MEMBERS ONLY

HOMEBUILDERS ARE HAVING A STRONG DAY -- USING RATIO ANALYSIS TO CHOOSE THE STRONGEST HOUSING ETF -- AMAZON, HOME DEPOT, AND WAL-MART LEAD VANECK RETAIL ETF HIGHER -- S&P 500 VALUE/GROWTH RATIO MAY BE JUST PAUSING IN UPTREND

by John Murphy,

Chief Technical Analyst, StockCharts.com

U.S. HOME CONSTRUCTION ISHARES HIT NEW HIGHS... Add housing stocks to parts of the stock market that still offer value and are attracting new money. Chart 1 shows the U.S. Home Construction iShares (ITB) climbing today to the highest level in nearly a decade. That's following...

READ MORE

MEMBERS ONLY

Warning Signs Beginning To Emerge

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Tuesday, February 21, 2017

Our major indices saw another solid day of gains with the Dow Jones, S&P 500, NASDAQ, NASDAQ 100 and Russell 2000 all breaking out to all-time highs once again. All nine sectors advanced and small caps led on a relative basis....

READ MORE

MEMBERS ONLY

Oil and Energy-related ETFs Look Poised to End Corrections

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Oil Bounces within Corrective Pattern

.... Measuring the Correlation between Oil and Energy ETF

.... XLE, XES and XOP Correct Along with Oil

.... Focus on Gold for Precious Metals ETFs

.... Watching the Wedge and Fib Retracement in Gold

.... 14 Bullish Stock Charts ....

Oil Bounces within Corrective Pattern

I will start off today...

READ MORE

MEMBERS ONLY

Crude Oil Surges This Morning, Could Provide Big Lift To Energy Sector

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, February 17, 2017

Consumer staples (XLP, +0.50%) led the market action on Friday as personal products ($DJUSCM) jumped 3.39%. Brewers ($DJUSDB) continued their recent surge and now appear to have clearly broken their downtrend that began in October. Take a look:

The trendline break...

READ MORE

MEMBERS ONLY

The Reign of Error

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

In 1987 a book was written, entitled “The Great Depression of 1990,” by Dr. Ravi Batra, an SMU professor of economics. Sadly, I bought and read that book back then. Batra was claimed as one of the great theorists in the world and ranked third in a group of 46...

READ MORE

MEMBERS ONLY

SPY: Price Is Stretched

by Carl Swenlin,

President and Founder, DecisionPoint.com

While the 200EMA (exponential moving average) smooths daily prices over a long period of time and shows us the trend within that time frame, it also acts as a moving base line of price. As we watch daily prices depart from the 200EMA, we can get a sense of how...

READ MORE

MEMBERS ONLY

Mondelez Takes Big Hit, But Remains in Bullish Triangle Pattern

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Mondelez International (MDLZ) had a rough week, tumbling over 5.5% after Kraft Heinz (KHC) made a bid for Unilever (UL). That suggested to many investors that the likelihood of a MDLZ acquisition was significantly reduced and the stock was priced lower accordingly. The technical pattern on MDLZ remains quite...

READ MORE

MEMBERS ONLY

Is The Dollar Getting Ready To Make A Big Move?

by Martin Pring,

President, Pring Research

* The Dollar Index -- primary trend

* The Dollar Index viewed from the short-term trend

* The euro

* The yen

* The Canadian dollar

* Emerging market currencies

Expectations were high for the US Dollar ($USD) following the election and indeed, the currency did rally for a while. However, the trend for most of...

