MEMBERS ONLY

Net Advances-Declines Indicators Rock the Ultra-Short Term

by Erin Swenlin,

Vice President, DecisionPoint.com

The DecisionPoint universe is evolving. As many of you are aware, some of our indicators will be retired. Two of the indicators many are concerned about losing are the Climactic Volume Indicator and Participation Index. Writing a blog everyday and doing regular webinars during the week tends to keep my...

READ MORE

MEMBERS ONLY

STOCKS REBOUND FROM SUCCESSFULL TEST OF 50-DAY AVERAGES -- ECONOMICALLY-SENSITIVE STOCKS LEAD WHILE STAPLES AND UTILITIES LAG -- BOND PRICES WEAKEN WHILE HIGH YIELD BONDS REBOUND -- GOLD AND THE EURO MEET RESISTANCE AT 200-DAY LINES AS DOLLAR REBOUNDS

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK ETFS REBOUND OFF 50-DAY AVERAGE ... Yesterday's message showed major stock indexes stabilizing at their 50-day averages. Today, they're rebounding impressively today off that rising support line. Chart 1 shows the Dow Jones Industrial SPDR (DIA) having its best day in a month. Chart 2 shows...

READ MORE

MEMBERS ONLY

Dow Jones Falls For 8th Straight Day, Tests 50 Day

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, March 27, 2017

It was yet another bifurcated day in the market with the Dow Jones losing ground for the eighth straight session and the S&P 500 joining the Dow in negative territory. For the second consecutive session, the NASDAQ and Russell 2000 bucked...

READ MORE

MEMBERS ONLY

Using the 50-day SMA to Compare Performance and Price Levels

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... SPY Remains the Key Yardstick

.... Using the 50-day SMA to Compare Charts

.... IJR Attempts another Oversold Bounce

.... Banking Stocks Hit Support Zones (BAC, C, JPM, WFC, STT)

.... Watch TLT and $TNX for Clues on XLF

.... Technology is Still the Strongest Sector (MSFT, NVDA, QLYS) ....

SPY Remains the Key Yardstick

Stocks...

READ MORE

MEMBERS ONLY

STOCK INDEXES TEST 50-DAY LINES -- BOND PRICES TEST OVERHEAD RESISTANCE -- DOLLAR FALLS TO 200-DAY LINE -- GOLD REACHES RESISTANCE -- MARKETS HAVE REACHED INFLECTION POINT WHICH WILL DETERMINE IF THE TRUMP RALLY IS OVER OR JUST PAUSING

by John Murphy,

Chief Technical Analyst, StockCharts.com

MARKET INDEXES TRY TO FIND SUPPORT AT THEIR 50-DAY LINES... Today's lower open pushed several stock indexes down to their 50-day averages. Chart 1 shows the Dow Industrials trying to regain lost ground in afternoon trading. Chart 2 shows the S&P 500 trying to stay above...

READ MORE

MEMBERS ONLY

Dollar Threatening A Major Breakdown, Gold A Beneficiary

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, March 24, 2017

Friday was another day of bifurcated action with both the NASDAQ and Russell 2000 higher while the Dow Jones and S&P 500 lagged and finished lower. Sector performance wasn't any better with four sectors higher and five lower. To...

