MEMBERS ONLY

Five Must-Have Tools for Analyzing Stock Charts

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave shares how he uses the powerful ChartLists feature on StockCharts to analyze trends and momentum shifts as part of his daily, weekly, and monthly chart routines. He shows how mindful investors can use ChartLists to identify inflection points, focus on top performers, analyze performance trends, and...

READ MORE

MEMBERS ONLY

Market Movements Today: Investors Rejoice as Stocks Rally, Bitcoin and Gold Backslide

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Stocks and bond prices rallied on Monday in response to President-elect Trump's pick for Treasury Secretary.

* Gold and oil prices fell steeply as concerns of geopolitical risks ease.

* Small and mid-cap stocks were the leaders in today's equity rally.

It's a short...

READ MORE

MEMBERS ONLY

A Bullish Opportunity in CrowdStrike (CRWD) with OptionsPlay Strategy Center

by Tony Zhang,

Chief Strategist, OptionsPlay

KEY TAKEAWAYS

* CrowdStrike's stock price is showing signs of reaching its 52-week highs and breaking above it.

* The bull put spread is an options strategy you can implement to take advantage of CrowdStrike stock's bullish move.

* A bull put spread will benefit even if CrowdStrike'...

READ MORE

MEMBERS ONLY

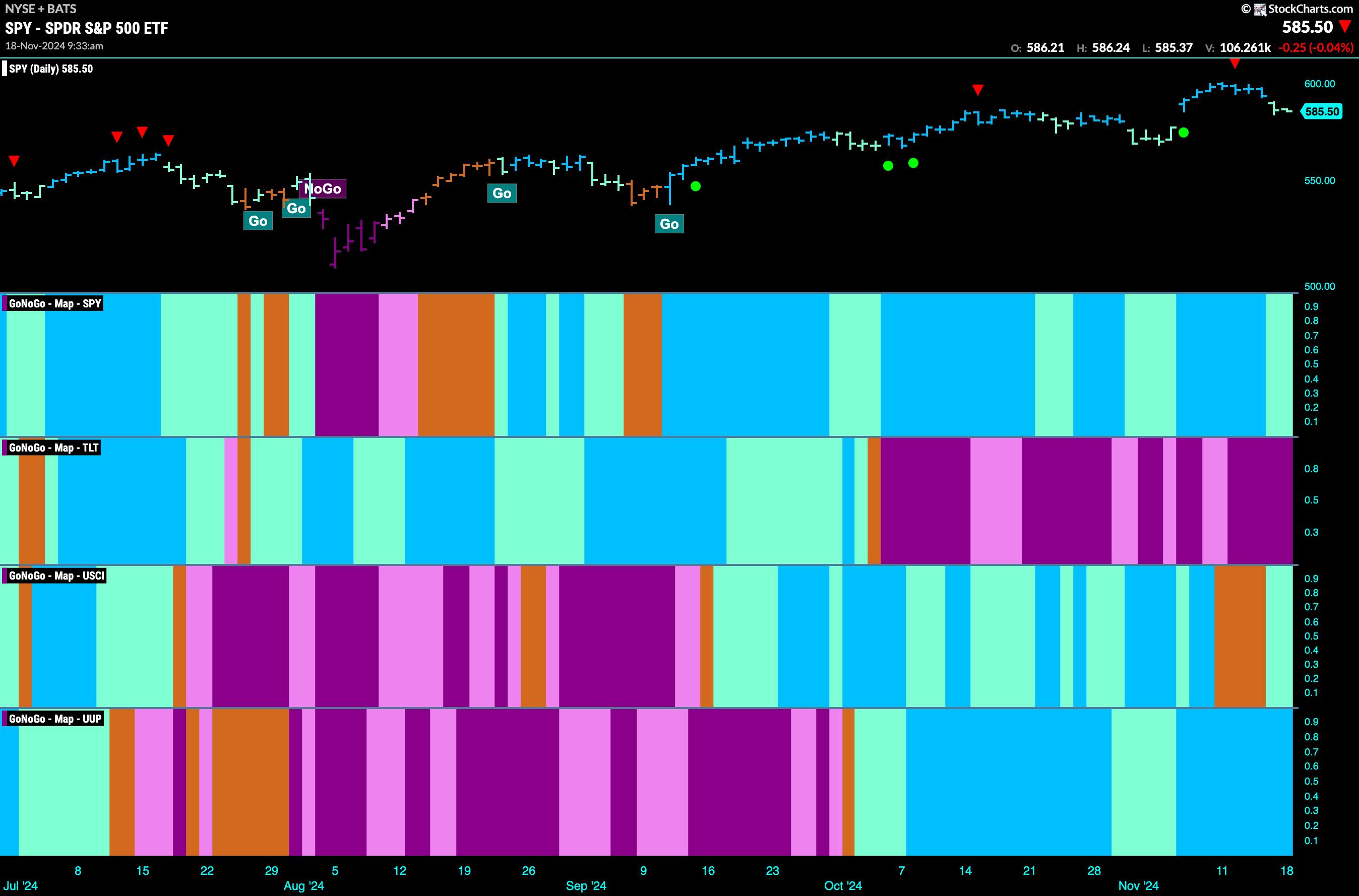

The Finances Look Good For Equity Trend

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

Good morning and welcome to this week's Flight Path. The "Go" trend in equities has proved to be resilient as we saw strong blue "Go" bars return this week. Treasury bond prices remained in a "NoGo" although this week we did see...

READ MORE

MEMBERS ONLY

Market Rally Broadens - New All-Time Highs?

by Erin Swenlin,

Vice President, DecisionPoint.com

Today Carl looks at the small-caps and mid-caps that have now begun to outperform the market. Clearly the rally is broadening, the question now is can we continue to make new all-time highs. It does seem very likely especially given the positive outlook on the Secretary of Treasury nomination.

Carl...

READ MORE

MEMBERS ONLY

Small and Mid Caps: Turning Lemons Into Lemonade

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

No matter how you slice it, small and mid caps have been absolutely crushed on a relative basis since 2021. The unfortunate part about this is that most traders have recency bias. They believe whatever has been working will continue to work and things that haven't been working...