READ MORE

MEMBERS ONLY

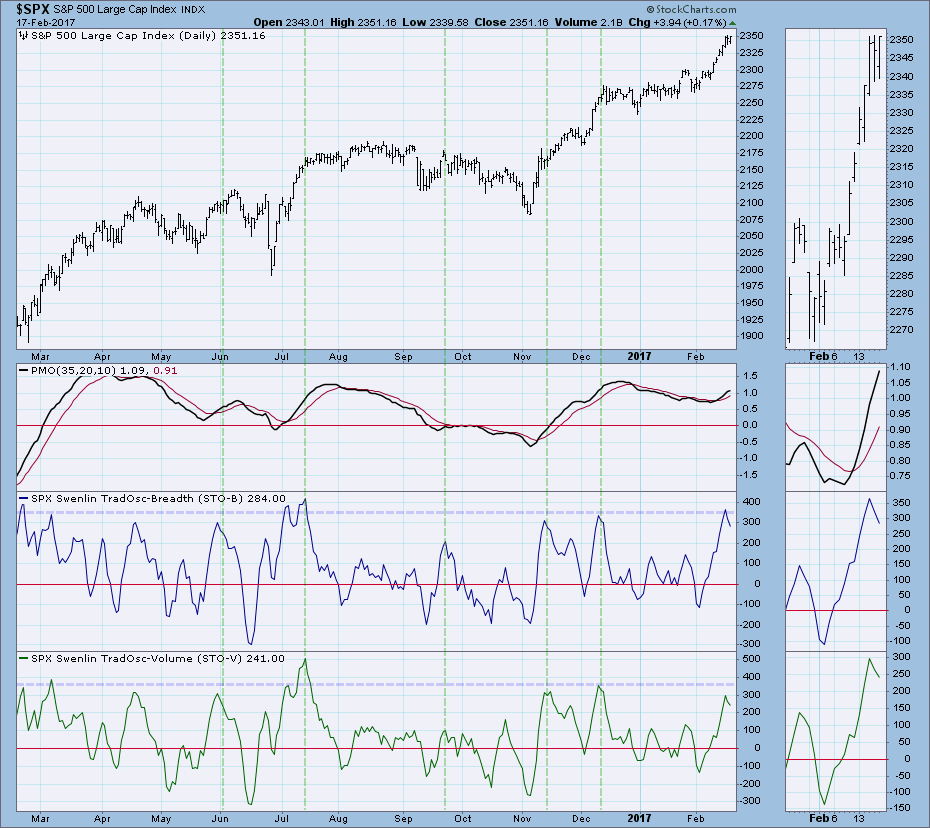

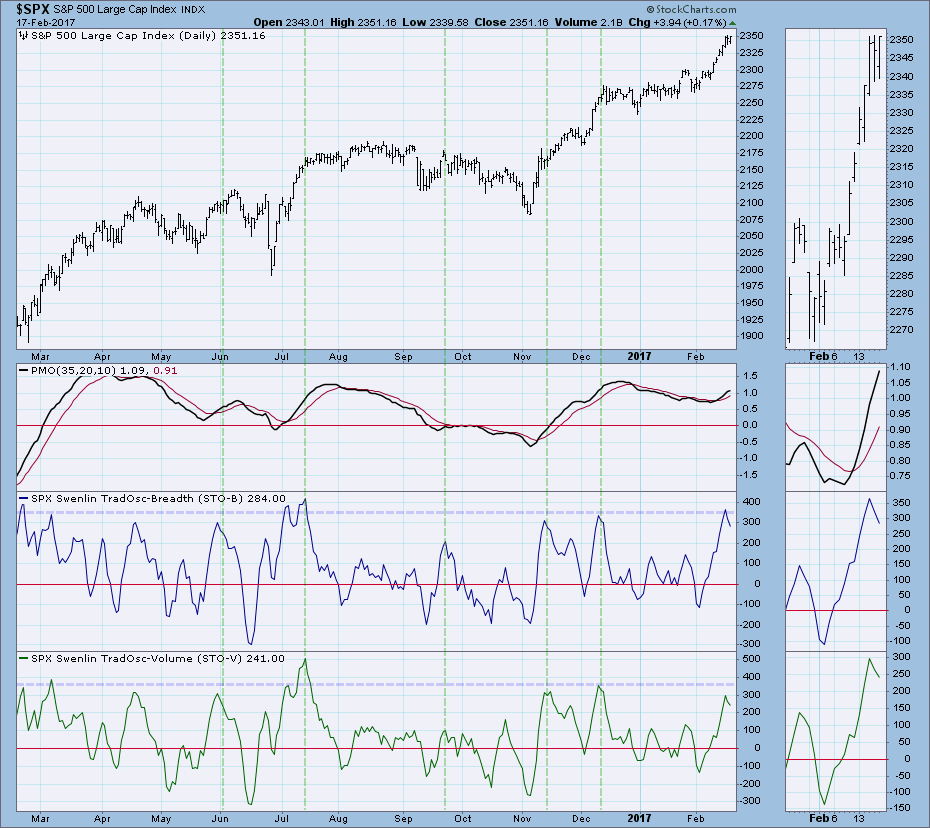

Swenlin Trading Oscillators Very Bearish

by Erin Swenlin,

Vice President, DecisionPoint.com

The market has been experiencing an almost vertical rally over the past few weeks, but it has cooled over the past two days. The steep rising trend pushed our short-term Swenlin Trading Oscillators (STOs) into highly overbought territory. With Thursday and Friday's cooling off period, they have peaked....

READ MORE

MEMBERS ONLY

Retail Stocks Remain Very Attractive And Here Are A Few To Consider

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

About a month ago, I wrote a ChartWatchers article detailing the bullish historical tendencies of retailers during the months of February, March and April. In particular, apparel retailers ($DJUSRA) have shown tremendous bullishness during the months of February, March and April. In addition, the DJUSRA was approaching a key price...

READ MORE

MEMBERS ONLY

Bonds. Shaken, Not Stirred.

by Bruce Fraser,

Industry-leading "Wyckoffian"

It is time to circle back and update our studies of the US Treasury Bond market. On October 7, 2016, we did a Wyckoffian analysis of Treasury Bonds as they appeared to be at a critical juncture. Take a few minutes now and go back to that post (click here...

