MEMBERS ONLY

Sector Spotlight: Sensitive Sectors Showing Strength

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

After looking at the Sector Rotation Model, Seasonality, and Monthly charts in recent episodes, it is time for an assessment of current market rotation again. In this week's edition of StockCharts TV's Sector Spotlight, I take a look at the rotations for asset classes on weekly...

READ MORE

MEMBERS ONLY

Alphabet Stock (GOOGL) Is Gaining Momentum: Will It Soar or Sink?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Running scans as part of your daily trading routine can reveal surprising trading candidates. Alphabet, Inc. stock is well-loved among investors and a massive component of the S&P 500 index. But GOOGL has struggled. Will it break through a critical resistance level?

After running a scan identifying large-cap...

READ MORE

MEMBERS ONLY

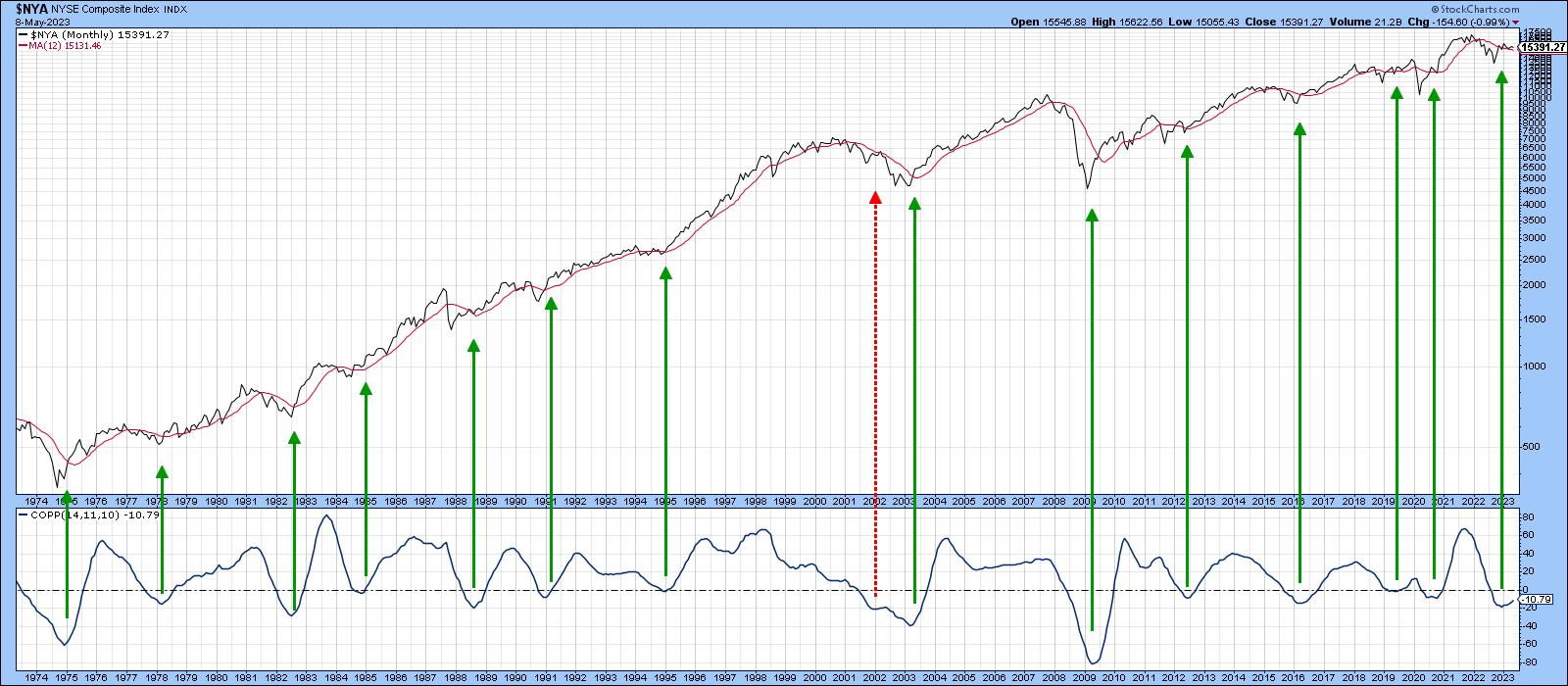

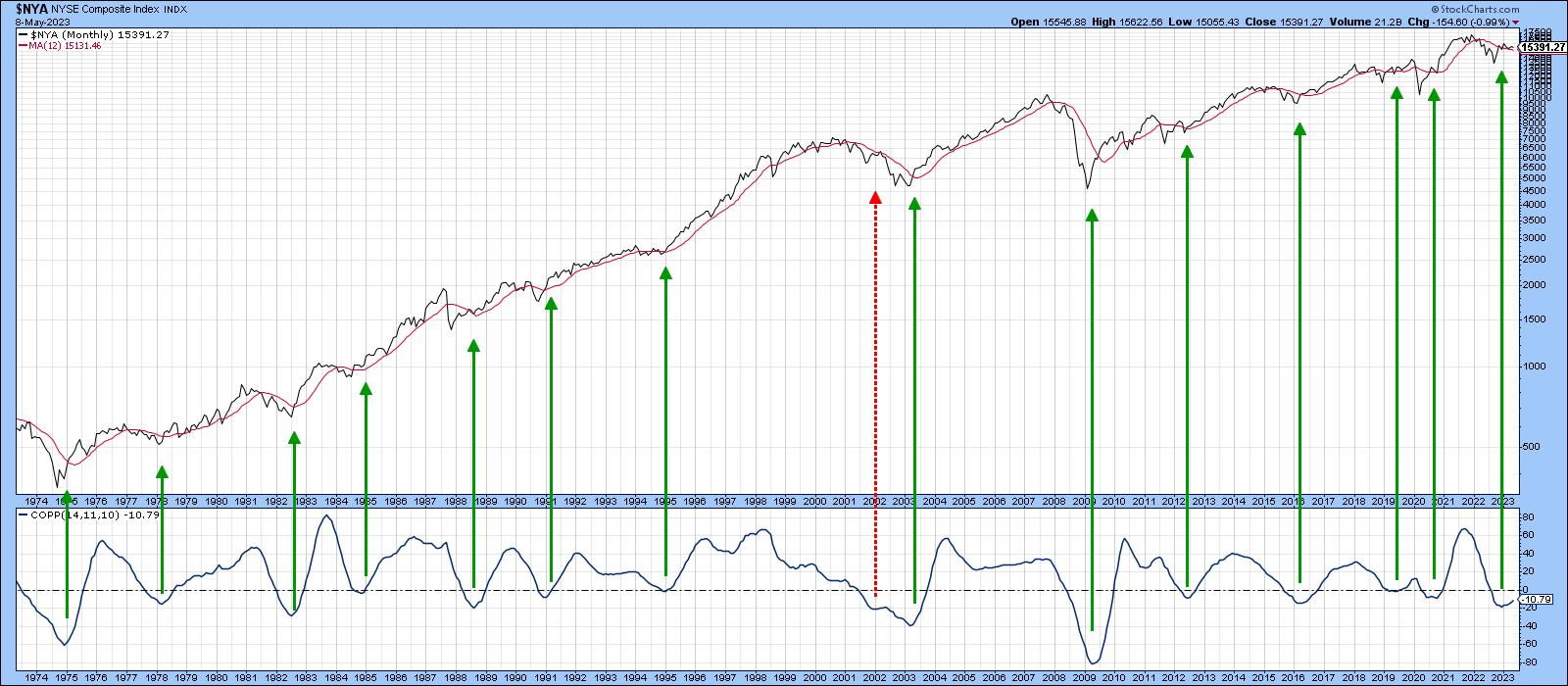

Could We See a Buy Signal for Stocks and Bonds Similar to 1982?

by Martin Pring,

President, Pring Research

The other day, I was looking at the charts of stocks, bonds, and gold and remembered that the lows of 1982 were preceded by a similar setup to what we see today. History rarely repeats exactly, and there are many differences between now and then. Still, I think it'...

READ MORE

MEMBERS ONLY

Small-Caps Feel the Pinch "Under the Hood"

by Erin Swenlin,

