MEMBERS ONLY

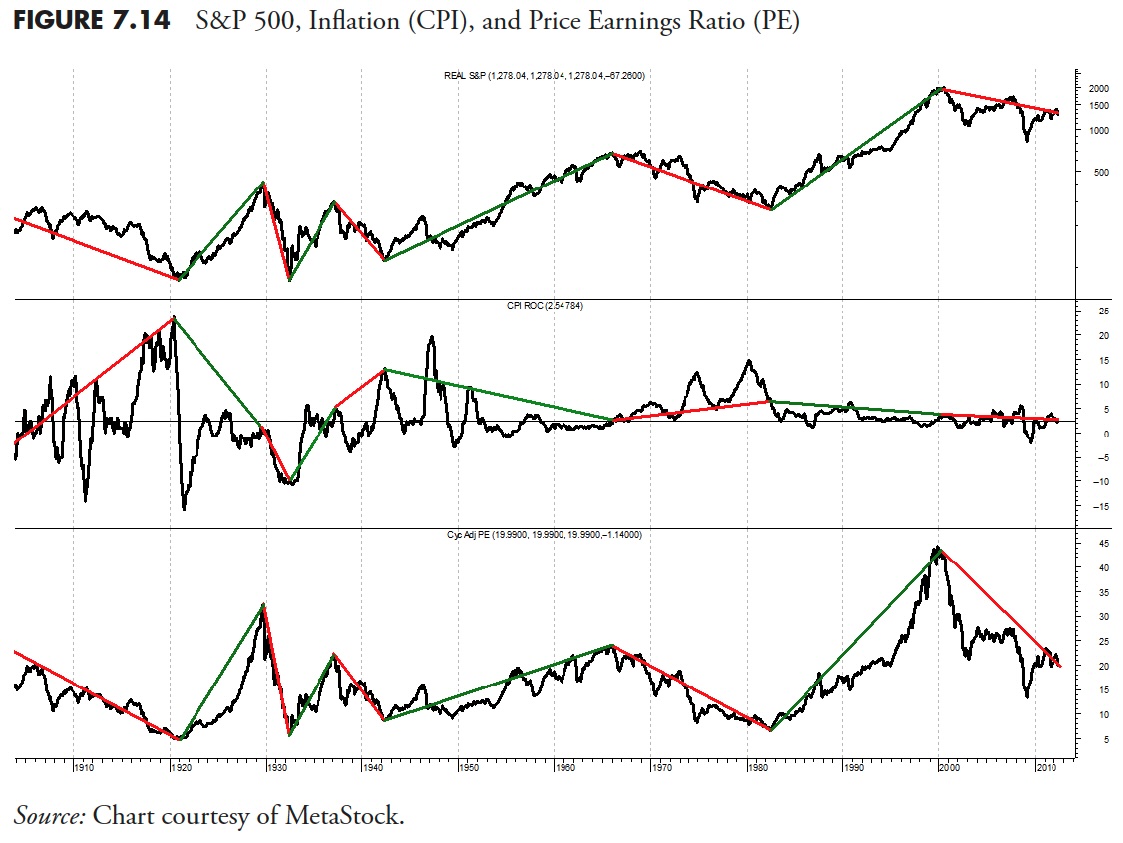

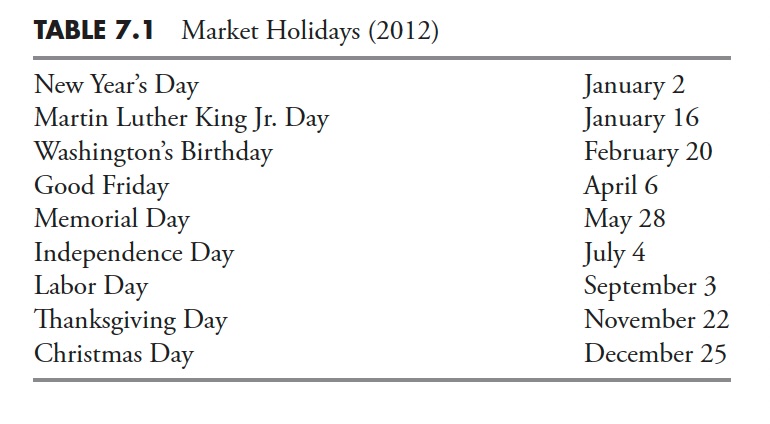

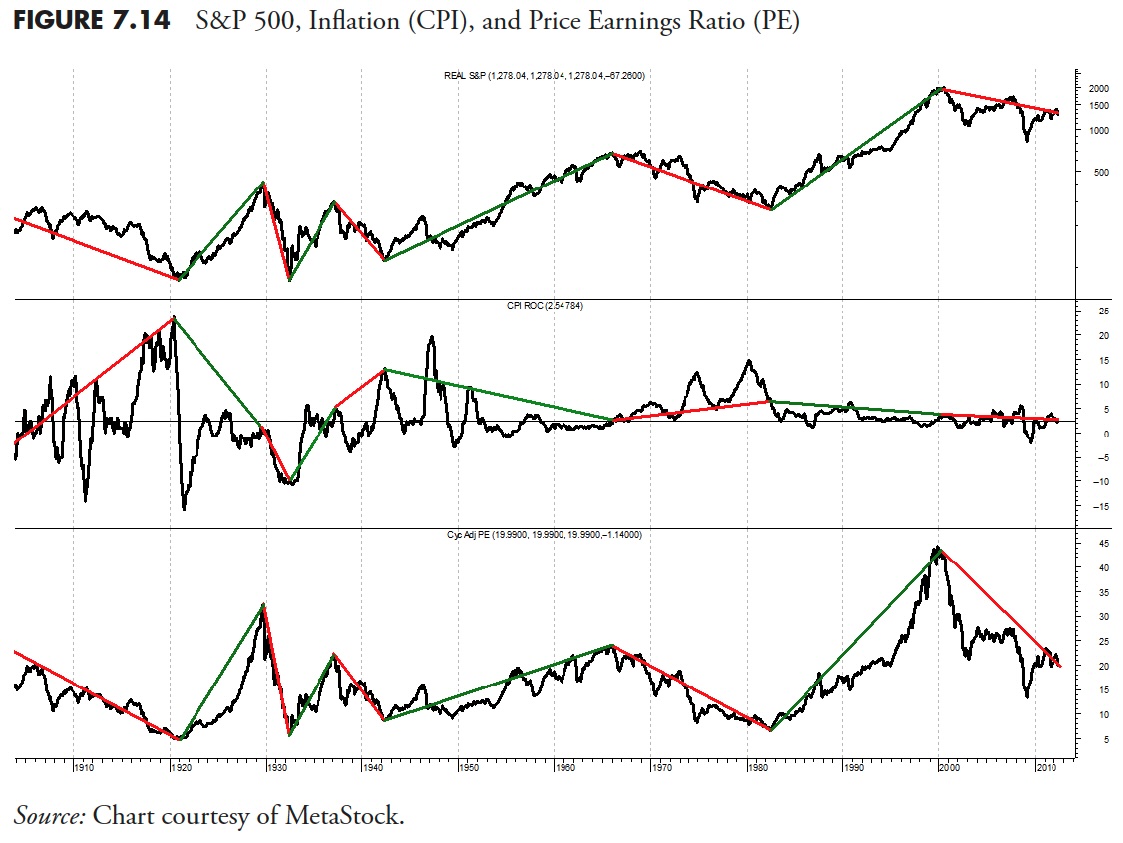

The Hoax of Modern Finance - Part 10: Market Facts — Secular Markets

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the tenth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

