MEMBERS ONLY

Lululemon Stock: Try This Simple Analysis Before You Buy

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

KEY TAKEAWAYS

* Lululemon stock could move higher in sync with the Consumer Discretionary sector

* LULU is trending higher above its 200-week moving average

* LULU could find support at its 50-day simple moving average before moving higher

Athleisure wear became trendy during the pandemic—what's not to like about...

READ MORE

MEMBERS ONLY

What a Healthy Correction in Energy Looks Like

An interesting article based on cycles and commodities versus stocks suggests that over the past 90 years, stocks have outperformed commodities by 4 to 1. Within those 90 years, though, there are times that commodities outperform stocks, generally for about 15 years.

The author believes that we will see such...

READ MORE

MEMBERS ONLY

DP Trading Room: Downside Exhaustion Climax

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Carl begins by discussing the downside exhaustion climax that occurred on Friday. He goes through DecisionPoint indicators and covers the major markets, as well as Crude Oil, Bitcoin and a discussion on the Dollar and Gold. Erin finds new...

READ MORE

MEMBERS ONLY

Do Not Get Bearish While Transportation Leads

What we know for sure, is that the demand side of the U.S. Economy, as seen through the lens of the transportation sector, is holding up.

IYT, shown AI-generated in the image above, is the ETF for things that move and carry people and cargo via ships, planes, freight,...

READ MORE

MEMBERS ONLY

Sector Spotlight: Stocks Lining Up for a Strong July

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, I look ahead to the month of July and what we can expect based on 20 years of seasonal performance. I then align that information with the current rotations for the various sectors in order to find interesting opportunities on...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY May Stay Tentative In The Truncated Week; Keep An Eye On These Things

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After a strong performance in the week before this one, the markets chose to take a breather. The NIFTY went within the kissing distance of the all-time high level of 18887 and saw corrective pressures at that point. The markets kept on testing these crucial levels multiple times while the...

READ MORE

MEMBERS ONLY

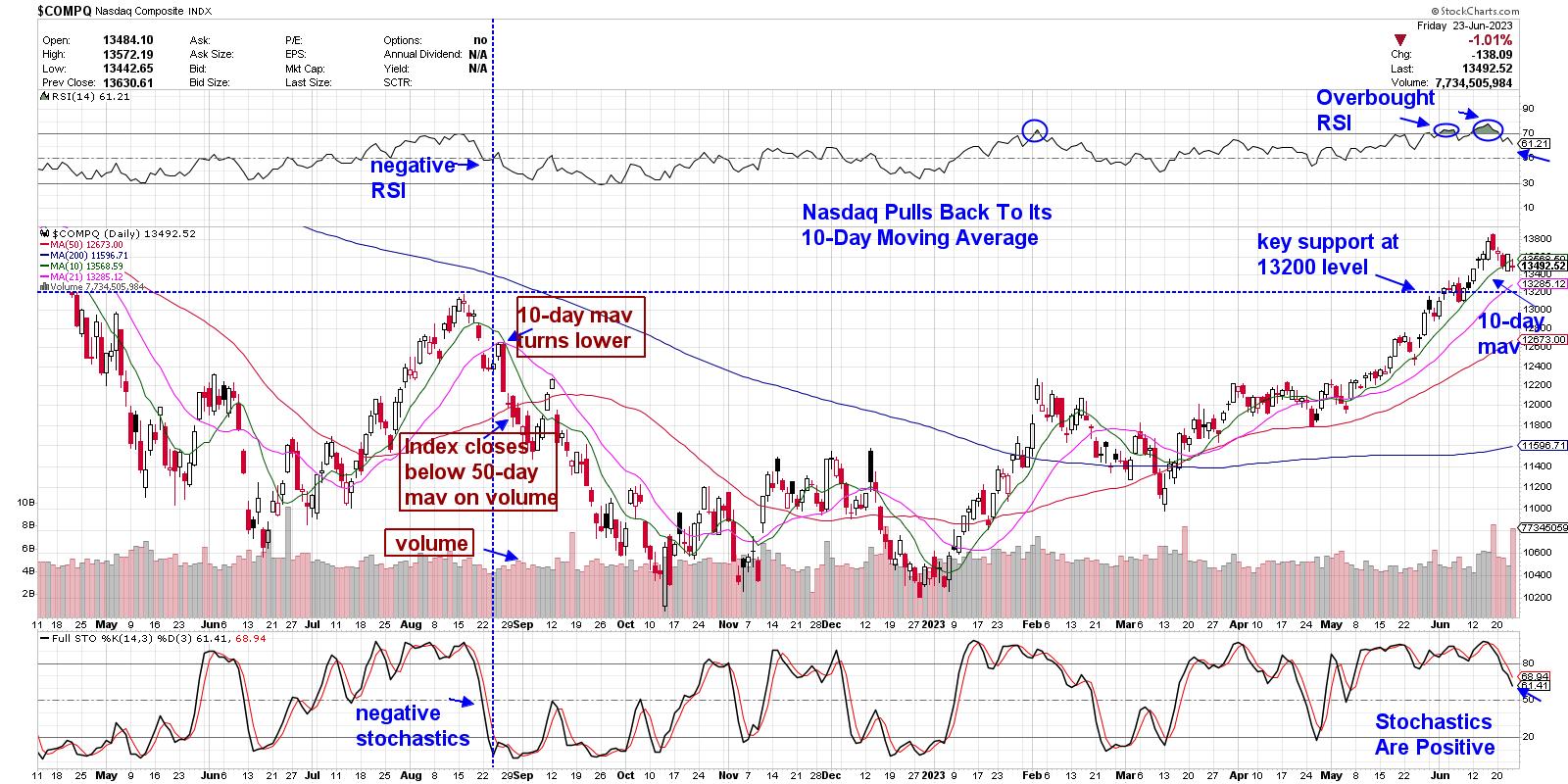

Are the Markets Just Pulling Back, or Is It More?

by Mary Ellen McGonagle,

President, MEM Investment Research

The markets pulled back this week amid global recession fears that followed the Bank of England's interest rate hike. Most concerning to investors was that the ½% increase came on the heels of an elevated U.K. inflation report for May. Thoughts that the U.S. may get stuck...