READ MORE

MEMBERS ONLY

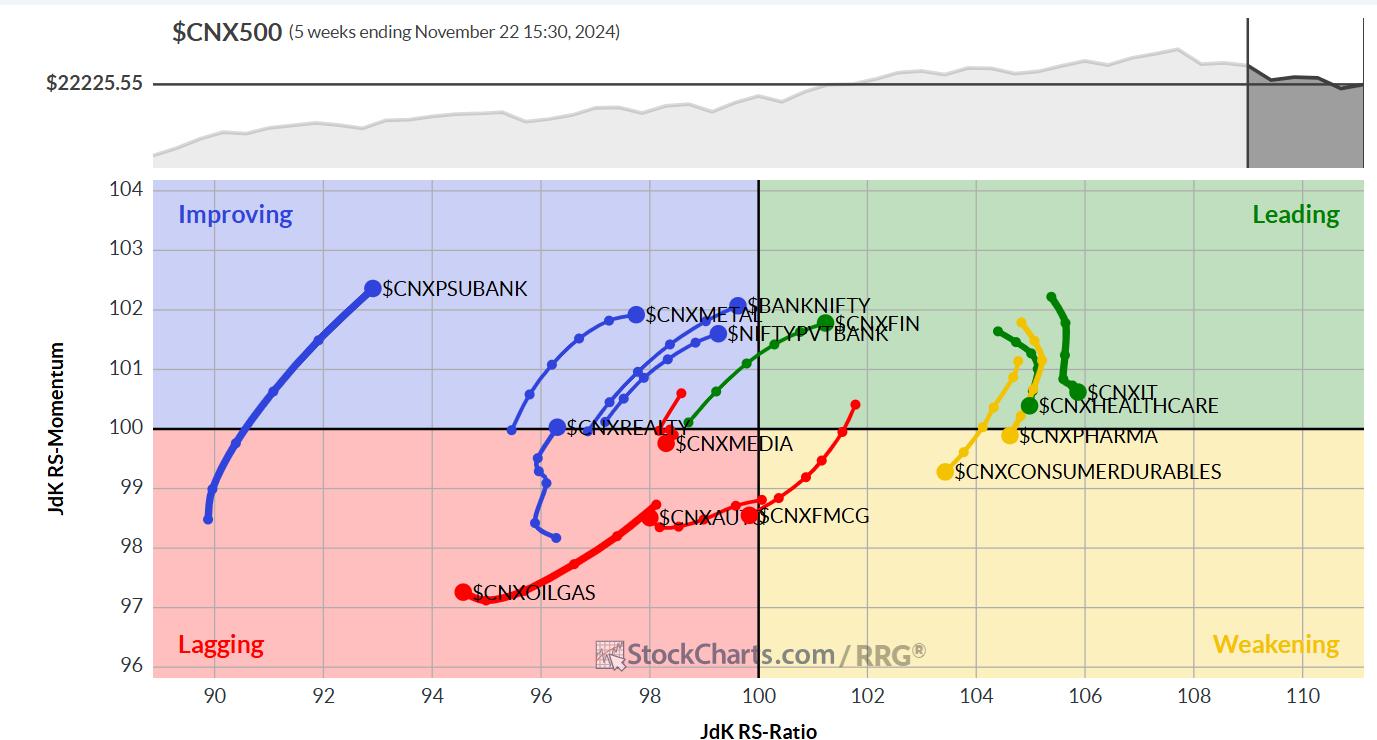

Week Ahead: NIFTY Defends This Crucial Support; Chase Rebounds Mindfully

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In a truncated trading week, the Indian equities closed the week with gains thanks to a robust technical rebound that it witnessed on Friday. The Nifty continued to wear a corrective look for three days; on the last trading day of the week, the Index managed to get itself into...

READ MORE

MEMBERS ONLY

These Old-School Stocks Have Joined The AI Rally!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen reviews the broad-based rally that pushed the Equal-Weighted SPX to new highs. She also shared base breakouts and downtrend reversal candidates in the now hot Retail space, and takes a close look at 3 old school stocks that are seeing AI-related growth.

This...

READ MORE

MEMBERS ONLY

2024 is Shaping Up Like 2021, Which Did Not End Particularly Well

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I've always found technical analysis to be a fantastic history lesson for the markets. If you want to consider how the current conditions relate to previous market cycles, just compare the charts; you'll usually have a pretty good starting point for the discussion.

As we near...

READ MORE

MEMBERS ONLY

An All-Around Rally: Navigating Stocks, US Dollar, Gold, and Bitcoin Price Action

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Broader equity indexes ended the week on a positive note, with small- and mid-caps gaining momentum.

* Gold regained its bullish momentum, and the US dollar surged.

* Bitcoin skyrocketed and crossed the 10K level, but closed lower.

The last full trading week before the Thanksgiving holiday has ended on...

