MEMBERS ONLY

MEM TV: Markets Stuck Amid Fed Comments

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen shares the key drivers of current price action, as well as what to be on the lookout for next week. She also shares the primary areas of support and resistance for the key market Indexes. The S&...

READ MORE

MEMBERS ONLY

The Bullish Case for Gold

by David Keller,

President and Chief Strategist, Sierra Alpha Research

People absolutely love to not love gold. When I post bullish gold comments on social media, I am guaranteed to get some not-so-constructive pushback on an optimistic thesis.

Why do people love to hate the gold trade? Well, for starters, it hasn't worked in a long time. But...

READ MORE

MEMBERS ONLY

How to Improve Your Trading by Limiting Your Options

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson shows you how to optimize your investable universe, shrinking down the list of trading targets or investing candidates to a more manageable group that you can filter against. He'll show you to build your...

READ MORE

MEMBERS ONLY

It's Hard to Fight This Current

by Carl Swenlin,

President and Founder, DecisionPoint.com

The market is currently topping because the Silver Cross Index (SCI), which expresses intermediate-term participation, is overbought and topping. A Silver Cross is when the 20-EMA of a price index crosses up through the 50-EMA. The Silver Cross Index shows the percentage of stocks in a market or sector index...

READ MORE

MEMBERS ONLY

Larger Pullback Could Be Forming

by TG Watkins,

Director of Stocks, Simpler Trading

We got the little pullback to SPY D21 correct last week, which left us wondering if it was going to be major support, or just minor support before the bigger pullback. In this week's edition of Moxie Indicator Minutes, TG will show you what signs he sees that...

READ MORE

MEMBERS ONLY

Year of the Big Swing and Month of the Small Flag

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 SPDR (SPY) is a period of big swings and above average volatility. There were six swings of at least 10% from late January to early February 2023. Looking at other 12-14 month periods, this is the fourth most in the last 23 years. There were...

READ MORE

MEMBERS ONLY

INTEREST RATES RISE ON INFLATION REPORTS -- STOCKS PULLBACK -- ENERGY HAS A BAD WEEK

by John Murphy,

Chief Technical Analyst, StockCharts.com

TEN-YEAR YIELD TESTS 3.90%... Bond yields climbed this week on two reports showing that inflation gained during January. Chart 1 shows the 10-Year Treasury yield testing some resistance at 3.90% formed at the end of December. A close above that level would put the TNX at the highest...

READ MORE

MEMBERS ONLY

Roblox Bounces Back: Is It Worth Buying?

by Karl Montevirgen,

The StockCharts Insider

Roblox (RBLX) may still be considered by some on Wall Street as a relative "noob," but the company's plans and ambitions are catching the attention of investors as its most recent Q4 22 earnings and guidance laid out a much clearer picture of its perceived arena....

READ MORE

MEMBERS ONLY

GNG TV: Finding Outperformance in Choppy Markets

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

Starting from the top asset class level, GoNoGo Charts help investors understand intermarket. Both $TNX and $USD are gaining strength on a daily basis from amber bars of neutral uncertainty to Go trend conditions. The recent rise in rates and the dollar index have a subtle, but observable, negative impact...

READ MORE

MEMBERS ONLY

Why This MA is So Powerful

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe shows how he uses a single MA to help do trend analysis in each timeframe. He explains price structure, then uses the MA to define the correct trendline when we are looking for a change of trend....

READ MORE

MEMBERS ONLY

Four Charts To Keep Inflation at Bay

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

The US consumer price index (CPI) came in slightly higher than expected; the market's been pretty chill about it so far. But will that change?

Inflation may be eating into your bank account, but you can stop it from taking a chunk out of your portfolio returns. Since...

READ MORE

MEMBERS ONLY

Boeing: Taking Flight Amid Cloudy Conditions

by Karl Montevirgen,

The StockCharts Insider

When traders and investors brave the heights of speculative endeavor, clear conditions, fundamentally and technically, are the most you could ask for. But there are cases where fundamentals remain foggy and technical chart patterns seem almost hidden or questionable. This is certainly the case with Boeing (BA), as it took...

READ MORE

MEMBERS ONLY

Is the Whole Country Buying Teslas and Eating at Wingstop?

Wednesday morning brought some love to the US economy. The January retail sales rose 3% month/month vs. +2% estimated.