Vice President, DecisionPoint.com

We've noticed that depending on what index you're in, price is holding up or not. The SP500 (SPY) (pink solid line) tested February highs, but the SP600 has been angling lower. Today we saw disparity again as the SPY was up slightly while SP600 (IJR) was...

READ MORE

MEMBERS ONLY

DP Trading Room: Beware These Groups of Stocks

by Carl Swenlin,

President and Founder, DecisionPoint.com

by Erin Swenlin,

Vice President, DecisionPoint.com

In this week's edition of The DecisionPoint Trading Room, Carl opens by discussing two groups of stocks that you should avoid in the near future. He gives his take on the overall market, Gold, Bonds and more. Erin takes a look "under the hood" of the...

READ MORE

MEMBERS ONLY

Daily Briefing Notes for the Market

I am back from 2 weeks of whirlwind travel and presenting at both the Money Show in Las Vegas and Charting Forward at StockCharts.com. I thank Geoff Bysshe, the President of MarketGauge.com for filling in for me.

After the market has absorbed bank crises, debt ceiling talk, the...

READ MORE

MEMBERS ONLY

The Halftime Show: Money Flow Bullish Buys

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

In this week's edition of StockCharts TV'sHalftime, Pete takes a look at the number of stocks have turned bullish versus the number of stocks that have turned bearish. Pete wants to see what's happening under the surface of the markets, keeping an eye out...

