MEMBERS ONLY

An Incredible Stock Market Rally Closes the Week on a Strong Note: The Best Week This Year, So Far

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite rally into the close

* Fed Chairman Jerome Powell's comments eased investor fears of further interest rate hikes

* Lower Treasury yields helped the banks, including regional banks

Five up days in a row for the...

READ MORE

MEMBERS ONLY

STOCKS SURGE ON FALLING BOND YIELDS -- REITS AND HOMEBUILDERS AMONG WEEKLY LEADERS --VIX TUMBLES AS STOCKS RISE

by John Murphy,

Chief Technical Analyst, StockCharts.com

TEN YEAR BOND YIELD MEETS RESISTANCE AT 5%... The 10-Year Treasury yield backed off sharply this week from long-term resistance near 5.00%. The upper box in Chart 1 also shows its 14-day RSI line peaking from overbought territory over 70 and falling to the lowest level in several months....

READ MORE

MEMBERS ONLY

Shopify Stock Shatters Expectations: What You Need to Know About Its Rise

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Shopify saw a significant surge of over 20% following a robust earnings report and guidance

* The daily price chart shows a breakaway gap from a prevailing near-term downtrend

* Breakaway gaps don't often fill, so if you are considering entering a position the stock has room to...

READ MORE

MEMBERS ONLY

What Can the VIX Reveal To Us In November 2023?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Tim Hayes of Ned Davis Research shares an outlook for interest rates in 2024, and explains why a VIX over 28.5 could mean disaster for risk assets. Host David Keller, CMT updates charts of stocks reporting earnings including SBUX,...

READ MORE

MEMBERS ONLY

Start Trading Like a Pro with These RSI Divergence Signals!

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe presents a few examples in different timeframes of how to use the RSI indicator for divergences. He explains what to look for when finding counter trend plays, as well as divergence with the trend. Joe then analyses...

READ MORE

MEMBERS ONLY

This Country ETF Rallies Sharply After War Breaks Out

by Martin Pring,

President, Pring Research

Understandably, most Middle Eastern country ETFs have performed poorly since the war broke out, but there is one noticeable exception, which I will get to later.

Israel

First, as might be expected, the iShares Israel ETF (EIS) has moved lower and completed what looks to be a massive top. The...

READ MORE

MEMBERS ONLY

Holiday Shopping Bonanza: Retail Stocks You Need to Watch

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Since holiday shopping season is here it could be a good time to add some retail stocks to your portfolio

* AMZN, WMT, COST, and TGT could be potential stocks to add to your portfolio as holiday shopping begins

* Set alerts for these stocks so you can enter at...

READ MORE

MEMBERS ONLY

Sector Spotlight: Monthly Charts Suggest Downside Risk is Limited

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, I address the completed monthly charts for October and assess the condition of the long term trends, along with whether they are still in play or have shifted. As usual, I start with the long-term rotation and trends in asset...

READ MORE

MEMBERS ONLY

Signs of Top in Rates As Fed Says NO CHANGE

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Katie Stockton, CMT of Fairlead Strategies shares her weekly charts of the S&P 500, VIX, and XLK and identifies three areas of opportunity through year-end 2023. Dave breaks down this week's Fed meeting from a technical...

READ MORE

MEMBERS ONLY

Focus on Stocks: November 2023

by Larry Williams,

Veteran Investor and Author

The Million Dollar Stock Market Bet

Warren Buffett proved his point in 2016 when he bet $1,000,000 that the S&P 500 Stock Index would outperform hedge funds. His bet was that active investment management by professionals would under-perform the returns of people who were passively investing....

READ MORE

MEMBERS ONLY

Arista Networks: A Profitable Tech Stock That Has Room to Surge

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* AI will need networks to support its development and growth and one stock that can benefit in this space is Arista Networks

* The stock is trading above its 50-day moving average and hit a new 52-week high

* The stock is outperforming the S&P 500 index and...

