST THAT COMMODITIES MAY BE BOTTOMING -- DROUGHT CONDITIONS BOOST GRAIN PRICES

by John Murphy,

Chief Technical Analyst, StockCharts.com

FALLING DOLLAR MAY GIVE FED A HAND... Bonds and stocks are reacting very positively to written comments by Janet Yellen before Congress today. Her comments are being interpreted as being more dovish than anticipated, owing mainly to Fed concerns about persistently low inflation. It's hard for the Fed...

READ MORE

MEMBERS ONLY

Financials Hit Resistance And Weaken As Yields Fall

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, July 11, 2017

Only two of nine sectors - energy (XLE, +0.54%) and technology (XLK, +0.22%) were able to finish in positive territory on Tuesday. Given that overall weakness, it was interesting to see that only one of our major indices lost ground (S&...

READ MORE

MEMBERS ONLY

Article Summaries - 3-2017 to 6-2017

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Periodically I write an article that reviews the past few months of articles. Why on Earth would I do this? Primarily for two reasons. One is that many new readers are involved and often they do not go back and look at the past articles. Two is that my articles...

READ MORE

MEMBERS ONLY

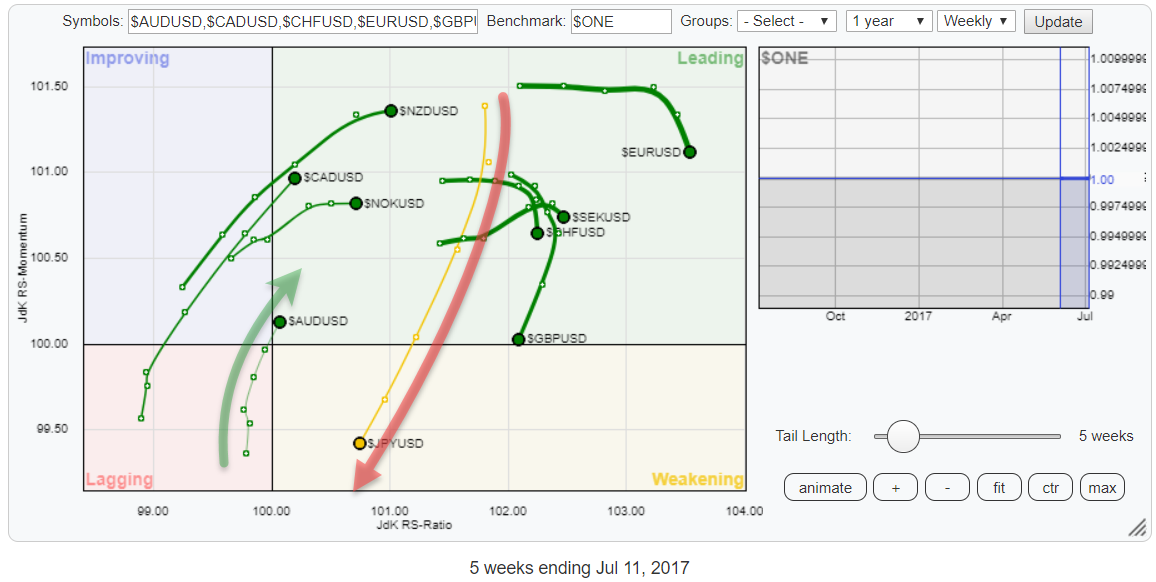

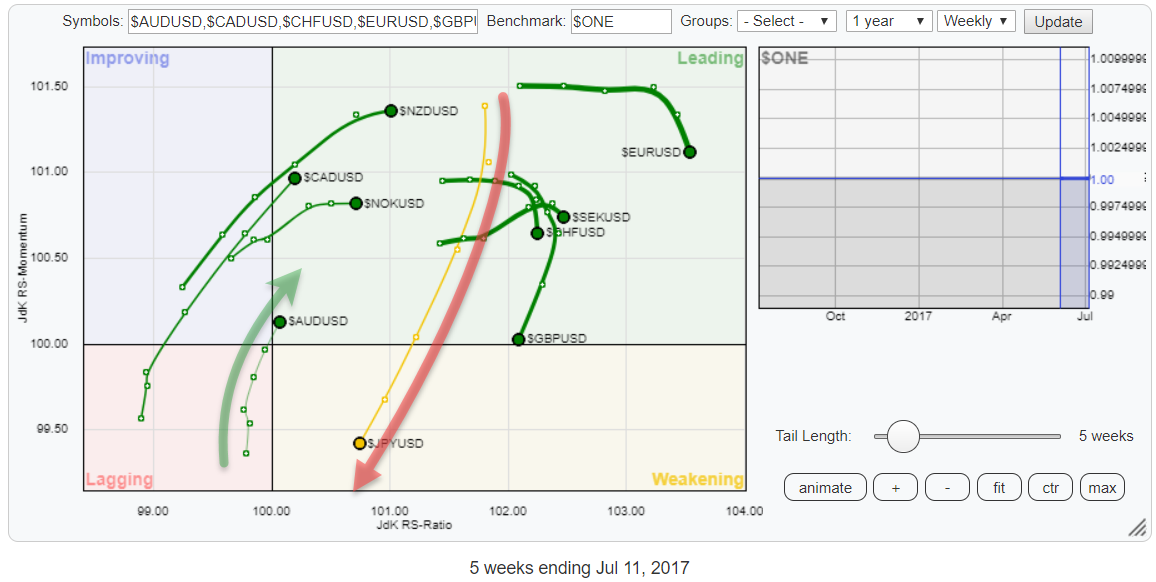

A FOREX pair trade idea from Relative Rotation Graphs

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The Relative Rotation Graph above shows the relative rotation, on a weekly basis, for the G10 currencies using the USD as the base.

For a better understanding of how to use RRGs to monitor currency rotation please refer to this blog article on the subject.

Looking at the RRG above...

READ MORE

MEMBERS ONLY

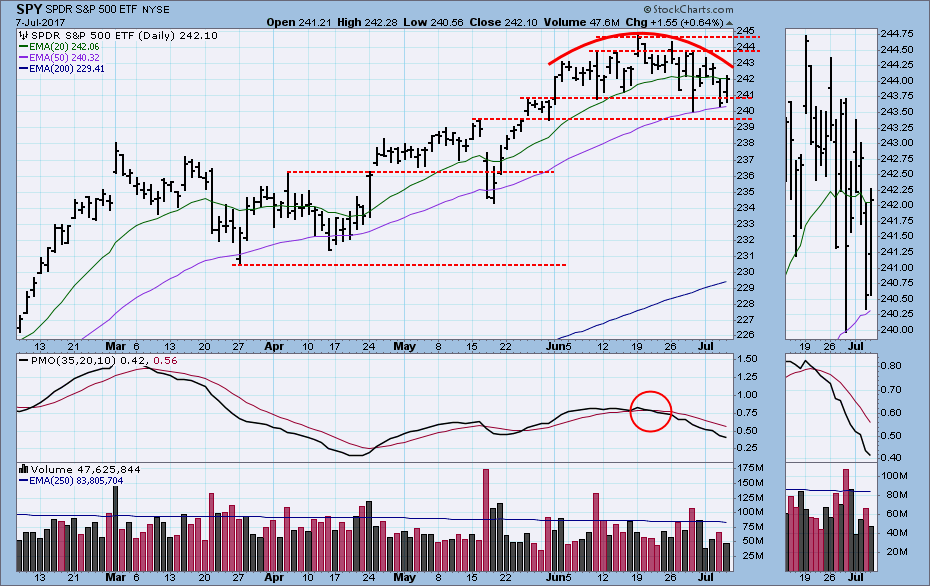

DP Alert: Rounded Top Concerning - Gold Breaks Through Neckline

by Erin Swenlin,

Vice President, DecisionPoint.com

No new signal changes on the DecisionPoint Scoreboards, but we did see three new Intermediate-Term Trend Model (ITTM) Neutral signals generate on three different sectors. Utilities, Consumer Discretionary and Consumer Staples. It's odd to see both Consumer Staples and Discretionary hitting bearish signals, but I think that is...