READ MORE

MEMBERS ONLY

Hot Gold Drops & Shaky Semis Pop

by Geoff Bysshe,

Co-founder and President, MarketGuage.com

Today, I've got a handful of bullish stock charts for your ChartLists next week, the importance of which begins with the above table. You can find this Sector Summary table updated daily at www.marketgauge.com/sectors.

If you were watching the market last week, it probably didn&...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Drags Resistance Levels Lower; Adopt a Defensive Approach

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous week's technical note, we discussed the persistently low levels of INDIAVIX, the volatility gauge, and how it can leave the markets vulnerable to profit-taking bouts. The week that went by saw the first cracks appearing in the frontline indexes, which may have put an intermediate...

READ MORE

MEMBERS ONLY

MEM TV: Strong Earnings Push Deeply Oversold Stocks Higher

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the broader markets to determine where we may be headed over the near term. She also explores the bottom fishing taking place among former leaders that have sold off sharply but are now reporting strong earnings.

This...

READ MORE

MEMBERS ONLY

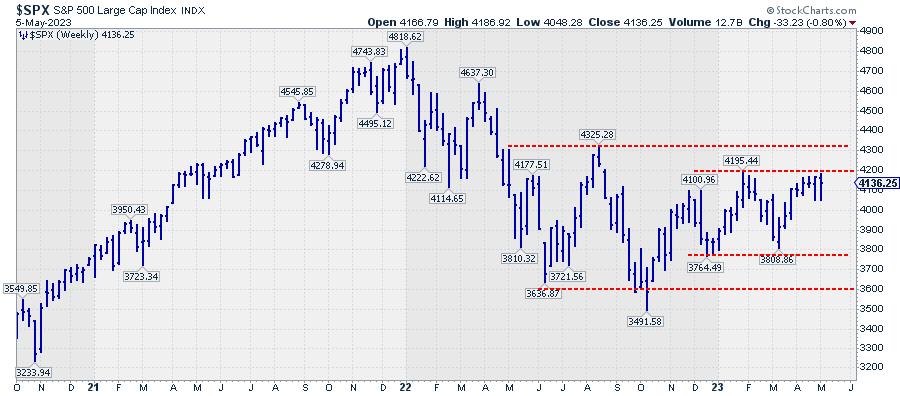

Market Holds Up Well as Money Rotates Out of Offensive Sectors

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

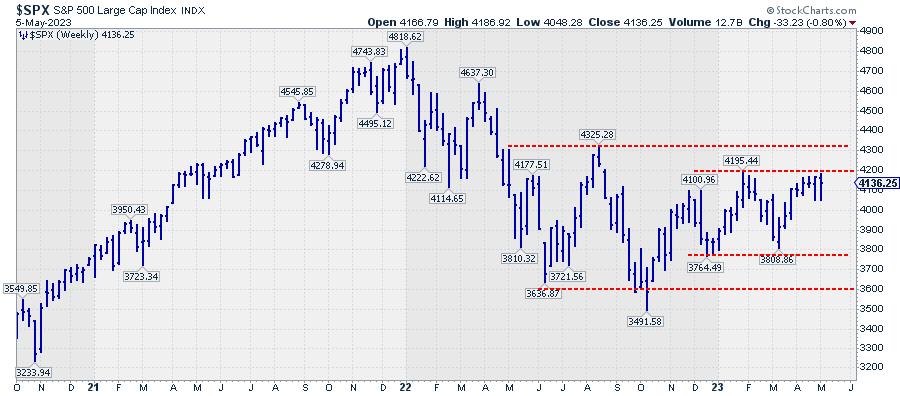

While the S&P 500 struggles to push beyond its overhead resistance in the area around 4200, money is rotating out of offensive sectors into defensive AND sensitive.

On the weekly chart, two trading ranges are starting to emerge. The first one is the more narrow one, between roughly...

READ MORE

MEMBERS ONLY

Quit Trading Without This! Track Entries & Stops on the Chart

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson reaches back into his bag of StockCharts tips and tricks to show you how to track entry points, stop levels and price targets directly on your charts. These simple yet powerful tools will greatly enhance your...

READ MORE

MEMBERS ONLY

FALLING BOND YIELDS HAVE BEEN GOOD FOR THE NASDAQ AND GOLD -- BUT BAD FOR CRUDE OIL

by John Murphy,

Chief Technical Analyst, StockCharts.com

BONDS YIELDS VS. THE NASDAQ...The direction of bond yields has had an impact on various intermarket relationships. One of the them is the Nasdaq market. The main point of Chart 1 is to show that falling bond yields have been good for the Nasdaq market so far this year....

