MEMBERS ONLY

July's Market Round Up Live Video Recording 2017-07-05

by Martin Pring,

President, Pring Research

Here is the July video recording for Market Round Up Live 2017-07-05.

2017-07-05 08.02 @Test Market Round Up Live With Martin Pring 2017-07-05 from StockCharts.com on Vimeo.

Good luck and good charting,

Martin J. Pring...

READ MORE

MEMBERS ONLY

Top Five Investing Mistakes Made Preparing for Retirement

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

After 20 years in the money management business I saw these mistakes all too often.Fortunately, this time, I’m not reciting the mistakes I have made in the past.I certainly made some, but not these.I’ll share those another time.

1 – The biggest and probably most common...

READ MORE

MEMBERS ONLY

Energy And Financials Fuel Rally As 10 Year Treasury Yield Breaks Out

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, July 3, 2017

Energy (XLE, +1.93%) had another strong day as crude oil ($WTIC) surged above $47 per barrel and tested its 50 day SMA for the first time in over a month. The XLE has overhead resistance issues using multiple time frames, the first...

READ MORE

MEMBERS ONLY

Are Small Caps About To Come Alive?

by Martin Pring,

President, Pring Research

* Watch those small caps

* Dr. Copper about to get better?

* Wheat enters a primary bull market

* The yen is getting close to a downside breakout

* Gold is close to a breakdown

Watch those small caps

Chart 1 features the iShares Russell 2000 ETF, the IWM, together with its relative strength...

READ MORE

MEMBERS ONLY

A Bullish Failure Swing for RSI on XLE

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Energy SPDR (XLE) continues to firm after an extended decline and RSI could trigger a bullish signal this week. On the price chart, XLE shows signs of stabilization with an outside reversal five weeks ago and an inside week last week. Notice that XLE is firming near support from...

READ MORE

MEMBERS ONLY

Industrials Lead Friday's Action But Market Bifurcated

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, June 30, 2017

We once again witnessed market bifurcation with both the Dow Jones and S&P 500 rising slightly, while the more aggressive NASDAQ and Russell 2000 finished with absolute and relative weakness. The Dow Jones received a big lift from Nike (NKE), which...

READ MORE

MEMBERS ONLY

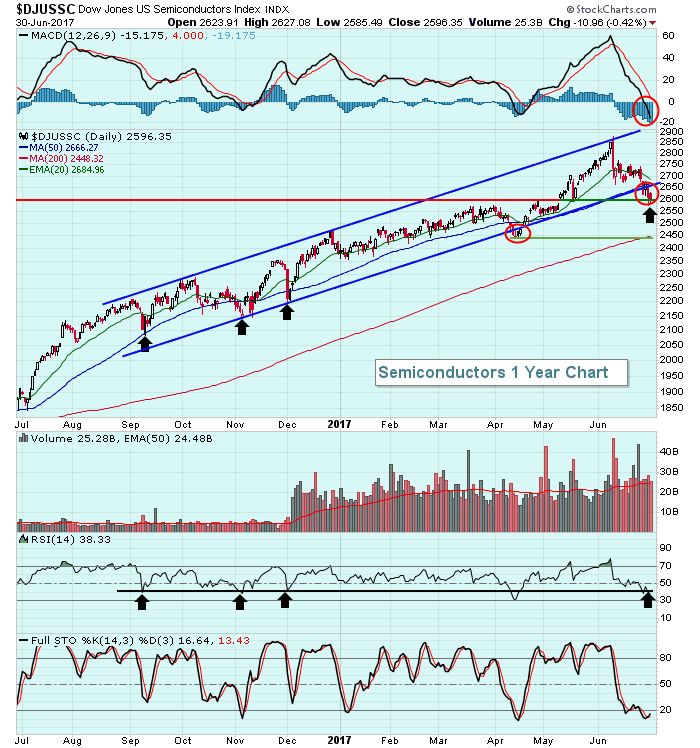

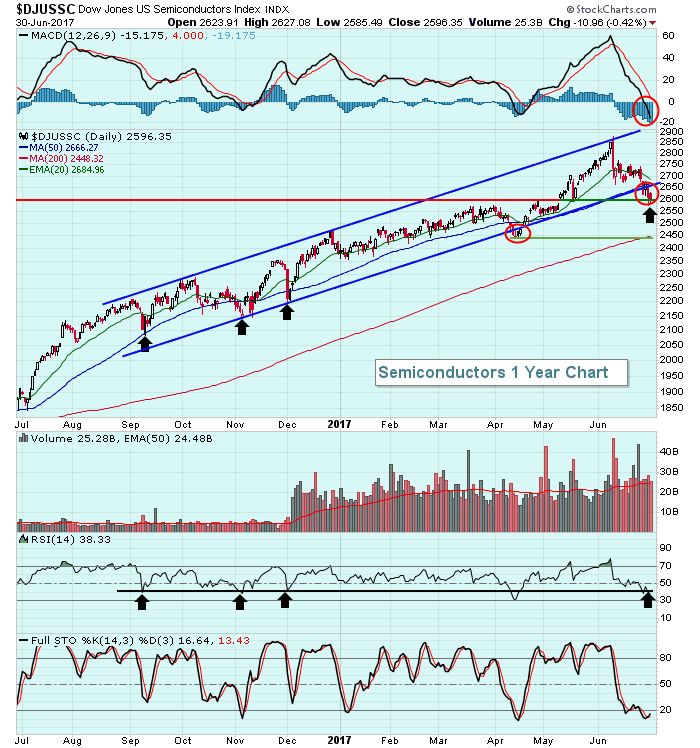

Semiconductors: Goodbye or a Good Buy?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The Dow Jones U.S. Semiconductors Index ($DJUSSC) is an extremely volatile index. When this index is trending higher, there aren't too many better places to be invested. But when the fire goes out, you want to run, not walk, for the exits. So where are we now,...

READ MORE

MEMBERS ONLY

Will These Summer Breakouts Materialize?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

It's generally not a great idea to wait until after a stock or index breaks out to consider short-term trades. It would seem somewhat obvious to instead plan for those breakouts by watching patterns develop and keeping an eye on volume. So let's do exactly that...

