MEMBERS ONLY

SMCI Breaks $1,000 Level - What's Next?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Bob Lang of Explosive Options shares three charts he's following as the S&P 500 continues to hold the crucial 5,000 level. Host David Keller, CMT highlights key stocks on the earnings list, including DKNG, COIN,...

READ MORE

MEMBERS ONLY

Identifying Powerful Trends with This Game-Changing ADX Setup

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe shares the criteria for his favorite ADX setup. He explains what he needs to see on 2 different timeframes to put a stock into position for a powerful trend that can last a long time. Joe closes...

READ MORE

MEMBERS ONLY

Larry's "Family Gathering" February 15, 2024 Recording

by Larry Williams,

Veteran Investor and Author

In this video, Larry begins by presenting two trade recommendations, then digs into AI stocks, Bitcoin, and what you should be doing right now. Is it time to go long? Go short? Or wait for a decline? He explains the difference between FOMO and actually losing money, and how pain...

READ MORE

MEMBERS ONLY

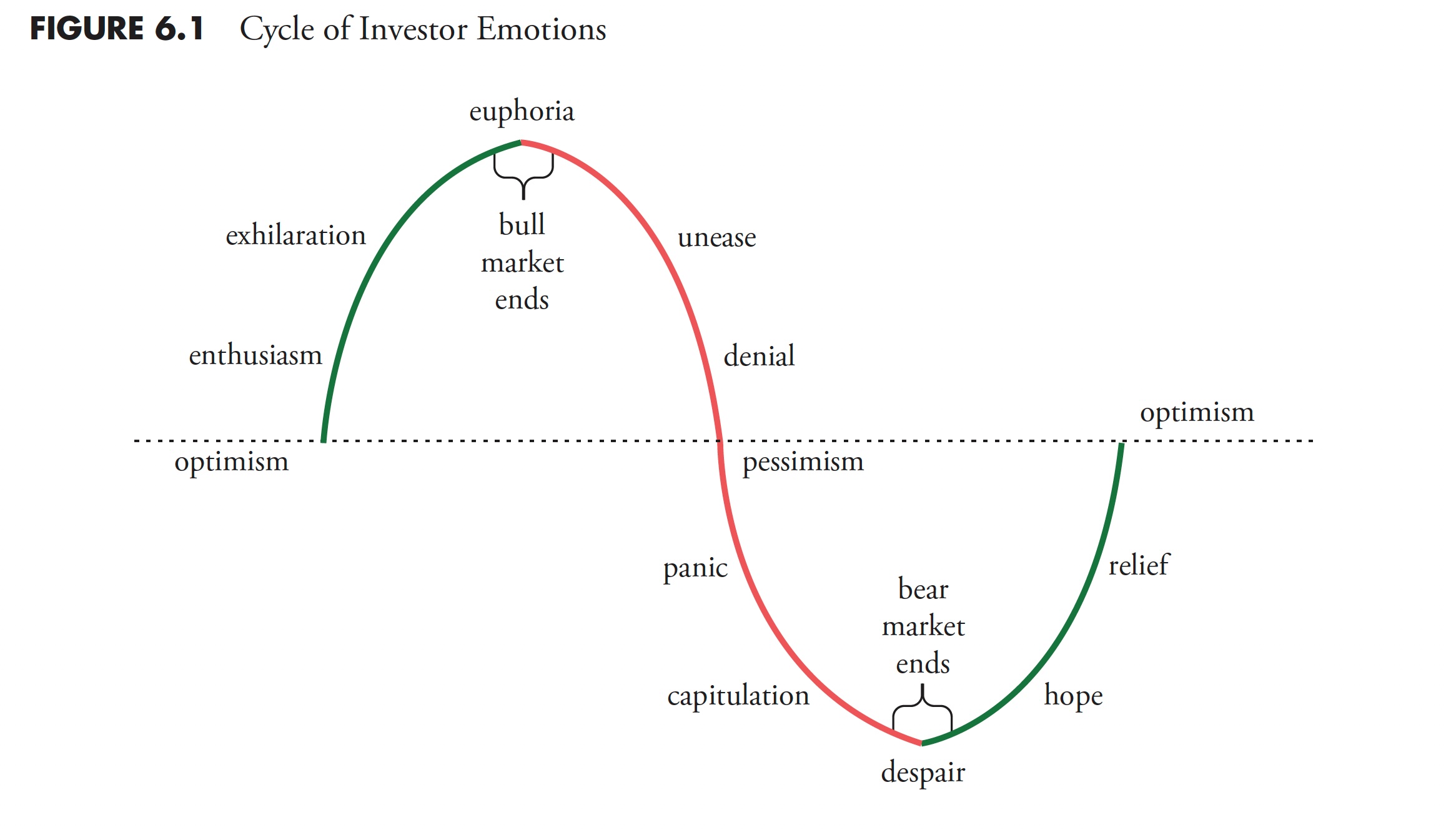

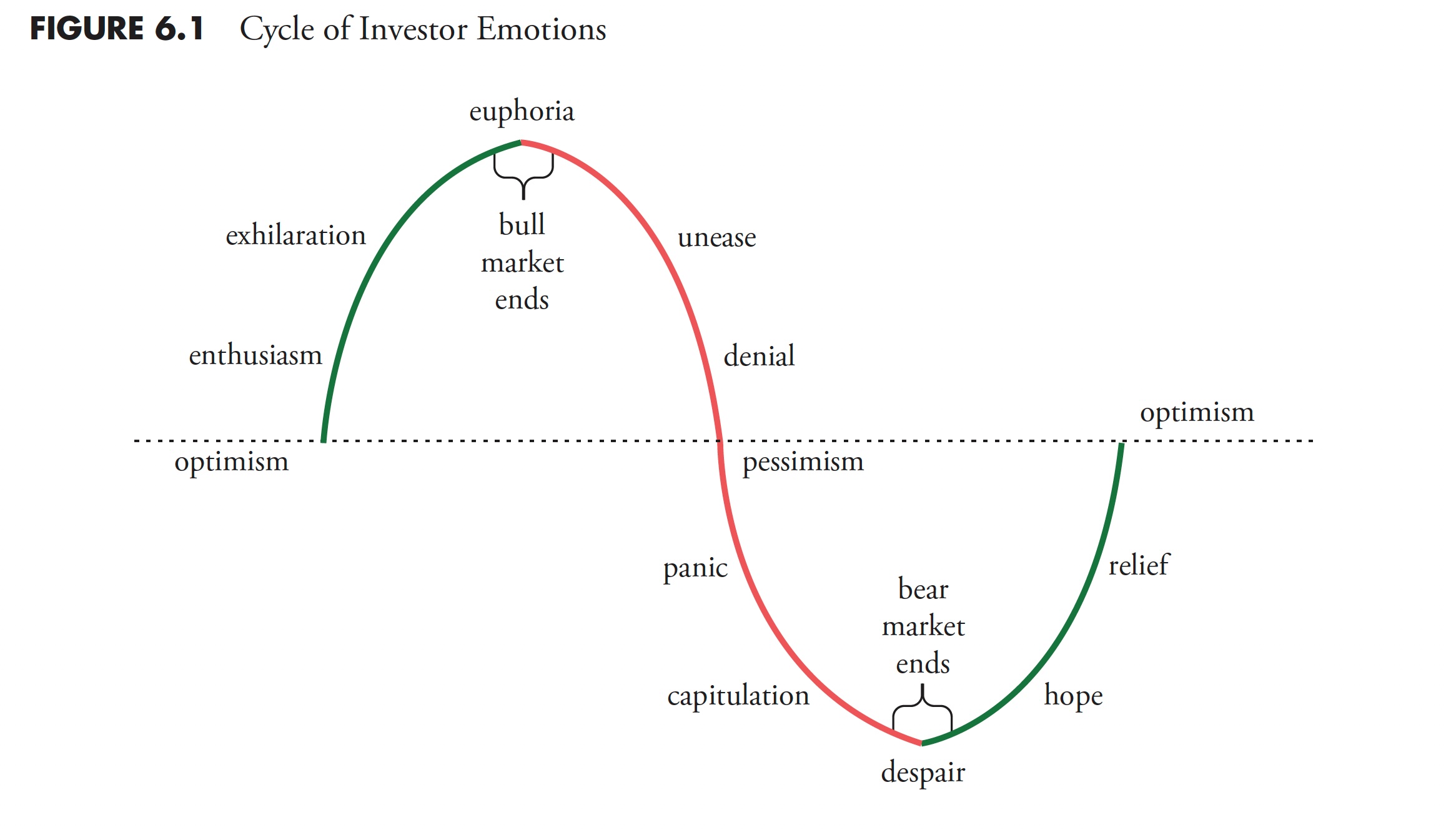

The Hoax of Modern Finance - Part 8: The Enemy in the Mirror

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the eighth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

Gold is at the Crossroad

by Martin Pring,

President, Pring Research

Last November and December, it looked as if gold had broken out from a multi-year inverse head-and-shoulders. Since then, the price has dropped below the breakout area, and the long-term KST has begun to roll over.