READ MORE

MEMBERS ONLY

Downside Targets For S&P 500 Pullback

by David Keller,

President and Chief Strategist, Sierra Alpha Research

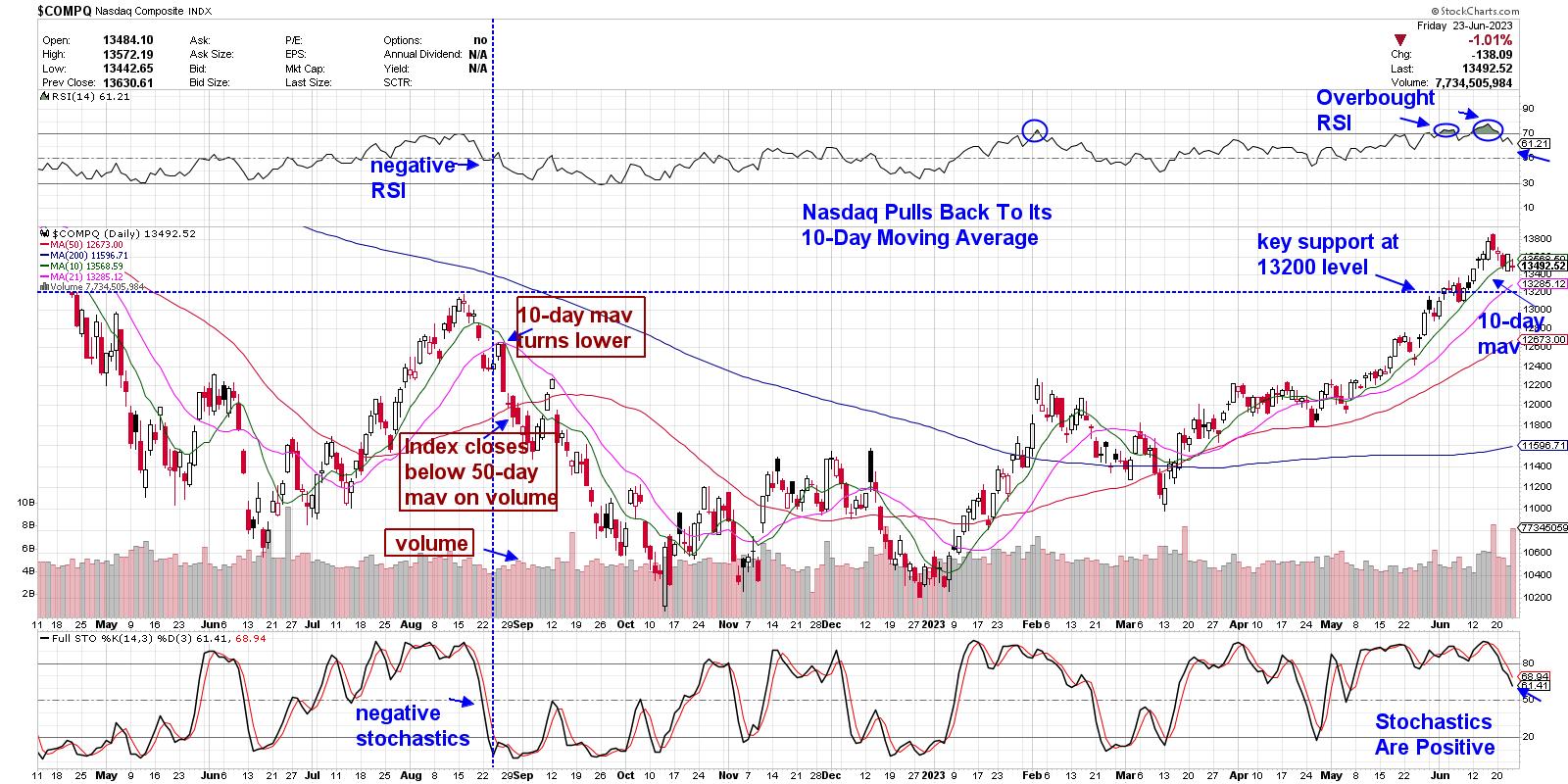

Recently, we've focused on the overextended nature of the small group of mega-cap leadership names in 2023, and even identified threekey charts to watch for a pullback in the technology sector.This week, we observed further deterioration in breadth indicators, with the cumulative advance-decline lines for all cap...

READ MORE

MEMBERS ONLY

MEM TV: Key Areas of Support as Markets Pull Back

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen shares important levels to watch as the markets pull back amid interest rate hike fears. She also highlights how to tell if your stock is pulling back or poised for further downside. The move into Crypto is also...

READ MORE

MEMBERS ONLY

Complete Trader: Macro to Micro and Top Picks Live

Once a month, I do a coaching session for our members of the Complete Trader, a MarketGauge comprehensive product for the discretionary trader.

During the 45-minute session, I cover EVERYTHING!

1. The Economic Modern Family

2. The Indices

3. The Big View Risk Gauges

4. The Bonds

5. The Metals...

READ MORE

MEMBERS ONLY

Chart and Trend Signals Align for Datadog

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It does not always happen, but sometimes the indicator and chart signals align to send a powerful message. Datadog (DDOG) sports a confirmed bullish reversal on the price chart and a trend signal from the Trend Composite. Today's article will review these signals and highlight a developing short-term...

