MEMBERS ONLY

Why Novo Nordisk's Stock Price Recovery Makes It a Promising Buy

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Novo Nordisk's stock price fell after its Q1 earnings report, but pivoted and reversed

* NVO stock could break above its all-time highs

* A couple of technical indicators can help confirm your buy decision

Novo Nordisk (NVO) reported Q1 earnings on May 2. Even though it was...

READ MORE

MEMBERS ONLY

The Market Breadth Indicator You Should Be Following

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps another strong day for stocks as the S&P 500 regains its 50-day moving average. He then identifies key levels to watch for PLTR, LCID, NFLX, NVDA, and AAPL, and breaks down the latest market breadth indicator...

READ MORE

MEMBERS ONLY

Here's My Long-Term Perspective on U.S. Stocks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

EB Weekly Market Recap Video

If you haven't seen our latest weekend recording, it's now available HERE at YouTube.com.

Sample - EB Weekly Market Report

This is a sample of our Weekly Market Report that is sent to EB members every Monday. We also provide...

READ MORE

MEMBERS ONLY

DP Trading Room: Two Industry Groups To Watch!

by Erin Swenlin,

Vice President, DecisionPoint.com

Today Erin uncovers two industry groups that are showing strength and potential in the short term. She takes a look "Under the Hood" to reveal participation and trends that are quite bullish.

Carl walks us through the market overall, covering not only the SPY, but also interest rates,...

READ MORE

MEMBERS ONLY

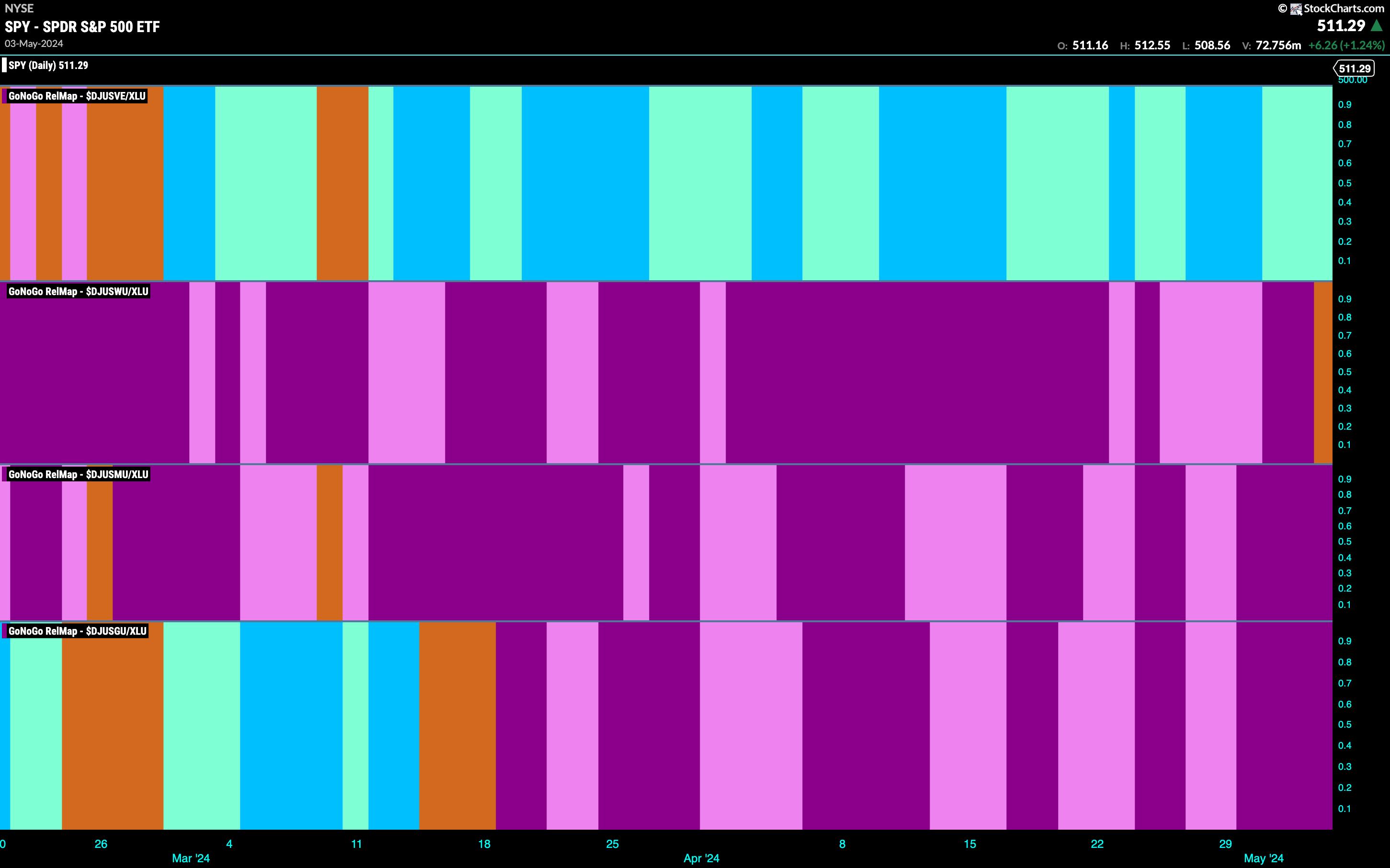

DEFENSE TRIES TO HELP EQUITIES MOVE OFF LOWS

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

Good morning and welcome to this week's Flight Path. The equity "NoGo" trend struggled this week as prices climbed from lows. We see an amber "Go Fish" bar as the market tries to understand the trend. GoNoGo Trend paints pink "NoGo" bars...

READ MORE

MEMBERS ONLY

It's May, So Should We Go Away?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

We've all heard that popular Wall Street adage, "Go away in May", right? It's cute and it rhymes, so why wouldn't we make the HUGE decision to liquidate all of our stock holdings? <sarcasm> Did I mention it rhymes? One...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Stays Vulnerable to Disruption of Primary Trend; Volatility Likely to Stay

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The markets traded in a much wider range in the past trading week. Over the past few days, we had seen the markets and the VIX inching higher, i.e. moving in the same direction. In the previous technical note, we had expressly mentioned this concern, as instances of VIX...

READ MORE

MEMBERS ONLY

MEM TV: NVIDA is Setting Up To SURGE

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the key drivers for this week's volatile period, including Core PCE and GDP numbers. She takes a look at where the S&P 500 and NASDAQ closed for the week and whether it'...