READ MORE

MEMBERS ONLY

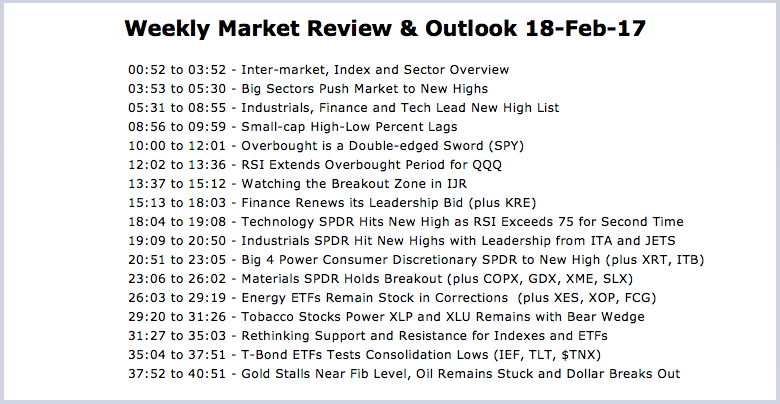

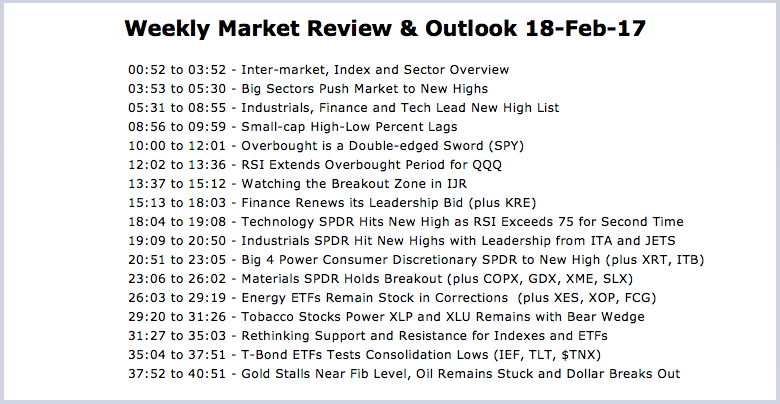

Weekly Market Review & Outlook 18-Feb-2017 - Banks Lead Finance Sector as New Highs Surge

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

----- Video Link ----- Art's Charts ChartList (updated 18-Feb) -----

Programming Note: The Art's Charts Chartlist has been updated with 30 annotated charts covering the industry group ETFs. The outline above is for the video and I cover many of these industry group ETFs in the...

READ MORE

MEMBERS ONLY

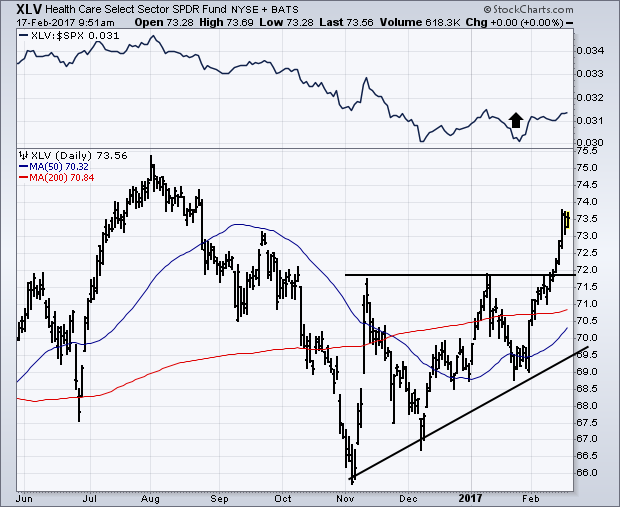

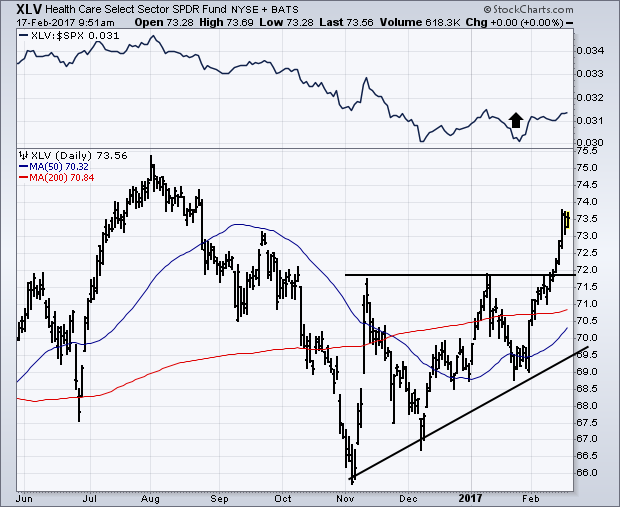

Healthcare SPDR Turns Up, Biotechs and Pharmaceutical ETFS Show Improvement

by John Murphy,

Chief Technical Analyst, StockCharts.com

In case you haven't noticed, the Health Care SPDR (XLV) has taken a bullish turn. Chart 1 shows the XLV breaking out of a bullish "ascending triangle" that I described in my February 4 message. At the same time, the XLV/SPX ratio (top of chart)...