READ MORE

MEMBERS ONLY

Is This a Turning Point?

by TG Watkins,

Director of Stocks, Simpler Trading

On this week's edition of Moxie Indicator Minutes, TG takes you inside the Moxie Indicator trading room to show you how he's been navigating this week of large up and down moves. It has been a fun and interesting several days as the market twists itself...

READ MORE

MEMBERS ONLY

The Next Leading Indicator

Today's daily features two videos that Mish recorded in the studio at StockCharts.com HQ!

The first video is Mish's appearance on today's episode of Your Daily Five.In this video, Mish explains why Grandma Retail (XRT) may become our new leading indicator. In...

READ MORE

MEMBERS ONLY

GNG TV: Dangerous Environment for Passive Investment

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

The rangebound nature of equity indices is a dangerous environment for passive investment vehicles and closet indexers. In this edition of the GoNoGo Charts show, using a top-down approach to their analysis, Alex and Tyler show there are leaders and laggards in each and every sector group, including Financials (XLF)...

READ MORE

MEMBERS ONLY

Broken Pattern vs. Shakeout

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe explains the difference between a broken pattern vs a shakeout. Shakeouts are a good opportunity to buy after "weak" holders have been shaken out of the pattern. Joe shows how to monitor the price structure...

READ MORE

MEMBERS ONLY

Another Market Collapsing

by Geoff Bysshe,

Co-founder and President, MarketGuage.com

The real reaction to today's Fed meeting is likely to happen tomorrow.

All eyes and ears were on Chairman Powell today. Most notable was how he and the markets were clearly uncomfortable with the press conference, but it was not until it was finished that the markets all...

READ MORE

MEMBERS ONLY

The Wisdom of Jesse Livermore, Part 3

by Dave Landry,

Founder, Sentive Trading, LLC

In this week's edition of Trading Simplified, Dave continues his series on "The Wisdom of Jesse Livermore", starting by discussing the fact that one of Livermore's blow-ups stemmed from not realizing how the game had changed. Dave also covered many other lessons such as...

READ MORE

MEMBERS ONLY

No Signs of an Interest Rate Pause: Stocks Down, Gold Up

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Today was Fed Decision Day, and investors were disappointed. No definite pause in interest rate hikes, but maybe just a little hint.

As expected, the Fed raised interest rates by 25 basis points. This brings interest rates to the 5.0%-to-5.25% range. The last time rates were this...

READ MORE

MEMBERS ONLY

Breakaway Gaps: Scanning for High-Probability Trading Opportunities

by Karl Montevirgen,

The StockCharts Insider

Scanning the market for a tradable "event" might get you an express ticket to the "fast money" line of opportunity and risk. Bear in mind that an "event" is something that has already happened. Jumping on the opportunity means you'll be a...

READ MORE

MEMBERS ONLY

Empowering Your Trading Journey: Handpicked Trading Books Every Trader Should Read

by Karl Montevirgen,

The StockCharts Insider

As a closing gesture to the end of April, which, as you know, was Financial Literacy Month, we're featuring a few trading books handpicked by some of the most respected traders and technical analysts in the field. These books had a strong impact on the people recommending them,...

READ MORE

MEMBERS ONLY

Europe and Japan to the Rescue?

by Martin Pring,

President, Pring Research

Most of the time, when looking at equity markets outside of the US, I focus on the various country ETFs, which are denominated in dollars rather than local currencies. In some ways, this limits my perspective, since currency fluctuations can change some of the outcomes--especially in countries experiencing a high...

READ MORE

MEMBERS ONLY

Will the Fed Make Gold Shine?

by Geoff Bysshe,

Co-founder and President, MarketGuage.com

Stocks began the day weak—weaker than most traders probably realized. As you can see in the intra-day chart below, short-term momentum, as measured by Real Motion, had rolled on Monday. As a result, when the SPDR S&P 500 ETF (SPY) broke its 30-minute Opening Range low (as...

READ MORE

MEMBERS ONLY

Brace Yourself: The Debt Ceiling is Now on the Horizon

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

The stock market has had quite a week. First, there was JP Morgan Chase (JPM)'s takeover of First Republic Bank (FRC). Then came the warning from Janet Yellen that the US may hit its debt ceiling as early as June 1. That's a lot to digest,...

READ MORE

MEMBERS ONLY

Sector Spotlight: Strong Seasonal Sector Rotation

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

This a packed episode of StockCharts TV's Sector Spotlight; as you'll notice from the different setup, Julius recorded IN the studio at the StockCharts.com headquarters! With the show on hiatus last and this week being the first Tuesday of the month, Julius covers both the...