READ MORE

MEMBERS ONLY

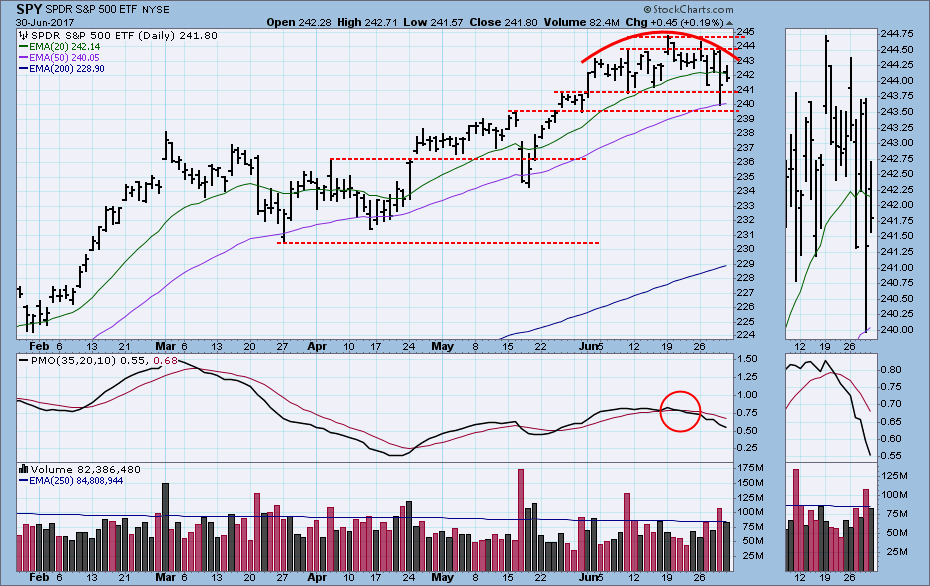

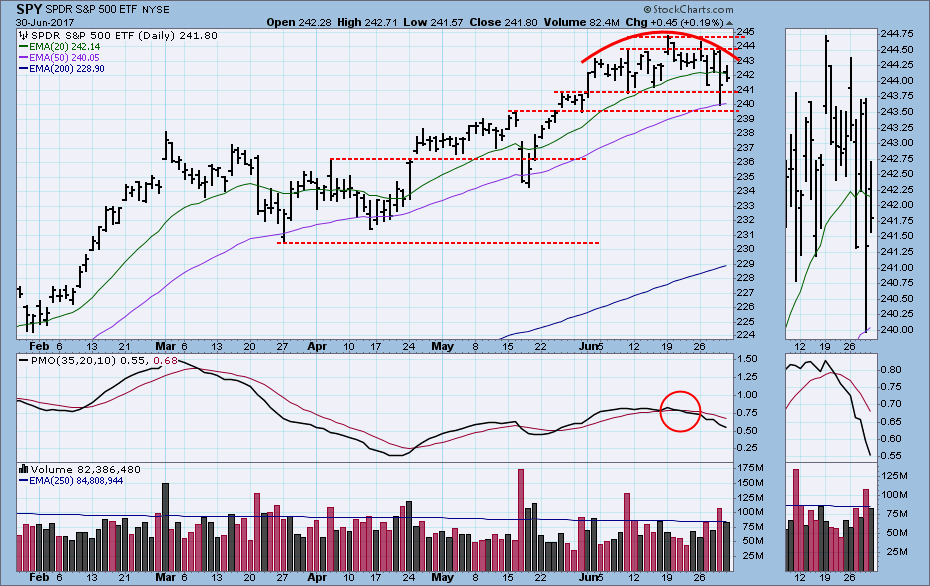

DecisionPoint Weekly/Monthly Wrap -- Topping In Progress?

by Carl Swenlin,

President and Founder, DecisionPoint.com

June has been a tedious month for the market with SPY being confined mostly within a three point range. I can't help noticing the rounded shape of June's price activity, which makes me think we may be seeing a rounded top leading to a period of...

READ MORE

MEMBERS ONLY

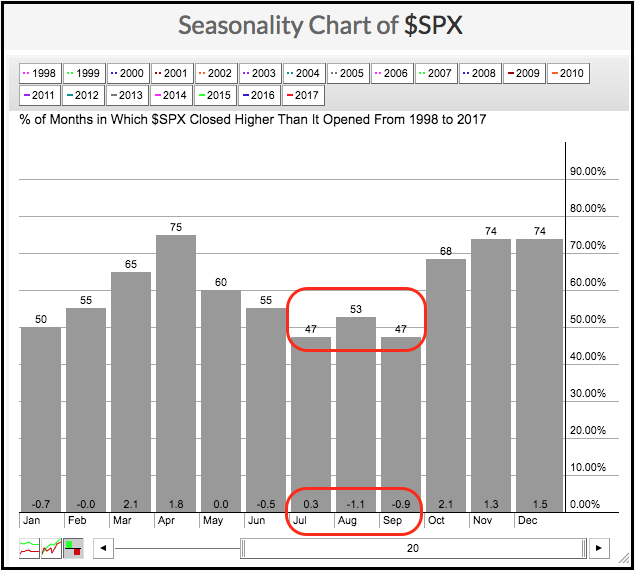

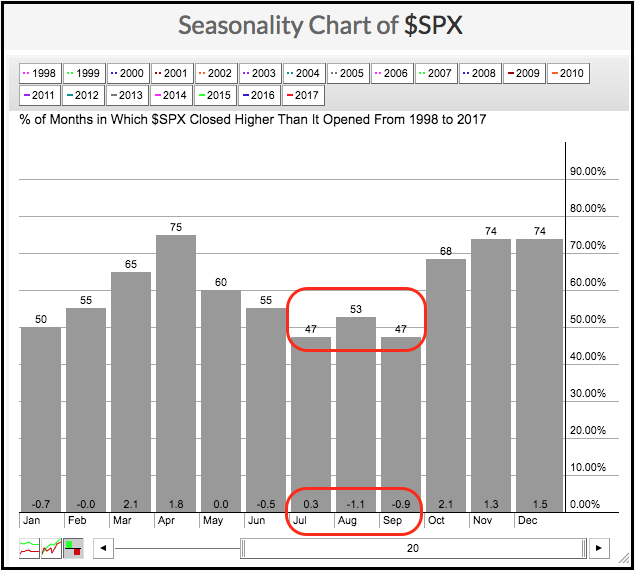

S&P 500 Seasonality and the Dog Days of Summer

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The chart below shows the seasonal tendency for the S&P 500 over the last twenty years (1998 to 2017). The number at the top of each bar shows the percentage of months the S&P 500 advanced for that particular month, while the number at the bottom...

