MEMBERS ONLY

MEM TV: Best Ways to Play Current Market Rally

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews the sector rotation taking place amid bullish price action in the markets. She also shares areas of strength that are poised to trade higher.

This video was originally broadcast on January 13, 2023. Click on the above...

READ MORE

MEMBERS ONLY

New Year Seeing Strength

by TG Watkins,

Director of Stocks, Simpler Trading

In this week's edition of Moxie Indicator Minutes, volatility products, breadth indicators, and individual tickers are showing TG that there is strength coming into the market. Is it the end of the Bear? We can't yet say, but there are trades setting up that you should...

READ MORE

MEMBERS ONLY

Return of the REITs?

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

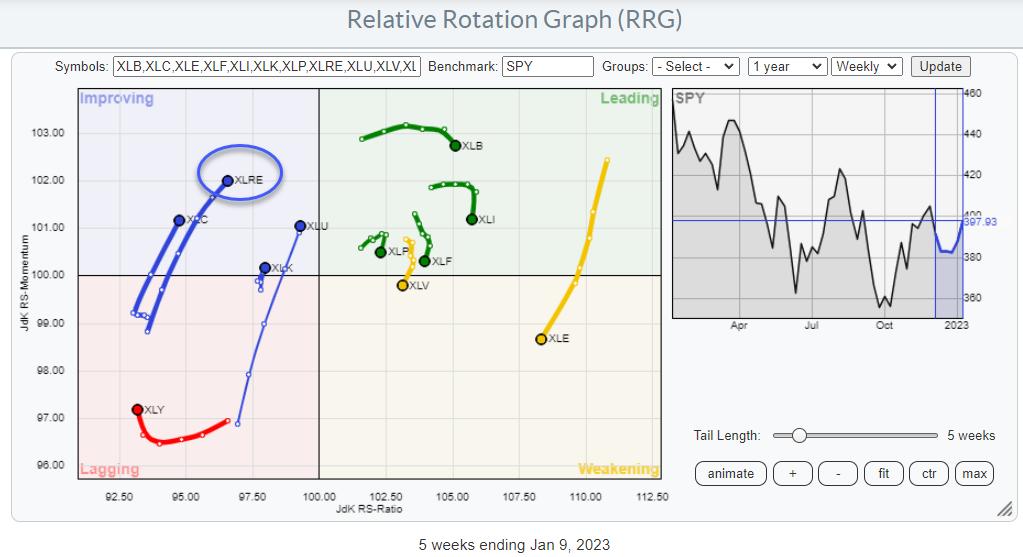

On the Relative Rotation Graph for US sectors, the tail for XLRE, the Real Estate Select Sector Fund, is inside the improving quadrant and heading towards leading at a positive RRG-Heading.

This is one of the few tails with a positive RRG-Heading, between 0-90 degrees. The other ones are Utilities,...

READ MORE

MEMBERS ONLY

Relative Seasonality and a Monthly Equity Curve

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The stock market has a long-term bullish bias and the monthly return metrics reflect this positive bias. Chartists looking for a seasonal edge can compare benchmark metrics with the monthly performance numbers. Months that outperform the benchmarks have a positive bias, while months that seriously underperform have a negative bias....

READ MORE

MEMBERS ONLY

FALLING DOLLAR HELPING COMMODITY-RELATED MATERIAL STOCKS—FOREIGN STOCKS RISING FASTER THAN THE U.S.

by John Murphy,

Chief Technical Analyst, StockCharts.com

Last week's message showed how a falling dollar was boosting the price of gold and its miners. The falling dollar may also be lending support to material stocks tied to various commodities which can also benefit from a weaker dollar.

FALLING DOLLAR BOOSTS MATERIAL STOCKS

The green area...

READ MORE

MEMBERS ONLY

Inflation Softens: Will Interest Rates Still Rise?

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

The December consumer price index (CPI) was welcome news for the stock market. Headline and core CPI numbers came in line with expectations. Headline CPI year-over-year is up 6.5% and core CPI is up 5.7%. Even though the softening inflation number was probably already priced into the market,...

