MEMBERS ONLY

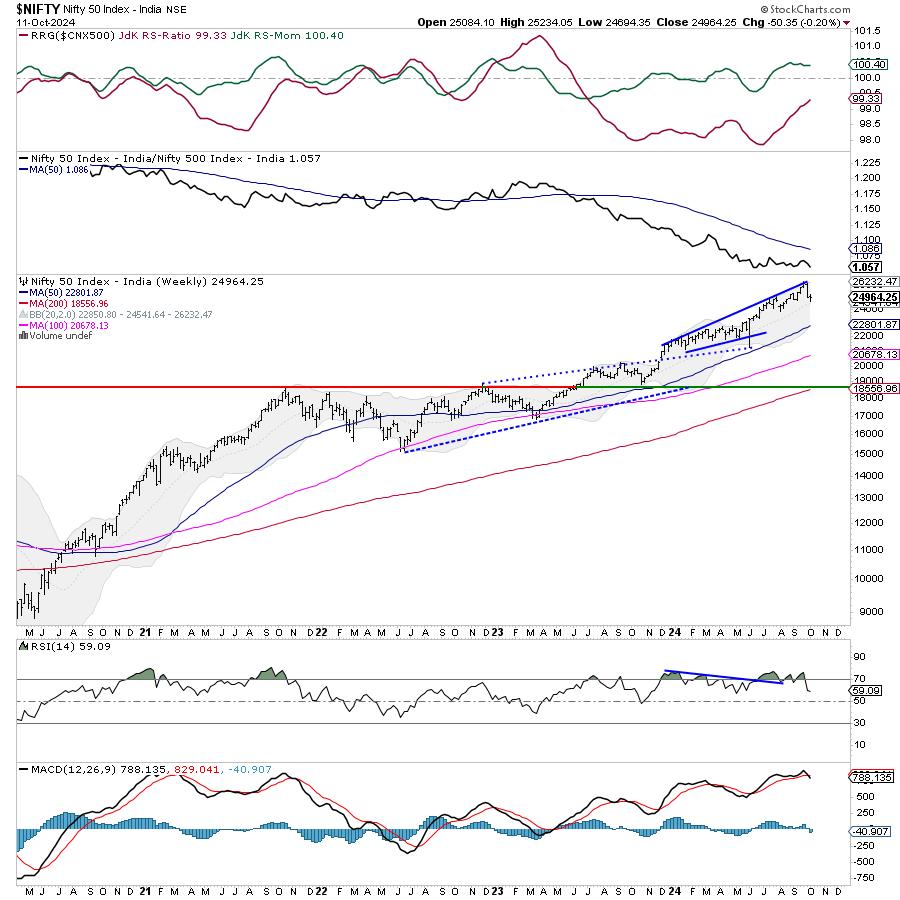

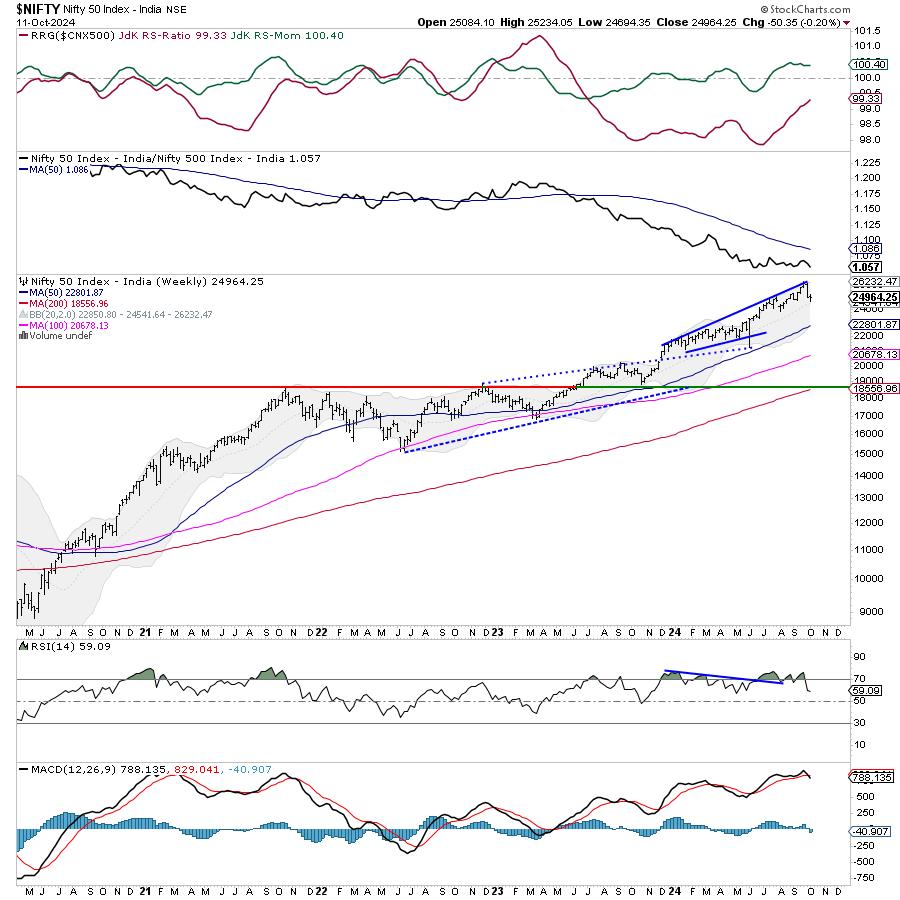

Week Ahead: While Nifty Consolidates, Keeping Above These Levels Crucial

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The week that went by was in complete contrast to the week before, as the markets heavily consolidated in a tight range. In the previous week, the Nifty had seen a significant retracement of over 1167 points; however, over the past five trading days, the index stayed totally devoid of...