READ MORE

MEMBERS ONLY

Is this a Dead-Cat Bounce or a Bounce with Legs?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

KEY TAKEAWAYS

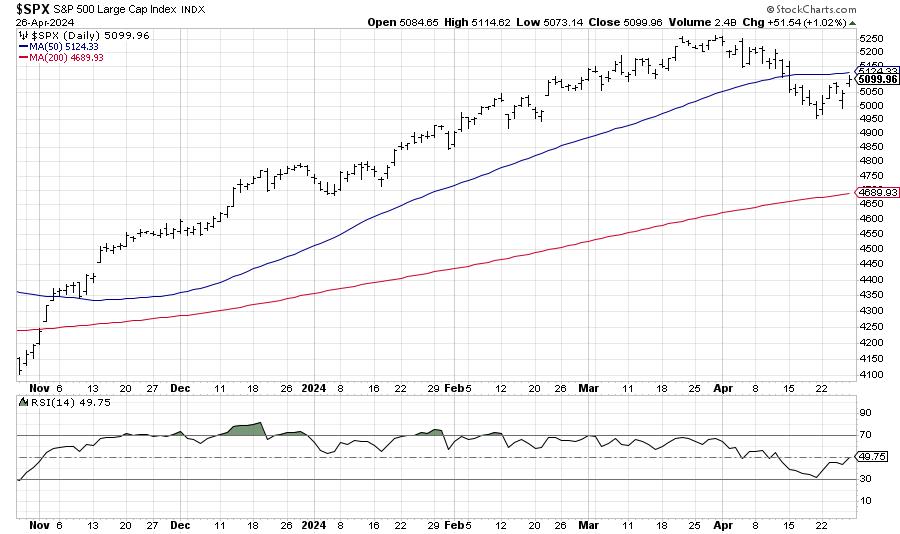

* A key short-term breadth indicator became oversold in mid April.

* Stocks are bouncing after this oversold reading.

* Breadth, however, has yet to show a serious expansion in participation.

Stocks fell sharply into late April and then rebounded over the last two weeks. SPY fell 5.34% from March...

READ MORE

MEMBERS ONLY

Technology Stocks Back In the Lead: Are Inflation Fears Behind Us?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The broader stock market indexes closed higher, but failed to show enough follow through to the upside

* Technology stocks were in the lead today and led the stock market higher

* The CBOE Volatility Index is back below 15, indicating lack of fear among investors

The weaker-than-expected jobs report...

READ MORE

MEMBERS ONLY

Key Breadth Indicator Flashes Buy Signal for Nasdaq 100

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave opens The Final Bar mailbag to answer viewer questions on the Nasdaq Bullish Percent Index, the value of long-term technical analysis techniques, how sentiment indicators relate to the market trend, and how the CMT program helped him improve his...

READ MORE

MEMBERS ONLY

The Bull Case for Buffett's Biggest Holding

by David Keller,

President and Chief Strategist, Sierra Alpha Research

As investors flock to Omaha, Nebraska in their annual pilgrimage to learn from the great Warren Buffett, it seems an opportune time to reflect on the technical evidence for Berkshire's biggest holding, Apple (AAPL).

Today, we'll consider AAPL using "multiple time frame analysis", in...