The breakdown fascinates.

With food inflation where it is, and egg prices the big headline, the leader for today's number is FOOD, particularly eating out. At the bottom...

READ MORE

MEMBERS ONLY

It's Not About the Crypto, Part 2

by Dave Landry,

Founder, Sentive Trading, LLC

In this week's edition of Trading Simplified, Dave continues to show his methodology in action by revealing an old mystery chart and adding a new one. He answers crypto questions on the 2/30EMA System and volume. Then, continuing his discussion on Crypto, he explains that it'...

READ MORE

MEMBERS ONLY

Trying to Unravel the Enigma of the US Dollar

by Martin Pring,

President, Pring Research

The US Dollar Index ($USD) has taken a hit in the last few months, causing many commentators to cry "bear market." However, an examination of the long-term indicators doesn't indicate a consensus pointing in a southerly direction. Neither is there unanimity that the recent setback represents...

READ MORE

MEMBERS ONLY

CPI Excludes Food: Have You Seen the ETF DBA?

Maybe it's just Valentine's Day, so the food and commodities market sees a push to chocolates, flowers, and fine dining.

And maybe not.

The consumer price index (CPI) came out with an unexpected rise... but goods remained softer. Services, on the other hand, rose. However, the...

READ MORE

MEMBERS ONLY

Sector Spotlight: Some Valentine Love for the Tech Sector

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, for this first week of February, I address high level asset-class rotation, then step into sectors. From the sector level, I use Relative Rotation Graphs, in combination with the scan engine, to drill down into industries and individual stocks.

This...

READ MORE

MEMBERS ONLY

DP Trading Room: New Calculation for CPI Could Change Market Direction

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Carl opens with a discussion of a change that is occurring in the calculation of the CPI from here on out and how it could affect the market's direction tomorrow. Carl gives his opinion on the market...

READ MORE

MEMBERS ONLY

Economic Modern Family: More to Prove to Traders

All in all, the key sectors (retail, transportation) have more to prove, especially by clearing the 23-month moving average or 2-year business cycle. This is a significant level, as these sectors proved recession was held off when they both held the 80-month moving average or their 6-7 year business cycle...

READ MORE

MEMBERS ONLY

The Halftime Show: S&P 500 Testing Its Resolve

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

As Pete watches the weekly S&P 500 rallies, he notices they've been stalling and somewhat back-filling. The S&P has been moving up, but is definitely testing its resolve around the 4100 level that everyone has been calling out. In this week's edition...

READ MORE

MEMBERS ONLY

The Big Wall Street Firms Use Manipulation Strategies To Fatten Their Wallets

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

I have been preaching Wall Street manipulation for years. And Wall Street took manipulation to a completely new level in 2022, accumulating shares of panicked retail traders after the distribution period from January through May 2022 ended. Sure, we had two more price lows - one the very next month...

READ MORE

MEMBERS ONLY

This Is Why You Shouldn't Have Bought Disney (DIS) After Earnings

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Monthly options expiration creates a whole new set of headaches for retail traders. As if trading wasn't already hard enough, throw in the short-term financial incentive for market makers to "manipulate" prices and cash in big time at options expiration, and you have a recipe for...

READ MORE

MEMBERS ONLY

Pullbacks within Uptrends Create Opportunities

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks went on a tear from late December to early February with the SPDR S&P 500 ETF (SPY) advancing some 11% from low to high. SPY then pulled back last week with a 2.5% decline from the February 2 high to the 10-February 10 low. A pullback...

READ MORE

MEMBERS ONLY

MEM TV: Clouds Descending Over the Market?

by Mary Ellen McGonagle,

President, MEM Investment Research

After a dicey week, are the clouds descending again? In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen covers some critical areas of support and resistance in the broader markets, before moving on to where the strength took shape and what drove the weakness this week.

This...

READ MORE

MEMBERS ONLY

The Ultimate Relative Strength Chart Shows True Market Leaders

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson shows you how to build what he calls the "Ultimate Relative Strength" chart template, inspired by the multi-level Sector Summary structure that we covered last week. You'll learn how to take the...

READ MORE

MEMBERS ONLY

This is Your Most Important Decision

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

I talk about it almost every week in Sector Spotlight, but I just realized that I have not written about it for quite a while.

The investment decision that has the most significant impact on your results...