READ MORE

MEMBERS ONLY

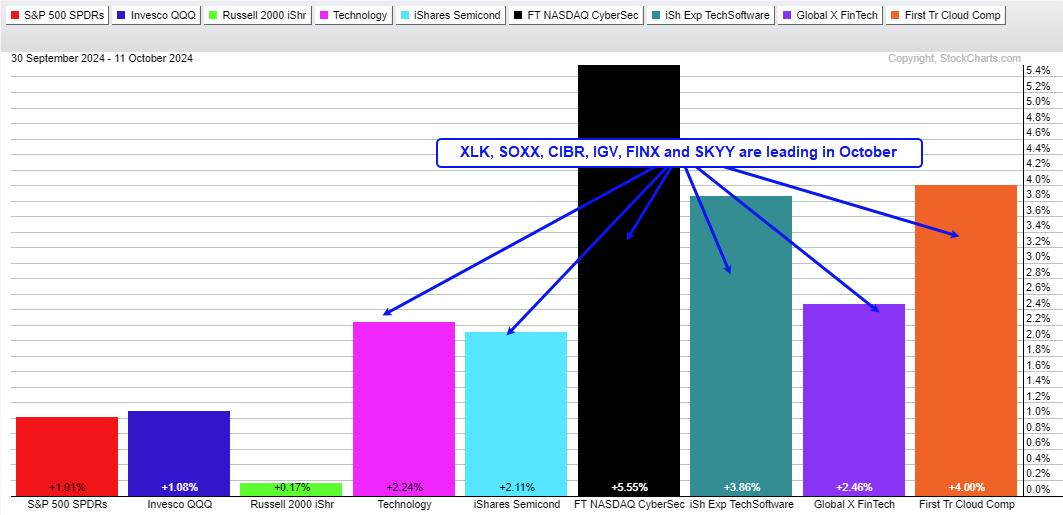

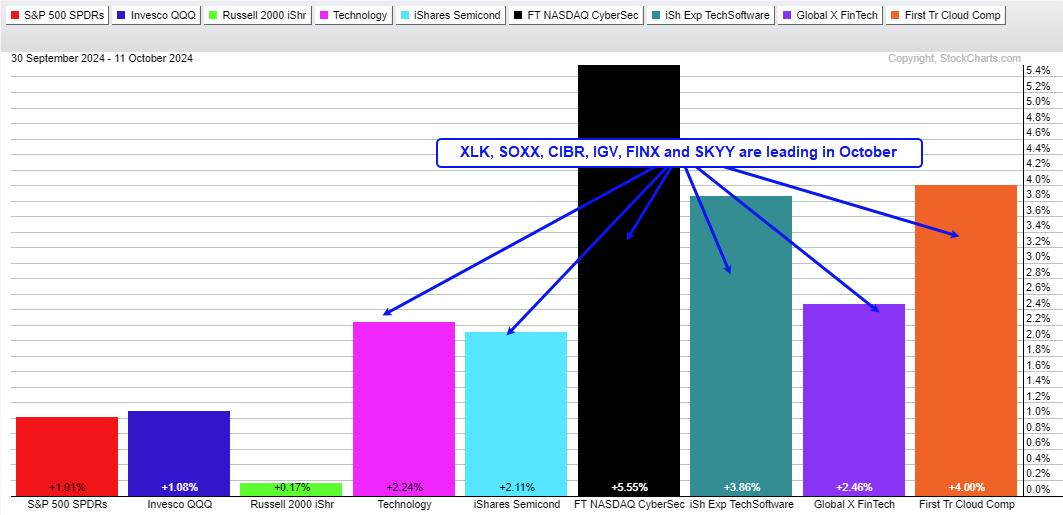

Cybersecurity ETF Comes to Life with New Trending Phase

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* Stocks go through trending and non-trending phases.

* Non-trending phases often last longer than trending phases.

* CIBR recently broke out and started a new trending phase.

The Cybersecurity ETF (CIBR) is resuming the lead as it surged to new highs this past week. It is important to note that...

READ MORE

MEMBERS ONLY

The One Volume Indicator You Should Follow

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* While the daily volume reading can give us limited insight on the balance of buyers and sellers, Chaikin Money Flow gives a much clearer picture of trends in volume.

* Major tops in the last 12-18 months have been marked with a particular pattern in the S&P...

READ MORE

MEMBERS ONLY

Last Week's Pullback is a Buying Opportunity!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen highlights what's driving these markets higher despite a rise in interest rates. She also focuses on the leadership area in Technology and shares several stocks from this group. Last up, she reviews how to quickly uncover top stock candidates when a...

READ MORE

MEMBERS ONLY

Small-Caps Get on Board!

by Erin Swenlin,

Vice President, DecisionPoint.com

Yesterday, we posted a short video about the lack of participation within the mid-and small-cap universes. Here, we had a rally to new all-time highs, yet we weren't seeing much of anything out of the broad market. Today was a reversal of fortune for these indexes, which rallied...