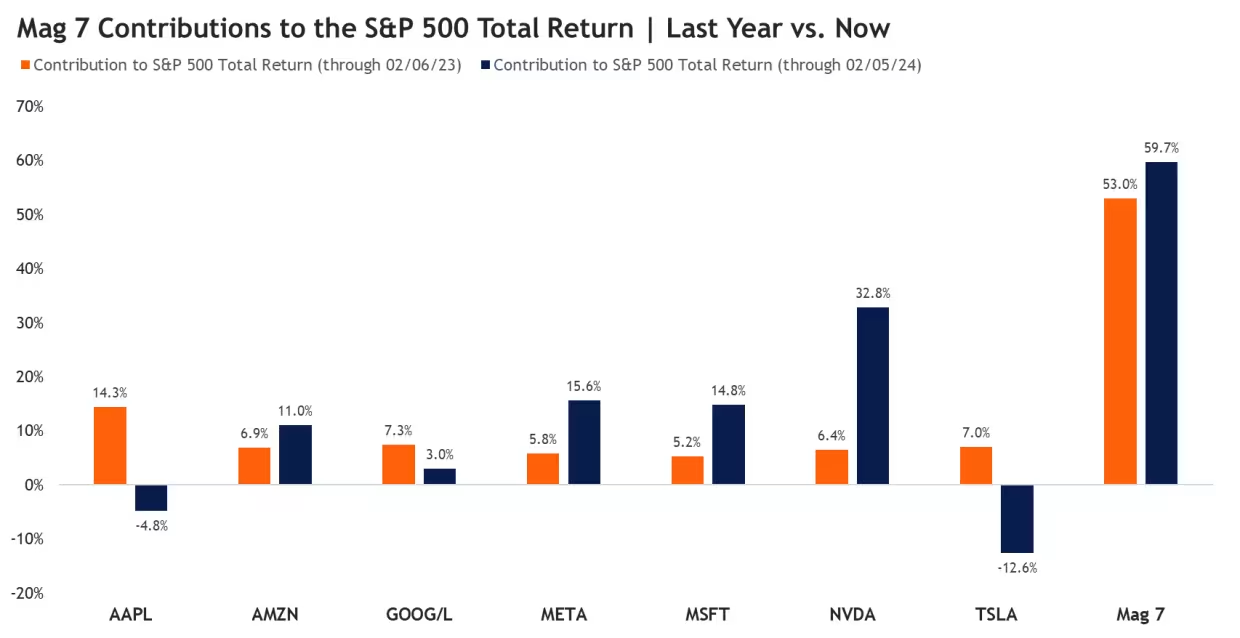

Magnificent 7 Not All Magnificent!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave speaks to the diversifying patterns within the Magnificent 7, with GOOGL and AAPL showing clear signs of short-term distribution. He also tracks Bitcoin reaching the 64K level and shares some initial thoughts from the CMT Dubai Summit.

This video...

READ MORE

MEMBERS ONLY

Three Intermarket Relationships That Say This Bull Market is Going Higher

by Martin Pring,

President, Pring Research

Absorbing the information gleaned from monthly charts for various asset classes or sectors can help gain some perspective. However, I find that an examination of the relationships between them can be equally rewarding, if not moreso. That's because they point out the nature of the current investment environment,...

READ MORE

MEMBERS ONLY

Market In a "Wait and See" Mode: Awaiting Important Inflation Data

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Investors are anxiously awaiting the PCE data to get clues on when the Fed will start cutting interest rates

* Small cap stocks look like they want to break out of a range and join the bullish equity rally

* Bitcoin is having a strong week with three consecutive significant...

READ MORE

MEMBERS ONLY

New Dow Theory CONFIRMS BULL Phase!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave continues his market recaps from Dubai, focusing on the impressive rally in small caps, continued strength in Bitcoin, and upside potential for crude oil and oil services stocks. He highlights one technology name in a persistent downtrend, but potentially...

READ MORE

MEMBERS ONLY

The False Flag of Fed Rate Cuts | Focus on Stocks: March 2024

by Larry Williams,

Veteran Investor and Author

Let's begin this month with a look at...

The False Flag of Fed Rate Cuts

Day after day, we hear how the Fed will embark on a series of rate cuts this year "because inflation has peaked" and is heading lower. The drop in inflation is...