READ MORE

MEMBERS ONLY

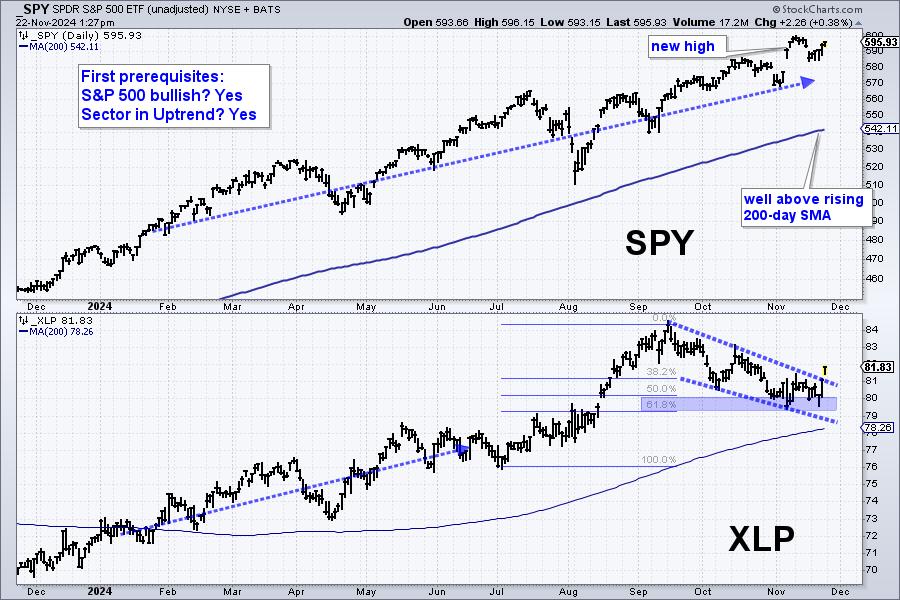

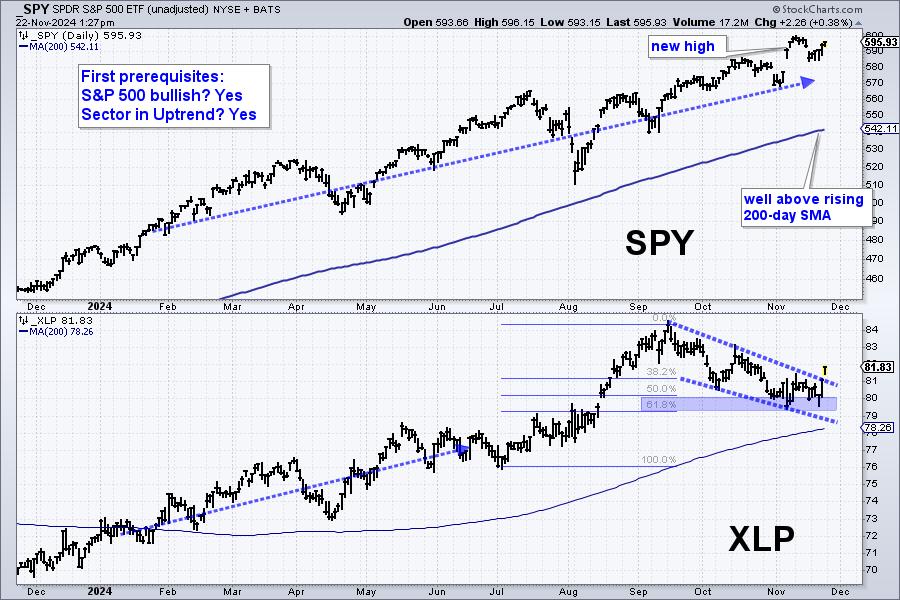

Four Prerequisites to Improve Your Odds - A Live Example

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* Traders can improve their odds with market, sector and stock filters.

* We should be in a bull market and the sector should be in an uptrend.

* The stock should be in a long-term uptrend and leading.

Even though trading based on chart analysis involves some discretionary decisions, chartists...

READ MORE

MEMBERS ONLY

Bonds Get Death Cross SELL Signal

by Carl Swenlin,

President and Founder, DecisionPoint.com

Today, the 20-Year Bond ETF (TLT) 50-day EMA crossed down through the 200-day EMA (Death Cross), generating an LT Trend Model SELL Signal. This was the result of a downtrend lasting over two months. We note that the PMO has been running flat below the zero line for a month,...

READ MORE

MEMBERS ONLY

Financial Upswing: Understanding the Stock Market Rally and Yield Rise

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Stock market indexes resumed their bullish trend.

* Small- and mid-cap stocks rose the most showing strong upside movement.

* Treasury yields rose higher on concerns of reinflation.

The afternoon turnaround seems to be more the norm than the exception. Thursday's stock market action followed the trend. What...

READ MORE

MEMBERS ONLY

AppLovin's 1,303% Rise: The Hidden Power of the SCTR Report

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* AppLovin has risen 1,303% since the SCTR Report first gave the green light on the stock.

* Other StockCharts indicators confirmed the opportunity when Wall Street insiders began quietly accumulating the stock.

* Key levels in AppLovin's price chart can guide you to enter a long position...