READ MORE

MEMBERS ONLY

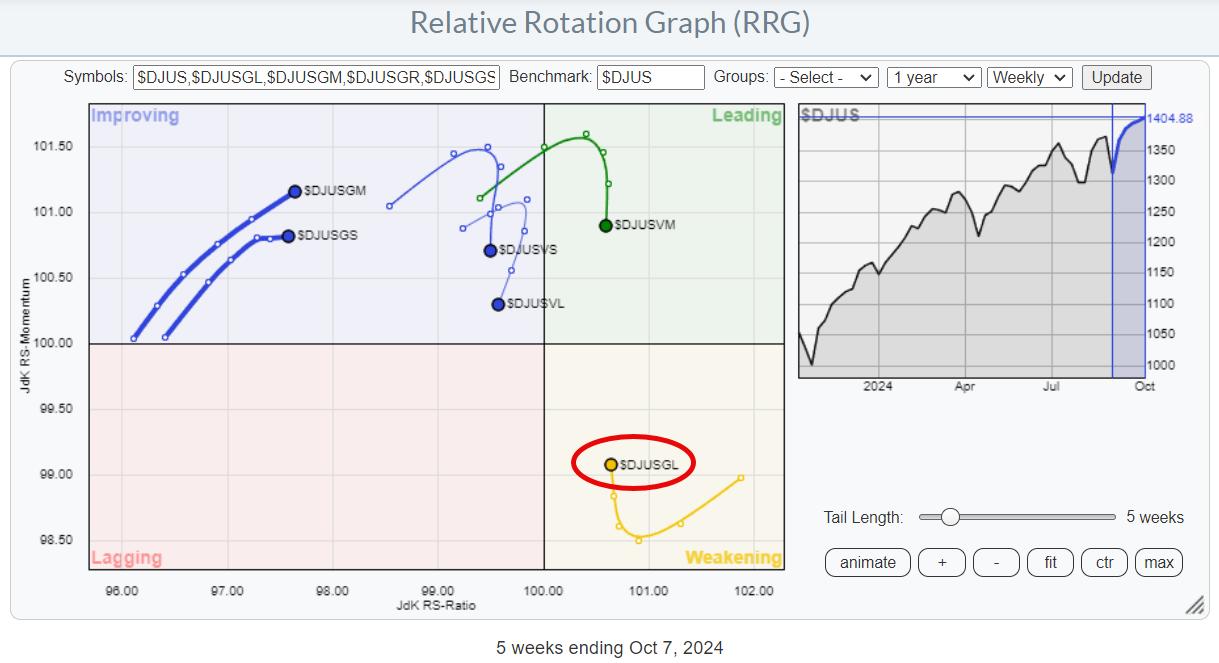

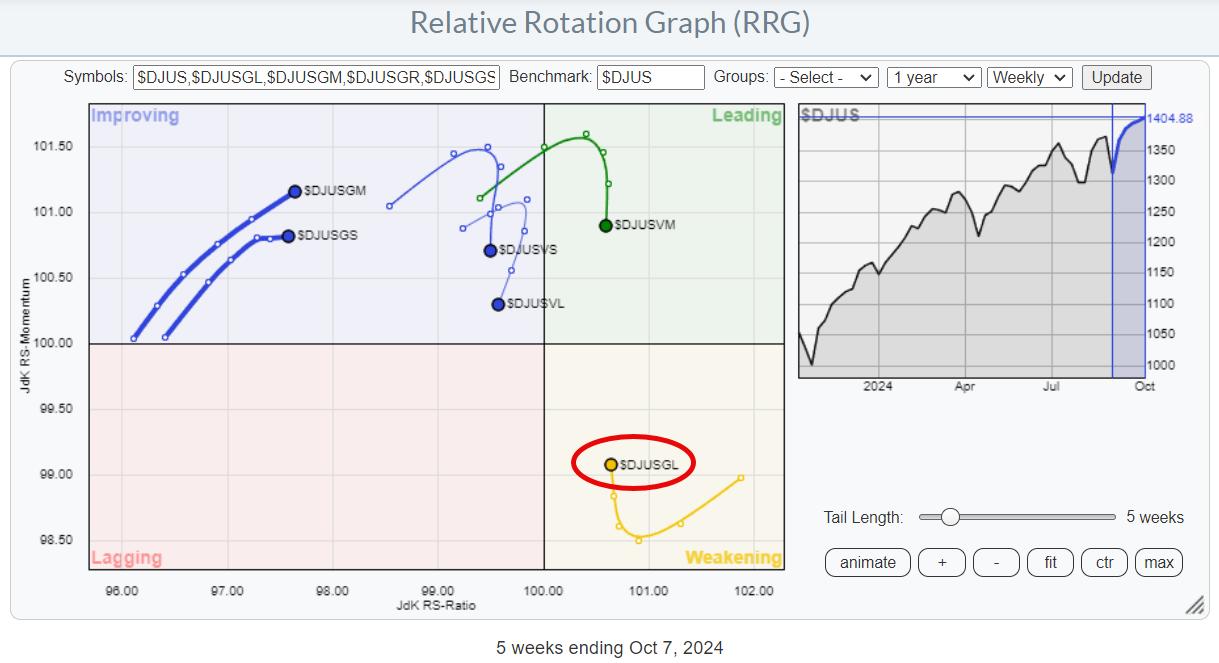

It's Large-Cap Growth Stocks (Mag 7) Once Again

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* SPY is starting to resolve its negative divergence with RSI.

* Large-cap growth is coming back into favor.

* Magnificent 7 stocks provided 2.9% of the S&P 50's 6.8% performance over the past five weeks.

Where is the Recent Performance in the S&...

READ MORE

MEMBERS ONLY

Alert: Small-Caps Not Participating in New All-Time Highs

by Erin Swenlin,

Vice President, DecisionPoint.com

DecisionPoint has started posting short video alerts on our YouTube Channel. These videos are less than four minutes and give you the scoop on news you need to know about the market right now. Subscribe to the DecisionPoint.com YouTube Channel HERE so you'll be notified when these...

READ MORE

MEMBERS ONLY

Tech vs Semiconductors: Which One Should You Be Trading?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Doing a top-down sector-to-industry analysis can be an effective way to find tradable opportunities.

* It makes sense to compare charts to see which ones are outperforming and which are underperforming.

* Get a bigger picture, drill down using relative performance indicators, and then examine specific key levels of each...

READ MORE

MEMBERS ONLY

What's Wrong With This SPX Breakout?

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts TV video, Joe presents the price pattern to follow the recent breakout in the S&P 500. He discusses narrow range bars, wide range bars and when they are important. Joe then explains what needs to take place now to either confirm a breakout or...

READ MORE

MEMBERS ONLY

Three Thoughts on Risk Management for October 2024

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* Watch the S&P 500's "line in the sand" for a signs of a breakdown in the major averages.