READ MORE

MEMBERS ONLY

Technology Rebound Strengthens With Internet Stocks Hitting Key Level

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, July 10, 2017

The NASDAQ and S&P 500 rallied on Monday, posting gains of 0.38% and 0.09%, respectively. The small cap Russell 2000 index was easily the worst performing major index, losing 0.52% on the session. Despite the weakness, the Russell...

READ MORE

MEMBERS ONLY

Are Precious Metals Likely To Get Less Precious?

by Martin Pring,

President, Pring Research

* The Long-term indicators

* Gold in Euro and Yen looking sick

* Dollar based Gold completes head and shoulders top gold shares not quite there yet

* Silver showing signs of tiredness

* Stocks breaking out against Gold

* The silver lining for Gold

Several articles I have written in the last few weeks have...

READ MORE

MEMBERS ONLY

Homebuilders Strong; Dow Component McBreaks Out

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, July 7, 2017

Dow Jones component McDonalds Corp (MCD) jumped more than 2% on Friday, extending an already strong 2017 with another all-time high closing breakout. It helped to lead a strong restaurants & bars ($DJUSRU) industry, which rose 1.26%. That, in turn, helped the...

READ MORE

MEMBERS ONLY

Life Insurance Index Breaks To All-Time High; Check Out This Stock

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Higher treasury yields ($TNX) are feared in some parts of the stock market like utilities (XLU), but not in others - especially in banking ($DJUSBK) and life insurance ($DJUSIL) where profits tend to soar during periods of rising interest rates. The recent spike in the 10 year treasury yield ($TNX)...

READ MORE

MEMBERS ONLY

FANGtastic Trendlines

by Bruce Fraser,

Industry-leading "Wyckoffian"

The Wyckoff Method for constructing Trendlines is unique. They inform our analysis and support sharper tactics. Trendlines and Trend Channels bring a chart to life. We have used significant amounts of ink drawing and discussing trendlines in this column (below are links to prior columns on Trendline construction and analysis)...