READ MORE

MEMBERS ONLY

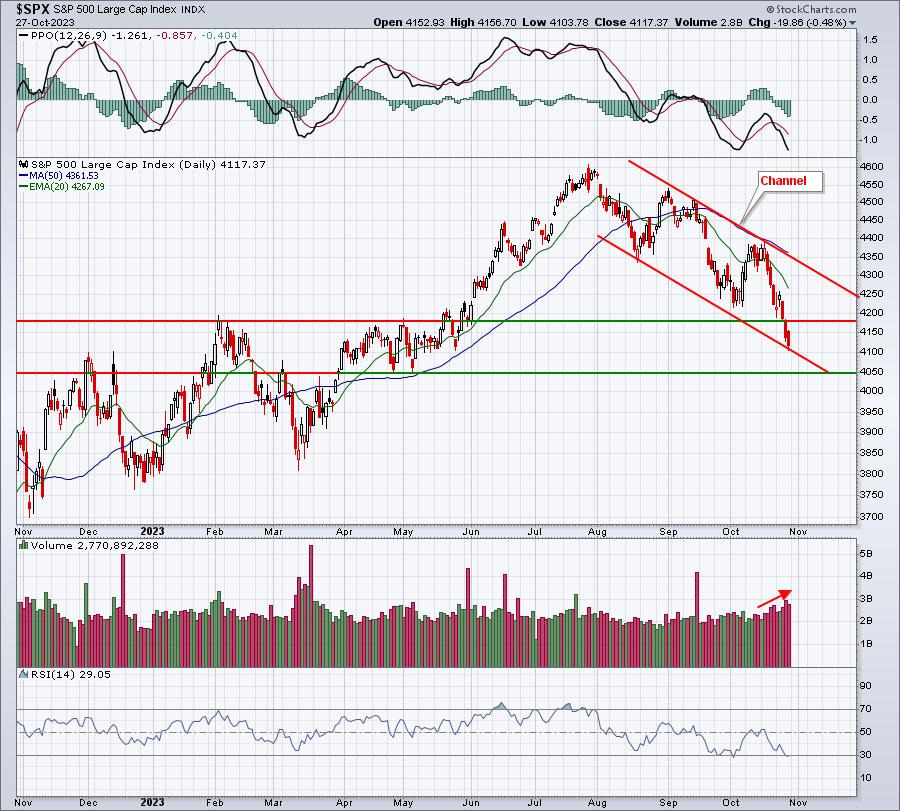

Stock Market Hinges on the Ten Year Interest Rate

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Tony Dwyer of Canaccord Genuity breaks down four charts that speak to a potential tactical rally for the S&P 500, and explains why this market is still all about interest rates. Meanwhile, Dave charts the downtrend channel for...

READ MORE

MEMBERS ONLY

The Halftime Show: Harness The Strength of Power Gauge on ACP Platform

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

On this week's edition of StockCharts TV'sHalftime, Pete starts the show with a review of the Chaikin Power Gauge and demonstrates how to access to the tool on the ACP platform. Pete then reviews a few names that are moving big today, like Amgen (AMGN) and...

READ MORE

MEMBERS ONLY

Sector Spotlight: Seasonality is Dropping Big Bomb on Real Estate Sector

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

On this episode of StockCharts TV's Sector Spotlight, I address the seasonality patterns that are likely to affect stock market and sector performance in the coming month. November is one of the strongest months in the year based on seasonality, but the Real Estate Sector looks to be...

READ MORE

MEMBERS ONLY

Countertrend Rally in the Works for SPX? What the Charts Reveal

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, Dave discusses implications for this week's earnings releases, the November Fed meeting, and geopolitical events. He answers live viewer questions on volume-based indicators, downside targets for the S&P 500 chart, possibilities for a countertrend rally for...

READ MORE

MEMBERS ONLY

DP Trading Room: Bad News for Buyers Weighing Hefty Mortgage Rates

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Carl opens the show with a look at a very bearish market BIAS Table. He examines how the latest mortgage rates are squeezing buyers and sellers alike by comparing today's mortgage payments versus payments at the lows;...

READ MORE

MEMBERS ONLY

A Soft Landing Is Starting To Look Much More Likely

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Since the 2020 pandemic, we've seen many relative leaders come and go. I've found the most difficult part of trading/investing these past few years to be trusting the relative strength we see. Rotation is normal as we move through various economic cycles, but trying to...

