MEMBERS ONLY

Can You Name These Charts? Different Types of Investments, Same Psychology.

by Carl Swenlin,

President and Founder, DecisionPoint.com

Last month in our DecisionPoint Trading Room, I gave our viewers a pop quiz. I presented two similar charts without names or price scales and challenged them to identify them by the shape of the price indexes alone. The point I was trying to make was that, while they were...

READ MORE

MEMBERS ONLY

GNG TV: Airlines, Casinos, & Luxury... Oh My!

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this week's edition of the GoNoGo Charts show, as the S&P 500 continues to show constructive evidence of trend reversal on longer timeframes, Alex and Tyler look to GoNoGo Charts to better understand the sector leadership and individual names that are leading equity markets. Importantly,...

READ MORE

MEMBERS ONLY

Combining Price Structure, MACD & ADX

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe shows how he puts it all together by looking at Price structure, MACD, and ADX, in conjunction with the Moving Averages, to identify a short-term trading opportunity in NVDA. He starts with Monthly and works down to...

READ MORE

MEMBERS ONLY

Poor Natural Gas

by Erin Swenlin,

Vice President, DecisionPoint.com

Natural Gas use has become a hot-button issue in the United States as bans begin to be discussed or enacted in certain states and cities. Whether you believe this is good or bad, it is news. A subscriber recently asked us to review Natural Gas (UNG), and today seems a...

READ MORE

MEMBERS ONLY

Are You Invested in Precious Metals Yet?

I started out this year saying that, to date, gold has been sold on strength and bought on weakness. And the day strength is bought is the day we see a much bigger rally.

A Few Gold Headlines

* Gold prices hit record high in Japan

* China steps up gold imports...

READ MORE

MEMBERS ONLY

Fourteen-Year Trend Favoring Relative Action of U.S. Equities May Be Over

by Martin Pring,

President, Pring Research

From the financial crisis in 2008 until October of last year, the U.S. stock market handsomely outperformed the Dow Jones Global Index ($DJW). However, recent price action suggests that this relationship may be about to change.

Stated more accurately, U.S. relative performance may have peaked last October, just...

READ MORE

MEMBERS ONLY

Stock Price Divergence and Potential Signs of Risk!

We cannot begin the Daily without a mention of the glitch in the NYSE right out of the gate Tuesday morning. A wild stock-price swing occurred at the open and 84 stocks suddenly plunged or spiked, causing volatility triggers and trading halts. The event is now under investigation.

The chart...