READ MORE

MEMBERS ONLY

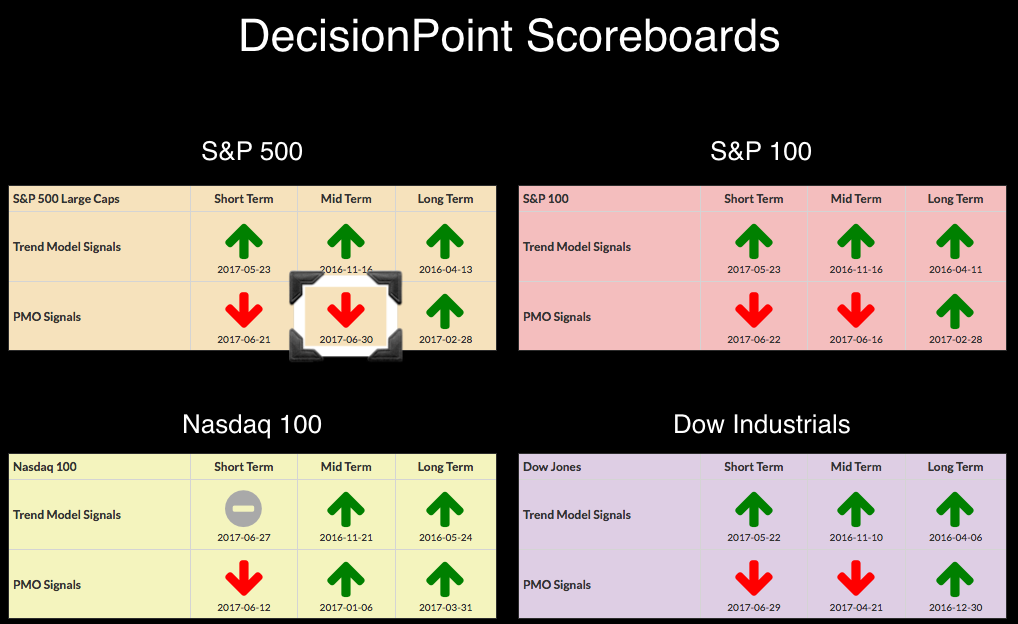

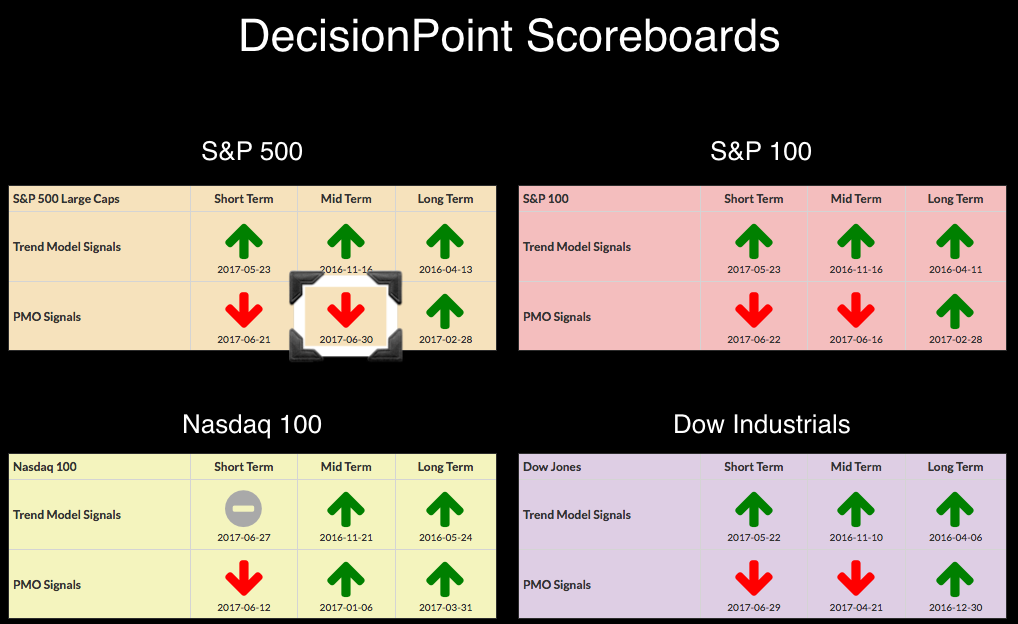

DecisionPoint Bulletin: New PMO SELL Signal on Weekly Chart for SPX

by Erin Swenlin,

Vice President, DecisionPoint.com

Price trends may be up, but momentum is clearly down in the in the short and intermediate terms. The NDX escaped a weekly PMO negative crossover SELL signal by only a small amount and that is because techs had a great run over the past month or so. FYI -...

READ MORE

MEMBERS ONLY

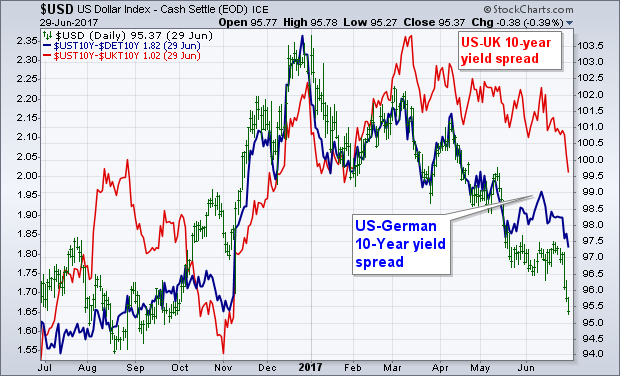

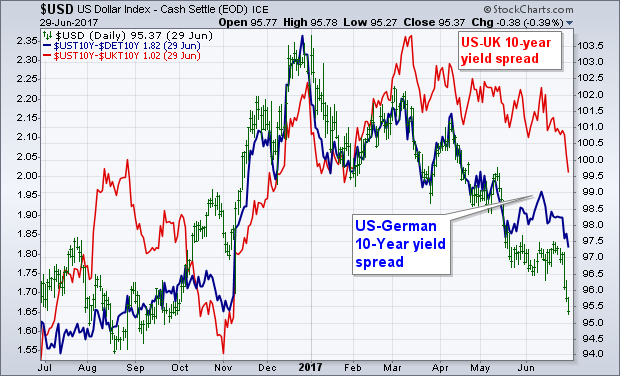

Narrowing Spread Between Treasuries and Foreign Yields Are Bad For the Dollar

by John Murphy,

Chief Technical Analyst, StockCharts.com

The U.S. Dollar has had a bad six months. And things got even worse this week. The driving force between currencies is the relationship between global interest rates. The 10-Year Treasury yield remains higher than foreign developed yields. The problem is that the difference between them is narrowing. The...