Just like takeoff and landing are the critical points for an aircraft, breakouts are...

READ MORE

MEMBERS ONLY

How To Buy Meta at a Bargain: An Options Strategy You Need to Know

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* META rose after the company's last earnings report and could be due for a pullback

* If META pulls back, you could buy the stock at a lower price using options

* By selling puts, you could collect premium from selling puts with the possibility of buying META...

READ MORE

MEMBERS ONLY

"Family Gathering" Meeting Today at 2:00 PM Eastern

Today, Larry Williams will be hosting a "Family Gathering" meeting at 2pm Eastern Standard Time (11am Pacific). Sign-in in begins 5 minutes prior. The show will be recorded and posted online for those of you who cannot attend. Use the link below to join:

Link to Join Webinar:...

READ MORE

MEMBERS ONLY

Market Pullback? Follow These Charts!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave tracks the S&P 500 back above 5K, Bitcoin back above 50K, and why NFLX, META, & AMZN may be the most important names to follow in the coming weeks. Guest Mish Schneider of MarketGauge breaks down the...

READ MORE

MEMBERS ONLY

The Halftime Show: Inflation Back in the Driver's Seat

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

Yesterday, the market saw a massive selloff of over 2% at market lows for the SPY and the NDX. However, the rebound at the end of the day was promising, though not enough to change sentiment. What this means is that the selloff came from the hot CPI print, so...