READ MORE

MEMBERS ONLY

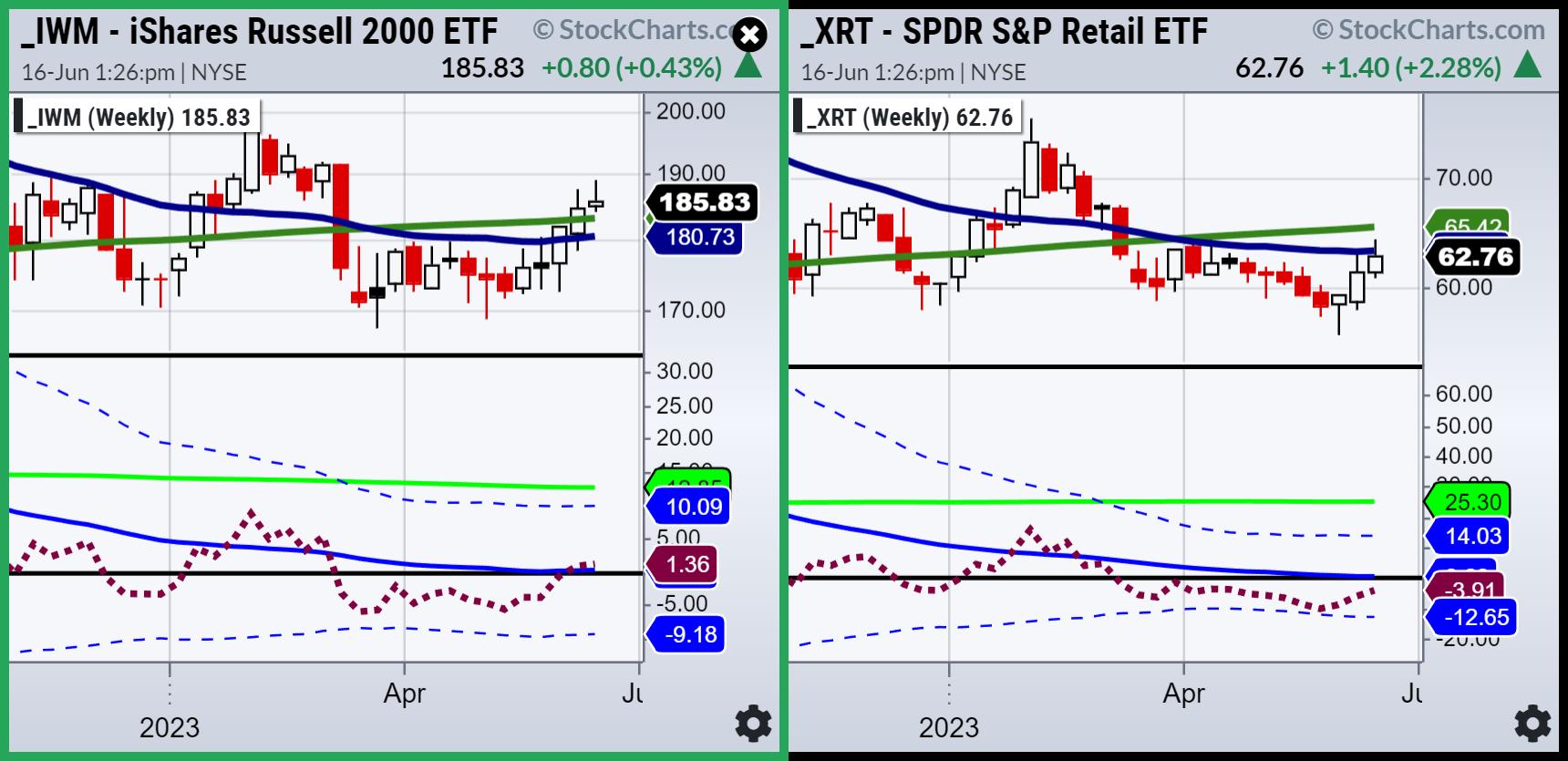

Granny Retail a Big Barometer: Video Analysis

It was a great day to sit down and talk to Dale Pinkert of FACE Live Market Analysis & Interviews.And we covered a lot of ground.