READ MORE

MEMBERS ONLY

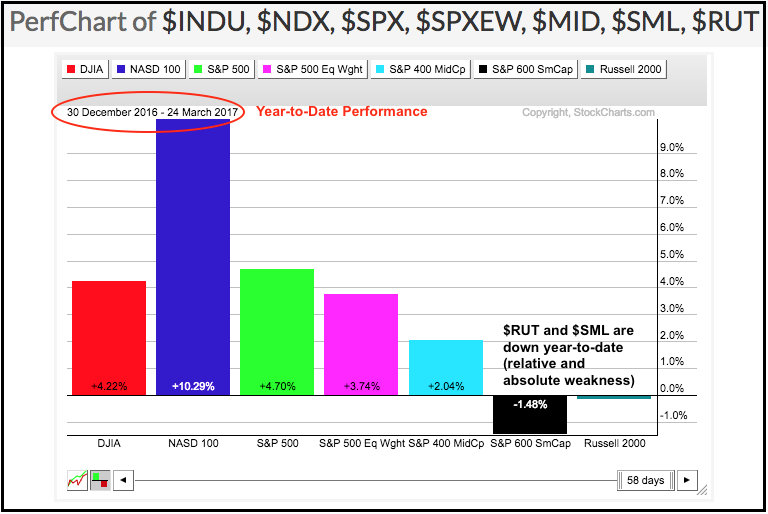

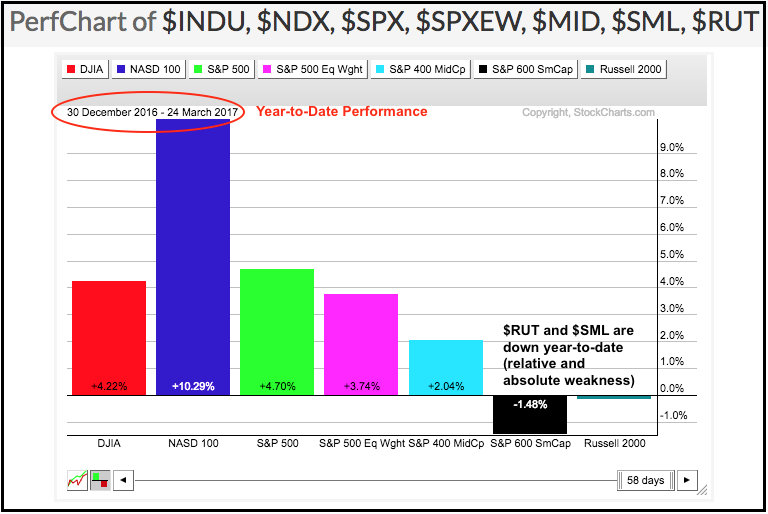

Small-caps Turn Negative Year-to-Date

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Small-caps are still leading the market since early November, but they are lagging in 2017 as year-to-date performance turned negative. The PerfChart below shows year-to-date performance for seven major stock indexes. The Nasdaq 100 is up around 10% and leading the pack by a wide margin. The Dow Industrials, S&...

READ MORE

MEMBERS ONLY

There's Not Much To Like About This NASDAQ 100 Stock

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Stocks that combine poor fundamentals, technicals and seasonal weakness are probably stocks to avoid. QUALCOMM Inc. (QCOM) is one such stock as it was hit in January with multiple lawsuits and Apple's (AAPL) suit against QCOM really damaged the QCOM chart technically. Here's a look at...

READ MORE

MEMBERS ONLY

Animal Spirits

by Bruce Fraser,

Industry-leading "Wyckoffian"

Leadership in the Technology Sector is generally a very good sign for the entire stock market. It bodes well for the market when technology stocks, as a group, are leadership as a rally starts. Speculative animal spirits are heightened by the emerging leadership of the Technology Sector. Conversely when technology...

READ MORE

MEMBERS ONLY

What Are Bond Market Intermarket Relationships Saying About Inflation?

by Martin Pring,

President, Pring Research

* The TIP/TLT Ratio reflects swings in commodity prices

* Watch that Technology/Staples ratio for a possible bullish breakout

* US breaking down against Global Equities

The TIP/TLT ratio reflects swings in commodity prices

When bond yields are compared to commodity prices there is definitely a connection, as we can...

READ MORE

MEMBERS ONLY

Video - Weekly Market Review & Outlook - The Art of Fibonacci Applied to SPY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

----- Video Link ----- Art's Charts ChartList (updated 25-Mar) -----

Note that the Art's Charts ChartList has been updated with 30 annotated charts covering the industry group ETFs. The outline above is for the video and I cover these industry group ETFs in the video.

See...