READ MORE

MEMBERS ONLY

Sector Spotlight: EASY SCAN! Find Growth Names in Small-Caps

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, I start with an assessment of the daily and weekly charts for SPY, trying to put recent developments into perspective. Then, I go over various Relative Rotation Graphs slicing the market down into various-size segments, as well as growth and...

READ MORE

MEMBERS ONLY

S&P 500 Plunges Below 5K!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave shows how the S&P 500 is just barely holding trendline support as his short-term Market Trend Model threatens to turn bearish this week. Guest Sean McLaughlin of All Star Charts talks through how he's playing...

READ MORE

MEMBERS ONLY

Walmart Stood Strong When The Market Crumbled - Time To Buy?

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Walmart's stock was one among 37 outliers, rising early amidst a major market decline before slightly pulling back

* Technical indicators warn of potential weakness, signaling an imminent dip, but there's a good entry point for WMT

* Setting price alerts around specific levels and watching...

READ MORE

MEMBERS ONLY

Catch BIGGER GAINS by Fishing for Alpha

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave highlights breakouts in home builders and Bitcoin and reviews key names reporting earnings including ABNB, SHOP, and MAR. He also shares an equity scan he uses every week to identify the next potential breakout candidates. Stay tuned until the...

READ MORE

MEMBERS ONLY

Larry's LIVE "Family Gathering" Webinar Airs THIS WEEK - Thursday, February 15th at 2:00pm EST!

Larry is going LIVE! Don't miss the upcoming "Family Gathering" webinar with Larry Williams, airing live through Zoom this coming Thursday, February 15 at 2:00pm Eastern Standard Time.

In this must-see event, Larry will be presenting his current opinions on a broad variety of current...

READ MORE

MEMBERS ONLY

DP Trading Room: Avoid These "Magnificent 7" Stocks!

by Erin Swenlin,

Vice President, DecisionPoint.com

On today's DecisionPoint Trading Room episode, Carl reviews the Magnificent 7 and gives you his opinion on their current and possible future states. He warns against two in particular and gives his stamp of approval on three others. Negative divergences are still a problem and Carl explains why....

READ MORE

MEMBERS ONLY

The EarningsBeats.com Strategy For Uncovering The New Winners

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Earnings and interest rates are always the key drivers to stock market success. There may be other short-term factors that influence price action, but, at the end of the day, rising earnings and interest rates conducive to job and economic growth is what results in secular bull markets.

Organize Your...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Set to Consolidate in a Broad Range; Runaway Moves Unlikely Below These Levels

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Two weeks of decline, one week of advance, and a week of consolidation. This is what sums up the market activity over the past month. The markets consolidated over the past week and stayed largely within a defined trading range, and the past five sessions remained choppy, with the NIFTY...

READ MORE

MEMBERS ONLY

Beware the Hindenburg Omen!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* Jim Miekka created the Hindenburg Omen after studying the conditions present at previous market peaks.

* The Hindenburg Omen triggered an initial signal this week, just as the S&P 500 finally closed above 5000 for the first time.

* If we see a second signal in the next...

READ MORE

MEMBERS ONLY

MEM TV: Best Way To Participate in Stronger Areas of The Market

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews why the markets continue to hit new highs while also highlighting which areas are driving this strength. She then shares a low-risk, simple way to participate in the uptrend among these stronger areas.

This video originally premiered...