1. BoE interest rate cut.

2. Inflation, Recession, or Stagflation?

3. Commodities -- grains, metals, industrial metals.

4. The "inside" sector...

READ MORE

MEMBERS ONLY

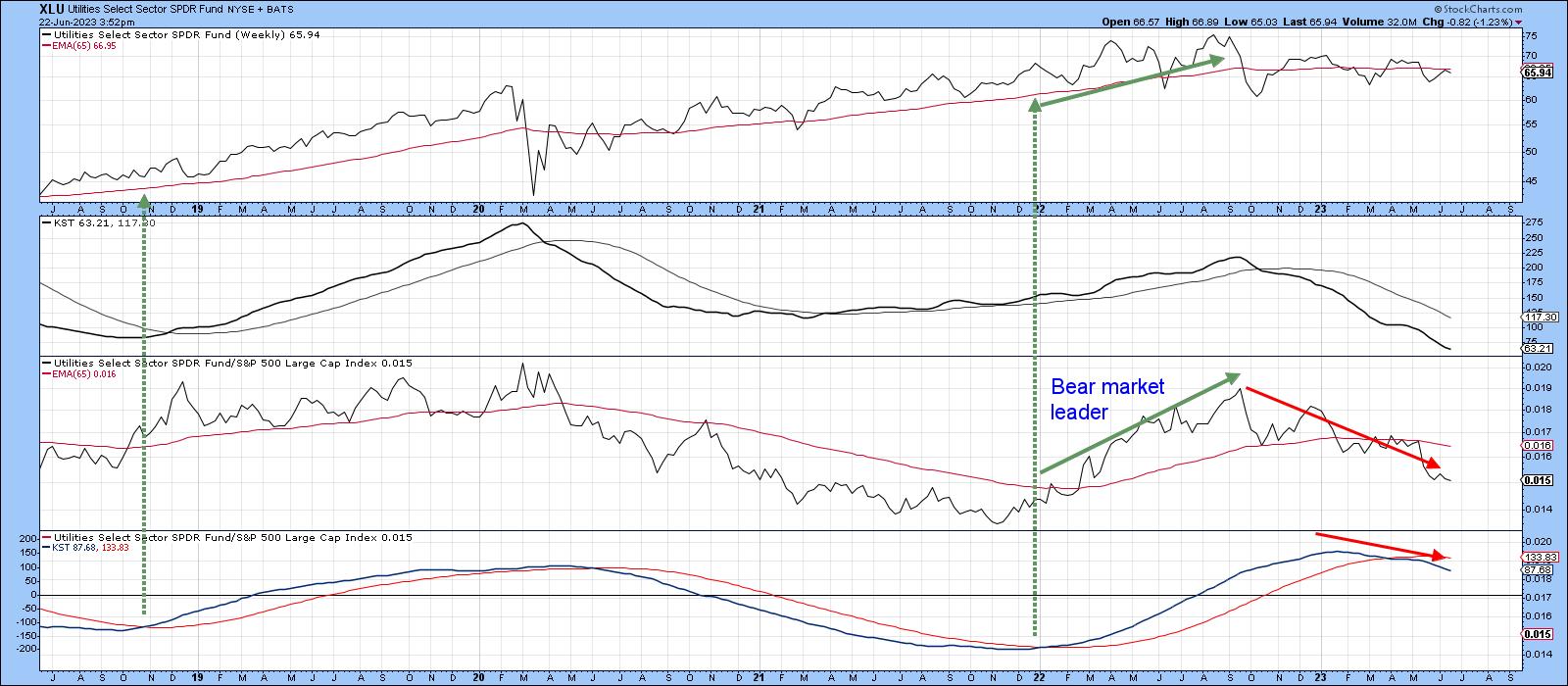

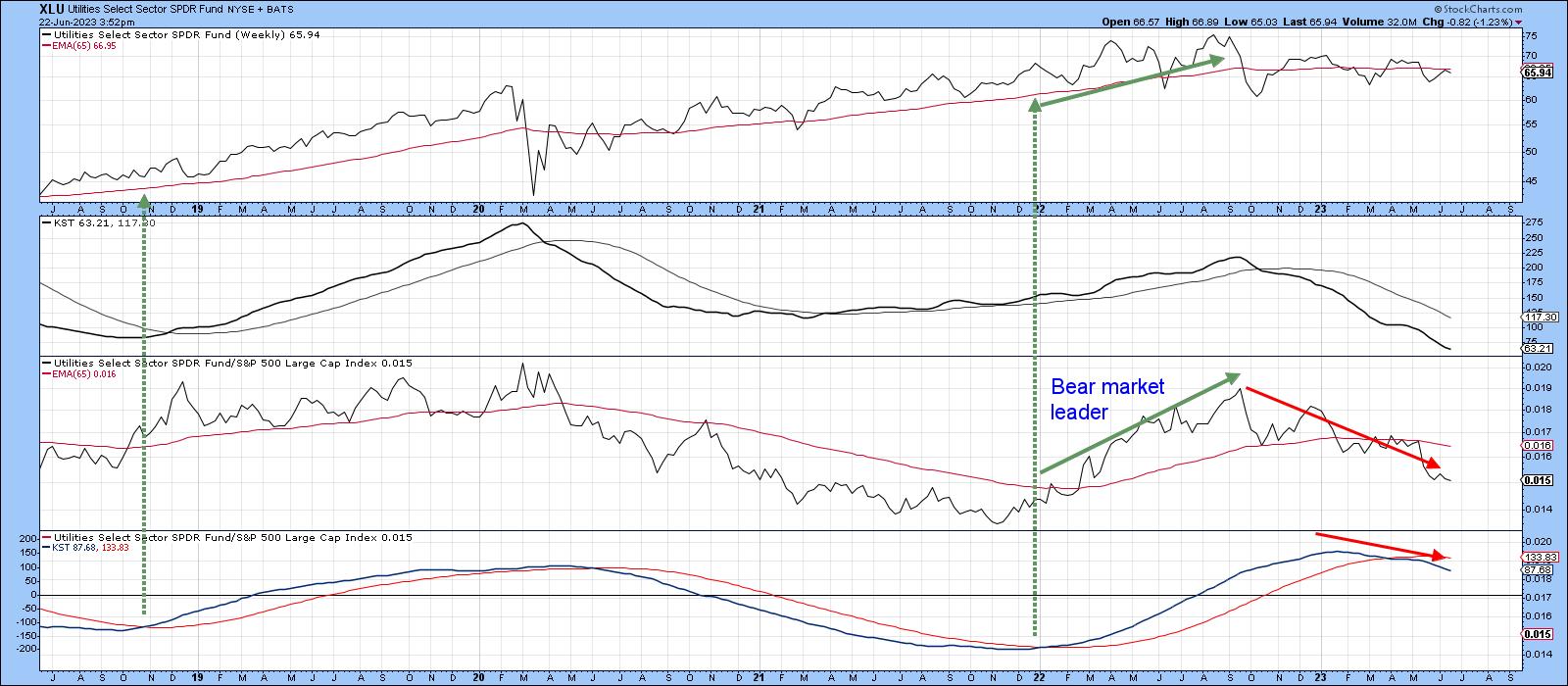

Is the Tech Rally Overdone?

by Martin Pring,

President, Pring Research

When the direction of the primary trend changes, it's usually because the business cycle is transitioning from a slowdown or recession to a recovery. That process usually results in a change in sector rotation, as defensive ones, such as utilities and consumer staples, come to the fore and...

READ MORE

MEMBERS ONLY

Wynn Resorts: Is Now a Good Time to Trade the Stock?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

When the stock market trends higher, it doesn't necessarily mean all stocks are moving higher. This is why it's necessary to have a method to filter through the day's market action and select stocks or securities to trade that have the potential for a...

READ MORE

MEMBERS ONLY

How to Increase Your Win Rate

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe shows how to build a case that can increase your odds of a winning trade. By using multiple timeframes and making sure a stock meets key criteria, you can improve your odds. Joe discusses an example and...

READ MORE

MEMBERS ONLY

Homebuilder Stocks are Soaring, But Is It a Good Time to Buy?

by Karl Montevirgen,

The StockCharts Insider

The May Housing Starts and Permits released this past Tuesday was quite eye-popping, despite riding the back of a disappointing market drop in the Dow, S&P, and Nasdaq.

How so? If you think about it, mortgage rates are averaging a painful 7%+. And still demand for homes rebounded,...

READ MORE

MEMBERS ONLY

Is Cannabis Finally Low Enough to Go High?

On Wednesday, we began to see a separation between what Chairman of the Fed Powell said on fighting inflation and the inflation indicators themselves.

Food commodities, particularly grains, soared. Weather is the dominant factor as we head into the summer season. Happy June equinox.

Oil rallied, and we hope you...

READ MORE

MEMBERS ONLY

The Wisdom of Jesse Livermore, Part 8

by Dave Landry,

Founder, Sentive Trading, LLC

In this week's edition of Trading Simplified, Dave shows his methodology in action with a "free rolling" big winner, a potential winner in the making, and a new mystery chart. He then continues his series on the wisdom of Jesse Livermore, examining the "big pull&...