READ MORE

MEMBERS ONLY

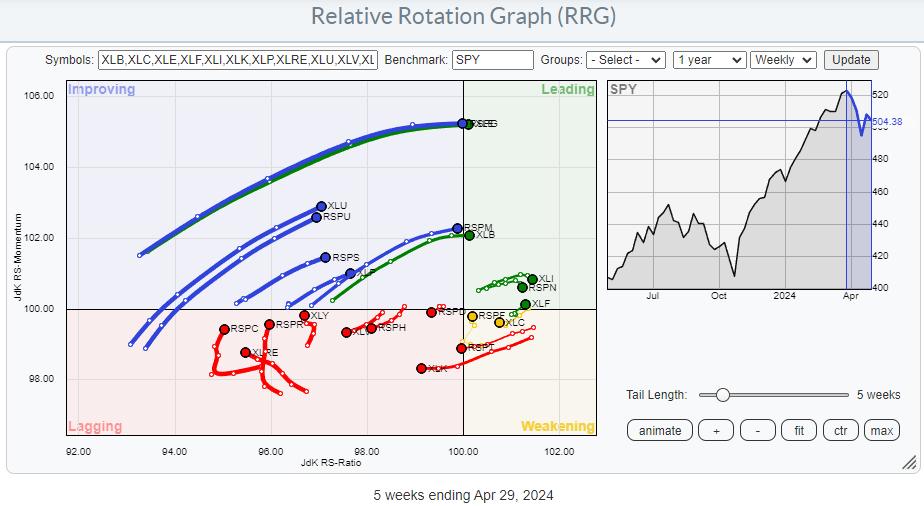

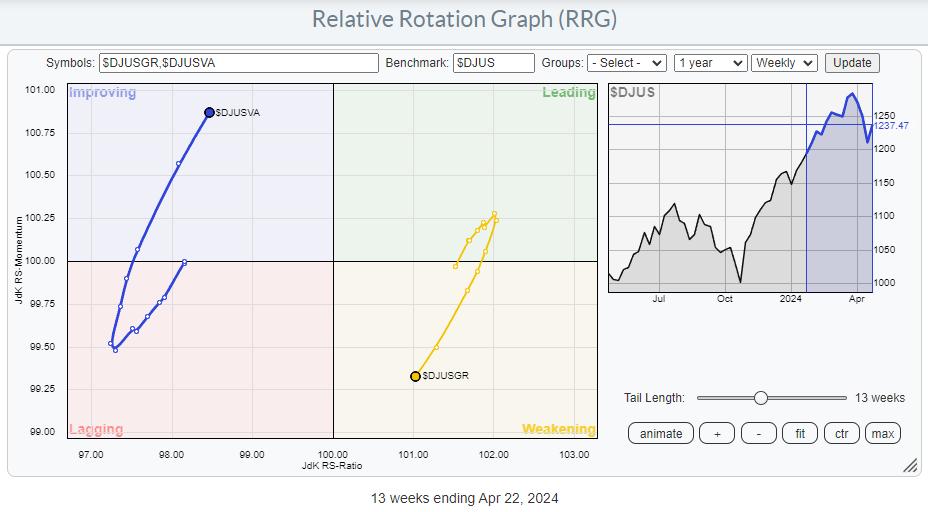

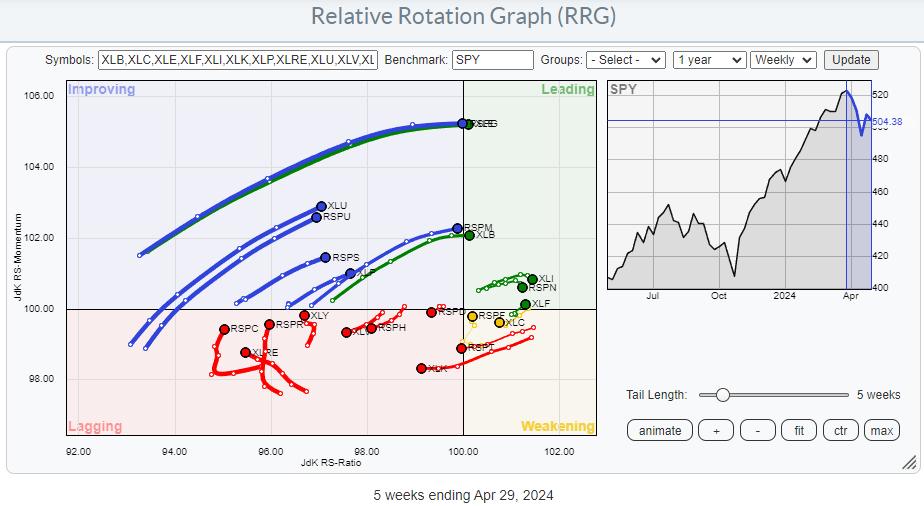

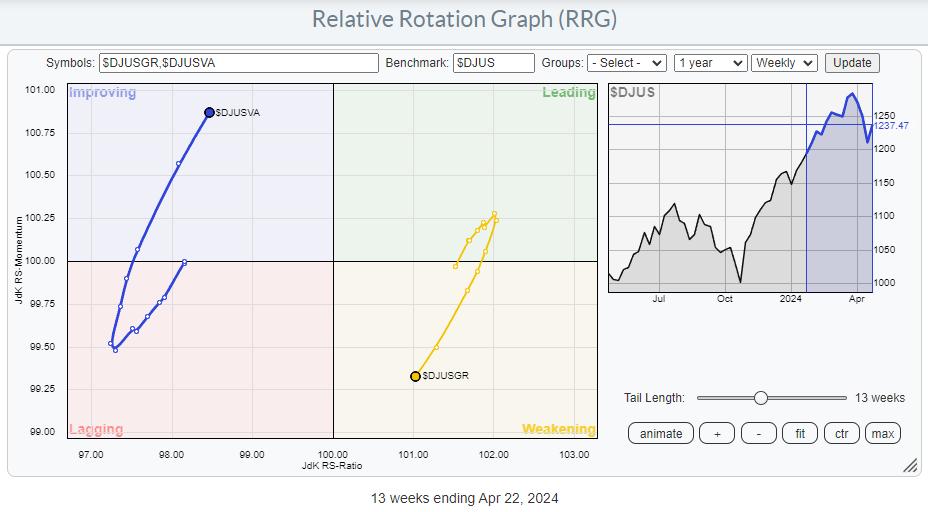

Diverging Tails on This Relative Rotation Graph Unveil Trading Opportunities

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Comparing equal-weighted and cap-weighted sectors on a Relative Rotation Graph can offer interesting insights

* When the trajectory of the tails and their position on the chart differ significantly, further investigation is warranted

* At the moment, two sectors are showing such divergences

All on the Same Track... or?

The...

READ MORE

MEMBERS ONLY

The BULL Case for BITCOIN

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes Adrian Zduńczyk, CMT of The ₿irb Nest. David recaps a busy earnings week, breaking down the charts of PTON, AAPL, and more. Adrian tracks the recent pullback for Bitcoin and why the long-term uptrend still remains the prevailing...