READ MORE

MEMBERS ONLY

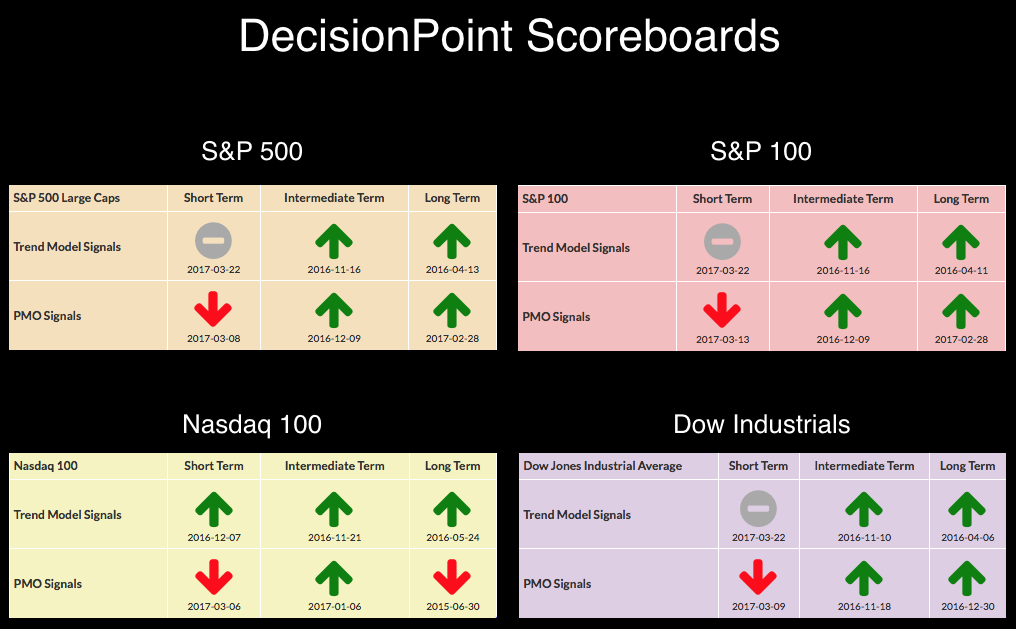

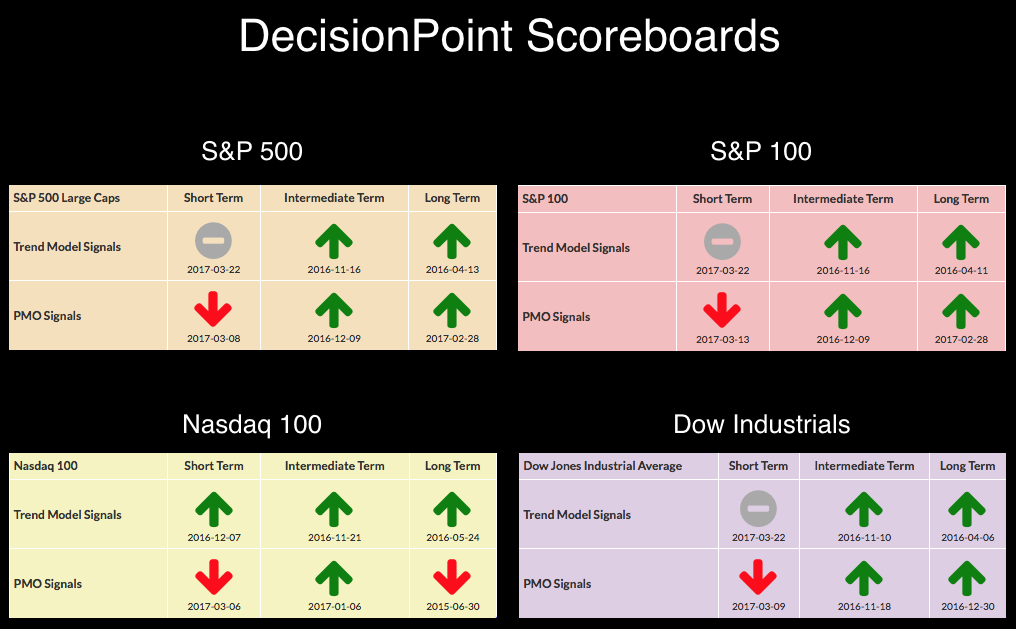

DecisionPoint Weekly Wrap 3/24/17

by Carl Swenlin,

President and Founder, DecisionPoint.com

*** IMPORTANT NOTE: We are making some changes to our DecisionPoint blogs and webinars starting on April 1st. Click here for more details. ***

Welcome to the DecisionPoint Weekly Wrap, where I make an end-of-week assessment of the internal condition, and trend of the stock market (S&P 500), the U....

READ MORE

MEMBERS ONLY

Charts I'm Stalking: Action Practice #13

by Gatis Roze,

Author, "Tensile Trading"

For those readers who embrace my CORE and EXPLORE approach (this is actually my version of John Bogle’s approach) with respect to Asset Allocation, you can see why I suggest considering country funds for a small percentage of your EXPLORE portfolio. Country funds fulfill the cardinal rule of diversification...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook 24-Mar-17 - Correction Targets for the Major Index ETFs

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Signs of a Correction Mount

.... Broad Market Breadth Deteriorates

.... The Art of Fibonacci Applied to SPY

.... RSI Breaks below 50 for QQQ

.... Mid-caps and Small-caps are Currently Correcting

.... Discretionary, Tech and Materials Hold Support

.... Staples and Utilities Lead with New Highs

.... Finance, Industrials and Healthcare Correct

.... Energy Remains the Weakest...

READ MORE

MEMBERS ONLY

Biotechnology's Recent Failure Is Disappointing But All Hope Is Not Lost

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, March 23, 2017

The Russell 2000 gained on Thursday while the other major indices declined slightly due to a selloff in the final three hours. Six of nine sectors finished in negative territory, led by energy (XLE, -0.41%). Oil & equipment services ($DJUSOI) led the...