READ MORE

MEMBERS ONLY

Trading Stocks in a Stretched Market

by John Hopkins,

President and Co-founder, EarningsBeats.com

I made my case to EarningsBeats members this past Wednesday just before we started to see a bit of selling. Here are the highlights:

1-The VIX is up by almost 9% today as it tests its 50 day moving average from the downside even though the market is higher. This...

READ MORE

MEMBERS ONLY

Rethinking Support and Resistance for Indexes and ETFs

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Just like potato salad in the fridge, support and resistance levels for the S&P 500 have a shelf life and become stale over time. The value of the S&P 500 is based on the price of its individual component stocks. Support and resistance levels for the...

READ MORE

MEMBERS ONLY

After 17 years, A Financial Journalist Discloses His "Top Investing Lesson"

by Gatis Roze,

Author, "Tensile Trading"

After seventeen years writing an investment column for USA Today, Matt Krantz is joining a money management firm and leaving us with the top lesson he’s learned in all those years.

Coincidentally and nearly simultaneously, I ran into two former students at a local Starbucks who had attended my...

READ MORE

MEMBERS ONLY

HEALTHCARE SPDR TURNS UP -- HEALTH CARE EQUIPMENT AND MEDICAL DEVICE ETFS HIT NEW RECORDS -- HEALTHCARE PROVIDERS ETF TOUCHES 52-WEEK HIGH -- BIOTECHS AND PHARMACEUTAL ETFS SHOW IMPROVEMENT BUT ARE HEALTHCARE LAGGARDS

by John Murphy,

Chief Technical Analyst, StockCharts.com

HEALTH CARE SPDR TURNS UP... In case you haven't noticed, the Health Care SPDR (XLV) has taken a bullish turn. Chart 1 shows the XLV breaking out of a bullish "ascending triangle" that I described in my February 4 message. At the same time, the XLV/...

READ MORE

MEMBERS ONLY

Will Homebuilders Finally Make Their Breakout?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Thursday, February 16, 2017

U.S. indices finished in bifurcated fashion on Thursday as the Dow Jones logged gains, the S&P 500 finished flat and the NASDAQ and Russell 2000 both finished with minor losses. We could see some additional weakness in coming days based...

READ MORE

MEMBERS ONLY

SRCL Wastes No Time Breaking To Six Month Highs

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Stericycle (SRCL) has been under rather intense selling pressure over the past 16 months, losing half its market cap. The waste management company disappointed Wall Street on several occasions and we've seen major gap downs on heavy volume three times over those 16 months. The stock seems to...

READ MORE

MEMBERS ONLY

Is The Market Topping? Relative Sector Performance Says NO WAY!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Wednesday, February 15, 2017

Healthcare (XLV, +1.08%) resumed its leadership role but relative performance in this sector has been quite weak since the summer. Below is a chart that shows a ratio of the XLV to the S&P 500. If you've been...

READ MORE

MEMBERS ONLY

Housing and Retail Stocks Power the Consumer Discretionary Sector

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Small-caps Join the New High Parade

.... Housing and Retail Come to Life

.... Equal-Weight Consumer Discretionary Sector Breaks Out

.... Five Housing Stocks to Watch (DHI, FBHS, KBH, SKY, TOL)

.... Commercial Metals Resumes Bigger Uptrend

.... United Airlines Challenges Flag Resistance

.... Cornerstone OnDemand Consolidates Above 200-day EMA

.... Itron Ends Correction with Breakout

.... AbbVie...

READ MORE

MEMBERS ONLY

WBA Turns Up after Deep Correction

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Walgreens Boots Alliance (WBA) has traded quite choppy over the last 12 months, but I think the bigger trend is up and the recent wedge breakout is bullish. First, notice that WBA broke above a major resistance zone with the November-December surge. This move forged a 52-week high and set...

READ MORE

MEMBERS ONLY

These Are Two Very Bullish Components Of The NASDAQ 100

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I'll return tomorrow morning with my regular Trading Places article with all the normal features. Today I simply want to point out two component stocks in the NASDAQ 100 ($NDX) that look very bullish to me. The first is Costco (COST). Basing patterns that finally breakout can lead...

READ MORE

MEMBERS ONLY

New Chart Spotlight Added to DecisionPoint LIVE Webinars

by Erin Swenlin,

Vice President, DecisionPoint.com

The DecisionPoint LIVE webinars on Wednesday and Fridays at 7:00pm EST are news programs. In just 30 minutes, I go over the current DecisionPoint Scoreboards, cover daily/weekly/monthly charts of major large- and small-cap indexes, review indicators and finish with analysis of the "Big Four" --...