READ MORE

MEMBERS ONLY

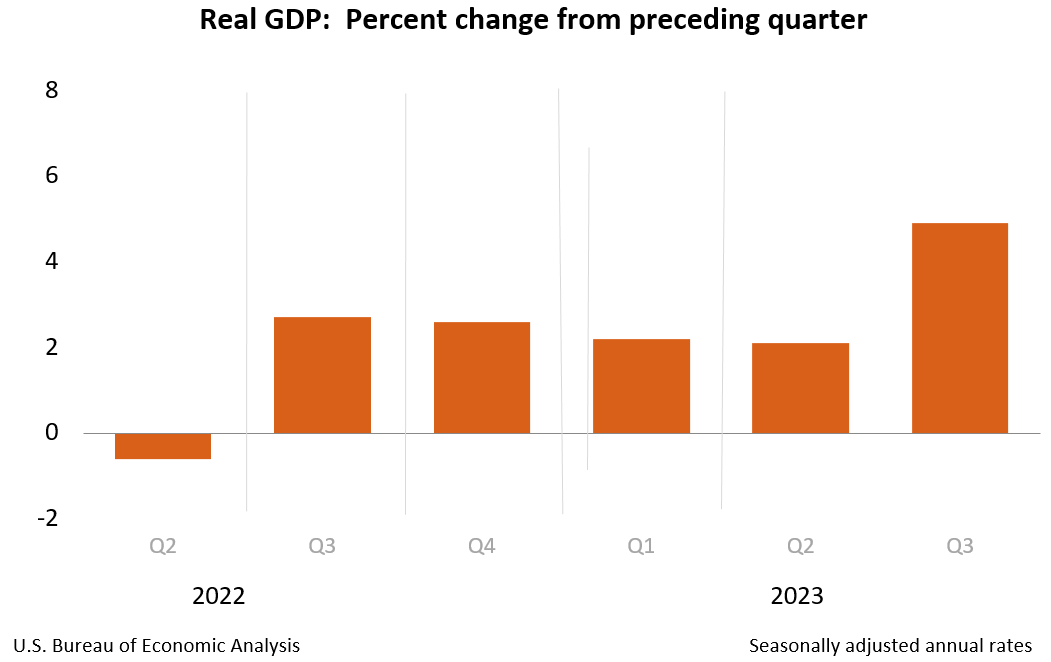

Consumer Spending Remains Strong - Here Are 3 Stocks For Your Watch List

by Mary Ellen McGonagle,

President, MEM Investment Research

The U.S. economy grew at a 4.9% annualized rate in the third quarter that was fueled mainly by consumer spending as Americans poured their disposable income into vacations, dining out and online shopping. The pace of growth was the fastest since late 2021 and was made possible by...

READ MORE

MEMBERS ONLY

MEM TV: Are the Magnificent Seven Ready to Rally?

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews last week's negative price action in the markets while sharing key areas of possible support for the Nasdaq and S&P 500. She also highlights the relative strength in defensive areas of the market...

READ MORE

MEMBERS ONLY

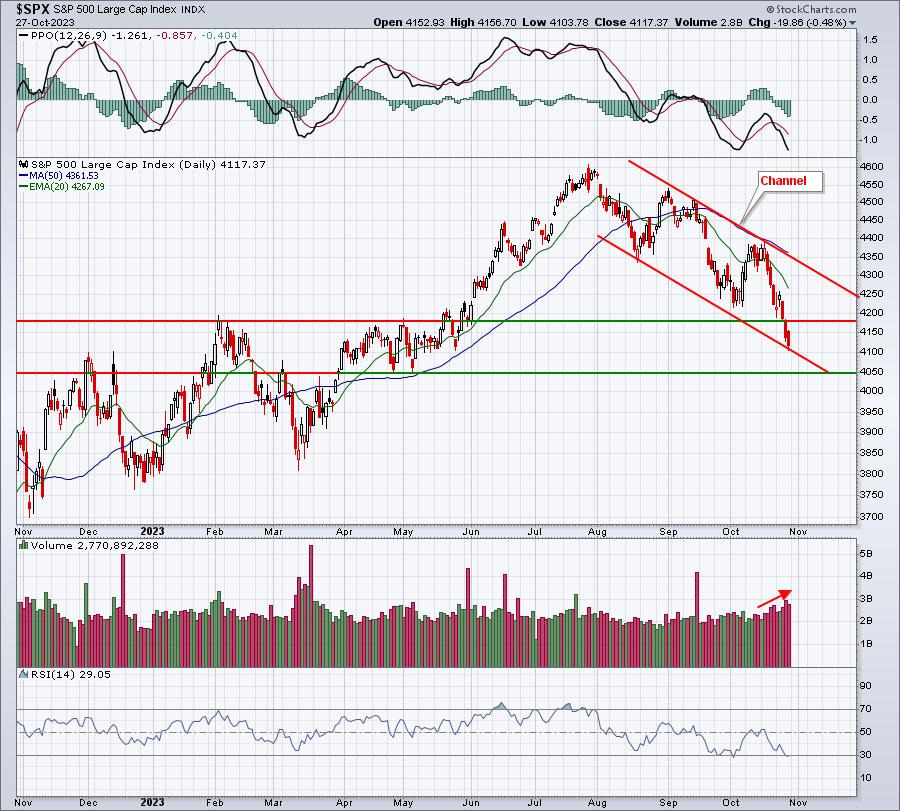

My Downside Targets for the S&P 500

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* The S&P 500 has almost reached the minimum downside objective based on the head and shoulders topping pattern.

* SPX 3800 would mean represent a 38.2% retracement level of the March 2020 to January 2022 bull market phase.

If you've been fighting the mounting...

READ MORE

MEMBERS ONLY

29 MUST SEE Charts You Can Start Using Today!

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson gives viewers 29 of the most important charts straight out of his own personal account. He'll review his weekly "Market Evaluation" ChartList and discuss all of the advanced charts within. This entire...

READ MORE

MEMBERS ONLY

Where to Find Stock Opportunities in Bear Territory

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, host Dave wraps a bearish week with a discussion on downtrend conditions, trendline resistance, deteriorating breadth, and finding opportunities in a bearish landscape. He answers viewer questions on inverted yield curves, recessionary periods, and leading vs. lagging technical indicators.

This...