READ MORE

MEMBERS ONLY

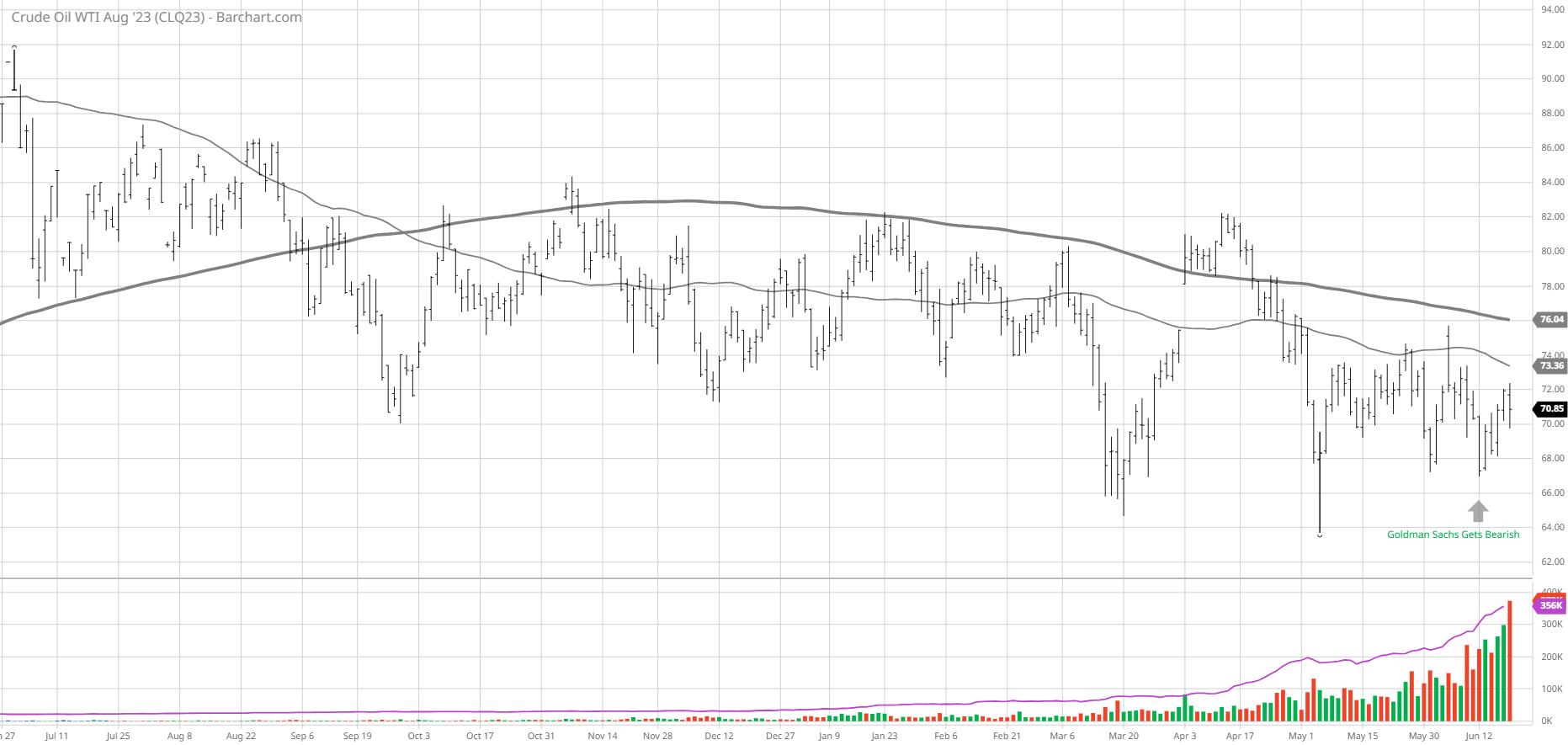

Bearish at the Bottom; Institutions Wrong on Oil

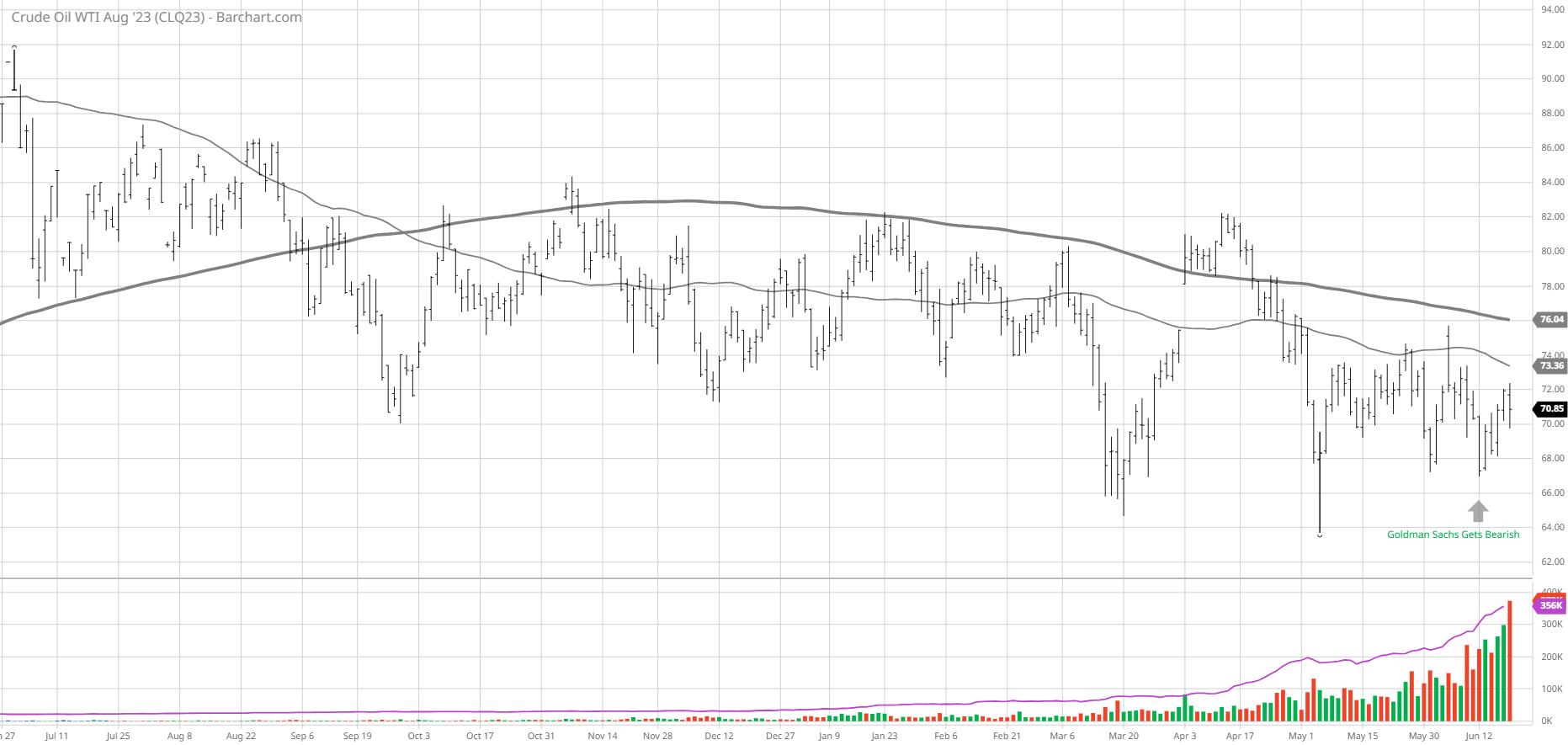

On June 12th, Goldman Sachs (GS) came out with this:

Goldman Sachs has slashed its forecast for oil prices by nearly 10%, citing weak demand in China and a glut of supply from sanctioned countries, including Russia.

What the big institutional analysts have done this year is get pretty much...

READ MORE

MEMBERS ONLY

Sector Spotlight: Bonds Surrender to Strong US Stock Market

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, I take a look at Asset Class rotations, highlighting the current strength of US stocks in comparison to Bonds. In the Sector Rotation segment, I address the differences between cap-weighted and equal-weighted sectors and find some interesting stocks inside the...