READ MORE

MEMBERS ONLY

What the Market Needs now is...Earnings

by John Hopkins,

President and Co-founder, EarningsBeats.com

The market moved into a rare funk last week as traders decided in unison to take profits, especially in the tech heavy NASDAQ. This is quite understandable with all three of the major indexes hitting record levels during the month of June.

There are various theories as to why stocks...

READ MORE

MEMBERS ONLY

How Not to Lose Sight of the Forest (the Market) by Focusing on the Trees (Individual Equities)

by Gatis Roze,

Author, "Tensile Trading"

Have any of you ever found yourselves so overly focused on your individual positions that you are missing the market’s essential big picture? For profitable investing, maintaining a birds-eye view is imperative. This is what asset allocation is all about, and from the academics, we know that this provides...

READ MORE

MEMBERS ONLY

NARROWING SPREAD BETWEEN TREASURIES AND FOREIGN YIELDS ARE BAD FOR THE DOLLAR -- A STUDY OF QE IMPACT ON DOLLAR DIRECTION -- FALLING DOLLAR MAY HELP STABILIZE COMMODITY PRICES -- BASE METALS HAD A STRONG WEEK -- OIL SERVICE STOCKS ALSO BOUNCED

by John Murphy,

Chief Technical Analyst, StockCharts.com

NARROWING SPREAD BETWEEN GLOBAL YIELDS HURTS THE DOLLAR... The U.S. Dollar has had a bad six months. And things got even worse this week. The driving force between currencies is the relationship between global interest rates. The 10-Year Treasury yield remains higher than foreign developed yields. The problem is...

READ MORE

MEMBERS ONLY

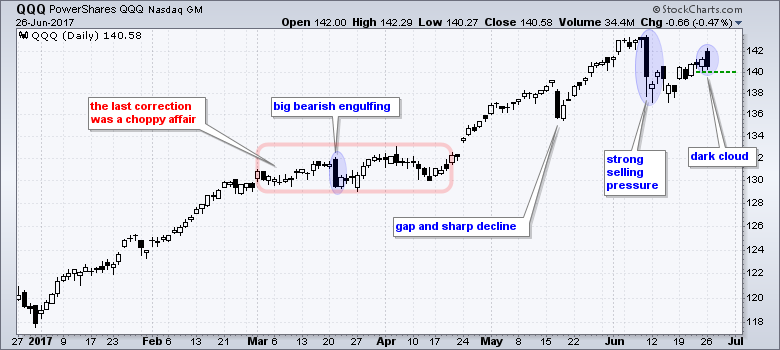

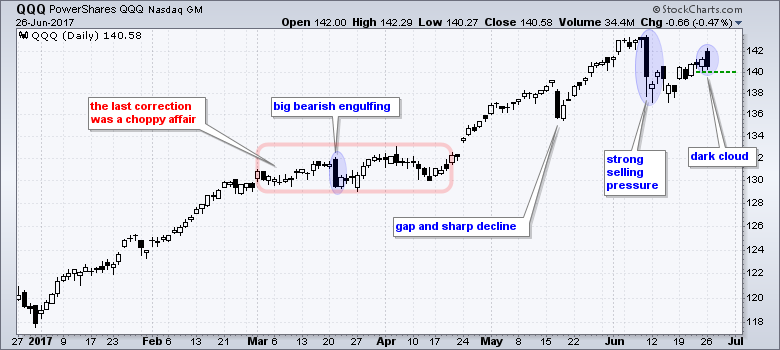

Weekly Market Review & Outlook - QQQ Starts Correction as SPY and IJR Hold Up

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Weekly Market Review & Outlook

.... SPY has Yet to Start a Correction

.... Small-caps Continue to Drift Higher

.... QQQ Forms Second Big Engulfing Pattern

.... S&P 500 Enters Weakest 3-month Stretch

.... So Does 10-yr Yield!

.... 10-yr T-Yield Bounces within Downtrend

.... TLT Forms Big Bearish Engulfing, but...

.... T-Bonds and the Dollar...

READ MORE

MEMBERS ONLY

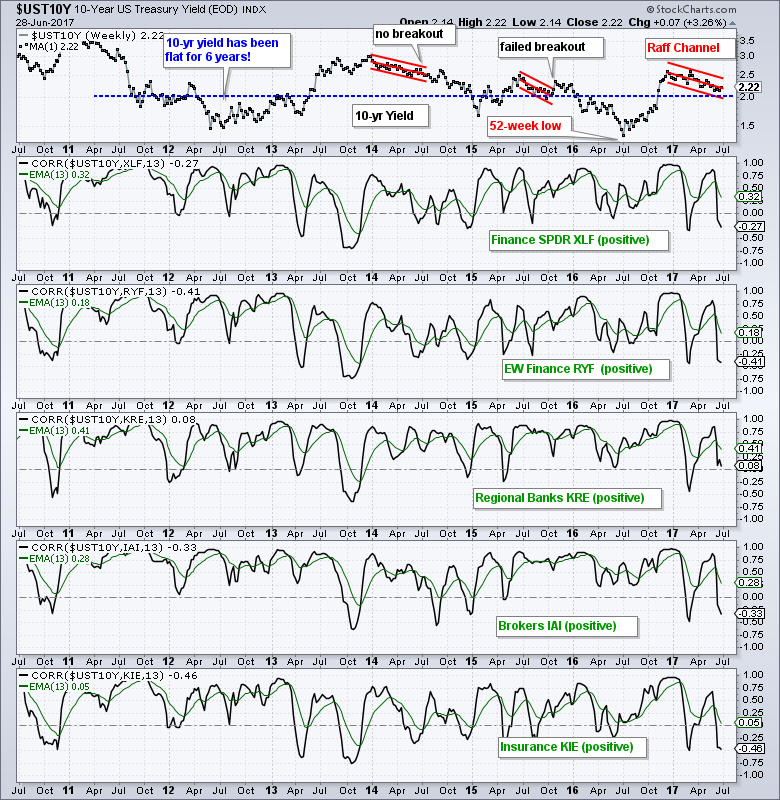

Give Me Financials.....Or Give Me Breadth

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, June 29, 2017

That's exactly what it's felt like recently. Financials (XLF) have easily been the best performing sector over the past week, rising nearly 3%, while energy (XLE) is the only other sector in positive territory as crude oil ($WTIC) has...