READ MORE

MEMBERS ONLY

Two Highly Entertaining Stocks to Watch

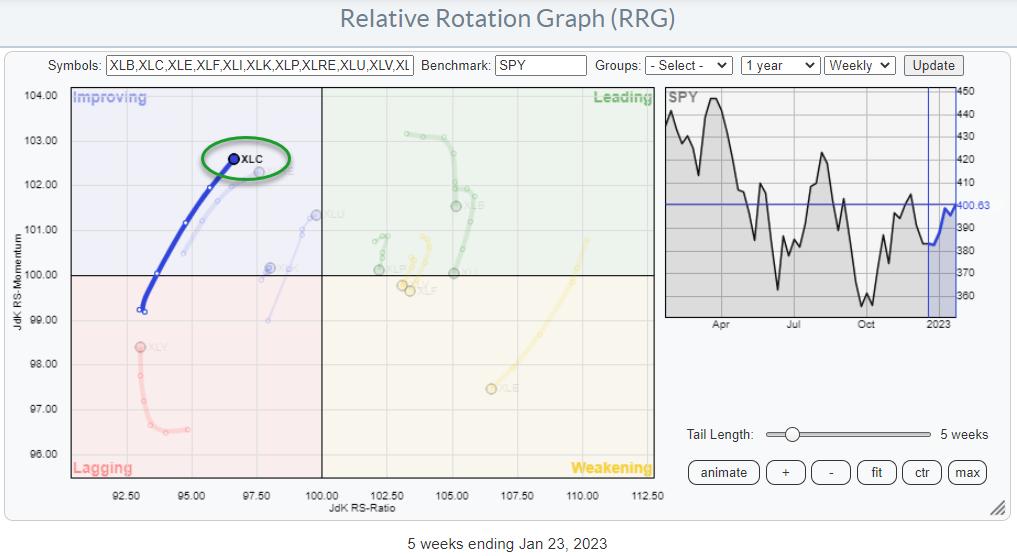

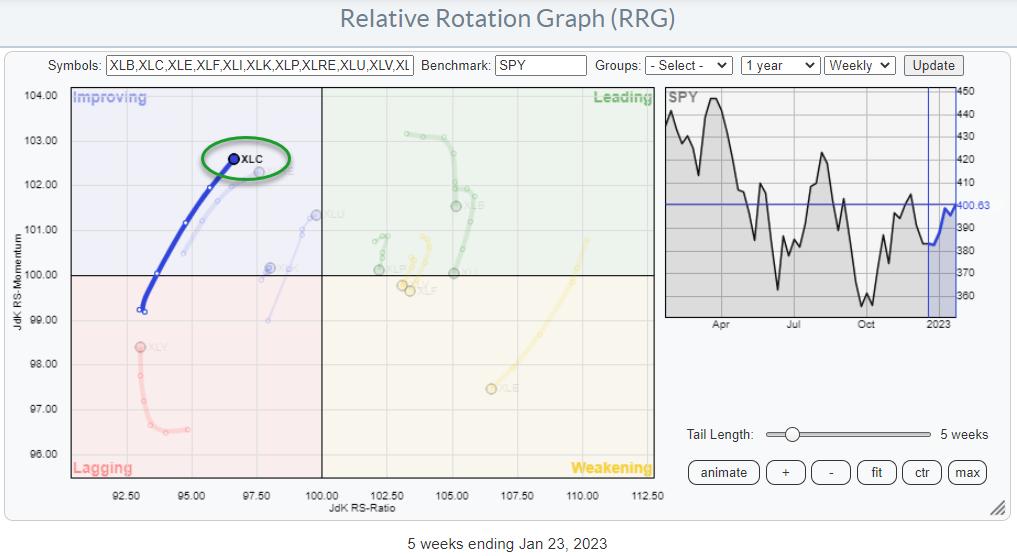

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

After a 50% decline, you need to make a 100% return to break even.

That is precisely what happened to the Communication Services sector. In August 2021, the Communications Services Select Sector SPDR fund (XLC) peaked at 85 and, from that point onward, started a disastrous decline, bringing its price...

READ MORE

MEMBERS ONLY

NVDA Hits Resistance: Can the Stock Go Higher?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Semiconductors are getting a lot of love from Wall Street once again, with many stocks in the industry getting upgrades from analysts. No wonder many of the semiconductor stocks spiked higher. All you have to do is pull up a chart of the iShares Semiconductor ETF (SOXX) and you'...

READ MORE

MEMBERS ONLY

Momentum vs. Price: Is the Stock Market Rally Over?

Last week was the reset of the January six-month calendar range. For the S&P 500 index, that range sits at 3770-4000.23.

In our 2023 Outlook, the prediction we made for the yearly range is much wider, or between 3200-4200. That is based on the position of two...

READ MORE

MEMBERS ONLY

DP Trading Room: What's Up with These Yields?

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Carl explores how yields are calculated with a few examples of yields that don't seem 'right'. He demonstrates how to add dividends and splits to your charts. Erin focuses in on two sectors that are...

READ MORE

MEMBERS ONLY

The S&P 500 Showing More Bullish Signals, Watch This Key Level

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Say what you want, but January has proven to be a very reliable predictor of U.S. stock market action from February through December since 1950 and, with just a little more than a week left to go in January 2023, market action is suggesting that we're going...

READ MORE

MEMBERS ONLY

Friday's 20% Gain Has This Stock's Short Sellers Running For the Exits

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

At EarningsBeats.com, we keep a Short Squeeze ChartList (SSCL). There are currently 42 stocks on it that have very high percentages in terms of short percentage of float. What these stocks have in common is a propensity for short sellers to panic and cover their short positions as price...

READ MORE

MEMBERS ONLY

Week Ahead: Ranged Movement Expected in this Truncated Week; These Levels Remain Crucial

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Over the past couple of weeks, it has been categorically mentioned that, so long as the NIFTY stays below the 18300 levels, it is likely to continue to consolidate in the present range. The index has created a very well-defined trading range for itself at the moment, and has continued...

READ MORE

MEMBERS ONLY

SPY Has a Clear Level to Beat

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 index has been trending lower since its peak in January 2022, but this decline could be a long correction after a massive advance. The pattern taking shape and the retracement amount is typical for corrections. Today's article highlights this setup and shows the...

READ MORE

MEMBERS ONLY

The Most Important Breadth Indicator to Follow

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I like to keep my process simple. That means I define the market trend using a simple combination of exponential moving averages. That also means that my charts are relatively straightforward, avoiding too many indicators and sticking to what I consider simple measures of trend and momentum.

So when I...

READ MORE

MEMBERS ONLY

MEM TV: S&P Regains Upside Momentum

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the bullish bias in the broader markets while highlighting which areas are in a position to trade higher. She also discusses what's driving stocks higher and what to be on the lookout for going into...

READ MORE

MEMBERS ONLY

Going, Going, Gone: End of Week Themes with GoNoGo Charts

by Alex Cole,

Co-founder, GoNoGo Charts®

As the week ends, let's use GoNoGo Charts to get sense of market moves.