READ MORE

MEMBERS ONLY

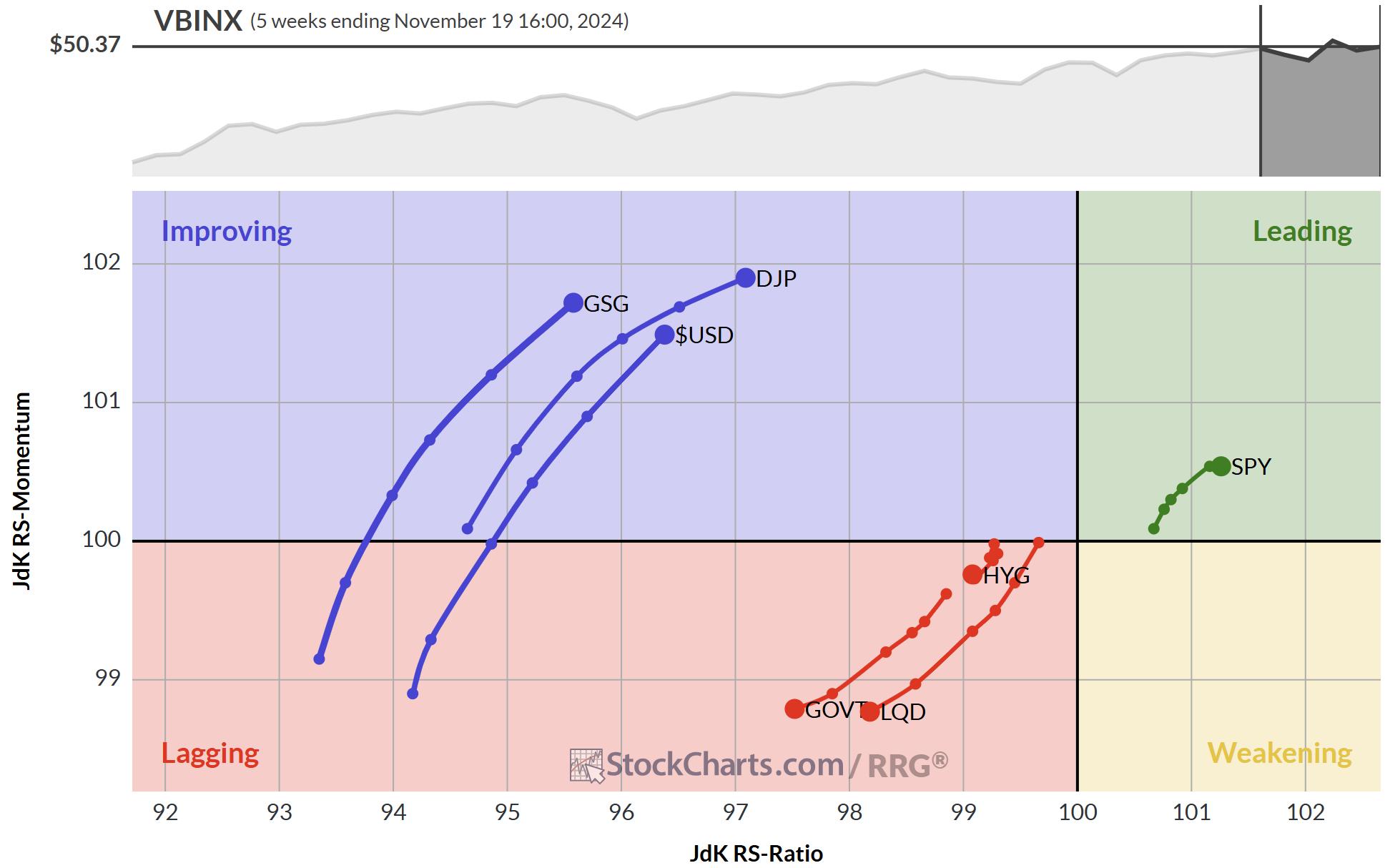

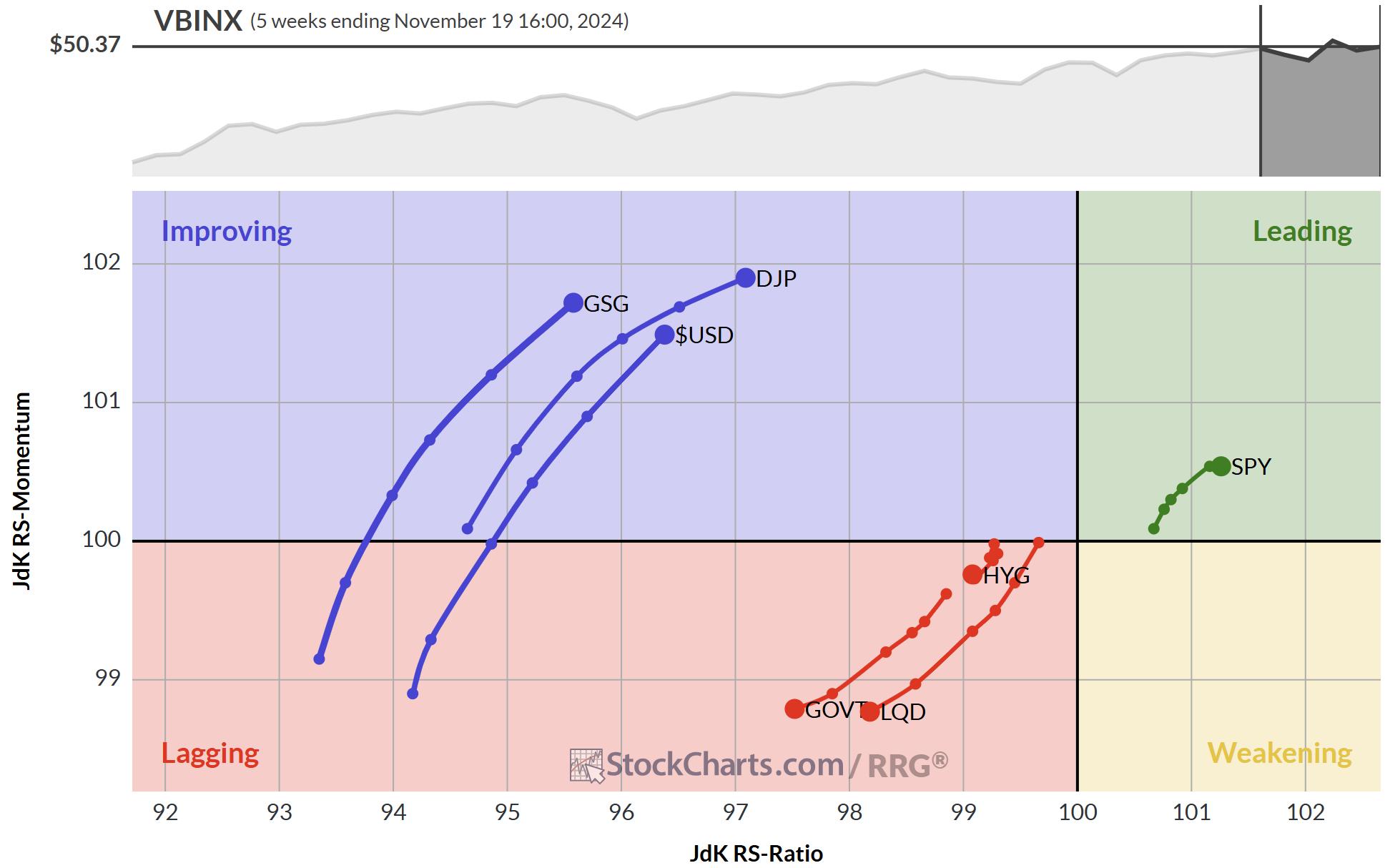

Is the USD Setting Up for a Perfect Rally?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Despite a lot of turmoil, SPY continues to show strong rotations on both weekly and daily RRGs.

* Rising yields have not damaged the stock rally yet.

* Stock/Bond ratio remains strongly in favor of stocks.

After the election, things have hardly settled in the world. New developments in...

READ MORE

MEMBERS ONLY

These Country ETFs are Looking Particularly Vulnerable

by Martin Pring,

President, Pring Research

Chart 1, below, compares the S&P Composite to the Europe Australia Far East ETF (EFA), which is effectively the rest of the world. It shows that US equities have been on a tear against its rivals since the financial crisis. More to the point, there are very few...

READ MORE

MEMBERS ONLY

Be ALERT for Warning Signs - S&P 500 Downturn

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts video, Joe goes into detail on the S&P 500 ETF (SPY), sharing why using MACD and ADX together can be beneficial -- especially in the current environment. He touches on Sentiment, Volatility and Momentum, pointing to reasons why we need to be on alert...

READ MORE

MEMBERS ONLY

Sector Rotation Suggests Offense Over Defense

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* Relative strength trends show a recent rotation into Consumer Discretionary, Communication Services, Financials, and Energy.

* The offense to defense ratio still favors "things you want" over "things you need."