READ MORE

MEMBERS ONLY

GNG TV: Changing Tides for Risk Assets

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

As all of Wall Street dissects CPI data and what that might mean for the Fed's next rate hike, Alex and Tyler look through what is actually happening from a price perspective in this week's edition of the GoNoGo Charts show. With inflation coming in softer...

READ MORE

MEMBERS ONLY

Multi-Timeframe Trade in Tesla

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe shows how he uses multiple timeframes to pinpoint a recent countertrend trade setup in TSLA. Joe uses Candles, Moving Averages, Price Structure, MACD, and ADX to help on this setup. He starts with the monthly chart and...

READ MORE

MEMBERS ONLY

2022 Stock Market Review

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

2022 has ended, but the bear market and need for risk management remains!

The year 2022 ended with the stock market delivering its largest yearly losses since 2008. The fourth quarter of 2022 saw new bear market lows in the S&P 500 index, Nasdaq Composite, and Bloomberg Agg...

READ MORE

MEMBERS ONLY

Mish's Daily: Ahead of CPI Inflation, The Market Rose in Expectation

You don't want to miss Mish's 2023 Market Outlook, E-available now!

Ahead of Thursday's CPI inflation print, the stock market rose on Wednesday, extending previous gains for the week. The stakes for the Fed-critical report are high, since most investors expect a lower CPI...

READ MORE

MEMBERS ONLY

How To Invest in Value Stocks: A Turn Around May Be in Play

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

If you've been too focused on how much the high-flying tech stocks have brought down the value of your portfolio, you may not have noticed that value stocks that have been sidelined are showing signs of a turnaround. This isn't unusual; in an economically uncertain environment,...

READ MORE

MEMBERS ONLY

Real Trading Techniques for Real Traders

by Dave Landry,

Founder, Sentive Trading, LLC

In this week's edition of Trading Simplified, Dave talks about real trading techniques for real traders, using real trades. He begins with a new mystery chart, explaining his Double Top Knockout Setup. He then continues his "Next 100" trades, noting updates to his open positions, discussing...

READ MORE

MEMBERS ONLY

Mish's Daily: The Shiller Ratio is Telling Us There is More to Come

You don't want to miss Mish's 2023 Market Outlook, E-available now!

As earnings season kicks off, the market is primed to witness some surprising turns in the coming days, weeks, and months ahead. Powell's speech today kept investors thinking about future interest rate hikes...

READ MORE

MEMBERS ONLY

A Recent Interview

by Greg Morris,

Veteran Technical Analyst, Investor, and Author

I had the honor of being interviewed by longtime friends, Sunny Harris and Sam Tennis. The link below will take you to that interview. It is about 1 hour long so try to stay awake.

https://anchor.fm/sunny-j-harris/episodes/Gregory-L--Morris...

READ MORE

MEMBERS ONLY

A Tale of Two Indexes

by Martin Pring,

President, Pring Research

Most of the time, the major indexes move in tandem. Occasionally, they'll throw up positive and negative divergences that technical analysts can use to better identify important trend reversals. Today, we will look at two market averages whose 2022 price action has resulted in completely different potential chart...

READ MORE

MEMBERS ONLY

Sector Spotlight: Reverse Engineering a Price Target for SPY

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this year's first episode of StockCharts TV's Sector Spotlight, I take a look at the Sector Rotation Model and address the current state of stock market sector rotation. Then, I discuss the four macroeconomic indicators that form an integral part of the model to assess...

READ MORE

MEMBERS ONLY

Mish's Daily: The Spot Where the US Dollar Still Stands

You don't want to miss Mish's 2023 Market Outlook, E-available now!

Despite the debate about the strength or weakness of the US Dollar, it will remain one of the most important currencies in the world for decades, and will continue to cause trouble for some. Still,...

