MEMBERS ONLY

Singapore ETF (EWS) Breaks Out - Upside Potential

by Erin Swenlin,

Vice President, DecisionPoint.com

During today's MarketWatchers LIVE show (Tune in MWF 12:00-1:30p EST) Tom Bowley and I looked at "Monday Set-Ups". Check the MarketWatchers Recap here to see the list. I found the Singapore ETF (EWS) through a Price Momentum Oscillator (PMO) Scan that I like to...

READ MORE

MEMBERS ONLY

Academia

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I’m on record in my book, “Investing with the Trend,” and probably in this blog of stating that Financial Academia is nothing more than the marketing department for Wall Street. When I do presentations about technical analysis and / or money management, I always begin with this slide:

Slide A...

READ MORE

MEMBERS ONLY

Regeneron Bounces within a Massive Base

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Regeneron has gone nowhere since February 2016, but recent volume bars suggest that this may be a massive base. The stock surged off the 325 area with big volume in November. After falling back into January, the stock held above the October low and turned up the last 14 weeks....

READ MORE

MEMBERS ONLY

Commercial Vehicles Break Out To Lead Industrials

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, April 28, 2017

Equities sold off throughout the day on Friday, but no significant levels of support were lost. Starbucks (SBUX) jolted the market a bit, gapping down to test its rising 20 day EMA, but that support level held and while the internet group ($DJUSNS)...

READ MORE

MEMBERS ONLY

Around the World in 21 Ways

by Bruce Fraser,

Industry-leading "Wyckoffian"

The EAFE Stock Market Index includes the large and mid-cap stocks of 21 developed countries throughout the world. The U.S. and Canada are excluded from this index. The stocks in the EAFE represent more than $1.9 trillion of market capitalization.

Currently there is a worldwide movement toward nationalism....

READ MORE

MEMBERS ONLY

DecisionPoint Weekly/Monthly Wrap -- Seasonality Turning Bearish

by Carl Swenlin,

President and Founder, DecisionPoint.com

Last week I wrote: "My posture is to look for an up move next week, and as last week, a daily PMO bottom will be the first, if not infallible, clue that the market is done correcting. If an upside breakout follows, I will believe it." As it...

READ MORE

MEMBERS ONLY

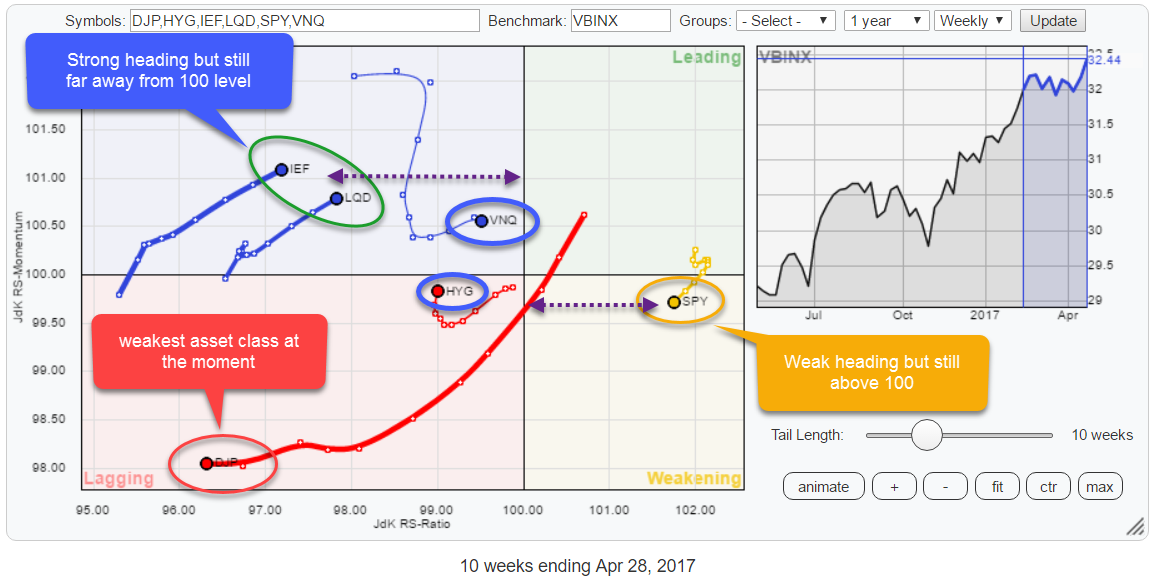

No asset class in leading quadrant on RRG but SPY still strongest!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