READ MORE

MEMBERS ONLY

GNG TV: Charts Flash Warning Signs of Further Risk to the Downside

by Alex Cole,

Co-founder, GoNoGo Charts®

In this edition of the GoNoGo Charts show, with US Equities delivering a streak of daily gains this week, Alex takes a top down approach to see what the GoNoGo Charts are saying about markets. With U.S. domestic equities in a "NoGo" trend, the charts warn that...

READ MORE

MEMBERS ONLY

Stock Market Indexes Shatter Critical Support Levels. Watch the March Lows.

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* The Dow, S&P 500, and Nasdaq Composite are trading below their 200-day moving averages

* US Treasury yields are taking a breather now but their near-term action could impact equities, especially big tech stocks

* Investors are anxiously awaiting to hear if Fed Chairman Jerome Powell will lean...

READ MORE

MEMBERS ONLY

Bonds Now Beating Stocks While NVDA Goes into Tailspin

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

KEY TAKEAWAYS

* The Stock/Bond ratio is changing course

* SPY:IEF complets top formation

* NVDA completes large H&S formation unlocking 20% downside risk

SPY:IEF completes top formation

One of the metrics I keep a close eye on is the ratio between stocks and bonds. Most of the...

READ MORE

MEMBERS ONLY

The Halftime Show: Watch the Unemployment Rate - It Could Change Everything!

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

On this week's edition of StockCharts TV'sHalftime, Pete explains how his TLT call from 10/10 was spot-on! But that could all change based on the unemployment rate. Pete believes that rates will fallifthe unemployment rate spikes higher, likely to the 4.25-4.5% level. Until...

READ MORE

MEMBERS ONLY

Is the Bear Back?

by Carl Swenlin,

President and Founder, DecisionPoint.com

The S&P 500 (SPY) has fallen about 10 percent from the July top, and the last two weeks has been pretty rough, so should we be looking for the Bear to take charge again?

First, looking at a weekly chart, it is not clear that the Bear actually...

READ MORE

MEMBERS ONLY

Late-Hour Selloff Confirms Downtrend Phase!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Tom Bowley of EarningsBeats shares his chart of key ratios illustrating how growth still has held its ground relative to value stocks. Host David Keller, CMT focuses in on distribution in the last hour of trading and highlights one...

READ MORE

MEMBERS ONLY

Market's At RISK in The Mega Cap Bloodbath!

by TG Watkins,

Director of Stocks, Simpler Trading

In this week's edition of Moxie Indicator Minutes, TG discusses how breadth continues to be abysmal, and now that some of the mega caps are reporting earnings, they are getting whacked hard. If they can't hold up, most of the market is at risk of moving...

READ MORE

MEMBERS ONLY

This Powerful MACD/ADX Screener Generates Valuable Ideas

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe shows an intraday trade setup in the SPY that took place this week. He uses the MACD and ADX in multiple timeframes to explain in detail how they can help with our entry and timing. He discusses...

READ MORE

MEMBERS ONLY

IMPORTANT SUPPORT LEVELS ARE BEING BROKEN

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 BREAKS 200-DAY LINE...Last week's message showed the S&P 500 testing important support lines which included its 200-day moving average. Those support levels are being broken to the downside. The daily bars in Chart 1 show the SPX falling below its 200-...

READ MORE

MEMBERS ONLY

Many Reasons to Love and Hate AMZN Stock

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Amazon stock has been falling ahead of earnings and is close to hitting the support of its 200-day moving average

* When AMZN announce its Q3 earnings, investors will be interested in the company's e-commerce and cloud services

* Keep an eye on AMZN's price action...