READ MORE

MEMBERS ONLY

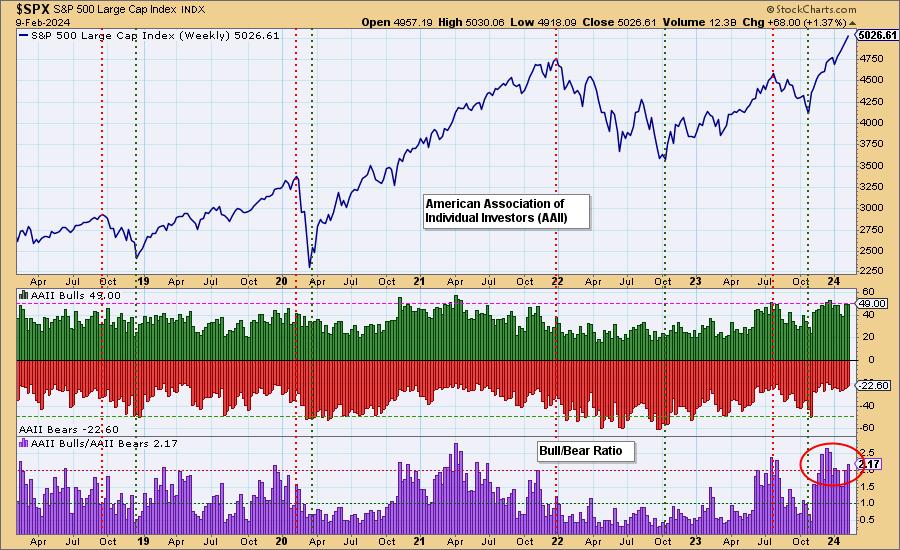

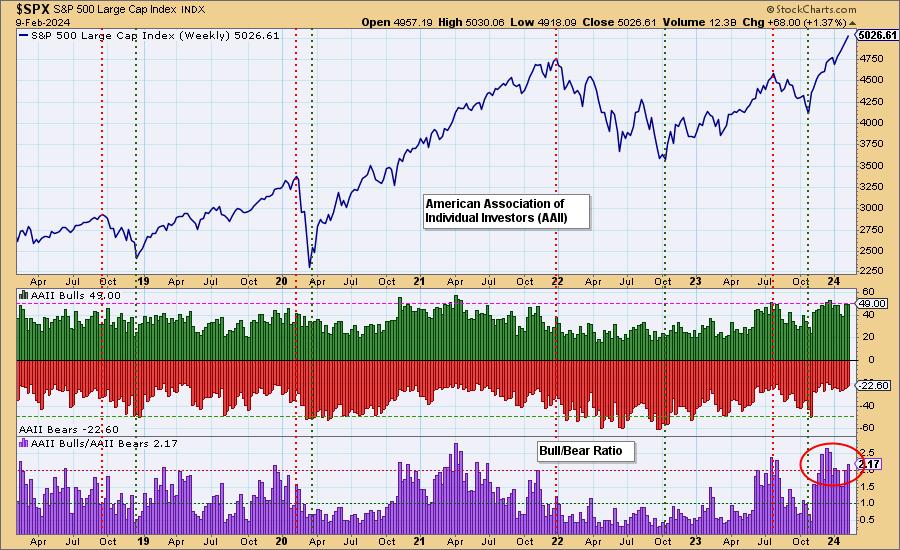

Sentiment Lopsided - Is It a Problem?

by Erin Swenlin,

Vice President, DecisionPoint.com

Periodically, we like to review sentiment charts, and today we have two for you. One is the poll results from the American Association of Individual Investors (AAII) and the other is the National Association of Active Investment Managers (NAAIM) Exposure level.

In both cases, we are starting to see sentiment...

READ MORE

MEMBERS ONLY

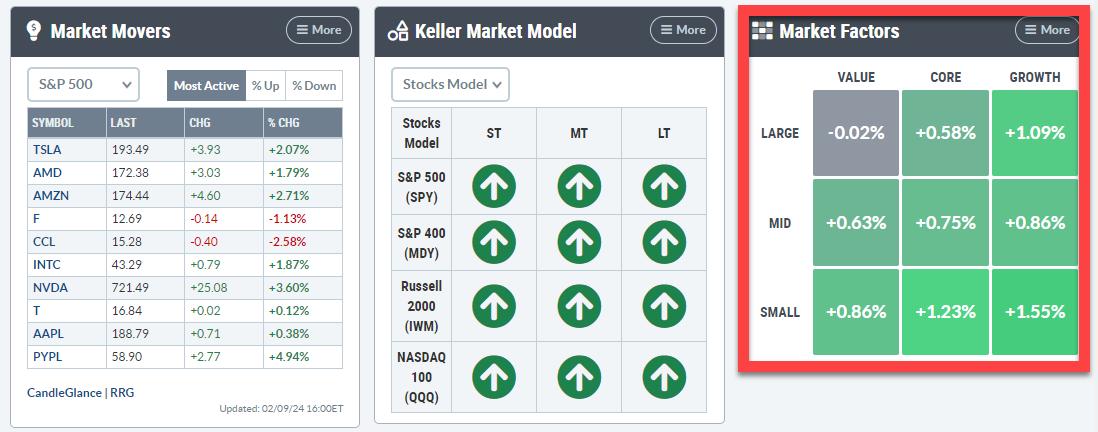

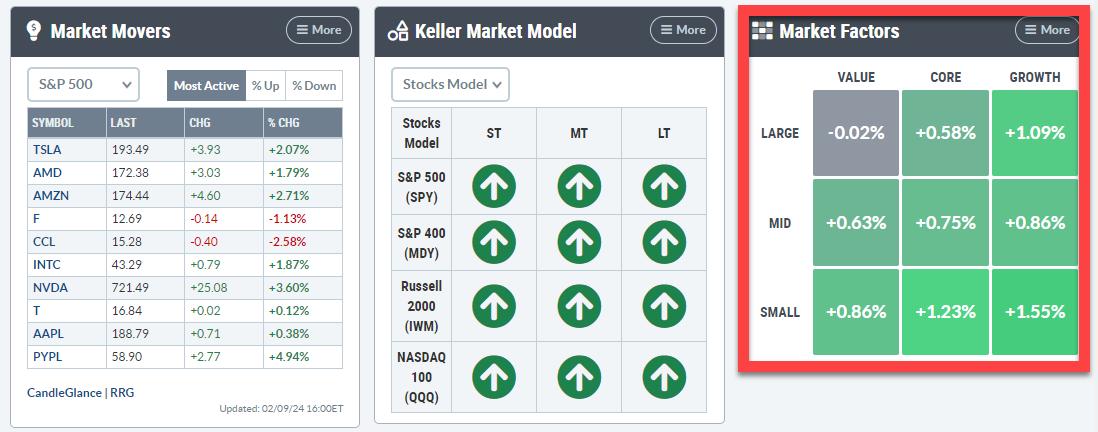

Visualizing the Market Factors Panel on RRG

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* Bring the New Market Factors Panel to a Relative Rotation Graph

* Same approach using different index family shows a different image

With the release of the new Panels feature on the StockCharts dashboard, there are a lot of ways that users of RRG charts can take advantage! Let&...