READ MORE

MEMBERS ONLY

BOND YIELDS CLEAR 50-DAY LINE ON YELLEN TESTIMONY -- THAT HELPS FINANCIALS AND HURTS UTILITIES -- FINANCIALS/UTILITIES RATIO TURNS BACK UP -- RISING YIELDS BOOST DOLLAR AND WHICH HURTS GOLD

by John Murphy,

Chief Technical Analyst, StockCharts.com

BOND YIELDS CLEAR 50-DAY LINE... Previous messages have described Treasury bond yields as consolidating within a major uptrend since mid-December . Today's jump in yields supports that view. In testimomy before Congress today, Janet Yellen warned about the danger of the Fed falling behind the inflation curve. That more...

READ MORE

MEMBERS ONLY

Webinar Recording - Bonds Plunge and Yields Surge - Banks Benefit - Utilities, REITs and Gold Suffer - IJR Holds Breakout - Stocks to Watch

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

TLT Forms Bearish Continuation Pattern

There is not much change in the broad market environment. The long-term trends are up, but SPY and QQQ are looking extended and ripe for a rest. IJR already got its rest and broke out on Friday to end its corrective period. This pits large-caps...

READ MORE

MEMBERS ONLY

February Has Sent This Stock Higher 95% Of The Time Over The Last Two Decades

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Monday, February 13, 2017

Recent leadership from financials (XLF, +1.14%) and industrials (XLI, +1.00%) appears to be resuming as these two groups led the benchmark S&P 500 to fresh all-time highs on Monday. The last week has been very strong for U.S....

READ MORE

MEMBERS ONLY

Market Extends Gains As Breadth Surprisingly Improves

by Martin Pring,

President, Pring Research

More stocks trading above their 150-day MA’s

Last week I pointed out that many indicators were overstretched, thereby indicating the probability of a correction. I also stated that during a bull market, surprises typically develop on the upside. Consequently, if the market was able to shrug off its overbought...

READ MORE

MEMBERS ONLY

0100111000100000

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

There are 10 types of people in this world, those who understand binary and those who do not. Yes, the title is binary for 20,000. I knew the title of this article would get your attention. The financial media is possessed with round numbers more than I can remember....

READ MORE

MEMBERS ONLY

Celgene Stalls within Trend - What's Next?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Celgene (CELG) has not made much headway the last twelve months, but the overall trend is up and the current consolidation looks like a bullish continuation pattern. Taking a step back, notice that CELG doubled from the April 2014 low to the July 2015 high (~70 to ~140). The stock...

READ MORE

MEMBERS ONLY

Aerospace Strength Sends Industrials To All-Time High

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Market Recap for Friday, February 10, 2017

Materials (XLB, +0.91%) and industrials (XLI, +0.79%) led yet another rally in U.S. equities on Friday as the Dow Jones, S&P 500, NASDAQ, NASDAQ 100 and the Russell 2000 all established new all-time closing highs. The small cap...