READ MORE

MEMBERS ONLY

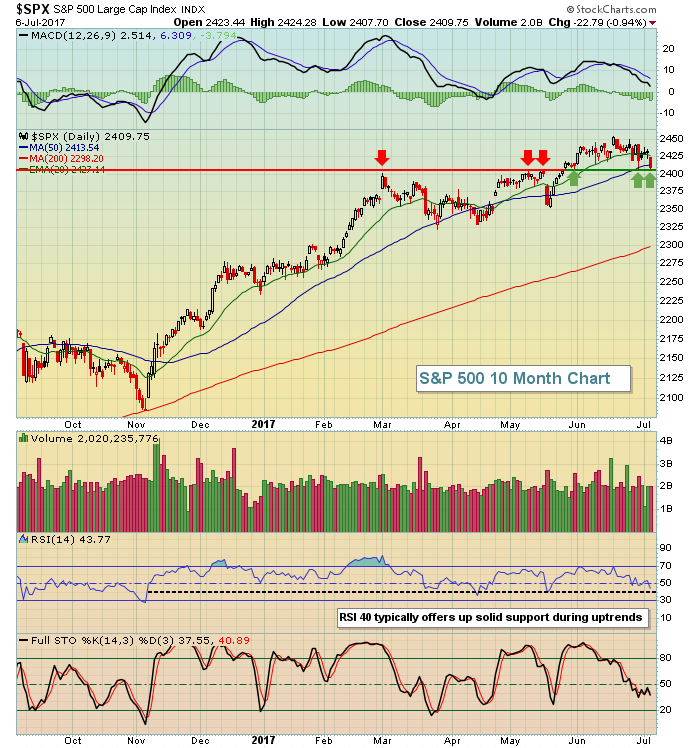

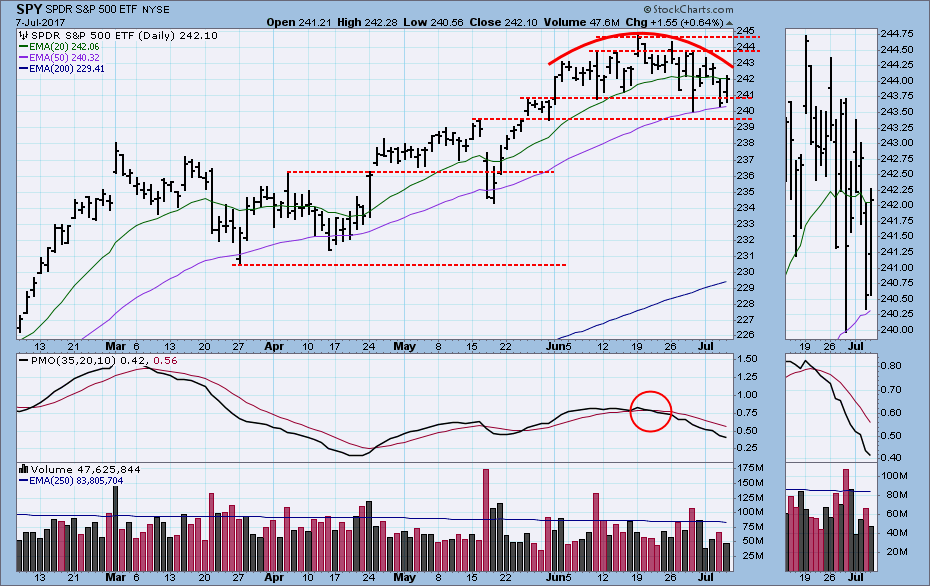

DecisionPoint Weekly Wrap -- Still Topping

by Carl Swenlin,

President and Founder, DecisionPoint.com

During a holiday week we don't expect much action, and this week was no exception. The market has been grinding away in a narrow range since the beginning of June, and a rounded top has formed. A rounded top is bearish, but in this persistent bull market it...

READ MORE

MEMBERS ONLY

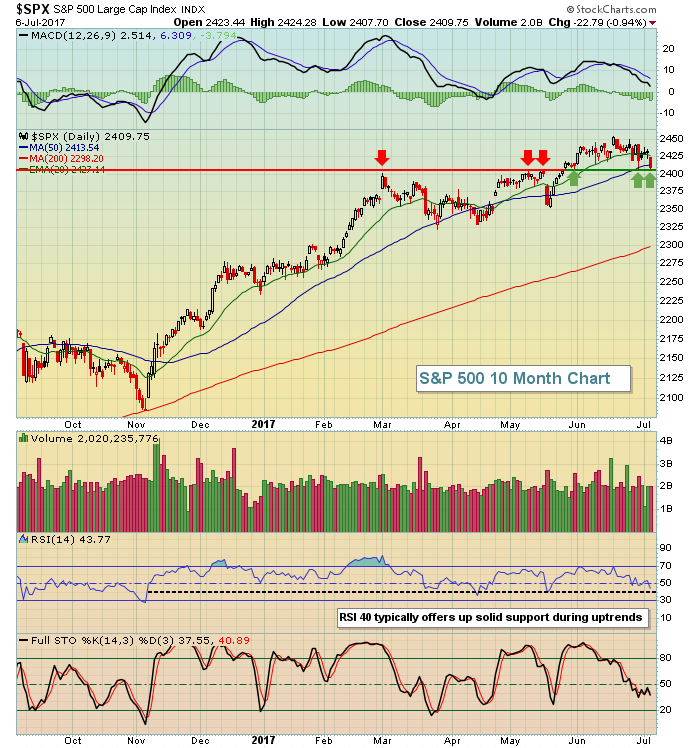

DESPITE FRIDAY'S STOCK BOUNCE, TECHNICAL INDICATORS SIGNAL CAUTION -- THE S&P 500 HASN'T HAD A 5% CORRECTION IN MORE THAN A YEAR AND APPEARS OVERDUE FOR ONE

by John Murphy,

Chief Technical Analyst, StockCharts.com

AUGUST AND SEPTEMBER ARE USUALLY WEAKER MONTHS... I've made references to seasonal patterns in some recent messages. I'm referring mainly to monthly seasonal patterns. Chart 1 plots the percent of months the S&P 500 closed higher over the last ten years. Average percentage gains...