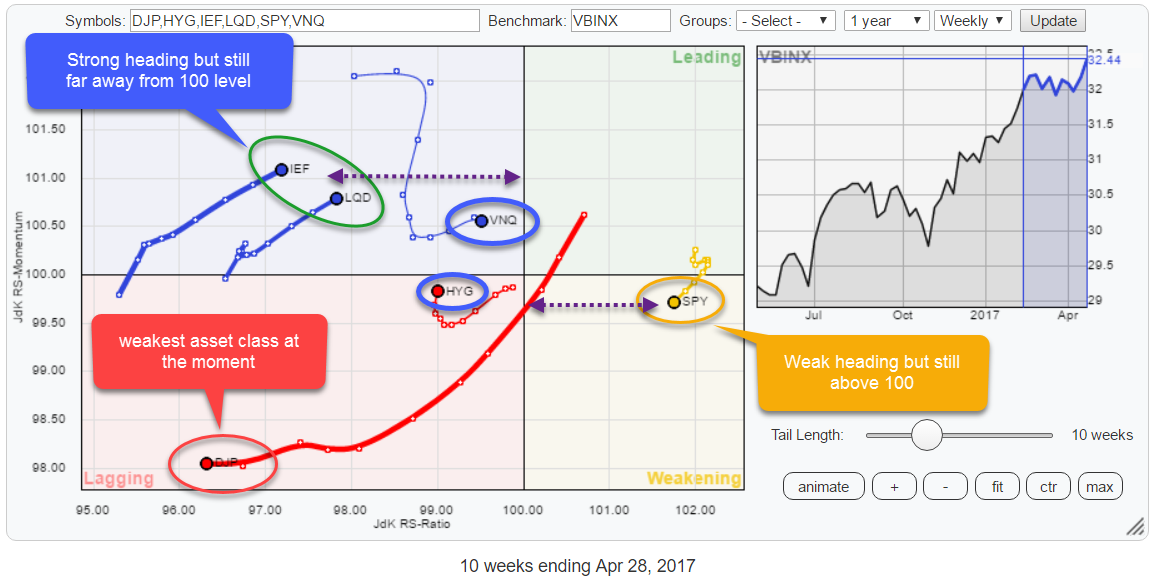

The Relative Rotation Graph for asset classes shows that not a single category is inside the leading quadrant at the moment and only one asset class, equities (SPY), is on the right-hand side of the plot.

The quick take from this reading is that only SPY, asset class equities, is...

READ MORE

MEMBERS ONLY

Video - Weekly Market Review & Outlook - Watching the Bond Market for Clues on Banks and the S&P 500

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

----- Video Link ----- Art's Charts ChartList (updated 29-Apr) -----

Stocks followed through this past week with further gains, but small-caps took a hit on Friday and underperformed for the week. Friday's hit was not enough to overshadow the breakouts in the S&P 500...

READ MORE

MEMBERS ONLY

Charts I'm Stalking: Action Practice #15

by Gatis Roze,

Author, "Tensile Trading"

When you revisit the Action Practice #14 blog, you’ll recall that I presented four equities chosen from Investor Business Daily’s 20 top-rated Big Cap stocks. (April 5, 2017 edition.) I asked you to choose the best equity from the following four: Western Digital (WDC), KLA-Tencor (KLAC), Priceline (PCLN)...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook - Indicators and Index ETFs Follow Through

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Weekly Market Review & Outlook

.... High-Low Percent Follow Through

.... MDY and SPY Follow Through

.... Large Techs and Small Caps Lead

.... Sector Balance is Clearly Bullish

.... Percent above 200-day EMA Reflects Broad Strength

.... XLK, XLY, XLI and XLB Lead with New Highs

.... Equal-weight and Small-cap Healthcare Lead

.... Biotech ETFs End Corrections...

READ MORE

MEMBERS ONLY

Exact Sciences Corp Posts Solid Results, Completes Right Side Of Cup

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

On Thursday morning, Exact Sciences Corp (EXAS) was the #1 percentage gainer on the NASDAQ, rising nearly 26%. While that's a massive move by any measure, I doubt that the move higher in EXAS has ended. If you look at a weekly chart, you'll see that...

READ MORE

MEMBERS ONLY

Consumer Discretionary Reasserting Leadership Role, Market Mixed

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, April 27, 2017

Consumer discretionary (XLY, +0.53%) led the bifurcated action on Thursday as travel & tourism ($DJUSTT), gambling ($DJUSCA) and toys ($DJUSTY) all broke to fresh new highs helping to lead the sector higher. The XLY has broken out and is leading once again...

READ MORE

MEMBERS ONLY

DP Alert: Market Pausing - Calm Before the Storm?