READ MORE

MEMBERS ONLY

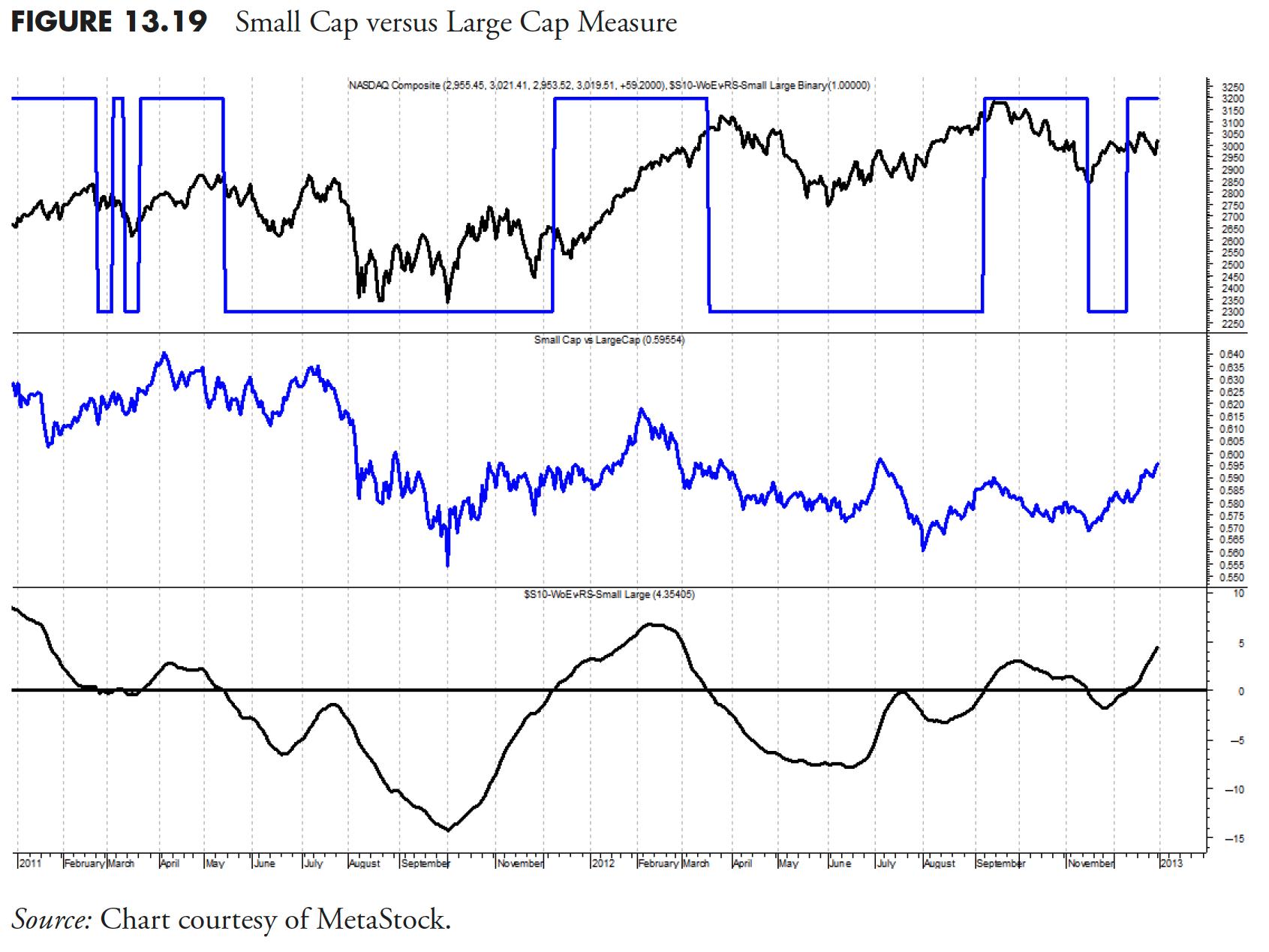

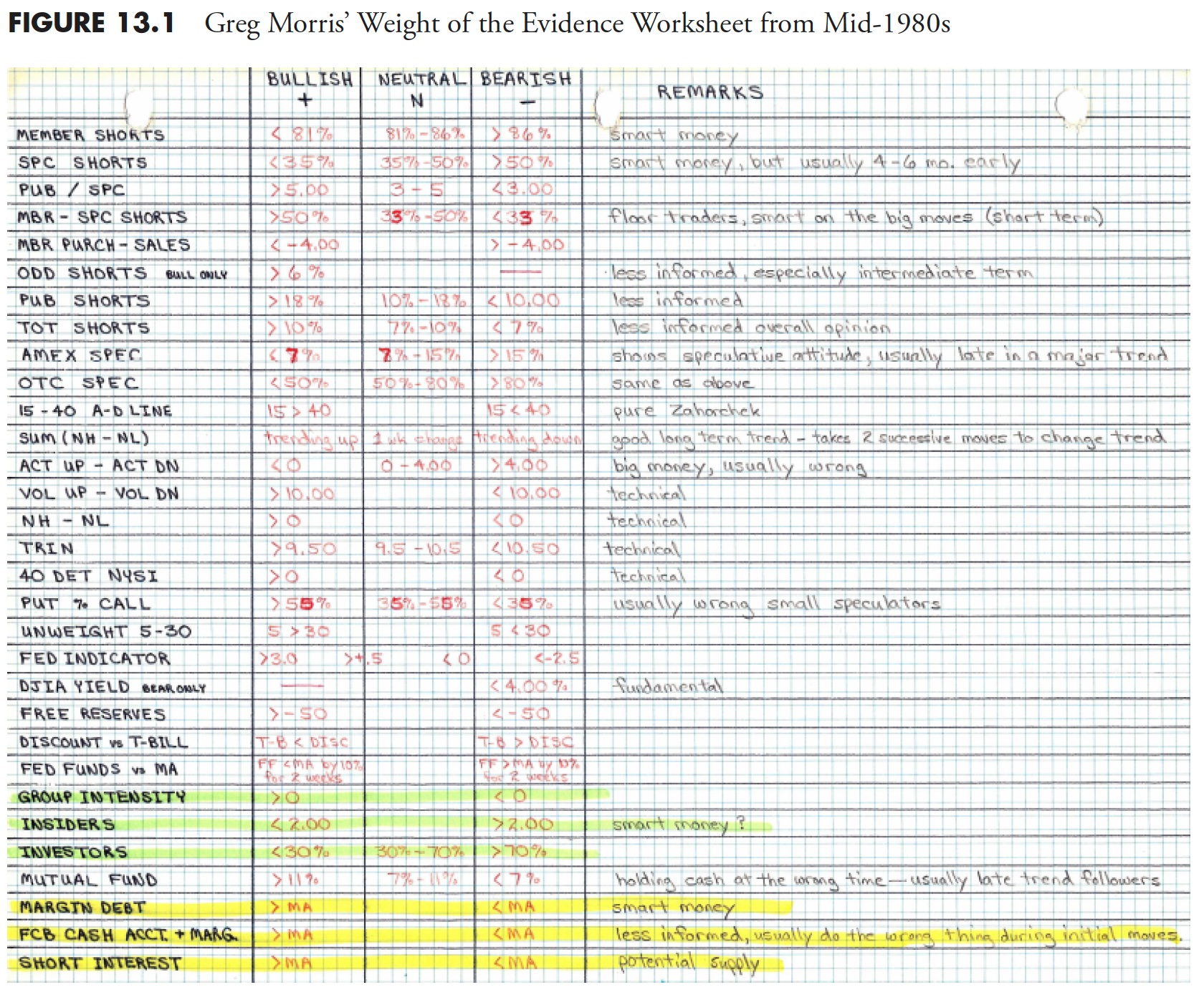

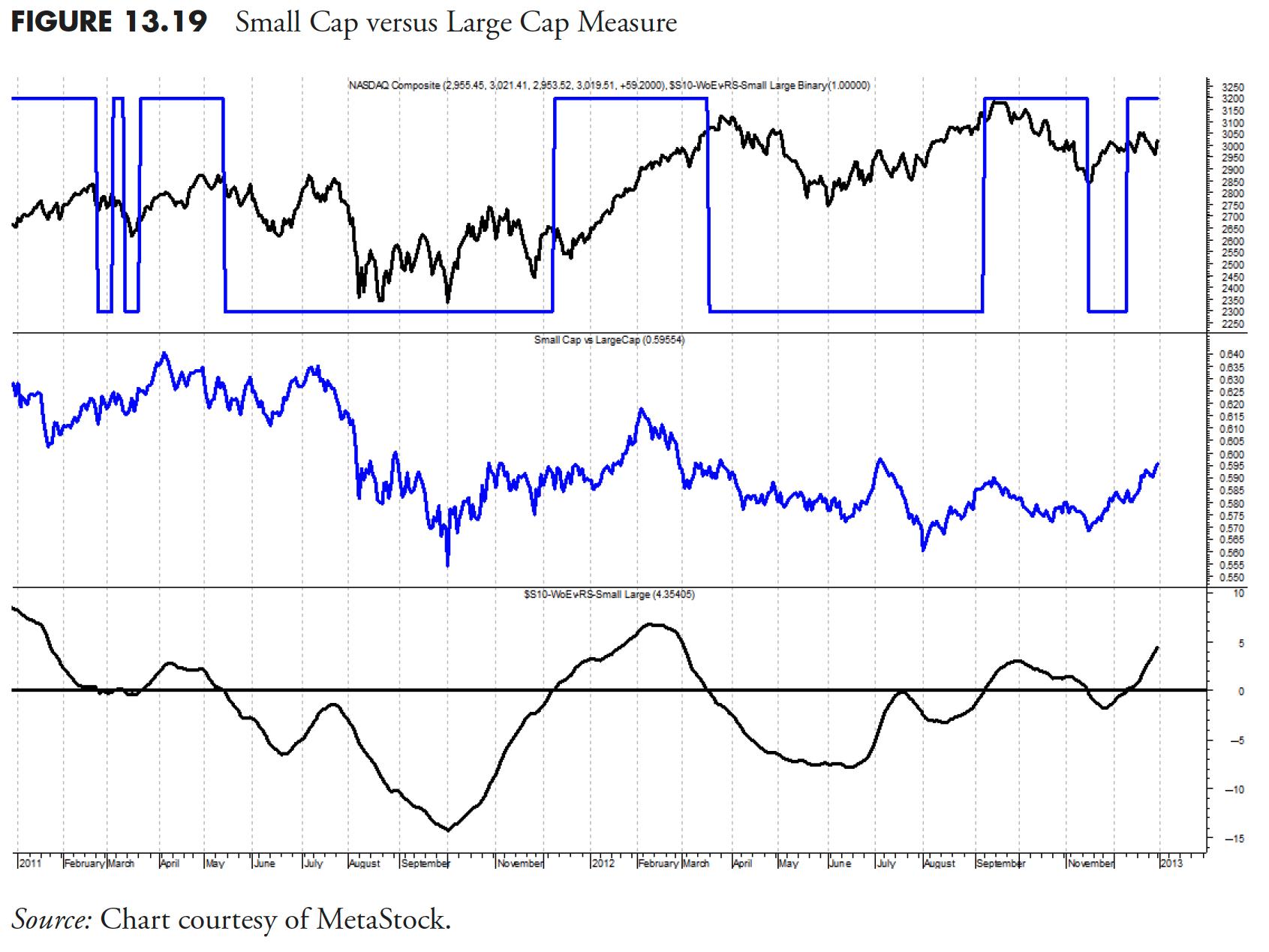

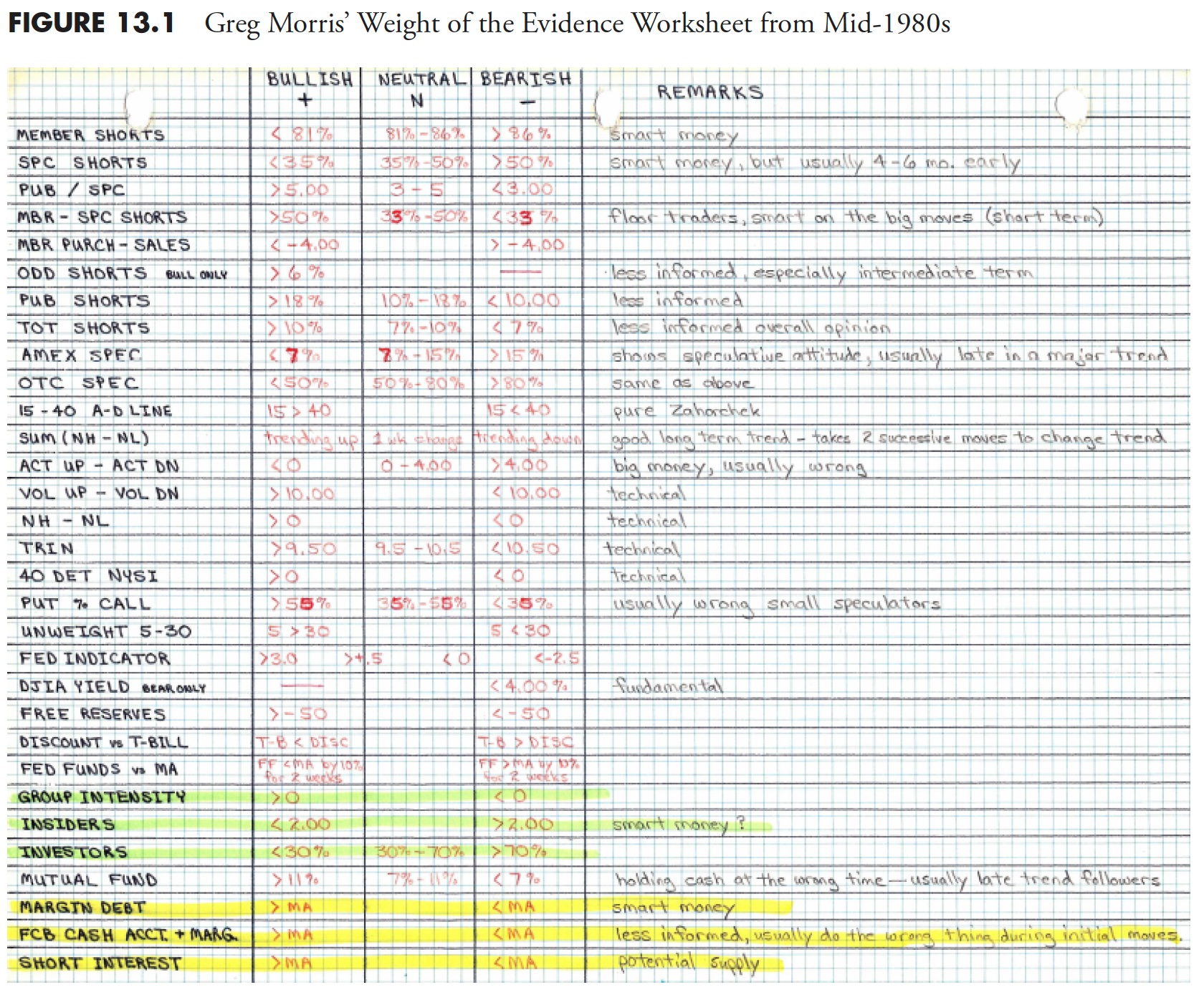

Rules-Based Money Management - Part 3: Relative Strength and Other Measures

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the nineteenth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

AMD at a Crossroads: Buy Now or Brace for More Losses?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* AMD stock plunged 7% after slightly topping Wall Street estimates

* There are three crucial turnaround levels to closely close monitor

* Momentum is key when deciding whether to go long, wait, or call off the trade

Advanced Micro Devices (AMD) slightly topped Wall Street's earnings and guidance...

READ MORE

MEMBERS ONLY

Market Pops, Then Drops on Fed Day

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes guest Adam Turnquist, CMT of LPL Financial. Dave debriefs on today's Fed meeting market reaction, reviewing concerning technical developments for NVDA, AMD, SMCI, NCLH, and MAR. Adam relates short-term weakness in growth stocks to long-term strength...

READ MORE

MEMBERS ONLY

Time for a Pause in the Ongoing Dollar Bull Market? Or Full Steam Ahead?

by Martin Pring,

President, Pring Research

I last wrote about the dollar in December, where I came to the conclusion that a limited rally was a likely possibility in what was assumed to be a primary bull market. I am still of the view that the bull market is alive and well, but it's...

READ MORE

MEMBERS ONLY

Gain AN EDGE Over Other Traders with ADX/DI

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe breaks down the differences between buyers and sellers, and shows how the ADX/DI can be used in three different ways: The action phase, low ADX period and an expansion phase. Understanding this indicator will give you...