READ MORE

MEMBERS ONLY

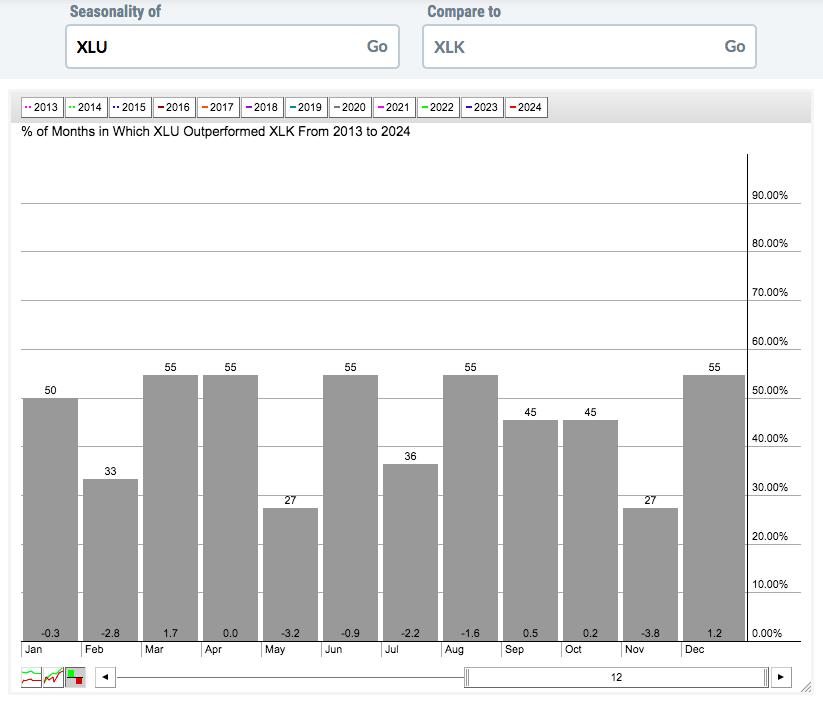

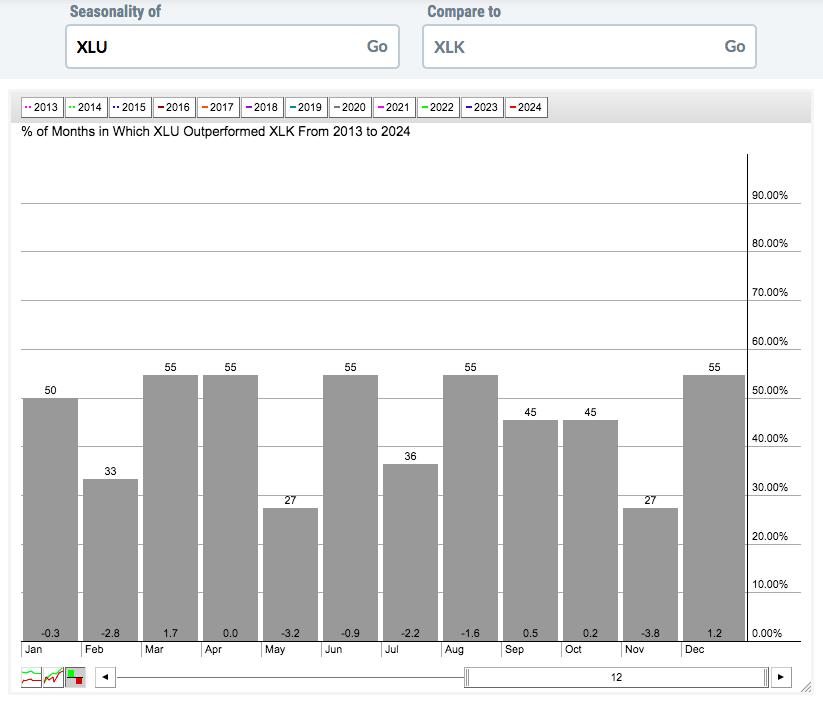

Flip the Script: Defense as Your New Offensive Playbook

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* March is a strong seasonal month for Utilities and Consumer Staples in relation to the broader market

* Utilities and Consumer Staples are defensive plays which, if timed correctly, can result in a positive market outcome

* The StockCharts Seasonality charts can help you identify sector plays that may not...