READ MORE

MEMBERS ONLY

DP Alert: Signals Galore! New PMO SELL Signals on Dow, Dollar and Bonds - IT Trend Model Neutral on Gold

by Erin Swenlin,

Vice President, DecisionPoint.com

Today brought a plethora of new DecisionPoint timing signals...all bearish. As far as the DP Scoreboards are concerned, the Dow initiated a PMO SELL signal on the daily chart today. This puts all four indexes on PMO SELL signals. I've included the daily chart of the Dow...

READ MORE

MEMBERS ONLY

TECH SELLOFF RESUMES WHILE FINANCIALS GAIN -- THAT CONTINUES THE ROTATION OUT OF GROWTH AND INTO VALUE STOCKS THAT STARTED ON JUNE 9 -- TECH SPDR UNDERCUTS 50-DAY AVERAGE -- BANKS GAINED ON STRESS TEST RESULTS AND RISING BOND YIELDS

by John Murphy,

Chief Technical Analyst, StockCharts.com

TECH SECTOR UNDERCUTS 50-DAY AVERAGE...STRESS TEST BOOSTS BANKS... Everyone in the media is suddenly talking about a rotation out of technology-dominated growth stocks into value stocks led by financials, healthcare, and (to a lesser extent) energy shares. We wrote about that on the day it started (June 9): "...

READ MORE

MEMBERS ONLY

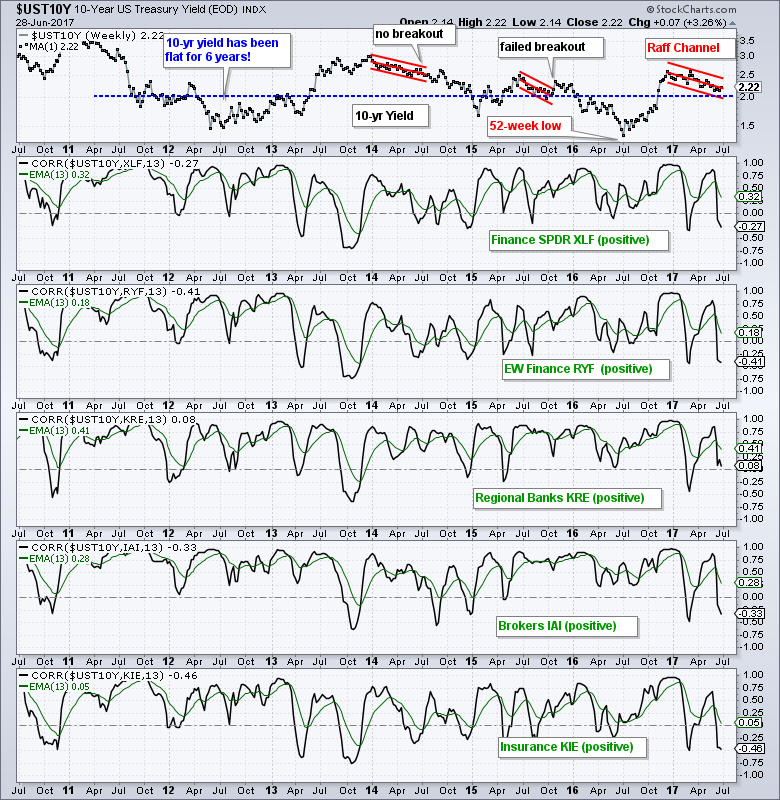

Yields Soar, Banks Explode Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The stubbornness of treasury buyers has kept a lid on treasury yields and, as a result, banks ($DJUSBK) have struggled to determine which direction they should move. Well.....this morning's reaction to an upwardly-revised GDP number (TNX up 7 basis points to 2.29% at last check) for...