* RRG charts give a fairly clear roadmap of what to look for rotation-wise into early...

READ MORE

MEMBERS ONLY

SCTR Report: The Palantir Trade Follow-Up—Transform Insights into Actions

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Palantir stock sold off significantly on Monday and may be ripe for a turnaround.

* The pullback in Palantir stock could be an opportunity to enter a long position.

* The chart of Palantir's stock price indicates increased buying pressure, but more upside momentum is needed to enter...

READ MORE

MEMBERS ONLY

Three Ways Top Investors Track Sector Rotation

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave outlines three tools he uses on the StockCharts platform to analyze sector rotation, from sector relative strength ratios to the powerful Relative Rotation Graphs (RRG). Dave shares how institutional investors think about sector rotation strategies, evaluating the current evidence to determine how money managers are allocating...

READ MORE

MEMBERS ONLY

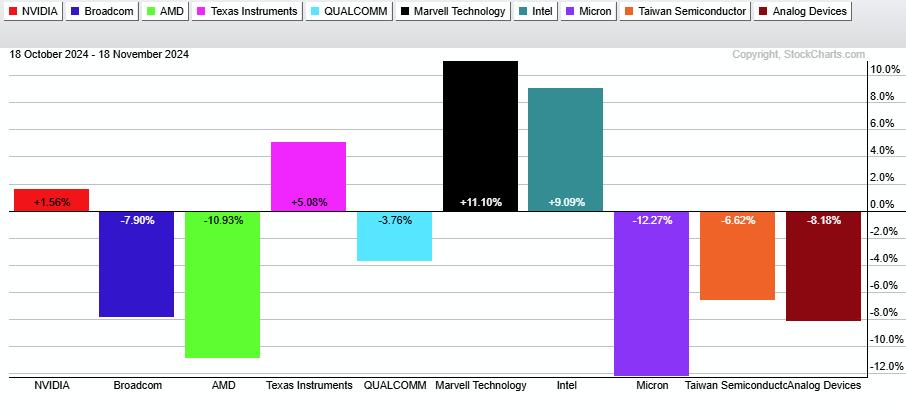

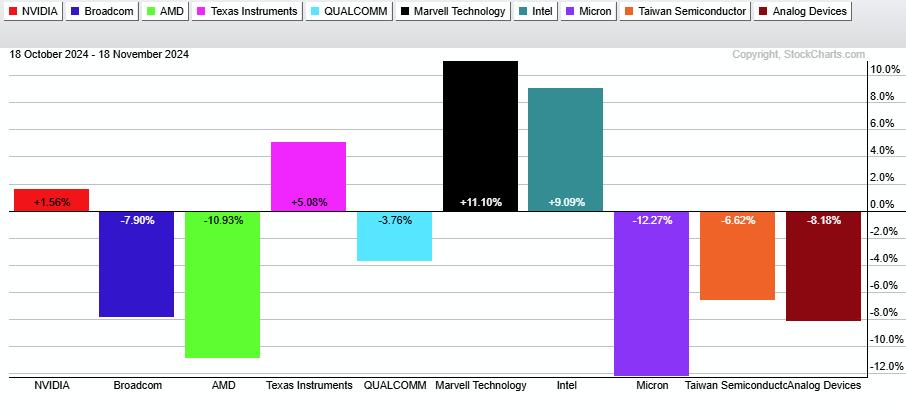

A Tale of Two Semiconductor ETFs - Why is SMH holding up better than SOXX?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* SOXX is lagging SMH as it broke the 200-day SMA and confirmed a bearish pattern.

* SMH is holding up because its top component remains strong.

* Nevertheless SMH is at a moment of truth ahead of a big earnings report from Nvidia.

Even though the iShares Semiconductor ETF (SMH)...

READ MORE

MEMBERS ONLY

Macro Market Outlook and Best Options Trade Ideas!

by Tony Zhang,

Chief Strategist, OptionsPlay

Join Tony as he walks you through a Macro Market outlook, where he shares his top bearish and bullish options trading ideas, These include Disney (DIS), Shopify (SHOP), Intel (INTC), Adobe (ADBE), and Apple (AAPL). He explores growth vs. value, current sector rotation, key earnings, and more.

This video premiered...

READ MORE

MEMBERS ONLY

MarketCarpets Secrets: How to Spot Winning Stocks in Minutes!

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* StockCharts' MarketCarpets can be customized to find stocks to invest in using specific criteria.

* The MarketCarpets tool helps users drill down from a big-picture view to individual stocks.

* Getting an at-a-glance view of strong stocks poised to bounce can be done immediately and efficiently with MarketCarpets.

When...

READ MORE

MEMBERS ONLY

Stocks: "...a PERMANENTLY high plateau"?

by Erin Swenlin,

Vice President, DecisionPoint.com

Today we explore the bullish sentiment that has taken SPX valuations to the moon. There are many out there that believe we have hit a plateau on prices that will continue permanently. We talk about the quote: "Stock prices have reached 'what looks like a permanently high plateau,...