READ MORE

MEMBERS ONLY

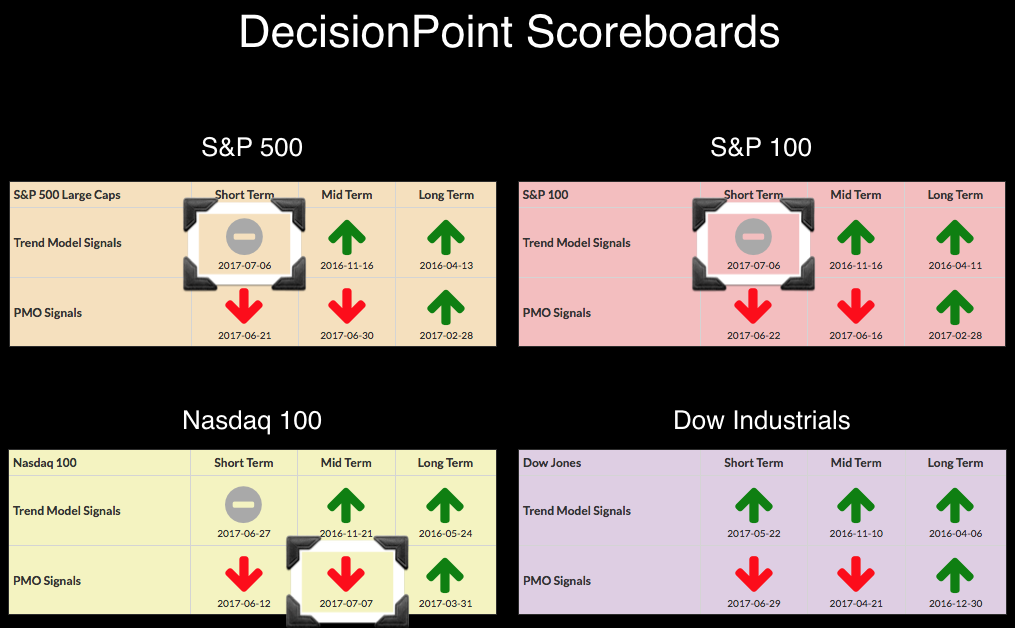

DP Bulletin: New IT PMO SELL Signal on NDX - ST Trend Model Neutrals for SPX and OEX

by Erin Swenlin,

Vice President, DecisionPoint.com

We have three new signals to report on the DecisionPoint Scoreboards and none of them are good. Momentum was already waning with PMO SELL signals coming in late June, but now we are seeing the destruction of upward price trends. Admittedly, the Short-Term Trend Model (STTM) is based on 5/...

READ MORE

MEMBERS ONLY

Charts I'm Stalking: Action Practice #18

by Gatis Roze,

Author, "Tensile Trading"

So, how did you stack up the equities of the Dow 30 based on Money Flow in Action Practice #17?

The first question you should have asked yourself is “what is my personal investing timeframe?” Clearly, a day trader would not analyze money flow the same as a position trader...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook (w/ Video) - Analyzing the Correction Evidence

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Evidence for Market Correction Builds

.... Seasonality for Stocks versus Bonds

.... High-Low Percent Turns Negative

.... Selling Pressure Ticks Up

.... Correction Could be Starting for SPY

.... QQQ Extends Correction

.... Small-caps Continue to Struggle

.... Five of Nine Sectors in Corrective Mode

.... XLY and XLK Lead Correction

.... Staples and Utilities Fall Hard

.... Finance and...