Asset Allocation.

Many, especially retail investors, are so focused on the stock market...

READ MORE

MEMBERS ONLY

SOTU's Not-so-Subtle Implications for the Market

This is not meant to be political. As we have written many times, politics and investing should not be in the same sentence.

With that said, during this past week's State of the Union Address, we were keenly listening for comments on our macro themes (as reported in...

READ MORE

MEMBERS ONLY

Three Concerning Signs for Stocks

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I've recognized the strength displayed by the S&P 500 and Nasdaq Composite off the October lows. I've written about the New Dow Theory buy signaland the improvement in breadth indicators like thepercent of stocks above moving averages.So, while I am not as all-in...

READ MORE

MEMBERS ONLY

Ready for the Pullback

by TG Watkins,

Director of Stocks, Simpler Trading

In this week's edition of Moxie Indicator Minutes, TG explains how we could see the pullback building this week, with breadth weakening and many stocks being in extended positions that made getting long a risky proposition. This is good though, and was needed. Now, we need to see...

READ MORE

MEMBERS ONLY

RISING RATES WEIGH ON STOCKS -- SMALL CAP INDEX STALLS AT AUGUST HIGHS -- ENERGY STOCKS JUMP WITH CRUDE OIL

by John Murphy,

Chief Technical Analyst, StockCharts.com

BOND YIELDS ARE CLIMBING... Last week's message showed the 10-Year Treasury yield bouncing off its 200-day moving average suggesting that a rebound in yields might be starting. Chart 1 shows the TNX climbing above its 50-day moving average and a falling trendline extending back to its October high....

READ MORE

MEMBERS ONLY

GNG TV: "Fish Where the Fish Are" -- GoNoGo Trends for Relative Strength

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this week's edition of the GoNoGo Charts show, Alex and Tyler explain the process and tools that investors can use to narrow their universe of securities to those in the highest performing sector, industry group, and even to individual names. Starting from the macro picture, GoNoGo Charts...

READ MORE

MEMBERS ONLY

Using RSI for Swing Trading

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe shows how he uses RSI for Swing Trading. He uses 2 different settings on this indicator and 1 is used to determine the trend and the other for ob/os. He also discusses the key levels to...

READ MORE

MEMBERS ONLY

Disney Stock: A "Small World" Worth Buying?

by Karl Montevirgen,

The StockCharts Insider

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Disney reported Q1 FY23 earnings on Wednesday, February 8, 2023, after the close. The company beat earnings per share and revenue estimates, and total Disney+ subscriptions were higher than expected.

Successive peaks and dips in rapid order may be thrilling for most roller coaster enthusiasts, but, on Wall Street, not...

READ MORE

MEMBERS ONLY

2-Year Business Cycles Matter in Commodities

This week, we have featured the 23-month moving average, or two-year business cycle, and its significance to the indices.

In particular, when speaking about the S&P 500 index, we wrote:

* There was a bullish run in 2021 based on easy money.

* Inflation ran hotter than most expected.

* The...

READ MORE

MEMBERS ONLY

It's Not About the Crypto

by Dave Landry,

Founder, Sentive Trading, LLC

If you want to be a trader, you only need to do two things: seek out trends and figure out how to get aboard them-nothing more, nothing less. You cannot "confuse the issue with facts" by interjecting logic or reasoning. A market might be a bubble, but bubbles...

READ MORE

MEMBERS ONLY

2-Year Business Cycles Matter in This Market

Some of you might have already heard us speak about the monthly moving averages or have read our commentary about their significance.

On Monday, we asked, "What if the trading range top at 4200 we have been calling for in the S&P 500 turns out to be....

READ MORE

MEMBERS ONLY

Will Shutterstock Buck the Bear Trend?

by Karl Montevirgen,

The StockCharts Insider

Shutterstock (SSTK), the American creative content solutions firm, has been riding a doozy of a downtrend from October 2021 to the end of 2022. Aside from the bear mauling, SSTK's fundamentals weren't entirely disappointing. There were two positive (yet dwindling) earnings and revenue "beats,"...

READ MORE

MEMBERS ONLY

Momentum for This Interasset Relationship Just Reversed. What Are the Implications?

by Martin Pring,

President, Pring Research

Every business cycle has an inflationary and deflationary part to it. And if you know the prevailing phase, it can be enormously helpful. For example, when inflation is dominating, it's usually a favorable environment for commodities and commodity defensive sectors, such as mining and energy. At such times,...

