MEMBERS ONLY

Zim's Group

by Bruce Fraser,

Industry-leading "Wyckoffian"

In 1987 Hank Pruden decided to take a break from teaching the Technical Analysis Courses at Golden Gate University. He offered me the job of teaching these courses during his absence. I was honored by his invitation and accepted. His sabbatical went on for three years and I believe it...

READ MORE

MEMBERS ONLY

DecisionPoint Weekly Wrap April 7, 2017

by Carl Swenlin,

President and Founder, DecisionPoint.com

*** IMPORTANT NOTE: We are making some changes to our DecisionPoint blogs and webinars starting on April 1st.Click here for more details. ***

Despite a negative reaction to Fed comments, and the U.S attack on a Syrian air base, the market held steady within the current corrective phase. The 10-minute...

READ MORE

MEMBERS ONLY

STOCK INDEXES STAY ABOVE 50-DAY AVERAGES AFTER MISSILE ATTACK -- SMALL CAPS AND FINANCIALS NEED TO DO BETTER -- BOND YIELDS BOUNCE OFF BOTTOM OF 2017 TRADING RANGE -- DOLLAR RALLIES AS SAFE HAVEN YEN WEAKENS -- GOLD STRUGGLES AT 200-DAY AVERAGE

by John Murphy,

Chief Technical Analyst, StockCharts.com

MAJOR STOCK INDEXES HOLD 50-DAY LINES ... Entering today's trading, stocks were relatively flat on the week. Bond prices, however, were nearing the top of their 2017 trading range. Other safe haven assets like gold and the yen have been bouncing as well. Yesterday's missile attack on...

READ MORE

MEMBERS ONLY

Charts I'm Stalking: Action Practice #14

by Gatis Roze,

Author, "Tensile Trading"

My intent with this Action Practice is not to wax on about the importance of understanding what the markets’ current preferences are. My point is simply that if the markets are favoring growth over value, then as investors, our probabilities are enhanced when we invest with the growth winds at...

READ MORE

MEMBERS ONLY

Treasury Yield Nears Support, Financials Wavering

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, April 6, 2017

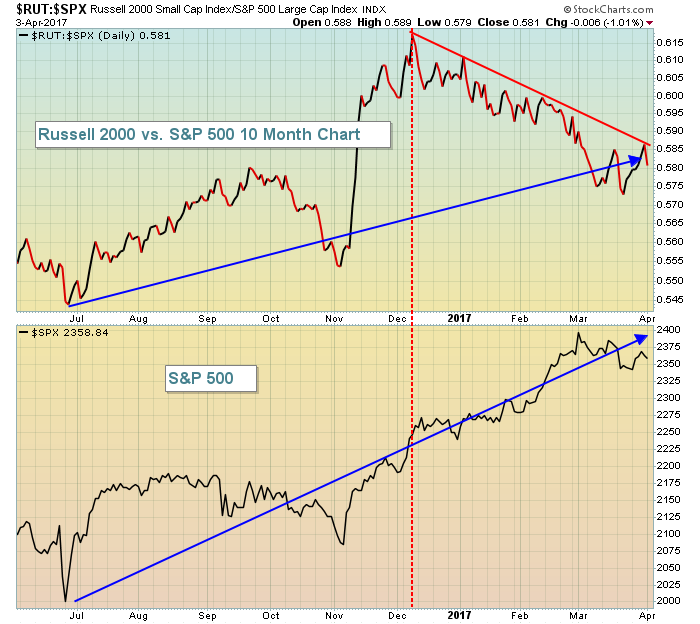

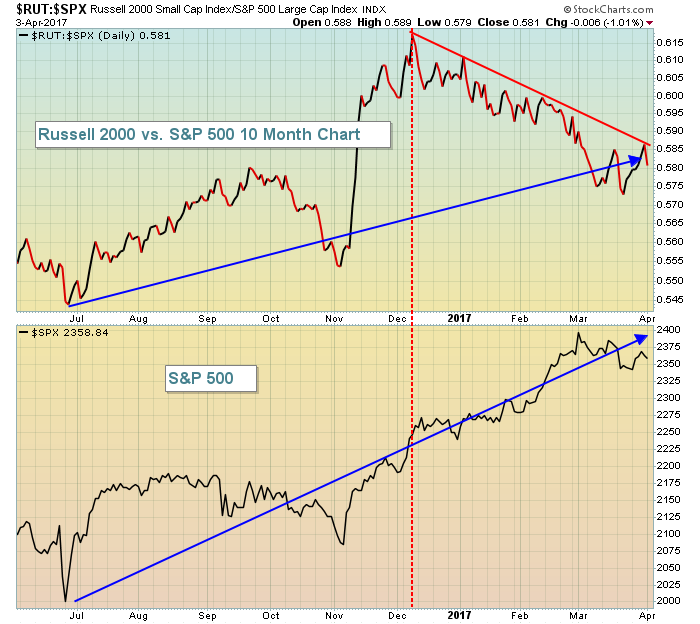

Yesterday, we saw better relative action on the Russell 2000, a positive for equities. However, that has not been the case over the past week as you can see from the chart below:

There's been a slight uptrend in Dow stocks...

READ MORE

MEMBERS ONLY

Charter Forms The Right Side Of A Cup

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Charter Communications (CHTR) extended its multi-year uptrend in late January with a heavy volume gap higher. CHTR spent the next several weeks consolidating and unwinding very overbought conditions. But the stock began to resume its prior strength after its RSI touched the 40s (black arrow below) and its MACD hit...