READ MORE

MEMBERS ONLY

Your Questions, Answered! Price Gaps, Bull Flags, Inverse Patterns, and MORE

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave digs into The Final Bar Mailbag and answers questions on price patterns like bull flags, what price gaps actually represent on the chart, and why analyzing earnings trends could help you anticipate subsequent moves for stocks like META.

This...

READ MORE

MEMBERS ONLY

The Costco Stock Surge: What You Need to Know Right Now!

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Costco's stock surged to unprecedented heights, surpassing its previous all-time record

* Costco's technical situation looks exceedingly bullish, but like many stocks hitting record highs, the stock may be slightly overbought

* The Money Flow Index can measure momentum and show whether price buying pressure is...

READ MORE

MEMBERS ONLY

3 Expert Earnings Plays: Maximizing Reward, Minimizing Risk

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes Danielle Shay of Simpler Trading. Danielle highlights three earnings plays she's focused on this week, and shares how she combines multiple time frames in her trading to better define risk vs. reward. Dave laments the weakening...

READ MORE

MEMBERS ONLY

Master Momentum Using Price Swings and Fibonacci Grids

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe discusses how he uses the price swings and Fibonacci grid to determine the momentum of a trend without the use of indicators. He explains how indicators can lag at reversal points and why we need to lean...

READ MORE

MEMBERS ONLY

The Hoax of Modern Finance - Part 7: The Illusion of Forecasting

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

Note to the reader: This is the seventh in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful. Market myths are generally perpetuated by repetition, misleading symbolic connections, and the complete ignorance of...

READ MORE

MEMBERS ONLY

Why the NAAIM Exposure Index Matters to Your Investments

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave welcomes Ryan Redfern, ChFC, CMT of Shadowridge Asset Management and President of NAAIM. Ryan provides a primer on the NAAIM Exposure Index, including what it is, how it's calculated, and how it can be used to measure...

READ MORE

MEMBERS ONLY

Decoding PLTR Stock: Why It's an Attractive Investment

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* PLTR stock gapped up after its impressive Q4 earnings and guidance

* Watch the average directional index and relative strength index to monitor the momentum of the upward trend

* If momentum continues to be strong, the stock would be an attractive investment

If you look at a chart of...

READ MORE

MEMBERS ONLY

Sector Spotlight: Stocks vs. Bonds -- Monthly Trends Revealed!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, I review the monthly charts for January 2024, in combination with the Relative Rotation on the Monthly RRGs for asset classes and sectors. At asset class level, the preference for stocks over bonds remains clearly visible. Looking at the monthly...

READ MORE

MEMBERS ONLY

Eli Lilly's Volatile Victory: What Tuesday's Turnaround Means for Your Portfolio

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Eli Lilly & Co's beat on earnings and revenue expectations led to a swift 5% spike and reversal in its stock price

* Analyzing Eli Lilly's stock price chart reveal some headwinds that may not be apparent in fundamental data

* Eli Lilly's stock...

READ MORE

MEMBERS ONLY

Three Things I WISH I'd Known About Trading

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave speaks to weakening short-term breadth conditions as the McClellan Oscillator rotates to a bearish level this week. Guest Dave Landry of DaveLandry.com drops some serious trader wisdom and also shares what he does first thing every morning to...

READ MORE

MEMBERS ONLY

Tape Reading for Distribution

by Bruce Fraser,

Industry-leading "Wyckoffian"

Recent Power Charting episodes have been devoted to the classic technique of chart reading innovated by Richard D. Wyckoff. He referred to the method as ‘Tape Reading' while it is actually the technique of reading charts, bar by bar to assess the likely future direction of an index, stock,...

READ MORE

MEMBERS ONLY

Market Breadth Divergence Says NO BULL!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave demonstrates how the market's recent upswing has left mid-caps and small-caps in the dust, with deteriorating breadth conditions suggesting an increased risk of downside for the S&P 500. He also unveils the latest enhancements to...