* Market breadth indicators could provide an early warning of a potential breakdown for the benchmarks.

* By being thoughtful about your position sizing for each...

READ MORE

MEMBERS ONLY

SCTR Report: Carvana Stock Skyrockets, Hits a New 52-Week High -- What This Means for Investors

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Carvana stock is back on top of the Top 10 Large-Cap SCTR Report.

* If you have a long position in Carvana, monitor your positions carefully.

* The stock has the potential to rise much higher, so enjoy the ride while you can.

Apologies for revisiting Carvana (CVNA), but it...

READ MORE

MEMBERS ONLY

Why This S&P Support Level is SO IMPORTANT

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius presents a few conflicting rotations and signals that continue to warrant caution while the S&P 500 keeps hovering just above support. With the negative divergences between price and MACD/RSI remaining intact, SPY should not break 565. Julius looks at rotations...

READ MORE

MEMBERS ONLY

Oil Prices Soar Amid Middle East Tensions – What's Next for Gas Prices?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Crude oil prices spiked, largely due to tensions in the Middle East.

* Gasoline prices are following crude oil prices.

* An analysis of the charts of crude oil and gasoline prices show potential trading opportunities.

Monday saw something of a bloodbath on Wall Street, with the Dow ($INDU) plunging...

READ MORE

MEMBERS ONLY

Market Top in October? 2007 vs. 2024

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Will we see a major market top during the month of October? Dave breaks down three market breadth indicators and compares their current configuration to what we observed at the 2007 market top. He then goes through the charts and reviews market topping conditions from a breadth perspective using the...

READ MORE

MEMBERS ONLY

Did We Just See a False Breakdown in Crude Oil?

by Martin Pring,

President, Pring Research

Using West Texas Crude, Chart 1 features one of my favorite techniques for identifying changes in long-term trends, which is simply a PPO using the 6- and 15-month parameters. When it is above zero, it's bullish, and when below, bearish. The pink shading indicates bearish periods, and the...

READ MORE

MEMBERS ONLY

Equities Remain in "Go" Trend and Lean into Energy

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

Good morning and welcome to this week's Flight Path. Equities saw the trend remain and as the week came to a close we saw more strong blue "Go" bars as price rallied close to prior highs. GoNoGo Trend shows that there has been a change in...

READ MORE

MEMBERS ONLY

DP Trading Room: A Case for a Market Top

by Erin Swenlin,

Vice President, DecisionPoint.com

During today's market analysis Carl laid out his reasons why we believe we are at a market top. He discusses the current market price action combined with exclusive DecisionPoint indicators to substantiate his position. Don't miss his analysis.

Carl also goes though the Magnificent Seven by...

READ MORE

MEMBERS ONLY

Week Ahead: Putting Market Moves in Perspective; Watch Nifty From This Angle

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

On the back of one of the major FII selloffs seen in recent times, the markets succumbed to strong corrective pressure through the week and ended on a very weak note. The Nifty 50 remained under selling pressure; at no point in time did it show any intention to stage...

READ MORE

MEMBERS ONLY

Stealth AI Stocks Are Taking Off in a Flat Market

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen highlights the continuation rally in AI-related stocks while also reviewing broader market conditions. The move higher in yields as well as volatility were discussed heading into next week's FOMC notes and inflation data.

This video originally premiered October 4, 2024. You...