READ MORE

MEMBERS ONLY

Bears Grip Wall Street, Key Levels To Watch

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Announcement

Greg Schnell and I will be co-hosting the latest StockCharts Outlook webinar tomorrow, July 8th at 11am EST. Please join us as we discuss what went right and wrong during the first half of 2017 and where we see the market heading in the second half. Have we...

READ MORE

MEMBERS ONLY

BOND YIELDS JUMP AGAIN IN EUROPE WHICH IS PRESSURING BONDS AND STOCKS -- TECHNOLOGY SECTOR REMAINS BELOW 50-DAY AVERAGE -- S&P 500 IS IN DANGER OF SLIPPING BELOW ITS 50-DAY LNE -- NASDAQ VOLATILITY REACHES EIGHT-MONTH HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

GERMAN 10-YEAR BUND YIELD REACHES 18-MONTH HIGH ... The jump in European bond yields that started last Tuesday is continuing. A weak French auction of 30-year bonds caused bond prices in Europe to fall sharply which pushed yields higher. Ten-Year French and German yields jumped 10 and 9 basis points respectively....

READ MORE

MEMBERS ONLY

Healthcare Is Entering A New Period Of Relative Strength

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Bull markets are comprised of rotating sector strength and bullishness. On a relative basis, healthcare (XLV) was a laggard during 2009 and 2010 before outperforming in a major way from 2011 through 2015. The sector saw relative weakness for nearly two years beginning in mid-2015, but has now resumed its...

READ MORE

MEMBERS ONLY

Homebuilders March Higher - Customizing CandleGlance - Plus 2 Housing Stocks, 3 Biotechs, 3 Cyber Security Plays and 3 for the Road

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Home Builders Continue to March Higher

.... Customize your CandleGlance Charts

.... Caesarstone and USG May Play Catchup

.... High and Tight Flags for Two Biotechs (AMGN, GILD)

.... 3 Cyber Security Stocks (PANW, FTNT, PFPT)

.... Three Charts for the Road (DOX, WEN, VLKAY)

The Home Construction iShares (ITB) is one of the strongest...

READ MORE

MEMBERS ONLY

Technology Rebounds, Crude Oil Plunges

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, July 5, 2017

Crude oil prices ($WTIC) tumbled on Wednesday and that put an abrupt end to the recent strength in energy shares (XLE, -2.03%). It's also one reason why I need to see the XLE downtrend end before I'd grow...