READ MORE

MEMBERS ONLY

Declining Trend Persists - IT Indicators Bottoming

by Erin Swenlin,

Vice President, DecisionPoint.com

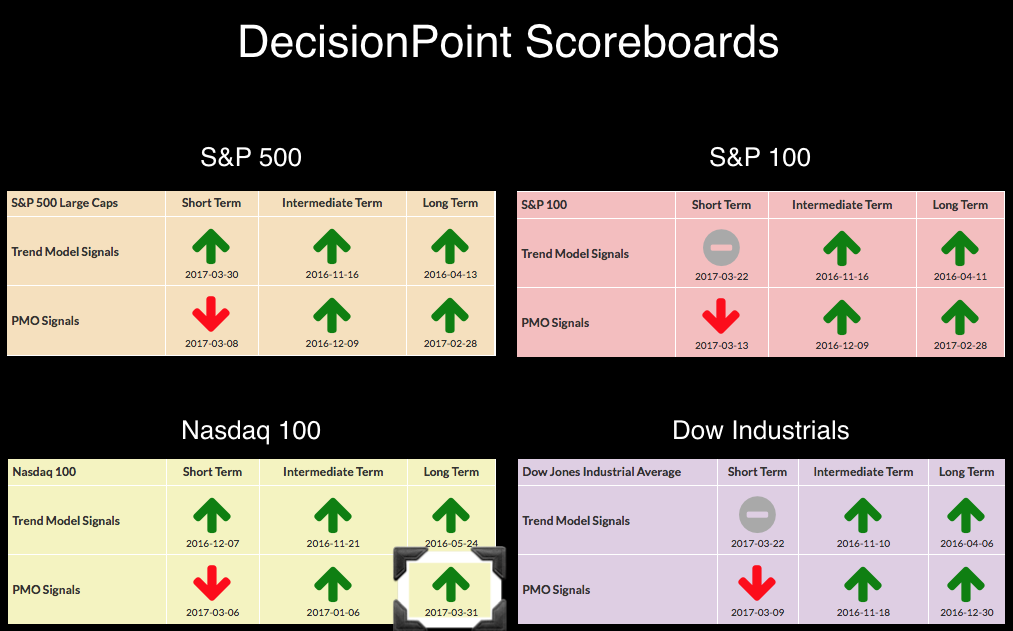

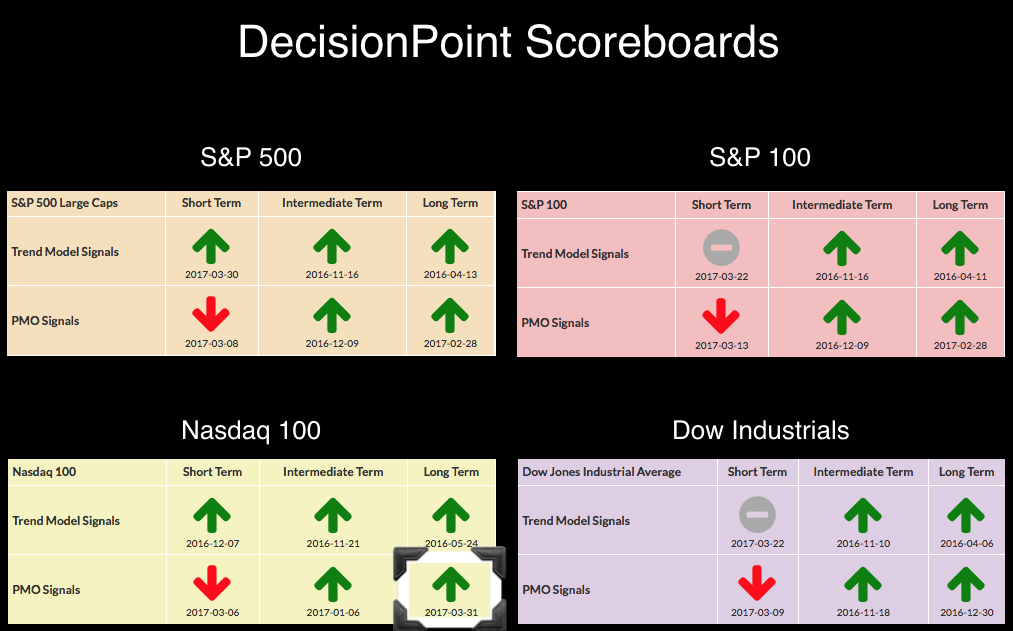

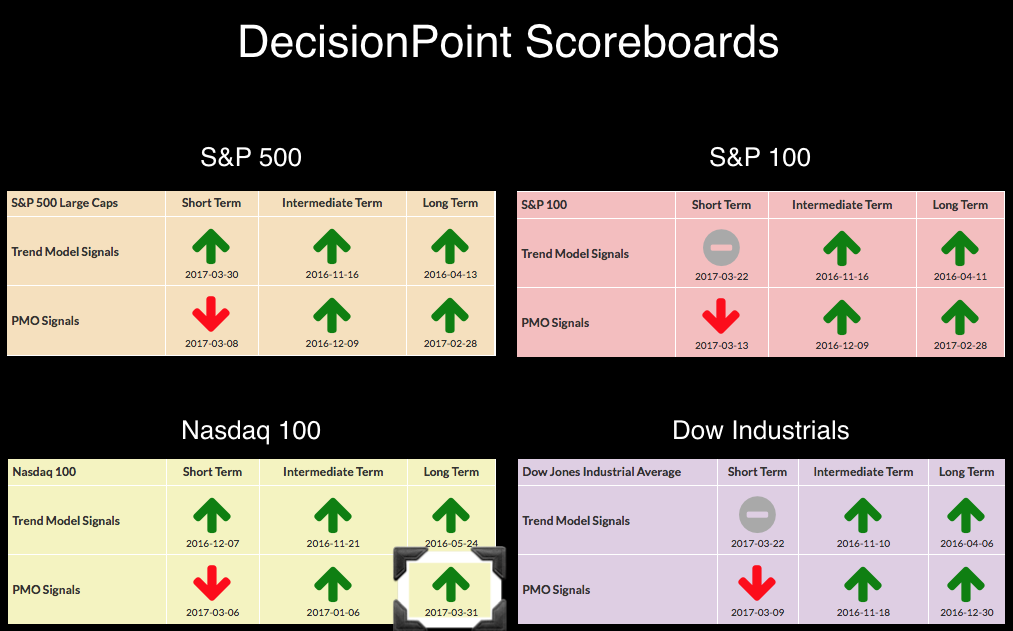

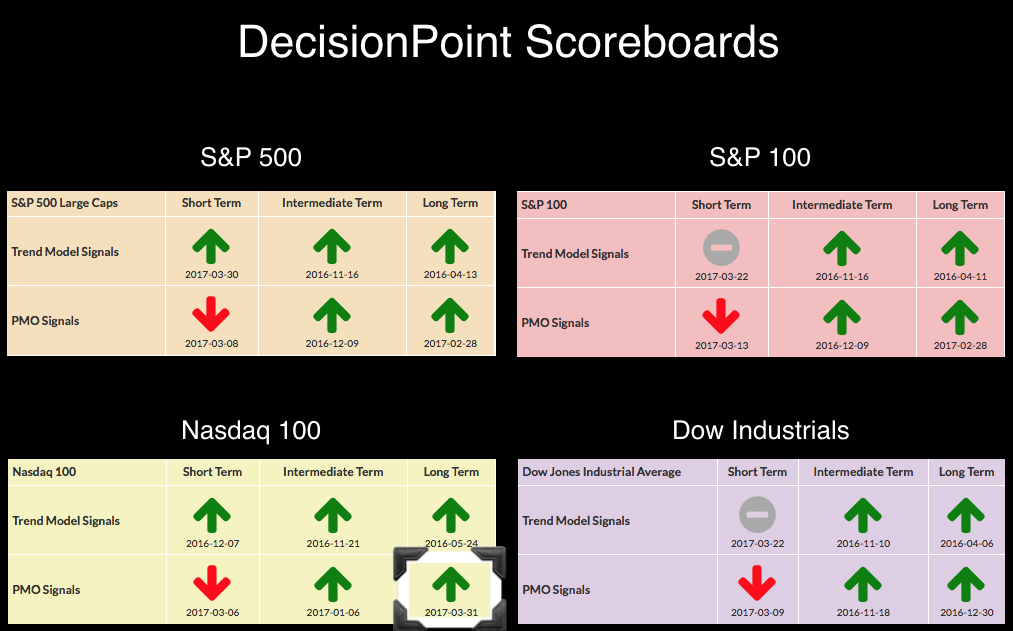

No new changes on the DP Scoreboards. I was expecting to see the Dow trigger a Short-Term Trend Model BUY signal, but with yesterday's failed breakout and price stagnating over the past week or two, you can see that the 5-EMA is maintaining below the 20-EMA with little...

READ MORE

MEMBERS ONLY

Markets Have Experienced A Lot Of Fake Breakouts Recently

by Martin Pring,

President, Pring Research

* A few words on false moves

* US market experiences false upside breakout this week

* Whipsaws in the sectors

* European currency whipsaws

A few words on false moves

Prices in financial markets are driven principally by psychology. They effectively reflect people in action. The problem is, that people can and do...

READ MORE

MEMBERS ONLY

SystemTrader - Scan Code for Bollinger Band Squeeze - Plus Coding Tips and Techniques

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Universe and Trend Filter

.... Bollinger Band Setup Code

.... StockRSI Trigger Code

.... Rate-of-Change Sort Code

.... Scan Code in Full

.... TTM Technologies Setup and Signal

.... Conclusions and Suggestions ....

Scan Code for Bollinger Band Squeeze

This article will focus on the scan code for last week's System Trader article featuring the...

READ MORE

MEMBERS ONLY

Fed Minutes Spook Traders; Afternoon Selloff Spoils Big Rally

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for April 5, 2017

The release of the FOMC minutes was widely anticipated to see if there were any hidden nuggets of information from the last Fed meeting. Traders apparently were not happy that the Fed is discussing an unwinding of its balance sheet earlier than expected. That...

READ MORE

MEMBERS ONLY

Retailers Continue To Hold Back Consumer Discretionary Stocks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, April 4, 2017

U.S. equities opened lower on Tuesday, but steadily marched higher throughout the day, finishing with mostly small gains across the board. The small cap Russell 2000 was an exception as it fell for a second consecutive session. That follows a winning streak...

READ MORE

MEMBERS ONLY

DP Alert: New BUY Signal for S&P 100 - S&P 600 (IJR) New ITTM Neutral Signal

by Erin Swenlin,

Vice President, DecisionPoint.com