READ MORE

MEMBERS ONLY

BITCOIN Rally Picks Up Steam, What's Next?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave shares his first market update from Dubai with a recap of Bitcoin's electrifying rally, Tesla's bounce higher, and Alphabet's pullback. The S&P 500 remains above 5K with plenty of new 52-week...

READ MORE

MEMBERS ONLY

DP Trading Room: The PMO Versus the MACD!

by Erin Swenlin,

Vice President, DecisionPoint.com

Today Carl explains the benefits of using the Price Momentum Oscillator versus the MACD. They are not the same!

Carl then gives us his insights on the market in general as well as Bitcoin news, Magnificent 7 overview, as well as Crude Oil and Interest Rates.

Erin gives us an...

READ MORE

MEMBERS ONLY

Evaluating Risk is a Key Difference Between Successful and Unsuccessful Traders

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

This secular bull market advance is running over everyone attempting to get in its way. It's why I always say never to bet against one. Trying to short this type of bull market is the equivalent of financial suicide. I usually have music playing in the background while...

READ MORE

MEMBERS ONLY

Finding Leaders and Bullish Signals on the Price Chart

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Chartists can improve their odds by focusing on stocks that are in long-term uptrends and showing upside leadership. This is similar to a dual-momentum approach, which was covered last week. Today's example will use the 40-week SMA to define the trend, a 52-week high to confirm upside leadership...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Likely to Continue Consolidating; Finding Relative Outperformance

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous technical note, it was categorically mentioned that, while the overall trend may stay intact, the markets could continue to largely consolidate. In line with the analysis, the markets kept consolidating, staying in a broad but defined trading range. That range, over the past week, was 422 points;...

READ MORE

MEMBERS ONLY

How Overextended Are You, QQQ?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

We've highlighted all the warning signs as this bull market phase has seemed to near an exhaustion point. We shared bearish market tells, including the dreaded Hindenburg Omen,and how leading growth stocks have beendemonstrating questionable patterns. But despite all of those signs of market exhaustion, our growth-led...

READ MORE

MEMBERS ONLY

MEM TV: Simple Way to Identify a Buy Point in NVDA

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews what drove the markets to new highs and what areas are outperforming. She also shares how to identify a buy point in NVDA after its gap up following earnings, as well as how to determine when a...

READ MORE

MEMBERS ONLY

AMD's Sensational Halt — What You Need to Watch

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Advanced Micro Devices (AMD) recovered quickly from a post-earnings slump

* Its longer term price action suggests indecision and the current pattern can also break either way

* This can either be a short-term trade or an investment; both scenarios will require different strategies

If you ran a StockCharts Gap...

READ MORE

MEMBERS ONLY

The Best Technical Indicator for Long-Term Investors

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave drops an all-mailbag episode featuring viewer questions on the Hindenburg Omen, ascending triangle patterns, Fibonacci Retracements, projecting upside targets for stocks like NVDA, and the best technical indicator long-term investors should use!

This video originally premiered on February 23,...

READ MORE

MEMBERS ONLY

Is Energy About to Undergo a Strong Seasonal Sector Surge?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Combining fundamental forecasts with seasonality patterns offers a potent strategy for identifying tradable opportunities in specific sectors

* The Energy (XLE), Utilities (XLU), and Materials (XLB) sectors exhibit the strongest seasonal performance in the near-term

* Seasonality charts provide valuable insights, but checking overall stock market conditions and technical trading...

READ MORE

MEMBERS ONLY

NVDA SCREAMS BULL With Earnings Breakout

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave identifies key resistance levels for QQQ and HYG, along with a technical analysis downtrend checklist for charts in confirmed bear phases. Guest Larry Tentarelli of Blue Chip Daily Trend Report shares two stocks he's tracking along with...

READ MORE

MEMBERS ONLY

S&P 500's Sensational Rally Keeps On Going Thanks to NVDA — What You Need to Watch

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* S&P 500 hits a new all-time high and could keep on going

* NVIDIA's stellar earnings report was a catalyst to the rise in the S&P 500

* Volatility declined, indicating that investors are still relatively calm

Well, Nvidia did it! A stellar earnings...