READ MORE

MEMBERS ONLY

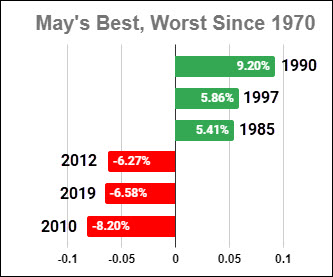

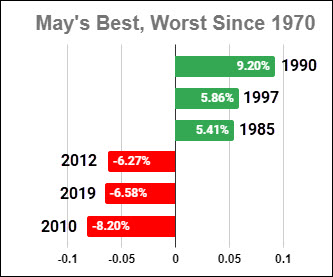

When to Buy in May

by Geoff Bysshe,

Co-founder and President, MarketGuage.com

The common refrain, "Sell in May..." gives this month a bad rap, but it doesn't deserve it.

May is historically one of the least volatile months of the year, as measured by its closing average return in the S&P 500 index. Since 1970, its...

READ MORE

MEMBERS ONLY

The Halftime Show: Stocks Turning Bullish This Week

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

In this week's edition of StockCharts TV'sHalftime, Pete takes a look at the Bullish Percent Indexes, New York Composite, the Nasdaq and the S&P. He then examines large-cap stocks that have turned bullish this week, including one name that has been under the radar...

READ MORE

MEMBERS ONLY

DP Trading Room: Market Holds Its Breath

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

As the upcoming Fed rate announcement nears, investors are holding their breath; on this week's edition of The DecisionPoint Trading Room, Carl talks about what that likely means for the market short-term. He covers the top ten mega-cap stocks, and both he and Erin discuss Banks and the...