READ MORE

MEMBERS ONLY

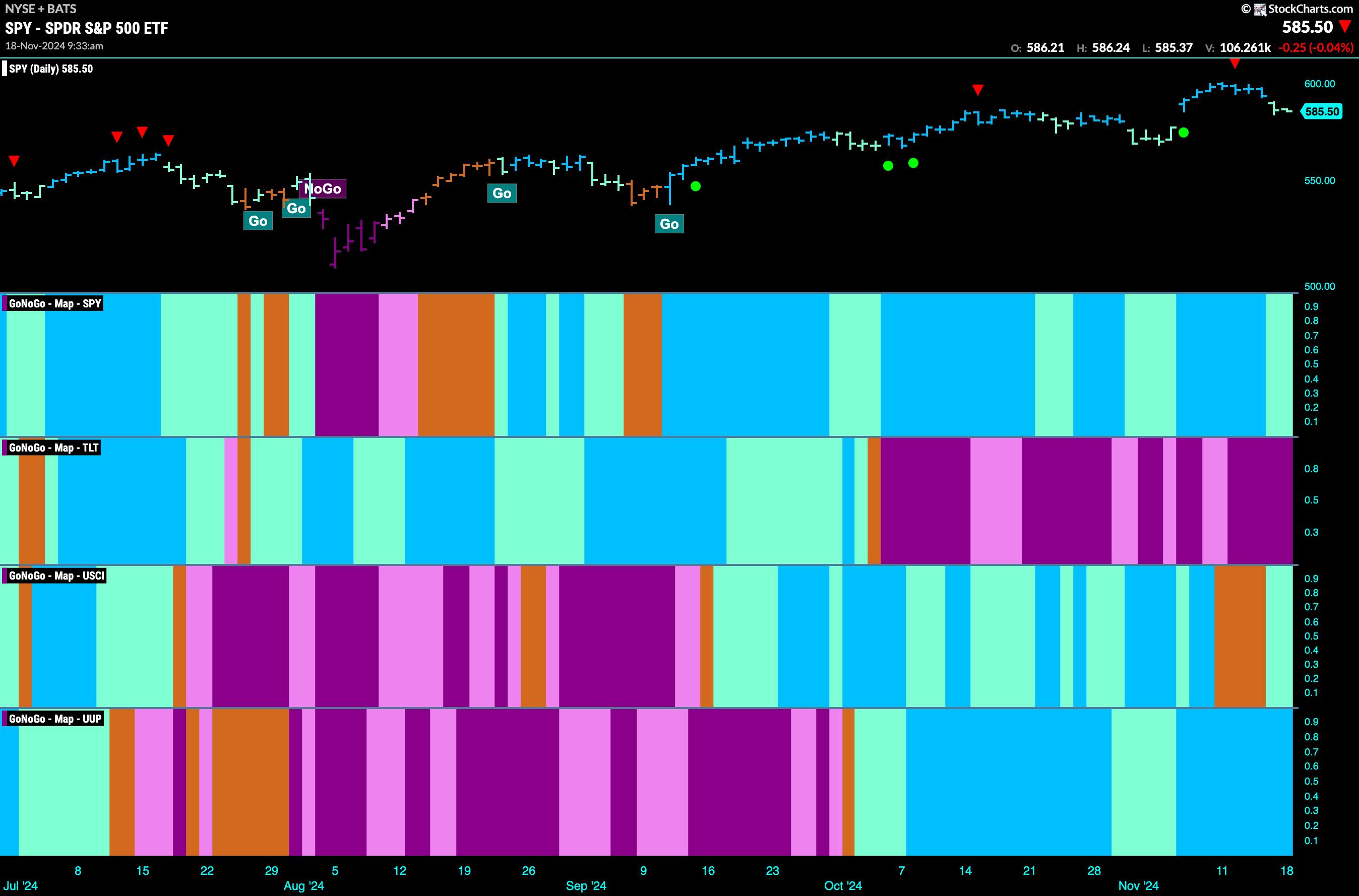

Equities Look for "Energy" in "Go" Trend

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

Good morning and welcome to this week's Flight Path. Equities saw the "Go" trend continue this week but we saw weaker aqua bars at the end of the week. Treasury bond prices painted strong purple "NoGo" bars as the weight of the evidence suggested...

READ MORE

MEMBERS ONLY

3 Breakouts Ready for Massive Climbs!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

As the secular bull market takes a short-term pause, now is the time to research tremendous opportunities that lie ahead. I've looked at more than a thousand charts and wanted to point out 3 in particular that I see heading much, much higher as we close out 2024...

READ MORE

MEMBERS ONLY

Don't Miss These Breakouts Poised to Trade Higher!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen reveals what took place last week and how the markets closed. She also revealed what drove price action, and what to be on the lookout for next week. In addition, she shares several stocks that broke out of powerful bases on bullish news....

READ MORE

MEMBERS ONLY

Tech Stocks Plunge: What This Means for Investors

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Tech stocks, especially semiconductors, get hammered.

* Treasury yields continue to rally higher in response to Fed comments and strong economy.

* The US dollar rally confirms the strength of the US economy.

"The economy is not sending any signals that we need to be in a hurry to...