READ MORE

MEMBERS ONLY

3 Unique RSI Techniques to Maximize Your Investments

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe dives into the world of technical analysis by sharing three unique ways to utilize the RSI indicator alongside MACD and ADX -- the Pullback Trade, Confirming a Breakout and 2nd Chance Entry. He then covers the symbol...

READ MORE

MEMBERS ONLY

The Hoax of Modern Finance - Part 9: Market Facts — Bull and Bear Markets

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the ninth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

Markets Bracing for NVDA Earnings

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave breaks down the latest market breadth indicators, ranging from bullish (S&P 500 advance-decline line) to bearish (Bullish Percent Indexes breaking down) to everything in between. He also analyzes key growth names including SMCI, PANW, AMZN, and NVDA....

READ MORE

MEMBERS ONLY

Emerging Markets Getting Closer to a Breakout

by Martin Pring,

President, Pring Research

Last November I asked the question "Are emerging markets about to emerge?"Using the iShares MSCI Emerging Markets ETF (EEM) as our benchmark, I concluded that more strength was needed in order to push the indicators into a bullish mode. In the intervening period, things have improved, but...

READ MORE

MEMBERS ONLY

The Halftime Show: Don't Box the Invisible Man -- EPS Reports

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

On this week's edition ofStockCharts TV'sHalftime, Pete takes a look at long-term trends. Semiconductors taking it on the chin. Inflation is still a problem. Bonds are selling off, and the Fed isn't cutting rates until, in Pete's opinion, the unemployment rate falls....

READ MORE

MEMBERS ONLY

The Titanic Syndrome Indicator Issues a WARNING!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave focuses on AAPL which closed below its 200-day moving average as it tests key price support. Guest Jesse Felder of The Felder Report reports on the Titanic Syndrome, a market breadth indicator similar to the Hindenburg Omen that suggests...