READ MORE

MEMBERS ONLY

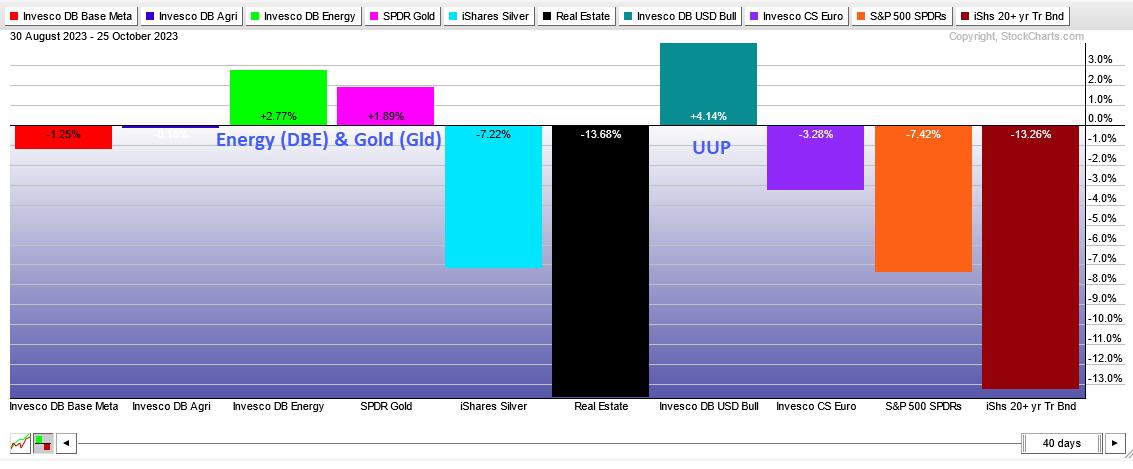

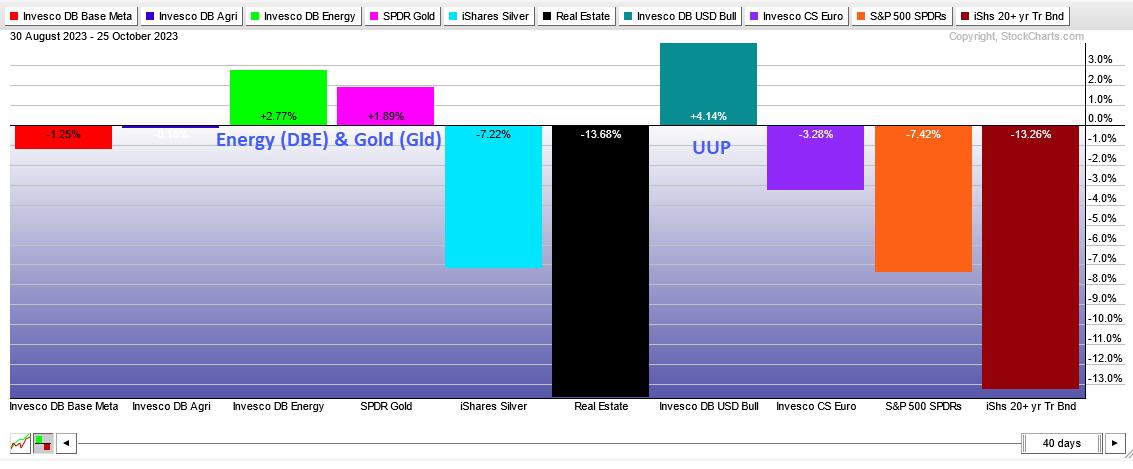

Looking Outside the Stock Market for Opportunities

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Correlations rise during bear markets. This means more stocks participate in broad market declines than broad market advances. In other words, the odds are stacked against us when picking stocks in bear markets. Traders are better off looking outside of the stock market for opportunities.

The Perfchart below shows the...

READ MORE

MEMBERS ONLY

Two Defensive Sectors are Outperforming - What Does This Mean?