READ MORE

MEMBERS ONLY

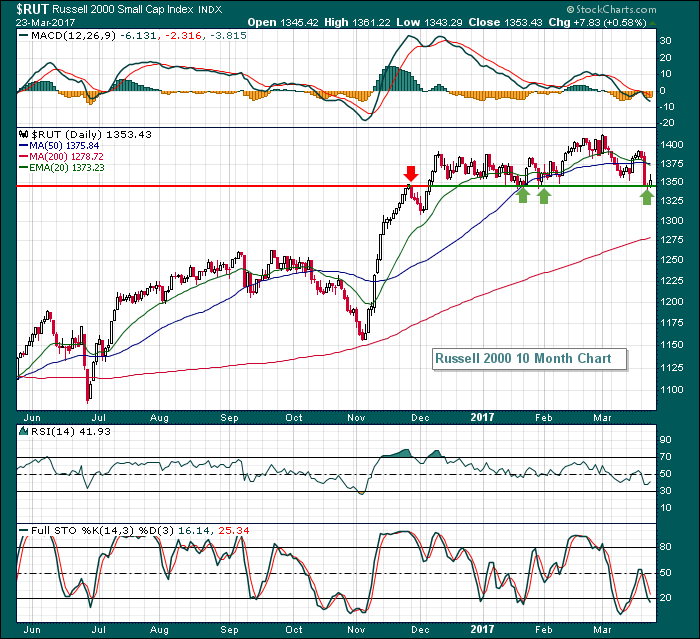

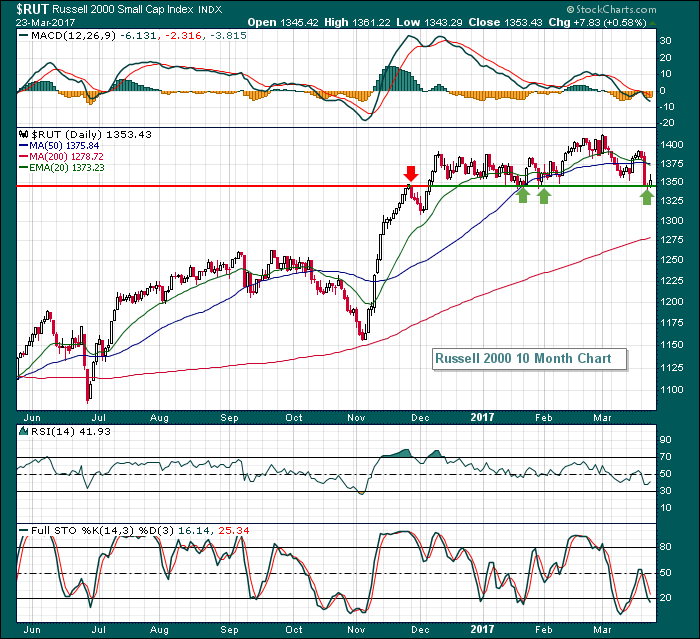

Small Caps Hang Onto Key Price Support

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The Russell 2000 has been under selling pressure but is now testing key support on both its daily and weekly charts. There is a slight negative divergence that's present on its weekly chart, so that would be a signal of possible weakness ahead. The good news is that...

READ MORE

MEMBERS ONLY

FALLING DOLLAR CONTRIBUTES TO RISING EMERGING MARKET CURRENCIES AND STOCKS -- MEXICAN PESO AND STOCK ETF ALSO GAIN GROUND -- A RISING YUAN IS HELPING BOOST CHINESE STOCKS -- STOCK GAINS EVAPORATE ON POSTPONEMENT OF HEALTHCARE VOTE

by John Murphy,

Chief Technical Analyst, StockCharts.com

EMERGING MARKET CURRENCIES SUPPORT RISING STOCKS... Previous messages have shown the rise in emerging market stocks, partially owing to the drop in the U.S. dollar. The same can be said of EM currencies. The red line in Chart 1 shows Emerging Markets iShares (EEM) rising to the highest level...

READ MORE

MEMBERS ONLY

SystemTrader - Testing Filters for Signal Line and Centerline Crosses using the PPO (MACD)

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Filtering out PPO Signals

.... MACD versus the Percentage Price Oscillator

.... Testing Signal Line Crossovers

.... Adding Some Filters to the PPO Signals

.... Adding Focus to the Portfolio

.... Conclusions - Caveat Emptor! ....

This System Trader article is a follow up to my ChartWatchers post on MACD. I will test the Percentage Price...

READ MORE

MEMBERS ONLY

Transports Mixed Technically As Market Rally Stalls

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, March 22, 2017

A strong technology sector (XLK, +0.63%) helped to lift the NASDAQ to moderate gains while the other major U.S. indices waffled near the flat line on Wednesday, a day after equities experienced their sharpest selling of 2017. From a bullish perspective,...