READ MORE

MEMBERS ONLY

Which Way Is The Dollar Heading? Watch This ONE Signal

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I've always been impressed by the strong correlation between the U.S. and German stock markets. Sometimes the strength in one of these markets can help to influence the direction of the other. Let me show you a long-term chart of the S&P 500 ($SPX) and...

READ MORE

MEMBERS ONLY

Economic Modern Family -- Let's Get Technical!

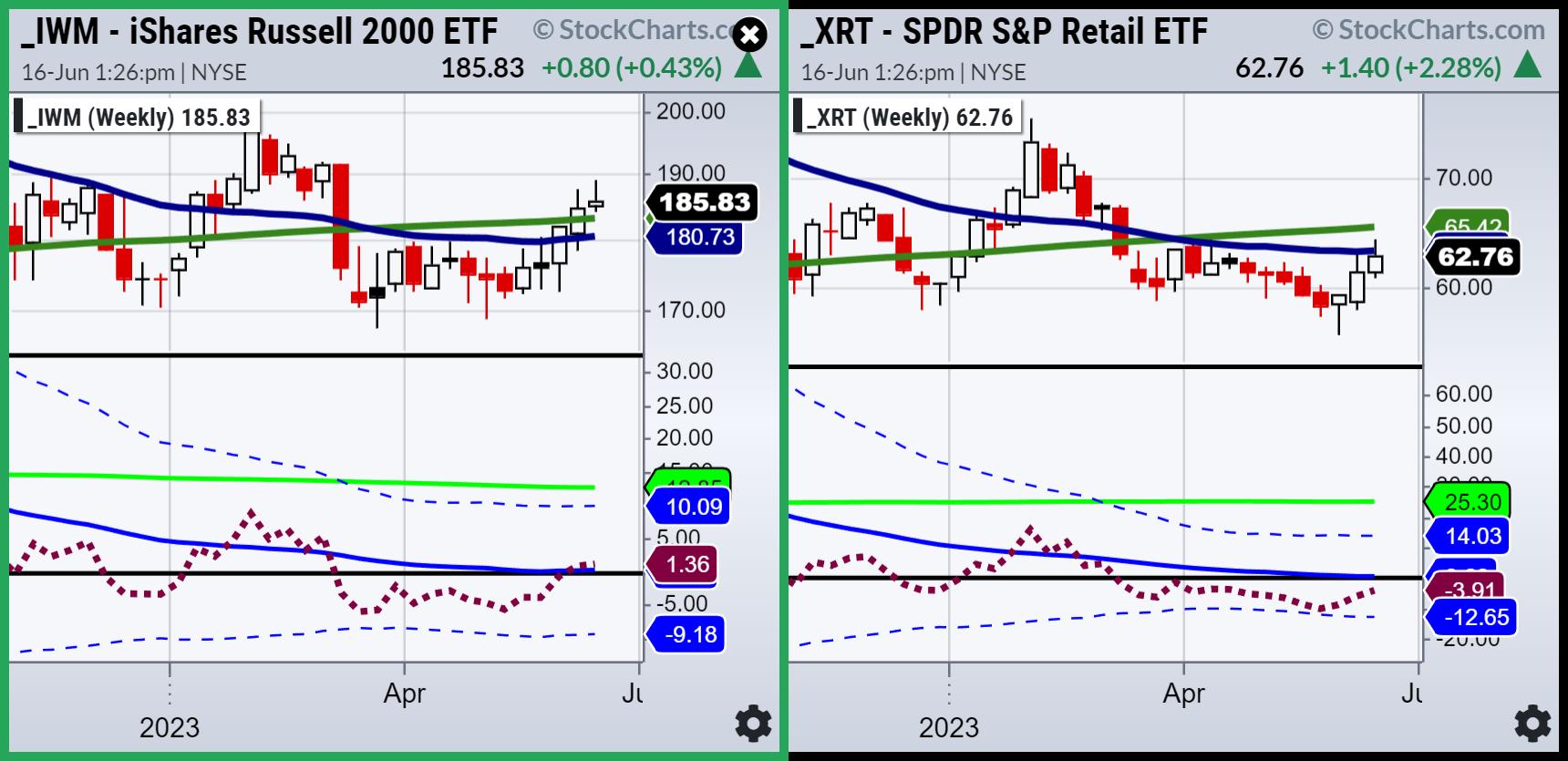

Focusing on the Economic Modern Family, the weekly charts will help us see who is doing what, why, and perhaps help us understand for how long.