READ MORE

MEMBERS ONLY

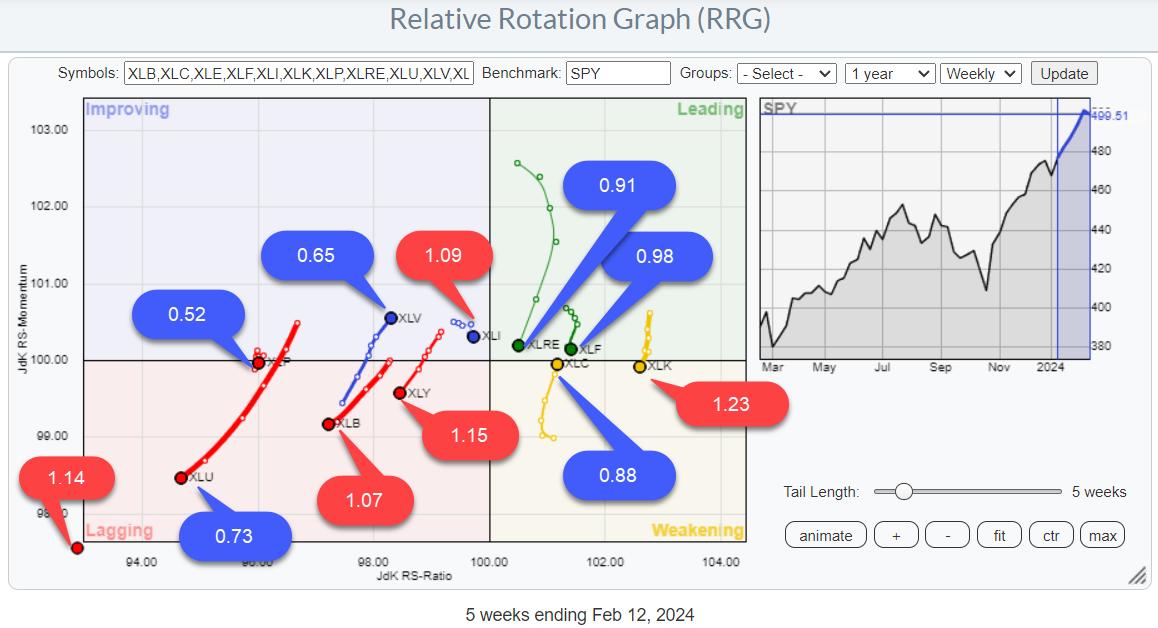

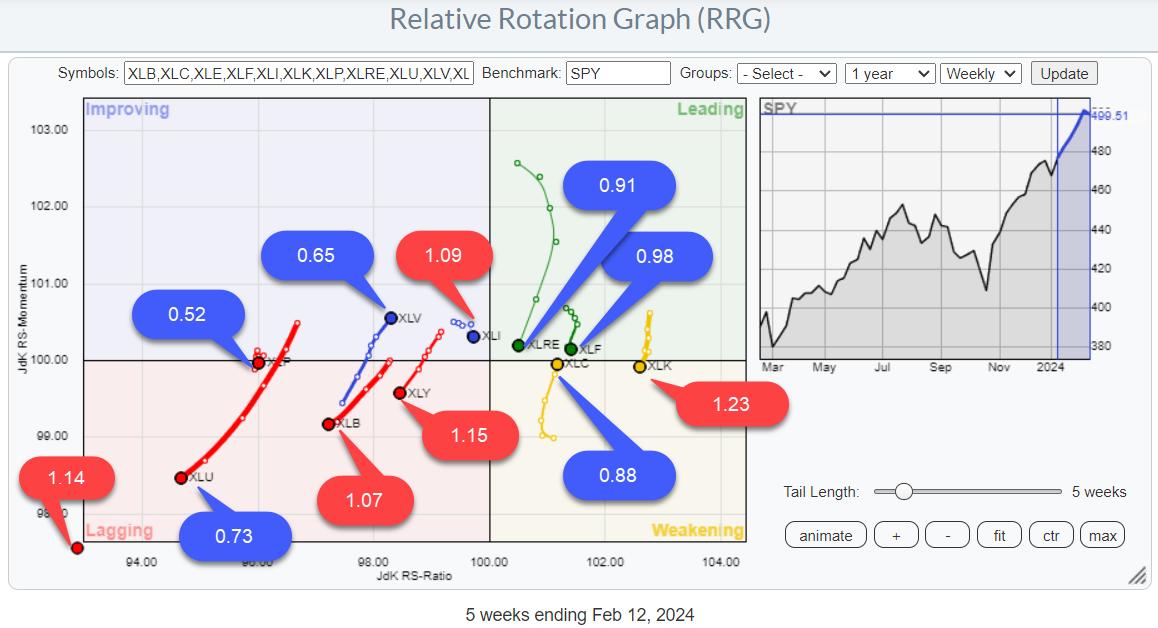

Sector Spotlight: Dominant Trend for Stocks Still UP

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, I separate the 11 sectors in the S&P 500 into Offensive, Defensive, and Sensitive, assessing their group rotational patterns to see if there is any alignment with the current technical condition of the S&P 500. After...

READ MORE

MEMBERS ONLY

SPY Uptrend Intact, But Mixed Sector Rotation Signals Hesitation

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Looking at Risk ON / OFF through BETA

* RRG shows mixed rotations

* SPY Uptrend intact with limited downside risk

BETA

One of the Risk ON/OFF metrics I like to keep an eye on is BETA.

From Investopedia:

—systematic risk—

I have updated my spreadsheet with last year'...

READ MORE

MEMBERS ONLY

With The Top 10 Picks In The Stock Market DRAFT, EarningsBeats.com Selects...

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

We're one day away from "DRAFT Day"! Every quarter, we select the 10 equal-weighted stocks that will comprise our 3 portfolios - Model, Aggressive, and Income. My background is in public accounting as I audited companies in the Washington, DC - Baltimore, MD metropolitan area for...

READ MORE

MEMBERS ONLY

Capturing the Momentum Phenomenon - Nvidia vs Tesla

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The momentum phenomenon has been a fixture in the US equity markets for decades. There are two types of momentum to consider: absolute momentum and relative momentum. Absolute momentum refers to the underlying trend, up or down. Relative momentum quantifies the strength of the uptrend and compares it to other...