READ MORE

MEMBERS ONLY

Sector Spotlight: Sector Rotation with Seasonality -- A Strong Combination

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, for this first week of February, I cover both the seasonality and the monthly charts. We have an interesting alignment of seasonal expectation and current sector rotation floating to the surface, offering a nice potential pair trading opportunity.

This video...

READ MORE

MEMBERS ONLY

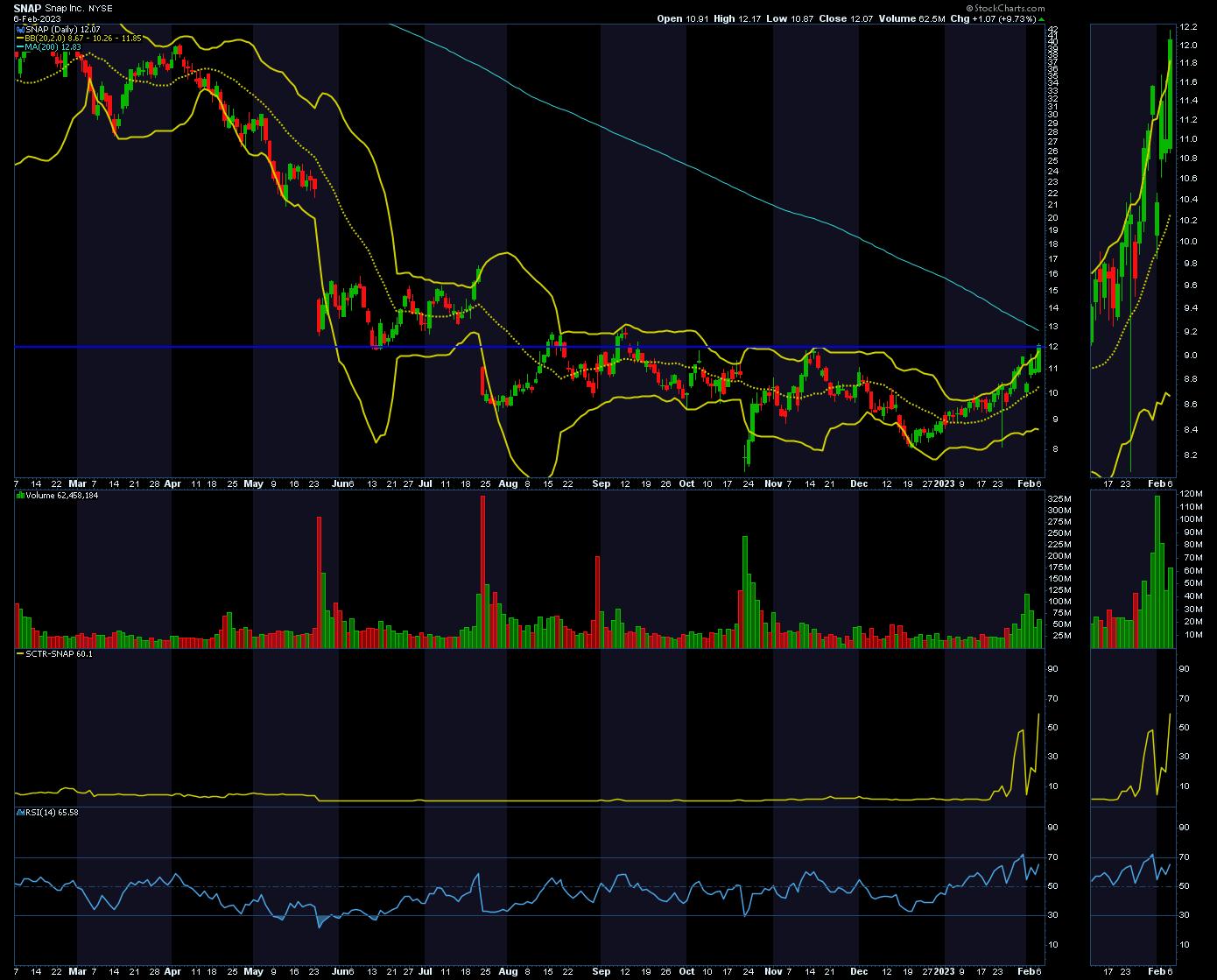

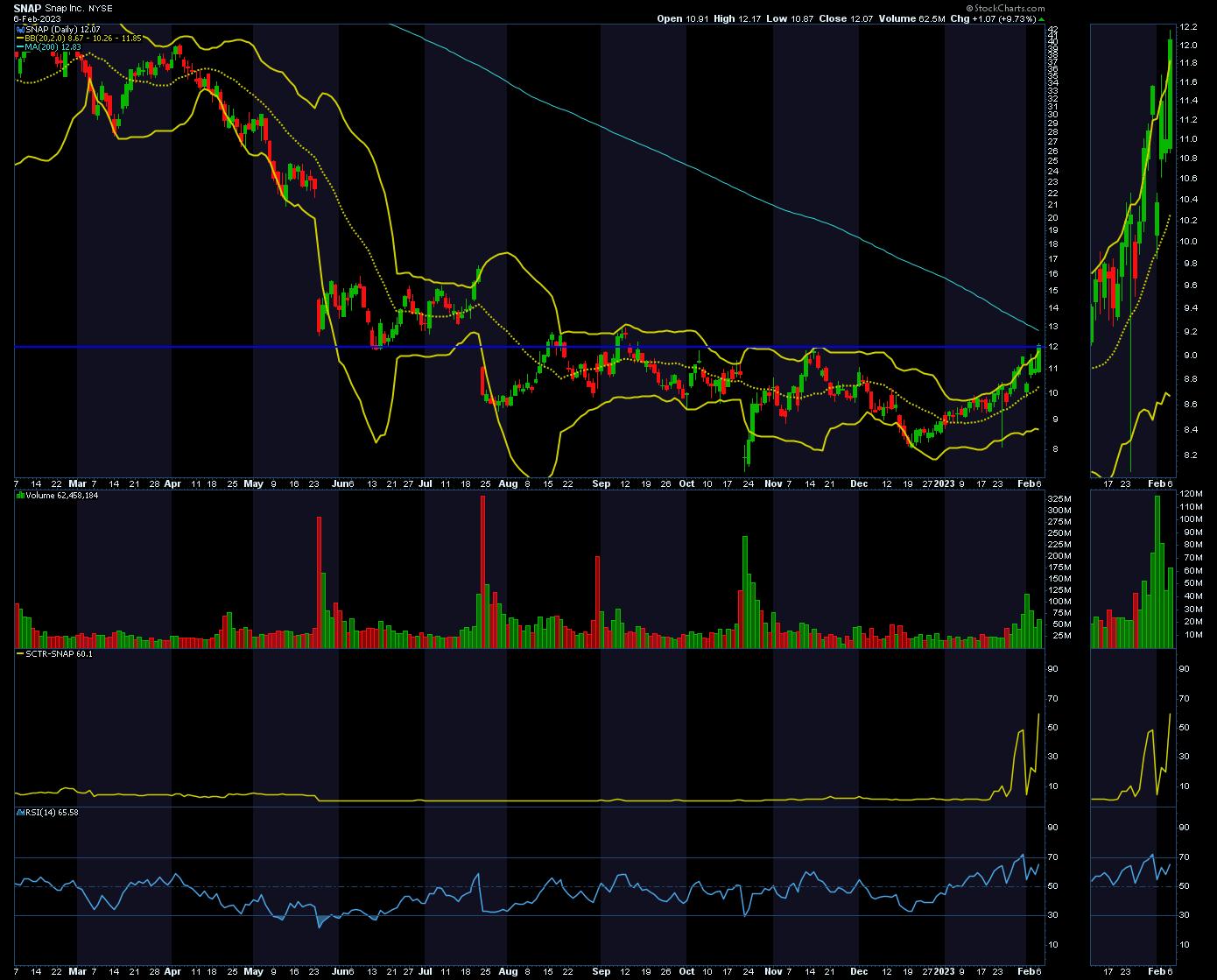

SNAP Stock: A Buy or Sell?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

SNAP's got a new game plan up its sleeve and, depending on how well it fits, it may make or break the stock.

After flat or disappointing earnings reports for most of 2022, mainly due to weak social media ad revenues, SNAP stock has suffered. The stock'...

READ MORE