The DecisionPoint Scoreboards updated with a new signal change today. The $OEX just managed a new Short-Term Trend Model BUY signal. The 5-EMA crossed above the 20-EMA triggering the signal. Right now price is running along the declining tops trendline. The PMO is no longer rising and that is a...

READ MORE

MEMBERS ONLY

PIPELINES ARE YEAR'S STRONGEST ENERGY GROUP -- ALERIAN MLP ETF COVERS THAT GROUP -- ONEOK AND MPLX ARE PIPELINE LEADERS -- TRANSCANADA CORP HOLDS 200-DAY LINE -- GLOBAL X MLP & ENERGY INFRASTRUCTURE ETF BOUNCES OFF 200-DAY LINE

by John Murphy,

Chief Technical Analyst, StockCharts.com

DOW JONES US PIPELINES INDEX IS TURNING UP ... My last two messages suggested that the energy sector was trying to stabilize near its 200-day average. That's based on the assumption that the price of oil is also bottoming. My Saturday message further suggested that oil service stocks were...

READ MORE

MEMBERS ONLY

Market Round Up Video Recording 2017-04-04

by Martin Pring,

President, Pring Research

Here is a link to this week's video.

Market RoundUp With Martin Pring 2017-04-04 from StockCharts.com on Vimeo.

Good luck and good charting,

Martin J. Pring

The views expressed in this article are those of the author and do not necessarily reflect the position or opinion of...

READ MORE

MEMBERS ONLY

Tesla Charged Up To Lead Automobiles

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, April 3, 2017

It was a rough day on Wall Street to open the month of April, but an afternoon rally did minimize any damage technically. The Russell 2000, the recent leader among our major indices, was trampled and lost 1.17%, while the Dow Jones...

READ MORE

MEMBERS ONLY

Correction Update - Plus Gold and Newmont are in Focus this Week

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Still in Corrective Mode

.... Newmont Mining Stalls with Pennant

.... Surge in TLT and Bounce in the Dollar Baffles Gold

.... Watch Baker Hughes and ExxonMobil for Clues on Energy Stocks

.... Kellogg and Monster Turn Lower within Downtrends

.... Pfizer and Thermo Fisher Correct after Surge ....

Still in Corrective Mode

I have a...

READ MORE

MEMBERS ONLY

MarketWatchers LIVE Kick-Off - Recap of Market Indicators

by Erin Swenlin,

Vice President, DecisionPoint.com

MarketWatchers LIVE kicked off today at noon EST! Tom Bowley and I host this new webcast Monday, Wednesday and Friday from 12:00p - 1:30p EST. Very soon we will have a public ChartList available for the show as well as a MarketWatchers LIVE blog that will recap some...