READ MORE

MEMBERS ONLY

35 Years of Crude Oil Forecasting the Future | Focus on Stocks: May 2024

by Larry Williams,

Veteran Investor and Author

All You Need to Know About Crude Oil and the Future

Gold, black gold, is what Crude Oil has become. The entire world runs on energy. 98% of our cars and transportation, our lights, the device you are using to read this... virtually everything we can do is thanks to...

READ MORE

MEMBERS ONLY

SPY's Pullback Continues: How To Know When It's Over

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The SPDR S&P 500 ETF (SPY) dipped lower after hitting resistance of its 50-day moving average

* There are three key turnaround levels to watch closely to determine if the pullback is over

* Breadth indicators can identify when the buyers are back

What's a trader...

READ MORE

MEMBERS ONLY

Stocks Plunge with Key Earnings on Tap

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes Gina Martin Adams, CMT CFA of Bloomberg Intelligence. David highlights a spike higher in the VIX, and charts names for earnings including AMZN, AMD, SMCI, SBUX, MCD, PYPL, and ETN. Gina shows how rising interest rates continue to...

READ MORE

MEMBERS ONLY

Key Levels for AMZN, AMD, & AAPL Earnings!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave recaps the S&P 500's late inning rally to test the 50-day moving average from below. What levels could come into play with this week's Fed meeting on Wednesday? He also focuses on key...

READ MORE

MEMBERS ONLY

DP Trading Room: Intermediate-Term View of the Magnificent 7

by Erin Swenlin,

Vice President, DecisionPoint.com

Today Carl puts the spotlight on the Magnificent 7 with a look at not only the daily charts, but also a review of the intermediate term using weekly charts. See where they are headed short-term and what are our expectations are in the intermediate term.

Carl also gave us his...