READ MORE

MEMBERS ONLY

DP Trading Room: Top Sectors & Industry Groups

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Carl opens the show with a reprise of his Tesla (TSLA) vs. Bitcoin discussion and the uncanny similarities as far as gains, losses, and price pattern, in spite of not really being related at all. Erin teases out the...

READ MORE

MEMBERS ONLY

The Halftime Show: Predicting Recessions and Bullish Names

by Pete Carmasino,

Chief Market Strategist, Chaikin Analytics

The 2022 year-end came with plenty of volatility in the market, and that's what bear market rallies and turning points look like. However, we don't know where the turning point really is. In this week's edition of StockCharts TV'sHalftime,Pete takes a...

READ MORE

MEMBERS ONLY

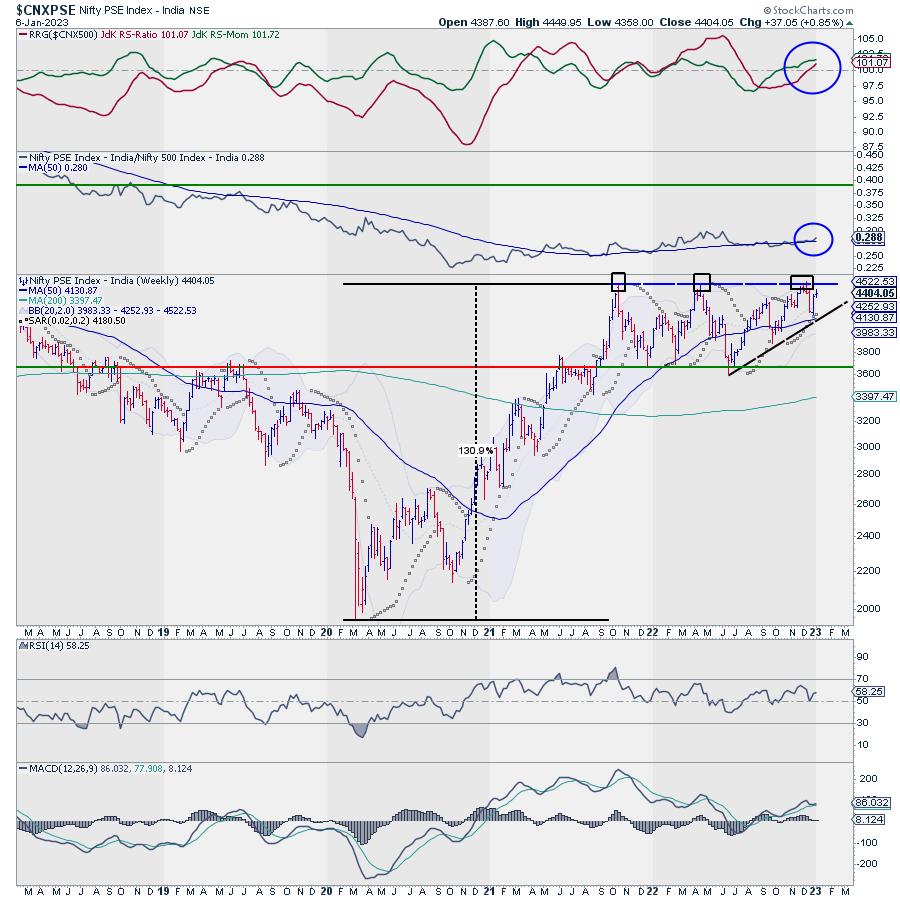

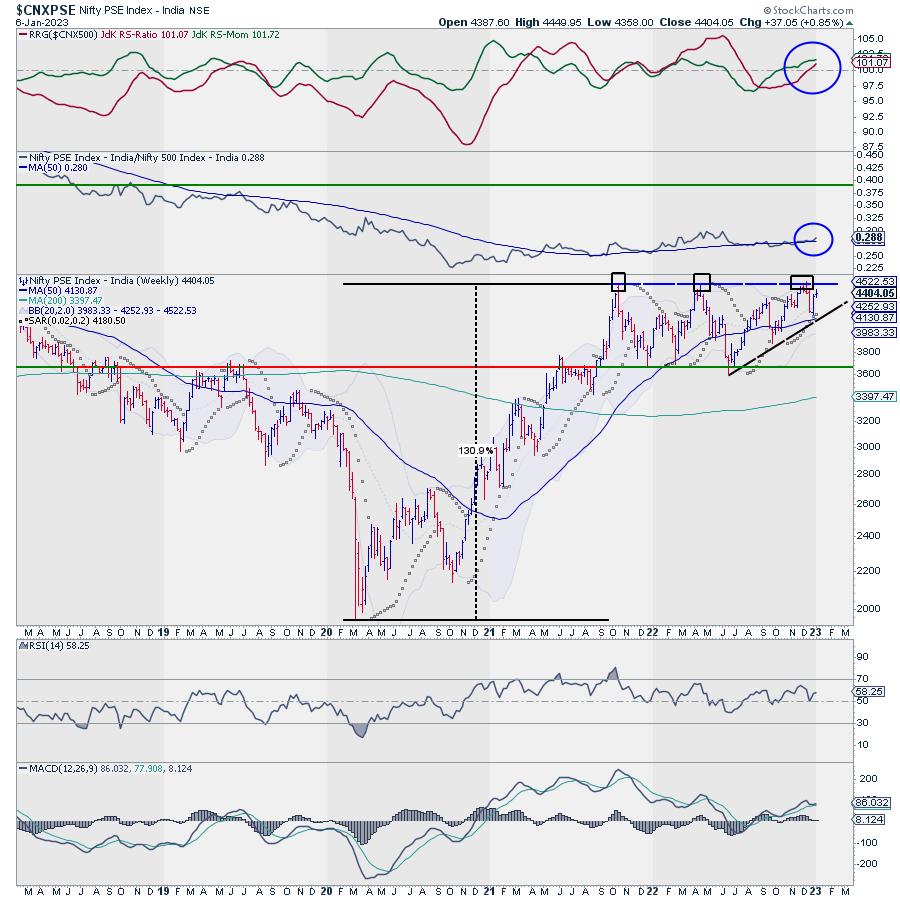

Sector Spotlight: Keep An Eye; This Could Be A Massive Multiyear Breakout

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

There is no debate when it comes to concluding that 2022 has been a choppy year for equities globally. The markets had to deal with all sorts of things; rising inflation, fear of recession, geopolitical tensions, and a slew of rate highs from the central banks all over the world....

READ MORE

MEMBERS ONLY

Weekend Daily: Gold is the Featured Pick of 2023

You don't want to miss Mish's 2023 Market Outlook, E-available now!