READ MORE

MEMBERS ONLY

Rising Treasury Yields Lift Banks, Financials

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

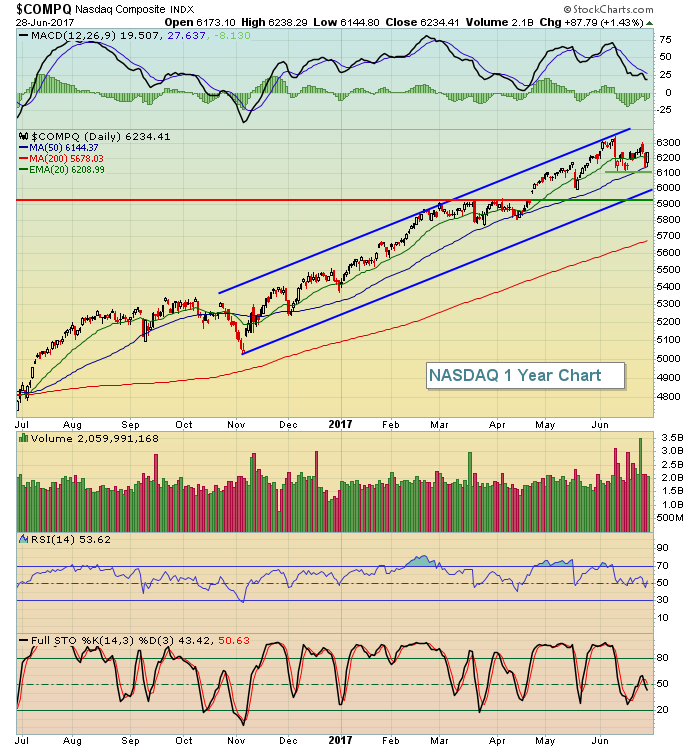

Market Recap for Wednesday, June 28, 2017

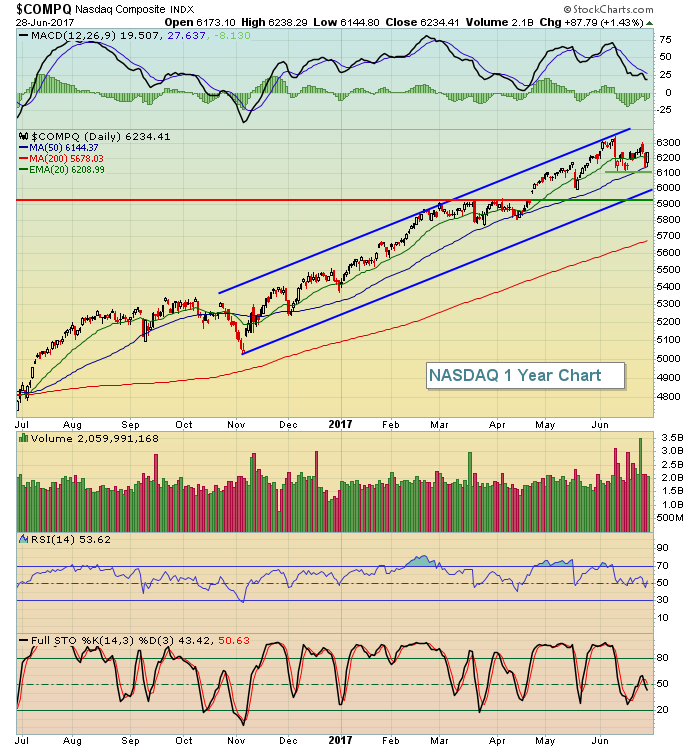

All of our major indices finished higher on Wednesday with the small cap Russell 2000 and tech-laden NASDAQ indices leading the charge with 1.55% and 1.43% gains, respectively. We saw solid participation across the board, however, with the Dow Jones ending...

READ MORE

MEMBERS ONLY

The Great Rate Debate - 4 Regional Banks and 3 Steel Stocks Bid to End Corrections

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... The Great Rate Debate

.... Correlations Do Not Reflect Magnitude

.... BB&T Takes Two Steps Forward and One Step Backward

.... Fifth Third, Huntington and PNC Financial

.... Three Steel Stocks on the Move ....

The Great Rate Debate

Are yields rising, falling or flat? This depends, as always, on your timeframe. Chartists...

READ MORE

MEMBERS ONLY

One PMO Scan to Rule Them All!

by Erin Swenlin,

Vice President, DecisionPoint.com

I love to use the Advanced Scanning Workbench and find it absolutely invaluable in my investment mining process. Every other Monday, I review the PMO scan that I've chosen for the day and use the results to create my "Monday Set-Ups" symbol list. "Monday Set-Ups&...

READ MORE

MEMBERS ONLY

GERMAN AND UK BOND YIELDS ARE JUMPING -- THAT'S BOOSTING FOREIGN CURRENCIES AND WEAKENING THE DOLLAR -- DOLLAR WEAKNESS SUPPORTS ROTATION INTO FOREIGN STOCKS -- RISING CANADIAN DOLLAR FAVORS CANADA ISHARES

by John Murphy,

Chief Technical Analyst, StockCharts.com

TODAY IT'S THE BRITS TURNING HAWKISH... Yesterday it was hawkish comments from Mario Draghi that pushed eurozone bond yields sharply higher, and the rest of the world with them. Today it's hawkish comments by Mark Carney that the Brits may have to raise rates soon. Rising...

READ MORE

MEMBERS ONLY

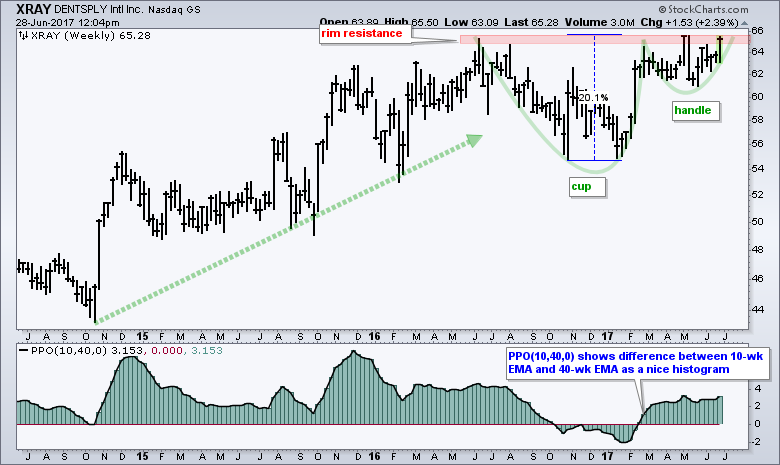

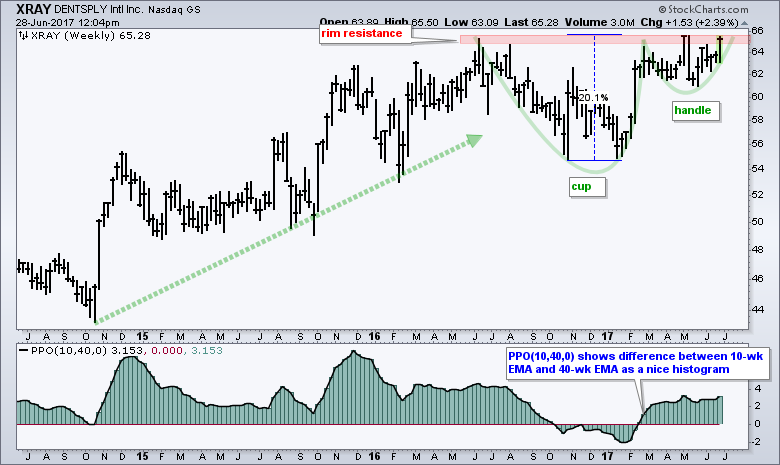

XRAY Traces Out a Classic Bullish Continuation Pattern

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Dentsply International (XRAY) has a large cup-with-handle pattern forming over the last twelve months and the stock is on the verge of breaking rim resistance. Popularized by William O'Neil of Investors Business Daily, the cup-with-handle is a bullish continuation pattern. This means it forms as a consolidation after...