READ MORE

MEMBERS ONLY

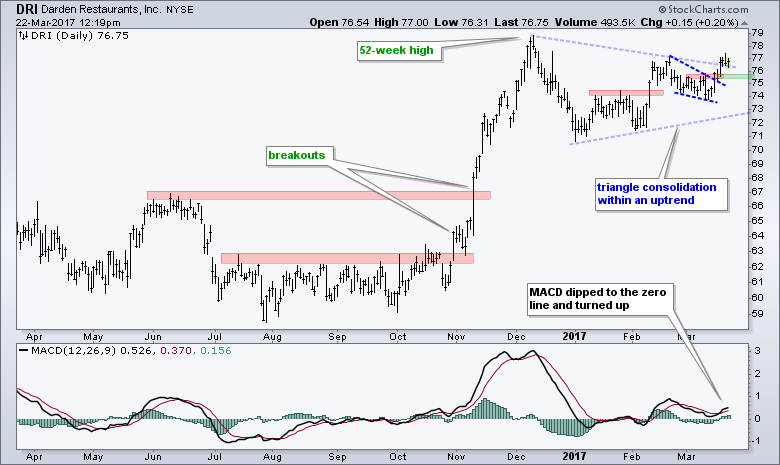

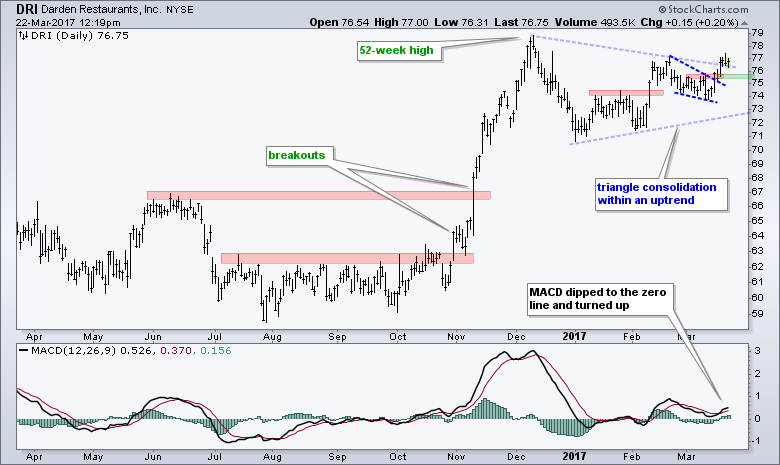

Darden Defies with a Triangle Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks got hammered on Tuesday with the S&P 500 falling the most this year (1.24%) and breaking below its March low. Even with the seemingly big decline, the index is still just 2.25% from an all time high. Darden Restaurants caught my attention because it did...

READ MORE

MEMBERS ONLY

U.S. Stocks Tumble Most Since September

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, March 21, 2017

After months of steady gains, Tuesday's action was painful with eight of nine sectors lower - the utilities sector (XLU, +1.39%) was the lone exception. Further, our major indices were led to the downside by the more aggressive Russell 2000,...

READ MORE

MEMBERS ONLY

Is the Correction Finally Here or is this Just Noise?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Breadth Indicators Plunge to Extremes

.... Finance, Industrials and Tech Get Hit Hard

.... SPY has not Done This since October

.... Small-cap Correlation Turns Down

.... RSI Breaks Key Level for QQQ

.... The Bottom Line ....

What a difference a day makes - 24 little hours. There is selling pressure and then there is...

READ MORE

MEMBERS ONLY

MAJOR STOCK INDEXES SUFFER BIGGEST DROP THIS YEAR -- SMALL CAPS AND TRANSPORTS LOOK EVEN WORSE -- BANKS LEAD FINANCIALS LOWER ON FALLING BOND YIELDS -- FALLING DOLLAR BOOSTS GOLD -- EURO NEARS TEST OF FEBRUARY HIGH

by John Murphy,

Chief Technical Analyst, StockCharts.com

STOCK ETFS SELLOFF... The market is suffering its worst day this year. Chart 1 show the PowerShares Nasdaq QQQ experiencing a downside reversal day after hitting a record high this morning. Its 14-day RSI has fallen out of overbought territory over 70 for the first time since December which shows...

READ MORE

MEMBERS ONLY

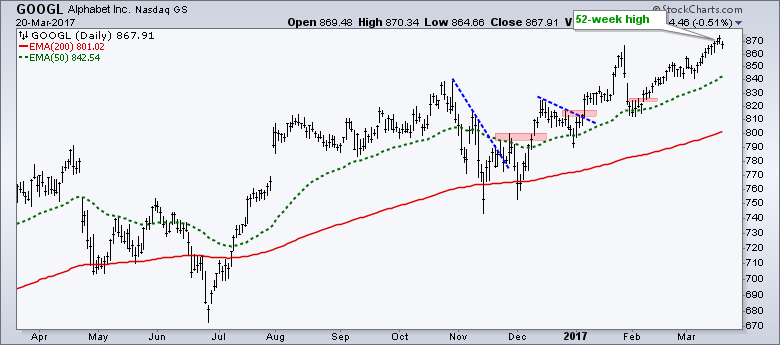

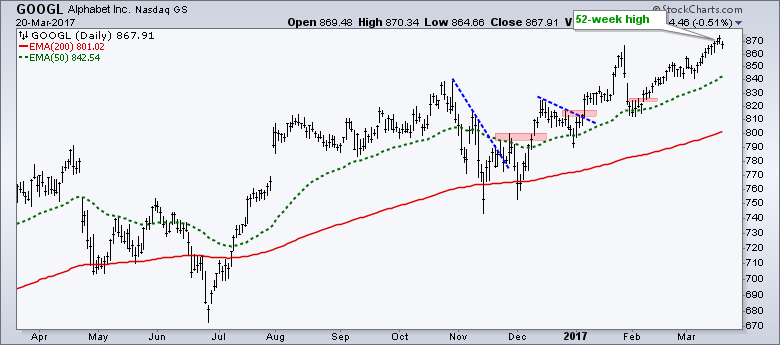

Strong Uptrends Continue in the Fab Five - Three Industrial Stocks to Watch

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... The Fab Five Remain Strong (GOOGL, AAPL, FB, MSFT, AMZN)

.... Equinix Looks Set to Continue Uptrend

.... Think Market, Sector, Group and Trend First (NVDA)

.... A Payment Processor, A Big Data Player and an IoT Leader (PYPL, TDC, XLNX)

.... Crown Castle, Zoetis and General Cable Turn Up (CCI, ZTS, BGC)

.... Watch...