READ MORE

MEMBERS ONLY

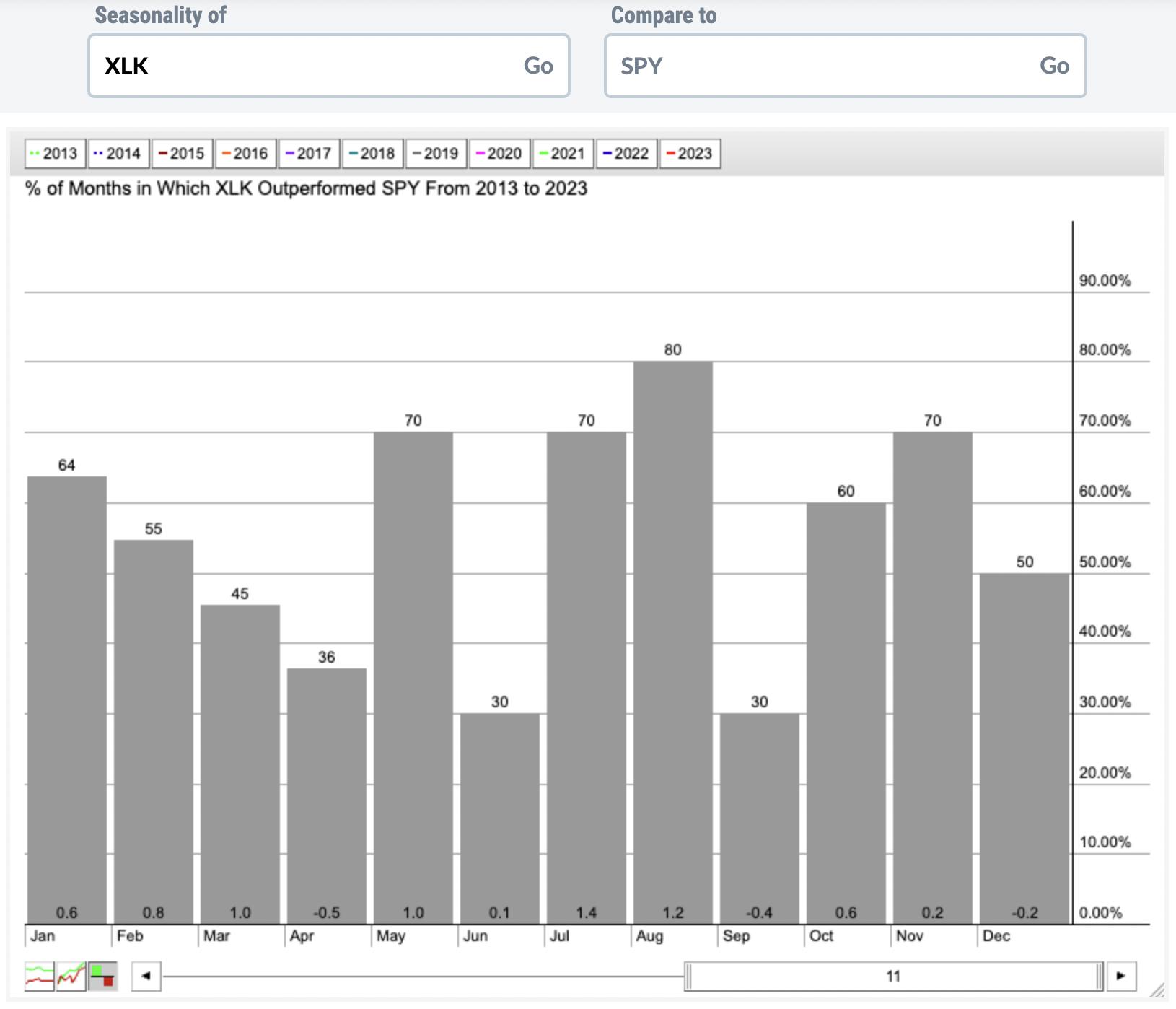

May Begins A Very Strong Period For Growth Stocks

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

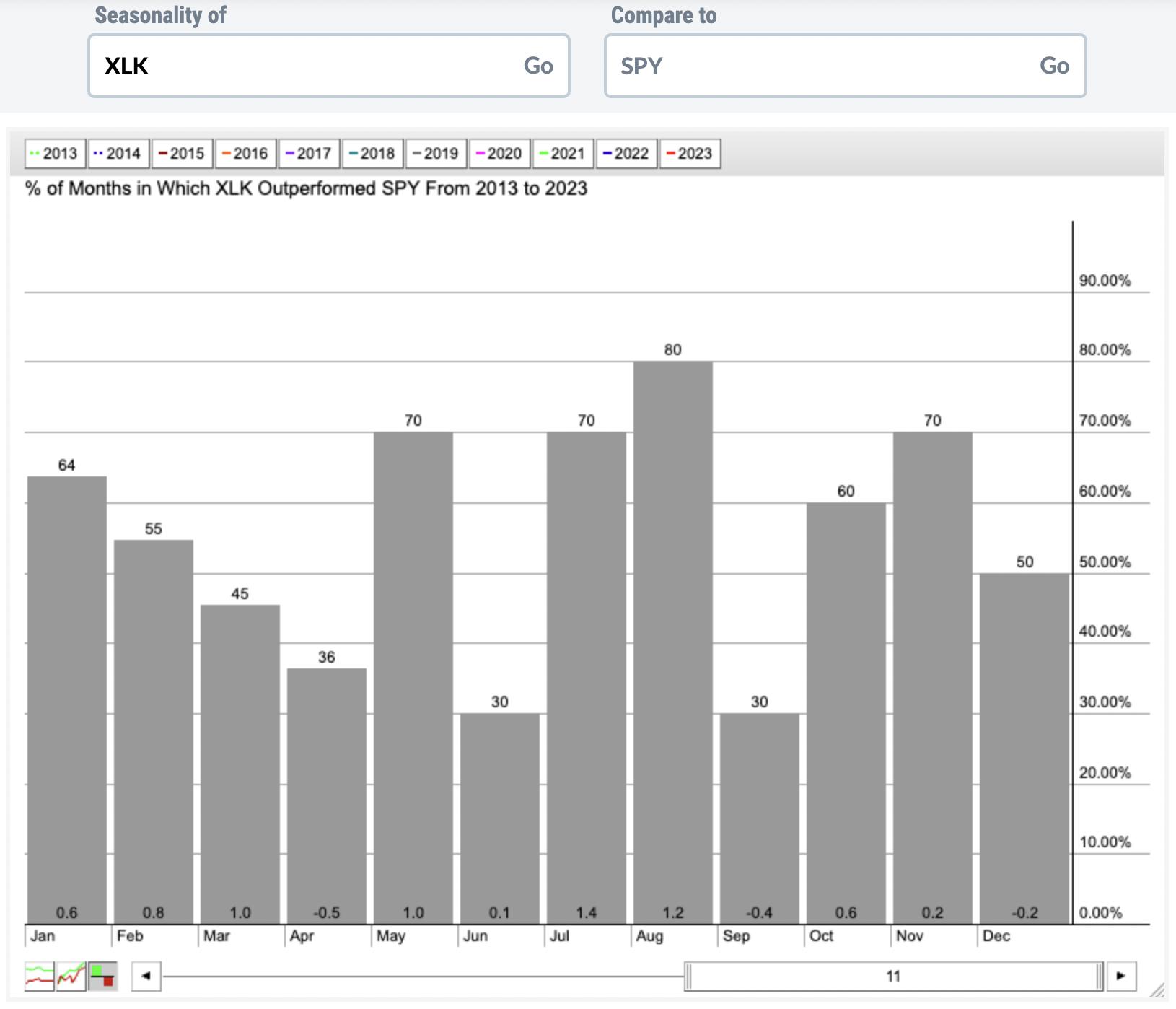

Growth-oriented stocks tend to have their best relative showing vs. value-oriented stocks beginning in May and running through August. Check out the relative seasonal performance of the XLK (vs. the SPY) over the next four months:

If you add the bottom numbers of each calendar month (represents average monthly outperformance...