From page 55 of How to Grow Your Wealth in 2023:

"Overall, the gold futures have the lion's share of our interest, (as referenced earlier in this Outlook). We wrote about the...

READ MORE

MEMBERS ONLY

Week Ahead: Positive Start To Nifty Expected; Muted Dollar Index May Benefit These Sectors

by Milan Vaishnav,

Founder and Technical Analyst, EquityResearch.asia and ChartWizard.ae

The equity markets have entered into the new year on a back foot and stayed choppy as well. In the previous technical note, it was mentioned that, so long as the NIFTY stays below its crucial resistance zone of the 18300-18600 levels, it will remain in a trading zone that...

READ MORE

MEMBERS ONLY

MEM TV: Has a New Bear Market Begun?

by Mary Ellen McGonagle,

President, MEM Investment Research

In this episode of StockCharts TV'sThe MEM Edge, Mary Ellen reviews some of the key events driving price action as we head into the New Year. She also highlights the impact of last week's rise in interest rates, as well as key areas of support for...

READ MORE

MEMBERS ONLY

Exploring the Official StockCharts Mobile App

by Grayson Roze,

Chief Strategist, StockCharts.com

On this week's edition of StockCharts TV'sStockCharts in Focus, Grayson takes you on a tour through the brand new StockCharts mobile app for iOS devices! You can now take your charts and the market anywhere with you on the go. We'll show you the...