READ MORE

MEMBERS ONLY

NASDAQ's Negative Divergence Holding The Market At Bay

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, March 20, 2017

Financials (XLF, -0.73%) led the market lower on Monday as short-term price and gap support was lost on one of the best performing sectors since the early November run. While I don't view this as a big technical development in...

READ MORE

MEMBERS ONLY

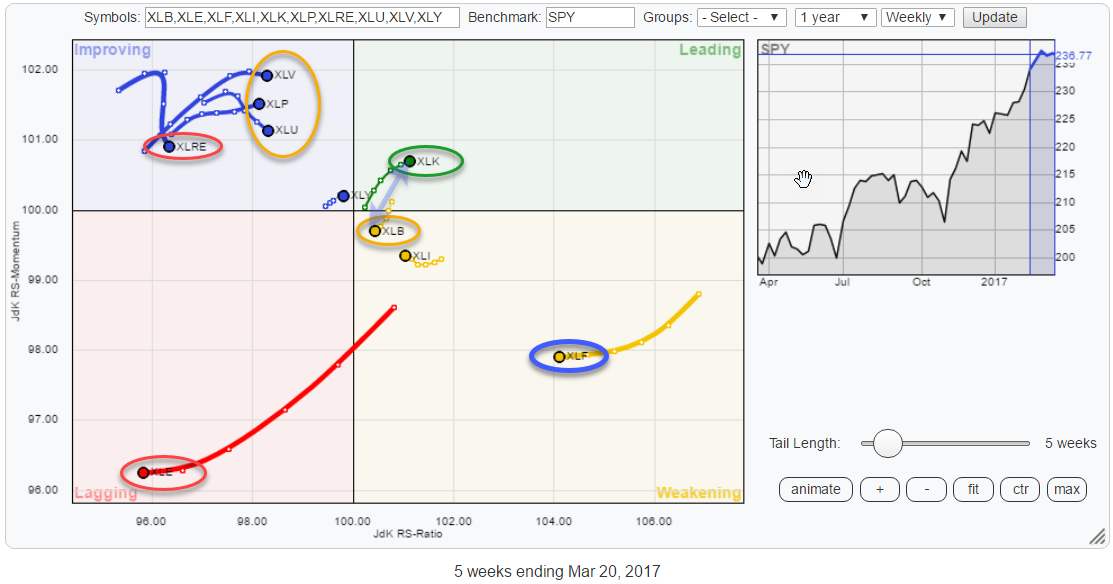

Three breaks and you're out .....

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

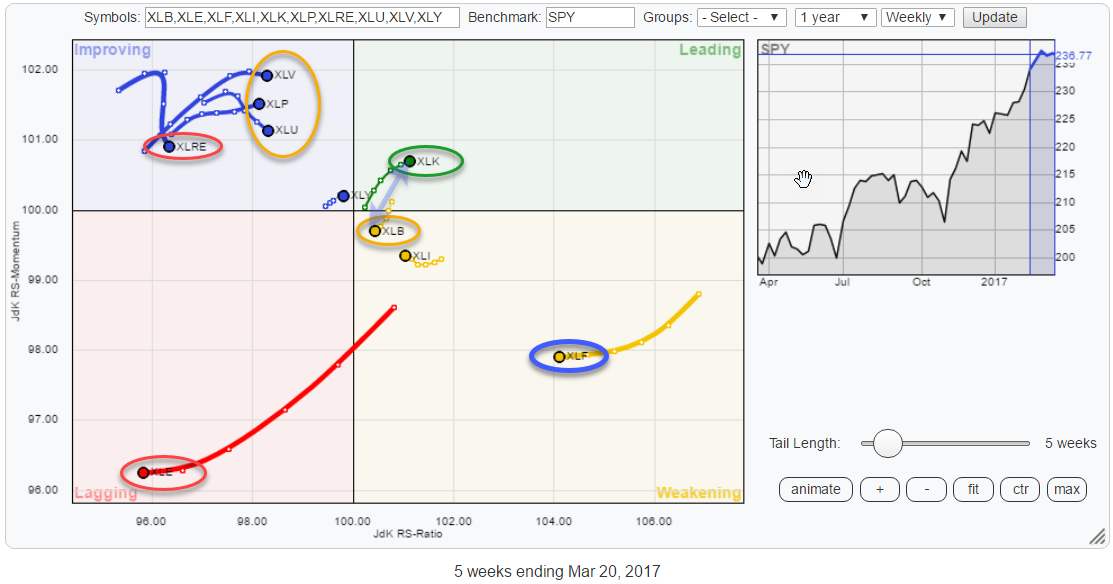

This post looks at the rotation of US sectors again. The Relative Rotation Graph above holds the ETFs that track the performance of US sectors.