READ MORE

MEMBERS ONLY

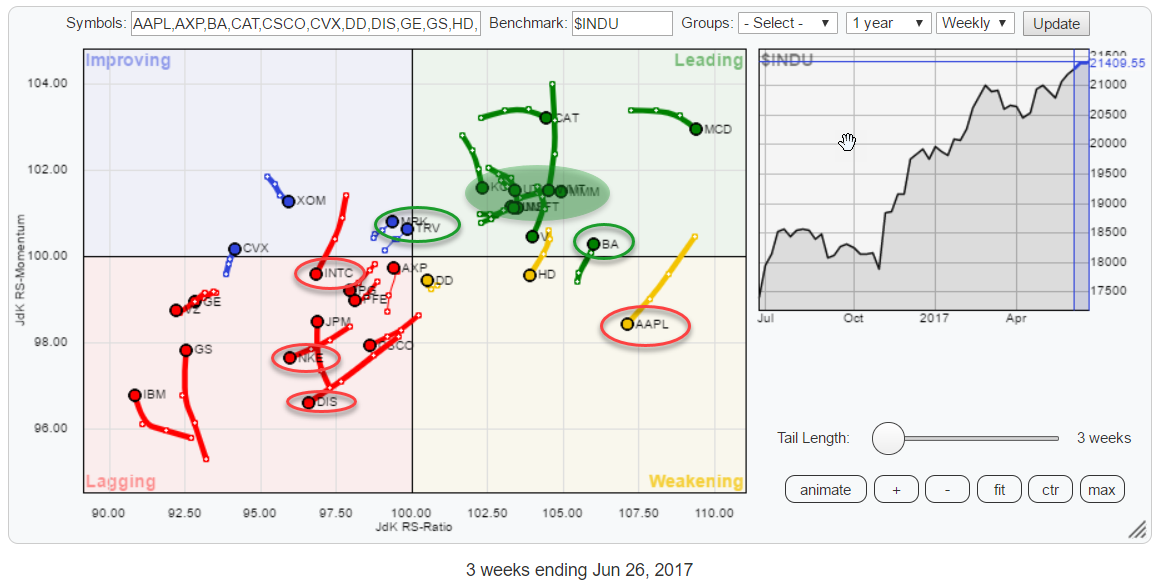

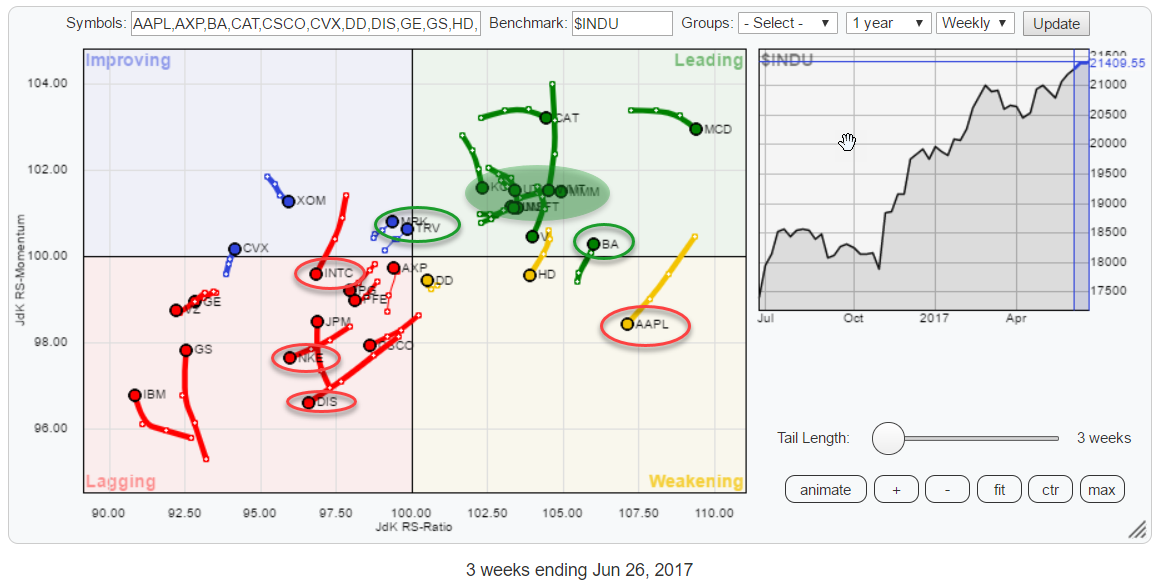

AAPL rotating opposite to BA on Relative Rotation Graph for $INDU

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Watching the 30 members of the Dow Jones Industrials index on a Relative Rotation Graph always provides a great insight into what's going on under the hood of that universe.

The first quick takes from the graph above are a fairly evenly spread universe with no big outliers...

READ MORE

MEMBERS ONLY

S&P 500 Loses 20 Day EMA Support As Second Shoe Drops In Technology

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, June 27, 2017

The relative sector leader for over a year - technology (XLK, -1.64%) - took another beating on Tuesday as selling ramped up for a second consecutive session. All industry groups within technology took a hit, but semiconductors ($DJUSSC) and internet stocks ($DJUSNS)...

READ MORE

MEMBERS ONLY

Investment Implications From A Breakout In The Stock/Gold Ratio?

by Martin Pring,

President, Pring Research

* Technical condition poised for an upside breakout in the stock/Gold ratio

* The significance for equities and gold from an upside or downside breakout.

* Wither the tech stocks?

Technical condition poised for an upside breakout in the stock/Gold ratio

The ratio ($SPX:$GOLD) between the S&P 500...

READ MORE

MEMBERS ONLY

DP Alert: NDX Posts New ST Trend Model Neutral Signal - TLT Fake Out Breakout

by Erin Swenlin,

Vice President, DecisionPoint.com

As annotated on the DecisionPoint Scoreboard Summary, the Nasdaq 100 just triggered a new Short-Term Trend Model (STTM) Neutral signal as the 5-EMA crossed below the 20-EMA on the daily chart. Today's breakdown took out support at the May high and closed just below the 50-EMA. The PMO...

READ MORE

MEMBERS ONLY

TREASURY YIELDS FOLLOW EUROPE HIGHER -- THAT'S HELPING FINANCIAL STOCKS -- LEADERS INCLUDE JP MORGAN, SCHWAB, AND METLIFE -- TECHNOLOGY SELLING RESUMES -- SEMIS ARE ALSO FALLING -- THAT'S STARTING TO TAKE A TOLL ON THE S&P 500

by John Murphy,

Chief Technical Analyst, StockCharts.com

TEN-YEAR TREASURY YIELD HAS A STRONG DAY ... For the first time in weeks, bond yields are climbing. Chart 1 shows the 10-Year Treasury Yield climbing 7 basis points to the highest level in two weeks. A lot of that is following even bigger gains in Europe. French and German 10-year...

READ MORE

MEMBERS ONLY

Extremely Low VIX Still Paints Bullish Picture

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, June 26, 2017

The Volatility Index ($VIX) is a signal of what the market expects in terms of volatility over the near-term (1 to 2 months). While some look at the current reading below 10 as a signal of extreme complacency that will result in a...