by Erin Swenlin,

Vice President, DecisionPoint.com

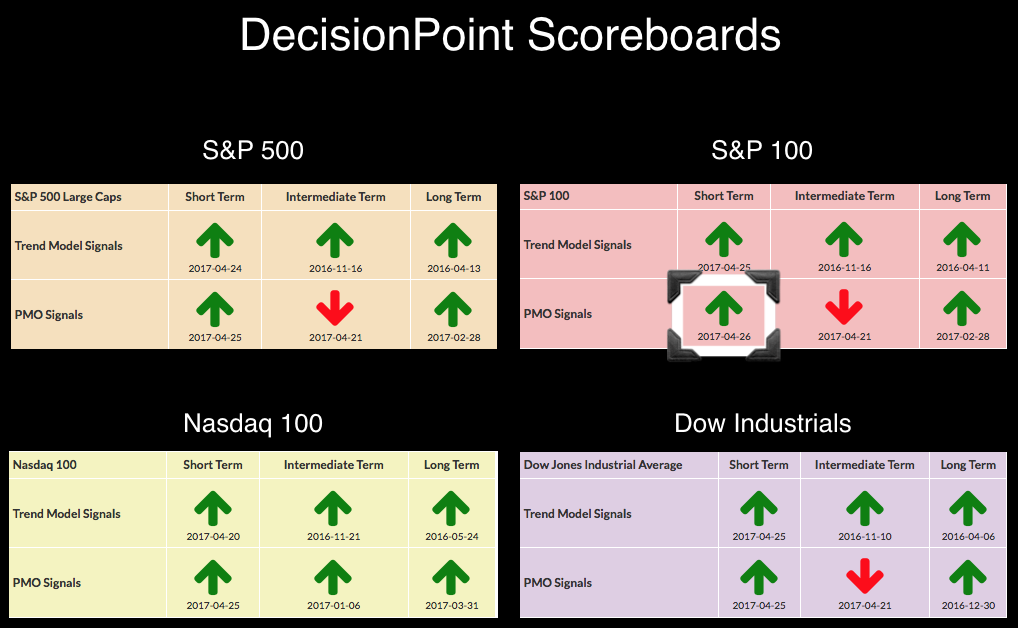

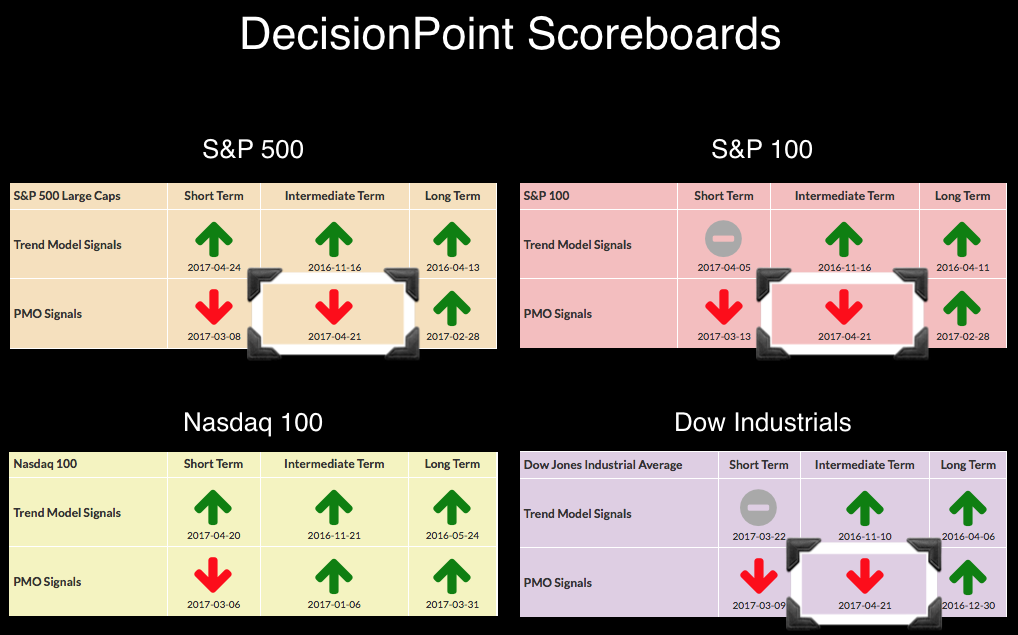

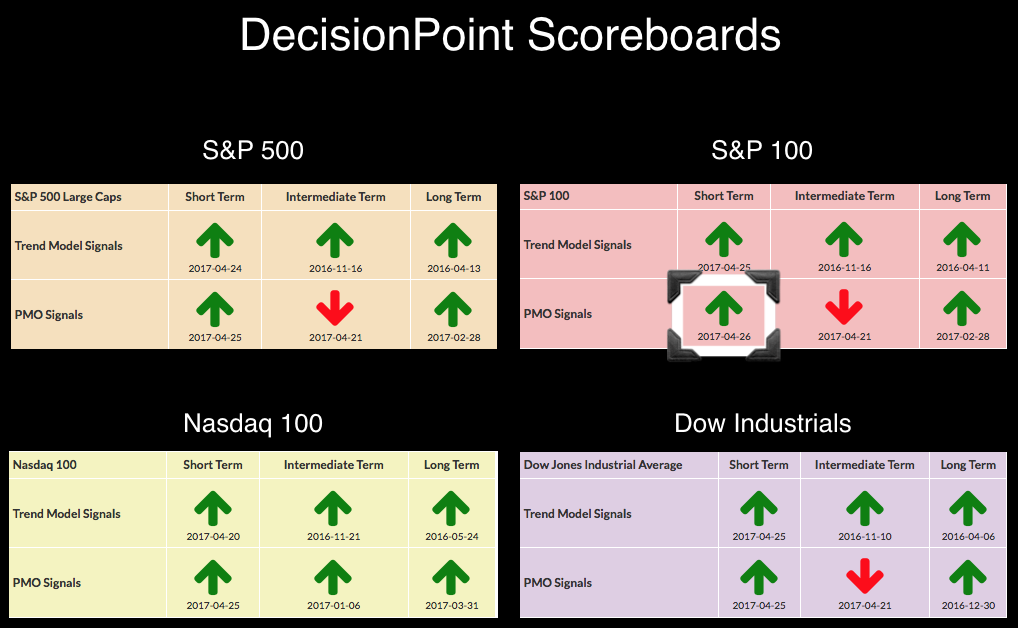

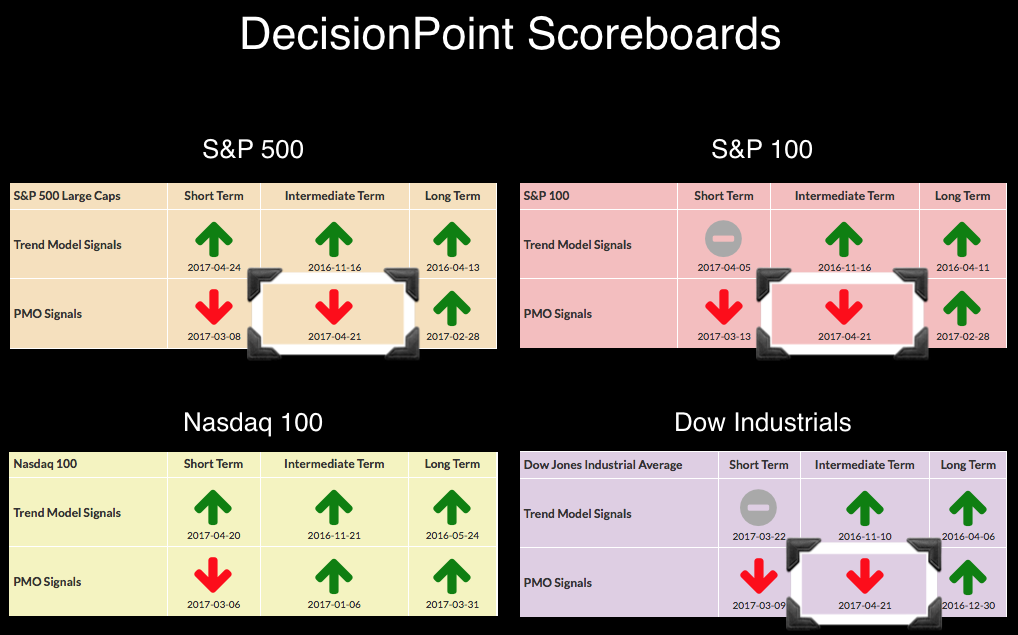

The short term remains bullish in terms of the DecisionPoint Scoreboards. The long term also is showing all bullish BUY signals. Momentum looks to be a problem in the intermediate term. The SELL signals on all but the NDX come from the Price Momentum Oscillator (PMO) on the weekly chart....

READ MORE

MEMBERS ONLY

Gold Faces A Critically Important Technical Test In The Weeks Ahead

by Martin Pring,

President, Pring Research

* Gold’s long term trading range

* Watch those Gold shares for clues about Gold

* Hail Silver?

Gold’s long term trading range

Gold is often regarded as a safe-haven investment, but is more normally held as a hedge against inflation. Chart 1 deflates the price by the CPI, so you...

READ MORE

MEMBERS ONLY

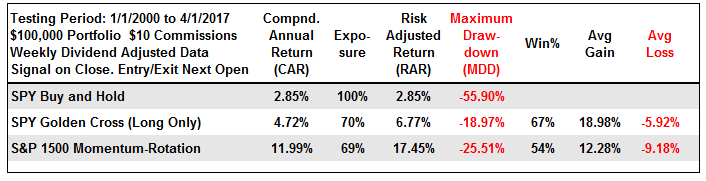

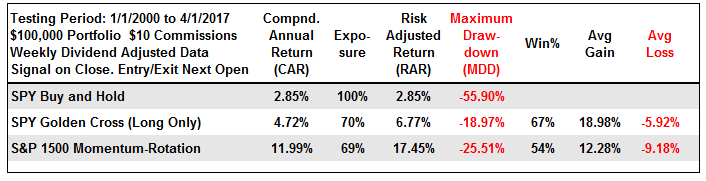

Comparing Momentum ETFs to the Major Index ETFs - Revisiting the ChartCon Momentum-Rotation Strategy

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... ChartCon Momentum-Rotation Update

.... What can we learn from this?

.... Comparing with the Momentum-Driven ETFs

.... Comparing Performance with PerfCharts

.... Ranking Performance with the Summary View

.... Measuring Relative Performance with RRGs

.... Performance Since Bull Run Began

.... Measuring Rolling Performance

.... Volatility Can Hurt Momentum ....

Today I am going to look at some momentum-style...

READ MORE

MEMBERS ONLY

HEALTHCARE IS QUIETLY MOVING HIGHER -- INDIVIDUAL LEADERS ARE EDWARDS LIFESCIENCES, VARIAN MEDICAL, AND ABBVIE -- U.S. MEDICAL DEVICES ETF REPRESENTS THE STRONGEST PART OF HEALTHCARE -- BOSTON SCIENTIFIC IS ONE OF ITS LEADERS

by John Murphy,

Chief Technical Analyst, StockCharts.com

HEALTH CARE SPDR NEARS RECORD HIGH... Although it hasn't received much attention lately, the healthcare sector is quietly moving higher. In fact, healthcare is the third strongest sector this year behind technology and consumer cyclicals. And its chart looks promising. Chart 1 shows the Health Care SPDR (XLV)...