READ MORE

MEMBERS ONLY

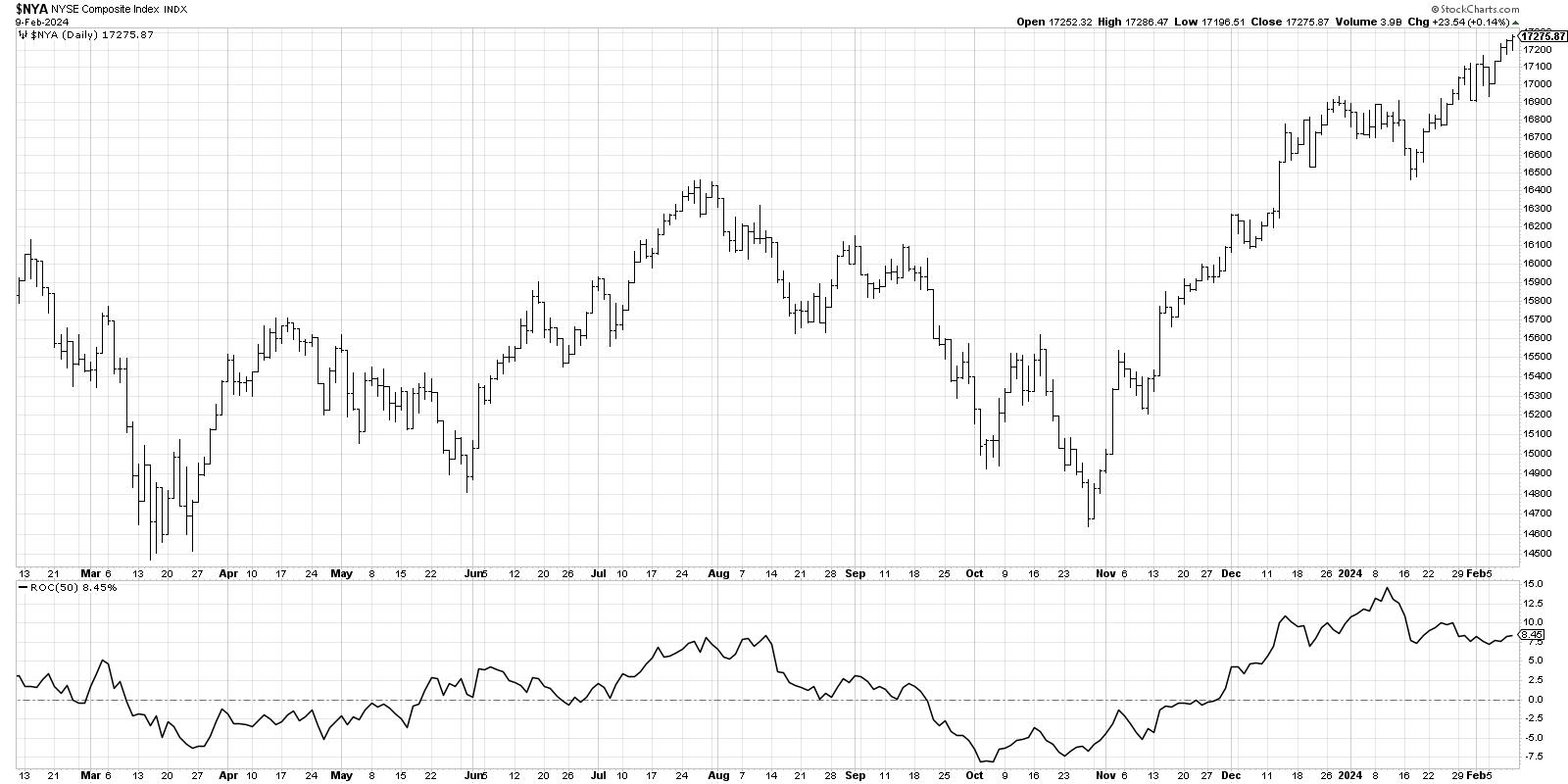

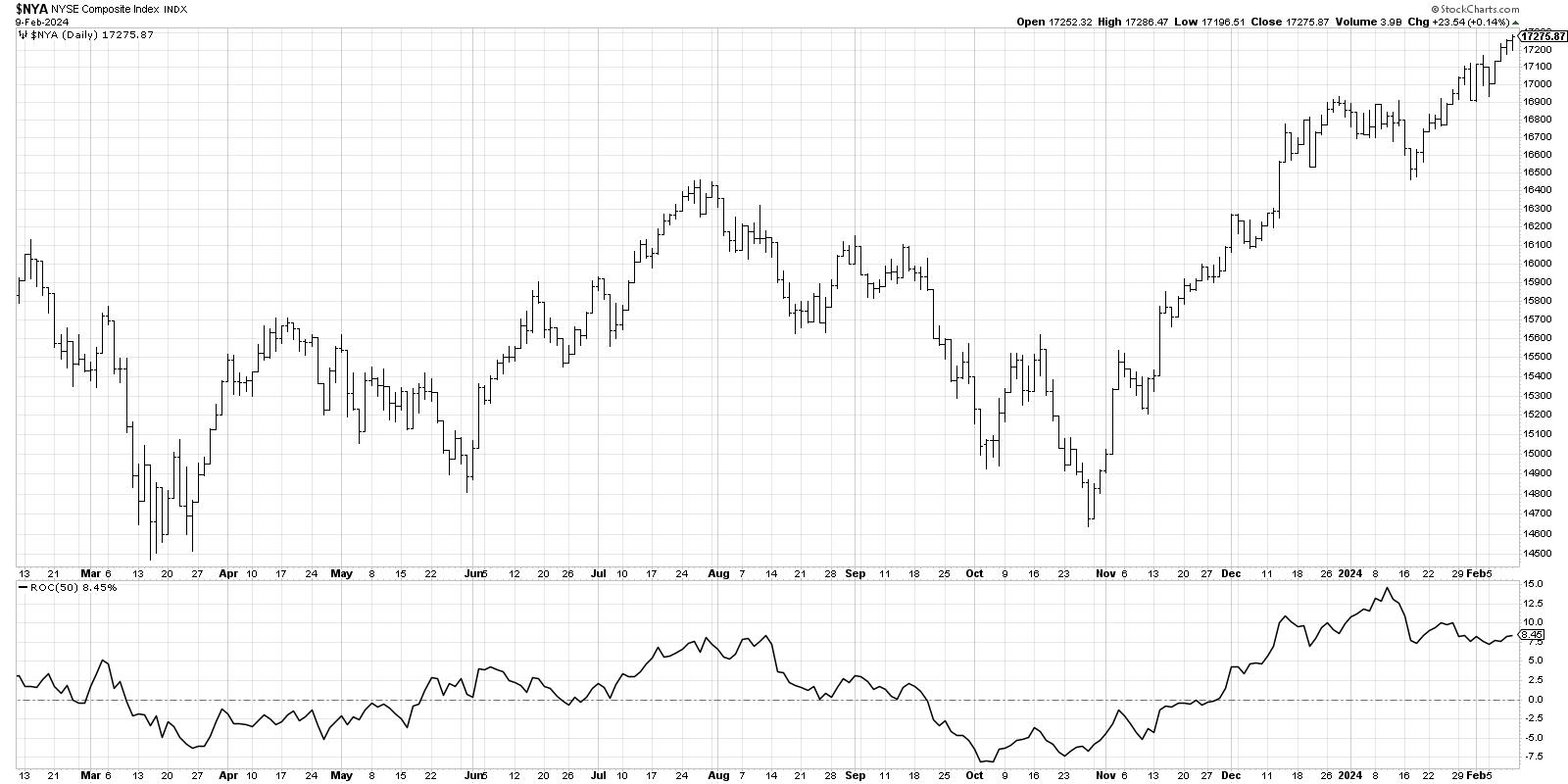

Only a Fool Would Try to Call a Correction in a Bull Market, So Here Goes!

by Martin Pring,

President, Pring Research

The vast majority of the primary trend indicators are pointing to a bull market and have been doing so for the better part of a year. Chart 1, for instance, shows that NYSE Margin Debt, or rather its long-term KST, has only recently gone bullish. The vertical lines point out...