The chart below shows the $SPY with daily prices and the full suite of single security GoNoGo Indicators applied. Price moved higher into midweek before tumbling on Wednesday. The last bar of the week...

READ MORE

MEMBERS ONLY

Has Inflation Cooled or Not?

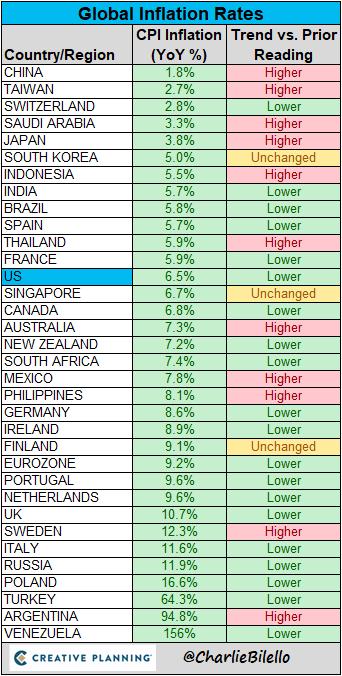

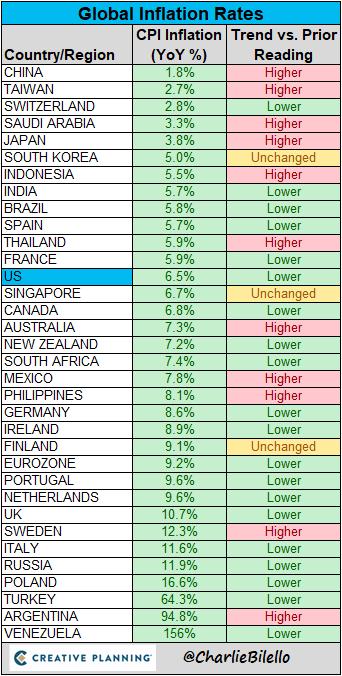

This past week, I got to talk a lot about inflation, something many have thrown in the towel about. But not us!

In particular, I sat down with Charles Payne during his show Making Money with Charles Payne on Fox Business. He prepared a list of questions for me.

Charles:...

READ MORE

MEMBERS ONLY

How to Manage & Maintain Your Watchlist of New Trade Targets

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus,we're talking process! Grayson digs into some of the tools that he personally uses on StockCharts to manage his watchlist. We've got a lot happening right now in the markets, including talk of...

READ MORE

MEMBERS ONLY

Smashed Names Showing Life

by TG Watkins,

Director of Stocks, Simpler Trading

In this week's edition of Moxie Indicator Minutes, TG explains that yes, we are still in a bear market, and yes, the indexes can still go lower. Heck, the SPY can still waterfall lower. But there are names that have been in their own bear market for a...

READ MORE

MEMBERS ONLY

S&P 500 BACKS OFF FROM MOVING AVERAGE AND TRENDLINE RESISTANCE -- TNX NEARS POTENTIAL SUPPORT AT 200-DAY LINE

by John Murphy,

Chief Technical Analyst, StockCharts.com

S&P 500 REMAINS IN MAJOR DOWNTREND...Although stocks have experienced a counter-trend rally over the last three months, their major trend is still down. One way to measure that is by looking at where moving averages and trendlines are located. Chart 1 show the S&P 500...

READ MORE

MEMBERS ONLY

This Stock Is Trending Higher: Why You Should Watch It

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

If you've logged into your Facebook account recently, you may have noticed a bunch of targeted reels. No, it's not TikTok. This just shows that Meta Platforms (META), parent company of Facebook, is rolling up its sleeves and getting aggressive in the advertising space. META has...

READ MORE

MEMBERS ONLY

GNG TV: Enough Leadership for Bull Market After October Lows?

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this week's edition of the GoNoGo Charts show, Alex and Tyler discuss the difficulty equities are having establishing a new "Go" trend. They walk through the technical analysis surrounding the macro factors that will have an impact on stocks, Interest rates, the dollar, commodities. They...

READ MORE

MEMBERS ONLY

Watch for These ADX Combinations

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe shows how he uses multiple timeframes in ADX to find stocks that have real potential. This approach can be used for screening and reducing a list to a workable number. ADX, used with the price pattern, can...

READ MORE

MEMBERS ONLY

Major Stock Indexes Are Faltering

by Carl Swenlin,

President and Founder, DecisionPoint.com

At the end of November the Dow Jones Industrial Average ETF (DIA) advanced just above +20% from its October low and officially entered a new bull market; however, technically, an intermediate-term rising trend had not been established. There is a bottom above the September bottom (green arrows), but there is...