READ MORE

MEMBERS ONLY

What Lies Ahead? Will Early 2024 Strength Continue?

by Bruce Fraser,

Industry-leading "Wyckoffian"

A Buying Climax typically concludes a long term uptrend. The rally phase from the October low of 2023 has these climactic characteristics. This advance comes after a major trend that began in late 2022. The steady upward march in the 4th quarter of 2023 was broad and powerful, which created...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Stays In A Defined Range; Expect Directional Moves Only Outside These Levels

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Some serious consolidation continued in the markets as the Nifty oscillated in a defined range before closing the week with modest gains. Examination of daily charts shows that the Nifty tested its 50-DMA again and rebounded from that level while defending that point as important support. The trading range widened...

READ MORE

MEMBERS ONLY

A Very Accurate Sentiment Reading That Is Flashing A RED Light For Bulls

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

While many analysts follow sentiment signals that involve feelings about market direction, I prefer one that follows the MONEY. I want to know what retail traders are doing with their money with respect to options. Extreme readings provide eerily accurate reversals in trend, which are obviously very important to any...

READ MORE

MEMBERS ONLY

There Remain A Lot Of Mixed Signals, But One Bullish Signal That We Cannot Ignore

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The masses have been confounded by the strength of this current secular bull market. Too many keep betting against it and they've cost themselves a huge opportunity for profit as prices have soared. I've pointed out on many occasions that the biggest stock market gains have...

READ MORE

MEMBERS ONLY

This Beaten-Down Magnificent Seven Stock is Poised to Regain Its Leadership Status

by Mary Ellen McGonagle,

President, MEM Investment Research

Going into last week, the Magnificent Seven stocks were looking more like the Magnificent Four. Leadership within the group became more concentrated, with Amazon, Meta, Microsoft and Nvidia having done most of the heavy lifting.

This is far different from the first 6 weeks of 2023, when gains among these...

READ MORE

MEMBERS ONLY

Three Leading Growth Stocks Testing Gap Support

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* The NYFANG+ index of leading growth stocks is up about 12% year-to-date, while the S&P 500 and Nasdaq 100 have gained only 5%.

* All three of these growth stocks show similar patterns, with a recent gap higher. But they have now all stalled out.

* If these...

READ MORE

MEMBERS ONLY

MEM TV: Risk-On Trades Emerge Amid Big Tech Selloff

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the sloppy week for the markets, driven by the key economic data that was released. We saw interest rates rise, which had some other carry-on impact. While the S&P 500 saw a bit of a...

READ MORE

MEMBERS ONLY

What to Do With NVDA (And Others Like It)

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave answers viewer questions on the Money Flow Index, using RSP vs. SPY for relative strength analysis, strategies for names in extended uptrends like NVDA, applying Fibonacci retracements to charts like KRE, and more.

This video originally premiered on February...

READ MORE

MEMBERS ONLY

Discover the Power of These 2 Cutting-Edge Tools!

by Grayson Roze,

Chief Strategist, StockCharts.com

It's all about groups on this week's edition of StockCharts TV'sStockCharts in Focus! In this video, Grayson shows you how to take your market analysis to the next with level with some of the latest enhancements on the StockCharts platform -- new features added...

READ MORE

MEMBERS ONLY

DraftKings' Stock Overheating? Here's What You Need to Do Now

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* DraftKings has demonstrated significant revenue growth following a lengthy period of outperformance relative to the S&P 500 and its respective sector and industry

* DraftKings' stock is overbought, with a declining RSI suggesting near term market correction

* Set a price alert to measure an anticipated pullback...

READ MORE

MEMBERS ONLY

BUY Signals Continue to Diminish

by Carl Swenlin,

President and Founder, DecisionPoint.com

A Golden Cross BUY Signal is generated when the 50-day EMA of a price index crosses up through its 200-day EMA. DecisionPoint's Golden Cross Index (GCI) shows the percentage of stocks in a price index that have a Golden Cross BUY Signal, and is an expression of long-term...

READ MORE