READ MORE

MEMBERS ONLY

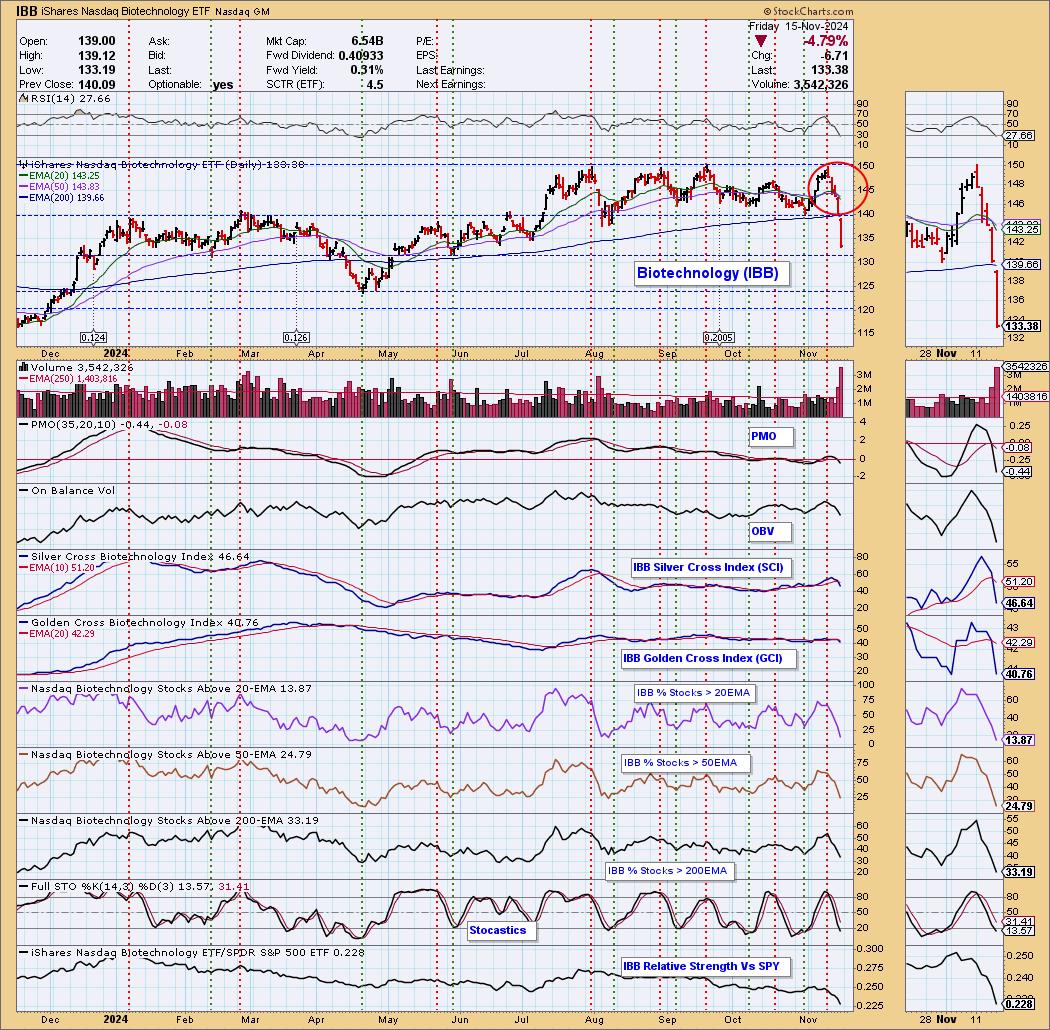

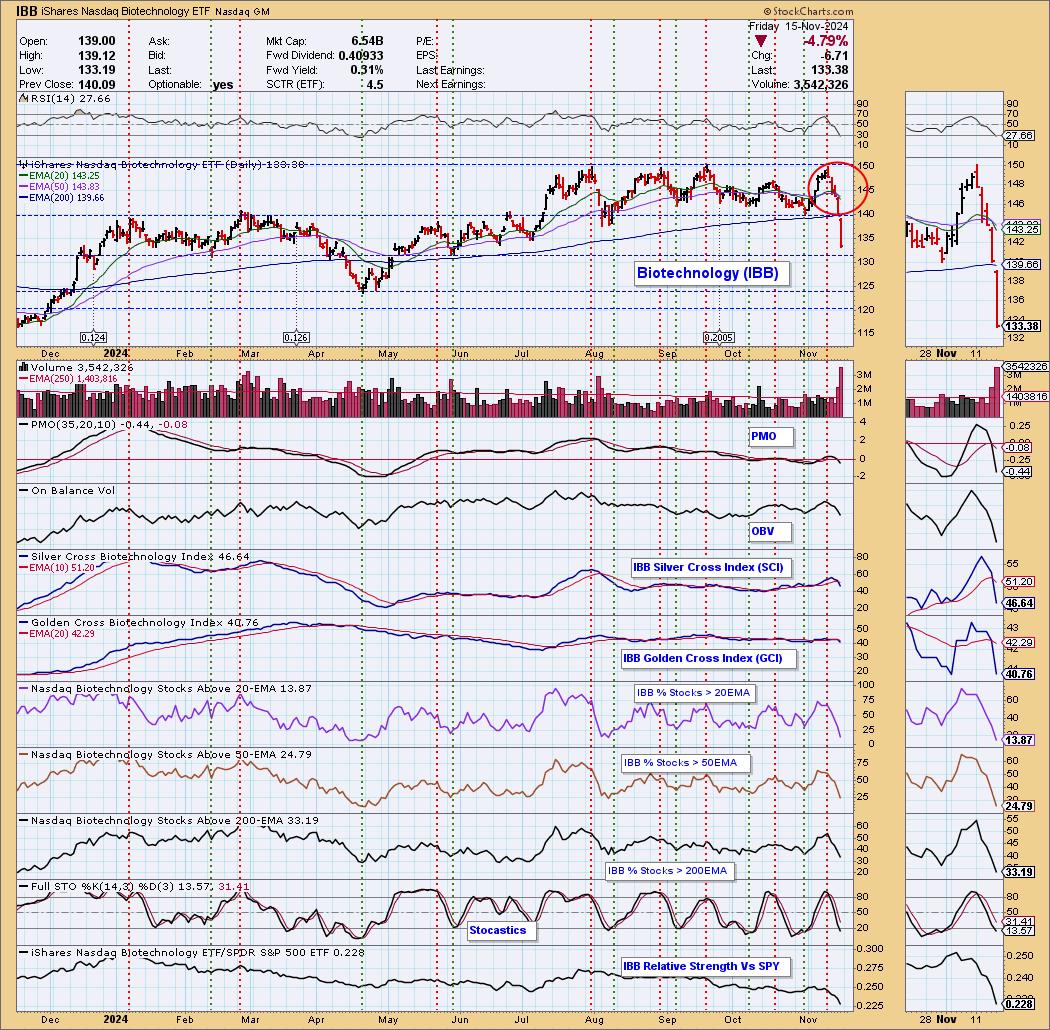

Biotechs Fall Apart with Dark Cross Neutral Signal

by Erin Swenlin,

Vice President, DecisionPoint.com

(This is an excerpt from the subscriber-only DP Weekly Wrap for Friday)

On Friday, the Biotechnology ETF (IBB) 20-day EMA crossed down through the 50-day EMA (Dark Cross) and above the 200-day EMA, generating an IT Trend Model NEUTRAL Signal. IBB recently switched to a BUY Signal on Friday November...

READ MORE

MEMBERS ONLY

Are the Magnificent 7 Still the Kings of Wall Street?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* The Breakout Names have already broken to new all-time highs in Q4, but will they be able to hold those gains?

* The Consolidating Charts have failed to break to new highs, so it's all about watching key price support levels.

* The Wild Cards may be the...

READ MORE

MEMBERS ONLY

Spotting a Bullish Opportunity in Zscaler (ZS) with OptionsPlay Strategy Center

by Tony Zhang,

Chief Strategist, OptionsPlay

KEY TAKEAWAYS

* Zscaler was identified as a stock gearing up for a bullish trend in the OptionsPlay Strategy Center.

* Technical and fundamental analysis of Zscaler makes the stock an ideal candidate for a put vertical options trade.

As the cybersecurity landscape continues to evolve with increasing digital threats, Zscaler, Inc....