Granddad and Grandma Russell and Retail are the matriarch and patriarch of the Family. IWM cleared the 50- and 200-week moving averages and is...

READ MORE

MEMBERS ONLY

One Year Anniversary Of A Very Bold Call

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Wow, things have changed. I looked at some charts that I had produced a year ago and looked at those same charts today. You'd never know it was the same stock market. Let's start with the S&P 500 and NASDAQ 100 (SPY and QQQ,...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Travels a Weak Rally; Stay Cautious of These Things

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In what can be called a fairly buoyant week of trade, NIFTY moved towards its previous high point and closed at its lifetime high. The financials, though, represented by BankNifty (Nifty Bank) relatively underperformed, as the BankNifty Index closed on a flat note. The trading range for the markets remained...

READ MORE

MEMBERS ONLY

Limited Leadership, but Still Plenty of Choice

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The weight of the evidence remains bullish for stocks, but this is not a bull market that lifts all boats. It is a relatively selective bull market led by technology, housing and a few other groups. This is not necessarily bad. It is, however, important to separate the leaders from...

READ MORE

MEMBERS ONLY

Three Charts Show Bear Case for Technology

by David Keller,

President and Chief Strategist, Sierra Alpha Research

As a trend follower, I'm bullish. I can't deny that the trend is positive on all three time frames using my Market Trend Model. So any bear case at this point has to be based on a market being so overextended that it is ripe for...

READ MORE

MEMBERS ONLY

MEM TV: An Exciting New Area Joins the Market's Uptrend

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the health of the broader market, while also highlighting breakout stocks among a new area and why they're trending higher. She also looks into the effects of the continued move into cyclical stocks.

This video...

READ MORE

MEMBERS ONLY

A Wild Ride in the Market

by TG Watkins,

Director of Stocks, Simpler Trading

On this week's edition of Moxie Indicator Minutes, TG explains how the market has been on a wild ride -- and it's not just 5 names anymore. While this means great things for the overall health of the market, its getting a little overdone at this...

READ MORE

MEMBERS ONLY

Is There Big Tech Trouble in FANG(sta's) Paradise?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

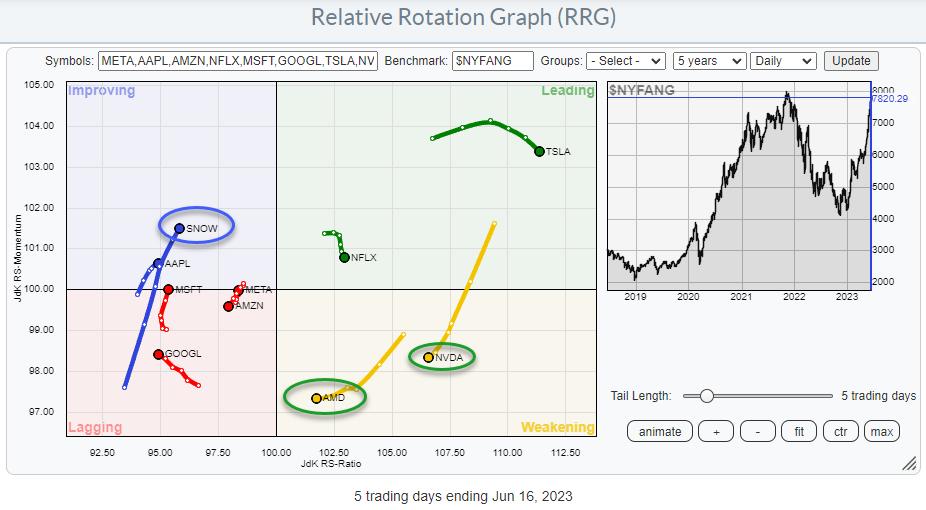

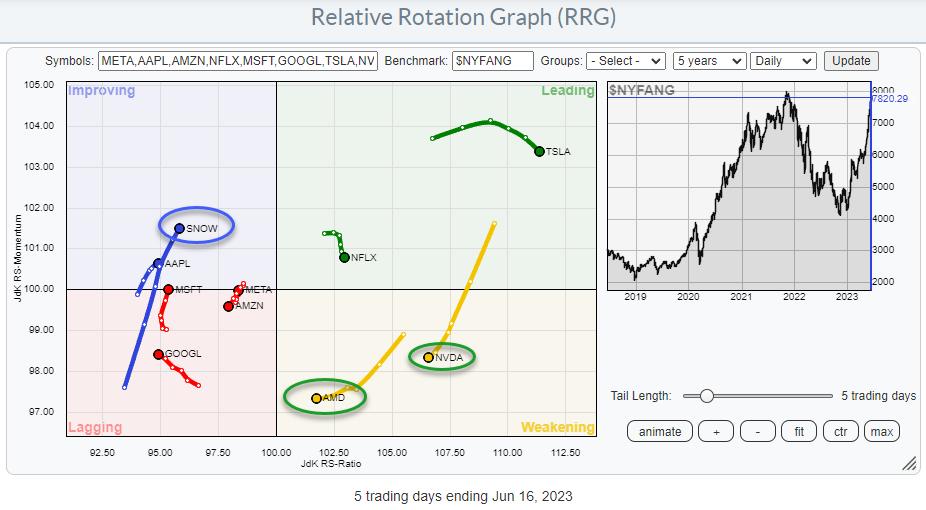

Near-Term Rotations

The Relative Rotation Graph above shows the stock rotation inside the NYFANG index.

Semiconductor stocks AMD and NVDA have been the leaders over the past weeks/months, but they are now rolling over into weakening and heading toward the lagging quadrant. TSLA and NFLX are still inside the...

READ MORE

MEMBERS ONLY

MARKET BREADTH CONTINUES TO IMPROVE--AIRLINES LEAD INDUSTRIAL SECTOR HIGHER

by John Murphy,

Chief Technical Analyst, StockCharts.com

MORE BROADENING OUT...Various measure of market breadth continue to improve. That includes the number of stocks moving back above their moving average lines. Chart 1 shows the Percent of S&P 500 stocks trading above their 200-day averages rising to the highest level in four months. As a...