READ MORE

MEMBERS ONLY

Medical Equipment Breaks Cup Resistance, Latest To Confirm Bullish Pattern

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for April 26, 2017

A late day selloff on Wednesday left the small cap Russell 2000 as the only major index left standing with gains. The Dow Jones penetrated 21000 for a second consecutive session after not doing so for nearly two months. The S&P 500...

READ MORE

MEMBERS ONLY

S&P 100 Joins the Gang with a New PMO BUY Signal

by Erin Swenlin,

Vice President, DecisionPoint.com

The DecisionPoint Scoreboards have been flipping out! I mean the signals are flipping quickly on all of the Boards! I wrote about the five signal changes we got yesterday in the DP Alert article here. The short term picture is very bullish with all four major indexes showing "green&...

READ MORE

MEMBERS ONLY

Vodafone and Cable Could be Bottoming

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Even though Vodafone remains in a long-term downtrend, the stock has been on my watch-list recently because it could be putting in bottom. Analysis of Vodafone and other ADRs is not straight-forward because there is a currency component. Usually, the movement of the stock is more than enough to compensate...

READ MORE

MEMBERS ONLY

Materials Break Out To Lead Another Market Surge

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, April 25, 2017

U.S. indices closed significantly higher for a second consecutive session, this time with materials (XLB, +1.61%) leading eight of the nine sectors higher. Only utilities (XLU, -0.13%) failed to gain on the session. We are seeing breakouts one at a...

READ MORE

MEMBERS ONLY

DP Alert: New Signals on DP Scoreboards - Market Follows-Through on Rally

by Erin Swenlin,

Vice President, DecisionPoint.com

We already saw some shake up on the DP Scoreboards on Friday with the new intermediate-term PMO SELL signals on all but the NDX. With the recent rally, we are now seeing the Scoreboards flip back to bullish in the short term. The S&P 100 is a hair...