READ MORE

MEMBERS ONLY

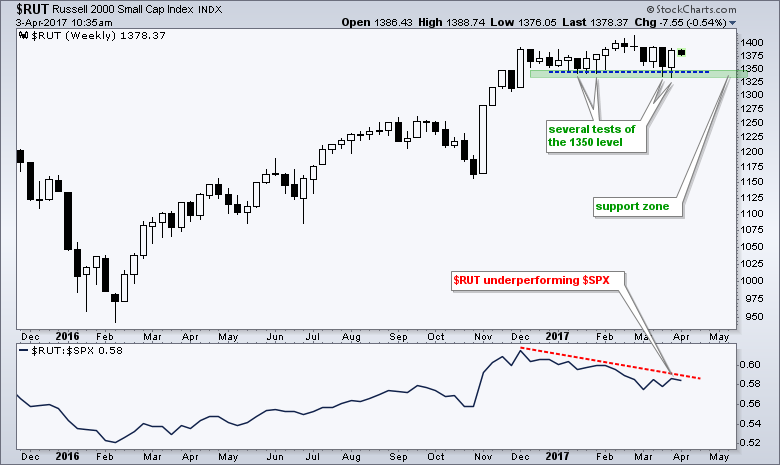

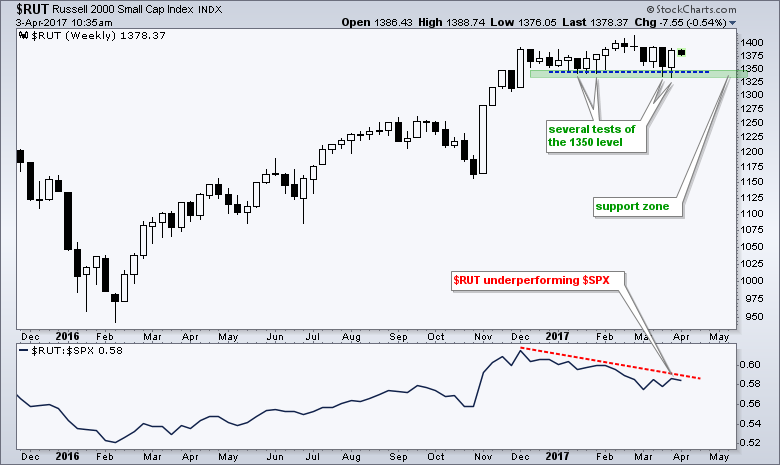

Russell 2000 Establishes a Clear Line-in-the-Sand $RUT

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Russell 2000 surged last week and this bounce gives chartists a clear level to watch going forward. The chart below shows the small-cap index surging from early November to early December and then stalling between 1330 and 1390 for nine weeks. The index exceeded the early December high and...

READ MORE

MEMBERS ONLY

MarketWatchers LIVE Starts Today!!!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Announcement

I'm very excited to announce the beginning of our new StockCharts.com show featuring me and Erin Heim. We'll have fun covering the global markets, discussing stocks on the move, providing technical analysis education and highlighting the various tools available here at StockCharts, among...

READ MORE

MEMBERS ONLY

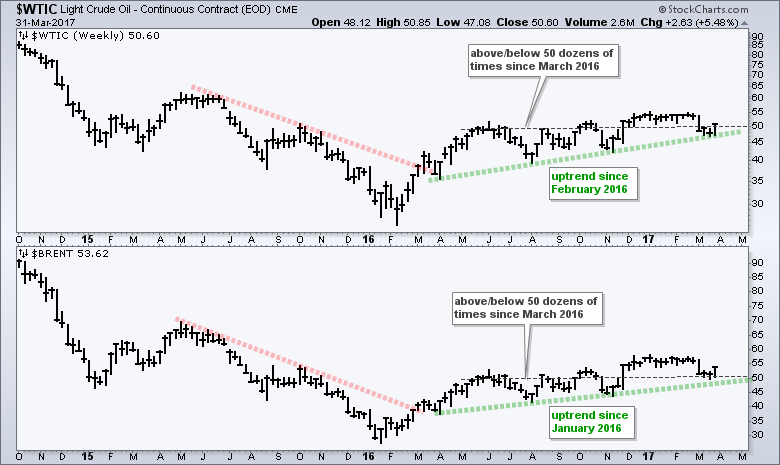

Mixing it up with Oil, Industrial Metals, 3 Emerging Market ETFs and a Kiwi

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

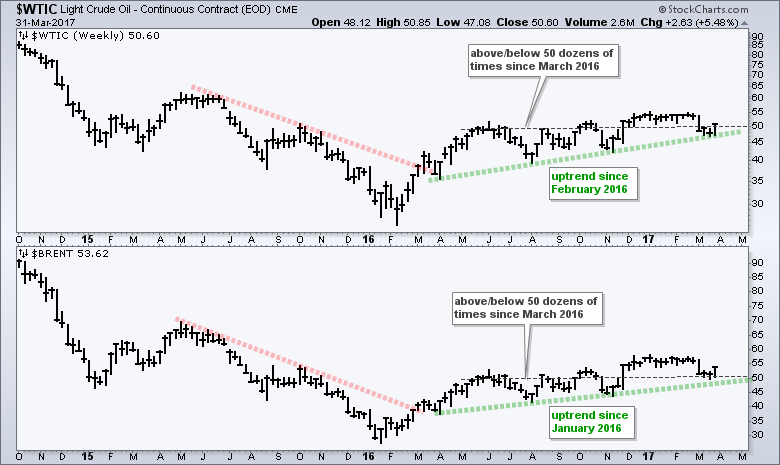

.... WTI and Brent Battle the $50 Level

.... Gasoline Looks Poised to Continue Uptrend

.... Industrial Metals Remain in Uptrends

.... Silver Surges off Breakout Zone

.... Two Emerging Market ETFs in Asia

.... New Zealand ETF Bounces off Breakout Zone

.... Colombia ETF Breaks Out of Flag ....

I am going to mix it up a...

READ MORE

MEMBERS ONLY

Defense Stocks Resolve Momentum Issues, Poised To Lead

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Bullish rotation continues in most areas of the market and we saw a perfect example of that last week in the Dow Jones U.S. Defense Index ($DJUSDN). The DJUSDN had a HUGE month in February, gaining roughly 6.5% in that month alone. That swamped the benchmark S&...