READ MORE

MEMBERS ONLY

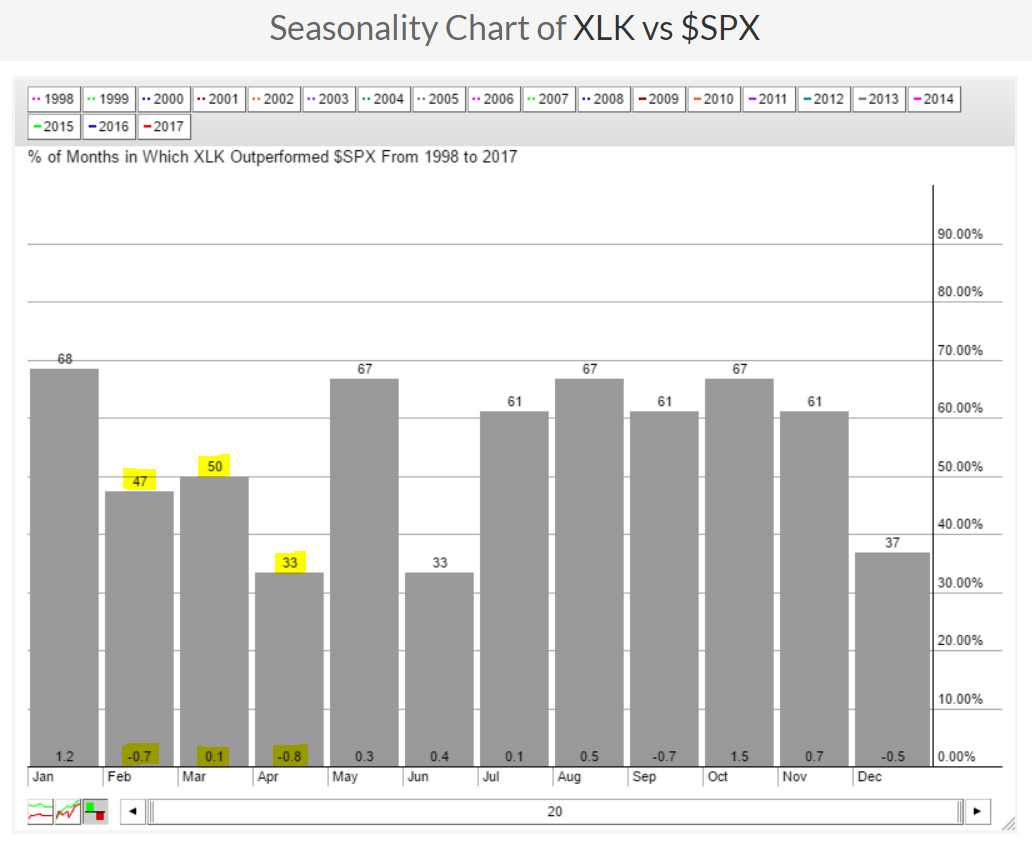

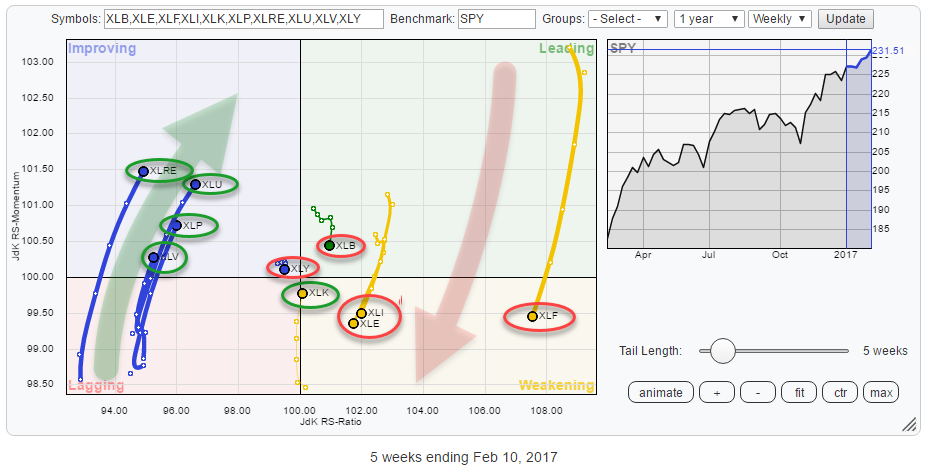

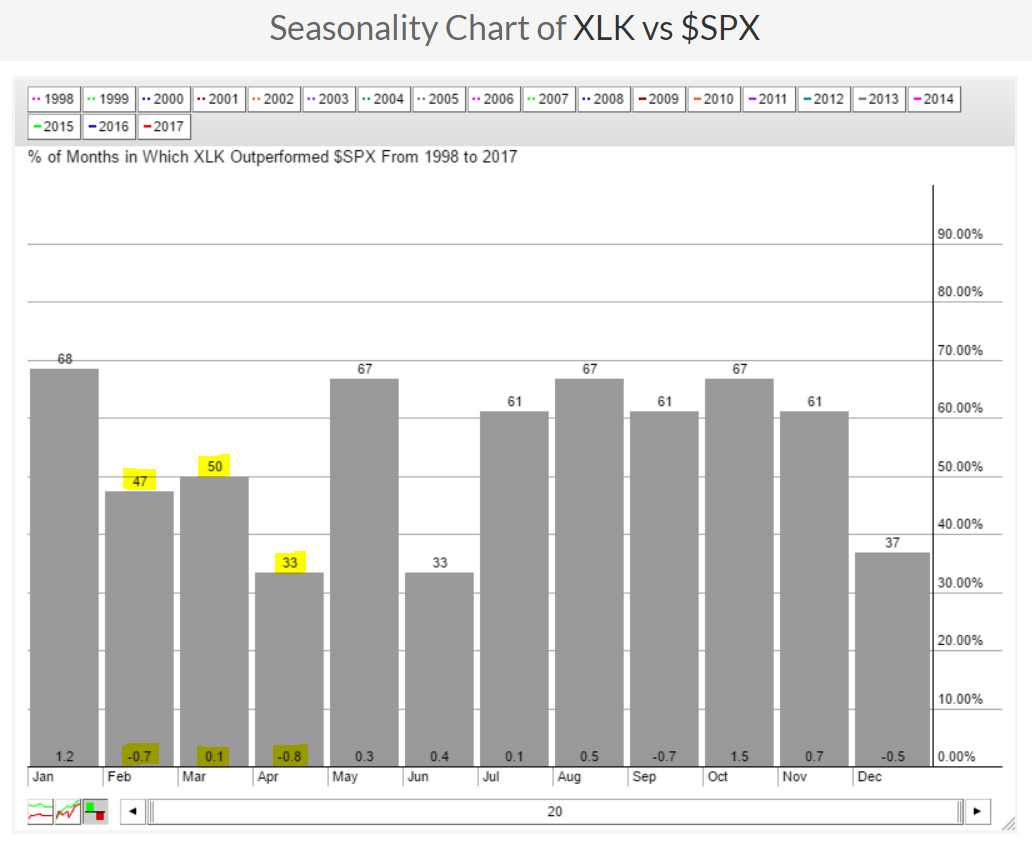

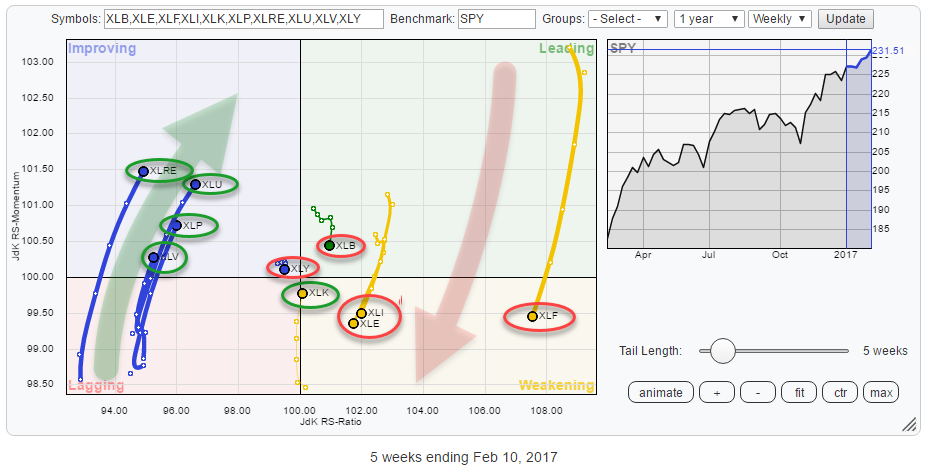

Sector rotation from Energy to Utilities, market in transition

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

Summary

* NO sectors inside the lagging quadrant and only one in leading

* Sector rotation suggests market in transition

* Financials continue to loose ground vs Healthcare

* Technology picking up against Materials

* Sector rotation from Energy to Utilities starting to shape up

Quick scan

A first look at the Relative Rotation Graph...