READ MORE

MEMBERS ONLY

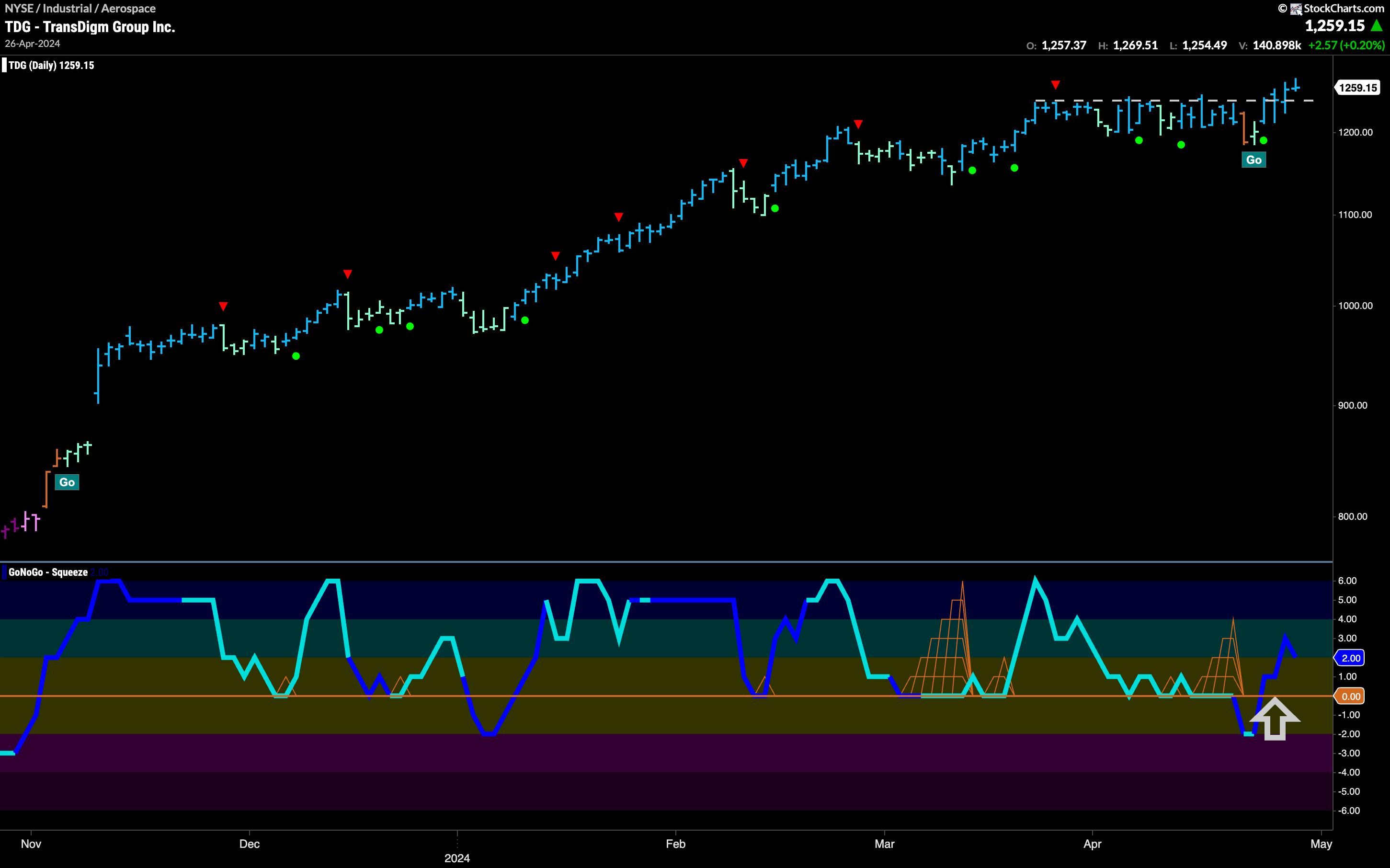

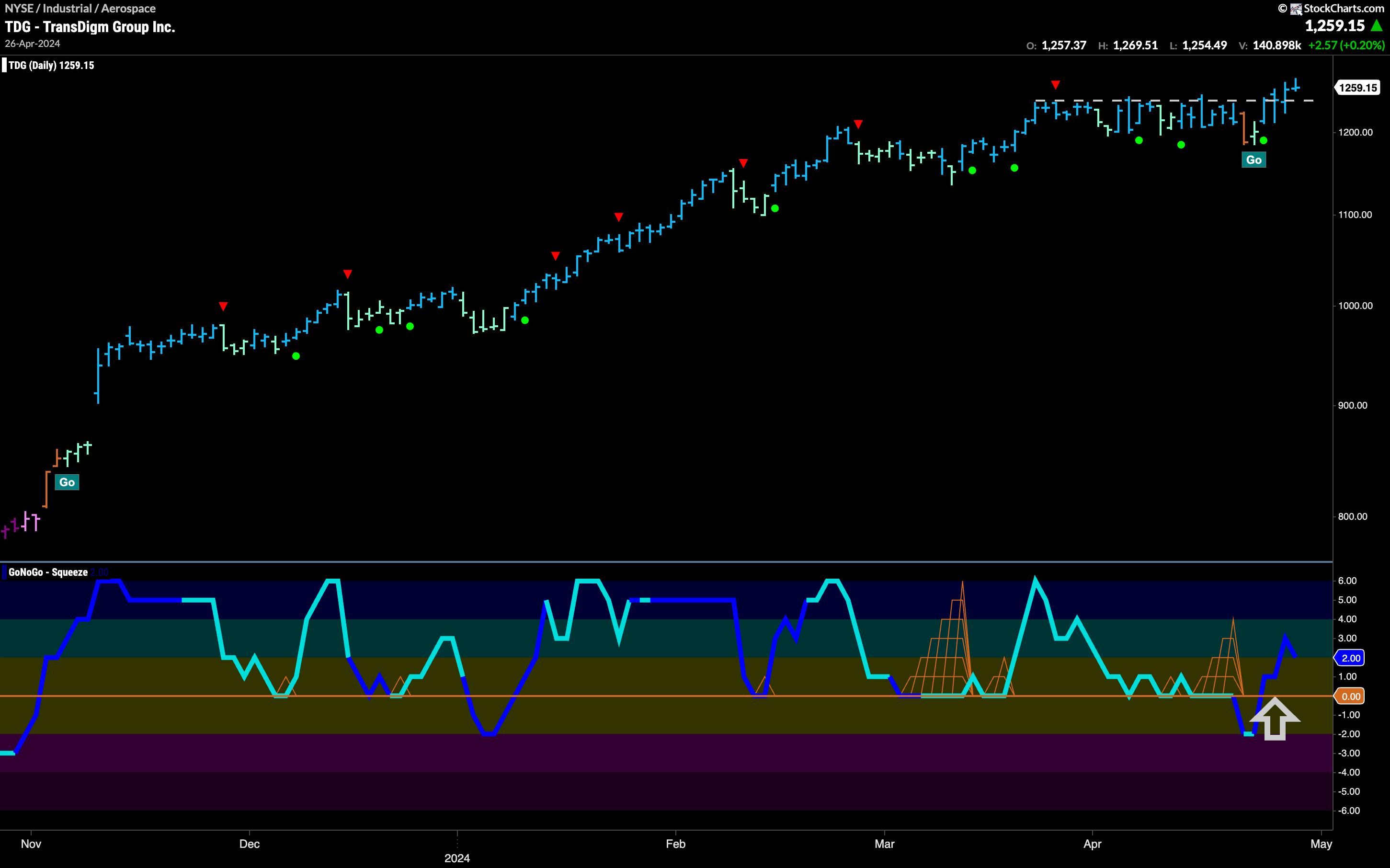

EQUITIES CLIMB OFF LOWS WITH A PUSH FROM AEROSPACE AS "NOGO" PREVAILS

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

Good morning and welcome to this week's Flight Path. The equity "NoGo" trend continued this week even with some relief rallies as price attempted to move higher from the recent low. We see GoNoGo Trend painting weaker "NoGo" bars as the week ended. Treasury...

READ MORE

MEMBERS ONLY

Here's What You Need To Know About Last Week's Rebound

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The Volatility Index ($VIX) is one of my key sentiment indicators and it has a history of accurately predicting corrections and bear markets. We've had neither without the VIX first clearing an important hurdle in the 17-20 range. Bear markets require a huge dose of fear and panic...

READ MORE

MEMBERS ONLY

Week Ahead: Upsides For NIFTY May Stay Capped; Sectoral Landscape Show These Changes

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Over the past trading week, it was expected that, while technical pullbacks in the markets could get extended, NIFTY would likely remain under corrective pressure at higher levels. The past trading days witnessed this precise scenario. The markets initially extended their technical pullback and extended their upmove; however, at the...

READ MORE

MEMBERS ONLY

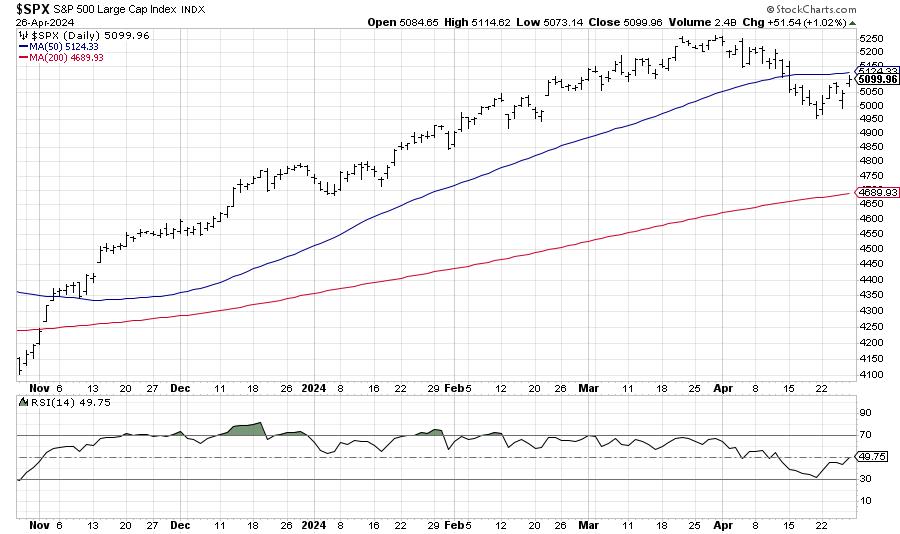

S&P 500 Makes a New All-Time High By End of June?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

We've been covering the signs of weakness for stocks, from the bearish divergences in March, to the mega-cap growth stocksbreaking through their 50-day moving averages, to even thedramatic increase in volatilityoften associated with major market tops. While Q1 was marked by broad market strength and plenty of new...