Pretty much immediately the attention goes out to the Energy sector (XLE) and the Financials sector (XLF) as they stand out because of the length...

READ MORE

MEMBERS ONLY

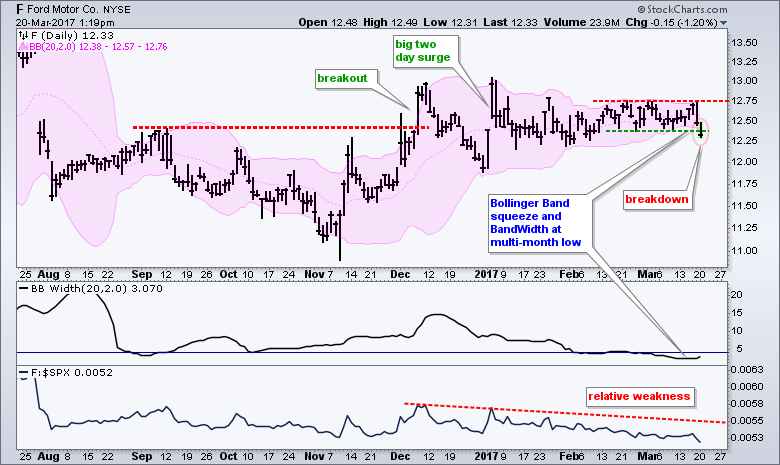

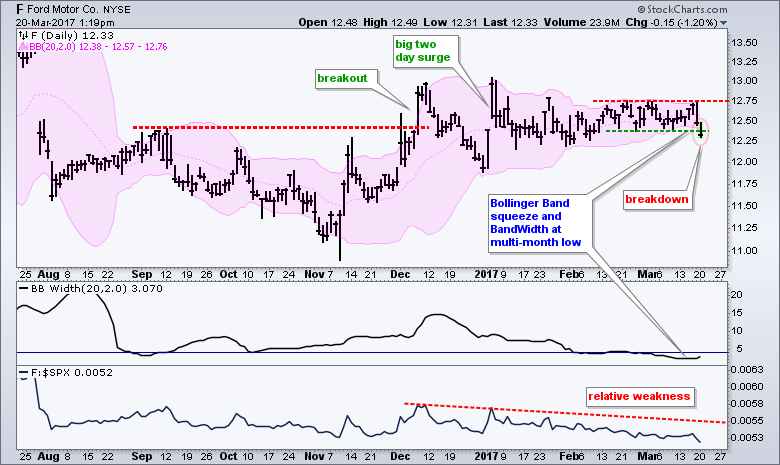

Ford Breaks Bollinger Band after a Long Squeeze

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Ford (F) looked as if it was simply consolidating after a sharp surge and breakout, but this consolidation strung out and the stock broke to the downside on Monday. The chart shows Ford breaking above the September high with a surge in November-December. The stock fell back after this breakout...

READ MORE

MEMBERS ONLY

Tires Gaining Traction, Ready To Put Your Portfolio In Overdrive

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, March 17, 2017

It was another bifurcated day in the market on Friday as rotation continued. The Dow Jones and S&P 500 both posted minor losses while the Russell 2000 led with a 0.40% gain. Utilities (XLU, +0.60%) and industrials (XLI, +0....

READ MORE

MEMBERS ONLY

My 100th Blog Article

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

This is funny. A few articles ago I commented on the foolishness of the media’s focus on Dow 20,000 and now I’m focusing on my 100th blog article. Is that being a hypocrite or what? I have been racking my feeble brain trying to think of an...

READ MORE

MEMBERS ONLY

Five Markets That Are Approaching Critical Junctures

by Martin Pring,

President, Pring Research

* US Dollar completes a head and shoulders top

* Dollar right at key up trendline against the rest of the world

* Gold caught in a tight trading range

* West Texas oil also restrained in a tight trading range

* Mexico---a chance to jump over the wall?

* Emerging markets to the rescue

It...

READ MORE

MEMBERS ONLY

AAPL: Correction Due

by Carl Swenlin,

President and Founder, DecisionPoint.com

Apple (AAPL) has rallied +60% from its May 2016 low, which was also the the low for the previous bear market for AAPL. The price advance for the last month-and-a-half has been pretty vigorous, but the PMO (Price Momentum Oscillator) has topped and crossed down through its signal line, so...

READ MORE

MEMBERS ONLY

Apparel Retailers Printing Bullish Inverse Head & Shoulders Pattern

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Over the past year, the Dow Jones U.S. Apparel Retailers Index ($DJUSRA) has been one of only four industry groups in the consumer discretionary space that has posted a loss. And over the past three months the DJUSRA is the worst performing area of consumer discretionary. But keep in...