READ MORE

MEMBERS ONLY

2023 Stock Market Forecast: Where's the Strength?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

Uncertain about where the stock market's headed? You should be, after a tumultuous 2022. Read on to hear what three experts think the 2023 investment landscape will look like. More importantly, get ready to take advantage of new trading and investing opportunities.

Forecasting the stock market is like...

READ MORE

MEMBERS ONLY

Mish's Daily: Should the Market Worry About Regional Banks Sector?

KRE Regional Banks is a member of my Economic Modern Family. With bank earnings in gear, this ETF measures the smaller banks--the ones where people living in more rural communities and smaller cities often go to borrow and save money.

Here is a passage from March 22, 2022:

"We...

READ MORE

MEMBERS ONLY

Selecting Sectors Using the Nirvana ChartStyle

by Martin Pring,

President, Pring Research

In the last couple of weeks, I've had a couple of conversations with clients asking how I go about selecting promising sectors, even when not much excites me at the moment.

To start with, I'm a believer in the principle that the character of short-term moves—...

READ MORE

MEMBERS ONLY

Mish's Daily: Sugar Futures and Social/Economic Impact to Stocks

The price of sugar is exposed to many global and national influences. These include government tariffs, costs of production, climate change, and geopolitical instability. These demand and supply factors all influence movement within the market.

Most sugar production occurs in a few countries across the world. The top producing countries...

READ MORE

MEMBERS ONLY

Sector Spotlight: Sector Rotation Model All Over the Place

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this episode of StockCharts TV's Sector Spotlight, I look at the current state of sector rotation, then walk through all 11 sector charts to make an assessment on their individual (relative) trends and their near-term support and resistance levels. Next, I use all this information to "...

READ MORE

MEMBERS ONLY

Trade Like Trevor

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Trevor Lawrence put in a performance for the ages in the AFC Wild Card game on Saturday. Chapeaux! Lawrence started the game with four interceptions in the first half but kept on throwing and brought his team back for a big win. There are some lessons here that we can...

READ MORE

MEMBERS ONLY

Earnings Season Started As Expected: Will the Trend Continue?

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Quarterly earnings is a time when management teams announce whether they've kept all their promises that were made over the prior 90 days. These quarterly earnings announcements shouldn't be shockers. Investors despise big surprises, especially when companies fall short of their consensus estimates. Wall Street firms...

READ MORE

MEMBERS ONLY

This IT Bellwether May Wake Up From a Slumber

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

Over the past couple of weeks, the performance of the IT stocks has remained quite muted; the NIFTY IT Index has come off from its November highs and has consolidated over some time. This has led to relative underperformance of the IT group against the broader markets. However, a few...

READ MORE

MEMBERS ONLY

Week Ahead: Expect Markets To Trade With Positive Bias So Long As These Levels Are Defended; These Sectors To Do Well

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

In the previous weekly technical note, it was mentioned that the markets may remain in a trading range until they trade below the crucial 18300 level, which is one of the major resistance points on the chart. Over the past five days, NIFTY not only remained below this point, but...

READ MORE

MEMBERS ONLY

Going, Going, Gone: End of Week Themes with GoNoGo Charts

by Alex Cole,

Co-founder, GoNoGo Charts®

As the week ends, let's use GoNoGo Charts to get a sense of market moves.

The chart below shows the $SPY with daily prices and the full suite of single security GoNoGo Indicators applied. As we can see, price has rallied this week and caused GoNoGo Trend to...

READ MORE

MEMBERS ONLY

Stocks in This Area Are Running: Many Poised to Go the Distance

by Mary Ellen McGonagle,

President, MEM Investment Research

It was a solid week for the markets with the S&P 500 index ($SPX) advancing above its key 200-day moving average which was a major area of possible upside resistance. With a positive relative strength index (RSI) and stochastic oscillator, the markets are poised to advance further as...

READ MORE

MEMBERS ONLY

The Four Scenarios for the S&P 500

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Position for the most probable scenario, but plan for alternative scenarios.

Why is this a sentence that should be printed out and taped to your monitor, now if not sooner? Because, as investors we often become very tied to a particular narrative.

The Fed is wrapping up its tightening cycle...

READ MORE

MEMBERS ONLY

Weekend Daily: Stock Market Outlook: New Year, New Calendar Range

Welcome to the new year and the new January reset!

The January 6-month calendar range could be even more influential than usual. Let me explain before showing you the S&P 500 (SPY) price chart...

After the first 10-trading days in January, a range is established. That range becomes...

READ MORE

MEMBERS ONLY

Follow Key Earnings Reports this Season with the Earnings Calendar!

by Grayson Roze,

Chief Strategist, StockCharts.com

Grayson kicks off earnings week in a big way on this week's edition of StockCharts TV'sStockCharts in Focus! He explores one of the latest new tools and features on StockCharts: our earnings calendar - with reported results and upcoming announcement dates to help you use the...

READ MORE