READ MORE

MEMBERS ONLY

5 Reasons Why This Isn't 2007

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Many market pundits on CNBC continue to predict a market top, discussing how we've run too far too fast and that valuations are too high and blah, blah, blah. Fear sells and CNBC is all about their ratings and advertisements. There's an occasional nugget of solid...

READ MORE

MEMBERS ONLY

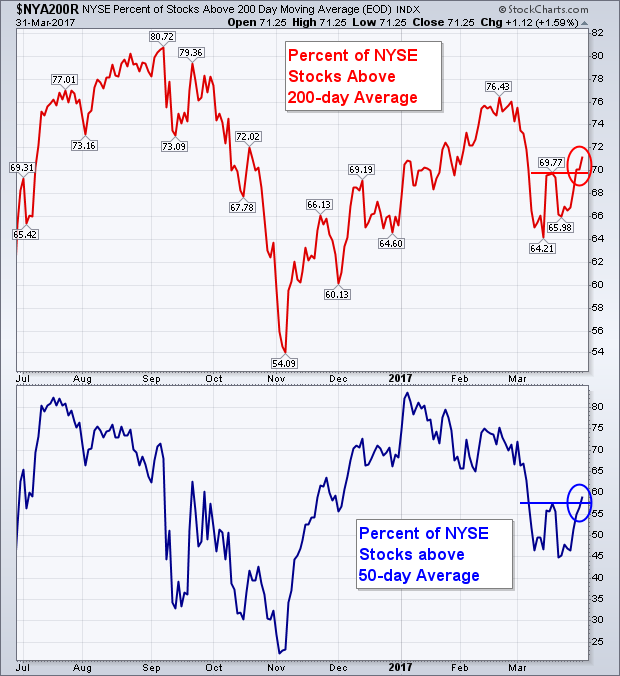

Percent of Stocks Over 200-Day Average Turns Back Up

by John Murphy,

Chief Technical Analyst, StockCharts.com

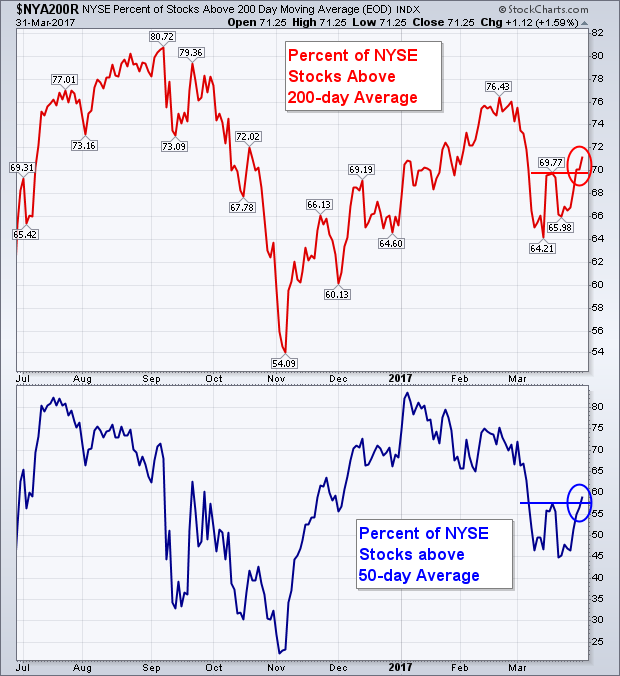

My last two messages have stressed the importance of the 200-day moving average. It's what separates uptrends from downtrends. In order to sustain a bull market, more stocks have be above their 200-day average than below it. And that is currently the case. The red line in Chart...

READ MORE

MEMBERS ONLY

Trust Your Good Work

by John Hopkins,

President and Co-founder, EarningsBeats.com

If you trade stocks you're going to run into situations where you question whether or not you are making good decisions. This could include identifying entry levels and setting price targets and stop losses. It could also include pulling the trigger on a trade, taking a loss or...

READ MORE

MEMBERS ONLY

BUILDING MATERIALS STOCKS MAY ALSO BE BOTTOMING -- MARTIN MARIETTA AND VULCAN MATERIALS FIND SUPPORT NEAR 200-DAY AVERAGES -- OIL SERVICE STOCKS LEAD ENERGY SECTOR HIGHER AND SHOW BETTER RELATIVE STRENGTH

by John Murphy,

Chief Technical Analyst, StockCharts.com

MARTIN MARIETTA MATERIALS BOUNCES OFF 200-DAY AVERAGE... My Thursday message showed three stock groups that had fallen to their 200-day averages and were starting to stabilize. They included commodity-related groups like energy and metals and mining ETFs. They also included heavy construction stocks like Fluor (FLR) and Jacobs Engineering (JEC)...

READ MORE

MEMBERS ONLY

Monthly PMO BUY Signal for Nasdaq 100

by Erin Swenlin,

Vice President, DecisionPoint.com

Patience was rewarded today as the Long-Term Price Momentum Oscillator (PMO) confirmed a BUY signal that had been pending most of the month. We don't log new monthly PMO signals until the chart goes "final" on the last trading day of the month. Similarly, we don&...

READ MORE

MEMBERS ONLY

DecisionPoint Weekly Wrap 3/31/17

by Carl Swenlin,

President and Founder, DecisionPoint.com

*** IMPORTANT NOTE: We are making some changes to our DecisionPoint blogs and webinars starting on April 1st. Click here for more details. ***

The DecisionPoint Weekly Wrap presents an end-of-week assessment of the trend and condition of the stock market (S&P 500), the U.S. Dollar, Gold, Crude Oil,...

READ MORE

MEMBERS ONLY

Finding New Highs and Measuring Trend Strength with Stochastics

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Stochastic Oscillator is best known as a momentum indicator, but a careful look at the formula reveals that it can also be used to measure trend strength. As noted in a previous article on MACD, it is imperative that chartists fully understand an indicator to get the most out...

READ MORE

MEMBERS ONLY

35 Years and 5 Key Personal Investment Passages

by Gatis Roze,

Author, "Tensile Trading"

I stumbled into a gift shop full of tchotchkes today. It was one of those retailers with endless trinkets and specialty items that encourage you to revisit your youth and marvel at someone else’s creativity. I became fascinated by one of those intricately detailed Russian “Matryoshka” – the wooden nesting...