READ MORE

MEMBERS ONLY

Useful (Multi)Utilities

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

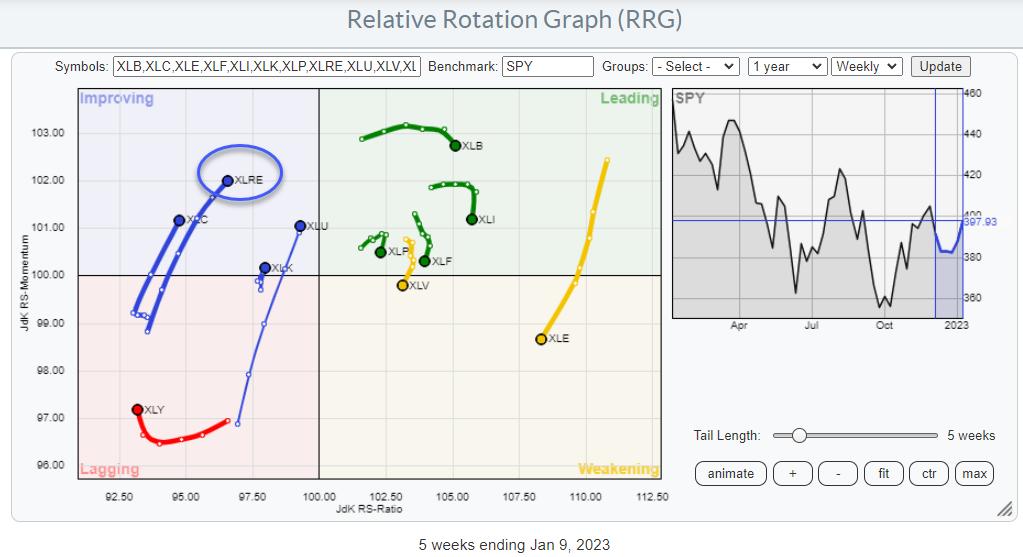

From the Sector Level

On the Relative Rotation Graph for US sectors, the tail for the Utilities sector stands out. It is relatively long compared to the other tails on the graph, which indicates that there is quite a bit of power behind the move. With the tail moving from...

READ MORE

MEMBERS ONLY

Respecting the Rangebound S&P 500

by David Keller,

President and Chief Strategist, Sierra Alpha Research

As the great bear market of 2022 was really hitting its stride, the 3800 level came into view as a likely support level for stocks. We keyed in on that level based on Fibonacci Retracements using the March 2020 low and the January 2022 high. At the time, that seemed...

READ MORE

MEMBERS ONLY

FALLING DOLLAR BOOSTS GOLD AND ITS MINERS -- STOCKS END WEEK ON STRONG NOTE AS RATES DROP

by John Murphy,

Chief Technical Analyst, StockCharts.com

BOND YIELDS AND THE DOLLAR WEAKEN... The direction of interest rates plays a big role in determining the direction of the dollar. Rising U.S. rates during 2022 helped push the dollar to the highest level in twenty years. Chart 1, however, shows the 10-Year Treasury yield peaking during October...

READ MORE

MEMBERS ONLY

Third Week of Chop

by TG Watkins,

Director of Stocks, Simpler Trading

The market got into its sideways range starting about December 16th and is still in that zone. They say don't short a quiet market, but it is also hard to see where strength will be coming in from. In this week's edition of Moxie Indicator Minutes,...

READ MORE

MEMBERS ONLY

The QQQ is Bouncing Off VERY Significant Price Support; MarketVision 2023 is TOMORROW!

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

The past three months have been torture for the Invesco QQQ Trust (QQQ), the ETF that tracks the NASDAQ 100. The large-cap stocks that dominate the QQQ performance have been breaking down one after another, and that has weighed much more heavily on the NASDAQ 100 than it has on...