READ MORE

MEMBERS ONLY

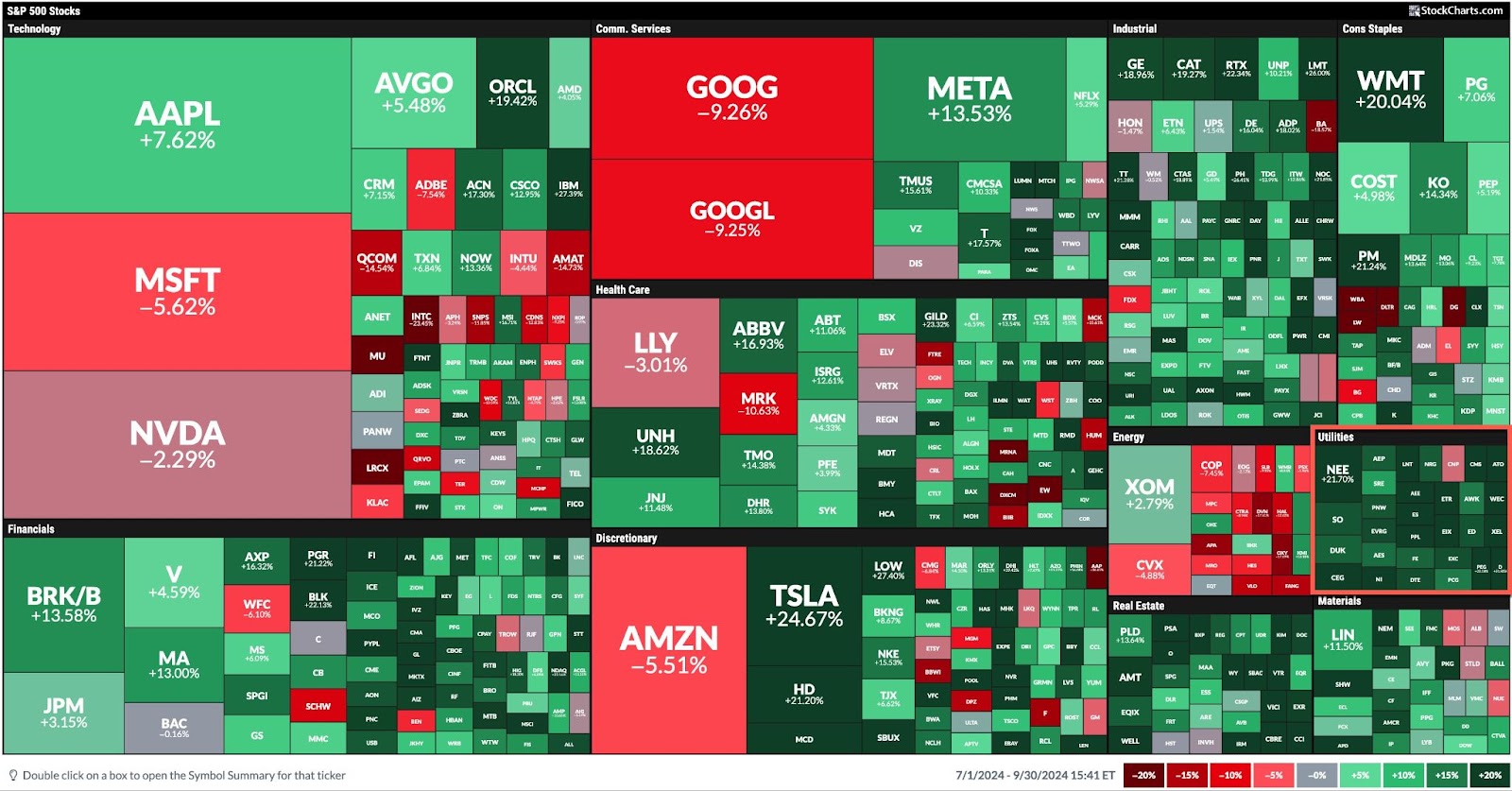

Stocks Soar, Energy Prices Spike: Are Geopolitical Tensions to Blame?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The macro picture of the US economy remains strong with the broader equity indexes in an uptrend.

* There has been some rotation in the sectors with Energy taking the lead as a result of rising crude oil prices.

* Use the StockCharts MarketCarpet to select stocks for your ChartLists....

READ MORE

MEMBERS ONLY

Does the Market Have Bad Breadth?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* There have been less new 52-week highs since mid-September, suggesting leaders are falling off.

* The percent of S&P 500 members above their 50-day moving average is below 75%, which often serves as a threshold for a downturn.

* The S&P 500 Bullish Percent Index remains...

READ MORE

MEMBERS ONLY

What More do the Bulls Want?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

* Over 70% of S&P 500 stocks are above their 200-day SMAs.

* SPY and RSP are trading near new highs.

* We see a bullish continuation pattern in a key AI stock.

It is a bull market for stocks. On the chart below, the S&P 500...

READ MORE

MEMBERS ONLY

Coming Soon: A New Era of Options Trading With OptionsPlay

by Tony Zhang,

Chief Strategist, OptionsPlay

We know that successful options trading requires precise analysis and actionable options strategies. That's why we're excited to introduce a groundbreaking partnership between OptionsPlay and StockCharts.com—bringing you the world's first integration of technical analysis and options screening in one powerful tool.

No...