READ MORE

MEMBERS ONLY

Setups That I Like Right Now

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I remain quite bullish the overall market. I call what I see and what I saw in 2022 were stock market participants that turned incredibly bearish. I said at the beginning of 2022 that we needed a bear market brutal enough to send the masses to the sidelines and never...

READ MORE

MEMBERS ONLY

Week Ahead: NIFTY Faces Imminent Consolidation; VIX Plunges to 2020 Low

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

After taking a short breather last week, the markets resumed their up-move and went on to post a decent gain over the past five sessions. In the previous technical notes, concerns were raised about the persistently declining value of VIX and the consequent vulnerability that it lends to the markets....

READ MORE

MEMBERS ONLY

Bank Fear Selloff Gives Way To Earnings Driven Rally - Was Last Week's Shakeout A Positive Signal?

by Mary Ellen McGonagle,

President, MEM Investment Research

The markets began last week with a sharp pullback that pushed the broader Indices toward key support, with many individual stocks breaking below support. The drop occurred amid renewed banking fears after Tuesday, when San Francisco-based First Republic Bank (FRC) reported a slump of more than $100 billion in deposits...

READ MORE

MEMBERS ONLY

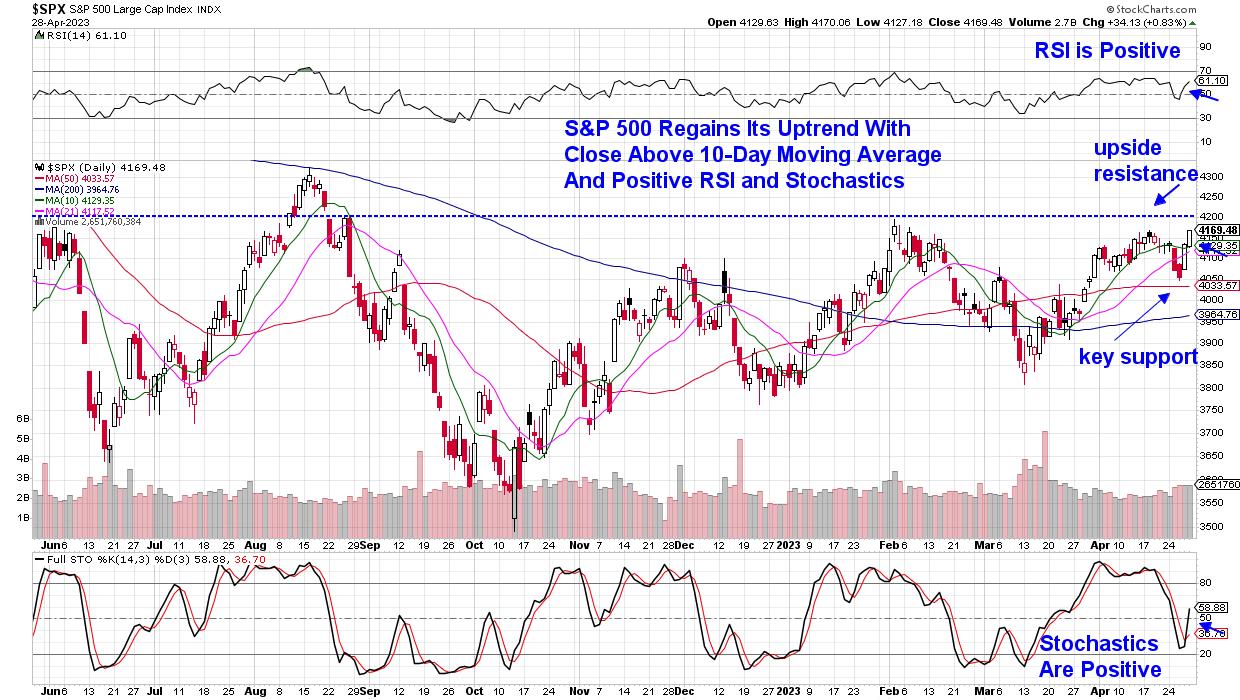

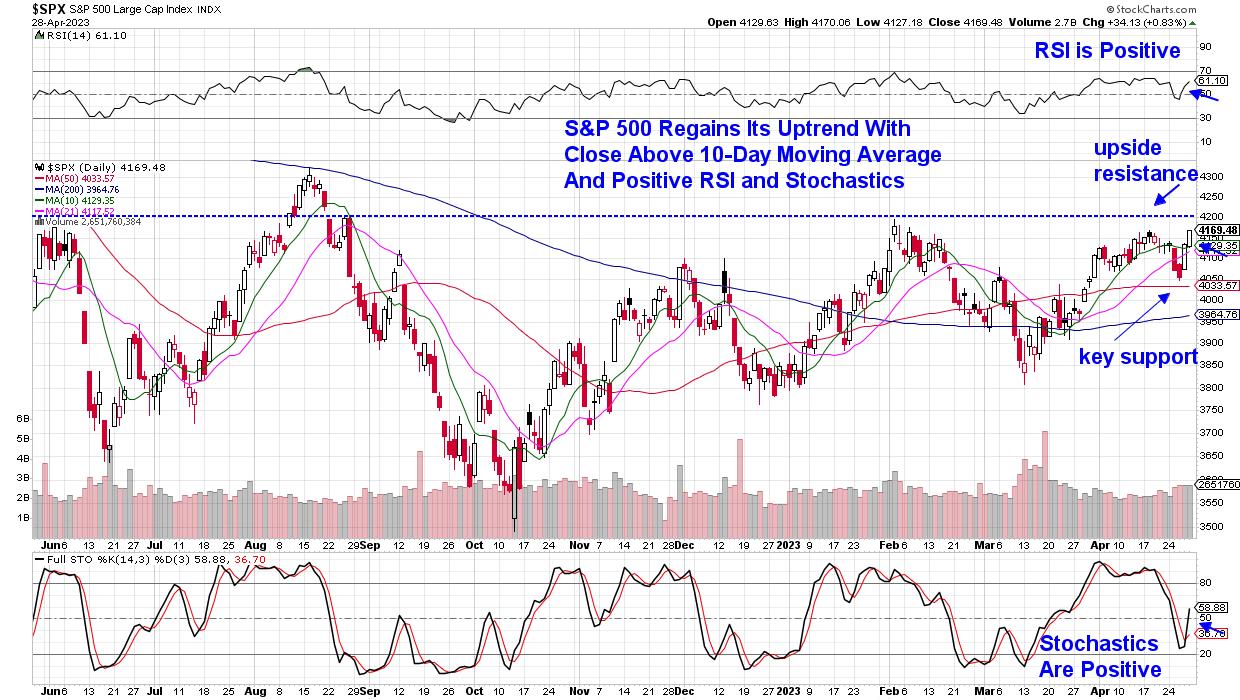

MEM TV: S&P 500 Regains its Uptrend

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the short-, intermediate-, and long term outlook for the S&P 500 after last week's bullish late-week price action. She also examined the Dow's out-performance this month and which stocks are poised...

READ MORE

MEMBERS ONLY

Broad-Based Rally Continues: Will It Soar Past Resistance This Time?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

A slowdown can sometimes be a good thing. That was the general thinking behind the market when the much-awaited GDP report was released on Thursday. The data showed that the US economy grew less than analysts expected; the overall economy grew 1.1% in the first quarter of 2023, which...