READ MORE

MEMBERS ONLY

This Sentiment Signal Is Solid And Says We Could Soar Short-Term

by Tom Bowley,

Chief Market Strategist, EarningsBeats.com

Late yesterday afternoon, I sent out a quick update to our EarningsBeats.com members, suggesting that we could see a sudden surge higher in equities. A bullish signal emerged in the Volatility Index ($VIX), one that doesn't appear very often. Typically, the S&P 500 and VIX...

READ MORE

MEMBERS ONLY

GNG TV: Defense is Still on the Field

by Alex Cole,

Co-founder, GoNoGo Charts®

by Tyler Wood,

Co-founder, GoNoGo Charts®

In this week's edition of the GoNoGo Charts show, Alex and Tyler examine a market that is largely consistent with the choppy downtrends and defensive characteristics of the prior year. The major difference across the asset classes is that the US Dollar index is in a NoGo and...

READ MORE

MEMBERS ONLY

Wealth-Building Strategies

by Joe Rabil,

President, Rabil Stock Research

On this week's edition of Stock Talk with Joe Rabil, Joe looks at the longer-term picture for stocks like AAPL, TSLA, and more. He gives a framework of how to play these stocks for long term accounts, then explains the process of a bottom and how to take...

READ MORE

MEMBERS ONLY

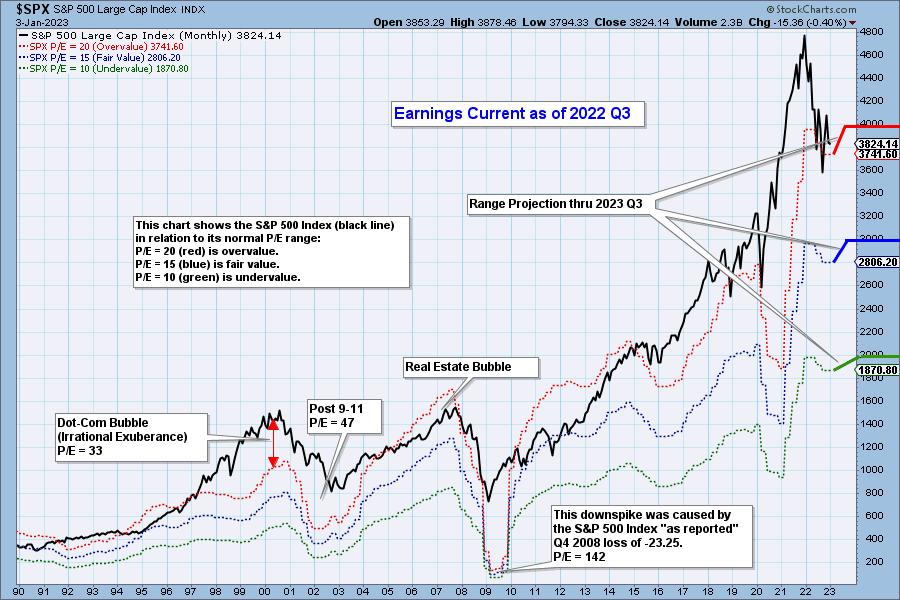

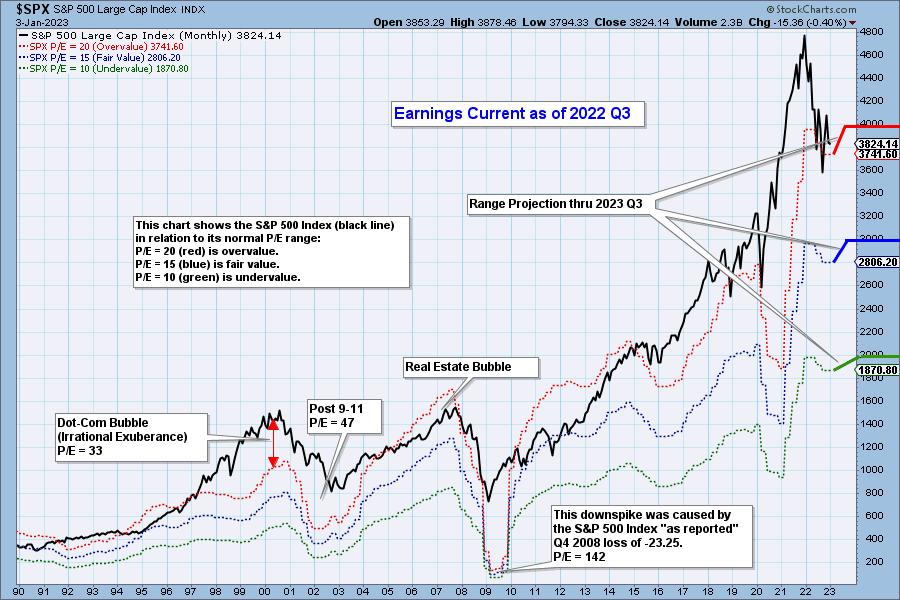

2022 Q3 Earnings: Market Still Overvalued

by Carl Swenlin,

President and Founder, DecisionPoint.com

Preliminary earnings numbers are in for 2022 Q3. To clarify, earnings results are collected for the three months after the end of the quarter. Meanwhile, "earnings season," the collection period for 2022 Q4, has just begun.

The chart below shows the normal value range of the S&...

READ MORE

MEMBERS ONLY

Are You Being Churchill or Einstein?

by Dave Landry,

Founder, Sentive Trading, LLC

Trading will make you question whether you are being Churchill's definition of success or Einstein's definition of insanity. Thus, the Einstein vs. Churchill argument. In this week's edition of Trading Simplified, Dave continues his discussion on his next 100 trades and presents an update...

READ MORE

MEMBERS ONLY

Gold Stocks are Starting To Shine: Keep an Eye on Them

by Jayanthi Gopalakrishnan,