READ MORE

MEMBERS ONLY

Bearish Candles Hit Big Tech Stocks - Plus two Brokers, Two Big Banks and More

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... QQQ and Facebook hit with Dark Clouds

.... Alphabet and Amazon Form Engulfing Patterns

.... AMAT Forms Bearish Pennant

.... A Feeble Bounce for Apple

.... Etrade and Schwab Stall after Breakouts

.... Citigroup Leads, but JP Morgan Shows Short-term Strength

.... Cypress Forms Engulfing within Correction ....

There were quite a few bearish candlestick patterns on...

READ MORE

MEMBERS ONLY

WFM Is Swallowed Whole

by Bruce Fraser,

Industry-leading "Wyckoffian"

Whole Foods Market agreed to be acquired by Amazon.com, Inc. on June 16, 2017. This ‘disruptive’ move by Amazon.com roiled the retail stocks, which were already sagging badly. The price drops extended throughout the retail brick-n-mortar stocks. Investors in these retail stocks feared that AMZN would strategically leverage...

READ MORE

MEMBERS ONLY

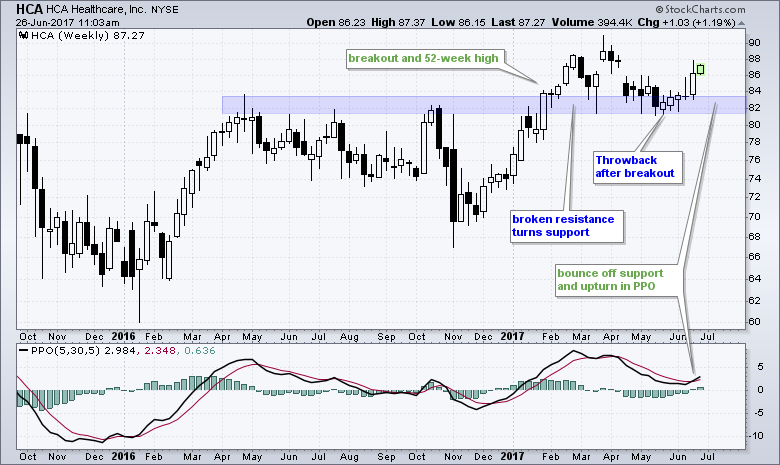

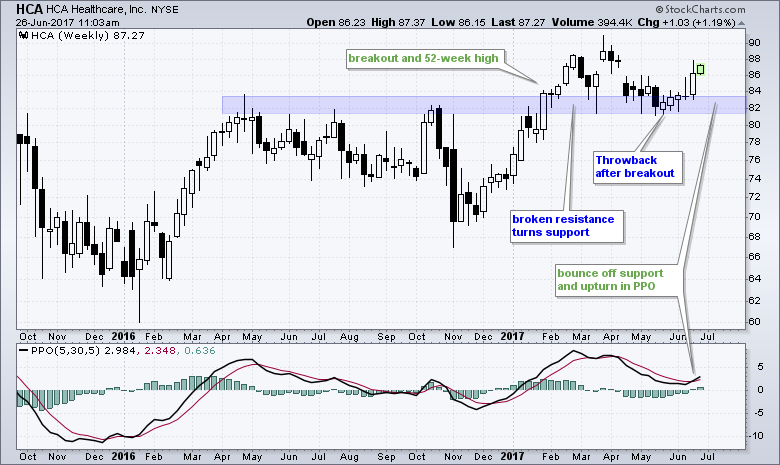

HCA Healthcare Bounces off Breakout Zone

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

HCA Healthcare (HCA) is turning up at a key level and showing signs that the long-term uptrend is resuming. HCA is in a long-term uptrend because it broke out in January and recorded a 52-week high. This breakout zone turned into support around 82 as the stock fell back to...

READ MORE

MEMBERS ONLY

AN EVEN LONGER-TERM COMPARISON OF THE LINK BETWEEN CRB INDEX AND CPI -- THE PAST TWO EXPERIENCES OF FULL EMPLOYMENT ALSO SAW RISING RISING OIL PRICES -- THIS TIME MAY BE DIFFERENT

by John Murphy,

Chief Technical Analyst, StockCharts.com

LONG TERM COMPARISON OF CPI AND COMMODITIES... I wrote a message over the weekend examining the impact that full employment and commodity prices have had on CPI inflation. At the risk of overdoing it, I'd like to finish that article with two more charts. I made the bold...

READ MORE

MEMBERS ONLY

Crude Oil Bounces Off $42 Support, Energy Rebounds

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, June 23, 2017

It's been a rough ride for crude oil ($WTIC) over the past several months and the steady march lower has taken oil back to test its November low just above $42 per barrel. It hasn't been a robust advance...

READ MORE

MEMBERS ONLY

STUDYING HISTORY TO MEASURE THE IMPACT OF FULL EMPLOYMENT AND COMMODITY PRICES ON CPI INFLATION -- THE FED IS BANKING ON FULL EMPLOYMENT TO BOOST INFLATION -- BUT THAT'S UNLIKELY AS LONG AS COMMODITY PRICES ARE FALLING

by John Murphy,

Chief Technical Analyst, StockCharts.com

A HISTORICAL COMPARISON... A big debate is going on regarding the path of inflation. Inflation figures have slipped during the second quarter. So have commodity prices. Normally, falling commodity prices signal lower inflation. Fed economists argue that the current low unemployment rate should boost inflation. The Fed generally defines "...

READ MORE

MEMBERS ONLY

BLUE Looking At Blue Skies Ahead?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Biotechnology stocks ($DJUSBT) were the second best performing industry group last week, trailing on renewable energy ($DWCREE). Both groups appear poised to continue their rally based on their longer-term weekly technical outlook. Therefore, it's probably not a bad idea to look at stocks in these groups that pull...

READ MORE

MEMBERS ONLY

DecisionPoint Weekly Wrap -- Troubling Negative Divergences

by Carl Swenlin,

President and Founder, DecisionPoint.com

SPY began the week with a breakout on very high volume that subsequently looks like a minor blowoff, as price retreated back into the June trading range. The expansion of New Highs on Monday failed to match the climactic level of New Highs on June 2, and a PMO top...

READ MORE

MEMBERS ONLY

Charts I'm Stalking: Action Practice #17

by Gatis Roze,

Author, "Tensile Trading"

This is all about your fiscal fitness and future financial fate. Pay attention!

I’ve written before about the indisputable number of academic studies proving asset allocation is the highest leverage activity that individual investors can focus on. Although this blog will touch upon this, it will be focused instead...

READ MORE