READ MORE

MEMBERS ONLY

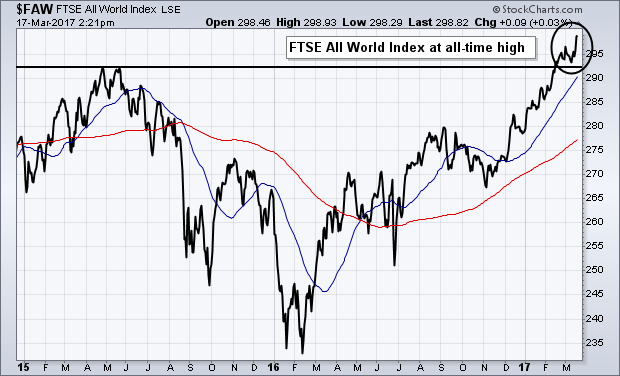

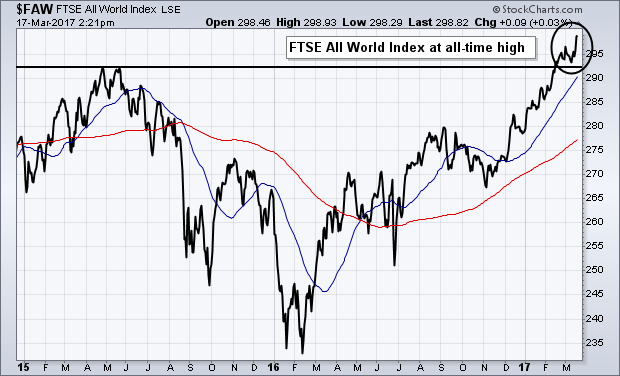

All-World Index Hits New Record

by John Murphy,

Chief Technical Analyst, StockCharts.com

Chart 1 shows the FTSE All-World Stock Index ($FAW) trading at a new record high. The FAW includes stocks from 47 developed and emerging markets. It just recently cleared its 2015 high which resumed its major uptrend. That's a positive sign because it shows that the stock market...

READ MORE

MEMBERS ONLY

Reward to Risk Calculation a Must

by John Hopkins,

President and Co-founder, EarningsBeats.com

As part of our service at EarningsBeats.com we send trade alerts to our members on stocks that beat earnings expectations. But before we notify members of any trade candidates we look closely at the "Reward to Risk' ratio as we want to make sure it is favorable...

READ MORE

MEMBERS ONLY

Video - Weekly Market Review & Outlook - Small-caps Catch a Bid

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The stock market moved higher again this past week with several sector and industry group ETFs hitting new highs. Four of the five sector SPDRs hit fresh 52-week highs. These include the Technology SPDR, HealthCare SPDR, Consumer Staples SPDR and Consumer Discretionary SPDR. Together, these four sectors account for over...

READ MORE

MEMBERS ONLY

Ignoring Signals is the First Step to Taking Signals - How Well do you Know MACD?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Two Indicators in One

Indicators generate lots of signals and many of these signals are just noise. It is imperative that chartists understand how their indicators work and exactly what these indicators are saying. Understanding the ins and outs of an indicator will help chartists determine which signals to take...

READ MORE

MEMBERS ONLY

Crude Oil's Slippery Slope

by Bruce Fraser,

Industry-leading "Wyckoffian"

Crude oil is on a slippery slope downward. Was this completely unexpected or were there clues of the impending decline? The stock market is a discounting mechanism. Stocks traditionally light the way by starting to move prior to the underlying economic events. That, of course, is the argument for Technical...

READ MORE

MEMBERS ONLY

PMO Scan from 3-17-2017 DP Webinar - Spotlight on KapStone Paper (KS)

by Erin Swenlin,

Vice President, DecisionPoint.com

I am asked constantly about how to use the Price Momentum Oscillator (PMO) and Trend Models in a scan. These two ingredients combine into a great tandem for the scan engine. I'll give you a reprint of the scan and analyze a chart I found in it today....

READ MORE

MEMBERS ONLY

Market Timing Tools That Work: Pullbacks versus Corrections

by Gatis Roze,

Author, "Tensile Trading"

Here is how to tell if it’s a regular market pullback versus a serious bearish correction. I strongly disagree with those that claim market timing is toxic. Review this sample of eight of my charts. These types of tools have helped me side-step all the major corrections over the...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook 17-Mar-17 - Small-Caps Hold the Line as 2-yr Yield Surges

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Small-caps versus Finance and Healthcare

.... New Highs Lag, but %Above 200-day Holds Up

.... Two Gaps Establish First Support for SPY

.... QQQ Continues to Lead and IJR Continues to Lag

.... Healthcare, Tech and Consumer Discretionary Lead

.... New High Milestones for Healthcare and Consumer discretionary

.... Industrials and Finance Pull Back

.... Breadth Indicators...

READ MORE