READ MORE

MEMBERS ONLY

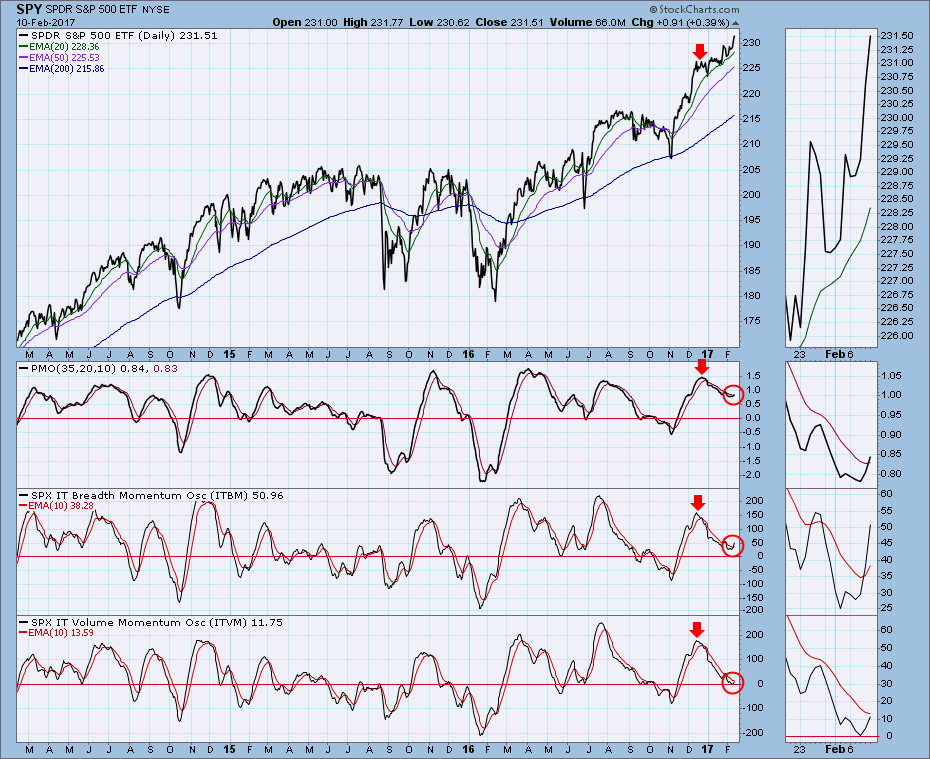

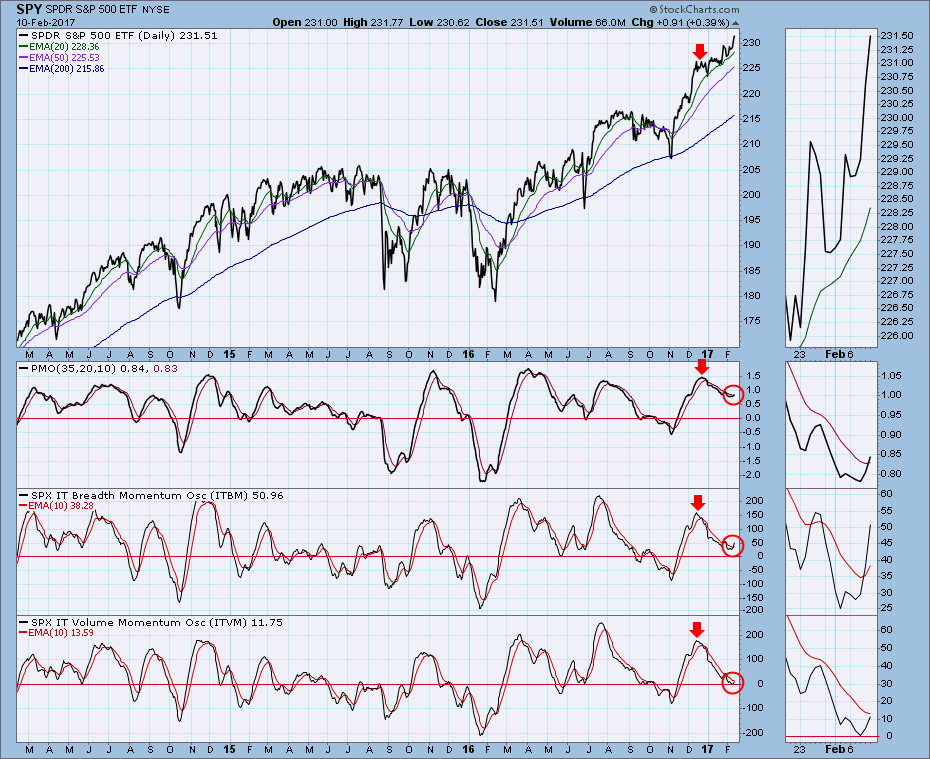

What Happened to the Correction?

by Carl Swenlin,

President and Founder, DecisionPoint.com

Just before Christmas I wrote an article saying I was expecting a correction or consolidation because our primary intermediate-term indicators had all topped. On the chart below we can see the annotations (down arrows) I made at the time, and we can see what actually happened. There was a small...

READ MORE

MEMBERS ONLY

Costco Finally Breaks Out Above Its 15 Month Consolidation Range

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

After long basing periods, breakouts can be very significant technical events that lead to powerful gains. Those invested in or trading Costco (COST) are hoping last week's breakout signals a nice advance in the months ahead. Three months ago, COST bulls successfully defended key price support and the...

READ MORE

MEMBERS ONLY

Avoidance Strategy

by Bruce Fraser,

Industry-leading "Wyckoffian"

The Wyckoffian mission is to trade and invest in the best stocks in the leading Industry Groups. We have been studying examples of leadership characteristics using Wyckoff Analysis in combination with Relative Strength. Recall that our workflow is to drill down from Sector to Industry Group to Stock. Always seeking...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook (with Video) - Consumer Discretionary, Housing and Retail Come Alive - Small-cap Breakout - Banks Key Off 10-yr Yield - Copper and Alum Lead Metals

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

----- Video Link ----- Art's Charts ChartList (updated 11-Feb) -----

Banks, Small-caps and the 10-yr Yield

Stocks extended their uptrends with the S&P 500, S&P MidCap 400 and Nasdaq 100 hitting new highs this week. The S&P Small-Cap 600 did not hit...

READ MORE

MEMBERS ONLY

Charts I'm Stalking Action Practice #11

by Gatis Roze,

Author, "Tensile Trading"

In Action Practice #10, we applied the Tensile Trading methodology to the buy side of the six charts. This week, we apply the same price relative approach to the sell side and show that it works just as effectively there. We even recycle the CDE buy chart and now annotate...

READ MORE

MEMBERS ONLY

COPPER AND STEEL STOCKS RESUME UPTRENDS -- CRUDE OIL BOUNCE BOOSTS ENERGY SECTOR -- OIL SERVICE STOCKS ARE ENERGY LEADERS -- CANADIAN STOCKS HIT NEW RECORD ON COMMODITY RALLY -- AUSSIE AND CANADIAN DOLLARS ALSO TURN UP

by John Murphy,

Chief Technical Analyst, StockCharts.com

COPPER AND STEEL STOCKS RESUME UPTRENDS... Economically-sensitive industrial metals are rising again, along with stocks tied to them. The price of copper is up 3.5% today to the highest level in nearly two years. So are copper shares. Chart 1 shows the Global X Copper Miners ETF (COPX) resuming...

READ MORE

MEMBERS ONLY

This Financial Industry Group Is Poised For A Big 2017

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Special Note

Greg Schnell (author of The Canadian Technician blog) and I will be co-hosting a special webinar tomorrow at 11am EST. I'll discuss trading strategies with respect to gaps created by earnings reports while Greg's discussion will focus on his outlook for biotech stocks. Greg...

READ MORE

MEMBERS ONLY

Mohawk Reports Strong Earnings, Looks To Break Out On Friday

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Mohawk Industries (MHK), a flooring designer and manufacturer, just reported quarterly earnings that exceeded Wall Street consensus estimates. The initial reaction in after hours is very bullish as MHK has been consolidating in sideways fashion for the better part of a year and the after hours price would constitute a...

READ MORE