READ MORE

MEMBERS ONLY

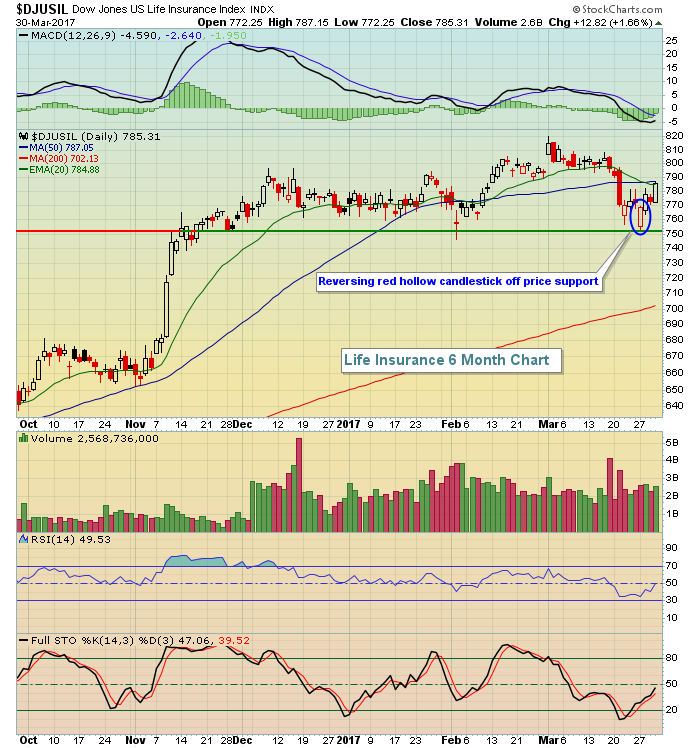

Banks At Critical Resistance Short-Term; Railroads Strengthening

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, March 30, 2017

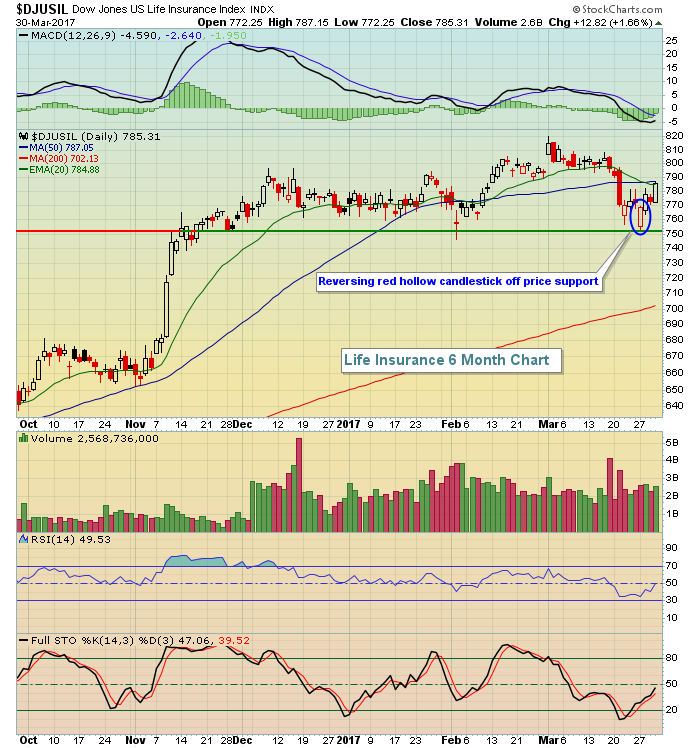

It was another strong day on Wall Street Thursday as six sectors advanced while only three declined - utilities (XLU, -0.78%), consumer staples (XLP, -0.20%) and energy (XLE, -0.02%). The four "power" sectors, the aggressive groups, finished 1-2-3-4...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook (with Video) - Is One Week of Risk-On Enough?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Is One Week of Risk-On Enough?

.... Breadth Underwhelms on latest Surge

.... SPY Remains in Corrective Mode

.... IJR Gets a Mini-Breakout within a Consolidation

.... Another New High for QQQ, but..,

.... Five Sectors Still Holding Up

.... Finance and Regional Bank ETFs Reverse

.... Watch TLT and the 10-yr Yield for Clues

.... Watch GE...

READ MORE

MEMBERS ONLY

ConocoPhillips Breaks Downtrend; SCTR Soars

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

ConocoPhillips (COP) saw its SCTR soar nearly 47 points after an 8.81% increase in its stock price broke its four month downtrend. COP's strength began earlier this week on a reversing candle at gap support and culminated with today's breakout. Here's the chart:...

READ MORE

MEMBERS ONLY

Short-Term Trend Model/PMO Scan from 3/29 DecisionPoint Report Webinar - James River Group (JRVR) Analyzed

by Erin Swenlin,

Vice President, DecisionPoint.com

Yesterday during the DecisionPoint Report webinar I decided to run a short-term scan and run through the results with my viewers. You can find the webinar here. I promised to write a blog article with the text of the scan so that Extra members can copy and paste directly into...

READ MORE

MEMBERS ONLY

HEAVY CONSTRUCTION AND MINING STOCKS TEST 200-DAY AVERAGES -- SO ARE ENERGY SHARES AS CRUDE OIL STRENGTHENS -- % OF NYSE STOCKS ABOVE 200-DAY AVERAGE REMAINS STRONG -- CONSUMER DISCRETIONARY SPDR HITS NEW RECORD -- SMALL CAPS OUTPACE LARGE CAPS

by John Murphy,

Chief Technical Analyst, StockCharts.com

HEAVY CONSTRUCTION INDEX BOUNCES OFF 200-DAY AVERAGE... This week's rebound by major stock indexes off their 50-day averages has been encouraging. So is the fact that several economically-sensitive stock groups are finding support at their 200-day lines. Chart 1 shows the Dow Jones US Heavy Construction Index bouncing...

READ MORE

MEMBERS ONLY

Financial Sector Update

by Bruce Fraser,

Industry-leading "Wyckoffian"

We looked at the Technology Sector (XLK) in the last post (click here for a link). Another very important market sector is the Financials. Here is a high-altitude view of the Financial Sector from a Wyckoffian perspective.

(click on chart for active version)

The Financial Select Sector ETF has a...