READ MORE

MEMBERS ONLY

Now That "Stagflation" Has Gone Mainstream

Below is just one of several headlines about stagflation we have seen this week.

From April 27, 2023, TheStreet.com:

"Stagflation Risks In Focus As U.S. Economy Slows, But Inflation Stays High"

"The coveted soft landingis looking increasingly difficult to achieve and we are now getting...

READ MORE

MEMBERS ONLY

Six-Month Period of UNfavorable Seasonality Begins Next Week

by Carl Swenlin,

President and Founder, DecisionPoint.com

An interesting Seasonality Timing System was developed by Yale Hirsh of the Stock Trader's Almanac. It was based upon the observation that stock market seasonality is broken into two six-month periods. The favorable period begins on November 1 and ends on April 30. The unfavorable period begins on...

READ MORE

MEMBERS ONLY

Dancing with the Market

by TG Watkins,

Director of Stocks, Simpler Trading

On this week's edition of Moxie Indicator Minutes, TG takes you inside the Moxie Indicator trading room to show you how he's been navigating this week of large up and down moves. It has been a fun and interesting several days as the market twists itself...

READ MORE

MEMBERS ONLY

TRANSPORTATION STOCKS LAG BEHIND INDUSTRIALS

by John Murphy,

Chief Technical Analyst, StockCharts.com

MARKET ENDS WEEK ON A STRONG NOTE... Stocks gained more ground this past week with major indexes moving closer to overhead resistance levels. The market is being led higher by communication and technology stocks. As a result, the Nasdaq 100 touched a new high for the year and is leading...

READ MORE

MEMBERS ONLY

What Can We Expect from Stagflation?

The PCE rises (although far from the 8% peak). The GDP falls (is contraction of the economy over?). Meanwhile, stagflation persists along with the trading ranges in indices and many sectors. Plus, the theory we have been expounding on (a 2-year business cycle within a longer 6–8-year business cycle)...

READ MORE