READ MORE

MEMBERS ONLY

Jobs Soar Past Estimates, But What Happens Next?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

This morning, September nonfarm payrolls soared past expectations, 254,000 vs. 132,500. Adding to the bullishness was the upward revision to August nonfarm payrolls as the prior reading of 142,000 was boosted to 159,000. This is solid news, especially in an environment where the Fed is committed...

READ MORE

MEMBERS ONLY

Will Technology Drive S&P Higher in October?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius explores the October seasonal outlook for the S&P 500 and various sectors. Seasonality suggests a potential rise in the S&P 500, fueled by strength in technology, but there are still concerns about the ongoing negative divergence between price and...

READ MORE

MEMBERS ONLY

Gold Price Surge: What Goldman Sachs' $2,900 Forecast Means for Investors

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Goldman Sachs just raised their price target for gold to $2,900 an ounce.

* Goldman Sachs' price target roughly equals $280 in SPDR Gold Shares ETF (GLD).

* GLD could have more room to run.

Here's the issue with gold: it's difficult to find...

READ MORE

MEMBERS ONLY

China Stocks May Be On to Something

by Martin Pring,

President, Pring Research

China's stock market exploded last week in an amazing rally, so formidable that it raises the question of whether it could be the start of a new bull market, or just a short-covering rally which will quickly fizzle out. In that respect, it's important to note...

READ MORE

MEMBERS ONLY

SCTR Report: Vistra Energy Soars, Reaches New All-Time High

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Vistra Energy can be a big player in providing nuclear power to AI companies.

* Vistra Energy's stock price has hit an all-time high.

* There are support levels on the daily price chart that could present buying opportunities in VST.

Utility stocks are now becoming cool. Going...

READ MORE

MEMBERS ONLY

These 4 Chinese Stocks are Worth a Look

by Joe Rabil,

President, Rabil Stock Research

In this exclusive StockCharts TV video, Joe explains how to use two timeframes to identify 2 important characteristics of a great setup. For examples, he shares a few Chinese stocks that are showing great strength to the upside and what levels to watch for a pullback. Joe also covers the...

READ MORE

MEMBERS ONLY

With 2024 Q2 Earnings In, Market Remains Very Overvalued

by Carl Swenlin,

President and Founder, DecisionPoint.com

S&P 500 earnings are in for 2024 Q2, and here is our valuation analysis.

The following chart shows the normal value range of the S&P 500 Index, indicating where the S&P 500 would have to be in order to have an overvalued P/E...

READ MORE

MEMBERS ONLY

Traders are Eyeing These Metals After China's Big Economic Shift: Here's What You Need to Know

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Metals appear to be reacting bullishly after China injected more stimulus into its economy.

* Gold, silver, and copper are displaying unique patterns and structures.

* Keep an eye on momentum for clues as to each metal's likely move within the context of its current pattern.

China'...

READ MORE

MEMBERS ONLY

US Sectors Soar to New Highs!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this video from StockCharts TV,Julius takes a detailed look at the monthly charts for all US sectors and the S&P 500. With many sectors breaking to new highs, he highlights how the long-term uptrend for the S&P 500 remains intact. Julius also examines the...

READ MORE

MEMBERS ONLY

Are Lower Interest Rates Bad For Workers? | Focus on Stocks: October 2024

by Larry Williams,

Veteran Investor and Author

The common economic perception is that lower interest rates are good for business, which, in turn, means good for job growth. The following charts will turn that idea upside down and inside out. Keep in mind there is no chart fancy-dancing going on here; I am just presenting the last...