READ MORE

MEMBERS ONLY

SystemTrader - Testing a Bollinger Band Squeeze System for Stocks in the S&P 1500

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

..... A Bollinger Band Squeeze System

.... Trend Filters and Trading Signals

.... JPM with a Winner and a Loser

.... XOM with Two Losing Trades

.... System Ground Rules

.... Backtest Results for S&P 1500

.... Conclusions - Caveat Emptor! ....

A Bollinger Band Squeeze System

Today we are going to look at a system...

READ MORE

MEMBERS ONLY

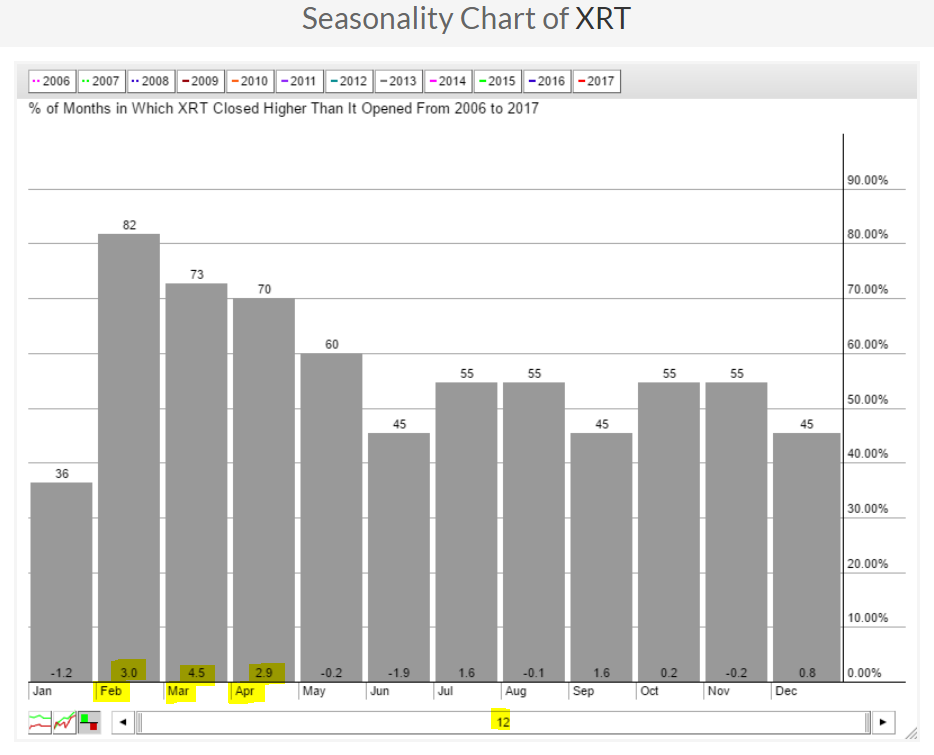

Retailers Lead Bifurcated Rally; What We Should Look For In April

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

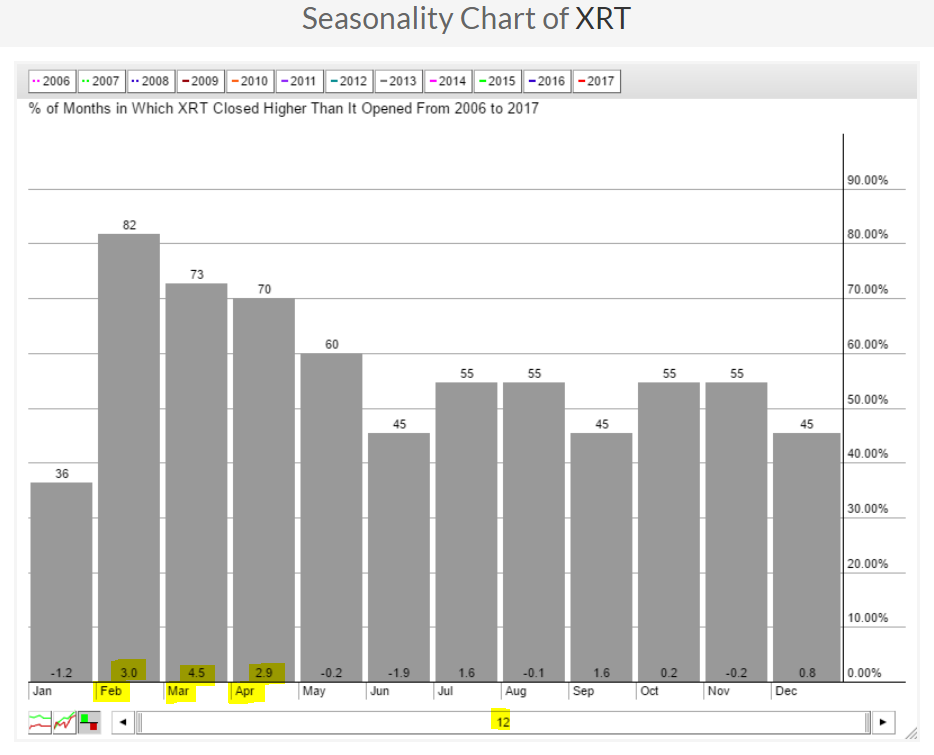

Market Recap for Wednesday, March 29, 2017

We haven't discussed leadership from retail (XRT) in quite some time, but we saw many retailers outperforming on Wednesday. The obvious question is whether this leadership will continue for an extended period. Well, first keep in mind that retail typically excels...

READ MORE

MEMBERS ONLY

Monday Was A Very Important Inflexion Point For Several Markets

by Martin Pring,

President, Pring Research

* Two short-term indicators that can support higher prices

* Global equities ex the US are poised for a mega breakout

* Three markets poised for a major breakout

* Commodities coming to life?

It’s a well-known axiom on Wall Street that it’s not the news that is important but the market’...

READ MORE

MEMBERS ONLY

Excellent Market Leadership Snaps Dow's 8 Day Losing Streak

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, March 28, 2017

The bullish action couldn't have been much better on Tuesday. Money clearly rotated back to aggressive areas of the market as the Dow Jones advanced for the first time in the last nine trading sessions. This bullish rotation will be key...