READ MORE

MEMBERS ONLY

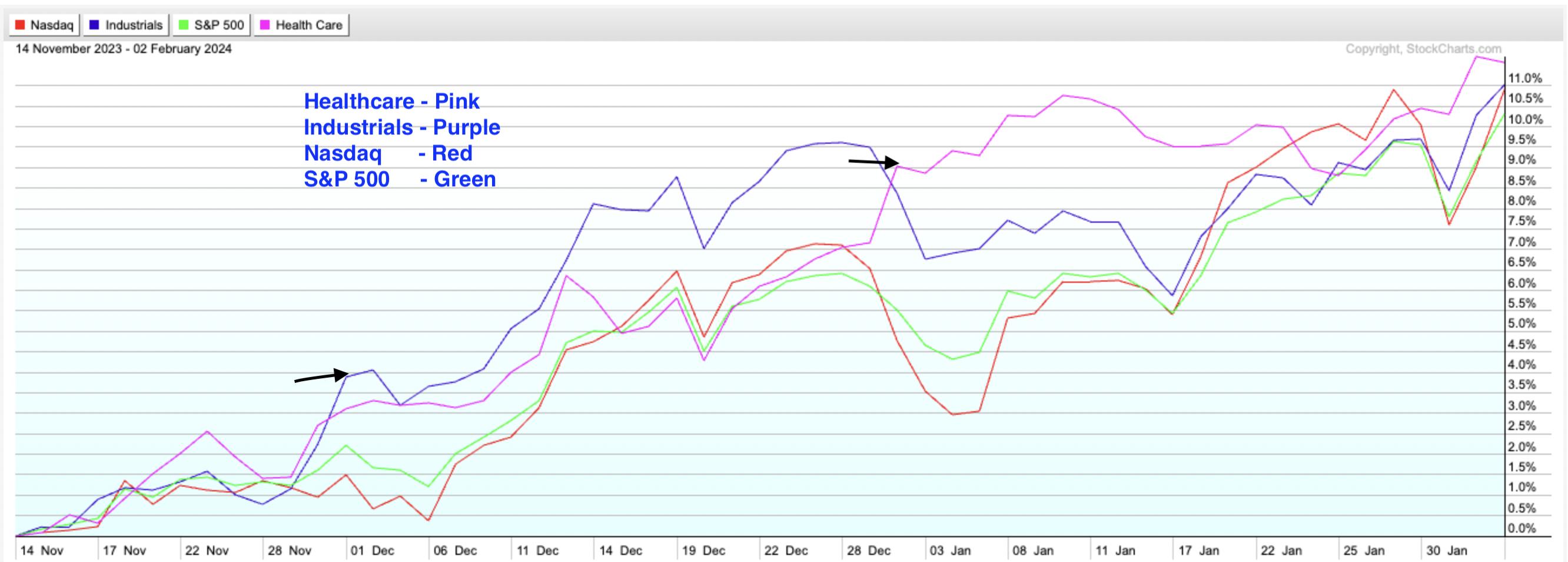

DecisionPoint Trading Room: Narrow Advance a Big Problem!

by Erin Swenlin,

Vice President, DecisionPoint.com

The market rally last week was very narrow, driven mainly by large gains in communication services stocks like Meta. Many technical indicators are showing negative divergences. The broader market struggled. Erin reviews all of the sectors under the hood and then takes your symbol requests.