READ MORE

MEMBERS ONLY

Major Indexes Have Reached Bull Market Participation Levels

by Carl Swenlin,

President and Founder, DecisionPoint.com

A Silver Cross is when a stock's 20-day EMA crosses above the 50-day EMA, and that event rates the stock to be bullish in the intermediate term. DecisionPoint's Silver Cross Index (SCI) expresses the percentage of stocks in the index that have a Silver Cross. We...

READ MORE

MEMBERS ONLY

How's the US Dollar Reacting to the Fed's Rate Hike Skip?

by Karl Montevirgen,

The StockCharts Insider

Maybe you were expecting the dollar to fall a bit more dramatically (and for gold to rise) when,after the FOMC meeting yesterday, the Federal Reserve announced that it was holding interest rates steady for the first time after 10 consecutive hikes. But the bearish response was a bit lackluster....

READ MORE

MEMBERS ONLY

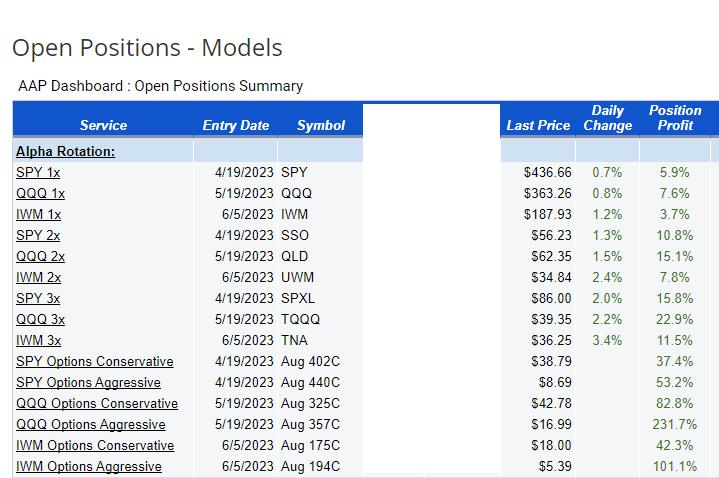

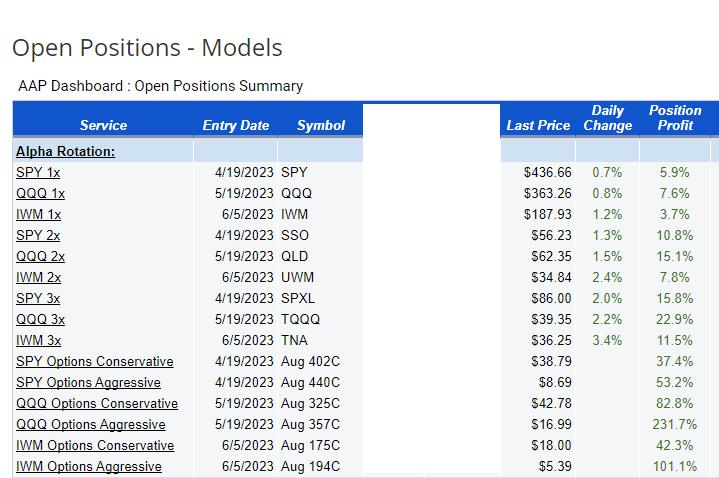

Speaking of AI -- A Look at Our Alpha Rotation

Those who read our Daily and follow us on the media know that we talk a lot about risk gauges. The big focus for me personally is the relationship between the S&P 500 and the long bonds. The other 2 I watch are the relationships between junk and...

READ MORE

MEMBERS ONLY

A Foray into Currency Pairs

Teaching an old dog new tricks means that the tricks might be new, but the notion of doing tricks is familiar.

Case in point-currencies and trading currency futures.

We have traded ETFs UUP and FXE (dollar and Euro) in the past.

And, I have been vocal through the years on...

READ MORE

MEMBERS ONLY

Fed's Rate Pause: Does It Really Change the Big Picture?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

With CPI data coming in as expected and a cooler PPI, it's clear that inflation is heading in the right direction, with the exception of a few areas such as housing. Overall, the data seal an interest rate pause from the Federal Reserve.

After 10 consecutive rate hikes,...

READ MORE

MEMBERS ONLY

Fed's Victory Lap and Next Steps for the Market

What we heard from the Fed and FOMC on Wednesday:

1. Unanimous

2. Holding rates allows FOMC to assess additional data

3. Tighter credit likely to weigh on activity

4. 2023 unemployment seen at 4.1% vs. 4.5%

5. Median rate forecasts rise to 5.6% end-`23, 4....

READ MORE

MEMBERS ONLY

Unlocking Strong AI Investments: You Need To Analyze These ETFs

by Karl Montevirgen,

The StockCharts Insider

Artificial intelligence (AI) stocks have become popular, almost fashionable. AI is a new frontier, an emerging technology offering unique opportunities and risks -- but is it a smart investment?

Why invest in AI?

AI has the capacity to revolutionize industries, drive economic growth, impact global challenges, and unlock scalable efficiency....

READ MORE

MEMBERS ONLY

Missed the AI Frenzy? Try This Promising Opportunity

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

If you missed the AI run, this could be an opportunity to jump into a related stock, which surprised when it showed up in the StockCharts Technical Ranking(SCTR) scan on June 13.

Intel Corp. (INTC) is a stock that could have some upside potential. Like most stocks in the...

READ MORE

MEMBERS ONLY

Sector Spotlight: Remarkably Strong Sector Rotation Out of Defense

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, I present an in-depth assessment of the current state of rotation in asset classes and sectors, and also share some background on where the split into three groups -- offensive, defensive, and sensitive -- is coming from. Spoiler alert: The...

READ MORE

MEMBERS ONLY

Cyclicals Continue To Help Broaden The Markets Out Beyond Tech

by Mary Ellen McGonagle,

President, MEM Investment Research

The S&P 500 Equal Weighted Index is continuing to advance higher led today by gains in Aluminum, Steel, Industrials and Consumer Cyclicals. This is great news for the possibility of a continuation rally as broader participation beyond mega-cap FAANMG and select Technology names will help keep the current...

READ MORE