READ MORE

MEMBERS ONLY

NASDAQ HITS NEW RECORD WHILE DOW INDUSTRIALS AND S&P 500 TURN UP -- SMALL CAPS HIT NEW RECORD AND SHOW NEW LEADERSHIP -- SO DO MATERIALS -- ALCOA LEADS ALUMINUM SHARES HIGHER -- FLIGHT FROM SAFE HAVENS PUSHES GOLD MINERS LOWER

by John Murphy,

Chief Technical Analyst, StockCharts.com

MARKET INDEXES TURN HIGHER ... The stock market is continuing to benefit from the "risk on" rally that started yesterday after the weekend vote in France. And all signs are currently positive. Chart 1 shows the PowerShares QQQ hitting a new record for the second day in row. The...

READ MORE

MEMBERS ONLY

S&P 500 Breaks Downtrend, Financials Surge

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, April 24, 2017

Global markets rallied on the heels of French election results and U.S. markets were no exception. We surged right out of the gate and didn't look back. The NASDAQ flirted with the 6000 level before settling for an all-time high...

READ MORE

MEMBERS ONLY

Major Index ETFs Finally Surge above Chandelier Exit - Chinese Stocks Remain Subdued

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Small-cap ETF Closes above Chandelier Exit

.... New Highs Expand within Tech and Industrials

.... Tech Stocks and ETFs Dominate New High List

.... Agribusiness ETF Gets a Wedge Breakout

.... Chinese Stocks Remain Subdued

.... Stocks to Watch: HBAN, JBHT, CA, PFPT, NKE, WBC ....

IJR Closes above Chandelier Exit

With a big surge in...

READ MORE

MEMBERS ONLY

Three New IT PMO SELL Signals on DecisionPoint Scoreboards!

by Erin Swenlin,

Vice President, DecisionPoint.com

We had three new signal changes hit the DecisionPoint Scoreboards on Friday (4/21). When I reviewed the weekly charts on Friday, I noted that the Price Momentum Oscillators (PMOs) had finally crossed below their signal lines on all but the NDX (which retains its current BUY signal).

One positive...

READ MORE

MEMBERS ONLY

Tensile Trading ChartPack Update (2017-Q1) Updated Charts and the Latest Fidelity Moves

by Gatis Roze,

Author, "Tensile Trading"

Anywhere you see excellence and mastery happening, you’ll discover the same set of recurring universal truths. Great athletes achieve excellence and make it look effortless. Great investors make market mastery seem natural and make profits look easy.

I love the line “I worked all my life to become an...

READ MORE

MEMBERS ONLY

FRENCH VOTE SENDS GLOBAL STOCKS HIGHER -- FRANCE LEADS EUROPEAN RALLY -- EUROZONE ISHARES REACH THREE-YEAR HIGH -- A STRONGER EURO WOULD BOOST EUROZONE PERFORMANCE -- U.S. STOCKS FOLLOW EUROPE HIGHER AS SAFE HAVENS WEAKEN

by John Murphy,

Chief Technical Analyst, StockCharts.com

FRANCE LEADS EUROPE HIGHER... French stocks are leading big gains in eurozone stocks. A strong Euro is giving an even bigger boost to eurozone ETFs. Chart 1 shows MSCI France iShares (EWQ) surging more than 5% to the highest level in three years. That compares with a 4% gain in...

READ MORE

MEMBERS ONLY

NASDAQ Poised To Set All-Time High After French Election

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, April 21, 2017

The S&P 500 trended lower from midday Thursday through Friday's close and that extended a much longer downtrend that began after the gap higher back on March 1st. Futures are very bright green this morning, however, so we could...

READ MORE

MEMBERS ONLY

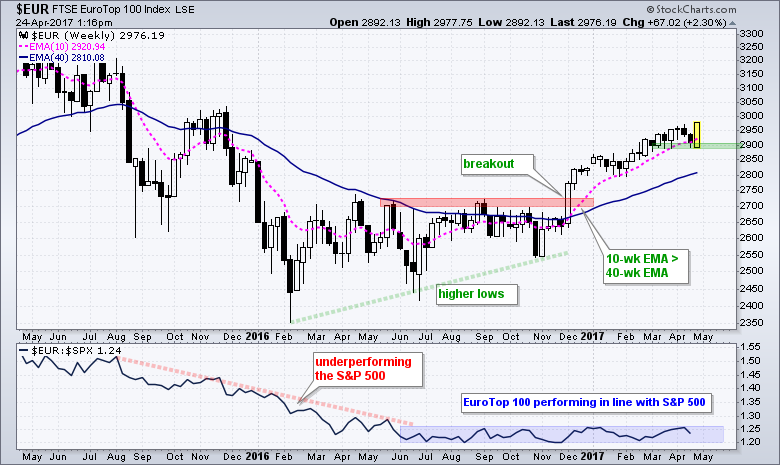

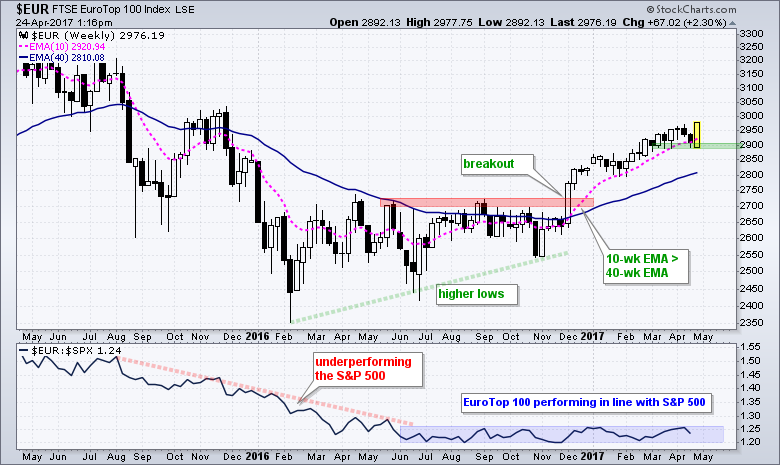

EuroTop 100 Hits New High, but Still Not Outperforming S&P 500

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Eurotop 100 Index surged over 2% and hit a new high to affirm its current uptrend, which began with the breakout and golden cross in early December. The index established support around 2900 over the last two months and this is the first area to watch going forward. A...