Key Takeaways:

- Communication services...

READ MORE

MEMBERS ONLY

Based on Relative Strength, Alphabet (GOOGL) Is An Unloved Stock

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Nearly two weeks ago, I was discussing in our FREE EB Digest newsletter why I felt Alphabet (GOOGL) was poised for a decline after earnings. It was continuing to push higher, which, on the surface, was a fairly bullish signal. However, if you looked at how strong internet stocks ($DJUSNS)...

READ MORE

MEMBERS ONLY

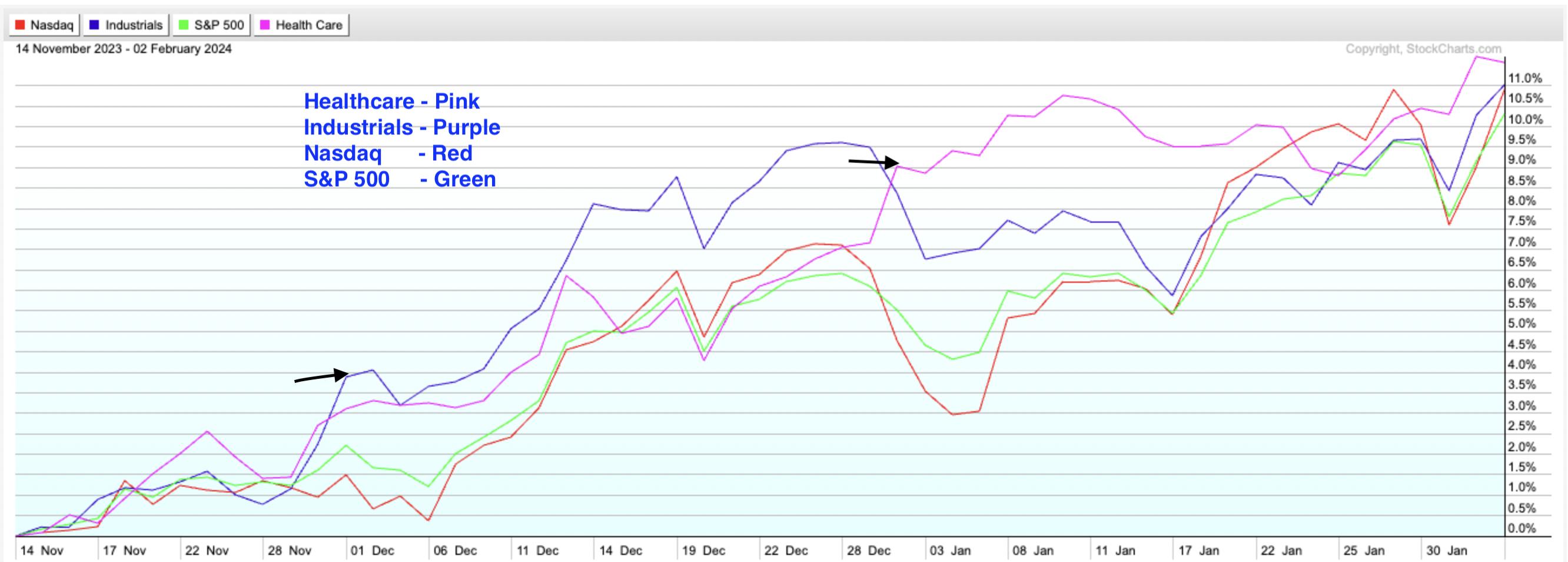

Why This Latest Bull Market Advance Is So Bullish

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I've been bullish for nearly two years now. Bullish rotation and Wall Street manipulation started the latest leg of this SECULAR bull market back in June 2022. If you follow my research and work, then I'm sure you remember these two headlines on YouTube:

You can...

READ MORE

MEMBERS ONLY

Generals March On, but Fewer Troops are Following - Get the Essential Breadth Indicator ChartList

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Divergences reflect a disconnect between price and the indicator. A bearish divergence forms when price forges a higher high and the indicator fails to confirm this high. In the case presented below, we have the S&P 500 moving higher and fewer stocks making it back above their 50...

READ MORE

MEMBERS ONLY

Strong Earnings Is Driving Sector Rotation Into These 2 Groups

by Mary Ellen McGonagle,

President, MEM Investment Research

It was a choppy push to new highs for the S&P 500 this week, after a sharp drop Wednesday on Fed news was followed by a recovery rally on the heels of strong earnings from select Magnificent 7 names. All three indexes posted a 4th consecutive week of...

READ MORE

MEMBERS ONLY

Tesla Tests Key Support: Is This a Trade? Or an Investment?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* Tesla is an outlier from the other Magnificent 7 stocks, remaining in a downtrend channel for the last six months.

* RSI oversold conditions, along with Fibonacci retracements, suggests a return to the upper end of the trend channel.

* TSLA shows a "confluence of resistance" above current...

READ MORE