by Erin Swenlin,

Vice President, DecisionPoint.com

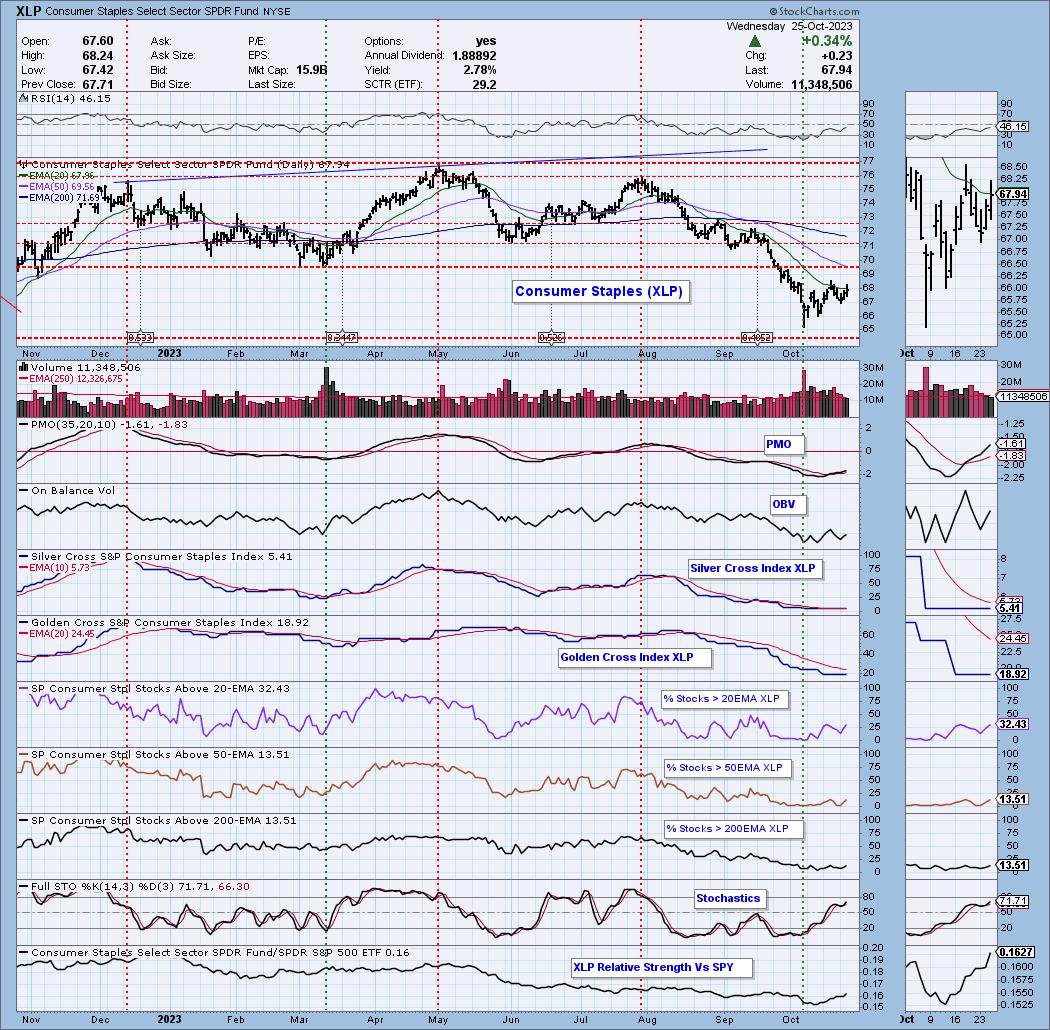

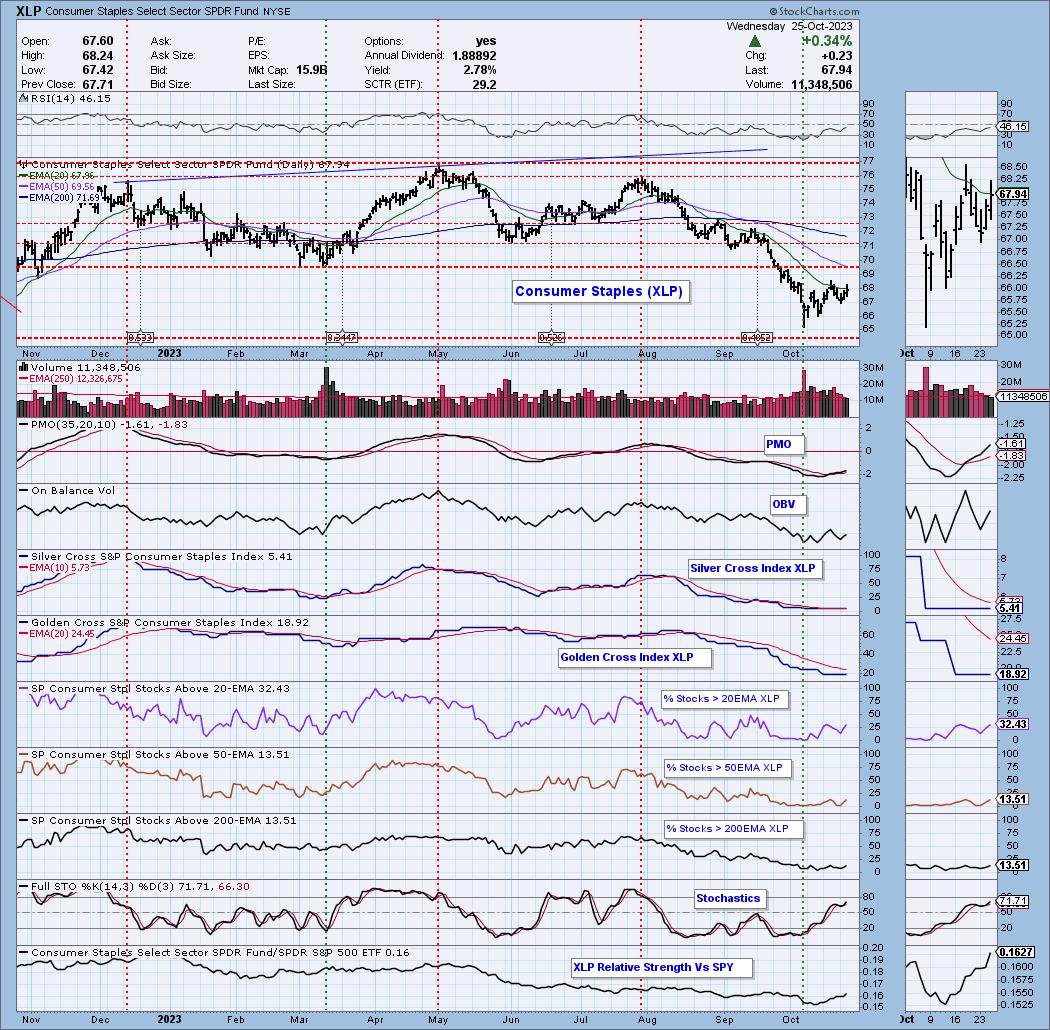

The only two sectors to close higher on Wednesday were in the defensive category, Consumer Staples (XLP) and Utilities (XLU).