READ MORE

MEMBERS ONLY

Filtering the Noise III

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

First of all, I must apologize for my lack of creativity for these article titles. The previous two “Filtering the Noise” and “Filtering the Noise II” were about moving averages and suggesting a better way to use a relationship between two moving averages, similar to the ubiquitous MACD. In this...

READ MORE

MEMBERS ONLY

DecisionPoint Weekly Wrap 4/21/2017 -- Correction Over?

by Carl Swenlin,

President and Founder, DecisionPoint.com

Last week I wrote, "The first necessary signal that the correction is over would be for the daily PMO (Price Momentum Oscillator) to turn up." That happened on Thursday, but there was no follow through on Friday due to, I believe, it being options expiration day, which tends...

READ MORE

MEMBERS ONLY

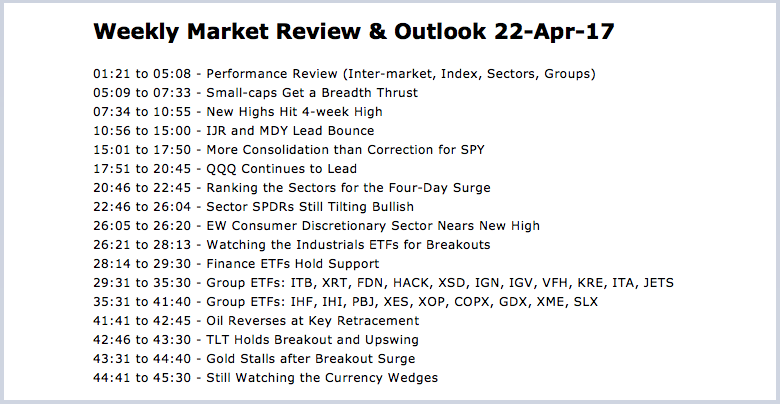

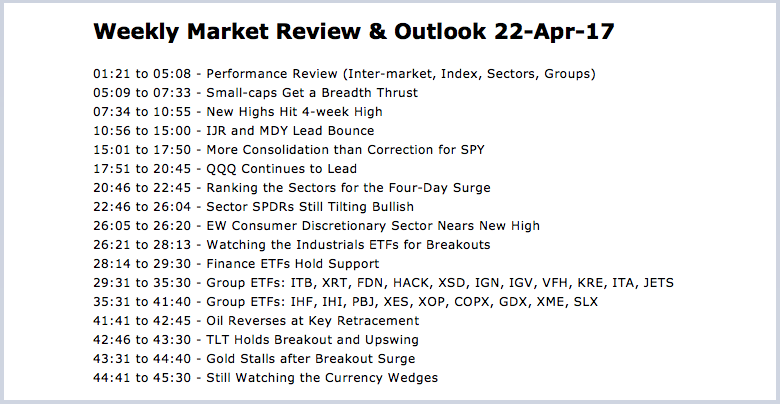

Video - Weekly Market Review & Outlook - Is the Correction Over?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

----- Video Link ----- Art's Charts ChartList (updated 22-Apr) -----

This video is a companion to the written commentary, which was posted on Friday. Small-caps and mid-caps led a market rebound this past week and we even saw a breadth improvement. This is an encouraging spark, but the...