READ MORE

MEMBERS ONLY

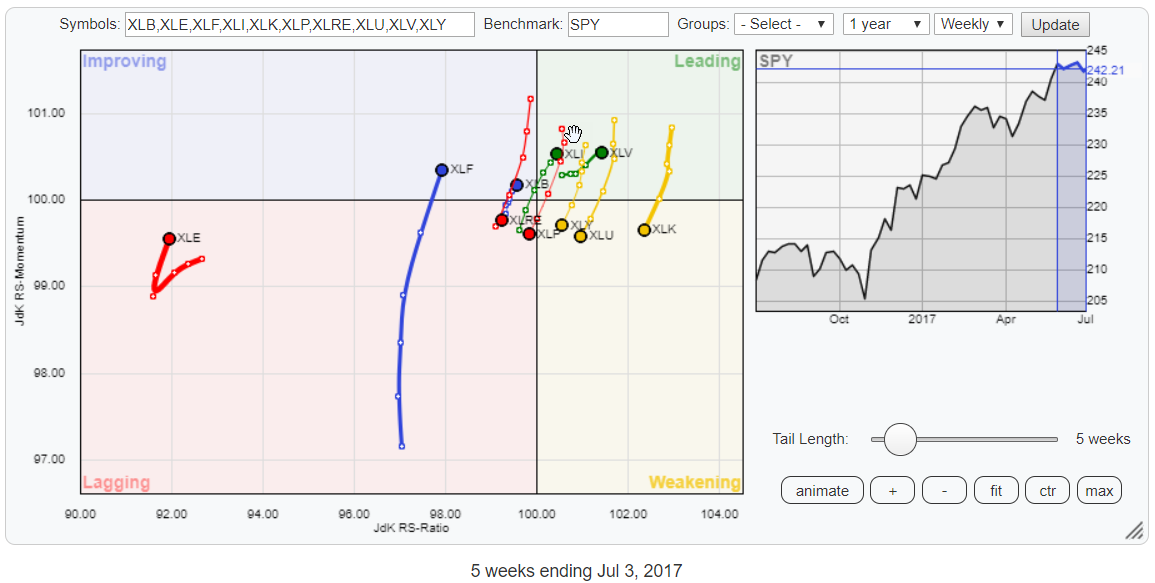

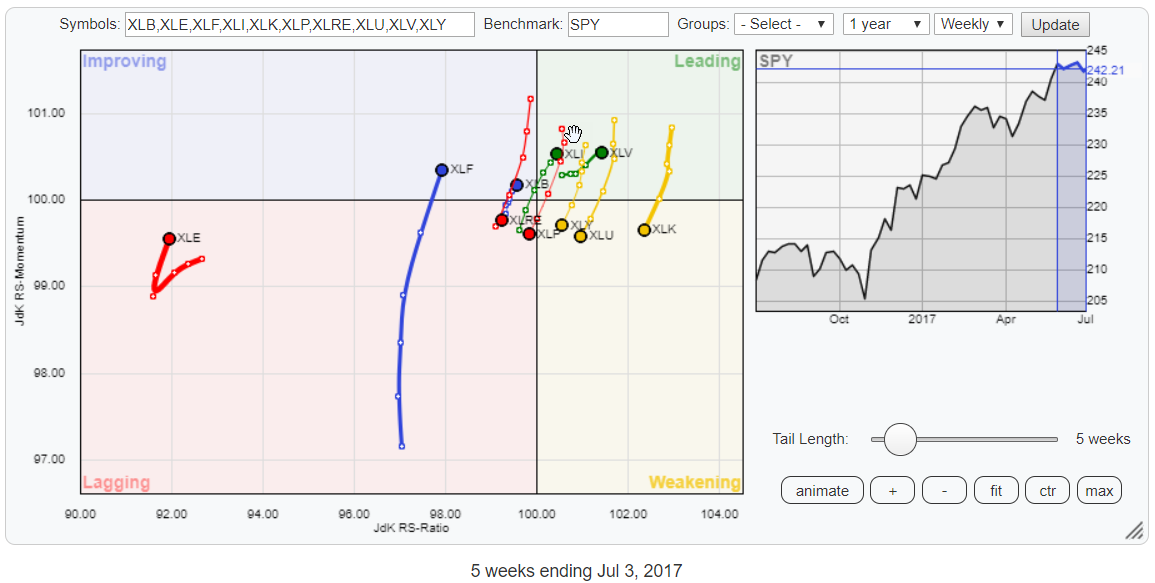

Strong (relative) momentum based rotations among S&P 500 sectors, powerful tail for XLF

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

The almost vertical tails on the above Relative Rotation Graph for US sectors indicates a very clear (relative) momentum rotation, sending some sectors from North to South and vice versa.

The two most obvious tails on the RRG are for XLE, far away on the left while sharply hooking upward,...

READ MORE

MEMBERS ONLY

Short-Term Price Trend Turning Up? Equal-Weight Consumer Staples ETF (RHS) ITTM Neutral Signal

by Erin Swenlin,

Vice President, DecisionPoint.com

It happened so fast that I missed it on Monday. Both the SPX and OEX generated ST Trend Model Neutral signals Friday and Monday, but today those signals have already bitten the dust as new ST Trend Model BUY signals came back to roost on the DecisionPoint Scoreboards. Those aren&...

READ MORE

MEMBERS ONLY

Goldman Goes for a Breakout $GS

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Goldman Sachs (GS) appears to be ending its correction as it bounces off the rising 200-day moving average. The chart shows GS hitting a 52-week high in March and then declining into June. I consider this a correction because the stock was entitled to a pullback after a massive advance...

READ MORE