We were already watching XLP as it established a short-term rising trend. What we aren't seeing is healthy participation...yet. We are seeing some expansion in stocks above...

READ MORE

MEMBERS ONLY

Some Gold Indicators Approach Critical Chart Points

by Martin Pring,

President, Pring Research

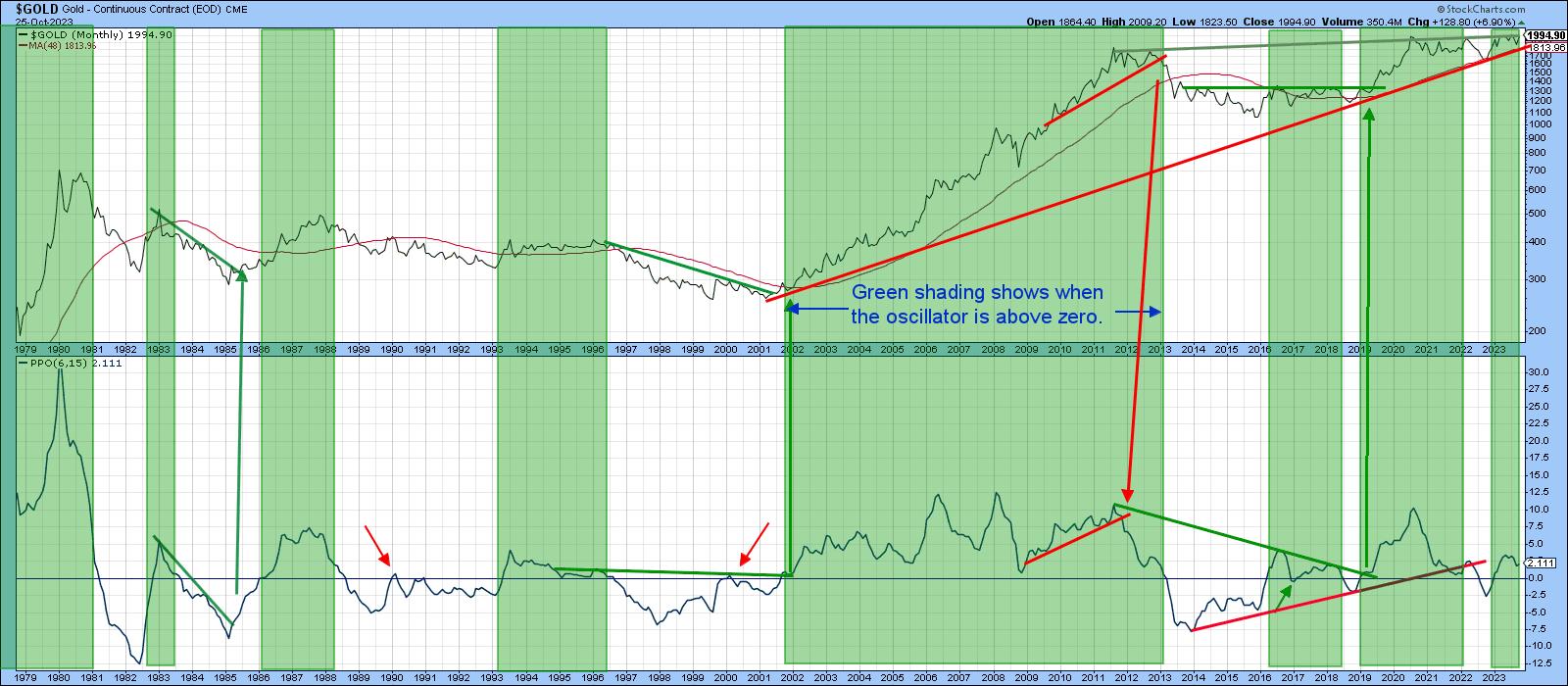

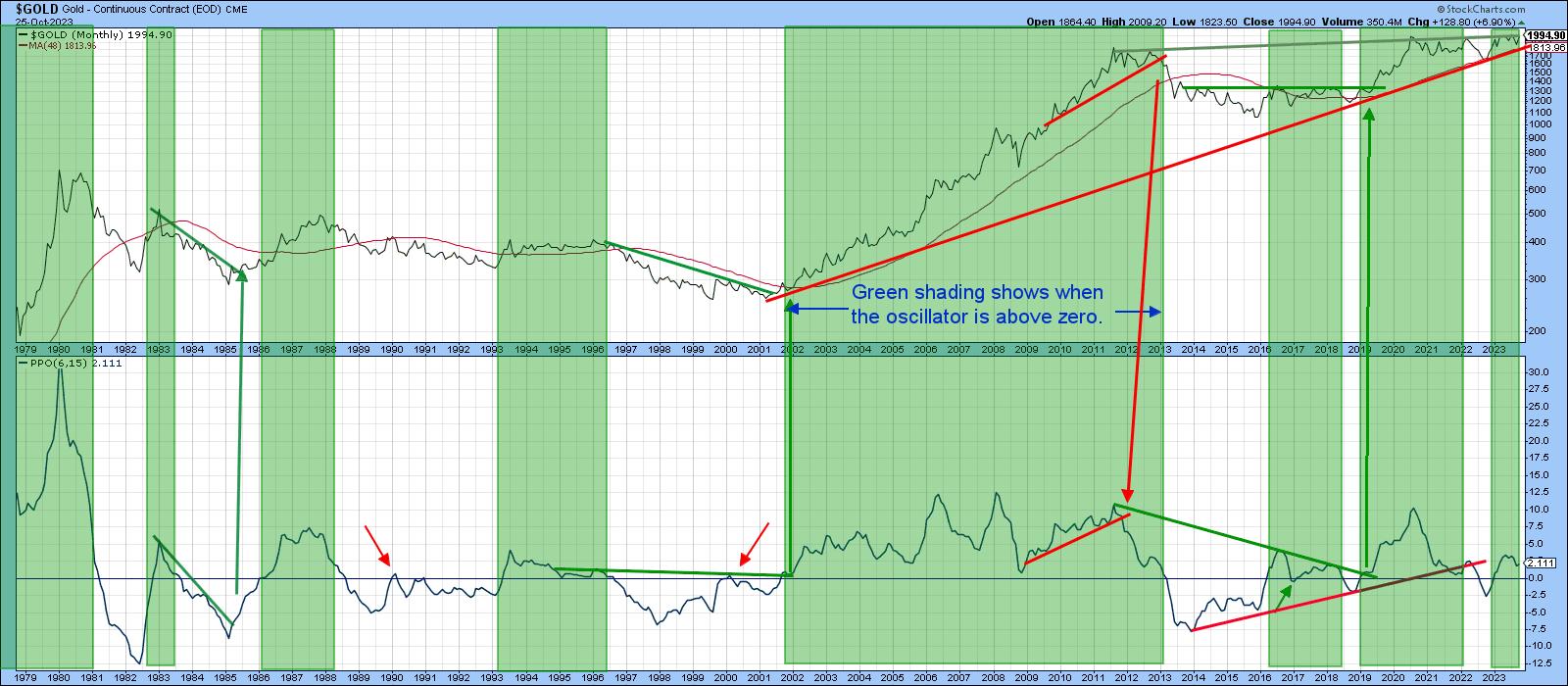

When Anwar Sadat, President of Egypt was assassinated in 1981, gold rallied sharply over the near-term, but the advance soon petered out. The reason was that gold was in a primary bear market, so the advance merely represented a counter-cyclical move. Gold has rallied sharply since the Middle East crisis...

READ MORE

MEMBERS ONLY

NASDAQ NOSEDIVES, Down Over 2% At The Close!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this edition of StockCharts TV'sThe Final Bar, guest Mary Ellen McGonagle of MEM Investment Research shares three stocks showing promise during a period of severe market distribution. Dave focuses in on the S&P 500 testing Fibonacci support and breaks down earnings for Microsoft, Alphabet, Spotify,...

READ MORE

MEMBERS ONLY

Microsoft (MSFT) Stock On the Verge of a Powerful Breakthrough

by Karl Montevirgen,

The StockCharts Insider

KEY TAKEAWAYS

* Microsoft's Q1 2024 earnings report beat analyst expectations

* Microsoft's weekly charts suggest a long-term bullish stance for MSFT stock

* Microsoft's daily chart also shows a bullish stance with the stock trading well above its 200-day movign average

When Microsoft (MSFT) reported earnings...

READ MORE

MEMBERS ONLY

Key Market Relationships for the Next Big Move

First off, we are heading out of town to New York where I will be visiting in studio several media channels and hosts.

Then, we are off to Orlando for the MoneyShow.

On November 1st, Keith and I go on vacation until the middle of the month.

This is the...

READ MORE

MEMBERS ONLY

Google Stock Expectations In the Spotlight: Will Earnings Results Exceed Expectations?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Google's Q3 earnings will have an impact on which way the stock moves

* GOOGL's daily stock chart shows the stock is trading very close to its 52-week high

* GOOGL stock is trading above its 21-day exponential moving average, it has a high SCTR rank,...

READ MORE

MEMBERS ONLY

It's All About Risk and the Long Bonds

Monday, after a lot of spooky headlines, the SPDR S&P 500 ETF (SPY) touched its 23-month moving average (MA) or the two-year biz cycle breakout point right around 417.

Plus, the iShares 20+ Year Treasury Bond ETF (TLT)flashed green as didIWM,the small caps.

The big question...

READ MORE