READ MORE

MEMBERS ONLY

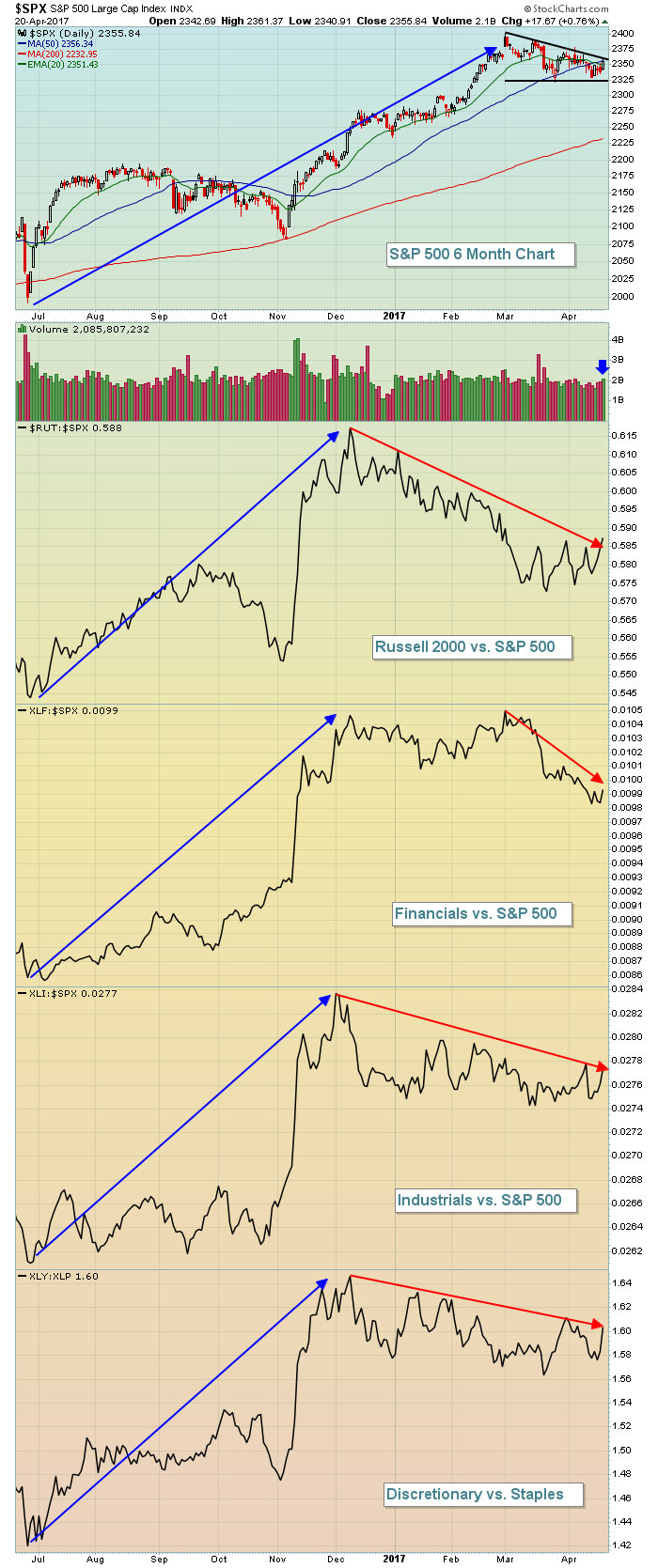

Weekly Market Review & Outlook - Small-caps Perk Up and Sector Balance is Bullish

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Weekly Market Review & Outlook

.... Economically Sensitive Groups Take the Lead

.... Small-caps Get a Breadth Thrust

.... New Highs Hit 4-week High

.... IJR and MDY Lead Bounce

.... More Consolidation than Correction for SPY

.... QQQ Continues to Lead

.... Ranking the Sectors for the Four Day Surge

.... Sector SPDRs Still Tilting Bullish

.... EW...

READ MORE

MEMBERS ONLY

Thursday's Rally Recipe Filled With Bullish Ingredients

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, April 20, 2017

We've yet to see the breakouts in our major indices that we're looking for, but yesterday's rally was quite bullish with leadership coming from the small cap Russell 2000 ($RUT, +1.24%), financials (XLF, +1.69%) and...

READ MORE

MEMBERS ONLY

DP Alert: New ST Trend Model BUY for NDX - Gold Pulls Back

by Erin Swenlin,

Vice President, DecisionPoint.com

Today the Nasdaq 100 triggered a new Short-Term Trend Model (STTM) BUY signal. This replaces a Neutral signal from exactly one week ago. In the thumbnail of the chart below the DecisionPoint Scoreboards, you can that the Neutral signal was the victim of whipsaw. I've been bearish on...

READ MORE

MEMBERS ONLY

Dycom Breaks Cup Resistance With Strong Volume

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Our major indices have been consolidating for many weeks and that's enabled many individual stocks to consolidate in bullish continuation patterns. Dycom Industries (DY) is one such stock as it formed a long-term cup from early-August to late-February before printing a handle throughout March. The right side of...

READ MORE

MEMBERS ONLY

MONEY IS ROTATING INTO THE EUROZONE WHICH IS OUTPERFORMING THE U.S. -- BRITISH STOCKS ARE LAGGING BEHIND -- BRITISH ISHARES HAVE BEEN HURT BY A WEAK POUND -- ROTATION INTO EUROPE MAY SLOW U.S. RALLY, BUT SUGGESTS GLOBAL BULL MARKET IS STILL INTACT

by John Murphy,

Chief Technical Analyst, StockCharts.com

EUROZONE STOCKS ARE ATTRACTING GLOBAL FUNDS ... Part of the reason that U.S. stocks haven't been doing so well during 2017 is that global funds are moving into other parts of the world. Especially to Europe. More specifically, the eurozone. The reason is simple. U.S. stocks are...

READ MORE

MEMBERS ONLY

Rally In Semiconductors Looking Suspicious

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, April 19, 2017

The U.S. equity market enjoyed strong early gains on Wednesday only to see them mostly evaporate throughout the balance of the session. The Dow Jones lagged badly all day as one of its components - IBM (-4.92%) - disappointed Wall Street...

READ MORE

MEMBERS ONLY

Some Markets And Key Ratios Are At The Brink, But At The Brink Of What?

by Martin Pring,

President, Pring Research

* Bond yields sending a deflationary message

* Intermarket signals from equities are close to deflationary signals

* So are similar measures for bonds

* More on confidence relationships

Wednesday’s close saw a lot of key ratios and some markets resting on key trendlines and moving averages. Since these benchmarks represent potential support,...