READ MORE

MEMBERS ONLY

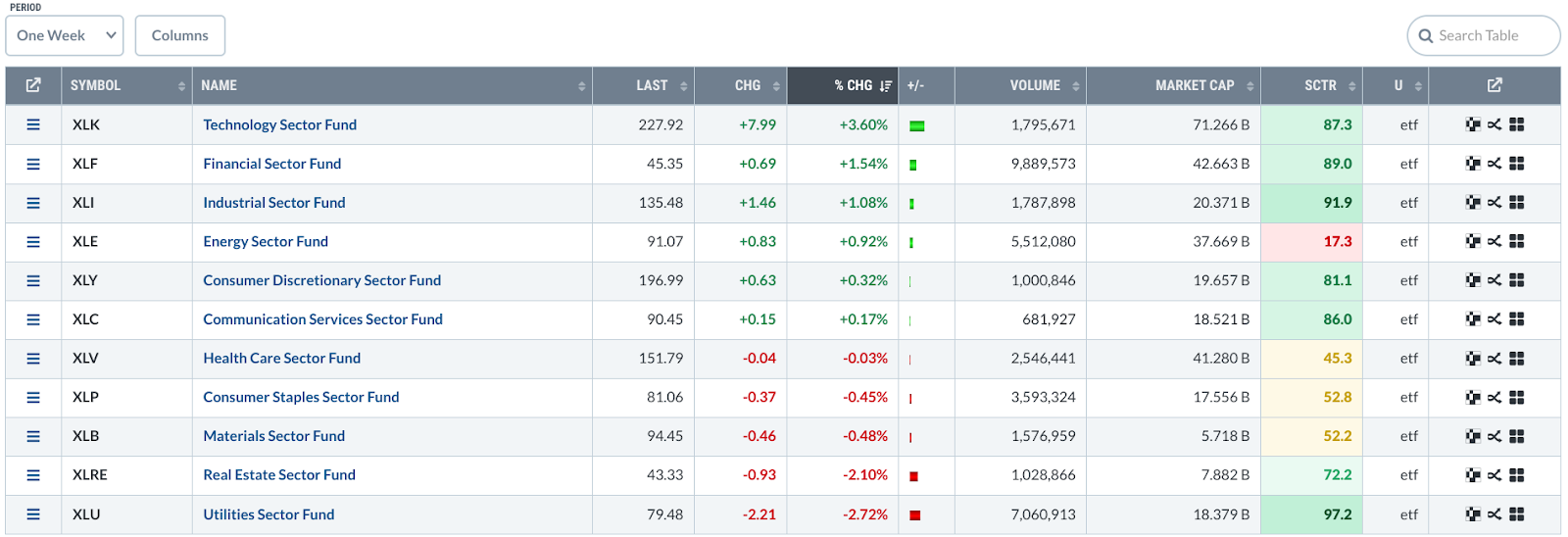

Stock Market's Spectacular Q3: Highest Sector Performer is Utilities

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The leading sector performer in Q3 was Utilities, up by 19.35%.

* Utility stocks are gaining attention because of their ability to power up AI companies.

* Many utility stocks provide dividends, which could add some extra cash to your portfolio.

September, typically considered to be the weakest month...

READ MORE

MEMBERS ONLY

DP Trading Room: Uncovering Stocks from DP Scan Alerts

by Erin Swenlin,

Vice President, DecisionPoint.com

In today's free DecisionPoint Trading Room, Erin pulls out her exclusive DecisionPoint Diamond Scans and finds us some new and interesting stock symbols to explore further. These scans are very powerful and bring the best charts to your attention. DecisionPoint has a new Scan Alert System for purchase...

READ MORE

MEMBERS ONLY

Equities Remain in Strong "Go" Trend as Communications Begin to Excel

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

Good morning and welcome to this week's Flight Path. Equities saw the "Go" trend remain strong with another uninterrupted week of strong blue "Go" bars. Treasury bond prices remained in the "Go" trend as well but we saw a whole week of...

READ MORE

MEMBERS ONLY

Can The China Strength Last Week Be Sustained?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

China's Shanghai Composite Index ($SSEC) surged higher last week by roughly 13%, which was one of its largest 1-week gains over the past decade. There were solid economic reasons for the surge as China's central bank approved measures to accelerate recent sluggish growth. The People'...

READ MORE

MEMBERS ONLY

Why Were Chinese Stocks Up 20% Last Week?!

by Mary Ellen McGonagle,

President, MEM Investment Research

In this StockCharts TV video, Mary Ellen reviews the broader markets, including sector and industry group rotation, before highlighting the sharp move into Chinese stocks. She shares her thoughts on whether it's too late to participate. In addition, she looks at the key traits that signal your stock...

READ MORE

MEMBERS ONLY

Stock Market Regains Bullish Edge: Can Geopolitical Tensions Change Its Direction?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The stock market got an influx of positive news, bringing bullish momentum.

* The Dow Jones Industrial Average closed at a record high on Friday.

* Investors are rotating out of mega-cap tech stocks and into other areas such as precious metals, as well as China-related stocks and ETFs.

There&...

READ MORE

MEMBERS ONLY

Could U.S. Stocks Crash In October?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

That's a great question right now as many folks still remain quite nervous. The Volatility Index ($VIX), for example, gained more than 10% today, despite a minimal decline in the S&P 500. It's a signal that the stock market likely won't handle...

READ MORE