READ MORE

MEMBERS ONLY

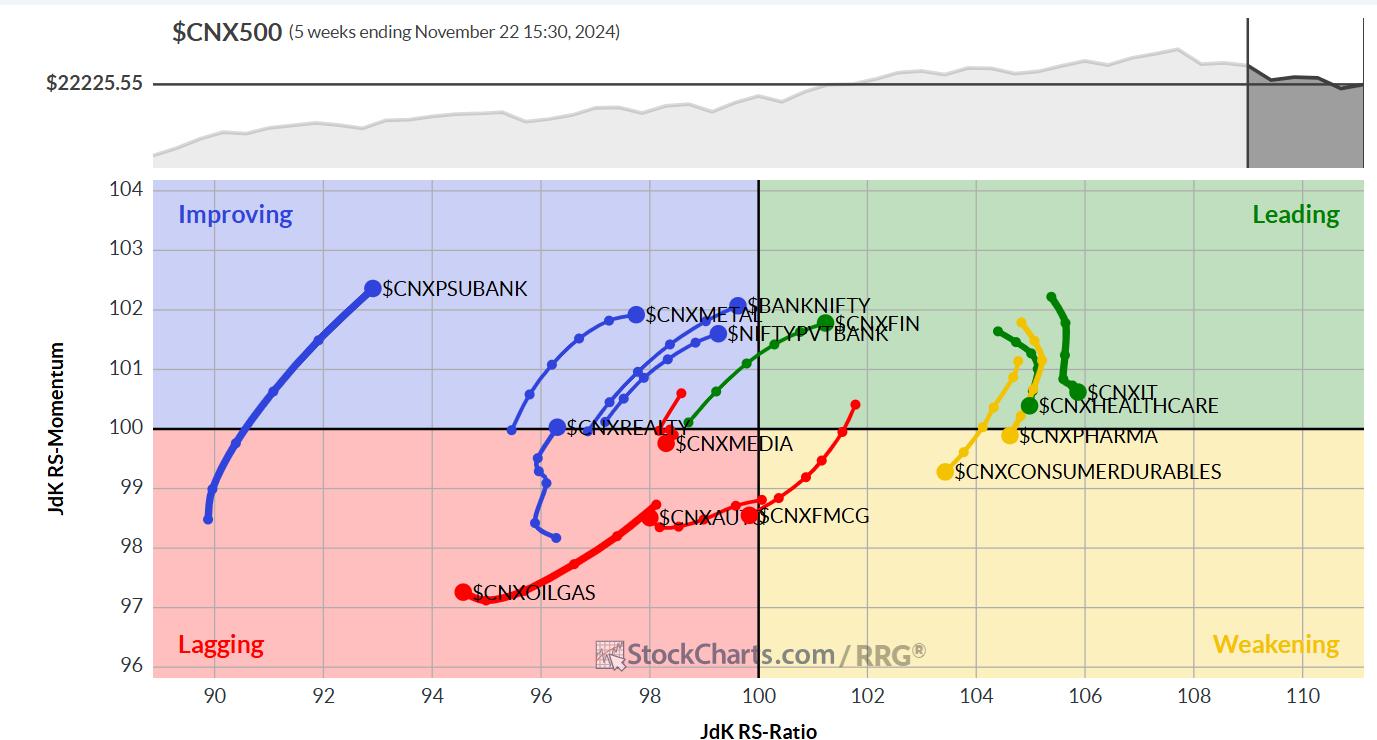

Week Ahead: NIFTY May See Mild Rebounds; Painful Mean Reversion May Continue

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The Indian benchmark Nifty 50 extended its corrective decline. Over the past four sessions of a truncated week, the Nifty 50 index remained largely under selling pressure, and the markets continued with their process of mean-reversion. The volatility, though, did not show any major surge. The volatility gauge, IndiaVIX rose...

READ MORE

MEMBERS ONLY

Riding the Cryptocurrency Wave: How to Maximize Your Gains

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* With a new administration set to take office in January, it may be time to seriously reconsider cryptocurrencies.

* Three cryptocurrencies to keep an eye on are Bitcoin, Ethereum, and (strangely) Dogecoin.

* Despite cryptocurrencies being a noisy market, the right tools can help guide you toward smarter decisions.

With...

READ MORE

MEMBERS ONLY

Upgrade Your Options Trading with OptionsPlay on StockCharts

by Tony Zhang,

Chief Strategist, OptionsPlay

by Grayson Roze,

Chief Strategist, StockCharts.com

Should you buy calls/puts? Should you write covered calls? Or should you trade bull/bear vertical spreads?

That's a lot to chew on -- and it's just the beginning. Once you decide on a strategy, you'll have to decide on which strikes and...

READ MORE

MEMBERS ONLY

This Industry Just Broke Out And Is Poised To Lead U.S. Equities Higher

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Now that Q4 historical bullishness has kicked in, it's time to allow the bears to go into hibernation, while the bulls search for key leadership to drive prices higher. Before I highlight a key industry group that just moved into all-time high territory, it's important to...

READ MORE

MEMBERS ONLY

The Sign of Strong Charts Getting Stronger

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I was originally taught to use RSI as a swing trading tool, helping me to identify when the price of a particular asset was overextended to the upside and downside. And, on the swing trading time frame, that approach very much works, especially if you employ a shorter time period...

READ MORE

MEMBERS ONLY

Key Support Levels for Gold

by Erin Swenlin,

Vice President, DecisionPoint.com

In today's DP Alert short video we discuss the key support levels for Gold as it has likely begun a longer-term correction. We also take a look at Gold Miners under the hood! Charts and commentary are taken from our subscriber-only DP Alert publication. Subscribe now and try...

READ MORE

MEMBERS ONLY

Simple Way to Find Confluence FAST Using Moving Averages

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts video, Joe explains how to use an 18 simple moving average in multiple timeframes to identify when a stock has confluence amongst 2-3 timeframes. He shows how to start with the higher timeframes first, before working down to the lower ones. Joe then covers the shifts...

READ MORE

MEMBERS ONLY

The SCTR Report: Palantir Stock's Rise Makes It the Hottest AI Play

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Palantir stock's rise to the third place in the SCTR Report makes it a worthy candidate to add to your portfolio.

* The price surge in Palantir stock after its stellar earnings report may just be the beginning of a bullish move.

* Palantir is a stock that...

READ MORE

MEMBERS ONLY

The Dollar's Technical Position is Crucial from a Short, Intermediate, Primary, and Secular Standpoint

by Martin Pring,

President, Pring Research

Chart 1 shows the Dollar Index has been in a trading range for the last couple of years and is now at resistance in the form of its upper part. The big question relates as to whether it can break to the upside, or if the resistance will once again...

READ MORE