READ MORE

MEMBERS ONLY

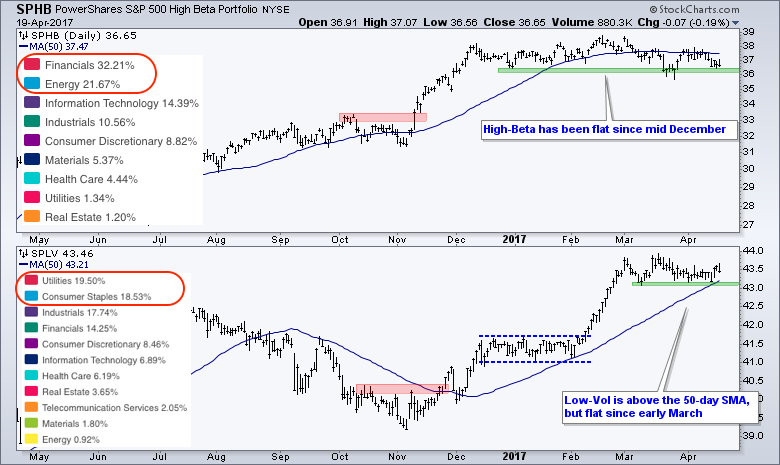

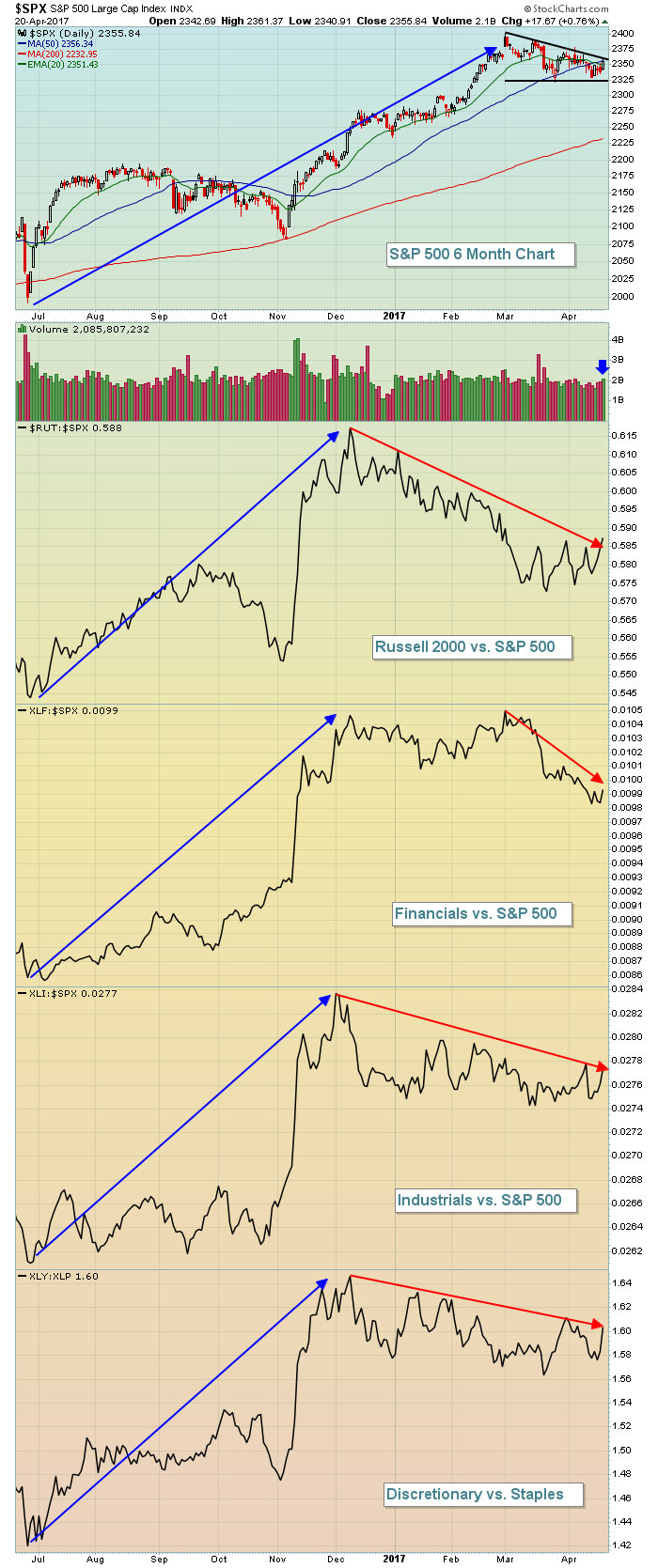

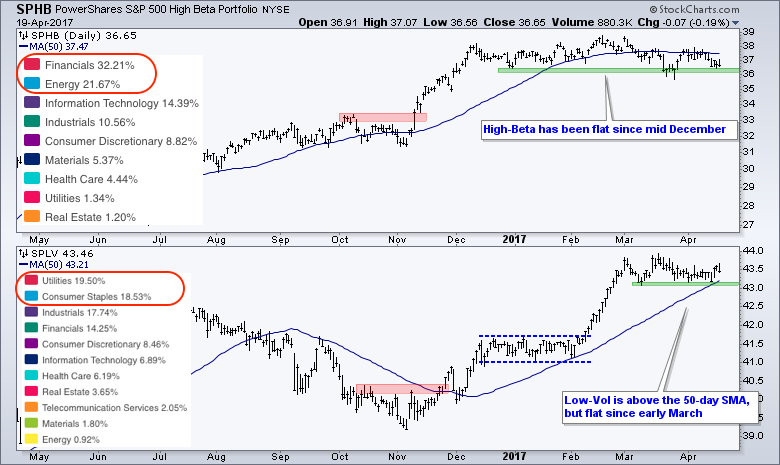

Measuring the Risk Appetite with Beta, Volatility and Ratios - GDX Underperforms GLD

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... High-Beta/Low-Vol Ratio Reflects Risk Environment

.... Risk Ratios Stabilize within Downtrends

.... Stock:Bond Ratio Turns Down

.... High Yield Bond SPDR Could be Vulnerable

.... Internet, Software and Cloud-Computing Hold Up

.... Gold Miners ETF Underperforms Gold ....

High-Beta/Low-Vol Ratio Reflects Risk Environment

There are a number of ways to measure the risk...

READ MORE