READ MORE

MEMBERS ONLY

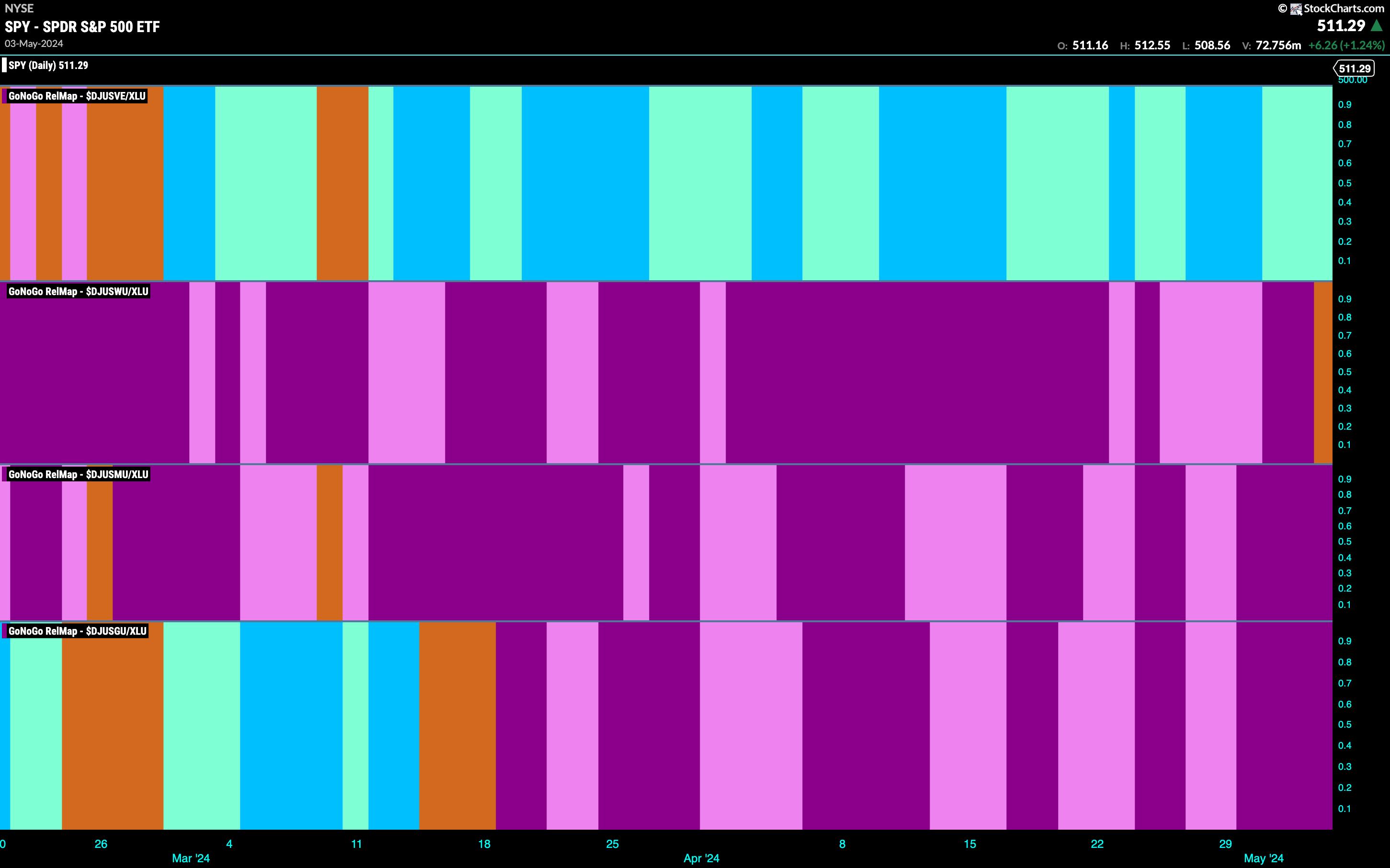

DEFENSE IS ON THE FIELD | GoNoGo Show APRIL 26, 2024

by Tyler Wood,

Co-founder, GoNoGo Charts®

KEY TAKEAWAYS

* Defensive Sector Leadership

* Risk Off Macro Environment

* Opportunities in Electricity Utilities Companies

Chart Above (XLU:SPY) highlights trending relative strength of Utilities Sector. Watch Video below for details:

The S&P500 trend conditions have continued this week in "NoGo" conditions despite relief rallies. Alex Cole...

READ MORE

MEMBERS ONLY

MEM TV: Wait For This Before Getting Back In

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the key drivers for this week's volatile period, including Core PCE and GDP numbers. She takes a look at where the S&P 500 and NASDAQ closed for the week and whether it'...

READ MORE

MEMBERS ONLY

Spotting Downturns Early: Daily or Weekly Charts?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave answers viewer questions on spotting downturns in daily vs. weekly charts, using the Relative Rotation Graphs (RRG) to identify actionable ideas, and comparing the NYSE Composite Index ($NYA) to the S&P 500 Index ($SPX). He also shares...

READ MORE

MEMBERS ONLY

S&P 500 & Nasdaq Composite Approach Critical Resistance; Watch for These Important Levels!

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The Nasdaq Composite is trading above its last swing high, which could a the first sign of a reversal to the upside

* The S&P 500 is up against resistance from its 50-day moving average and a downward sloping trendline

* The Dow Jones Industrial Average has reversed...

READ MORE

MEMBERS ONLY

Analyzing Alphabet's Surge — Here's How to Get In Earlier Next Time

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Alphabet shocked Wall Street on Thursday when it reported earnings, its first dividend, and a $70-billion buyback

* The stock gapped up 16%, its biggest since 2015

* Alphabet's technical "undervaluation" and quirks signaled the go-ahead to go long

Using technical indicators to identify stocks fundamentally...

READ MORE

MEMBERS ONLY

META's Reverse Island - Two More Mag Seven Islands to Monitor

by Carl Swenlin,

President and Founder, DecisionPoint.com

by Erin Swenlin,

Vice President, DecisionPoint.com

Whenever we see price gapping up or down, as happened with META in February, we prepare for the possibility of an island reversal. After the gap up, price forms a cluster, the island, and we ponder the possibility of a gap down to complete the reversal. During the formation of...

READ MORE

MEMBERS ONLY

Analyzing the SPY: How to Know When the Pullback is Over

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* SPY is trading within a downward channel in the daily chart and has equal odds of breaking out in either direction

* The weekly chart shows the uptrend is still in play and SPY is going through a healthy correction

* Analyze different index and sector exchange-traded funds to identify...

READ MORE

MEMBERS ONLY

Rules-Based Money Management - Part 2: Measuring the Market

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the eighteenth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

10% Downside Risk For Stocks as Value Takes The Lead

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Value stocks are taking over the lead from Growth

* When Value beats Growth, the S&P 500 usually does not do too well

* The strength of Value is surfacing across all size segments of the market

* Important support areas for SPY at 480 and 460

Value Taking...

READ MORE

MEMBERS ONLY

Three Sectors are Showing Strength, Three are Not

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes Ryan Redfern, ChFC CMT of Shadowridge Asset Management. David highlights companies reporting earnings this week, including TSLA, V, ENPH, STLD, STX, ODLF, and GD. Ryan shares key levels to watch on the S&P 500, along with...

READ MORE

MEMBERS ONLY

What's Really Driving Tesla's Surprising Stock Surge?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* TSLA has been riding a long and volatile downtrend since 2021

* Tuesday's earnings were dismal, yet the stock jumped 16% after an announcement about near-term EV production

* The big question is if the gap up in TSLA's stock price has any substance or if...

READ MORE

MEMBERS ONLY

Pinpoint the Next Buying Opportunity in SPY

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe uses the MACD to analyze SPY and shares what to look for to find the next buy point. Joe then analyzes stocks including ADBE, XOM, and CRM.

This video was originally published on April 24, 2024. Click...

READ MORE