Director of Site Content, StockCharts.com

After a pretty dismal stock performance in 2022, investors are looking forward to some signs of optimism in the first trading week of the new year. Alas, the first two days didn't bring much hope. Fed minutes indicate that inflation is still high, and that means more interest...

READ MORE

MEMBERS ONLY

How to Grow Your Wealth in 2023

Investors and traders should utilize sensible trading strategies, intelligent portfolio management, and vigilant risk governance to stay ahead in today's fast-paced, liquid markets. In this article, renowned and legendary trader Michele Schneider outlines 10 themes that are likely to shape and drive the markets in 2023 and into...

READ MORE

MEMBERS ONLY

2023 Outlook

by Larry Williams,

Veteran Investor and Author

The Boy Scout Motto "Be Prepared" is apt for the year 2023. In this exclusive StockCharts TV special, Larry shows you the things you should be prepared for and some of his expectations for what's coming in the new year.

This video was originally broadcast on...

READ MORE

MEMBERS ONLY

Mish's Daily: The New Year Could Be All About Junk Bonds

Now that we are one day into the new year, there are two pieces of advice to give you.

1. Learn a strategy and then become a specialist in that strategy. As an example, you could use phases. And once you understand the phases on a daily and weekly timeframe,...

READ MORE

MEMBERS ONLY

Tesla's Bear Market Low: Are We There Yet?

by Martin Pring,

President, Pring Research

I don't usually get into individual stocks, but, back in August, I found Tesla's price action to be quite interesting. That's because I felt the stock, along with its fearless leader Elon Musk, were important icons of the 2020–2022 phase of the post-financial...

READ MORE

MEMBERS ONLY

Sector Spotlight: Seasonality Points to a Weak Start for 2023!

by Julius de Kempenaer,

Senior Technical Analyst, StockCharts.com

In this year's first episode of StockCharts TV's Sector Spotlight, I address the expected seasonal performance for the stock market and the individual sectors. I locate one sector at high odds for outperforming the S&P 500 in January, as well as a sector with...

READ MORE