READ MORE

MEMBERS ONLY

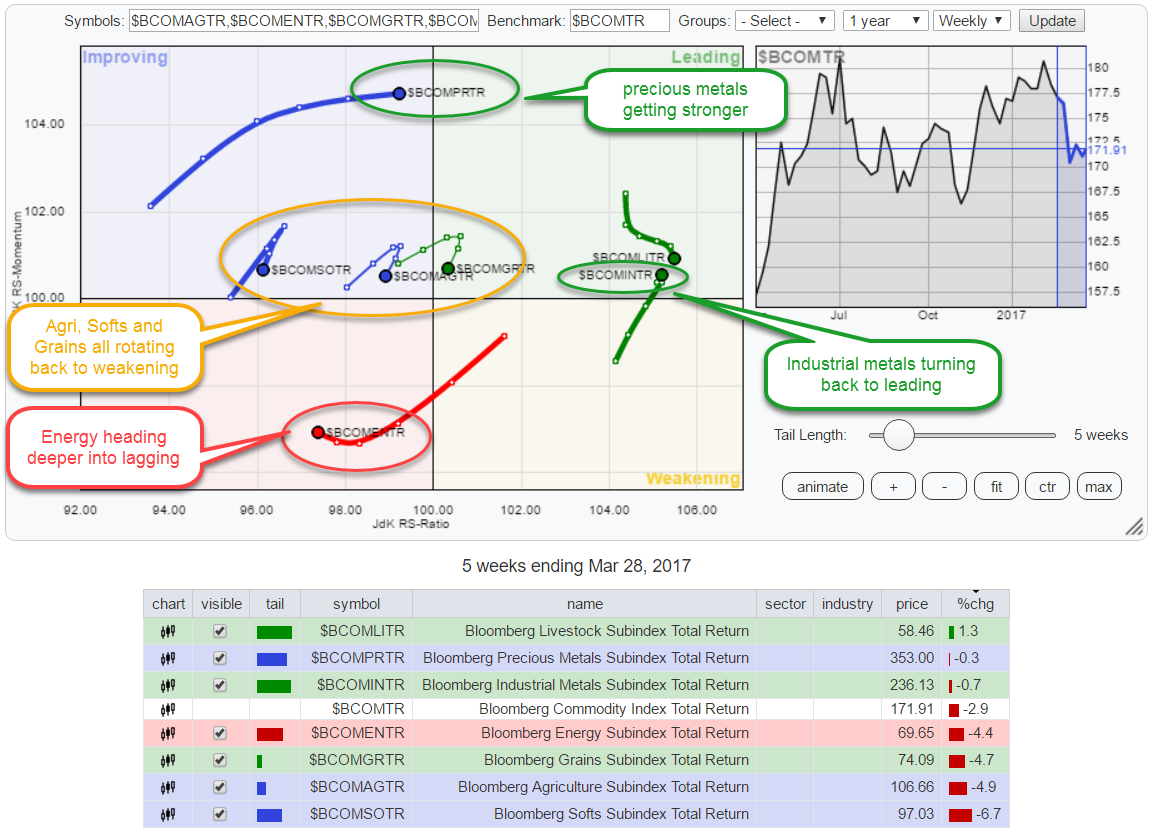

Precious metals shining on Relative Rotation Graph

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

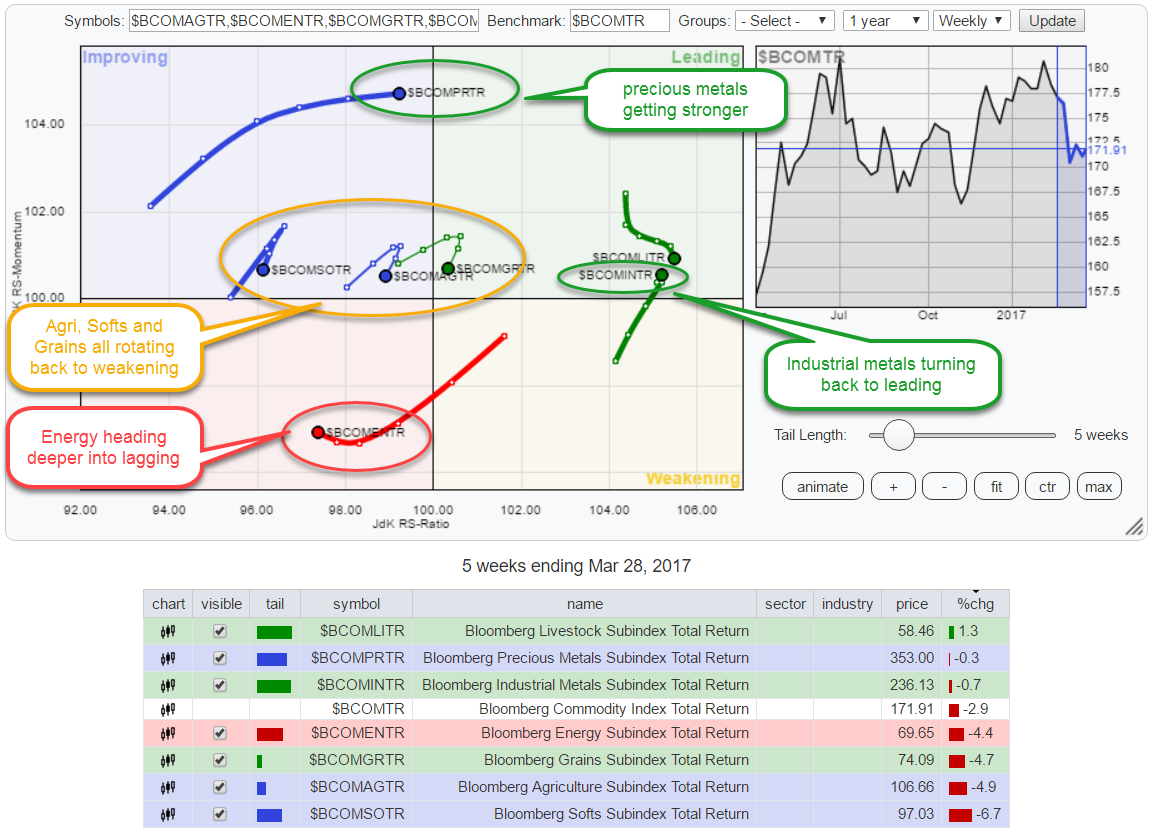

Most of the time Relative Rotation Graphs are used to visualize stock-related universes but please "Don't Ignore the fact" that RRGs can be used to visualize the rotation of any universe that holds comparable securities.

In the chart above I have plotted the rotations for all...

READ MORE